HI5020 Corporate Accounting: Analysis of Inghams and Woolworths

VerifiedAdded on 2023/06/04

ertyuiopasdfghjklzxcvbnmqwert

yuiopasdfghjklzxcvbnmqwertyui

opasdfghjklzxcvbnmqwertyuiopa

sdfghjklzxcvbnmqwertyuiopasdf

ghjklzxcvbnmqwertyuiopasdfghj

klzxcvbnmqwertyuiopasdfghjklz

xcvbnmqwertyuiopasdfghjklzxcv

bnmqwertyuiopasdfghjklzxcvbn

mqwertyuiopasdfghjklzxcvbnmq

wertyuiopasdfghjklzxcvbnmqwer

tyuiopasdfghjklzxcvbnmqwertyui

opasdfghjklzxcvbnmqwertyuiopa

sdfghjklzxcvbnmqwertyuiopasdf

ghjklzxcvbnmqwertyuiopasdfghj

klzxcvbnmqwertyuiopasdfghjklz

xcvbnmrtyuiopasdfghjklzxcvbnm

qwertyuiopasdfghjklzxcvbnmqw

HI5020 Corporate Accounting

Assessment item 2 — Assignment

Paraphrase This Document

Executive summary

Evaluation on different aspects between two organizations can play a major role in shedding

light betwixt their approaches and performance. Thus, with the help of this report, the annual

reports of Inghams Ltd and Woolworths Ltd will be selected and a comparative analysis will

be conducted betwixt their cash flow statements, comprehensive statement of income, equity,

and income tax. With such comparative analysis, any changes in these segments when

compared to the last year can be obtained. Furthermore, this report also intends to consider

the notes and footnotes of financials of these companies for more efficiency in evaluation.

Overall, the comparison betwixt these companies can assist in reflecting which company has

been performing better on a whole.

2

Contents

Introduction...........................................................................................................................................3

Owners’ equity......................................................................................................................................3

Cash flow statement..............................................................................................................................4

Comparative evaluation........................................................................................................................7

Comprehensive income statements......................................................................................................8

Accounting for corporate income related tax......................................................................................11

Calculation of effective tax rate:..........................................................................................................12

Deferred assets....................................................................................................................................12

Cash Tax Rate......................................................................................................................................14

References...........................................................................................................................................16

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Introduction

The main aim of the report is to assess the financial information of Inghams Group Limited

and Woolworths. Woolworths is a major player when it comes to retail business and has its

business scattered immensely. On the other hand, Ingham Group Limited is a poultry

producer and has its business located in Australia and New Zealand. Both the companies are

significant player and the report aims to shed light on their performance through a detailed

analysis.

Owners’ equity

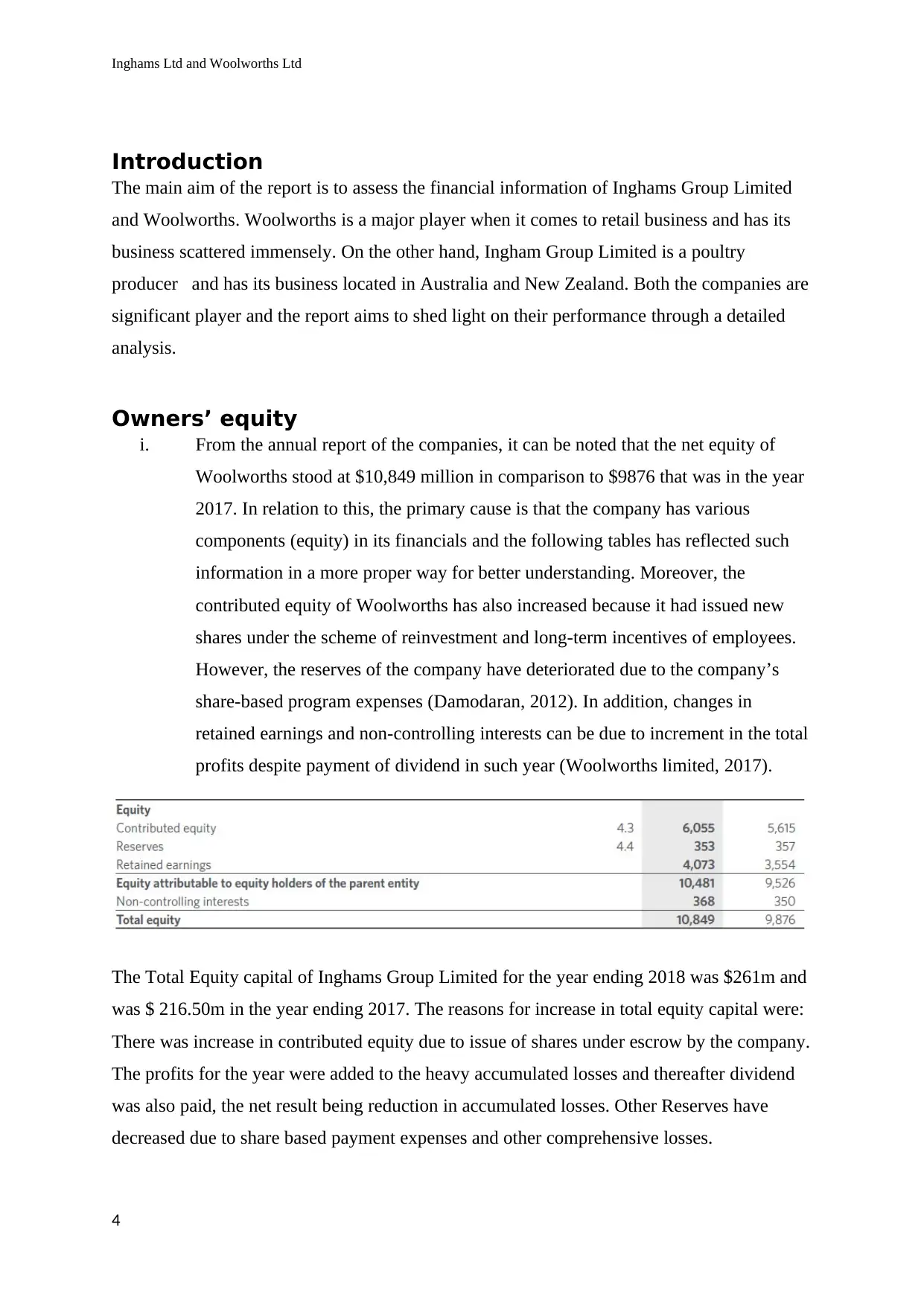

i. From the annual report of the companies, it can be noted that the net equity of

Woolworths stood at $10,849 million in comparison to $9876 that was in the year

2017. In relation to this, the primary cause is that the company has various

components (equity) in its financials and the following tables has reflected such

information in a more proper way for better understanding. Moreover, the

contributed equity of Woolworths has also increased because it had issued new

shares under the scheme of reinvestment and long-term incentives of employees.

However, the reserves of the company have deteriorated due to the company’s

share-based program expenses (Damodaran, 2012). In addition, changes in

retained earnings and non-controlling interests can be due to increment in the total

profits despite payment of dividend in such year (Woolworths limited, 2017).

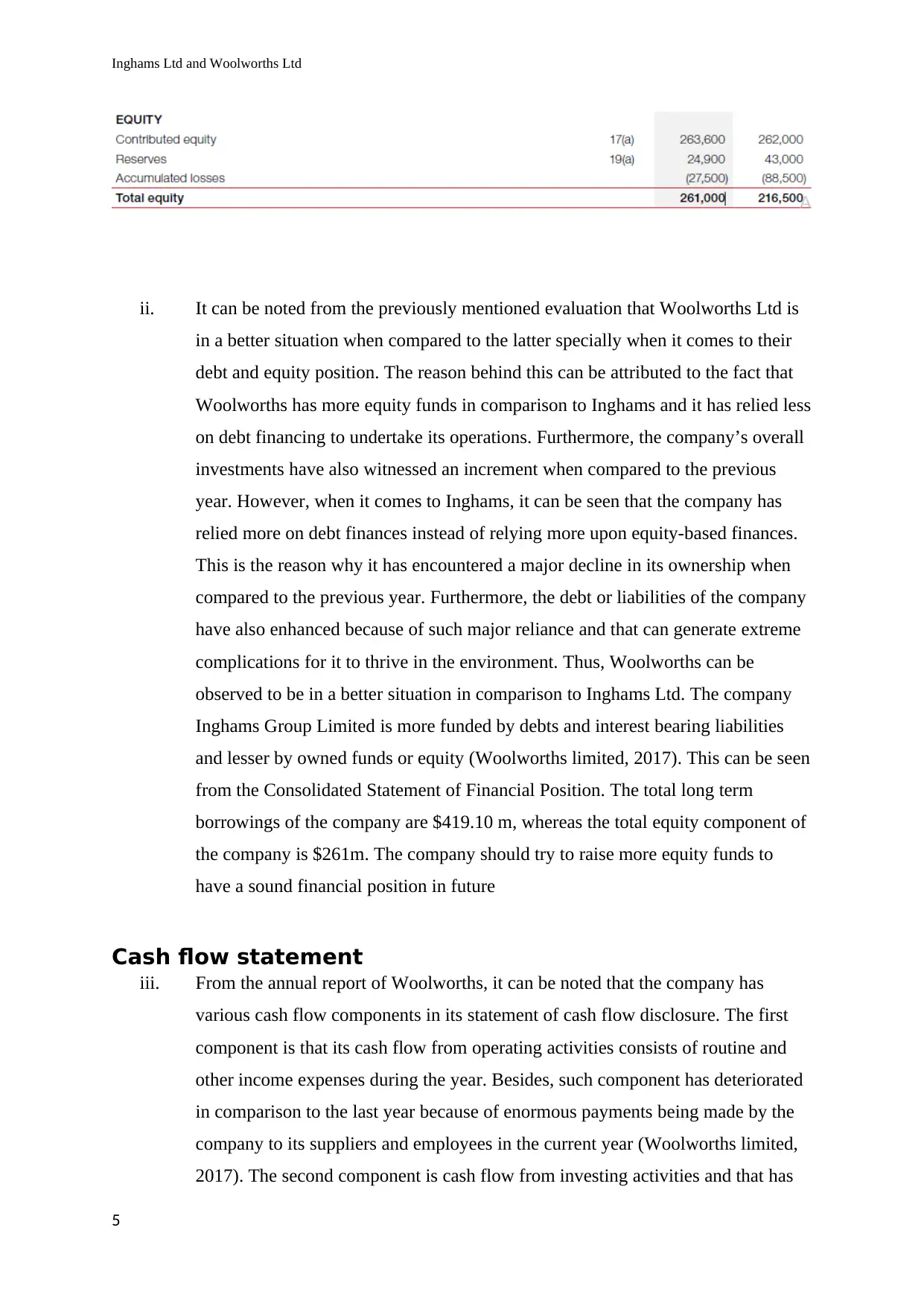

The Total Equity capital of Inghams Group Limited for the year ending 2018 was $261m and

was $ 216.50m in the year ending 2017. The reasons for increase in total equity capital were:

There was increase in contributed equity due to issue of shares under escrow by the company.

The profits for the year were added to the heavy accumulated losses and thereafter dividend

was also paid, the net result being reduction in accumulated losses. Other Reserves have

decreased due to share based payment expenses and other comprehensive losses.

4

Paraphrase This Document

ii. It can be noted from the previously mentioned evaluation that Woolworths Ltd is

in a better situation when compared to the latter specially when it comes to their

debt and equity position. The reason behind this can be attributed to the fact that

Woolworths has more equity funds in comparison to Inghams and it has relied less

on debt financing to undertake its operations. Furthermore, the company’s overall

investments have also witnessed an increment when compared to the previous

year. However, when it comes to Inghams, it can be seen that the company has

relied more on debt finances instead of relying more upon equity-based finances.

This is the reason why it has encountered a major decline in its ownership when

compared to the previous year. Furthermore, the debt or liabilities of the company

have also enhanced because of such major reliance and that can generate extreme

complications for it to thrive in the environment. Thus, Woolworths can be

observed to be in a better situation in comparison to Inghams Ltd. The company

Inghams Group Limited is more funded by debts and interest bearing liabilities

and lesser by owned funds or equity (Woolworths limited, 2017). This can be seen

from the Consolidated Statement of Financial Position. The total long term

borrowings of the company are $419.10 m, whereas the total equity component of

the company is $261m. The company should try to raise more equity funds to

have a sound financial position in future

Cash flow statement

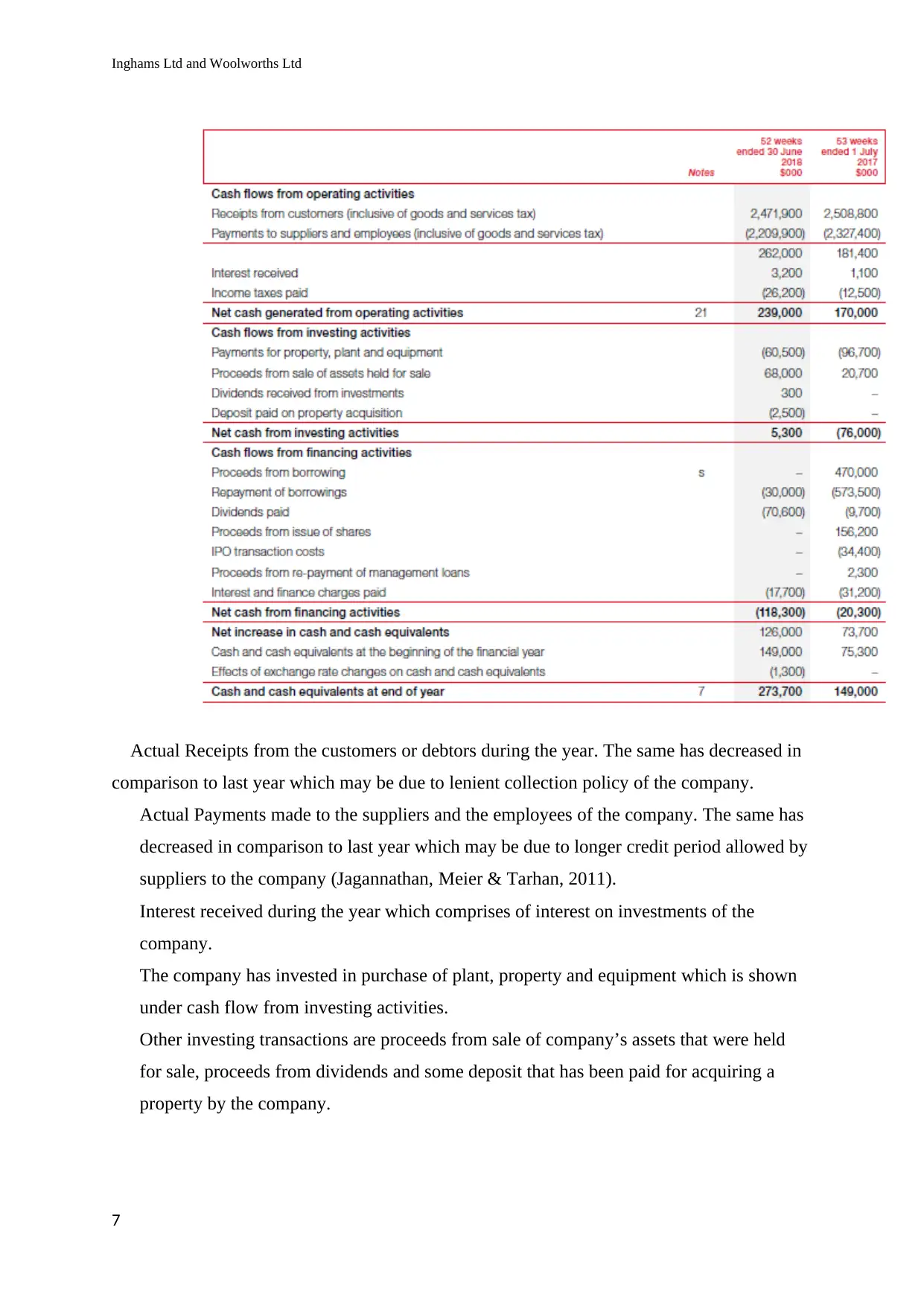

iii. From the annual report of Woolworths, it can be noted that the company has

various cash flow components in its statement of cash flow disclosure. The first

component is that its cash flow from operating activities consists of routine and

other income expenses during the year. Besides, such component has deteriorated

in comparison to the last year because of enormous payments being made by the

company to its suppliers and employees in the current year (Woolworths limited,

2017). The second component is cash flow from investing activities and that has

5

increased when compared to the past year. This is because the company had

conducted huge purchases and had attained fewer returns from its sale of Property,

Plant, and Equipments. The third and last component is cash flow from financing

activities that have also deteriorated in comparison to the past year. Despite proper

payments of dividend in the present year, there has been inadequate payment of

outstanding debt obligations in the year when compared to the last tenure

(Woolworths limited, 2017).

The company Inghams Group Limited has the following components in its cash

flow statement:

Cash flow from operating activities consists of the recurring expenses and

incomes of the company during the year. The net cash from operating activities

has increased in comparison to last year as a net effect of receipts from customers,

receipt from interest income and payments to suppliers and employees & income

taxes paid (Ingham, 2017).

Net cash used in Investing Activities has decreased considerably since last year.

The reasons are that there have been higher receipts from sale of some assets sold

this year. Moreover lesser amount has been paid for purchase of property, plant

and equipment, etc as compared to the last year (Banbura, Giannone & Lenza,

2015).

There has been no cash inflow from financing activities. No borrowings have been

done for the year ending 2018. There has been only outflow during year 2018

which includes repayment of borrowings, dividends paid and interest and finance

charges paid.

The net result of all these three activities is increase in cash and cash equivalents

at the end of the year which shows a good liquidity position of the company at the

year end.

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Actual Receipts from the customers or debtors during the year. The same has decreased in

comparison to last year which may be due to lenient collection policy of the company.

Actual Payments made to the suppliers and the employees of the company. The same has

decreased in comparison to last year which may be due to longer credit period allowed by

suppliers to the company (Jagannathan, Meier & Tarhan, 2011).

Interest received during the year which comprises of interest on investments of the

company.

The company has invested in purchase of plant, property and equipment which is shown

under cash flow from investing activities.

Other investing transactions are proceeds from sale of company’s assets that were held

for sale, proceeds from dividends and some deposit that has been paid for acquiring a

property by the company.

7

Paraphrase This Document

Financing activities in the year 2018 comprise of repayment of borrowings, dividends

paid and interest on loans taken by the company. This has reduced in comparison to last

year where there were many other transactions as well.

Comparative evaluation

iv. Woolworths Ltd

It can be seen that the company’s net cash from operating activities have declined when

compared to the past year and the reason is because of extreme payments being made to the

employees and suppliers. Further, in relation to net cash from investing activities, the reason

behind such decline can be because of higher purchases and lesser returns from sale of PPE

when compared to the previous tenure (Woolworths limited, 2017). In addition, the company

has also used lesser cash in relation to its financing activities.

The company Inghams Group Limited has the following components in its cash flow

statement:

Cash flow from operating activities consists of the recurring expenses and incomes of the

company during the year. The net cash from operating activities has increased in comparison

to last year as a net effect of receipts from customers, receipt from interest income and

payments to suppliers and employees & income taxes paid (Inghams Group Limited, 2017).

Net cash used in Investing Activities has decreased considerably since last year. The reasons

are that there have been higher receipts from sale of some assets sold this year. Moreover

lesser amount has been paid for purchase of property, plant and equipment, etc as compared

to the last year.

There has been no cash inflow from financing activities. No borrowings have been done for

the year ending 2018. There has been only outflow during year 2018 which includes

repayment of borrowings, dividends paid and interest and finance charges paid.

The net result of all these three activities is increase in cash and cash equivalents at the end of

the year which shows a good liquidity position of the company at the year end (Inghams

Group Limited, 2017).

v. Insight of such comparative evaluation

8

In association with Woolworths, it can be commented that the company has experienced

improvements in its cash and cash equivalent in the present year that signifies better

development and growth.

Comprehensive income statements

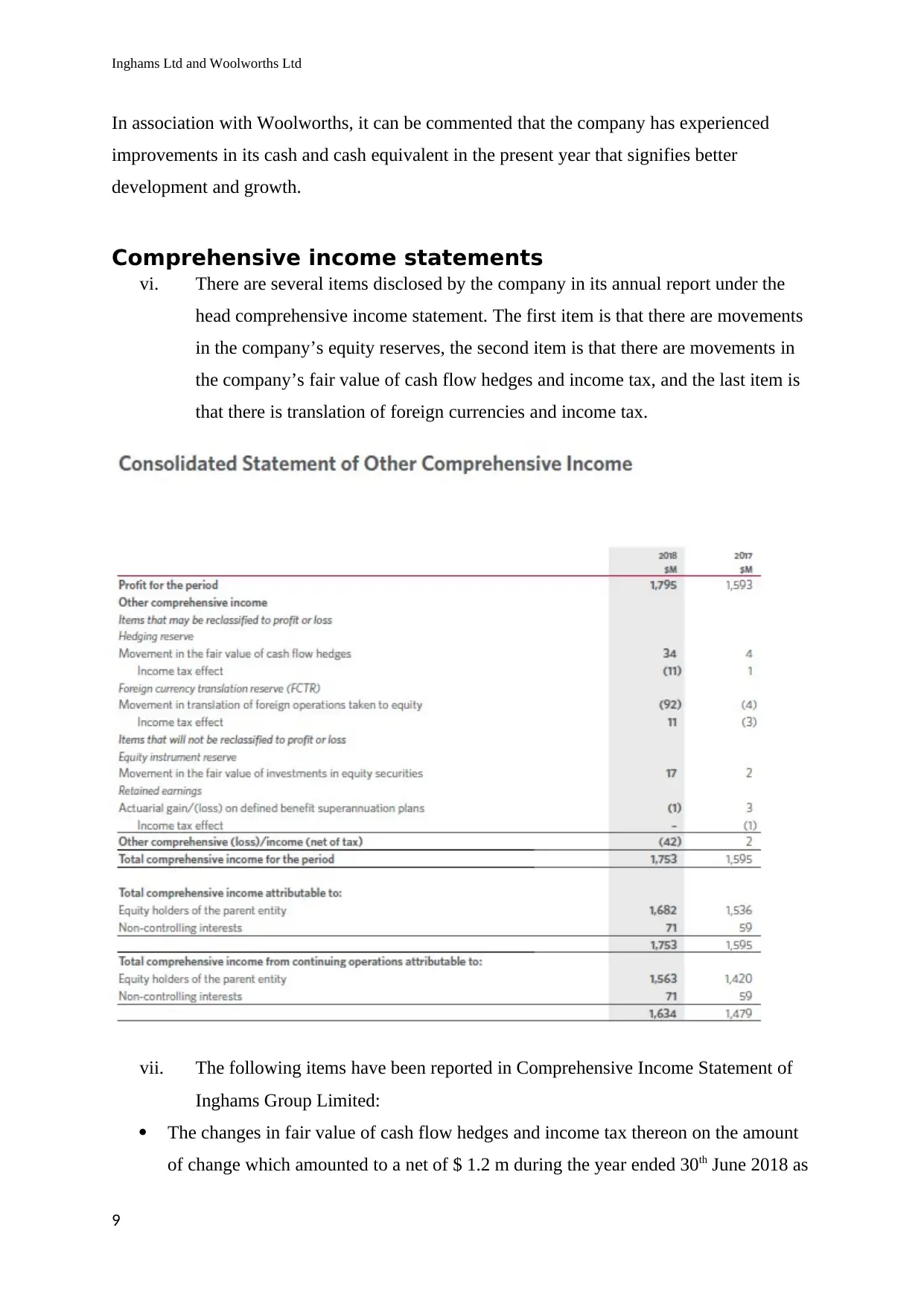

vi. There are several items disclosed by the company in its annual report under the

head comprehensive income statement. The first item is that there are movements

in the company’s equity reserves, the second item is that there are movements in

the company’s fair value of cash flow hedges and income tax, and the last item is

that there is translation of foreign currencies and income tax.

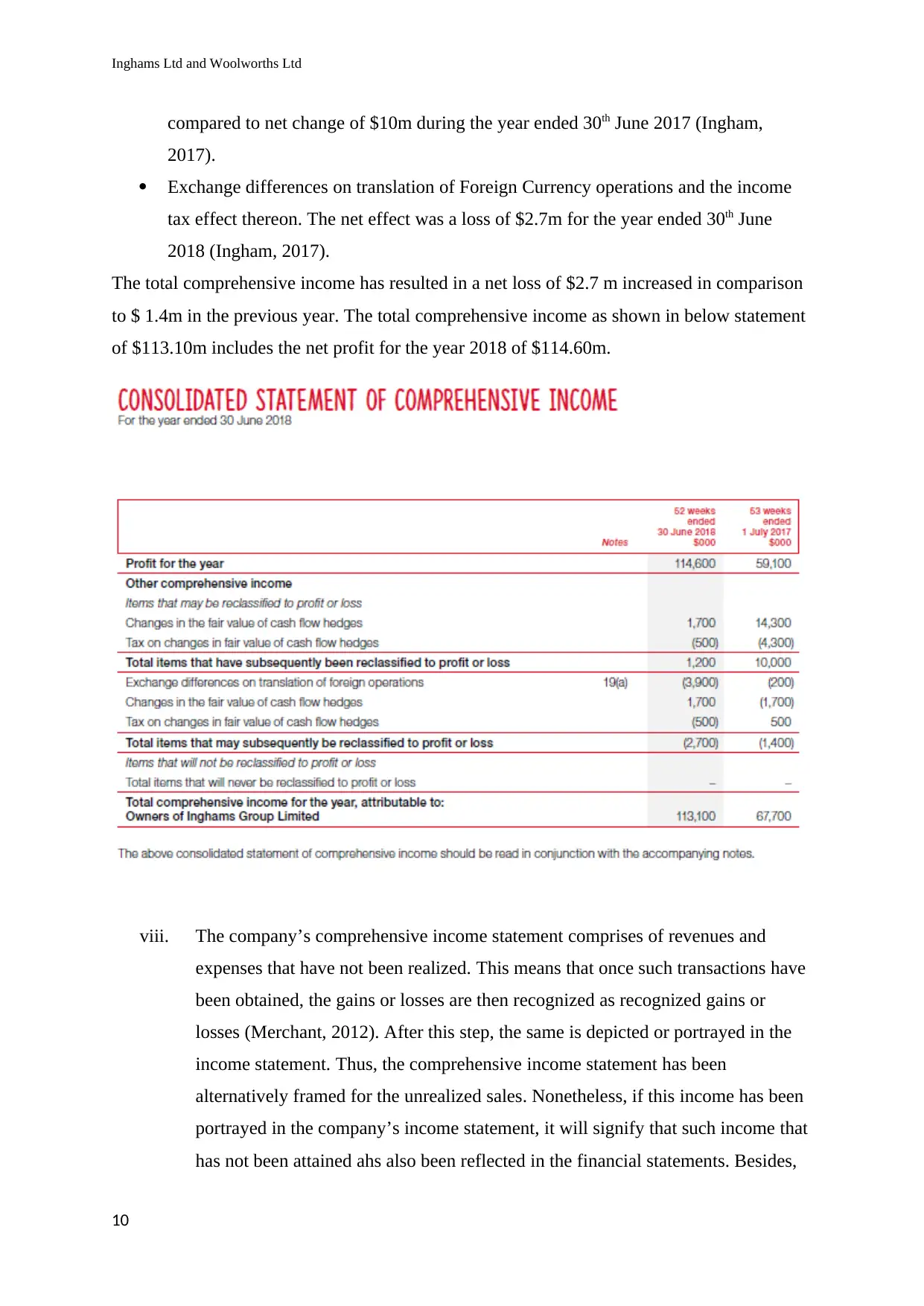

vii. The following items have been reported in Comprehensive Income Statement of

Inghams Group Limited:

The changes in fair value of cash flow hedges and income tax thereon on the amount

of change which amounted to a net of $ 1.2 m during the year ended 30th June 2018 as

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

compared to net change of $10m during the year ended 30th June 2017 (Ingham,

2017).

Exchange differences on translation of Foreign Currency operations and the income

tax effect thereon. The net effect was a loss of $2.7m for the year ended 30th June

2018 (Ingham, 2017).

The total comprehensive income has resulted in a net loss of $2.7 m increased in comparison

to $ 1.4m in the previous year. The total comprehensive income as shown in below statement

of $113.10m includes the net profit for the year 2018 of $114.60m.

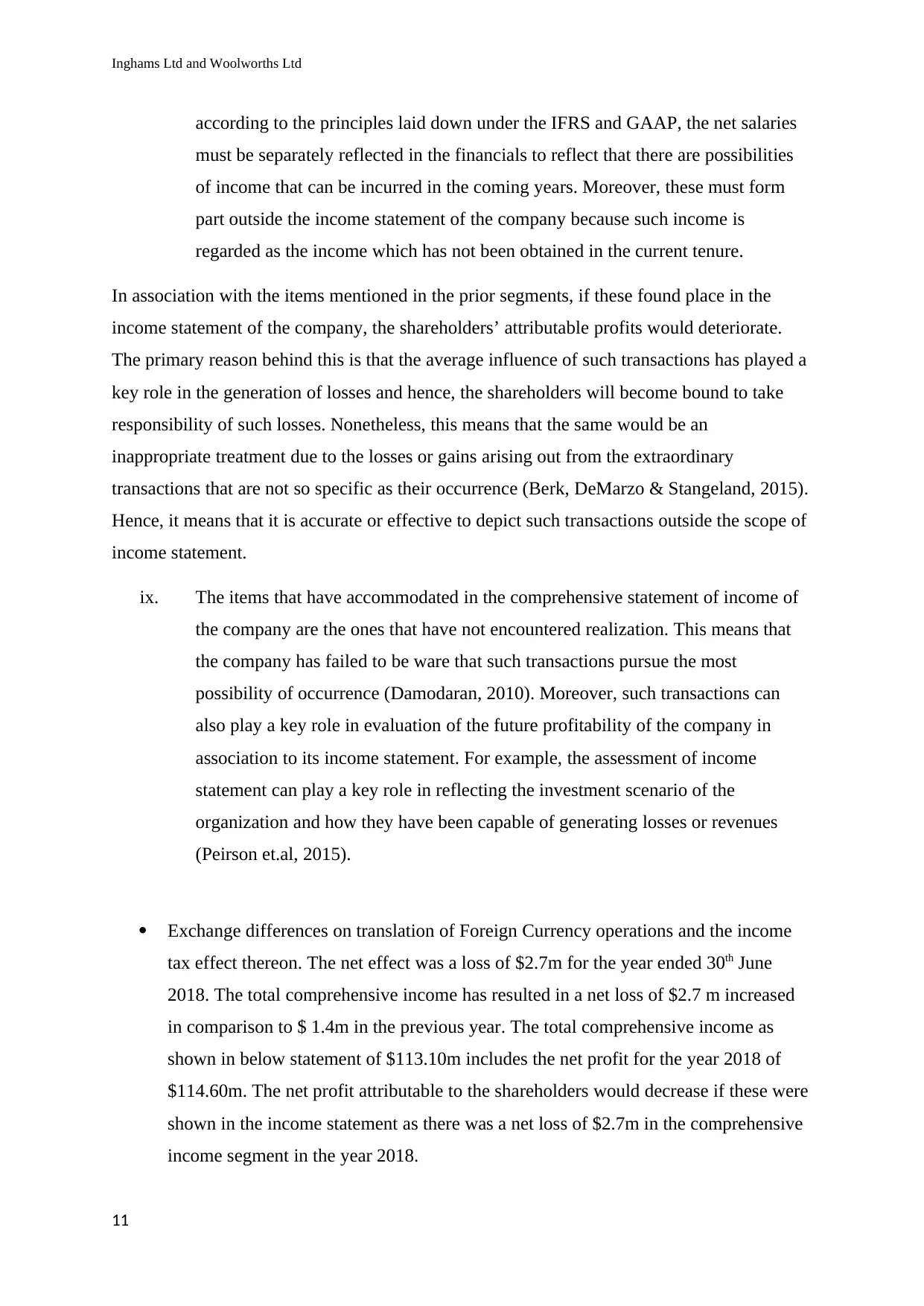

viii. The company’s comprehensive income statement comprises of revenues and

expenses that have not been realized. This means that once such transactions have

been obtained, the gains or losses are then recognized as recognized gains or

losses (Merchant, 2012). After this step, the same is depicted or portrayed in the

income statement. Thus, the comprehensive income statement has been

alternatively framed for the unrealized sales. Nonetheless, if this income has been

portrayed in the company’s income statement, it will signify that such income that

has not been attained ahs also been reflected in the financial statements. Besides,

10

Paraphrase This Document

according to the principles laid down under the IFRS and GAAP, the net salaries

must be separately reflected in the financials to reflect that there are possibilities

of income that can be incurred in the coming years. Moreover, these must form

part outside the income statement of the company because such income is

regarded as the income which has not been obtained in the current tenure.

In association with the items mentioned in the prior segments, if these found place in the

income statement of the company, the shareholders’ attributable profits would deteriorate.

The primary reason behind this is that the average influence of such transactions has played a

key role in the generation of losses and hence, the shareholders will become bound to take

responsibility of such losses. Nonetheless, this means that the same would be an

inappropriate treatment due to the losses or gains arising out from the extraordinary

transactions that are not so specific as their occurrence (Berk, DeMarzo & Stangeland, 2015).

Hence, it means that it is accurate or effective to depict such transactions outside the scope of

income statement.

ix. The items that have accommodated in the comprehensive statement of income of

the company are the ones that have not encountered realization. This means that

the company has failed to be ware that such transactions pursue the most

possibility of occurrence (Damodaran, 2010). Moreover, such transactions can

also play a key role in evaluation of the future profitability of the company in

association to its income statement. For example, the assessment of income

statement can play a key role in reflecting the investment scenario of the

organization and how they have been capable of generating losses or revenues

(Peirson et.al, 2015).

Exchange differences on translation of Foreign Currency operations and the income

tax effect thereon. The net effect was a loss of $2.7m for the year ended 30th June

2018. The total comprehensive income has resulted in a net loss of $2.7 m increased

in comparison to $ 1.4m in the previous year. The total comprehensive income as

shown in below statement of $113.10m includes the net profit for the year 2018 of

$114.60m. The net profit attributable to the shareholders would decrease if these were

shown in the income statement as there was a net loss of $2.7m in the comprehensive

income segment in the year 2018.

11

As the company is not certain about the happening or realisation of the

comprehensive income, these are not shown in the Income Statement. But these

information are usually analysed by the analysts to judge the overall performance of

the company. So, it may be said that it may evaluate the performance of the managers

of the company as well.

Accounting for corporate income related tax

(x)

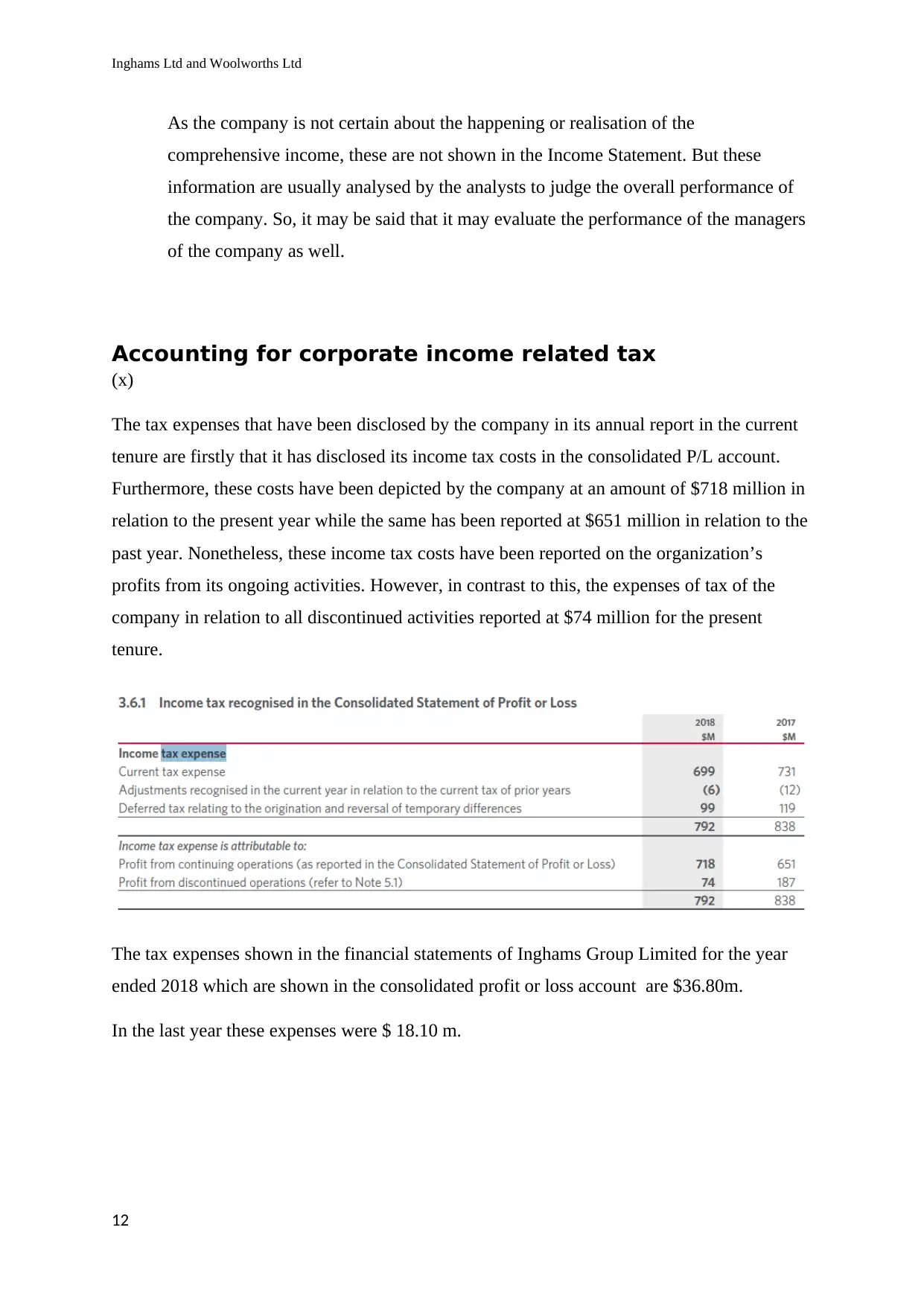

The tax expenses that have been disclosed by the company in its annual report in the current

tenure are firstly that it has disclosed its income tax costs in the consolidated P/L account.

Furthermore, these costs have been depicted by the company at an amount of $718 million in

relation to the present year while the same has been reported at $651 million in relation to the

past year. Nonetheless, these income tax costs have been reported on the organization’s

profits from its ongoing activities. However, in contrast to this, the expenses of tax of the

company in relation to all discontinued activities reported at $74 million for the present

tenure.

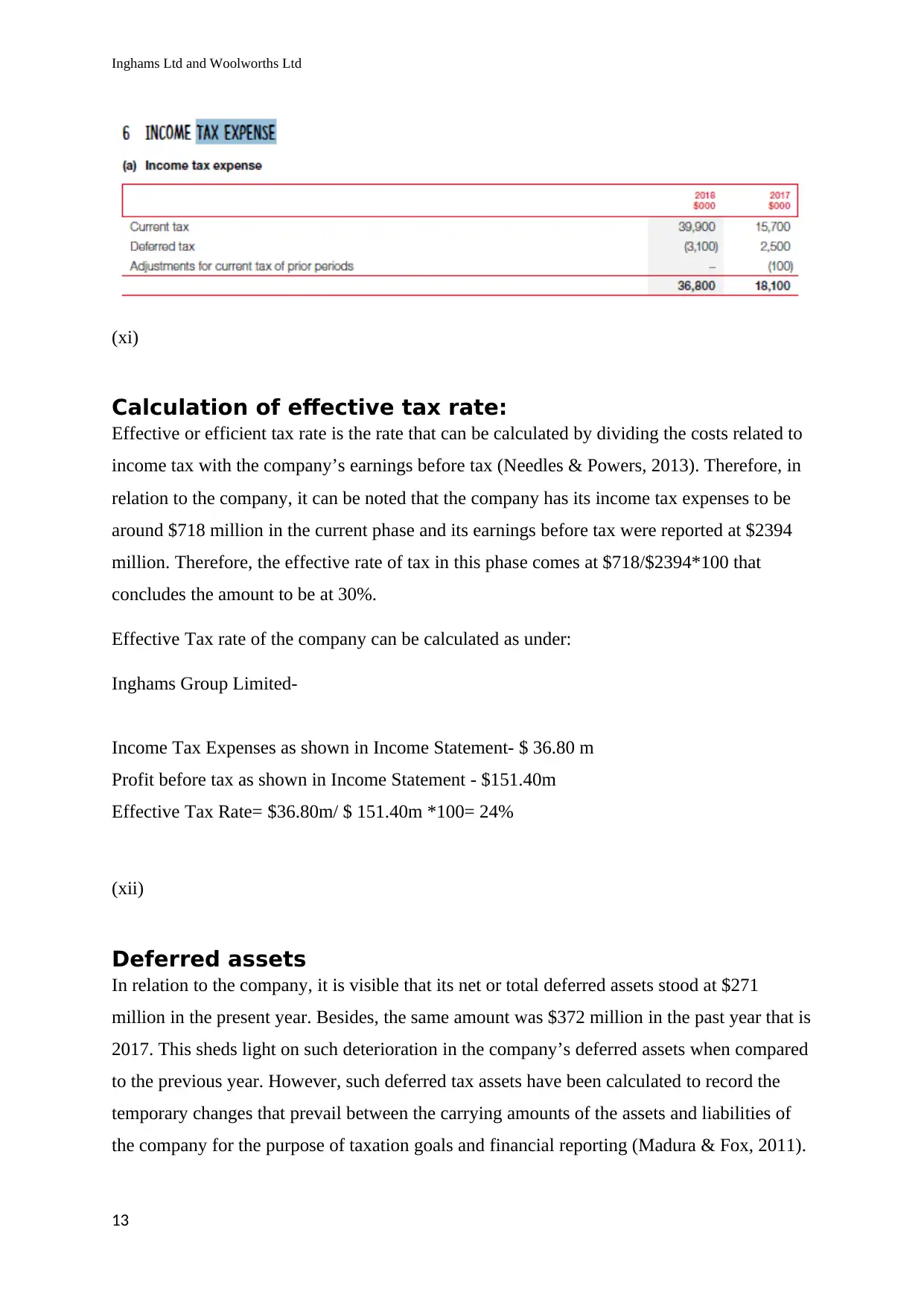

The tax expenses shown in the financial statements of Inghams Group Limited for the year

ended 2018 which are shown in the consolidated profit or loss account are $36.80m.

In the last year these expenses were $ 18.10 m.

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

(xi)

Calculation of effective tax rate:

Effective or efficient tax rate is the rate that can be calculated by dividing the costs related to

income tax with the company’s earnings before tax (Needles & Powers, 2013). Therefore, in

relation to the company, it can be noted that the company has its income tax expenses to be

around $718 million in the current phase and its earnings before tax were reported at $2394

million. Therefore, the effective rate of tax in this phase comes at $718/$2394*100 that

concludes the amount to be at 30%.

Effective Tax rate of the company can be calculated as under:

Inghams Group Limited-

Income Tax Expenses as shown in Income Statement- $ 36.80 m

Profit before tax as shown in Income Statement - $151.40m

Effective Tax Rate= $36.80m/ $ 151.40m *100= 24%

(xii)

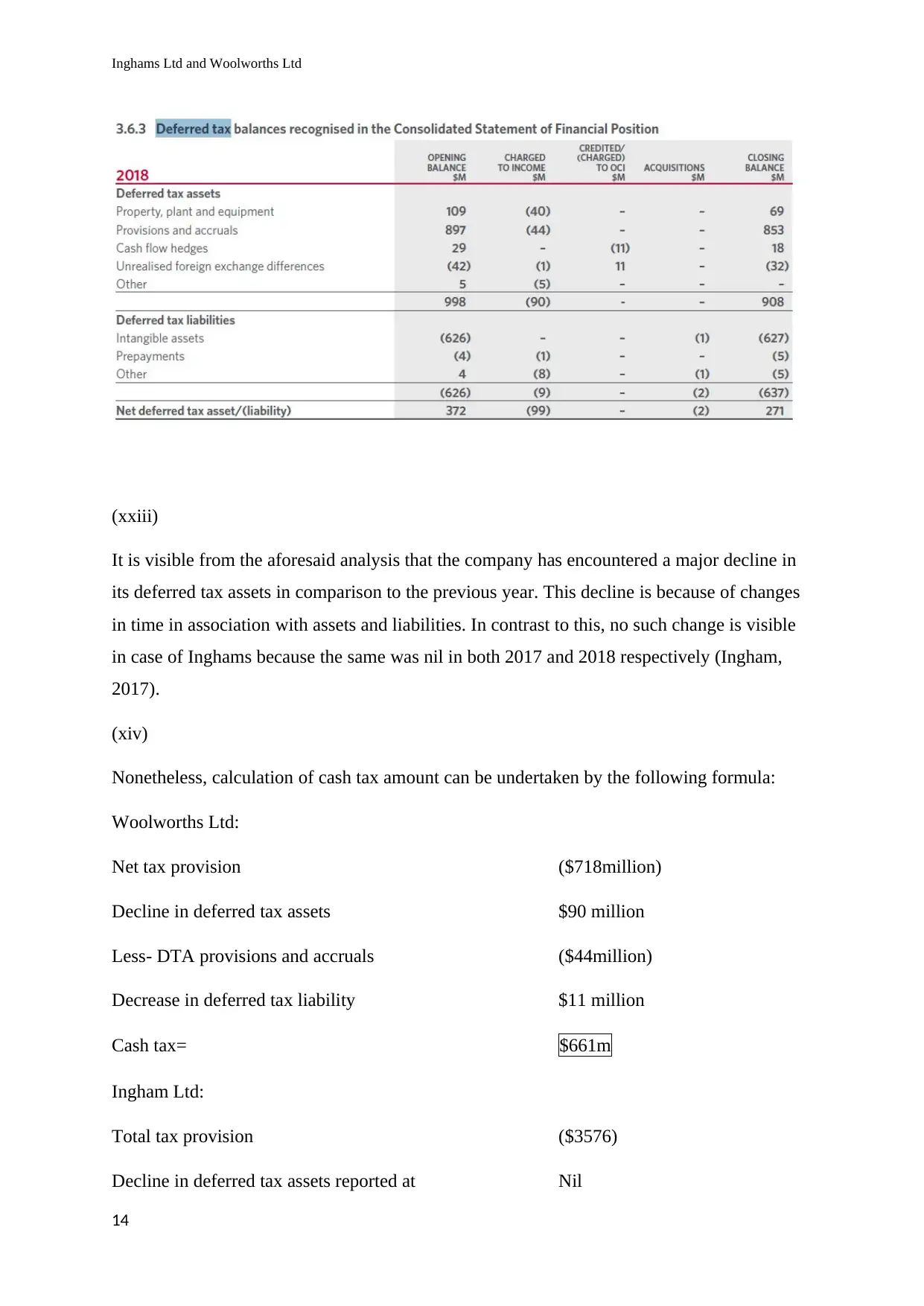

Deferred assets

In relation to the company, it is visible that its net or total deferred assets stood at $271

million in the present year. Besides, the same amount was $372 million in the past year that is

2017. This sheds light on such deterioration in the company’s deferred assets when compared

to the previous year. However, such deferred tax assets have been calculated to record the

temporary changes that prevail between the carrying amounts of the assets and liabilities of

the company for the purpose of taxation goals and financial reporting (Madura & Fox, 2011).

13

Paraphrase This Document

(xxiii)

It is visible from the aforesaid analysis that the company has encountered a major decline in

its deferred tax assets in comparison to the previous year. This decline is because of changes

in time in association with assets and liabilities. In contrast to this, no such change is visible

in case of Inghams because the same was nil in both 2017 and 2018 respectively (Ingham,

2017).

(xiv)

Nonetheless, calculation of cash tax amount can be undertaken by the following formula:

Woolworths Ltd:

Net tax provision ($718million)

Decline in deferred tax assets $90 million

Less- DTA provisions and accruals ($44million)

Decrease in deferred tax liability $11 million

Cash tax= $661m

Ingham Ltd:

Total tax provision ($3576)

Decline in deferred tax assets reported at Nil

14

Less- DTA provisions and accruals Nil

Decline in deferred tax liability Nil

Cash tax= $3576

(xv) In relation to the aforesaid analysis, cash rate of tax can be calculated by dividing the

cash tax by earnings before tax. Inghams has reported such amount at thirty percent but

Woolworths pursues an effective tax rate of 27.61% that can be obtained by dividing cash tax

by earnings before tax. In this phase, Inghams is in a better scenario than the former.

In order to calculate the cash tax amount, we shall use:

book tax amount,

changes in deferred tax assets and deferred tax liabilities

For Inghams Group Limited, cash tax shall be :

Total Tax Provision as per Company’s Income Statement – ($36.8m)

(Increase)/Decrease in Deferred Tax Liability - $2.2m

Cash Tax Amount $34.6m

Cash tax is paid to the government bodies and must form part in the income tax return of

companies. Besides, such amounts are used by every stakeholders of the company for their

own benefits so that organizational performance can be attained (Arnold, 2010). Further, the

deferred tax assets and liabilities are also reported in the financials that assist in ascertaining

the actual tax payable by the company. Nevertheless, the company has reflected its income

tax liability in its annual report even if the same can be transacted in future. Overall, cash and

book tax are different because of deferred tax assets and liabilities together with all

provisions established for income tax liabilities forming part of the financials (Davies &

Crawford, 2012).

Cash Tax Rate

Cash Tax Rate can be calculated in the same manner as effective tax rate, but in place of

income tax expense we shall take the cash tax amount:

Inghams Group Limited-

15

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Cash Tax amount- $ 34.60 m

Profit before tax as shown in Income Statement - $151.40m

Effective Tax Rate= $34.60m/ $ 151.40m *100= 22.85%

(xvi) The cash tax and the book tax of the company are different due to the effect of

deferred tax liabilities that have been considered while calculating the cash tax amount

(Gowthrope, 2011).

16

Paraphrase This Document

References

Arnold, G. (2010). The Financial Times Guide to Investing. Prentice Hall.

Banbura, M., Giannone, D. and Lenza, M. (2015). Conditional forecasts and scenario

analysis with vector autoregressions for large cross-sections. International Journal of

Forecasting, 31(3), pp.739-756. Retrieved from:

https://www.ecb.europa.eu/pub/pdf/scpwps/ecbwp1733.pdf?

34d83c4b9cc14af18001108a69abb1c3

Berk, J., DeMarzo, P. and Stangeland, D. (2015). Corporate Finance. Canadian Toronto:

Pearson Canada.

Damodaran, A. (2010). Applied Corporate Finance: A User’s Manual. New York: John

Wiley & Sons

Damodaran, A. (2012). Investment Valuation. New York: John Wiley & Sons.

Davies, T., and Crawford, I. (2012). Financial accounting. Harlow, England: Pearson.

Gowthrope, C. (2011). Business accounting and finance for non specialists (3rd ed.). South

Western

Jagannathan, R., Meier, I., Tarhan, V. (2011). The Cross Section of Hurdle Rates for Capital

Budgeting: An Empirical Analysis of Survey Data. Unpublished Working Paper.

Northwestern University.

Ingham. (2017). Ingham 2017 annual report & accounts 2017. Retrieved from:

http://investors.inghams.com.au/FormBuilder/_Resource/_module/11sM2pu-

rkuf_aNBmyFnWw/file/ING-FY17-Annual-Report.pdf

Madura, R., & Fox, J. (2011). International financial management (2nd ed.). South Western

Merchant, K. A. (2012). Making Management Accounting Research More Useful. Pacific

Accounting Review, 24(3), 1-34. Doi: https://doi.org/10.1108/01140581211283904

Needles, B.E., & Powers, M. (2013). Principles of Financial Accounting. Financial

Accounting Series: Cengage Learning.

Peirson, G., Brown, R., Easton, S., Howard, P & Pinder, S. (2015). Business FinanceNorth

Ryde: McGraw-Hill Australia.

17

Woolworths limited. (2017). Woolworths limited Annual Report and accounts 2017. [online]

Retrieved from:

http://www.woolworthslimited.com.au/icms_docs/182381_Annual_Report_2017.pdf

18

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

© 2024 | Zucol Services PVT LTD | All rights reserved.