Financial Reports: Income Statement and Balance Sheet Analysis

VerifiedAdded on 2021/02/19

|10

|2084

|109

Report

AI Summary

This report delves into the preparation and analysis of financial statements, crucial for understanding a company's financial performance. It covers the creation of income statements, balance sheets, and cash flow statements, essential components for assessing a company's profitability, financial position, and cash flow activities. The report includes practical examples from Twinkle Toes Shoe Shop and Brisbane Camping World, demonstrating the application of accounting principles and the interpretation of financial data. It explores key financial concepts such as assets, liabilities, owner's equity, and the use of general ledgers. The report emphasizes the importance of financial statement analysis for predicting future performance, identifying potential issues, and making informed business decisions, supported by references to relevant academic literature.

Financial Reports

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

Preparation of income statement and balance sheet Twinkle Toes Shoe Shop:.....................1

Preparation of financial statements of Brisbane Camping World:.........................................4

CONCLUSION................................................................................................................................7

REFERENCES................................................................................................................................8

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

Preparation of income statement and balance sheet Twinkle Toes Shoe Shop:.....................1

Preparation of financial statements of Brisbane Camping World:.........................................4

CONCLUSION................................................................................................................................7

REFERENCES................................................................................................................................8

INTRODUCTION

The financial statements show the net outcomes for the specified year in the preparing of

a company's final accounts. They play an important role in enabling a user to comprehend a

company's outcomes for a specified year. A financial statement is indeed a official document of a

company, individual, or any other entity's economic operations and status. It is submitted in an

simple-to-understand and organized way. The primary aim of the evaluation of a financial

statements is to use data on the business's preceding performance in order to anticipate how it is

possible in the near future. A further significant aim of the financial reports assessment is to

define and configure prospective issue regions. As financial statements are ready to satisfy

demands, the 2nd stage of the process is to efficiently evaluate them in order to predict future

productivity and cash flows (Cadman, Rusticus and Sunder, 2013). The report studies about

practical implication of steps applied in preparation of final accounts viz. Income statements,

balance sheet, cash flow analysis and other necessary records.

MAIN BODY

Preparation of income statement and balance sheet Twinkle Toes Shoe Shop:

Financial statements: These may be defined as written records that provides details about the

business transactions (only monetary transactions) and financial performances of a company. In

listed and big organisation which is not listed, there is requirement to do audit by various Govt.

agencies and other regulatory bodies to determine that these financial statements gives true

picture or not (Dyreng, Mayew and Williams, 2012). for various class of organisation different

different format for preparing the financial statements are given, therefore, it is required to

prepare such financial statements according to applicable laws. Financial statements of an

organisation includes following reports:

Profit and loss account

Balance sheet

cash flow statement

Changes in the equity

Notes on account

1

The financial statements show the net outcomes for the specified year in the preparing of

a company's final accounts. They play an important role in enabling a user to comprehend a

company's outcomes for a specified year. A financial statement is indeed a official document of a

company, individual, or any other entity's economic operations and status. It is submitted in an

simple-to-understand and organized way. The primary aim of the evaluation of a financial

statements is to use data on the business's preceding performance in order to anticipate how it is

possible in the near future. A further significant aim of the financial reports assessment is to

define and configure prospective issue regions. As financial statements are ready to satisfy

demands, the 2nd stage of the process is to efficiently evaluate them in order to predict future

productivity and cash flows (Cadman, Rusticus and Sunder, 2013). The report studies about

practical implication of steps applied in preparation of final accounts viz. Income statements,

balance sheet, cash flow analysis and other necessary records.

MAIN BODY

Preparation of income statement and balance sheet Twinkle Toes Shoe Shop:

Financial statements: These may be defined as written records that provides details about the

business transactions (only monetary transactions) and financial performances of a company. In

listed and big organisation which is not listed, there is requirement to do audit by various Govt.

agencies and other regulatory bodies to determine that these financial statements gives true

picture or not (Dyreng, Mayew and Williams, 2012). for various class of organisation different

different format for preparing the financial statements are given, therefore, it is required to

prepare such financial statements according to applicable laws. Financial statements of an

organisation includes following reports:

Profit and loss account

Balance sheet

cash flow statement

Changes in the equity

Notes on account

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

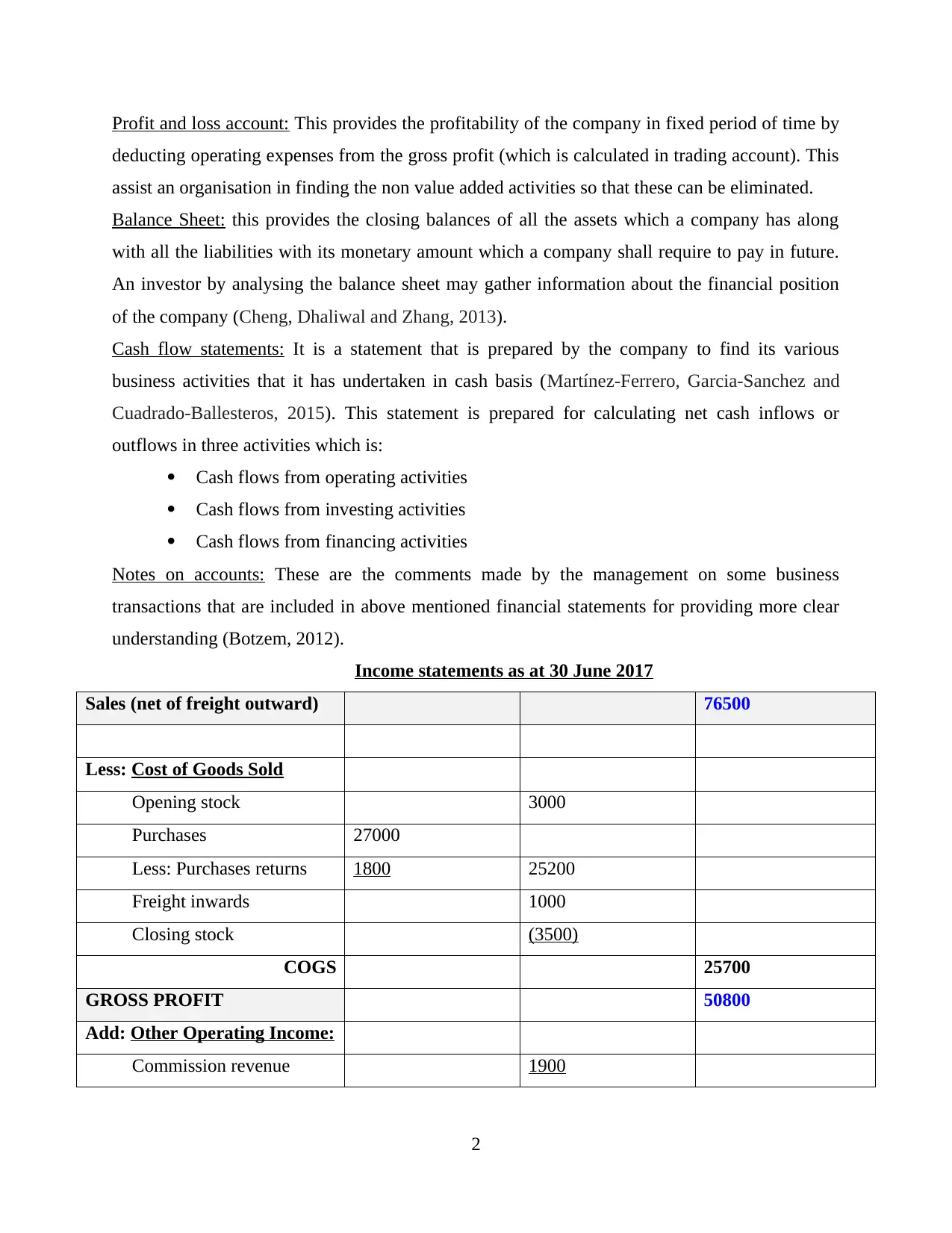

Profit and loss account: This provides the profitability of the company in fixed period of time by

deducting operating expenses from the gross profit (which is calculated in trading account). This

assist an organisation in finding the non value added activities so that these can be eliminated.

Balance Sheet: this provides the closing balances of all the assets which a company has along

with all the liabilities with its monetary amount which a company shall require to pay in future.

An investor by analysing the balance sheet may gather information about the financial position

of the company (Cheng, Dhaliwal and Zhang, 2013).

Cash flow statements: It is a statement that is prepared by the company to find its various

business activities that it has undertaken in cash basis (Martínez‐Ferrero, Garcia‐Sanchez and

Cuadrado‐Ballesteros, 2015). This statement is prepared for calculating net cash inflows or

outflows in three activities which is:

Cash flows from operating activities

Cash flows from investing activities

Cash flows from financing activities

Notes on accounts: These are the comments made by the management on some business

transactions that are included in above mentioned financial statements for providing more clear

understanding (Botzem, 2012).

Income statements as at 30 June 2017

Sales (net of freight outward) 76500

Less: Cost of Goods Sold

Opening stock 3000

Purchases 27000

Less: Purchases returns 1800 25200

Freight inwards 1000

Closing stock (3500)

COGS 25700

GROSS PROFIT 50800

Add: Other Operating Income:

Commission revenue 1900

2

deducting operating expenses from the gross profit (which is calculated in trading account). This

assist an organisation in finding the non value added activities so that these can be eliminated.

Balance Sheet: this provides the closing balances of all the assets which a company has along

with all the liabilities with its monetary amount which a company shall require to pay in future.

An investor by analysing the balance sheet may gather information about the financial position

of the company (Cheng, Dhaliwal and Zhang, 2013).

Cash flow statements: It is a statement that is prepared by the company to find its various

business activities that it has undertaken in cash basis (Martínez‐Ferrero, Garcia‐Sanchez and

Cuadrado‐Ballesteros, 2015). This statement is prepared for calculating net cash inflows or

outflows in three activities which is:

Cash flows from operating activities

Cash flows from investing activities

Cash flows from financing activities

Notes on accounts: These are the comments made by the management on some business

transactions that are included in above mentioned financial statements for providing more clear

understanding (Botzem, 2012).

Income statements as at 30 June 2017

Sales (net of freight outward) 76500

Less: Cost of Goods Sold

Opening stock 3000

Purchases 27000

Less: Purchases returns 1800 25200

Freight inwards 1000

Closing stock (3500)

COGS 25700

GROSS PROFIT 50800

Add: Other Operating Income:

Commission revenue 1900

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Total Operating Income 52700

Less: Operating Expenses

Depreciation on building 10000

Depreciation on motor

vehicles 4800

Doubtful debts

Telephone 4150

Bad debts

Insurance 4500

Office expenses 650

Discount expenses 200

Total Expenses 24300

Net Profit 28400

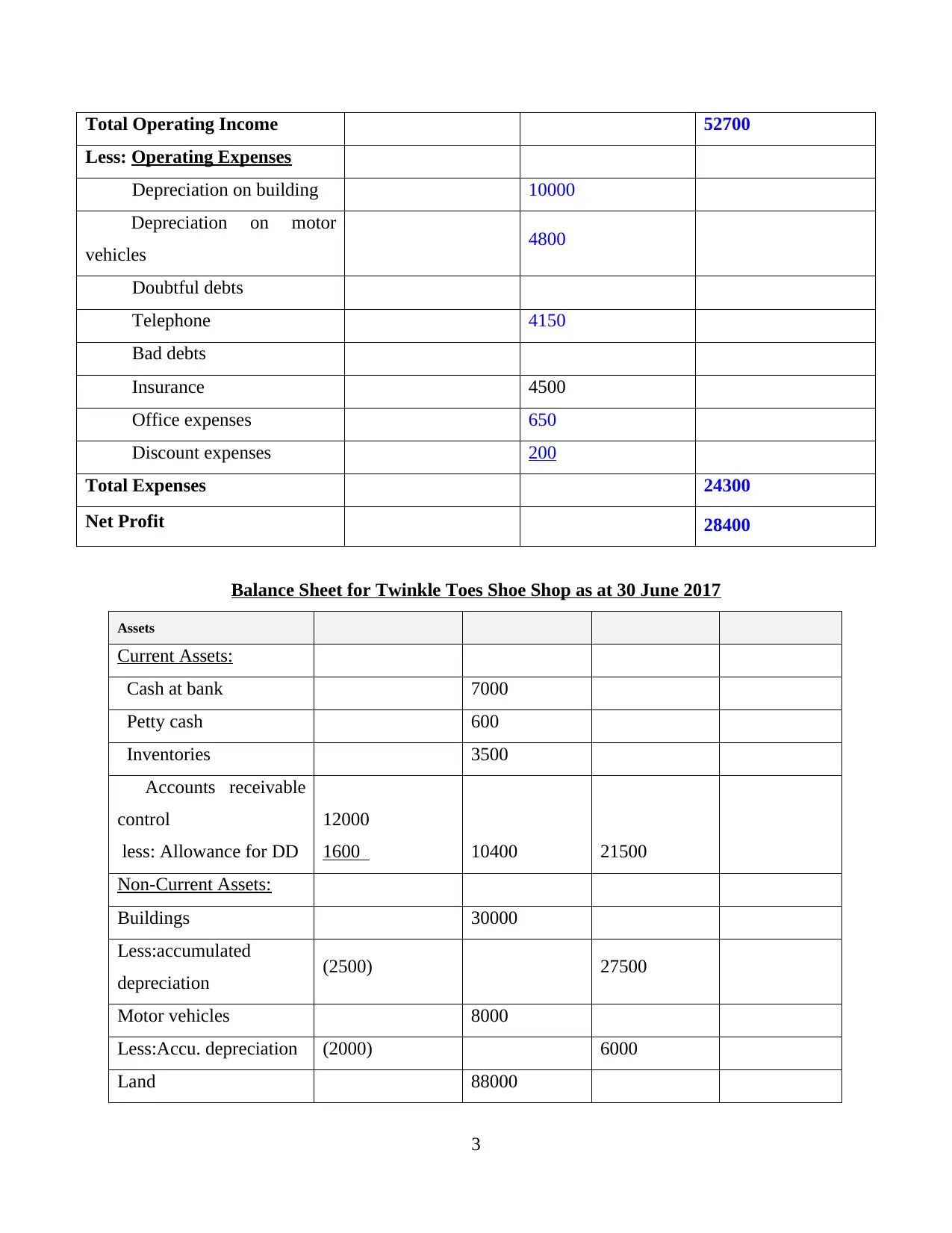

Balance Sheet for Twinkle Toes Shoe Shop as at 30 June 2017

Assets

Current Assets:

Cash at bank 7000

Petty cash 600

Inventories 3500

Accounts receivable

control

less: Allowance for DD

12000

1600 10400 21500

Non-Current Assets:

Buildings 30000

Less:accumulated

depreciation (2500) 27500

Motor vehicles 8000

Less:Accu. depreciation (2000) 6000

Land 88000

3

Less: Operating Expenses

Depreciation on building 10000

Depreciation on motor

vehicles 4800

Doubtful debts

Telephone 4150

Bad debts

Insurance 4500

Office expenses 650

Discount expenses 200

Total Expenses 24300

Net Profit 28400

Balance Sheet for Twinkle Toes Shoe Shop as at 30 June 2017

Assets

Current Assets:

Cash at bank 7000

Petty cash 600

Inventories 3500

Accounts receivable

control

less: Allowance for DD

12000

1600 10400 21500

Non-Current Assets:

Buildings 30000

Less:accumulated

depreciation (2500) 27500

Motor vehicles 8000

Less:Accu. depreciation (2000) 6000

Land 88000

3

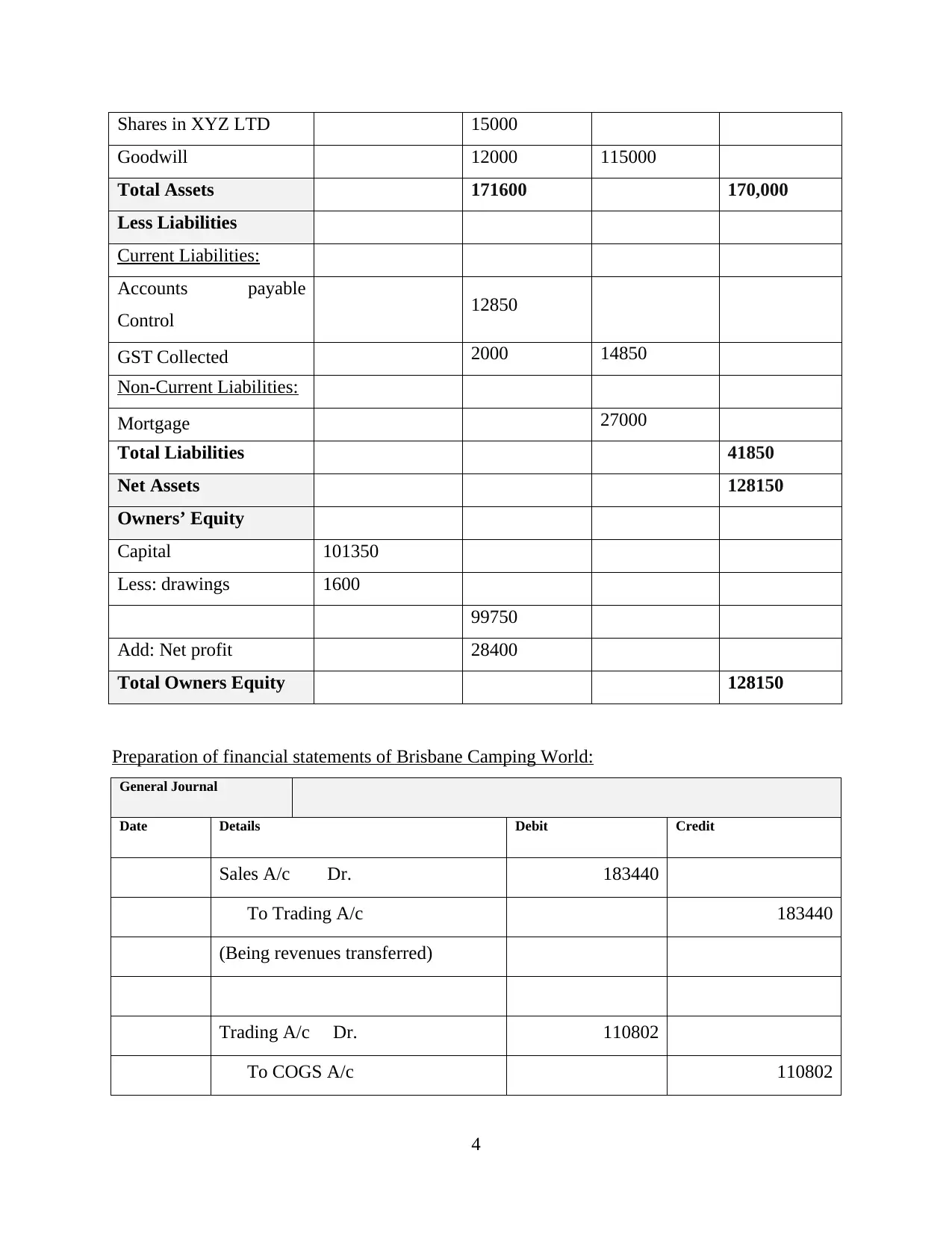

Shares in XYZ LTD 15000

Goodwill 12000 115000

Total Assets 171600 170,000

Less Liabilities

Current Liabilities:

Accounts payable

Control 12850

GST Collected 2000 14850

Non-Current Liabilities:

Mortgage 27000

Total Liabilities 41850

Net Assets 128150

Owners’ Equity

Capital 101350

Less: drawings 1600

99750

Add: Net profit 28400

Total Owners Equity 128150

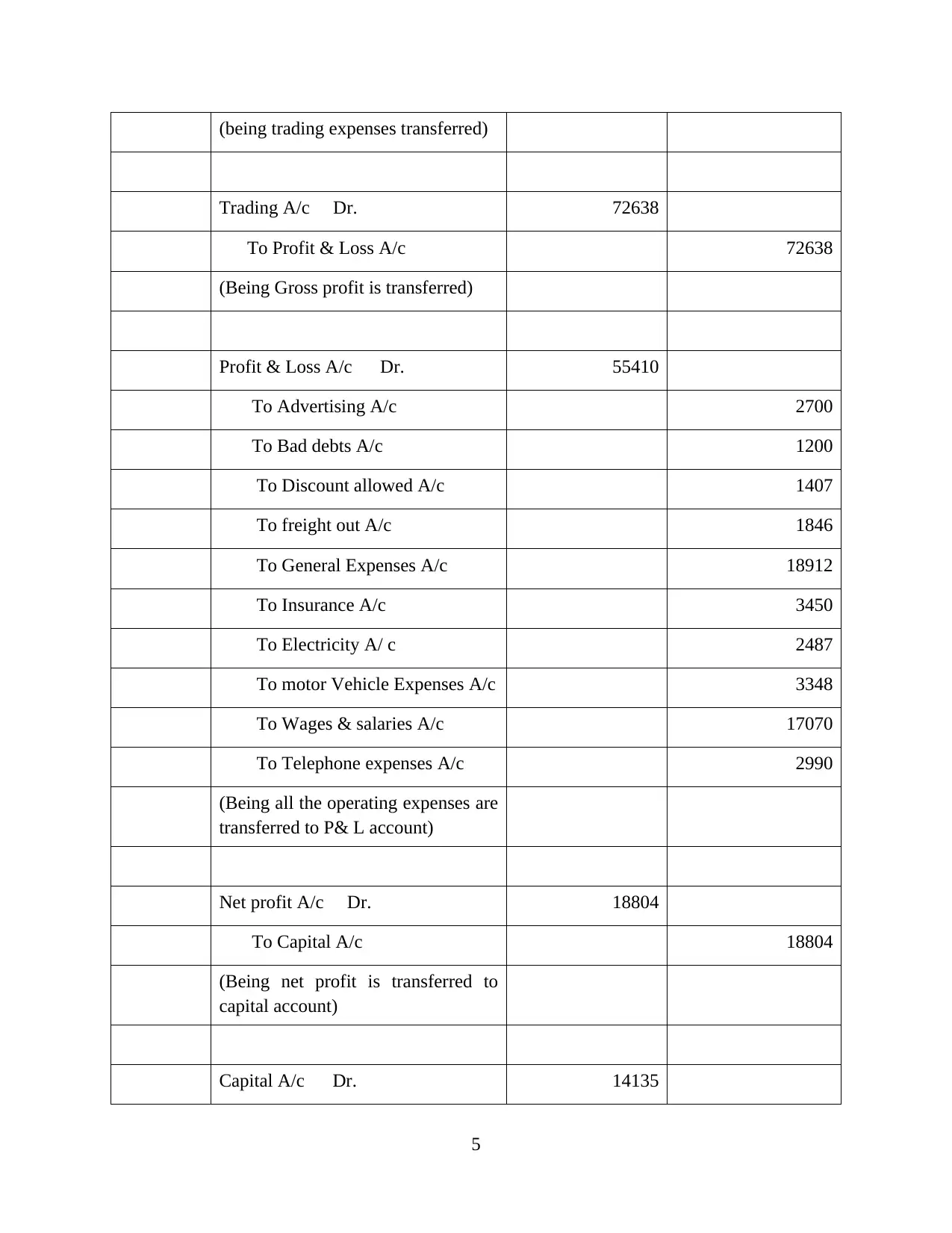

Preparation of financial statements of Brisbane Camping World:

General Journal

Date Details Debit Credit

Sales A/c Dr. 183440

To Trading A/c 183440

(Being revenues transferred)

Trading A/c Dr. 110802

To COGS A/c 110802

4

Goodwill 12000 115000

Total Assets 171600 170,000

Less Liabilities

Current Liabilities:

Accounts payable

Control 12850

GST Collected 2000 14850

Non-Current Liabilities:

Mortgage 27000

Total Liabilities 41850

Net Assets 128150

Owners’ Equity

Capital 101350

Less: drawings 1600

99750

Add: Net profit 28400

Total Owners Equity 128150

Preparation of financial statements of Brisbane Camping World:

General Journal

Date Details Debit Credit

Sales A/c Dr. 183440

To Trading A/c 183440

(Being revenues transferred)

Trading A/c Dr. 110802

To COGS A/c 110802

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

(being trading expenses transferred)

Trading A/c Dr. 72638

To Profit & Loss A/c 72638

(Being Gross profit is transferred)

Profit & Loss A/c Dr. 55410

To Advertising A/c 2700

To Bad debts A/c 1200

To Discount allowed A/c 1407

To freight out A/c 1846

To General Expenses A/c 18912

To Insurance A/c 3450

To Electricity A/ c 2487

To motor Vehicle Expenses A/c 3348

To Wages & salaries A/c 17070

To Telephone expenses A/c 2990

(Being all the operating expenses are

transferred to P& L account)

Net profit A/c Dr. 18804

To Capital A/c 18804

(Being net profit is transferred to

capital account)

Capital A/c Dr. 14135

5

Trading A/c Dr. 72638

To Profit & Loss A/c 72638

(Being Gross profit is transferred)

Profit & Loss A/c Dr. 55410

To Advertising A/c 2700

To Bad debts A/c 1200

To Discount allowed A/c 1407

To freight out A/c 1846

To General Expenses A/c 18912

To Insurance A/c 3450

To Electricity A/ c 2487

To motor Vehicle Expenses A/c 3348

To Wages & salaries A/c 17070

To Telephone expenses A/c 2990

(Being all the operating expenses are

transferred to P& L account)

Net profit A/c Dr. 18804

To Capital A/c 18804

(Being net profit is transferred to

capital account)

Capital A/c Dr. 14135

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

To Drawings A/C 14135

(Being drawing is transferred into

capital account )

455229 455229

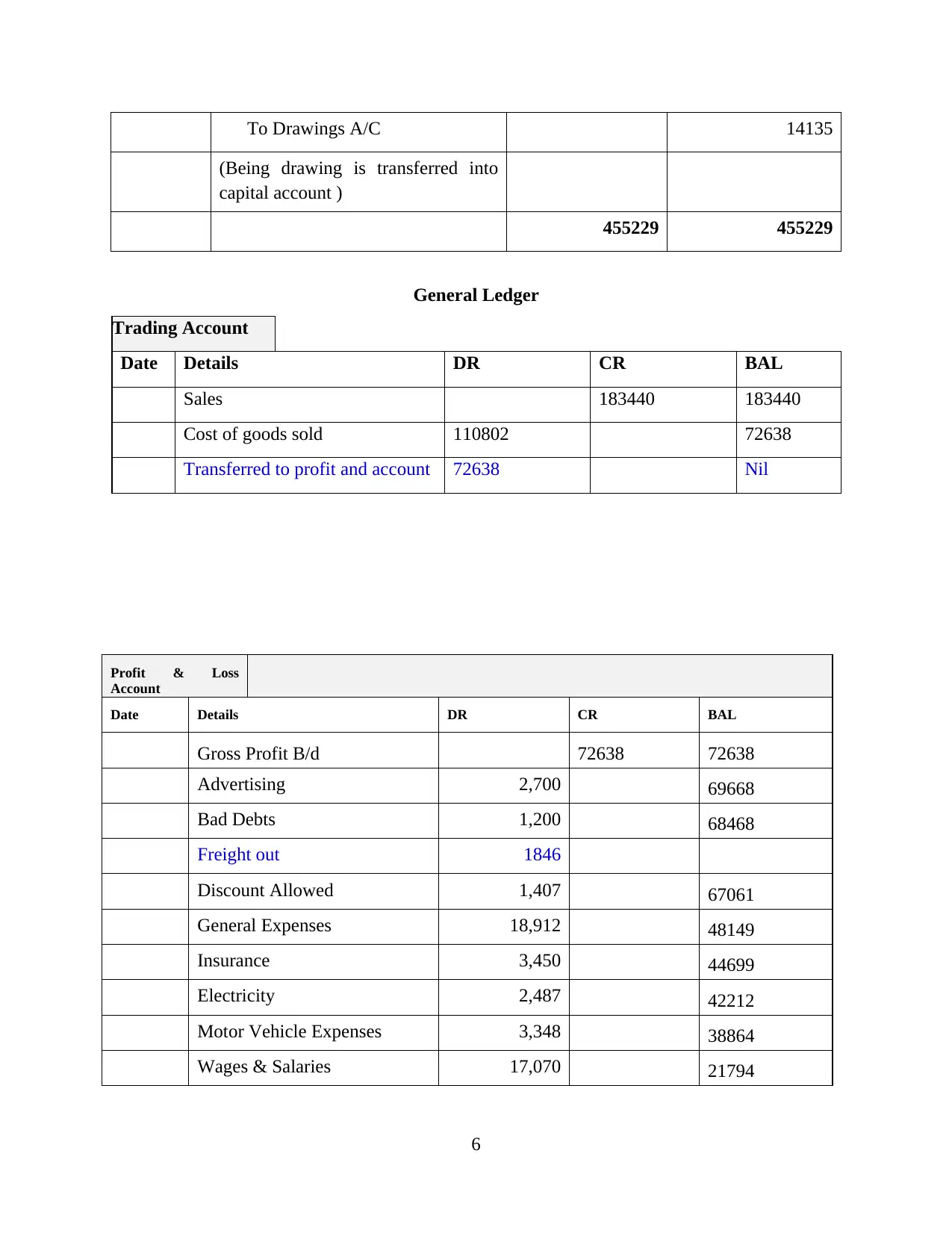

General Ledger

Trading Account

Date Details DR CR BAL

Sales 183440 183440

Cost of goods sold 110802 72638

Transferred to profit and account 72638 Nil

Profit & Loss

Account

Date Details DR CR BAL

Gross Profit B/d 72638 72638

Advertising 2,700 69668

Bad Debts 1,200 68468

Freight out 1846

Discount Allowed 1,407 67061

General Expenses 18,912 48149

Insurance 3,450 44699

Electricity 2,487 42212

Motor Vehicle Expenses 3,348 38864

Wages & Salaries 17,070 21794

6

(Being drawing is transferred into

capital account )

455229 455229

General Ledger

Trading Account

Date Details DR CR BAL

Sales 183440 183440

Cost of goods sold 110802 72638

Transferred to profit and account 72638 Nil

Profit & Loss

Account

Date Details DR CR BAL

Gross Profit B/d 72638 72638

Advertising 2,700 69668

Bad Debts 1,200 68468

Freight out 1846

Discount Allowed 1,407 67061

General Expenses 18,912 48149

Insurance 3,450 44699

Electricity 2,487 42212

Motor Vehicle Expenses 3,348 38864

Wages & Salaries 17,070 21794

6

Telephone Expenses 2,990 17228

Net profit transferred to

capital account

17228 NIL

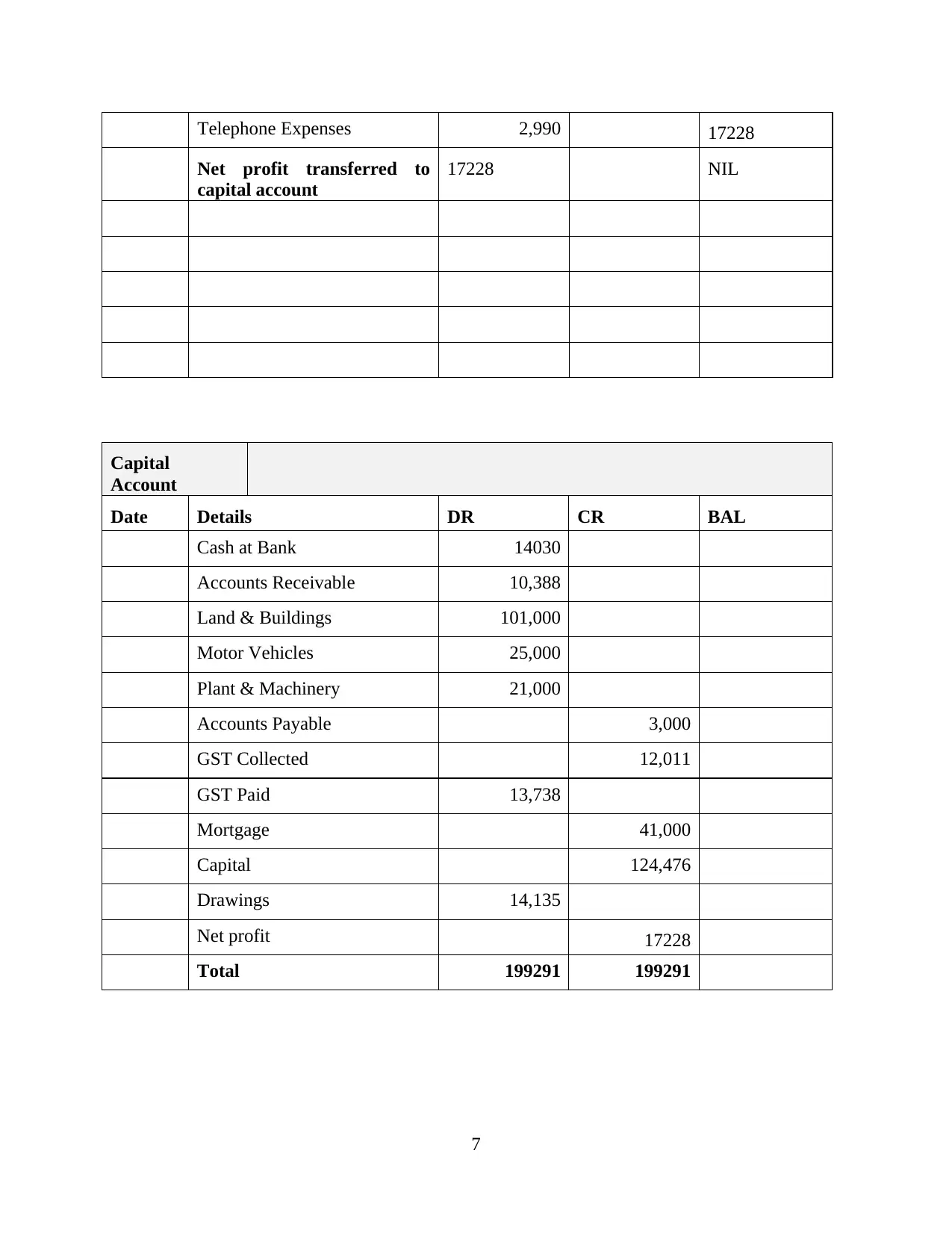

Capital

Account

Date Details DR CR BAL

Cash at Bank 14030

Accounts Receivable 10,388

Land & Buildings 101,000

Motor Vehicles 25,000

Plant & Machinery 21,000

Accounts Payable 3,000

GST Collected 12,011

GST Paid 13,738

Mortgage 41,000

Capital 124,476

Drawings 14,135

Net profit 17228

Total 199291 199291

7

Net profit transferred to

capital account

17228 NIL

Capital

Account

Date Details DR CR BAL

Cash at Bank 14030

Accounts Receivable 10,388

Land & Buildings 101,000

Motor Vehicles 25,000

Plant & Machinery 21,000

Accounts Payable 3,000

GST Collected 12,011

GST Paid 13,738

Mortgage 41,000

Capital 124,476

Drawings 14,135

Net profit 17228

Total 199291 199291

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

CONCLUSION

From the above report it is concluded that company has to prepare its financial statements

to represent its financial transactions in such a way that it may be understandable to the various

users of financial statements. Further while preparing the income statements of an business

organisation, such company is required to follow prescribed format as applicable to that

company as per the its regulatory requirements. It is mandatory for any business organisation to

prepare its balance sheet in such a way that it gives true and fair view of its state of affairs. It is

further concluded that various ledger accounts shall be required to prepared because it assist the

company in preparing its financial statements. Company shall recognises the need of audit of its

financial statement if regulatory framework provides such requirements upon such company.

REFERENCES

Books and Journal:

Dyreng, S.D., Mayew, W.J. and Williams, C.D., 2012. Religious social norms and corporate

financial reporting. Journal of Business Finance & Accounting. 39(7‐8). pp.845-875.

Cheng, M., Dhaliwal, D. and Zhang, Y., 2013. Does investment efficiency improve after the

disclosure of material weaknesses in internal control over financial reporting?. Journal

of Accounting and Economics. 56(1). pp.1-18.

Botzem, S., 2012. The politics of accounting regulation: Organizing transnational standard

setting in financial reporting. Edward Elgar Publishing.

Martínez‐Ferrero, J., Garcia‐Sanchez, I.M. and Cuadrado‐Ballesteros, B., 2015. Effect of

financial reporting quality on sustainability information disclosure. Corporate Social

Responsibility and Environmental Management. 22(1). pp.45-64.

Cadman, B.D., Rusticus, T.O. and Sunder, J., 2013. Stock option grant vesting terms: Economic

and financial reporting determinants. Review of Accounting Studies. 18(4). pp.1159-

1190.

Johnston, R. and Petacchi, R., 2017. Regulatory oversight of financial reporting: Securities and

Exchange Commission comment letters. Contemporary Accounting Research. 34(2).

pp.1128-1155.

8

From the above report it is concluded that company has to prepare its financial statements

to represent its financial transactions in such a way that it may be understandable to the various

users of financial statements. Further while preparing the income statements of an business

organisation, such company is required to follow prescribed format as applicable to that

company as per the its regulatory requirements. It is mandatory for any business organisation to

prepare its balance sheet in such a way that it gives true and fair view of its state of affairs. It is

further concluded that various ledger accounts shall be required to prepared because it assist the

company in preparing its financial statements. Company shall recognises the need of audit of its

financial statement if regulatory framework provides such requirements upon such company.

REFERENCES

Books and Journal:

Dyreng, S.D., Mayew, W.J. and Williams, C.D., 2012. Religious social norms and corporate

financial reporting. Journal of Business Finance & Accounting. 39(7‐8). pp.845-875.

Cheng, M., Dhaliwal, D. and Zhang, Y., 2013. Does investment efficiency improve after the

disclosure of material weaknesses in internal control over financial reporting?. Journal

of Accounting and Economics. 56(1). pp.1-18.

Botzem, S., 2012. The politics of accounting regulation: Organizing transnational standard

setting in financial reporting. Edward Elgar Publishing.

Martínez‐Ferrero, J., Garcia‐Sanchez, I.M. and Cuadrado‐Ballesteros, B., 2015. Effect of

financial reporting quality on sustainability information disclosure. Corporate Social

Responsibility and Environmental Management. 22(1). pp.45-64.

Cadman, B.D., Rusticus, T.O. and Sunder, J., 2013. Stock option grant vesting terms: Economic

and financial reporting determinants. Review of Accounting Studies. 18(4). pp.1159-

1190.

Johnston, R. and Petacchi, R., 2017. Regulatory oversight of financial reporting: Securities and

Exchange Commission comment letters. Contemporary Accounting Research. 34(2).

pp.1128-1155.

8

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.