Financial Reporting Report: Financial Reporting Standards and Analysis

VerifiedAdded on 2021/01/05

|30

|4693

|90

Report

AI Summary

This report delves into the core aspects of financial reporting, commencing with an introduction to its context and purpose, emphasizing its role in measuring organizational performance and providing crucial information to stakeholders such as management, investors, and government entities. The report then explores the conceptual and regulatory frameworks, including the qualitative characteristics that underpin reliable financial reporting. It highlights the significance of financial information for various stakeholders and their roles in organizational growth and objectives. The report also examines the framing of financial statements in accordance with IAS 1, followed by an interpretation of Glaxo Smith Plc's financial performance using profitability ratios. A comparative analysis of IAS and IFRS is presented, including the benefits of IFRS adoption and compliance considerations. The report concludes by summarizing the importance of financial reporting in achieving organizational goals and objectives, providing a comprehensive understanding of financial reporting principles and their practical applications.

FINANCIAL REPORTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENT

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

1.) Context and purpose of financial reporting............................................................................1

2.) Conceptual and regulatory framework of financial reporting and qualitative characteristics

of financial reporting....................................................................................................................2

3.) Main stakeholders of organisation and their importance in financial information.................4

4. Importance of financial reporting for accomplishing organizational growth and objectives. .1

5. Framing financial statements as per IAS 1..............................................................................2

6.) Interpretation of the financial performance of Glaxo Smith Plc............................................4

7.) Presenting the difference between IAS and IFRS..................................................................6

8. Benefits of IFRS......................................................................................................................8

9. Compliance with IFRS.............................................................................................................9

CONCLUSION..............................................................................................................................10

REFERENCES..............................................................................................................................11

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

1.) Context and purpose of financial reporting............................................................................1

2.) Conceptual and regulatory framework of financial reporting and qualitative characteristics

of financial reporting....................................................................................................................2

3.) Main stakeholders of organisation and their importance in financial information.................4

4. Importance of financial reporting for accomplishing organizational growth and objectives. .1

5. Framing financial statements as per IAS 1..............................................................................2

6.) Interpretation of the financial performance of Glaxo Smith Plc............................................4

7.) Presenting the difference between IAS and IFRS..................................................................6

8. Benefits of IFRS......................................................................................................................8

9. Compliance with IFRS.............................................................................................................9

CONCLUSION..............................................................................................................................10

REFERENCES..............................................................................................................................11

INTRODUCTION

Financial reporting is known to be the process of producing financial statements for

measuring overall financial performance of organisation which disclose a performance status to

management, investor and government of the company (Nobes, 2014). This present report will

cover purpose of financial reporting with its conceptual framework. Importance of financial

reporting for stakeholders of organisation and financial statements as per IAS-1 is also to be

discussed in this report. Difference between international accounting standards and international

financial reporting standards with the benefits of IFRS is to be studied in this report. Further, this

report will cover degree of compliance with IFRS by organisation across the world is to be

cover.

MAIN BODY

1.) Context and purpose of financial reporting

Financial reporting is the process of measuring performance of the organisation. Purpose

of preparing financial information is to provide useful and relevant information to owners of

company. Preparation of financial statements in compulsory for every types of organisation but

mainly it is compulsory for public limited companies, where share capital of organisation is sold

through stock exchange among public of business market. This financial statements are analysed

by investors and government to analyse business performance in which they have invested their

money (Leuz and Wysocki, 2016). Mainly purpose of financial statements is for meeting needs

of the organisation according to their previous year financial performance of the company.

Context and purpose of financial statements is to provide information regarding the

business operations under which mainly three statements are prepared by the company which is

cash flow, income statements and balance sheet. Cash flow statement helps in revealing amount

of money which comes in and out from the organisation. Income statement of the organisation

will provide amount of expenses company has incurred in overall financial year of the company.

This statement helps in analysing overall operating profits in the organisation. Balance sheets of

the organisation will produce current status of company in which information has been used in

estimating liquidity, funding with overall debt position of company.

Another several purposes and context of producing financial statement are as follows-

1

Financial reporting is known to be the process of producing financial statements for

measuring overall financial performance of organisation which disclose a performance status to

management, investor and government of the company (Nobes, 2014). This present report will

cover purpose of financial reporting with its conceptual framework. Importance of financial

reporting for stakeholders of organisation and financial statements as per IAS-1 is also to be

discussed in this report. Difference between international accounting standards and international

financial reporting standards with the benefits of IFRS is to be studied in this report. Further, this

report will cover degree of compliance with IFRS by organisation across the world is to be

cover.

MAIN BODY

1.) Context and purpose of financial reporting

Financial reporting is the process of measuring performance of the organisation. Purpose

of preparing financial information is to provide useful and relevant information to owners of

company. Preparation of financial statements in compulsory for every types of organisation but

mainly it is compulsory for public limited companies, where share capital of organisation is sold

through stock exchange among public of business market. This financial statements are analysed

by investors and government to analyse business performance in which they have invested their

money (Leuz and Wysocki, 2016). Mainly purpose of financial statements is for meeting needs

of the organisation according to their previous year financial performance of the company.

Context and purpose of financial statements is to provide information regarding the

business operations under which mainly three statements are prepared by the company which is

cash flow, income statements and balance sheet. Cash flow statement helps in revealing amount

of money which comes in and out from the organisation. Income statement of the organisation

will provide amount of expenses company has incurred in overall financial year of the company.

This statement helps in analysing overall operating profits in the organisation. Balance sheets of

the organisation will produce current status of company in which information has been used in

estimating liquidity, funding with overall debt position of company.

Another several purposes and context of producing financial statement are as follows-

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Credit decision- financial reports are analysed by the lenders of the organisation form

which company has taken loan. They analysed overall financial position of the company

to develop decision which is about whether to extend credit in business or to restrict that

amount of credit which they have extended in business organisation.

Investment decision- investors analyse financial reports of the organisation in deciding whether

to invest in organisation or not (Adams, 2015). This analysis of the financial statements will help

investor in analysing price per share of organisation in which they want to invest. Taxation decision- government will also analyse the financial statements of the

organisation in which they measure its assets or income which helps government in

deriving the information which applying tax on business operations.

Union bargaining decision- to analyse bargaining position and the ability of the

company to pay business compensation, unions analysed financial reports of the

organisation.

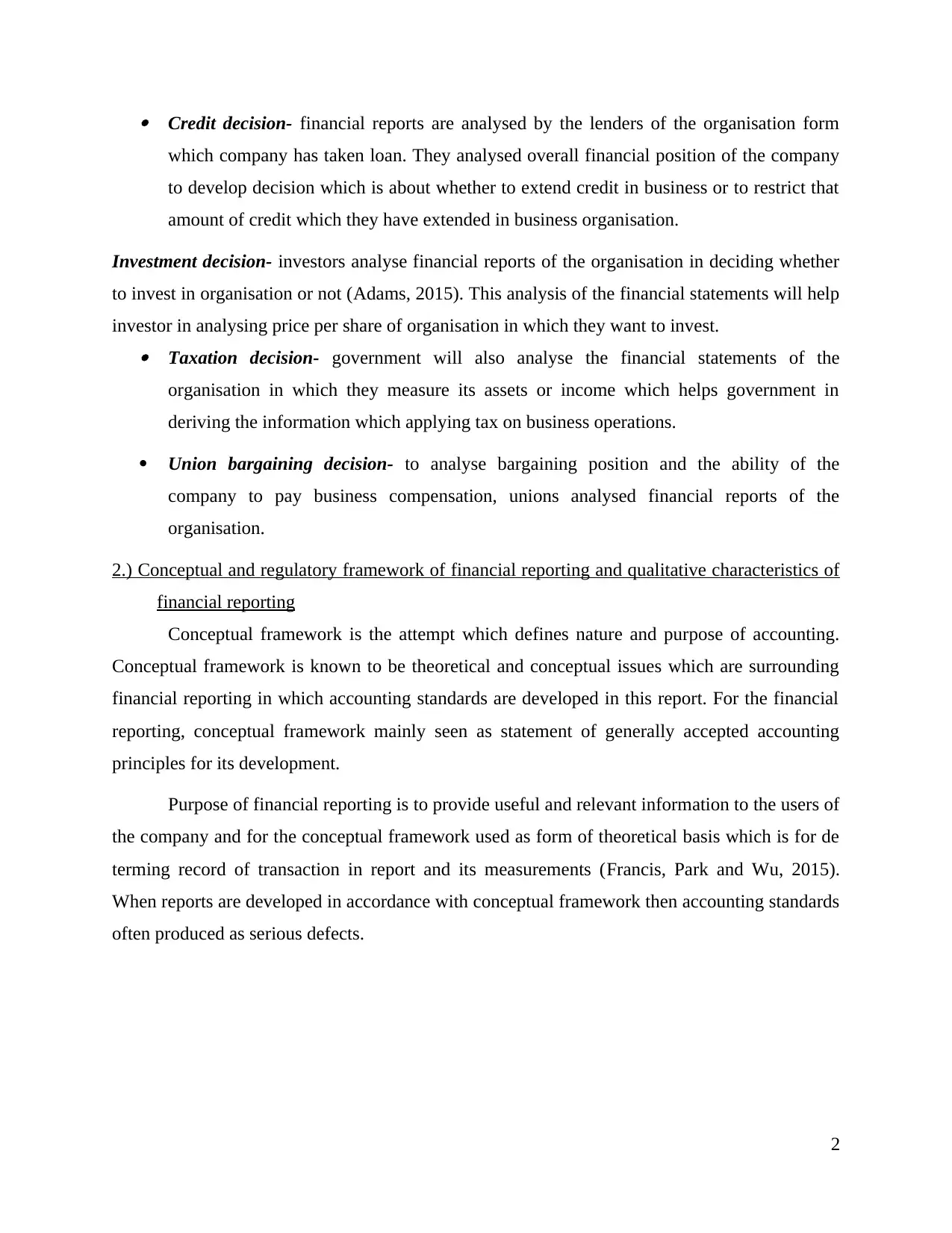

2.) Conceptual and regulatory framework of financial reporting and qualitative characteristics of

financial reporting

Conceptual framework is the attempt which defines nature and purpose of accounting.

Conceptual framework is known to be theoretical and conceptual issues which are surrounding

financial reporting in which accounting standards are developed in this report. For the financial

reporting, conceptual framework mainly seen as statement of generally accepted accounting

principles for its development.

Purpose of financial reporting is to provide useful and relevant information to the users of

the company and for the conceptual framework used as form of theoretical basis which is for de

terming record of transaction in report and its measurements (Francis, Park and Wu, 2015).

When reports are developed in accordance with conceptual framework then accounting standards

often produced as serious defects.

2

which company has taken loan. They analysed overall financial position of the company

to develop decision which is about whether to extend credit in business or to restrict that

amount of credit which they have extended in business organisation.

Investment decision- investors analyse financial reports of the organisation in deciding whether

to invest in organisation or not (Adams, 2015). This analysis of the financial statements will help

investor in analysing price per share of organisation in which they want to invest. Taxation decision- government will also analyse the financial statements of the

organisation in which they measure its assets or income which helps government in

deriving the information which applying tax on business operations.

Union bargaining decision- to analyse bargaining position and the ability of the

company to pay business compensation, unions analysed financial reports of the

organisation.

2.) Conceptual and regulatory framework of financial reporting and qualitative characteristics of

financial reporting

Conceptual framework is the attempt which defines nature and purpose of accounting.

Conceptual framework is known to be theoretical and conceptual issues which are surrounding

financial reporting in which accounting standards are developed in this report. For the financial

reporting, conceptual framework mainly seen as statement of generally accepted accounting

principles for its development.

Purpose of financial reporting is to provide useful and relevant information to the users of

the company and for the conceptual framework used as form of theoretical basis which is for de

terming record of transaction in report and its measurements (Francis, Park and Wu, 2015).

When reports are developed in accordance with conceptual framework then accounting standards

often produced as serious defects.

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Qualitative characteristics of financial reporting

Main purpose of financial statements is to educate users of the company which is about

financial status and financial performance of the company. Mainly financial reporting are

analysed by the shareholders of company because they are the real owners of company which is

governed by directors. It is the duty of directors to prepare financial statements which is free

from material misstatements as well as which also possess qualitative characteristics in

statements (Frias‐Aceituno, Rodríguez‐Ariza and Garcia‐Sánchez, 2014). There are mainly four

contents of qualitative characteristics in financial report that is Understandability, Relevance,

Reliability and comparability.

Relevance- financial reports provides relevance information which adds value which is for

decision making. This will help users to evaluate decision for company.

Reliability- financial reports are free from errors, mainly it is free from material errors and free

from bias.

Comparability- financial reports provides information which is full of comparable and have

ability in providing useful financial information to the users of the company.

3

Illustration 1: conceptual framework of accounting and reporting problems

(Source: Objectives of General Purpose Financial Reporting, 2014)

Main purpose of financial statements is to educate users of the company which is about

financial status and financial performance of the company. Mainly financial reporting are

analysed by the shareholders of company because they are the real owners of company which is

governed by directors. It is the duty of directors to prepare financial statements which is free

from material misstatements as well as which also possess qualitative characteristics in

statements (Frias‐Aceituno, Rodríguez‐Ariza and Garcia‐Sánchez, 2014). There are mainly four

contents of qualitative characteristics in financial report that is Understandability, Relevance,

Reliability and comparability.

Relevance- financial reports provides relevance information which adds value which is for

decision making. This will help users to evaluate decision for company.

Reliability- financial reports are free from errors, mainly it is free from material errors and free

from bias.

Comparability- financial reports provides information which is full of comparable and have

ability in providing useful financial information to the users of the company.

3

Illustration 1: conceptual framework of accounting and reporting problems

(Source: Objectives of General Purpose Financial Reporting, 2014)

Understandability- financial reports are very much understandable for the users. Therefore,

entities present their financial reports in a way that it provides clear Understandability of the

financial performance.

3.) Main stakeholders of organisation and their importance in financial information

There are many users of financial statements for which financial information is the

essential part. Therefore, financial reporting is mainly produced by organisation to provide

information which is about the stability and capability of organisation in business market.

Shareholders generally want financial statements of the organisation to analyse their

performance and to measure whether the money which they invest in organisation is used by

directors for business purpose or not (Cheng, Konishi and Romi, 2014). Main stakeholder of the

organisation and its importance for financial information are as follows-

company management-

Management of the company generally needs information regarding financial position of the

company to analyse its profitability, liquidity and cash flow so that they work accordingly to

meet goals of organisation. Therefore, management is considered as shareholders of organisation

it is necessary for directors to disclose their financial reports to company's management.

Competitors

This is point where management analyse their financial statements with competitors of

organisation. So that effective decision will be developed in improving overall performance and

profitability of the organisation in business market. Competitors are considered as shareholder of

company because by comparing their financial report, company will determine their business

outcomes.

Customers

For selecting which supplier is selected for major contract, financial statements of the company

are review by customers of the organisation. This analysis of the financial statements helps

customers to select which supplier has effective financial ability in providing goods and services

to customer on long term basis.

Employees

Financial reports are important for employees so that employees will able to measure overall

capability of company to pay their compensation. These financial statements help employees to

understand business policy so that they work accordingly in achieving overall business goals.

4

entities present their financial reports in a way that it provides clear Understandability of the

financial performance.

3.) Main stakeholders of organisation and their importance in financial information

There are many users of financial statements for which financial information is the

essential part. Therefore, financial reporting is mainly produced by organisation to provide

information which is about the stability and capability of organisation in business market.

Shareholders generally want financial statements of the organisation to analyse their

performance and to measure whether the money which they invest in organisation is used by

directors for business purpose or not (Cheng, Konishi and Romi, 2014). Main stakeholder of the

organisation and its importance for financial information are as follows-

company management-

Management of the company generally needs information regarding financial position of the

company to analyse its profitability, liquidity and cash flow so that they work accordingly to

meet goals of organisation. Therefore, management is considered as shareholders of organisation

it is necessary for directors to disclose their financial reports to company's management.

Competitors

This is point where management analyse their financial statements with competitors of

organisation. So that effective decision will be developed in improving overall performance and

profitability of the organisation in business market. Competitors are considered as shareholder of

company because by comparing their financial report, company will determine their business

outcomes.

Customers

For selecting which supplier is selected for major contract, financial statements of the company

are review by customers of the organisation. This analysis of the financial statements helps

customers to select which supplier has effective financial ability in providing goods and services

to customer on long term basis.

Employees

Financial reports are important for employees so that employees will able to measure overall

capability of company to pay their compensation. These financial statements help employees to

understand business policy so that they work accordingly in achieving overall business goals.

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Government

Government also consider financial reports of organisation to analyse capability of company and

to analyse their overall income so that taxation will be charged to entity for generating revenues.

Government analyse financial statements to analyse entity in which jurisdiction company has

located whether pays their tax or not.

Investors

Company disclose their financial statements among investors so that effective decision will

develop by them for invest in organisation.

5

Government also consider financial reports of organisation to analyse capability of company and

to analyse their overall income so that taxation will be charged to entity for generating revenues.

Government analyse financial statements to analyse entity in which jurisdiction company has

located whether pays their tax or not.

Investors

Company disclose their financial statements among investors so that effective decision will

develop by them for invest in organisation.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4. Importance of financial reporting for accomplishing organizational growth and objectives

The financial reporting could not be easily overemphasized as it is mandatory for every

stakeholder for numerous reasons and purpose as it helps business entity for complying with

different statues along with regulatory requirements. The company has need for filing financial

statements to government agencies. If any of listed organization, quarterly along with annual

outcome is in need to be filed for published and stock exchanges. In the similar aspect, it will

facilitate statutory audit and these auditors are in need for auditing financial statements of

business entity for expressing their opinion. The financial reports would be replicated as

backbone for financial planning, benchmarking, decision making and analysis. It is used with

multiple perspective of various stakeholders. This will help business entity for increment of

capital both overseas and domestic. Furthermore, with context of financials the public in large

could analyse the performance of business entity along with management. With context to

bidding, government, supplies and labour contract etc. the business entities are in need for

furnishing financial reports with statements as well (Importance of Financial Planning for

Organizations, 2018).

This is considered as base for purpose of financial control as finance team has

information about allocation of money and to which activity, they could not be applicable for

getting information about going over or under budget. In case of any remedial action undertaken,

there will be presence of base for purpose of taking corrective measures. The financial reporting

is one of the important element in the company's financial reporting which takes into account

internal operations of company. Moreover, it helps firm to carry out the duty to provide

effectively results to the stakeholders involved in company and adhering to statutory and

regulatory requirements in the best manner possible.

It is required that business may should provide financial statements in a understandable

manner so that even layman can understand the same without any difficulty. It is required in

order to clarify financial position or health of company in effective manner. The financial

reporting include balance sheet, cash flow statement, statement of changes in equity, notes to

financial statements, quarterly and annual reports mandatory for listed companies on the

recognised stock exchange. Prospectus is also included in case of firm opting for IPO (Initial

Public Offering) and management discussion analysis when company is public limited. It can be

The financial reporting could not be easily overemphasized as it is mandatory for every

stakeholder for numerous reasons and purpose as it helps business entity for complying with

different statues along with regulatory requirements. The company has need for filing financial

statements to government agencies. If any of listed organization, quarterly along with annual

outcome is in need to be filed for published and stock exchanges. In the similar aspect, it will

facilitate statutory audit and these auditors are in need for auditing financial statements of

business entity for expressing their opinion. The financial reports would be replicated as

backbone for financial planning, benchmarking, decision making and analysis. It is used with

multiple perspective of various stakeholders. This will help business entity for increment of

capital both overseas and domestic. Furthermore, with context of financials the public in large

could analyse the performance of business entity along with management. With context to

bidding, government, supplies and labour contract etc. the business entities are in need for

furnishing financial reports with statements as well (Importance of Financial Planning for

Organizations, 2018).

This is considered as base for purpose of financial control as finance team has

information about allocation of money and to which activity, they could not be applicable for

getting information about going over or under budget. In case of any remedial action undertaken,

there will be presence of base for purpose of taking corrective measures. The financial reporting

is one of the important element in the company's financial reporting which takes into account

internal operations of company. Moreover, it helps firm to carry out the duty to provide

effectively results to the stakeholders involved in company and adhering to statutory and

regulatory requirements in the best manner possible.

It is required that business may should provide financial statements in a understandable

manner so that even layman can understand the same without any difficulty. It is required in

order to clarify financial position or health of company in effective manner. The financial

reporting include balance sheet, cash flow statement, statement of changes in equity, notes to

financial statements, quarterly and annual reports mandatory for listed companies on the

recognised stock exchange. Prospectus is also included in case of firm opting for IPO (Initial

Public Offering) and management discussion analysis when company is public limited. It can be

analysed that business will be able to gain trust of stakeholders in effectual manner. Hence,

financial reporting is quite significant in meeting organisational objectives with ease.

2

financial reporting is quite significant in meeting organisational objectives with ease.

2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

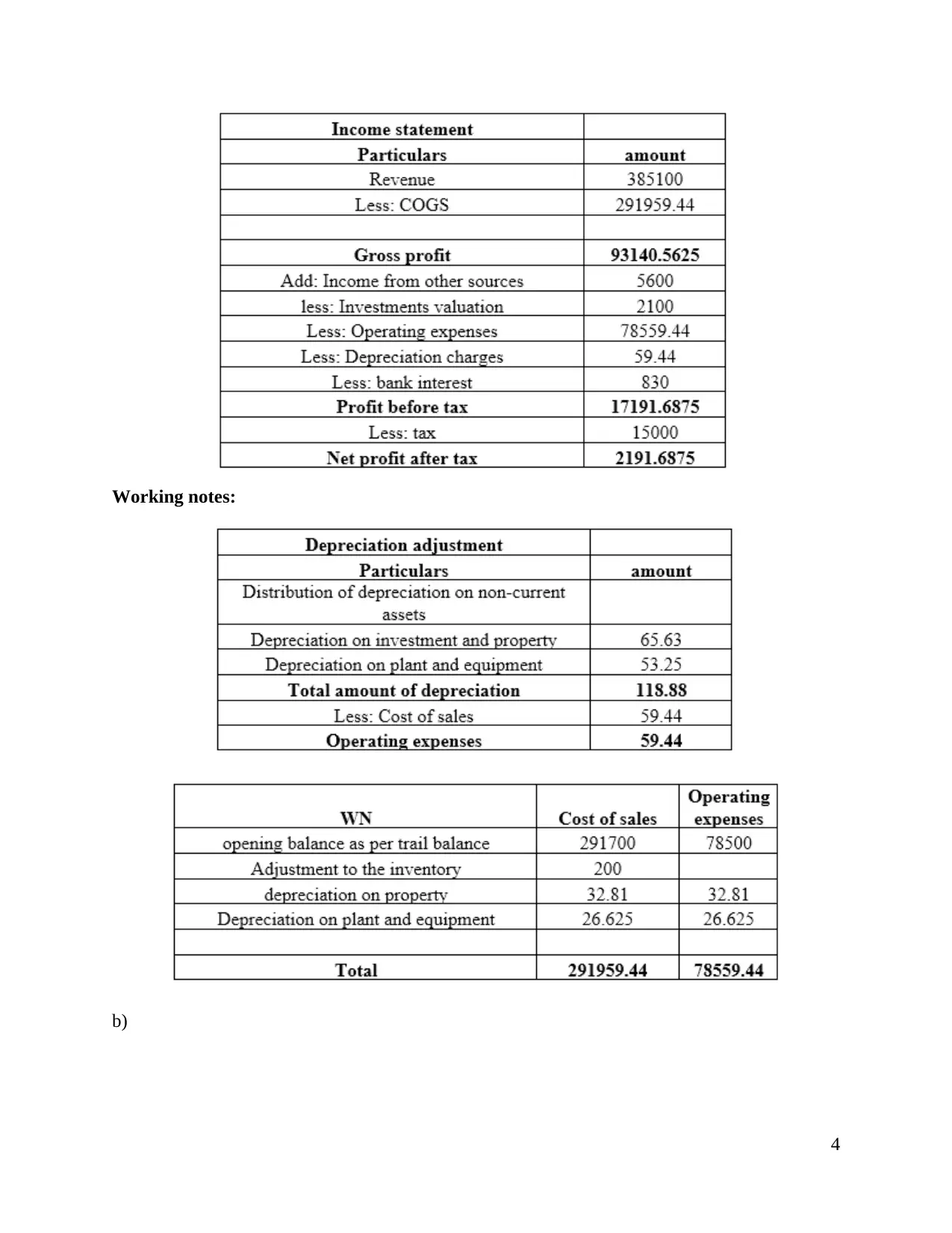

5. Framing financial statements as per IAS 1

a)

3

a)

3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Working notes:

b)

4

b)

4

c)

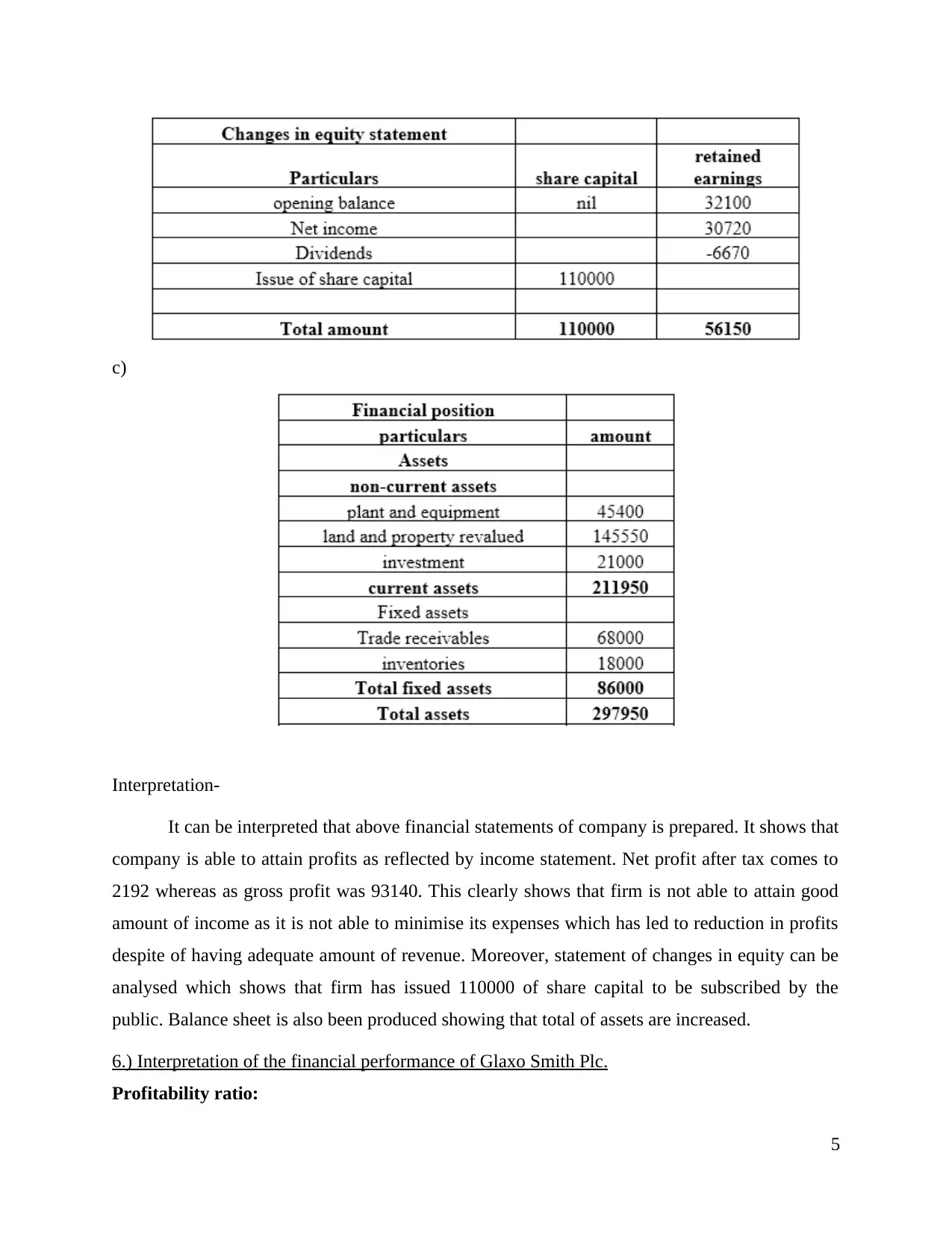

Interpretation-

It can be interpreted that above financial statements of company is prepared. It shows that

company is able to attain profits as reflected by income statement. Net profit after tax comes to

2192 whereas as gross profit was 93140. This clearly shows that firm is not able to attain good

amount of income as it is not able to minimise its expenses which has led to reduction in profits

despite of having adequate amount of revenue. Moreover, statement of changes in equity can be

analysed which shows that firm has issued 110000 of share capital to be subscribed by the

public. Balance sheet is also been produced showing that total of assets are increased.

6.) Interpretation of the financial performance of Glaxo Smith Plc.

Profitability ratio:

5

Interpretation-

It can be interpreted that above financial statements of company is prepared. It shows that

company is able to attain profits as reflected by income statement. Net profit after tax comes to

2192 whereas as gross profit was 93140. This clearly shows that firm is not able to attain good

amount of income as it is not able to minimise its expenses which has led to reduction in profits

despite of having adequate amount of revenue. Moreover, statement of changes in equity can be

analysed which shows that firm has issued 110000 of share capital to be subscribed by the

public. Balance sheet is also been produced showing that total of assets are increased.

6.) Interpretation of the financial performance of Glaxo Smith Plc.

Profitability ratio:

5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 30

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.