Financial Statements Analysis and Corporate Accounting

VerifiedAdded on 2023/06/03

|18

|3986

|77

AI Summary

This report analyses the financial statements of Woolworths Group Limited and Wesfarmers Company in the Australian retail sector. It covers cash flow, equity, comprehensive income statement, and accounting for corporate income tax for effective investment decisions.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: FINANCIAL STATEMENTS ANALYSIS AND CORPORATE ACCOUNTING

Financial Statements Analysis and Corporate Accounting

Name of the Student:

Student Number:

Author’s Note:

Course ID:

Financial Statements Analysis and Corporate Accounting

Name of the Student:

Student Number:

Author’s Note:

Course ID:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1FINANCIAL STATEMENTS ANALYSIS AND CORPORATE ACCOUNTING

Executive Summary:

Certain factors that are chosen to be reported in other comprehensive statement of income for the

Wesfarmers and Woolworths Company encompass retained earnings, cash flow hedge reserve

along with translation reserve in foreign currency.The current report focussed on analysingcash

flow, equity, comprehensive income statement along with accounting for corporate income tax

for implementing certain effective investment decisions.Deferred tax assets are deemed to be a

situation in which the companies decide to paycertainadvance taxes on the related financial

assets or increased taxes. It is also revealed from the report that It is important for organizations

to bear several expenses which encompass research and development costs along with the selling

and distribution costs and the tax expense is deemed to be a vital aspect. Moreover, the

organization is deemed to be a vital liability existing within the organization due to certain

municipal, state governments within the country.

Executive Summary:

Certain factors that are chosen to be reported in other comprehensive statement of income for the

Wesfarmers and Woolworths Company encompass retained earnings, cash flow hedge reserve

along with translation reserve in foreign currency.The current report focussed on analysingcash

flow, equity, comprehensive income statement along with accounting for corporate income tax

for implementing certain effective investment decisions.Deferred tax assets are deemed to be a

situation in which the companies decide to paycertainadvance taxes on the related financial

assets or increased taxes. It is also revealed from the report that It is important for organizations

to bear several expenses which encompass research and development costs along with the selling

and distribution costs and the tax expense is deemed to be a vital aspect. Moreover, the

organization is deemed to be a vital liability existing within the organization due to certain

municipal, state governments within the country.

2FINANCIAL STATEMENTS ANALYSIS AND CORPORATE ACCOUNTING

Table of Contents

Introduction:....................................................................................................................................4

Owners’ Equity:...............................................................................................................................4

Requirement (i):...........................................................................................................................4

Requirement (ii):..........................................................................................................................5

Cash Flow Statement:......................................................................................................................6

Requirement (iii):.........................................................................................................................6

Requirement (iv):.........................................................................................................................7

Requirement (v):..........................................................................................................................8

Other comprehensive income statement:.........................................................................................9

Requirement (vi):.........................................................................................................................9

Requirement (viii):.......................................................................................................................9

Requirement (viii):.....................................................................................................................10

Requirement (ix):.......................................................................................................................10

Accounting for Corporate Income Tax:.........................................................................................11

Requirement (x):........................................................................................................................11

Requirement (xi):.......................................................................................................................11

Requirement (xii):......................................................................................................................12

Requirement (xiii):.....................................................................................................................12

Table of Contents

Introduction:....................................................................................................................................4

Owners’ Equity:...............................................................................................................................4

Requirement (i):...........................................................................................................................4

Requirement (ii):..........................................................................................................................5

Cash Flow Statement:......................................................................................................................6

Requirement (iii):.........................................................................................................................6

Requirement (iv):.........................................................................................................................7

Requirement (v):..........................................................................................................................8

Other comprehensive income statement:.........................................................................................9

Requirement (vi):.........................................................................................................................9

Requirement (viii):.......................................................................................................................9

Requirement (viii):.....................................................................................................................10

Requirement (ix):.......................................................................................................................10

Accounting for Corporate Income Tax:.........................................................................................11

Requirement (x):........................................................................................................................11

Requirement (xi):.......................................................................................................................11

Requirement (xii):......................................................................................................................12

Requirement (xiii):.....................................................................................................................12

3FINANCIAL STATEMENTS ANALYSIS AND CORPORATE ACCOUNTING

Requirement (xiv):.....................................................................................................................13

Requirement (xv):......................................................................................................................13

Requirement (xvi):.....................................................................................................................14

Conclusion:....................................................................................................................................14

References:....................................................................................................................................15

Requirement (xiv):.....................................................................................................................13

Requirement (xv):......................................................................................................................13

Requirement (xvi):.....................................................................................................................14

Conclusion:....................................................................................................................................14

References:....................................................................................................................................15

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4FINANCIAL STATEMENTS ANALYSIS AND CORPORATE ACCOUNTING

Introduction:

Woolworths Group Limited and Wesfarmers Company has been used in this report as

these major retail companies those have their business operations in the Australian retail sector

(Akhmetshinand Osadchy 2015). Moreover, it has been observed that in the current competitive

world it is highly necessary for the shareholders to evaluate its cash flow, equity, comprehensive

income statement along with accounting for corporate income tax for implementing certain

effective investment decisions. These segments are considered in analysing two chose companies

in order to evaluate techniques followed in allaying all the important aspects within the

company’s financial statements.

Owners’ Equity:

Requirement (i):

The major items those are covered within the balance sheet statement includes three

items and owner’s equity is one of them for the reason that both the companies Wesfarmers and

Woolworths have this aspect within their balance sheets. In case of Woolworths it has been

observed that there has been a drastic increase in the year 2017 from 2016 that is $5,252.20

million more than $5,615 million (Ball, Gerakos, Linnainmaa and Nikolaev 2016). This is

because of the reason that the management of these companies have decreased considering

increased debt funding.

Another owner’s equity item is deemed to be reserves that is an aspect of equity and is

revealed to be an increased amount rather than the basic share capital. Similar trend is also

Introduction:

Woolworths Group Limited and Wesfarmers Company has been used in this report as

these major retail companies those have their business operations in the Australian retail sector

(Akhmetshinand Osadchy 2015). Moreover, it has been observed that in the current competitive

world it is highly necessary for the shareholders to evaluate its cash flow, equity, comprehensive

income statement along with accounting for corporate income tax for implementing certain

effective investment decisions. These segments are considered in analysing two chose companies

in order to evaluate techniques followed in allaying all the important aspects within the

company’s financial statements.

Owners’ Equity:

Requirement (i):

The major items those are covered within the balance sheet statement includes three

items and owner’s equity is one of them for the reason that both the companies Wesfarmers and

Woolworths have this aspect within their balance sheets. In case of Woolworths it has been

observed that there has been a drastic increase in the year 2017 from 2016 that is $5,252.20

million more than $5,615 million (Ball, Gerakos, Linnainmaa and Nikolaev 2016). This is

because of the reason that the management of these companies have decreased considering

increased debt funding.

Another owner’s equity item is deemed to be reserves that is an aspect of equity and is

revealed to be an increased amount rather than the basic share capital. Similar trend is also

5FINANCIAL STATEMENTS ANALYSIS AND CORPORATE ACCOUNTING

observed in case of Wesfarmers as its reserves increased from $166 million to $190

millionduring the years 2016 and 2017 (Koo, Ramalingegowda and Yu 2017).

Through analysing Wesfarmers Limited’s balance sheet, it is gathered that the required

reserved shares have decreased from $28 million to $26 million that is from the year 2016 to

2017. Moreover, there are decreased shares as observed in the Woolworths Company (Tayeh,

Al-Jarrah and Tarhini 2015). Another item explained within these company’s owner’s equity is

retained earnings that signifies profit and loss of the company after it has established its business

after shareholder dividend payments. In case of both Wesfarmers and Woolworths certain

increase in retained earnings because of a drastic rise in profit base for the year.

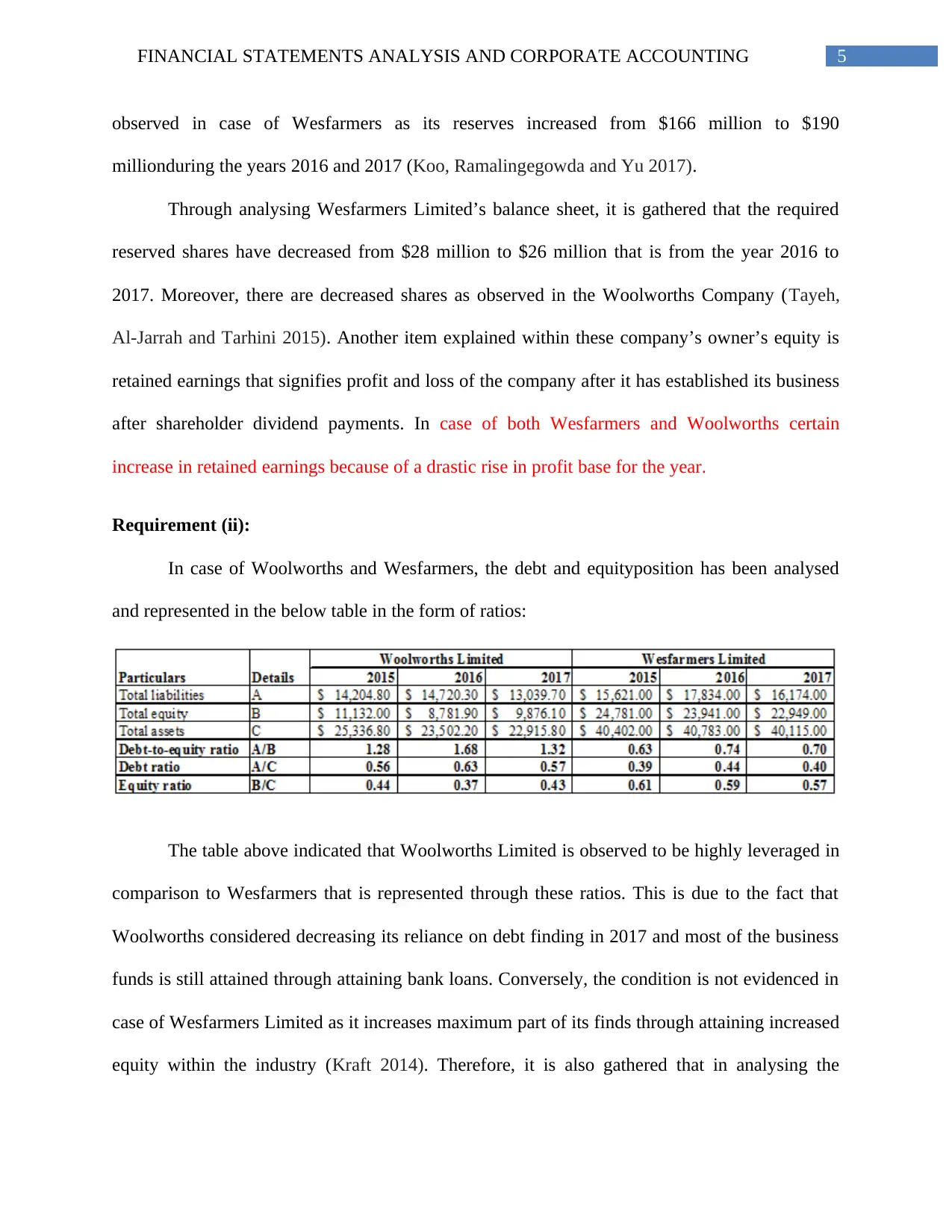

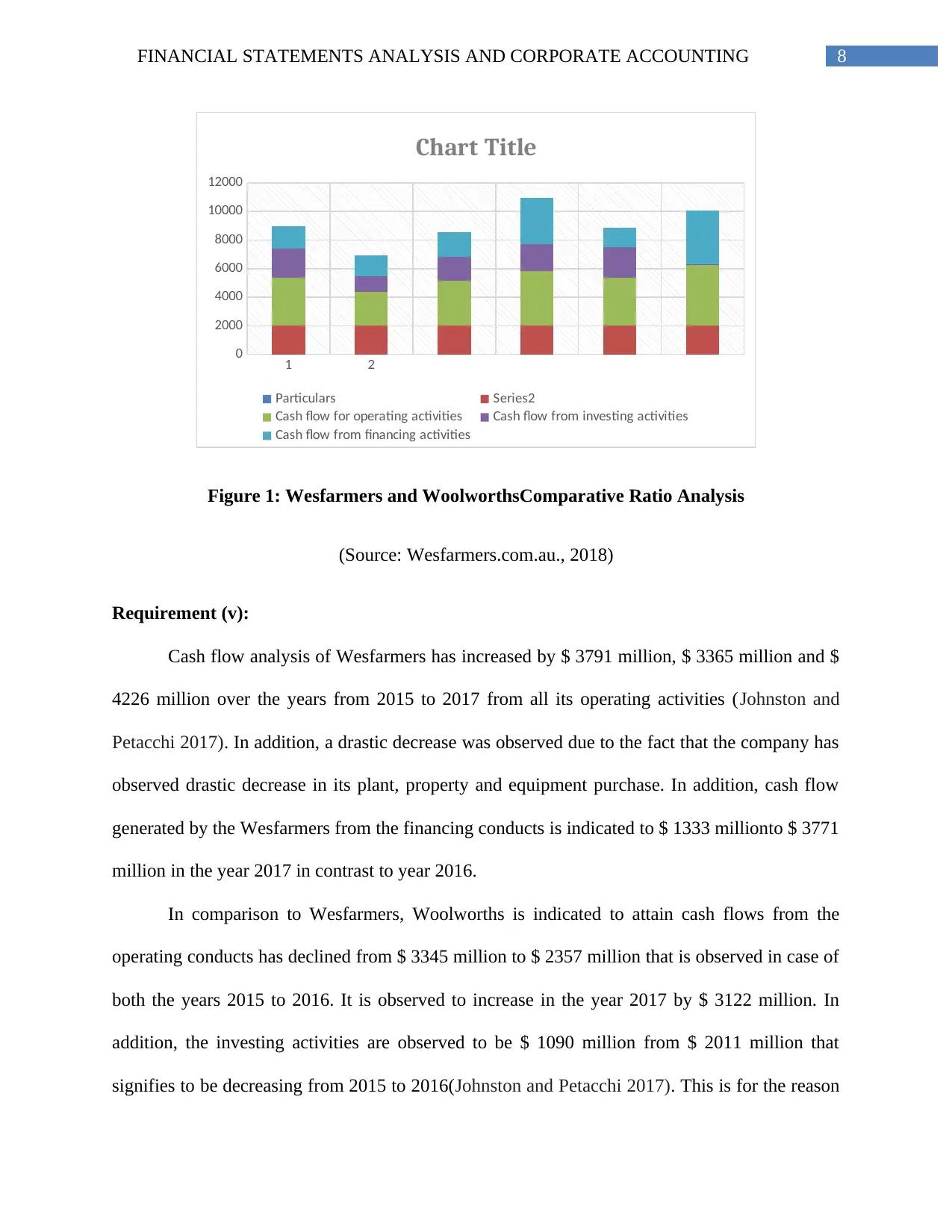

Requirement (ii):

In case of Woolworths and Wesfarmers, the debt and equityposition has been analysed

and represented in the below table in the form of ratios:

The table above indicated that Woolworths Limited is observed to be highly leveraged in

comparison to Wesfarmers that is represented through these ratios. This is due to the fact that

Woolworths considered decreasing its reliance on debt finding in 2017 and most of the business

funds is still attained through attaining bank loans. Conversely, the condition is not evidenced in

case of Wesfarmers Limited as it increases maximum part of its finds through attaining increased

equity within the industry (Kraft 2014). Therefore, it is also gathered that in analysing the

observed in case of Wesfarmers as its reserves increased from $166 million to $190

millionduring the years 2016 and 2017 (Koo, Ramalingegowda and Yu 2017).

Through analysing Wesfarmers Limited’s balance sheet, it is gathered that the required

reserved shares have decreased from $28 million to $26 million that is from the year 2016 to

2017. Moreover, there are decreased shares as observed in the Woolworths Company (Tayeh,

Al-Jarrah and Tarhini 2015). Another item explained within these company’s owner’s equity is

retained earnings that signifies profit and loss of the company after it has established its business

after shareholder dividend payments. In case of both Wesfarmers and Woolworths certain

increase in retained earnings because of a drastic rise in profit base for the year.

Requirement (ii):

In case of Woolworths and Wesfarmers, the debt and equityposition has been analysed

and represented in the below table in the form of ratios:

The table above indicated that Woolworths Limited is observed to be highly leveraged in

comparison to Wesfarmers that is represented through these ratios. This is due to the fact that

Woolworths considered decreasing its reliance on debt finding in 2017 and most of the business

funds is still attained through attaining bank loans. Conversely, the condition is not evidenced in

case of Wesfarmers Limited as it increases maximum part of its finds through attaining increased

equity within the industry (Kraft 2014). Therefore, it is also gathered that in analysing the

6FINANCIAL STATEMENTS ANALYSIS AND CORPORATE ACCOUNTING

solvency position, Wesfarmers has attained a sustainable position in Australian retail industry in

comparison to Woolworths Limited.

Cash Flow Statement:

Requirement (iii):

There are several aspects those are explained within the Woolworths and Wesfarmers

cash flow statements that has been indicated in the factors below:

Operating Cash Flows- This segment includes four major factors that encompass

borrowings expenses, interest payments along with consumers receipts. Few reasechersnamely,

Wesfarmers.com.au. (2018) indicated that consumer receipts signify an increased number of

attained amounts through which sales are carried out based on credit in the previous years.

Conversely, suppler payments for Wesfarmers along with Woolworths company has elevated

because of is development in the production lines and addressing consumers varying preferences.

In contrast to such situation, it is revealed by the interest payments that a company needs to deal

with increased bank loans taken in fulfilling needs of its every business conduct.

Investing Cash Flows- The items considered within the investing cash flows encompass

payment and purchase of property, plant and equipment along with intangible assets payment.

The amount paid for the plant, property and equipment is deemed to be the expenses incurred in

acquiring and purchasing it as it is important in all the business activities. On the other hand,

these assets attain economic benefits for organizations that is mentioned within proceedings of

plant, property and equipment. From case analysis of Wesfarmers Limited it is evidenced that

Wesfarmers have decreased its asset investment in 2017 that has increased in the upcoming years

due to increased sale of its assets (Woolworthsgroup.com.au. 2018). While selling or acquiring

solvency position, Wesfarmers has attained a sustainable position in Australian retail industry in

comparison to Woolworths Limited.

Cash Flow Statement:

Requirement (iii):

There are several aspects those are explained within the Woolworths and Wesfarmers

cash flow statements that has been indicated in the factors below:

Operating Cash Flows- This segment includes four major factors that encompass

borrowings expenses, interest payments along with consumers receipts. Few reasechersnamely,

Wesfarmers.com.au. (2018) indicated that consumer receipts signify an increased number of

attained amounts through which sales are carried out based on credit in the previous years.

Conversely, suppler payments for Wesfarmers along with Woolworths company has elevated

because of is development in the production lines and addressing consumers varying preferences.

In contrast to such situation, it is revealed by the interest payments that a company needs to deal

with increased bank loans taken in fulfilling needs of its every business conduct.

Investing Cash Flows- The items considered within the investing cash flows encompass

payment and purchase of property, plant and equipment along with intangible assets payment.

The amount paid for the plant, property and equipment is deemed to be the expenses incurred in

acquiring and purchasing it as it is important in all the business activities. On the other hand,

these assets attain economic benefits for organizations that is mentioned within proceedings of

plant, property and equipment. From case analysis of Wesfarmers Limited it is evidenced that

Wesfarmers have decreased its asset investment in 2017 that has increased in the upcoming years

due to increased sale of its assets (Woolworthsgroup.com.au. 2018). While selling or acquiring

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7FINANCIAL STATEMENTS ANALYSIS AND CORPORATE ACCOUNTING

these long-term assetsthese are deemed as proceeds and investments. In case of Woolworths

Limited, a good fraction of proceedings can be attained from certain joint arrangements along

with associates for the year 2017. However, the investment amount has remained constant for the

selected years. An increased investment of $47 million has been made by Wesfarmers in loan

notes of 2016 that has obtained loan rates redemption of $54 million.

Financing Cash Flows- The financing activities of these companies encompass the

repayments along with equity dividend and borrowings proceeds provided to the shareholders of

Wesfarmers Limited. Borrowings include net amount provided to the borrowers by its lenders

within important loan agreement terms. Through observing the situation of Woolworths Limited

a huge decline in borrowing proceeds due to debtor’slong-termextension. Moreover, a high

amount is paid as loan repayment to banks (Wu, Chen and Lee2016). Equity dividends explains

the yearly cash flows which is provided to the organization’s equity shareholders. Through

observing situation of Wesfarmers, dividend payment equity is declined in 2017as it focussed in

obtaining retained earnings base.

Requirement (iv):

The annual report of both the companies namely Woolworths and Wesfarmers

organization has three major aspects included within its statement of cash flows. These segments

encompass operating, financing along with investing activities. The comparative evaluation of all

the recognised segments in the statement of cash flow over the past three years are indicated

under:

these long-term assetsthese are deemed as proceeds and investments. In case of Woolworths

Limited, a good fraction of proceedings can be attained from certain joint arrangements along

with associates for the year 2017. However, the investment amount has remained constant for the

selected years. An increased investment of $47 million has been made by Wesfarmers in loan

notes of 2016 that has obtained loan rates redemption of $54 million.

Financing Cash Flows- The financing activities of these companies encompass the

repayments along with equity dividend and borrowings proceeds provided to the shareholders of

Wesfarmers Limited. Borrowings include net amount provided to the borrowers by its lenders

within important loan agreement terms. Through observing the situation of Woolworths Limited

a huge decline in borrowing proceeds due to debtor’slong-termextension. Moreover, a high

amount is paid as loan repayment to banks (Wu, Chen and Lee2016). Equity dividends explains

the yearly cash flows which is provided to the organization’s equity shareholders. Through

observing situation of Wesfarmers, dividend payment equity is declined in 2017as it focussed in

obtaining retained earnings base.

Requirement (iv):

The annual report of both the companies namely Woolworths and Wesfarmers

organization has three major aspects included within its statement of cash flows. These segments

encompass operating, financing along with investing activities. The comparative evaluation of all

the recognised segments in the statement of cash flow over the past three years are indicated

under:

8FINANCIAL STATEMENTS ANALYSIS AND CORPORATE ACCOUNTING

1 2

0

2000

4000

6000

8000

10000

12000

Chart Title

Particulars Series2

Cash flow for operating activities Cash flow from investing activities

Cash flow from financing activities

Figure 1: Wesfarmers and WoolworthsComparative Ratio Analysis

(Source: Wesfarmers.com.au., 2018)

Requirement (v):

Cash flow analysis of Wesfarmers has increased by $ 3791 million, $ 3365 million and $

4226 million over the years from 2015 to 2017 from all its operating activities (Johnston and

Petacchi 2017). In addition, a drastic decrease was observed due to the fact that the company has

observed drastic decrease in its plant, property and equipment purchase. In addition, cash flow

generated by the Wesfarmers from the financing conducts is indicated to $ 1333 millionto $ 3771

million in the year 2017 in contrast to year 2016.

In comparison to Wesfarmers, Woolworths is indicated to attain cash flows from the

operating conducts has declined from $ 3345 million to $ 2357 million that is observed in case of

both the years 2015 to 2016. It is observed to increase in the year 2017 by $ 3122 million. In

addition, the investing activities are observed to be $ 1090 million from $ 2011 million that

signifies to be decreasing from 2015 to 2016(Johnston and Petacchi 2017). This is for the reason

1 2

0

2000

4000

6000

8000

10000

12000

Chart Title

Particulars Series2

Cash flow for operating activities Cash flow from investing activities

Cash flow from financing activities

Figure 1: Wesfarmers and WoolworthsComparative Ratio Analysis

(Source: Wesfarmers.com.au., 2018)

Requirement (v):

Cash flow analysis of Wesfarmers has increased by $ 3791 million, $ 3365 million and $

4226 million over the years from 2015 to 2017 from all its operating activities (Johnston and

Petacchi 2017). In addition, a drastic decrease was observed due to the fact that the company has

observed drastic decrease in its plant, property and equipment purchase. In addition, cash flow

generated by the Wesfarmers from the financing conducts is indicated to $ 1333 millionto $ 3771

million in the year 2017 in contrast to year 2016.

In comparison to Wesfarmers, Woolworths is indicated to attain cash flows from the

operating conducts has declined from $ 3345 million to $ 2357 million that is observed in case of

both the years 2015 to 2016. It is observed to increase in the year 2017 by $ 3122 million. In

addition, the investing activities are observed to be $ 1090 million from $ 2011 million that

signifies to be decreasing from 2015 to 2016(Johnston and Petacchi 2017). This is for the reason

9FINANCIAL STATEMENTS ANALYSIS AND CORPORATE ACCOUNTING

that the organization has to deal with addressing all its bank loans for the investing activities for

the tear 2016. In addition, it is due to the reason that the organization attained increase in bank

loans by $ 1690 million for the year 2017. Cash generating from the financing activities is

indicated to attain increase significantly in contrast to Wesfarmers over the years from 2015 to

2017.

Other comprehensive income statement:

Requirement (vi):

Certain factors that are chosen to be reported in other comprehensive statement of income

for the Wesfarmers and Woolworths Company encompass retained earnings, cash flow hedge

reserve along with translation reserve in foreign currency (Johnston and Petacchi 2017).

Requirement (viii):

Foreign currency is used by organizations for the purpose of transforming the existing

foreign subsidiaries of the parent organization to a specified reporting currency. This acts as a

vital consolidation process aspect within the financial reports. Moreover, these are remeasured in

the reporting currency of the parent company based on which retained earnings recover an aspect

of net income after making necessary payments of dividend to all its shareholders for investing

in the capital projects in the upcoming years (Hribar and Yehuda2015). On the other hand, from

case analysis of WoolworthsLimited it is evident that cash flow hedge reserve is implemented in

a situation where an organization has attempted to deal with exposure taking place from

variations in financial asset or liability-based cash flows. Considering such reasons, changes in

specific uncetainities like interest rate takes place in the debt instrument floating rate.

that the organization has to deal with addressing all its bank loans for the investing activities for

the tear 2016. In addition, it is due to the reason that the organization attained increase in bank

loans by $ 1690 million for the year 2017. Cash generating from the financing activities is

indicated to attain increase significantly in contrast to Wesfarmers over the years from 2015 to

2017.

Other comprehensive income statement:

Requirement (vi):

Certain factors that are chosen to be reported in other comprehensive statement of income

for the Wesfarmers and Woolworths Company encompass retained earnings, cash flow hedge

reserve along with translation reserve in foreign currency (Johnston and Petacchi 2017).

Requirement (viii):

Foreign currency is used by organizations for the purpose of transforming the existing

foreign subsidiaries of the parent organization to a specified reporting currency. This acts as a

vital consolidation process aspect within the financial reports. Moreover, these are remeasured in

the reporting currency of the parent company based on which retained earnings recover an aspect

of net income after making necessary payments of dividend to all its shareholders for investing

in the capital projects in the upcoming years (Hribar and Yehuda2015). On the other hand, from

case analysis of WoolworthsLimited it is evident that cash flow hedge reserve is implemented in

a situation where an organization has attempted to deal with exposure taking place from

variations in financial asset or liability-based cash flows. Considering such reasons, changes in

specific uncetainities like interest rate takes place in the debt instrument floating rate.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10FINANCIAL STATEMENTS ANALYSIS AND CORPORATE ACCOUNTING

Requirement (viii):

From analysing the comprehensive income, it is evident that this is a distinct manner in

recording net profit. In the past years, some alterations in organizational profits was deemed to

remain out of its key operations and because of the same being highly risky was transferred to

shareholders equity (Hope, Thomas and Vyas 2017). On the other hand, Wesfarmers Company

uses some aspects related with comprehensive income statement with the standard net income.

These items included within the organization is drastically reported in comprehensive statement

of income in order to provide detailed and holistic viewpoint regarding all the conducts and

necessary operation drivers of the business which is not reported in the statement of income.

Requirement (ix):

By means of analysing the other comprehensive statement of income it is considered to

identify highly necessary aspects. This is because of the fact that this might lead to elaborating

the ways in which the organizations are managing all their investments along with anticipating

any type of future losses (Haslamet al.2016). This is the cause for which all the above statements

are supported in a way that the auditors can obtain an effective measure concerned with an

organization’s investment’s fair value. By associating all these factors, the inclusion of few

factors of comprehensive statement of income that can be recoded s a useful technique in

overviewing an organization’s managerial performance.

Accounting for Corporate Income Tax:

Requirement (x):

It is important for organizations to bear several expenses which encompass research and

development costs along with the selling and distribution costs and the tax expense is deemed to

Requirement (viii):

From analysing the comprehensive income, it is evident that this is a distinct manner in

recording net profit. In the past years, some alterations in organizational profits was deemed to

remain out of its key operations and because of the same being highly risky was transferred to

shareholders equity (Hope, Thomas and Vyas 2017). On the other hand, Wesfarmers Company

uses some aspects related with comprehensive income statement with the standard net income.

These items included within the organization is drastically reported in comprehensive statement

of income in order to provide detailed and holistic viewpoint regarding all the conducts and

necessary operation drivers of the business which is not reported in the statement of income.

Requirement (ix):

By means of analysing the other comprehensive statement of income it is considered to

identify highly necessary aspects. This is because of the fact that this might lead to elaborating

the ways in which the organizations are managing all their investments along with anticipating

any type of future losses (Haslamet al.2016). This is the cause for which all the above statements

are supported in a way that the auditors can obtain an effective measure concerned with an

organization’s investment’s fair value. By associating all these factors, the inclusion of few

factors of comprehensive statement of income that can be recoded s a useful technique in

overviewing an organization’s managerial performance.

Accounting for Corporate Income Tax:

Requirement (x):

It is important for organizations to bear several expenses which encompass research and

development costs along with the selling and distribution costs and the tax expense is deemed to

11FINANCIAL STATEMENTS ANALYSIS AND CORPORATE ACCOUNTING

be a vital aspect. Moreover, the organization is deemed to bea vital liability existing within the

organization due to certain municipal, state governments within the country. The tax expense

computation is through multiplying earnings before tax along with applicable tax rate after

considering certain factors such as tax liabilities and assets related with non-deductible aspects

(Barua and Saha 2015). For both the companies Woolworths and Wesfarmers are deemed not to

be tax exempted.

Certain applicable corporate tax rate in Australia is recorded to be 30% and, in such

scenario, tax expense beared by Wesfarmers can be $1,241 million in compassion to Woolworths

for the year 2017 that is recorded to be $640 million (Hanlon, Maydewand Saavedra 2017).

Considering such facts, it might be recorded that tax expenses for companies is indicated as

normal figures of tax rate because of increase in income of these two organizations.

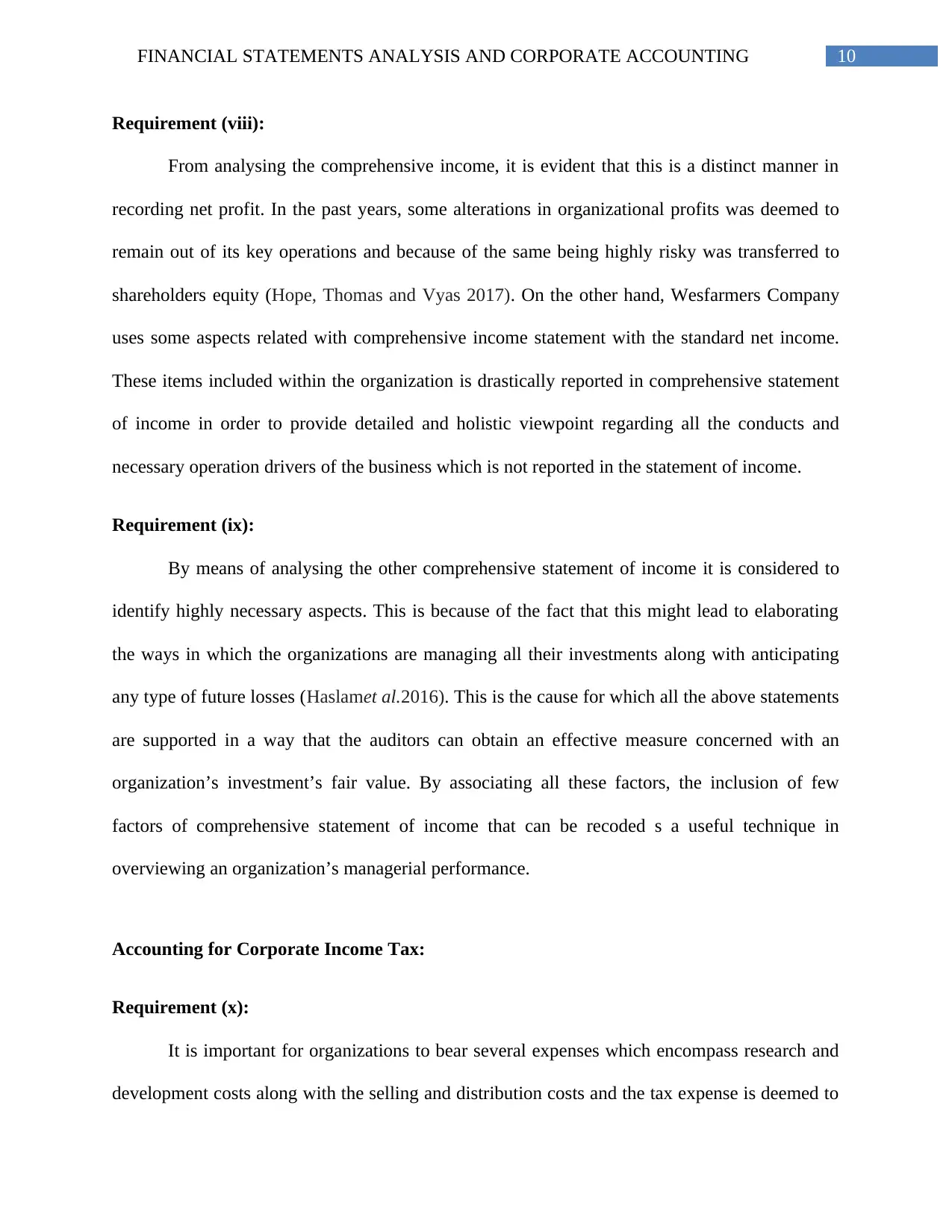

Requirement (xi):

It is indicated from the above table that the average rate of tax is deemed to be the taxed

business profits. Based on the below table, it might be explained that Woolworths has attained an

effective tax rate of 30.50% and for Wesfarmers Limited it is recorded to be 30.57% (Gordon,

Henry, Jorgensen and Linthicum 2017). For thisreason, it is present that Wesfarmers effective

tax rate is increased in comparison to Woolworths Company.

be a vital aspect. Moreover, the organization is deemed to bea vital liability existing within the

organization due to certain municipal, state governments within the country. The tax expense

computation is through multiplying earnings before tax along with applicable tax rate after

considering certain factors such as tax liabilities and assets related with non-deductible aspects

(Barua and Saha 2015). For both the companies Woolworths and Wesfarmers are deemed not to

be tax exempted.

Certain applicable corporate tax rate in Australia is recorded to be 30% and, in such

scenario, tax expense beared by Wesfarmers can be $1,241 million in compassion to Woolworths

for the year 2017 that is recorded to be $640 million (Hanlon, Maydewand Saavedra 2017).

Considering such facts, it might be recorded that tax expenses for companies is indicated as

normal figures of tax rate because of increase in income of these two organizations.

Requirement (xi):

It is indicated from the above table that the average rate of tax is deemed to be the taxed

business profits. Based on the below table, it might be explained that Woolworths has attained an

effective tax rate of 30.50% and for Wesfarmers Limited it is recorded to be 30.57% (Gordon,

Henry, Jorgensen and Linthicum 2017). For thisreason, it is present that Wesfarmers effective

tax rate is increased in comparison to Woolworths Company.

12FINANCIAL STATEMENTS ANALYSIS AND CORPORATE ACCOUNTING

Requirement (xii):

Deferred tax assets are deemed to be a situation in which the companies decide to

paycertainadvance taxes on the related financial assets or increased taxes. In contrast to that,

there is an increase in the deferred tax liabilities in which variation is considered to be revealed

between the profit carrying amounts and tax (Goh, Lee, Lim and Shevlin 2016). The main cause

for which deferred tax assets might be recognised is because of increased depreciation payments

due to increased alterations in depreciationamount and the taxable rate of depreciation. In

contrast to that, the major cause of identifying the tax liabilities that is because of few variations

in company profits in which low tax is experienced in the year 2017.

Requirement (xiii):

From observing the situation of Wesfarmers Company, the deferred tax assets are

observed to be $971 million in comparison to $611 million from the year 2016 to the year 2017.

The Woolworths Company’s annual report revealed that tax assets are $372.3 million in 2017 in

comparison to $497.7 million in 2016. Moreover, the deferred tax liabilitiesare deemed to be

$625.7 million that has decreased in the year 2017 in comparison to the year 2016 that recorded

to be $626.4 million (Givoly, Hayn and Katz 2017).

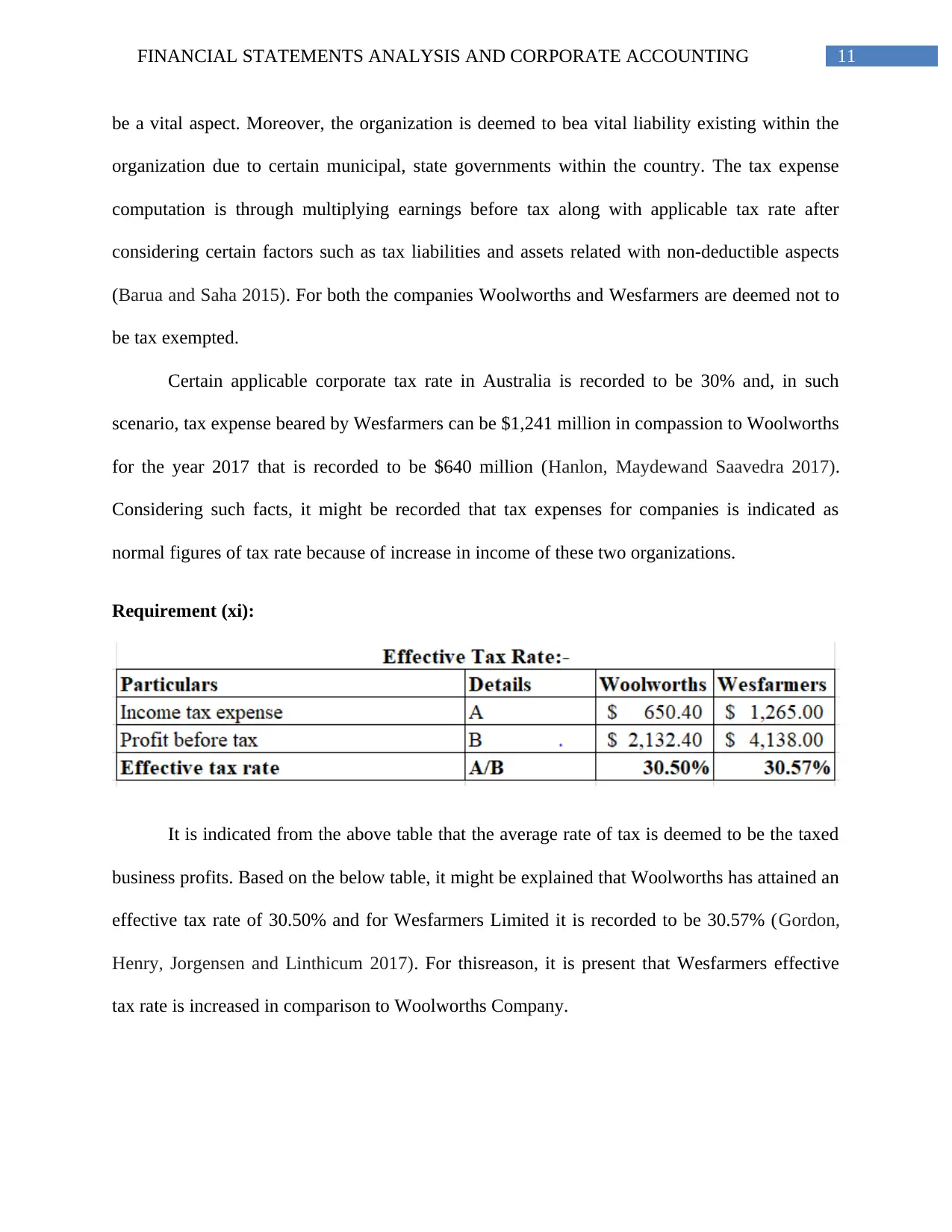

Requirement (xiv):

Requirement (xii):

Deferred tax assets are deemed to be a situation in which the companies decide to

paycertainadvance taxes on the related financial assets or increased taxes. In contrast to that,

there is an increase in the deferred tax liabilities in which variation is considered to be revealed

between the profit carrying amounts and tax (Goh, Lee, Lim and Shevlin 2016). The main cause

for which deferred tax assets might be recognised is because of increased depreciation payments

due to increased alterations in depreciationamount and the taxable rate of depreciation. In

contrast to that, the major cause of identifying the tax liabilities that is because of few variations

in company profits in which low tax is experienced in the year 2017.

Requirement (xiii):

From observing the situation of Wesfarmers Company, the deferred tax assets are

observed to be $971 million in comparison to $611 million from the year 2016 to the year 2017.

The Woolworths Company’s annual report revealed that tax assets are $372.3 million in 2017 in

comparison to $497.7 million in 2016. Moreover, the deferred tax liabilitiesare deemed to be

$625.7 million that has decreased in the year 2017 in comparison to the year 2016 that recorded

to be $626.4 million (Givoly, Hayn and Katz 2017).

Requirement (xiv):

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

13FINANCIAL STATEMENTS ANALYSIS AND CORPORATE ACCOUNTING

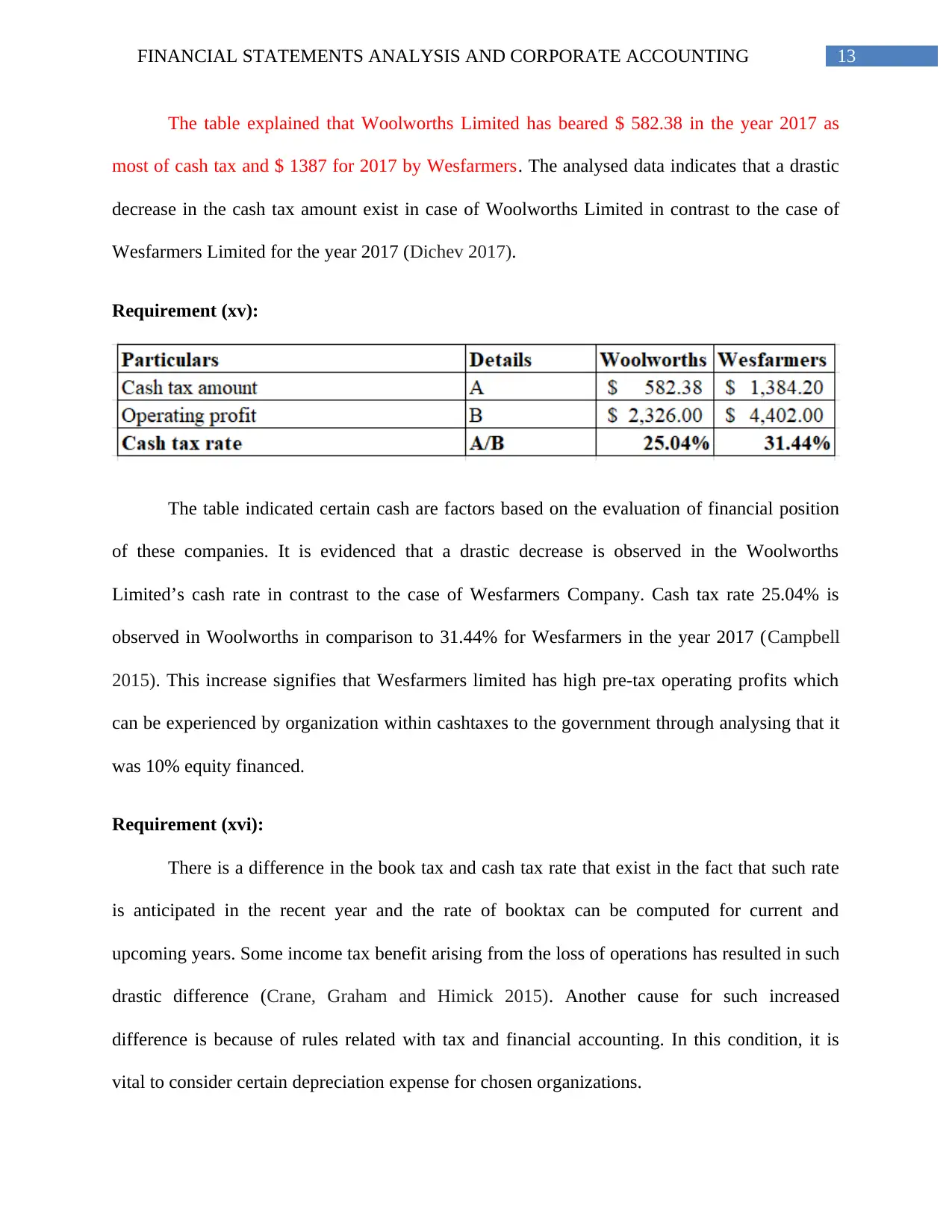

The table explained that Woolworths Limited has beared $ 582.38 in the year 2017 as

most of cash tax and $ 1387 for 2017 by Wesfarmers. The analysed data indicates that a drastic

decrease in the cash tax amount exist in case of Woolworths Limited in contrast to the case of

Wesfarmers Limited for the year 2017 (Dichev 2017).

Requirement (xv):

The table indicated certain cash are factors based on the evaluation of financial position

of these companies. It is evidenced that a drastic decrease is observed in the Woolworths

Limited’s cash rate in contrast to the case of Wesfarmers Company. Cash tax rate 25.04% is

observed in Woolworths in comparison to 31.44% for Wesfarmers in the year 2017 (Campbell

2015). This increase signifies that Wesfarmers limited has high pre-tax operating profits which

can be experienced by organization within cashtaxes to the government through analysing that it

was 10% equity financed.

Requirement (xvi):

There is a difference in the book tax and cash tax rate that exist in the fact that such rate

is anticipated in the recent year and the rate of booktax can be computed for current and

upcoming years. Some income tax benefit arising from the loss of operations has resulted in such

drastic difference (Crane, Graham and Himick 2015). Another cause for such increased

difference is because of rules related with tax and financial accounting. In this condition, it is

vital to consider certain depreciation expense for chosen organizations.

The table explained that Woolworths Limited has beared $ 582.38 in the year 2017 as

most of cash tax and $ 1387 for 2017 by Wesfarmers. The analysed data indicates that a drastic

decrease in the cash tax amount exist in case of Woolworths Limited in contrast to the case of

Wesfarmers Limited for the year 2017 (Dichev 2017).

Requirement (xv):

The table indicated certain cash are factors based on the evaluation of financial position

of these companies. It is evidenced that a drastic decrease is observed in the Woolworths

Limited’s cash rate in contrast to the case of Wesfarmers Company. Cash tax rate 25.04% is

observed in Woolworths in comparison to 31.44% for Wesfarmers in the year 2017 (Campbell

2015). This increase signifies that Wesfarmers limited has high pre-tax operating profits which

can be experienced by organization within cashtaxes to the government through analysing that it

was 10% equity financed.

Requirement (xvi):

There is a difference in the book tax and cash tax rate that exist in the fact that such rate

is anticipated in the recent year and the rate of booktax can be computed for current and

upcoming years. Some income tax benefit arising from the loss of operations has resulted in such

drastic difference (Crane, Graham and Himick 2015). Another cause for such increased

difference is because of rules related with tax and financial accounting. In this condition, it is

vital to consider certain depreciation expense for chosen organizations.

14FINANCIAL STATEMENTS ANALYSIS AND CORPORATE ACCOUNTING

Conclusion:

Woolworths Group Limited and Wesfarmers Company was used in this report as these

major retail companies those have their business operations in the Australian retail sector. It is

gathered from the report that the main cause for which deferred tax assets might be recognised is

because of increased depreciation payments due to increased alterations in depreciationamount

and the taxable rate of depreciation. Moreover, by associating all the income statement factors,

the inclusion of few factors of comprehensive statement of income that can be recoded s a useful

technique in overviewing an organization’s managerial performance.

Conclusion:

Woolworths Group Limited and Wesfarmers Company was used in this report as these

major retail companies those have their business operations in the Australian retail sector. It is

gathered from the report that the main cause for which deferred tax assets might be recognised is

because of increased depreciation payments due to increased alterations in depreciationamount

and the taxable rate of depreciation. Moreover, by associating all the income statement factors,

the inclusion of few factors of comprehensive statement of income that can be recoded s a useful

technique in overviewing an organization’s managerial performance.

15FINANCIAL STATEMENTS ANALYSIS AND CORPORATE ACCOUNTING

References:

Akhmetshin, E.M. and Osadchy, E.A., 2015. New requirements to the control of the maintenance

of accounting records of the company in the conditions of the economic insecurity. International

Business Management, 9(5), pp.895-902.

Ball, R., Gerakos, J., Linnainmaa, J.T. and Nikolaev, V., 2016. Accruals, cash flows, and

operating profitability in the cross section of stock returns. Journal of Financial

Economics, 121(1), pp.28-45.

Barua, S. and Saha, A.K., 2015. Traditional Ratios vs. Cash Flow based Ratios: Which One is

Better Performance Indicator?. Advances in Economics and Business, 3(6), pp.232-251.

Campbell, J.L., 2015. The fair value of cash flow hedges, future profitability, and stock

returns. Contemporary Accounting Research, 32(1), pp.243-279.

Crane, A., Graham, C. and Himick, D., 2015. Financializing stakeholder claims. Journal of

Management Studies, 52(7), pp.878-906.

Dichev, I.D., 2017. On the conceptual foundations of financial reporting. Accounting and

Business Research, 47(6), pp.617-632.

Givoly, D., Hayn, C. and Katz, S., 2017. The changing relevance of accounting information to

debt holders over time. Review of Accounting Studies, 22(1), pp.64-108.

Goh, B.W., Lee, J., Lim, C.Y. and Shevlin, T., 2016. The effect of corporate tax avoidance on

the cost of equity. The Accounting Review, 91(6), pp.1647-1670.

References:

Akhmetshin, E.M. and Osadchy, E.A., 2015. New requirements to the control of the maintenance

of accounting records of the company in the conditions of the economic insecurity. International

Business Management, 9(5), pp.895-902.

Ball, R., Gerakos, J., Linnainmaa, J.T. and Nikolaev, V., 2016. Accruals, cash flows, and

operating profitability in the cross section of stock returns. Journal of Financial

Economics, 121(1), pp.28-45.

Barua, S. and Saha, A.K., 2015. Traditional Ratios vs. Cash Flow based Ratios: Which One is

Better Performance Indicator?. Advances in Economics and Business, 3(6), pp.232-251.

Campbell, J.L., 2015. The fair value of cash flow hedges, future profitability, and stock

returns. Contemporary Accounting Research, 32(1), pp.243-279.

Crane, A., Graham, C. and Himick, D., 2015. Financializing stakeholder claims. Journal of

Management Studies, 52(7), pp.878-906.

Dichev, I.D., 2017. On the conceptual foundations of financial reporting. Accounting and

Business Research, 47(6), pp.617-632.

Givoly, D., Hayn, C. and Katz, S., 2017. The changing relevance of accounting information to

debt holders over time. Review of Accounting Studies, 22(1), pp.64-108.

Goh, B.W., Lee, J., Lim, C.Y. and Shevlin, T., 2016. The effect of corporate tax avoidance on

the cost of equity. The Accounting Review, 91(6), pp.1647-1670.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

16FINANCIAL STATEMENTS ANALYSIS AND CORPORATE ACCOUNTING

Gordon, E.A., Henry, E., Jorgensen, B.N. and Linthicum, C.L., 2017. Flexibility in cash-flow

classification under IFRS: determinants and consequences. Review of Accounting Studies, 22(2),

pp.839-872.

Hanlon, M., Maydew, E.L. and Saavedra, D., 2017. The taxman cometh: Does tax uncertainty

affect corporate cash holdings?. Review of Accounting Studies, 22(3), pp.1198-1228.

Haslam, C., Tsitsianis, N., Hoinaru, R., Andersson, T. and Katechos, G., 2016. Stress testing

international financial reporting standards (IFRS): Accounting for stability and the public good

in a financialized world. Accounting, Economics and Law: A Convivium, 6(2), pp.93-118.

Hope, O.K., Thomas, W.B. and Vyas, D., 2017. Stakeholder demand for accounting quality and

economic usefulness of accounting in US private firms. Journal of Accounting and Public

Policy, 36(1), pp.1-13.

Hribar, P. and Yehuda, N., 2015. The mispricing of cash flows and accruals at different life‐

cycle stages. Contemporary Accounting Research, 32(3), pp.1053-1072.

Johnston, R. and Petacchi, R., 2017. Regulatory oversight of financial reporting: Securities and

Exchange Commission comment letters. Contemporary Accounting Research, 34(2), pp.1128-

1155.

Koo, D.S., Ramalingegowda, S. and Yu, Y., 2017. The effect of financial reporting quality on

corporate dividend policy. Review of Accounting Studies, 22(2), pp.753-790.

Kraft, P., 2014. Rating agency adjustments to GAAP financial statements and their effect on

ratings and credit spreads. The Accounting Review, 90(2), pp.641-674.

Gordon, E.A., Henry, E., Jorgensen, B.N. and Linthicum, C.L., 2017. Flexibility in cash-flow

classification under IFRS: determinants and consequences. Review of Accounting Studies, 22(2),

pp.839-872.

Hanlon, M., Maydew, E.L. and Saavedra, D., 2017. The taxman cometh: Does tax uncertainty

affect corporate cash holdings?. Review of Accounting Studies, 22(3), pp.1198-1228.

Haslam, C., Tsitsianis, N., Hoinaru, R., Andersson, T. and Katechos, G., 2016. Stress testing

international financial reporting standards (IFRS): Accounting for stability and the public good

in a financialized world. Accounting, Economics and Law: A Convivium, 6(2), pp.93-118.

Hope, O.K., Thomas, W.B. and Vyas, D., 2017. Stakeholder demand for accounting quality and

economic usefulness of accounting in US private firms. Journal of Accounting and Public

Policy, 36(1), pp.1-13.

Hribar, P. and Yehuda, N., 2015. The mispricing of cash flows and accruals at different life‐

cycle stages. Contemporary Accounting Research, 32(3), pp.1053-1072.

Johnston, R. and Petacchi, R., 2017. Regulatory oversight of financial reporting: Securities and

Exchange Commission comment letters. Contemporary Accounting Research, 34(2), pp.1128-

1155.

Koo, D.S., Ramalingegowda, S. and Yu, Y., 2017. The effect of financial reporting quality on

corporate dividend policy. Review of Accounting Studies, 22(2), pp.753-790.

Kraft, P., 2014. Rating agency adjustments to GAAP financial statements and their effect on

ratings and credit spreads. The Accounting Review, 90(2), pp.641-674.

17FINANCIAL STATEMENTS ANALYSIS AND CORPORATE ACCOUNTING

Tayeh, M., Al-Jarrah, I.M. and Tarhini, A., 2015. Accounting vs. market-based measures of firm

performance related to information technology investments. International Review of Social

Sciences and Humanities, 9(1), pp.129-145.

Wesfarmers.com.au., 2018. [online] Available at: https://www.wesfarmers.com.au/docs/default-

source/default-document-library/2017-annual-report.pdf?sfvrsn=0 [Accessed 15 Sep. 2018].

Woolworthsgroup.com.au., 2018. [online] Available at:

https://www.woolworthsgroup.com.au/icms_docs/188795_annual-report-2017.pdf [Accessed 15

Sep. 2018].

Wu, S., Chen, C.M. and Lee, P.C., 2016. Independent directors and earnings management: The

moderating effects of controlling shareholders and the divergence of cash-flow and control

rights. The North American Journal of Economics and Finance, 35, pp.153-165.

Tayeh, M., Al-Jarrah, I.M. and Tarhini, A., 2015. Accounting vs. market-based measures of firm

performance related to information technology investments. International Review of Social

Sciences and Humanities, 9(1), pp.129-145.

Wesfarmers.com.au., 2018. [online] Available at: https://www.wesfarmers.com.au/docs/default-

source/default-document-library/2017-annual-report.pdf?sfvrsn=0 [Accessed 15 Sep. 2018].

Woolworthsgroup.com.au., 2018. [online] Available at:

https://www.woolworthsgroup.com.au/icms_docs/188795_annual-report-2017.pdf [Accessed 15

Sep. 2018].

Wu, S., Chen, C.M. and Lee, P.C., 2016. Independent directors and earnings management: The

moderating effects of controlling shareholders and the divergence of cash-flow and control

rights. The North American Journal of Economics and Finance, 35, pp.153-165.

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.