Accounting & Information System: Financial Statement Analysis

VerifiedAdded on 2023/06/11

|19

|1376

|344

Report

AI Summary

This report provides a detailed analysis of the financial statements of Saminul, focusing on key business transactions and their impact. The analysis includes a review of the trial balance, statement of profit and loss, and balance sheet. The trial balance, with a total debit and credit balance of $566660, verifies numeral accuracy. The statement of profit and loss reveals a loss of $2822, attributed to high operating expenses, particularly rent and interest. A pie chart illustrates the distribution of operating expenses. The balance sheet highlights liquid assets, including a bank balance of $416,140.78, and classifies current assets such as accounts receivable, inventories, and prepaid expenses, depicted in a bar diagram. The report concludes with an overview of current liabilities and equities, emphasizing the importance of double-entry accounting to ensure balanced financial statements.

Running head: ACCOUNTING AND INFORMATION SYSTEM

Accounting and Information System

Name of the Student:

Name of the University:

Author’s Note:

Accounting and Information System

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

ACCOUNTING AND INFORMATION SYSTEM

Table of Contents

Introduction......................................................................................................................................2

Analysis of Financial Statements.....................................................................................................2

Reference.........................................................................................................................................6

Appendix..........................................................................................................................................7

ACCOUNTING AND INFORMATION SYSTEM

Table of Contents

Introduction......................................................................................................................................2

Analysis of Financial Statements.....................................................................................................2

Reference.........................................................................................................................................6

Appendix..........................................................................................................................................7

2

ACCOUNTING AND INFORMATION SYSTEM

Introduction:

In this particular report, the analysis of financial statements of Saminul has been

demonstrated for evaluation of several items that are presented. The business of Saminul carries

out the transactions that are related to the wide-ranging business functions. Main activities of

business are to carry out stock trading activities. Recording of such transactions are done in the

form of journals in the books of account of company (Simkin et al. 2014). The appendix section

presents the various financial statements of company.

Financial Statements analysis:

The trial balance has been prepared that depicts all the transactions that have occurred by

carrying out the business activities during the month of May. Verifying the numeral accuracy of

trail balance is the main objective of preparing trail balance. In order to depict that whether the

financial statements are free from any human errors while preparation of trial balances the debit

side of such statement should be equal to credit side (Prasad and Green 2015). A sales of amount

$ 9,829 is generated by business as presented by the trail balance and the cost of goods stood at $

5932 that shows the business production cost. Moreover, some of the items that are incorporated

while preparing trial balance include liabilities, assets, expenses, and income and capital

contributed owner. As depicted in the appendix of trial balance statement, the total amount of

credit and debit balance stood at $ 566660.

The total amount of profit that the business earns during any particular reporting year is

presented in the statement of profit and loss. Al the income earned and expenses incurred by the

business are summarized in this statement by segmenting all the items of expenses and items of

income. Total amount of loss that has been incurred by activities of Saminul during a month as

ACCOUNTING AND INFORMATION SYSTEM

Introduction:

In this particular report, the analysis of financial statements of Saminul has been

demonstrated for evaluation of several items that are presented. The business of Saminul carries

out the transactions that are related to the wide-ranging business functions. Main activities of

business are to carry out stock trading activities. Recording of such transactions are done in the

form of journals in the books of account of company (Simkin et al. 2014). The appendix section

presents the various financial statements of company.

Financial Statements analysis:

The trial balance has been prepared that depicts all the transactions that have occurred by

carrying out the business activities during the month of May. Verifying the numeral accuracy of

trail balance is the main objective of preparing trail balance. In order to depict that whether the

financial statements are free from any human errors while preparation of trial balances the debit

side of such statement should be equal to credit side (Prasad and Green 2015). A sales of amount

$ 9,829 is generated by business as presented by the trail balance and the cost of goods stood at $

5932 that shows the business production cost. Moreover, some of the items that are incorporated

while preparing trial balance include liabilities, assets, expenses, and income and capital

contributed owner. As depicted in the appendix of trial balance statement, the total amount of

credit and debit balance stood at $ 566660.

The total amount of profit that the business earns during any particular reporting year is

presented in the statement of profit and loss. Al the income earned and expenses incurred by the

business are summarized in this statement by segmenting all the items of expenses and items of

income. Total amount of loss that has been incurred by activities of Saminul during a month as

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

ACCOUNTING AND INFORMATION SYSTEM

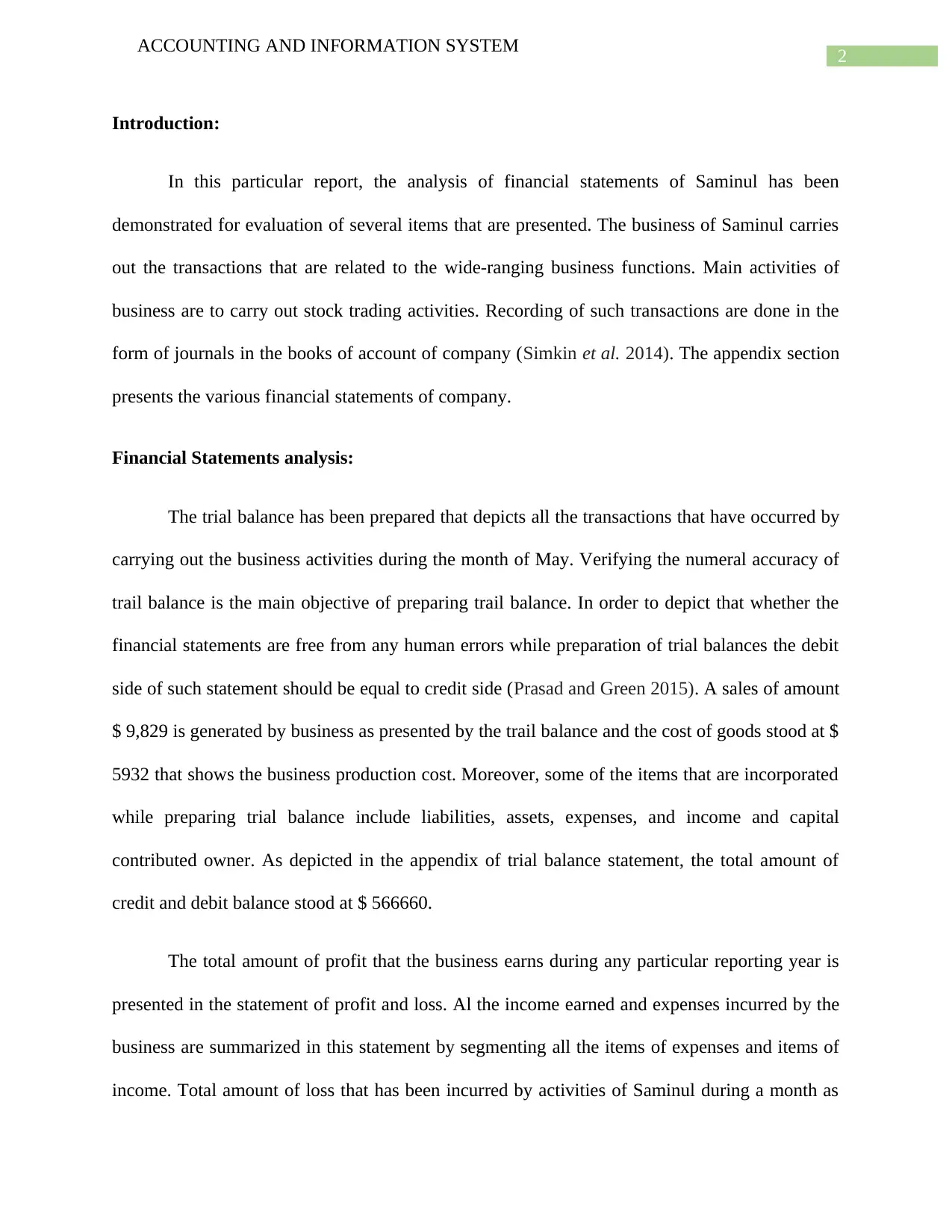

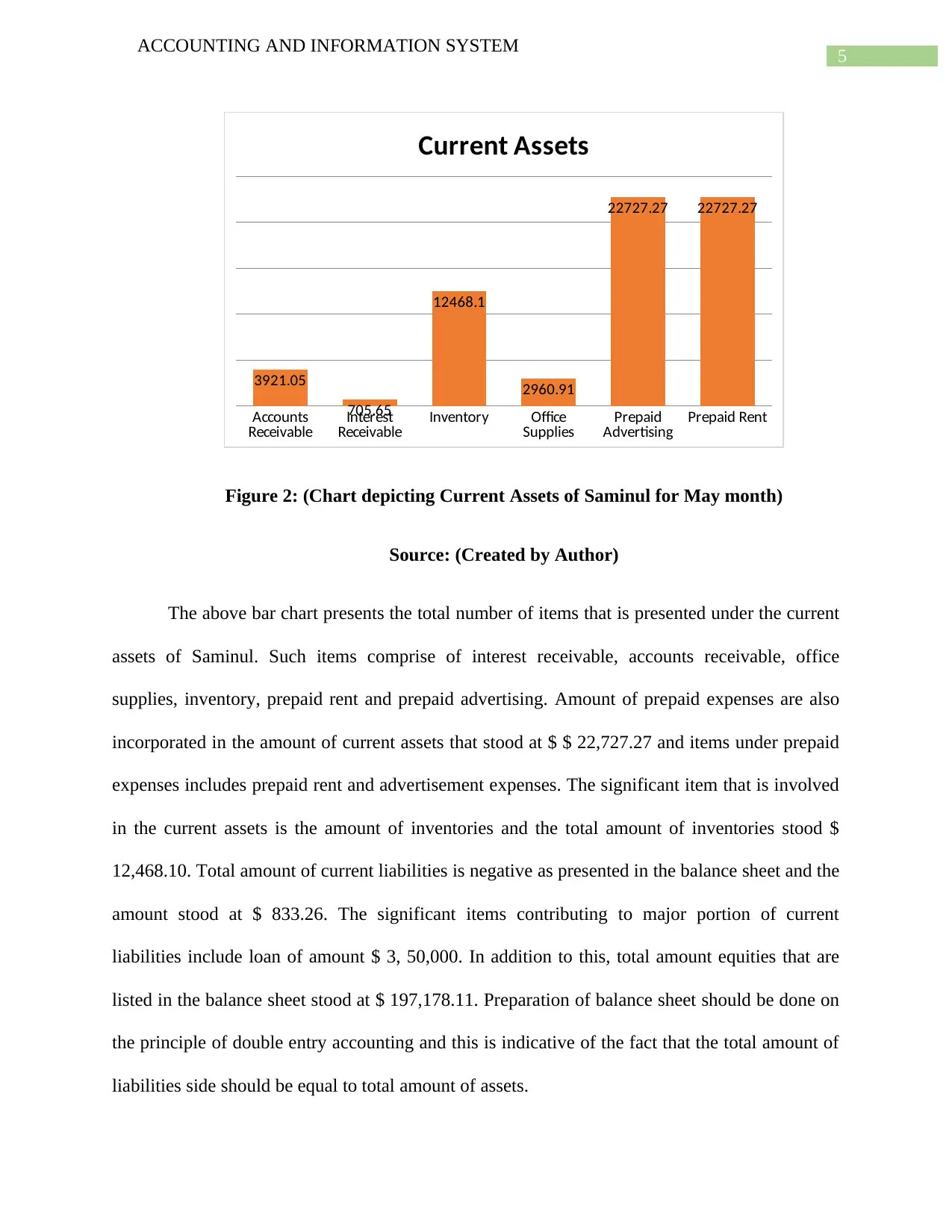

depicted in the profit and loss statement shown in the appendix stood at $ 2822. The reason that

is attributable to this increase is loss is increase in operating expenses and the amount is

considerably higher at amount $ 7,425 compared to previous time period. The pie chart presented

below helps in explaining the analysis and classification business operating expenses (Laudon

and Laudon 2016).

Depreciation

4%

Interest Expense

28%

Motor Vehicle Expenses

7%

Rent

61%

Operating Expenses

Depreciation Interest Expense

Motor Vehicle Expenses Rent

Figure 1: (Pie Chart depicting Expenses of the Saminul for the May month)

Source: (Created by Author)

An amount of $ 7425 is incurred by operating activities of business of Saminul as

presented in the pie chart. However, the major amount of expenses that have been incurred by

business is in relation to rent paid and the total amount of rent paid stood $ 4,545. The total

amount of operating expenses comprises of 61% of total expenses that has been incurred by

business and such expenses are of fixed nature. Moreover, an interest expense of $ 2,042 has

been incurred by business that comprise of 28% of total amount of expenses incurred on

operations. Total amount of interest expenses comprise of the loan that is taken by the business

ACCOUNTING AND INFORMATION SYSTEM

depicted in the profit and loss statement shown in the appendix stood at $ 2822. The reason that

is attributable to this increase is loss is increase in operating expenses and the amount is

considerably higher at amount $ 7,425 compared to previous time period. The pie chart presented

below helps in explaining the analysis and classification business operating expenses (Laudon

and Laudon 2016).

Depreciation

4%

Interest Expense

28%

Motor Vehicle Expenses

7%

Rent

61%

Operating Expenses

Depreciation Interest Expense

Motor Vehicle Expenses Rent

Figure 1: (Pie Chart depicting Expenses of the Saminul for the May month)

Source: (Created by Author)

An amount of $ 7425 is incurred by operating activities of business of Saminul as

presented in the pie chart. However, the major amount of expenses that have been incurred by

business is in relation to rent paid and the total amount of rent paid stood $ 4,545. The total

amount of operating expenses comprises of 61% of total expenses that has been incurred by

business and such expenses are of fixed nature. Moreover, an interest expense of $ 2,042 has

been incurred by business that comprise of 28% of total amount of expenses incurred on

operations. Total amount of interest expenses comprise of the loan that is taken by the business

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

ACCOUNTING AND INFORMATION SYSTEM

and the amount of loan taken is presented in the balance sheet of company. Some of the other

expenses of company include expenses incurred in motor vehicle and depreciation expenses.

Expenses attributable to depreciation happen in the normal course of business due to wearing and

tearing of the assets. Expenses attributable to depreciation are the expenses for which there is nit

outflow of cash by business (Collier 2015). In addition to this, the expenses that have been

incurred on motor vehicle are associated with the maintenance of business motor vehicle. Total

amount of expense that is attributable to depreciation and motor vehicles is recorded at $ 306 and

$ 531.

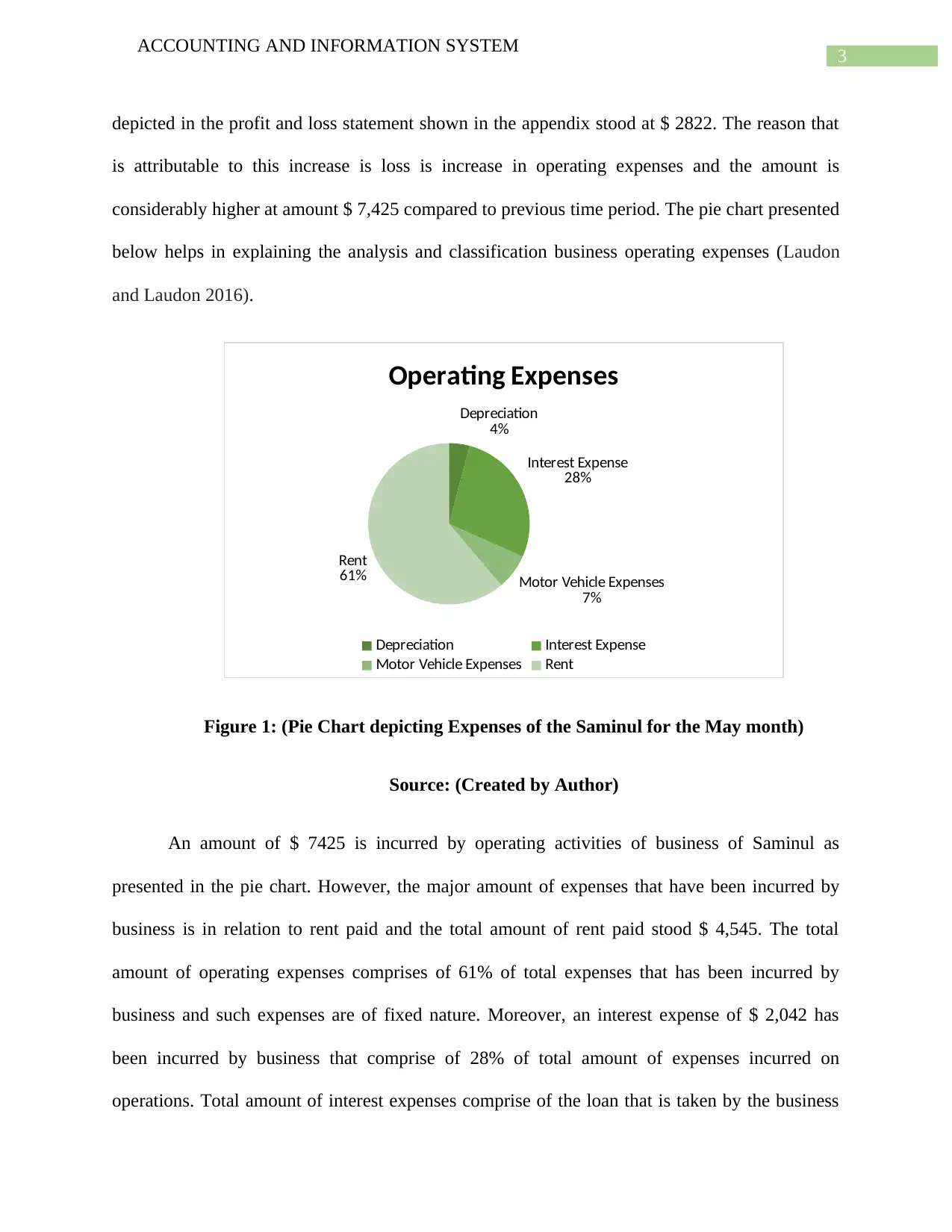

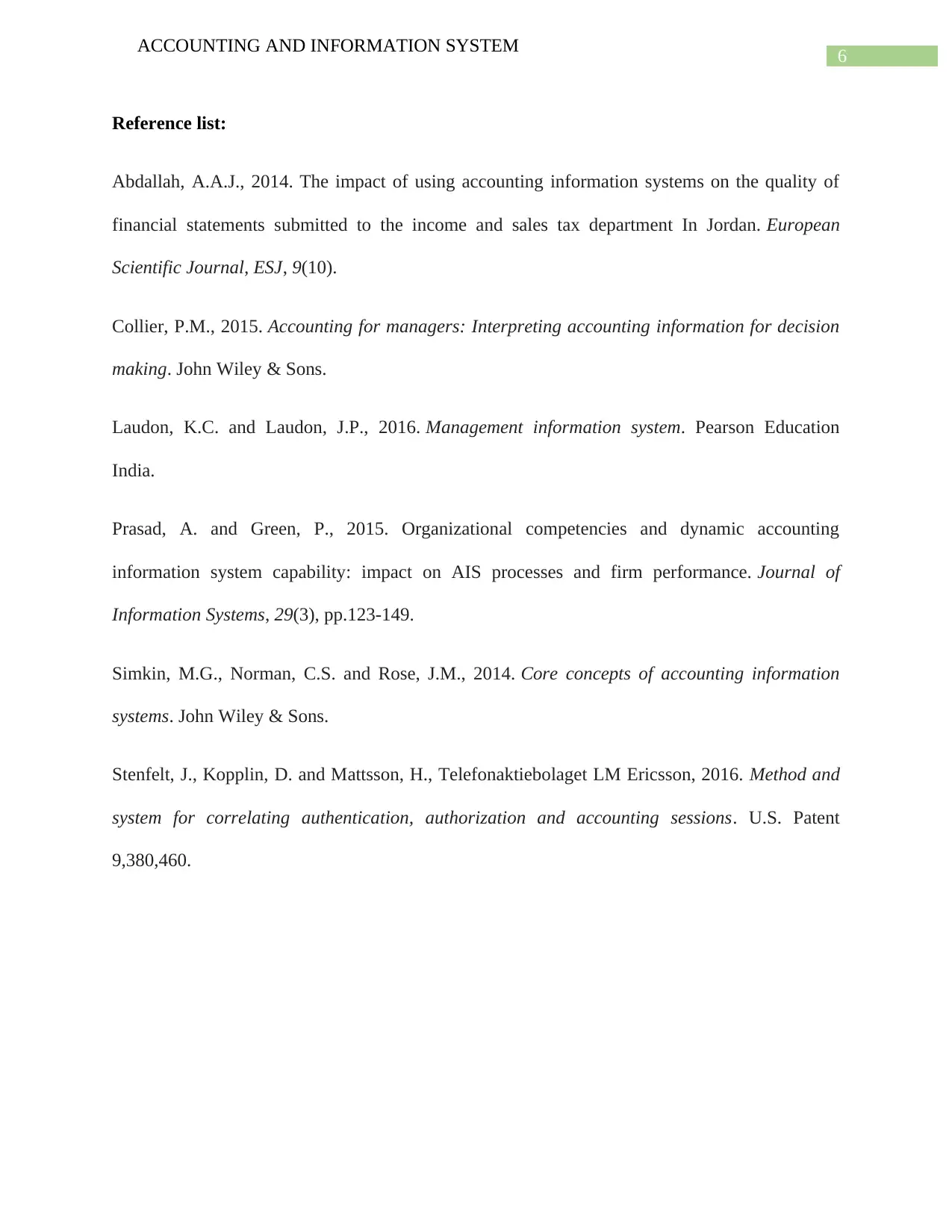

The balance sheet or the statement of financial position is the most crucial financial

statement that the business prepares for presenting the total amount of assets and total amount of

liabilities. In case of Saminul, the balance sheet is prepared on monthly basis and the most liquid

assets that are possessed by business are presented in the balance sheet. Such liquid assets

comprise of investment and bank balance that and the total amount of cash at bank stood at $

416,140.78 and this amount is the availability of liquid cash that is used whenever it is required

by company. Some of the items that are included in the current assets of business are accounts

receivable and inventories (Stenfelt et al. 2016). The bar diagram presented below depicts the

current assets classification.

ACCOUNTING AND INFORMATION SYSTEM

and the amount of loan taken is presented in the balance sheet of company. Some of the other

expenses of company include expenses incurred in motor vehicle and depreciation expenses.

Expenses attributable to depreciation happen in the normal course of business due to wearing and

tearing of the assets. Expenses attributable to depreciation are the expenses for which there is nit

outflow of cash by business (Collier 2015). In addition to this, the expenses that have been

incurred on motor vehicle are associated with the maintenance of business motor vehicle. Total

amount of expense that is attributable to depreciation and motor vehicles is recorded at $ 306 and

$ 531.

The balance sheet or the statement of financial position is the most crucial financial

statement that the business prepares for presenting the total amount of assets and total amount of

liabilities. In case of Saminul, the balance sheet is prepared on monthly basis and the most liquid

assets that are possessed by business are presented in the balance sheet. Such liquid assets

comprise of investment and bank balance that and the total amount of cash at bank stood at $

416,140.78 and this amount is the availability of liquid cash that is used whenever it is required

by company. Some of the items that are included in the current assets of business are accounts

receivable and inventories (Stenfelt et al. 2016). The bar diagram presented below depicts the

current assets classification.

5

ACCOUNTING AND INFORMATION SYSTEM

Accounts

Receivable Interest

Receivable Inventory Office

Supplies Prepaid

Advertising Prepaid Rent

3921.05

705.65

12468.1

2960.91

22727.27 22727.27

Current Assets

Figure 2: (Chart depicting Current Assets of Saminul for May month)

Source: (Created by Author)

The above bar chart presents the total number of items that is presented under the current

assets of Saminul. Such items comprise of interest receivable, accounts receivable, office

supplies, inventory, prepaid rent and prepaid advertising. Amount of prepaid expenses are also

incorporated in the amount of current assets that stood at $ $ 22,727.27 and items under prepaid

expenses includes prepaid rent and advertisement expenses. The significant item that is involved

in the current assets is the amount of inventories and the total amount of inventories stood $

12,468.10. Total amount of current liabilities is negative as presented in the balance sheet and the

amount stood at $ 833.26. The significant items contributing to major portion of current

liabilities include loan of amount $ 3, 50,000. In addition to this, total amount equities that are

listed in the balance sheet stood at $ 197,178.11. Preparation of balance sheet should be done on

the principle of double entry accounting and this is indicative of the fact that the total amount of

liabilities side should be equal to total amount of assets.

ACCOUNTING AND INFORMATION SYSTEM

Accounts

Receivable Interest

Receivable Inventory Office

Supplies Prepaid

Advertising Prepaid Rent

3921.05

705.65

12468.1

2960.91

22727.27 22727.27

Current Assets

Figure 2: (Chart depicting Current Assets of Saminul for May month)

Source: (Created by Author)

The above bar chart presents the total number of items that is presented under the current

assets of Saminul. Such items comprise of interest receivable, accounts receivable, office

supplies, inventory, prepaid rent and prepaid advertising. Amount of prepaid expenses are also

incorporated in the amount of current assets that stood at $ $ 22,727.27 and items under prepaid

expenses includes prepaid rent and advertisement expenses. The significant item that is involved

in the current assets is the amount of inventories and the total amount of inventories stood $

12,468.10. Total amount of current liabilities is negative as presented in the balance sheet and the

amount stood at $ 833.26. The significant items contributing to major portion of current

liabilities include loan of amount $ 3, 50,000. In addition to this, total amount equities that are

listed in the balance sheet stood at $ 197,178.11. Preparation of balance sheet should be done on

the principle of double entry accounting and this is indicative of the fact that the total amount of

liabilities side should be equal to total amount of assets.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

ACCOUNTING AND INFORMATION SYSTEM

Reference list:

Abdallah, A.A.J., 2014. The impact of using accounting information systems on the quality of

financial statements submitted to the income and sales tax department In Jordan. European

Scientific Journal, ESJ, 9(10).

Collier, P.M., 2015. Accounting for managers: Interpreting accounting information for decision

making. John Wiley & Sons.

Laudon, K.C. and Laudon, J.P., 2016. Management information system. Pearson Education

India.

Prasad, A. and Green, P., 2015. Organizational competencies and dynamic accounting

information system capability: impact on AIS processes and firm performance. Journal of

Information Systems, 29(3), pp.123-149.

Simkin, M.G., Norman, C.S. and Rose, J.M., 2014. Core concepts of accounting information

systems. John Wiley & Sons.

Stenfelt, J., Kopplin, D. and Mattsson, H., Telefonaktiebolaget LM Ericsson, 2016. Method and

system for correlating authentication, authorization and accounting sessions. U.S. Patent

9,380,460.

ACCOUNTING AND INFORMATION SYSTEM

Reference list:

Abdallah, A.A.J., 2014. The impact of using accounting information systems on the quality of

financial statements submitted to the income and sales tax department In Jordan. European

Scientific Journal, ESJ, 9(10).

Collier, P.M., 2015. Accounting for managers: Interpreting accounting information for decision

making. John Wiley & Sons.

Laudon, K.C. and Laudon, J.P., 2016. Management information system. Pearson Education

India.

Prasad, A. and Green, P., 2015. Organizational competencies and dynamic accounting

information system capability: impact on AIS processes and firm performance. Journal of

Information Systems, 29(3), pp.123-149.

Simkin, M.G., Norman, C.S. and Rose, J.M., 2014. Core concepts of accounting information

systems. John Wiley & Sons.

Stenfelt, J., Kopplin, D. and Mattsson, H., Telefonaktiebolaget LM Ericsson, 2016. Method and

system for correlating authentication, authorization and accounting sessions. U.S. Patent

9,380,460.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

ACCOUNTING AND INFORMATION SYSTEM

Appendix:

ACCOUNTING AND INFORMATION SYSTEM

Appendix:

8

ACCOUNTING AND INFORMATION SYSTEM

ACCOUNTING AND INFORMATION SYSTEM

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

ACCOUNTING AND INFORMATION SYSTEM

ACCOUNTING AND INFORMATION SYSTEM

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

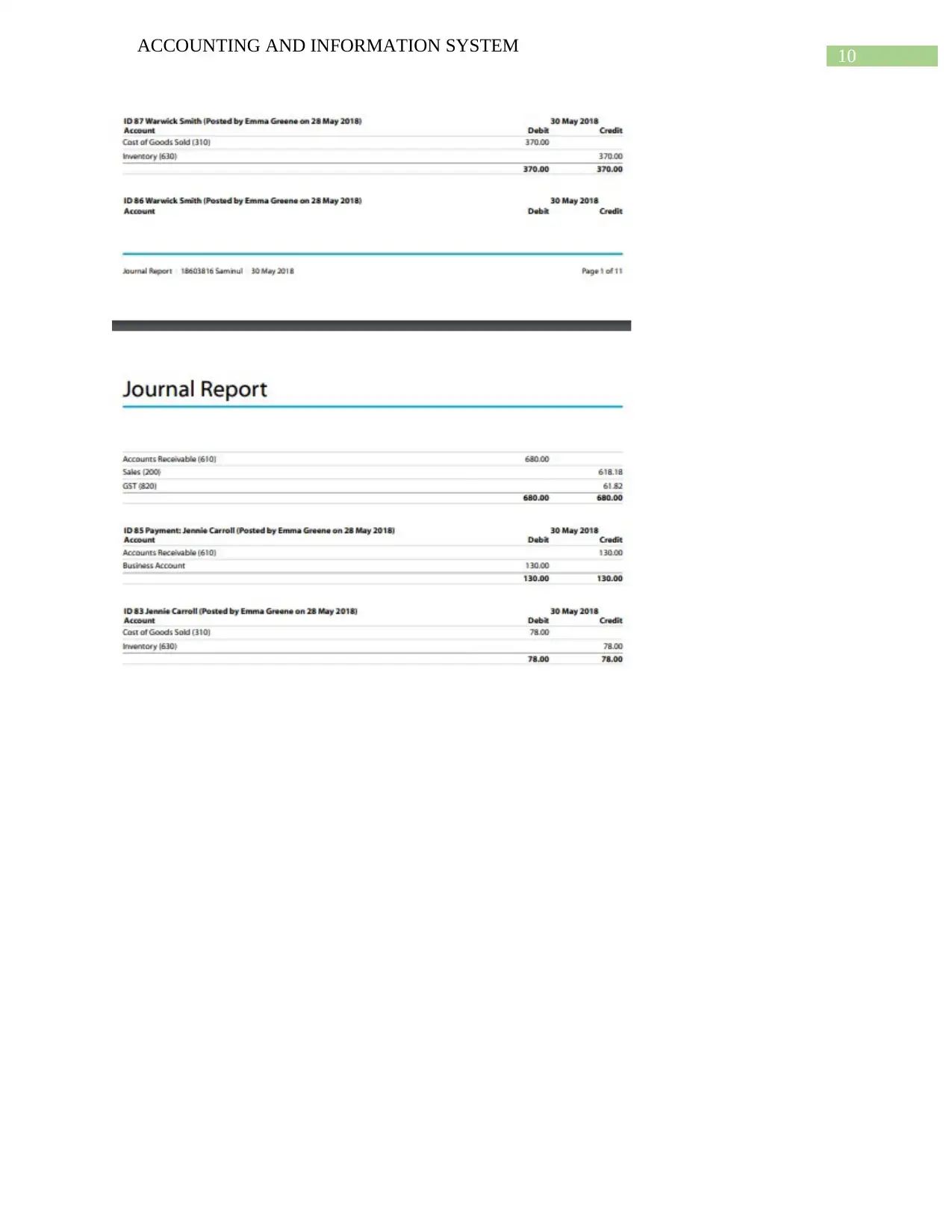

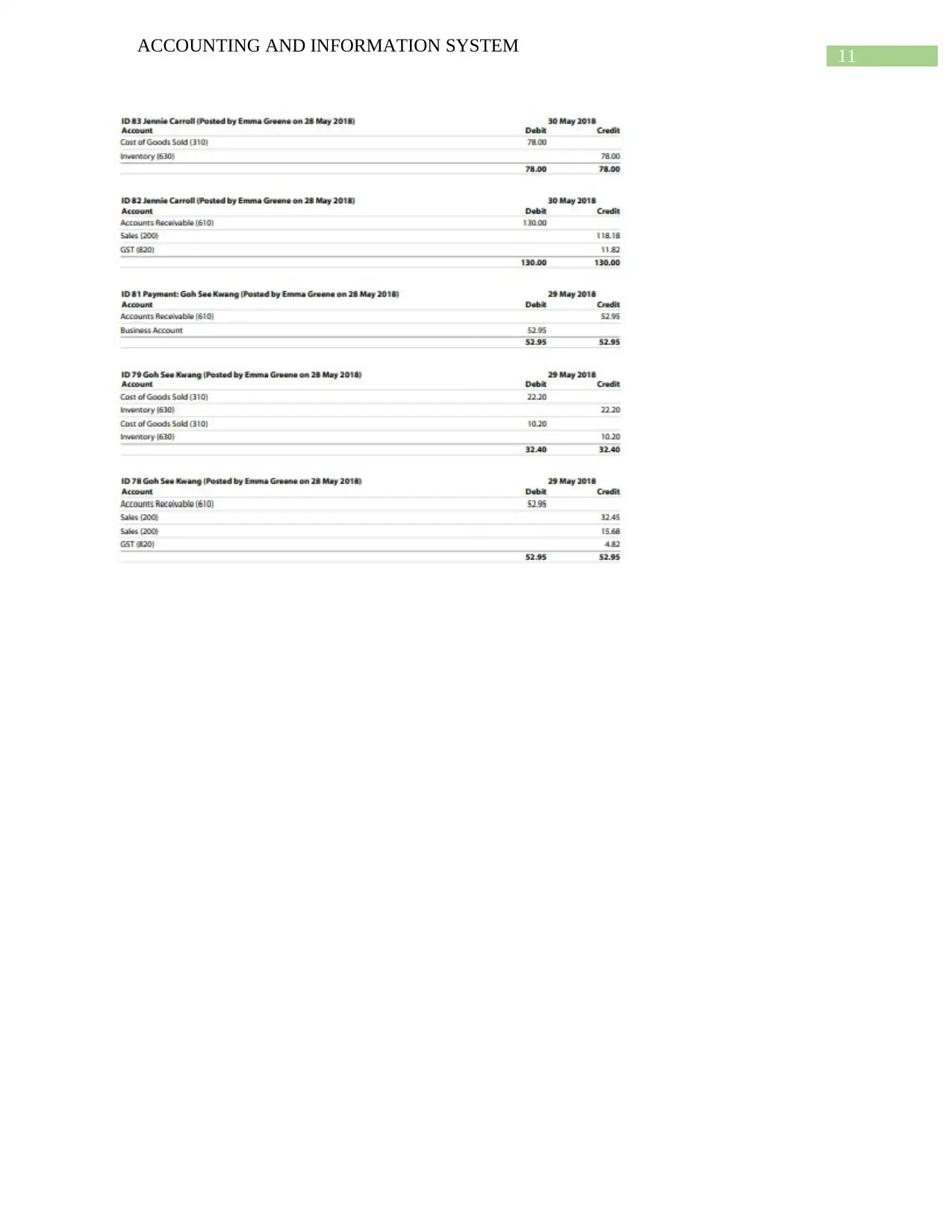

10

ACCOUNTING AND INFORMATION SYSTEM

ACCOUNTING AND INFORMATION SYSTEM

11

ACCOUNTING AND INFORMATION SYSTEM

ACCOUNTING AND INFORMATION SYSTEM

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.