Financial Accounting Assignment: FNSACC504 Assessment 2 Solution

VerifiedAdded on 2020/02/05

|15

|3277

|205

Homework Assignment

AI Summary

This document presents a comprehensive solution to a financial accounting assignment, specifically addressing the requirements of FNSACC504 Assessment 2. The solution includes detailed preparation of a Profit and Loss (P&L) account, along with supporting notes and illustrations of expenses. It covers the preparation of a statement of changes in equity, a balance sheet with accompanying notes according to Australian accounting standards, and a cash flow statement. Furthermore, the assignment delves into consolidation, providing consolidated worksheets, journal entries, and an overview of the use of accounting software like MYOB. The solution encompasses all five questions outlined in the assignment brief, offering a thorough understanding of financial accounting principles and practices.

Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

QUESTION 1...................................................................................................................................3

1. Preparation of P&L a/c ..........................................................................................................3

2. Notes preparation for the below mentioned aspects ..............................................................3

3. Presenting or illustrating expenses .......................................................................................4

Part b: Preparation of statement of changes in equity ................................................................4

QUESTION 2...................................................................................................................................5

a. Preparing balance sheet ...........................................................................................................5

2. Preparation of notes according to Australian accounting standard Board ..............................7

QUESTION 3...................................................................................................................................7

a....................................................................................................................................................7

b. ..................................................................................................................................................8

QUESTION 4...................................................................................................................................8

a....................................................................................................................................................8

b....................................................................................................................................................9

c..................................................................................................................................................10

QUESTION 5.................................................................................................................................10

QUESTION 1...................................................................................................................................3

1. Preparation of P&L a/c ..........................................................................................................3

2. Notes preparation for the below mentioned aspects ..............................................................3

3. Presenting or illustrating expenses .......................................................................................4

Part b: Preparation of statement of changes in equity ................................................................4

QUESTION 2...................................................................................................................................5

a. Preparing balance sheet ...........................................................................................................5

2. Preparation of notes according to Australian accounting standard Board ..............................7

QUESTION 3...................................................................................................................................7

a....................................................................................................................................................7

b. ..................................................................................................................................................8

QUESTION 4...................................................................................................................................8

a....................................................................................................................................................8

b....................................................................................................................................................9

c..................................................................................................................................................10

QUESTION 5.................................................................................................................................10

QUESTION 1

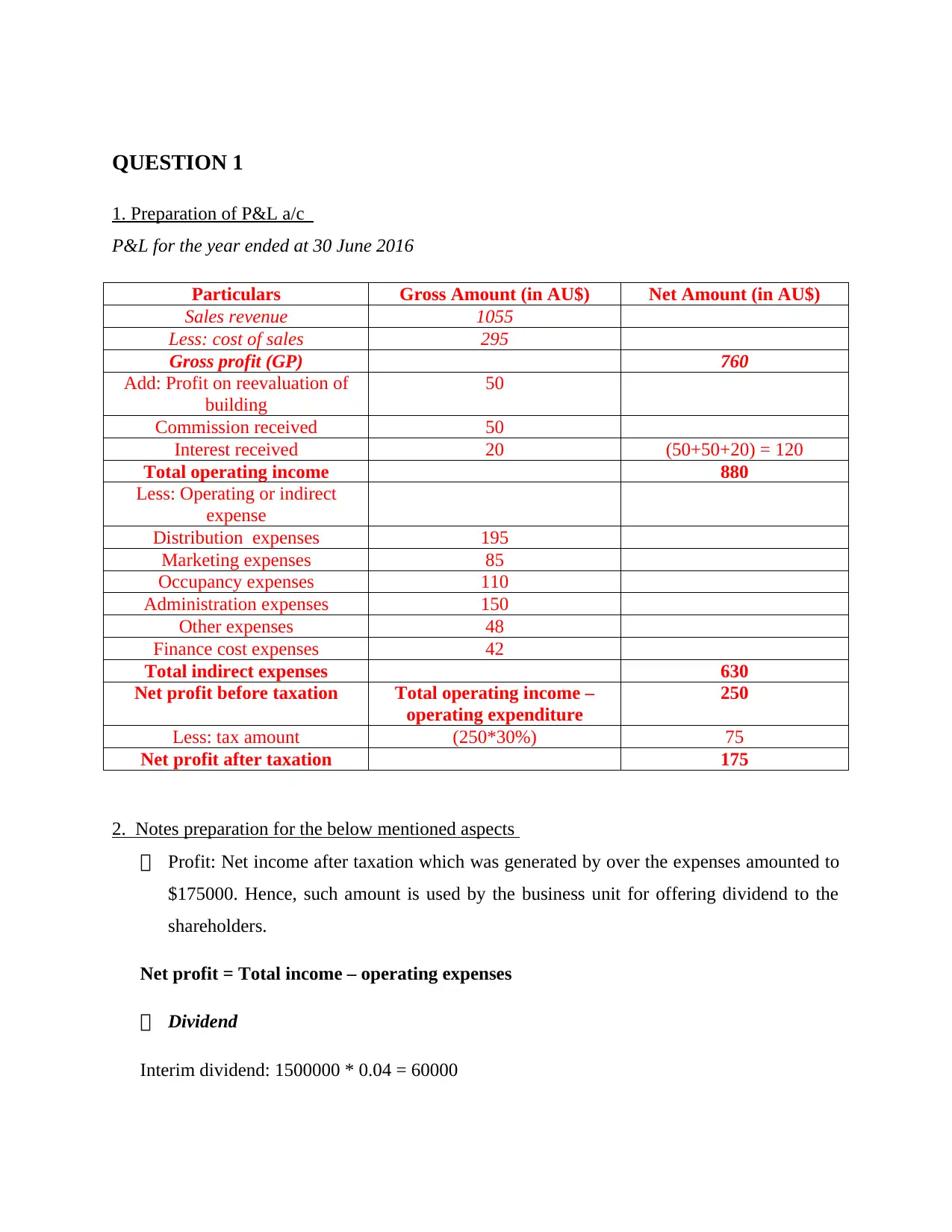

1. Preparation of P&L a/c

P&L for the year ended at 30 June 2016

Particulars Gross Amount (in AU$) Net Amount (in AU$)

Sales revenue 1055

Less: cost of sales 295

Gross profit (GP) 760

Add: Profit on reevaluation of

building

50

Commission received 50

Interest received 20 (50+50+20) = 120

Total operating income 880

Less: Operating or indirect

expense

Distribution expenses 195

Marketing expenses 85

Occupancy expenses 110

Administration expenses 150

Other expenses 48

Finance cost expenses 42

Total indirect expenses 630

Net profit before taxation Total operating income –

operating expenditure

250

Less: tax amount (250*30%) 75

Net profit after taxation 175

2. Notes preparation for the below mentioned aspects

Profit: Net income after taxation which was generated by over the expenses amounted to

$175000. Hence, such amount is used by the business unit for offering dividend to the

shareholders.

Net profit = Total income – operating expenses

Dividend

Interim dividend: 1500000 * 0.04 = 60000

1. Preparation of P&L a/c

P&L for the year ended at 30 June 2016

Particulars Gross Amount (in AU$) Net Amount (in AU$)

Sales revenue 1055

Less: cost of sales 295

Gross profit (GP) 760

Add: Profit on reevaluation of

building

50

Commission received 50

Interest received 20 (50+50+20) = 120

Total operating income 880

Less: Operating or indirect

expense

Distribution expenses 195

Marketing expenses 85

Occupancy expenses 110

Administration expenses 150

Other expenses 48

Finance cost expenses 42

Total indirect expenses 630

Net profit before taxation Total operating income –

operating expenditure

250

Less: tax amount (250*30%) 75

Net profit after taxation 175

2. Notes preparation for the below mentioned aspects

Profit: Net income after taxation which was generated by over the expenses amounted to

$175000. Hence, such amount is used by the business unit for offering dividend to the

shareholders.

Net profit = Total income – operating expenses

Dividend

Interim dividend: 1500000 * 0.04 = 60000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

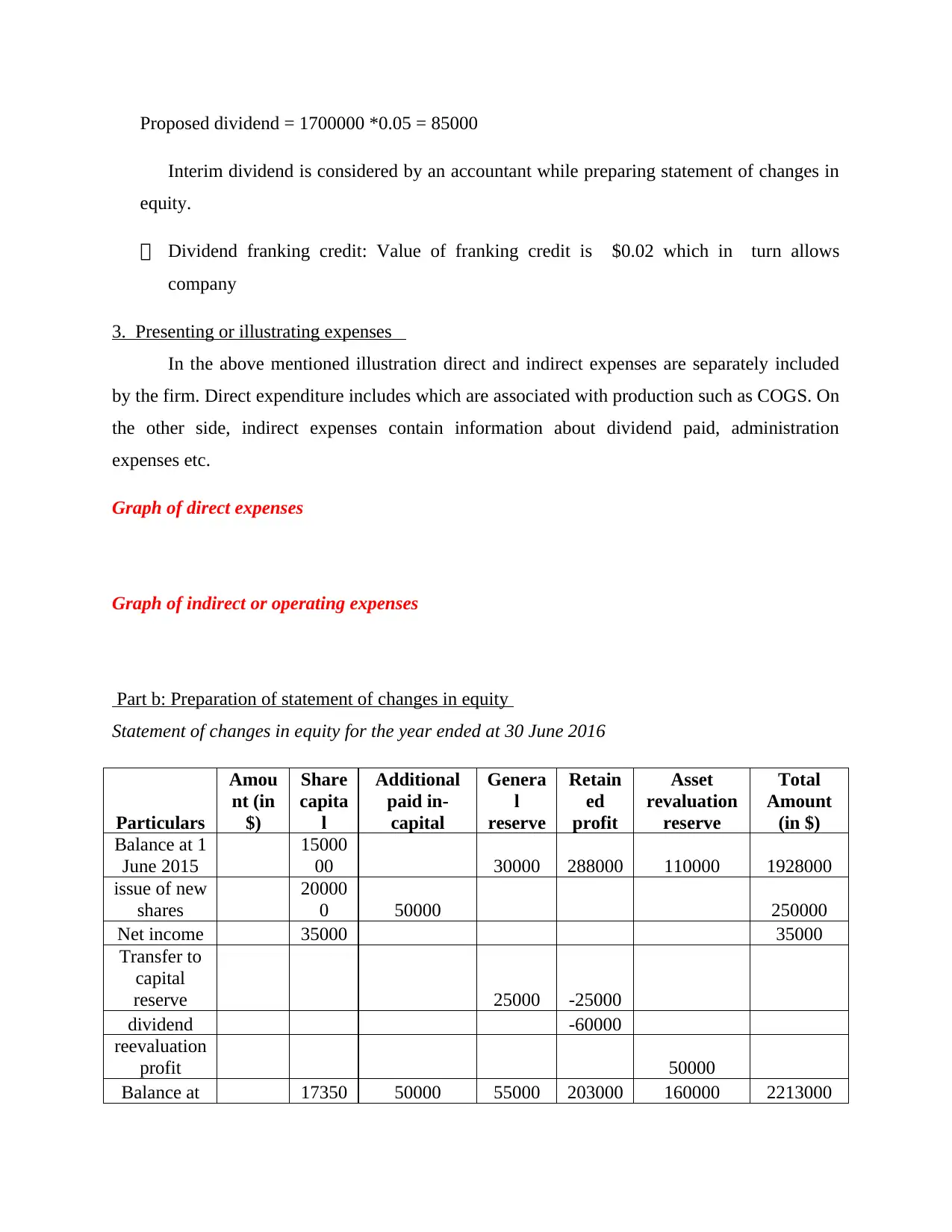

Proposed dividend = 1700000 *0.05 = 85000

Interim dividend is considered by an accountant while preparing statement of changes in

equity.

Dividend franking credit: Value of franking credit is $0.02 which in turn allows

company

3. Presenting or illustrating expenses

In the above mentioned illustration direct and indirect expenses are separately included

by the firm. Direct expenditure includes which are associated with production such as COGS. On

the other side, indirect expenses contain information about dividend paid, administration

expenses etc.

Graph of direct expenses

Graph of indirect or operating expenses

Part b: Preparation of statement of changes in equity

Statement of changes in equity for the year ended at 30 June 2016

Particulars

Amou

nt (in

$)

Share

capita

l

Additional

paid in-

capital

Genera

l

reserve

Retain

ed

profit

Asset

revaluation

reserve

Total

Amount

(in $)

Balance at 1

June 2015

15000

00 30000 288000 110000 1928000

issue of new

shares

20000

0 50000 250000

Net income 35000 35000

Transfer to

capital

reserve 25000 -25000

dividend -60000

reevaluation

profit 50000

Balance at 17350 50000 55000 203000 160000 2213000

Interim dividend is considered by an accountant while preparing statement of changes in

equity.

Dividend franking credit: Value of franking credit is $0.02 which in turn allows

company

3. Presenting or illustrating expenses

In the above mentioned illustration direct and indirect expenses are separately included

by the firm. Direct expenditure includes which are associated with production such as COGS. On

the other side, indirect expenses contain information about dividend paid, administration

expenses etc.

Graph of direct expenses

Graph of indirect or operating expenses

Part b: Preparation of statement of changes in equity

Statement of changes in equity for the year ended at 30 June 2016

Particulars

Amou

nt (in

$)

Share

capita

l

Additional

paid in-

capital

Genera

l

reserve

Retain

ed

profit

Asset

revaluation

reserve

Total

Amount

(in $)

Balance at 1

June 2015

15000

00 30000 288000 110000 1928000

issue of new

shares

20000

0 50000 250000

Net income 35000 35000

Transfer to

capital

reserve 25000 -25000

dividend -60000

reevaluation

profit 50000

Balance at 17350 50000 55000 203000 160000 2213000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

30 June

2016 00

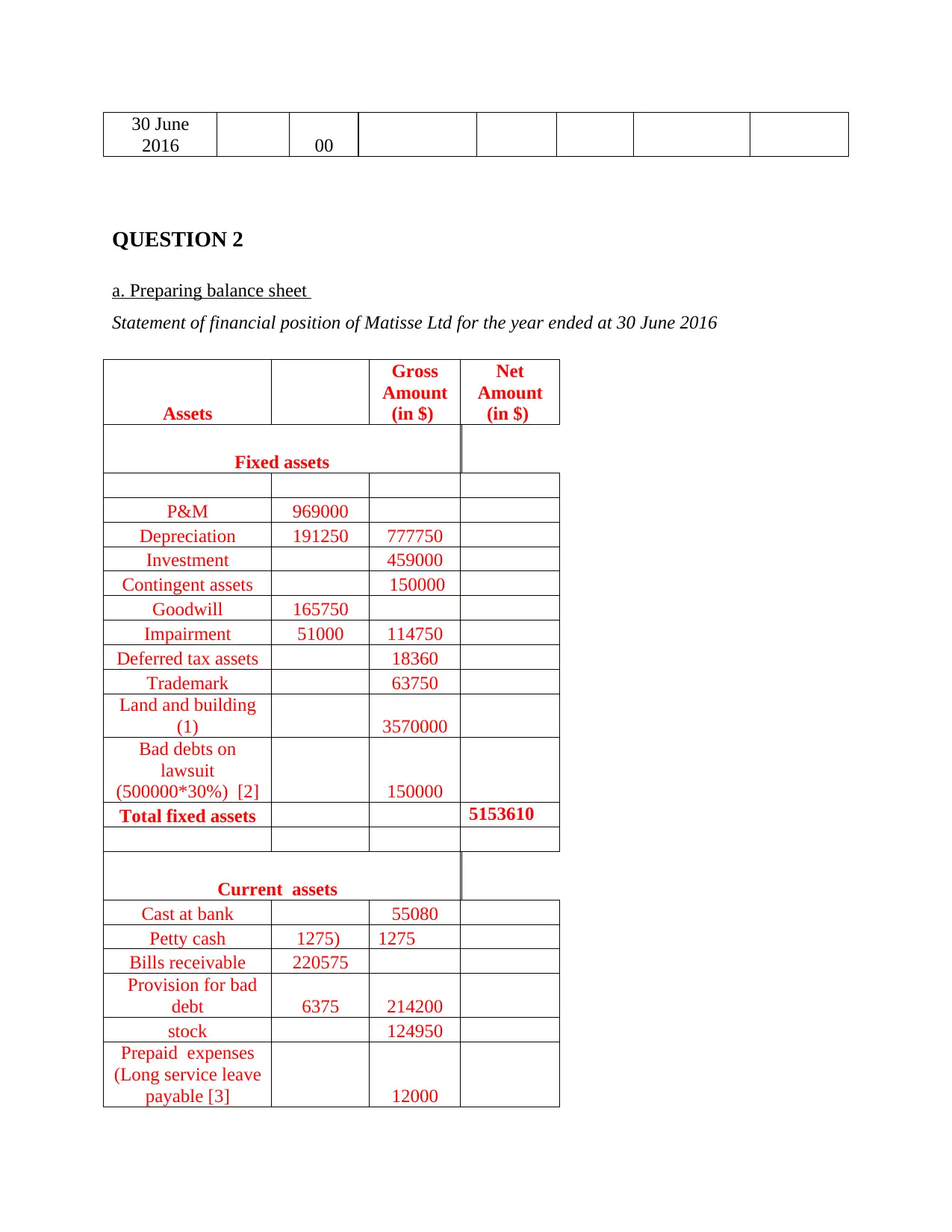

QUESTION 2

a. Preparing balance sheet

Statement of financial position of Matisse Ltd for the year ended at 30 June 2016

Assets

Gross

Amount

(in $)

Net

Amount

(in $)

Fixed assets

P&M 969000

Depreciation 191250 777750

Investment 459000

Contingent assets 150000

Goodwill 165750

Impairment 51000 114750

Deferred tax assets 18360

Trademark 63750

Land and building

(1) 3570000

Bad debts on

lawsuit

(500000*30%) [2] 150000

Total fixed assets 5153610

Current assets

Cast at bank 55080

Petty cash 1275) 1275

Bills receivable 220575

Provision for bad

debt 6375 214200

stock 124950

Prepaid expenses

(Long service leave

payable [3] 12000

2016 00

QUESTION 2

a. Preparing balance sheet

Statement of financial position of Matisse Ltd for the year ended at 30 June 2016

Assets

Gross

Amount

(in $)

Net

Amount

(in $)

Fixed assets

P&M 969000

Depreciation 191250 777750

Investment 459000

Contingent assets 150000

Goodwill 165750

Impairment 51000 114750

Deferred tax assets 18360

Trademark 63750

Land and building

(1) 3570000

Bad debts on

lawsuit

(500000*30%) [2] 150000

Total fixed assets 5153610

Current assets

Cast at bank 55080

Petty cash 1275) 1275

Bills receivable 220575

Provision for bad

debt 6375 214200

stock 124950

Prepaid expenses

(Long service leave

payable [3] 12000

Total current

assets

Total assets

(current + fixed)

407505

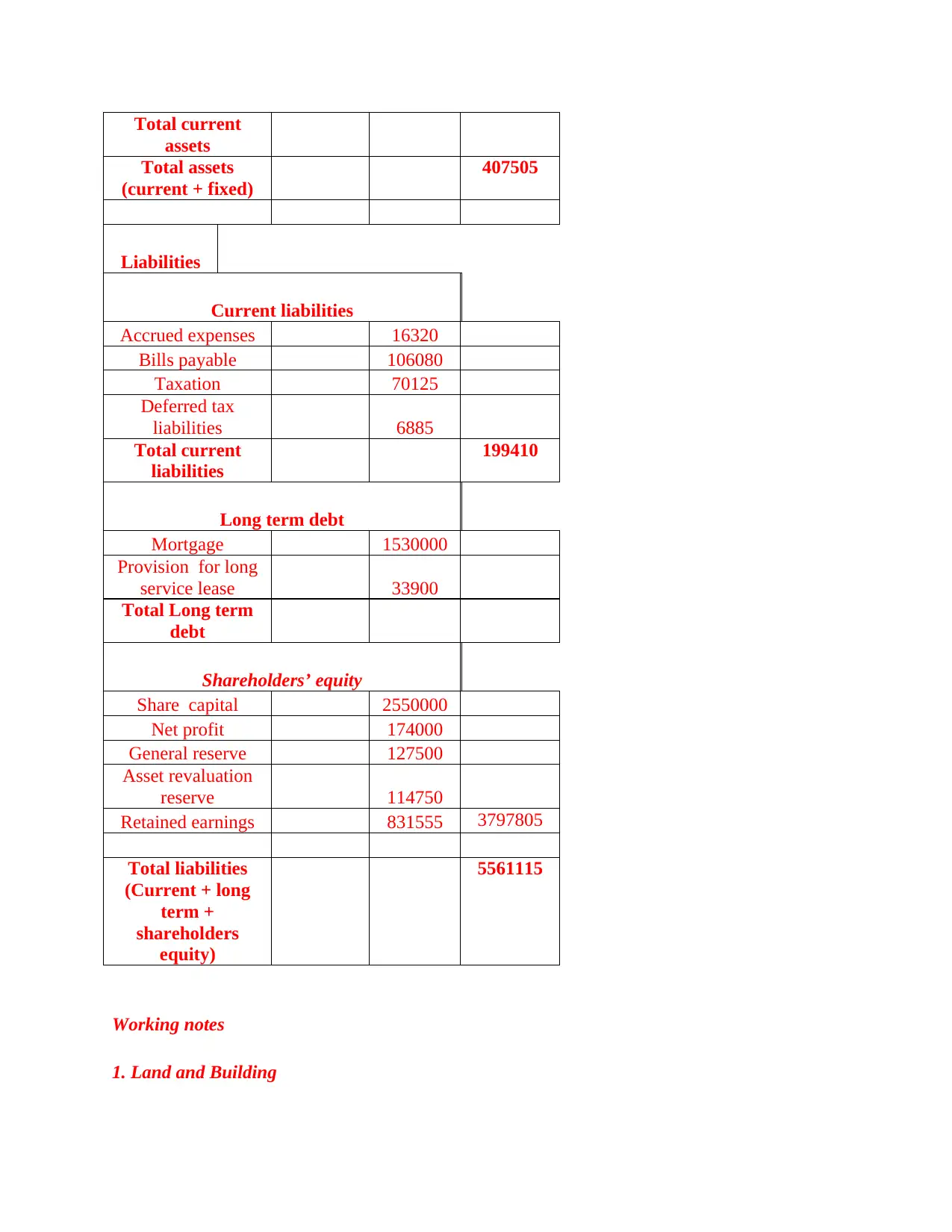

Liabilities

Current liabilities

Accrued expenses 16320

Bills payable 106080

Taxation 70125

Deferred tax

liabilities 6885

Total current

liabilities

199410

Long term debt

Mortgage 1530000

Provision for long

service lease 33900

Total Long term

debt

Shareholders’ equity

Share capital 2550000

Net profit 174000

General reserve 127500

Asset revaluation

reserve 114750

Retained earnings 831555 3797805

Total liabilities

(Current + long

term +

shareholders

equity)

5561115

Working notes

1. Land and Building

assets

Total assets

(current + fixed)

407505

Liabilities

Current liabilities

Accrued expenses 16320

Bills payable 106080

Taxation 70125

Deferred tax

liabilities 6885

Total current

liabilities

199410

Long term debt

Mortgage 1530000

Provision for long

service lease 33900

Total Long term

debt

Shareholders’ equity

Share capital 2550000

Net profit 174000

General reserve 127500

Asset revaluation

reserve 114750

Retained earnings 831555 3797805

Total liabilities

(Current + long

term +

shareholders

equity)

5561115

Working notes

1. Land and Building

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Amount of land reevaluation = $2420000

Amount of building reevaluation = $1150000

According the reevaluation business unit has not attained any gain on revaluation so amount of

$3570000 is mentioned in balance sheet.

2. Bad debts: 500000 * 30% = $150000

3. Prepaid long service leave payable = 12000

2. Preparation of notes according to Australian accounting standard Board

AASB 101 has followed by the accountant of business unit while preparing the final

accounts or statement of financial position. Such standard contains rules and information

regarding the preparation and publishing aspect of final accounts.

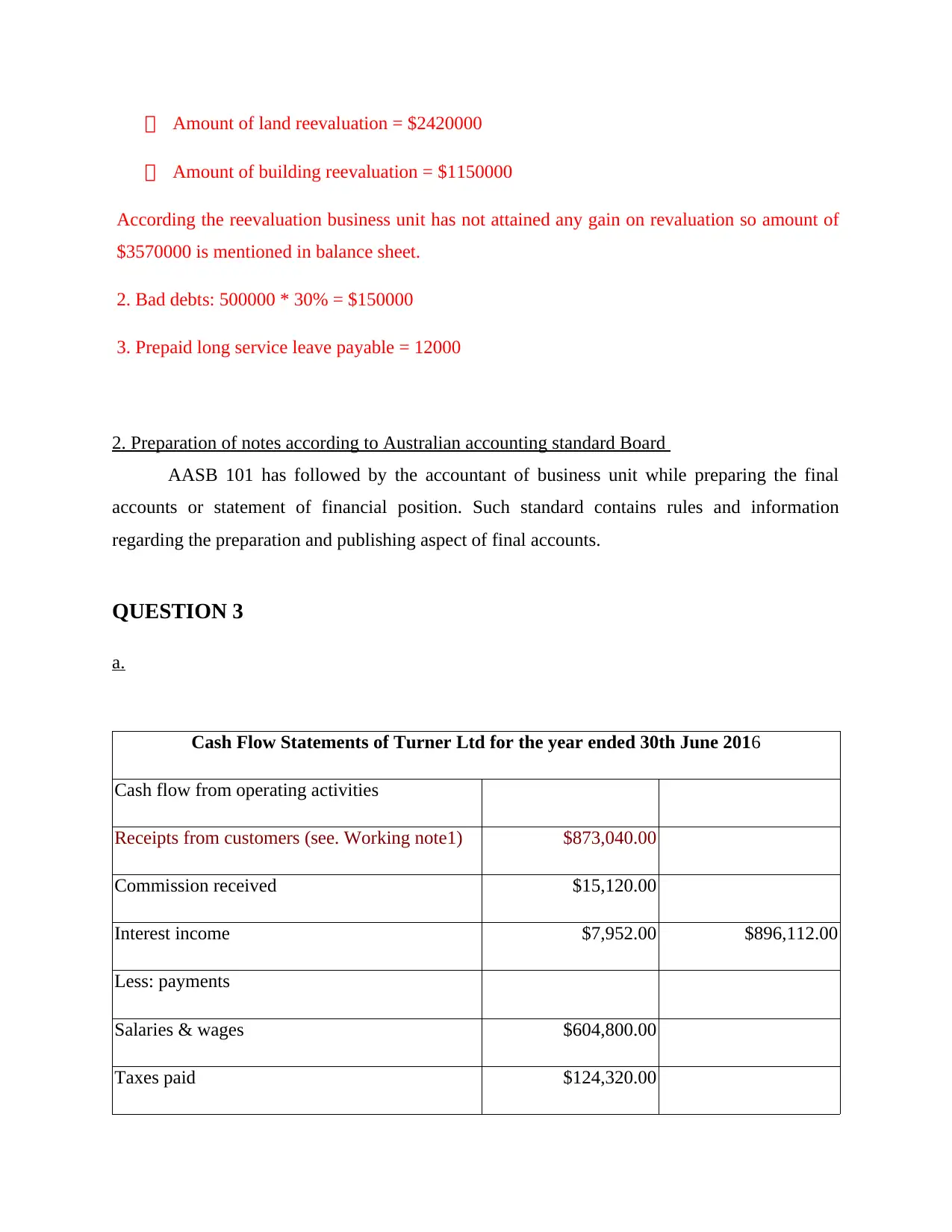

QUESTION 3

a.

Cash Flow Statements of Turner Ltd for the year ended 30th June 2016

Cash flow from operating activities

Receipts from customers (see. Working note1) $873,040.00

Commission received $15,120.00

Interest income $7,952.00 $896,112.00

Less: payments

Salaries & wages $604,800.00

Taxes paid $124,320.00

Amount of building reevaluation = $1150000

According the reevaluation business unit has not attained any gain on revaluation so amount of

$3570000 is mentioned in balance sheet.

2. Bad debts: 500000 * 30% = $150000

3. Prepaid long service leave payable = 12000

2. Preparation of notes according to Australian accounting standard Board

AASB 101 has followed by the accountant of business unit while preparing the final

accounts or statement of financial position. Such standard contains rules and information

regarding the preparation and publishing aspect of final accounts.

QUESTION 3

a.

Cash Flow Statements of Turner Ltd for the year ended 30th June 2016

Cash flow from operating activities

Receipts from customers (see. Working note1) $873,040.00

Commission received $15,120.00

Interest income $7,952.00 $896,112.00

Less: payments

Salaries & wages $604,800.00

Taxes paid $124,320.00

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Petty cash payments $1,000.00

Other operational payments $228,480.00 $958,600.00

-$62,488.00

Less: decrease In accounts payable $243,600.00

Less: Increase in inventory $95,200.00

Less: Decrease in provision for annual leave $23,640.00

Net Cash Outflow from operating activities

[A] -$424,928.00

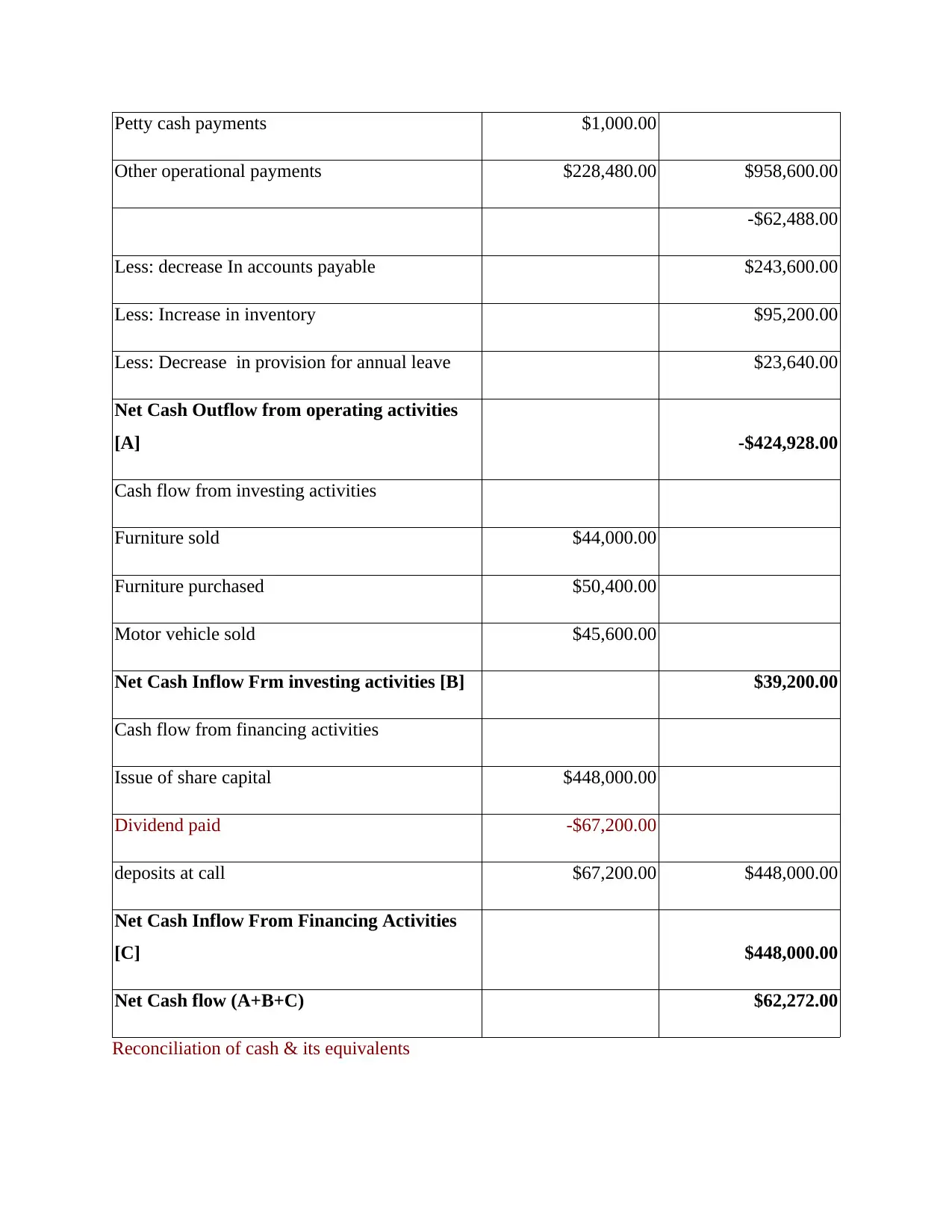

Cash flow from investing activities

Furniture sold $44,000.00

Furniture purchased $50,400.00

Motor vehicle sold $45,600.00

Net Cash Inflow Frm investing activities [B] $39,200.00

Cash flow from financing activities

Issue of share capital $448,000.00

Dividend paid -$67,200.00

deposits at call $67,200.00 $448,000.00

Net Cash Inflow From Financing Activities

[C] $448,000.00

Net Cash flow (A+B+C) $62,272.00

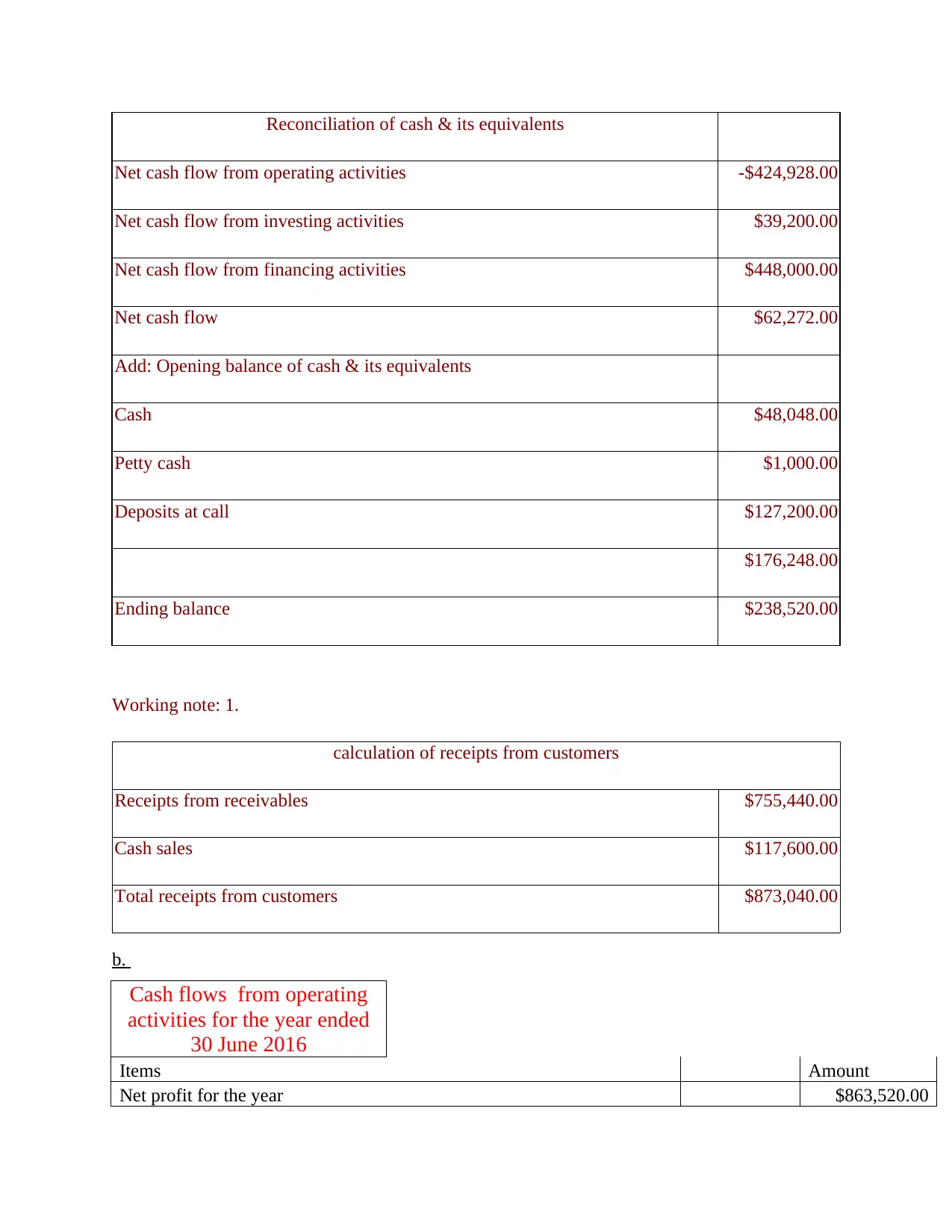

Reconciliation of cash & its equivalents

Other operational payments $228,480.00 $958,600.00

-$62,488.00

Less: decrease In accounts payable $243,600.00

Less: Increase in inventory $95,200.00

Less: Decrease in provision for annual leave $23,640.00

Net Cash Outflow from operating activities

[A] -$424,928.00

Cash flow from investing activities

Furniture sold $44,000.00

Furniture purchased $50,400.00

Motor vehicle sold $45,600.00

Net Cash Inflow Frm investing activities [B] $39,200.00

Cash flow from financing activities

Issue of share capital $448,000.00

Dividend paid -$67,200.00

deposits at call $67,200.00 $448,000.00

Net Cash Inflow From Financing Activities

[C] $448,000.00

Net Cash flow (A+B+C) $62,272.00

Reconciliation of cash & its equivalents

Reconciliation of cash & its equivalents

Net cash flow from operating activities -$424,928.00

Net cash flow from investing activities $39,200.00

Net cash flow from financing activities $448,000.00

Net cash flow $62,272.00

Add: Opening balance of cash & its equivalents

Cash $48,048.00

Petty cash $1,000.00

Deposits at call $127,200.00

$176,248.00

Ending balance $238,520.00

Working note: 1.

calculation of receipts from customers

Receipts from receivables $755,440.00

Cash sales $117,600.00

Total receipts from customers $873,040.00

b.

Cash flows from operating

activities for the year ended

30 June 2016

Items Amount

Net profit for the year $863,520.00

Net cash flow from operating activities -$424,928.00

Net cash flow from investing activities $39,200.00

Net cash flow from financing activities $448,000.00

Net cash flow $62,272.00

Add: Opening balance of cash & its equivalents

Cash $48,048.00

Petty cash $1,000.00

Deposits at call $127,200.00

$176,248.00

Ending balance $238,520.00

Working note: 1.

calculation of receipts from customers

Receipts from receivables $755,440.00

Cash sales $117,600.00

Total receipts from customers $873,040.00

b.

Cash flows from operating

activities for the year ended

30 June 2016

Items Amount

Net profit for the year $863,520.00

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

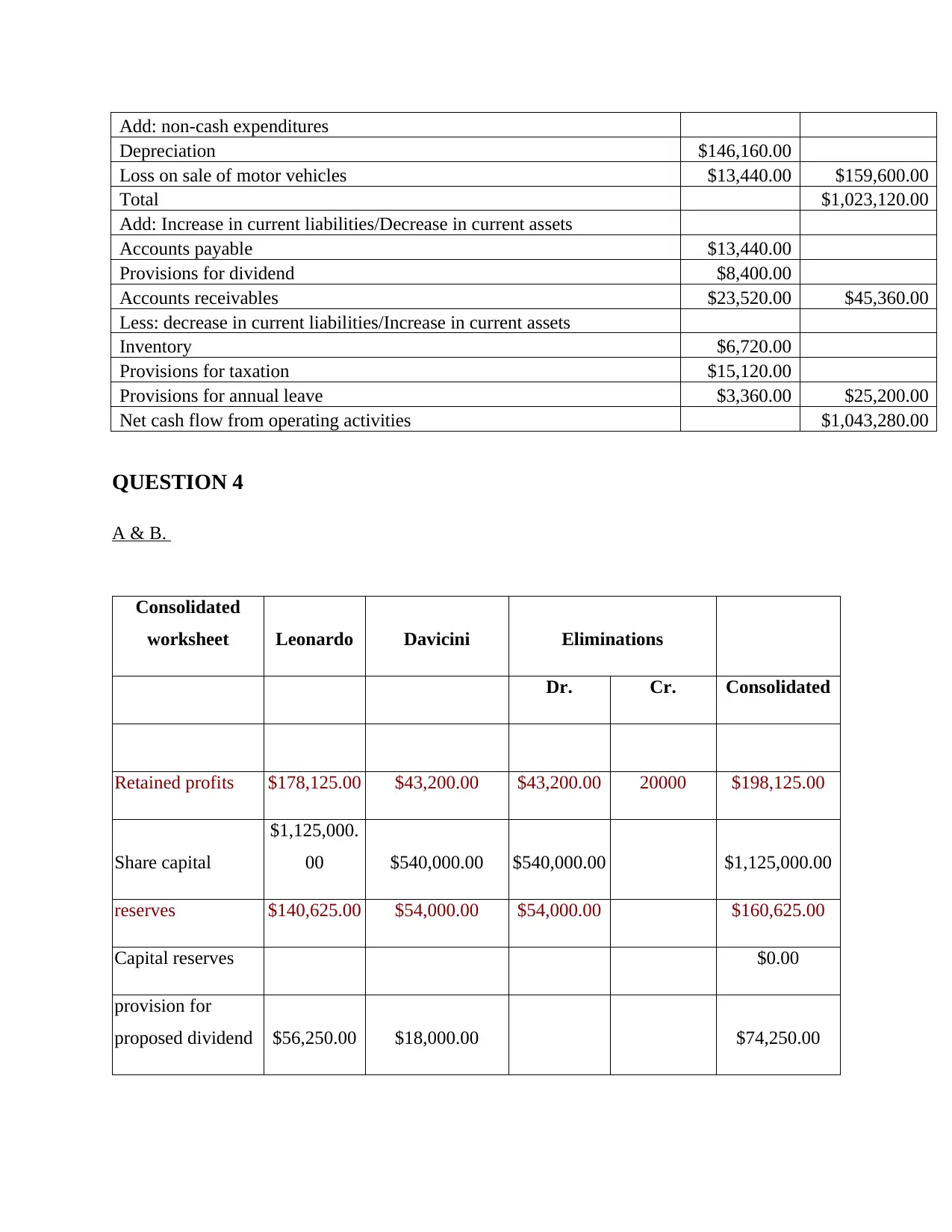

Add: non-cash expenditures

Depreciation $146,160.00

Loss on sale of motor vehicles $13,440.00 $159,600.00

Total $1,023,120.00

Add: Increase in current liabilities/Decrease in current assets

Accounts payable $13,440.00

Provisions for dividend $8,400.00

Accounts receivables $23,520.00 $45,360.00

Less: decrease in current liabilities/Increase in current assets

Inventory $6,720.00

Provisions for taxation $15,120.00

Provisions for annual leave $3,360.00 $25,200.00

Net cash flow from operating activities $1,043,280.00

QUESTION 4

A & B.

Consolidated

worksheet Leonardo Davicini Eliminations

Dr. Cr. Consolidated

Retained profits $178,125.00 $43,200.00 $43,200.00 20000 $198,125.00

Share capital

$1,125,000.

00 $540,000.00 $540,000.00 $1,125,000.00

reserves $140,625.00 $54,000.00 $54,000.00 $160,625.00

Capital reserves $0.00

provision for

proposed dividend $56,250.00 $18,000.00 $74,250.00

Depreciation $146,160.00

Loss on sale of motor vehicles $13,440.00 $159,600.00

Total $1,023,120.00

Add: Increase in current liabilities/Decrease in current assets

Accounts payable $13,440.00

Provisions for dividend $8,400.00

Accounts receivables $23,520.00 $45,360.00

Less: decrease in current liabilities/Increase in current assets

Inventory $6,720.00

Provisions for taxation $15,120.00

Provisions for annual leave $3,360.00 $25,200.00

Net cash flow from operating activities $1,043,280.00

QUESTION 4

A & B.

Consolidated

worksheet Leonardo Davicini Eliminations

Dr. Cr. Consolidated

Retained profits $178,125.00 $43,200.00 $43,200.00 20000 $198,125.00

Share capital

$1,125,000.

00 $540,000.00 $540,000.00 $1,125,000.00

reserves $140,625.00 $54,000.00 $54,000.00 $160,625.00

Capital reserves $0.00

provision for

proposed dividend $56,250.00 $18,000.00 $74,250.00

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

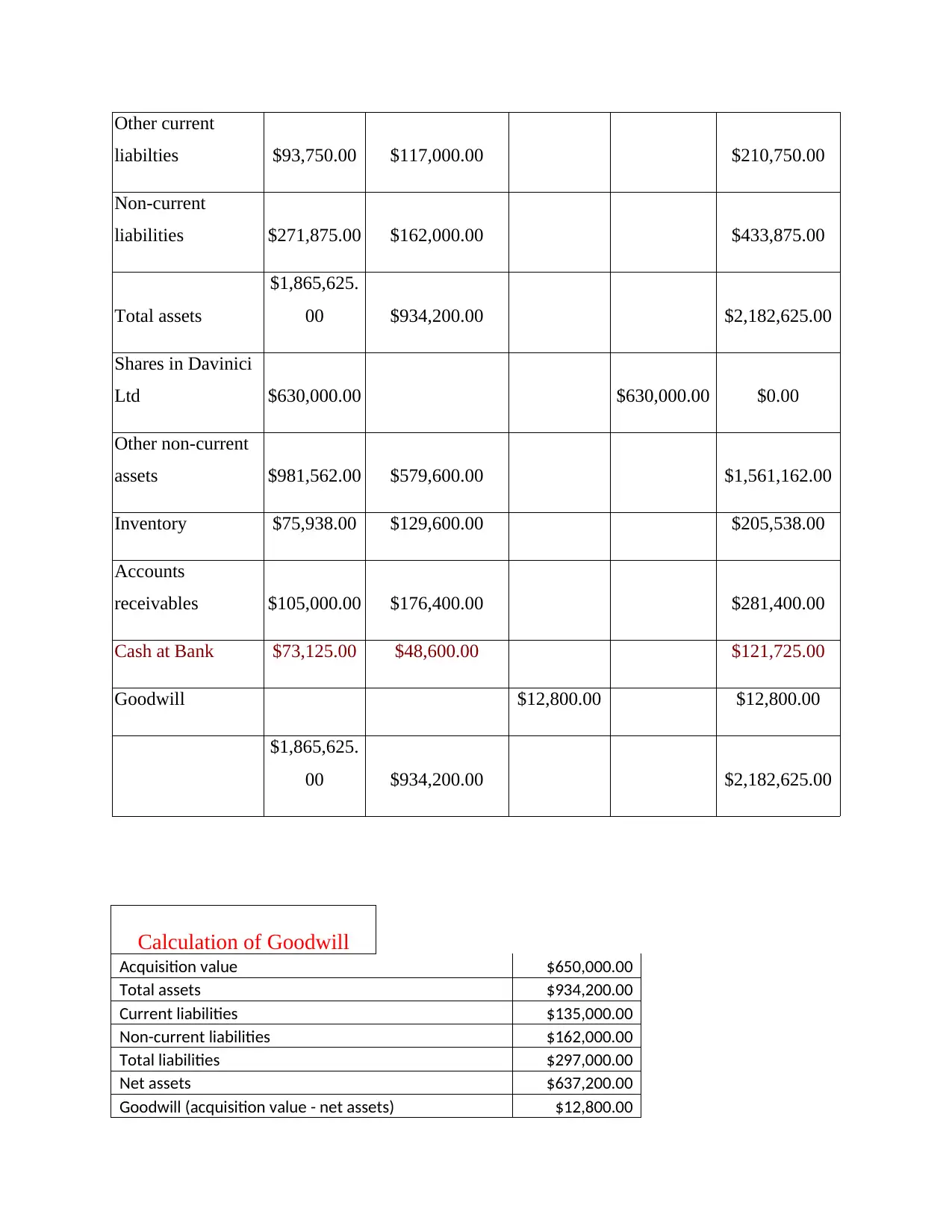

Other current

liabilties $93,750.00 $117,000.00 $210,750.00

Non-current

liabilities $271,875.00 $162,000.00 $433,875.00

Total assets

$1,865,625.

00 $934,200.00 $2,182,625.00

Shares in Davinici

Ltd $630,000.00 $630,000.00 $0.00

Other non-current

assets $981,562.00 $579,600.00 $1,561,162.00

Inventory $75,938.00 $129,600.00 $205,538.00

Accounts

receivables $105,000.00 $176,400.00 $281,400.00

Cash at Bank $73,125.00 $48,600.00 $121,725.00

Goodwill $12,800.00 $12,800.00

$1,865,625.

00 $934,200.00 $2,182,625.00

Calculation of Goodwill

Acquisition value $650,000.00

Total assets $934,200.00

Current liabilities $135,000.00

Non-current liabilities $162,000.00

Total liabilities $297,000.00

Net assets $637,200.00

Goodwill (acquisition value - net assets) $12,800.00

liabilties $93,750.00 $117,000.00 $210,750.00

Non-current

liabilities $271,875.00 $162,000.00 $433,875.00

Total assets

$1,865,625.

00 $934,200.00 $2,182,625.00

Shares in Davinici

Ltd $630,000.00 $630,000.00 $0.00

Other non-current

assets $981,562.00 $579,600.00 $1,561,162.00

Inventory $75,938.00 $129,600.00 $205,538.00

Accounts

receivables $105,000.00 $176,400.00 $281,400.00

Cash at Bank $73,125.00 $48,600.00 $121,725.00

Goodwill $12,800.00 $12,800.00

$1,865,625.

00 $934,200.00 $2,182,625.00

Calculation of Goodwill

Acquisition value $650,000.00

Total assets $934,200.00

Current liabilities $135,000.00

Non-current liabilities $162,000.00

Total liabilities $297,000.00

Net assets $637,200.00

Goodwill (acquisition value - net assets) $12,800.00

Journal entries

Common stock a/c

Dr. $540,000.00

Retained profits a/c Dr. $43,200.00

Reserves a/c

Dr. $54,000.00

Goodwill a/c (B/F)

Dr. $12,800.00

To business purchase a/c 650000

Business purchase a/c Dr. $650,000.00

To shares in Davinici ltd a/c 630000

To cash (B/F) $20,000.00

c.

Yes, Myob Software can be used for making financial reports and integrated annual reports to

measure their financial performance. It is extremely helpful to make and prepare consolidated

financial reports and accounts of subsidiary and holding company through using an Add-on

consolidated system on the software. It helps to integrate and compile data from number of files

and generate automatically consolidated financial reports including both the profit and loss

account and balance sheet.

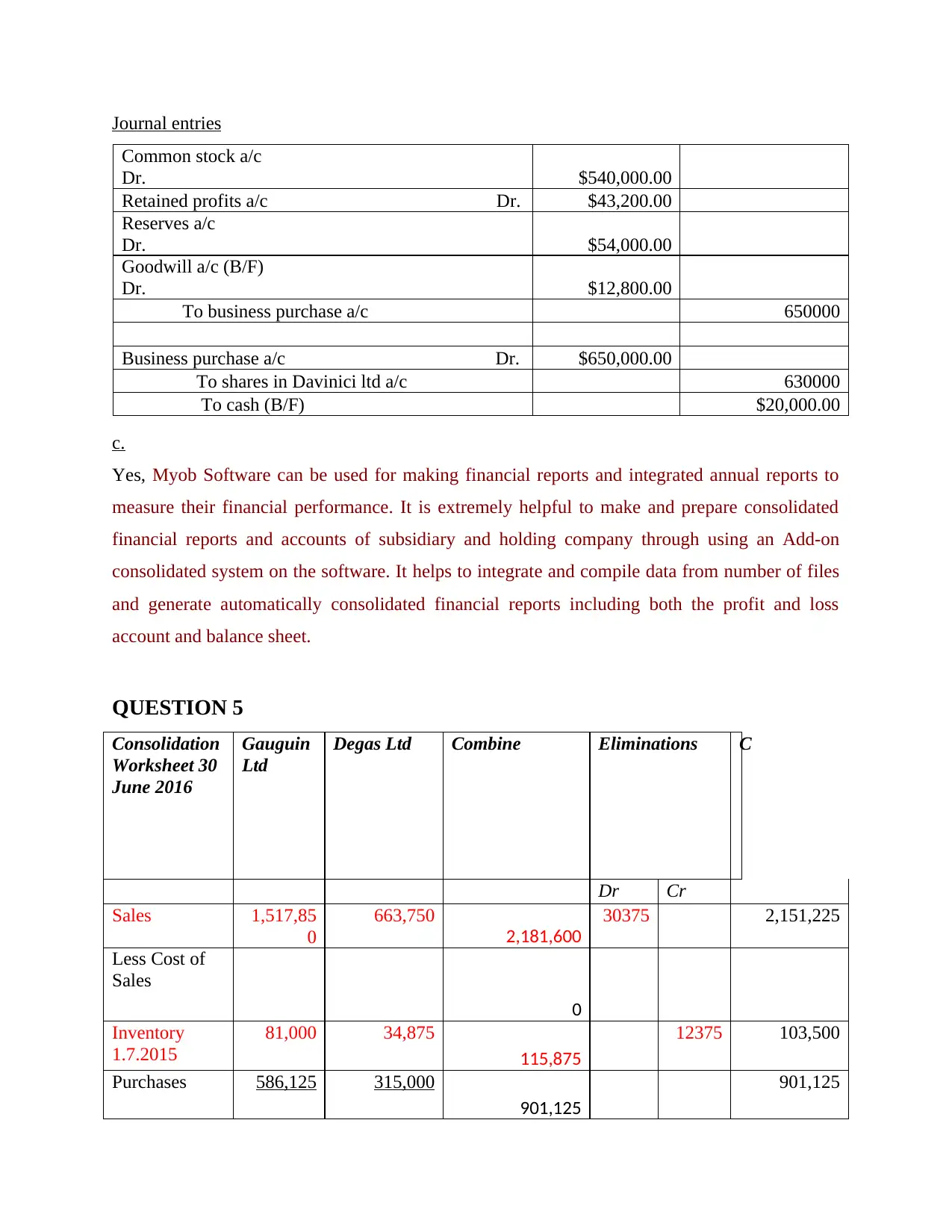

QUESTION 5

Consolidation

Worksheet 30

June 2016

Gauguin

Ltd

Degas Ltd Combine Eliminations C

Dr Cr

Sales 1,517,85

0

663,750

2,181,600

30375 2,151,225

Less Cost of

Sales

0

Inventory

1.7.2015

81,000 34,875

115,875

12375 103,500

Purchases 586,125 315,000

901,125

901,125

Common stock a/c

Dr. $540,000.00

Retained profits a/c Dr. $43,200.00

Reserves a/c

Dr. $54,000.00

Goodwill a/c (B/F)

Dr. $12,800.00

To business purchase a/c 650000

Business purchase a/c Dr. $650,000.00

To shares in Davinici ltd a/c 630000

To cash (B/F) $20,000.00

c.

Yes, Myob Software can be used for making financial reports and integrated annual reports to

measure their financial performance. It is extremely helpful to make and prepare consolidated

financial reports and accounts of subsidiary and holding company through using an Add-on

consolidated system on the software. It helps to integrate and compile data from number of files

and generate automatically consolidated financial reports including both the profit and loss

account and balance sheet.

QUESTION 5

Consolidation

Worksheet 30

June 2016

Gauguin

Ltd

Degas Ltd Combine Eliminations C

Dr Cr

Sales 1,517,85

0

663,750

2,181,600

30375 2,151,225

Less Cost of

Sales

0

Inventory

1.7.2015

81,000 34,875

115,875

12375 103,500

Purchases 586,125 315,000

901,125

901,125

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.