Case Study: Financial Statement Analysis & Accounting Concepts

VerifiedAdded on 2023/06/10

|6

|865

|140

Case Study

AI Summary

This assignment presents a case study involving financial statement analysis and accounting principles. It includes preparing an income statement for Collins Consignment Sales, identifying discrepancies in a provided income statement, creating a balance sheet for Tanilba Bay Didgeridoo’s, and conducting a variance analysis for JB Hi-Fi's FY2017 income statement. The analysis involves comparing budgeted and actual figures to assess management performance, highlighting the impact of acquisitions on revenue and costs. The document also includes references to relevant finance and accounting literature.

ACCOUNTING:CONCEPTS & PRINCIPLES

STUDENT ID:

[Pick the date]

STUDENT ID:

[Pick the date]

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Question B1

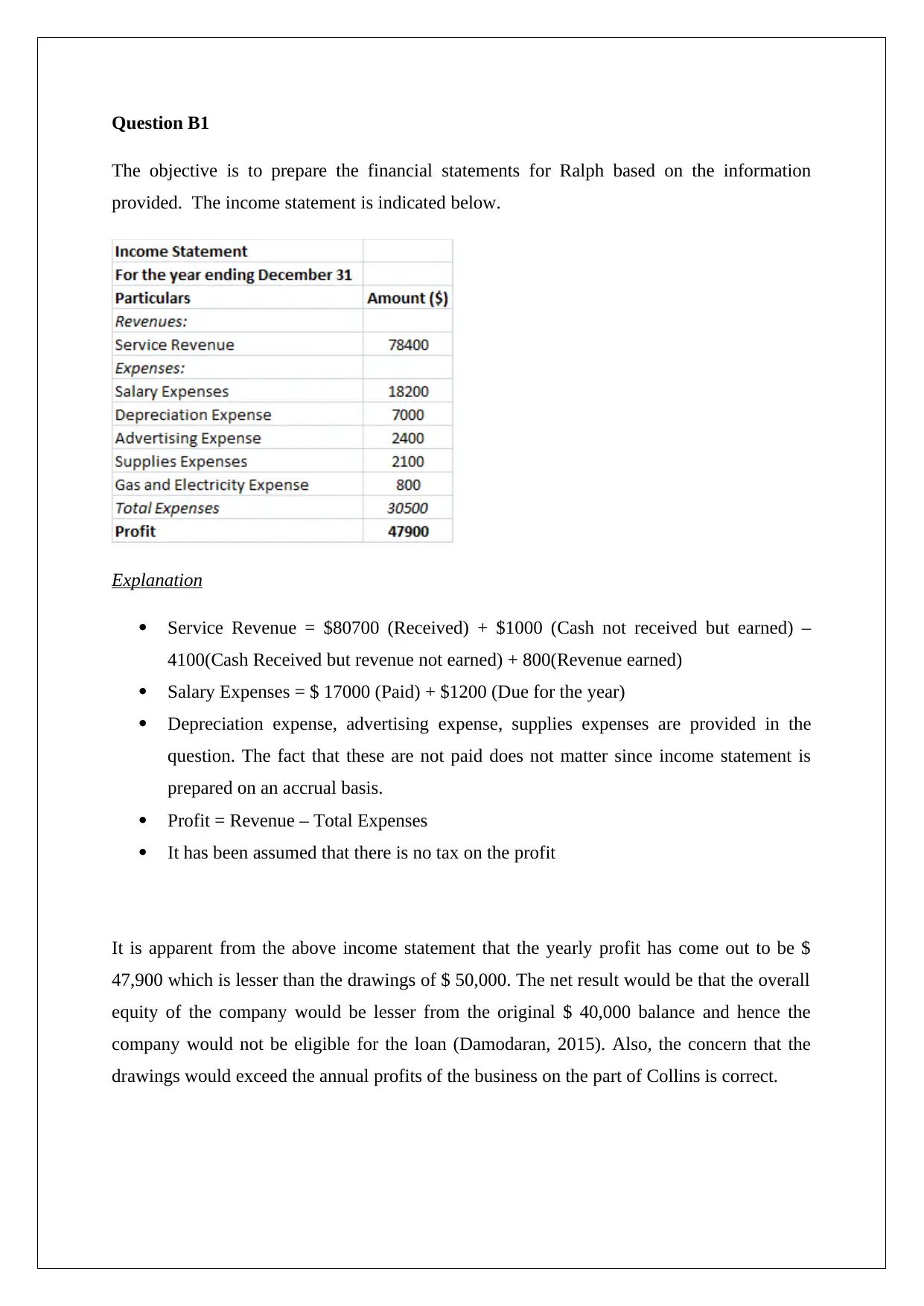

The objective is to prepare the financial statements for Ralph based on the information

provided. The income statement is indicated below.

Explanation

Service Revenue = $80700 (Received) + $1000 (Cash not received but earned) –

4100(Cash Received but revenue not earned) + 800(Revenue earned)

Salary Expenses = $ 17000 (Paid) + $1200 (Due for the year)

Depreciation expense, advertising expense, supplies expenses are provided in the

question. The fact that these are not paid does not matter since income statement is

prepared on an accrual basis.

Profit = Revenue – Total Expenses

It has been assumed that there is no tax on the profit

It is apparent from the above income statement that the yearly profit has come out to be $

47,900 which is lesser than the drawings of $ 50,000. The net result would be that the overall

equity of the company would be lesser from the original $ 40,000 balance and hence the

company would not be eligible for the loan (Damodaran, 2015). Also, the concern that the

drawings would exceed the annual profits of the business on the part of Collins is correct.

The objective is to prepare the financial statements for Ralph based on the information

provided. The income statement is indicated below.

Explanation

Service Revenue = $80700 (Received) + $1000 (Cash not received but earned) –

4100(Cash Received but revenue not earned) + 800(Revenue earned)

Salary Expenses = $ 17000 (Paid) + $1200 (Due for the year)

Depreciation expense, advertising expense, supplies expenses are provided in the

question. The fact that these are not paid does not matter since income statement is

prepared on an accrual basis.

Profit = Revenue – Total Expenses

It has been assumed that there is no tax on the profit

It is apparent from the above income statement that the yearly profit has come out to be $

47,900 which is lesser than the drawings of $ 50,000. The net result would be that the overall

equity of the company would be lesser from the original $ 40,000 balance and hence the

company would not be eligible for the loan (Damodaran, 2015). Also, the concern that the

drawings would exceed the annual profits of the business on the part of Collins is correct.

Question B2

1) No, I would not congratulate them due to the presence of serious discrepancies in the

income statement which comprises solely of the balance sheet items. It is expected that the

income statement should comprise of the revenue generated from sales and the various

expenses should be taken into account for delivering the product being sold. This would

include the cost of goods sold besides other operating costs (Brigham & Houston, 2014).

The costs incurred for asset acquisition are not operating expenses and therefore should

not be recorded in the income statement. Additionally, the cash obtained by way of equity

or bank loan does not constitute revenue. Further, the cash balance does not necessarily

indicate profit as the cash balance highlights the closing cash balance on a given date

which is derived from cash flow statement. The income statement on the other hand is

usually prepared on accrual basis (Brealey, Myers & Allen, 2014).

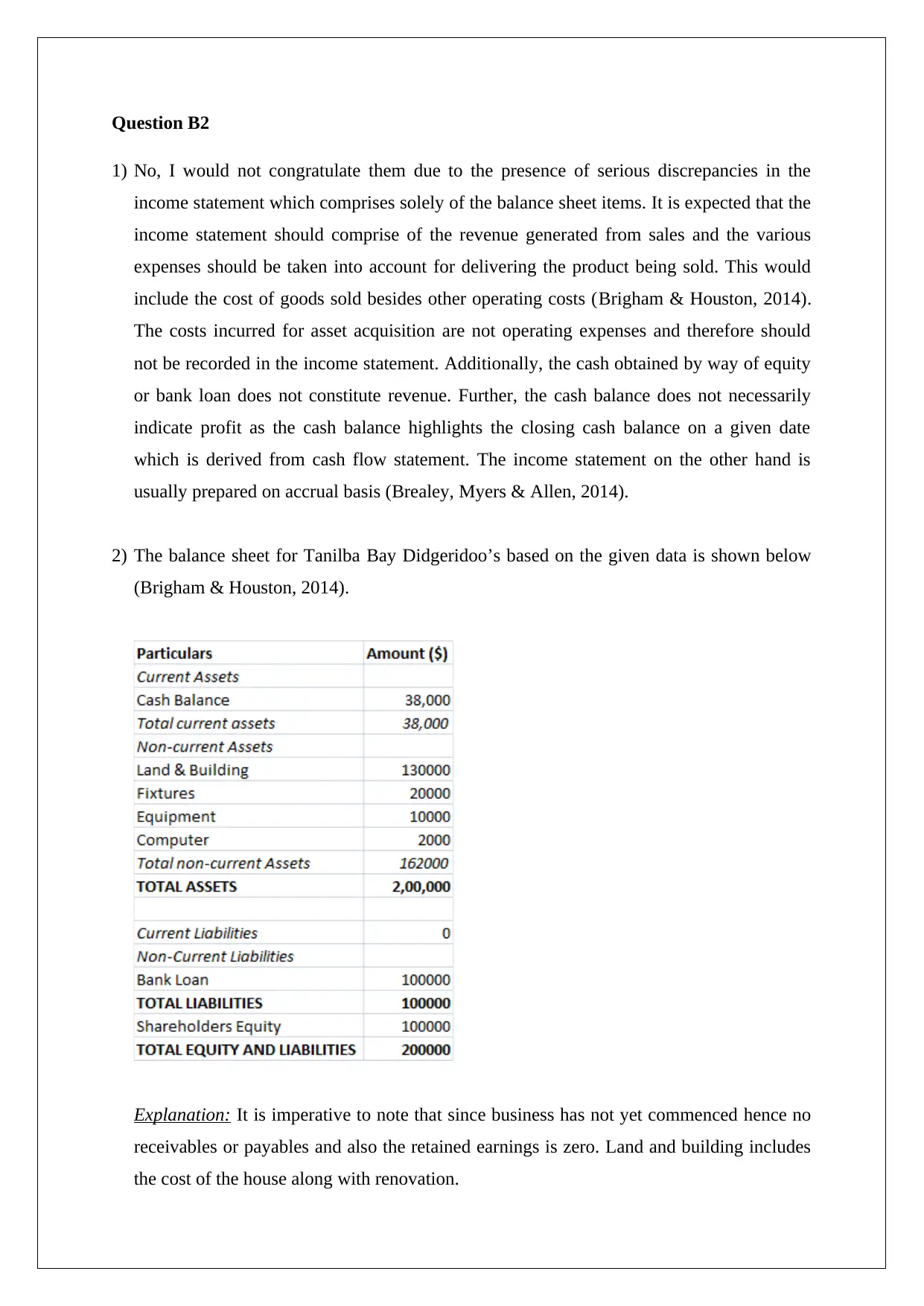

2) The balance sheet for Tanilba Bay Didgeridoo’s based on the given data is shown below

(Brigham & Houston, 2014).

Explanation: It is imperative to note that since business has not yet commenced hence no

receivables or payables and also the retained earnings is zero. Land and building includes

the cost of the house along with renovation.

1) No, I would not congratulate them due to the presence of serious discrepancies in the

income statement which comprises solely of the balance sheet items. It is expected that the

income statement should comprise of the revenue generated from sales and the various

expenses should be taken into account for delivering the product being sold. This would

include the cost of goods sold besides other operating costs (Brigham & Houston, 2014).

The costs incurred for asset acquisition are not operating expenses and therefore should

not be recorded in the income statement. Additionally, the cash obtained by way of equity

or bank loan does not constitute revenue. Further, the cash balance does not necessarily

indicate profit as the cash balance highlights the closing cash balance on a given date

which is derived from cash flow statement. The income statement on the other hand is

usually prepared on accrual basis (Brealey, Myers & Allen, 2014).

2) The balance sheet for Tanilba Bay Didgeridoo’s based on the given data is shown below

(Brigham & Houston, 2014).

Explanation: It is imperative to note that since business has not yet commenced hence no

receivables or payables and also the retained earnings is zero. Land and building includes

the cost of the house along with renovation.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Question B3

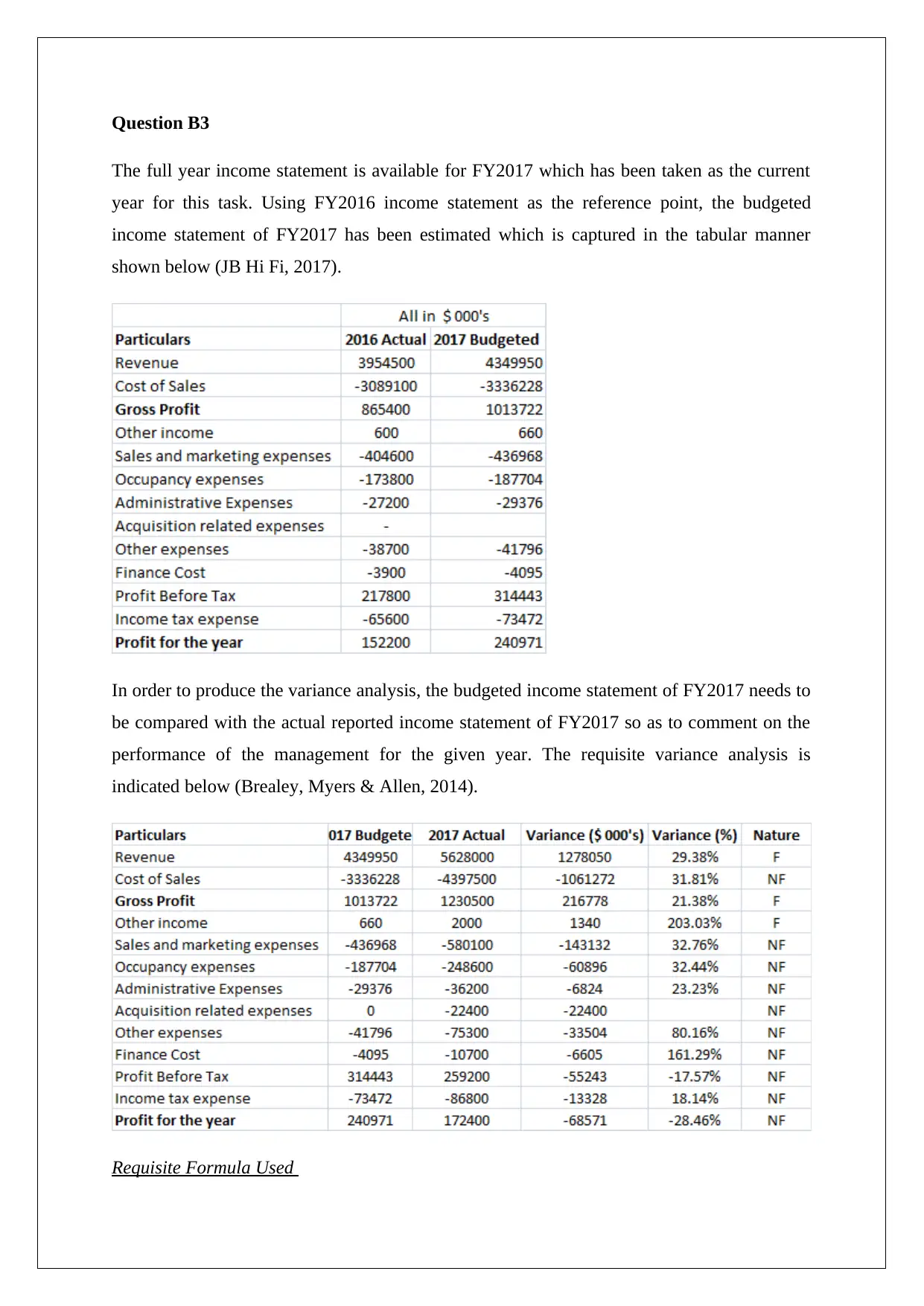

The full year income statement is available for FY2017 which has been taken as the current

year for this task. Using FY2016 income statement as the reference point, the budgeted

income statement of FY2017 has been estimated which is captured in the tabular manner

shown below (JB Hi Fi, 2017).

In order to produce the variance analysis, the budgeted income statement of FY2017 needs to

be compared with the actual reported income statement of FY2017 so as to comment on the

performance of the management for the given year. The requisite variance analysis is

indicated below (Brealey, Myers & Allen, 2014).

Requisite Formula Used

The full year income statement is available for FY2017 which has been taken as the current

year for this task. Using FY2016 income statement as the reference point, the budgeted

income statement of FY2017 has been estimated which is captured in the tabular manner

shown below (JB Hi Fi, 2017).

In order to produce the variance analysis, the budgeted income statement of FY2017 needs to

be compared with the actual reported income statement of FY2017 so as to comment on the

performance of the management for the given year. The requisite variance analysis is

indicated below (Brealey, Myers & Allen, 2014).

Requisite Formula Used

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1) Variance = 2017 Actual - 2017 Budgeted

2) Variance (%) = (2017 Actual - 2017 Budgeted)/2017 Budgeted

3) F indicates favourable variance whereas NF indicates not favourable or unfavourable

variance

Comment

From the above variance analysis, it is apparent that in terms of top line growth the year was

better than the management expected but in terms of operating or net profit, the year was

worse than management expected. This is apparent from the fact that favourable variances

have been witnessed only for the revenue and the gross profit while for all the underlying

costs the variances are unfavourable thus implying that the actual costs incurred were

significantly higher than estimated (Damodaran, 2015). This may be attributed to the

acquisition that the company has undertaken owing to which the revenues and related costs

have both jumped significantly (JB Hi Fi, 2017).

2) Variance (%) = (2017 Actual - 2017 Budgeted)/2017 Budgeted

3) F indicates favourable variance whereas NF indicates not favourable or unfavourable

variance

Comment

From the above variance analysis, it is apparent that in terms of top line growth the year was

better than the management expected but in terms of operating or net profit, the year was

worse than management expected. This is apparent from the fact that favourable variances

have been witnessed only for the revenue and the gross profit while for all the underlying

costs the variances are unfavourable thus implying that the actual costs incurred were

significantly higher than estimated (Damodaran, 2015). This may be attributed to the

acquisition that the company has undertaken owing to which the revenues and related costs

have both jumped significantly (JB Hi Fi, 2017).

References

Brealey, R. A., Myers, S. C., & Allen, F. (2014) Principles of corporate finance (2nd ed.).

New York: McGraw-Hill Inc.

Brigham, E. F. & Houston, J. F., (2014) .Fundamentals of Financial Management (14th ed.).

Boston: Cengage Learning.

Damodaran, A. (2015). Applied corporate finance: A user’s manual (3rd ed.). New York:

Wiley, John & Sons.

JBHiFi (2017) Annual Report 2017, Retrieved from

https://www.jbhifi.com.au/Documents/2017%20Annual%20Report.pdf

Brealey, R. A., Myers, S. C., & Allen, F. (2014) Principles of corporate finance (2nd ed.).

New York: McGraw-Hill Inc.

Brigham, E. F. & Houston, J. F., (2014) .Fundamentals of Financial Management (14th ed.).

Boston: Cengage Learning.

Damodaran, A. (2015). Applied corporate finance: A user’s manual (3rd ed.). New York:

Wiley, John & Sons.

JBHiFi (2017) Annual Report 2017, Retrieved from

https://www.jbhifi.com.au/Documents/2017%20Annual%20Report.pdf

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 6

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.