AAMC Training: FNSSAM403 - Cross-Selling Products and Services

VerifiedAdded on 2023/06/18

|24

|6392

|416

Homework Assignment

AI Summary

This document provides a solution to the FNSSAM403 assessment, focusing on identifying opportunities for cross-selling products and services within the finance and mortgage broking context. It includes answers to short-answer questions covering prospecting methods, building client relationships, understanding the Credit Guide, addressing client concerns, and researching appropriate finance options. The assessment also requires analyzing a client's financial situation to identify goals, concerns, and creditworthiness. The student provides answers related to cold calling, creating professional social media profiles, and the importance of understanding client needs. The document acts as a study aid, and students can find similar resources, including past papers and solved assignments, on Desklib.

Assessment cover sheet

In order for your assessment to be marked you must complete and

upload all tasks and this cover sheet via the AAMC Training Group

portal. Your assessment tasks may be uploaded in an electronic format, i.e.

Word, Excel or PDF, unless specified. A maximum of five (5) attachments

(maximum 20MB each) can be uploaded for this assessment. Please see the

step-by-step instructions in your Member Area on how to upload

assessments.

Student details

Course name FNS40815 Certificate IV in Finance & Mortgage Broking

Assessment name FNSSAM403 Assessment

Student name

When you upload your assessment you will be asked to confirm that your assessment submission to

AAMC Training is your own work and NOT the result of plagiarism or excessive collaboration, and that

all material used from any third party has been identified and referenced appropriately. AAMC Training

may conduct independent evaluation checks and contact your supervisor to discuss your assessment.

Checklist of attachments:

☐ Task 1 – Short Answer

☐ Task 2 – Written Test

Please indicate style of course undertaken:

☐ Online ☐ Virtual class ☐ Face to face – Trainer’s name:

Once your assessment has been successfully uploaded it will be pending review with your

nominated course assessor. Your assessor will mark your assessment and you will receive an

email advising you if you have been assessed as satisfactory. If you are marked as ‘assessor

requires additional information’ or ‘not yet satisfactory’ you may be required to provide

additional information or re-visit the assessment and re-upload your amended case study or

written tasks.

If you have queries relating specifically to your assessment please log an ‘Assessment Query’

under the HELP tab on your Members Area dashboard and a Student Support officer will

respond.

Alternatively, if you have an administration query please go to ‘Admin Query’. For example: I

am having trouble with uploading my assessments and require assistance – can you please help

me with this?

In order for your assessment to be marked you must complete and

upload all tasks and this cover sheet via the AAMC Training Group

portal. Your assessment tasks may be uploaded in an electronic format, i.e.

Word, Excel or PDF, unless specified. A maximum of five (5) attachments

(maximum 20MB each) can be uploaded for this assessment. Please see the

step-by-step instructions in your Member Area on how to upload

assessments.

Student details

Course name FNS40815 Certificate IV in Finance & Mortgage Broking

Assessment name FNSSAM403 Assessment

Student name

When you upload your assessment you will be asked to confirm that your assessment submission to

AAMC Training is your own work and NOT the result of plagiarism or excessive collaboration, and that

all material used from any third party has been identified and referenced appropriately. AAMC Training

may conduct independent evaluation checks and contact your supervisor to discuss your assessment.

Checklist of attachments:

☐ Task 1 – Short Answer

☐ Task 2 – Written Test

Please indicate style of course undertaken:

☐ Online ☐ Virtual class ☐ Face to face – Trainer’s name:

Once your assessment has been successfully uploaded it will be pending review with your

nominated course assessor. Your assessor will mark your assessment and you will receive an

email advising you if you have been assessed as satisfactory. If you are marked as ‘assessor

requires additional information’ or ‘not yet satisfactory’ you may be required to provide

additional information or re-visit the assessment and re-upload your amended case study or

written tasks.

If you have queries relating specifically to your assessment please log an ‘Assessment Query’

under the HELP tab on your Members Area dashboard and a Student Support officer will

respond.

Alternatively, if you have an administration query please go to ‘Admin Query’. For example: I

am having trouble with uploading my assessments and require assistance – can you please help

me with this?

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FNSSAM403 FMB Assessment

CREDIT TRANSFER

You may be able to claim credit transfer for a unit/s of competency that you have previously

completed with AAMC Training or another RTO. If you have been awarded a record of result or

statement of attainment for any of the units detailed below then please go to the Credit Transfer

tab in your Learning Centre and follow the prompts.

This assessment relates to the following units of competency:

FNSSAM403 – Identify opportunities for cross-selling products and services

Please refer to AAMC Training’s full Recognition Policy for further details.

Task 1 – Short Answer

In order to successfully complete some of the tasks in this assessment you should have access to the

following documents. These are available in the AAMC Training Useful Resources or you may wish

to find your own/use your company documents.

Credit Guide – important facts about the business and products you provide

Adviser Profile – this may be included in your credit guide and could be simply your licence

number as the services you provide are one in the same as your licensee

Client Needs Review – for client data gathering

Preliminary Assessment

Questions

1. What do you believe to be three good prospecting methods and why?

1 Cohort study This method refers to the study of samples and it

shears defining characters tics.

2 Group study It is totally concerned with the study of group

elements and various tools.

3 Screening tools It is also a beneficial for screening different tools

and technique. This is one of the beneficial tool

CREDIT TRANSFER

You may be able to claim credit transfer for a unit/s of competency that you have previously

completed with AAMC Training or another RTO. If you have been awarded a record of result or

statement of attainment for any of the units detailed below then please go to the Credit Transfer

tab in your Learning Centre and follow the prompts.

This assessment relates to the following units of competency:

FNSSAM403 – Identify opportunities for cross-selling products and services

Please refer to AAMC Training’s full Recognition Policy for further details.

Task 1 – Short Answer

In order to successfully complete some of the tasks in this assessment you should have access to the

following documents. These are available in the AAMC Training Useful Resources or you may wish

to find your own/use your company documents.

Credit Guide – important facts about the business and products you provide

Adviser Profile – this may be included in your credit guide and could be simply your licence

number as the services you provide are one in the same as your licensee

Client Needs Review – for client data gathering

Preliminary Assessment

Questions

1. What do you believe to be three good prospecting methods and why?

1 Cohort study This method refers to the study of samples and it

shears defining characters tics.

2 Group study It is totally concerned with the study of group

elements and various tools.

3 Screening tools It is also a beneficial for screening different tools

and technique. This is one of the beneficial tool

and most important perspective method.

2. In your own opinion, what are some areas which are important to say about yourself and your

business when creating a Facebook or LinkedIn profile? Why would correct and professional

information be important to your organisation?

While creating a Facebook or Linkdin profile it is very important to share all the necessary

information about the business and theuir products so that all the professionals of Link-din can

get to know about the business. Apart from this it is also very important for the business to keep

update their Facebook and linkdin profile so that those who want to work with this company may

approach it.

3. What is cold calling? Is cold calling an effective prospecting method? Explain your answer.

Cold calling is one of the popular technique in which is used by the salesperson to contact those

people who have shown some interest earlier about the product and services. Yes cold calling is

effective method due to which sales person can easily sell their products. It can be done by

phone and telemarketing.

4. How would you build a relationship with a client through cold calling?

Relation can get build when the sales person focuses on the needs of the client and by fulfilling

their needs they may easily make a relationship with their clients. Besides this, sales person

should speak naturally so that clients may understand the products and its benefits. Conversation

should be bilateral to build strong relationship.

5. In your opinion, why would the following areas of information (found in the Credit Guide) be

important for a new client to understand? How could this information protect all parties?

Your role and responsibility as Credit Adviser

Credit advisers are financial professionals, and they help individual and entities to management

their finance and collect fund form different sources.

the role of the organisation

Organisation's role is to provide services to person entities withing the system.

The identity of and information about the Credit Licence holder

2. In your own opinion, what are some areas which are important to say about yourself and your

business when creating a Facebook or LinkedIn profile? Why would correct and professional

information be important to your organisation?

While creating a Facebook or Linkdin profile it is very important to share all the necessary

information about the business and theuir products so that all the professionals of Link-din can

get to know about the business. Apart from this it is also very important for the business to keep

update their Facebook and linkdin profile so that those who want to work with this company may

approach it.

3. What is cold calling? Is cold calling an effective prospecting method? Explain your answer.

Cold calling is one of the popular technique in which is used by the salesperson to contact those

people who have shown some interest earlier about the product and services. Yes cold calling is

effective method due to which sales person can easily sell their products. It can be done by

phone and telemarketing.

4. How would you build a relationship with a client through cold calling?

Relation can get build when the sales person focuses on the needs of the client and by fulfilling

their needs they may easily make a relationship with their clients. Besides this, sales person

should speak naturally so that clients may understand the products and its benefits. Conversation

should be bilateral to build strong relationship.

5. In your opinion, why would the following areas of information (found in the Credit Guide) be

important for a new client to understand? How could this information protect all parties?

Your role and responsibility as Credit Adviser

Credit advisers are financial professionals, and they help individual and entities to management

their finance and collect fund form different sources.

the role of the organisation

Organisation's role is to provide services to person entities withing the system.

The identity of and information about the Credit Licence holder

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Credit license holder is responsible for providing credit ser5vices and information to their client.

the range of services provided

They provide range of services such as mortgage, lines of credit, providing auto loans and

other saving accounts.

all costs, fees, commissions etc. associated with the transaction

the procedures for handling complaints and disputes.

To handle complaints and disputes it is very important for the organisation to get deep research

and find out the reason behind dispute.

6. Why do you believe is it important to encourage prospective clients to express their needs

and goals when completing a data collection?

It is very important because when the client express their needs then only sales person can

provide them effective product which satisfy their needs but if the sales man don't know then

there is high chances that they may offere them wrong product and this will harm their

relationship.

7. Your client Mary Jane has advised that she would like to purchase a home worth $400,000

and you have worked out associated costs of around $30,000. She has a deposit of $150,000. She

has spoken to friends and are concerned that she may have to pay mortgage insurance which she

hears can be a very high cost.

a) Complete a quick LVR calculation and explain the outcome to the client. Please

ensure you show your workings. Information on calculating LVR’s are found in your

learning guide and via the internet.

Purchase of home $4000000 also it will add $30000 = 4300000 As she has saving of $

150000 so she can easily get mortgage insurance on the behalf of savings.

b) Why is it important to respond clearly to the client in this case?

It is necessary to respond to client so that they may know in which product they can get good

income and other return, and they can invest in good product as well which will fulfil their

needs.

the range of services provided

They provide range of services such as mortgage, lines of credit, providing auto loans and

other saving accounts.

all costs, fees, commissions etc. associated with the transaction

the procedures for handling complaints and disputes.

To handle complaints and disputes it is very important for the organisation to get deep research

and find out the reason behind dispute.

6. Why do you believe is it important to encourage prospective clients to express their needs

and goals when completing a data collection?

It is very important because when the client express their needs then only sales person can

provide them effective product which satisfy their needs but if the sales man don't know then

there is high chances that they may offere them wrong product and this will harm their

relationship.

7. Your client Mary Jane has advised that she would like to purchase a home worth $400,000

and you have worked out associated costs of around $30,000. She has a deposit of $150,000. She

has spoken to friends and are concerned that she may have to pay mortgage insurance which she

hears can be a very high cost.

a) Complete a quick LVR calculation and explain the outcome to the client. Please

ensure you show your workings. Information on calculating LVR’s are found in your

learning guide and via the internet.

Purchase of home $4000000 also it will add $30000 = 4300000 As she has saving of $

150000 so she can easily get mortgage insurance on the behalf of savings.

b) Why is it important to respond clearly to the client in this case?

It is necessary to respond to client so that they may know in which product they can get good

income and other return, and they can invest in good product as well which will fulfil their

needs.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

c) What could you do to make sure the client has understood what you have advised?

By asking to clients about their queries, it can easily be known by the salesperson whether the client

has understand or not. So when client raise their question then only they get more deep knowledge

about the product and services.

8. Your client Mary Jane is hesitant about completing some of the information in the client

needs review. As an Adviser, you must fully complete a client needs review for a number of

reasons.

a) What is a probing question you may ask the client to determine their resistance?

As resistance is very important for the kyc proocess so the major probing questions which

can be asked client about their contact information and other resistant details so that they

may know all the basic details of the client which is very important for them.

b) What are two points you may highlight to the client to try to overcome this situation in an

appropriate manner?

The two major point which need to be considered is that firstly the sales man has to

understand the needs of their client and ask them to provide all the basis details of their

family and those people who are deep-endent on them.

9. A prospective client is hesitant to use you as their broker because they are already a client

with a competitor. What interpersonal techniques and communication skills would you used

to overcome this?

Verbal communication will work effectively and also it will will help the sales person to sell

their all products and services. Besides this motivation will be used as interpersonal technique

to bring some confidence to them,.

10. You have now gained Mary Jane’s consent to move forward with fully completing the fact

find. She has advised that further to the basic information provided above (in question 7), she is

buying the home to live in and is a single parent on a good income in long term employment.

Mary Jane would like to pay the home off early but would also like some spare funds for a

By asking to clients about their queries, it can easily be known by the salesperson whether the client

has understand or not. So when client raise their question then only they get more deep knowledge

about the product and services.

8. Your client Mary Jane is hesitant about completing some of the information in the client

needs review. As an Adviser, you must fully complete a client needs review for a number of

reasons.

a) What is a probing question you may ask the client to determine their resistance?

As resistance is very important for the kyc proocess so the major probing questions which

can be asked client about their contact information and other resistant details so that they

may know all the basic details of the client which is very important for them.

b) What are two points you may highlight to the client to try to overcome this situation in an

appropriate manner?

The two major point which need to be considered is that firstly the sales man has to

understand the needs of their client and ask them to provide all the basis details of their

family and those people who are deep-endent on them.

9. A prospective client is hesitant to use you as their broker because they are already a client

with a competitor. What interpersonal techniques and communication skills would you used

to overcome this?

Verbal communication will work effectively and also it will will help the sales person to sell

their all products and services. Besides this motivation will be used as interpersonal technique

to bring some confidence to them,.

10. You have now gained Mary Jane’s consent to move forward with fully completing the fact

find. She has advised that further to the basic information provided above (in question 7), she is

buying the home to live in and is a single parent on a good income in long term employment.

Mary Jane would like to pay the home off early but would also like some spare funds for a

holiday over the next 12 months. Protection of the home and her child in case of job loss or

becoming ill is highly important.

Mary Jane would like to purchase another investment property down the track to provide for

her retirement. Prior to a marital separation, Mary Jane and her ex husband had paid off

another mortgage. Mary Jane has a clear credit history.

The client may also like a 100% offset account as she had one in the past and it worked well to

pay the loan off quickly. Mary Jane would prefer a major bank as she is concerned a smaller

provider may not have any branches in her area.

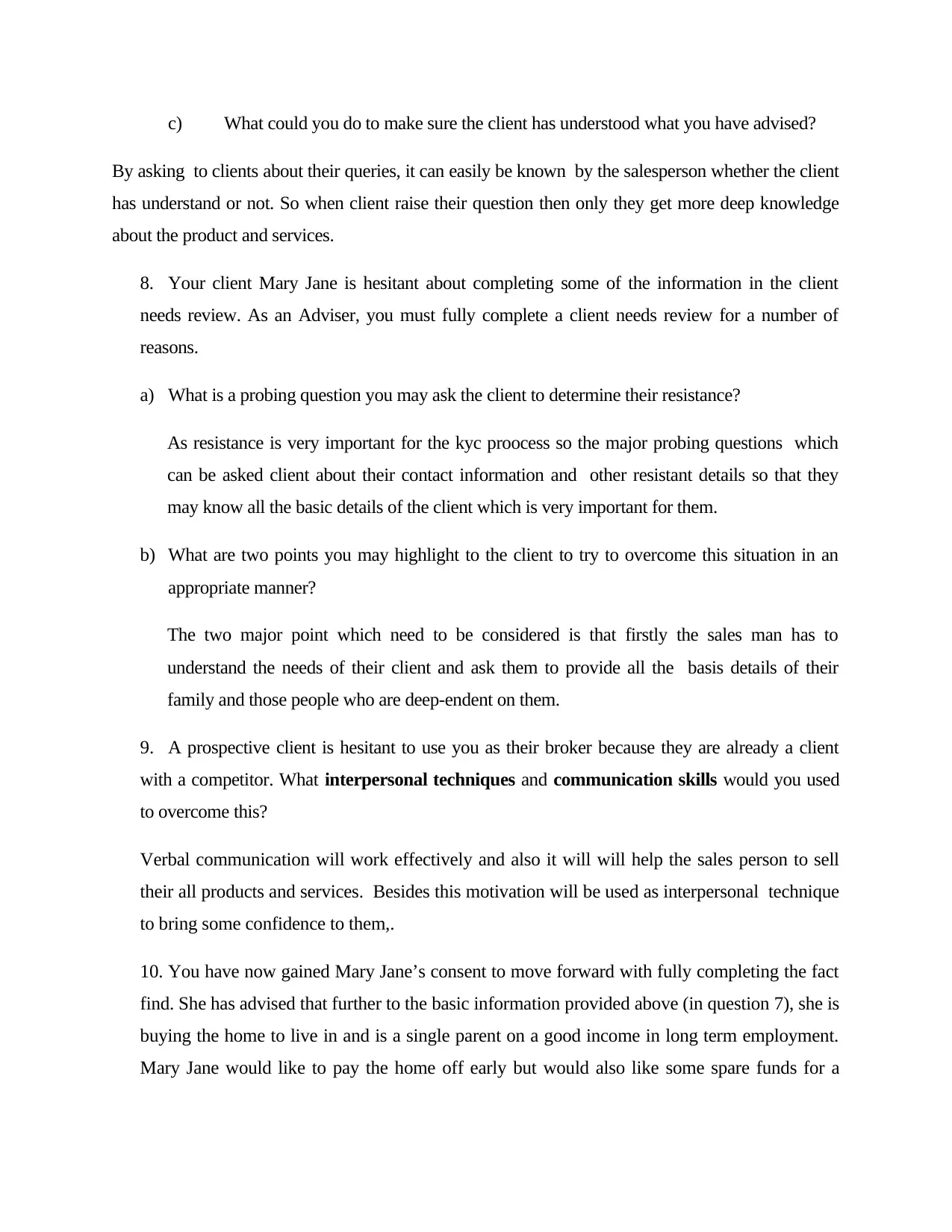

Whilst it would be prudent to complete a fact find under normal circumstances, for this exercise

we ask you to highlight and record some of the client’s goals, concerns and creditworthiness (i.e.

why the lender should consider them for the loan) in the table below.

Goal Concern Creditworthiness

Buying home She has the concern to buy a

big home

As she has save lot of money

to purchase house so she

thas the creditworthiness

that she will, repay the loan.

Vacation She wants to go for a

vacation to next 12 months

As she is working with a good

reputed company so she will

easily repay the loan.

To buy another investment

property.

She has saved enough

money to purchase new

property.

As she having good

creditworthiness so she may

get loan easily.

11. John has asked you for some advice on buying a car for personal use worth $40,000 over a

five year loan term. You have completed his client needs review and must now complete some

research to present John with appropriate finance options. Research and present two products that

may be appropriate for John, highlight all fees, features, repayment amount, etc. (You can use a

number of sites including rate city to complete this activity.)

1 As John wants to purchase car so it can be suggested to go for a car loan so that john does

not have to pay all the amount at the same time.

2 Another suggestion will be is that john may use their all savings to buy a car but loan will

becoming ill is highly important.

Mary Jane would like to purchase another investment property down the track to provide for

her retirement. Prior to a marital separation, Mary Jane and her ex husband had paid off

another mortgage. Mary Jane has a clear credit history.

The client may also like a 100% offset account as she had one in the past and it worked well to

pay the loan off quickly. Mary Jane would prefer a major bank as she is concerned a smaller

provider may not have any branches in her area.

Whilst it would be prudent to complete a fact find under normal circumstances, for this exercise

we ask you to highlight and record some of the client’s goals, concerns and creditworthiness (i.e.

why the lender should consider them for the loan) in the table below.

Goal Concern Creditworthiness

Buying home She has the concern to buy a

big home

As she has save lot of money

to purchase house so she

thas the creditworthiness

that she will, repay the loan.

Vacation She wants to go for a

vacation to next 12 months

As she is working with a good

reputed company so she will

easily repay the loan.

To buy another investment

property.

She has saved enough

money to purchase new

property.

As she having good

creditworthiness so she may

get loan easily.

11. John has asked you for some advice on buying a car for personal use worth $40,000 over a

five year loan term. You have completed his client needs review and must now complete some

research to present John with appropriate finance options. Research and present two products that

may be appropriate for John, highlight all fees, features, repayment amount, etc. (You can use a

number of sites including rate city to complete this activity.)

1 As John wants to purchase car so it can be suggested to go for a car loan so that john does

not have to pay all the amount at the same time.

2 Another suggestion will be is that john may use their all savings to buy a car but loan will

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

be beneficial as by paying downpay7ment john can easily get new car.

12. Using a search engine, research “Ten tips to protect your

customers’ personal information”. Select one of the 10 points and in your

own words briefly describe the purpose of this step.

1. By getting limited access to customers information

2. By using encryption practises

3. Collect only those information which is necessary

4. They should destroy data after getting used

5. Give importance to customer privacy

6. Make customer believe that their information is safe

7. To collect vital data

8. Sources should be appropriate

9. Use various password management tools

10. Avoid all the silos data

13. You have completed a fact finder, costing analysis, and LVR

calculation for a client and have worked out the due to affordability

issues, based on the living expenses they have provided, the client is

unable to borrow the required loan amount. They would be able to borrow

a loan amount of $5,000 less. Referring back to your client needs review,

what additional question/s would you ask the client?

One of the major question would be how much loan is being needed by

the client. What are the other affordability issues is being faced by the

client. How effective is for them to get loan frequently. Besides this, it is

also important for the client to share their credit score the only they will

get loan.

14. You have completed the product research for the client. How would you

prepare for the next contact and what would you do at that meeting?

For the next contact it is very important to know the credit sore and

creditworthiness of the client so that the chances of faillier and counter

12. Using a search engine, research “Ten tips to protect your

customers’ personal information”. Select one of the 10 points and in your

own words briefly describe the purpose of this step.

1. By getting limited access to customers information

2. By using encryption practises

3. Collect only those information which is necessary

4. They should destroy data after getting used

5. Give importance to customer privacy

6. Make customer believe that their information is safe

7. To collect vital data

8. Sources should be appropriate

9. Use various password management tools

10. Avoid all the silos data

13. You have completed a fact finder, costing analysis, and LVR

calculation for a client and have worked out the due to affordability

issues, based on the living expenses they have provided, the client is

unable to borrow the required loan amount. They would be able to borrow

a loan amount of $5,000 less. Referring back to your client needs review,

what additional question/s would you ask the client?

One of the major question would be how much loan is being needed by

the client. What are the other affordability issues is being faced by the

client. How effective is for them to get loan frequently. Besides this, it is

also important for the client to share their credit score the only they will

get loan.

14. You have completed the product research for the client. How would you

prepare for the next contact and what would you do at that meeting?

For the next contact it is very important to know the credit sore and

creditworthiness of the client so that the chances of faillier and counter

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

party risk can be mitigated so that salesperson does not have to face any

difficulty and issues.

Task 2 – Written Test

1. List six buyer motives and in your own words, analyse and discuss issues

relating to two of them.

1 Need It is one of the important thing which is being considered

by very client as in the absence of need no one client will

buy different goods and services. In the absence of need no

one client will purchase new products and services.

2 Financial gain This is again an important part when the customer is

financially strong then only they will buy more new

products, services and goods.

3 Acceptance It is again an important tool and technique because when

the client do not give acceptance then they can't purchase

goods and services.

4 Aspiration Most of the customer buy products on the basis of their self

improvement and they purchase various goods.

5 Variety of use It has been seen very often that most of the customer prefer

products as p0er their variety of uses.

6 Safety Most of the customer buy those products which is safe for

them.

2. Using conflict resolution and persuasion techniques, write a response to

the following examples of buyer resistance:

Not interested By using the right body language and discussing the

issues which is arises to them and it is also very

difficulty and issues.

Task 2 – Written Test

1. List six buyer motives and in your own words, analyse and discuss issues

relating to two of them.

1 Need It is one of the important thing which is being considered

by very client as in the absence of need no one client will

buy different goods and services. In the absence of need no

one client will purchase new products and services.

2 Financial gain This is again an important part when the customer is

financially strong then only they will buy more new

products, services and goods.

3 Acceptance It is again an important tool and technique because when

the client do not give acceptance then they can't purchase

goods and services.

4 Aspiration Most of the customer buy products on the basis of their self

improvement and they purchase various goods.

5 Variety of use It has been seen very often that most of the customer prefer

products as p0er their variety of uses.

6 Safety Most of the customer buy those products which is safe for

them.

2. Using conflict resolution and persuasion techniques, write a response to

the following examples of buyer resistance:

Not interested By using the right body language and discussing the

issues which is arises to them and it is also very

important for the salesperson to know the reason that

why customers is not interested what they expect more.

Send me

some

information

If the client want some information then they are interested in the product

and services so the situation of conflict get reduced.

No money –

Can’t afford it

In this scenario there is no option of conflict arises.

You’re wasting

your time

It means client is not interested and salesperson should focus on other

client, and they do not get indulged in argument with the client.

3. How do you successfully undertake cold calling? Explain the process from

start to finish.

Cold calling is the procedure of establishing a relation with the new client. In

the cold calling the sales person get the contact detail of their client

through some reference or going door to door. Then the salesperson

describe the product and its benefits so that customer can buy them. It

is very important for the sales person to prepare a script or highlight

important points which they need to tell the customer on the call.

Besides this it I also important that salesman know the need of the client

and as per their desire they may share products and services.

why customers is not interested what they expect more.

Send me

some

information

If the client want some information then they are interested in the product

and services so the situation of conflict get reduced.

No money –

Can’t afford it

In this scenario there is no option of conflict arises.

You’re wasting

your time

It means client is not interested and salesperson should focus on other

client, and they do not get indulged in argument with the client.

3. How do you successfully undertake cold calling? Explain the process from

start to finish.

Cold calling is the procedure of establishing a relation with the new client. In

the cold calling the sales person get the contact detail of their client

through some reference or going door to door. Then the salesperson

describe the product and its benefits so that customer can buy them. It

is very important for the sales person to prepare a script or highlight

important points which they need to tell the customer on the call.

Besides this it I also important that salesman know the need of the client

and as per their desire they may share products and services.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4. Read the following article, and answer the questions below.

Information in this article may not be based on current market

statistics and is for assessment purposes only

Why Melbourne’s properties will keep on rising

In Australia, over some 120 years or so of not quite so accurate statistics,

property prices have risen at an average compound rate of 10.4%, very

slightly ahead of England. Again, property prices have doubled every 7

years or so despite droughts, wars, changes of government, interstate

and overseas migration, interest rate movements, exchange rate

movements, changing rates of unemployment, CPI movements, etc.

Property cycles

When one takes a short-term view of property price movements, one can

get confused by apparently contradictory statistics. However, if you

understand that property prices move in 7-10 year cycles, the picture

becomes a lot clearer.

Let’s take one obvious example. The movement in NSW and Victorian

property prices tend to be counter-cyclical to Queensland prices

(especially South East Queensland). This is heavily influenced by what is

happening in the NSW & Victorian economics which encourages

migration to Queensland, and at other times in the cycle, people

returning to NSW and Victoria.

So, when Queensland prices are moving ahead strongly (because of this

additional demand from interstate migration), prices in NSW and Victoria

exhibit slower growth, and vice versa.

A study of cycles shows that the Sydney market is much more volatile

than, for example, the Melbourne market. Sydney prices rise faster but

can also experience significant falls in each cycle – Melbourne prices tend

to rise rapidly (+25%, +20%) in the first two years of an upturn and then

more moderate increases of 3-7% in the remaining years of the cycle till

growth spurts again.

Relative prices in each capital city

Over the last 100+ years in Australia, each of the six State and Territory

capitals have established a fairly stable ranking with each other in terms

of their median house and apartment prices.

Information in this article may not be based on current market

statistics and is for assessment purposes only

Why Melbourne’s properties will keep on rising

In Australia, over some 120 years or so of not quite so accurate statistics,

property prices have risen at an average compound rate of 10.4%, very

slightly ahead of England. Again, property prices have doubled every 7

years or so despite droughts, wars, changes of government, interstate

and overseas migration, interest rate movements, exchange rate

movements, changing rates of unemployment, CPI movements, etc.

Property cycles

When one takes a short-term view of property price movements, one can

get confused by apparently contradictory statistics. However, if you

understand that property prices move in 7-10 year cycles, the picture

becomes a lot clearer.

Let’s take one obvious example. The movement in NSW and Victorian

property prices tend to be counter-cyclical to Queensland prices

(especially South East Queensland). This is heavily influenced by what is

happening in the NSW & Victorian economics which encourages

migration to Queensland, and at other times in the cycle, people

returning to NSW and Victoria.

So, when Queensland prices are moving ahead strongly (because of this

additional demand from interstate migration), prices in NSW and Victoria

exhibit slower growth, and vice versa.

A study of cycles shows that the Sydney market is much more volatile

than, for example, the Melbourne market. Sydney prices rise faster but

can also experience significant falls in each cycle – Melbourne prices tend

to rise rapidly (+25%, +20%) in the first two years of an upturn and then

more moderate increases of 3-7% in the remaining years of the cycle till

growth spurts again.

Relative prices in each capital city

Over the last 100+ years in Australia, each of the six State and Territory

capitals have established a fairly stable ranking with each other in terms

of their median house and apartment prices.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Traditionally, Sydney has always been the most expensive followed by

Melbourne, Canberra, Brisbane, Perth, Adelaide, Darwin & Hobart.

Increases in prices in each of these markets, for whatever reasons

(mining booms, economic recessions, rural booms and droughts etc) can

cause some temporary shifts in the relative standing of each of these

cities. But these are normally temporary shifts and the long-term

standings re-assert themselves as the various cycles evolve.

continued on the next page

In the last 3-4 years, Perth & Darwin prices (and to a lesser extent

Adelaide and Brisbane prices) have increased dramatically due to the

boom in mining and oil company revenues and increased demand for

labour (and therefore housing) in those cities. Sydney and Melbourne

prices, while still rising, have slipped behind these other cities in terms of

relative price increases.

Basic demand & supply

The ever-increasing need for housing in Melbourne and Sydney is not

based on temporary boom factors but on underlying (substantial and

permanent) shifts in population. Each city has a strong underlying

economy, which is not dependent on one particular industry. In addition,

estimates of Melbourne’s population for 2020 is over four million people

(an approximate increase of 25% in 13 years). This is huge in terms of

population increase and the need to accommodate these extra people.

The reality is that Melbourne’s building industry cannot build more than

about 140,000 accommodation units (houses and apartments) per

annum due to shortages of qualified tradespeople of all types and

shortage of suitably zoned land and the building permit process.

Demand, on the other hand, is estimated at approximately 170,000

accommodation units per annum. Added to this, State and Federal

governments have all but completely removed themselves from supply

of affordable housing.

The inevitable consequence is that house and apartment prices will

continue to rise (quickly over the next 2-3 years and then more

moderately). And rentals, which are already moving up quickly, will

continue to rise ahead of CPI.

Melbourne, Canberra, Brisbane, Perth, Adelaide, Darwin & Hobart.

Increases in prices in each of these markets, for whatever reasons

(mining booms, economic recessions, rural booms and droughts etc) can

cause some temporary shifts in the relative standing of each of these

cities. But these are normally temporary shifts and the long-term

standings re-assert themselves as the various cycles evolve.

continued on the next page

In the last 3-4 years, Perth & Darwin prices (and to a lesser extent

Adelaide and Brisbane prices) have increased dramatically due to the

boom in mining and oil company revenues and increased demand for

labour (and therefore housing) in those cities. Sydney and Melbourne

prices, while still rising, have slipped behind these other cities in terms of

relative price increases.

Basic demand & supply

The ever-increasing need for housing in Melbourne and Sydney is not

based on temporary boom factors but on underlying (substantial and

permanent) shifts in population. Each city has a strong underlying

economy, which is not dependent on one particular industry. In addition,

estimates of Melbourne’s population for 2020 is over four million people

(an approximate increase of 25% in 13 years). This is huge in terms of

population increase and the need to accommodate these extra people.

The reality is that Melbourne’s building industry cannot build more than

about 140,000 accommodation units (houses and apartments) per

annum due to shortages of qualified tradespeople of all types and

shortage of suitably zoned land and the building permit process.

Demand, on the other hand, is estimated at approximately 170,000

accommodation units per annum. Added to this, State and Federal

governments have all but completely removed themselves from supply

of affordable housing.

The inevitable consequence is that house and apartment prices will

continue to rise (quickly over the next 2-3 years and then more

moderately). And rentals, which are already moving up quickly, will

continue to rise ahead of CPI.

Relativities with other capital cities will be restored by above average

price increases in Melbourne and then Sydney.

Interest rates

The spectre of a return to 16-17% interest rates (experienced only once

in Australia’s history and then only for a few months in 1990) has loomed

large in many would-be investors’ minds. This fear is understandable but

not justified.

Interest rates are now approximately 1-1.5% above the lowest they have

been in the last 40 years. From an economist’s viewpoint, they are

currently above the theoretical long-term average that they should be

(arrived at by adding the present CPI increase and the additional

incentive needed to be offered for people to save and lend their money

to others – historically 1.5-2.0%).

Currently rates are above their theoretically justified level. This is not to

say that the Reserve Bank will not use one or even two more 0.25 per

cent interest rate rises to send a message to the market not to get

“overheated”. Even two such increases will leave interest rates within 2%

of their 40-year lows. A 0.25% per cent increase in the average mortgage

of around $220,000 is equivalent to an extra $10.60 per week ($45.80

per month) in repayments.

By comparison, a 10% increase in the median house price in Melbourne

is equivalent to an $817 per week ($3542 per month) increase in the

owner’s wealth.

continued on the next page

price increases in Melbourne and then Sydney.

Interest rates

The spectre of a return to 16-17% interest rates (experienced only once

in Australia’s history and then only for a few months in 1990) has loomed

large in many would-be investors’ minds. This fear is understandable but

not justified.

Interest rates are now approximately 1-1.5% above the lowest they have

been in the last 40 years. From an economist’s viewpoint, they are

currently above the theoretical long-term average that they should be

(arrived at by adding the present CPI increase and the additional

incentive needed to be offered for people to save and lend their money

to others – historically 1.5-2.0%).

Currently rates are above their theoretically justified level. This is not to

say that the Reserve Bank will not use one or even two more 0.25 per

cent interest rate rises to send a message to the market not to get

“overheated”. Even two such increases will leave interest rates within 2%

of their 40-year lows. A 0.25% per cent increase in the average mortgage

of around $220,000 is equivalent to an extra $10.60 per week ($45.80

per month) in repayments.

By comparison, a 10% increase in the median house price in Melbourne

is equivalent to an $817 per week ($3542 per month) increase in the

owner’s wealth.

continued on the next page

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 24

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.