Self-Assessed Exercises: Superannuation and SMSF Workbook for Monarch

VerifiedAdded on 2020/03/02

|45

|4842

|475

Homework Assignment

AI Summary

This workbook presents a series of self-assessed exercises designed to enhance understanding of key superannuation and SMSF concepts. It covers a range of topics including contribution types (Superannuation Guarantee, salary sacrifice, etc.), contribution caps, and eligibility criteria. Exercises involve matching contribution types, applying cap limits to various scenarios, determining eligibility to contribute, calculating superannuation guarantee and government co-contributions, and calculating tax rebates for spouse contributions. Furthermore, it delves into salary sacrifice calculations, earnings tax, franking credits, conditions of release, benefit components, and withdrawal tax implications. The workbook includes detailed calculations and scenarios to illustrate practical applications of superannuation rules and regulations, and also incorporates SMSF specific topics. The solution is provided for self-assessment.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INTRODUCTION

This workbook provides self-assessed exercises which cover the key superannuation and SMSF

concepts.

This is a formative assessment so you can monitor your understanding of the material before you

complete the assessed activities.

Monarch will not assess this workbook, however they may access it if you require a second attempt

to achieve competency.

Some exercises will ask you to move the text boxes. To do this, left click on the text box and it will

look like this. Hover over the box until you see the 4 arrows in each direction, then left click and drag

to the required spot.

We suggest that you save your changes as you work through the book.

If you make a mistake moving boxes around, you can just close the document without saving, or

download the workbook again.

Simply complete the exercises at your own pace and then turn to page 24 for the solutions so you

can cross check your answers.

You should then upload your completed workbook in the Learning Management System

If you have any questions regarding this workbook please contact fpsupport@monarch.edu.au. and

provide details of your concerns.

This workbook provides self-assessed exercises which cover the key superannuation and SMSF

concepts.

This is a formative assessment so you can monitor your understanding of the material before you

complete the assessed activities.

Monarch will not assess this workbook, however they may access it if you require a second attempt

to achieve competency.

Some exercises will ask you to move the text boxes. To do this, left click on the text box and it will

look like this. Hover over the box until you see the 4 arrows in each direction, then left click and drag

to the required spot.

We suggest that you save your changes as you work through the book.

If you make a mistake moving boxes around, you can just close the document without saving, or

download the workbook again.

Simply complete the exercises at your own pace and then turn to page 24 for the solutions so you

can cross check your answers.

You should then upload your completed workbook in the Learning Management System

If you have any questions regarding this workbook please contact fpsupport@monarch.edu.au. and

provide details of your concerns.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

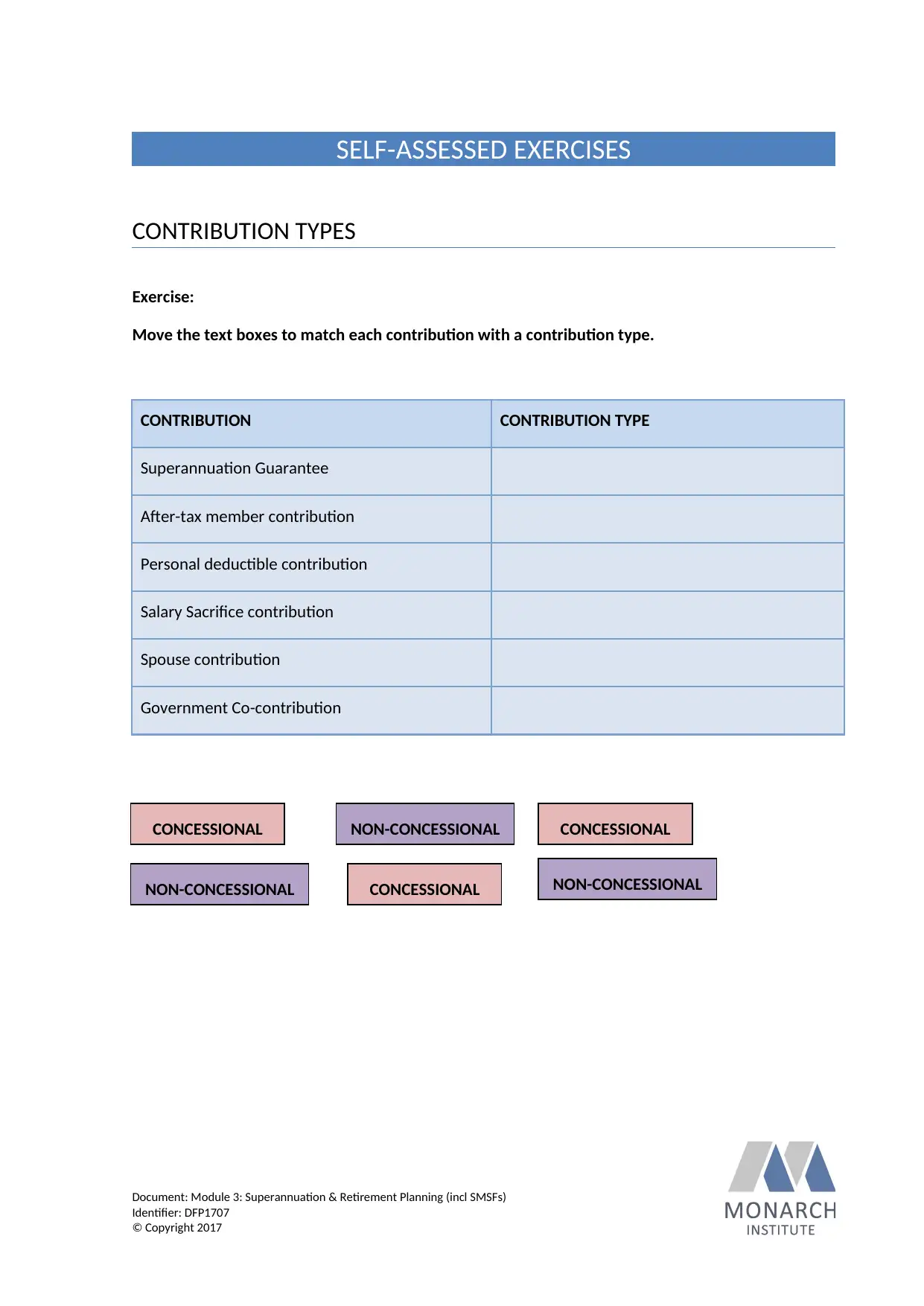

SELF-ASSESSED EXERCISES

CONTRIBUTION TYPES

Exercise:

Move the text boxes to match each contribution with a contribution type.

CONTRIBUTION CONTRIBUTION TYPE

Superannuation Guarantee

After-tax member contribution

Personal deductible contribution

Salary Sacrifice contribution

Spouse contribution

Government Co-contribution

Document: Module 3: Superannuation & Retirement Planning (incl SMSFs)

Identifier: DFP1707

© Copyright 2017

CONCESSIONAL NON-CONCESSIONAL CONCESSIONAL

CONCESSIONALNON-CONCESSIONAL NON-CONCESSIONAL

CONTRIBUTION TYPES

Exercise:

Move the text boxes to match each contribution with a contribution type.

CONTRIBUTION CONTRIBUTION TYPE

Superannuation Guarantee

After-tax member contribution

Personal deductible contribution

Salary Sacrifice contribution

Spouse contribution

Government Co-contribution

Document: Module 3: Superannuation & Retirement Planning (incl SMSFs)

Identifier: DFP1707

© Copyright 2017

CONCESSIONAL NON-CONCESSIONAL CONCESSIONAL

CONCESSIONALNON-CONCESSIONAL NON-CONCESSIONAL

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

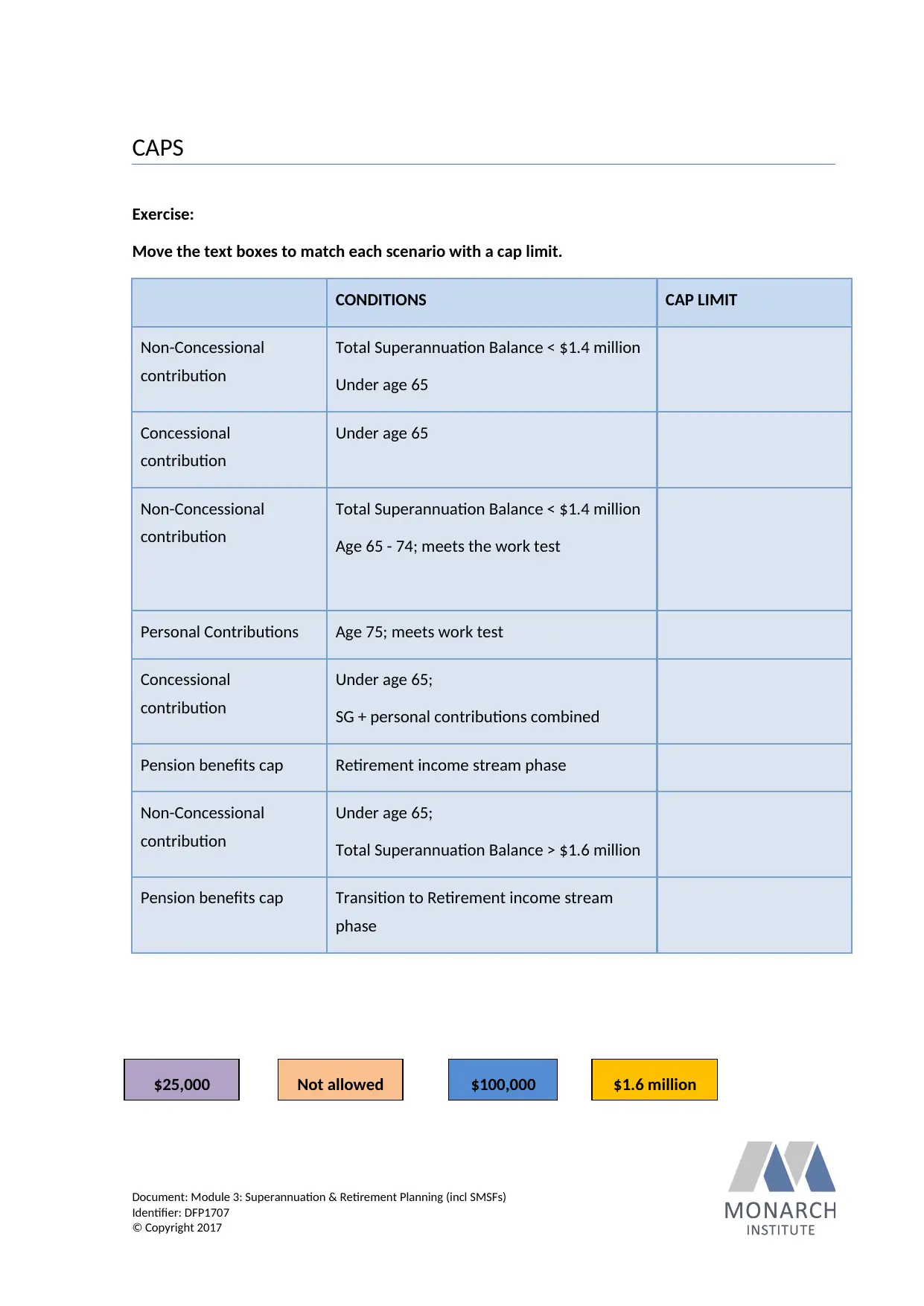

CAPS

Exercise:

Move the text boxes to match each scenario with a cap limit.

CONDITIONS CAP LIMIT

Non-Concessional

contribution

Total Superannuation Balance < $1.4 million

Under age 65

Concessional

contribution

Under age 65

Non-Concessional

contribution

Total Superannuation Balance < $1.4 million

Age 65 - 74; meets the work test

Personal Contributions Age 75; meets work test

Concessional

contribution

Under age 65;

SG + personal contributions combined

Pension benefits cap Retirement income stream phase

Non-Concessional

contribution

Under age 65;

Total Superannuation Balance > $1.6 million

Pension benefits cap Transition to Retirement income stream

phase

Document: Module 3: Superannuation & Retirement Planning (incl SMSFs)

Identifier: DFP1707

© Copyright 2017

$100,000Not allowed$25,000 $1.6 million

Exercise:

Move the text boxes to match each scenario with a cap limit.

CONDITIONS CAP LIMIT

Non-Concessional

contribution

Total Superannuation Balance < $1.4 million

Under age 65

Concessional

contribution

Under age 65

Non-Concessional

contribution

Total Superannuation Balance < $1.4 million

Age 65 - 74; meets the work test

Personal Contributions Age 75; meets work test

Concessional

contribution

Under age 65;

SG + personal contributions combined

Pension benefits cap Retirement income stream phase

Non-Concessional

contribution

Under age 65;

Total Superannuation Balance > $1.6 million

Pension benefits cap Transition to Retirement income stream

phase

Document: Module 3: Superannuation & Retirement Planning (incl SMSFs)

Identifier: DFP1707

© Copyright 2017

$100,000Not allowed$25,000 $1.6 million

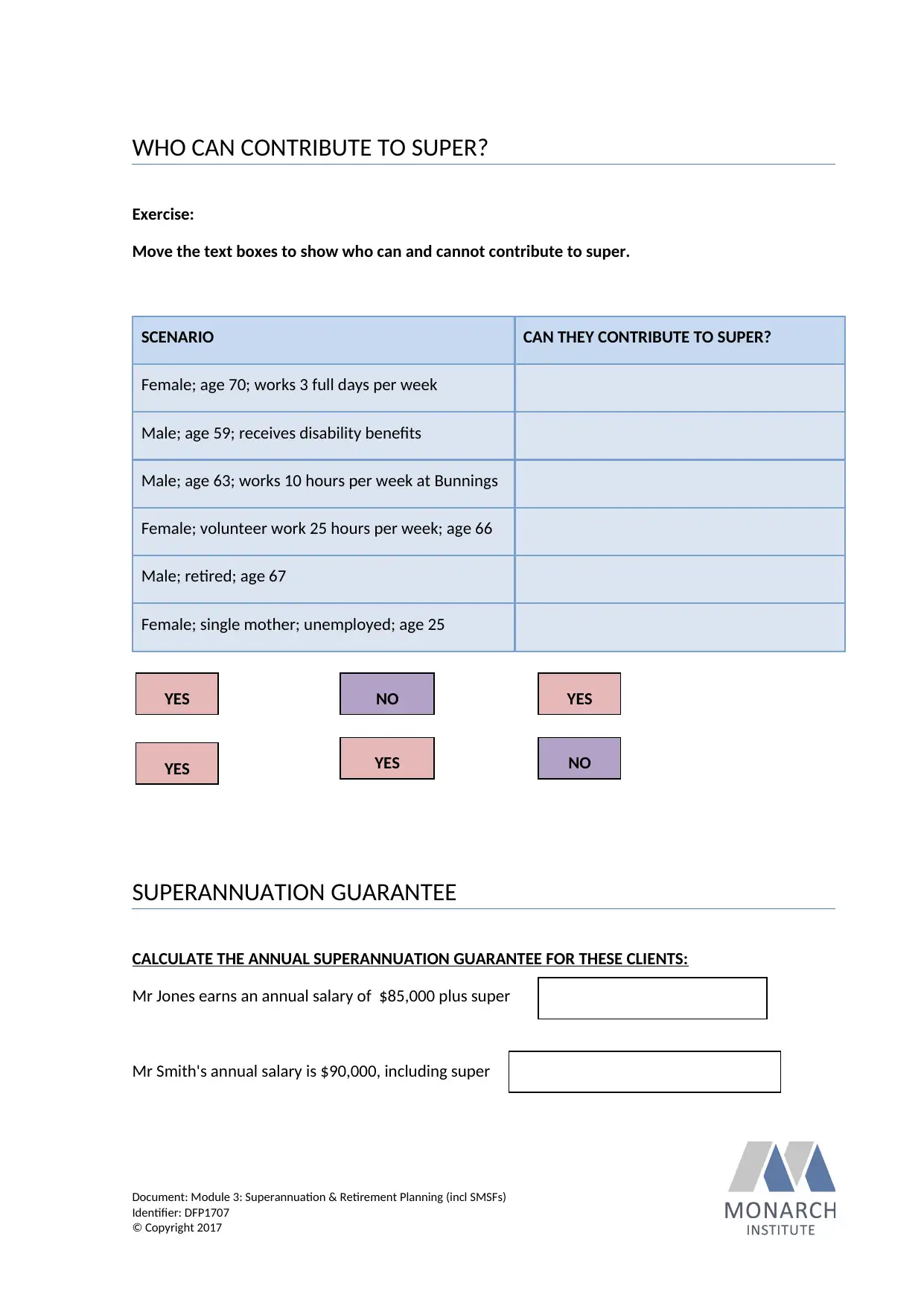

WHO CAN CONTRIBUTE TO SUPER?

Exercise:

Move the text boxes to show who can and cannot contribute to super.

SCENARIO CAN THEY CONTRIBUTE TO SUPER?

Female; age 70; works 3 full days per week

Male; age 59; receives disability benefits

Male; age 63; works 10 hours per week at Bunnings

Female; volunteer work 25 hours per week; age 66

Male; retired; age 67

Female; single mother; unemployed; age 25

SUPERANNUATION GUARANTEE

CALCULATE THE ANNUAL SUPERANNUATION GUARANTEE FOR THESE CLIENTS:

Mr Jones earns an annual salary of $85,000 plus super

Mr Smith's annual salary is $90,000, including super

Document: Module 3: Superannuation & Retirement Planning (incl SMSFs)

Identifier: DFP1707

© Copyright 2017

YES YES

YES

NO

NOYES

Exercise:

Move the text boxes to show who can and cannot contribute to super.

SCENARIO CAN THEY CONTRIBUTE TO SUPER?

Female; age 70; works 3 full days per week

Male; age 59; receives disability benefits

Male; age 63; works 10 hours per week at Bunnings

Female; volunteer work 25 hours per week; age 66

Male; retired; age 67

Female; single mother; unemployed; age 25

SUPERANNUATION GUARANTEE

CALCULATE THE ANNUAL SUPERANNUATION GUARANTEE FOR THESE CLIENTS:

Mr Jones earns an annual salary of $85,000 plus super

Mr Smith's annual salary is $90,000, including super

Document: Module 3: Superannuation & Retirement Planning (incl SMSFs)

Identifier: DFP1707

© Copyright 2017

YES YES

YES

NO

NOYES

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

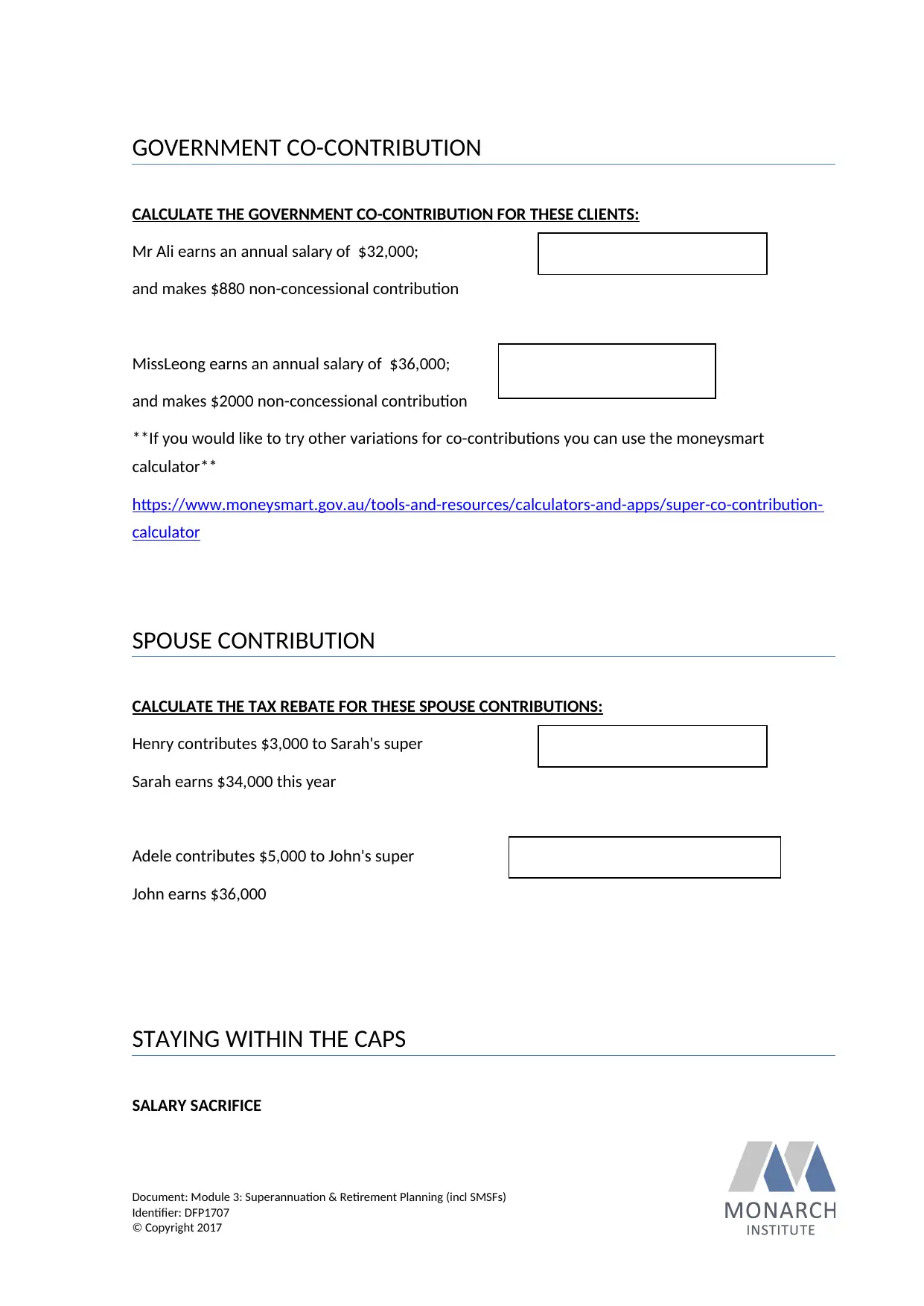

GOVERNMENT CO-CONTRIBUTION

CALCULATE THE GOVERNMENT CO-CONTRIBUTION FOR THESE CLIENTS:

Mr Ali earns an annual salary of $32,000;

and makes $880 non-concessional contribution

MissLeong earns an annual salary of $36,000;

and makes $2000 non-concessional contribution

**If you would like to try other variations for co-contributions you can use the moneysmart

calculator**

https://www.moneysmart.gov.au/tools-and-resources/calculators-and-apps/super-co-contribution-

calculator

SPOUSE CONTRIBUTION

CALCULATE THE TAX REBATE FOR THESE SPOUSE CONTRIBUTIONS:

Henry contributes $3,000 to Sarah's super

Sarah earns $34,000 this year

Adele contributes $5,000 to John's super

John earns $36,000

STAYING WITHIN THE CAPS

SALARY SACRIFICE

Document: Module 3: Superannuation & Retirement Planning (incl SMSFs)

Identifier: DFP1707

© Copyright 2017

CALCULATE THE GOVERNMENT CO-CONTRIBUTION FOR THESE CLIENTS:

Mr Ali earns an annual salary of $32,000;

and makes $880 non-concessional contribution

MissLeong earns an annual salary of $36,000;

and makes $2000 non-concessional contribution

**If you would like to try other variations for co-contributions you can use the moneysmart

calculator**

https://www.moneysmart.gov.au/tools-and-resources/calculators-and-apps/super-co-contribution-

calculator

SPOUSE CONTRIBUTION

CALCULATE THE TAX REBATE FOR THESE SPOUSE CONTRIBUTIONS:

Henry contributes $3,000 to Sarah's super

Sarah earns $34,000 this year

Adele contributes $5,000 to John's super

John earns $36,000

STAYING WITHIN THE CAPS

SALARY SACRIFICE

Document: Module 3: Superannuation & Retirement Planning (incl SMSFs)

Identifier: DFP1707

© Copyright 2017

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

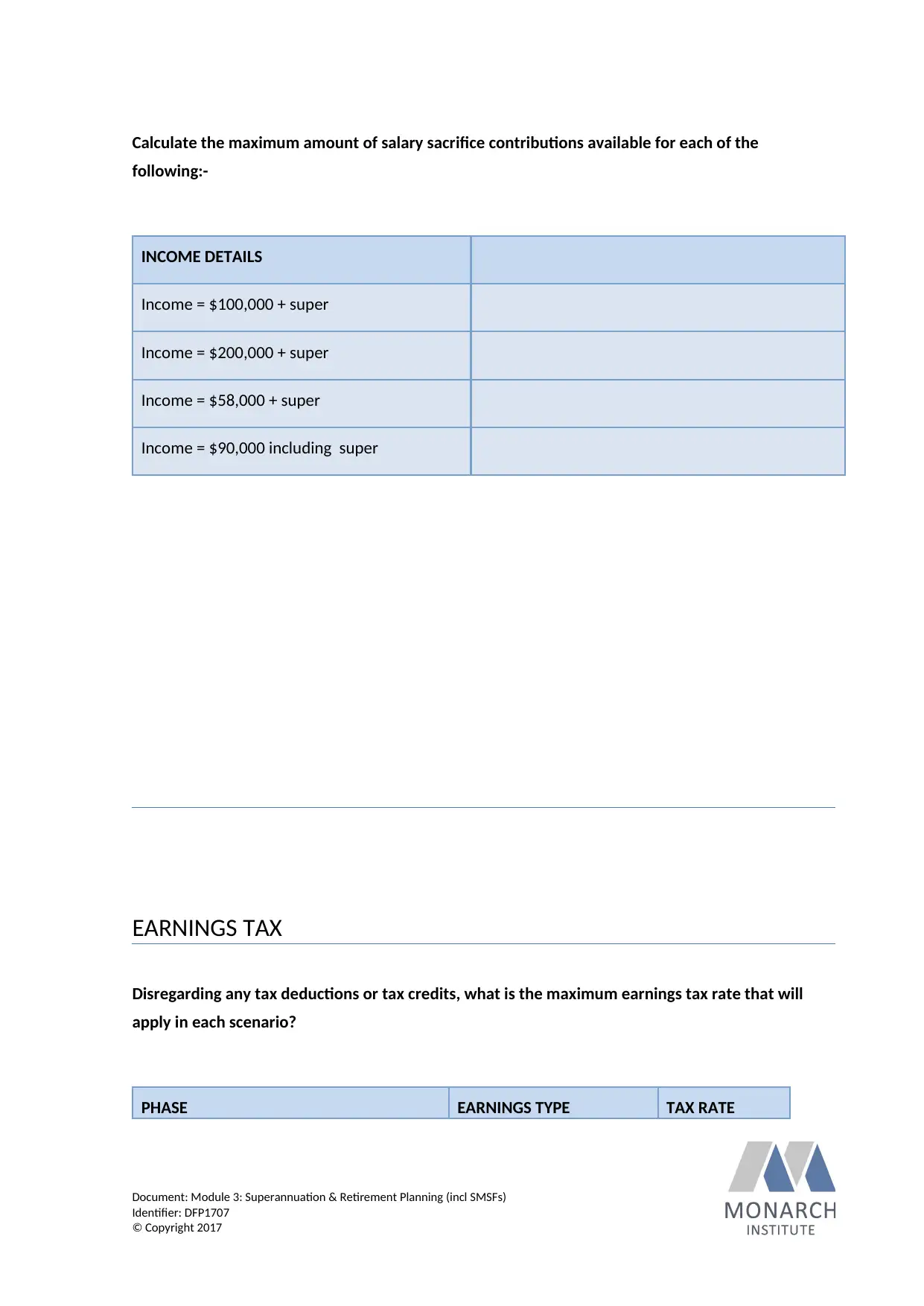

Calculate the maximum amount of salary sacrifice contributions available for each of the

following:-

INCOME DETAILS

Income = $100,000 + super

Income = $200,000 + super

Income = $58,000 + super

Income = $90,000 including super

EARNINGS TAX

Disregarding any tax deductions or tax credits, what is the maximum earnings tax rate that will

apply in each scenario?

PHASE EARNINGS TYPE TAX RATE

Document: Module 3: Superannuation & Retirement Planning (incl SMSFs)

Identifier: DFP1707

© Copyright 2017

following:-

INCOME DETAILS

Income = $100,000 + super

Income = $200,000 + super

Income = $58,000 + super

Income = $90,000 including super

EARNINGS TAX

Disregarding any tax deductions or tax credits, what is the maximum earnings tax rate that will

apply in each scenario?

PHASE EARNINGS TYPE TAX RATE

Document: Module 3: Superannuation & Retirement Planning (incl SMSFs)

Identifier: DFP1707

© Copyright 2017

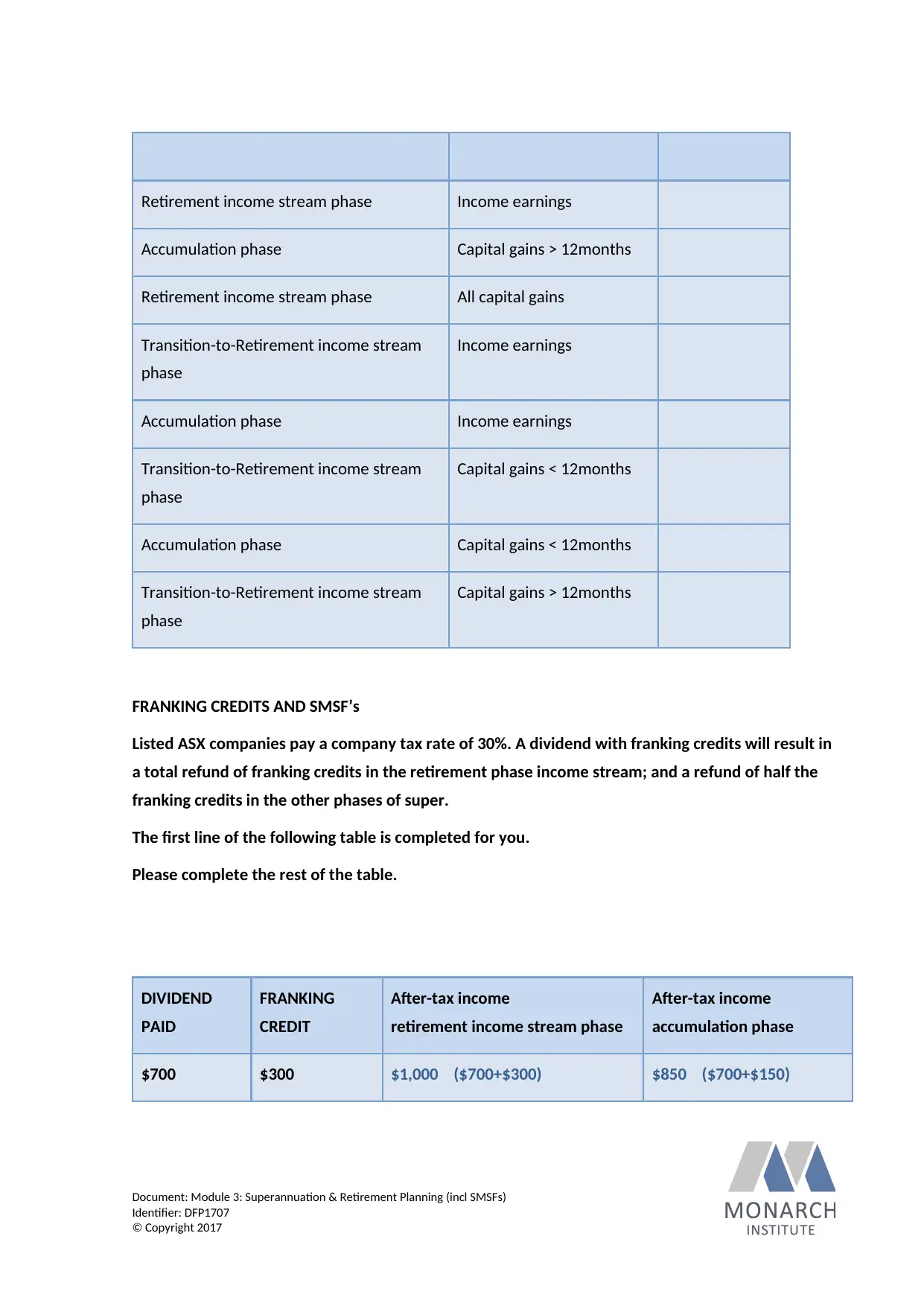

Retirement income stream phase Income earnings

Accumulation phase Capital gains > 12months

Retirement income stream phase All capital gains

Transition-to-Retirement income stream

phase

Income earnings

Accumulation phase Income earnings

Transition-to-Retirement income stream

phase

Capital gains < 12months

Accumulation phase Capital gains < 12months

Transition-to-Retirement income stream

phase

Capital gains > 12months

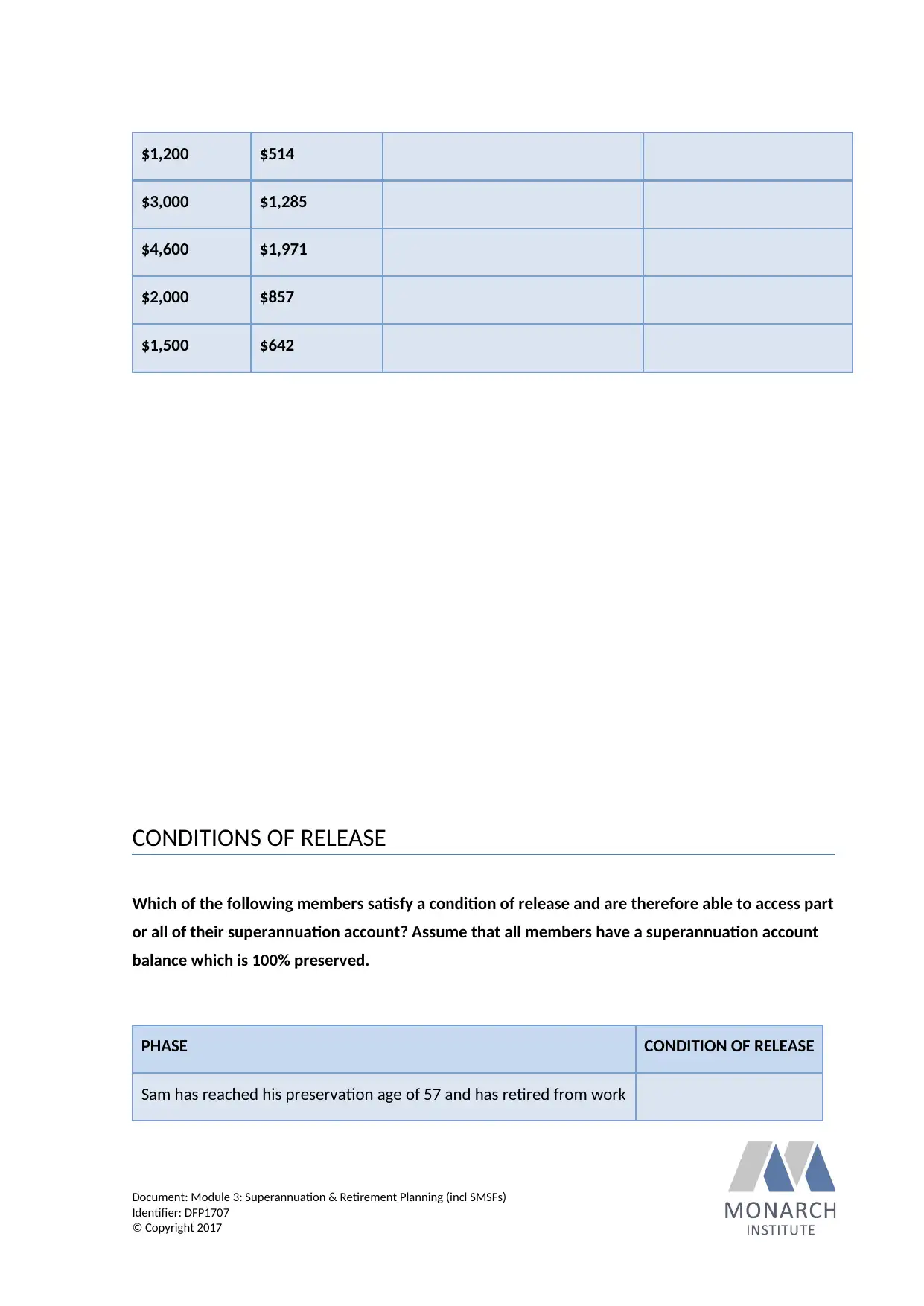

FRANKING CREDITS AND SMSF’s

Listed ASX companies pay a company tax rate of 30%. A dividend with franking credits will result in

a total refund of franking credits in the retirement phase income stream; and a refund of half the

franking credits in the other phases of super.

The first line of the following table is completed for you.

Please complete the rest of the table.

DIVIDEND

PAID

FRANKING

CREDIT

After-tax income

retirement income stream phase

After-tax income

accumulation phase

$700 $300 $1,000 ($700+$300) $850 ($700+$150)

Document: Module 3: Superannuation & Retirement Planning (incl SMSFs)

Identifier: DFP1707

© Copyright 2017

Accumulation phase Capital gains > 12months

Retirement income stream phase All capital gains

Transition-to-Retirement income stream

phase

Income earnings

Accumulation phase Income earnings

Transition-to-Retirement income stream

phase

Capital gains < 12months

Accumulation phase Capital gains < 12months

Transition-to-Retirement income stream

phase

Capital gains > 12months

FRANKING CREDITS AND SMSF’s

Listed ASX companies pay a company tax rate of 30%. A dividend with franking credits will result in

a total refund of franking credits in the retirement phase income stream; and a refund of half the

franking credits in the other phases of super.

The first line of the following table is completed for you.

Please complete the rest of the table.

DIVIDEND

PAID

FRANKING

CREDIT

After-tax income

retirement income stream phase

After-tax income

accumulation phase

$700 $300 $1,000 ($700+$300) $850 ($700+$150)

Document: Module 3: Superannuation & Retirement Planning (incl SMSFs)

Identifier: DFP1707

© Copyright 2017

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

$1,200 $514

$3,000 $1,285

$4,600 $1,971

$2,000 $857

$1,500 $642

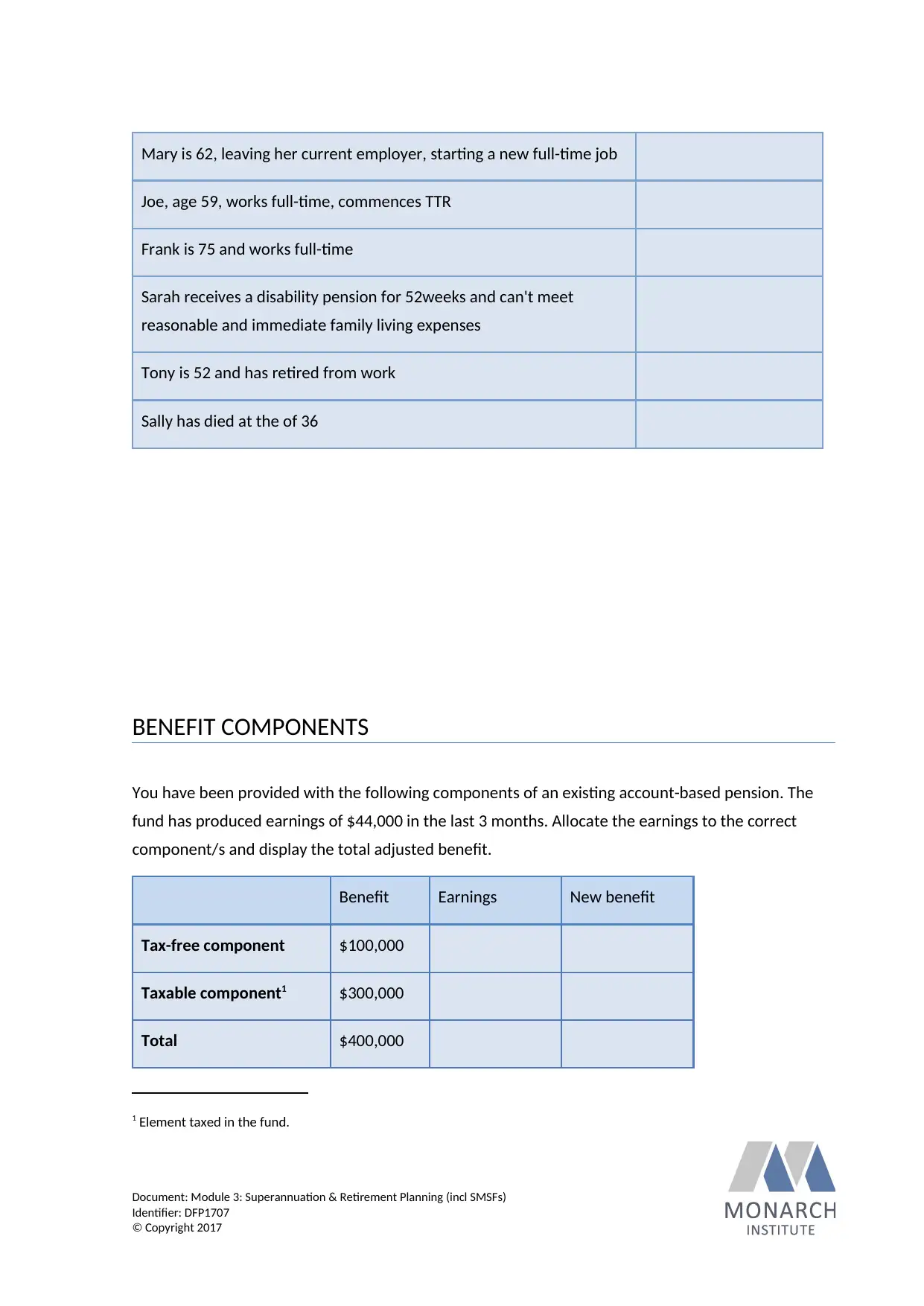

CONDITIONS OF RELEASE

Which of the following members satisfy a condition of release and are therefore able to access part

or all of their superannuation account? Assume that all members have a superannuation account

balance which is 100% preserved.

PHASE CONDITION OF RELEASE

Sam has reached his preservation age of 57 and has retired from work

Document: Module 3: Superannuation & Retirement Planning (incl SMSFs)

Identifier: DFP1707

© Copyright 2017

$3,000 $1,285

$4,600 $1,971

$2,000 $857

$1,500 $642

CONDITIONS OF RELEASE

Which of the following members satisfy a condition of release and are therefore able to access part

or all of their superannuation account? Assume that all members have a superannuation account

balance which is 100% preserved.

PHASE CONDITION OF RELEASE

Sam has reached his preservation age of 57 and has retired from work

Document: Module 3: Superannuation & Retirement Planning (incl SMSFs)

Identifier: DFP1707

© Copyright 2017

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Mary is 62, leaving her current employer, starting a new full-time job

Joe, age 59, works full-time, commences TTR

Frank is 75 and works full-time

Sarah receives a disability pension for 52weeks and can't meet

reasonable and immediate family living expenses

Tony is 52 and has retired from work

Sally has died at the of 36

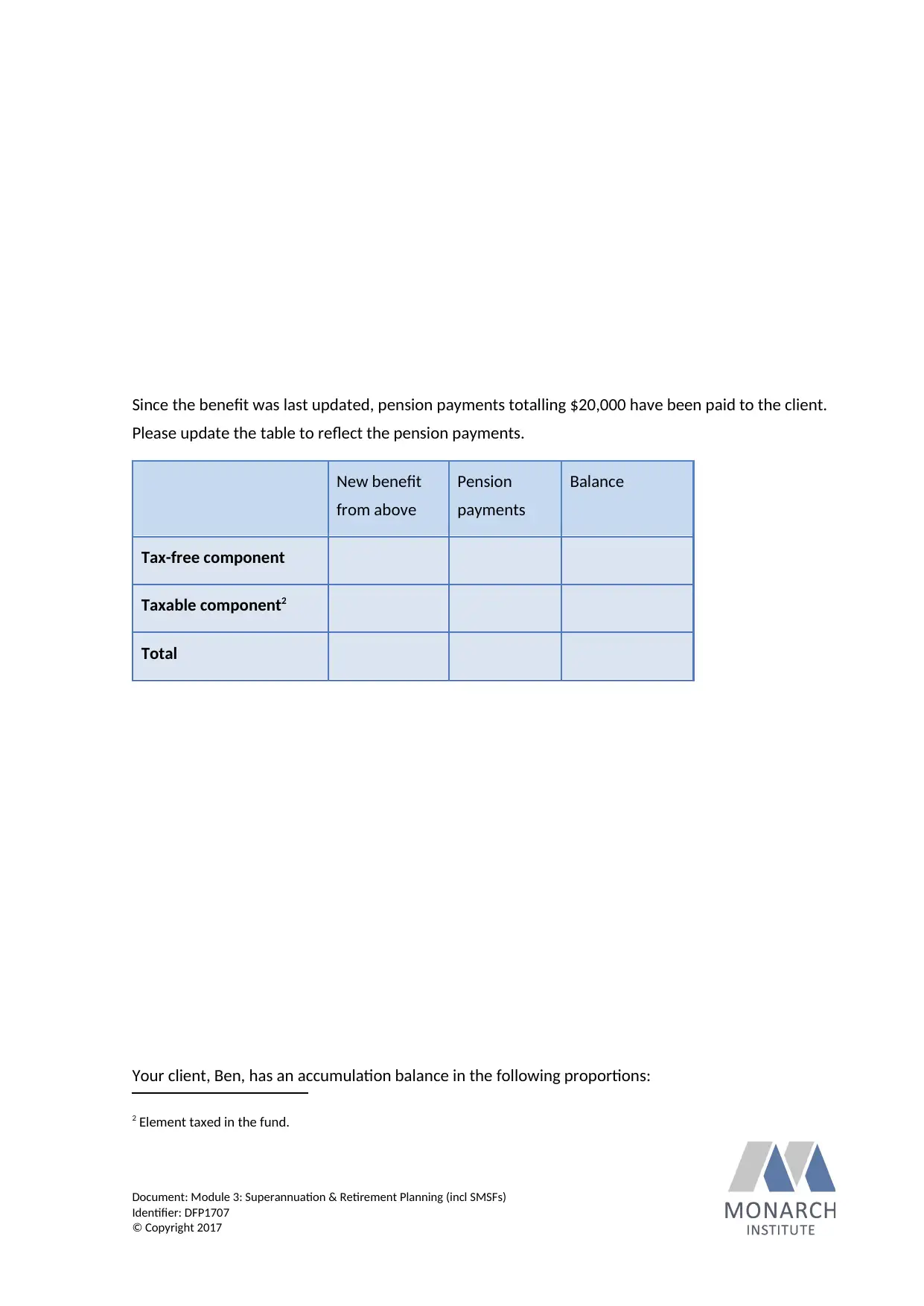

BENEFIT COMPONENTS

You have been provided with the following components of an existing account-based pension. The

fund has produced earnings of $44,000 in the last 3 months. Allocate the earnings to the correct

component/s and display the total adjusted benefit.

Benefit Earnings New benefit

Tax-free component $100,000

Taxable component1 $300,000

Total $400,000

1 Element taxed in the fund.

Document: Module 3: Superannuation & Retirement Planning (incl SMSFs)

Identifier: DFP1707

© Copyright 2017

Joe, age 59, works full-time, commences TTR

Frank is 75 and works full-time

Sarah receives a disability pension for 52weeks and can't meet

reasonable and immediate family living expenses

Tony is 52 and has retired from work

Sally has died at the of 36

BENEFIT COMPONENTS

You have been provided with the following components of an existing account-based pension. The

fund has produced earnings of $44,000 in the last 3 months. Allocate the earnings to the correct

component/s and display the total adjusted benefit.

Benefit Earnings New benefit

Tax-free component $100,000

Taxable component1 $300,000

Total $400,000

1 Element taxed in the fund.

Document: Module 3: Superannuation & Retirement Planning (incl SMSFs)

Identifier: DFP1707

© Copyright 2017

Since the benefit was last updated, pension payments totalling $20,000 have been paid to the client.

Please update the table to reflect the pension payments.

New benefit

from above

Pension

payments

Balance

Tax-free component

Taxable component2

Total

Your client, Ben, has an accumulation balance in the following proportions:

2 Element taxed in the fund.

Document: Module 3: Superannuation & Retirement Planning (incl SMSFs)

Identifier: DFP1707

© Copyright 2017

Please update the table to reflect the pension payments.

New benefit

from above

Pension

payments

Balance

Tax-free component

Taxable component2

Total

Your client, Ben, has an accumulation balance in the following proportions:

2 Element taxed in the fund.

Document: Module 3: Superannuation & Retirement Planning (incl SMSFs)

Identifier: DFP1707

© Copyright 2017

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 45

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.