FNSACC501 Assessment 2: Financial and Business Performance Information

VerifiedAdded on 2020/10/23

|6

|780

|451

Report

AI Summary

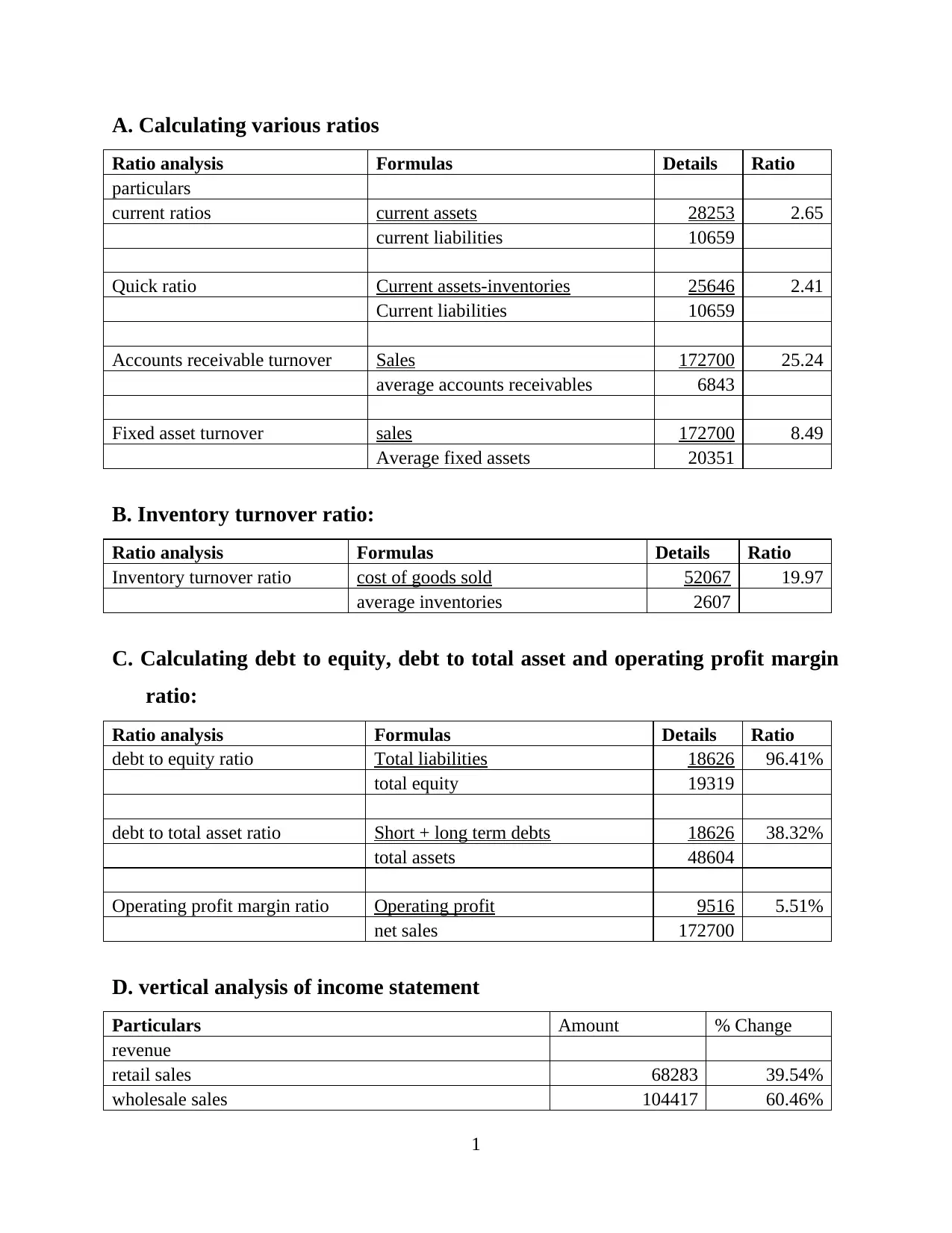

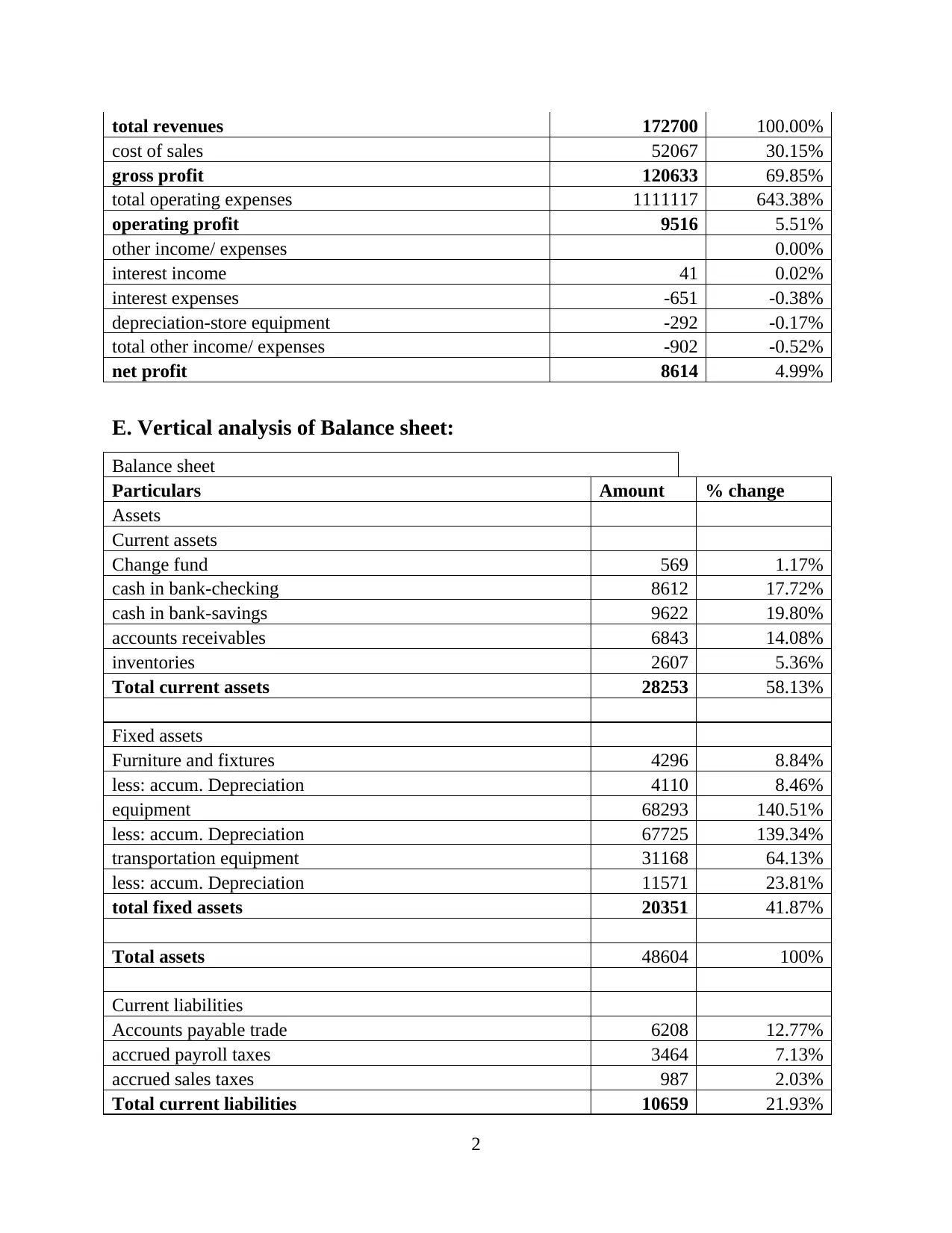

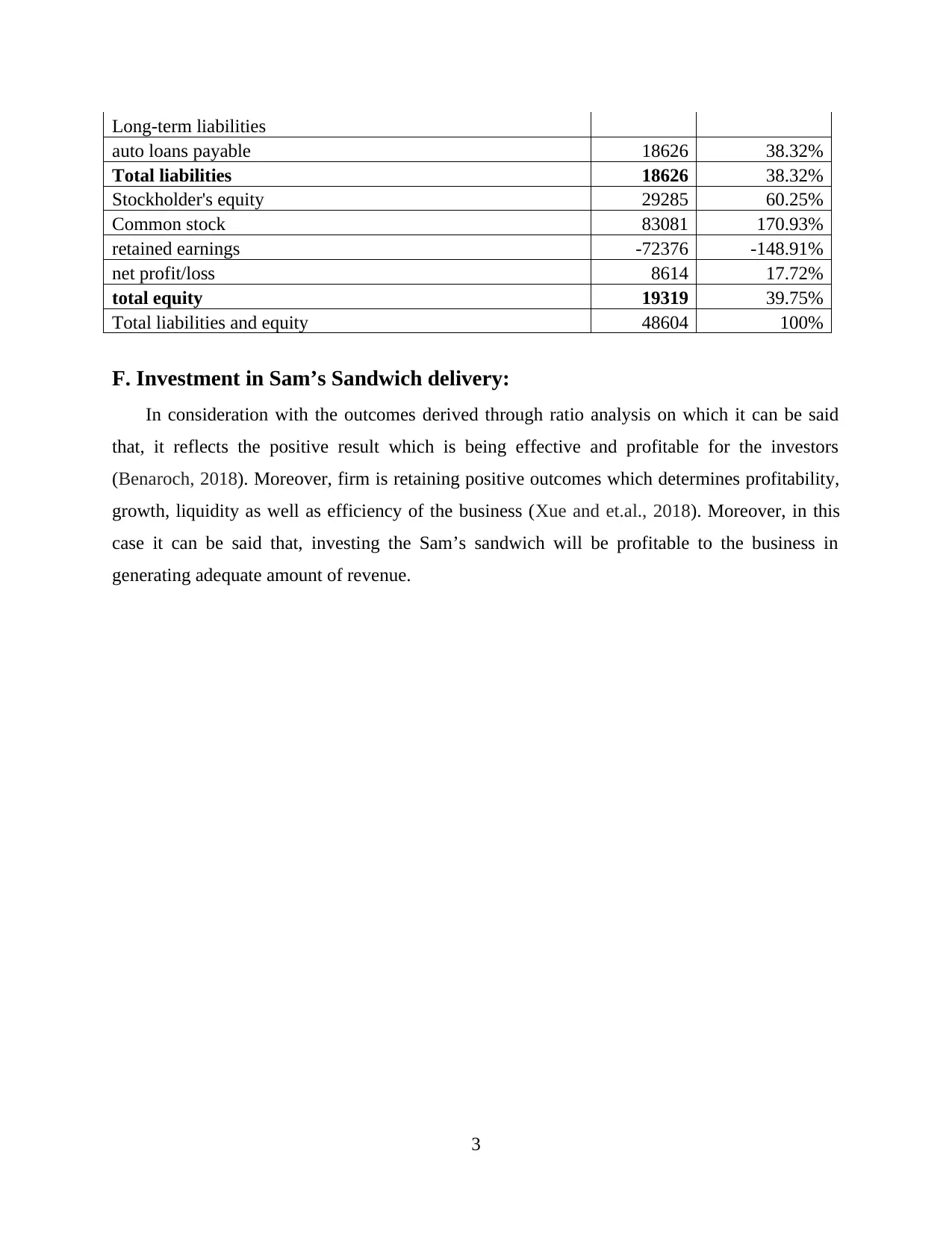

This report provides a comprehensive analysis of financial and business performance, focusing on various financial ratios and vertical analysis of income statements and balance sheets. The report calculates and interprets key ratios such as current ratio, quick ratio, accounts receivable turnover, fixed asset turnover, inventory turnover ratio, debt to equity ratio, debt to total asset ratio, and operating profit margin ratio. It also includes a vertical analysis of the income statement and balance sheet, providing insights into the percentage changes of different financial statement items. Furthermore, the report assesses the financial implications of an investment in Sam’s Sandwich delivery, concluding that the investment is likely to be profitable based on the positive outcomes derived through ratio analysis. The analysis is supported by references to relevant academic sources.

1 out of 6