Financial Performance Analysis, Cost Management, and Dividend Policy

VerifiedAdded on 2022/12/30

|11

|2785

|96

Report

AI Summary

This report provides a comprehensive analysis of financial performance, encompassing ratio calculations for Apple and Pear, and strategic advice for financial decision-making. It delves into liquidity, inventory turnover, and price-earnings ratios to compare the financial health of the two companies, with recommendations for investment. The report also addresses cost management strategies, including Economic Order Quantity (EOQ) calculations and methods to minimize costs. Furthermore, it explores customer policies to encourage cash sales and examines the cost of capital, including weighted average cost of capital (WACC). Finally, it offers guidance on dividend policies to attract investors, considering different investor demographics and the advantages of imputation systems.

Provide financial and

business performance

information

business performance

information

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION.........................................................................................................................4

TASK 1..........................................................................................................................................4

Calculation of performance indicator of apple & pear..............................................................4

Analysis financial performance for decision making purpose...................................................5

TASK 2..........................................................................................................................................6

Explanation of main reason for decrement in inventory turnover rate and use of management

policies to overcome this problem.............................................................................................6

Brief description regarding signs which show that business experience liquidity problem......7

TASK 3..........................................................................................................................................8

Given advice to Arctic, ways through which they can minimise their cost...............................8

TASK 4..........................................................................................................................................9

Customer policy use for encourage cash sales...........................................................................9

TASK 5..........................................................................................................................................9

Brief description regarding cost of capital.................................................................................9

Calculation of weighted average cost of capital......................................................................10

TASK 6........................................................................................................................................10

Advice regarding with opting dividend policy to attract customer..........................................10

Advantages of imputation system for residents individuals....................................................10

CONCLUSION............................................................................................................................11

REFERENCES............................................................................................................................12

INTRODUCTION.........................................................................................................................4

TASK 1..........................................................................................................................................4

Calculation of performance indicator of apple & pear..............................................................4

Analysis financial performance for decision making purpose...................................................5

TASK 2..........................................................................................................................................6

Explanation of main reason for decrement in inventory turnover rate and use of management

policies to overcome this problem.............................................................................................6

Brief description regarding signs which show that business experience liquidity problem......7

TASK 3..........................................................................................................................................8

Given advice to Arctic, ways through which they can minimise their cost...............................8

TASK 4..........................................................................................................................................9

Customer policy use for encourage cash sales...........................................................................9

TASK 5..........................................................................................................................................9

Brief description regarding cost of capital.................................................................................9

Calculation of weighted average cost of capital......................................................................10

TASK 6........................................................................................................................................10

Advice regarding with opting dividend policy to attract customer..........................................10

Advantages of imputation system for residents individuals....................................................10

CONCLUSION............................................................................................................................11

REFERENCES............................................................................................................................12

INTRODUCTION

Finance is essential part of any organization. It is necessary for personal to manage their

financial resource in effective way. This report has been formulated to define the relevance of

tools of financial management for managing and controlling as well as recording and measuring

business performance in systematic way.

TASK 1

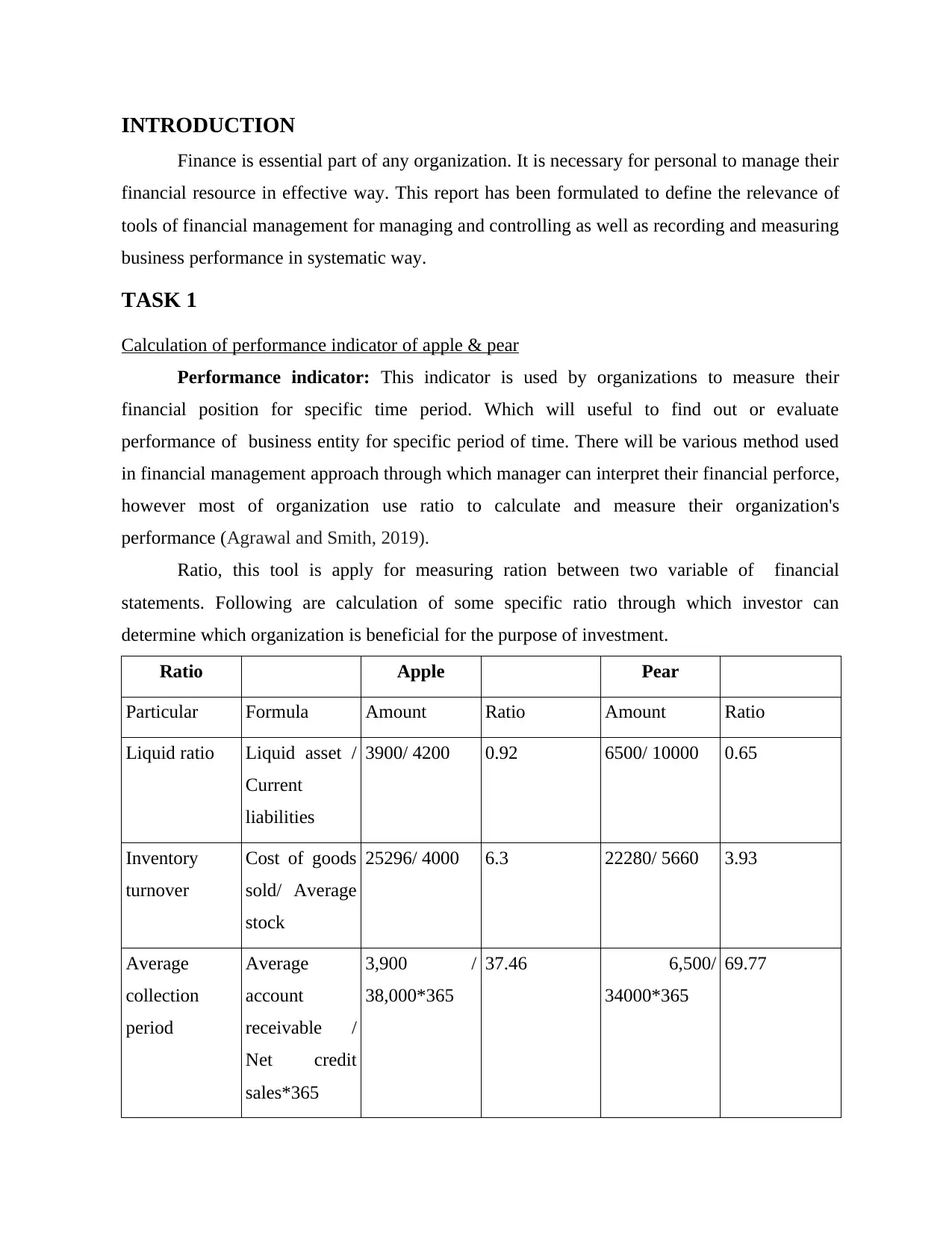

Calculation of performance indicator of apple & pear

Performance indicator: This indicator is used by organizations to measure their

financial position for specific time period. Which will useful to find out or evaluate

performance of business entity for specific period of time. There will be various method used

in financial management approach through which manager can interpret their financial perforce,

however most of organization use ratio to calculate and measure their organization's

performance (Agrawal and Smith, 2019).

Ratio, this tool is apply for measuring ration between two variable of financial

statements. Following are calculation of some specific ratio through which investor can

determine which organization is beneficial for the purpose of investment.

Ratio Apple Pear

Particular Formula Amount Ratio Amount Ratio

Liquid ratio Liquid asset /

Current

liabilities

3900/ 4200 0.92 6500/ 10000 0.65

Inventory

turnover

Cost of goods

sold/ Average

stock

25296/ 4000 6.3 22280/ 5660 3.93

Average

collection

period

Average

account

receivable /

Net credit

sales*365

3,900 /

38,000*365

37.46 6,500/

34000*365

69.77

Finance is essential part of any organization. It is necessary for personal to manage their

financial resource in effective way. This report has been formulated to define the relevance of

tools of financial management for managing and controlling as well as recording and measuring

business performance in systematic way.

TASK 1

Calculation of performance indicator of apple & pear

Performance indicator: This indicator is used by organizations to measure their

financial position for specific time period. Which will useful to find out or evaluate

performance of business entity for specific period of time. There will be various method used

in financial management approach through which manager can interpret their financial perforce,

however most of organization use ratio to calculate and measure their organization's

performance (Agrawal and Smith, 2019).

Ratio, this tool is apply for measuring ration between two variable of financial

statements. Following are calculation of some specific ratio through which investor can

determine which organization is beneficial for the purpose of investment.

Ratio Apple Pear

Particular Formula Amount Ratio Amount Ratio

Liquid ratio Liquid asset /

Current

liabilities

3900/ 4200 0.92 6500/ 10000 0.65

Inventory

turnover

Cost of goods

sold/ Average

stock

25296/ 4000 6.3 22280/ 5660 3.93

Average

collection

period

Average

account

receivable /

Net credit

sales*365

3,900 /

38,000*365

37.46 6,500/

34000*365

69.77

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Ratio Apple Pear

Debt to equity

ratio

Total

liabilities/

Total

shareholders

equity fund

7200.../

16000..

0.45 16000.../ 6000 2.66

Return on

shareholders’

funds

Net profit/

Shareholder's

equity

3377.../ 6000.. 0.56 2408 / 2800 0.86

Interest

coverage

EBIT /

Interest

4824..../ 80... 60.3 3,440..../ 680. 5.05

Earnings per

share

Net profit/

Shareholder's

equity

3377.../ 6000.. 0.56 2408 / 2800 0.89

Price/earnings

ratio

Market value

per share/

Earning per

share

$2.80/0.56 5 1.95 / 0.86 2.26

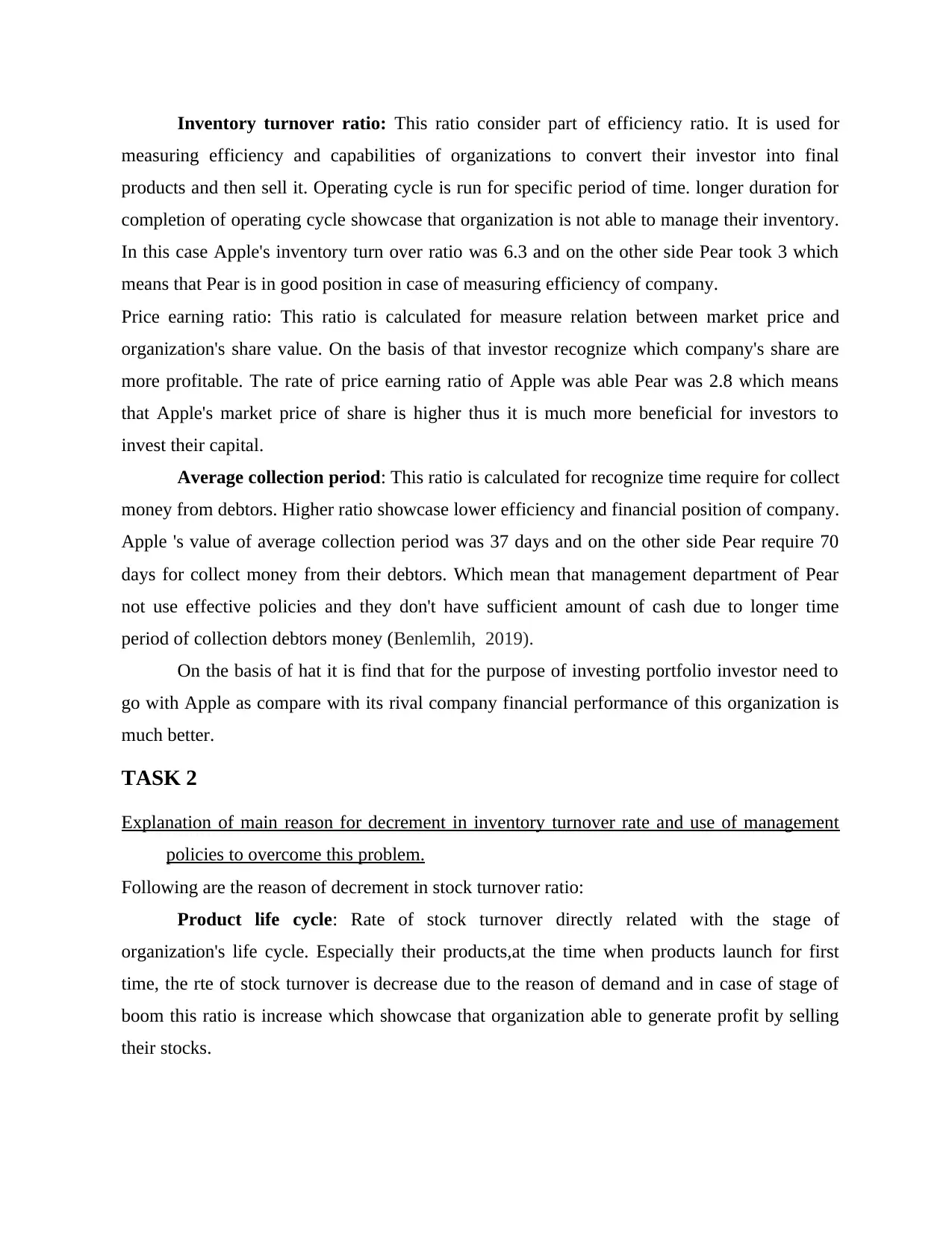

Analysis financial performance for decision making purpose

From the calculation of liquidity, profitably ratio it has been identified that Apple is

comparatively in better position for the purpose of investment. Following are the main reason ,

which describe the main cause of selection of Apple

Liquidity ratio: This ratio is use for calculate the liquidity position of organization.

This ratio help in identifying availability of liquid assets through which organization can fulfil

their current liabilities. In case of Apple liquid ratio is measure at 0.92 and on the other side

Pear's liquid ratio is measure at 0.62 which means that management department of Apple use

their assets in effective manner thus they have sufficient liquid asset for fulfil their day to day

business liabilities (Amalia, Fadjriah and Nugraha, 2020).

Debt to equity

ratio

Total

liabilities/

Total

shareholders

equity fund

7200.../

16000..

0.45 16000.../ 6000 2.66

Return on

shareholders’

funds

Net profit/

Shareholder's

equity

3377.../ 6000.. 0.56 2408 / 2800 0.86

Interest

coverage

EBIT /

Interest

4824..../ 80... 60.3 3,440..../ 680. 5.05

Earnings per

share

Net profit/

Shareholder's

equity

3377.../ 6000.. 0.56 2408 / 2800 0.89

Price/earnings

ratio

Market value

per share/

Earning per

share

$2.80/0.56 5 1.95 / 0.86 2.26

Analysis financial performance for decision making purpose

From the calculation of liquidity, profitably ratio it has been identified that Apple is

comparatively in better position for the purpose of investment. Following are the main reason ,

which describe the main cause of selection of Apple

Liquidity ratio: This ratio is use for calculate the liquidity position of organization.

This ratio help in identifying availability of liquid assets through which organization can fulfil

their current liabilities. In case of Apple liquid ratio is measure at 0.92 and on the other side

Pear's liquid ratio is measure at 0.62 which means that management department of Apple use

their assets in effective manner thus they have sufficient liquid asset for fulfil their day to day

business liabilities (Amalia, Fadjriah and Nugraha, 2020).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Inventory turnover ratio: This ratio consider part of efficiency ratio. It is used for

measuring efficiency and capabilities of organizations to convert their investor into final

products and then sell it. Operating cycle is run for specific period of time. longer duration for

completion of operating cycle showcase that organization is not able to manage their inventory.

In this case Apple's inventory turn over ratio was 6.3 and on the other side Pear took 3 which

means that Pear is in good position in case of measuring efficiency of company.

Price earning ratio: This ratio is calculated for measure relation between market price and

organization's share value. On the basis of that investor recognize which company's share are

more profitable. The rate of price earning ratio of Apple was able Pear was 2.8 which means

that Apple's market price of share is higher thus it is much more beneficial for investors to

invest their capital.

Average collection period: This ratio is calculated for recognize time require for collect

money from debtors. Higher ratio showcase lower efficiency and financial position of company.

Apple 's value of average collection period was 37 days and on the other side Pear require 70

days for collect money from their debtors. Which mean that management department of Pear

not use effective policies and they don't have sufficient amount of cash due to longer time

period of collection debtors money (Benlemlih, 2019).

On the basis of hat it is find that for the purpose of investing portfolio investor need to

go with Apple as compare with its rival company financial performance of this organization is

much better.

TASK 2

Explanation of main reason for decrement in inventory turnover rate and use of management

policies to overcome this problem.

Following are the reason of decrement in stock turnover ratio:

Product life cycle: Rate of stock turnover directly related with the stage of

organization's life cycle. Especially their products,at the time when products launch for first

time, the rte of stock turnover is decrease due to the reason of demand and in case of stage of

boom this ratio is increase which showcase that organization able to generate profit by selling

their stocks.

measuring efficiency and capabilities of organizations to convert their investor into final

products and then sell it. Operating cycle is run for specific period of time. longer duration for

completion of operating cycle showcase that organization is not able to manage their inventory.

In this case Apple's inventory turn over ratio was 6.3 and on the other side Pear took 3 which

means that Pear is in good position in case of measuring efficiency of company.

Price earning ratio: This ratio is calculated for measure relation between market price and

organization's share value. On the basis of that investor recognize which company's share are

more profitable. The rate of price earning ratio of Apple was able Pear was 2.8 which means

that Apple's market price of share is higher thus it is much more beneficial for investors to

invest their capital.

Average collection period: This ratio is calculated for recognize time require for collect

money from debtors. Higher ratio showcase lower efficiency and financial position of company.

Apple 's value of average collection period was 37 days and on the other side Pear require 70

days for collect money from their debtors. Which mean that management department of Pear

not use effective policies and they don't have sufficient amount of cash due to longer time

period of collection debtors money (Benlemlih, 2019).

On the basis of hat it is find that for the purpose of investing portfolio investor need to

go with Apple as compare with its rival company financial performance of this organization is

much better.

TASK 2

Explanation of main reason for decrement in inventory turnover rate and use of management

policies to overcome this problem.

Following are the reason of decrement in stock turnover ratio:

Product life cycle: Rate of stock turnover directly related with the stage of

organization's life cycle. Especially their products,at the time when products launch for first

time, the rte of stock turnover is decrease due to the reason of demand and in case of stage of

boom this ratio is increase which showcase that organization able to generate profit by selling

their stocks.

Buying in bulk: This is also consider as main reason of declining in the rate of stock

turnover , in case of bulk of products demand of theses tools is comparatively low thus cost of

storing these products and maintain is getting high which will adversely impact on the stock

turnover rate.

High cost of products: Most of organizations; inventory cost is high due to the time

and cot required for maintain of inventory , thus organization face issue related with decrement

in tock turn over rate.

Mismanagement of inventory: This is consider as main reason that business entities

face reduction in stock turnover ratio. Due to not applying effective tool of managing stock,

they face problem related with high cost, issue of Wastage of stock thus they face turnover

related problems.

Manager to overcome issue related with stock turnover can apply following strategies:

They need to use ABC , VED, EOQ and other technique of managing stock which help in

recording and manage as well as control the cost of maintaining stock which help in generate

profits by stock.

By using proper forecastle tool and use of LIFO, FIFO method manager can find

requirement of sector and demand of their product, it will useful for measuring maximum,

minimum level of demanding stock which useful for control wastage of products.

By applying effective pricing strategy manage able to increase their inventory turnover ratio.

By motivating and encouraging customers for pre-order to organizations products they able to

overcome their stock related problems (Feranecová, and Krigovská, 2016).

Brief description regarding signs which show that business experience liquidity problem.

Following are the signs through which manager can recognize that their organization

financial problems. Even theses sign are helpful for investor to find out which organizations is

in better liquid position.

Decrease of profits: When financial performance of an organization has been decline

over past few years and thy are not able to generate profits due to reduction in sales rate then it

is symbol which showcase that organization's liquidity position in getting down.

Problem in fulfil debt liability: Manager by measuring organization's capital to paying

their debt liability can recognize that their entity is face liquid position. Organization generally

turnover , in case of bulk of products demand of theses tools is comparatively low thus cost of

storing these products and maintain is getting high which will adversely impact on the stock

turnover rate.

High cost of products: Most of organizations; inventory cost is high due to the time

and cot required for maintain of inventory , thus organization face issue related with decrement

in tock turn over rate.

Mismanagement of inventory: This is consider as main reason that business entities

face reduction in stock turnover ratio. Due to not applying effective tool of managing stock,

they face problem related with high cost, issue of Wastage of stock thus they face turnover

related problems.

Manager to overcome issue related with stock turnover can apply following strategies:

They need to use ABC , VED, EOQ and other technique of managing stock which help in

recording and manage as well as control the cost of maintaining stock which help in generate

profits by stock.

By using proper forecastle tool and use of LIFO, FIFO method manager can find

requirement of sector and demand of their product, it will useful for measuring maximum,

minimum level of demanding stock which useful for control wastage of products.

By applying effective pricing strategy manage able to increase their inventory turnover ratio.

By motivating and encouraging customers for pre-order to organizations products they able to

overcome their stock related problems (Feranecová, and Krigovská, 2016).

Brief description regarding signs which show that business experience liquidity problem.

Following are the signs through which manager can recognize that their organization

financial problems. Even theses sign are helpful for investor to find out which organizations is

in better liquid position.

Decrease of profits: When financial performance of an organization has been decline

over past few years and thy are not able to generate profits due to reduction in sales rate then it

is symbol which showcase that organization's liquidity position in getting down.

Problem in fulfil debt liability: Manager by measuring organization's capital to paying

their debt liability can recognize that their entity is face liquid position. Organization generally

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

not able to pay their current debt liabilities at the time when they face financial problem. Thus it

is the symbol which directly sign that business suffers from lack of liquid assets problem.

No access of cash items: When the rate of cash inflow activities has been decline and

organizations not able to generate cash then it is also symbol which directly showcase that

organization is face liquid problem as the rate of access of cash outflow activity is higher then

cash inflow activity.

TASK 3

Given advice to Arctic, ways through which they can minimise their cost.

Calculation of EOQ

√2SD/ H =

S = Annual demand = 32000

D = Cost per order = 200

H = Annual holding cost per unit = 0.20 = √2*32000*200/0.20 = 8000

Calculation of minimum number of bags =

Average weekly sales = 32000/50 = 640

Re order period = order time + stock of safety = 6 week

Minimum number of begs = 2560+1280 = 3840

Calculation of saving money by ordering EOQ.

Computation of EOQ when 16000 order sold = √2*16000*200/0.20 = 5657

Cost of purchase = 200*16000 = 3200000

Ordering cost = 16000/50 = 320

200*32000

holding cost = 0.20*5657/2 = 566

3200000+566+640 = 3201206

Purchase cost = 200*32000 = 6400000

Computation of EOQ when 32000 order sold

Computation of annual ordering cost = Order per year/ ordering cost = 32000/50 = 640

Computation of annual carrying cost = Carrying cost * EOQ/ 2 = 0.20*800/2 = 320

is the symbol which directly sign that business suffers from lack of liquid assets problem.

No access of cash items: When the rate of cash inflow activities has been decline and

organizations not able to generate cash then it is also symbol which directly showcase that

organization is face liquid problem as the rate of access of cash outflow activity is higher then

cash inflow activity.

TASK 3

Given advice to Arctic, ways through which they can minimise their cost.

Calculation of EOQ

√2SD/ H =

S = Annual demand = 32000

D = Cost per order = 200

H = Annual holding cost per unit = 0.20 = √2*32000*200/0.20 = 8000

Calculation of minimum number of bags =

Average weekly sales = 32000/50 = 640

Re order period = order time + stock of safety = 6 week

Minimum number of begs = 2560+1280 = 3840

Calculation of saving money by ordering EOQ.

Computation of EOQ when 16000 order sold = √2*16000*200/0.20 = 5657

Cost of purchase = 200*16000 = 3200000

Ordering cost = 16000/50 = 320

200*32000

holding cost = 0.20*5657/2 = 566

3200000+566+640 = 3201206

Purchase cost = 200*32000 = 6400000

Computation of EOQ when 32000 order sold

Computation of annual ordering cost = Order per year/ ordering cost = 32000/50 = 640

Computation of annual carrying cost = Carrying cost * EOQ/ 2 = 0.20*800/2 = 320

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Computation of inventory cost = Ordering cost + Carrying cost + Purchase cost

=6400000+640+320 = 6400960 =3199754 can save by ordering at EOQ level.

Advantages of maintaining adequate inventory level.

Organizations able to increase their level of production by maximizing their efficiency

level (García-Sánchez, and Noguera-Gámez, 2017). Stock management useful for control cost

required for maintaining and managing orders which useful for generate more cash inflow

activities.

Maintenance of stock level help in create more organized warehouse which useful for

record each and every transaction related with stock level. Thus beneficial for saving time of

managers.

Maintenance of adequate level of stock help in control wastage of extra items of

products. They maintain accurate level which help in retain potential customer as goods deliver

at given time period.

TASK 4

Customer policy use for encourage cash sales.

Jasmine Ltd in order to encourage their debtors for cash sales need to apply 30 % cash

sales pay in one month policy. It is beneficial for them and organization will able to generate

more cash inflow activities by increasing their cash use over credit sales (Koo,

Ramalingegowda and Yu, 2017).

This is much better alternative among others as by applying this method manager of

Jasmine Ltd able to control their cost require for managing debtor account and time or cost

required for collection of credit money. When cash sales has been increase then the rate of cash

inflow activities has been increases. Which beneficial for growth of organization as well as it

reduce risk of default debtors. For encouraging cash sale manager need to use effective

promotion tool and change pricing strategy which help to influence customer for cash purchase.

=6400000+640+320 = 6400960 =3199754 can save by ordering at EOQ level.

Advantages of maintaining adequate inventory level.

Organizations able to increase their level of production by maximizing their efficiency

level (García-Sánchez, and Noguera-Gámez, 2017). Stock management useful for control cost

required for maintaining and managing orders which useful for generate more cash inflow

activities.

Maintenance of stock level help in create more organized warehouse which useful for

record each and every transaction related with stock level. Thus beneficial for saving time of

managers.

Maintenance of adequate level of stock help in control wastage of extra items of

products. They maintain accurate level which help in retain potential customer as goods deliver

at given time period.

TASK 4

Customer policy use for encourage cash sales.

Jasmine Ltd in order to encourage their debtors for cash sales need to apply 30 % cash

sales pay in one month policy. It is beneficial for them and organization will able to generate

more cash inflow activities by increasing their cash use over credit sales (Koo,

Ramalingegowda and Yu, 2017).

This is much better alternative among others as by applying this method manager of

Jasmine Ltd able to control their cost require for managing debtor account and time or cost

required for collection of credit money. When cash sales has been increase then the rate of cash

inflow activities has been increases. Which beneficial for growth of organization as well as it

reduce risk of default debtors. For encouraging cash sale manager need to use effective

promotion tool and change pricing strategy which help to influence customer for cash purchase.

TASK 5

Brief description regarding cost of capital.

Cost of equity

Dividend per share/ Market value / price per share+ growth rate = 3000000*8.4/100/8900000+5

% = 5.22 (1-.30) = 38.86

Cost of preference share

Annual reference share dividend/ Net proceed = 960/8000*70 = 8.4

Cost of debenture = Total interest incurred/ Total debt/ 0.70 = 100000/ 1000000 = 7

Cost of retain earnings = Dividend/ Retain earnings * (1- Tax rate) = 5.88

Calculation of weighted average cost of capital.

{WD ( Kd( 1-t) + We ( Ke) + Ep( Kp(1-t)+ Wr( Kr( 1-t) }

Weighted of financing debt = WD

Weighted of financing equity = 1*38.86+2*8.4+3*7+4*5.88 = 96

TASK 6

Advice regarding with opting dividend policy to attract customer.

Dividend policy is a document which define the way through which organization

distracted their dividend and rate at which dividend paid as well duration when organization

distribute dividend.

To attract young 25 years old investor organization ned to use progressive dividend

policy, as being youth expectation of investor is high and they select organization which

provides them high rate of dividend and work for speed growth rate (Nugroho, Nurdiansyah,

and Erviana, 2017).

For attract their senior citizen investor thy need to apply stable dividend policy as

investor are not interest in generate profit moreover they just want stable source of income with

low rate of risk thus organization need to use stable dividend policy in which they provides

dividend at fixed rate.

Brief description regarding cost of capital.

Cost of equity

Dividend per share/ Market value / price per share+ growth rate = 3000000*8.4/100/8900000+5

% = 5.22 (1-.30) = 38.86

Cost of preference share

Annual reference share dividend/ Net proceed = 960/8000*70 = 8.4

Cost of debenture = Total interest incurred/ Total debt/ 0.70 = 100000/ 1000000 = 7

Cost of retain earnings = Dividend/ Retain earnings * (1- Tax rate) = 5.88

Calculation of weighted average cost of capital.

{WD ( Kd( 1-t) + We ( Ke) + Ep( Kp(1-t)+ Wr( Kr( 1-t) }

Weighted of financing debt = WD

Weighted of financing equity = 1*38.86+2*8.4+3*7+4*5.88 = 96

TASK 6

Advice regarding with opting dividend policy to attract customer.

Dividend policy is a document which define the way through which organization

distracted their dividend and rate at which dividend paid as well duration when organization

distribute dividend.

To attract young 25 years old investor organization ned to use progressive dividend

policy, as being youth expectation of investor is high and they select organization which

provides them high rate of dividend and work for speed growth rate (Nugroho, Nurdiansyah,

and Erviana, 2017).

For attract their senior citizen investor thy need to apply stable dividend policy as

investor are not interest in generate profit moreover they just want stable source of income with

low rate of risk thus organization need to use stable dividend policy in which they provides

dividend at fixed rate.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Advantages of imputation system for residents individuals.

Dividend imputation system has been introduced for reduce the drawbacks of tax system

for individual as well as business organizations.

It is beneficial for resident as will the implementation of this system, issue arises due to

double taxation system has been solve (Shen, Chan,Chow and Thoney-Barletta, 2016).

Process of calculating and paying tax liability is become more flexible which is

beneficial for saving time as well as cost.

In this system franking credit facility which help in set of credit by personal liabilities of

individual.

They can set of their tax liability in upcoming year and burden of tax is comparative

reduce.

Tax credit is given to individuals which is further beneficial to encourage them for pay tax

liability.

CONCLUSION

From the above analysis it has been concluded that manager by using financial ratio can

determine potion of their organization in market. They use effective inventory management

policy to control cost of wastage. By calculating cost of capital thy can find out worth of their

organization and to attract customers manager need to apply dividend policy according to the

expectations of their investor.

Dividend imputation system has been introduced for reduce the drawbacks of tax system

for individual as well as business organizations.

It is beneficial for resident as will the implementation of this system, issue arises due to

double taxation system has been solve (Shen, Chan,Chow and Thoney-Barletta, 2016).

Process of calculating and paying tax liability is become more flexible which is

beneficial for saving time as well as cost.

In this system franking credit facility which help in set of credit by personal liabilities of

individual.

They can set of their tax liability in upcoming year and burden of tax is comparative

reduce.

Tax credit is given to individuals which is further beneficial to encourage them for pay tax

liability.

CONCLUSION

From the above analysis it has been concluded that manager by using financial ratio can

determine potion of their organization in market. They use effective inventory management

policy to control cost of wastage. By calculating cost of capital thy can find out worth of their

organization and to attract customers manager need to apply dividend policy according to the

expectations of their investor.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Agrawal, N. and Smith, S. A., 2019. Optimal inventory management using retail

prepacks. European Journal of Operational Research. 274(2). pp.531-544.

Amalia, S., Fadjriah, N. E. and Nugraha, N. M., 2020. The Influence of the Financial Ratio to

the Prevention of Bankruptcy in Cigarette Manufacturing Companies Sub Sector. Solid

State Technology. 63(3). pp.4173-4182.

Benlemlih, M., 2019. Corporate social responsibility and dividend policy. Research in

International Business and Finance. 47. pp.114-138.

Feranecová, A. and Krigovská, A., 2016. Measuring the performance of universities through

cluster analysis and the use of financial ratio indexes. Economics & Sociology, 9(4),

p.259.

García-Sánchez, I. M. and Noguera-Gámez, L., 2017. Integrated information and the cost of

capital. International Business Review. 26(5).pp.959-975.

Koo, D. S., Ramalingegowda, S. and Yu, Y., 2017. The effect of financial reporting quality on

corporate dividend policy. Review of Accounting Studies.22(2). pp.753-790.

Nugroho, E. S., Nurdiansyah, D. H. and Erviana, N., 2017. Financial Ratio to Predicting the

Growth Income (Case Study: Pharmaceutical Manufacturing Company Listed on

Indonesia Stock Exchange Period 2012 to 2016). International Review of Management

and Marketing. 7(5). pp.77-84.

Shen, B., Chan, H. L., Chow, P. S. and Thoney-Barletta, K. A., 2016. Inventory management

research for the fashion industry. International Journal of Inventory Research. 3(4).

pp.297-317.

Agrawal, N. and Smith, S. A., 2019. Optimal inventory management using retail

prepacks. European Journal of Operational Research. 274(2). pp.531-544.

Amalia, S., Fadjriah, N. E. and Nugraha, N. M., 2020. The Influence of the Financial Ratio to

the Prevention of Bankruptcy in Cigarette Manufacturing Companies Sub Sector. Solid

State Technology. 63(3). pp.4173-4182.

Benlemlih, M., 2019. Corporate social responsibility and dividend policy. Research in

International Business and Finance. 47. pp.114-138.

Feranecová, A. and Krigovská, A., 2016. Measuring the performance of universities through

cluster analysis and the use of financial ratio indexes. Economics & Sociology, 9(4),

p.259.

García-Sánchez, I. M. and Noguera-Gámez, L., 2017. Integrated information and the cost of

capital. International Business Review. 26(5).pp.959-975.

Koo, D. S., Ramalingegowda, S. and Yu, Y., 2017. The effect of financial reporting quality on

corporate dividend policy. Review of Accounting Studies.22(2). pp.753-790.

Nugroho, E. S., Nurdiansyah, D. H. and Erviana, N., 2017. Financial Ratio to Predicting the

Growth Income (Case Study: Pharmaceutical Manufacturing Company Listed on

Indonesia Stock Exchange Period 2012 to 2016). International Review of Management

and Marketing. 7(5). pp.77-84.

Shen, B., Chan, H. L., Chow, P. S. and Thoney-Barletta, K. A., 2016. Inventory management

research for the fashion industry. International Journal of Inventory Research. 3(4).

pp.297-317.

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.