National Business Institute: FNSASICW503 Securities Assignment

VerifiedAdded on 2023/05/27

|19

|6072

|493

Homework Assignment

AI Summary

This assignment, designed for the FNSASICW503 course at the National Business Institute of Australia, covers a wide range of topics related to securities and the stock market. It begins with an overview of the two main types of securities – debt and equities – and delves into the specifics of debt securities, including who issues them. The assignment then explores practical calculations, such as capital gains, bonus issues, and margin lending, providing step-by-step solutions to real-world scenarios. It also examines exchange-traded options, including their elements, intrinsic and time values, and how they are used in trading strategies. Further, it addresses the SPI 200 contract, hedging strategies, and the difference between intrinsic and time value. Finally, the assignment analyzes various aspects of trading, including the ASX, risk management, and investment versus speculation, providing a comprehensive understanding of the securities market and its intricacies.

Assignment – FNSASICW503

Question 1:

There are a wide variety of securities traded on the stock market. List the two (2) main types.

Answer

The two main types of securities traded on the stock market are Debt and Equities.

Question 2:

Name the two (2) main types of debt securities traded on the stock market. Who issues them?

Answer

The two main types of debt securities traded on the stock market are:

Short-term debt securities issued by the money market, and

Long-term debt securities issued by the capital or fixed-interest market.

Question 3:

2,000 shares in XYZ were bought at $14.00 per share in September 1993 and sold in May

2000 at $17.00. The dividend received was $0.25 fully franked (sold before final dividend).

CPI Sept '93 109.8 Sept '99 123.4

(a) Calculate the income tax on the dividend.

(b) Calculate the capital gain under both allowable methods.

(c) Choose what amount you would include in assessable income.

Answer

Dividends are paid by the company from the net profit that is available for equity

shareholders. This net income is after adjusting for the income taxes to be paid. The

dividends which are paid from the profit after tax of the company are called franked

dividends and the receiver of the dividend receives a rebate on the tax to be paid by him.

Thus, this eliminates double taxation on the dividend.

Question 1:

There are a wide variety of securities traded on the stock market. List the two (2) main types.

Answer

The two main types of securities traded on the stock market are Debt and Equities.

Question 2:

Name the two (2) main types of debt securities traded on the stock market. Who issues them?

Answer

The two main types of debt securities traded on the stock market are:

Short-term debt securities issued by the money market, and

Long-term debt securities issued by the capital or fixed-interest market.

Question 3:

2,000 shares in XYZ were bought at $14.00 per share in September 1993 and sold in May

2000 at $17.00. The dividend received was $0.25 fully franked (sold before final dividend).

CPI Sept '93 109.8 Sept '99 123.4

(a) Calculate the income tax on the dividend.

(b) Calculate the capital gain under both allowable methods.

(c) Choose what amount you would include in assessable income.

Answer

Dividends are paid by the company from the net profit that is available for equity

shareholders. This net income is after adjusting for the income taxes to be paid. The

dividends which are paid from the profit after tax of the company are called franked

dividends and the receiver of the dividend receives a rebate on the tax to be paid by him.

Thus, this eliminates double taxation on the dividend.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

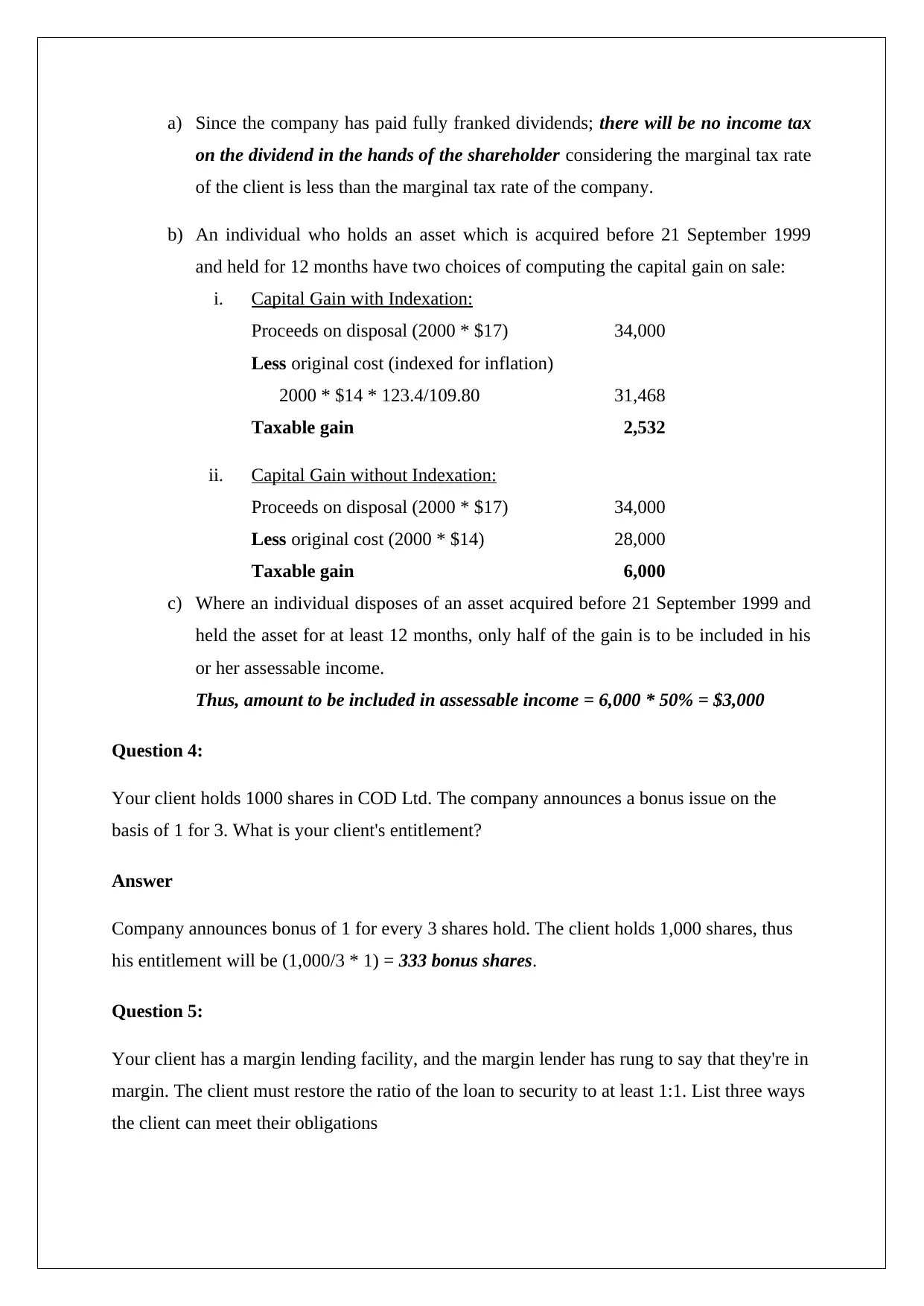

a) Since the company has paid fully franked dividends; there will be no income tax

on the dividend in the hands of the shareholder considering the marginal tax rate

of the client is less than the marginal tax rate of the company.

b) An individual who holds an asset which is acquired before 21 September 1999

and held for 12 months have two choices of computing the capital gain on sale:

i. Capital Gain with Indexation:

Proceeds on disposal (2000 * $17) 34,000

Less original cost (indexed for inflation)

2000 * $14 * 123.4/109.80 31,468

Taxable gain 2,532

ii. Capital Gain without Indexation:

Proceeds on disposal (2000 * $17) 34,000

Less original cost (2000 * $14) 28,000

Taxable gain 6,000

c) Where an individual disposes of an asset acquired before 21 September 1999 and

held the asset for at least 12 months, only half of the gain is to be included in his

or her assessable income.

Thus, amount to be included in assessable income = 6,000 * 50% = $3,000

Question 4:

Your client holds 1000 shares in COD Ltd. The company announces a bonus issue on the

basis of 1 for 3. What is your client's entitlement?

Answer

Company announces bonus of 1 for every 3 shares hold. The client holds 1,000 shares, thus

his entitlement will be (1,000/3 * 1) = 333 bonus shares.

Question 5:

Your client has a margin lending facility, and the margin lender has rung to say that they're in

margin. The client must restore the ratio of the loan to security to at least 1:1. List three ways

the client can meet their obligations

on the dividend in the hands of the shareholder considering the marginal tax rate

of the client is less than the marginal tax rate of the company.

b) An individual who holds an asset which is acquired before 21 September 1999

and held for 12 months have two choices of computing the capital gain on sale:

i. Capital Gain with Indexation:

Proceeds on disposal (2000 * $17) 34,000

Less original cost (indexed for inflation)

2000 * $14 * 123.4/109.80 31,468

Taxable gain 2,532

ii. Capital Gain without Indexation:

Proceeds on disposal (2000 * $17) 34,000

Less original cost (2000 * $14) 28,000

Taxable gain 6,000

c) Where an individual disposes of an asset acquired before 21 September 1999 and

held the asset for at least 12 months, only half of the gain is to be included in his

or her assessable income.

Thus, amount to be included in assessable income = 6,000 * 50% = $3,000

Question 4:

Your client holds 1000 shares in COD Ltd. The company announces a bonus issue on the

basis of 1 for 3. What is your client's entitlement?

Answer

Company announces bonus of 1 for every 3 shares hold. The client holds 1,000 shares, thus

his entitlement will be (1,000/3 * 1) = 333 bonus shares.

Question 5:

Your client has a margin lending facility, and the margin lender has rung to say that they're in

margin. The client must restore the ratio of the loan to security to at least 1:1. List three ways

the client can meet their obligations

Answer

The three ways in which the client can meet their obligations are:

Deposit additional cash to reduce the loan value,

Deposit additional shares which increase the security value, or

Sell some of the existing shares to reduce the loan value.

Question 6:

Where would you find a current trading price for an exchange-traded option?

Answer

The current price of the exchange-traded option can be found under the Derivatives market

on the ASX.

Question 7:

List the five basic elements of an option

Answer

The five basic elements of an option are:

Type of option – Call or put

Contract Size

Expiry Date

Exercise price

The underlying shares

Question 8:

Your client has bought a NCP DEC 1100 Put option for 74 cents while NCP is trading at

$10.83. Calculate the intrinsic and time value of the option

Answer

Here in the above situation, my client has the right to exercise and sell the shares for $11.00,

which is 17 cents higher than the current share price. This 17 cents is the intrinsic value of

The three ways in which the client can meet their obligations are:

Deposit additional cash to reduce the loan value,

Deposit additional shares which increase the security value, or

Sell some of the existing shares to reduce the loan value.

Question 6:

Where would you find a current trading price for an exchange-traded option?

Answer

The current price of the exchange-traded option can be found under the Derivatives market

on the ASX.

Question 7:

List the five basic elements of an option

Answer

The five basic elements of an option are:

Type of option – Call or put

Contract Size

Expiry Date

Exercise price

The underlying shares

Question 8:

Your client has bought a NCP DEC 1100 Put option for 74 cents while NCP is trading at

$10.83. Calculate the intrinsic and time value of the option

Answer

Here in the above situation, my client has the right to exercise and sell the shares for $11.00,

which is 17 cents higher than the current share price. This 17 cents is the intrinsic value of

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

the share (Intrinsic value is the difference between the current share price $10.83 and the

right to sell at $11.00).

The time value of option = Option Premium – Intrinsic Value

The time value of option = 74 cents – 17 cents

The time value of option = 57 cents.

Thus, for the NCP DEC put option, Intrinsic Value = 17 cents and Time value of option =

57 cents.

Question 9:

You see a BHP DEC 900 call option trading for 72 cents. At the same time, you see a BHP

900 call warrant with the same expiry date as the option trading for 36 ……? Calculate

Answer

In this case, the conversion ratio can be calculated as 2: 1, indicating that the owner of the

warrant can purchase 2 options at the price of one warrant.

Question 10:

Your client has bought a DEC SPI 200 contract at 6867. What is the full face value of the

contract?

Answer

SPI 200 introduced in 2000 is based on the ASX 200 index which is a weighted index of 200

companies listed on the stock exchange. It is a sort of balanced portfolio of underlying 200

companies and the underlying value of the index is equal to twenty-five times the S&P 200

index or $A25.

Thus, the full face value of the contract of DEC SPI 200 bought at 6867 = 6867 * $A25 =

$A171,675.

Question 11:

Jim buys 5,000 Coles Myer Limited (CML) shares for $7.00 a share. He is expecting them to

pay an unfranked dividend of $0.15c per share in one month. He has heard that he can

increase his return by selling call options on the CML shares as well. He decides to sell five

right to sell at $11.00).

The time value of option = Option Premium – Intrinsic Value

The time value of option = 74 cents – 17 cents

The time value of option = 57 cents.

Thus, for the NCP DEC put option, Intrinsic Value = 17 cents and Time value of option =

57 cents.

Question 9:

You see a BHP DEC 900 call option trading for 72 cents. At the same time, you see a BHP

900 call warrant with the same expiry date as the option trading for 36 ……? Calculate

Answer

In this case, the conversion ratio can be calculated as 2: 1, indicating that the owner of the

warrant can purchase 2 options at the price of one warrant.

Question 10:

Your client has bought a DEC SPI 200 contract at 6867. What is the full face value of the

contract?

Answer

SPI 200 introduced in 2000 is based on the ASX 200 index which is a weighted index of 200

companies listed on the stock exchange. It is a sort of balanced portfolio of underlying 200

companies and the underlying value of the index is equal to twenty-five times the S&P 200

index or $A25.

Thus, the full face value of the contract of DEC SPI 200 bought at 6867 = 6867 * $A25 =

$A171,675.

Question 11:

Jim buys 5,000 Coles Myer Limited (CML) shares for $7.00 a share. He is expecting them to

pay an unfranked dividend of $0.15c per share in one month. He has heard that he can

increase his return by selling call options on the CML shares as well. He decides to sell five

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

(5) call options expiring in exactly three months. The options have a strike price of $7.25 and

sell for 16c. The delta of the option is 0.25

In answering the following questions, show all calculations and ignore fees and commissions.

a) How much is the premium Jim earns by selling the call options?

b) What is the break even for the combined purchase of CML shares and sale of CML

options?

c) What is the breakeven level of CML for the options only?

A few days after Jim's initial purchase of CML shares and sale of CML call options, the share

price falls to $6.76.

a) What should the options now be worth?

b) At what share price will Jim make the maximum profit on the whole strategy?

c) What is the maximum potential loss on the strategy?

If Jim had sold his shares for $7.05 after receiving the dividend, what would his potential loss

now be?

At expiry, the share price leapt to $8.00. What is the intrinsic value of the options now?

What are the two (2) choices available to Jim on expiry and what will result from each choice

Assume that Jim decides not to sell his call options. When the price of CML reached $8.00

per share, he sold the shares. What is the return on the total strategy in dollars?

Answer

a) Premium is the cost, or market value, of the option and consists of two parts namely

Intrinsic Value and Time Value of Option. Here the option has a strike price of $7.25

and is sold for 16 cents with a delta of 0.25.

The premium that Jim earns by selling the call = 5 * 1000 * 0.16 = $800.

b) Jim bought shares at $7 each and sold call option at a strike price of $7.25 for 16c.

The breakeven for the combined purchase of shares and sell of options is $7 + 16c =

$7.16. It is after $7.16 that Jim will start making profit.

c) The breakeven for the CML option only is $7.25 + 0.16 = $7.41

sell for 16c. The delta of the option is 0.25

In answering the following questions, show all calculations and ignore fees and commissions.

a) How much is the premium Jim earns by selling the call options?

b) What is the break even for the combined purchase of CML shares and sale of CML

options?

c) What is the breakeven level of CML for the options only?

A few days after Jim's initial purchase of CML shares and sale of CML call options, the share

price falls to $6.76.

a) What should the options now be worth?

b) At what share price will Jim make the maximum profit on the whole strategy?

c) What is the maximum potential loss on the strategy?

If Jim had sold his shares for $7.05 after receiving the dividend, what would his potential loss

now be?

At expiry, the share price leapt to $8.00. What is the intrinsic value of the options now?

What are the two (2) choices available to Jim on expiry and what will result from each choice

Assume that Jim decides not to sell his call options. When the price of CML reached $8.00

per share, he sold the shares. What is the return on the total strategy in dollars?

Answer

a) Premium is the cost, or market value, of the option and consists of two parts namely

Intrinsic Value and Time Value of Option. Here the option has a strike price of $7.25

and is sold for 16 cents with a delta of 0.25.

The premium that Jim earns by selling the call = 5 * 1000 * 0.16 = $800.

b) Jim bought shares at $7 each and sold call option at a strike price of $7.25 for 16c.

The breakeven for the combined purchase of shares and sell of options is $7 + 16c =

$7.16. It is after $7.16 that Jim will start making profit.

c) The breakeven for the CML option only is $7.25 + 0.16 = $7.41

Now when the share price falls to $6.76

a. In case the share price falls below the strike price, the option becomes worthless.

Thus, when the share price falls to $6.76, the options are worth nothing.

b. Jim would have made the maximum profit if the share price rose to $7.25 as the

option would have been exercised and gain on shares would be made.

c. The maximum potential loss on the strategy is losing his entire option investment

which is 16c * 5000 shares = $800.

After receipt of dividend which is 15 cents on 5000 shares = $750, the loss would now be

limited to $800 - $750 = $50.

At Expiry, Share price = $8.00

Intrinsic Value of the option is the premium paid which is 16 cents or .15 * 5000 = $750.

The two choices available to Jim at expiry are:

Exercise call options

Do not exercise

When price reaches $8.00, Jim sells the shares thereby generating return of ($8.00 - $7.00)

* 5000 share = $5,000.

Question 12:

Adams Apple owns a substantial share portfolio consisting of blue chip stocks. He is

concerned about the world economy and the possibility of another share market crash. He

discusses his concerns with you, his stockbroker. You suggest he use the exchange-traded

options market in order to hedge his portfolio completely. Discuss the strategy you would

advise.

Answer

Exchange-traded funds are securities that consist of a stock index and all the assets therein

rather than one single asset and tend to outperform them through continuous trading at the

stock index.

a. In case the share price falls below the strike price, the option becomes worthless.

Thus, when the share price falls to $6.76, the options are worth nothing.

b. Jim would have made the maximum profit if the share price rose to $7.25 as the

option would have been exercised and gain on shares would be made.

c. The maximum potential loss on the strategy is losing his entire option investment

which is 16c * 5000 shares = $800.

After receipt of dividend which is 15 cents on 5000 shares = $750, the loss would now be

limited to $800 - $750 = $50.

At Expiry, Share price = $8.00

Intrinsic Value of the option is the premium paid which is 16 cents or .15 * 5000 = $750.

The two choices available to Jim at expiry are:

Exercise call options

Do not exercise

When price reaches $8.00, Jim sells the shares thereby generating return of ($8.00 - $7.00)

* 5000 share = $5,000.

Question 12:

Adams Apple owns a substantial share portfolio consisting of blue chip stocks. He is

concerned about the world economy and the possibility of another share market crash. He

discusses his concerns with you, his stockbroker. You suggest he use the exchange-traded

options market in order to hedge his portfolio completely. Discuss the strategy you would

advise.

Answer

Exchange-traded funds are securities that consist of a stock index and all the assets therein

rather than one single asset and tend to outperform them through continuous trading at the

stock index.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Whereas Hedging is a risk management tool which is used by the investors to protect against

potential losses and involves taking opposite and equal position in the market thus

minimizing and preventing losses.

Here I would suggest the client to hedge his portfolio against ETF’s as his portfolio consists

of only blue chip funds (which are more or less positively correlated and losses of one cannot

be offset by income from other) whereas ETF’s track the entire index which is a combination

of varied stocks thus giving him higher benefit of diversification and prevention against

potential losses.

Question 13:

Explain the difference between the intrinsic value and the time value of an option. List four

(4) factors that can affect the time value of an option.

Answer

Option premium consists of two portions:

Intrinsic Value which is the difference between the exercise price of the option and

the market price of the underlying share

Time value which is the difference between the option premium and the intrinsic

value

The difference between intrinsic value and time value is that time value is the residual value

of option after intrinsic value.

Four factors that can affect the time value of option are:

a. Market Value of Option

b. Strike Price of the option

c. Volatility of the underlying share of the option

d. Time to expiry of the option.

Question 14:

Balance of Payments figures have just been released and you notice that the SPI 200 spot

month futures are falling in price, yet there has not been a relative fall in the S&P ASX 200

index. What accounts for this difference?

potential losses and involves taking opposite and equal position in the market thus

minimizing and preventing losses.

Here I would suggest the client to hedge his portfolio against ETF’s as his portfolio consists

of only blue chip funds (which are more or less positively correlated and losses of one cannot

be offset by income from other) whereas ETF’s track the entire index which is a combination

of varied stocks thus giving him higher benefit of diversification and prevention against

potential losses.

Question 13:

Explain the difference between the intrinsic value and the time value of an option. List four

(4) factors that can affect the time value of an option.

Answer

Option premium consists of two portions:

Intrinsic Value which is the difference between the exercise price of the option and

the market price of the underlying share

Time value which is the difference between the option premium and the intrinsic

value

The difference between intrinsic value and time value is that time value is the residual value

of option after intrinsic value.

Four factors that can affect the time value of option are:

a. Market Value of Option

b. Strike Price of the option

c. Volatility of the underlying share of the option

d. Time to expiry of the option.

Question 14:

Balance of Payments figures have just been released and you notice that the SPI 200 spot

month futures are falling in price, yet there has not been a relative fall in the S&P ASX 200

index. What accounts for this difference?

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Answer

SPI 200 introduced in 2000 is based on the ASX 200 index which is a weighted index of 200

companies listed on the stock exchange. It is a sort of balanced portfolio of underlying 200

companies in the S&P ASX 200. SPI 200 is sold as one unit in the open market.

When the SPI 200 spot month future prices are falling this is speculation among market

investors about the future price of S&P ASX 200 whereas S&P ASX reflects the speculation

in all the 200 companies within it.

The difference between the two is attributable to the speculation in the market and the fact

that SPI 200 reflects performance of one consolidated index and the S&P ASX 200 reflects

the performance of all 200 companies within it.

Question 15:

Your client has a view that XYZ stock will rise strongly over the next three months and they

would like to take advantage of that by entering the market. What are the four different

strategies that you could employ? What are your considerations concerning the relative merits

of each?

Answer

Four different strategies and consideration of merits that we could employ for entering the

market are:

Sl No. Strategies Consideration

1 Invest in the XYZ Shares High Transaction Cost and the risk as the

entire amount is paid in full.

2 Buy XYZ shares on Margin Interest rate risk as the total value of the

shares is outstanding.

3 Buy XYZ call option No dividends or voting rights

4 Buy XYZ equity call warrant No dividends or voting rights

Question 16:

You have two new clients. Client A is 23 years old, has just started a new job with an income

of $78,000 per annum, and has $25,000 held in fixed interest term deposits. Client B is 57

years old, and planning to retire in 3 years, has a current annual income of $46,000, and

assets of $73,000 spread across stocks and debentures. Both want to invest $25,000. What is

SPI 200 introduced in 2000 is based on the ASX 200 index which is a weighted index of 200

companies listed on the stock exchange. It is a sort of balanced portfolio of underlying 200

companies in the S&P ASX 200. SPI 200 is sold as one unit in the open market.

When the SPI 200 spot month future prices are falling this is speculation among market

investors about the future price of S&P ASX 200 whereas S&P ASX reflects the speculation

in all the 200 companies within it.

The difference between the two is attributable to the speculation in the market and the fact

that SPI 200 reflects performance of one consolidated index and the S&P ASX 200 reflects

the performance of all 200 companies within it.

Question 15:

Your client has a view that XYZ stock will rise strongly over the next three months and they

would like to take advantage of that by entering the market. What are the four different

strategies that you could employ? What are your considerations concerning the relative merits

of each?

Answer

Four different strategies and consideration of merits that we could employ for entering the

market are:

Sl No. Strategies Consideration

1 Invest in the XYZ Shares High Transaction Cost and the risk as the

entire amount is paid in full.

2 Buy XYZ shares on Margin Interest rate risk as the total value of the

shares is outstanding.

3 Buy XYZ call option No dividends or voting rights

4 Buy XYZ equity call warrant No dividends or voting rights

Question 16:

You have two new clients. Client A is 23 years old, has just started a new job with an income

of $78,000 per annum, and has $25,000 held in fixed interest term deposits. Client B is 57

years old, and planning to retire in 3 years, has a current annual income of $46,000, and

assets of $73,000 spread across stocks and debentures. Both want to invest $25,000. What is

the relative risk-carrying ability of each client? Why? What general strategies are appropriate

for each client?

Answer

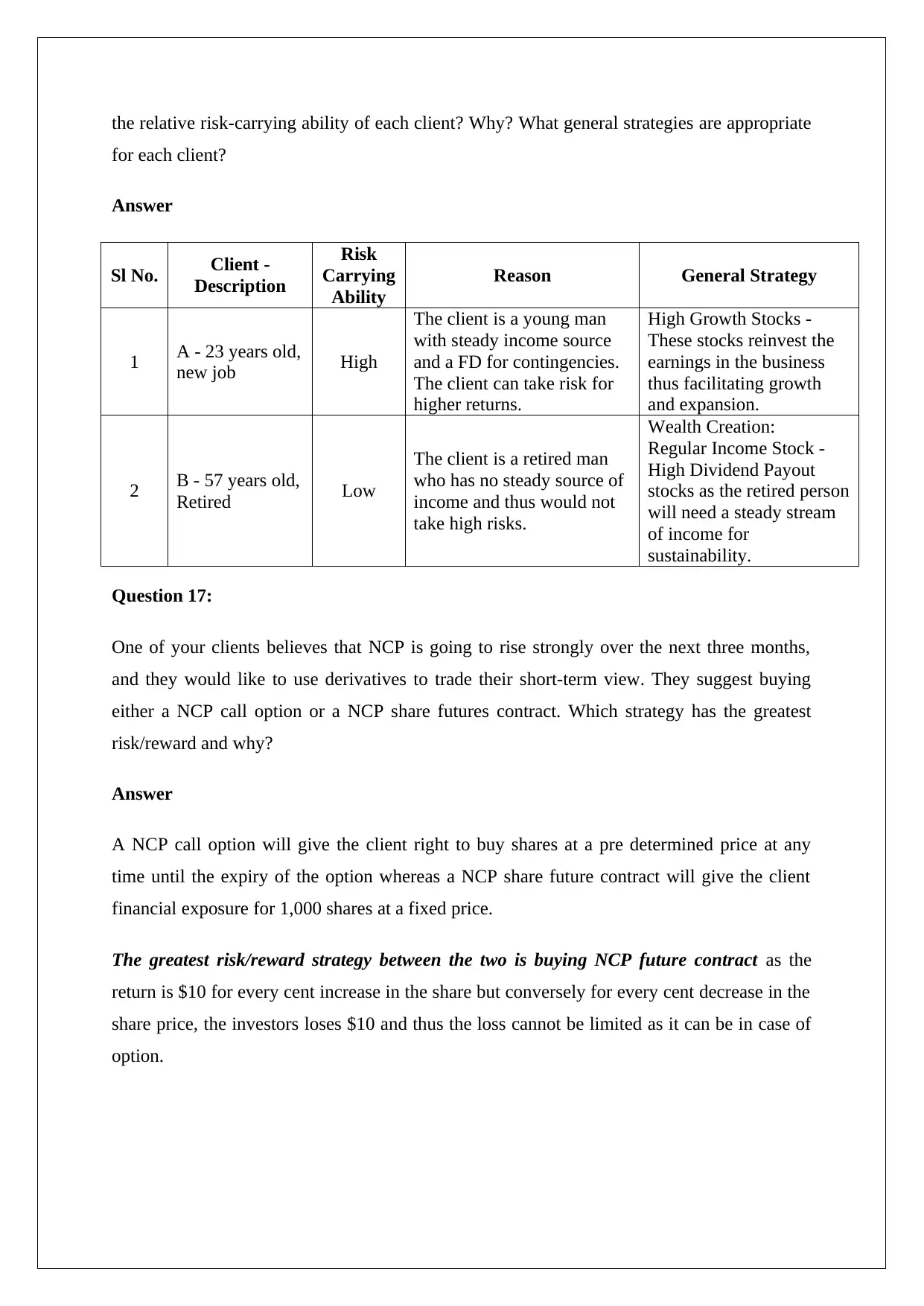

Sl No. Client -

Description

Risk

Carrying

Ability

Reason General Strategy

1 A - 23 years old,

new job High

The client is a young man

with steady income source

and a FD for contingencies.

The client can take risk for

higher returns.

High Growth Stocks -

These stocks reinvest the

earnings in the business

thus facilitating growth

and expansion.

2 B - 57 years old,

Retired Low

The client is a retired man

who has no steady source of

income and thus would not

take high risks.

Wealth Creation:

Regular Income Stock -

High Dividend Payout

stocks as the retired person

will need a steady stream

of income for

sustainability.

Question 17:

One of your clients believes that NCP is going to rise strongly over the next three months,

and they would like to use derivatives to trade their short-term view. They suggest buying

either a NCP call option or a NCP share futures contract. Which strategy has the greatest

risk/reward and why?

Answer

A NCP call option will give the client right to buy shares at a pre determined price at any

time until the expiry of the option whereas a NCP share future contract will give the client

financial exposure for 1,000 shares at a fixed price.

The greatest risk/reward strategy between the two is buying NCP future contract as the

return is $10 for every cent increase in the share but conversely for every cent decrease in the

share price, the investors loses $10 and thus the loss cannot be limited as it can be in case of

option.

for each client?

Answer

Sl No. Client -

Description

Risk

Carrying

Ability

Reason General Strategy

1 A - 23 years old,

new job High

The client is a young man

with steady income source

and a FD for contingencies.

The client can take risk for

higher returns.

High Growth Stocks -

These stocks reinvest the

earnings in the business

thus facilitating growth

and expansion.

2 B - 57 years old,

Retired Low

The client is a retired man

who has no steady source of

income and thus would not

take high risks.

Wealth Creation:

Regular Income Stock -

High Dividend Payout

stocks as the retired person

will need a steady stream

of income for

sustainability.

Question 17:

One of your clients believes that NCP is going to rise strongly over the next three months,

and they would like to use derivatives to trade their short-term view. They suggest buying

either a NCP call option or a NCP share futures contract. Which strategy has the greatest

risk/reward and why?

Answer

A NCP call option will give the client right to buy shares at a pre determined price at any

time until the expiry of the option whereas a NCP share future contract will give the client

financial exposure for 1,000 shares at a fixed price.

The greatest risk/reward strategy between the two is buying NCP future contract as the

return is $10 for every cent increase in the share but conversely for every cent decrease in the

share price, the investors loses $10 and thus the loss cannot be limited as it can be in case of

option.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Question 19:

You open a new account for a husband and wife with funds from the recent sale of their

house. You fill in the client profile, and during the discussion, your clients inform you that

their objective is to invest the funds short-term, until they find another house to buy. They

stress that the funds cannot go into high risk investments, and you decide on a mix of short-

term fixed interest investments and stock. A few weeks later the husband rings you and says

he wants to allocate some of the funds to speculative options trading, because he has heard of

the potential rewards. What do you do?

Answer

Every investor in the market must have a definite strategy to meet the defined objectives. All

the investments by the investor must be aligned to the strategy adopted. Here the client wants

to invest in short-term liquid fixed interest funds because he has the objective to buy a house

in near future and will need cash for the same.

In this situation as an advisor, I will let the client know the potential risks of investing in the

speculative options trading and how he might not meet his objective of saving for the house

that he intends to buy. If the client still insists, I will have to go ahead with his plans as

ultimately it is his money and he is the investor. I can provide guidance and let him know the

potential risks involved.

Question 20:

Your manager calls you into his office and explains that there is a client dispute involving

one of your clients. The client has suffered substantial losses as a result of options trading,

and is claiming that they did not understand the risks involved with the strategies you advised

them on. The client is insisting that the firm makes good the losses, or they will pursue legal

action against you and the firm. How do you prove that you followed the 'know your client

requirements'? What documents/recorded history could you produce to prove you met your

obligations to the client

Answer

As per the new regulatory regime released on 11 March 2002, every investor needs to know

complete details of their client which includes basic personal details, references, cash flow,

You open a new account for a husband and wife with funds from the recent sale of their

house. You fill in the client profile, and during the discussion, your clients inform you that

their objective is to invest the funds short-term, until they find another house to buy. They

stress that the funds cannot go into high risk investments, and you decide on a mix of short-

term fixed interest investments and stock. A few weeks later the husband rings you and says

he wants to allocate some of the funds to speculative options trading, because he has heard of

the potential rewards. What do you do?

Answer

Every investor in the market must have a definite strategy to meet the defined objectives. All

the investments by the investor must be aligned to the strategy adopted. Here the client wants

to invest in short-term liquid fixed interest funds because he has the objective to buy a house

in near future and will need cash for the same.

In this situation as an advisor, I will let the client know the potential risks of investing in the

speculative options trading and how he might not meet his objective of saving for the house

that he intends to buy. If the client still insists, I will have to go ahead with his plans as

ultimately it is his money and he is the investor. I can provide guidance and let him know the

potential risks involved.

Question 20:

Your manager calls you into his office and explains that there is a client dispute involving

one of your clients. The client has suffered substantial losses as a result of options trading,

and is claiming that they did not understand the risks involved with the strategies you advised

them on. The client is insisting that the firm makes good the losses, or they will pursue legal

action against you and the firm. How do you prove that you followed the 'know your client

requirements'? What documents/recorded history could you produce to prove you met your

obligations to the client

Answer

As per the new regulatory regime released on 11 March 2002, every investor needs to know

complete details of their client which includes basic personal details, references, cash flow,

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

assets and liabilities, objectives, custody of securities, net worth, bank details, reason for

short selling and other important details. These details will enable the advisor to form a

“reasonable basis for advice”.

I can prove that I have followed the 'know your client requirements' by presenting the KYC

form and the application form which the client have must filled in before investing.

Further, the documents and history that I can produce to prove that I have met the obligations

are the form, my advice, and client’s acceptance on the same, securities history showing the

transactions that were carried out.

Question 21:

A new employee has just come on board. You overhear them with a client explaining that

they will monitor their portfolio. What is the difference between monitoring and reviewing a

portfolio? What could be the repercussions? Explain and discuss.

Answer

Monitoring is a continuous process which involves regular collection and analysis of a

portfolio to ensure that the portfolio is moving in the direction of the set objective. It is

continuous and involves gathering of information primarily.

Reviewing on the other hand is careful evaluation of the portfolio on the basis of the data

collected while monitoring. While reviewing we decide whether or not to change the

strategy for meeting the set objectives. The repercussions of review can be a complete change

in the strategy of the portfolio.

Question 22:

Find a resource that will explain the difference between forward and lagging indicators

Answer

A good resource that helps explain the difference between forward and lagging indicators can

be found on https://www.investopedia.com/university/indicator_oscillator/ind_osc1.asp

Here the authors have elaborately described what leading and lagging indicators are, their

differences, examples and practical use in investment.

short selling and other important details. These details will enable the advisor to form a

“reasonable basis for advice”.

I can prove that I have followed the 'know your client requirements' by presenting the KYC

form and the application form which the client have must filled in before investing.

Further, the documents and history that I can produce to prove that I have met the obligations

are the form, my advice, and client’s acceptance on the same, securities history showing the

transactions that were carried out.

Question 21:

A new employee has just come on board. You overhear them with a client explaining that

they will monitor their portfolio. What is the difference between monitoring and reviewing a

portfolio? What could be the repercussions? Explain and discuss.

Answer

Monitoring is a continuous process which involves regular collection and analysis of a

portfolio to ensure that the portfolio is moving in the direction of the set objective. It is

continuous and involves gathering of information primarily.

Reviewing on the other hand is careful evaluation of the portfolio on the basis of the data

collected while monitoring. While reviewing we decide whether or not to change the

strategy for meeting the set objectives. The repercussions of review can be a complete change

in the strategy of the portfolio.

Question 22:

Find a resource that will explain the difference between forward and lagging indicators

Answer

A good resource that helps explain the difference between forward and lagging indicators can

be found on https://www.investopedia.com/university/indicator_oscillator/ind_osc1.asp

Here the authors have elaborately described what leading and lagging indicators are, their

differences, examples and practical use in investment.

Question 23:

With the potential of the ASX merging with another exchange, what would be positives and

potential negatives of a merger for the Australian investor?

Answer

Positives of ASX merging with another exchange for an Australian investor can be easy

access to large pool of funds, indexation benefits, greater possibility of diversification of

portfolio etc.

Potential negatives of ASX merging with another exchange for an Australian investor can be

dilution in the level of control by the Australian exchange, possibilities of higher charges

and/or commissions etc.

Question 24:

The traditional advice for retired investors is to seek and invest in dividend stocks. In regards

to capital growth stocks why is this NOT a good idea?

Answer

Capital Growth Stocks are stocks which reinvest their earnings in the business to accumulate

funds, for tapping larger available opportunities in the future. They do not pay regular

dividends and reinvest them for growth and expansion. Thus, retired investors who needs

regular stream of income should not opt for capital growth stocks as the dividend payment

are not guaranteed.

With the potential of the ASX merging with another exchange, what would be positives and

potential negatives of a merger for the Australian investor?

Answer

Positives of ASX merging with another exchange for an Australian investor can be easy

access to large pool of funds, indexation benefits, greater possibility of diversification of

portfolio etc.

Potential negatives of ASX merging with another exchange for an Australian investor can be

dilution in the level of control by the Australian exchange, possibilities of higher charges

and/or commissions etc.

Question 24:

The traditional advice for retired investors is to seek and invest in dividend stocks. In regards

to capital growth stocks why is this NOT a good idea?

Answer

Capital Growth Stocks are stocks which reinvest their earnings in the business to accumulate

funds, for tapping larger available opportunities in the future. They do not pay regular

dividends and reinvest them for growth and expansion. Thus, retired investors who needs

regular stream of income should not opt for capital growth stocks as the dividend payment

are not guaranteed.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.