A Study on Foreign Ownership and Firm Performance in China (2015-2019)

VerifiedAdded on 2023/06/11

|49

|18017

|184

Report

AI Summary

This report investigates the direct impact of foreign ownership on firm performance in China, utilizing data from 625 publicly listed companies on the Shanghai Stock Exchange (SSE) and Shenzhen Stock Exchange (SZSE) between 2015 and 2019. The study explores the relationship between foreign ownership and firm performance, considering factors such as firm size, age, and capital intensity. The findings suggest no significant relationship between foreign ownership and firm performance. However, the age of the firms in China is found to be positively related to performance. The research delves into the theoretical framework, including the Eclectic Paradigm and Resource-based Theory, and employs OLS regression to analyze the data. The report concludes with implications, limitations, and recommendations for future research, contributing to the understanding of foreign investment dynamics in the Chinese market. Desklib provides access to this and other solved assignments for students.

Impact of foregin ownership on PERFROMANCE; EVIDANCE fromChina

[Document subtitle]

OCTOBER 10, 2021

Abstract:

This thesis has attempted to examine the Direct effect of Foreign Ownership On Firm

Performance In China.

Data and Methodology: Data of 625 publicly listed stocks both in (SSE)or Shanghai Stock

Exchange & (SZSE) Shenzhen Stock Exchange over the period of 5 years 2015-2019, A total

of 3125 years of data.

Findings: There is no significant relationship between Foreign ownership and firm

performance. Secondly, in terms of firms characterises, In China the age of the firms is found

to be positively related with the performance.

[Document subtitle]

OCTOBER 10, 2021

Abstract:

This thesis has attempted to examine the Direct effect of Foreign Ownership On Firm

Performance In China.

Data and Methodology: Data of 625 publicly listed stocks both in (SSE)or Shanghai Stock

Exchange & (SZSE) Shenzhen Stock Exchange over the period of 5 years 2015-2019, A total

of 3125 years of data.

Findings: There is no significant relationship between Foreign ownership and firm

performance. Secondly, in terms of firms characterises, In China the age of the firms is found

to be positively related with the performance.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Table of Contents............................................................................................................................1

1.1 Background of the study...........................................................................................................4

1.2 Research problem......................................................................................................................5

1.3 Research Questions and Objectives..........................................................................................8

1.3.1 Research Questions...................................................................................................................8

1.3.2 Research Objectives..................................................................................................................8

1.4 Justification of the study in China context................................................................................8

1.5 Scope of the study......................................................................................................................9

1.5.1 The Scope of study...................................................................................................................9

1.5.2 Research methodology..............................................................................................................9

1.6 Structure of the Study...............................................................................................................9

CHAPTER 2: LITRATURE REVIEW........................................................................................10

2.1 Introduction.............................................................................................................................10

2.2 Theoretical Framework...........................................................................................................10

2.2.1 Direct Impact of Foreign Ownership on Firm Performance....................................................10

2.2.1.1 The Eclectic Paradigm.........................................................................................................10

2.2.1.2 Variables of Eclectic Paradigm............................................................................................11

A) Ownership-specific Advantages.............................................................................................11

B) Location Specific Advantages................................................................................................12

C) Internalization advantages......................................................................................................12

2.3 The Resource-based Theory....................................................................................................13

2.4 The Relationship Between FO and Firm Performance...........................................................14

2.4.1 Linear Relationship.................................................................................................................14

2.4.2 Non-Linear Relationship.........................................................................................................16

2.4.3 No Relationship......................................................................................................................17

2.5 Firm Performance...................................................................................................................18

2.6 Conclusion...............................................................................................................................19

CHAPTER 3: RESEARCH METHODOLOGY..........................................................................20

3.1 Introduction...............................................................................................................................20

3.2 Data...........................................................................................................................................20

Table 3.2.1: Descriptive Measures of the key variables................................................................21

Table 3.2.2: Descriptive Statistics.................................................................................................21

3.3 Direct Effect of Foreign Ownership on Firm Performance........................................................22

3.3.1 The Variables......................................................................................................................23

3.4.1 Empirical Model...................................................................................................................26

CHAPTER 4: DATA ANALYSIS...........................................................................................................27

Table of Contents............................................................................................................................1

1.1 Background of the study...........................................................................................................4

1.2 Research problem......................................................................................................................5

1.3 Research Questions and Objectives..........................................................................................8

1.3.1 Research Questions...................................................................................................................8

1.3.2 Research Objectives..................................................................................................................8

1.4 Justification of the study in China context................................................................................8

1.5 Scope of the study......................................................................................................................9

1.5.1 The Scope of study...................................................................................................................9

1.5.2 Research methodology..............................................................................................................9

1.6 Structure of the Study...............................................................................................................9

CHAPTER 2: LITRATURE REVIEW........................................................................................10

2.1 Introduction.............................................................................................................................10

2.2 Theoretical Framework...........................................................................................................10

2.2.1 Direct Impact of Foreign Ownership on Firm Performance....................................................10

2.2.1.1 The Eclectic Paradigm.........................................................................................................10

2.2.1.2 Variables of Eclectic Paradigm............................................................................................11

A) Ownership-specific Advantages.............................................................................................11

B) Location Specific Advantages................................................................................................12

C) Internalization advantages......................................................................................................12

2.3 The Resource-based Theory....................................................................................................13

2.4 The Relationship Between FO and Firm Performance...........................................................14

2.4.1 Linear Relationship.................................................................................................................14

2.4.2 Non-Linear Relationship.........................................................................................................16

2.4.3 No Relationship......................................................................................................................17

2.5 Firm Performance...................................................................................................................18

2.6 Conclusion...............................................................................................................................19

CHAPTER 3: RESEARCH METHODOLOGY..........................................................................20

3.1 Introduction...............................................................................................................................20

3.2 Data...........................................................................................................................................20

Table 3.2.1: Descriptive Measures of the key variables................................................................21

Table 3.2.2: Descriptive Statistics.................................................................................................21

3.3 Direct Effect of Foreign Ownership on Firm Performance........................................................22

3.3.1 The Variables......................................................................................................................23

3.4.1 Empirical Model...................................................................................................................26

CHAPTER 4: DATA ANALYSIS...........................................................................................................27

4.0Introduction...............................................................................................................................27

4.1 Statistical analysis.....................................................................................................................27

4.2 Hypothetical framework...........................................................................................................28

4.2.1 Hypothesis 1:..........................................................................................................................29

4.2.2Data analysis through regression equation.............................................................................29

Model Summary..........................................................................................................................29

4.2.2.1 Interpretation of the results............................................................................................30

4.2.2.2 Analysis of Variance.........................................................................................................31

4.2.2.3 Interpretation of the Coefficient......................................................................................32

4.3 Hypothesis 2..............................................................................................................................34

4.3.1 Interpretation of the results...................................................................................................35

4.3.2 Analysis of Variance................................................................................................................35

4.3.4 Interpretation.........................................................................................................................36

CHAPTER – 5 DISCUSSION ON THE FINDINGS...................................................................................39

5.0 Impact of Foreign ownership on Chinese listed firms................................................................39

5.1 Positive relationship(U-shape)...................................................................................................39

CHAPTER 6: CONCLUSION AND RECOMMENDATIONS....................................................................41

6.0 Conclusion.................................................................................................................................41

6.1 Implication of the study.............................................................................................................42

6.2 Limitations and strength............................................................................................................42

6.3 Recommendations.....................................................................................................................43

References.....................................................................................................................................44

4.1 Statistical analysis.....................................................................................................................27

4.2 Hypothetical framework...........................................................................................................28

4.2.1 Hypothesis 1:..........................................................................................................................29

4.2.2Data analysis through regression equation.............................................................................29

Model Summary..........................................................................................................................29

4.2.2.1 Interpretation of the results............................................................................................30

4.2.2.2 Analysis of Variance.........................................................................................................31

4.2.2.3 Interpretation of the Coefficient......................................................................................32

4.3 Hypothesis 2..............................................................................................................................34

4.3.1 Interpretation of the results...................................................................................................35

4.3.2 Analysis of Variance................................................................................................................35

4.3.4 Interpretation.........................................................................................................................36

CHAPTER – 5 DISCUSSION ON THE FINDINGS...................................................................................39

5.0 Impact of Foreign ownership on Chinese listed firms................................................................39

5.1 Positive relationship(U-shape)...................................................................................................39

CHAPTER 6: CONCLUSION AND RECOMMENDATIONS....................................................................41

6.0 Conclusion.................................................................................................................................41

6.1 Implication of the study.............................................................................................................42

6.2 Limitations and strength............................................................................................................42

6.3 Recommendations.....................................................................................................................43

References.....................................................................................................................................44

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Acknowledgment

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1.1 Background of the study

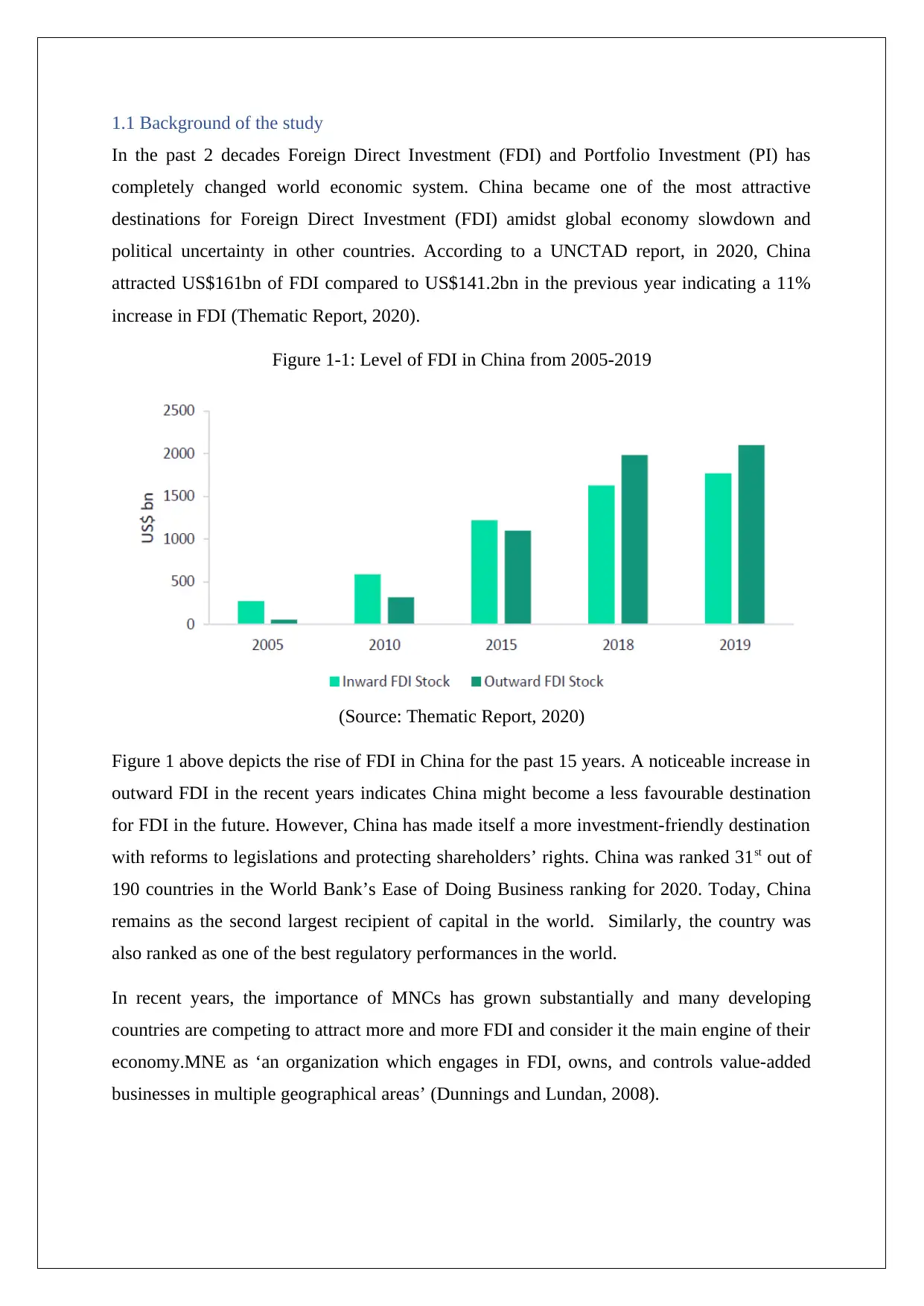

In the past 2 decades Foreign Direct Investment (FDI) and Portfolio Investment (PI) has

completely changed world economic system. China became one of the most attractive

destinations for Foreign Direct Investment (FDI) amidst global economy slowdown and

political uncertainty in other countries. According to a UNCTAD report, in 2020, China

attracted US$161bn of FDI compared to US$141.2bn in the previous year indicating a 11%

increase in FDI (Thematic Report, 2020).

Figure 1-1: Level of FDI in China from 2005-2019

(Source: Thematic Report, 2020)

Figure 1 above depicts the rise of FDI in China for the past 15 years. A noticeable increase in

outward FDI in the recent years indicates China might become a less favourable destination

for FDI in the future. However, China has made itself a more investment-friendly destination

with reforms to legislations and protecting shareholders’ rights. China was ranked 31st out of

190 countries in the World Bank’s Ease of Doing Business ranking for 2020. Today, China

remains as the second largest recipient of capital in the world. Similarly, the country was

also ranked as one of the best regulatory performances in the world.

In recent years, the importance of MNCs has grown substantially and many developing

countries are competing to attract more and more FDI and consider it the main engine of their

economy.MNE as ‘an organization which engages in FDI, owns, and controls value-added

businesses in multiple geographical areas’ (Dunnings and Lundan, 2008).

In the past 2 decades Foreign Direct Investment (FDI) and Portfolio Investment (PI) has

completely changed world economic system. China became one of the most attractive

destinations for Foreign Direct Investment (FDI) amidst global economy slowdown and

political uncertainty in other countries. According to a UNCTAD report, in 2020, China

attracted US$161bn of FDI compared to US$141.2bn in the previous year indicating a 11%

increase in FDI (Thematic Report, 2020).

Figure 1-1: Level of FDI in China from 2005-2019

(Source: Thematic Report, 2020)

Figure 1 above depicts the rise of FDI in China for the past 15 years. A noticeable increase in

outward FDI in the recent years indicates China might become a less favourable destination

for FDI in the future. However, China has made itself a more investment-friendly destination

with reforms to legislations and protecting shareholders’ rights. China was ranked 31st out of

190 countries in the World Bank’s Ease of Doing Business ranking for 2020. Today, China

remains as the second largest recipient of capital in the world. Similarly, the country was

also ranked as one of the best regulatory performances in the world.

In recent years, the importance of MNCs has grown substantially and many developing

countries are competing to attract more and more FDI and consider it the main engine of their

economy.MNE as ‘an organization which engages in FDI, owns, and controls value-added

businesses in multiple geographical areas’ (Dunnings and Lundan, 2008).

1.2 Research problem

Given the importance of foreign investments as a source of capital, numerous studies have

undertaken the motivation behind FDI and how to attract foreign capital and sustain them

over a period in a host-country through adopting policies. Firstly, determinants and the effect

of FDI are often studied at the country level. For example, a large body of literature exists on

the technology and know-how transfer in the host country. (Bwalya,2005), (Liu,2006),

(Kamal,2015) and (TŐKÉS,2019).

Secondly, the impact of foreign ownership on firm performance has been generally analysed

based on specific industries (Phung and Vyle,2013), (Jusoh,2015) and (Nofal,2020).

However, very few researchers have attempted to analyse the effect of FDI at the firm level,

where the focus is on the impact of foreign ownership and firm performance when compared

to domestic firms in the same country. Furthermore, existing theories and frameworks which

are used to analyse the relationship between FDI, and firm performance provides assertingas

to whether foreign ownership has positive/negative direct or indirect effect on firm

performance.

With regards to the direct effect of foreign ownership, Electric paradigm determines the

impact of competitive advantage according to the patterns of international productions of

(Dunning,1988; Dunnig,2001) over their purely domestic firm. These theories and framework

argue that for a foreign investor to operate outside its home country as a MNC,these three

conditions must be satisfied:

1) unique and sustainable ownership-specific advantages over their domestic

competitors. The extended version of Electric paradigm further breaks it down to Oa

asset-based advantage, and Ot transaction-based advantage.

2) the extent to which the company perceives it is useful to add to its O advantages

rather than to sell them to other foreign firms (Internalization Advantages – “I”).

3) the extent to which companies are interested in creating, accessing, or utilizing their

“O” advantages in a foreign location (Location Advantages – “L”).

Therefore, a firm must have sufficient ownership(monopolistic advantage) to compensate the

cost of operating as a multinational company.

Given the importance of foreign investments as a source of capital, numerous studies have

undertaken the motivation behind FDI and how to attract foreign capital and sustain them

over a period in a host-country through adopting policies. Firstly, determinants and the effect

of FDI are often studied at the country level. For example, a large body of literature exists on

the technology and know-how transfer in the host country. (Bwalya,2005), (Liu,2006),

(Kamal,2015) and (TŐKÉS,2019).

Secondly, the impact of foreign ownership on firm performance has been generally analysed

based on specific industries (Phung and Vyle,2013), (Jusoh,2015) and (Nofal,2020).

However, very few researchers have attempted to analyse the effect of FDI at the firm level,

where the focus is on the impact of foreign ownership and firm performance when compared

to domestic firms in the same country. Furthermore, existing theories and frameworks which

are used to analyse the relationship between FDI, and firm performance provides assertingas

to whether foreign ownership has positive/negative direct or indirect effect on firm

performance.

With regards to the direct effect of foreign ownership, Electric paradigm determines the

impact of competitive advantage according to the patterns of international productions of

(Dunning,1988; Dunnig,2001) over their purely domestic firm. These theories and framework

argue that for a foreign investor to operate outside its home country as a MNC,these three

conditions must be satisfied:

1) unique and sustainable ownership-specific advantages over their domestic

competitors. The extended version of Electric paradigm further breaks it down to Oa

asset-based advantage, and Ot transaction-based advantage.

2) the extent to which the company perceives it is useful to add to its O advantages

rather than to sell them to other foreign firms (Internalization Advantages – “I”).

3) the extent to which companies are interested in creating, accessing, or utilizing their

“O” advantages in a foreign location (Location Advantages – “L”).

Therefore, a firm must have sufficient ownership(monopolistic advantage) to compensate the

cost of operating as a multinational company.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Understanding the dynamic nature of MNCs, (Dunning,2000) further explains that O

advantages are not limited to firm-specific; these capabilities are either created internally or

acquired externally through business networks.

Similarly, L advantages are not restricted to specific geographical region(country-specific); it

can be in the region or even a cluster of regions. Following these theories(Srithanpong,2012)

studied the impact of foreign ownership in Thai companies and concluded that, foreign

ownership positively correlated with higher wage and better management capabilities.Their

conclusions are in line with (Chhibber and Majumdar,1999) where they analysed the impact

of foreign ownership on Indian firms.Similarly, (Anttila et al, 2014) in their paper focused on

the Finnish listed stock and concluded that foreign owned firms in Helsinki stock exchange

tend to show higher labour productivity, superior management skills and greater global

distribution networks.

While growth prospects of MNCs, particularly by addressing country-specific advantages

(CSA) or firm specific and firm specific advantages (FSA) (Rugman,1981) or the theory of

dynamic ownership (Dunning,2001) such as asset-based and transaction-based advantages are

largely unchallenged,we know very little about the causes and the outcomes of these

advantages at the firm level.

Adding to that complexity of the relationship, the level of ownership has also its own

complexities.For example, in the case of the Turkish economy, firms with more than 51%

tend to negatively affect return on asset (RoA) while firms with low foreign percentage show

a positive relationship with performance (Yavaş and Erdoğan, 2016). But in the case of

Vietnamese listed firms, foreign ownership lower than 50% has negative impact on the firm

performance when compared to domestic firms (Phung and VyLe,2013).The following

conclusion can be made on these findings: firstly, the relationship between performance and

foreign ownership is nonlinear. Secondly, country specific advantages might not be very

scientific as the country might have some specific disadvantages as we have seen in the case

of Vietnamese firms where foreigners are limited to only 49% shares and are not able to

increase their shares beyond that.

Lastly, the direction and the shape of the relationship between foreign ownership and firm

performance further widen the gap. There is no relationship between performance and

ownership (Tawfeeq and Abdullah), inverted U-shape relationship, if foreign ownership

increases beyond 36.26% it negatively affects company performance (Phung et al.,2021). U-

advantages are not limited to firm-specific; these capabilities are either created internally or

acquired externally through business networks.

Similarly, L advantages are not restricted to specific geographical region(country-specific); it

can be in the region or even a cluster of regions. Following these theories(Srithanpong,2012)

studied the impact of foreign ownership in Thai companies and concluded that, foreign

ownership positively correlated with higher wage and better management capabilities.Their

conclusions are in line with (Chhibber and Majumdar,1999) where they analysed the impact

of foreign ownership on Indian firms.Similarly, (Anttila et al, 2014) in their paper focused on

the Finnish listed stock and concluded that foreign owned firms in Helsinki stock exchange

tend to show higher labour productivity, superior management skills and greater global

distribution networks.

While growth prospects of MNCs, particularly by addressing country-specific advantages

(CSA) or firm specific and firm specific advantages (FSA) (Rugman,1981) or the theory of

dynamic ownership (Dunning,2001) such as asset-based and transaction-based advantages are

largely unchallenged,we know very little about the causes and the outcomes of these

advantages at the firm level.

Adding to that complexity of the relationship, the level of ownership has also its own

complexities.For example, in the case of the Turkish economy, firms with more than 51%

tend to negatively affect return on asset (RoA) while firms with low foreign percentage show

a positive relationship with performance (Yavaş and Erdoğan, 2016). But in the case of

Vietnamese listed firms, foreign ownership lower than 50% has negative impact on the firm

performance when compared to domestic firms (Phung and VyLe,2013).The following

conclusion can be made on these findings: firstly, the relationship between performance and

foreign ownership is nonlinear. Secondly, country specific advantages might not be very

scientific as the country might have some specific disadvantages as we have seen in the case

of Vietnamese firms where foreigners are limited to only 49% shares and are not able to

increase their shares beyond that.

Lastly, the direction and the shape of the relationship between foreign ownership and firm

performance further widen the gap. There is no relationship between performance and

ownership (Tawfeeq and Abdullah), inverted U-shape relationship, if foreign ownership

increases beyond 36.26% it negatively affects company performance (Phung et al.,2021). U-

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

shape relationship firms with less than 50% foreign shares perform better than domestic firms

but firms with more than 50% foreign ownership tend to destroy value and negatively affect

RoA (Gurbuz and Aybars,2010) and direct and positive relationship(Douma, George and

Kabir,2006).

Therefore, the lack of strong evidence on the impact of foreign ownership on firm

performance raises questions on the benefits of foreign investments in a country. While there

is strong competition among firms in China to attract foreign investments, the real

performance of these investments at the firm-level, and degree of effectiveness are yet to be

explored. Most of the previous papers have recommended country specific policies such to

avoid increasing foreign shares to control knowledge and technology transfer from the

country of origin (Ylä,2004). On the other hand (Anil and Mishra,2014) suggest that

Australian firms should encourage more foreign investments to diversify their risk.

Implementing certain polices at the firm level may not be possible in the case of Chinese

firms as they are bound to obey country and state level policies. To the best of the author’s

knowledge, there is no study, to date, that has examined the relationship between foreign

ownership, the optimal level of ownership and performance in China.While taking into

consideration the possibility of a direct/indirect or even non-linear relationship. Technology

spill over and managerial improvements are considered as the indirect impact of foreign

ownership, potential endogeneity across the firms in the sample. Thus, to address this

research gap, this study intends to fully consider all factors in assessing the relationship

between foreign ownership and firm performance among Chinese firms, thereby ensuring

robust and reliable results.

1.3 Research Questions and Objectives

1.3.1 Research Questions

The main question of this study is to find out:

To what extent foreign ownership affects a firm’s performance in the context of

China?

The main research questions will be answered by exploring firm characteristics through

following secondary questions:

To what extant size affect firm performance?

To what extent ownership-level affect firm performance?

but firms with more than 50% foreign ownership tend to destroy value and negatively affect

RoA (Gurbuz and Aybars,2010) and direct and positive relationship(Douma, George and

Kabir,2006).

Therefore, the lack of strong evidence on the impact of foreign ownership on firm

performance raises questions on the benefits of foreign investments in a country. While there

is strong competition among firms in China to attract foreign investments, the real

performance of these investments at the firm-level, and degree of effectiveness are yet to be

explored. Most of the previous papers have recommended country specific policies such to

avoid increasing foreign shares to control knowledge and technology transfer from the

country of origin (Ylä,2004). On the other hand (Anil and Mishra,2014) suggest that

Australian firms should encourage more foreign investments to diversify their risk.

Implementing certain polices at the firm level may not be possible in the case of Chinese

firms as they are bound to obey country and state level policies. To the best of the author’s

knowledge, there is no study, to date, that has examined the relationship between foreign

ownership, the optimal level of ownership and performance in China.While taking into

consideration the possibility of a direct/indirect or even non-linear relationship. Technology

spill over and managerial improvements are considered as the indirect impact of foreign

ownership, potential endogeneity across the firms in the sample. Thus, to address this

research gap, this study intends to fully consider all factors in assessing the relationship

between foreign ownership and firm performance among Chinese firms, thereby ensuring

robust and reliable results.

1.3 Research Questions and Objectives

1.3.1 Research Questions

The main question of this study is to find out:

To what extent foreign ownership affects a firm’s performance in the context of

China?

The main research questions will be answered by exploring firm characteristics through

following secondary questions:

To what extant size affect firm performance?

To what extent ownership-level affect firm performance?

To what extent age affect firm performance?

To what extent capital intensity affect performance?

1.3.2 Research Objectives

The main objectives of this paper are as follow:

To shed light on the impact of foreign ownership on firm performance at the micro-

level.

To explore the direction and the relationship of firm characteristics such as (Size,

ownership-level, age, and capital intensity) with their performance.

If the direct relationship is non-linear, to quantify the optimal level of foreign

ownership in each country.

1.4 Justification of the study in China context

Southeast Asia, particularly China, is a persuasive country to undertake the impact of foreign

ownership on a firm’s performance. Most of the developing countries see FDI as the source

of growth and all are competing to attract foreign investments in the region. Furthermore, this

study will provide insights to investors in terms of a firm’s performance and the optimal level

of ownership in the country. For domestic firms it also provides insight on the level of control

they can give to foreign shareholders if they want to maximise their shareholders’ value. At

the country level, it might also provide insights in terms of job creation and economic

growth.

1.5 Scope of the study

1.5.1 The Scope of study

This paper attempts to analyse post-impact of Foreign Direct Investment in China, with

respect of foreign holdings at the firm-level on the Shenzhen Stock Exchange (SZSE) and

Shanghai Stock Exchange (SSE) of China. The literature review of this paper will focus on

the direct effect of foreign ownership on performance and how firm characteristics such as

size, ownership-level, age, and its capital intensity influence their performance. The study

covers a period of 5 years from 2015 to 2019. Unlike most of the past studies of this nature,

the sample includes financial firms but winsorise extreme outliers for other firms.

To what extent capital intensity affect performance?

1.3.2 Research Objectives

The main objectives of this paper are as follow:

To shed light on the impact of foreign ownership on firm performance at the micro-

level.

To explore the direction and the relationship of firm characteristics such as (Size,

ownership-level, age, and capital intensity) with their performance.

If the direct relationship is non-linear, to quantify the optimal level of foreign

ownership in each country.

1.4 Justification of the study in China context

Southeast Asia, particularly China, is a persuasive country to undertake the impact of foreign

ownership on a firm’s performance. Most of the developing countries see FDI as the source

of growth and all are competing to attract foreign investments in the region. Furthermore, this

study will provide insights to investors in terms of a firm’s performance and the optimal level

of ownership in the country. For domestic firms it also provides insight on the level of control

they can give to foreign shareholders if they want to maximise their shareholders’ value. At

the country level, it might also provide insights in terms of job creation and economic

growth.

1.5 Scope of the study

1.5.1 The Scope of study

This paper attempts to analyse post-impact of Foreign Direct Investment in China, with

respect of foreign holdings at the firm-level on the Shenzhen Stock Exchange (SZSE) and

Shanghai Stock Exchange (SSE) of China. The literature review of this paper will focus on

the direct effect of foreign ownership on performance and how firm characteristics such as

size, ownership-level, age, and its capital intensity influence their performance. The study

covers a period of 5 years from 2015 to 2019. Unlike most of the past studies of this nature,

the sample includes financial firms but winsorise extreme outliers for other firms.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1.5.2 Research methodology

To assess the empirical relationship between Foreign ownership and firm performance, this

paper in the first step using OLS or ordinary least squares to assess the relationship between

IVs(FO=percentage of foreign ownership),(SIZE=Netincome),(AGE=IPO_date)and

DVs(RoA, Tobin’s Q). to satisfy the second objective, which the optimal level of foreign

ownership , we are going to create a dummy variable for the foreign ownership level

categorizing into(Low, Medium, High) and test the optimal level of foreign ownership using

2SLS or 2 stage-least squares regression to test the relationship.

1.6 Structure of the Study

The remainder steps of the study are as follows:

Chapter 2 presents the literature reviews and the theoretical foundation for test used to

analyse the relationship, the nature of the relationship and the direction of the relationship.

This chapter also cover an extensive revies of the past studies of similar nature, their findings

for each variable used in this study . It also shades light on the literature gaps that exists and

the main purpose of this paper. of the theoretical foundations on the direct and spill over

effects of foreign ownership on firm performance. This chapter also includes a

comprehensive review of empirical studies on the topic, which is subdivided according to

financial performance and firm productivity. Subsequently, chapter three explains the nature

of data gathering, data cleaning and outliner handling. In Chapter 4 the results from each of

the models are presented, together with an analysis of the findings. Chapter 5 provides

answers to the research questions and attempts to draw inferences from the findings. The

final segment of this chapter details the potential weaknesses of this study, recommendations

for future research on the topic and the conclusion of the study.

To assess the empirical relationship between Foreign ownership and firm performance, this

paper in the first step using OLS or ordinary least squares to assess the relationship between

IVs(FO=percentage of foreign ownership),(SIZE=Netincome),(AGE=IPO_date)and

DVs(RoA, Tobin’s Q). to satisfy the second objective, which the optimal level of foreign

ownership , we are going to create a dummy variable for the foreign ownership level

categorizing into(Low, Medium, High) and test the optimal level of foreign ownership using

2SLS or 2 stage-least squares regression to test the relationship.

1.6 Structure of the Study

The remainder steps of the study are as follows:

Chapter 2 presents the literature reviews and the theoretical foundation for test used to

analyse the relationship, the nature of the relationship and the direction of the relationship.

This chapter also cover an extensive revies of the past studies of similar nature, their findings

for each variable used in this study . It also shades light on the literature gaps that exists and

the main purpose of this paper. of the theoretical foundations on the direct and spill over

effects of foreign ownership on firm performance. This chapter also includes a

comprehensive review of empirical studies on the topic, which is subdivided according to

financial performance and firm productivity. Subsequently, chapter three explains the nature

of data gathering, data cleaning and outliner handling. In Chapter 4 the results from each of

the models are presented, together with an analysis of the findings. Chapter 5 provides

answers to the research questions and attempts to draw inferences from the findings. The

final segment of this chapter details the potential weaknesses of this study, recommendations

for future research on the topic and the conclusion of the study.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CHAPTER2: LITRATURE REVIEW

2.1 Introduction

This chapter, covering of the theoretical framework and review of empirical evidence centred

around the direct and indirect impact of foreign ownership on firm performance. Existing

empirical studies proving the enhanced results of foreign direct businesses in host nations and

technological indirect effects from all these companies to their local competitors reinforce

accepted thinking that FDI can improve host country efficiency. Caused by the financial

disasters of the 1980s and 1990s, FDI has become the preferred type of foreign investment

for developing markets, as it is deemed secure than some other forms of direct investment. As

a consequence, many advanced economies offer tax and other advantages to attract Foreign

direct investment, and Foreign investment to these nations have increased dramatically over

the last 3 decades. To fully explain the relationship between the percentage of foreign

ownership and firm performance, this study adopts the OLI Framework from Dunnings

(1988) which integrates elements of FDI and Trade Theories and bridges between Macro and

Microeconomics (Shanker,2007), a multi-theoretical approach by integrating components of

financial and economic theories. After adjusting for unobserved heterogeneity factors that

significantly ex-ante purchase choices, Fons-Rosen et al. (2013) conclude that FDI has a very

little impact on its performance companies' efficiency in their collection of developed

European nations. The empirical evidence consists of prior studies on this topic and is

reviewed based on three sub-topics: Financial Performance, Productivity and FDI Spillovers.

2.2 Theoretical Framework

2.2.1 Direct Impact of Foreign Ownership on Firm Performance

The chosen theories in this section aim to explain a more holistic understanding of the direct

relationship between dependent and independent variables.

2.2.1.1 The Eclectic Paradigm

In 1958, John Dunnings in his PhD research paperfound out that American firms operating in

Britain tends to be less productive than their parents but more productive than their domestic

competitors. And he hypothesised that these production differences could be explained by the

locational and ownership-specific differences (Dunnings,2012). Therefore, the

EclecticParadigm proposition itself in explaining the extent and the pattern of international

production financed by FDI and managed by MNEs. It asserts that at any given moment of

time for an MNE to operate successfully these three conditions must be satisfied:

2.1 Introduction

This chapter, covering of the theoretical framework and review of empirical evidence centred

around the direct and indirect impact of foreign ownership on firm performance. Existing

empirical studies proving the enhanced results of foreign direct businesses in host nations and

technological indirect effects from all these companies to their local competitors reinforce

accepted thinking that FDI can improve host country efficiency. Caused by the financial

disasters of the 1980s and 1990s, FDI has become the preferred type of foreign investment

for developing markets, as it is deemed secure than some other forms of direct investment. As

a consequence, many advanced economies offer tax and other advantages to attract Foreign

direct investment, and Foreign investment to these nations have increased dramatically over

the last 3 decades. To fully explain the relationship between the percentage of foreign

ownership and firm performance, this study adopts the OLI Framework from Dunnings

(1988) which integrates elements of FDI and Trade Theories and bridges between Macro and

Microeconomics (Shanker,2007), a multi-theoretical approach by integrating components of

financial and economic theories. After adjusting for unobserved heterogeneity factors that

significantly ex-ante purchase choices, Fons-Rosen et al. (2013) conclude that FDI has a very

little impact on its performance companies' efficiency in their collection of developed

European nations. The empirical evidence consists of prior studies on this topic and is

reviewed based on three sub-topics: Financial Performance, Productivity and FDI Spillovers.

2.2 Theoretical Framework

2.2.1 Direct Impact of Foreign Ownership on Firm Performance

The chosen theories in this section aim to explain a more holistic understanding of the direct

relationship between dependent and independent variables.

2.2.1.1 The Eclectic Paradigm

In 1958, John Dunnings in his PhD research paperfound out that American firms operating in

Britain tends to be less productive than their parents but more productive than their domestic

competitors. And he hypothesised that these production differences could be explained by the

locational and ownership-specific differences (Dunnings,2012). Therefore, the

EclecticParadigm proposition itself in explaining the extent and the pattern of international

production financed by FDI and managed by MNEs. It asserts that at any given moment of

time for an MNE to operate successfully these three conditions must be satisfied:

(1) The (net) unique and sustainable ownership-specific advantages over their domestic

competitors in a particular market. The extended version of Eclectic Paradigm further

breaks it down Oa to asset-based advantage, or privileged access to a set of income-

generating assets, and Ot transaction-based advantage or the ability to co-ordinate

these assets with others across national boundaries in ways to get competitive

advantage relative to their competitors.

(2) The extent to which the company perceives it is useful to internalise such ownership

advantages in the market in generating more value or to sell them to other foreign

firms (Internalization Advantages – “I”).

(3) The extent to which companies are interested in creating, accessing, or utilizing their

“O” advantages in a foreign location (Location Advantages – “L”) (Dunnings,2012).

In a way it offers a more holistic explanation of FDI and international productions. Eclectic

Paradigm includes three variables: ownership-specific (O), location-specific (L), and

internalization (I). The significance and interdependency of variables differ across industries

and countries. For example, in China most forging firms could not fully internalise or sell

their R&D and brand value due to lose copyright law in China.

OLI variables are grounded in the economic and IB theories. For example, in terms of

locational factors, labour cost in China was one of the most significant determinants of

explaining locational advantage for MNEs and international production. Thus, OLIin a way

links the macroeconomic theory of international trade (L) and the microeconomic theory of

the firm (O and I) (Shanker, 2007) and attempts to provide a more comprehensive

explanation of FDI than other theories such as: Product Life Cycle, Internationalization, and

the Monopolistic Advantage Theory. In the case of intra-country or sub-national economic

determinants of FDI, it enables foreign investors to have a more flexible approach to political

dynamics of location factors (Amal et al.,2020).

2.2.1.2 Variables of Eclectic Paradigm

A) Ownership-specific Advantages

Ownership advantages are the most direct and inherent factors that give firm a strategic edge

in a global market. (Dunning, 1988) breaks down ownership advantages into (Oa) Asset-

based Advantages and (Ot) Transaction-based Advantages. Ownership advantages are

defined as ‘proprietary ownership-specific assets held by MNEs and Ot is the ability of the

firm to add more value from its transaction with external market relative to its competitors’.

competitors in a particular market. The extended version of Eclectic Paradigm further

breaks it down Oa to asset-based advantage, or privileged access to a set of income-

generating assets, and Ot transaction-based advantage or the ability to co-ordinate

these assets with others across national boundaries in ways to get competitive

advantage relative to their competitors.

(2) The extent to which the company perceives it is useful to internalise such ownership

advantages in the market in generating more value or to sell them to other foreign

firms (Internalization Advantages – “I”).

(3) The extent to which companies are interested in creating, accessing, or utilizing their

“O” advantages in a foreign location (Location Advantages – “L”) (Dunnings,2012).

In a way it offers a more holistic explanation of FDI and international productions. Eclectic

Paradigm includes three variables: ownership-specific (O), location-specific (L), and

internalization (I). The significance and interdependency of variables differ across industries

and countries. For example, in China most forging firms could not fully internalise or sell

their R&D and brand value due to lose copyright law in China.

OLI variables are grounded in the economic and IB theories. For example, in terms of

locational factors, labour cost in China was one of the most significant determinants of

explaining locational advantage for MNEs and international production. Thus, OLIin a way

links the macroeconomic theory of international trade (L) and the microeconomic theory of

the firm (O and I) (Shanker, 2007) and attempts to provide a more comprehensive

explanation of FDI than other theories such as: Product Life Cycle, Internationalization, and

the Monopolistic Advantage Theory. In the case of intra-country or sub-national economic

determinants of FDI, it enables foreign investors to have a more flexible approach to political

dynamics of location factors (Amal et al.,2020).

2.2.1.2 Variables of Eclectic Paradigm

A) Ownership-specific Advantages

Ownership advantages are the most direct and inherent factors that give firm a strategic edge

in a global market. (Dunning, 1988) breaks down ownership advantages into (Oa) Asset-

based Advantages and (Ot) Transaction-based Advantages. Ownership advantages are

defined as ‘proprietary ownership-specific assets held by MNEs and Ot is the ability of the

firm to add more value from its transaction with external market relative to its competitors’.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 49

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.