Comprehensive Analysis: Form 3800 General Business Credit Explained

VerifiedAdded on 2023/03/31

|3

|2546

|96

Homework Assignment

AI Summary

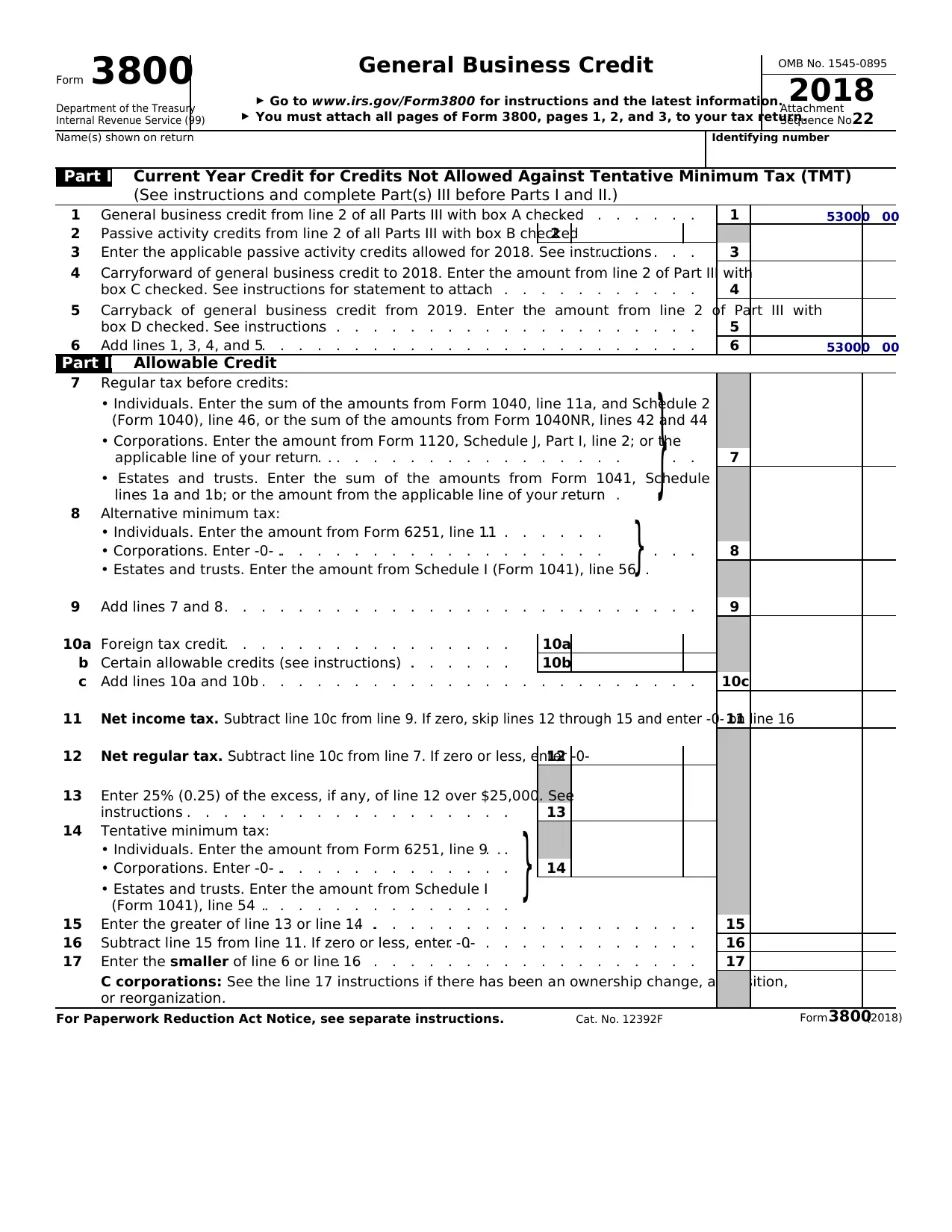

This assignment analyzes Form 3800, the General Business Credit form, focusing on the calculation and application of various business credits. The form is used to determine the allowable credit for the current year, considering credits not allowed against tentative minimum tax (TMT). The analysis covers different parts of the form, including the calculation of allowable credit, passive activity credits, carryforwards, and carrybacks. It involves understanding the regular tax, alternative minimum tax, and net income tax, as well as applying limitations and calculating the credit allowed for the current year. The document also includes related forms like Form 6251 (Alternative Minimum Tax—Individuals), Schedule A (Itemized Deductions), and Form 2441 (Child and Dependent Care Expenses) to provide context. The assignment includes a breakdown of the different types of credits, such as investment, research activities, low-income housing, disabled access, and renewable electricity, and how they are reported on the form.

Form 3800

Department of the Treasury

Internal Revenue Service (99)

General Business Credit

▶ Go to www.irs.gov/Form3800 for instructions and the latest information.

▶ You must attach all pages of Form 3800, pages 1, 2, and 3, to your tax return.

OMB No. 1545-0895

2018Attachment

Sequence No.22

Name(s) shown on return Identifying number

Part I Current Year Credit for Credits Not Allowed Against Tentative Minimum Tax (TMT)

(See instructions and complete Part(s) III before Parts I and II.)

1 General business credit from line 2 of all Parts III with box A checked. . . . . . . . . 1

2 Passive activity credits from line 2 of all Parts III with box B checked2

3 Enter the applicable passive activity credits allowed for 2018. See instructions. . . . . . 3

4 Carryforward of general business credit to 2018. Enter the amount from line 2 of Part III with

box C checked. See instructions for statement to attach. . . . . . . . . . . . . 4

5 Carryback of general business credit from 2019. Enter the amount from line 2 of Part III with

box D checked. See instructions. . . . . . . . . . . . . . . . . . . . . 5

6 Add lines 1, 3, 4, and 5. . . . . . . . . . . . . . . . . . . . . . . . 6

Part II Allowable Credit

7 Regular tax before credits:

• Individuals. Enter the sum of the amounts from Form 1040, line 11a, and Schedule 2

(Form 1040), line 46, or the sum of the amounts from Form 1040NR, lines 42 and 44

• Corporations. Enter the amount from Form 1120, Schedule J, Part I, line 2; or the

applicable line of your return .. . . . . . . . . . . . . . . . .

• Estates and trusts. Enter the sum of the amounts from Form 1041, Schedule G,

lines 1a and 1b; or the amount from the applicable line of your return. . . .

} . . 7

8 Alternative minimum tax:

• Individuals. Enter the amount from Form 6251, line 11. . . . . . . .

• Corporations. Enter -0- .. . . . . . . . . . . . . . . . . .

• Estates and trusts. Enter the amount from Schedule I (Form 1041), line 56 .. } . . . 8

9 Add lines 7 and 8 . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10a Foreign tax credit. . . . . . . . . . . . . . . . 10a

b Certain allowable credits (see instructions) .. . . . . . . 10b

c Add lines 10a and 10b . . . . . . . . . . . . . . . . . . . . . . . . 10c

11 Net income tax. Subtract line 10c from line 9. If zero, skip lines 12 through 15 and enter -0- on line 1611

12 Net regular tax. Subtract line 10c from line 7. If zero or less, enter -0-12

13 Enter 25% (0.25) of the excess, if any, of line 12 over $25,000. See

instructions . . . . . . . . . . . . . . . . . . 13

14 Tentative minimum tax:

• Individuals. Enter the amount from Form 6251, line 9 .. . .

• Corporations. Enter -0- .. . . . . . . . . . . . .

• Estates and trusts. Enter the amount from Schedule I

(Form 1041), line 54 .. . . . . . . . . . . . . .

} 14

15 Enter the greater of line 13 or line 14 .. . . . . . . . . . . . . . . . . . . 15

16 Subtract line 15 from line 11. If zero or less, enter -0-. . . . . . . . . . . . . . 16

17 Enter the smaller of line 6 or line 16. . . . . . . . . . . . . . . . . . . . 17

C corporations: See the line 17 instructions if there has been an ownership change, acquisition,

or reorganization.

For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 12392F Form 3800(2018)

53000 00

53000 00

Department of the Treasury

Internal Revenue Service (99)

General Business Credit

▶ Go to www.irs.gov/Form3800 for instructions and the latest information.

▶ You must attach all pages of Form 3800, pages 1, 2, and 3, to your tax return.

OMB No. 1545-0895

2018Attachment

Sequence No.22

Name(s) shown on return Identifying number

Part I Current Year Credit for Credits Not Allowed Against Tentative Minimum Tax (TMT)

(See instructions and complete Part(s) III before Parts I and II.)

1 General business credit from line 2 of all Parts III with box A checked. . . . . . . . . 1

2 Passive activity credits from line 2 of all Parts III with box B checked2

3 Enter the applicable passive activity credits allowed for 2018. See instructions. . . . . . 3

4 Carryforward of general business credit to 2018. Enter the amount from line 2 of Part III with

box C checked. See instructions for statement to attach. . . . . . . . . . . . . 4

5 Carryback of general business credit from 2019. Enter the amount from line 2 of Part III with

box D checked. See instructions. . . . . . . . . . . . . . . . . . . . . 5

6 Add lines 1, 3, 4, and 5. . . . . . . . . . . . . . . . . . . . . . . . 6

Part II Allowable Credit

7 Regular tax before credits:

• Individuals. Enter the sum of the amounts from Form 1040, line 11a, and Schedule 2

(Form 1040), line 46, or the sum of the amounts from Form 1040NR, lines 42 and 44

• Corporations. Enter the amount from Form 1120, Schedule J, Part I, line 2; or the

applicable line of your return .. . . . . . . . . . . . . . . . .

• Estates and trusts. Enter the sum of the amounts from Form 1041, Schedule G,

lines 1a and 1b; or the amount from the applicable line of your return. . . .

} . . 7

8 Alternative minimum tax:

• Individuals. Enter the amount from Form 6251, line 11. . . . . . . .

• Corporations. Enter -0- .. . . . . . . . . . . . . . . . . .

• Estates and trusts. Enter the amount from Schedule I (Form 1041), line 56 .. } . . . 8

9 Add lines 7 and 8 . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10a Foreign tax credit. . . . . . . . . . . . . . . . 10a

b Certain allowable credits (see instructions) .. . . . . . . 10b

c Add lines 10a and 10b . . . . . . . . . . . . . . . . . . . . . . . . 10c

11 Net income tax. Subtract line 10c from line 9. If zero, skip lines 12 through 15 and enter -0- on line 1611

12 Net regular tax. Subtract line 10c from line 7. If zero or less, enter -0-12

13 Enter 25% (0.25) of the excess, if any, of line 12 over $25,000. See

instructions . . . . . . . . . . . . . . . . . . 13

14 Tentative minimum tax:

• Individuals. Enter the amount from Form 6251, line 9 .. . .

• Corporations. Enter -0- .. . . . . . . . . . . . .

• Estates and trusts. Enter the amount from Schedule I

(Form 1041), line 54 .. . . . . . . . . . . . . .

} 14

15 Enter the greater of line 13 or line 14 .. . . . . . . . . . . . . . . . . . . 15

16 Subtract line 15 from line 11. If zero or less, enter -0-. . . . . . . . . . . . . . 16

17 Enter the smaller of line 6 or line 16. . . . . . . . . . . . . . . . . . . . 17

C corporations: See the line 17 instructions if there has been an ownership change, acquisition,

or reorganization.

For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 12392F Form 3800(2018)

53000 00

53000 00

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

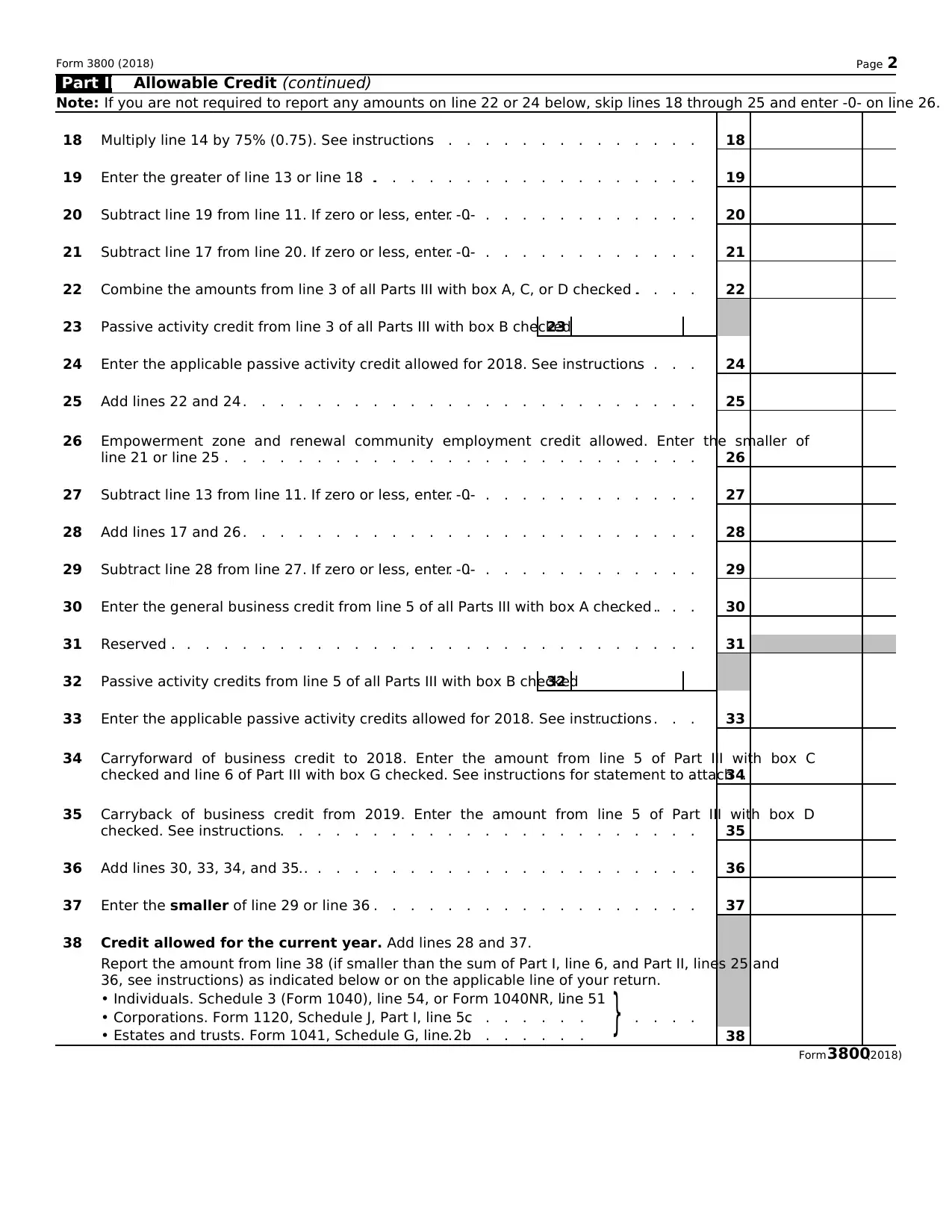

Form 3800 (2018) Page 2

Part II Allowable Credit (continued)

Note: If you are not required to report any amounts on line 22 or 24 below, skip lines 18 through 25 and enter -0- on line 26.

18 Multiply line 14 by 75% (0.75). See instructions. . . . . . . . . . . . . . . . 18

19 Enter the greater of line 13 or line 18 .. . . . . . . . . . . . . . . . . . . 19

20 Subtract line 19 from line 11. If zero or less, enter -0-. . . . . . . . . . . . . . 20

21 Subtract line 17 from line 20. If zero or less, enter -0-. . . . . . . . . . . . . . 21

22 Combine the amounts from line 3 of all Parts III with box A, C, or D checked .. . . . . . 22

23 Passive activity credit from line 3 of all Parts III with box B checked23

24 Enter the applicable passive activity credit allowed for 2018. See instructions. . . . . . 24

25 Add lines 22 and 24 . . . . . . . . . . . . . . . . . . . . . . . . . 25

26 Empowerment zone and renewal community employment credit allowed. Enter the smaller of

line 21 or line 25 . . . . . . . . . . . . . . . . . . . . . . . . . . 26

27 Subtract line 13 from line 11. If zero or less, enter -0-. . . . . . . . . . . . . . 27

28 Add lines 17 and 26 . . . . . . . . . . . . . . . . . . . . . . . . . 28

29 Subtract line 28 from line 27. If zero or less, enter -0-. . . . . . . . . . . . . . 29

30 Enter the general business credit from line 5 of all Parts III with box A checked .. . . . . 30

31 Reserved . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31

32 Passive activity credits from line 5 of all Parts III with box B checked32

33 Enter the applicable passive activity credits allowed for 2018. See instructions. . . . . . 33

34 Carryforward of business credit to 2018. Enter the amount from line 5 of Part III with box C

checked and line 6 of Part III with box G checked. See instructions for statement to attach .. 34

35 Carryback of business credit from 2019. Enter the amount from line 5 of Part III with box D

checked. See instructions. . . . . . . . . . . . . . . . . . . . . . . 35

36 Add lines 30, 33, 34, and 35 .. . . . . . . . . . . . . . . . . . . . . . 36

37 Enter the smaller of line 29 or line 36. . . . . . . . . . . . . . . . . . . 37

38 Credit allowed for the current year. Add lines 28 and 37.

Report the amount from line 38 (if smaller than the sum of Part I, line 6, and Part II, lines 25 and

36, see instructions) as indicated below or on the applicable line of your return.

• Individuals. Schedule 3 (Form 1040), line 54, or Form 1040NR, line 51. .

• Corporations. Form 1120, Schedule J, Part I, line 5c. . . . . . . .

• Estates and trusts. Form 1041, Schedule G, line 2b. . . . . . . . } . . . .

38

Form 3800(2018)

Part II Allowable Credit (continued)

Note: If you are not required to report any amounts on line 22 or 24 below, skip lines 18 through 25 and enter -0- on line 26.

18 Multiply line 14 by 75% (0.75). See instructions. . . . . . . . . . . . . . . . 18

19 Enter the greater of line 13 or line 18 .. . . . . . . . . . . . . . . . . . . 19

20 Subtract line 19 from line 11. If zero or less, enter -0-. . . . . . . . . . . . . . 20

21 Subtract line 17 from line 20. If zero or less, enter -0-. . . . . . . . . . . . . . 21

22 Combine the amounts from line 3 of all Parts III with box A, C, or D checked .. . . . . . 22

23 Passive activity credit from line 3 of all Parts III with box B checked23

24 Enter the applicable passive activity credit allowed for 2018. See instructions. . . . . . 24

25 Add lines 22 and 24 . . . . . . . . . . . . . . . . . . . . . . . . . 25

26 Empowerment zone and renewal community employment credit allowed. Enter the smaller of

line 21 or line 25 . . . . . . . . . . . . . . . . . . . . . . . . . . 26

27 Subtract line 13 from line 11. If zero or less, enter -0-. . . . . . . . . . . . . . 27

28 Add lines 17 and 26 . . . . . . . . . . . . . . . . . . . . . . . . . 28

29 Subtract line 28 from line 27. If zero or less, enter -0-. . . . . . . . . . . . . . 29

30 Enter the general business credit from line 5 of all Parts III with box A checked .. . . . . 30

31 Reserved . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31

32 Passive activity credits from line 5 of all Parts III with box B checked32

33 Enter the applicable passive activity credits allowed for 2018. See instructions. . . . . . 33

34 Carryforward of business credit to 2018. Enter the amount from line 5 of Part III with box C

checked and line 6 of Part III with box G checked. See instructions for statement to attach .. 34

35 Carryback of business credit from 2019. Enter the amount from line 5 of Part III with box D

checked. See instructions. . . . . . . . . . . . . . . . . . . . . . . 35

36 Add lines 30, 33, 34, and 35 .. . . . . . . . . . . . . . . . . . . . . . 36

37 Enter the smaller of line 29 or line 36. . . . . . . . . . . . . . . . . . . 37

38 Credit allowed for the current year. Add lines 28 and 37.

Report the amount from line 38 (if smaller than the sum of Part I, line 6, and Part II, lines 25 and

36, see instructions) as indicated below or on the applicable line of your return.

• Individuals. Schedule 3 (Form 1040), line 54, or Form 1040NR, line 51. .

• Corporations. Form 1120, Schedule J, Part I, line 5c. . . . . . . .

• Estates and trusts. Form 1041, Schedule G, line 2b. . . . . . . . } . . . .

38

Form 3800(2018)

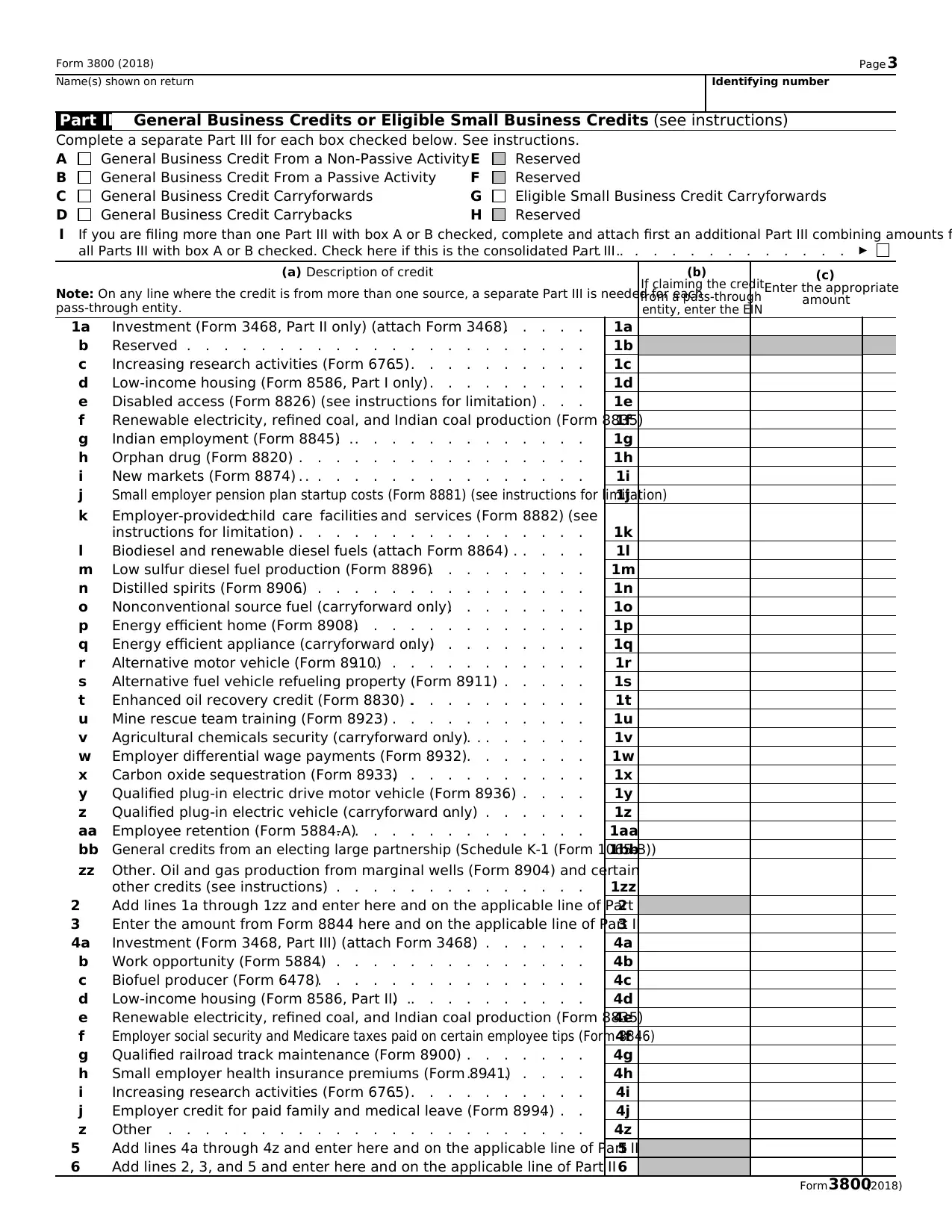

Form 3800 (2018) Page 3

Name(s) shown on return Identifying number

Part III General Business Credits or Eligible Small Business Credits (see instructions)

Complete a separate Part III for each box checked below. See instructions.

A General Business Credit From a Non-Passive Activity

B General Business Credit From a Passive Activity

C General Business Credit Carryforwards

D General Business Credit Carrybacks

E Reserved

F Reserved

G Eligible Small Business Credit Carryforwards

H Reserved

I If you are filing more than one Part III with box A or B checked, complete and attach first an additional Part III combining amounts f

all Parts III with box A or B checked. Check here if this is the consolidated Part III .. . . . . . . . . . . . . . . ▶

(a) Description of credit

Note: On any line where the credit is from more than one source, a separate Part III is needed for each

pass-through entity.

(b)

If claiming the credit

from a pass-through

entity, enter the EIN

(c)

Enter the appropriate

amount

1a Investment (Form 3468, Part II only) (attach Form 3468). . . . . . . 1a

b Reserved . . . . . . . . . . . . . . . . . . . . . . 1b

c Increasing research activities (Form 6765). . . . . . . . . . . 1c

d Low-income housing (Form 8586, Part I only). . . . . . . . . . 1d

e Disabled access (Form 8826) (see instructions for limitation). . . . . 1e

f Renewable electricity, refined coal, and Indian coal production (Form 8835)1f

g Indian employment (Form 8845) .. . . . . . . . . . . . . . 1g

h Orphan drug (Form 8820). . . . . . . . . . . . . . . . . 1h

i New markets (Form 8874) .. . . . . . . . . . . . . . . . 1i

j Small employer pension plan startup costs (Form 8881) (see instructions for limitation)1j

k Employer-providedchild care facilities and services (Form 8882) (see

instructions for limitation). . . . . . . . . . . . . . . . . 1k

l Biodiesel and renewable diesel fuels (attach Form 8864) .. . . . . . 1l

m Low sulfur diesel fuel production (Form 8896). . . . . . . . . . 1m

n Distilled spirits (Form 8906). . . . . . . . . . . . . . . . 1n

o Nonconventional source fuel (carryforward only). . . . . . . . . 1o

p Energy efficient home (Form 8908). . . . . . . . . . . . . . 1p

q Energy efficient appliance (carryforward only). . . . . . . . . . 1q

r Alternative motor vehicle (Form 8910). . . . . . . . . . . . . 1r

s Alternative fuel vehicle refueling property (Form 8911). . . . . . . 1s

t Enhanced oil recovery credit (Form 8830) .. . . . . . . . . . . 1t

u Mine rescue team training (Form 8923). . . . . . . . . . . . 1u

v Agricultural chemicals security (carryforward only) .. . . . . . . . 1v

w Employer differential wage payments (Form 8932). . . . . . . . . 1w

x Carbon oxide sequestration (Form 8933). . . . . . . . . . . . 1x

y Qualified plug-in electric drive motor vehicle (Form 8936). . . . . . 1y

z Qualified plug-in electric vehicle (carryforward only). . . . . . . . 1z

aa Employee retention (Form 5884-A). . . . . . . . . . . . . . 1aa

bb General credits from an electing large partnership (Schedule K-1 (Form 1065-B))1bb

zz Other. Oil and gas production from marginal wells (Form 8904) and certain

other credits (see instructions). . . . . . . . . . . . . . . 1zz

2 Add lines 1a through 1zz and enter here and on the applicable line of Part I2

3 Enter the amount from Form 8844 here and on the applicable line of Part II3

4a Investment (Form 3468, Part III) (attach Form 3468). . . . . . . . 4a

b Work opportunity (Form 5884). . . . . . . . . . . . . . . 4b

c Biofuel producer (Form 6478). . . . . . . . . . . . . . . 4c

d Low-income housing (Form 8586, Part II) .. . . . . . . . . . . 4d

e Renewable electricity, refined coal, and Indian coal production (Form 8835)4e

f Employer social security and Medicare taxes paid on certain employee tips (Form 8846)4f

g Qualified railroad track maintenance (Form 8900). . . . . . . . . 4g

h Small employer health insurance premiums (Form 8941). . . . . . . 4h

i Increasing research activities (Form 6765). . . . . . . . . . . 4i

j Employer credit for paid family and medical leave (Form 8994). . . . . 4j

z Other . . . . . . . . . . . . . . . . . . . . . . . 4z

5 Add lines 4a through 4z and enter here and on the applicable line of Part II5

6 Add lines 2, 3, and 5 and enter here and on the applicable line of Part II. 6

Form 3800(2018)

Name(s) shown on return Identifying number

Part III General Business Credits or Eligible Small Business Credits (see instructions)

Complete a separate Part III for each box checked below. See instructions.

A General Business Credit From a Non-Passive Activity

B General Business Credit From a Passive Activity

C General Business Credit Carryforwards

D General Business Credit Carrybacks

E Reserved

F Reserved

G Eligible Small Business Credit Carryforwards

H Reserved

I If you are filing more than one Part III with box A or B checked, complete and attach first an additional Part III combining amounts f

all Parts III with box A or B checked. Check here if this is the consolidated Part III .. . . . . . . . . . . . . . . ▶

(a) Description of credit

Note: On any line where the credit is from more than one source, a separate Part III is needed for each

pass-through entity.

(b)

If claiming the credit

from a pass-through

entity, enter the EIN

(c)

Enter the appropriate

amount

1a Investment (Form 3468, Part II only) (attach Form 3468). . . . . . . 1a

b Reserved . . . . . . . . . . . . . . . . . . . . . . 1b

c Increasing research activities (Form 6765). . . . . . . . . . . 1c

d Low-income housing (Form 8586, Part I only). . . . . . . . . . 1d

e Disabled access (Form 8826) (see instructions for limitation). . . . . 1e

f Renewable electricity, refined coal, and Indian coal production (Form 8835)1f

g Indian employment (Form 8845) .. . . . . . . . . . . . . . 1g

h Orphan drug (Form 8820). . . . . . . . . . . . . . . . . 1h

i New markets (Form 8874) .. . . . . . . . . . . . . . . . 1i

j Small employer pension plan startup costs (Form 8881) (see instructions for limitation)1j

k Employer-providedchild care facilities and services (Form 8882) (see

instructions for limitation). . . . . . . . . . . . . . . . . 1k

l Biodiesel and renewable diesel fuels (attach Form 8864) .. . . . . . 1l

m Low sulfur diesel fuel production (Form 8896). . . . . . . . . . 1m

n Distilled spirits (Form 8906). . . . . . . . . . . . . . . . 1n

o Nonconventional source fuel (carryforward only). . . . . . . . . 1o

p Energy efficient home (Form 8908). . . . . . . . . . . . . . 1p

q Energy efficient appliance (carryforward only). . . . . . . . . . 1q

r Alternative motor vehicle (Form 8910). . . . . . . . . . . . . 1r

s Alternative fuel vehicle refueling property (Form 8911). . . . . . . 1s

t Enhanced oil recovery credit (Form 8830) .. . . . . . . . . . . 1t

u Mine rescue team training (Form 8923). . . . . . . . . . . . 1u

v Agricultural chemicals security (carryforward only) .. . . . . . . . 1v

w Employer differential wage payments (Form 8932). . . . . . . . . 1w

x Carbon oxide sequestration (Form 8933). . . . . . . . . . . . 1x

y Qualified plug-in electric drive motor vehicle (Form 8936). . . . . . 1y

z Qualified plug-in electric vehicle (carryforward only). . . . . . . . 1z

aa Employee retention (Form 5884-A). . . . . . . . . . . . . . 1aa

bb General credits from an electing large partnership (Schedule K-1 (Form 1065-B))1bb

zz Other. Oil and gas production from marginal wells (Form 8904) and certain

other credits (see instructions). . . . . . . . . . . . . . . 1zz

2 Add lines 1a through 1zz and enter here and on the applicable line of Part I2

3 Enter the amount from Form 8844 here and on the applicable line of Part II3

4a Investment (Form 3468, Part III) (attach Form 3468). . . . . . . . 4a

b Work opportunity (Form 5884). . . . . . . . . . . . . . . 4b

c Biofuel producer (Form 6478). . . . . . . . . . . . . . . 4c

d Low-income housing (Form 8586, Part II) .. . . . . . . . . . . 4d

e Renewable electricity, refined coal, and Indian coal production (Form 8835)4e

f Employer social security and Medicare taxes paid on certain employee tips (Form 8846)4f

g Qualified railroad track maintenance (Form 8900). . . . . . . . . 4g

h Small employer health insurance premiums (Form 8941). . . . . . . 4h

i Increasing research activities (Form 6765). . . . . . . . . . . 4i

j Employer credit for paid family and medical leave (Form 8994). . . . . 4j

z Other . . . . . . . . . . . . . . . . . . . . . . . 4z

5 Add lines 4a through 4z and enter here and on the applicable line of Part II5

6 Add lines 2, 3, and 5 and enter here and on the applicable line of Part II. 6

Form 3800(2018)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 3

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.