FIN5FMA - Analysis of Financial Policies at Fortescue Metals Group

VerifiedAdded on 2023/06/11

|7

|1138

|395

Report

AI Summary

This report provides a financial analysis of Fortescue Metals Group Limited, focusing on its weighted average cost of capital (WACC), capital structure, dividend policy, and overall financial policies. The WACC is calculated to be 4.41%, indicating the company's cost of capital. The capital structure, with a debt-to-equity ratio of 51:49, is deemed optimal. The company follows a relevant dividend policy, though the payout ratio fluctuates due to various factors. The report also highlights the positive impact of dividend announcements on the company's stock price. Overall, the analysis suggests that Fortescue Metals Group maintains sound financial and corporate policies, contributing to its positive market performance. Appendix includes calculations for cost of debt, cost of equity, and dividend payout ratio.

Running Head: Financial Management

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial Management

2

Contents

Introduction:.....................................................................................................................3

Fortescue Metals group limited overview:.......................................................................3

Fortescue Metals group limited’s weighted average cost of capital:................................3

Fortescue Metals group limited’s cost of capital:.............................................................4

Fortescue Metals group limited’s dividend structure:......................................................5

Fortescue Metals group limited’s corporate financial policies:........................................5

Conclusion:.......................................................................................................................5

References:.......................................................................................................................6

Appendix:.........................................................................................................................7

2

Contents

Introduction:.....................................................................................................................3

Fortescue Metals group limited overview:.......................................................................3

Fortescue Metals group limited’s weighted average cost of capital:................................3

Fortescue Metals group limited’s cost of capital:.............................................................4

Fortescue Metals group limited’s dividend structure:......................................................5

Fortescue Metals group limited’s corporate financial policies:........................................5

Conclusion:.......................................................................................................................5

References:.......................................................................................................................6

Appendix:.........................................................................................................................7

Financial Management

3

Introduction:

The report emphasizes on the Fortescue Metals group limited. In this report, the

performance of the company has been measured to identify the market performance and the

investment position of the company. In the report, modern financial analysis techniques have

been applied on the company to measure the performance.

Fortescue Metals group limited overview:

The company is running its operations under the iron ore manufacturing industry. The

main operations of the company include production and exploration of iron ore in Australian

market. Company has started operating its business in the year of 2003 (Home,

2018).Company has been awarded as amongst the top 5 iron ore production companies.

Fortescue Metals group limited’s weighted average cost of capital:

Total cost of capital of an organization can be calculated on the basis of the weighted

average cost of capital of the company. Weighted average cost of capital (WACC) of an

organization could be derived from the total cost of equity and total cost of debt of the

company. Cost of equity and cost of debt is multiplied from their capital fraction to measure

the total capital of the company.

In case of Fortescue Metals group limited, cost of equity and cost of debt of the

company is 5.05% and 3.75%. It further explains that the cost of equity and cost of debt of

the company is 5.05% and 3.75%. The fraction of debt and equity in context with the capital

of the company is 49.08 and 50.92%.

So, the WACC of the company is:

= (5.05% * 49.08) + (3.75% + 50.92%)

= (0.0183+ 0.025)

= 4.41% (Annual report, 2017)

The measurements and the analysis on Weighted average cost of capital explains that

the total cost of capital of the company in current scenario is 4.41%. It explains about the cost

3

Introduction:

The report emphasizes on the Fortescue Metals group limited. In this report, the

performance of the company has been measured to identify the market performance and the

investment position of the company. In the report, modern financial analysis techniques have

been applied on the company to measure the performance.

Fortescue Metals group limited overview:

The company is running its operations under the iron ore manufacturing industry. The

main operations of the company include production and exploration of iron ore in Australian

market. Company has started operating its business in the year of 2003 (Home,

2018).Company has been awarded as amongst the top 5 iron ore production companies.

Fortescue Metals group limited’s weighted average cost of capital:

Total cost of capital of an organization can be calculated on the basis of the weighted

average cost of capital of the company. Weighted average cost of capital (WACC) of an

organization could be derived from the total cost of equity and total cost of debt of the

company. Cost of equity and cost of debt is multiplied from their capital fraction to measure

the total capital of the company.

In case of Fortescue Metals group limited, cost of equity and cost of debt of the

company is 5.05% and 3.75%. It further explains that the cost of equity and cost of debt of

the company is 5.05% and 3.75%. The fraction of debt and equity in context with the capital

of the company is 49.08 and 50.92%.

So, the WACC of the company is:

= (5.05% * 49.08) + (3.75% + 50.92%)

= (0.0183+ 0.025)

= 4.41% (Annual report, 2017)

The measurements and the analysis on Weighted average cost of capital explains that

the total cost of capital of the company in current scenario is 4.41%. It explains about the cost

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial Management

4

of the company’s capital. Company must ensure that the projects and the investment of the

company offer more than 4.41%.

Fortescue Metals group limited’s cost of capital:

Capital structure is a systematic approach which focuses on the financing of business

activities on the basis of the combination of liabilities and the equities. Capital structure

techniques explore the companionship among the equity and debt of the company. It briefs

about the risk and return position of an organization.

Annual report (2017) of Fortescue Metals group limited explains that the debt and

equity of the company is 51% and 49% respectively.

(Annual report, 2017)

The capital structure of the company is 51:49. The cost of equity is 5.05% and the Cost

of debt of the company is 3.75%. It explains that if the debt amount is increased more than

the cost of capital of the company would be reduced.

However, if the risk position is concerned than the debt position of the company must

be lower than the equity of the company. So, the current position of the company is optimal.

Company should not make further changes in the structure.

4

of the company’s capital. Company must ensure that the projects and the investment of the

company offer more than 4.41%.

Fortescue Metals group limited’s cost of capital:

Capital structure is a systematic approach which focuses on the financing of business

activities on the basis of the combination of liabilities and the equities. Capital structure

techniques explore the companionship among the equity and debt of the company. It briefs

about the risk and return position of an organization.

Annual report (2017) of Fortescue Metals group limited explains that the debt and

equity of the company is 51% and 49% respectively.

(Annual report, 2017)

The capital structure of the company is 51:49. The cost of equity is 5.05% and the Cost

of debt of the company is 3.75%. It explains that if the debt amount is increased more than

the cost of capital of the company would be reduced.

However, if the risk position is concerned than the debt position of the company must

be lower than the equity of the company. So, the current position of the company is optimal.

Company should not make further changes in the structure.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial Management

5

Fortescue Metals group limited’s dividend structure:

Dividend is the return amount given to the shareholders of the company against their

investment after a particular time period. Dividend policies are of two types: relevant and

irrelevant dividend policies. The company follows the relevant dividend policy as the

dividend payout ratio of the company is better.

The dividend policy of the company explains that the target policy of the company is

relevant dividend policy. However, the payout ratio of the company is not stable. The payout

ratio has been affected due to taxation factor, economical factors and the profitability level of

the company.

Fortescue Metals group limited’s corporate financial policies:

Dividend amount has been announced by company on 10th July 2017 last time. The

dividend announcement has affected the stock price of the company. The share price was $

5.21 per share and the stock was 3,113.798 million. Study on Yahoo finance (2018) briefs

that the dividend announcement has positively impacted on the share price of the company.

The dividend announcement of the company is most crucial part which could impact on

the market position of the company in depth. The policy of Fortescue Metals Group Limited

explains that the company has maintained the policies in better way.

Conclusion:

The WACC position of the company is quite better. Optimal capital structure has been

maintained by the company. Relevant dividend policies are followed by the company.

Dividend offerings are also better. Financial and corporate policies of the company is

attractive. It explains about better performance.

5

Fortescue Metals group limited’s dividend structure:

Dividend is the return amount given to the shareholders of the company against their

investment after a particular time period. Dividend policies are of two types: relevant and

irrelevant dividend policies. The company follows the relevant dividend policy as the

dividend payout ratio of the company is better.

The dividend policy of the company explains that the target policy of the company is

relevant dividend policy. However, the payout ratio of the company is not stable. The payout

ratio has been affected due to taxation factor, economical factors and the profitability level of

the company.

Fortescue Metals group limited’s corporate financial policies:

Dividend amount has been announced by company on 10th July 2017 last time. The

dividend announcement has affected the stock price of the company. The share price was $

5.21 per share and the stock was 3,113.798 million. Study on Yahoo finance (2018) briefs

that the dividend announcement has positively impacted on the share price of the company.

The dividend announcement of the company is most crucial part which could impact on

the market position of the company in depth. The policy of Fortescue Metals Group Limited

explains that the company has maintained the policies in better way.

Conclusion:

The WACC position of the company is quite better. Optimal capital structure has been

maintained by the company. Relevant dividend policies are followed by the company.

Dividend offerings are also better. Financial and corporate policies of the company is

attractive. It explains about better performance.

Financial Management

6

References:

Annual report. 2013. Fortescue Metals group limited. Available at:

https://www.fmg.co.nz/globalassets/about-fmg/corporate-information/annual-report-and-

publications/fmg-annual-report-2013.pdf (accessed 27/05/2018).

Home. 2018. Fortescue Metals group limited. Available at: https://www.fmg.co.nz/ (accessed

27/05/2018).

Yahoo finance. 2018. Fortescue Metals group limited. Available at:

https://finance.yahoo.com/quote/FMG.AX/history?

period1=1495436782&period2=1526972782&interval=1d&filter=history&frequency=1d

(accessed 27/05/2018).

6

References:

Annual report. 2013. Fortescue Metals group limited. Available at:

https://www.fmg.co.nz/globalassets/about-fmg/corporate-information/annual-report-and-

publications/fmg-annual-report-2013.pdf (accessed 27/05/2018).

Home. 2018. Fortescue Metals group limited. Available at: https://www.fmg.co.nz/ (accessed

27/05/2018).

Yahoo finance. 2018. Fortescue Metals group limited. Available at:

https://finance.yahoo.com/quote/FMG.AX/history?

period1=1495436782&period2=1526972782&interval=1d&filter=history&frequency=1d

(accessed 27/05/2018).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial Management

7

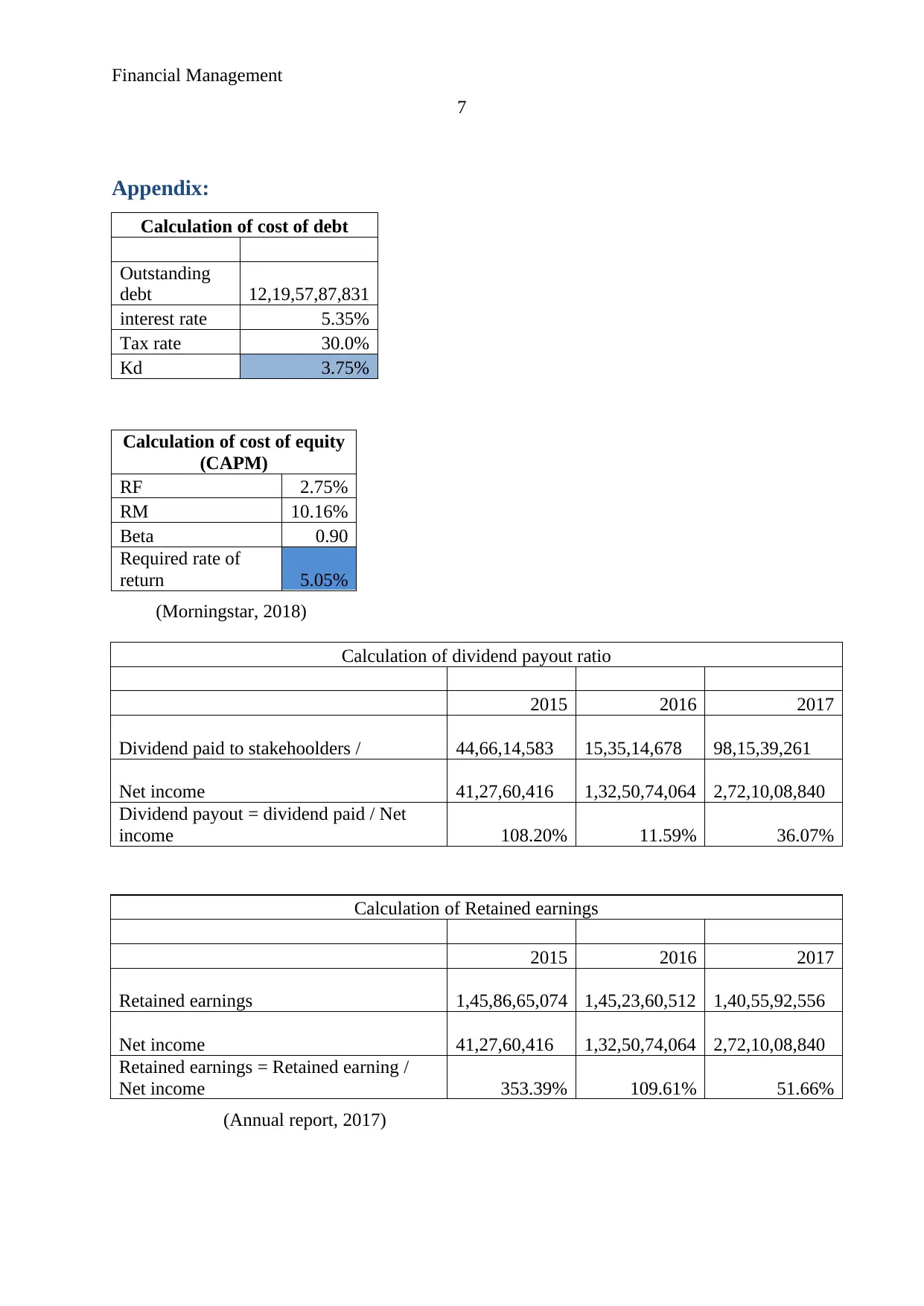

Appendix:

Calculation of cost of debt

Outstanding

debt 12,19,57,87,831

interest rate 5.35%

Tax rate 30.0%

Kd 3.75%

Calculation of cost of equity

(CAPM)

RF 2.75%

RM 10.16%

Beta 0.90

Required rate of

return 5.05%

(Morningstar, 2018)

Calculation of dividend payout ratio

2015 2016 2017

Dividend paid to stakehoolders / 44,66,14,583 15,35,14,678 98,15,39,261

Net income 41,27,60,416 1,32,50,74,064 2,72,10,08,840

Dividend payout = dividend paid / Net

income 108.20% 11.59% 36.07%

Calculation of Retained earnings

2015 2016 2017

Retained earnings 1,45,86,65,074 1,45,23,60,512 1,40,55,92,556

Net income 41,27,60,416 1,32,50,74,064 2,72,10,08,840

Retained earnings = Retained earning /

Net income 353.39% 109.61% 51.66%

(Annual report, 2017)

7

Appendix:

Calculation of cost of debt

Outstanding

debt 12,19,57,87,831

interest rate 5.35%

Tax rate 30.0%

Kd 3.75%

Calculation of cost of equity

(CAPM)

RF 2.75%

RM 10.16%

Beta 0.90

Required rate of

return 5.05%

(Morningstar, 2018)

Calculation of dividend payout ratio

2015 2016 2017

Dividend paid to stakehoolders / 44,66,14,583 15,35,14,678 98,15,39,261

Net income 41,27,60,416 1,32,50,74,064 2,72,10,08,840

Dividend payout = dividend paid / Net

income 108.20% 11.59% 36.07%

Calculation of Retained earnings

2015 2016 2017

Retained earnings 1,45,86,65,074 1,45,23,60,512 1,40,55,92,556

Net income 41,27,60,416 1,32,50,74,064 2,72,10,08,840

Retained earnings = Retained earning /

Net income 353.39% 109.61% 51.66%

(Annual report, 2017)

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.