Fraud Risk Assessment and Internal Controls for Hot Line Audit Report

VerifiedAdded on 2020/01/28

|9

|2445

|253

Report

AI Summary

This report conducts a fraud audit for Hot Line, a national surf wear retail chain. It identifies various fraud risks, including breach of covenant, fictitious invoices, ineffective material quality, decline in profitability, and concealment of information. The report explains the incentives, pressures, opportunities, and rationalizations behind these fraudulent activities. It recommends internal control mechanisms to mitigate these risks, such as segregating duties, implementing effective quality control, verifying transactions, and improving communication. The conclusion emphasizes the importance of consistent management oversight and monitoring to prevent fraud and ensure the accuracy and fairness of Hot Line's financial statements. The report provides detailed explanations and recommendations for the audit of Hot Line.

Auditing

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION................................................................................................................................3

1. Identify and explain fraud risk factor in relation to the audit of Hot line....................................3

2. Incentives, pressures and opportunities to commit financial report fraud and attitude and

rationalisation to justify a fraud.......................................................................................................5

3. Recommend internal control mechanism to mitigate risk of fraud company's financial

statement..........................................................................................................................................6

CONCLUSION ...................................................................................................................................7

REFERENCES.....................................................................................................................................8

2

INTRODUCTION................................................................................................................................3

1. Identify and explain fraud risk factor in relation to the audit of Hot line....................................3

2. Incentives, pressures and opportunities to commit financial report fraud and attitude and

rationalisation to justify a fraud.......................................................................................................5

3. Recommend internal control mechanism to mitigate risk of fraud company's financial

statement..........................................................................................................................................6

CONCLUSION ...................................................................................................................................7

REFERENCES.....................................................................................................................................8

2

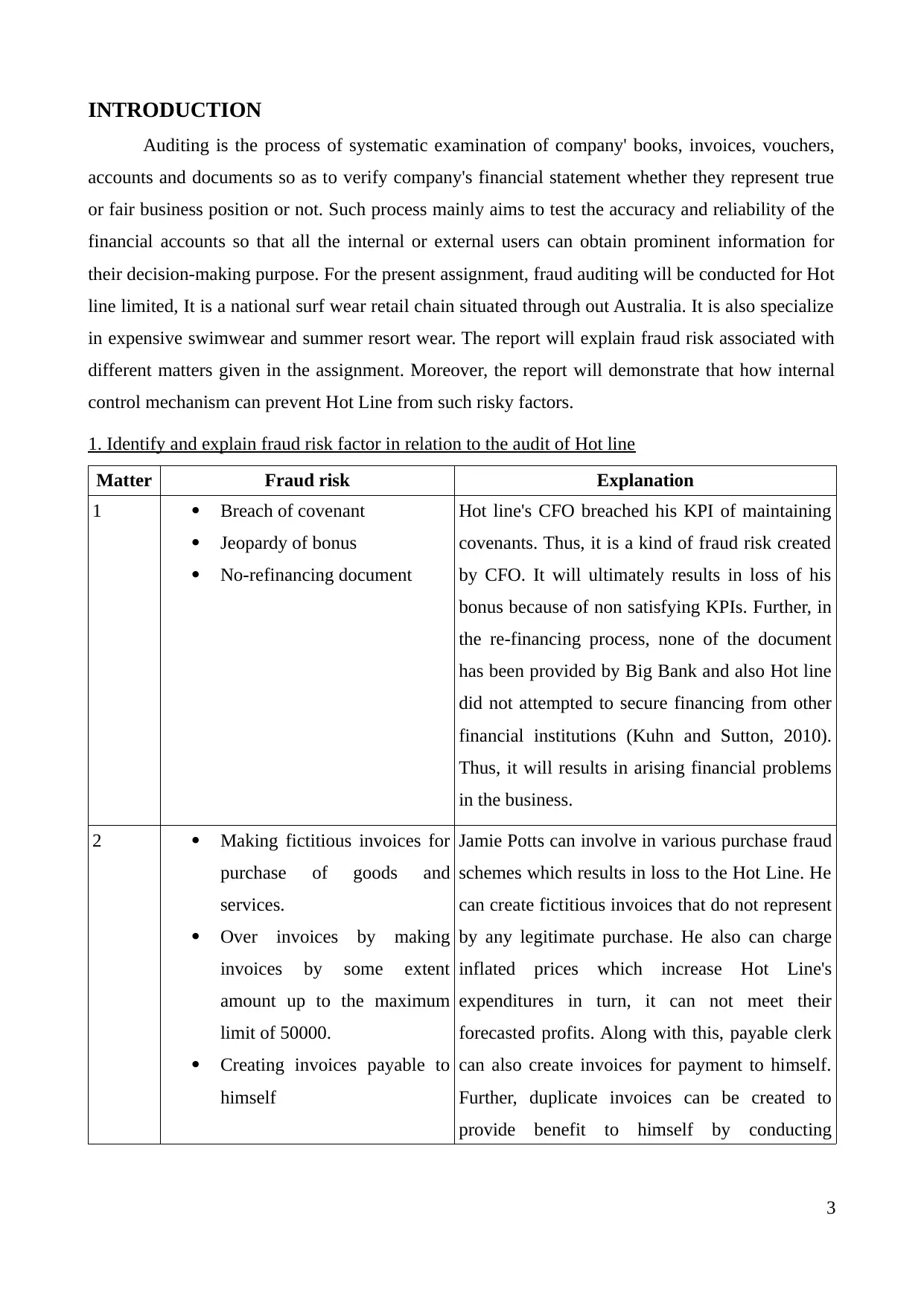

INTRODUCTION

Auditing is the process of systematic examination of company' books, invoices, vouchers,

accounts and documents so as to verify company's financial statement whether they represent true

or fair business position or not. Such process mainly aims to test the accuracy and reliability of the

financial accounts so that all the internal or external users can obtain prominent information for

their decision-making purpose. For the present assignment, fraud auditing will be conducted for Hot

line limited, It is a national surf wear retail chain situated through out Australia. It is also specialize

in expensive swimwear and summer resort wear. The report will explain fraud risk associated with

different matters given in the assignment. Moreover, the report will demonstrate that how internal

control mechanism can prevent Hot Line from such risky factors.

1. Identify and explain fraud risk factor in relation to the audit of Hot line

Matter Fraud risk Explanation

1 Breach of covenant

Jeopardy of bonus

No-refinancing document

Hot line's CFO breached his KPI of maintaining

covenants. Thus, it is a kind of fraud risk created

by CFO. It will ultimately results in loss of his

bonus because of non satisfying KPIs. Further, in

the re-financing process, none of the document

has been provided by Big Bank and also Hot line

did not attempted to secure financing from other

financial institutions (Kuhn and Sutton, 2010).

Thus, it will results in arising financial problems

in the business.

2 Making fictitious invoices for

purchase of goods and

services.

Over invoices by making

invoices by some extent

amount up to the maximum

limit of 50000.

Creating invoices payable to

himself

Jamie Potts can involve in various purchase fraud

schemes which results in loss to the Hot Line. He

can create fictitious invoices that do not represent

by any legitimate purchase. He also can charge

inflated prices which increase Hot Line's

expenditures in turn, it can not meet their

forecasted profits. Along with this, payable clerk

can also create invoices for payment to himself.

Further, duplicate invoices can be created to

provide benefit to himself by conducting

3

Auditing is the process of systematic examination of company' books, invoices, vouchers,

accounts and documents so as to verify company's financial statement whether they represent true

or fair business position or not. Such process mainly aims to test the accuracy and reliability of the

financial accounts so that all the internal or external users can obtain prominent information for

their decision-making purpose. For the present assignment, fraud auditing will be conducted for Hot

line limited, It is a national surf wear retail chain situated through out Australia. It is also specialize

in expensive swimwear and summer resort wear. The report will explain fraud risk associated with

different matters given in the assignment. Moreover, the report will demonstrate that how internal

control mechanism can prevent Hot Line from such risky factors.

1. Identify and explain fraud risk factor in relation to the audit of Hot line

Matter Fraud risk Explanation

1 Breach of covenant

Jeopardy of bonus

No-refinancing document

Hot line's CFO breached his KPI of maintaining

covenants. Thus, it is a kind of fraud risk created

by CFO. It will ultimately results in loss of his

bonus because of non satisfying KPIs. Further, in

the re-financing process, none of the document

has been provided by Big Bank and also Hot line

did not attempted to secure financing from other

financial institutions (Kuhn and Sutton, 2010).

Thus, it will results in arising financial problems

in the business.

2 Making fictitious invoices for

purchase of goods and

services.

Over invoices by making

invoices by some extent

amount up to the maximum

limit of 50000.

Creating invoices payable to

himself

Jamie Potts can involve in various purchase fraud

schemes which results in loss to the Hot Line. He

can create fictitious invoices that do not represent

by any legitimate purchase. He also can charge

inflated prices which increase Hot Line's

expenditures in turn, it can not meet their

forecasted profits. Along with this, payable clerk

can also create invoices for payment to himself.

Further, duplicate invoices can be created to

provide benefit to himself by conducting

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

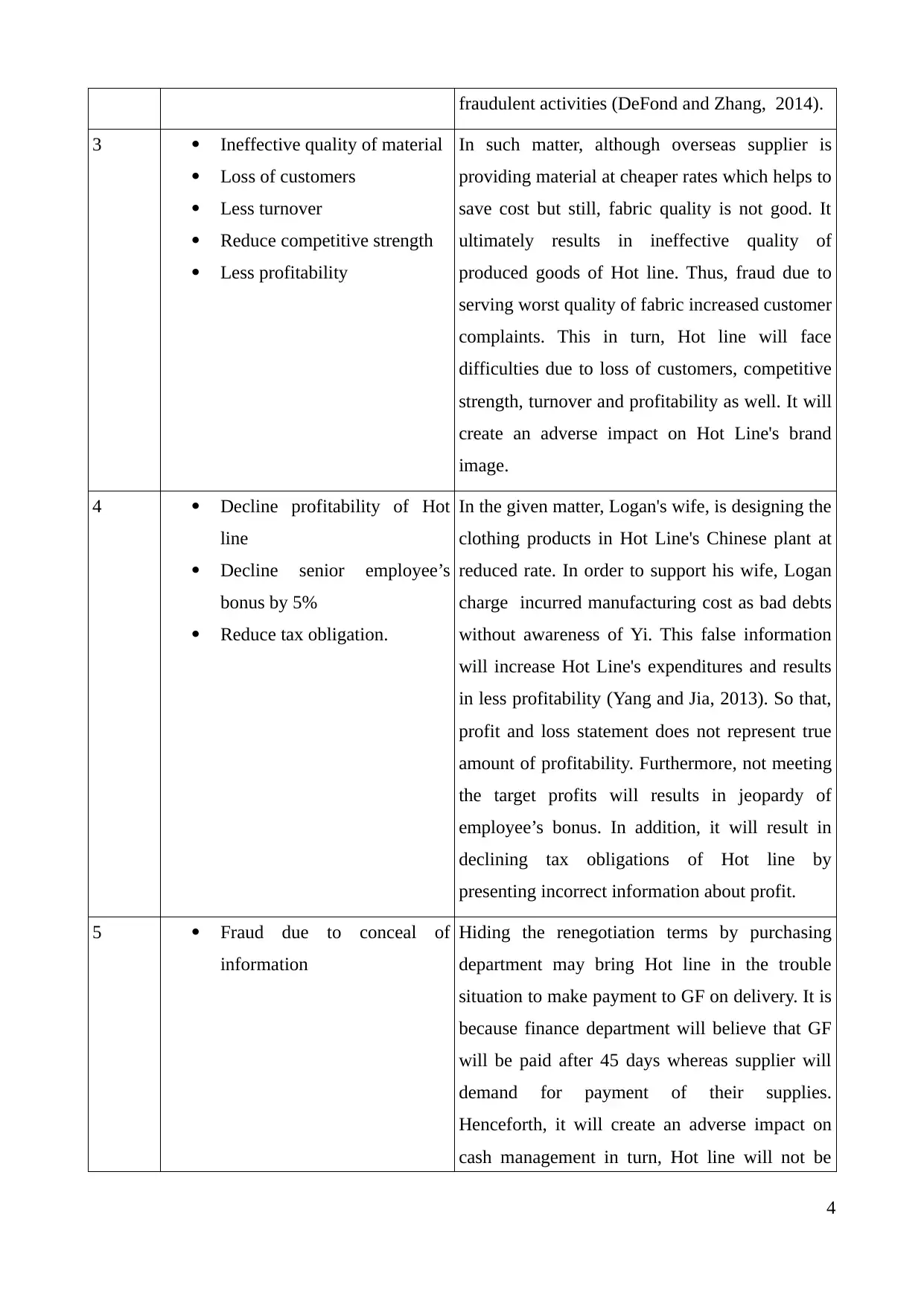

fraudulent activities (DeFond and Zhang, 2014).

3 Ineffective quality of material

Loss of customers

Less turnover

Reduce competitive strength

Less profitability

In such matter, although overseas supplier is

providing material at cheaper rates which helps to

save cost but still, fabric quality is not good. It

ultimately results in ineffective quality of

produced goods of Hot line. Thus, fraud due to

serving worst quality of fabric increased customer

complaints. This in turn, Hot line will face

difficulties due to loss of customers, competitive

strength, turnover and profitability as well. It will

create an adverse impact on Hot Line's brand

image.

4 Decline profitability of Hot

line

Decline senior employee’s

bonus by 5%

Reduce tax obligation.

In the given matter, Logan's wife, is designing the

clothing products in Hot Line's Chinese plant at

reduced rate. In order to support his wife, Logan

charge incurred manufacturing cost as bad debts

without awareness of Yi. This false information

will increase Hot Line's expenditures and results

in less profitability (Yang and Jia, 2013). So that,

profit and loss statement does not represent true

amount of profitability. Furthermore, not meeting

the target profits will results in jeopardy of

employee’s bonus. In addition, it will result in

declining tax obligations of Hot line by

presenting incorrect information about profit.

5 Fraud due to conceal of

information

Hiding the renegotiation terms by purchasing

department may bring Hot line in the trouble

situation to make payment to GF on delivery. It is

because finance department will believe that GF

will be paid after 45 days whereas supplier will

demand for payment of their supplies.

Henceforth, it will create an adverse impact on

cash management in turn, Hot line will not be

4

3 Ineffective quality of material

Loss of customers

Less turnover

Reduce competitive strength

Less profitability

In such matter, although overseas supplier is

providing material at cheaper rates which helps to

save cost but still, fabric quality is not good. It

ultimately results in ineffective quality of

produced goods of Hot line. Thus, fraud due to

serving worst quality of fabric increased customer

complaints. This in turn, Hot line will face

difficulties due to loss of customers, competitive

strength, turnover and profitability as well. It will

create an adverse impact on Hot Line's brand

image.

4 Decline profitability of Hot

line

Decline senior employee’s

bonus by 5%

Reduce tax obligation.

In the given matter, Logan's wife, is designing the

clothing products in Hot Line's Chinese plant at

reduced rate. In order to support his wife, Logan

charge incurred manufacturing cost as bad debts

without awareness of Yi. This false information

will increase Hot Line's expenditures and results

in less profitability (Yang and Jia, 2013). So that,

profit and loss statement does not represent true

amount of profitability. Furthermore, not meeting

the target profits will results in jeopardy of

employee’s bonus. In addition, it will result in

declining tax obligations of Hot line by

presenting incorrect information about profit.

5 Fraud due to conceal of

information

Hiding the renegotiation terms by purchasing

department may bring Hot line in the trouble

situation to make payment to GF on delivery. It is

because finance department will believe that GF

will be paid after 45 days whereas supplier will

demand for payment of their supplies.

Henceforth, it will create an adverse impact on

cash management in turn, Hot line will not be

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

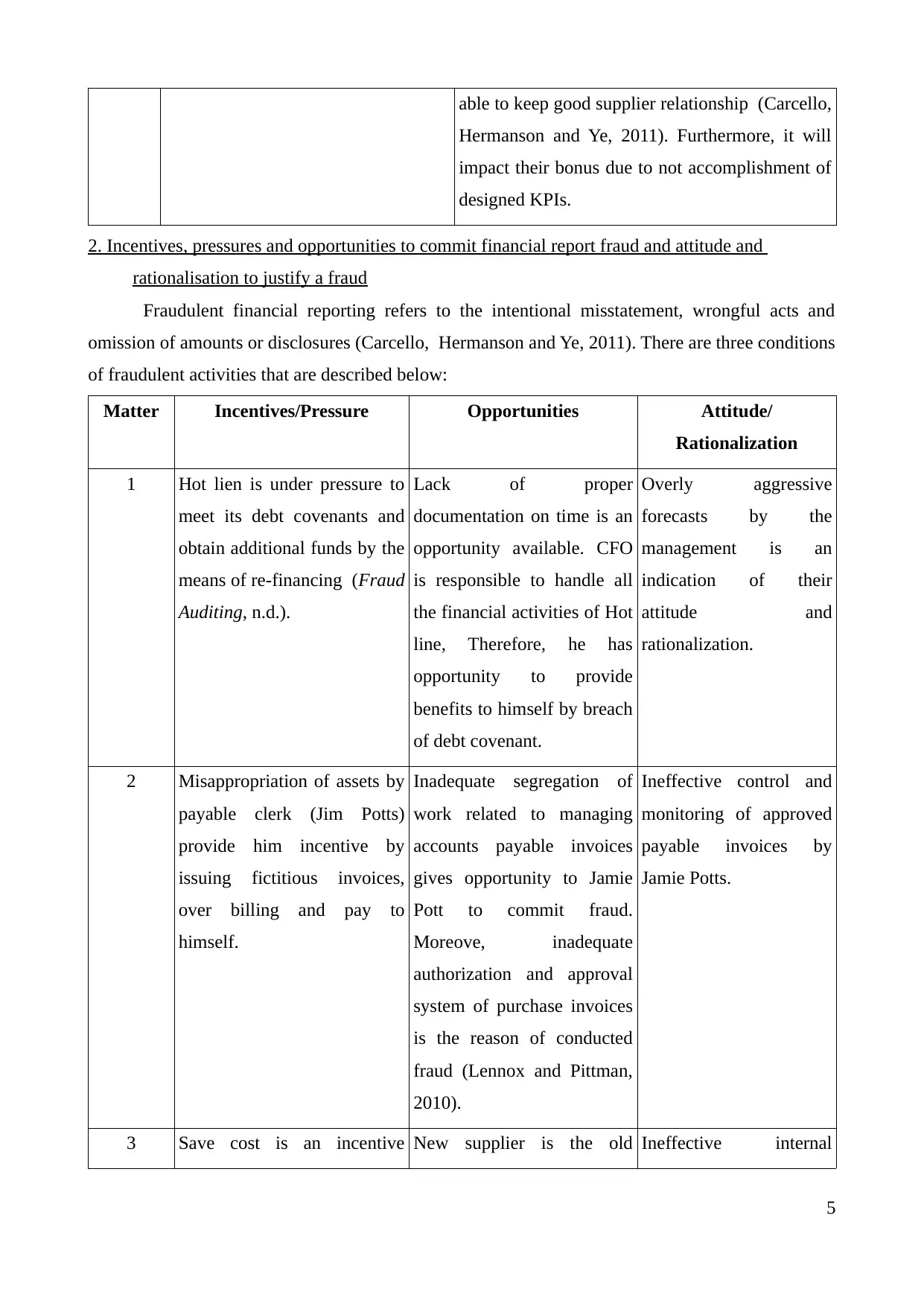

able to keep good supplier relationship (Carcello,

Hermanson and Ye, 2011). Furthermore, it will

impact their bonus due to not accomplishment of

designed KPIs.

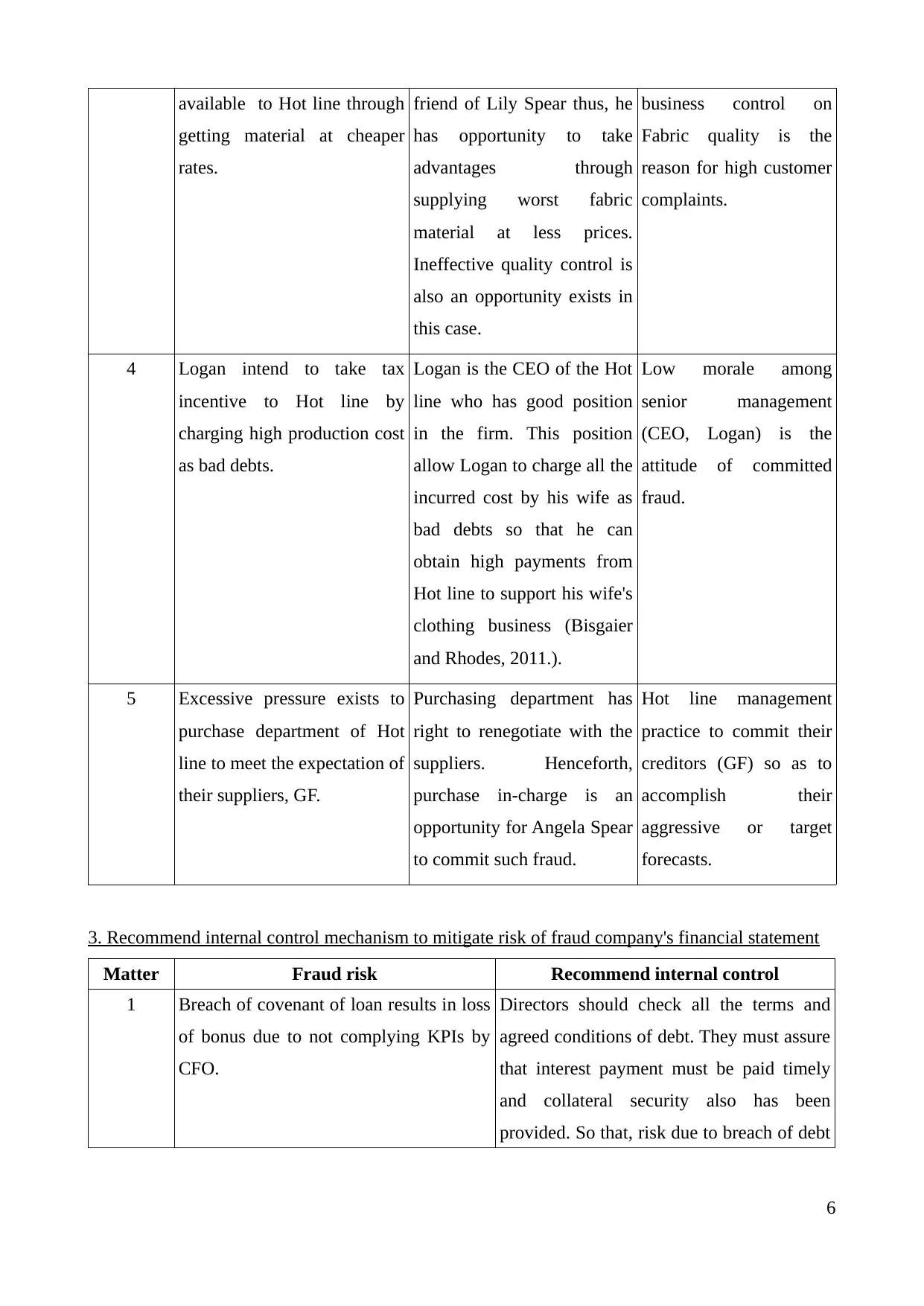

2. Incentives, pressures and opportunities to commit financial report fraud and attitude and

rationalisation to justify a fraud

Fraudulent financial reporting refers to the intentional misstatement, wrongful acts and

omission of amounts or disclosures (Carcello, Hermanson and Ye, 2011). There are three conditions

of fraudulent activities that are described below:

Matter Incentives/Pressure Opportunities Attitude/

Rationalization

1 Hot lien is under pressure to

meet its debt covenants and

obtain additional funds by the

means of re-financing (Fraud

Auditing, n.d.).

Lack of proper

documentation on time is an

opportunity available. CFO

is responsible to handle all

the financial activities of Hot

line, Therefore, he has

opportunity to provide

benefits to himself by breach

of debt covenant.

Overly aggressive

forecasts by the

management is an

indication of their

attitude and

rationalization.

2 Misappropriation of assets by

payable clerk (Jim Potts)

provide him incentive by

issuing fictitious invoices,

over billing and pay to

himself.

Inadequate segregation of

work related to managing

accounts payable invoices

gives opportunity to Jamie

Pott to commit fraud.

Moreove, inadequate

authorization and approval

system of purchase invoices

is the reason of conducted

fraud (Lennox and Pittman,

2010).

Ineffective control and

monitoring of approved

payable invoices by

Jamie Potts.

3 Save cost is an incentive New supplier is the old Ineffective internal

5

Hermanson and Ye, 2011). Furthermore, it will

impact their bonus due to not accomplishment of

designed KPIs.

2. Incentives, pressures and opportunities to commit financial report fraud and attitude and

rationalisation to justify a fraud

Fraudulent financial reporting refers to the intentional misstatement, wrongful acts and

omission of amounts or disclosures (Carcello, Hermanson and Ye, 2011). There are three conditions

of fraudulent activities that are described below:

Matter Incentives/Pressure Opportunities Attitude/

Rationalization

1 Hot lien is under pressure to

meet its debt covenants and

obtain additional funds by the

means of re-financing (Fraud

Auditing, n.d.).

Lack of proper

documentation on time is an

opportunity available. CFO

is responsible to handle all

the financial activities of Hot

line, Therefore, he has

opportunity to provide

benefits to himself by breach

of debt covenant.

Overly aggressive

forecasts by the

management is an

indication of their

attitude and

rationalization.

2 Misappropriation of assets by

payable clerk (Jim Potts)

provide him incentive by

issuing fictitious invoices,

over billing and pay to

himself.

Inadequate segregation of

work related to managing

accounts payable invoices

gives opportunity to Jamie

Pott to commit fraud.

Moreove, inadequate

authorization and approval

system of purchase invoices

is the reason of conducted

fraud (Lennox and Pittman,

2010).

Ineffective control and

monitoring of approved

payable invoices by

Jamie Potts.

3 Save cost is an incentive New supplier is the old Ineffective internal

5

available to Hot line through

getting material at cheaper

rates.

friend of Lily Spear thus, he

has opportunity to take

advantages through

supplying worst fabric

material at less prices.

Ineffective quality control is

also an opportunity exists in

this case.

business control on

Fabric quality is the

reason for high customer

complaints.

4 Logan intend to take tax

incentive to Hot line by

charging high production cost

as bad debts.

Logan is the CEO of the Hot

line who has good position

in the firm. This position

allow Logan to charge all the

incurred cost by his wife as

bad debts so that he can

obtain high payments from

Hot line to support his wife's

clothing business (Bisgaier

and Rhodes, 2011.).

Low morale among

senior management

(CEO, Logan) is the

attitude of committed

fraud.

5 Excessive pressure exists to

purchase department of Hot

line to meet the expectation of

their suppliers, GF.

Purchasing department has

right to renegotiate with the

suppliers. Henceforth,

purchase in-charge is an

opportunity for Angela Spear

to commit such fraud.

Hot line management

practice to commit their

creditors (GF) so as to

accomplish their

aggressive or target

forecasts.

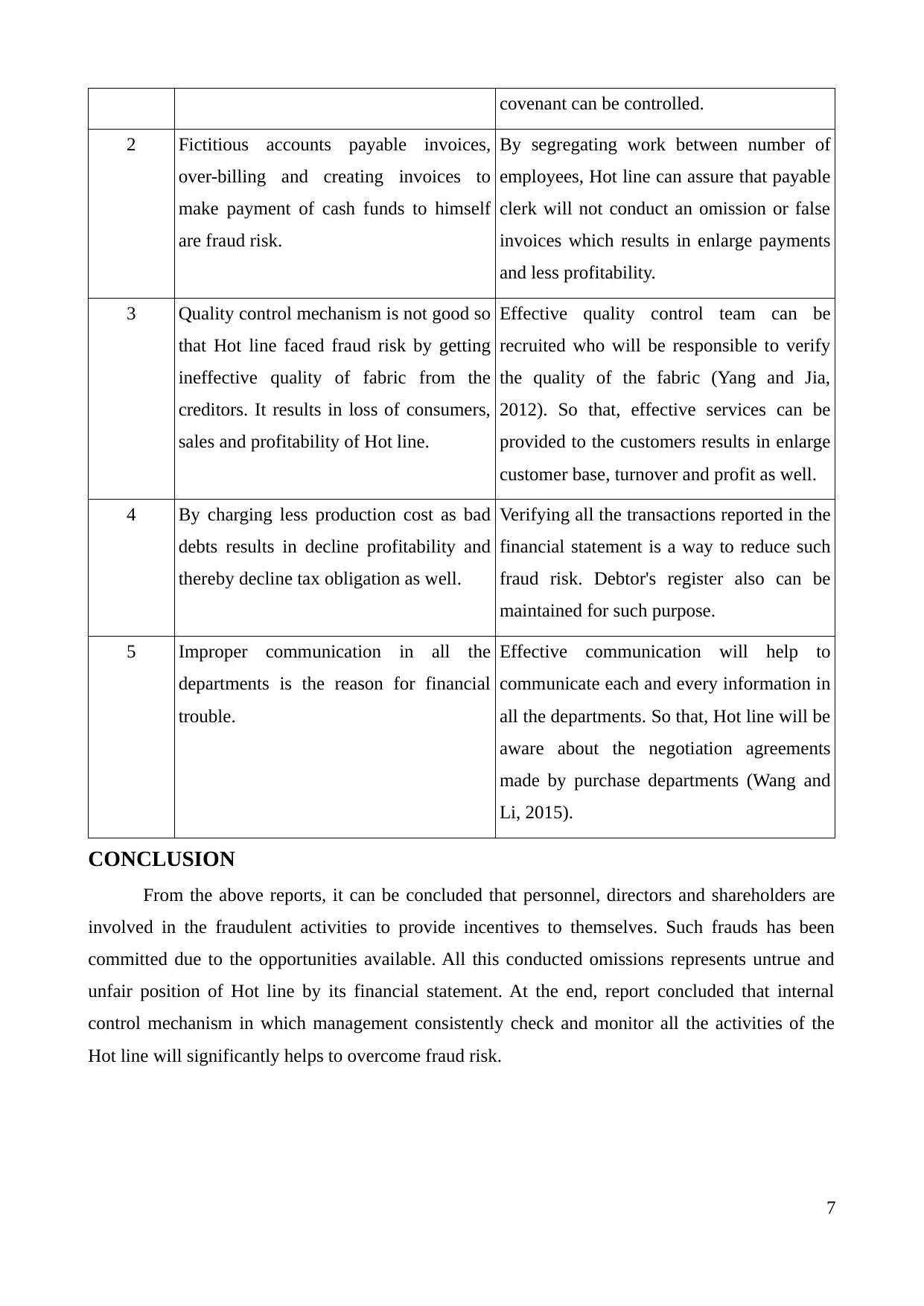

3. Recommend internal control mechanism to mitigate risk of fraud company's financial statement

Matter Fraud risk Recommend internal control

1 Breach of covenant of loan results in loss

of bonus due to not complying KPIs by

CFO.

Directors should check all the terms and

agreed conditions of debt. They must assure

that interest payment must be paid timely

and collateral security also has been

provided. So that, risk due to breach of debt

6

getting material at cheaper

rates.

friend of Lily Spear thus, he

has opportunity to take

advantages through

supplying worst fabric

material at less prices.

Ineffective quality control is

also an opportunity exists in

this case.

business control on

Fabric quality is the

reason for high customer

complaints.

4 Logan intend to take tax

incentive to Hot line by

charging high production cost

as bad debts.

Logan is the CEO of the Hot

line who has good position

in the firm. This position

allow Logan to charge all the

incurred cost by his wife as

bad debts so that he can

obtain high payments from

Hot line to support his wife's

clothing business (Bisgaier

and Rhodes, 2011.).

Low morale among

senior management

(CEO, Logan) is the

attitude of committed

fraud.

5 Excessive pressure exists to

purchase department of Hot

line to meet the expectation of

their suppliers, GF.

Purchasing department has

right to renegotiate with the

suppliers. Henceforth,

purchase in-charge is an

opportunity for Angela Spear

to commit such fraud.

Hot line management

practice to commit their

creditors (GF) so as to

accomplish their

aggressive or target

forecasts.

3. Recommend internal control mechanism to mitigate risk of fraud company's financial statement

Matter Fraud risk Recommend internal control

1 Breach of covenant of loan results in loss

of bonus due to not complying KPIs by

CFO.

Directors should check all the terms and

agreed conditions of debt. They must assure

that interest payment must be paid timely

and collateral security also has been

provided. So that, risk due to breach of debt

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

covenant can be controlled.

2 Fictitious accounts payable invoices,

over-billing and creating invoices to

make payment of cash funds to himself

are fraud risk.

By segregating work between number of

employees, Hot line can assure that payable

clerk will not conduct an omission or false

invoices which results in enlarge payments

and less profitability.

3 Quality control mechanism is not good so

that Hot line faced fraud risk by getting

ineffective quality of fabric from the

creditors. It results in loss of consumers,

sales and profitability of Hot line.

Effective quality control team can be

recruited who will be responsible to verify

the quality of the fabric (Yang and Jia,

2012). So that, effective services can be

provided to the customers results in enlarge

customer base, turnover and profit as well.

4 By charging less production cost as bad

debts results in decline profitability and

thereby decline tax obligation as well.

Verifying all the transactions reported in the

financial statement is a way to reduce such

fraud risk. Debtor's register also can be

maintained for such purpose.

5 Improper communication in all the

departments is the reason for financial

trouble.

Effective communication will help to

communicate each and every information in

all the departments. So that, Hot line will be

aware about the negotiation agreements

made by purchase departments (Wang and

Li, 2015).

CONCLUSION

From the above reports, it can be concluded that personnel, directors and shareholders are

involved in the fraudulent activities to provide incentives to themselves. Such frauds has been

committed due to the opportunities available. All this conducted omissions represents untrue and

unfair position of Hot line by its financial statement. At the end, report concluded that internal

control mechanism in which management consistently check and monitor all the activities of the

Hot line will significantly helps to overcome fraud risk.

7

2 Fictitious accounts payable invoices,

over-billing and creating invoices to

make payment of cash funds to himself

are fraud risk.

By segregating work between number of

employees, Hot line can assure that payable

clerk will not conduct an omission or false

invoices which results in enlarge payments

and less profitability.

3 Quality control mechanism is not good so

that Hot line faced fraud risk by getting

ineffective quality of fabric from the

creditors. It results in loss of consumers,

sales and profitability of Hot line.

Effective quality control team can be

recruited who will be responsible to verify

the quality of the fabric (Yang and Jia,

2012). So that, effective services can be

provided to the customers results in enlarge

customer base, turnover and profit as well.

4 By charging less production cost as bad

debts results in decline profitability and

thereby decline tax obligation as well.

Verifying all the transactions reported in the

financial statement is a way to reduce such

fraud risk. Debtor's register also can be

maintained for such purpose.

5 Improper communication in all the

departments is the reason for financial

trouble.

Effective communication will help to

communicate each and every information in

all the departments. So that, Hot line will be

aware about the negotiation agreements

made by purchase departments (Wang and

Li, 2015).

CONCLUSION

From the above reports, it can be concluded that personnel, directors and shareholders are

involved in the fraudulent activities to provide incentives to themselves. Such frauds has been

committed due to the opportunities available. All this conducted omissions represents untrue and

unfair position of Hot line by its financial statement. At the end, report concluded that internal

control mechanism in which management consistently check and monitor all the activities of the

Hot line will significantly helps to overcome fraud risk.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Books and Journals

Bisgaier, J. and Rhodes, K.V., 2011. Auditing access to specialty care for children with public

insurance. New England Journal of Medicine. 364(24). pp.2324-2333.

Carcello, J.V., Hermanson, D.R. and Ye, Z., 2011. Corporate governance research in accounting and

auditing: Insights, practice implications, and future research directions. Auditing: A Journal

of Practice & Theory. 30(3). pp.1-31.

DeFond, M. and Zhang, J., 2014. A review of archival auditing research. Journal of Accounting and

Economics. 58(2). pp.275-326.

Kuhn Jr, J.R. and Sutton, S.G., 2010. Continuous auditing in ERP system environments: The current

state and future directions. Journal of Information Systems. 24(1). pp.91-112.

Lennox, C. and Pittman, J., 2010. Auditing the auditors: Evidence on the recent reforms to the

external monitoring of audit firms. Journal of Accounting and Economics. 49(1). pp.84-103.

Wang, B., Li, B. and Li, H., 2015. Panda: public auditing for shared data with efficient user

revocation in the cloud. Services Computing, IEEE Transactions on. 8(1). pp.92-106.

Yang, K. and Jia, X., 2012. Data storage auditing service in cloud computing: challenges, methods

and opportunities. World Wide Web. 15(4). pp.409-428.

Yang, K. and Jia, X., 2013. An efficient and secure dynamic auditing protocol for data storage in

cloud computing. Parallel and Distributed Systems, IEEE Transactions on. 24(9). pp.1717-

1726.

Online

Fraud Auditing, n.d. [Online]. Available through: <http://www4.semo.edu/gjohnson/AC437/chapter

%20notes/chapter_11__notes.htm>. [Accessed on 12th May, 2016].

8

Books and Journals

Bisgaier, J. and Rhodes, K.V., 2011. Auditing access to specialty care for children with public

insurance. New England Journal of Medicine. 364(24). pp.2324-2333.

Carcello, J.V., Hermanson, D.R. and Ye, Z., 2011. Corporate governance research in accounting and

auditing: Insights, practice implications, and future research directions. Auditing: A Journal

of Practice & Theory. 30(3). pp.1-31.

DeFond, M. and Zhang, J., 2014. A review of archival auditing research. Journal of Accounting and

Economics. 58(2). pp.275-326.

Kuhn Jr, J.R. and Sutton, S.G., 2010. Continuous auditing in ERP system environments: The current

state and future directions. Journal of Information Systems. 24(1). pp.91-112.

Lennox, C. and Pittman, J., 2010. Auditing the auditors: Evidence on the recent reforms to the

external monitoring of audit firms. Journal of Accounting and Economics. 49(1). pp.84-103.

Wang, B., Li, B. and Li, H., 2015. Panda: public auditing for shared data with efficient user

revocation in the cloud. Services Computing, IEEE Transactions on. 8(1). pp.92-106.

Yang, K. and Jia, X., 2012. Data storage auditing service in cloud computing: challenges, methods

and opportunities. World Wide Web. 15(4). pp.409-428.

Yang, K. and Jia, X., 2013. An efficient and secure dynamic auditing protocol for data storage in

cloud computing. Parallel and Distributed Systems, IEEE Transactions on. 24(9). pp.1717-

1726.

Online

Fraud Auditing, n.d. [Online]. Available through: <http://www4.semo.edu/gjohnson/AC437/chapter

%20notes/chapter_11__notes.htm>. [Accessed on 12th May, 2016].

8

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.