GSP177e: Fundamentals of Investing - Portfolio Analysis Report

VerifiedAdded on 2023/06/07

|7

|1175

|294

Report

AI Summary

This report, prepared for a Fundamentals of Investing course, analyzes investment opportunities for Mr. M, focusing on real estate, REITs, and stocks. The analysis identifies investment opportunities in residential condominiums and commercial offices, comparing their potential returns. It evaluates the performance of specific stocks like Jedi Star Ltd and C-REIT, using metrics like Price to Book Ratio and dividend yield to assess their suitability for the portfolio. The report recommends a diversified portfolio, including both property and stocks, and provides calculations for potential returns, considering mortgage payments and inflation. The conclusion advises Mr. M to leverage the drafted portfolio to capitalize on the rising property market in Singapore and maximize returns, highlighting the benefits of a well-diversified investment strategy with the use of mortgagee to increase the value of investment. The analysis suggests an annual return of 3.41% before inflation and 0.41% after considering the inflation rate.

Running head: FUNDAMENTALS OF INVESTING

Fundamentals of Investing

Name of the Student:

Name of the University:

Authors Note:

Fundamentals of Investing

Name of the Student:

Name of the University:

Authors Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FUNDAMENTALS OF INVESTING

1

Table of Contents

Introduction:...............................................................................................................................2

1. Identifying the investment opportunities presented to Mr. M:..............................................2

2. Recommendation provided to MR. M:..................................................................................3

Conclusion:................................................................................................................................5

Reference and Bibliography:......................................................................................................6

1

Table of Contents

Introduction:...............................................................................................................................2

1. Identifying the investment opportunities presented to Mr. M:..............................................2

2. Recommendation provided to MR. M:..................................................................................3

Conclusion:................................................................................................................................5

Reference and Bibliography:......................................................................................................6

FUNDAMENTALS OF INVESTING

2

Introduction:

The overall assessment aims in detecting the level of investment opportunity, which

could allow Mr. M to formulate a portfolio that can generate higher returns from investment.

Moreover, the overall usage of equity stocks, REIT, and Property investment is mainly used

for drafting the portfolio, which can generate higher returns from investment. Furthermore,

the evaluation also helps in depicting the level of investment on each class that needs to be

conducted by Mr M. for increasing his profits from investment.

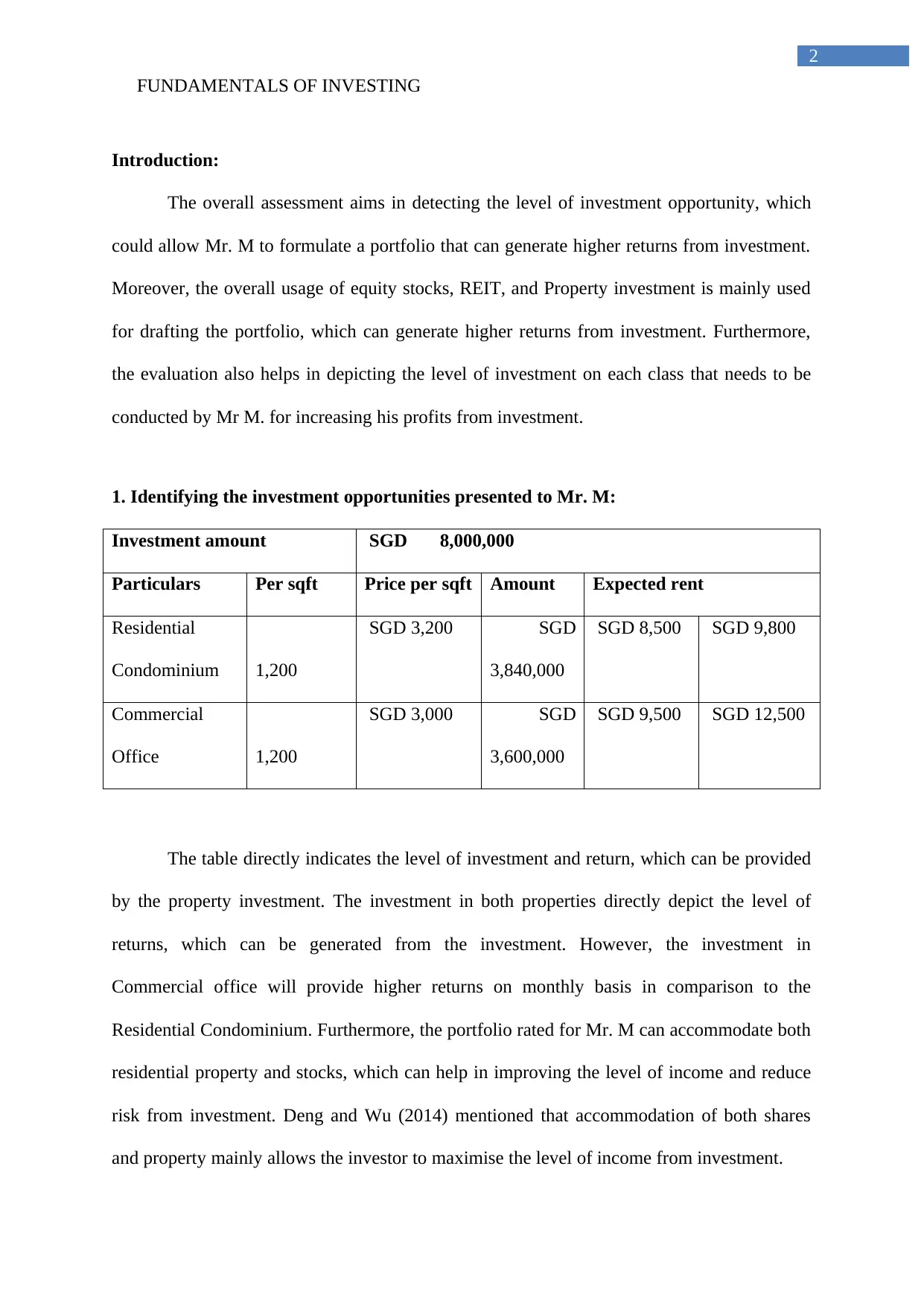

1. Identifying the investment opportunities presented to Mr. M:

Investment amount SGD 8,000,000

Particulars Per sqft Price per sqft Amount Expected rent

Residential

Condominium 1,200

SGD 3,200 SGD

3,840,000

SGD 8,500 SGD 9,800

Commercial

Office 1,200

SGD 3,000 SGD

3,600,000

SGD 9,500 SGD 12,500

The table directly indicates the level of investment and return, which can be provided

by the property investment. The investment in both properties directly depict the level of

returns, which can be generated from the investment. However, the investment in

Commercial office will provide higher returns on monthly basis in comparison to the

Residential Condominium. Furthermore, the portfolio rated for Mr. M can accommodate both

residential property and stocks, which can help in improving the level of income and reduce

risk from investment. Deng and Wu (2014) mentioned that accommodation of both shares

and property mainly allows the investor to maximise the level of income from investment.

2

Introduction:

The overall assessment aims in detecting the level of investment opportunity, which

could allow Mr. M to formulate a portfolio that can generate higher returns from investment.

Moreover, the overall usage of equity stocks, REIT, and Property investment is mainly used

for drafting the portfolio, which can generate higher returns from investment. Furthermore,

the evaluation also helps in depicting the level of investment on each class that needs to be

conducted by Mr M. for increasing his profits from investment.

1. Identifying the investment opportunities presented to Mr. M:

Investment amount SGD 8,000,000

Particulars Per sqft Price per sqft Amount Expected rent

Residential

Condominium 1,200

SGD 3,200 SGD

3,840,000

SGD 8,500 SGD 9,800

Commercial

Office 1,200

SGD 3,000 SGD

3,600,000

SGD 9,500 SGD 12,500

The table directly indicates the level of investment and return, which can be provided

by the property investment. The investment in both properties directly depict the level of

returns, which can be generated from the investment. However, the investment in

Commercial office will provide higher returns on monthly basis in comparison to the

Residential Condominium. Furthermore, the portfolio rated for Mr. M can accommodate both

residential property and stocks, which can help in improving the level of income and reduce

risk from investment. Deng and Wu (2014) mentioned that accommodation of both shares

and property mainly allows the investor to maximise the level of income from investment.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

FUNDAMENTALS OF INVESTING

3

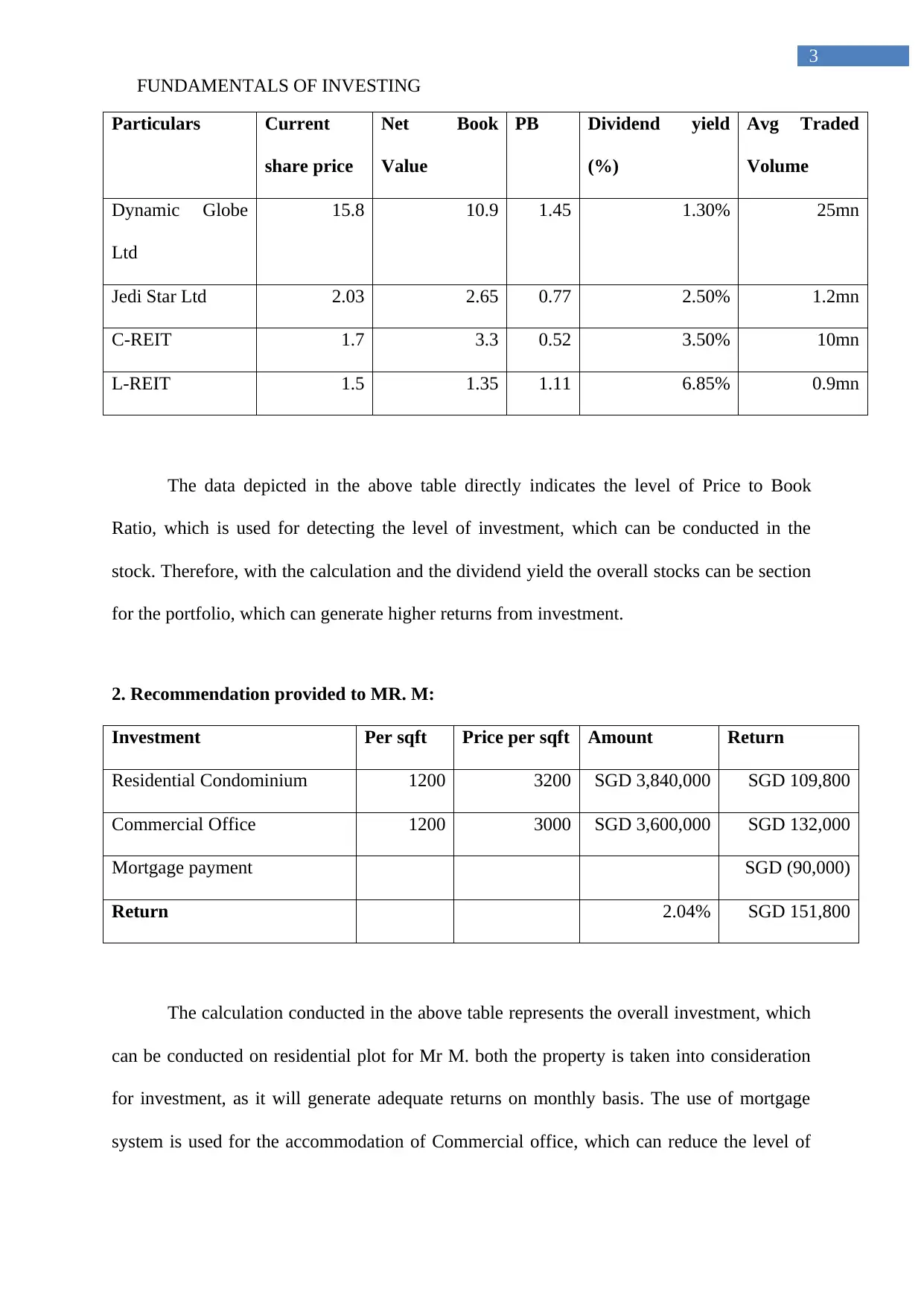

Particulars Current

share price

Net Book

Value

PB Dividend yield

(%)

Avg Traded

Volume

Dynamic Globe

Ltd

15.8 10.9 1.45 1.30% 25mn

Jedi Star Ltd 2.03 2.65 0.77 2.50% 1.2mn

C-REIT 1.7 3.3 0.52 3.50% 10mn

L-REIT 1.5 1.35 1.11 6.85% 0.9mn

The data depicted in the above table directly indicates the level of Price to Book

Ratio, which is used for detecting the level of investment, which can be conducted in the

stock. Therefore, with the calculation and the dividend yield the overall stocks can be section

for the portfolio, which can generate higher returns from investment.

2. Recommendation provided to MR. M:

Investment Per sqft Price per sqft Amount Return

Residential Condominium 1200 3200 SGD 3,840,000 SGD 109,800

Commercial Office 1200 3000 SGD 3,600,000 SGD 132,000

Mortgage payment SGD (90,000)

Return 2.04% SGD 151,800

The calculation conducted in the above table represents the overall investment, which

can be conducted on residential plot for Mr M. both the property is taken into consideration

for investment, as it will generate adequate returns on monthly basis. The use of mortgage

system is used for the accommodation of Commercial office, which can reduce the level of

3

Particulars Current

share price

Net Book

Value

PB Dividend yield

(%)

Avg Traded

Volume

Dynamic Globe

Ltd

15.8 10.9 1.45 1.30% 25mn

Jedi Star Ltd 2.03 2.65 0.77 2.50% 1.2mn

C-REIT 1.7 3.3 0.52 3.50% 10mn

L-REIT 1.5 1.35 1.11 6.85% 0.9mn

The data depicted in the above table directly indicates the level of Price to Book

Ratio, which is used for detecting the level of investment, which can be conducted in the

stock. Therefore, with the calculation and the dividend yield the overall stocks can be section

for the portfolio, which can generate higher returns from investment.

2. Recommendation provided to MR. M:

Investment Per sqft Price per sqft Amount Return

Residential Condominium 1200 3200 SGD 3,840,000 SGD 109,800

Commercial Office 1200 3000 SGD 3,600,000 SGD 132,000

Mortgage payment SGD (90,000)

Return 2.04% SGD 151,800

The calculation conducted in the above table represents the overall investment, which

can be conducted on residential plot for Mr M. both the property is taken into consideration

for investment, as it will generate adequate returns on monthly basis. The use of mortgage

system is used for the accommodation of Commercial office, which can reduce the level of

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FUNDAMENTALS OF INVESTING

4

mortgage payment and generate a total of 2.04% on yearly basis. Haila (2015) stated that

with the use of property investment directly allows the investor to increase the value of

property and generate returns from rent, which helps in securing the overall investment.

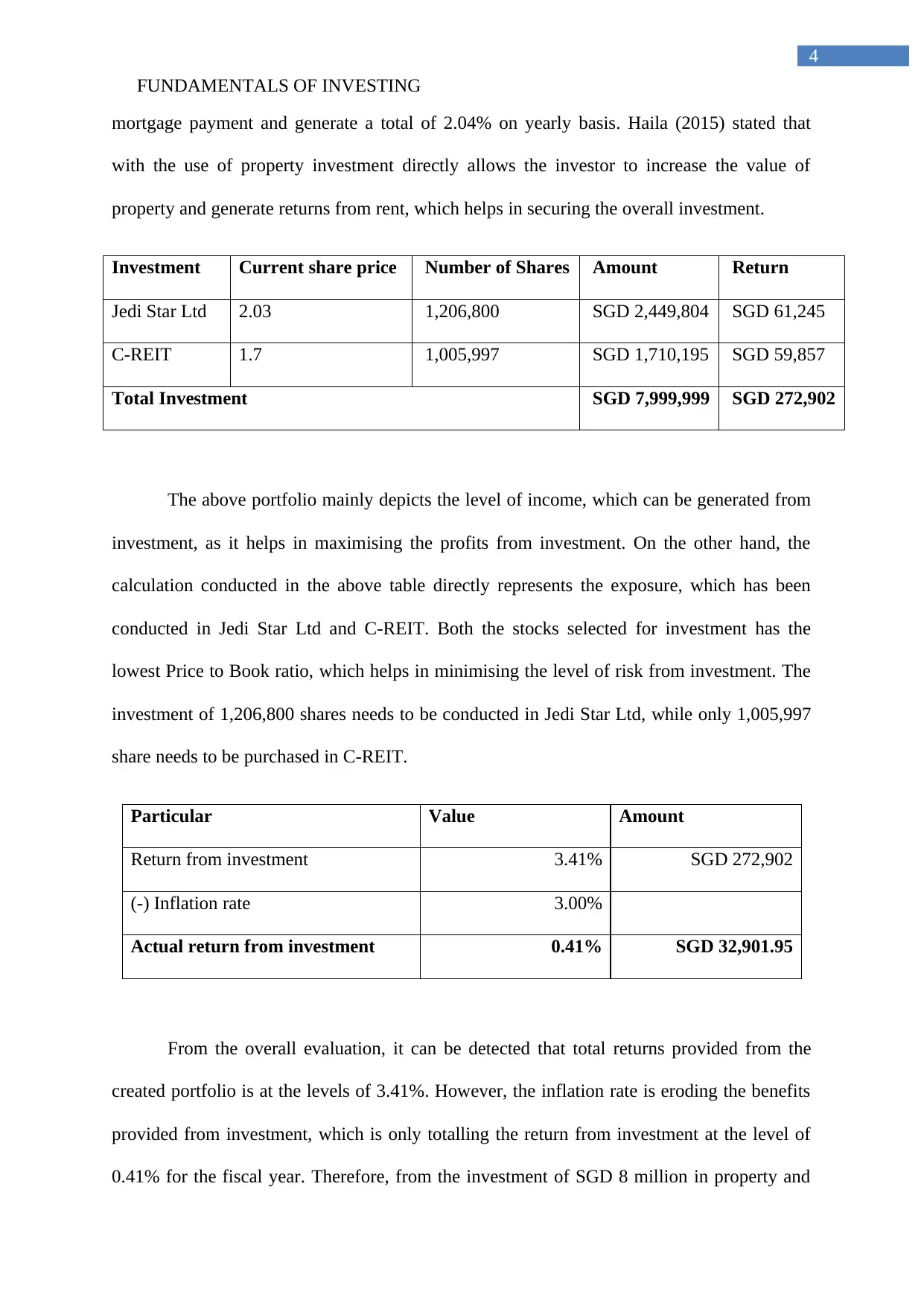

Investment Current share price Number of Shares Amount Return

Jedi Star Ltd 2.03 1,206,800 SGD 2,449,804 SGD 61,245

C-REIT 1.7 1,005,997 SGD 1,710,195 SGD 59,857

Total Investment SGD 7,999,999 SGD 272,902

The above portfolio mainly depicts the level of income, which can be generated from

investment, as it helps in maximising the profits from investment. On the other hand, the

calculation conducted in the above table directly represents the exposure, which has been

conducted in Jedi Star Ltd and C-REIT. Both the stocks selected for investment has the

lowest Price to Book ratio, which helps in minimising the level of risk from investment. The

investment of 1,206,800 shares needs to be conducted in Jedi Star Ltd, while only 1,005,997

share needs to be purchased in C-REIT.

Particular Value Amount

Return from investment 3.41% SGD 272,902

(-) Inflation rate 3.00%

Actual return from investment 0.41% SGD 32,901.95

From the overall evaluation, it can be detected that total returns provided from the

created portfolio is at the levels of 3.41%. However, the inflation rate is eroding the benefits

provided from investment, which is only totalling the return from investment at the level of

0.41% for the fiscal year. Therefore, from the investment of SGD 8 million in property and

4

mortgage payment and generate a total of 2.04% on yearly basis. Haila (2015) stated that

with the use of property investment directly allows the investor to increase the value of

property and generate returns from rent, which helps in securing the overall investment.

Investment Current share price Number of Shares Amount Return

Jedi Star Ltd 2.03 1,206,800 SGD 2,449,804 SGD 61,245

C-REIT 1.7 1,005,997 SGD 1,710,195 SGD 59,857

Total Investment SGD 7,999,999 SGD 272,902

The above portfolio mainly depicts the level of income, which can be generated from

investment, as it helps in maximising the profits from investment. On the other hand, the

calculation conducted in the above table directly represents the exposure, which has been

conducted in Jedi Star Ltd and C-REIT. Both the stocks selected for investment has the

lowest Price to Book ratio, which helps in minimising the level of risk from investment. The

investment of 1,206,800 shares needs to be conducted in Jedi Star Ltd, while only 1,005,997

share needs to be purchased in C-REIT.

Particular Value Amount

Return from investment 3.41% SGD 272,902

(-) Inflation rate 3.00%

Actual return from investment 0.41% SGD 32,901.95

From the overall evaluation, it can be detected that total returns provided from the

created portfolio is at the levels of 3.41%. However, the inflation rate is eroding the benefits

provided from investment, which is only totalling the return from investment at the level of

0.41% for the fiscal year. Therefore, from the investment of SGD 8 million in property and

FUNDAMENTALS OF INVESTING

5

stocks the organisation is getting a total annual return of SGD 32,901.95, while the total value

of the portfolio is increasing due to the rising values of property in Singapore.

Conclusion:

After evaluating the portfolio data, it is advisable to Mr. M that he should utilise the

drafted portfolio for tapping into the rising property market of Singapore. The adoption of

drafted portfolio might eventually allow Mr. M to improve the level of income from the

investment by 0.41% on yearly basis after deducting the inflation rate of Singapore. The use

of mortgagee has mainly helped in increasing the total value of investments, which can be

conducted in property. Therefore, Mr. M with the drafted portfolio could eventually generate

higher rate of return from investment over the period of time.

5

stocks the organisation is getting a total annual return of SGD 32,901.95, while the total value

of the portfolio is increasing due to the rising values of property in Singapore.

Conclusion:

After evaluating the portfolio data, it is advisable to Mr. M that he should utilise the

drafted portfolio for tapping into the rising property market of Singapore. The adoption of

drafted portfolio might eventually allow Mr. M to improve the level of income from the

investment by 0.41% on yearly basis after deducting the inflation rate of Singapore. The use

of mortgagee has mainly helped in increasing the total value of investments, which can be

conducted in property. Therefore, Mr. M with the drafted portfolio could eventually generate

higher rate of return from investment over the period of time.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

FUNDAMENTALS OF INVESTING

6

Reference and Bibliography:

Deng, Y., & Wu, J. (2014). Economic returns to residential green building investment: The

developers' perspective. Regional Science and Urban Economics, 47, 35-44.

Haila, A. (2015). Urban land rent: Singapore as a property state. John Wiley & Sons.

Ho, K. H. D., & Rengarajan, S. (2017). Industrial Real Estate Market Dynamics in Singapore:

A VAR Approach. International Real Estate Review, 20(4), 417-450.

Nanda, R., & Rhodes-Kropf, M. (2013). Investment cycles and startup innovation. Journal of

Financial Economics, 110(2), 403-418.

Reddy, W., Higgins, D., & Wakefield, R. (2014). An investigation of property-related

decision practice of Australian fund managers. Journal of Property Investment &

Finance, 32(3), 282-305.

Uphoff, E. (2018). Intellectual property and US relations with Indonesia, Malaysia,

Singapore, and Thailand. Cornell University Press.

6

Reference and Bibliography:

Deng, Y., & Wu, J. (2014). Economic returns to residential green building investment: The

developers' perspective. Regional Science and Urban Economics, 47, 35-44.

Haila, A. (2015). Urban land rent: Singapore as a property state. John Wiley & Sons.

Ho, K. H. D., & Rengarajan, S. (2017). Industrial Real Estate Market Dynamics in Singapore:

A VAR Approach. International Real Estate Review, 20(4), 417-450.

Nanda, R., & Rhodes-Kropf, M. (2013). Investment cycles and startup innovation. Journal of

Financial Economics, 110(2), 403-418.

Reddy, W., Higgins, D., & Wakefield, R. (2014). An investigation of property-related

decision practice of Australian fund managers. Journal of Property Investment &

Finance, 32(3), 282-305.

Uphoff, E. (2018). Intellectual property and US relations with Indonesia, Malaysia,

Singapore, and Thailand. Cornell University Press.

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.