Fundamentals of Accounting: Cost Accounting and Cash Flow Statement

VerifiedAdded on 2023/06/11

|5

|509

|300

Homework Assignment

AI Summary

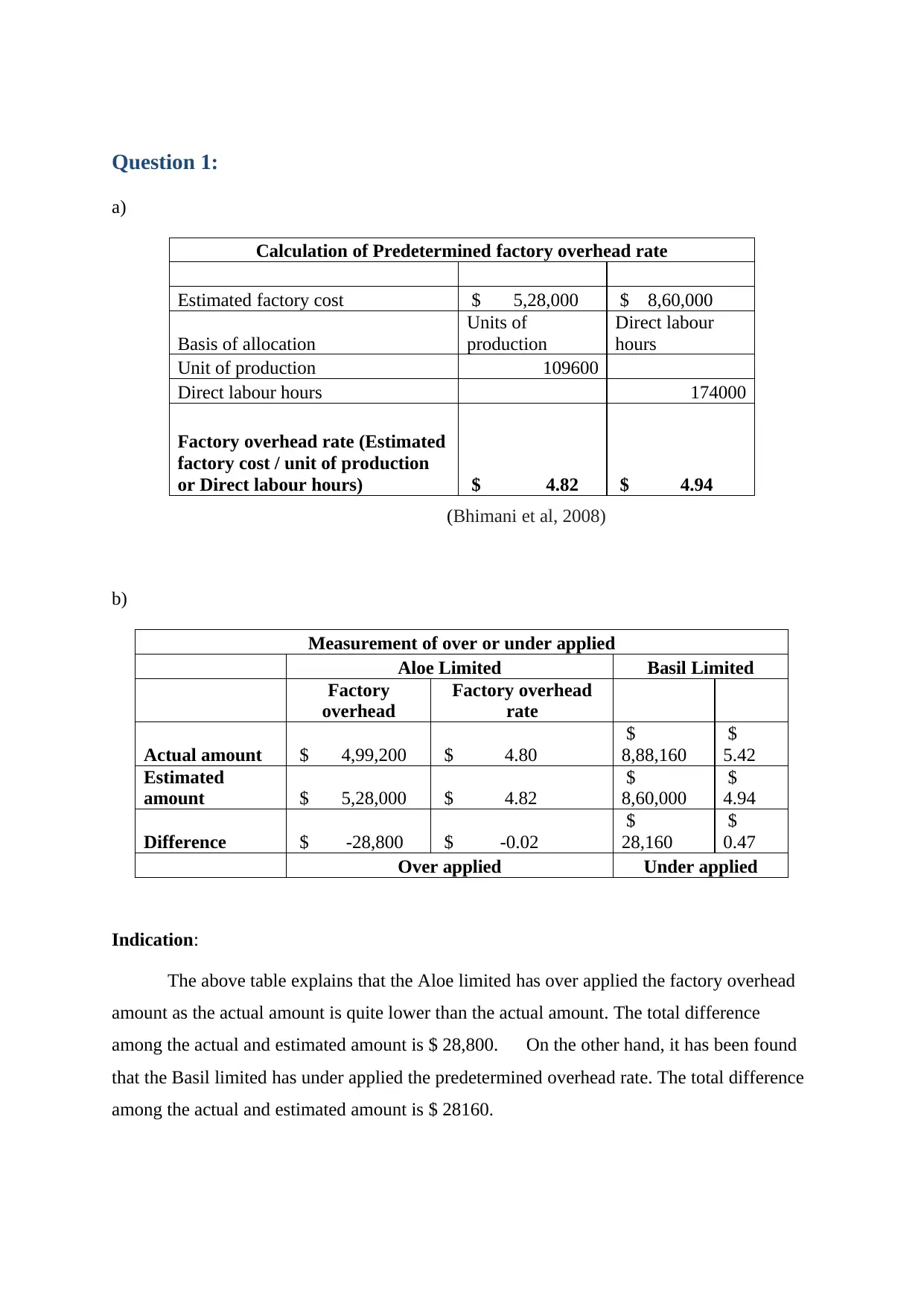

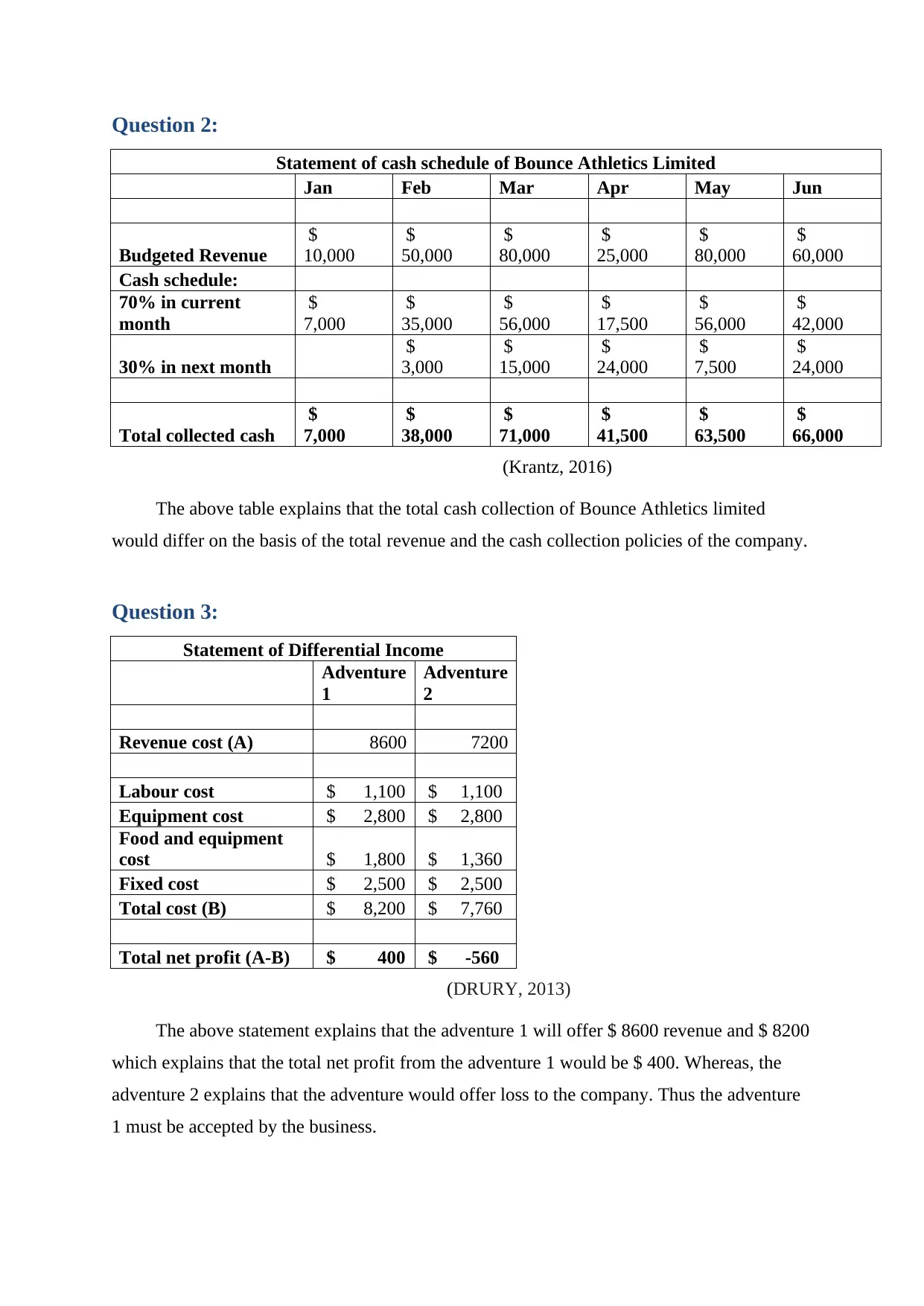

This assignment solution delves into the fundamentals of accounting, addressing key concepts such as predetermined factory overhead rates and cash schedule analysis. It calculates factory overhead rates based on different allocation bases like unit production and direct labor hours, further measuring over or under applied overhead for Aloe Limited and Basil Limited. The assignment also constructs a cash schedule for Bounce Athletics Limited, projecting cash collections based on revenue and collection policies. Additionally, it presents a differential income statement to evaluate Adventure 1 and Adventure 2, advising on which adventure to accept based on profitability. This detailed solution provides a comprehensive understanding of cost accounting, cash flow management, and financial decision-making.

1 out of 5

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)