Detailed GST Calculation Worksheet for GB Pty Ltd. - May 2019

VerifiedAdded on 2022/11/13

|3

|553

|470

Homework Assignment

AI Summary

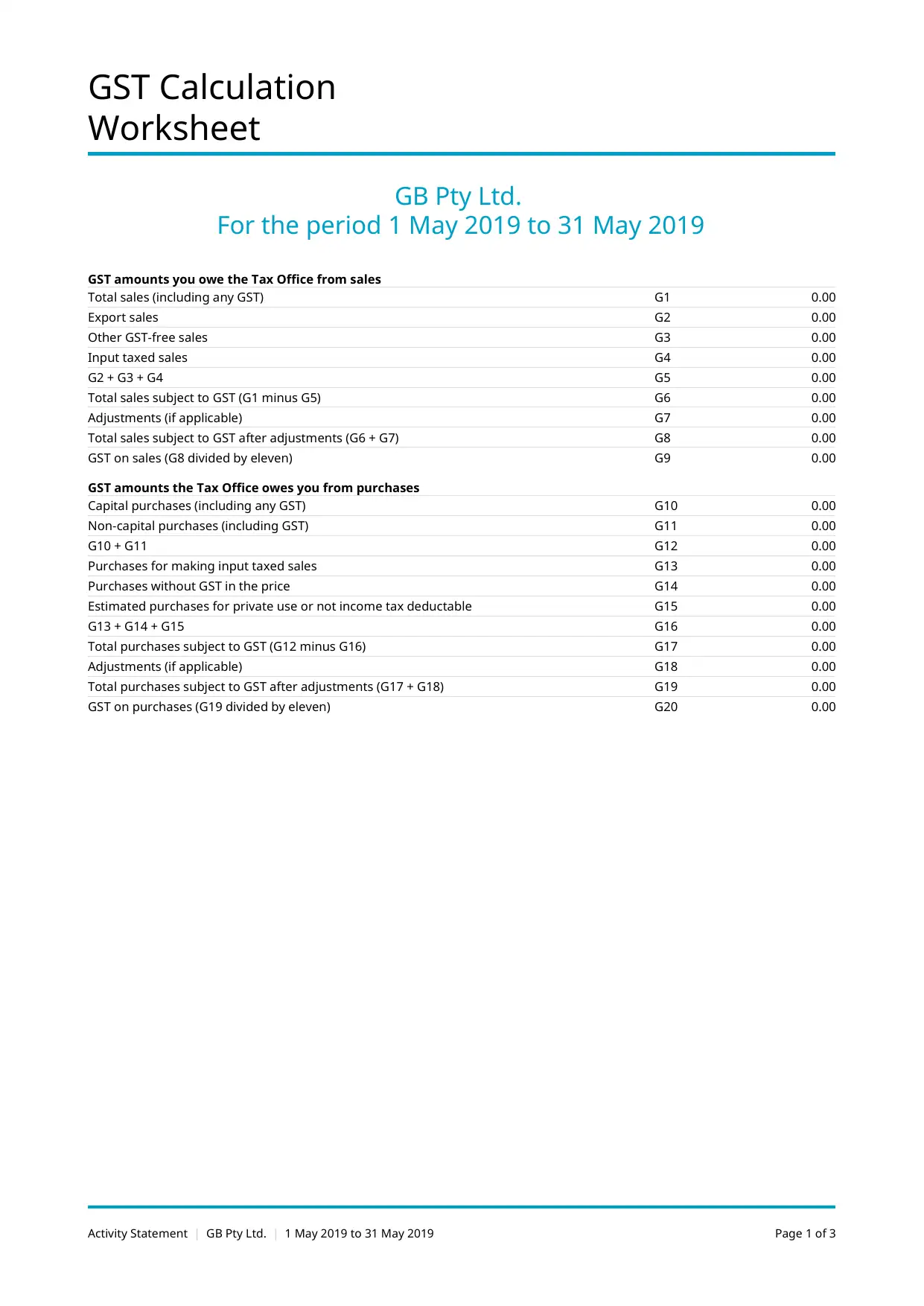

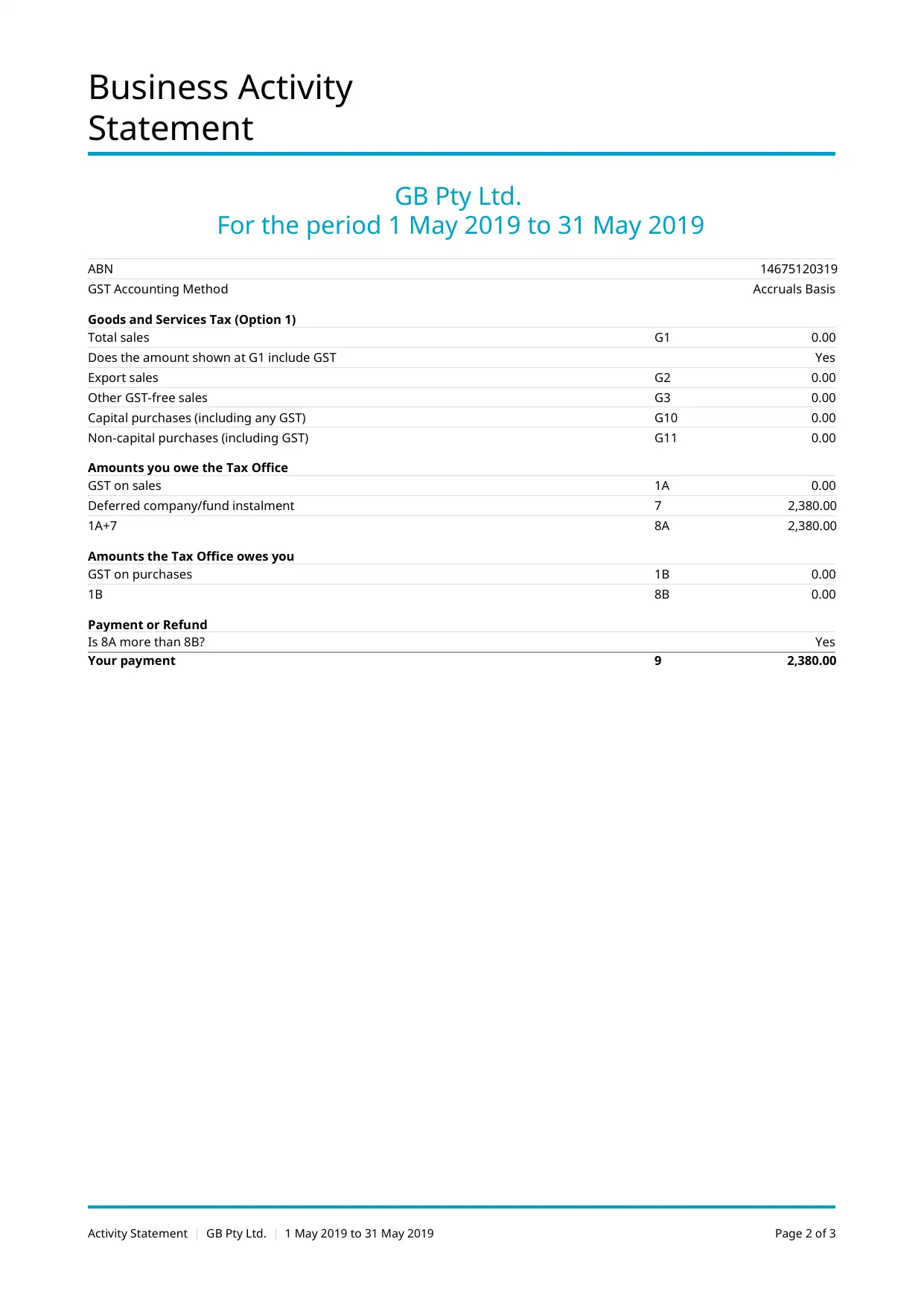

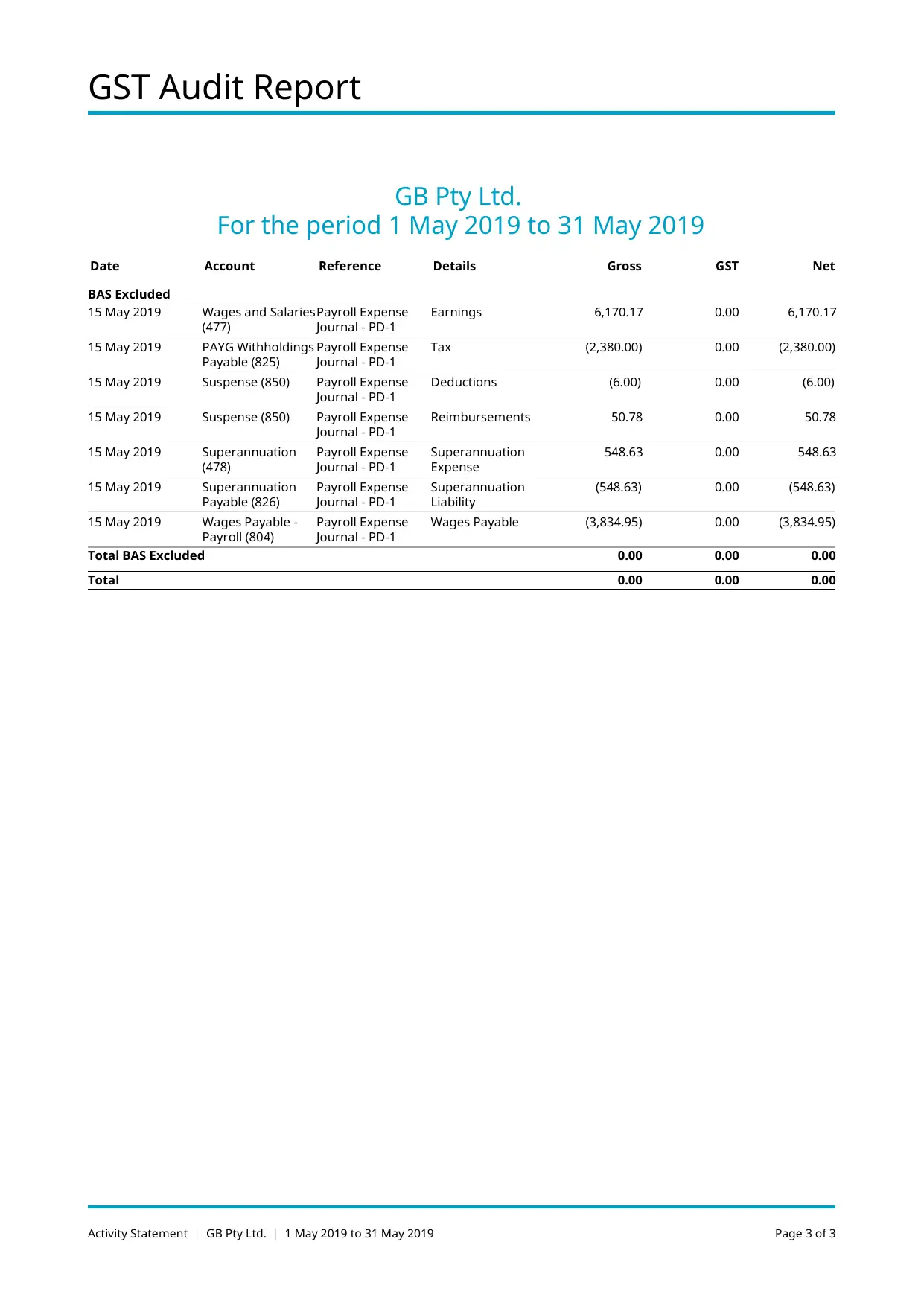

The assignment comprises a comprehensive GST (Goods and Services Tax) calculation worksheet for GB Pty Ltd. covering the period from May 1 to May 31, 2019. The worksheet details the calculation of GST amounts owed to or owed by the Tax Office, including total sales, export sales, GST-free sales, input taxed sales, capital and non-capital purchases, and adjustments. The document also includes the Business Activity Statement (BAS) with key figures such as total sales, GST on sales, capital purchases, and non-capital purchases. Additionally, a GST Audit Report is provided, detailing transactions excluded from the BAS and including account references, details, gross, GST, and net amounts for various payroll expenses, such as wages and salaries, PAYG withholdings, and superannuation. This document offers a practical example of GST accounting, reporting, and auditing within a business context, and is available on Desklib to aid students in understanding and solving similar financial assignments.

1 out of 3

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)