H15020 Corporate Accounting: Analyzing Woodside Petroleum's Financial Statements

VerifiedAdded on 2024/06/04

|21

|3075

|63

AI Summary

This report analyzes the financial statements of Woodside Petroleum Limited, a leading Australian oil and gas company. It examines the cash flow statement, other comprehensive income statement, and accounting for corporate income tax. The report provides a comparative analysis of cash flows over three years, explains the components of other comprehensive income, and explores the relationship between tax expense, tax payable, and deferred tax assets/liabilities. The analysis aims to provide insights into the company's financial performance and its tax accounting practices.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

H15020 Corporate Accounting

1

1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Contents

CASH FLOWS STATEMENT....................................................................Error! Bookmark not defined.

(i) From your firm’s financial statement, list each item of reported in the cash flows statement

and write your understanding of each item. Discuss any changes in each item of cash flows

statement for your firm over the past year articulating the reasons for the change.................Error!

Bookmark not defined.

(ii) Provide a comparative analysis of your company’s three broad categories of cash flows

(operating activities, investing activities, financing activities) and make a comparative evaluation

for three years...........................................................................................Error! Bookmark not defined.

Other Comprehensive Income Statement...................................................Error! Bookmark not defined.

(iii) What items have been reported in the other comprehensive income statement?...............Error!

Bookmark not defined.

(iv) Explain your understanding of each item reported in the other comprehensive income

statement...................................................................................................Error! Bookmark not defined.

(v) Why these items have not been reported in Income Statement/Profit and Loss StatementError!

Bookmark not defined.

Accounting For Corporate Income Tax......................................................Error! Bookmark not defined.

(vii) Is this figure the same as the company tax rate times your firm’s accounting income?

Explain why this is, or is not, the case for your firm..............................Error! Bookmark not defined.

(viii) Comment on deferred tax assets/liabilities that are reported in the balance sheet

articulating the possible reasons why they have been recorded............Error! Bookmark not defined.

(ix) Is there any current tax assets or income tax payable recorded by your company? Why is the

income tax payable not the same as income tax expense?.....................Error! Bookmark not defined.

(x) Is the income tax expense shown in the income statement same as the income tax paid shown

in the cash flow statement? If not why is the difference?......................Error! Bookmark not defined.

(xi)What do you find interesting, confusing, surprising or difficult to understand about the

treatment of tax in your firm’s financial statements? What new insights, if any, have you gained

about how companies account for income tax as a result of examining your firm’s tax expense in

its accounts?..............................................................................................Error! Bookmark not defined.

2

CASH FLOWS STATEMENT....................................................................Error! Bookmark not defined.

(i) From your firm’s financial statement, list each item of reported in the cash flows statement

and write your understanding of each item. Discuss any changes in each item of cash flows

statement for your firm over the past year articulating the reasons for the change.................Error!

Bookmark not defined.

(ii) Provide a comparative analysis of your company’s three broad categories of cash flows

(operating activities, investing activities, financing activities) and make a comparative evaluation

for three years...........................................................................................Error! Bookmark not defined.

Other Comprehensive Income Statement...................................................Error! Bookmark not defined.

(iii) What items have been reported in the other comprehensive income statement?...............Error!

Bookmark not defined.

(iv) Explain your understanding of each item reported in the other comprehensive income

statement...................................................................................................Error! Bookmark not defined.

(v) Why these items have not been reported in Income Statement/Profit and Loss StatementError!

Bookmark not defined.

Accounting For Corporate Income Tax......................................................Error! Bookmark not defined.

(vii) Is this figure the same as the company tax rate times your firm’s accounting income?

Explain why this is, or is not, the case for your firm..............................Error! Bookmark not defined.

(viii) Comment on deferred tax assets/liabilities that are reported in the balance sheet

articulating the possible reasons why they have been recorded............Error! Bookmark not defined.

(ix) Is there any current tax assets or income tax payable recorded by your company? Why is the

income tax payable not the same as income tax expense?.....................Error! Bookmark not defined.

(x) Is the income tax expense shown in the income statement same as the income tax paid shown

in the cash flow statement? If not why is the difference?......................Error! Bookmark not defined.

(xi)What do you find interesting, confusing, surprising or difficult to understand about the

treatment of tax in your firm’s financial statements? What new insights, if any, have you gained

about how companies account for income tax as a result of examining your firm’s tax expense in

its accounts?..............................................................................................Error! Bookmark not defined.

2

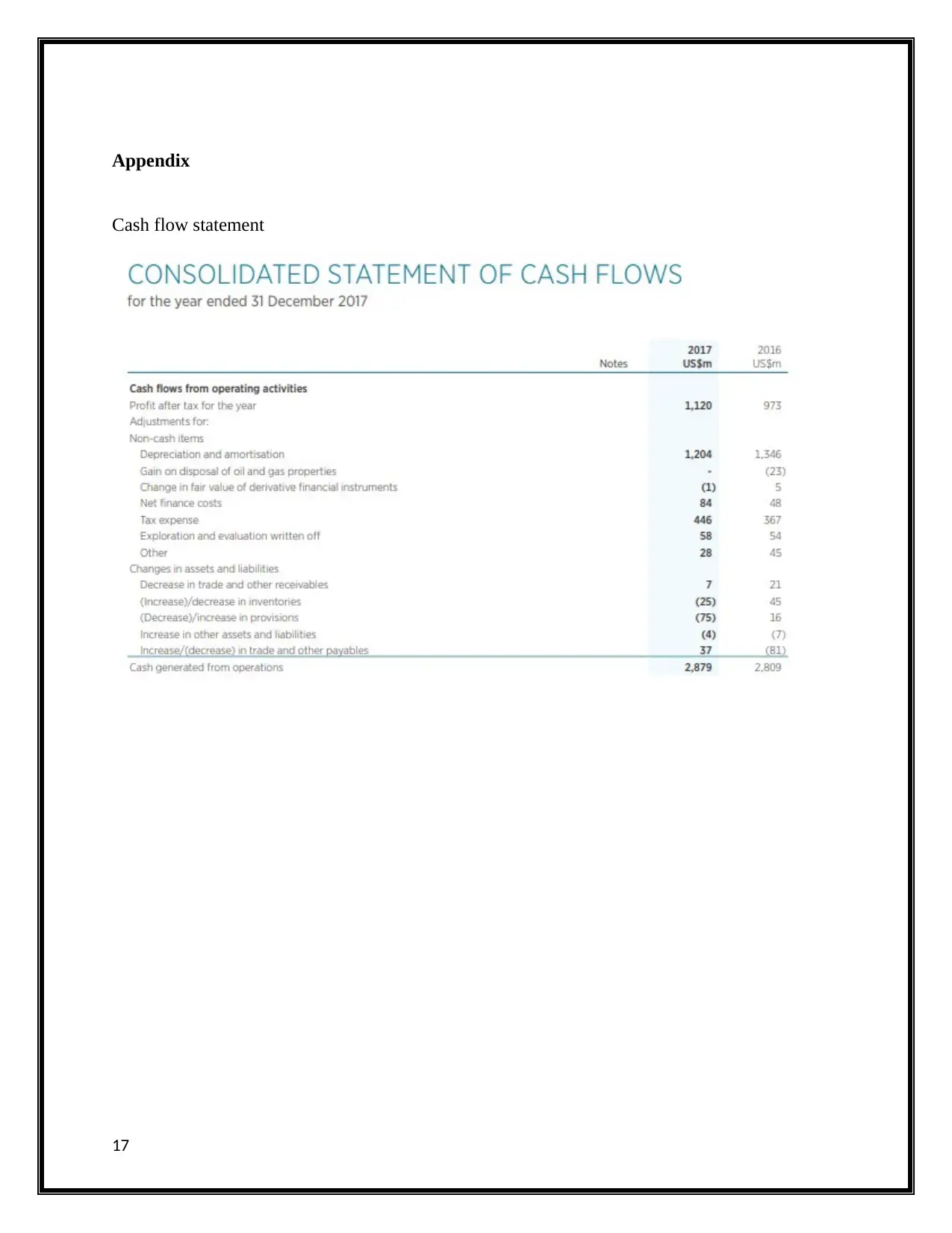

Cash Flows Statement

i)From your firm’s financial statement, list each item of reported in the cash flows statement

and write your understanding of each item. Discuss any changes in each item of cash

flows statement for your firm over the past year articulating the reasons for the change.

Woodside petroleum Limited is a one of the largest company in Australia which deals in

production and exploration of oil and natural gas. It has its headquarters in west Australia,

Perth.

Cash Flow Statements:

Net cash flow from operating activities

1. Depreciation and amortization: cash outflow for depreciation from assets and other

amortization from expenses.

2. Disposal of oil and gas properties: sale proceeds from oil and gaseous properties.

3. Net finance cost: adjustments from or cash outflow from net finance cost from activities.

4. Tax expenses: cash outflow from tax paid in operations and other activities.

5. Change in fair value of financial instruments: cash flow from the adjustments of the

true value of financial markets and other financial instruments.

6. Changes in assets and liabilities: Increase or decrease in inventories, receivables and

other provisions.

7. Payments to employees: for share plans, purchase of shares and other benefits in form of

cash are given.

8. Interest received: from the operations that are performed from the oil or natural gas

production.

9. Dividend Received: from the money invested in various financial market.

10. Borrowing cost: payment as cash and interest of loan taken.

Cash flow from investing activities:

3

i)From your firm’s financial statement, list each item of reported in the cash flows statement

and write your understanding of each item. Discuss any changes in each item of cash

flows statement for your firm over the past year articulating the reasons for the change.

Woodside petroleum Limited is a one of the largest company in Australia which deals in

production and exploration of oil and natural gas. It has its headquarters in west Australia,

Perth.

Cash Flow Statements:

Net cash flow from operating activities

1. Depreciation and amortization: cash outflow for depreciation from assets and other

amortization from expenses.

2. Disposal of oil and gas properties: sale proceeds from oil and gaseous properties.

3. Net finance cost: adjustments from or cash outflow from net finance cost from activities.

4. Tax expenses: cash outflow from tax paid in operations and other activities.

5. Change in fair value of financial instruments: cash flow from the adjustments of the

true value of financial markets and other financial instruments.

6. Changes in assets and liabilities: Increase or decrease in inventories, receivables and

other provisions.

7. Payments to employees: for share plans, purchase of shares and other benefits in form of

cash are given.

8. Interest received: from the operations that are performed from the oil or natural gas

production.

9. Dividend Received: from the money invested in various financial market.

10. Borrowing cost: payment as cash and interest of loan taken.

Cash flow from investing activities:

3

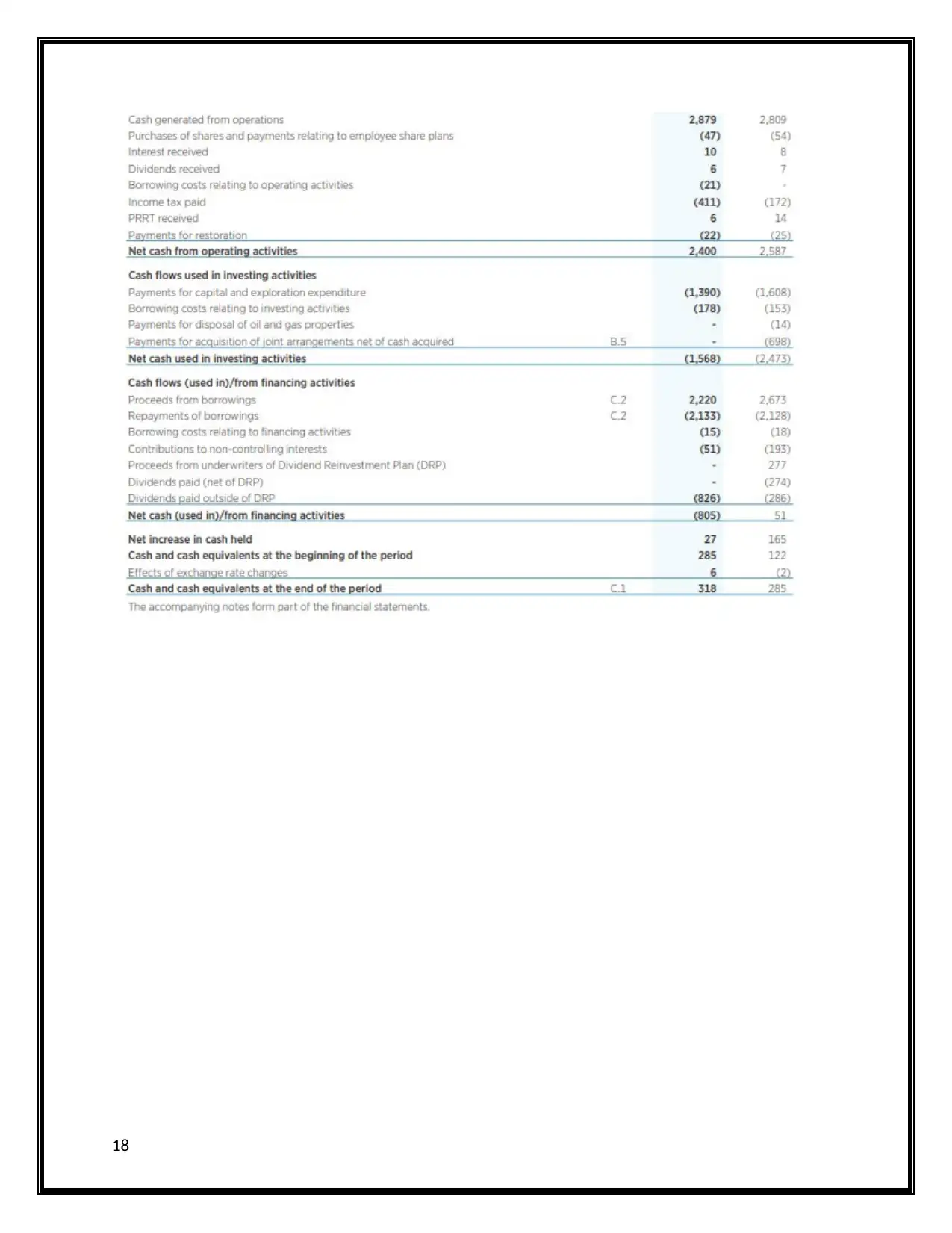

1. Payment for exploration: cash outflow for exploration and production of oil and

natural gas.

2. Borrowing cost: this cost bears the expenses related to the financing activities.

3. Proceeds from oil and gas properties: sale of units of business as oil and natural gas

properties.

4. Payments for acquisition: cash outflow for acquisition and takeover of some units

foe production (Annual report, 2017).

Cash flow from financing activities:

1. Proceeds from borrowings: cash inflow from borrowings given to investors.

2. Repayment from borrowings: cash outflow of loan amount given with interest

3. Borrowing cost: cash outflow for the borrowing cost.

4. Proceeds from DRP: proceeds available from dividend reinvestment plans.

(Fabozzi, 2018).

4

natural gas.

2. Borrowing cost: this cost bears the expenses related to the financing activities.

3. Proceeds from oil and gas properties: sale of units of business as oil and natural gas

properties.

4. Payments for acquisition: cash outflow for acquisition and takeover of some units

foe production (Annual report, 2017).

Cash flow from financing activities:

1. Proceeds from borrowings: cash inflow from borrowings given to investors.

2. Repayment from borrowings: cash outflow of loan amount given with interest

3. Borrowing cost: cash outflow for the borrowing cost.

4. Proceeds from DRP: proceeds available from dividend reinvestment plans.

(Fabozzi, 2018).

4

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

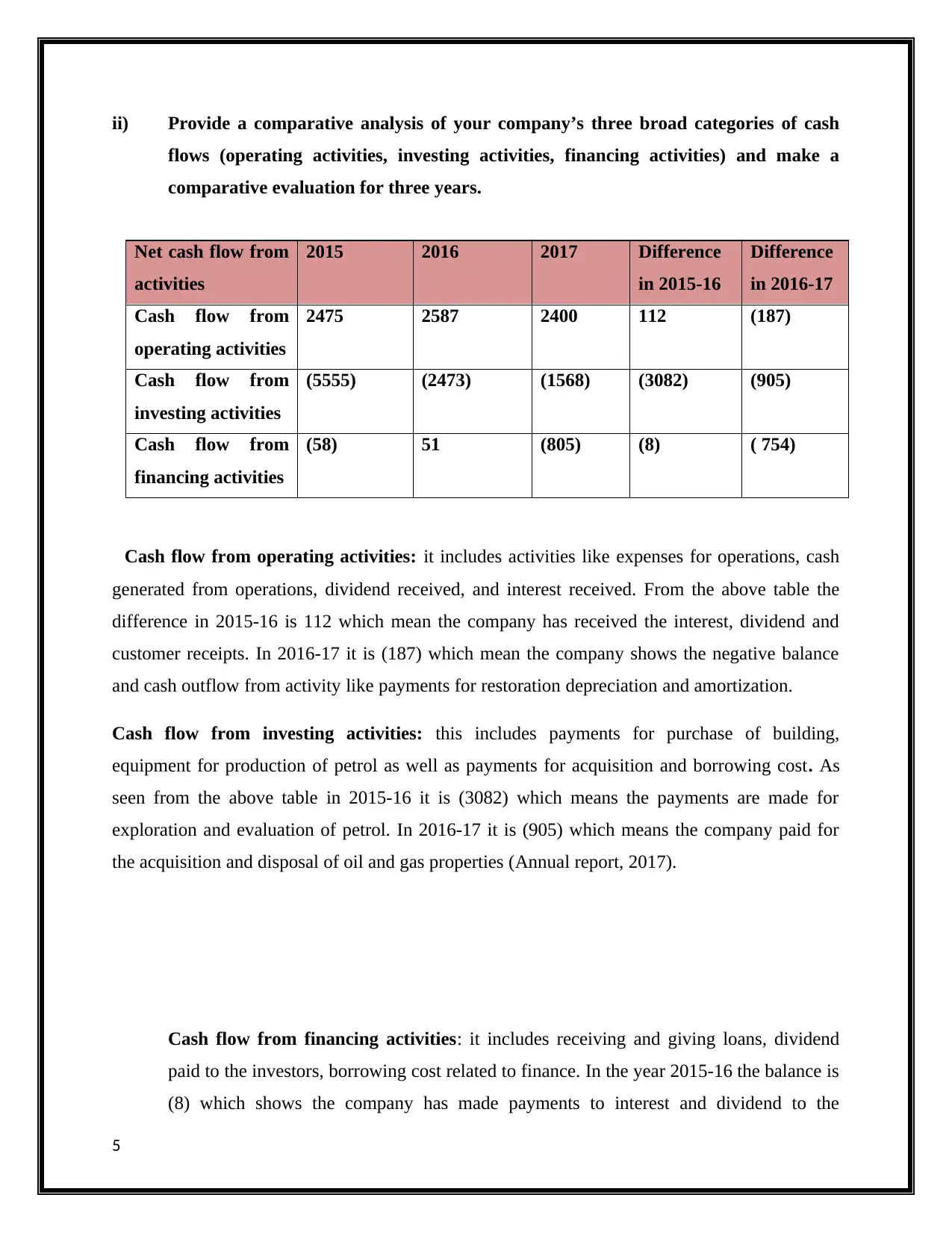

ii) Provide a comparative analysis of your company’s three broad categories of cash

flows (operating activities, investing activities, financing activities) and make a

comparative evaluation for three years.

Net cash flow from

activities

2015 2016 2017 Difference

in 2015-16

Difference

in 2016-17

Cash flow from

operating activities

2475 2587 2400 112 (187)

Cash flow from

investing activities

(5555) (2473) (1568) (3082) (905)

Cash flow from

financing activities

(58) 51 (805) (8) ( 754)

Cash flow from operating activities: it includes activities like expenses for operations, cash

generated from operations, dividend received, and interest received. From the above table the

difference in 2015-16 is 112 which mean the company has received the interest, dividend and

customer receipts. In 2016-17 it is (187) which mean the company shows the negative balance

and cash outflow from activity like payments for restoration depreciation and amortization.

Cash flow from investing activities: this includes payments for purchase of building,

equipment for production of petrol as well as payments for acquisition and borrowing cost. As

seen from the above table in 2015-16 it is (3082) which means the payments are made for

exploration and evaluation of petrol. In 2016-17 it is (905) which means the company paid for

the acquisition and disposal of oil and gas properties (Annual report, 2017).

Cash flow from financing activities: it includes receiving and giving loans, dividend

paid to the investors, borrowing cost related to finance. In the year 2015-16 the balance is

(8) which shows the company has made payments to interest and dividend to the

5

flows (operating activities, investing activities, financing activities) and make a

comparative evaluation for three years.

Net cash flow from

activities

2015 2016 2017 Difference

in 2015-16

Difference

in 2016-17

Cash flow from

operating activities

2475 2587 2400 112 (187)

Cash flow from

investing activities

(5555) (2473) (1568) (3082) (905)

Cash flow from

financing activities

(58) 51 (805) (8) ( 754)

Cash flow from operating activities: it includes activities like expenses for operations, cash

generated from operations, dividend received, and interest received. From the above table the

difference in 2015-16 is 112 which mean the company has received the interest, dividend and

customer receipts. In 2016-17 it is (187) which mean the company shows the negative balance

and cash outflow from activity like payments for restoration depreciation and amortization.

Cash flow from investing activities: this includes payments for purchase of building,

equipment for production of petrol as well as payments for acquisition and borrowing cost. As

seen from the above table in 2015-16 it is (3082) which means the payments are made for

exploration and evaluation of petrol. In 2016-17 it is (905) which means the company paid for

the acquisition and disposal of oil and gas properties (Annual report, 2017).

Cash flow from financing activities: it includes receiving and giving loans, dividend

paid to the investors, borrowing cost related to finance. In the year 2015-16 the balance is

(8) which shows the company has made payments to interest and dividend to the

5

investors. In 2016-17 the balance shows the (754) which shows the company has received

from the underwriters in the dividend reinvestment plan and received from the

borrowings (Defusco, et. al., 2015).

6

from the underwriters in the dividend reinvestment plan and received from the

borrowings (Defusco, et. al., 2015).

6

Other Comprehensive Income Statement

iii) What items have been reported in the other comprehensive income statement?

The comprehensive income statement includes those items which are not realized yet in includes

all the revenues, expenses, gains and losses, finance cost and excludes the profit and loss. It

always shows in table form below the income statement.

It comes as total of net income from the income statement plus the items of the comprehensive

item= comprehensive income. The items that are included in the comprehensive income

statements are gains and loss from the foreign currency adjustments, pension and retirement

plans, speculation and hedging activities, winnings and lottery, investments and holdings

(Annual report, 2017).

The reason behind including these statements in the annual report is that they are items of

shareholders equity and if not recorded the value of shareholder decreases so to enhance their

goodwill they are recorded as a comprehensive item. The word comprehensive means including

something, so here the items which are related to shareholders equity (Damodaran, 2018).

7

iii) What items have been reported in the other comprehensive income statement?

The comprehensive income statement includes those items which are not realized yet in includes

all the revenues, expenses, gains and losses, finance cost and excludes the profit and loss. It

always shows in table form below the income statement.

It comes as total of net income from the income statement plus the items of the comprehensive

item= comprehensive income. The items that are included in the comprehensive income

statements are gains and loss from the foreign currency adjustments, pension and retirement

plans, speculation and hedging activities, winnings and lottery, investments and holdings

(Annual report, 2017).

The reason behind including these statements in the annual report is that they are items of

shareholders equity and if not recorded the value of shareholder decreases so to enhance their

goodwill they are recorded as a comprehensive item. The word comprehensive means including

something, so here the items which are related to shareholders equity (Damodaran, 2018).

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

iv) Explain your understanding of each item reported in the other comprehensive

income statement

It includes all the items that are not realized yet and does not include the items of profit

and loss. So, here are some of the items of these statements

Gains and losses from winnings and lottery: Any amount which a shareholder incurred

from the lottery and winnings outside the business but which is associated with

shareholder examples like horse racing, cricket matches games tends to come as items of

comprehensive statement (Annual report, 2017).

Gains and losses from pension plans: any income or loss from the pension or retirement

benefit plans or after retirement plans. For an example change in govt. policy could result

in increase or decrease in pension plan or gratuity should result in comprehensive income.

Gains and losses from foreign currency: any adjustments which result in gains and

losses from foreign currency could be treated as comprehensive item. For an example

currency swap rates, increase or decrease in exchange of currency (Damodaran, 2018).

Gains and losses from debt securities: any adjustments in the stock market increase or

decrease in prices of stocks inflation/deflation in market risk and speculation activities.

Gains and losses from unrealized holdings: gains and losses from the sale of return of

investment and any adjustments made in unrealized holdings that are available for sale.

8

income statement

It includes all the items that are not realized yet and does not include the items of profit

and loss. So, here are some of the items of these statements

Gains and losses from winnings and lottery: Any amount which a shareholder incurred

from the lottery and winnings outside the business but which is associated with

shareholder examples like horse racing, cricket matches games tends to come as items of

comprehensive statement (Annual report, 2017).

Gains and losses from pension plans: any income or loss from the pension or retirement

benefit plans or after retirement plans. For an example change in govt. policy could result

in increase or decrease in pension plan or gratuity should result in comprehensive income.

Gains and losses from foreign currency: any adjustments which result in gains and

losses from foreign currency could be treated as comprehensive item. For an example

currency swap rates, increase or decrease in exchange of currency (Damodaran, 2018).

Gains and losses from debt securities: any adjustments in the stock market increase or

decrease in prices of stocks inflation/deflation in market risk and speculation activities.

Gains and losses from unrealized holdings: gains and losses from the sale of return of

investment and any adjustments made in unrealized holdings that are available for sale.

8

(v) Why these items have not been reported in Income Statement/Profit and Loss

Statement

These items include only the unrealized items and it does not include direct items of incomes and

losses. These are the items that are associated with the stakeholder value and they are necessary

to be recorded in any way. They are shown apart because the reason to get more highlights the

values, rights and goodwill of stakeholders. As they are not the direct items that are realized by

the company so they show just below the income statements.

Moreover, it becomes convenient not to show in P&L. If any stakeholder wants to know its value

they can just look on comprehensive income statement (Fraser, et. al., 2010).

9

Statement

These items include only the unrealized items and it does not include direct items of incomes and

losses. These are the items that are associated with the stakeholder value and they are necessary

to be recorded in any way. They are shown apart because the reason to get more highlights the

values, rights and goodwill of stakeholders. As they are not the direct items that are realized by

the company so they show just below the income statements.

Moreover, it becomes convenient not to show in P&L. If any stakeholder wants to know its value

they can just look on comprehensive income statement (Fraser, et. al., 2010).

9

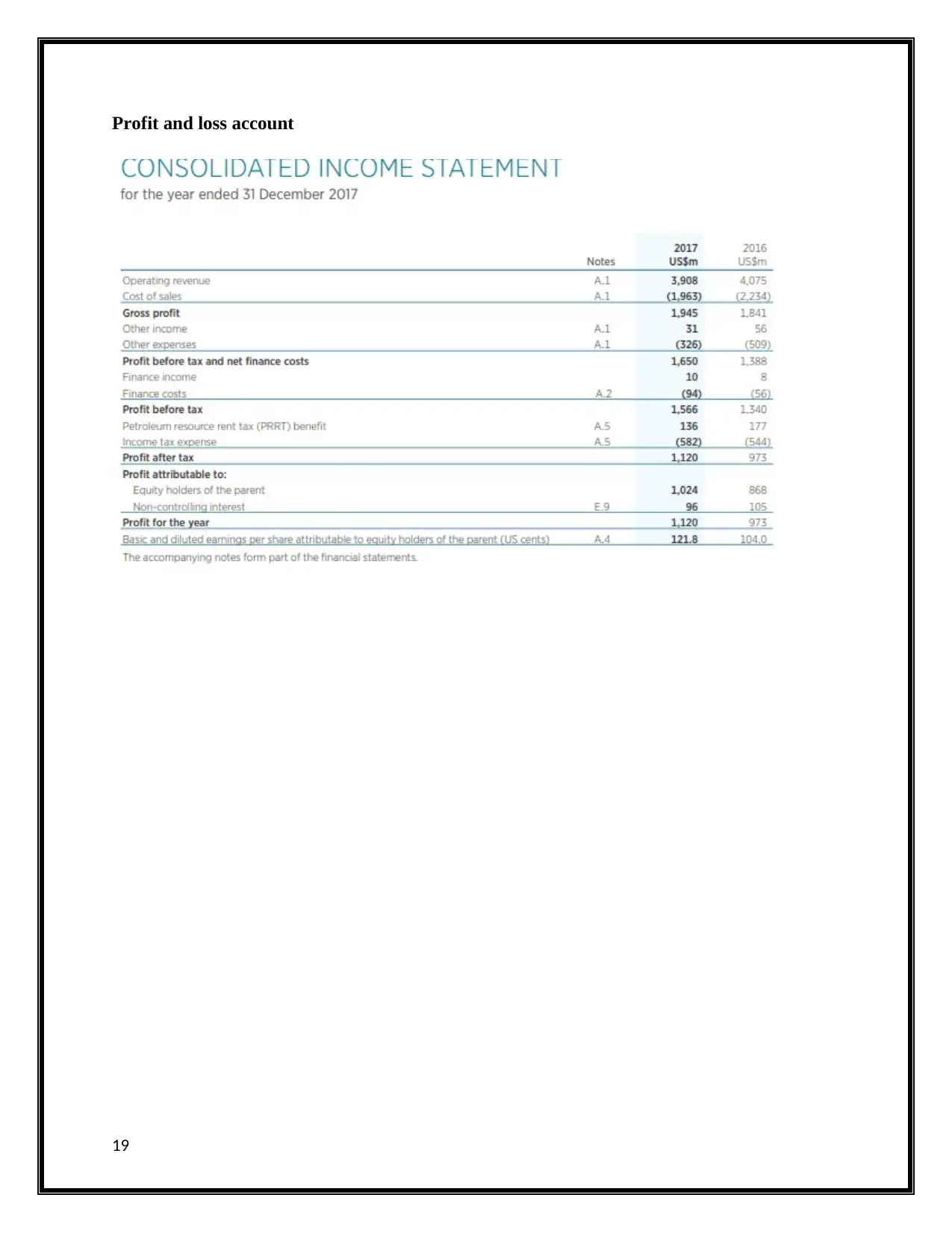

Accounting For Corporate Income Tax

(vi) What is your firm’s tax expense in its latest financial statements?

The tax expense for the current financial year in 2016 and 2017 respectively are (544) and (582).

The tax expense of any firm is depicted in the income statements.

The tax expense of the company is the actual expenses that derived with the mathematical

formula. These are the expenses for the year. They are deductable from profit before tax. It is

quite different from tax payable (Slemrod & Bakija, 2017).

10

(vi) What is your firm’s tax expense in its latest financial statements?

The tax expense for the current financial year in 2016 and 2017 respectively are (544) and (582).

The tax expense of any firm is depicted in the income statements.

The tax expense of the company is the actual expenses that derived with the mathematical

formula. These are the expenses for the year. They are deductable from profit before tax. It is

quite different from tax payable (Slemrod & Bakija, 2017).

10

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

(vii) Is this figure the same as the company tax rate times your firm’s accounting income?

Explain why this is, or is not, the case for your firm.

No, the figure of tax expense is not same as that of firms accounting income The tax expense for

the current financial year in 2016 and 2017 respectively are (544) and (582) and the income tax

rate as per the Australian standards is 30% Other things that income tax expense does not

include the entire amount which is not taxable are as depreciation and amortization, capital

income or losses realized, tax benefits on acquisitions and mergers etc. (Warren & Jones, 2018).

11

Explain why this is, or is not, the case for your firm.

No, the figure of tax expense is not same as that of firms accounting income The tax expense for

the current financial year in 2016 and 2017 respectively are (544) and (582) and the income tax

rate as per the Australian standards is 30% Other things that income tax expense does not

include the entire amount which is not taxable are as depreciation and amortization, capital

income or losses realized, tax benefits on acquisitions and mergers etc. (Warren & Jones, 2018).

11

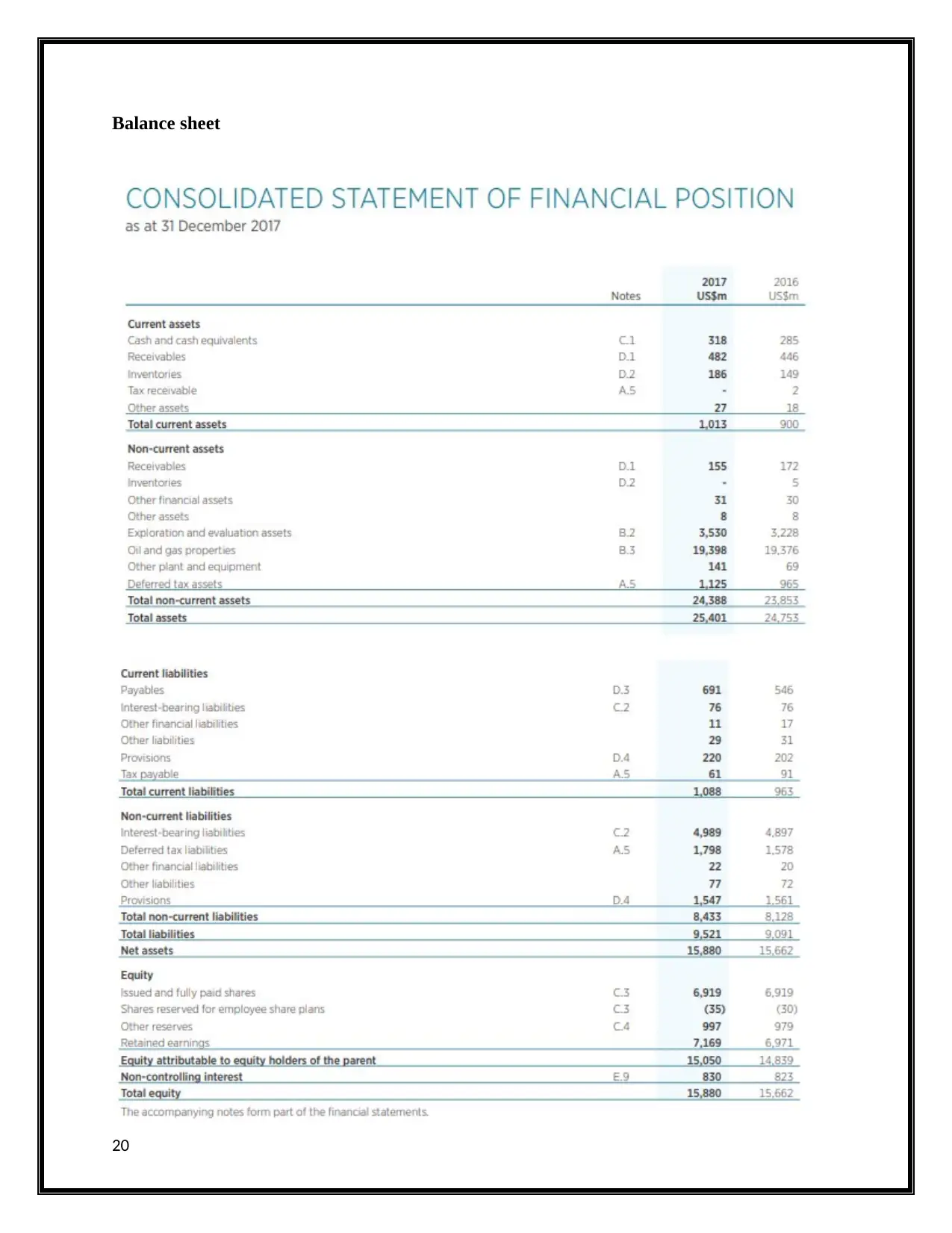

(viii) Comment on deferred tax assets/liabilities that are reported in the balance sheet

articulating the possible reasons why they have been recorded.

The deferred tax assets/liabilities are the overpaid and advance tax paid by the company. The

deferred tax of our company Woodside petroleum limited is 965 and 1125 in the year 2016 and

2017 respectively. They are always shown on the assets side of the balance sheet.

They are always treated and shown on the balance sheet:

The deferred assets are always treated as assets though they are paid as advance tax. The reason

is the nature that they poses by giving lump sum or advance tax and then using that advance tax

amount by taking the tax reliefs, tax rebates in tax concessions in the near future. So, the reason

that they reduce the future tax liability that’s why they are treated as an asset and all the assets of

the company are shown in the balance sheet. (Wang, et. al., 2016).

12

articulating the possible reasons why they have been recorded.

The deferred tax assets/liabilities are the overpaid and advance tax paid by the company. The

deferred tax of our company Woodside petroleum limited is 965 and 1125 in the year 2016 and

2017 respectively. They are always shown on the assets side of the balance sheet.

They are always treated and shown on the balance sheet:

The deferred assets are always treated as assets though they are paid as advance tax. The reason

is the nature that they poses by giving lump sum or advance tax and then using that advance tax

amount by taking the tax reliefs, tax rebates in tax concessions in the near future. So, the reason

that they reduce the future tax liability that’s why they are treated as an asset and all the assets of

the company are shown in the balance sheet. (Wang, et. al., 2016).

12

(ix) Is there any current tax assets or income tax payable recorded by your company? Why

is the income tax payable not the same as income tax expense?

The current tax assets are $ 965 and 1125 in the year 2016 and 2017 respectively. The company

current tax liability is $ 91 and 61 in the year 2016 and 2017 respectively.

The income tax payable and income tax expense are both the different terms. The tax expenses

of firm are 2016 and 2017 respectively (544) and (582). The tax payable is $ 91 and 61 in the

year 2016 and 2017 respectively. So, we can see the difference in the figure the tax is not paid in

full. This will stand as a liability in balance sheet until it is written off in full. There can be many

reasons by which we stand the liability of tax payable to get reduce by means of deferred tax and

other tax concessions from the govt. but the tax expense cannot be reduce, paid off latter or can

set-off because they are the actual expenses one has to bear it because if the company has not

done expenses it could not have earned the profits (Annual report, 2017). The profits of the

company are result of the expenses incurred by the company and they are not payable to govt.

either they are deducted in the income statement.

13

is the income tax payable not the same as income tax expense?

The current tax assets are $ 965 and 1125 in the year 2016 and 2017 respectively. The company

current tax liability is $ 91 and 61 in the year 2016 and 2017 respectively.

The income tax payable and income tax expense are both the different terms. The tax expenses

of firm are 2016 and 2017 respectively (544) and (582). The tax payable is $ 91 and 61 in the

year 2016 and 2017 respectively. So, we can see the difference in the figure the tax is not paid in

full. This will stand as a liability in balance sheet until it is written off in full. There can be many

reasons by which we stand the liability of tax payable to get reduce by means of deferred tax and

other tax concessions from the govt. but the tax expense cannot be reduce, paid off latter or can

set-off because they are the actual expenses one has to bear it because if the company has not

done expenses it could not have earned the profits (Annual report, 2017). The profits of the

company are result of the expenses incurred by the company and they are not payable to govt.

either they are deducted in the income statement.

13

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

(x) Is the income tax expense shown in the income statement same as the income tax paid

shown in the cash flow statement? If not why is the difference?

No, the figures are not at all the same as tax expense for the current financial year in 2016 and

2017 respectively are (544) and (582) and the income tax paid is (411) and (172) in 2016 and

2017 respectively.

The reason of difference: From the figures we can note that the tax expense is more than the tax

paid, the tax expense should be the full expense they are derived with a mathematical formula for

a particular year, whereas the tax payment stand as a liability for a company they can pay a

particular amount in the particular year or in the future year. They can also rebate their taxes by

the deferred taxes. So, it is not required by the company to pay all the taxes in a particular year

so, that’s why the figures of the company are different (Annual report, 2017).

14

shown in the cash flow statement? If not why is the difference?

No, the figures are not at all the same as tax expense for the current financial year in 2016 and

2017 respectively are (544) and (582) and the income tax paid is (411) and (172) in 2016 and

2017 respectively.

The reason of difference: From the figures we can note that the tax expense is more than the tax

paid, the tax expense should be the full expense they are derived with a mathematical formula for

a particular year, whereas the tax payment stand as a liability for a company they can pay a

particular amount in the particular year or in the future year. They can also rebate their taxes by

the deferred taxes. So, it is not required by the company to pay all the taxes in a particular year

so, that’s why the figures of the company are different (Annual report, 2017).

14

(xi) What do you find interesting, confusing, surprising or difficult to understand about the

treatment of tax in your firm’s financial statements? What new insights, if any, have you

gained about how companies account for income tax as a result of examining your firm’s

tax expense in its accounts?

It is interesting that financial statements include the comprehensive income statement for

increasing the value of the stakeholders but at a time it is also difficult because for making the

financial statements we need to gather the data from the various historical records which

sometimes proves to be the time consuming and inappropriate (Annual report, 2017).

Our company Woodside petroleum Limited consist of the tax expenses 2016 and 2017

respectively are (544) and (582) after examining this it gives us information that company should

keep its account updated. Use of simple and quick answer base methods so that company can

maintain its expenses properly and wisely.

15

treatment of tax in your firm’s financial statements? What new insights, if any, have you

gained about how companies account for income tax as a result of examining your firm’s

tax expense in its accounts?

It is interesting that financial statements include the comprehensive income statement for

increasing the value of the stakeholders but at a time it is also difficult because for making the

financial statements we need to gather the data from the various historical records which

sometimes proves to be the time consuming and inappropriate (Annual report, 2017).

Our company Woodside petroleum Limited consist of the tax expenses 2016 and 2017

respectively are (544) and (582) after examining this it gives us information that company should

keep its account updated. Use of simple and quick answer base methods so that company can

maintain its expenses properly and wisely.

15

References:

Annual report, 2017. Woodside Petroleum Limited. [Online] Annual report. Available at:

https://woodsideannouncements.app.woodside/14.02.2018 AnnualReport2017.pdf

[Accessed on: 29 may 2018].

Damodaran, A., 2018. The dark side of valuation: Valuing young, distressed, and

complex businesses. Ft Press.

DeFusco, R.A., McLeavey, D.W., Pinto, J.E., Anson, M.J. and Runkle, D.E.,

(2015. Quantitative investment analysis. John Wiley & Sons.

Fabozzi, F.J. ed., 2018. The handbook of financial instruments. John Wiley & Sons.

Fraser, L.M., Ormiston, A. and Fraser, L.M., 2010. Understanding financial statements.

Pearson.

Slemrod, J. and Bakija, J., 2017. Taxing ourselves: a citizen's guide to the debate over

taxes. MIt Press.

Wang, Y., Butterfield, S., & Campbell, M. (2016). Deferred Tax Items As Earnings

Warren, C.S. and Jones, J., 2018. Corporate financial accounting. Cengage Learning.

16

Annual report, 2017. Woodside Petroleum Limited. [Online] Annual report. Available at:

https://woodsideannouncements.app.woodside/14.02.2018 AnnualReport2017.pdf

[Accessed on: 29 may 2018].

Damodaran, A., 2018. The dark side of valuation: Valuing young, distressed, and

complex businesses. Ft Press.

DeFusco, R.A., McLeavey, D.W., Pinto, J.E., Anson, M.J. and Runkle, D.E.,

(2015. Quantitative investment analysis. John Wiley & Sons.

Fabozzi, F.J. ed., 2018. The handbook of financial instruments. John Wiley & Sons.

Fraser, L.M., Ormiston, A. and Fraser, L.M., 2010. Understanding financial statements.

Pearson.

Slemrod, J. and Bakija, J., 2017. Taxing ourselves: a citizen's guide to the debate over

taxes. MIt Press.

Wang, Y., Butterfield, S., & Campbell, M. (2016). Deferred Tax Items As Earnings

Warren, C.S. and Jones, J., 2018. Corporate financial accounting. Cengage Learning.

16

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Appendix

Cash flow statement

17

Cash flow statement

17

18

Profit and loss account

19

19

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Balance sheet

20

20

21

1 out of 21

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.