H15020 Corporate Accounting: Detailed Financial Statement Analysis

VerifiedAdded on 2024/06/03

|13

|2789

|205

Report

AI Summary

This report provides a comprehensive analysis of financial statements, focusing on cash flow statements, other comprehensive income statements, and accounting for corporate income tax. It includes an examination of Galaxy Resources Limited's financial activities from 2015 to 2017, detailing operating, investing, and financing cash flows. The report explains the components of the other comprehensive income statement, highlighting items not reported in the income statement and their significance. Additionally, it covers tax expenses, deferred tax assets and liabilities, and the differences between income tax expense and income tax paid. This analysis aims to provide a clear understanding of corporate accounting practices and financial reporting.

H15020 Corporate Accounting

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

Cash Flows Statement.................................................................................................................................3

Other Comprehensive Income Statement....................................................................................................5

Accounting For Corporate Income Tax.......................................................................................................8

2

Cash Flows Statement.................................................................................................................................3

Other Comprehensive Income Statement....................................................................................................5

Accounting For Corporate Income Tax.......................................................................................................8

2

Cash Flows Statement

(i) From your firm’s financial statement, list each item of reported in the CASH FLOWS

STATEMENT and write your understanding of each item. Discuss any changes in each

item of CASH FLOWS STATEMENT for your firm over the past year articulating the

reasons for the change.

Galaxy Resources limited is an Australian company ASX listed. It is a mining company which

deals in production of lithium carbonate as well as exploration of minerals. It used to operate its

business operations globally. Cash flow statement of this company and an understanding over it:

Operating activities:

1. Receipts from customers: receipts of raw materials and other goods and services.

2. Payments made to suppliers, contractors and employees: payments made in form of

wages, salaries and other payments.

Investing activities:

1. Interest Received: from mining activities and exploration.

2. Payments for plant, property: cash outflow for purchase of palnt, property and

equipment.

3. Proceeds from pre-production: cash inflow from pre- production of mining.

4. Proceeds from non-current assets: cash inflow from deferred assets.

5. Payments received from acquisition: cash inflow from acquisition and merger of

mining properties.

6. Payments for exploration: cash outflow from exploration of lithium and carbonates.

Financing activities:

1. Proceeds from issue of shares: capital generated from issue of shares and debentures.

2. Bank charges: cash outflow from bank charges and interest paid

3. Proceeds from borrowing: sale proceeds from borrowing.

3

(i) From your firm’s financial statement, list each item of reported in the CASH FLOWS

STATEMENT and write your understanding of each item. Discuss any changes in each

item of CASH FLOWS STATEMENT for your firm over the past year articulating the

reasons for the change.

Galaxy Resources limited is an Australian company ASX listed. It is a mining company which

deals in production of lithium carbonate as well as exploration of minerals. It used to operate its

business operations globally. Cash flow statement of this company and an understanding over it:

Operating activities:

1. Receipts from customers: receipts of raw materials and other goods and services.

2. Payments made to suppliers, contractors and employees: payments made in form of

wages, salaries and other payments.

Investing activities:

1. Interest Received: from mining activities and exploration.

2. Payments for plant, property: cash outflow for purchase of palnt, property and

equipment.

3. Proceeds from pre-production: cash inflow from pre- production of mining.

4. Proceeds from non-current assets: cash inflow from deferred assets.

5. Payments received from acquisition: cash inflow from acquisition and merger of

mining properties.

6. Payments for exploration: cash outflow from exploration of lithium and carbonates.

Financing activities:

1. Proceeds from issue of shares: capital generated from issue of shares and debentures.

2. Bank charges: cash outflow from bank charges and interest paid

3. Proceeds from borrowing: sale proceeds from borrowing.

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4. Transaction cost: book keeping of accounts and register cost.

5. Repayment of borrowing: outflow of cash paying amount with interest

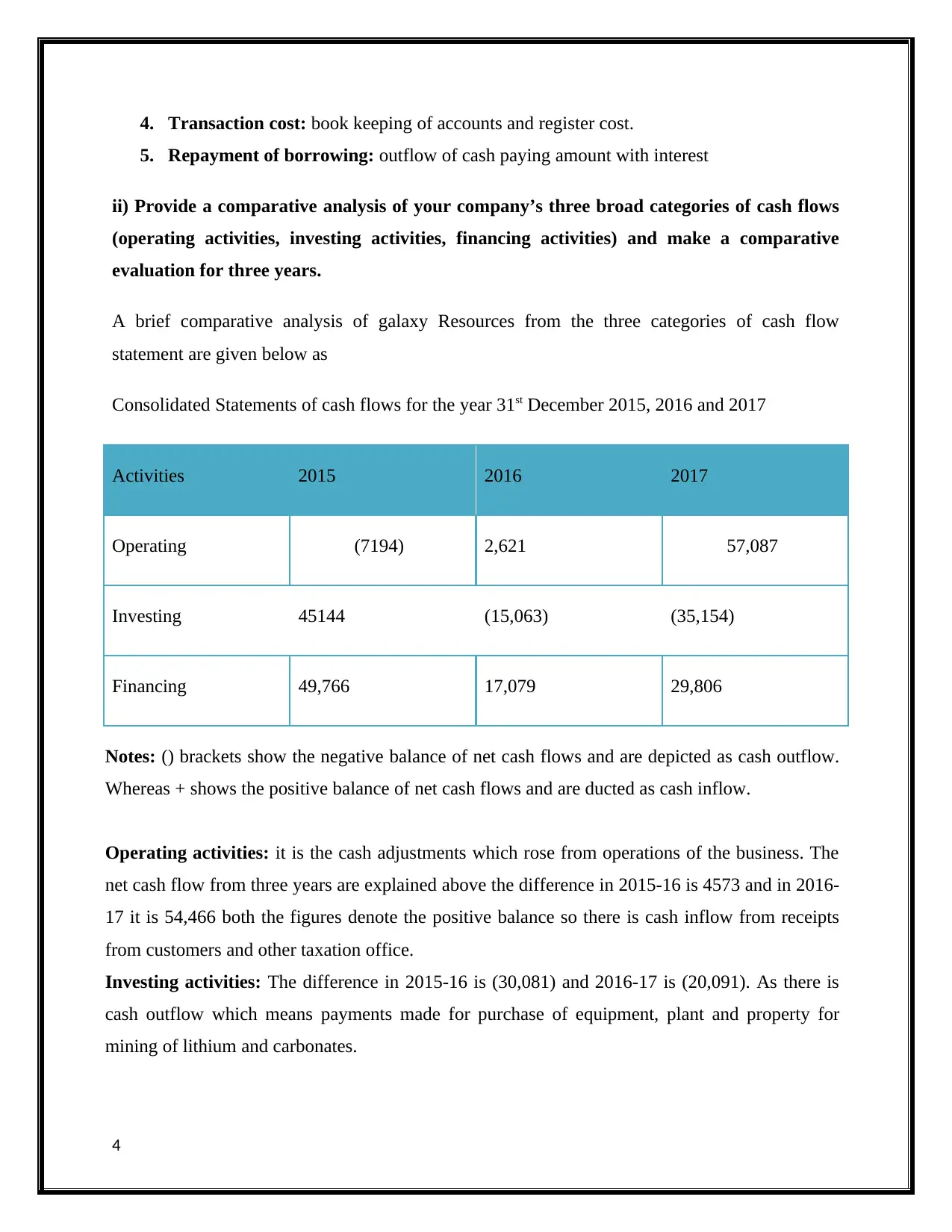

ii) Provide a comparative analysis of your company’s three broad categories of cash flows

(operating activities, investing activities, financing activities) and make a comparative

evaluation for three years.

A brief comparative analysis of galaxy Resources from the three categories of cash flow

statement are given below as

Consolidated Statements of cash flows for the year 31st December 2015, 2016 and 2017

Activities 2015 2016 2017

Operating (7194) 2,621 57,087

Investing 45144 (15,063) (35,154)

Financing 49,766 17,079 29,806

Notes: () brackets show the negative balance of net cash flows and are depicted as cash outflow.

Whereas + shows the positive balance of net cash flows and are ducted as cash inflow.

Operating activities: it is the cash adjustments which rose from operations of the business. The

net cash flow from three years are explained above the difference in 2015-16 is 4573 and in 2016-

17 it is 54,466 both the figures denote the positive balance so there is cash inflow from receipts

from customers and other taxation office.

Investing activities: The difference in 2015-16 is (30,081) and 2016-17 is (20,091). As there is

cash outflow which means payments made for purchase of equipment, plant and property for

mining of lithium and carbonates.

4

5. Repayment of borrowing: outflow of cash paying amount with interest

ii) Provide a comparative analysis of your company’s three broad categories of cash flows

(operating activities, investing activities, financing activities) and make a comparative

evaluation for three years.

A brief comparative analysis of galaxy Resources from the three categories of cash flow

statement are given below as

Consolidated Statements of cash flows for the year 31st December 2015, 2016 and 2017

Activities 2015 2016 2017

Operating (7194) 2,621 57,087

Investing 45144 (15,063) (35,154)

Financing 49,766 17,079 29,806

Notes: () brackets show the negative balance of net cash flows and are depicted as cash outflow.

Whereas + shows the positive balance of net cash flows and are ducted as cash inflow.

Operating activities: it is the cash adjustments which rose from operations of the business. The

net cash flow from three years are explained above the difference in 2015-16 is 4573 and in 2016-

17 it is 54,466 both the figures denote the positive balance so there is cash inflow from receipts

from customers and other taxation office.

Investing activities: The difference in 2015-16 is (30,081) and 2016-17 is (20,091). As there is

cash outflow which means payments made for purchase of equipment, plant and property for

mining of lithium and carbonates.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financing Activities: The difference in 2015-16 is 32,687 and in 2016-17 is 12,727. Both denote

the positive balance which means cash generated from the financing activities as proceeds from

borrowings and receivables from issue of shares.

Other Comprehensive Income Statement

iii) What items have been reported in the other comprehensive income statement?

It includes all the unrealized items such as gains and losses from foreign currency, Speculation

Business, Hedging and risk, Pension Plans, Lottery and winnings, debt securities etc. It also

includes revenues, income and expenses which are met during the year. Revenues, expenses,

finance cost, profit and loss and do not include the income statement because it is not realized.

It includes every kind of items that haven’t been realized yet.

Unrealized gains and losses from:

1. Securities available for sale.

2. Financial statements

3. Pension and retirement benefit plans.

4. Foreign currency adjustments.

The comprehensive income is shown just below the income statement. In short the

comprehensive income includes the net income plus all the items included in the comprehensive

Income statements. These are all shown in order to increase the value of stakeholder of the

Company in order to make them know that company has also included the gains and losses from

the unrealized items.

Moreover, every item that effect the Shareholders equity or any gains and losses are not every

time included in the income statements so to know the other items that affect the equity account

are needed to know by the company, that’s why they prepare the comprehensive income

statement in different side which is not related to income statement.

5

the positive balance which means cash generated from the financing activities as proceeds from

borrowings and receivables from issue of shares.

Other Comprehensive Income Statement

iii) What items have been reported in the other comprehensive income statement?

It includes all the unrealized items such as gains and losses from foreign currency, Speculation

Business, Hedging and risk, Pension Plans, Lottery and winnings, debt securities etc. It also

includes revenues, income and expenses which are met during the year. Revenues, expenses,

finance cost, profit and loss and do not include the income statement because it is not realized.

It includes every kind of items that haven’t been realized yet.

Unrealized gains and losses from:

1. Securities available for sale.

2. Financial statements

3. Pension and retirement benefit plans.

4. Foreign currency adjustments.

The comprehensive income is shown just below the income statement. In short the

comprehensive income includes the net income plus all the items included in the comprehensive

Income statements. These are all shown in order to increase the value of stakeholder of the

Company in order to make them know that company has also included the gains and losses from

the unrealized items.

Moreover, every item that effect the Shareholders equity or any gains and losses are not every

time included in the income statements so to know the other items that affect the equity account

are needed to know by the company, that’s why they prepare the comprehensive income

statement in different side which is not related to income statement.

5

(iv) Explain your understanding of each item reported in the other comprehensive income

Statement

To understand each item of comprehensive income statement are as follows:

1. Gains and losses from lottery and winning: it includes any winsome amount, lottery

Benefit, chit funds amount, any gain and losses from these businesses which are legal in terms of

corporate view. These all come in the head of comprehensive income.

2. Gains and losses from foreign currency: adjustments like any exchange rates, swap

Rates of foreign currency. Or any gains or losses arising from foreign currency are treated as

income for e.g. any increase or decrease in the purchase or sale of any item which denominated

in Rupees for exchange of foreign currency gives rise to comprehensive Income.

3. Gains and losses from debt securities: it includes any adjustments from the hedging,

Speculation or securities market like rise in prices of stock market, any stock market gains

Or losses are treated as a comprehensive income.

4. Gains and losses from unrealized holdings: any adjustments from return on

Investments that is available for the sale.

5. Gains and losses from debt securities: it includes any adjustments from the hedging,

Speculation or securities market like rise in prices of stock market, any stock market gains

Or losses are treated as a comprehensive income.

6. Gains and losses from pension plan and retirement benefits: any such adjustments

From the pension plans and retirement benefits arising to comprehensive income as Gratuity,

retirement benefits etc.

6

Statement

To understand each item of comprehensive income statement are as follows:

1. Gains and losses from lottery and winning: it includes any winsome amount, lottery

Benefit, chit funds amount, any gain and losses from these businesses which are legal in terms of

corporate view. These all come in the head of comprehensive income.

2. Gains and losses from foreign currency: adjustments like any exchange rates, swap

Rates of foreign currency. Or any gains or losses arising from foreign currency are treated as

income for e.g. any increase or decrease in the purchase or sale of any item which denominated

in Rupees for exchange of foreign currency gives rise to comprehensive Income.

3. Gains and losses from debt securities: it includes any adjustments from the hedging,

Speculation or securities market like rise in prices of stock market, any stock market gains

Or losses are treated as a comprehensive income.

4. Gains and losses from unrealized holdings: any adjustments from return on

Investments that is available for the sale.

5. Gains and losses from debt securities: it includes any adjustments from the hedging,

Speculation or securities market like rise in prices of stock market, any stock market gains

Or losses are treated as a comprehensive income.

6. Gains and losses from pension plan and retirement benefits: any such adjustments

From the pension plans and retirement benefits arising to comprehensive income as Gratuity,

retirement benefits etc.

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

(v) Why these items have not been reported in Income Statement/Profit and Loss

Statement

The items of income statement include all the realized items. Income statement or profit and loss

statements are the financial statements which include all the expenses and income which are

directly related to company. On the other hand, comprehensive includes only unrealized income

such as gains and losses arising from speculation or hedging business, pension or retirement

plans, adjustment from foreign currency, gains or losses arising from the investment holding

available for sale.

These all items are not shown in Profit & loss statements because are not realized; they are

shown below the head of P&L because they should in different head so that even individual,

stakeholder or shareholder can know the equity they pose in the company. All the items shown

are that which increases or decreases the value of stakeholder that why they shown apart.

Moreover, the reason to show them apart is they are not a part of P&L. It will be more convents

to show it separately.

Accounting For Corporate Income Tax

(vi) What is your firm’s tax expense in its latest financial statements?

Tax expenses are the actual tax that is calculated by the company using a mathematical formula,

it usually depicted as expenses of company. It is also known as taxable income before tax. It is

truly different from tax payable.

The tax expense for the financial year 31st December 2017 is as follows:

It is $64,686 and (5,999) respectively in 2016 and 2017. The tax expense of any firm is shown in

the income statement.

The tax expense used to variant from year to year on the basis of different mathematical formula

applied in calculation of tax. Tax expense usually come or depicted in the income statement or

the profit and loss statement. They are the expense and are very different from tax payable.

7

Statement

The items of income statement include all the realized items. Income statement or profit and loss

statements are the financial statements which include all the expenses and income which are

directly related to company. On the other hand, comprehensive includes only unrealized income

such as gains and losses arising from speculation or hedging business, pension or retirement

plans, adjustment from foreign currency, gains or losses arising from the investment holding

available for sale.

These all items are not shown in Profit & loss statements because are not realized; they are

shown below the head of P&L because they should in different head so that even individual,

stakeholder or shareholder can know the equity they pose in the company. All the items shown

are that which increases or decreases the value of stakeholder that why they shown apart.

Moreover, the reason to show them apart is they are not a part of P&L. It will be more convents

to show it separately.

Accounting For Corporate Income Tax

(vi) What is your firm’s tax expense in its latest financial statements?

Tax expenses are the actual tax that is calculated by the company using a mathematical formula,

it usually depicted as expenses of company. It is also known as taxable income before tax. It is

truly different from tax payable.

The tax expense for the financial year 31st December 2017 is as follows:

It is $64,686 and (5,999) respectively in 2016 and 2017. The tax expense of any firm is shown in

the income statement.

The tax expense used to variant from year to year on the basis of different mathematical formula

applied in calculation of tax. Tax expense usually come or depicted in the income statement or

the profit and loss statement. They are the expense and are very different from tax payable.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

(vii) Is this figure the same as the company tax rate times your firm’s accounting income?

Explain why this is, or is not, the case for your firm.

No, the figure of tax expense is not same as because the net profit of the company is 166 and the

income tax rate is 30.00% so we can see the figure both are different. Other things that income

tax expense does not include the entire amount which is not taxable are as:

capital income, Depreciation and amortization or losses realized tax benefits on acquisitions and

mergers etc. But in calculation of the accounting income it used to take the entire amount and all

other respective principles. So, obviously the figures are not going to be the same.

8

Explain why this is, or is not, the case for your firm.

No, the figure of tax expense is not same as because the net profit of the company is 166 and the

income tax rate is 30.00% so we can see the figure both are different. Other things that income

tax expense does not include the entire amount which is not taxable are as:

capital income, Depreciation and amortization or losses realized tax benefits on acquisitions and

mergers etc. But in calculation of the accounting income it used to take the entire amount and all

other respective principles. So, obviously the figures are not going to be the same.

8

viii) Comment on deferred tax assets/liabilities that are reported in the balance sheet

articulating the possible reasons why they have been recorded.

The deferred tax assets and liabilities are shown in the balance sheet in the assets side. They are

treated as the overpaid or advance payment of taxes that are paid by the company which is set off

by the govt. in the form of tax rebates, tax reliefs and other benefits. They are generally paid

former to get the tax benefits latter on. So, the deferred tax assets are the assets that show the

overpayment of taxation to the govt. authority which will be given to company in form of tax

benefits (Annual Report, 2017).

They are shown in the head of balance sheet:

As it is explained in the above that they are advance payment of tax and so we can set them off

with certain liability and taxes. So, they all are treated as the assets of the company and all assets

are shown in the right side of the balance sheet. As explained above that they used to reduce the

future tax liability. They are often set off with certain penalties, duties, other unpaid taxes and

certain other govt. taxes. The deferred tax assets of the company for the year end 31st December

2017 is 53,619 (Annual Report, 2017).

9

articulating the possible reasons why they have been recorded.

The deferred tax assets and liabilities are shown in the balance sheet in the assets side. They are

treated as the overpaid or advance payment of taxes that are paid by the company which is set off

by the govt. in the form of tax rebates, tax reliefs and other benefits. They are generally paid

former to get the tax benefits latter on. So, the deferred tax assets are the assets that show the

overpayment of taxation to the govt. authority which will be given to company in form of tax

benefits (Annual Report, 2017).

They are shown in the head of balance sheet:

As it is explained in the above that they are advance payment of tax and so we can set them off

with certain liability and taxes. So, they all are treated as the assets of the company and all assets

are shown in the right side of the balance sheet. As explained above that they used to reduce the

future tax liability. They are often set off with certain penalties, duties, other unpaid taxes and

certain other govt. taxes. The deferred tax assets of the company for the year end 31st December

2017 is 53,619 (Annual Report, 2017).

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

(ix) Is there any current tax assets or income tax payable recorded by your company? Why

is the income tax payable not the same as income tax expense?

The company has current tax assets which are depicted as deferred tax assets in the balance sheet

of the company for the year end 31st December 2017 is 53,619. But the company does not have

any tax payable.

No, the Income tax payable is not same as income tax expense because, the income tax payable

is always emerged as liability in balance sheet until it is paid off or written off The tax expense

are the actual expense for a firm which are calculated with the mathematical formula. It is 64,686

and (5,999) respectively in 2016 and 2017 and the tax paid is nil so, we can see that are tax

expenses exceed tax paid. We cannot in any way try to hide or evade the tax. Failure to do so can

attract different liability.

10

is the income tax payable not the same as income tax expense?

The company has current tax assets which are depicted as deferred tax assets in the balance sheet

of the company for the year end 31st December 2017 is 53,619. But the company does not have

any tax payable.

No, the Income tax payable is not same as income tax expense because, the income tax payable

is always emerged as liability in balance sheet until it is paid off or written off The tax expense

are the actual expense for a firm which are calculated with the mathematical formula. It is 64,686

and (5,999) respectively in 2016 and 2017 and the tax paid is nil so, we can see that are tax

expenses exceed tax paid. We cannot in any way try to hide or evade the tax. Failure to do so can

attract different liability.

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

(x) Is the income tax expense shown in the income statement same as the income tax paid

shown in the cash flow statement? If not why is the difference?

Both the figures are not same because the reason for their difference is given differently as we

can see the tax expense for the current financial year in 2017 (5,999) whereas tax paid is NIL.

So, we can see that the tax expense of our company is more than the tax paid and the difference

is (5999). So, from above analysis it is clear that tax expenses are derived with the mathematical

formula they are the actual expenses to be paid before the tax. But tax paid may be differed by

paying less or more. Since, the company does not have deferred tax it cannot take a tax relief or

cannot set off its amount.

Again that tax expenses are always shown in the head of income statement they are deducted

from profit before income tax. Whereas, tax payable is stand as a tax liability in balance sheet

until and unless it is paid off.

11

shown in the cash flow statement? If not why is the difference?

Both the figures are not same because the reason for their difference is given differently as we

can see the tax expense for the current financial year in 2017 (5,999) whereas tax paid is NIL.

So, we can see that the tax expense of our company is more than the tax paid and the difference

is (5999). So, from above analysis it is clear that tax expenses are derived with the mathematical

formula they are the actual expenses to be paid before the tax. But tax paid may be differed by

paying less or more. Since, the company does not have deferred tax it cannot take a tax relief or

cannot set off its amount.

Again that tax expenses are always shown in the head of income statement they are deducted

from profit before income tax. Whereas, tax payable is stand as a tax liability in balance sheet

until and unless it is paid off.

11

(xi)What do you find interesting, confusing, surprising or difficult to understand about the

treatment of tax in your firm’s financial statements? What new insights, if any, have you

gained about how companies account for income tax as a result of examining your firm’s

tax expense in its accounts?

Every company have different treatment of tax some have very rigid taxation the other one have

very reliable taxation. And the whole formation is very interesting and little bit difficult to

understand the treatment of tax in our financial Statements as because our firm include a lot of

data interpretation, making of financial statements.

It is difficult because various formulas and techniques which also time consuming, on the other

hand it is not easy for every employee to conduct this treatment because it very brain task. But it

is also surprising to have treatment of our tax expense or liability with the future tax payments as

deferred tax payments. So, it is quite surprising, interesting and difficult.

The new insights gained from the companies account for income tax from its tax expense are

which includes 2016 and 2017 respectively 64,686 and (5,999). The tax expense of any firm is

shown in the income statement. The firms account for income tax should be clearly stated, so

that even public can know why and when to invest. It should have an accurate and simple

formula to derive the results. Accuracy, compatibility, flexibility all should maintained in one

frame.

12

treatment of tax in your firm’s financial statements? What new insights, if any, have you

gained about how companies account for income tax as a result of examining your firm’s

tax expense in its accounts?

Every company have different treatment of tax some have very rigid taxation the other one have

very reliable taxation. And the whole formation is very interesting and little bit difficult to

understand the treatment of tax in our financial Statements as because our firm include a lot of

data interpretation, making of financial statements.

It is difficult because various formulas and techniques which also time consuming, on the other

hand it is not easy for every employee to conduct this treatment because it very brain task. But it

is also surprising to have treatment of our tax expense or liability with the future tax payments as

deferred tax payments. So, it is quite surprising, interesting and difficult.

The new insights gained from the companies account for income tax from its tax expense are

which includes 2016 and 2017 respectively 64,686 and (5,999). The tax expense of any firm is

shown in the income statement. The firms account for income tax should be clearly stated, so

that even public can know why and when to invest. It should have an accurate and simple

formula to derive the results. Accuracy, compatibility, flexibility all should maintained in one

frame.

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.