ACCY962: Examining Harris Scarfe Collapse, Audit Issues & CLERP 9

VerifiedAdded on 2023/06/04

|9

|2490

|445

Essay

AI Summary

This essay delves into the audit issues that surfaced during the Harris Scarfe collapse in Australia, including the roles of the audit committee, ethical considerations, and auditor independence. It critically analyzes the relevance of developments following the collapse, particularly the Corporate Law Economic Reform Program (CLERP 9), in shaping Australian auditing practices. The essay references academic journals, audit standards, and ethical codes to provide a comprehensive understanding of the failures and subsequent reforms in the Australian auditing landscape, highlighting the importance of transparency, accountability, and ethical conduct in maintaining stakeholder confidence. This document is available on Desklib, a platform offering a wide range of study resources and solved assignments for students.

AUDITING THEORY AND PRACTICE

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The corporate scandals in Australia during 2000 shook the public confidence and trust in the

accounting and auditing industry. The audit industry, as a result, decided to test all the

procedures and policies so as to understand the root of such scandals, that is, from where the

default is arising such as due to weak internal control, audit committee, ethical issues, absence of

professional conduct from auditors, management's responsibilities or the legal liability of auditor.

The following discussion is about implications of corporate collapses by having reference to the

case of Harris Scarfe which took place in 2001 and was collapsed with a debt of $265 million

dollars (Calderon, Song, & Wang, 2016).

The Harris Scarfe Limited not only suffered a severe decline but brought adverse impact on the

accounting & auditing profession. However, before discussing about the root causes and

initiatives taken, let us first have a discussion regarding the issues behind such a collapse. The

conflict arose in March in the company's stock position in the market. One of the main reasons of

its declining is the default in the setting of company’s records and picturing a fraud expression to

its stakeholders. It was a big question that why the company was never involved in any financial

problems and suddenly, it declared voluntary declaration in 2001 due to heavy cash flow

troubles. The statement made on this for explaining the conflict was that Hodgson used to make

a few book entries that inflated its stock price and resulted in rolling of profits (Jensen &

Meckling, 1976). But, when the trading didn't take place, he started making bigger entries and

that continuance led to cash flow problems. Basically, the company was involved in fraudulent

representation of higher profits. With this, we need to understand those roles that lacked

professionalism and ethical standards. However, our discussion requires the audit issues related

with such collapses. So let us discuss the audit issues with such a corporate scandal:

Audit Committee: Audit Committee is responsible for assisting the board of directors

regarding the financial information to be disclosed in the financial statements, preparation

and presentation of such financial information and monitoring & assisting the audit team

in their work. They are responsible for advising the BOD in fulfilling its responsibilities

towards its shareholders by providing them all the material information of the company

they have invested in whether in terms of finance or trust or both. It is basically

responsible for taking decisions such as nomination of auditor, scope of management's

responsibilities, etc. It regularly meets with the external auditor team to review their

accounting and auditing industry. The audit industry, as a result, decided to test all the

procedures and policies so as to understand the root of such scandals, that is, from where the

default is arising such as due to weak internal control, audit committee, ethical issues, absence of

professional conduct from auditors, management's responsibilities or the legal liability of auditor.

The following discussion is about implications of corporate collapses by having reference to the

case of Harris Scarfe which took place in 2001 and was collapsed with a debt of $265 million

dollars (Calderon, Song, & Wang, 2016).

The Harris Scarfe Limited not only suffered a severe decline but brought adverse impact on the

accounting & auditing profession. However, before discussing about the root causes and

initiatives taken, let us first have a discussion regarding the issues behind such a collapse. The

conflict arose in March in the company's stock position in the market. One of the main reasons of

its declining is the default in the setting of company’s records and picturing a fraud expression to

its stakeholders. It was a big question that why the company was never involved in any financial

problems and suddenly, it declared voluntary declaration in 2001 due to heavy cash flow

troubles. The statement made on this for explaining the conflict was that Hodgson used to make

a few book entries that inflated its stock price and resulted in rolling of profits (Jensen &

Meckling, 1976). But, when the trading didn't take place, he started making bigger entries and

that continuance led to cash flow problems. Basically, the company was involved in fraudulent

representation of higher profits. With this, we need to understand those roles that lacked

professionalism and ethical standards. However, our discussion requires the audit issues related

with such collapses. So let us discuss the audit issues with such a corporate scandal:

Audit Committee: Audit Committee is responsible for assisting the board of directors

regarding the financial information to be disclosed in the financial statements, preparation

and presentation of such financial information and monitoring & assisting the audit team

in their work. They are responsible for advising the BOD in fulfilling its responsibilities

towards its shareholders by providing them all the material information of the company

they have invested in whether in terms of finance or trust or both. It is basically

responsible for taking decisions such as nomination of auditor, scope of management's

responsibilities, etc. It regularly meets with the external auditor team to review their

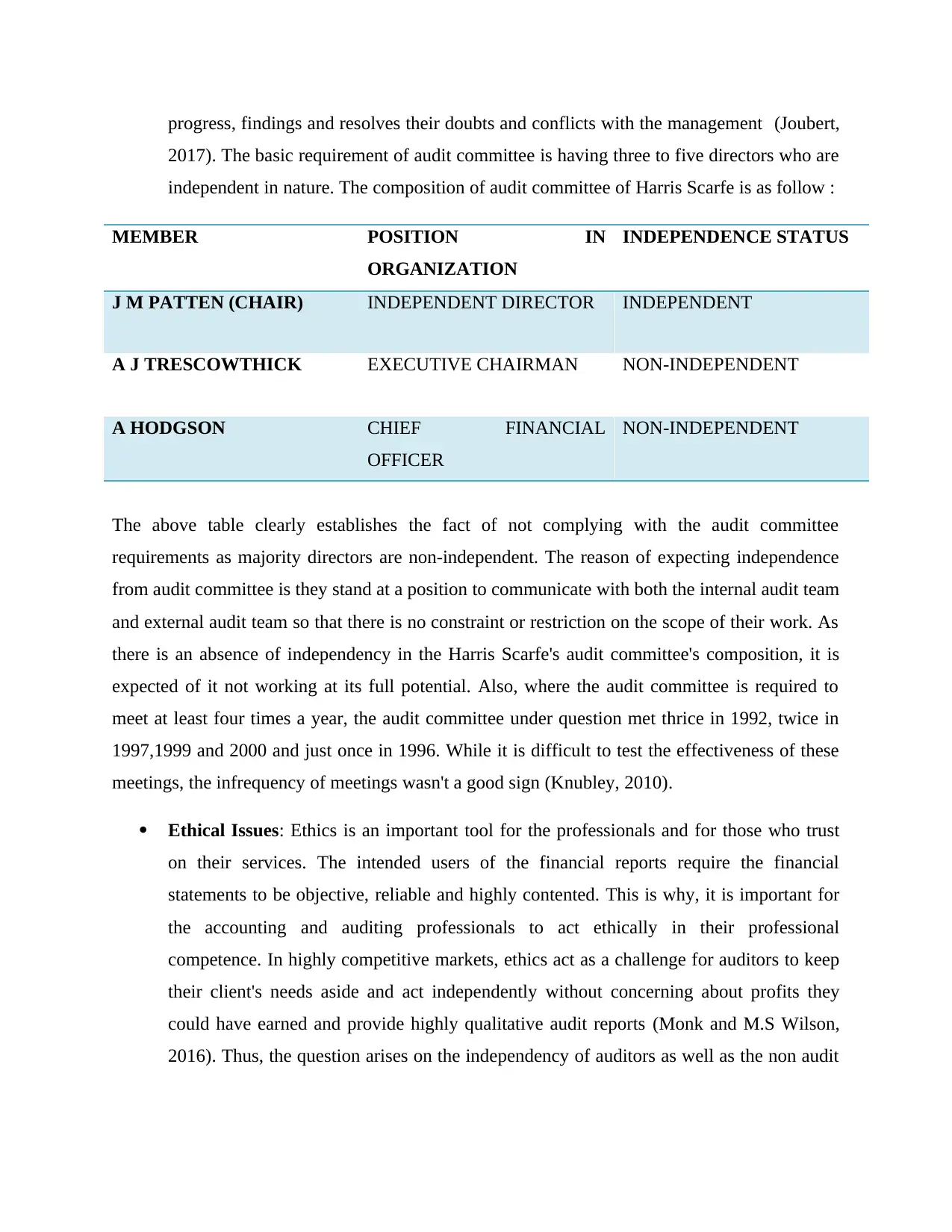

progress, findings and resolves their doubts and conflicts with the management (Joubert,

2017). The basic requirement of audit committee is having three to five directors who are

independent in nature. The composition of audit committee of Harris Scarfe is as follow :

MEMBER POSITION IN

ORGANIZATION

INDEPENDENCE STATUS

J M PATTEN (CHAIR) INDEPENDENT DIRECTOR INDEPENDENT

A J TRESCOWTHICK EXECUTIVE CHAIRMAN NON-INDEPENDENT

A HODGSON CHIEF FINANCIAL

OFFICER

NON-INDEPENDENT

The above table clearly establishes the fact of not complying with the audit committee

requirements as majority directors are non-independent. The reason of expecting independence

from audit committee is they stand at a position to communicate with both the internal audit team

and external audit team so that there is no constraint or restriction on the scope of their work. As

there is an absence of independency in the Harris Scarfe's audit committee's composition, it is

expected of it not working at its full potential. Also, where the audit committee is required to

meet at least four times a year, the audit committee under question met thrice in 1992, twice in

1997,1999 and 2000 and just once in 1996. While it is difficult to test the effectiveness of these

meetings, the infrequency of meetings wasn't a good sign (Knubley, 2010).

Ethical Issues: Ethics is an important tool for the professionals and for those who trust

on their services. The intended users of the financial reports require the financial

statements to be objective, reliable and highly contented. This is why, it is important for

the accounting and auditing professionals to act ethically in their professional

competence. In highly competitive markets, ethics act as a challenge for auditors to keep

their client's needs aside and act independently without concerning about profits they

could have earned and provide highly qualitative audit reports (Monk and M.S Wilson,

2016). Thus, the question arises on the independency of auditors as well as the non audit

2017). The basic requirement of audit committee is having three to five directors who are

independent in nature. The composition of audit committee of Harris Scarfe is as follow :

MEMBER POSITION IN

ORGANIZATION

INDEPENDENCE STATUS

J M PATTEN (CHAIR) INDEPENDENT DIRECTOR INDEPENDENT

A J TRESCOWTHICK EXECUTIVE CHAIRMAN NON-INDEPENDENT

A HODGSON CHIEF FINANCIAL

OFFICER

NON-INDEPENDENT

The above table clearly establishes the fact of not complying with the audit committee

requirements as majority directors are non-independent. The reason of expecting independence

from audit committee is they stand at a position to communicate with both the internal audit team

and external audit team so that there is no constraint or restriction on the scope of their work. As

there is an absence of independency in the Harris Scarfe's audit committee's composition, it is

expected of it not working at its full potential. Also, where the audit committee is required to

meet at least four times a year, the audit committee under question met thrice in 1992, twice in

1997,1999 and 2000 and just once in 1996. While it is difficult to test the effectiveness of these

meetings, the infrequency of meetings wasn't a good sign (Knubley, 2010).

Ethical Issues: Ethics is an important tool for the professionals and for those who trust

on their services. The intended users of the financial reports require the financial

statements to be objective, reliable and highly contented. This is why, it is important for

the accounting and auditing professionals to act ethically in their professional

competence. In highly competitive markets, ethics act as a challenge for auditors to keep

their client's needs aside and act independently without concerning about profits they

could have earned and provide highly qualitative audit reports (Monk and M.S Wilson,

2016). Thus, the question arises on the independency of auditors as well as the non audit

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

services provided by him or her whether it is compromising with the independence of the

auditor's role (Kusano, 2018).

Ernest & Young was replaced by Pricewaterhouse Coopers as Harris Scarfe's auditors in the year

1998. It was revealed that PWC received $120,000 for providing audit services while for non-

audit services, it received $211,284. Such non audit services were recorded as 'other services' in

the statements and the doubt arises when such other services were found unexplainable in the

reports. It is like the auditors who are expected to work in the best interest of shareholders are

performing such unexplainable services for their clients. Also, the suspicions arose about

whether such services have compromised with the auditor's independent nature or not.

Auditor’s Independence: The common liability of the audit firms was not being able to

trace the weakness of the company and was responsible for not acting with due care or in

their professional competence while performing their audit work. The claim was that the

auditors lacked control over their work and are responsible in a sense that they depended

themselves on the misstated financial information provided by the management. The

suspicion regarding auditor is that they failed to find the irregularities in the accounting

department. Also, they were expected to have compromised with their independence and

might have somewhere helped their client to represent fraudulent profits to enjoy the

benefits of a strong reputation in the market (Magazine, 2015).

However, an external auditor is not a guarantor but only provides reasonable assurance about the

financial statements that whether they are free of material misstatements. Preparation and

presentation of such financial statements is management's responsibility and the external auditor

has to rely on the information provided by them (Lyon, 2010). Thus, an expectation gap arose.

In the following case, the judgment declared was against the Chief Financial Officer (CFO) who

was sentenced to 6 years jail and the Chairman who was charged for acting fraudulently.

However, the audit firms wasn't found at guilt as giving true and fair financial information is the

duty of the management and the auditor's duty starts after that and ends with the reasonable

assurance provided by it. However, the court might not have found the audit team guilty but they

were responsible somewhere for not assessing the fraud.

auditor's role (Kusano, 2018).

Ernest & Young was replaced by Pricewaterhouse Coopers as Harris Scarfe's auditors in the year

1998. It was revealed that PWC received $120,000 for providing audit services while for non-

audit services, it received $211,284. Such non audit services were recorded as 'other services' in

the statements and the doubt arises when such other services were found unexplainable in the

reports. It is like the auditors who are expected to work in the best interest of shareholders are

performing such unexplainable services for their clients. Also, the suspicions arose about

whether such services have compromised with the auditor's independent nature or not.

Auditor’s Independence: The common liability of the audit firms was not being able to

trace the weakness of the company and was responsible for not acting with due care or in

their professional competence while performing their audit work. The claim was that the

auditors lacked control over their work and are responsible in a sense that they depended

themselves on the misstated financial information provided by the management. The

suspicion regarding auditor is that they failed to find the irregularities in the accounting

department. Also, they were expected to have compromised with their independence and

might have somewhere helped their client to represent fraudulent profits to enjoy the

benefits of a strong reputation in the market (Magazine, 2015).

However, an external auditor is not a guarantor but only provides reasonable assurance about the

financial statements that whether they are free of material misstatements. Preparation and

presentation of such financial statements is management's responsibility and the external auditor

has to rely on the information provided by them (Lyon, 2010). Thus, an expectation gap arose.

In the following case, the judgment declared was against the Chief Financial Officer (CFO) who

was sentenced to 6 years jail and the Chairman who was charged for acting fraudulently.

However, the audit firms wasn't found at guilt as giving true and fair financial information is the

duty of the management and the auditor's duty starts after that and ends with the reasonable

assurance provided by it. However, the court might not have found the audit team guilty but they

were responsible somewhere for not assessing the fraud.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The above three discussed issues reflected the lack of independence in the external auditor's role

and the audit committee. It also reflected the absence of ethical framework within which the

company, the audit team and every other professional is supposed to act. Thus, a default arose in

the ethical and accounting framework (Mat Zain, Zaman, & Mohamed, 2015). Moreover, above

all these, the default was in the intentions of the company that played fake to retain their

shareholders as well as enjoy all such benefits that comes to a well reputed company such as

strong credibility, public confidence, sanctioning of financial loans from banks, Inflated stock

prices in the market, etc.

The second discussion is regarding the developments made or policies adopted following the

Harris Scarfe collapse. Following the corporate collapses taking place in Australia, several

recommendations and initiatives were adopted by the regulatory bodies (Malaescu & Sutton,

2015).

Response from government accounting professions: CLERP 9 (Corporate Law

Economic Reform Program) was a response from the government that incorporated a

number of additional independent standards into the Corporation Act. Earlier, before the

HIH Insurance collapse, the Australian Accounting Standards were in consistent with

IFAC's International Audit and Assurance Standards Board (IAASB). However, with

introduction of CLERP 9, such standards have been backed legally. The government

focused on exploring the audit independence and focused on having efficient corporate

governance within an organization. It involved an active role from the side of audit

committee that they should participate actively in the whole audit process and shouldn't

be just concerned with the final output.

The Ramsay report stated that the increase in audit independence norms would lead to

reduction in expectation gap. It mentioned certain norms regarding audit committee and

the relationship between external and internal auditor as well the relation between the

management and the external auditor

CPC F. 1 came into effect on 31st December, 2003 and was made mandatory. According

to this norm, the auditor's independence is explained again and a safeguarding system

should be adopted and assessed so as to increase the quality of control done by the

auditor (Mazza & Azzali, 2018).

and the audit committee. It also reflected the absence of ethical framework within which the

company, the audit team and every other professional is supposed to act. Thus, a default arose in

the ethical and accounting framework (Mat Zain, Zaman, & Mohamed, 2015). Moreover, above

all these, the default was in the intentions of the company that played fake to retain their

shareholders as well as enjoy all such benefits that comes to a well reputed company such as

strong credibility, public confidence, sanctioning of financial loans from banks, Inflated stock

prices in the market, etc.

The second discussion is regarding the developments made or policies adopted following the

Harris Scarfe collapse. Following the corporate collapses taking place in Australia, several

recommendations and initiatives were adopted by the regulatory bodies (Malaescu & Sutton,

2015).

Response from government accounting professions: CLERP 9 (Corporate Law

Economic Reform Program) was a response from the government that incorporated a

number of additional independent standards into the Corporation Act. Earlier, before the

HIH Insurance collapse, the Australian Accounting Standards were in consistent with

IFAC's International Audit and Assurance Standards Board (IAASB). However, with

introduction of CLERP 9, such standards have been backed legally. The government

focused on exploring the audit independence and focused on having efficient corporate

governance within an organization. It involved an active role from the side of audit

committee that they should participate actively in the whole audit process and shouldn't

be just concerned with the final output.

The Ramsay report stated that the increase in audit independence norms would lead to

reduction in expectation gap. It mentioned certain norms regarding audit committee and

the relationship between external and internal auditor as well the relation between the

management and the external auditor

CPC F. 1 came into effect on 31st December, 2003 and was made mandatory. According

to this norm, the auditor's independence is explained again and a safeguarding system

should be adopted and assessed so as to increase the quality of control done by the

auditor (Mazza & Azzali, 2018).

The legislation, applied on 30 June, 2004, is composed of 14 clauses that included

auditor’s independence, auditor's rotation, audit quality, auditor's liability, enhanced

importance of corporate disclosures, etc. This initiative was to increase the transparency,

reliability, accountability and enhance shareholder's rights. However, CLERP 9 is all

about audit independence and doesn't necessarily offer a framework within which this can

occur.

Australian Stock Exchange (ASX) : Experiencing a number of corporate scandals on a

short span in Australia made a strong urge for ASX to set up a corporate governance

council. This council is basically composed of representatives of professional groups and

key persons of big organizations to review the standards of corporate governance as an

initiative on the behalf of ASX. The primary objective of this council is to incorporate

principle based recommendations regarding the practices of corporate governance which

are to be incorporated by the listed organizations. Such recommendations are introduced

with an intention of enhancing the investor's trust & confidence and also provide

assistance to the organizations so that they meet up with their stakeholder's expectations.

Accordingly, ASX listed companies are required to practice such governance that meet

up with the Council's recommendations.

Year 2001 in Australia didn't only experience Harris Scarfe collapse but also the collapses of

HIH Insurance, Ansett Australia and OneTel that happened one by one in a short time span.

Therefore, we can consider 2001 as the year of corporate collapses and accounting scandals of

Australia. There is no doubt that there were irregularities in the accounting norms. However,

such irregularities are less likely to occur in entities having strong corporate governance and a

strong control over its business. Harris Scarfe lacked such practices and in fact, neither the audit

committee nor the board of directors possessed the required independence.

Such a collapse resulted in demanding of more transparency and greater levels of accountability

from the management regarding the financial performance and position of their companies. On

the other hand, the auditor is expected to take an initiative of assessing such irregularities and

have a reconsideration of issues such as ethics, his legal liabilities and his independent nature.

The main focus of the accounting & auditing industry is to enhance the audit quality that works

in the best interest of all the external and internal stakeholders because satisfaction of

auditor’s independence, auditor's rotation, audit quality, auditor's liability, enhanced

importance of corporate disclosures, etc. This initiative was to increase the transparency,

reliability, accountability and enhance shareholder's rights. However, CLERP 9 is all

about audit independence and doesn't necessarily offer a framework within which this can

occur.

Australian Stock Exchange (ASX) : Experiencing a number of corporate scandals on a

short span in Australia made a strong urge for ASX to set up a corporate governance

council. This council is basically composed of representatives of professional groups and

key persons of big organizations to review the standards of corporate governance as an

initiative on the behalf of ASX. The primary objective of this council is to incorporate

principle based recommendations regarding the practices of corporate governance which

are to be incorporated by the listed organizations. Such recommendations are introduced

with an intention of enhancing the investor's trust & confidence and also provide

assistance to the organizations so that they meet up with their stakeholder's expectations.

Accordingly, ASX listed companies are required to practice such governance that meet

up with the Council's recommendations.

Year 2001 in Australia didn't only experience Harris Scarfe collapse but also the collapses of

HIH Insurance, Ansett Australia and OneTel that happened one by one in a short time span.

Therefore, we can consider 2001 as the year of corporate collapses and accounting scandals of

Australia. There is no doubt that there were irregularities in the accounting norms. However,

such irregularities are less likely to occur in entities having strong corporate governance and a

strong control over its business. Harris Scarfe lacked such practices and in fact, neither the audit

committee nor the board of directors possessed the required independence.

Such a collapse resulted in demanding of more transparency and greater levels of accountability

from the management regarding the financial performance and position of their companies. On

the other hand, the auditor is expected to take an initiative of assessing such irregularities and

have a reconsideration of issues such as ethics, his legal liabilities and his independent nature.

The main focus of the accounting & auditing industry is to enhance the audit quality that works

in the best interest of all the external and internal stakeholders because satisfaction of

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

stakeholders is important as the nation overall desires a flourishing economy which doesn't come

only with the profits but also with all those people who directly and indirectly influence such

profits.

only with the profits but also with all those people who directly and indirectly influence such

profits.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

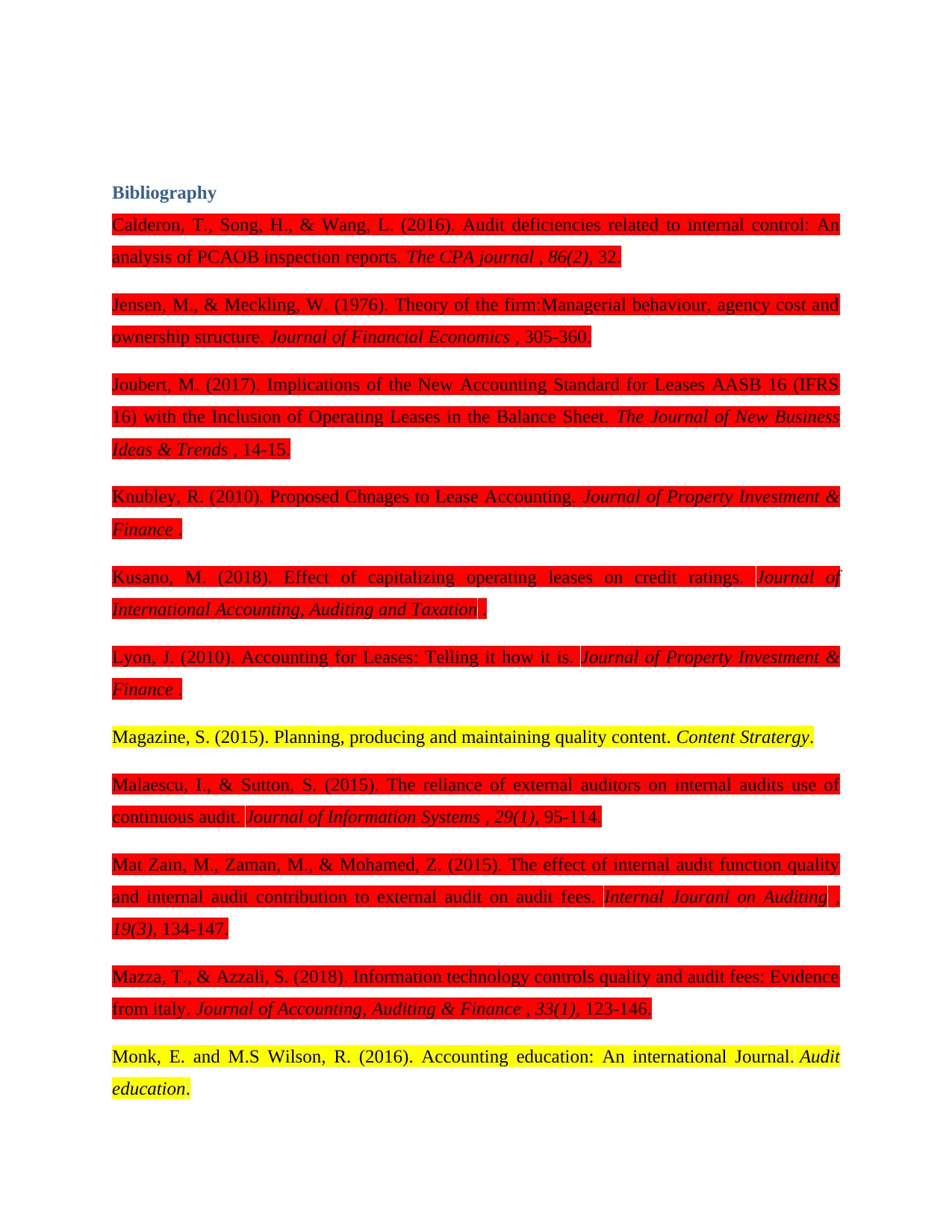

Bibliography

Calderon, T., Song, H., & Wang, L. (2016). Audit deficiencies related to internal control: An

analysis of PCAOB inspection reports. The CPA journal , 86(2), 32.

Jensen, M., & Meckling, W. (1976). Theory of the firm:Managerial behaviour, agency cost and

ownership structure. Journal of Financial Economics , 305-360.

Joubert, M. (2017). Implications of the New Accounting Standard for Leases AASB 16 (IFRS

16) with the Inclusion of Operating Leases in the Balance Sheet. The Journal of New Business

Ideas & Trends , 14-15.

Knubley, R. (2010). Proposed Chnages to Lease Accounting. Journal of Property Investment &

Finance .

Kusano, M. (2018). Effect of capitalizing operating leases on credit ratings. Journal of

International Accounting, Auditing and Taxation .

Lyon, J. (2010). Accounting for Leases: Telling it how it is. Journal of Property Investment &

Finance .

Magazine, S. (2015). Planning, producing and maintaining quality content. Content Stratergy.

Malaescu, I., & Sutton, S. (2015). The reliance of external auditors on internal audits use of

continuous audit. Journal of Information Systems , 29(1), 95-114.

Mat Zain, M., Zaman, M., & Mohamed, Z. (2015). The effect of internal audit function quality

and internal audit contribution to external audit on audit fees. Internal Jouranl on Auditing ,

19(3), 134-147.

Mazza, T., & Azzali, S. (2018). Information technology controls quality and audit fees: Evidence

from italy. Journal of Accounting, Auditing & Finance , 33(1), 123-146.

Monk, E. and M.S Wilson, R. (2016). Accounting education: An international Journal. Audit

education.

Calderon, T., Song, H., & Wang, L. (2016). Audit deficiencies related to internal control: An

analysis of PCAOB inspection reports. The CPA journal , 86(2), 32.

Jensen, M., & Meckling, W. (1976). Theory of the firm:Managerial behaviour, agency cost and

ownership structure. Journal of Financial Economics , 305-360.

Joubert, M. (2017). Implications of the New Accounting Standard for Leases AASB 16 (IFRS

16) with the Inclusion of Operating Leases in the Balance Sheet. The Journal of New Business

Ideas & Trends , 14-15.

Knubley, R. (2010). Proposed Chnages to Lease Accounting. Journal of Property Investment &

Finance .

Kusano, M. (2018). Effect of capitalizing operating leases on credit ratings. Journal of

International Accounting, Auditing and Taxation .

Lyon, J. (2010). Accounting for Leases: Telling it how it is. Journal of Property Investment &

Finance .

Magazine, S. (2015). Planning, producing and maintaining quality content. Content Stratergy.

Malaescu, I., & Sutton, S. (2015). The reliance of external auditors on internal audits use of

continuous audit. Journal of Information Systems , 29(1), 95-114.

Mat Zain, M., Zaman, M., & Mohamed, Z. (2015). The effect of internal audit function quality

and internal audit contribution to external audit on audit fees. Internal Jouranl on Auditing ,

19(3), 134-147.

Mazza, T., & Azzali, S. (2018). Information technology controls quality and audit fees: Evidence

from italy. Journal of Accounting, Auditing & Finance , 33(1), 123-146.

Monk, E. and M.S Wilson, R. (2016). Accounting education: An international Journal. Audit

education.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.