Financial Management in Healthcare Assignment: Budgeting and Variance

VerifiedAdded on 2023/06/03

|13

|2016

|445

Homework Assignment

AI Summary

This assignment delves into the intricacies of financial management within the healthcare sector. It begins with the preparation of monthly budgets under both normal and increased donation scenarios, analyzing the impact on net surplus. The assignment then explores the implications of changes in funding, specifically cuts from major donors like the Bill and Melinda Gates Foundation and the Australian Government. The second part involves creating a flexible budget for a Community Health Centre, comparing revenue and expenses under different fee options, and determining the most favorable option. This is followed by a detailed variance analysis, comparing actual figures with budgeted amounts to identify areas of favorable and unfavorable performance. The analysis highlights the significance of variable costs and revenue fluctuations. The assignment concludes with recommendations for improving the financial performance of the health center, focusing on increasing revenue and managing costs to maximize net surplus.

Running head: FINANCIAL MANAGEMENT IN HEALTHCARE

Financial Management in Healthcare

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Financial Management in Healthcare

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1FINANCIAL MANAGEMENT IN HEALTHCARE

Table of Contents

Answer to Question 1:.....................................................................................................................2

Requirement a:.............................................................................................................................2

Requirement b:.............................................................................................................................4

Requirement c:.............................................................................................................................6

Answer to Question 2:.....................................................................................................................6

Requirement a:.............................................................................................................................6

Requirement b:...........................................................................................................................10

Requirement c:...........................................................................................................................10

Requirement d:...........................................................................................................................12

Table of Contents

Answer to Question 1:.....................................................................................................................2

Requirement a:.............................................................................................................................2

Requirement b:.............................................................................................................................4

Requirement c:.............................................................................................................................6

Answer to Question 2:.....................................................................................................................6

Requirement a:.............................................................................................................................6

Requirement b:...........................................................................................................................10

Requirement c:...........................................................................................................................10

Requirement d:...........................................................................................................................12

2FINANCIAL MANAGEMENT IN HEALTHCARE

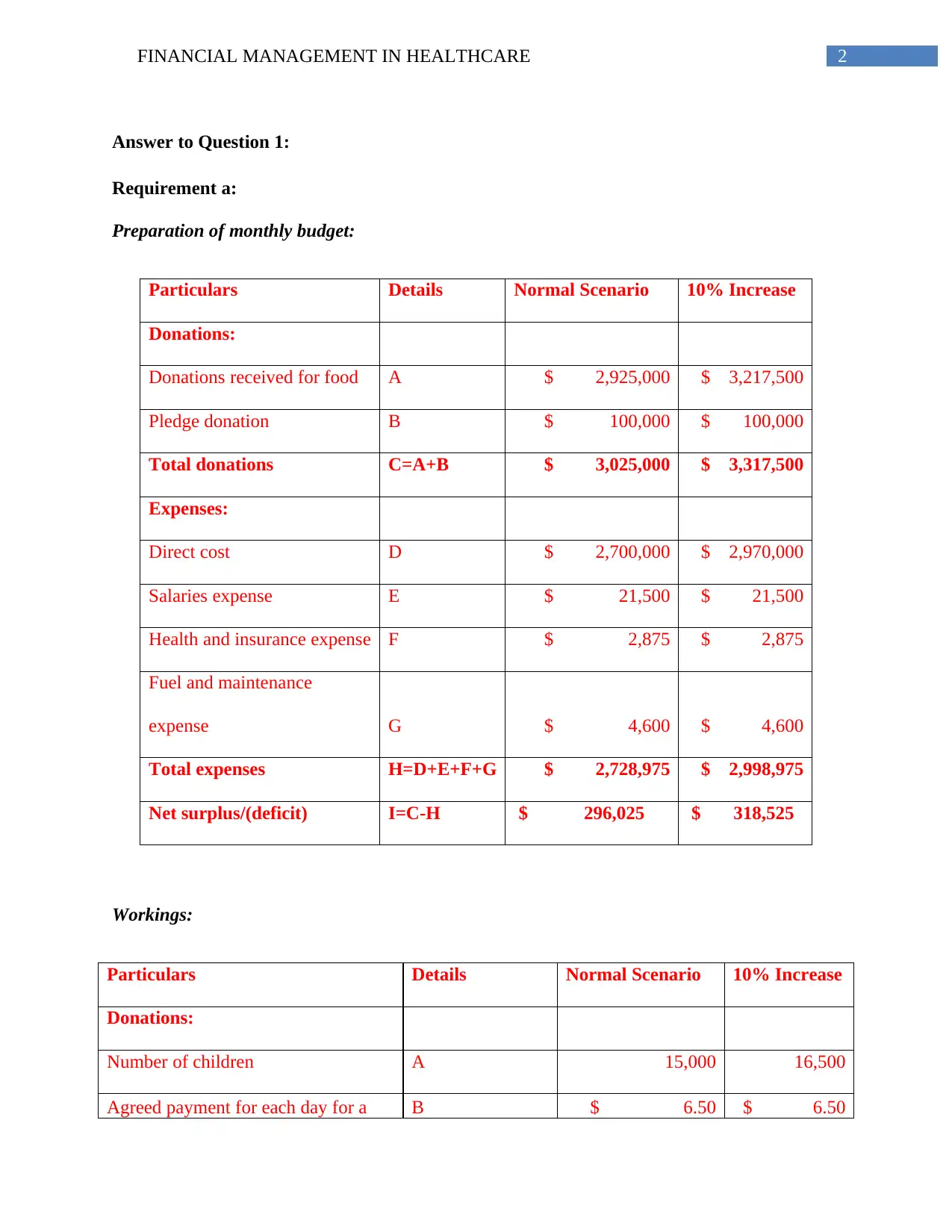

Answer to Question 1:

Requirement a:

Preparation of monthly budget:

Particulars Details Normal Scenario 10% Increase

Donations:

Donations received for food A $ 2,925,000 $ 3,217,500

Pledge donation B $ 100,000 $ 100,000

Total donations C=A+B $ 3,025,000 $ 3,317,500

Expenses:

Direct cost D $ 2,700,000 $ 2,970,000

Salaries expense E $ 21,500 $ 21,500

Health and insurance expense F $ 2,875 $ 2,875

Fuel and maintenance

expense G $ 4,600 $ 4,600

Total expenses H=D+E+F+G $ 2,728,975 $ 2,998,975

Net surplus/(deficit) I=C-H $ 296,025 $ 318,525

Workings:

Particulars Details Normal Scenario 10% Increase

Donations:

Number of children A 15,000 16,500

Agreed payment for each day for a B $ 6.50 $ 6.50

Answer to Question 1:

Requirement a:

Preparation of monthly budget:

Particulars Details Normal Scenario 10% Increase

Donations:

Donations received for food A $ 2,925,000 $ 3,217,500

Pledge donation B $ 100,000 $ 100,000

Total donations C=A+B $ 3,025,000 $ 3,317,500

Expenses:

Direct cost D $ 2,700,000 $ 2,970,000

Salaries expense E $ 21,500 $ 21,500

Health and insurance expense F $ 2,875 $ 2,875

Fuel and maintenance

expense G $ 4,600 $ 4,600

Total expenses H=D+E+F+G $ 2,728,975 $ 2,998,975

Net surplus/(deficit) I=C-H $ 296,025 $ 318,525

Workings:

Particulars Details Normal Scenario 10% Increase

Donations:

Number of children A 15,000 16,500

Agreed payment for each day for a B $ 6.50 $ 6.50

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

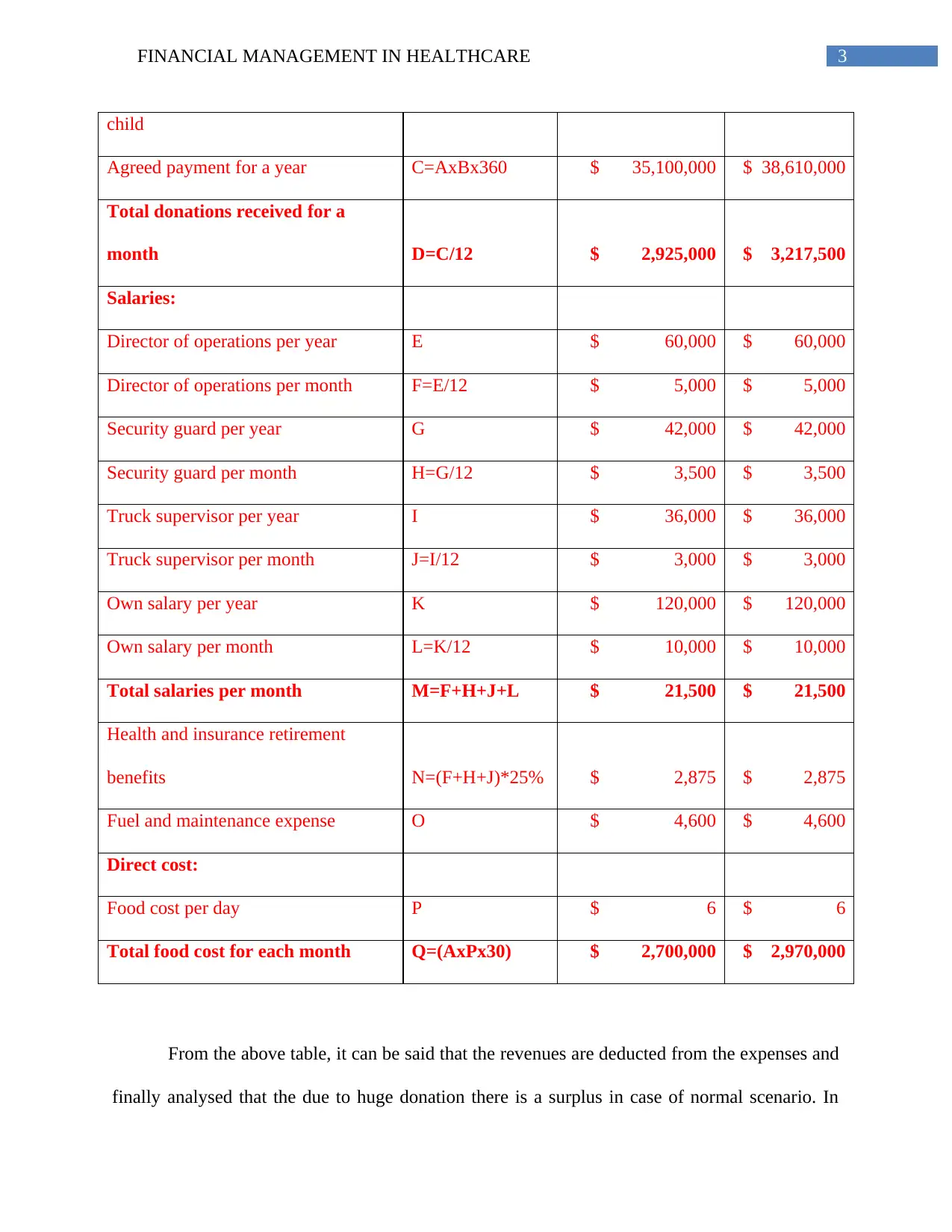

3FINANCIAL MANAGEMENT IN HEALTHCARE

child

Agreed payment for a year C=AxBx360 $ 35,100,000 $ 38,610,000

Total donations received for a

month D=C/12 $ 2,925,000 $ 3,217,500

Salaries:

Director of operations per year E $ 60,000 $ 60,000

Director of operations per month F=E/12 $ 5,000 $ 5,000

Security guard per year G $ 42,000 $ 42,000

Security guard per month H=G/12 $ 3,500 $ 3,500

Truck supervisor per year I $ 36,000 $ 36,000

Truck supervisor per month J=I/12 $ 3,000 $ 3,000

Own salary per year K $ 120,000 $ 120,000

Own salary per month L=K/12 $ 10,000 $ 10,000

Total salaries per month M=F+H+J+L $ 21,500 $ 21,500

Health and insurance retirement

benefits N=(F+H+J)*25% $ 2,875 $ 2,875

Fuel and maintenance expense O $ 4,600 $ 4,600

Direct cost:

Food cost per day P $ 6 $ 6

Total food cost for each month Q=(AxPx30) $ 2,700,000 $ 2,970,000

From the above table, it can be said that the revenues are deducted from the expenses and

finally analysed that the due to huge donation there is a surplus in case of normal scenario. In

child

Agreed payment for a year C=AxBx360 $ 35,100,000 $ 38,610,000

Total donations received for a

month D=C/12 $ 2,925,000 $ 3,217,500

Salaries:

Director of operations per year E $ 60,000 $ 60,000

Director of operations per month F=E/12 $ 5,000 $ 5,000

Security guard per year G $ 42,000 $ 42,000

Security guard per month H=G/12 $ 3,500 $ 3,500

Truck supervisor per year I $ 36,000 $ 36,000

Truck supervisor per month J=I/12 $ 3,000 $ 3,000

Own salary per year K $ 120,000 $ 120,000

Own salary per month L=K/12 $ 10,000 $ 10,000

Total salaries per month M=F+H+J+L $ 21,500 $ 21,500

Health and insurance retirement

benefits N=(F+H+J)*25% $ 2,875 $ 2,875

Fuel and maintenance expense O $ 4,600 $ 4,600

Direct cost:

Food cost per day P $ 6 $ 6

Total food cost for each month Q=(AxPx30) $ 2,700,000 $ 2,970,000

From the above table, it can be said that the revenues are deducted from the expenses and

finally analysed that the due to huge donation there is a surplus in case of normal scenario. In

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4FINANCIAL MANAGEMENT IN HEALTHCARE

case of the 10% increase, the donations received have also increased which finally resulted that

the financial health of the budget is viable. There is a surplus increase from the above computed

table as the number of children fed increases due to the donations received in this case is much

more than the expenses incurred.

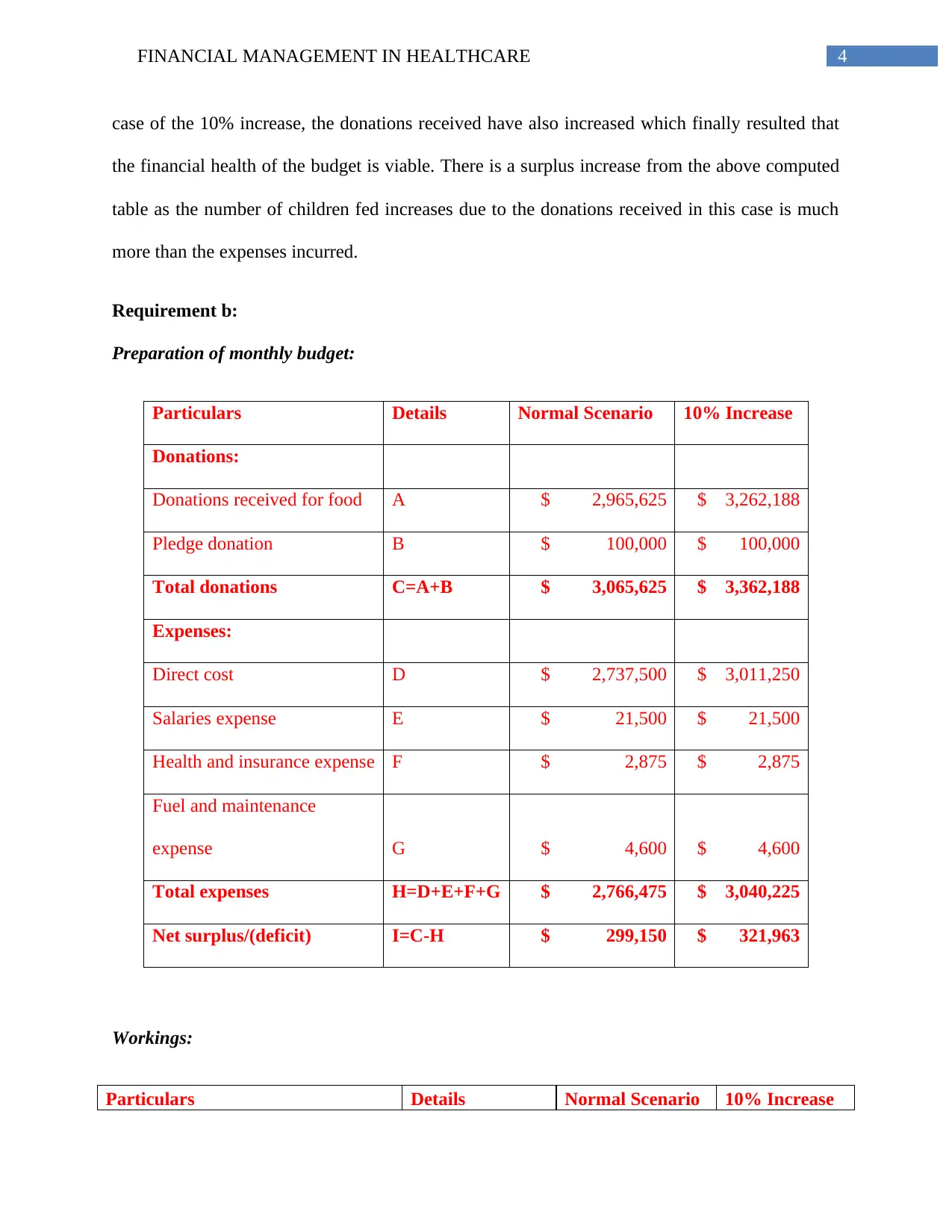

Requirement b:

Preparation of monthly budget:

Particulars Details Normal Scenario 10% Increase

Donations:

Donations received for food A $ 2,965,625 $ 3,262,188

Pledge donation B $ 100,000 $ 100,000

Total donations C=A+B $ 3,065,625 $ 3,362,188

Expenses:

Direct cost D $ 2,737,500 $ 3,011,250

Salaries expense E $ 21,500 $ 21,500

Health and insurance expense F $ 2,875 $ 2,875

Fuel and maintenance

expense G $ 4,600 $ 4,600

Total expenses H=D+E+F+G $ 2,766,475 $ 3,040,225

Net surplus/(deficit) I=C-H $ 299,150 $ 321,963

Workings:

Particulars Details Normal Scenario 10% Increase

case of the 10% increase, the donations received have also increased which finally resulted that

the financial health of the budget is viable. There is a surplus increase from the above computed

table as the number of children fed increases due to the donations received in this case is much

more than the expenses incurred.

Requirement b:

Preparation of monthly budget:

Particulars Details Normal Scenario 10% Increase

Donations:

Donations received for food A $ 2,965,625 $ 3,262,188

Pledge donation B $ 100,000 $ 100,000

Total donations C=A+B $ 3,065,625 $ 3,362,188

Expenses:

Direct cost D $ 2,737,500 $ 3,011,250

Salaries expense E $ 21,500 $ 21,500

Health and insurance expense F $ 2,875 $ 2,875

Fuel and maintenance

expense G $ 4,600 $ 4,600

Total expenses H=D+E+F+G $ 2,766,475 $ 3,040,225

Net surplus/(deficit) I=C-H $ 299,150 $ 321,963

Workings:

Particulars Details Normal Scenario 10% Increase

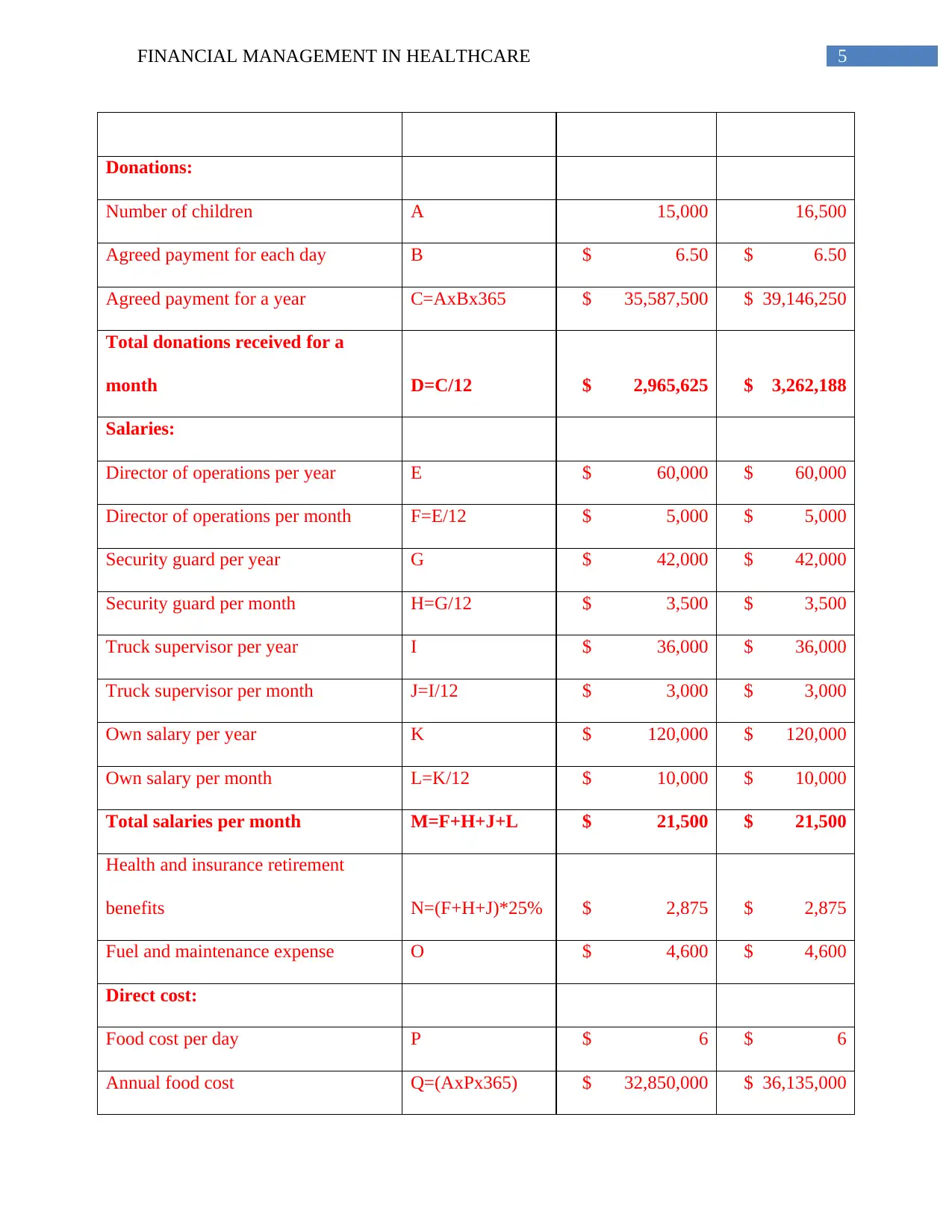

5FINANCIAL MANAGEMENT IN HEALTHCARE

Donations:

Number of children A 15,000 16,500

Agreed payment for each day B $ 6.50 $ 6.50

Agreed payment for a year C=AxBx365 $ 35,587,500 $ 39,146,250

Total donations received for a

month D=C/12 $ 2,965,625 $ 3,262,188

Salaries:

Director of operations per year E $ 60,000 $ 60,000

Director of operations per month F=E/12 $ 5,000 $ 5,000

Security guard per year G $ 42,000 $ 42,000

Security guard per month H=G/12 $ 3,500 $ 3,500

Truck supervisor per year I $ 36,000 $ 36,000

Truck supervisor per month J=I/12 $ 3,000 $ 3,000

Own salary per year K $ 120,000 $ 120,000

Own salary per month L=K/12 $ 10,000 $ 10,000

Total salaries per month M=F+H+J+L $ 21,500 $ 21,500

Health and insurance retirement

benefits N=(F+H+J)*25% $ 2,875 $ 2,875

Fuel and maintenance expense O $ 4,600 $ 4,600

Direct cost:

Food cost per day P $ 6 $ 6

Annual food cost Q=(AxPx365) $ 32,850,000 $ 36,135,000

Donations:

Number of children A 15,000 16,500

Agreed payment for each day B $ 6.50 $ 6.50

Agreed payment for a year C=AxBx365 $ 35,587,500 $ 39,146,250

Total donations received for a

month D=C/12 $ 2,965,625 $ 3,262,188

Salaries:

Director of operations per year E $ 60,000 $ 60,000

Director of operations per month F=E/12 $ 5,000 $ 5,000

Security guard per year G $ 42,000 $ 42,000

Security guard per month H=G/12 $ 3,500 $ 3,500

Truck supervisor per year I $ 36,000 $ 36,000

Truck supervisor per month J=I/12 $ 3,000 $ 3,000

Own salary per year K $ 120,000 $ 120,000

Own salary per month L=K/12 $ 10,000 $ 10,000

Total salaries per month M=F+H+J+L $ 21,500 $ 21,500

Health and insurance retirement

benefits N=(F+H+J)*25% $ 2,875 $ 2,875

Fuel and maintenance expense O $ 4,600 $ 4,600

Direct cost:

Food cost per day P $ 6 $ 6

Annual food cost Q=(AxPx365) $ 32,850,000 $ 36,135,000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6FINANCIAL MANAGEMENT IN HEALTHCARE

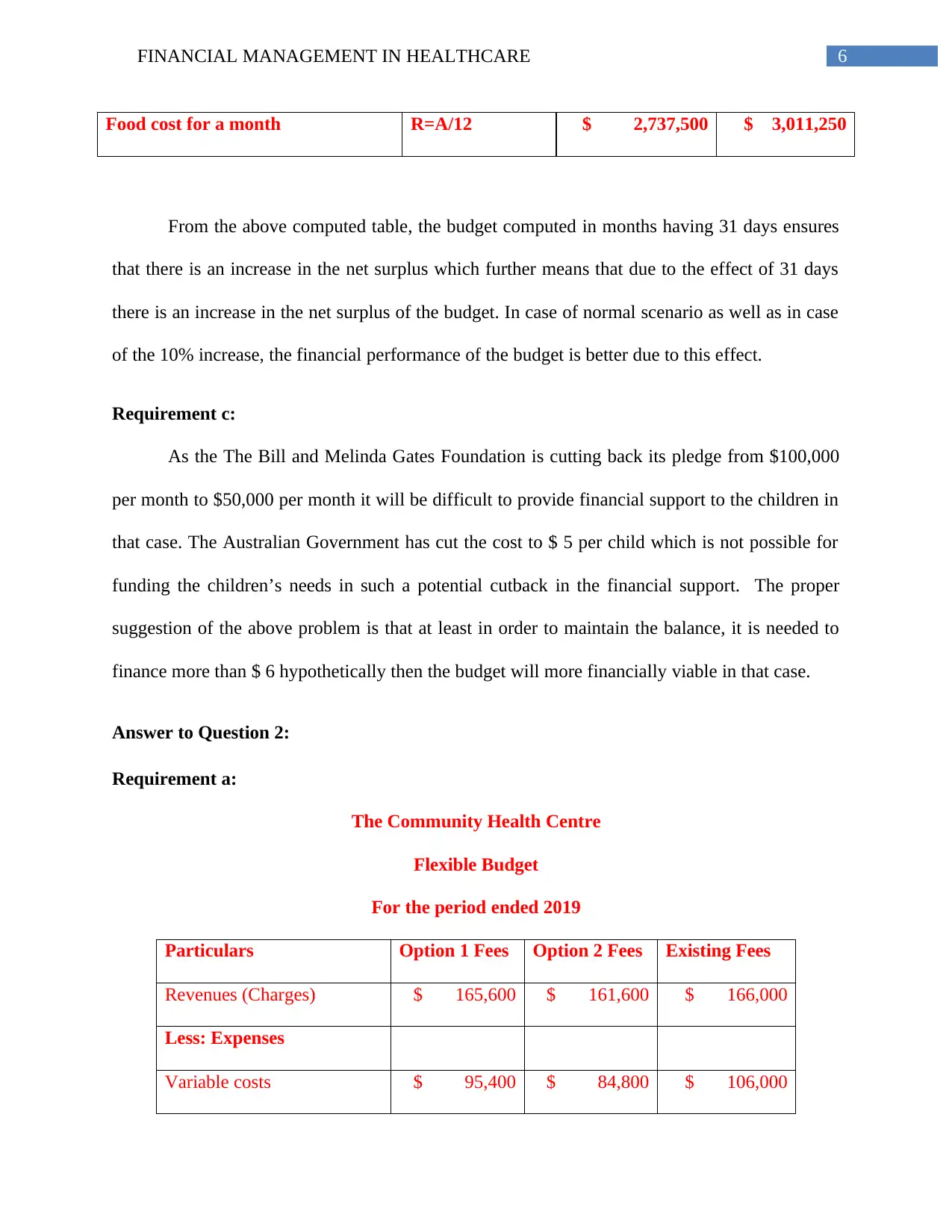

Food cost for a month R=A/12 $ 2,737,500 $ 3,011,250

From the above computed table, the budget computed in months having 31 days ensures

that there is an increase in the net surplus which further means that due to the effect of 31 days

there is an increase in the net surplus of the budget. In case of normal scenario as well as in case

of the 10% increase, the financial performance of the budget is better due to this effect.

Requirement c:

As the The Bill and Melinda Gates Foundation is cutting back its pledge from $100,000

per month to $50,000 per month it will be difficult to provide financial support to the children in

that case. The Australian Government has cut the cost to $ 5 per child which is not possible for

funding the children’s needs in such a potential cutback in the financial support. The proper

suggestion of the above problem is that at least in order to maintain the balance, it is needed to

finance more than $ 6 hypothetically then the budget will more financially viable in that case.

Answer to Question 2:

Requirement a:

The Community Health Centre

Flexible Budget

For the period ended 2019

Particulars Option 1 Fees Option 2 Fees Existing Fees

Revenues (Charges) $ 165,600 $ 161,600 $ 166,000

Less: Expenses

Variable costs $ 95,400 $ 84,800 $ 106,000

Food cost for a month R=A/12 $ 2,737,500 $ 3,011,250

From the above computed table, the budget computed in months having 31 days ensures

that there is an increase in the net surplus which further means that due to the effect of 31 days

there is an increase in the net surplus of the budget. In case of normal scenario as well as in case

of the 10% increase, the financial performance of the budget is better due to this effect.

Requirement c:

As the The Bill and Melinda Gates Foundation is cutting back its pledge from $100,000

per month to $50,000 per month it will be difficult to provide financial support to the children in

that case. The Australian Government has cut the cost to $ 5 per child which is not possible for

funding the children’s needs in such a potential cutback in the financial support. The proper

suggestion of the above problem is that at least in order to maintain the balance, it is needed to

finance more than $ 6 hypothetically then the budget will more financially viable in that case.

Answer to Question 2:

Requirement a:

The Community Health Centre

Flexible Budget

For the period ended 2019

Particulars Option 1 Fees Option 2 Fees Existing Fees

Revenues (Charges) $ 165,600 $ 161,600 $ 166,000

Less: Expenses

Variable costs $ 95,400 $ 84,800 $ 106,000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7FINANCIAL MANAGEMENT IN HEALTHCARE

Salary expense $ 40,000 $ 40,000 $ 40,000

Rent expense $ 10,000 $ 10,000 $ 10,000

Cleaning expense $ 5,000 $ 5,000 $ 5,000

General maintenance

expense $ 10,000 $ 10,000 $ 10,000

Total expenses $ 160,400 $ 149,800 $ 171,000

Net operating

income/(loss) $ 5,200 $ 11,800 -$ 5,000

Workings:

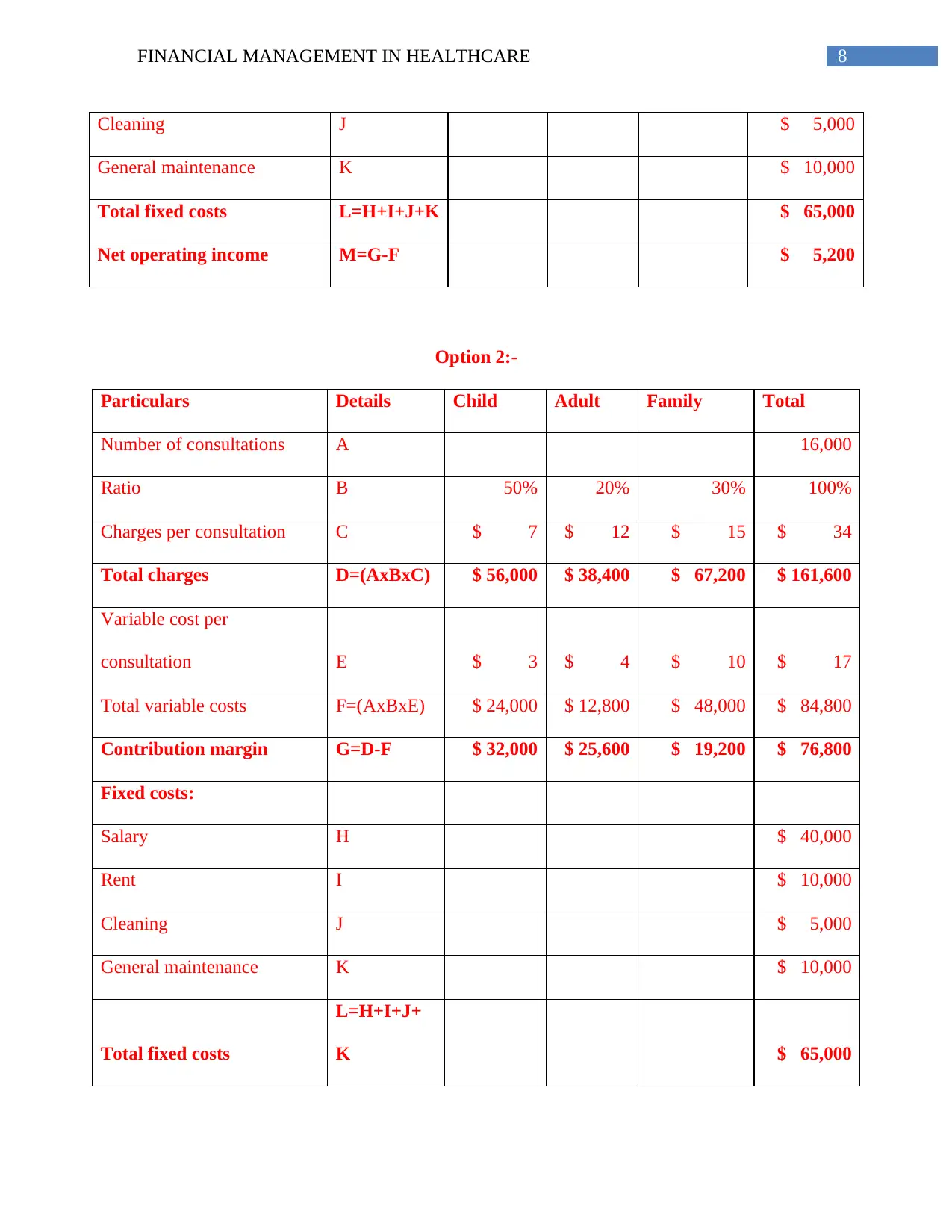

Option 1:-

Particulars Details Child Adult Family Total

Number of consultations A 18,000

Ratio B 50% 20% 30% 100%

Charges per consultation C $ 6 $ 10 $ 14 $ 30

Total charges D=(AxBxC) $ 54,000 $ 36,000 $ 75,600 $ 165,600

Variable cost per consultation E $ 3 $ 4 $ 10 $ 17

Total variable costs F=(AxBxE) $ 27,000 $ 14,400 $ 54,000 $ 95,400

Contribution margin G=D-F $ 27,000 $ 21,600 $ 21,600 $ 70,200

Fixed costs:

Salary H $ 40,000

Rent I $ 10,000

Salary expense $ 40,000 $ 40,000 $ 40,000

Rent expense $ 10,000 $ 10,000 $ 10,000

Cleaning expense $ 5,000 $ 5,000 $ 5,000

General maintenance

expense $ 10,000 $ 10,000 $ 10,000

Total expenses $ 160,400 $ 149,800 $ 171,000

Net operating

income/(loss) $ 5,200 $ 11,800 -$ 5,000

Workings:

Option 1:-

Particulars Details Child Adult Family Total

Number of consultations A 18,000

Ratio B 50% 20% 30% 100%

Charges per consultation C $ 6 $ 10 $ 14 $ 30

Total charges D=(AxBxC) $ 54,000 $ 36,000 $ 75,600 $ 165,600

Variable cost per consultation E $ 3 $ 4 $ 10 $ 17

Total variable costs F=(AxBxE) $ 27,000 $ 14,400 $ 54,000 $ 95,400

Contribution margin G=D-F $ 27,000 $ 21,600 $ 21,600 $ 70,200

Fixed costs:

Salary H $ 40,000

Rent I $ 10,000

8FINANCIAL MANAGEMENT IN HEALTHCARE

Cleaning J $ 5,000

General maintenance K $ 10,000

Total fixed costs L=H+I+J+K $ 65,000

Net operating income M=G-F $ 5,200

Option 2:-

Particulars Details Child Adult Family Total

Number of consultations A 16,000

Ratio B 50% 20% 30% 100%

Charges per consultation C $ 7 $ 12 $ 15 $ 34

Total charges D=(AxBxC) $ 56,000 $ 38,400 $ 67,200 $ 161,600

Variable cost per

consultation E $ 3 $ 4 $ 10 $ 17

Total variable costs F=(AxBxE) $ 24,000 $ 12,800 $ 48,000 $ 84,800

Contribution margin G=D-F $ 32,000 $ 25,600 $ 19,200 $ 76,800

Fixed costs:

Salary H $ 40,000

Rent I $ 10,000

Cleaning J $ 5,000

General maintenance K $ 10,000

Total fixed costs

L=H+I+J+

K $ 65,000

Cleaning J $ 5,000

General maintenance K $ 10,000

Total fixed costs L=H+I+J+K $ 65,000

Net operating income M=G-F $ 5,200

Option 2:-

Particulars Details Child Adult Family Total

Number of consultations A 16,000

Ratio B 50% 20% 30% 100%

Charges per consultation C $ 7 $ 12 $ 15 $ 34

Total charges D=(AxBxC) $ 56,000 $ 38,400 $ 67,200 $ 161,600

Variable cost per

consultation E $ 3 $ 4 $ 10 $ 17

Total variable costs F=(AxBxE) $ 24,000 $ 12,800 $ 48,000 $ 84,800

Contribution margin G=D-F $ 32,000 $ 25,600 $ 19,200 $ 76,800

Fixed costs:

Salary H $ 40,000

Rent I $ 10,000

Cleaning J $ 5,000

General maintenance K $ 10,000

Total fixed costs

L=H+I+J+

K $ 65,000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9FINANCIAL MANAGEMENT IN HEALTHCARE

Net operating income M=G-F $ 11,800

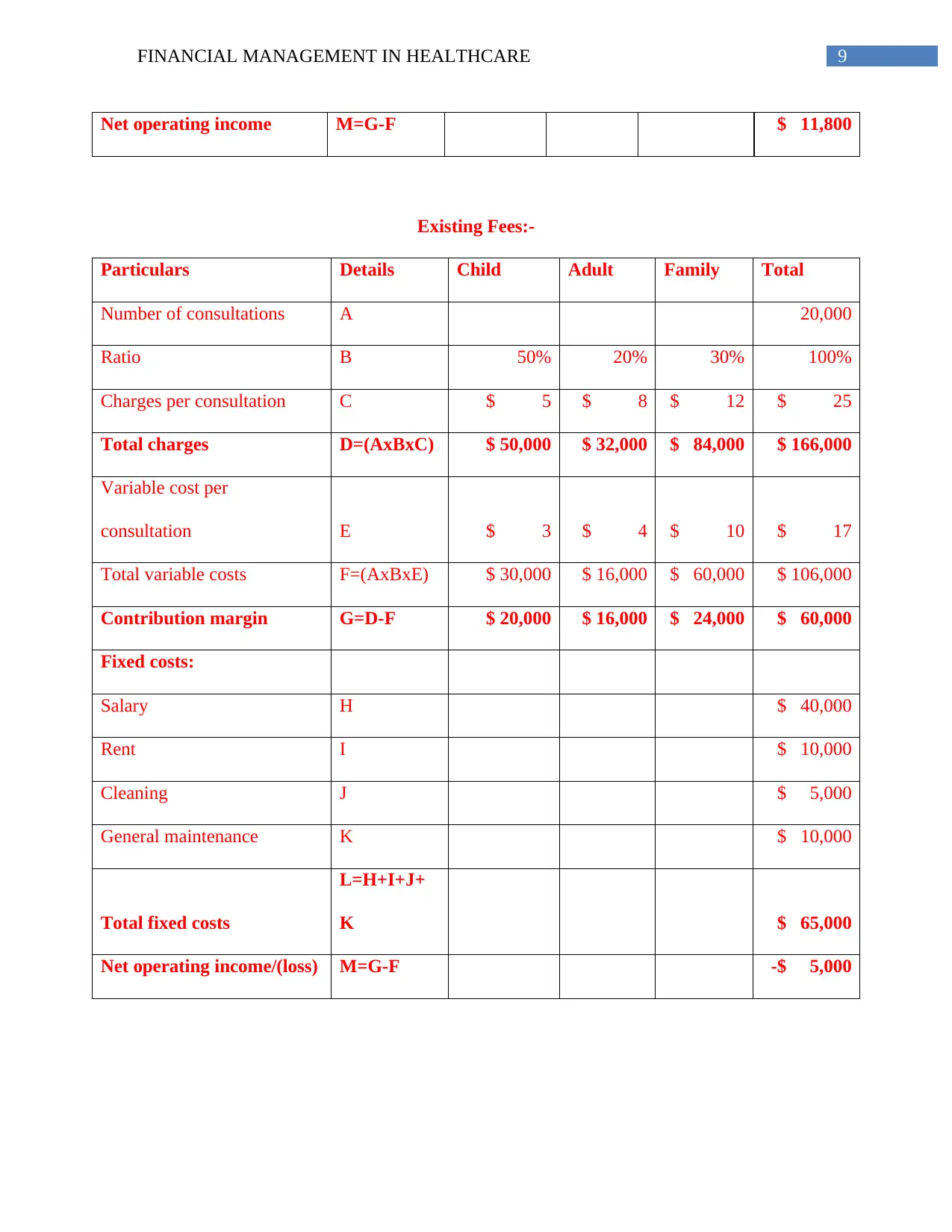

Existing Fees:-

Particulars Details Child Adult Family Total

Number of consultations A 20,000

Ratio B 50% 20% 30% 100%

Charges per consultation C $ 5 $ 8 $ 12 $ 25

Total charges D=(AxBxC) $ 50,000 $ 32,000 $ 84,000 $ 166,000

Variable cost per

consultation E $ 3 $ 4 $ 10 $ 17

Total variable costs F=(AxBxE) $ 30,000 $ 16,000 $ 60,000 $ 106,000

Contribution margin G=D-F $ 20,000 $ 16,000 $ 24,000 $ 60,000

Fixed costs:

Salary H $ 40,000

Rent I $ 10,000

Cleaning J $ 5,000

General maintenance K $ 10,000

Total fixed costs

L=H+I+J+

K $ 65,000

Net operating income/(loss) M=G-F -$ 5,000

Net operating income M=G-F $ 11,800

Existing Fees:-

Particulars Details Child Adult Family Total

Number of consultations A 20,000

Ratio B 50% 20% 30% 100%

Charges per consultation C $ 5 $ 8 $ 12 $ 25

Total charges D=(AxBxC) $ 50,000 $ 32,000 $ 84,000 $ 166,000

Variable cost per

consultation E $ 3 $ 4 $ 10 $ 17

Total variable costs F=(AxBxE) $ 30,000 $ 16,000 $ 60,000 $ 106,000

Contribution margin G=D-F $ 20,000 $ 16,000 $ 24,000 $ 60,000

Fixed costs:

Salary H $ 40,000

Rent I $ 10,000

Cleaning J $ 5,000

General maintenance K $ 10,000

Total fixed costs

L=H+I+J+

K $ 65,000

Net operating income/(loss) M=G-F -$ 5,000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10FINANCIAL MANAGEMENT IN HEALTHCARE

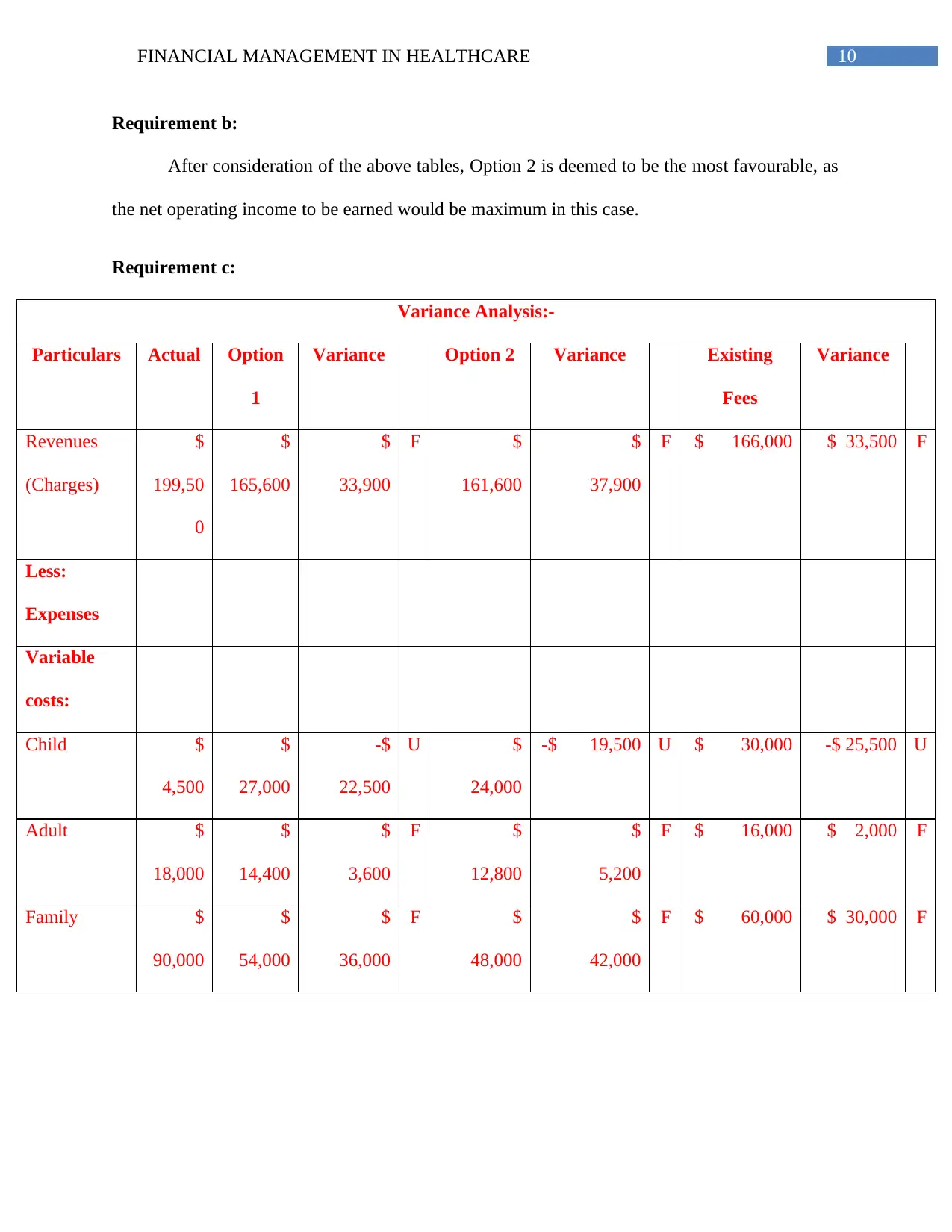

Requirement b:

After consideration of the above tables, Option 2 is deemed to be the most favourable, as

the net operating income to be earned would be maximum in this case.

Requirement c:

Variance Analysis:-

Particulars Actual Option

1

Variance Option 2 Variance Existing

Fees

Variance

Revenues

(Charges)

$

199,50

0

$

165,600

$

33,900

F $

161,600

$

37,900

F $ 166,000 $ 33,500 F

Less:

Expenses

Variable

costs:

Child $

4,500

$

27,000

-$

22,500

U $

24,000

-$ 19,500 U $ 30,000 -$ 25,500 U

Adult $

18,000

$

14,400

$

3,600

F $

12,800

$

5,200

F $ 16,000 $ 2,000 F

Family $

90,000

$

54,000

$

36,000

F $

48,000

$

42,000

F $ 60,000 $ 30,000 F

Requirement b:

After consideration of the above tables, Option 2 is deemed to be the most favourable, as

the net operating income to be earned would be maximum in this case.

Requirement c:

Variance Analysis:-

Particulars Actual Option

1

Variance Option 2 Variance Existing

Fees

Variance

Revenues

(Charges)

$

199,50

0

$

165,600

$

33,900

F $

161,600

$

37,900

F $ 166,000 $ 33,500 F

Less:

Expenses

Variable

costs:

Child $

4,500

$

27,000

-$

22,500

U $

24,000

-$ 19,500 U $ 30,000 -$ 25,500 U

Adult $

18,000

$

14,400

$

3,600

F $

12,800

$

5,200

F $ 16,000 $ 2,000 F

Family $

90,000

$

54,000

$

36,000

F $

48,000

$

42,000

F $ 60,000 $ 30,000 F

11FINANCIAL MANAGEMENT IN HEALTHCARE

Total

variable

costs

$

112,50

0

$

95,400

$

17,100

F $

84,800

$

27,700

F $ 106,000 $ 6,500 F

Salary

expense

$

50,000

$

40,000

$

10,000

F $

40,000

$

10,000

F $ 40,000 $ 10,000 F

Rent expense $

8,000

$

10,000

-$

2,000

U $

10,000

-$ 2,000 U $ 10,000 -$ 2,000 U

Cleaning

expense

$

15,000

$

5,000

$

10,000

F $

5,000

$

10,000

F $ 5,000 $ 10,000 F

General

maintenance

expense

$

12,000

$

10,000

$

2,000

F $

10,000

$

2,000

F $ 10,000 $ 2,000 F

Total

expenses

$

197,50

0

$

160,400

$

37,100

F $

149,800

$

47,700

F $ 171,000 $ 26,500 F

Net

operating

income/(loss

)

$

2,000

$

5,200

-$

3,200

F $

11,800

-$

9,800

F -$ 5,000 $ 7,000 U

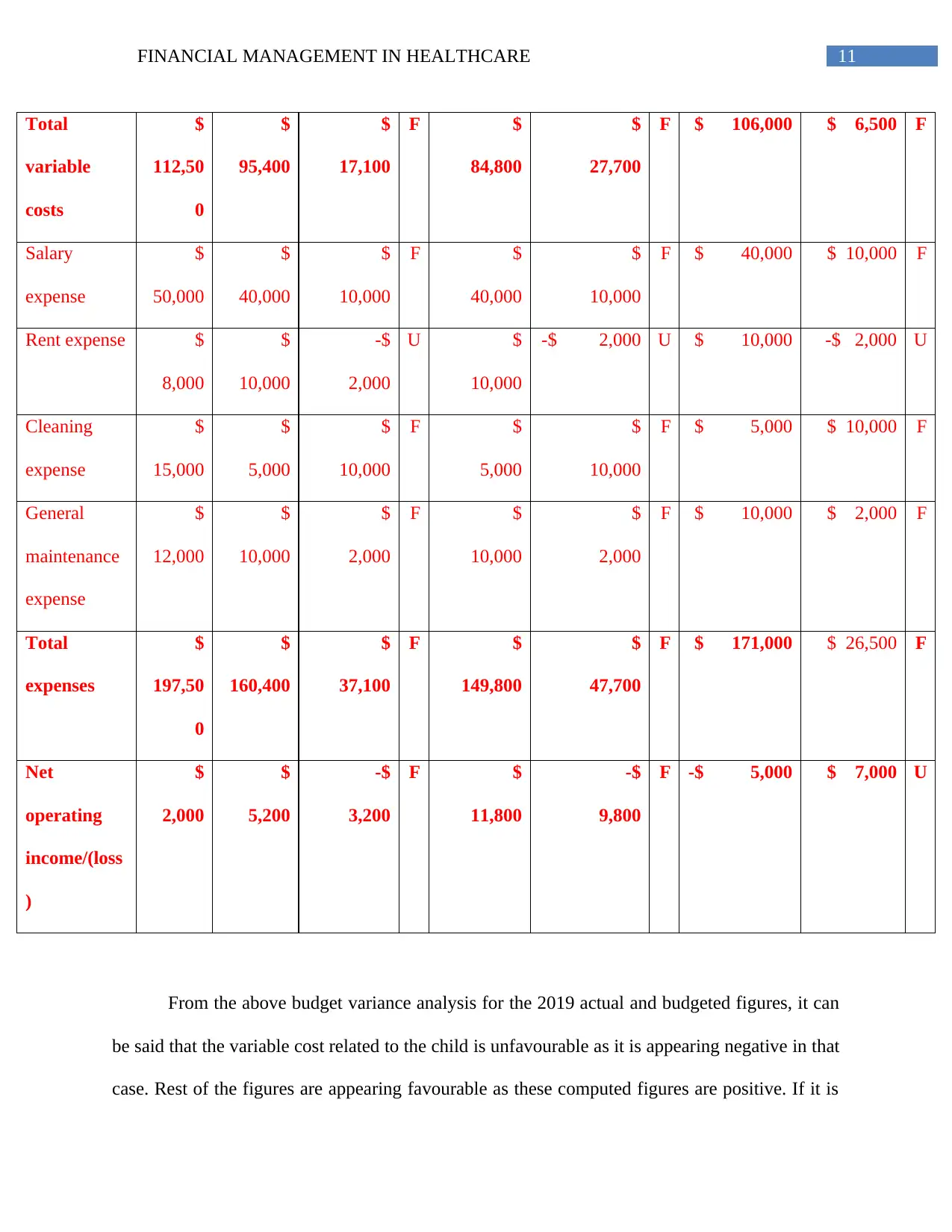

From the above budget variance analysis for the 2019 actual and budgeted figures, it can

be said that the variable cost related to the child is unfavourable as it is appearing negative in that

case. Rest of the figures are appearing favourable as these computed figures are positive. If it is

Total

variable

costs

$

112,50

0

$

95,400

$

17,100

F $

84,800

$

27,700

F $ 106,000 $ 6,500 F

Salary

expense

$

50,000

$

40,000

$

10,000

F $

40,000

$

10,000

F $ 40,000 $ 10,000 F

Rent expense $

8,000

$

10,000

-$

2,000

U $

10,000

-$ 2,000 U $ 10,000 -$ 2,000 U

Cleaning

expense

$

15,000

$

5,000

$

10,000

F $

5,000

$

10,000

F $ 5,000 $ 10,000 F

General

maintenance

expense

$

12,000

$

10,000

$

2,000

F $

10,000

$

2,000

F $ 10,000 $ 2,000 F

Total

expenses

$

197,50

0

$

160,400

$

37,100

F $

149,800

$

47,700

F $ 171,000 $ 26,500 F

Net

operating

income/(loss

)

$

2,000

$

5,200

-$

3,200

F $

11,800

-$

9,800

F -$ 5,000 $ 7,000 U

From the above budget variance analysis for the 2019 actual and budgeted figures, it can

be said that the variable cost related to the child is unfavourable as it is appearing negative in that

case. Rest of the figures are appearing favourable as these computed figures are positive. If it is

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.