Capital Projects Planning, Budgeting, and Financing Strategies

VerifiedAdded on 2019/09/20

|8

|1100

|157

Report

AI Summary

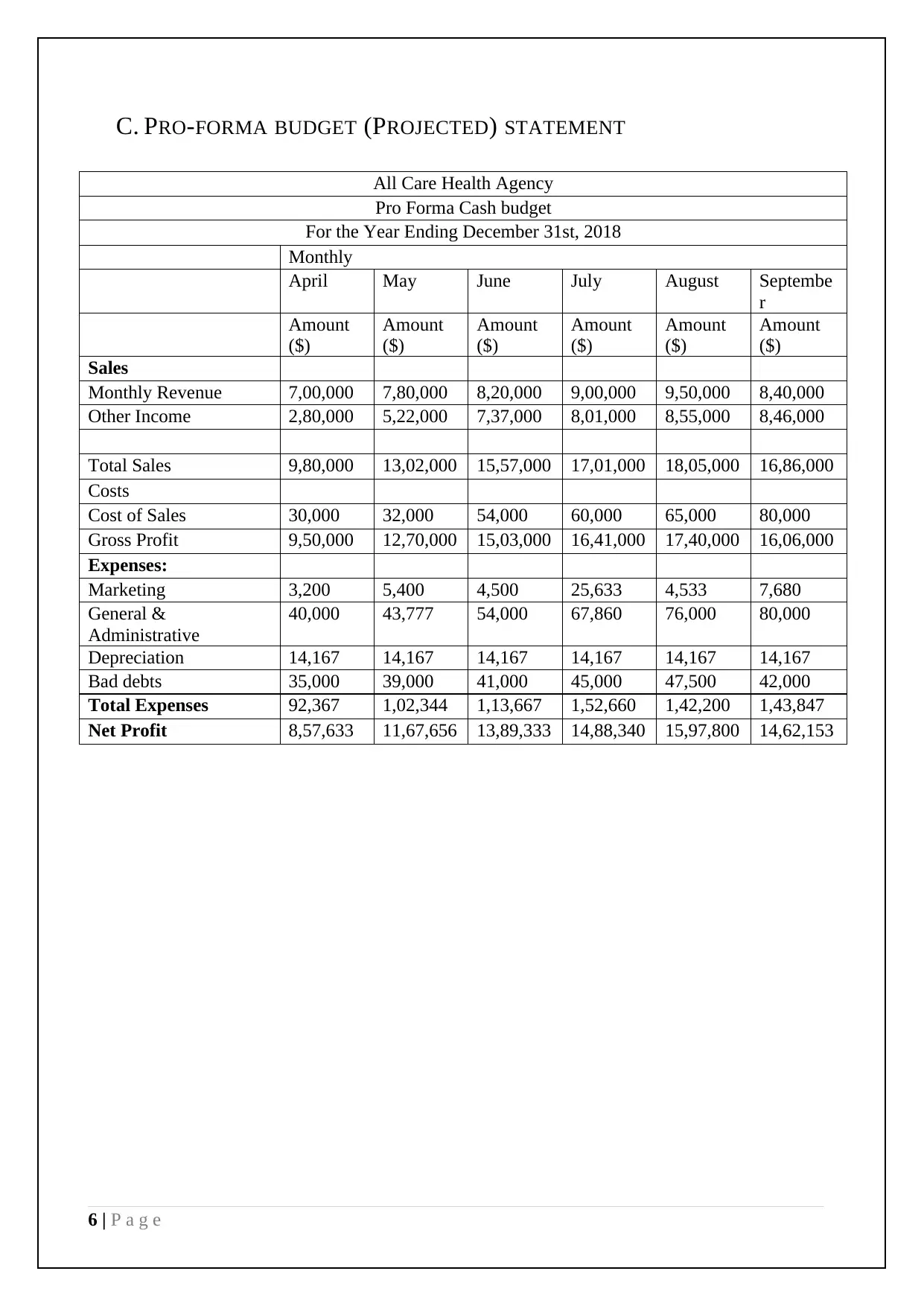

The provided content is about capital infrastructure and facilities built or acquired by the Hospital management, which requires a significant amount of money for financing and management procedures. The capital assets have long lives, and their costs are spread over several years. Debt financing is often utilized to invest in large capital assets. The assignment also includes a pro-forma budget statement for All Care Health Agency, showing monthly sales revenue, cost of sales, gross profit, expenses, depreciation, bad debts, and net profit. A memo is also provided, recommending investment in long-term debts and short-term equities, dividend distribution to stakeholders, equipment purchase, employee increment, and medical insurance benefits.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

1 out of 8

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)