HI5002 Finance for Business: Financial Statement and WACC Analysis

VerifiedAdded on 2024/06/04

|12

|1724

|184

Report

AI Summary

This report provides a financial analysis of a selected company, including the calculation and interpretation of fundamental ratios such as short-term solvency, long-term solvency, asset utilization, and profitability ratios for the past two years. It features a share price analysis presented graphically, comparing it with an index, and discusses the implications of a company's weighted average cost of capital (WACC). The report also examines the company's capital structure, gearing ratios, and dividend policy, referencing the company's annual reports to support its findings. Desklib provides access to this and other solved assignments for students.

HI5002: FINANCE FOR BUSINESS

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

Question 3..................................................................................................................................3

Question 4..................................................................................................................................6

Question 7..................................................................................................................................8

Question 8................................................................................................................................10

Question 9................................................................................................................................11

2

Question 3..................................................................................................................................3

Question 4..................................................................................................................................6

Question 7..................................................................................................................................8

Question 8................................................................................................................................10

Question 9................................................................................................................................11

2

Question 3

Calculate the following Fundamental Ratios for your selected company for the past 2 years.

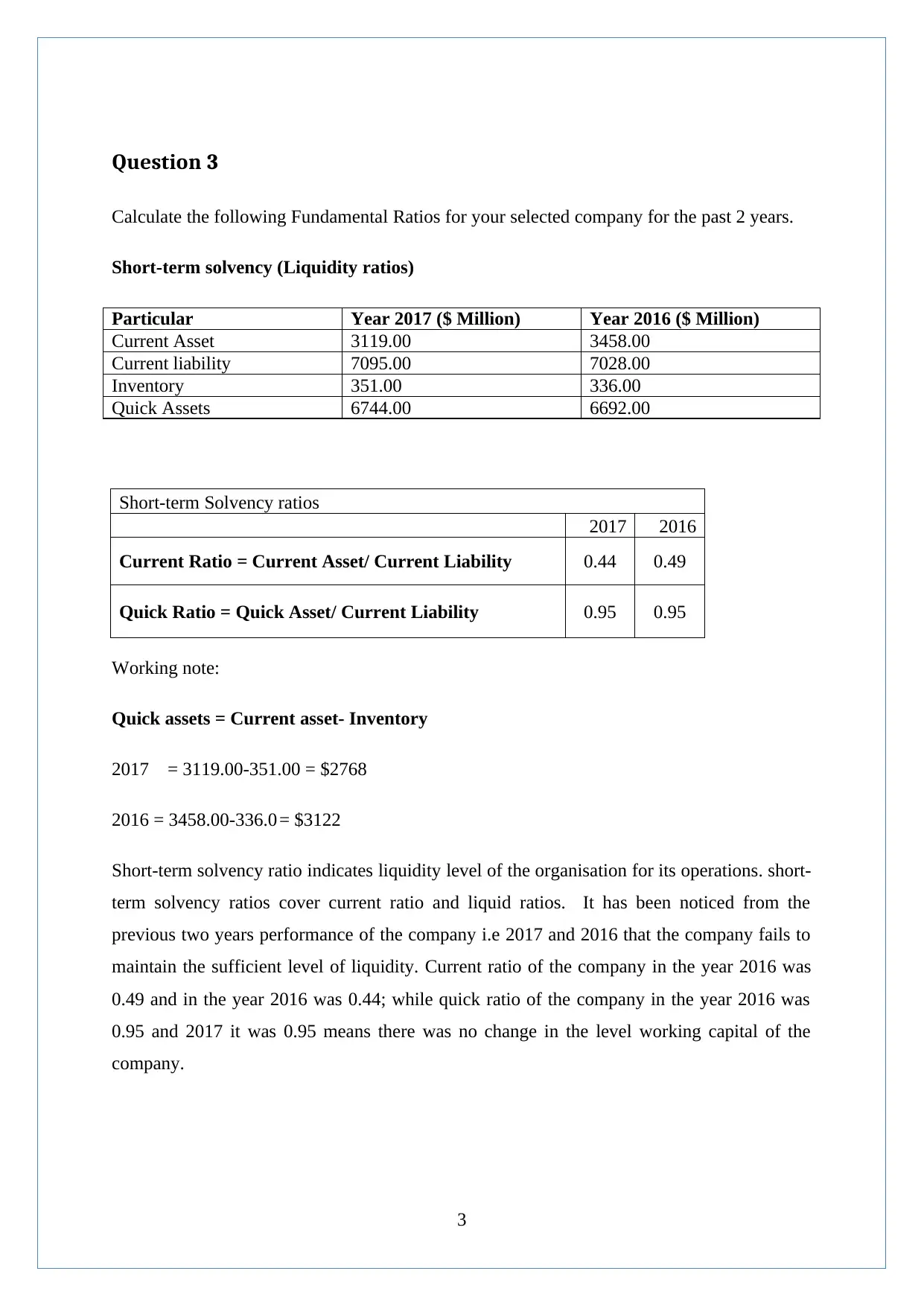

Short-term solvency (Liquidity ratios)

Particular Year 2017 ($ Million) Year 2016 ($ Million)

Current Asset 3119.00 3458.00

Current liability 7095.00 7028.00

Inventory 351.00 336.00

Quick Assets 6744.00 6692.00

Short-term Solvency ratios

2017 2016

Current Ratio = Current Asset/ Current Liability 0.44 0.49

Quick Ratio = Quick Asset/ Current Liability 0.95 0.95

Working note:

Quick assets = Current asset- Inventory

2017 = 3119.00-351.00 = $2768

2016 = 3458.00-336.0 = $3122

Short-term solvency ratio indicates liquidity level of the organisation for its operations. short-

term solvency ratios cover current ratio and liquid ratios. It has been noticed from the

previous two years performance of the company i.e 2017 and 2016 that the company fails to

maintain the sufficient level of liquidity. Current ratio of the company in the year 2016 was

0.49 and in the year 2016 was 0.44; while quick ratio of the company in the year 2016 was

0.95 and 2017 it was 0.95 means there was no change in the level working capital of the

company.

3

Calculate the following Fundamental Ratios for your selected company for the past 2 years.

Short-term solvency (Liquidity ratios)

Particular Year 2017 ($ Million) Year 2016 ($ Million)

Current Asset 3119.00 3458.00

Current liability 7095.00 7028.00

Inventory 351.00 336.00

Quick Assets 6744.00 6692.00

Short-term Solvency ratios

2017 2016

Current Ratio = Current Asset/ Current Liability 0.44 0.49

Quick Ratio = Quick Asset/ Current Liability 0.95 0.95

Working note:

Quick assets = Current asset- Inventory

2017 = 3119.00-351.00 = $2768

2016 = 3458.00-336.0 = $3122

Short-term solvency ratio indicates liquidity level of the organisation for its operations. short-

term solvency ratios cover current ratio and liquid ratios. It has been noticed from the

previous two years performance of the company i.e 2017 and 2016 that the company fails to

maintain the sufficient level of liquidity. Current ratio of the company in the year 2016 was

0.49 and in the year 2016 was 0.44; while quick ratio of the company in the year 2016 was

0.95 and 2017 it was 0.95 means there was no change in the level working capital of the

company.

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

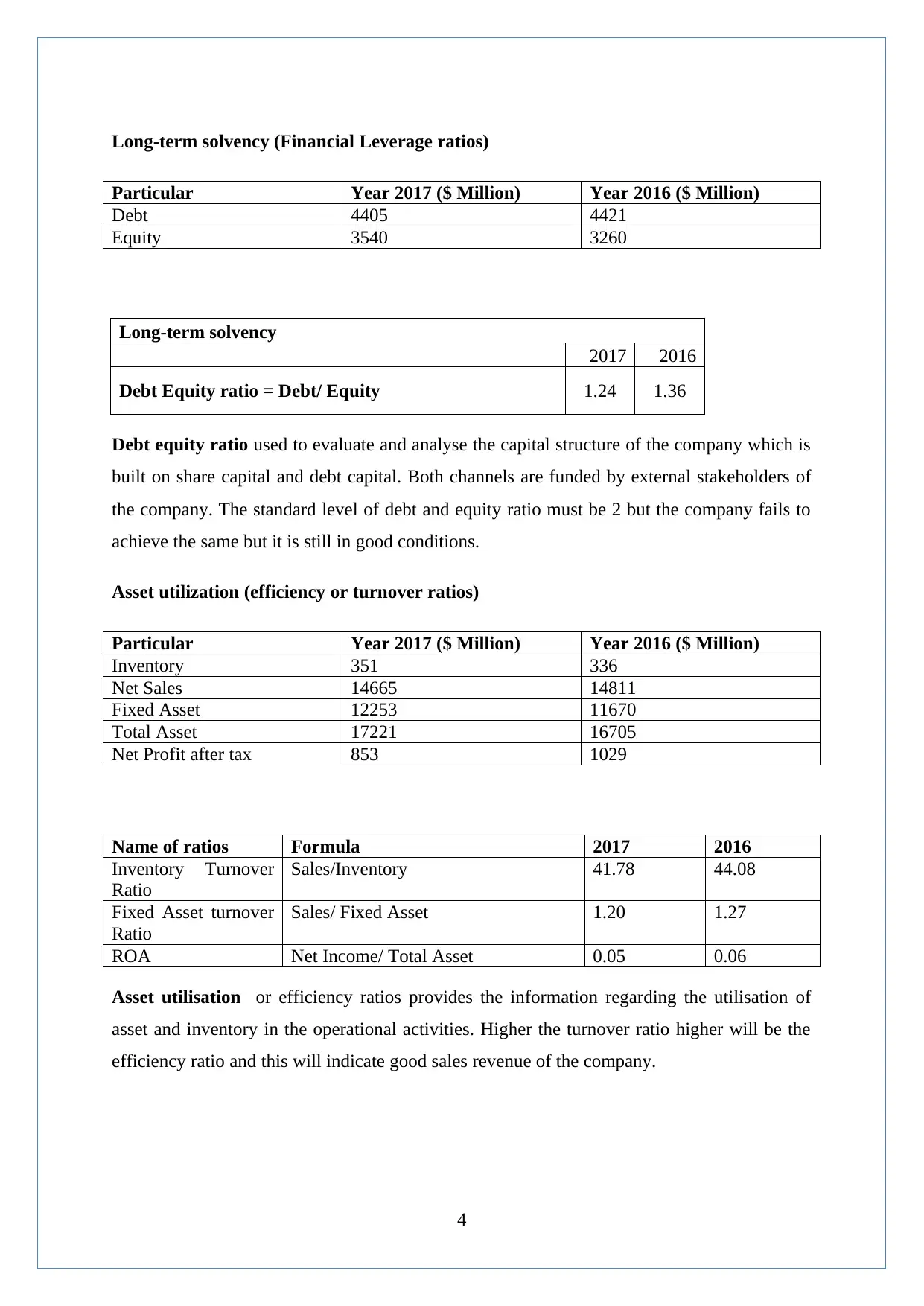

Long-term solvency (Financial Leverage ratios)

Particular Year 2017 ($ Million) Year 2016 ($ Million)

Debt 4405 4421

Equity 3540 3260

Long-term solvency

2017 2016

Debt Equity ratio = Debt/ Equity 1.24 1.36

Debt equity ratio used to evaluate and analyse the capital structure of the company which is

built on share capital and debt capital. Both channels are funded by external stakeholders of

the company. The standard level of debt and equity ratio must be 2 but the company fails to

achieve the same but it is still in good conditions.

Asset utilization (efficiency or turnover ratios)

Particular Year 2017 ($ Million) Year 2016 ($ Million)

Inventory 351 336

Net Sales 14665 14811

Fixed Asset 12253 11670

Total Asset 17221 16705

Net Profit after tax 853 1029

Name of ratios Formula 2017 2016

Inventory Turnover

Ratio

Sales/Inventory 41.78 44.08

Fixed Asset turnover

Ratio

Sales/ Fixed Asset 1.20 1.27

ROA Net Income/ Total Asset 0.05 0.06

Asset utilisation or efficiency ratios provides the information regarding the utilisation of

asset and inventory in the operational activities. Higher the turnover ratio higher will be the

efficiency ratio and this will indicate good sales revenue of the company.

4

Particular Year 2017 ($ Million) Year 2016 ($ Million)

Debt 4405 4421

Equity 3540 3260

Long-term solvency

2017 2016

Debt Equity ratio = Debt/ Equity 1.24 1.36

Debt equity ratio used to evaluate and analyse the capital structure of the company which is

built on share capital and debt capital. Both channels are funded by external stakeholders of

the company. The standard level of debt and equity ratio must be 2 but the company fails to

achieve the same but it is still in good conditions.

Asset utilization (efficiency or turnover ratios)

Particular Year 2017 ($ Million) Year 2016 ($ Million)

Inventory 351 336

Net Sales 14665 14811

Fixed Asset 12253 11670

Total Asset 17221 16705

Net Profit after tax 853 1029

Name of ratios Formula 2017 2016

Inventory Turnover

Ratio

Sales/Inventory 41.78 44.08

Fixed Asset turnover

Ratio

Sales/ Fixed Asset 1.20 1.27

ROA Net Income/ Total Asset 0.05 0.06

Asset utilisation or efficiency ratios provides the information regarding the utilisation of

asset and inventory in the operational activities. Higher the turnover ratio higher will be the

efficiency ratio and this will indicate good sales revenue of the company.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

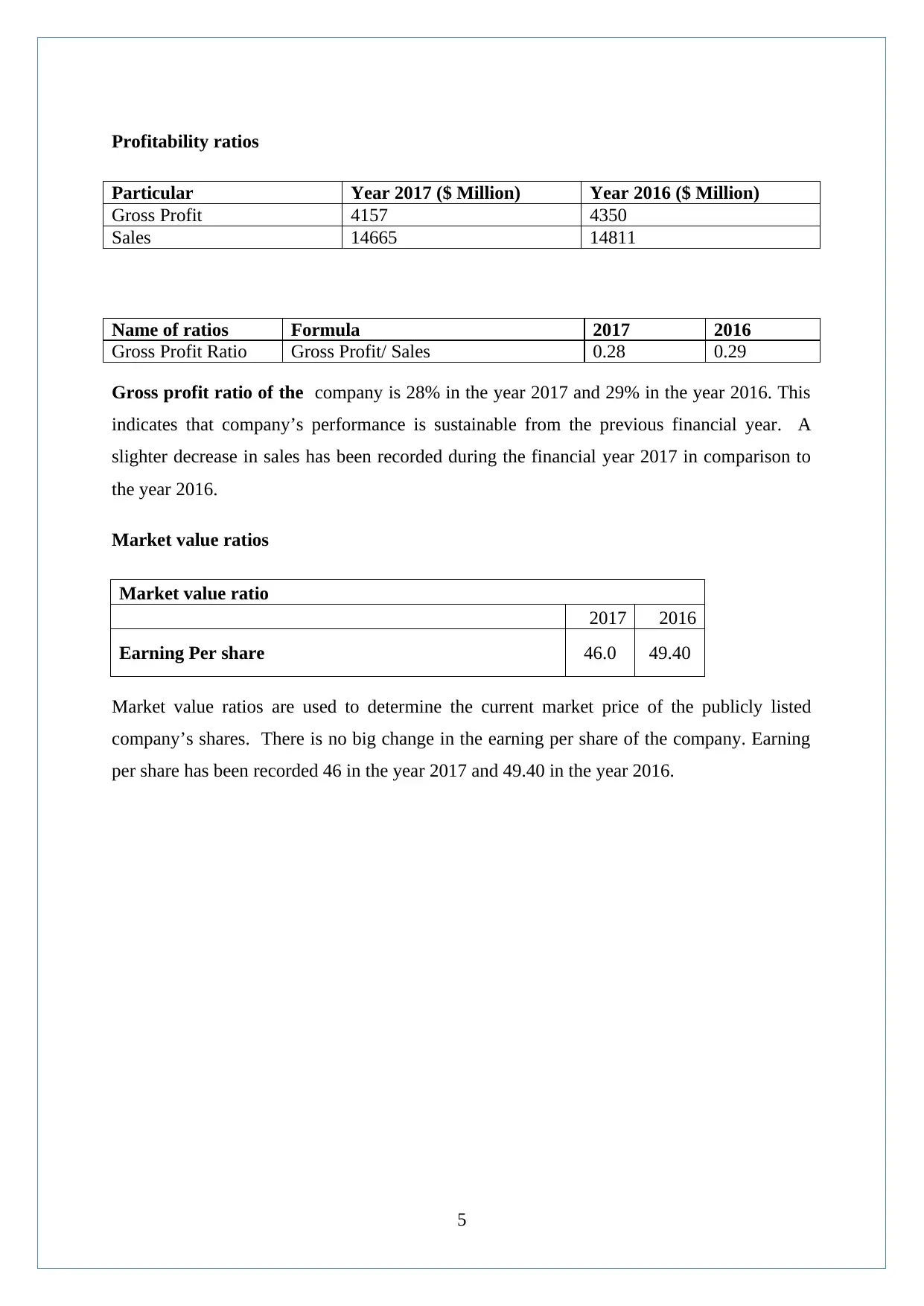

Profitability ratios

Particular Year 2017 ($ Million) Year 2016 ($ Million)

Gross Profit 4157 4350

Sales 14665 14811

Name of ratios Formula 2017 2016

Gross Profit Ratio Gross Profit/ Sales 0.28 0.29

Gross profit ratio of the company is 28% in the year 2017 and 29% in the year 2016. This

indicates that company’s performance is sustainable from the previous financial year. A

slighter decrease in sales has been recorded during the financial year 2017 in comparison to

the year 2016.

Market value ratios

Market value ratio

2017 2016

Earning Per share 46.0 49.40

Market value ratios are used to determine the current market price of the publicly listed

company’s shares. There is no big change in the earning per share of the company. Earning

per share has been recorded 46 in the year 2017 and 49.40 in the year 2016.

5

Particular Year 2017 ($ Million) Year 2016 ($ Million)

Gross Profit 4157 4350

Sales 14665 14811

Name of ratios Formula 2017 2016

Gross Profit Ratio Gross Profit/ Sales 0.28 0.29

Gross profit ratio of the company is 28% in the year 2017 and 29% in the year 2016. This

indicates that company’s performance is sustainable from the previous financial year. A

slighter decrease in sales has been recorded during the financial year 2017 in comparison to

the year 2016.

Market value ratios

Market value ratio

2017 2016

Earning Per share 46.0 49.40

Market value ratios are used to determine the current market price of the publicly listed

company’s shares. There is no big change in the earning per share of the company. Earning

per share has been recorded 46 in the year 2017 and 49.40 in the year 2016.

5

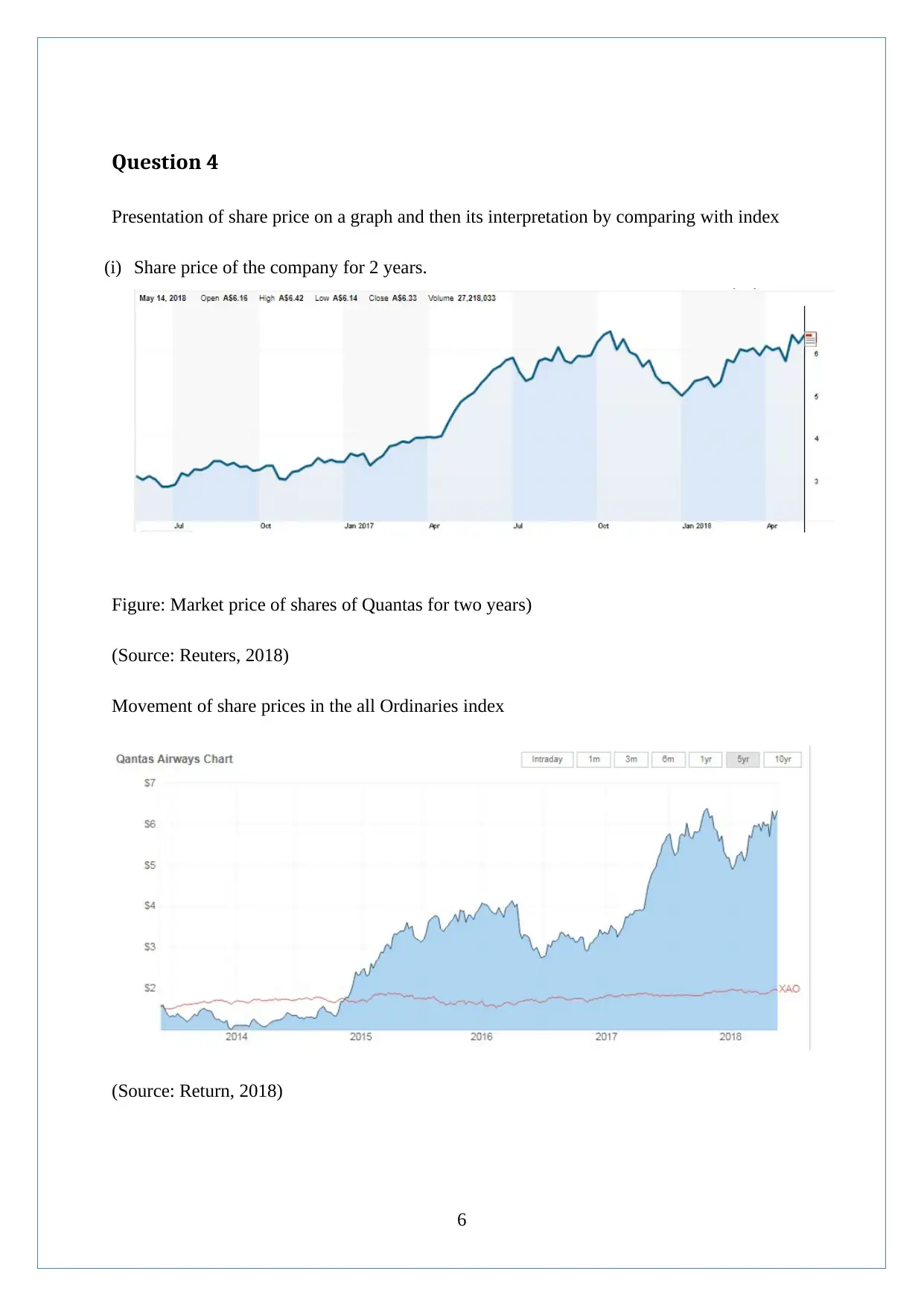

Question 4

Presentation of share price on a graph and then its interpretation by comparing with index

(i) Share price of the company for 2 years.

Figure: Market price of shares of Quantas for two years)

(Source: Reuters, 2018)

Movement of share prices in the all Ordinaries index

(Source: Return, 2018)

6

Presentation of share price on a graph and then its interpretation by comparing with index

(i) Share price of the company for 2 years.

Figure: Market price of shares of Quantas for two years)

(Source: Reuters, 2018)

Movement of share prices in the all Ordinaries index

(Source: Return, 2018)

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Introduction

The report provides information regarding the movement of share prices of the company

“Quantas Limited" during the last two years 2016 and 2017. Along with this, the report

provides comparison of share prices with all ordinaries index. The report is based upon the

graphical representation of share prices.

Analysis of movement of share prices

As the company has recorded improvement in its market share and market performance in the

past years 2016 and 2017. The share prices have increased in the year 2016 but the share

price movement goes downward during the financial year 2017, but it was only for some time

after that the prices go high and remain same for remaining time period in the year 2017. The

fluctuation in the market prices of the shares are due to changing market conditions but it

does not impact over the performance and market share of the company. Upon analysis of all

ordinaries ind. Of share prices, no major fluctuations have been recorded in that. But this

fluctuations company is facing risk in the market (Reuters, 2018).

Conclusion

It can be concluded that the changes in share prices take place in the market due to change in

economy of country, prices not only affect with the company’s performance but it also

changes due to change made in existing market situations. The same has been analysed in the

case of Quantas Limited.

7

The report provides information regarding the movement of share prices of the company

“Quantas Limited" during the last two years 2016 and 2017. Along with this, the report

provides comparison of share prices with all ordinaries index. The report is based upon the

graphical representation of share prices.

Analysis of movement of share prices

As the company has recorded improvement in its market share and market performance in the

past years 2016 and 2017. The share prices have increased in the year 2016 but the share

price movement goes downward during the financial year 2017, but it was only for some time

after that the prices go high and remain same for remaining time period in the year 2017. The

fluctuation in the market prices of the shares are due to changing market conditions but it

does not impact over the performance and market share of the company. Upon analysis of all

ordinaries ind. Of share prices, no major fluctuations have been recorded in that. But this

fluctuations company is facing risk in the market (Reuters, 2018).

Conclusion

It can be concluded that the changes in share prices take place in the market due to change in

economy of country, prices not only affect with the company’s performance but it also

changes due to change made in existing market situations. The same has been analysed in the

case of Quantas Limited.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

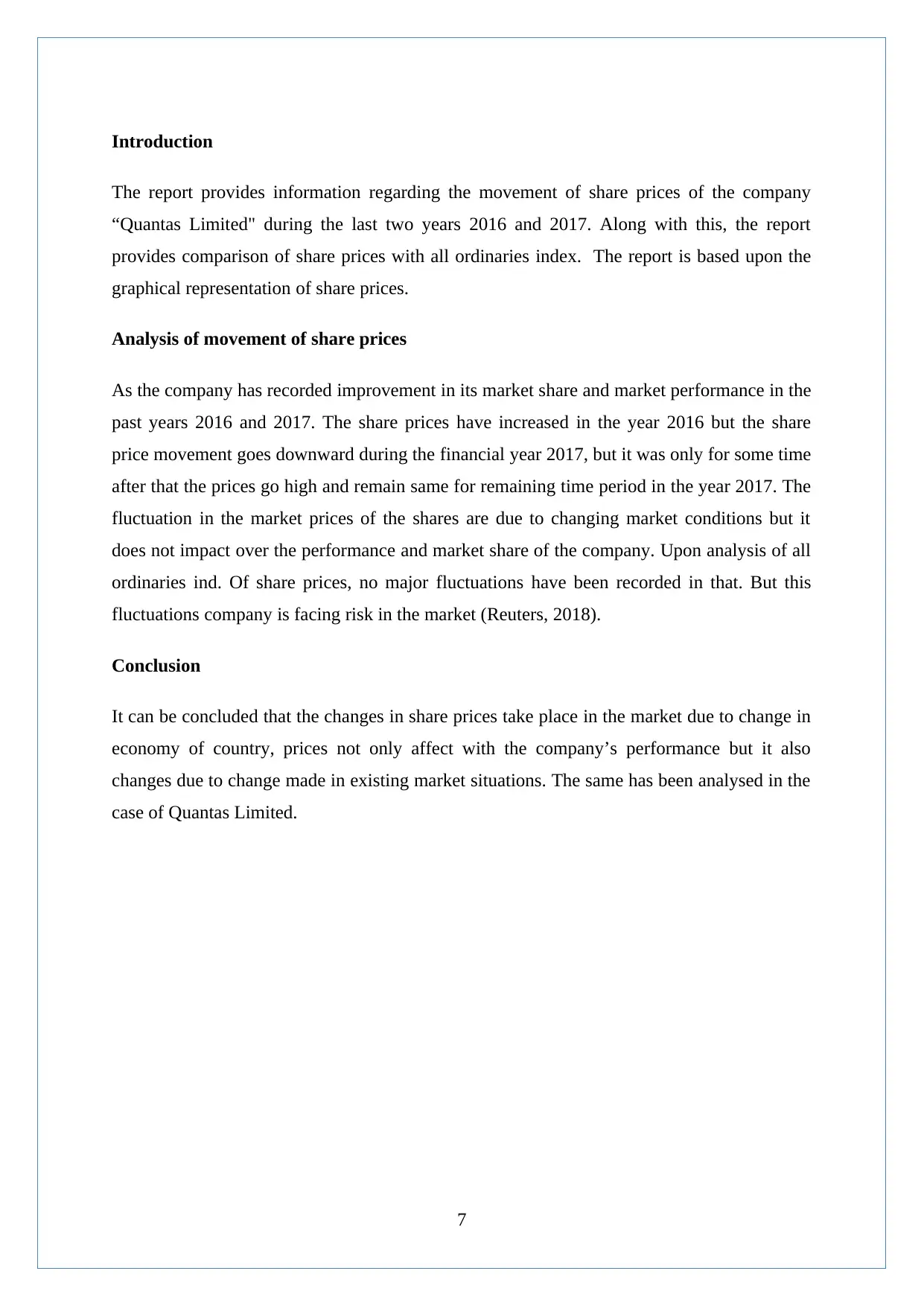

Question 7

Calculation of Weighted Average cost of the company.

(i) Weighted Average cost of company “Quantas Limited”

Calculation of weighted average cost of capital of the company includes both the share of

equity capital and debt capital. Very company needs to maintain balance between share

capital and debt capital because it affects the solvency situation.

Formula of Weighted average cost of capital is as follows:

WACC = E x Re + D x Rd (1 – T)

V V

Here,

Re = Rate on equity

D = Debt capital

E= Equity capital

Rd = = Cost of debt

V = Equity + Debt

T = Tax Rate

WACC = 3540 x 0.0892 + 4838 x 0.0502 (1 – 0.30)

8378 8378

WACC = 0.0377 + 0.0203

WACC = 0.058

WACC = 5.80%

8

Calculation of Weighted Average cost of the company.

(i) Weighted Average cost of company “Quantas Limited”

Calculation of weighted average cost of capital of the company includes both the share of

equity capital and debt capital. Very company needs to maintain balance between share

capital and debt capital because it affects the solvency situation.

Formula of Weighted average cost of capital is as follows:

WACC = E x Re + D x Rd (1 – T)

V V

Here,

Re = Rate on equity

D = Debt capital

E= Equity capital

Rd = = Cost of debt

V = Equity + Debt

T = Tax Rate

WACC = 3540 x 0.0892 + 4838 x 0.0502 (1 – 0.30)

8378 8378

WACC = 0.0377 + 0.0203

WACC = 0.058

WACC = 5.80%

8

(ii) Implication of higher WACC

Weighted average cost of capital must be lower for the company. Higher cost of capital is

good for lenders and equity holders but it is not good for the financial health of the

company. If the weighted average cost of capital increases then it is not possible for the

management to make investment in the other projects related to its business on the other

hand higher cost means higher interest rate and higher dividend on shares which is good

for shareholders but after that company will fail in maintaining reserves for future and

investment proposals.

9

Weighted average cost of capital must be lower for the company. Higher cost of capital is

good for lenders and equity holders but it is not good for the financial health of the

company. If the weighted average cost of capital increases then it is not possible for the

management to make investment in the other projects related to its business on the other

hand higher cost means higher interest rate and higher dividend on shares which is good

for shareholders but after that company will fail in maintaining reserves for future and

investment proposals.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

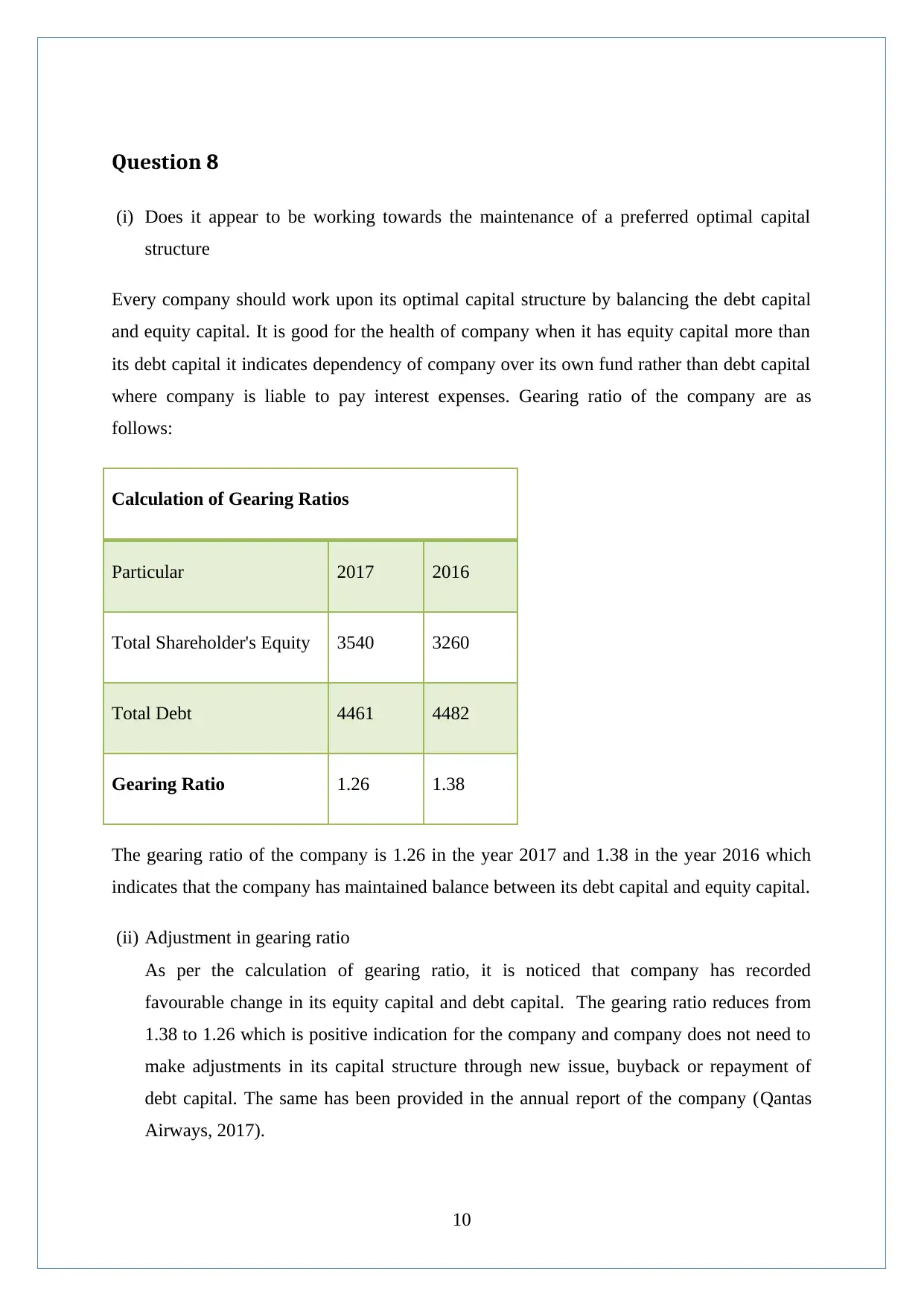

Question 8

(i) Does it appear to be working towards the maintenance of a preferred optimal capital

structure

Every company should work upon its optimal capital structure by balancing the debt capital

and equity capital. It is good for the health of company when it has equity capital more than

its debt capital it indicates dependency of company over its own fund rather than debt capital

where company is liable to pay interest expenses. Gearing ratio of the company are as

follows:

Calculation of Gearing Ratios

Particular 2017 2016

Total Shareholder's Equity 3540 3260

Total Debt 4461 4482

Gearing Ratio 1.26 1.38

The gearing ratio of the company is 1.26 in the year 2017 and 1.38 in the year 2016 which

indicates that the company has maintained balance between its debt capital and equity capital.

(ii) Adjustment in gearing ratio

As per the calculation of gearing ratio, it is noticed that company has recorded

favourable change in its equity capital and debt capital. The gearing ratio reduces from

1.38 to 1.26 which is positive indication for the company and company does not need to

make adjustments in its capital structure through new issue, buyback or repayment of

debt capital. The same has been provided in the annual report of the company (Qantas

Airways, 2017).

10

(i) Does it appear to be working towards the maintenance of a preferred optimal capital

structure

Every company should work upon its optimal capital structure by balancing the debt capital

and equity capital. It is good for the health of company when it has equity capital more than

its debt capital it indicates dependency of company over its own fund rather than debt capital

where company is liable to pay interest expenses. Gearing ratio of the company are as

follows:

Calculation of Gearing Ratios

Particular 2017 2016

Total Shareholder's Equity 3540 3260

Total Debt 4461 4482

Gearing Ratio 1.26 1.38

The gearing ratio of the company is 1.26 in the year 2017 and 1.38 in the year 2016 which

indicates that the company has maintained balance between its debt capital and equity capital.

(ii) Adjustment in gearing ratio

As per the calculation of gearing ratio, it is noticed that company has recorded

favourable change in its equity capital and debt capital. The gearing ratio reduces from

1.38 to 1.26 which is positive indication for the company and company does not need to

make adjustments in its capital structure through new issue, buyback or repayment of

debt capital. The same has been provided in the annual report of the company (Qantas

Airways, 2017).

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

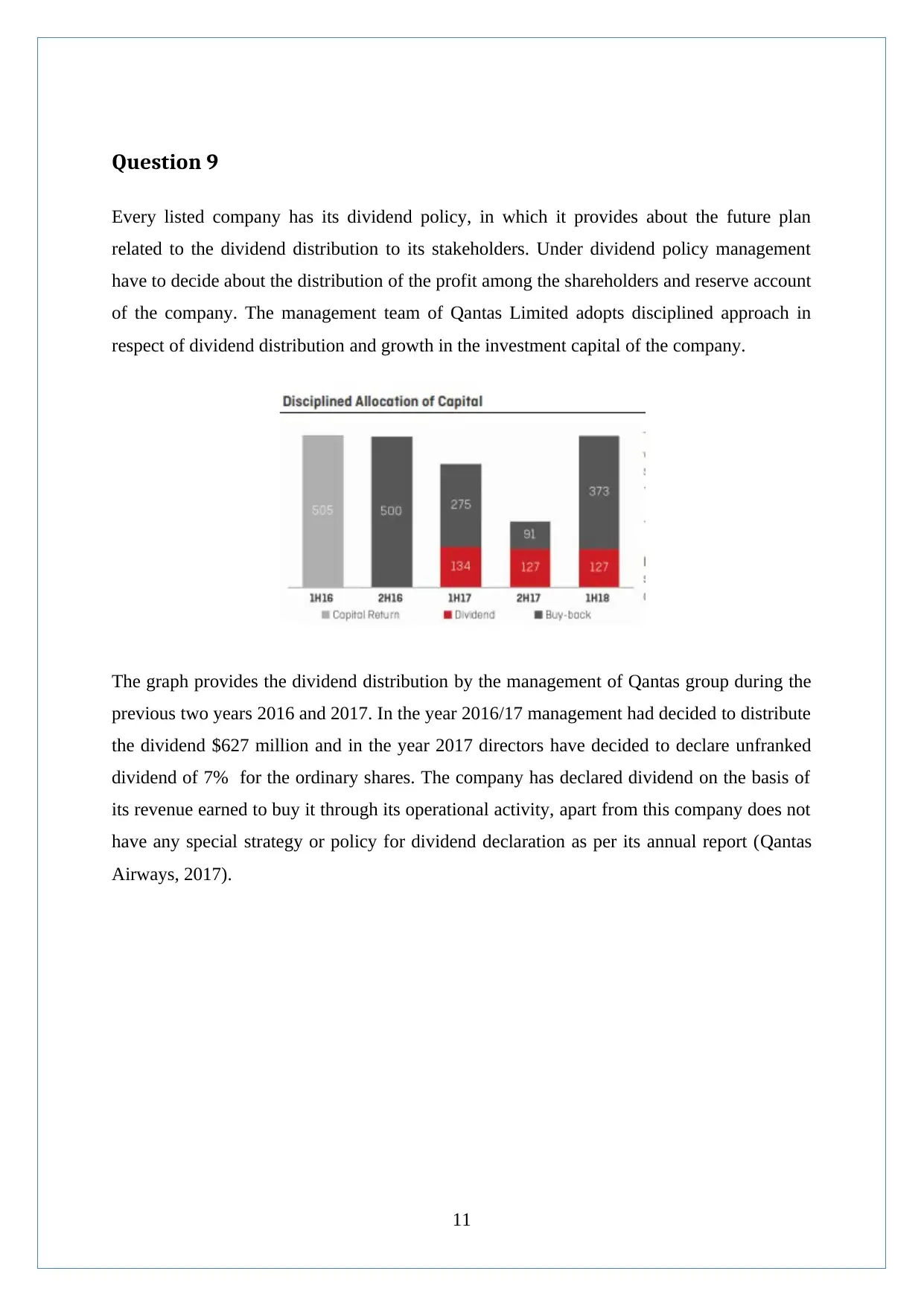

Question 9

Every listed company has its dividend policy, in which it provides about the future plan

related to the dividend distribution to its stakeholders. Under dividend policy management

have to decide about the distribution of the profit among the shareholders and reserve account

of the company. The management team of Qantas Limited adopts disciplined approach in

respect of dividend distribution and growth in the investment capital of the company.

The graph provides the dividend distribution by the management of Qantas group during the

previous two years 2016 and 2017. In the year 2016/17 management had decided to distribute

the dividend $627 million and in the year 2017 directors have decided to declare unfranked

dividend of 7% for the ordinary shares. The company has declared dividend on the basis of

its revenue earned to buy it through its operational activity, apart from this company does not

have any special strategy or policy for dividend declaration as per its annual report (Qantas

Airways, 2017).

11

Every listed company has its dividend policy, in which it provides about the future plan

related to the dividend distribution to its stakeholders. Under dividend policy management

have to decide about the distribution of the profit among the shareholders and reserve account

of the company. The management team of Qantas Limited adopts disciplined approach in

respect of dividend distribution and growth in the investment capital of the company.

The graph provides the dividend distribution by the management of Qantas group during the

previous two years 2016 and 2017. In the year 2016/17 management had decided to distribute

the dividend $627 million and in the year 2017 directors have decided to declare unfranked

dividend of 7% for the ordinary shares. The company has declared dividend on the basis of

its revenue earned to buy it through its operational activity, apart from this company does not

have any special strategy or policy for dividend declaration as per its annual report (Qantas

Airways, 2017).

11

References:

Qantas Airways. (2017). Annual Report 2017. Quantas Airways. [Online]. Available

at:

http://investor.qantas.com/FormBuilder/_Resource/_module/doLLG5ufYkCyEPjF1tp

gyw/file/annual-reports/2017AnnualReport.pdf [Accessed 29-05-2018]

Qantas Airways. (2016). Annual Report 2016. Quantas Airways. [Online]. Available

at:

https://www.qantas.com.au/infodetail/about/corporateGovernance/2016AnnualReport.

pdf [Accessed 29-05-2018]

Reuters, (2018). Qantas Airways Ltd (QAN.AX). Reuters. [Online]. Available at

https://www.reuters.com/finance/stocks/chart/QAN.AX. [Accessed on 29-05-2018]

Sattar, M.S.A. (2015). Cost of Capital – The Effect to the Firm Value and

Profitability; Empirical Evidences in Case of Personal Goods (Textile) Sector of KSE

100 Index. Journal of Poverty, Investment and Development, pp 24- 28.

12

Qantas Airways. (2017). Annual Report 2017. Quantas Airways. [Online]. Available

at:

http://investor.qantas.com/FormBuilder/_Resource/_module/doLLG5ufYkCyEPjF1tp

gyw/file/annual-reports/2017AnnualReport.pdf [Accessed 29-05-2018]

Qantas Airways. (2016). Annual Report 2016. Quantas Airways. [Online]. Available

at:

https://www.qantas.com.au/infodetail/about/corporateGovernance/2016AnnualReport.

pdf [Accessed 29-05-2018]

Reuters, (2018). Qantas Airways Ltd (QAN.AX). Reuters. [Online]. Available at

https://www.reuters.com/finance/stocks/chart/QAN.AX. [Accessed on 29-05-2018]

Sattar, M.S.A. (2015). Cost of Capital – The Effect to the Firm Value and

Profitability; Empirical Evidences in Case of Personal Goods (Textile) Sector of KSE

100 Index. Journal of Poverty, Investment and Development, pp 24- 28.

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.