HI5002 Finance for Business: Analyzing Wesfarmers Ltd Performance

VerifiedAdded on 2023/03/30

1

Paraphrase This Document

This report has been developed for the purpose of providing an insight into the financial

performance of an ASX listed entity, that is, Wesfarmers Ltd. The financial evaluation conducted

with the use of ratio analysis, systematic and unsystematic risks, dividend policy, cash

management and sensitivity analysis has revealed that Wesfarmers is having good future growth

prospects owing to its higher profitability position. It is also effectively managing its systematic

and unsystematic risks in an effective manner and providing good dividend to shareholders and

thus selected for an investment purpose by an institutional investor.

2

Abstract............................................................................................................................................2

Section I: Introduction to the report.................................................................................................4

Section II: Financial Analysis of Wesfarmers for last three years (2016, 2017 and 2018).............4

Section 2.1: Overview of the selected company..........................................................................4

Section 2.2: Ratio Analysis of Wesfarmers.................................................................................5

Profitability Analysis of Wesfarmers...........................................................................................5

Operating Efficiency Analysis of Wesfarmers............................................................................7

Section 2.3: Use of marketable securities by Wesfarmers for cash management purpose..........9

Section 2.4: Application of sensitivity analysis through using the capital budgeting scenario...9

Section 2.5: Information on systematic risks and unsystematic risks that impacts the

performance of Wesfarmers.......................................................................................................16

Systematic Risks........................................................................................................................16

Unsystematic Risks....................................................................................................................16

Section 2.6: Estimation of dividend payout ratio and identification of dividend policy used by

the management at Wesfarmers.................................................................................................17

Section III: Recommendation Letter.............................................................................................18

Section IV: Conclusion..................................................................................................................19

References......................................................................................................................................20

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

The business entities tend to disclose the information relating to their financial

performance through the help of developing the financial statements. The financial statements

are analyzed by the end-users such as investors for gaining an insight into the present and future

growth of a company. This is largely required to take correct investment decisions and ensuring

that the wealth of the investors’ remains protected. This report has been developed for providing

support to an institutional investor aiming to invest within the Australian market. In this context,

an ASX listed entity having a promising future for investment in Australia has been selected for

the purpose of financial evaluation. The financial evaluation has been done by the use of

examination of the financial statements of the selected company with the use of technique such

as ratio analysis, cash management, and sensitivity analysis, discussion of systematic and

unsystematic risks, analysis of dividend payout ratio and providing recommendation to the

investors on the basis of financial evaluation carried out. The ASX listed entity that has been

selected for the purpose of financial evaluation is Wesfarmers Limited, a supermarket giant in

Australia.

Section II: Financial Analysis of Wesfarmers for last three years (2016, 2017 and 2018)

Section 2.1: Overview of the selected company

Wesfarmers Limited is a supermarket giant of Australia whose headquarter is located

Perth. The company is regarded to be in a conglomerate business as it is involved in different

businesses such as retail, chemicals, fertilizers, home improvement, outdoor living, apparel,

general merchandise and industrial safety products. As such, the major business segments have

been divided into following categories:

Home Improvements

Department Stores

Industrial Safety Products

Office Works

The company since its establishment in the year 1914 has been recognized as one of the

major retailing company within Australia. It is regarded as one of the largest employer within the

country. It conducts its diverse business operations with the help of its many subsidiaries such as

Bunning’s Warehouse, Kmart, Officeworks and others across Australia. The primary objective of

the company is to promote sustainable growth of its business through long-term management.

The company since its establishment has prioritized to become a sustainable company by

conducts its business operations in a responsible and ethical manner. The high emphasis placed

on sustainability has enabled the company to promote its long-term growth and development by

achieving a distinctive position in the retailing sector of Australia. It strong commitment towards

4

Paraphrase This Document

impact has enabled it to create value over long-term (Wesfarmers Limited, 2019).

Section 2.2: Ratio Analysis of Wesfarmers

This section of the report will provide the detailed calculation of performance ratios

divided into two major categories profitability and operating efficiency. Firstly detailed

calculation has been made for ratios for last three years (2016, 2017 and 2018). All financial data

has been gathered from the annual reports available on company website under investor’s

relation section.

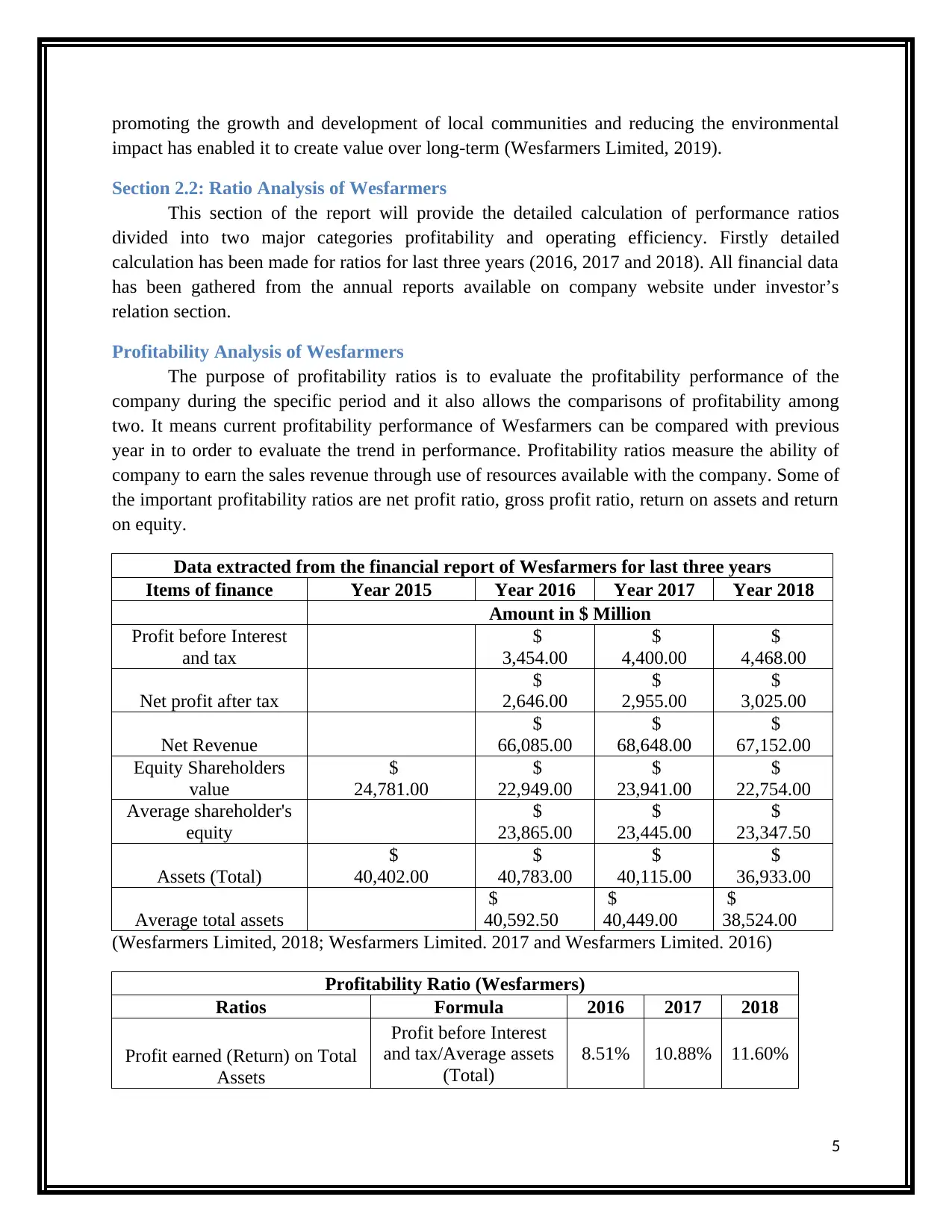

Profitability Analysis of Wesfarmers

The purpose of profitability ratios is to evaluate the profitability performance of the

company during the specific period and it also allows the comparisons of profitability among

two. It means current profitability performance of Wesfarmers can be compared with previous

year in to order to evaluate the trend in performance. Profitability ratios measure the ability of

company to earn the sales revenue through use of resources available with the company. Some of

the important profitability ratios are net profit ratio, gross profit ratio, return on assets and return

on equity.

Data extracted from the financial report of Wesfarmers for last three years

Items of finance Year 2015 Year 2016 Year 2017 Year 2018

Amount in $ Million

Profit before Interest

and tax

$

3,454.00

$

4,400.00

$

4,468.00

Net profit after tax

$

2,646.00

$

2,955.00

$

3,025.00

Net Revenue

$

66,085.00

$

68,648.00

$

67,152.00

Equity Shareholders

value

$

24,781.00

$

22,949.00

$

23,941.00

$

22,754.00

Average shareholder's

equity

$

23,865.00

$

23,445.00

$

23,347.50

Assets (Total)

$

40,402.00

$

40,783.00

$

40,115.00

$

36,933.00

Average total assets

$

40,592.50

$

40,449.00

$

38,524.00

(Wesfarmers Limited, 2018; Wesfarmers Limited. 2017 and Wesfarmers Limited. 2016)

Profitability Ratio (Wesfarmers)

Ratios Formula 2016 2017 2018

Profit earned (Return) on Total

Assets

Profit before Interest

and tax/Average assets

(Total)

8.51% 10.88% 11.60%

5

Revenue (Net) 4.00% 4.30% 4.50%

Profit earned (Return) on Total

Equity

Net profit after

tax/Average

shareholder's equity

11.09% 12.60% 12.96%

(Brigham and Michael, 2013)

2016 2017 2018

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

14.00%

8.51%

10.88%

11.60%

4.00% 4.30% 4.50%

11.09%

12.60% 12.96%

Profitability Ratio of Wesfarmers

Percentage

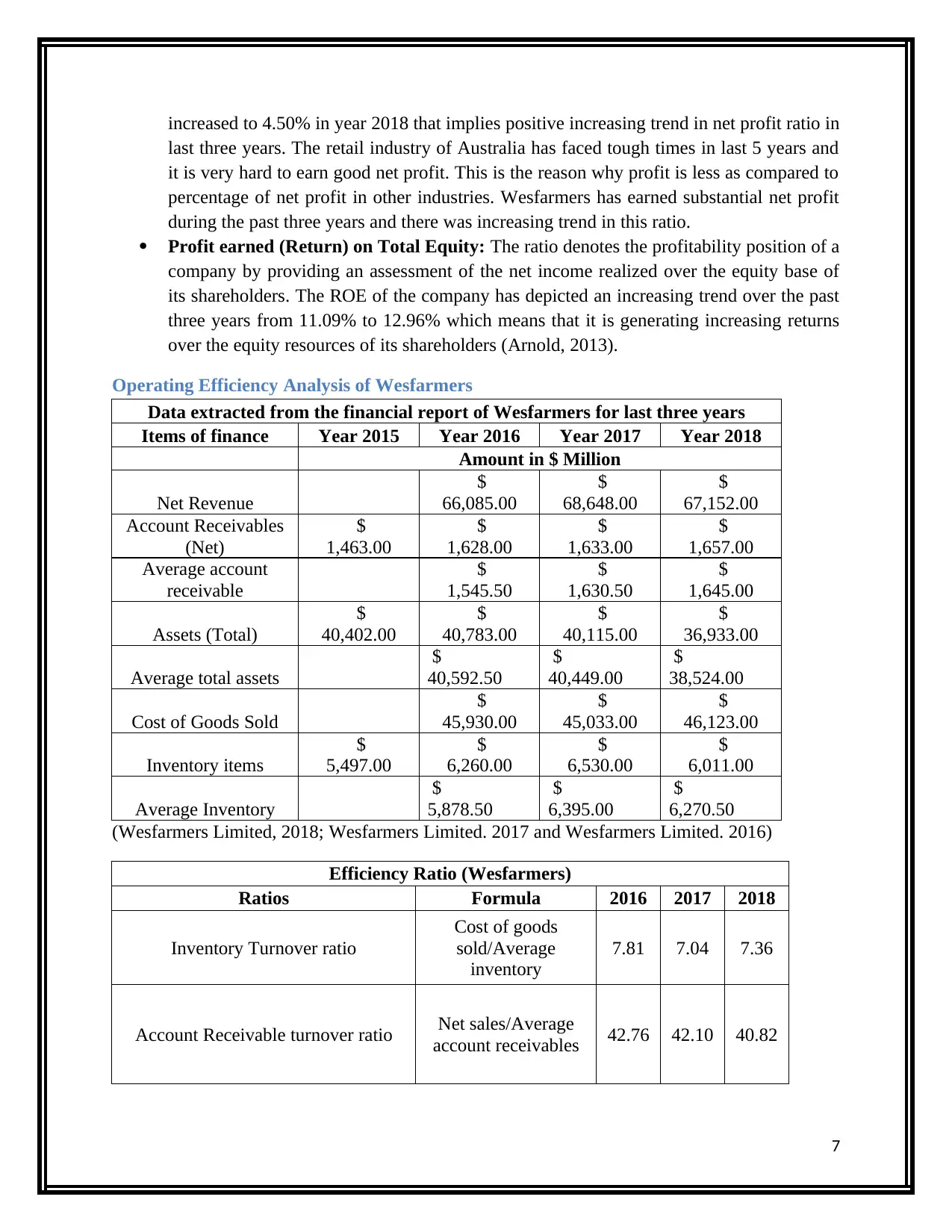

Profit earned (Return) on Total Assets: Percentage of earnings earned through use of

total assets implying how efficient management is using the assets to earn the earnings.

Return on total assets implies percentage of profits before tax and interest earned on

average total assets applied in the particular year. Wesfarmers has return on total assets of

8.51% in year 2016 that got increased to 10.88% in year 2017 and further increased to

11.60% in year 2018. It means there is positive increasing trend in this ratio from year

2016 to 2018. The main reason behind the increase in return on total assets was better

management policies and change in policies to utilize the assets available with the

company (Tracy, 2012).

Net profit ratio: Net profit ratio is very important as it provide percentage of earnings

left after all expenses including tax has been applied on total net revenue from the

particular period. This ratio is very important from the investor’s point of view as it

provides information on how return company has earned in particular period. Wesfarmers

has earned profit of 4% in year 2016, increased to 4.30% in year 2017 and further

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

last three years. The retail industry of Australia has faced tough times in last 5 years and

it is very hard to earn good net profit. This is the reason why profit is less as compared to

percentage of net profit in other industries. Wesfarmers has earned substantial net profit

during the past three years and there was increasing trend in this ratio.

Profit earned (Return) on Total Equity: The ratio denotes the profitability position of a

company by providing an assessment of the net income realized over the equity base of

its shareholders. The ROE of the company has depicted an increasing trend over the past

three years from 11.09% to 12.96% which means that it is generating increasing returns

over the equity resources of its shareholders (Arnold, 2013).

Operating Efficiency Analysis of Wesfarmers

Data extracted from the financial report of Wesfarmers for last three years

Items of finance Year 2015 Year 2016 Year 2017 Year 2018

Amount in $ Million

Net Revenue

$

66,085.00

$

68,648.00

$

67,152.00

Account Receivables

(Net)

$

1,463.00

$

1,628.00

$

1,633.00

$

1,657.00

Average account

receivable

$

1,545.50

$

1,630.50

$

1,645.00

Assets (Total)

$

40,402.00

$

40,783.00

$

40,115.00

$

36,933.00

Average total assets

$

40,592.50

$

40,449.00

$

38,524.00

Cost of Goods Sold

$

45,930.00

$

45,033.00

$

46,123.00

Inventory items

$

5,497.00

$

6,260.00

$

6,530.00

$

6,011.00

Average Inventory

$

5,878.50

$

6,395.00

$

6,270.50

(Wesfarmers Limited, 2018; Wesfarmers Limited. 2017 and Wesfarmers Limited. 2016)

Efficiency Ratio (Wesfarmers)

Ratios Formula 2016 2017 2018

Inventory Turnover ratio

Cost of goods

sold/Average

inventory

7.81 7.04 7.36

Account Receivable turnover ratio Net sales/Average

account receivables 42.76 42.10 40.82

7

Paraphrase This Document

total assets 1.63 1.70 1.74

2016 2017 2018

0.00

5.00

10.00

15.00

20.00

25.00

30.00

35.00

40.00

45.00

7.81 7.04 7.36

42.76 42.10 40.82

1.63 1.70 1.74

Effeciency Ratio of Wesfarmers

Times

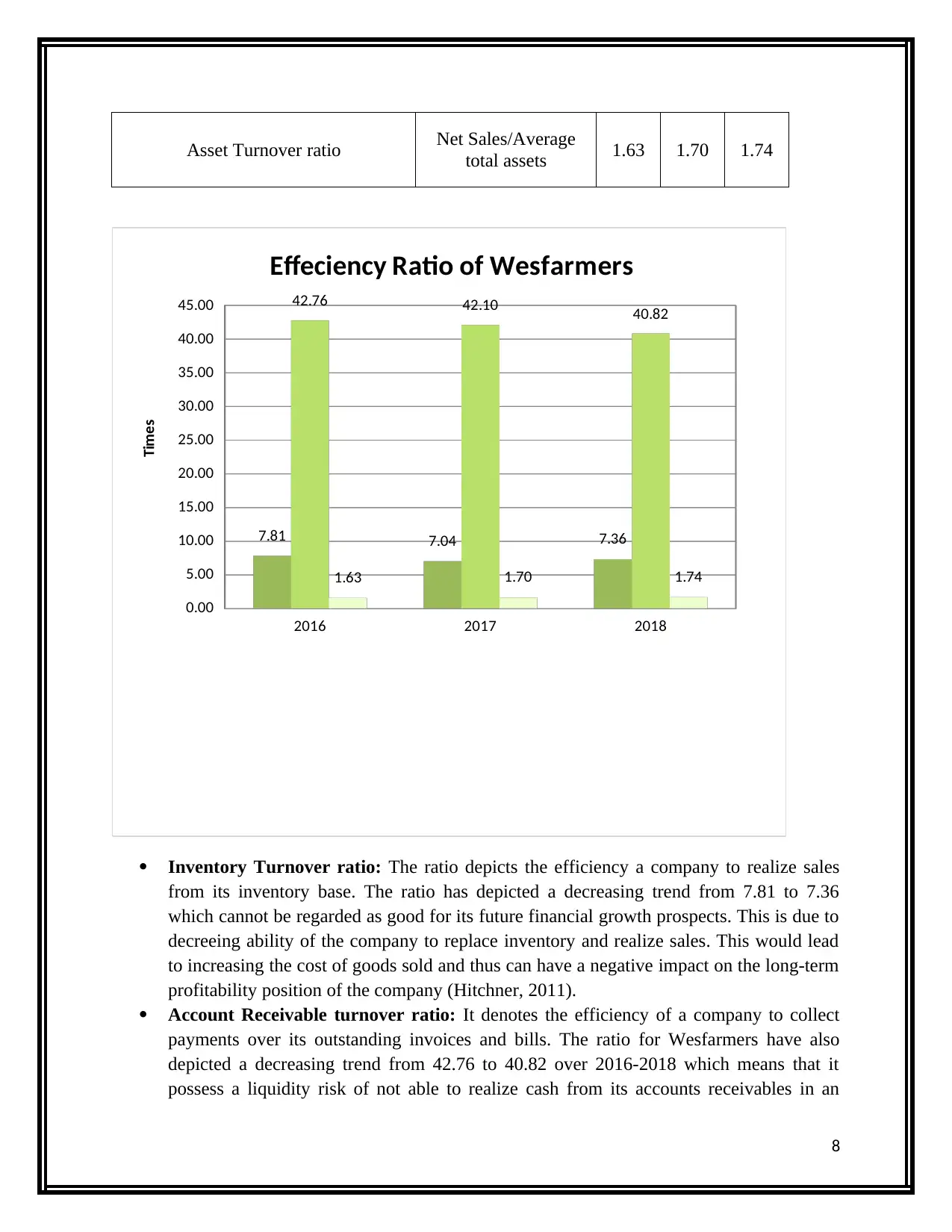

Inventory Turnover ratio: The ratio depicts the efficiency a company to realize sales

from its inventory base. The ratio has depicted a decreasing trend from 7.81 to 7.36

which cannot be regarded as good for its future financial growth prospects. This is due to

decreeing ability of the company to replace inventory and realize sales. This would lead

to increasing the cost of goods sold and thus can have a negative impact on the long-term

profitability position of the company (Hitchner, 2011).

Account Receivable turnover ratio: It denotes the efficiency of a company to collect

payments over its outstanding invoices and bills. The ratio for Wesfarmers have also

depicted a decreasing trend from 42.76 to 40.82 over 2016-2018 which means that it

possess a liquidity risk of not able to realize cash from its accounts receivables in an

8

term profits,.

Asset Turnover ratio: The asset turnover ratio for the company has depicted an

increasing trend over the past three financial years from 1.63 to 1.74. The ratio is also

higher than 1 over the selected time-period which means that it possess good efficiency to

realize sales from the asset base (Baker and Powell, 2009).

Section 2.3: Use of marketable securities by Wesfarmers for cash management purpose

Marketable securities refer to the short term financial instruments that are easily

redeemable in the market and they can be easily brought and sold in the market. It means

maturity period of the marketable securities is less than 1 year. The purpose of using the

marketable securities is to make sure enough liquidated cash is available with the company that

can be used in one year time period to pay the current liabilities. Marketable securities can be

both debt securities and equity securities dependent upon the securities chosen by the company.

Investment in shares, bonds, and debentures are some of examples of marketable securities

(Krantz, 2016).

Wesfarmers Limited manages uses cash and cash equivalent such as capital market debt,

corporate bonds, financial instruments and other derivatives to manage their cash requirements.

All these marketable securities are being valued at fair value or carrying value depending upon

the value of marketable securities. So, it can be said that Wesfarmers make efficient use of

marketable securities to manage its cash requirements. Wesfarmers regularly trades in derivative

market and also in corporate bonds to get some benefit from the market. In addition to this

Wesfarmers have enough cash and cash equivalents to achieve the working capital requirements

(Wesfarmers Limited, 2018).

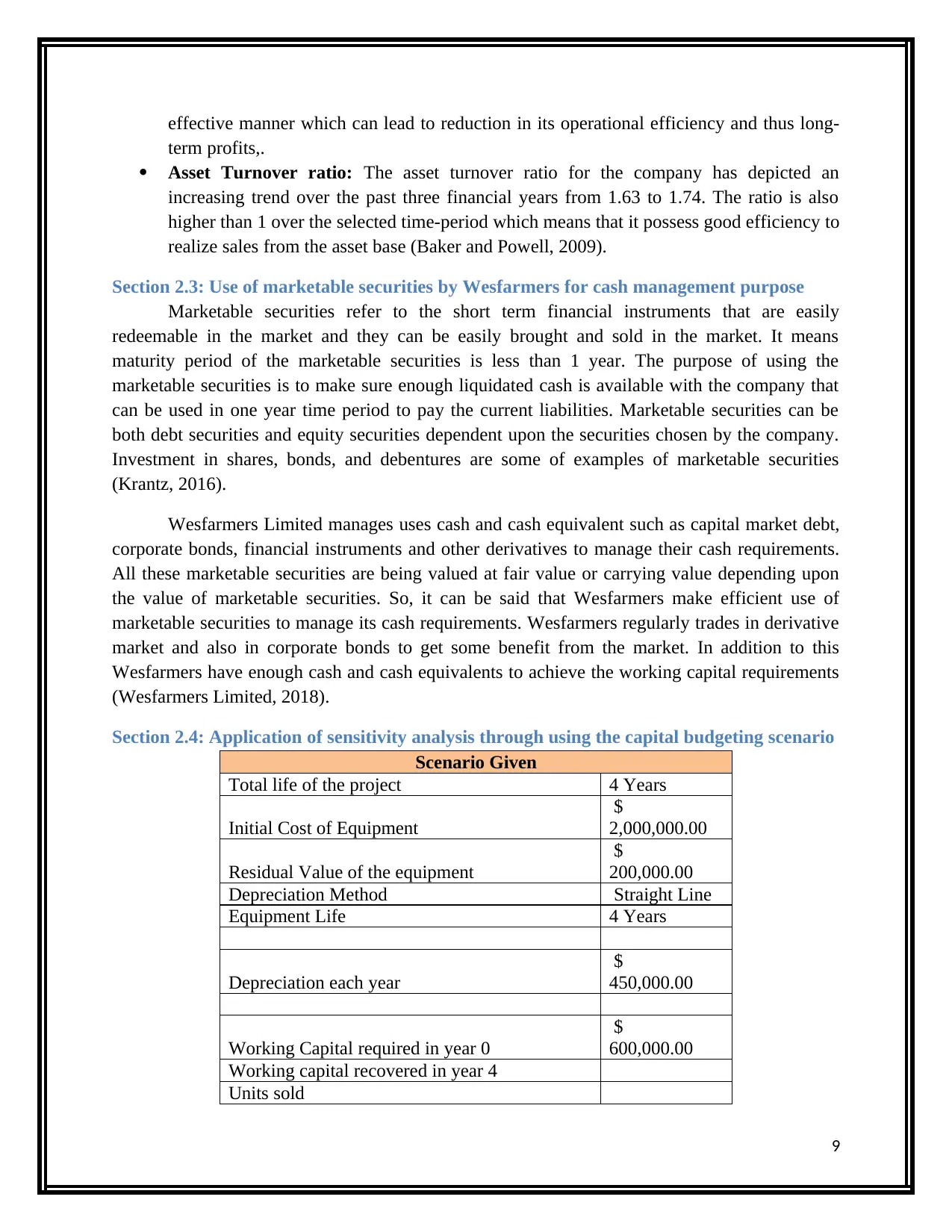

Section 2.4: Application of sensitivity analysis through using the capital budgeting scenario

Scenario Given

Total life of the project 4 Years

Initial Cost of Equipment

$

2,000,000.00

Residual Value of the equipment

$

200,000.00

Depreciation Method Straight Line

Equipment Life 4 Years

Depreciation each year

$

450,000.00

Working Capital required in year 0

$

600,000.00

Working capital recovered in year 4

Units sold

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Year 2 300000

Year 3 300000

Year 4 300000

Selling Price of product

$

20.00

Variable Cost of the product

$

12.00

Fixed Cost in each year

$

300,000.00

Discount Rate used to discount the cash flows 10%

Tax Rate 30%

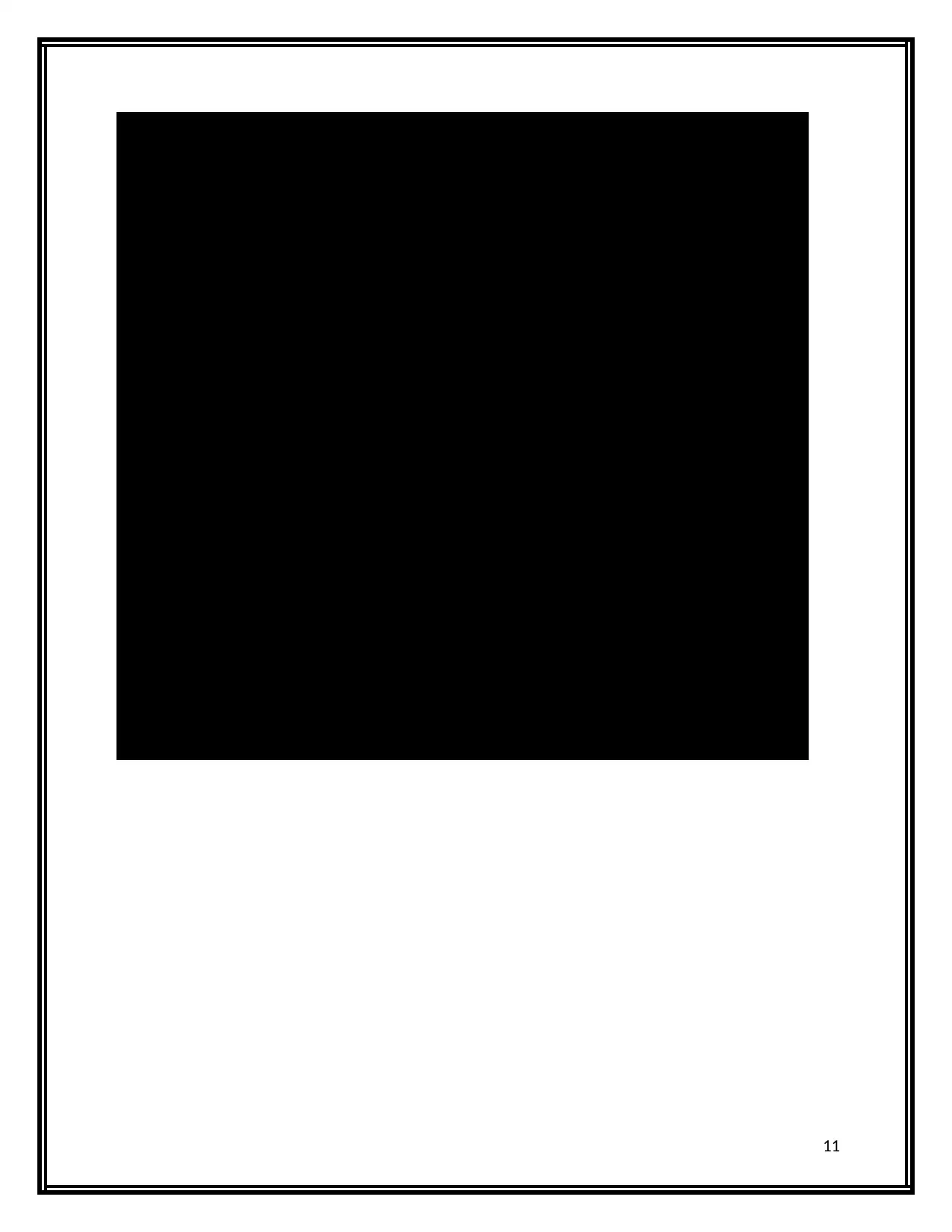

Firstly there is need to calculate the cash flow without any change in value driver:

10

Paraphrase This Document

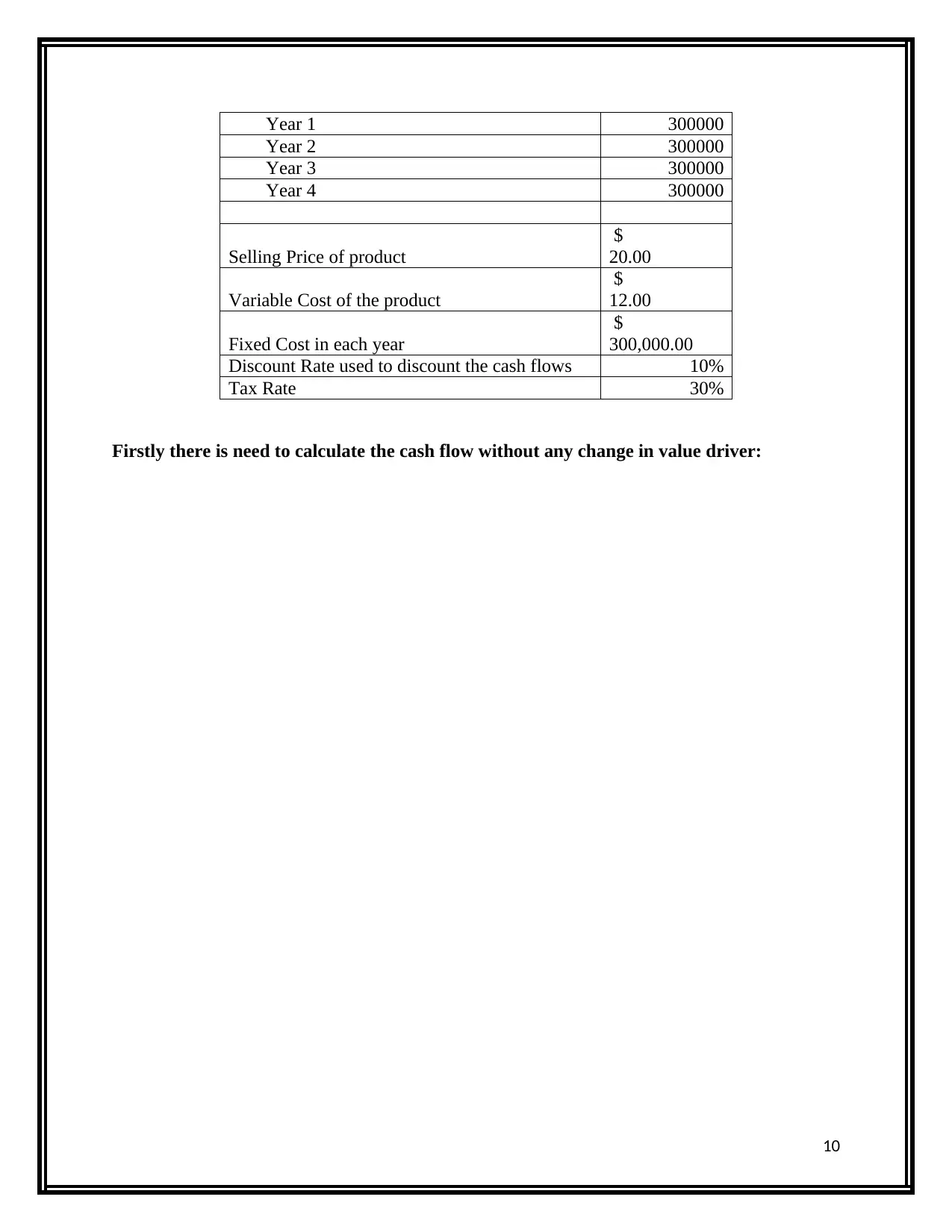

Cash Inflows

Units sold 300000 300000 300000 300000

Selling price 20$ 20$ 20$ 20$

Net Cash Inflows 6,000,000$ 6,000,000$ 6,000,000$ 6,000,000$

Cash Outflows

Variable Cost 3,600,000$ 3,600,000$ 3,600,000$ 3,600,000$

Fixed Cost 300,000$ 300,000$ 300,000$ 300,000$

Depreciation 450,000$ 450,000$ 450,000$ 450,000$

Total Cash outflows 4,350,000$ 4,350,000$ 4,350,000$ 4,350,000$

Cash flows before tax 1,650,000$ 1,650,000$ 1,650,000$ 1,650,000$

Less: Tax @ 30% 495,000$ 495,000$ 495,000$ 495,000$

Cash Flows after tax 1,155,000$ 1,155,000$ 1,155,000$ 1,155,000$

Add: Depreciation 450,000$ 450,000$ 450,000$ 450,000$

Cash Flows before

depreciation after tax 1,605,000$ 1,605,000$ 1,605,000$ 1,605,000$

Initial Equiment Cost (2,000,000)$

Salvage Value 200,000$

Working Capital

Initial Requirement (600,000)$

Recovery 600,000$

Net Cash Flows (2,600,000)$ 1,605,000$ 1,605,000$ 1,605,000$ 2,405,000$

PVF @ 10% 1.000 0.909 0.826 0.751 0.683

(2,600,000)$ 1,459,091$ 1,326,446$ 1,205,860$ 1,642,647$

Net Present Value 3,034,045$

Cash Flows during the life of the project in normal Case

Years

Particulars

11

0 1 2 3 4

Cash Inflows

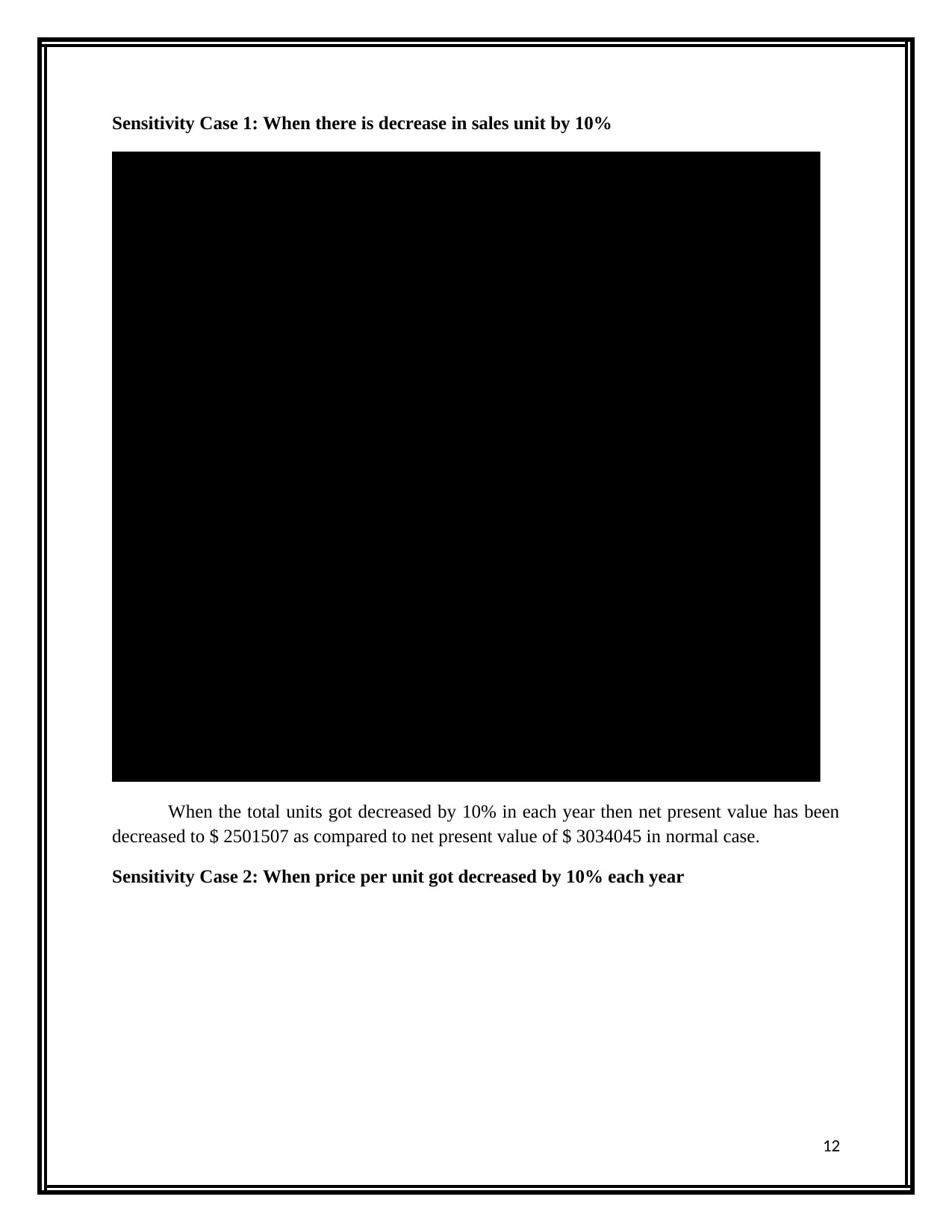

Selling Units 270000 270000 270000 270000

Selling price 20.00$ 20.00$ 20.00$ 20.00$

Net Cash Inflows $5,400,000 $5,400,000 $5,400,000 $5,400,000

Cash Outflows

Variable Cost $3,240,000 $3,240,000 $3,240,000 $3,240,000

Fixed Cost $300,000 $300,000 $300,000 $300,000

Depreciation $450,000 $450,000 $450,000 $450,000

Total Cash outflows $3,990,000 $3,990,000 $3,990,000 $3,990,000

Cash flows before tax $1,410,000 $1,410,000 $1,410,000 $1,410,000

Less: Tax @ 30% $423,000 $423,000 $423,000 $423,000

Cash Flows after tax $987,000 $987,000 $987,000 $987,000

Add: Depreciation $450,000 $450,000 $450,000 $450,000

Cash Flows before

depreciation after tax $1,437,000 $1,437,000 $1,437,000 $1,437,000

Initial Equiment Cost (2,000,000)$

Salvage Value 200,000$

Working Capital

Initial Requirement (600,000)$

Recovery 600,000$

Net Cash Flows -$2,600,000 $1,437,000 $1,437,000 $1,437,000 $2,237,000

PVF @ 10% 1.000 0.909 0.826 0.751 0.683

(2,600,000)$ 1,306,364$ 1,187,603$ 1,079,639$ 1,527,901$

Net Present Value 2,501,507$

Statement of Cash flows when Unit sales decrease by 10%

Particulars Years

When the total units got decreased by 10% in each year then net present value has been

decreased to $ 2501507 as compared to net present value of $ 3034045 in normal case.

Sensitivity Case 2: When price per unit got decreased by 10% each year

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

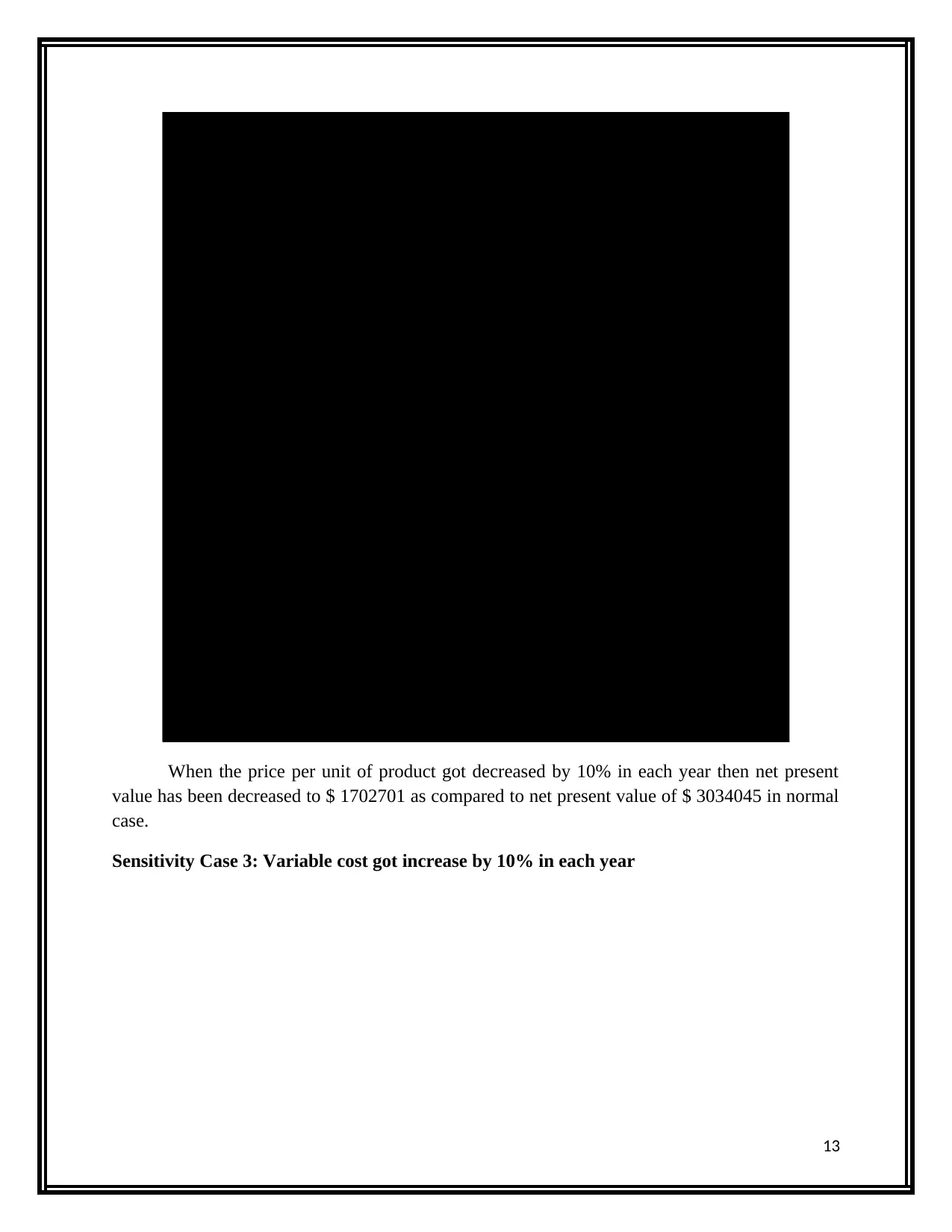

Cash Inflows

Selling Units 300000 300000 300000 300000

Selling price 18.00$ 18.00$ 18.00$ 18.00$

Net Cash Inflows 5,400,000$ 5,400,000$ 5,400,000$ 5,400,000$

Cash Outflows

Variable Cost 3,600,000$ 3,600,000$ 3,600,000$ 3,600,000$

Fixed Cost 300,000$ 300,000$ 300,000$ 300,000$

Depreciation 450,000$ 450,000$ 450,000$ 450,000$

Total Cash outflows 4,350,000$ 4,350,000$ 4,350,000$ 4,350,000$

Cash flows before tax 1,050,000$ 1,050,000$ 1,050,000$ 1,050,000$

Less: Tax @ 30% 315,000$ 315,000$ 315,000$ 315,000$

Cash Flows after tax 735,000$ 735,000$ 735,000$ 735,000$

Add: Depreciation 450,000$ 450,000$ 450,000$ 450,000$

Cash Flows before

depreciation after tax $1,185,000 $1,185,000 $1,185,000 $1,185,000

Initial Equiment Cost (2,000,000)$

Salvage Value 200,000$

Working Capital

Initial Requirement (600,000)$

Recovery 600,000$

Net Cash Flows -$2,600,000 $1,185,000 $1,185,000 $1,185,000 $1,985,000

PVF @ 10% 1.000 0.909 0.826 0.751 0.683

(2,600,000)$ 1,077,273$ 979,339$ 890,308$ 1,355,782$

Net Present Value 1,702,701$

Statement of Cash flows when Price per unit decreases by 10%

Particulars Years

When the price per unit of product got decreased by 10% in each year then net present

value has been decreased to $ 1702701 as compared to net present value of $ 3034045 in normal

case.

Sensitivity Case 3: Variable cost got increase by 10% in each year

13

Paraphrase This Document

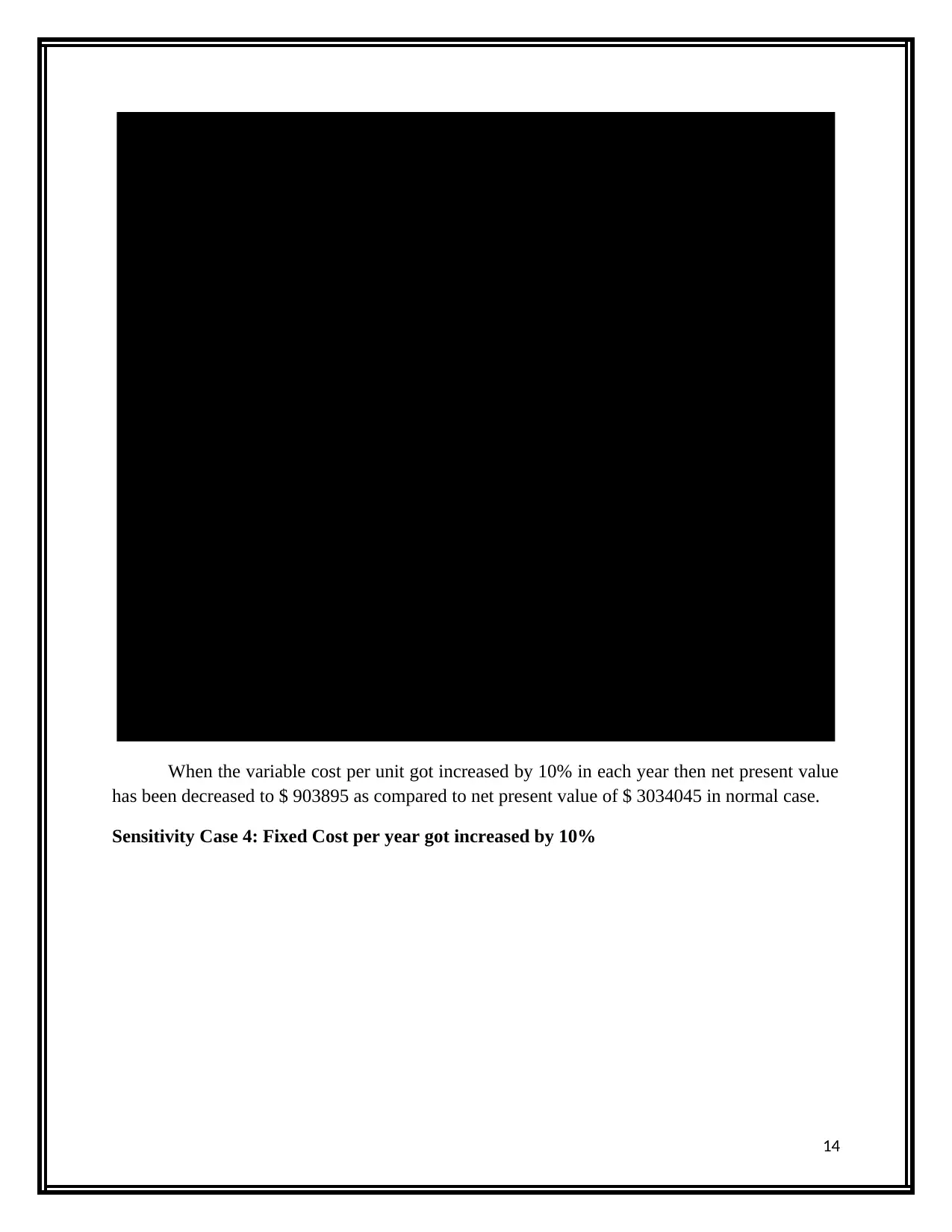

Cash Inflows

Selling Units 300000 300000 300000 300000

Selling price 18.00$ 18.00$ 18.00$ 18.00$

Net Cash Inflows 5,400,000$ 5,400,000$ 5,400,000$ 5,400,000$

Cash Outflows

Variable Cost 3,960,000$ 3,960,000$ 3,960,000$ 3,960,000$

Fixed Cost 300,000$ 300,000$ 300,000$ 300,000$

Depreciation 450,000$ 450,000$ 450,000$ 450,000$

Total Cash outflows 4,710,000$ 4,710,000$ 4,710,000$ 4,710,000$

Cash flows before tax 690,000$ 690,000$ 690,000$ 690,000$

Less: Tax @ 30% 207,000$ 207,000$ 207,000$ 207,000$

Cash Flows after tax 483,000$ 483,000$ 483,000$ 483,000$

Add: Depreciation 450,000$ 450,000$ 450,000$ 450,000$

Cash Flows before

depreciation after tax 933,000$ 933,000$ 933,000$ 933,000$

Initial Equiment Cost -$2,000,000

Salvage Value $200,000

Working Capital

Initial Requirement -$600,000

Recovery $600,000

Net Cash Flows -$2,600,000 $933,000 $933,000 $933,000 $1,733,000

PVF @ 10% 1.000 0.909 0.826 0.751 0.683

(2,600,000)$ 848,182$ 771,074$ 700,977$ 1,183,662$

Net Present Value 903,895$

Statement of Cash flows when Variable cost per unit increases 10%

Particulars Years

When the variable cost per unit got increased by 10% in each year then net present value

has been decreased to $ 903895 as compared to net present value of $ 3034045 in normal case.

Sensitivity Case 4: Fixed Cost per year got increased by 10%

14

Cash Inflows

Selling Units 300000 300000 300000 300000

Selling price 18.00$ 18.00$ 18.00$ 18.00$

Net Cash Inflows 5,400,000$ 5,400,000$ 5,400,000$ 5,400,000$

Cash Outflows

Variable Cost 3,960,000$ 3,960,000$ 3,960,000$ 3,960,000$

Fixed Cost 330,000$ 330,000$ 330,000$ 330,000$

Depreciation 450,000$ 450,000$ 450,000$ 450,000$

Total Cash outflows 4,740,000$ 4,740,000$ 4,740,000$ 4,740,000$

Cash flows before tax 660,000$ 660,000$ 660,000$ 660,000$

Less: Tax @ 30% 198,000$ 198,000$ 198,000$ 198,000$

Cash Flows after tax 462,000$ 462,000$ 462,000$ 462,000$

Add: Depreciation 450,000$ 450,000$ 450,000$ 450,000$

Cash Flows before

depreciation after tax 912,000$ 912,000$ 912,000$ 912,000$

Initial Equiment Cost (2,000,000)$

Salvage Value 200,000$

Working Capital

Initial Requirement -$600,000

Recovery $600,000

Net Cash Flows -$2,600,000 $912,000 $912,000 $912,000 $1,712,000

PVF @ 10% 1.000 0.909 0.826 0.751 0.683

(2,600,000)$ 829,091$ 753,719$ 685,199$ 1,169,319$

Net Present Value 837,328$

Statement of Cash flows when Cash fixed cost per year increases by 10%

Particulars Years

When fixed cost per year increased by 10% than net present value has decreased to $

837328 as compared to net present value of $ 3034045 in normal case.

Overall conclusion: It can be said that even a small change in main value driver can impact the

net present to greater extent and it has been seen in all the four cases of sensitivity. When the

value of main driver has been altered to consider overall risks than it has been found that net

present value also got decreased. It means value of net present is greatly impacted by the risk

associated with the project (Davies and Crawford, 2011).

15

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

performance of Wesfarmers

Systematic Risks

The systematic risks that are the market risk associated with the fluctuations in the

external marketplace and are non-diversifiable in nature. The systematic risks that are related

with Wesfarmers are discussed as follows:

Foreign Currency Risk

The Wesfarmers Group is exposed to the risks of variations in the foreign currency that

arises due to sale of its products in foreign currencies other than the division’s functional

currency. It is exposed to the fluctuations in the US dollar and Euro in context of its debt

obligations also. It also conducts its operations in New Zealand and therefore its earnings’

potential can also be significantly impacted by the fluctuations in the currency movement among

Australia and New Zealand dollar rate. As such, the Group tends to reduce the effect of

fluctuations in the foreign currency with the use of hedging contracts. The Group ensures that the

hedging instrument must be in the same currency as the item being hedged. It will in establishing

the earning potential of the company from the negative impact of the sudden fluctuations in the

currency market (Wesfarmers Limited, 2018).

Interest Rate Risk

The Group is exposed to changes in the market interest rate mainly due to its debt

obligations that are associated with having floating rate of interest. The Group as such advocates

the use of interest rate risk management policy that intends for developing recommendations

regarding hedging of interest rate that is carried out by the Chief Financial Officer. It also adopts

the use of interest rate swaps for hedging the interest rate costs that is associated with its debt

obligations (Wesfarmers Limited, 2018).

Commodity Price Risk

The risks are associated with the operations of Wesfarmers due to variations in the

process of coal that would have an impact on its coal mining operations. It tends to mitigate the

risk by the use of future contract that helps it to gain a hedge over the cash flows that can arise

due the adverse movements in the natural gas (Wesfarmers Limited, 2018).

Unsystematic Risks

The risks are related with internal operations of a company and it can be reduced to a

large extent by the use of diversification strategy by an investor. The unsystematic risks

associated with Wesfarmers can be categorized as follows:

Liquidity Risk

16

Paraphrase This Document

of its capital management policies that incorporates the use of debt for conducting its various

operations (Wesfarmers Limited, 2018). It tends to adopt the sue of a flexible financing structure

that emphasizes on taking advantages of new investment as a result of which the use of debt

tends to increase in the capital structure. The Group tends to maintain a balance between

different sources of funds such as using bank loans, accepted bills, commercial paper, corporate

bonds and gaining access to overnight money from different financial instruments having short-

term maturities. The flexibility in the debt structure of the company ensures that risk of liquidity

is managed by maintaining adequate of cash through using diverse resources (Damodaran, 2011).

Credit Risk

The credit risk is the risk that is associated with the operations of Wesfarmers due to

inability of its contractual parties to meet the financial obligations and this can results in

incurring financial loss to the Group. The Group is exposed to credit risk mainly due to operating

and financing activities such as customer receivables, foreign exchange transactions and other

financial instruments. The Group tends to manage the risk by regular assessing the credit terms

and conducting credit verification. The credit verification can be conducted through assessing the

independent credit rating and analyzing their past, present and estimated future financial

outcome (Wesfarmers Limited, 2018).

Section 2.6: Estimation of dividend payout ratio and identification of dividend policy used

by the management at Wesfarmers

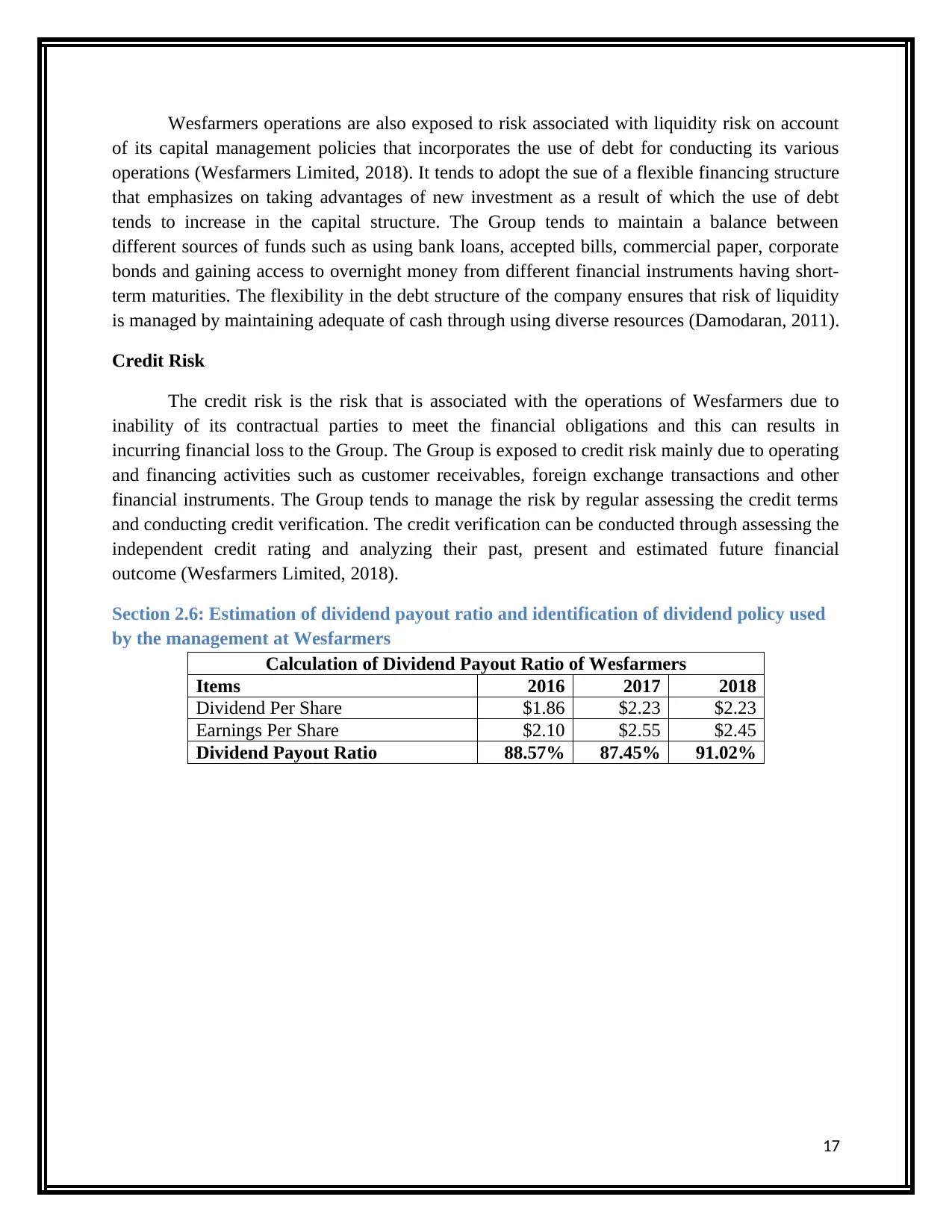

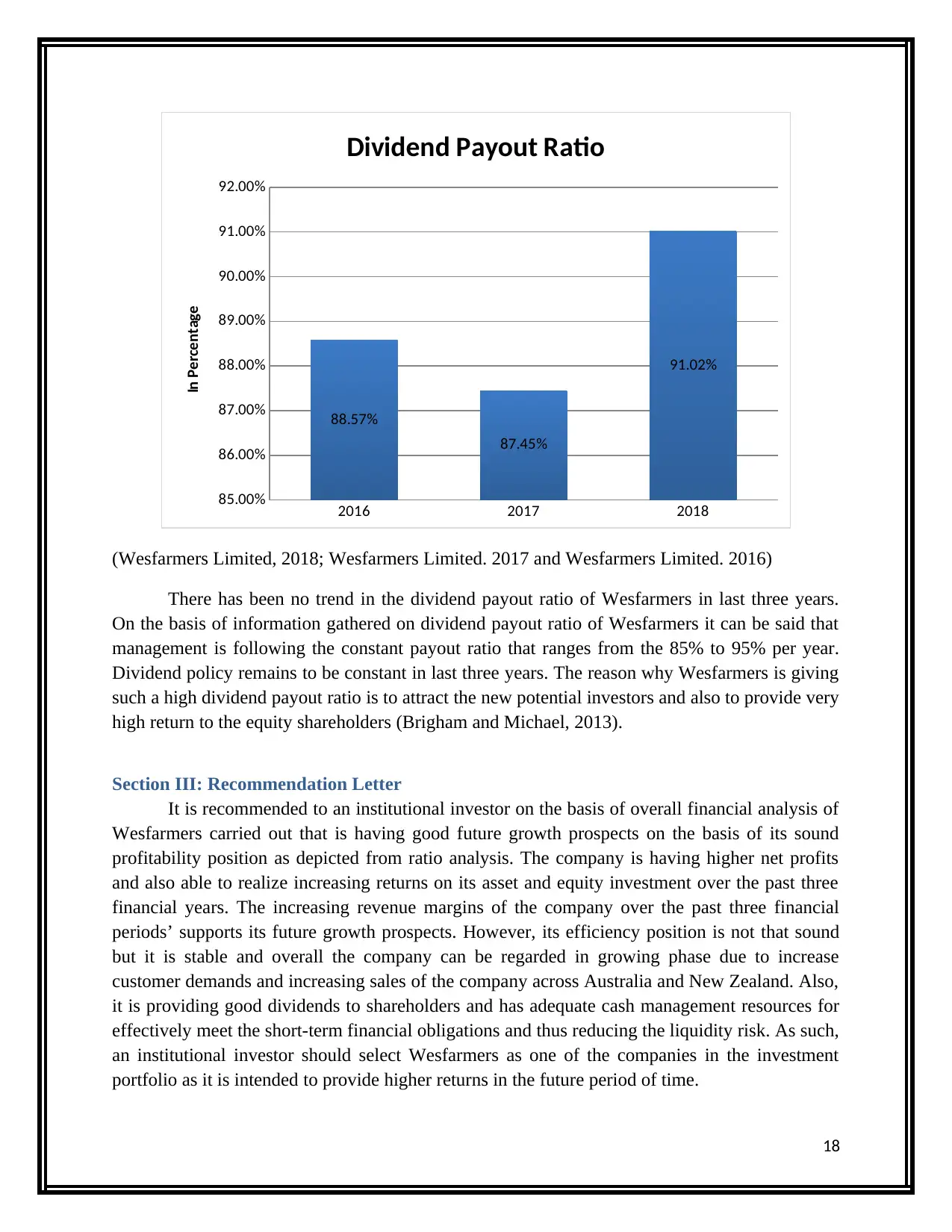

Calculation of Dividend Payout Ratio of Wesfarmers

Items 2016 2017 2018

Dividend Per Share $1.86 $2.23 $2.23

Earnings Per Share $2.10 $2.55 $2.45

Dividend Payout Ratio 88.57% 87.45% 91.02%

17

85.00%

86.00%

87.00%

88.00%

89.00%

90.00%

91.00%

92.00%

88.57%

87.45%

91.02%

Dividend Payout Ratio

In Percentage

(Wesfarmers Limited, 2018; Wesfarmers Limited. 2017 and Wesfarmers Limited. 2016)

There has been no trend in the dividend payout ratio of Wesfarmers in last three years.

On the basis of information gathered on dividend payout ratio of Wesfarmers it can be said that

management is following the constant payout ratio that ranges from the 85% to 95% per year.

Dividend policy remains to be constant in last three years. The reason why Wesfarmers is giving

such a high dividend payout ratio is to attract the new potential investors and also to provide very

high return to the equity shareholders (Brigham and Michael, 2013).

Section III: Recommendation Letter

It is recommended to an institutional investor on the basis of overall financial analysis of

Wesfarmers carried out that is having good future growth prospects on the basis of its sound

profitability position as depicted from ratio analysis. The company is having higher net profits

and also able to realize increasing returns on its asset and equity investment over the past three

financial years. The increasing revenue margins of the company over the past three financial

periods’ supports its future growth prospects. However, its efficiency position is not that sound

but it is stable and overall the company can be regarded in growing phase due to increase

customer demands and increasing sales of the company across Australia and New Zealand. Also,

it is providing good dividends to shareholders and has adequate cash management resources for

effectively meet the short-term financial obligations and thus reducing the liquidity risk. As such,

an institutional investor should select Wesfarmers as one of the companies in the investment

portfolio as it is intended to provide higher returns in the future period of time.

18

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

It can be summarized from the discussion held that financial evaluation of a company can

be adequately carried out by the use of techniques of ratio analysis, examination of cash

management, conducting sensitivity analysis, identifying systematic and unsystematic risks and

also through evaluation of the dividend policy. Wesfarmers on the basis of overall financial

evaluation carried out is stated to have higher growth prospects and as such can be regarded as

good for investment purpose by an institutional investor.

19

Paraphrase This Document

Arnold, G., 2013. Corporate financial management. USA: Pearson Higher Ed.

Baker, K. and Powell, G. 2009. Understanding Financial Management: A Practical Guide.

USA: John Wiley & Sons.

Brigham, F., and Michael C. 2013. Financial management: Theory & practice. Canada: Cengage

Learning.

Damodaran, A, 2011. Applied corporate finance. USA: John Wiley & sons.

Davies, T. and Crawford, I., 2011. Business accounting and finance. USA: Pearson.

Hitchner, J. 2011. Financial Valuation: Applications and Models. US: John Wiley & Sons.

Krantz, M. 2016. Fundamental Analysis for Dummies. USA: John Wiley & Sons.

Moles, P. and Kidwekk, D. 2011. Corporate finance. USA: John Wiley &sons.

Tracy, A. 2012. Ratio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to

Analyse Any Business on the Planet. US: RatioAnalysis.net.

Wesfarmers Limited. 2016. Annual Report. [Online]. Available at:

https://www.wesfarmers.com.au/docs/default-source/reports/2016-annual-report.pdf?

sfvrsn=8[Accessed on: 2 June 2019].

Wesfarmers Limited. 2017. Annual Report. [Online]. Available at:

https://www.wesfarmers.com.au/docs/default-source/default-document-library/2017-annual-

report.pdf?sfvrsn=0 [Accessed on: 2 June 2019].

Wesfarmers Limited. 2018. Annual Report. [Online]. Available at:

https://www.wesfarmers.com.au/docs/default-source/asx-announcements/2018-annual-

report.pdf?sfvrsn=0 [Accessed on: 2 June 2019].

Wesfarmers Limited. 2019. Who we are. [Online]. Available at:

https://www.wesfarmers.com.au/who-we-are/our-history/fifth-chief-executive-trevor-eastwood-

managing-director-1984-1992 [Accessed on: 2 June 2019].

20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

© 2024 | Zucol Services PVT LTD | All rights reserved.