HI5020 Corporate Accounting: Analyzing Dulux Group Limited's Financial Performance

VerifiedAdded on 2024/05/31

|14

|2500

|416

AI Summary

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

HI5020 Corporate Accounting

1

1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Contents

Introduction:....................................................................................................................................3

CASH FLOWS STATEMENT...................................................................................................4

OTHER COMPREHENSIVE INCOME STATEMENT............................................................9

ACCOUNTING FOR CORPORATE INCOME TAX.............................................................11

Conclusion:....................................................................................................................................13

References:....................................................................................................................................14

2

Introduction:....................................................................................................................................3

CASH FLOWS STATEMENT...................................................................................................4

OTHER COMPREHENSIVE INCOME STATEMENT............................................................9

ACCOUNTING FOR CORPORATE INCOME TAX.............................................................11

Conclusion:....................................................................................................................................13

References:....................................................................................................................................14

2

Introduction:

The report has been prepared in order to analyse the financial position of the company in respect

of the cash flow position and other financial indicators. In order to serve this purpose annual

report of the company has been used to obtain the information about various financial items

concerned with the company during the year. The company chosen here is Dulux Group Limited

which is the manufacturer and marketer of the products that assists in protecting, maintaining

and enhancing the spaces and places where people live and work. Therefore the company is

engaged in home décor operations and other interiors designing works which helps in preserving

the place in a better position. The report will include a cash flow analysis of the company by

recognizing the information about various investing, financial and operational activities. The

report will further include a description about income statement of the company and the current

tax expense associated with the company during the year.

3

The report has been prepared in order to analyse the financial position of the company in respect

of the cash flow position and other financial indicators. In order to serve this purpose annual

report of the company has been used to obtain the information about various financial items

concerned with the company during the year. The company chosen here is Dulux Group Limited

which is the manufacturer and marketer of the products that assists in protecting, maintaining

and enhancing the spaces and places where people live and work. Therefore the company is

engaged in home décor operations and other interiors designing works which helps in preserving

the place in a better position. The report will include a cash flow analysis of the company by

recognizing the information about various investing, financial and operational activities. The

report will further include a description about income statement of the company and the current

tax expense associated with the company during the year.

3

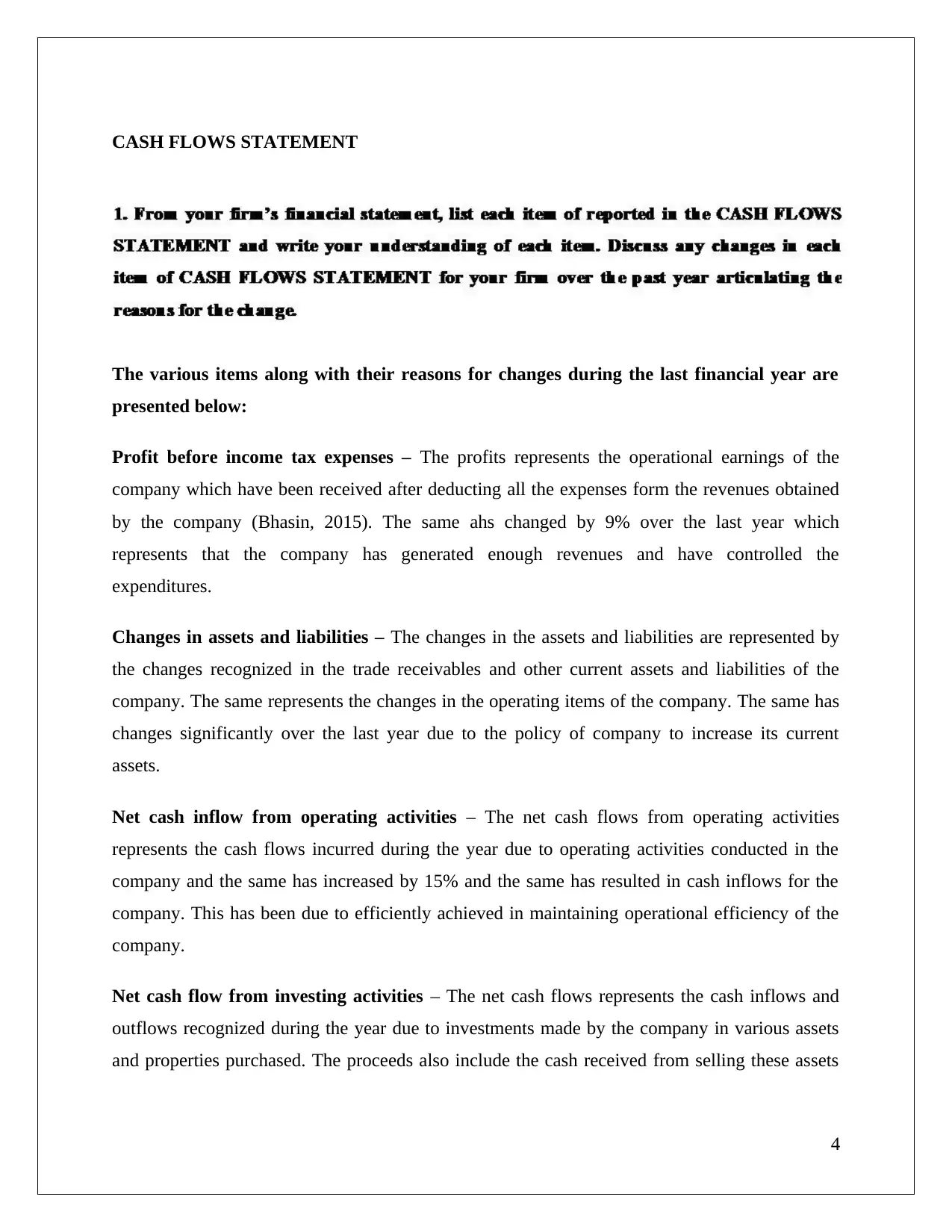

CASH FLOWS STATEMENT

The various items along with their reasons for changes during the last financial year are

presented below:

Profit before income tax expenses – The profits represents the operational earnings of the

company which have been received after deducting all the expenses form the revenues obtained

by the company (Bhasin, 2015). The same ahs changed by 9% over the last year which

represents that the company has generated enough revenues and have controlled the

expenditures.

Changes in assets and liabilities – The changes in the assets and liabilities are represented by

the changes recognized in the trade receivables and other current assets and liabilities of the

company. The same represents the changes in the operating items of the company. The same has

changes significantly over the last year due to the policy of company to increase its current

assets.

Net cash inflow from operating activities – The net cash flows from operating activities

represents the cash flows incurred during the year due to operating activities conducted in the

company and the same has increased by 15% and the same has resulted in cash inflows for the

company. This has been due to efficiently achieved in maintaining operational efficiency of the

company.

Net cash flow from investing activities – The net cash flows represents the cash inflows and

outflows recognized during the year due to investments made by the company in various assets

and properties purchased. The proceeds also include the cash received from selling these assets

4

The various items along with their reasons for changes during the last financial year are

presented below:

Profit before income tax expenses – The profits represents the operational earnings of the

company which have been received after deducting all the expenses form the revenues obtained

by the company (Bhasin, 2015). The same ahs changed by 9% over the last year which

represents that the company has generated enough revenues and have controlled the

expenditures.

Changes in assets and liabilities – The changes in the assets and liabilities are represented by

the changes recognized in the trade receivables and other current assets and liabilities of the

company. The same represents the changes in the operating items of the company. The same has

changes significantly over the last year due to the policy of company to increase its current

assets.

Net cash inflow from operating activities – The net cash flows from operating activities

represents the cash flows incurred during the year due to operating activities conducted in the

company and the same has increased by 15% and the same has resulted in cash inflows for the

company. This has been due to efficiently achieved in maintaining operational efficiency of the

company.

Net cash flow from investing activities – The net cash flows represents the cash inflows and

outflows recognized during the year due to investments made by the company in various assets

and properties purchased. The proceeds also include the cash received from selling these assets

4

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

and properties (Bhasin, 2015). The change represented an increase in the outflow by 32% which

is a major concern for the company as it is focusing ion investing activities more.

Net cash flows form financing activities – The cash flows form financing activities represents

the inflows and outflows concerned with conducting the financing activities in the company. The

financing activities includes dividend paid and proceeds and cash outflows form various

borrowings obtained during the year. The change is concerned with controlling the cash outflows

by 10% in the current year. The financing activities have been reduced in the current year 2017.

5

is a major concern for the company as it is focusing ion investing activities more.

Net cash flows form financing activities – The cash flows form financing activities represents

the inflows and outflows concerned with conducting the financing activities in the company. The

financing activities includes dividend paid and proceeds and cash outflows form various

borrowings obtained during the year. The change is concerned with controlling the cash outflows

by 10% in the current year. The financing activities have been reduced in the current year 2017.

5

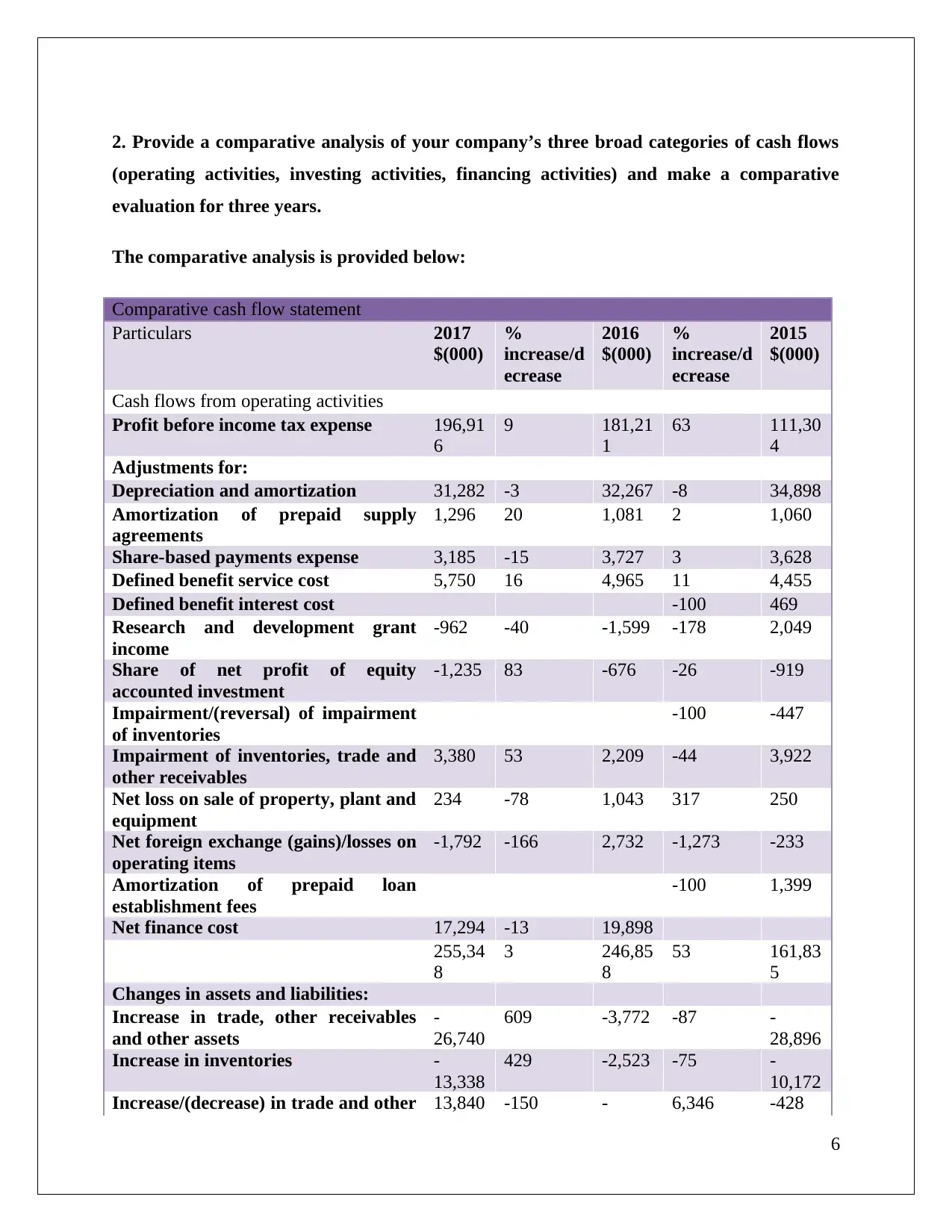

2. Provide a comparative analysis of your company’s three broad categories of cash flows

(operating activities, investing activities, financing activities) and make a comparative

evaluation for three years.

The comparative analysis is provided below:

Comparative cash flow statement

Particulars 2017

$(000)

%

increase/d

ecrease

2016

$(000)

%

increase/d

ecrease

2015

$(000)

Cash flows from operating activities

Profit before income tax expense 196,91

6

9 181,21

1

63 111,30

4

Adjustments for:

Depreciation and amortization 31,282 -3 32,267 -8 34,898

Amortization of prepaid supply

agreements

1,296 20 1,081 2 1,060

Share-based payments expense 3,185 -15 3,727 3 3,628

Defined benefit service cost 5,750 16 4,965 11 4,455

Defined benefit interest cost -100 469

Research and development grant

income

-962 -40 -1,599 -178 2,049

Share of net profit of equity

accounted investment

-1,235 83 -676 -26 -919

Impairment/(reversal) of impairment

of inventories

-100 -447

Impairment of inventories, trade and

other receivables

3,380 53 2,209 -44 3,922

Net loss on sale of property, plant and

equipment

234 -78 1,043 317 250

Net foreign exchange (gains)/losses on

operating items

-1,792 -166 2,732 -1,273 -233

Amortization of prepaid loan

establishment fees

-100 1,399

Net finance cost 17,294 -13 19,898

255,34

8

3 246,85

8

53 161,83

5

Changes in assets and liabilities:

Increase in trade, other receivables

and other assets

-

26,740

609 -3,772 -87 -

28,896

Increase in inventories -

13,338

429 -2,523 -75 -

10,172

Increase/(decrease) in trade and other 13,840 -150 - 6,346 -428

6

(operating activities, investing activities, financing activities) and make a comparative

evaluation for three years.

The comparative analysis is provided below:

Comparative cash flow statement

Particulars 2017

$(000)

%

increase/d

ecrease

2016

$(000)

%

increase/d

ecrease

2015

$(000)

Cash flows from operating activities

Profit before income tax expense 196,91

6

9 181,21

1

63 111,30

4

Adjustments for:

Depreciation and amortization 31,282 -3 32,267 -8 34,898

Amortization of prepaid supply

agreements

1,296 20 1,081 2 1,060

Share-based payments expense 3,185 -15 3,727 3 3,628

Defined benefit service cost 5,750 16 4,965 11 4,455

Defined benefit interest cost -100 469

Research and development grant

income

-962 -40 -1,599 -178 2,049

Share of net profit of equity

accounted investment

-1,235 83 -676 -26 -919

Impairment/(reversal) of impairment

of inventories

-100 -447

Impairment of inventories, trade and

other receivables

3,380 53 2,209 -44 3,922

Net loss on sale of property, plant and

equipment

234 -78 1,043 317 250

Net foreign exchange (gains)/losses on

operating items

-1,792 -166 2,732 -1,273 -233

Amortization of prepaid loan

establishment fees

-100 1,399

Net finance cost 17,294 -13 19,898

255,34

8

3 246,85

8

53 161,83

5

Changes in assets and liabilities:

Increase in trade, other receivables

and other assets

-

26,740

609 -3,772 -87 -

28,896

Increase in inventories -

13,338

429 -2,523 -75 -

10,172

Increase/(decrease) in trade and other 13,840 -150 - 6,346 -428

6

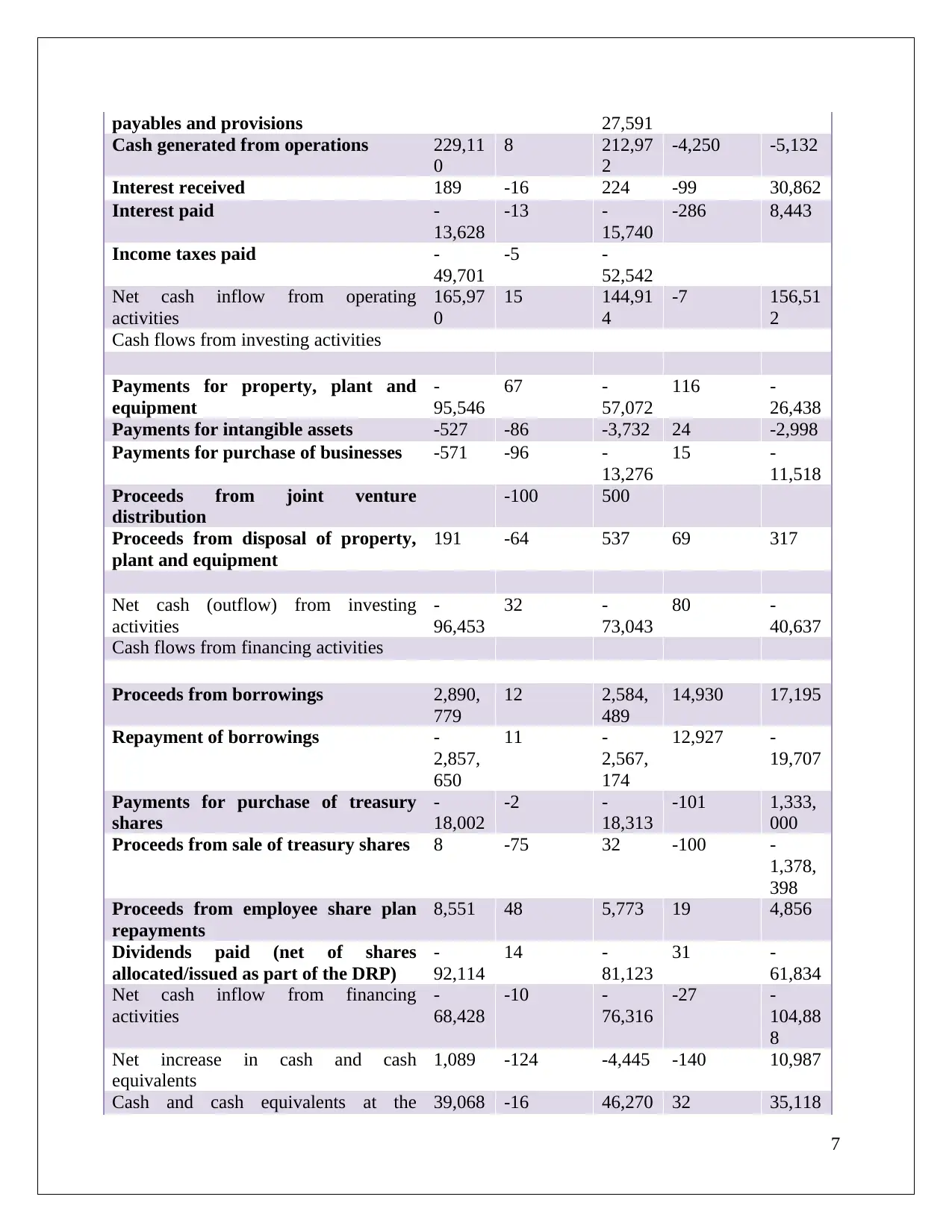

payables and provisions 27,591

Cash generated from operations 229,11

0

8 212,97

2

-4,250 -5,132

Interest received 189 -16 224 -99 30,862

Interest paid -

13,628

-13 -

15,740

-286 8,443

Income taxes paid -

49,701

-5 -

52,542

Net cash inflow from operating

activities

165,97

0

15 144,91

4

-7 156,51

2

Cash flows from investing activities

Payments for property, plant and

equipment

-

95,546

67 -

57,072

116 -

26,438

Payments for intangible assets -527 -86 -3,732 24 -2,998

Payments for purchase of businesses -571 -96 -

13,276

15 -

11,518

Proceeds from joint venture

distribution

-100 500

Proceeds from disposal of property,

plant and equipment

191 -64 537 69 317

Net cash (outflow) from investing

activities

-

96,453

32 -

73,043

80 -

40,637

Cash flows from financing activities

Proceeds from borrowings 2,890,

779

12 2,584,

489

14,930 17,195

Repayment of borrowings -

2,857,

650

11 -

2,567,

174

12,927 -

19,707

Payments for purchase of treasury

shares

-

18,002

-2 -

18,313

-101 1,333,

000

Proceeds from sale of treasury shares 8 -75 32 -100 -

1,378,

398

Proceeds from employee share plan

repayments

8,551 48 5,773 19 4,856

Dividends paid (net of shares

allocated/issued as part of the DRP)

-

92,114

14 -

81,123

31 -

61,834

Net cash inflow from financing

activities

-

68,428

-10 -

76,316

-27 -

104,88

8

Net increase in cash and cash

equivalents

1,089 -124 -4,445 -140 10,987

Cash and cash equivalents at the 39,068 -16 46,270 32 35,118

7

Cash generated from operations 229,11

0

8 212,97

2

-4,250 -5,132

Interest received 189 -16 224 -99 30,862

Interest paid -

13,628

-13 -

15,740

-286 8,443

Income taxes paid -

49,701

-5 -

52,542

Net cash inflow from operating

activities

165,97

0

15 144,91

4

-7 156,51

2

Cash flows from investing activities

Payments for property, plant and

equipment

-

95,546

67 -

57,072

116 -

26,438

Payments for intangible assets -527 -86 -3,732 24 -2,998

Payments for purchase of businesses -571 -96 -

13,276

15 -

11,518

Proceeds from joint venture

distribution

-100 500

Proceeds from disposal of property,

plant and equipment

191 -64 537 69 317

Net cash (outflow) from investing

activities

-

96,453

32 -

73,043

80 -

40,637

Cash flows from financing activities

Proceeds from borrowings 2,890,

779

12 2,584,

489

14,930 17,195

Repayment of borrowings -

2,857,

650

11 -

2,567,

174

12,927 -

19,707

Payments for purchase of treasury

shares

-

18,002

-2 -

18,313

-101 1,333,

000

Proceeds from sale of treasury shares 8 -75 32 -100 -

1,378,

398

Proceeds from employee share plan

repayments

8,551 48 5,773 19 4,856

Dividends paid (net of shares

allocated/issued as part of the DRP)

-

92,114

14 -

81,123

31 -

61,834

Net cash inflow from financing

activities

-

68,428

-10 -

76,316

-27 -

104,88

8

Net increase in cash and cash

equivalents

1,089 -124 -4,445 -140 10,987

Cash and cash equivalents at the 39,068 -16 46,270 32 35,118

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

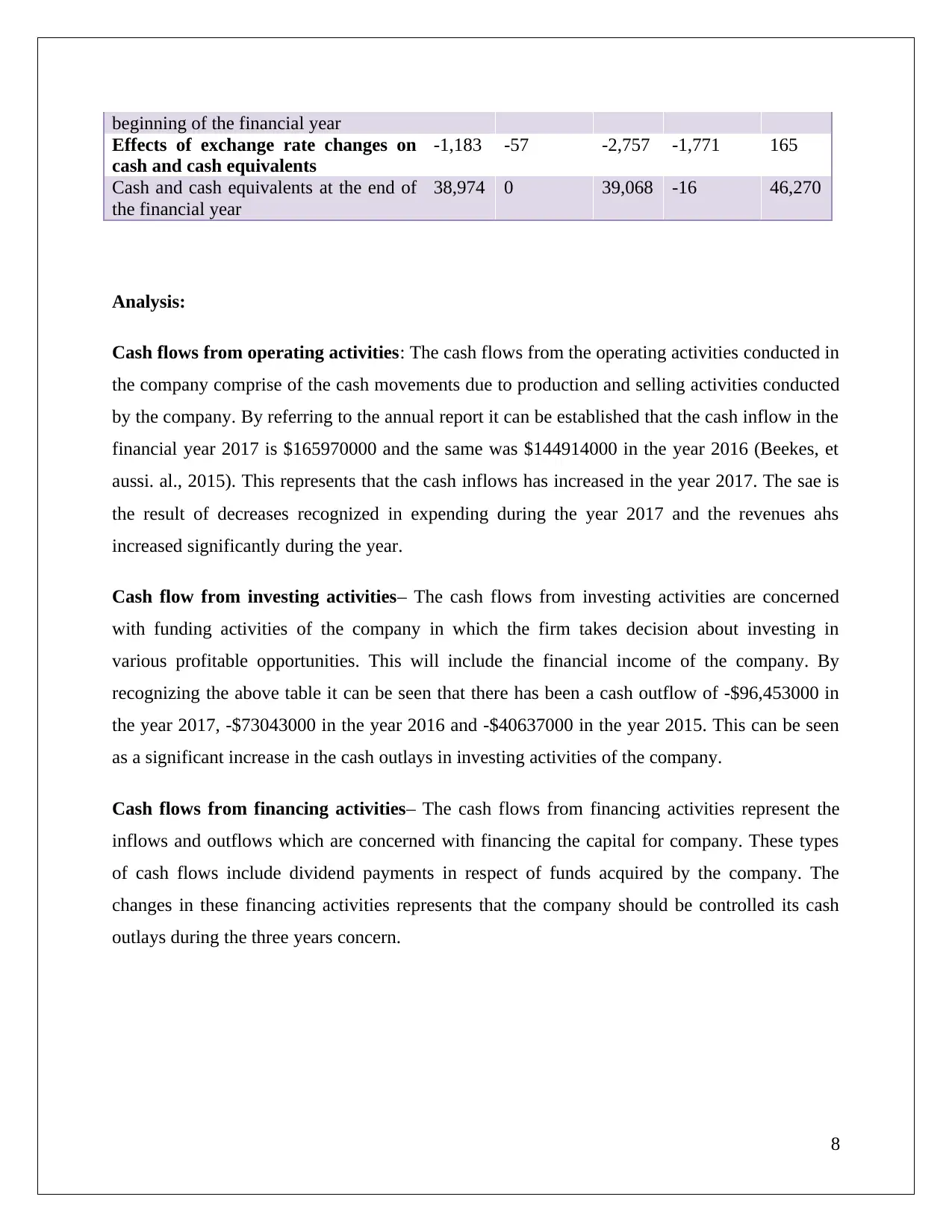

beginning of the financial year

Effects of exchange rate changes on

cash and cash equivalents

-1,183 -57 -2,757 -1,771 165

Cash and cash equivalents at the end of

the financial year

38,974 0 39,068 -16 46,270

Analysis:

Cash flows from operating activities: The cash flows from the operating activities conducted in

the company comprise of the cash movements due to production and selling activities conducted

by the company. By referring to the annual report it can be established that the cash inflow in the

financial year 2017 is $165970000 and the same was $144914000 in the year 2016 (Beekes, et

aussi. al., 2015). This represents that the cash inflows has increased in the year 2017. The sae is

the result of decreases recognized in expending during the year 2017 and the revenues ahs

increased significantly during the year.

Cash flow from investing activities– The cash flows from investing activities are concerned

with funding activities of the company in which the firm takes decision about investing in

various profitable opportunities. This will include the financial income of the company. By

recognizing the above table it can be seen that there has been a cash outflow of -$96,453000 in

the year 2017, -$73043000 in the year 2016 and -$40637000 in the year 2015. This can be seen

as a significant increase in the cash outlays in investing activities of the company.

Cash flows from financing activities– The cash flows from financing activities represent the

inflows and outflows which are concerned with financing the capital for company. These types

of cash flows include dividend payments in respect of funds acquired by the company. The

changes in these financing activities represents that the company should be controlled its cash

outlays during the three years concern.

8

Effects of exchange rate changes on

cash and cash equivalents

-1,183 -57 -2,757 -1,771 165

Cash and cash equivalents at the end of

the financial year

38,974 0 39,068 -16 46,270

Analysis:

Cash flows from operating activities: The cash flows from the operating activities conducted in

the company comprise of the cash movements due to production and selling activities conducted

by the company. By referring to the annual report it can be established that the cash inflow in the

financial year 2017 is $165970000 and the same was $144914000 in the year 2016 (Beekes, et

aussi. al., 2015). This represents that the cash inflows has increased in the year 2017. The sae is

the result of decreases recognized in expending during the year 2017 and the revenues ahs

increased significantly during the year.

Cash flow from investing activities– The cash flows from investing activities are concerned

with funding activities of the company in which the firm takes decision about investing in

various profitable opportunities. This will include the financial income of the company. By

recognizing the above table it can be seen that there has been a cash outflow of -$96,453000 in

the year 2017, -$73043000 in the year 2016 and -$40637000 in the year 2015. This can be seen

as a significant increase in the cash outlays in investing activities of the company.

Cash flows from financing activities– The cash flows from financing activities represent the

inflows and outflows which are concerned with financing the capital for company. These types

of cash flows include dividend payments in respect of funds acquired by the company. The

changes in these financing activities represents that the company should be controlled its cash

outlays during the three years concern.

8

OTHER COMPREHENSIVE INCOME STATEMENT

3. What items have been reported in the other comprehensive income statement?

There are two types of items recognized in this type of comprehensive income statement which

are concerned with:

Items that may be reclassified to profit or loss – This represents the exchanges differences

recognized during the translation of foreign operation which results in changes in incomes due to

various fluctuations in foreign exchange rates and the type of differences has not been

recognized in income statement yet.

Items that will not be reclassified to profit or loss – The type of items includes actuarial gains

and losses which are represented by retirement benefit obligations.

9

3. What items have been reported in the other comprehensive income statement?

There are two types of items recognized in this type of comprehensive income statement which

are concerned with:

Items that may be reclassified to profit or loss – This represents the exchanges differences

recognized during the translation of foreign operation which results in changes in incomes due to

various fluctuations in foreign exchange rates and the type of differences has not been

recognized in income statement yet.

Items that will not be reclassified to profit or loss – The type of items includes actuarial gains

and losses which are represented by retirement benefit obligations.

9

4. Explain your understanding of each item reported in the other comprehensive income

statement

The foreign currency loss represents the actual losses that can be incurred to the company sue to

differences recognized in foreign exchange rates. The income tax obligation represents the

expense associate with income tax and which has not been recognized yet.

Also there have been actuarial gains in case of retirements benefit obligations and the same has

not been recognized in income statements.

5. Why these items have not been reported in Income Statement/Profit and Loss Statement.

The types of incomes and losses represent the portion of income and losses which does not affect

the profit and loss of company directly by affects the shareholders equity (Beekes, et aussi. al.,

2015). These types of items either relates to prior periods or are not recognized in current year

profit and therefore they are considered in comprehensive income of the company.

10

statement

The foreign currency loss represents the actual losses that can be incurred to the company sue to

differences recognized in foreign exchange rates. The income tax obligation represents the

expense associate with income tax and which has not been recognized yet.

Also there have been actuarial gains in case of retirements benefit obligations and the same has

not been recognized in income statements.

5. Why these items have not been reported in Income Statement/Profit and Loss Statement.

The types of incomes and losses represent the portion of income and losses which does not affect

the profit and loss of company directly by affects the shareholders equity (Beekes, et aussi. al.,

2015). These types of items either relates to prior periods or are not recognized in current year

profit and therefore they are considered in comprehensive income of the company.

10

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

ACCOUNTING FOR CORPORATE INCOME TAX

6. What is your firm’s tax expense in its latest financial statements?

The current income tax as recognized in the income statements of the company is $57255000.

7. Is this figure the same as the company tax rate times your firm’s accounting income?

Explain why this is, or is not, the case for your firm.

No, The same is not as per the accounting calculation of the company because as per the

accounting income of the company and applying corporate tax rate of 30% the tax expense

comes out to be $59075000 but this has been different due to existence of Foreign tax rate

differential, Share of net profit of equity accounted investment, Tax losses not recognised, Non-

taxable income and profits, net of non-deductible expenditure, Sundry items and Amounts over

provided in prior years.

8. Comment on deferred tax assets/liabilities that are reported in the balance sheet

articulating the possible reasons why they have been recorded.

The deferred tax assets which have been recorded are $50436000 in the year 2017 whereas the

deferred tax liabilities represents the amount $28096000 (Warren & Jones, 2018). These have

been recorded in order to consider the effect of temporary differences recognized in the treatment

of accounting and taxation laws applicable to company.

9. Is there any current tax assets or income tax payable recorded by your company? Why is

the income tax payable not the same as income tax expense?

Yes the current tax liabilities which have been recorded in current liabilities of the company are

amounting to $18567000 which is different from what is recognized as income tax expense

because it only represents the amount which have been accumulated and remaining unpaid in

cash.

10. Is the income tax expense shown in the income statement same as the income tax paid

shown in the cash flow statement? If not why is the difference?

11

6. What is your firm’s tax expense in its latest financial statements?

The current income tax as recognized in the income statements of the company is $57255000.

7. Is this figure the same as the company tax rate times your firm’s accounting income?

Explain why this is, or is not, the case for your firm.

No, The same is not as per the accounting calculation of the company because as per the

accounting income of the company and applying corporate tax rate of 30% the tax expense

comes out to be $59075000 but this has been different due to existence of Foreign tax rate

differential, Share of net profit of equity accounted investment, Tax losses not recognised, Non-

taxable income and profits, net of non-deductible expenditure, Sundry items and Amounts over

provided in prior years.

8. Comment on deferred tax assets/liabilities that are reported in the balance sheet

articulating the possible reasons why they have been recorded.

The deferred tax assets which have been recorded are $50436000 in the year 2017 whereas the

deferred tax liabilities represents the amount $28096000 (Warren & Jones, 2018). These have

been recorded in order to consider the effect of temporary differences recognized in the treatment

of accounting and taxation laws applicable to company.

9. Is there any current tax assets or income tax payable recorded by your company? Why is

the income tax payable not the same as income tax expense?

Yes the current tax liabilities which have been recorded in current liabilities of the company are

amounting to $18567000 which is different from what is recognized as income tax expense

because it only represents the amount which have been accumulated and remaining unpaid in

cash.

10. Is the income tax expense shown in the income statement same as the income tax paid

shown in the cash flow statement? If not why is the difference?

11

No this is not the same in both the statement because the cash flow statement contains the

amount actually paid for income tax in which accumulated or less amount of tax have been paid

by the company (Warren & Jones, 2018).

It is interesting to note that the company has recognized current tax assets and liabilities without

considering any tests on the future income earnings of the company and considering the situation

that there can be loss to the company it is doubtful to create deferred tax assets in this situation.

12

amount actually paid for income tax in which accumulated or less amount of tax have been paid

by the company (Warren & Jones, 2018).

It is interesting to note that the company has recognized current tax assets and liabilities without

considering any tests on the future income earnings of the company and considering the situation

that there can be loss to the company it is doubtful to create deferred tax assets in this situation.

12

Conclusion:

It can be concluded that corporate accounting of the company can be conducted by analysing and

evaluating the financial and cash performance of the company in order to investigate the long

term sustainability. The company Dulux Group Limited has carefully prepared its financial

statements and proper accounting records have been maintained by the company in order to

differentiate between different cash flows activities. The analysis of current tax shows that the

liability has been correctly recognized in the financial records of company.

13

It can be concluded that corporate accounting of the company can be conducted by analysing and

evaluating the financial and cash performance of the company in order to investigate the long

term sustainability. The company Dulux Group Limited has carefully prepared its financial

statements and proper accounting records have been maintained by the company in order to

differentiate between different cash flows activities. The analysis of current tax shows that the

liability has been correctly recognized in the financial records of company.

13

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

References:

Ali, S., 2016. Corporate governance and stock liquidity in Australia: A pitch. Journal of

Accounting and Management Information Systems, 15(3), pp.624-631.

Beekes, W., Brown, P. and Zhang, Q., 2015. Corporate governance and the

informativeness of disclosures in Australia: a re‐examination. Accounting &

Finance, 55(4), pp.931-963.

Bhasin, M.L., 2015. Corporate accounting fraud: A case study of Satyam Computers

Limited.

Duff, A., 2016. Corporate social responsibility reporting in professional accounting

firms. The British Accounting Review, 48(1), pp.74-86.

Henderson, S., Peirson, G., Herbohn, K. and Howieson, B., 2015. Issues in financial

accounting. Pearson Higher Education AU.

Lee, T.A., 2014. Evolution of Corporate Financial Reporting (RLE Accounting).

Routledge.

Ramanna, K., 2014. Political standards: Accounting for legitimacy.

Sivathaasan, N., 2016. Corporate governance and leverage in Australia: A pitch. Journal

of Accounting and Management Information Systems, 15(4), pp.819-825.

Dulux Group Limited, 2017 Annual Report.Concise Annual Report 2017, Available at:

DuluxGroup%20Annual%20Report%20November%202017.pdf, [Accessed on:

15/05/2018]

Warren, C.S. and Jones, J., 2018. Corporate financial accounting. Cengage Learning.

14

Ali, S., 2016. Corporate governance and stock liquidity in Australia: A pitch. Journal of

Accounting and Management Information Systems, 15(3), pp.624-631.

Beekes, W., Brown, P. and Zhang, Q., 2015. Corporate governance and the

informativeness of disclosures in Australia: a re‐examination. Accounting &

Finance, 55(4), pp.931-963.

Bhasin, M.L., 2015. Corporate accounting fraud: A case study of Satyam Computers

Limited.

Duff, A., 2016. Corporate social responsibility reporting in professional accounting

firms. The British Accounting Review, 48(1), pp.74-86.

Henderson, S., Peirson, G., Herbohn, K. and Howieson, B., 2015. Issues in financial

accounting. Pearson Higher Education AU.

Lee, T.A., 2014. Evolution of Corporate Financial Reporting (RLE Accounting).

Routledge.

Ramanna, K., 2014. Political standards: Accounting for legitimacy.

Sivathaasan, N., 2016. Corporate governance and leverage in Australia: A pitch. Journal

of Accounting and Management Information Systems, 15(4), pp.819-825.

Dulux Group Limited, 2017 Annual Report.Concise Annual Report 2017, Available at:

DuluxGroup%20Annual%20Report%20November%202017.pdf, [Accessed on:

15/05/2018]

Warren, C.S. and Jones, J., 2018. Corporate financial accounting. Cengage Learning.

14

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.