Statistical Analysis Assignment 2: Data Interpretation and Analysis

VerifiedAdded on 2021/06/17

|15

|1409

|164

Homework Assignment

AI Summary

This assignment presents a comprehensive statistical analysis covering various topics. The first question involves analyzing quarterly opening stock prices for MQG and PPT, using stem-and-leaf plots, histograms, and frequency polygons to compare investment potential. The second question calculates and interprets mean, median, quartiles, standard deviation, and range for different variables, along with box and whisker plots, to assess growth potential. Question three delves into the probabilities of Australian deaths from neoplasms and circulatory diseases. Question four focuses on calculating rainfall probabilities, assuming a normal distribution. Finally, question five examines the normality of refractive index data for float and non-float glass, including confidence intervals for normally distributed variables. The assignment demonstrates the application of various statistical techniques to real-world scenarios, drawing conclusions based on the data analysis.

Running head: ASSIGNMENT 2

Assignment 2

Name

Course Number

Date

Faculty Name

Assignment 2

Name

Course Number

Date

Faculty Name

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ASSIGNMENT 2 2

Assignment 2

Question 1

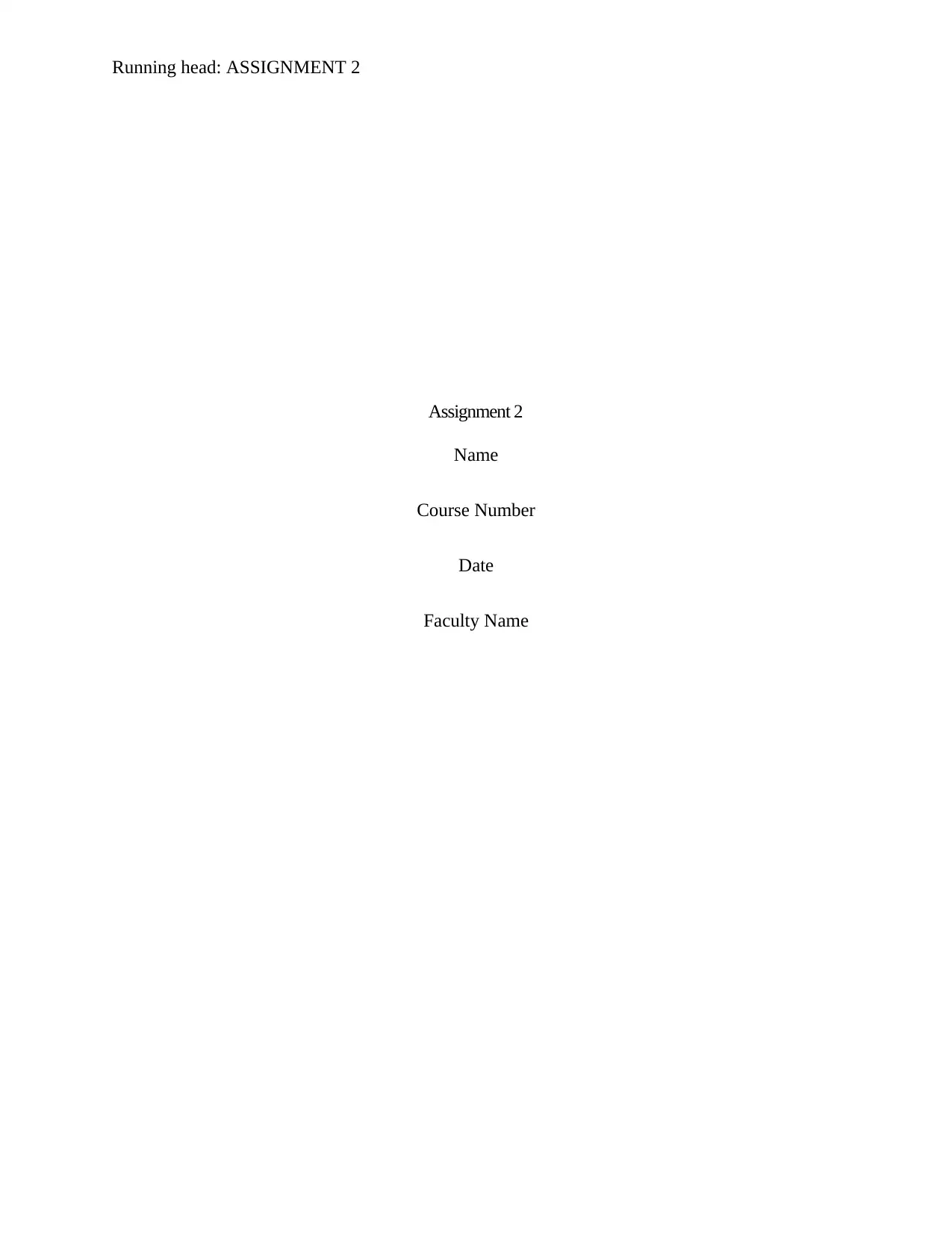

a) Quarterly opening prices

Year Quarter MQG PPT Year Quarte

r

MQG PPT

2007 1 79.65 78.45 2013 1 37.86 38.84

2 85.56 80.91 2 38.54 41.20

3 81.13 77.50 3 43.16 39.90

4 82.66 74.26 4 50.11 46.00

2008 1 63.92 58.30 2014 1 54.09 47.04

2 62.37 54.84 2 57.70 46.90

3 50.58 40.76 3 58.52 48.82

4 28.91 34.93 4 61.17 46.45

2009 1 25.56 30.72 2015 1 62.15 49.18

2 32.93 32.18 2 77.97 54.16

3 43.29 33.51 3 82.15 44.85

4 49.17 37.62 4 85.70 44.91

2010 1 49.33 35.05 2016 1 71.58 41.31

2 49.46 34.55 2 63.50 42.75

3 36.58 29.03 3 74.39 45.50

4 35.60 37.85 4 79.80 45.24

2011 1 39.95 31.29 2017 1 84.60 46.80

2 34.58 28.89 2 93.00 52.78

3 27.11 23.58 3 85.83 50.48

4 24.50 22.75 4 98.35 48.48

2012 1 25.08 20.25

2 28.73 25.50

3 24.57 23.91

4 31.37 27.94

Assignment 2

Question 1

a) Quarterly opening prices

Year Quarter MQG PPT Year Quarte

r

MQG PPT

2007 1 79.65 78.45 2013 1 37.86 38.84

2 85.56 80.91 2 38.54 41.20

3 81.13 77.50 3 43.16 39.90

4 82.66 74.26 4 50.11 46.00

2008 1 63.92 58.30 2014 1 54.09 47.04

2 62.37 54.84 2 57.70 46.90

3 50.58 40.76 3 58.52 48.82

4 28.91 34.93 4 61.17 46.45

2009 1 25.56 30.72 2015 1 62.15 49.18

2 32.93 32.18 2 77.97 54.16

3 43.29 33.51 3 82.15 44.85

4 49.17 37.62 4 85.70 44.91

2010 1 49.33 35.05 2016 1 71.58 41.31

2 49.46 34.55 2 63.50 42.75

3 36.58 29.03 3 74.39 45.50

4 35.60 37.85 4 79.80 45.24

2011 1 39.95 31.29 2017 1 84.60 46.80

2 34.58 28.89 2 93.00 52.78

3 27.11 23.58 3 85.83 50.48

4 24.50 22.75 4 98.35 48.48

2012 1 25.08 20.25

2 28.73 25.50

3 24.57 23.91

4 31.37 27.94

ASSIGNMENT 2 3

MQG and PPT Stem-and-Leaf Plot

Stem & Leaf

98753320 . 2 . 4455788

98775443210 . 3 . 12456789

9887666655442110 . 4 . 33999

4420 . 5 . 00478

. 6 . 12233

874 . 7 . 14799

1 . 8 . 1224555

. 9 . 38

Each leaf: 1 case(s)

(Fletcher, 2009)

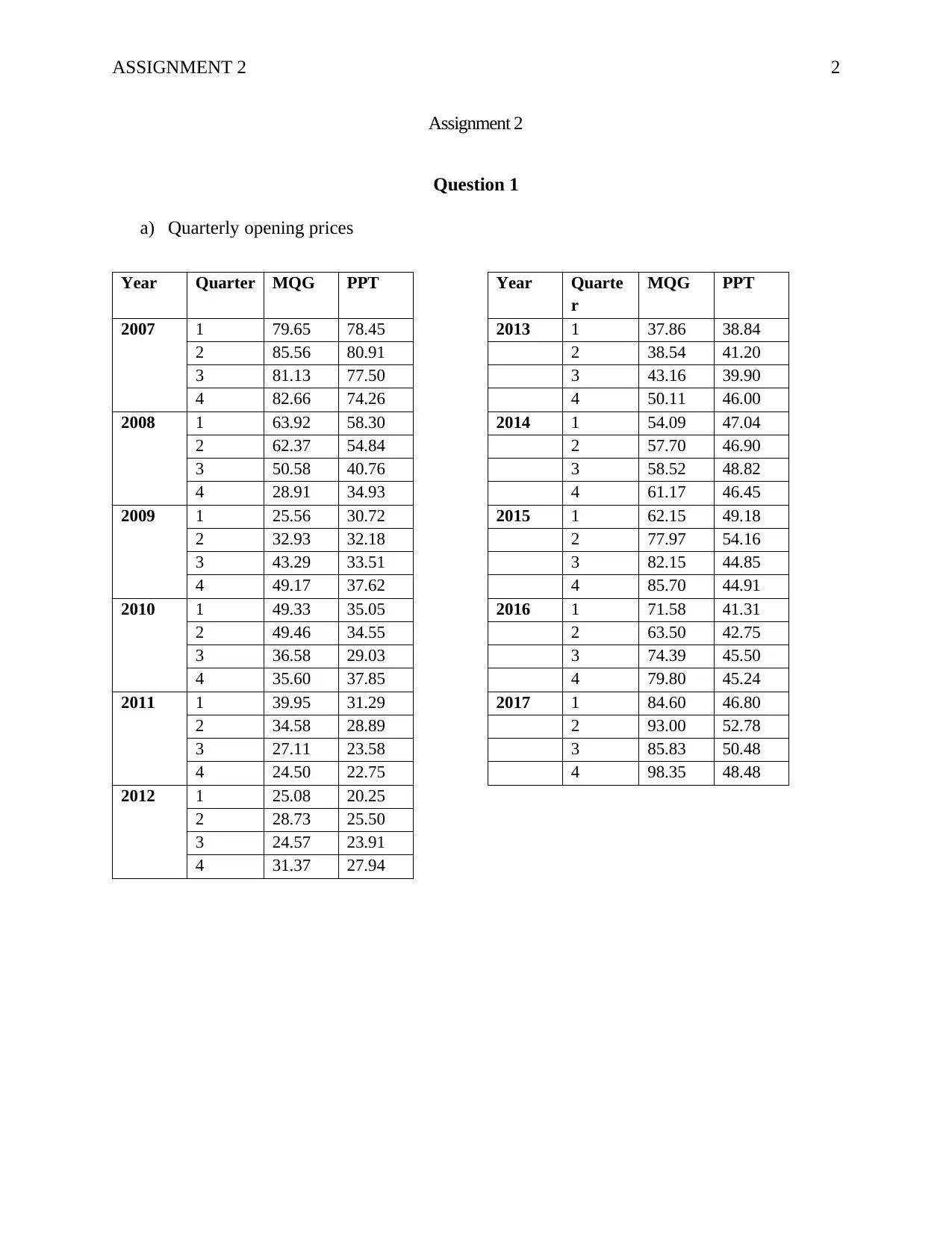

b) Histogram and Frequency polygon for MQG and PPT

10 20 30 40 50 60 70 80 90 100 Total

0.000

0.050

0.100

0.150

0.200

0.250

0.300

0.350

0.400

MDQ PPT

Bin

Relative Frequency

Figure 1: Histogram and Frequency polygon of MQG and PPT

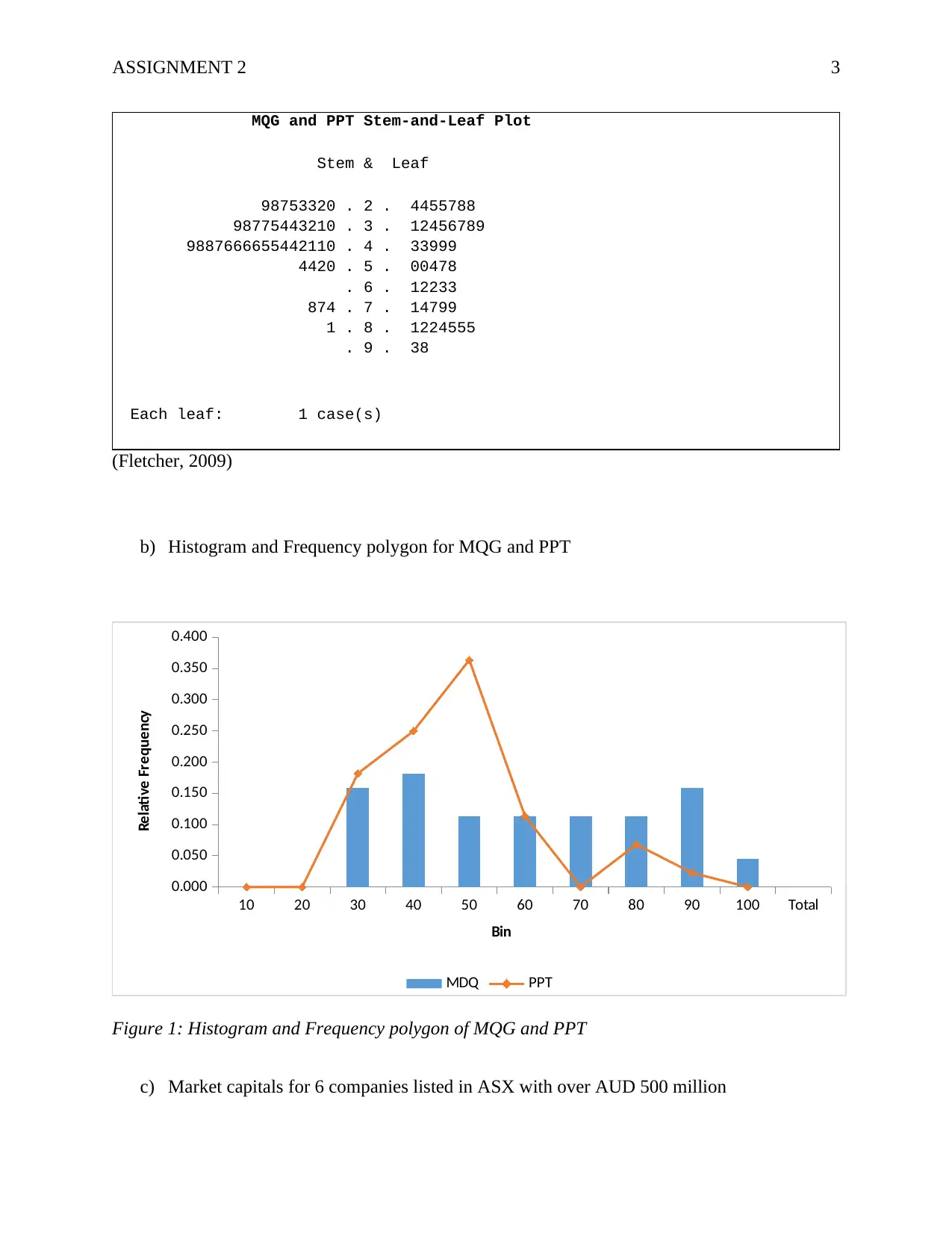

c) Market capitals for 6 companies listed in ASX with over AUD 500 million

MQG and PPT Stem-and-Leaf Plot

Stem & Leaf

98753320 . 2 . 4455788

98775443210 . 3 . 12456789

9887666655442110 . 4 . 33999

4420 . 5 . 00478

. 6 . 12233

874 . 7 . 14799

1 . 8 . 1224555

. 9 . 38

Each leaf: 1 case(s)

(Fletcher, 2009)

b) Histogram and Frequency polygon for MQG and PPT

10 20 30 40 50 60 70 80 90 100 Total

0.000

0.050

0.100

0.150

0.200

0.250

0.300

0.350

0.400

MDQ PPT

Bin

Relative Frequency

Figure 1: Histogram and Frequency polygon of MQG and PPT

c) Market capitals for 6 companies listed in ASX with over AUD 500 million

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ASSIGNMENT 2 4

Perpetual Limited

Macquarie Group Limited

APA GROUP

Aristocrat Leisure

Ramsay Health Care

Stockland Units/ Stapled Securities

AUD

1,869,000,000.00

AUD

37,072,000,000.00

AUD

9,690,000,000.00

AUD

17,125,800,000.00

AUD

13,072,600,000.00

AUD

10,078,700,000.00

Market Capitals

Figure 2: Market capitals

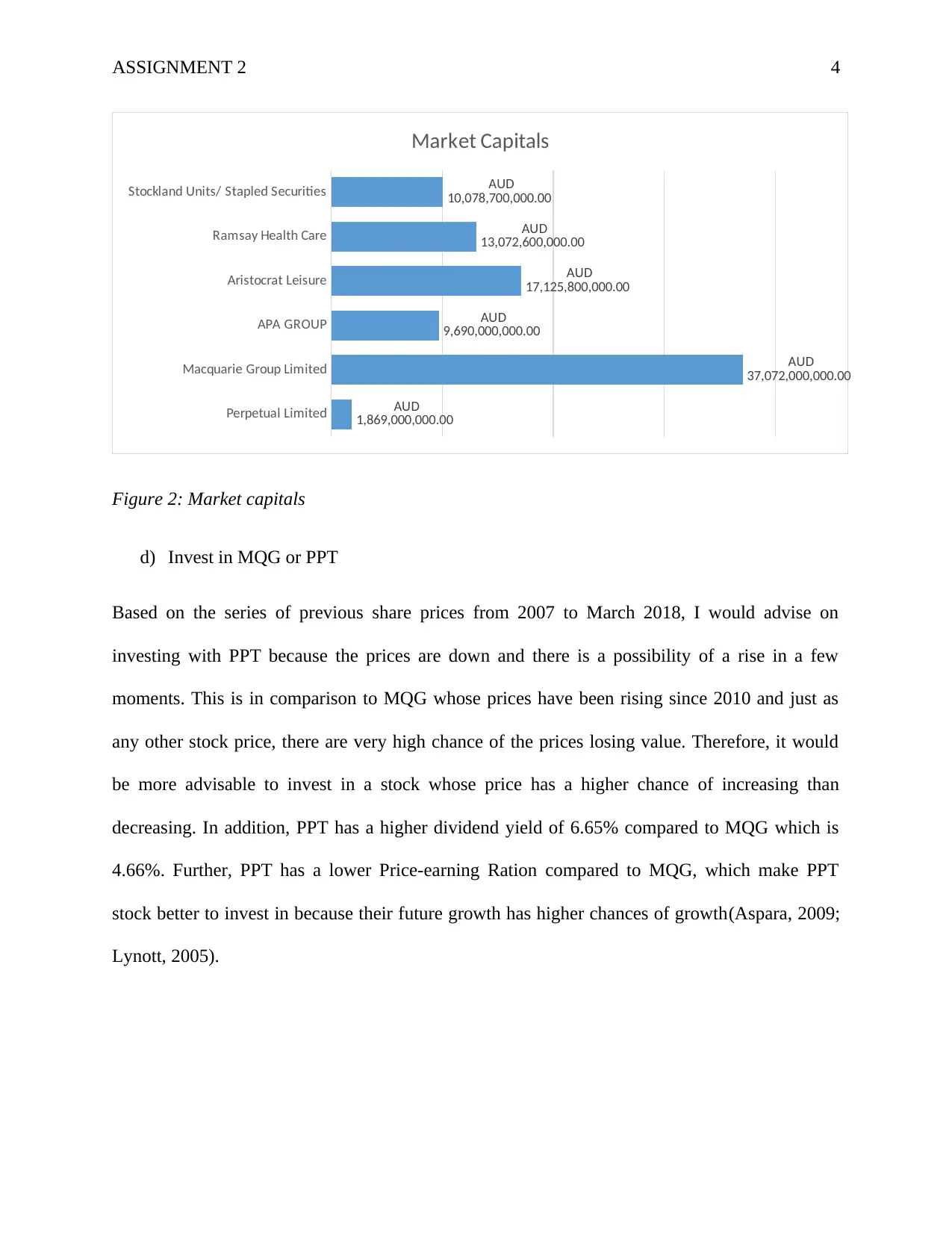

d) Invest in MQG or PPT

Based on the series of previous share prices from 2007 to March 2018, I would advise on

investing with PPT because the prices are down and there is a possibility of a rise in a few

moments. This is in comparison to MQG whose prices have been rising since 2010 and just as

any other stock price, there are very high chance of the prices losing value. Therefore, it would

be more advisable to invest in a stock whose price has a higher chance of increasing than

decreasing. In addition, PPT has a higher dividend yield of 6.65% compared to MQG which is

4.66%. Further, PPT has a lower Price-earning Ration compared to MQG, which make PPT

stock better to invest in because their future growth has higher chances of growth(Aspara, 2009;

Lynott, 2005).

Perpetual Limited

Macquarie Group Limited

APA GROUP

Aristocrat Leisure

Ramsay Health Care

Stockland Units/ Stapled Securities

AUD

1,869,000,000.00

AUD

37,072,000,000.00

AUD

9,690,000,000.00

AUD

17,125,800,000.00

AUD

13,072,600,000.00

AUD

10,078,700,000.00

Market Capitals

Figure 2: Market capitals

d) Invest in MQG or PPT

Based on the series of previous share prices from 2007 to March 2018, I would advise on

investing with PPT because the prices are down and there is a possibility of a rise in a few

moments. This is in comparison to MQG whose prices have been rising since 2010 and just as

any other stock price, there are very high chance of the prices losing value. Therefore, it would

be more advisable to invest in a stock whose price has a higher chance of increasing than

decreasing. In addition, PPT has a higher dividend yield of 6.65% compared to MQG which is

4.66%. Further, PPT has a lower Price-earning Ration compared to MQG, which make PPT

stock better to invest in because their future growth has higher chances of growth(Aspara, 2009;

Lynott, 2005).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ASSIGNMENT 2 5

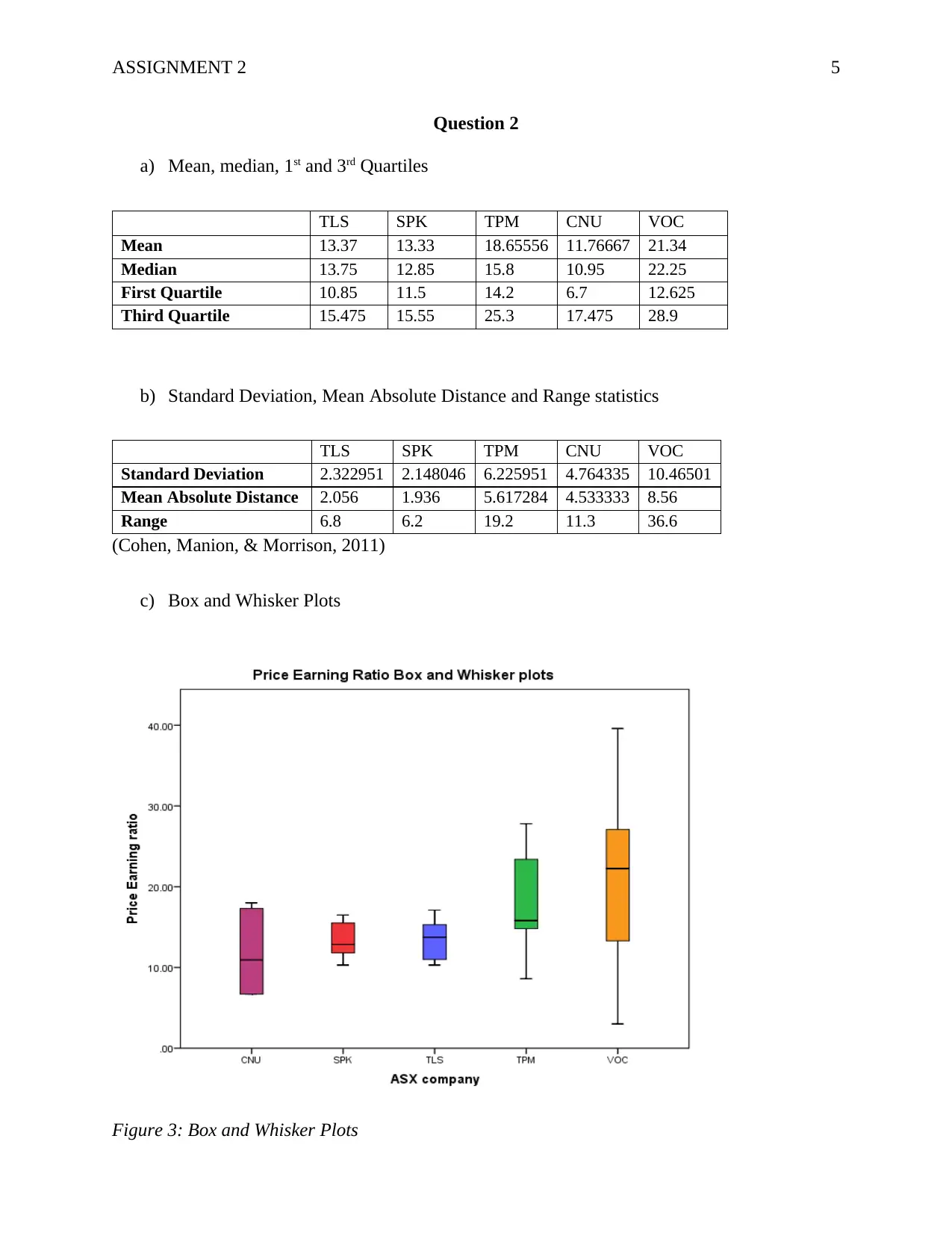

Question 2

a) Mean, median, 1st and 3rd Quartiles

TLS SPK TPM CNU VOC

Mean 13.37 13.33 18.65556 11.76667 21.34

Median 13.75 12.85 15.8 10.95 22.25

First Quartile 10.85 11.5 14.2 6.7 12.625

Third Quartile 15.475 15.55 25.3 17.475 28.9

b) Standard Deviation, Mean Absolute Distance and Range statistics

TLS SPK TPM CNU VOC

Standard Deviation 2.322951 2.148046 6.225951 4.764335 10.46501

Mean Absolute Distance 2.056 1.936 5.617284 4.533333 8.56

Range 6.8 6.2 19.2 11.3 36.6

(Cohen, Manion, & Morrison, 2011)

c) Box and Whisker Plots

Figure 3: Box and Whisker Plots

Question 2

a) Mean, median, 1st and 3rd Quartiles

TLS SPK TPM CNU VOC

Mean 13.37 13.33 18.65556 11.76667 21.34

Median 13.75 12.85 15.8 10.95 22.25

First Quartile 10.85 11.5 14.2 6.7 12.625

Third Quartile 15.475 15.55 25.3 17.475 28.9

b) Standard Deviation, Mean Absolute Distance and Range statistics

TLS SPK TPM CNU VOC

Standard Deviation 2.322951 2.148046 6.225951 4.764335 10.46501

Mean Absolute Distance 2.056 1.936 5.617284 4.533333 8.56

Range 6.8 6.2 19.2 11.3 36.6

(Cohen, Manion, & Morrison, 2011)

c) Box and Whisker Plots

Figure 3: Box and Whisker Plots

ASSIGNMENT 2 6

d) A discussion on the price-earnings ratio values

Higher values of price-earnings ratio show that the stock is overpriced while stocks with small

values are seen to be better because they have higher growth potentials. Therefore, CNU has the

highest growth potential compared to the others because the median measure small compared to

the others. However, SPK has the least margin for the 3rd and 1st quartile, hence lower deviation

from the median. It is very risky to invest in VOC stock because it is hard to estimate its ideal

price-earnings ratio because of the higher variation. Therefore, it will be safer to invest in CNU,

SPK and TLS stock as opposed to TPM and VOC(Titman, Wei, & Xie, 2004).

Question 3

a) The probability that an Australian will die from neoplasms.

44674

147678 =0.3025

b) The probability of a Female Australian to die from disease of the circulatory system

22493

71896 =0.313

c) Proportions of deaths

The disease with the highest proportion of male deaths compared to female deaths is Neoplasms

with a difference of 6.3%. Diseases of circulatory system such as heart disease have the highest

difference in proportion between female deaths and male deaths with a difference of 3.4%.

d) The probability of dying from diabetes mellitus

male= 2298

75782=0.0303

d) A discussion on the price-earnings ratio values

Higher values of price-earnings ratio show that the stock is overpriced while stocks with small

values are seen to be better because they have higher growth potentials. Therefore, CNU has the

highest growth potential compared to the others because the median measure small compared to

the others. However, SPK has the least margin for the 3rd and 1st quartile, hence lower deviation

from the median. It is very risky to invest in VOC stock because it is hard to estimate its ideal

price-earnings ratio because of the higher variation. Therefore, it will be safer to invest in CNU,

SPK and TLS stock as opposed to TPM and VOC(Titman, Wei, & Xie, 2004).

Question 3

a) The probability that an Australian will die from neoplasms.

44674

147678 =0.3025

b) The probability of a Female Australian to die from disease of the circulatory system

22493

71896 =0.313

c) Proportions of deaths

The disease with the highest proportion of male deaths compared to female deaths is Neoplasms

with a difference of 6.3%. Diseases of circulatory system such as heart disease have the highest

difference in proportion between female deaths and male deaths with a difference of 3.4%.

d) The probability of dying from diabetes mellitus

male= 2298

75782=0.0303

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ASSIGNMENT 2 7

female= 2030

71896 =0.0282

overrall = 4328

147678 =0.0293

(McCluskey & Lalkhen, 2007)

Question 4

a) Probability of rainfall

i. The probability that there will be no rainfall in any given day

yearly rate of rainfall (λ yr)= number of days withrainfall

365 =230

365 =0.63

Weekly rate of rainfall( λwk )= 0.63

52 =0.0121

daily rate( λday )= 0.012118

7 =0.00173

P ( 0 )= λwk

0

0 ! ∗e− λwk

=e−λwk

=e−0.0121=0.988

ii. The probability of 2 or more days of rainfall in a week

P ( 2∨more days of rainfall )=1−P ( 0 ) −P ( 1 )

P ( 0 )= λday

0

0 ! ∗e− λday

=e−0.0017=0.998

female= 2030

71896 =0.0282

overrall = 4328

147678 =0.0293

(McCluskey & Lalkhen, 2007)

Question 4

a) Probability of rainfall

i. The probability that there will be no rainfall in any given day

yearly rate of rainfall (λ yr)= number of days withrainfall

365 =230

365 =0.63

Weekly rate of rainfall( λwk )= 0.63

52 =0.0121

daily rate( λday )= 0.012118

7 =0.00173

P ( 0 )= λwk

0

0 ! ∗e− λwk

=e−λwk

=e−0.0121=0.988

ii. The probability of 2 or more days of rainfall in a week

P ( 2∨more days of rainfall )=1−P ( 0 ) −P ( 1 )

P ( 0 )= λday

0

0 ! ∗e− λday

=e−0.0017=0.998

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ASSIGNMENT 2 8

P ( 1 )= 0.0017

1 ∗0.998=0.0017

P ( 2∨more days of rainfall∈a week ) =1−0.998−0.0017=0.0003

b) Assuming that the weekly rainfall follows a normal distribution

The mean weekly rainfall is 9.9132mm and a standard deviation of 12.297mm

i) The probability of having rainfall between 5mm to 15mm

5−9.9132

12.297 >Z> 15−9.9132

12.297

−0.4 >Z >0.414

0.6591−0.3446=0.3145

ii) Amount of rainfall if only 10% of the weeks have that amount of rainfall or higher

1.28= X −9.9132

12.297

X = ( 1.28∗12.297 ) + 9.9132 (Tsokos, Wooten, Tsokos, & Wooten, 2016)

The amount of rainfall will be 25.653 mm

Question 5

a) Normality Test

Refractive Index

P ( 1 )= 0.0017

1 ∗0.998=0.0017

P ( 2∨more days of rainfall∈a week ) =1−0.998−0.0017=0.0003

b) Assuming that the weekly rainfall follows a normal distribution

The mean weekly rainfall is 9.9132mm and a standard deviation of 12.297mm

i) The probability of having rainfall between 5mm to 15mm

5−9.9132

12.297 >Z> 15−9.9132

12.297

−0.4 >Z >0.414

0.6591−0.3446=0.3145

ii) Amount of rainfall if only 10% of the weeks have that amount of rainfall or higher

1.28= X −9.9132

12.297

X = ( 1.28∗12.297 ) + 9.9132 (Tsokos, Wooten, Tsokos, & Wooten, 2016)

The amount of rainfall will be 25.653 mm

Question 5

a) Normality Test

Refractive Index

ASSIGNMENT 2 9

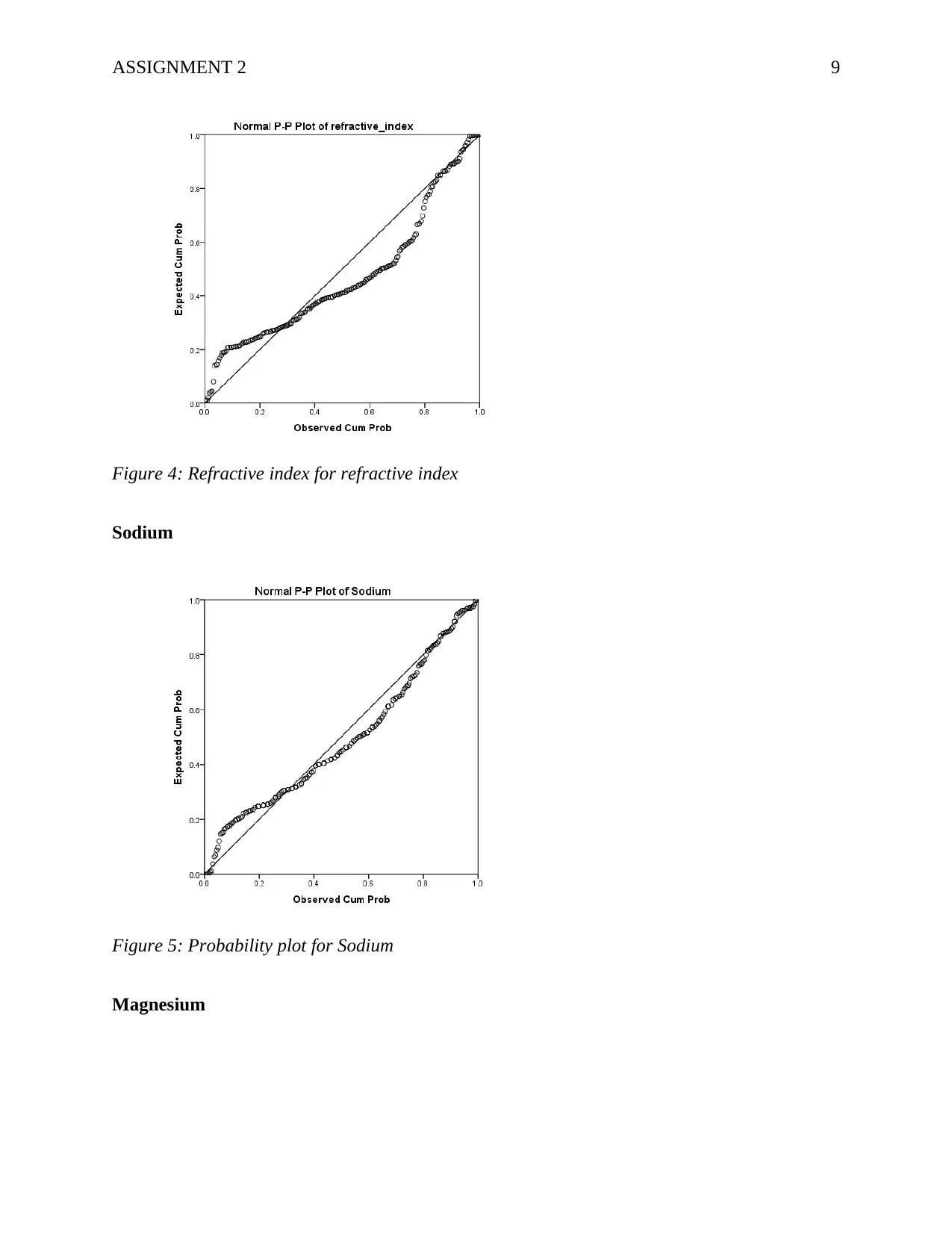

Figure 4: Refractive index for refractive index

Sodium

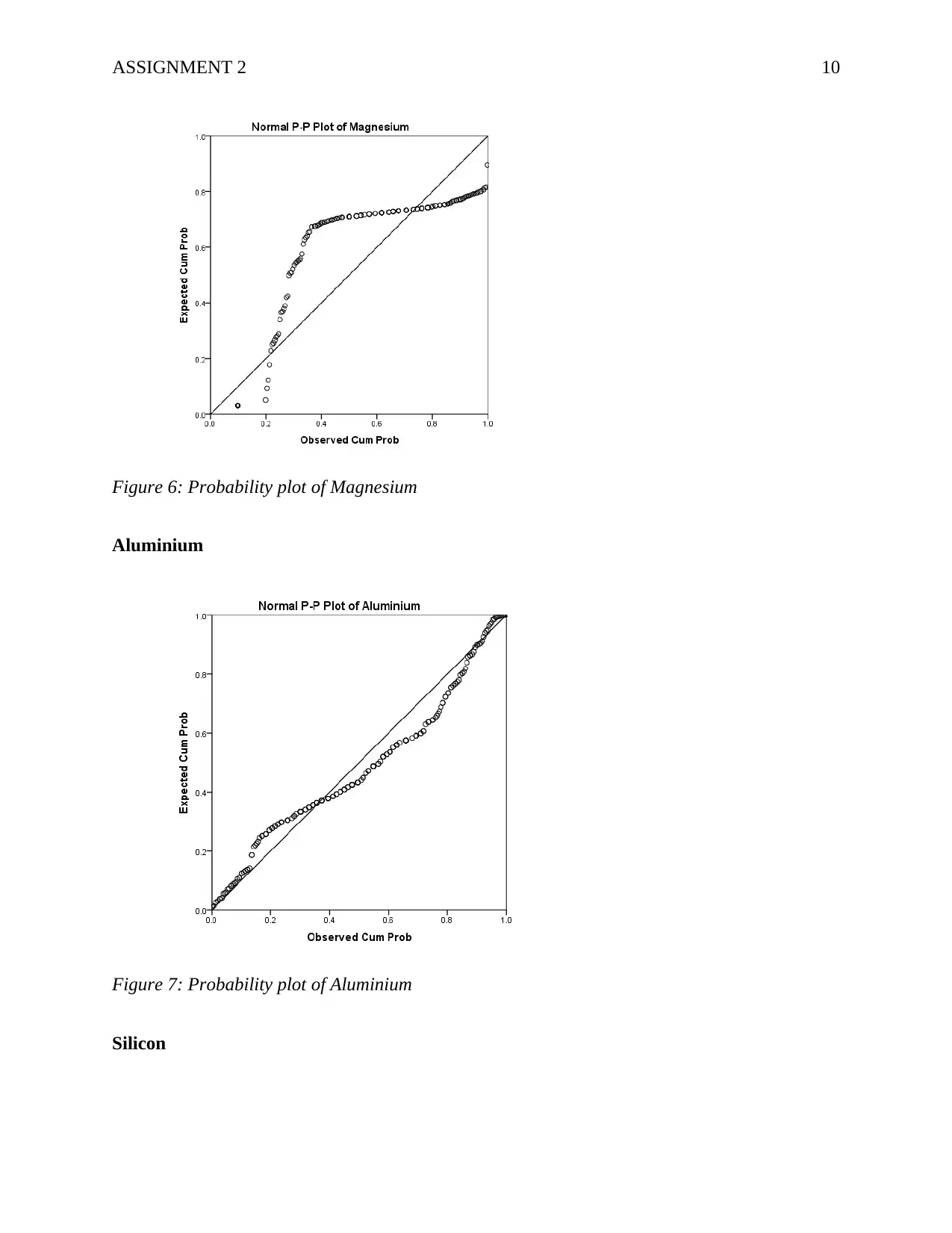

Figure 5: Probability plot for Sodium

Magnesium

Figure 4: Refractive index for refractive index

Sodium

Figure 5: Probability plot for Sodium

Magnesium

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ASSIGNMENT 2 10

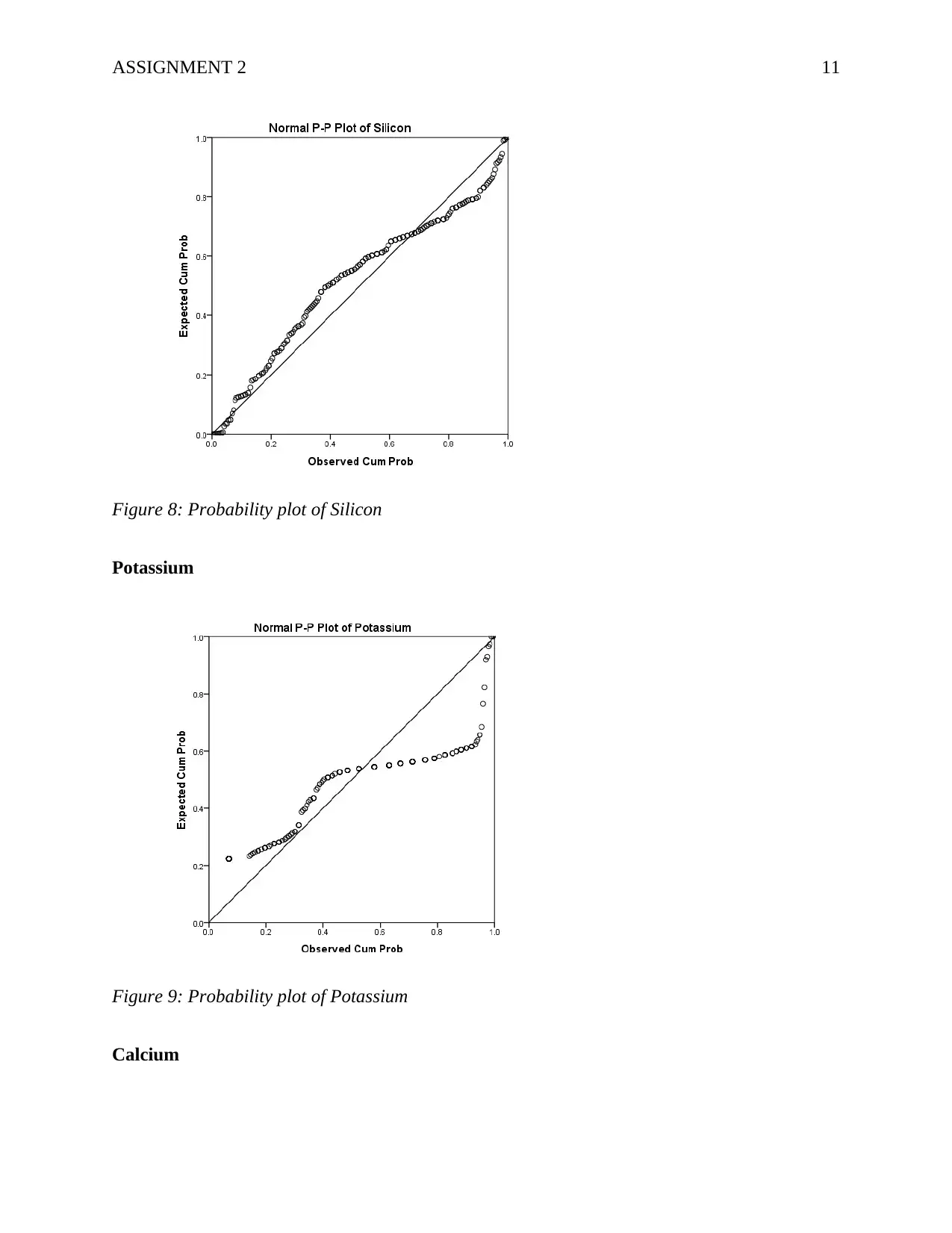

Figure 6: Probability plot of Magnesium

Aluminium

Figure 7: Probability plot of Aluminium

Silicon

Figure 6: Probability plot of Magnesium

Aluminium

Figure 7: Probability plot of Aluminium

Silicon

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ASSIGNMENT 2 11

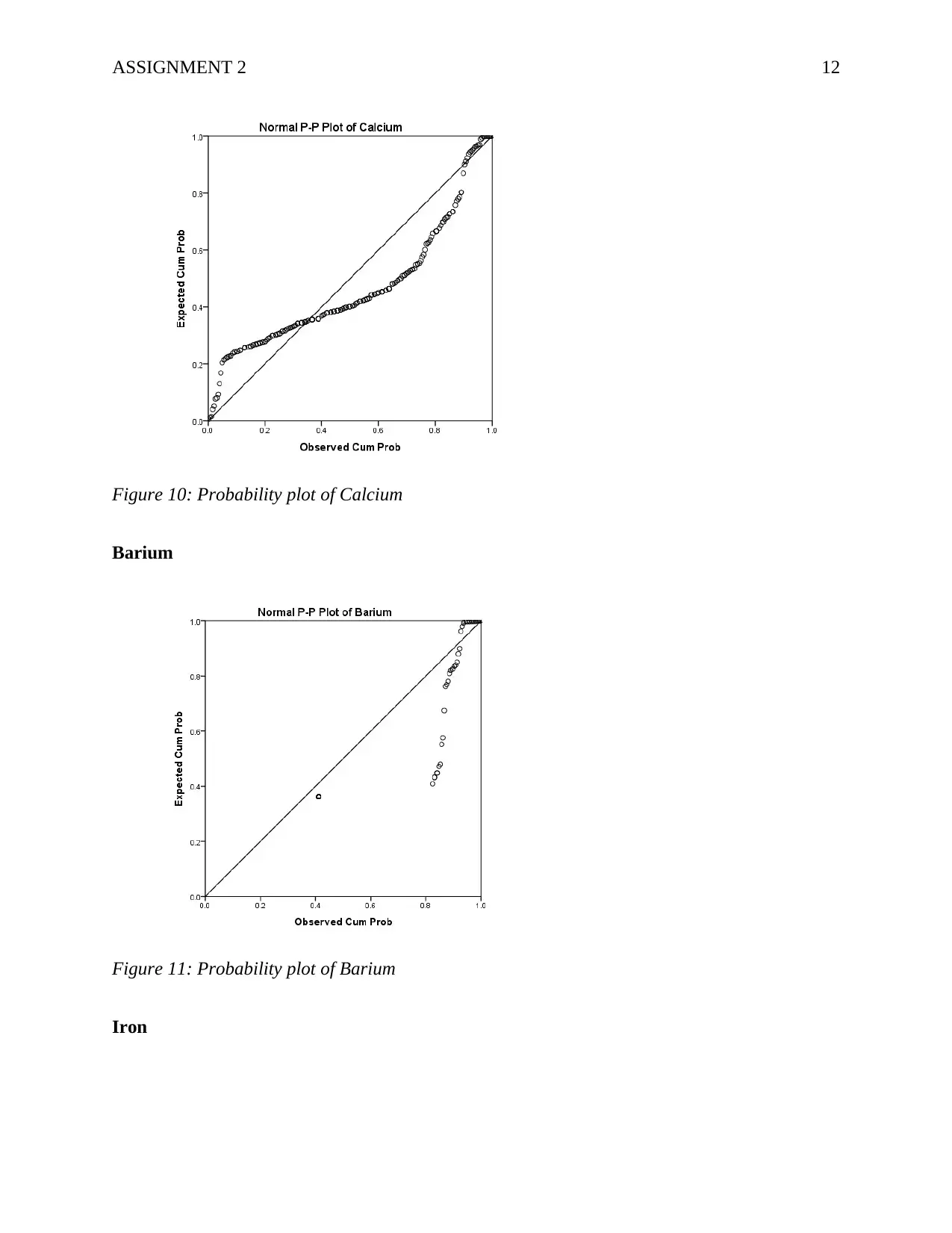

Figure 8: Probability plot of Silicon

Potassium

Figure 9: Probability plot of Potassium

Calcium

Figure 8: Probability plot of Silicon

Potassium

Figure 9: Probability plot of Potassium

Calcium

ASSIGNMENT 2 12

Figure 10: Probability plot of Calcium

Barium

Figure 11: Probability plot of Barium

Iron

Figure 10: Probability plot of Calcium

Barium

Figure 11: Probability plot of Barium

Iron

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.

![Statistics for Managerial Decision Assignment - II, [Date], Analysis](/_next/image/?url=https%3A%2F%2Fdesklib.com%2Fmedia%2Fimages%2Fdg%2F212559e8bb9e4b7a88ae50f7f34bd535.jpg&w=256&q=75)