Australian Housing Affordability: Data Analysis and Findings Report

VerifiedAdded on 2020/04/07

|29

|5626

|72

Report

AI Summary

This report, submitted for a Master of Business and Project Management program, analyzes the state of housing affordability in Australia. The report presents data collected and analyzed from Galaxy Research on various socioeconomic groups' perceptions of homeownership and its affordability. It examines key metrics such as price-to-income ratios, the proportion of household income required for deposits and mortgage servicing, and rental costs across different regions. The report highlights the increasing challenges faced by younger generations in achieving homeownership, the impact of rising property prices, and the concerns of older Australians regarding moving costs. The data analysis section outlines the methodology used, including weighting of data and analysis of housing stress measures. The findings reveal regional disparities in affordability, with Sydney and Melbourne facing more significant challenges. The report concludes by emphasizing the importance of homeownership and the concerns surrounding housing affordability across different demographics.

TITLE

Submitted by:

Full Name of Student

For Partial Fulfilment of:

Master of Business and Project Management

Submission Date:

October 2017

Submitted by:

Full Name of Student

For Partial Fulfilment of:

Master of Business and Project Management

Submission Date:

October 2017

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2

Table of Contents

1. Data Collection..............................................................................................................................4

2. Data Analysis.................................................................................................................................8

For Data analysis.............................................................................................................................10

3. Findings.......................................................................................................................................12

4. Future Work................................................................................................................................25

5. Conclusion...................................................................................................................................26

6. References...................................................................................................................................27

3

1. Data Collection..............................................................................................................................4

2. Data Analysis.................................................................................................................................8

For Data analysis.............................................................................................................................10

3. Findings.......................................................................................................................................12

4. Future Work................................................................................................................................25

5. Conclusion...................................................................................................................................26

6. References...................................................................................................................................27

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1. Data Collection

The data collection in this document distinguishes how Australians of all socioeconomics feel

about moderateness and its effect on their fantasies of property proprietorship or property

updating and gives bits of knowledge into what governments and experts can do to influence

change. Private land is the nation's biggest resource class at $7.0 trillion – far overwhelming

superannuation at $2.2 trillion and recorded stocks at $1.8 trillion. Australian family units

have the greater part their riches tied up in the private lodging area and around 70% of their

obligation is lodging related. This new review uncovers the degrees to which the colossal

Australian long for home possession is turning into a difficult test. It uncovers that a

developing extent of more youthful ages, while overwhelmingly keeping up a supported

hunger to experience the fantasy, are remaining home with guardians – progressively into

their 30s – to put something aside for stores. It catches how much guardians are being relied

upon to help their grown-up youngsters in either putting something aside for - or paying for -

a home, and uncovers how families with low salaries as well as youthful kids are winding up

more powerless against contract push. The review recognizes how purchasing a house is

turning into the benefit of high wage workers who are being required to relegate regularly

expanding extents of wage towards adjusting a home loan. What's more, it uncovers how

more seasoned Australians are profoundly frightful of the expenses of moving or downsizing,

which thusly is influencing supply and adding to raising lodging costs considerably

encourage particularly in internal urban areas. Following measures were done during on the

data collected:

Price to income ratio

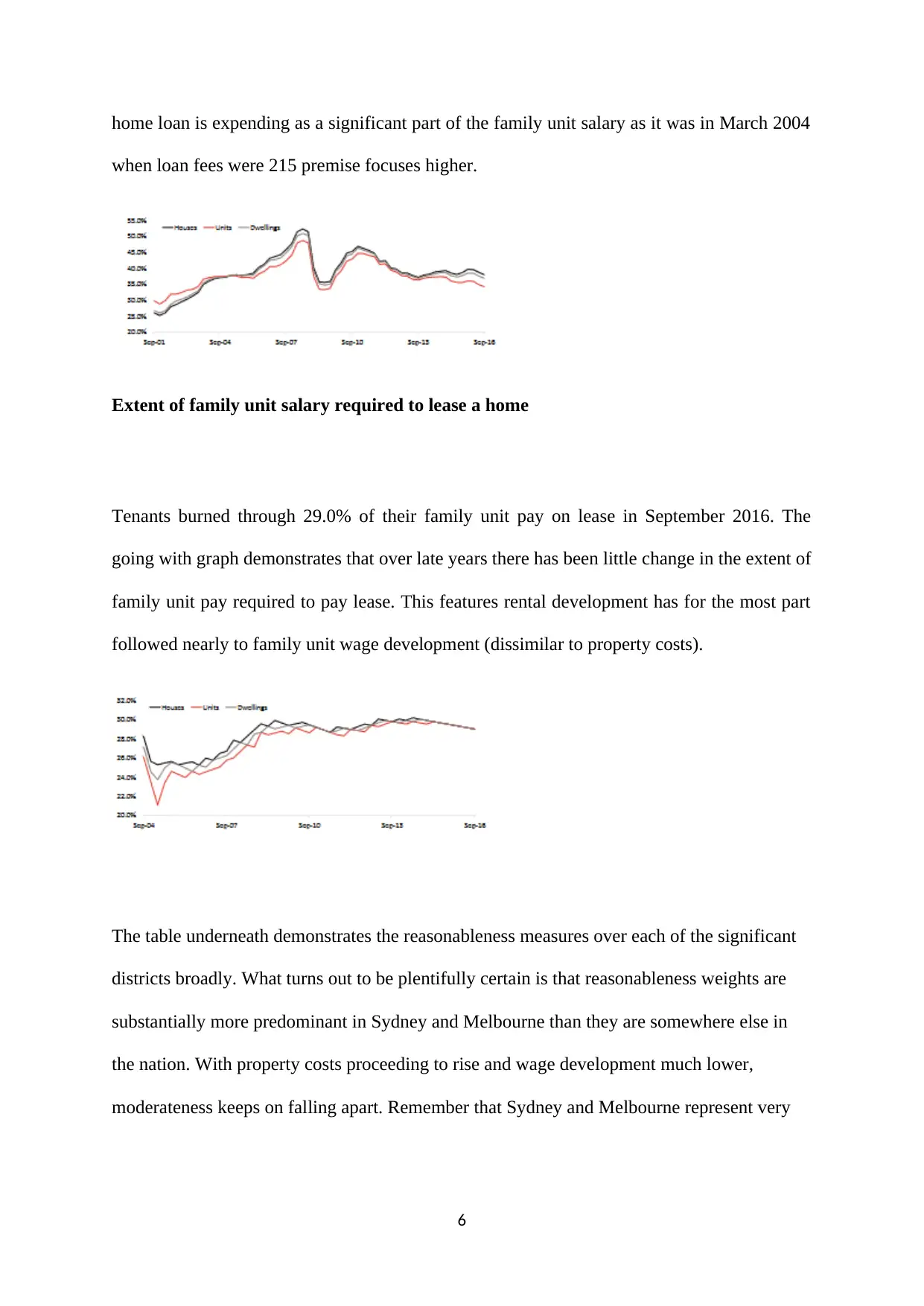

As shown in graph below, the national cost to wage proportion was recorded at 6.10x (8.0x

for houses and 7.1x for units). 15 years prior the national proportion was recorded at 4.4x

4

The data collection in this document distinguishes how Australians of all socioeconomics feel

about moderateness and its effect on their fantasies of property proprietorship or property

updating and gives bits of knowledge into what governments and experts can do to influence

change. Private land is the nation's biggest resource class at $7.0 trillion – far overwhelming

superannuation at $2.2 trillion and recorded stocks at $1.8 trillion. Australian family units

have the greater part their riches tied up in the private lodging area and around 70% of their

obligation is lodging related. This new review uncovers the degrees to which the colossal

Australian long for home possession is turning into a difficult test. It uncovers that a

developing extent of more youthful ages, while overwhelmingly keeping up a supported

hunger to experience the fantasy, are remaining home with guardians – progressively into

their 30s – to put something aside for stores. It catches how much guardians are being relied

upon to help their grown-up youngsters in either putting something aside for - or paying for -

a home, and uncovers how families with low salaries as well as youthful kids are winding up

more powerless against contract push. The review recognizes how purchasing a house is

turning into the benefit of high wage workers who are being required to relegate regularly

expanding extents of wage towards adjusting a home loan. What's more, it uncovers how

more seasoned Australians are profoundly frightful of the expenses of moving or downsizing,

which thusly is influencing supply and adding to raising lodging costs considerably

encourage particularly in internal urban areas. Following measures were done during on the

data collected:

Price to income ratio

As shown in graph below, the national cost to wage proportion was recorded at 6.10x (8.0x

for houses and 7.1x for units). 15 years prior the national proportion was recorded at 4.4x

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

(4.3x for houses and 4.9x for units). The current moderating of middle value development has

seen the two measures really fall a little from their current pinnacles.

Proportion of household income required for a 20% deposit

As per the statistics available it took out138.9% of a family’s salary in September 2016 for a

20% store on a home, 143.2% for a house and 128.9% for a unit. In September 2001 it took

85.9% of a family units wage to buy a home, with figures of 83.4% for a house and 95.7% for

a unit. The information demonstrates that as property costs have kept on surging it has turned

out to be progressively hard to put something aside for a store particularly considering

negligible family pay development.

Extent of family pay required to benefit a 80%

LVR contract 36.8% of a family's pay was required to benefit a 80% LVR contract for a

home in September 2016 with the figures 38.0% for a house and 34.2% for units. In

September 2001 it took 26.8% of family unit pay with a figure of 26.0% for a house and

29.8% for units. This investigation is especially affected by loan fees. In spite of the fact that

financing costs are right now the most minimal they've been in the course of recent years, a

5

seen the two measures really fall a little from their current pinnacles.

Proportion of household income required for a 20% deposit

As per the statistics available it took out138.9% of a family’s salary in September 2016 for a

20% store on a home, 143.2% for a house and 128.9% for a unit. In September 2001 it took

85.9% of a family units wage to buy a home, with figures of 83.4% for a house and 95.7% for

a unit. The information demonstrates that as property costs have kept on surging it has turned

out to be progressively hard to put something aside for a store particularly considering

negligible family pay development.

Extent of family pay required to benefit a 80%

LVR contract 36.8% of a family's pay was required to benefit a 80% LVR contract for a

home in September 2016 with the figures 38.0% for a house and 34.2% for units. In

September 2001 it took 26.8% of family unit pay with a figure of 26.0% for a house and

29.8% for units. This investigation is especially affected by loan fees. In spite of the fact that

financing costs are right now the most minimal they've been in the course of recent years, a

5

home loan is expending as a significant part of the family unit salary as it was in March 2004

when loan fees were 215 premise focuses higher.

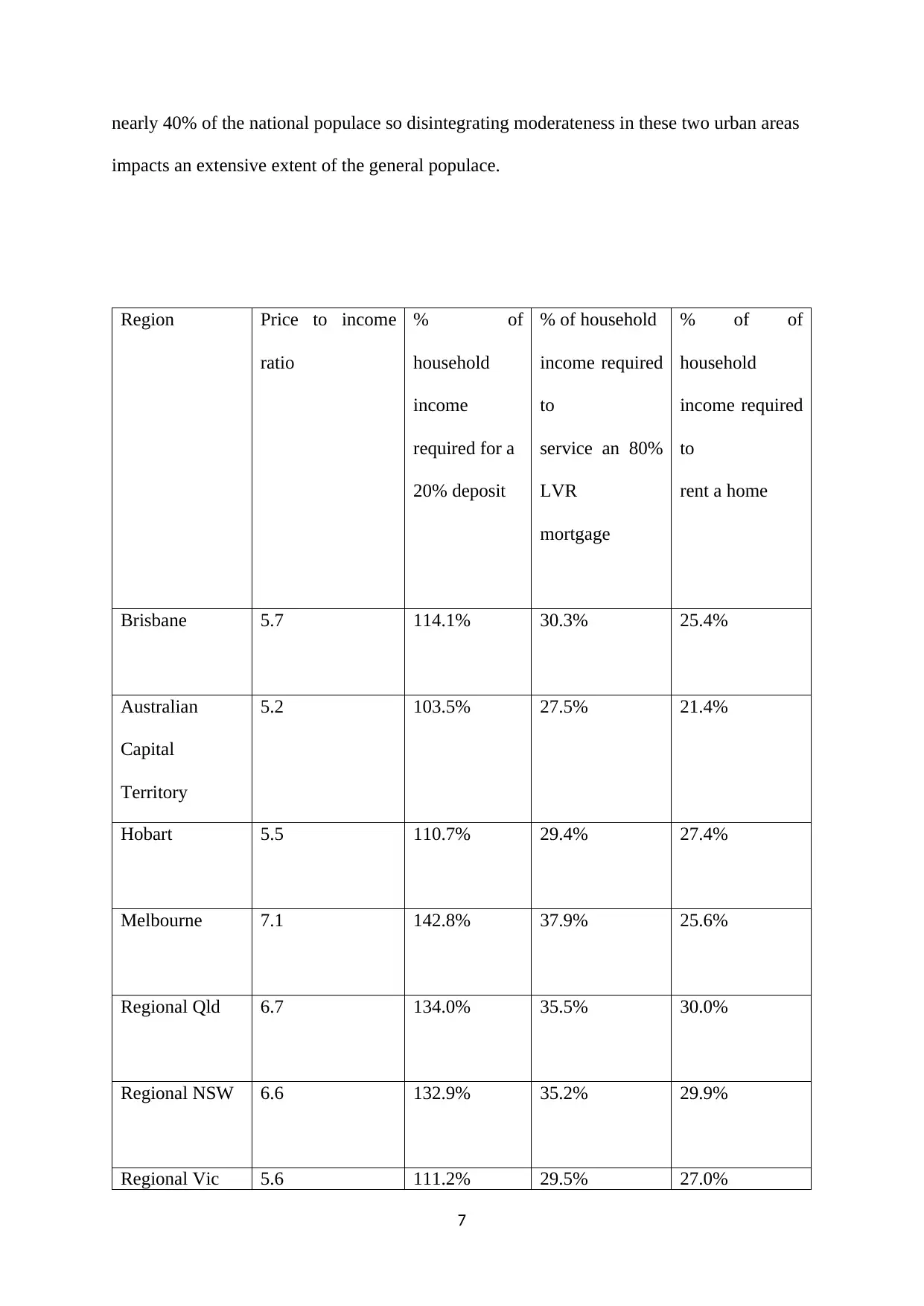

Extent of family unit salary required to lease a home

Tenants burned through 29.0% of their family unit pay on lease in September 2016. The

going with graph demonstrates that over late years there has been little change in the extent of

family unit pay required to pay lease. This features rental development has for the most part

followed nearly to family unit wage development (dissimilar to property costs).

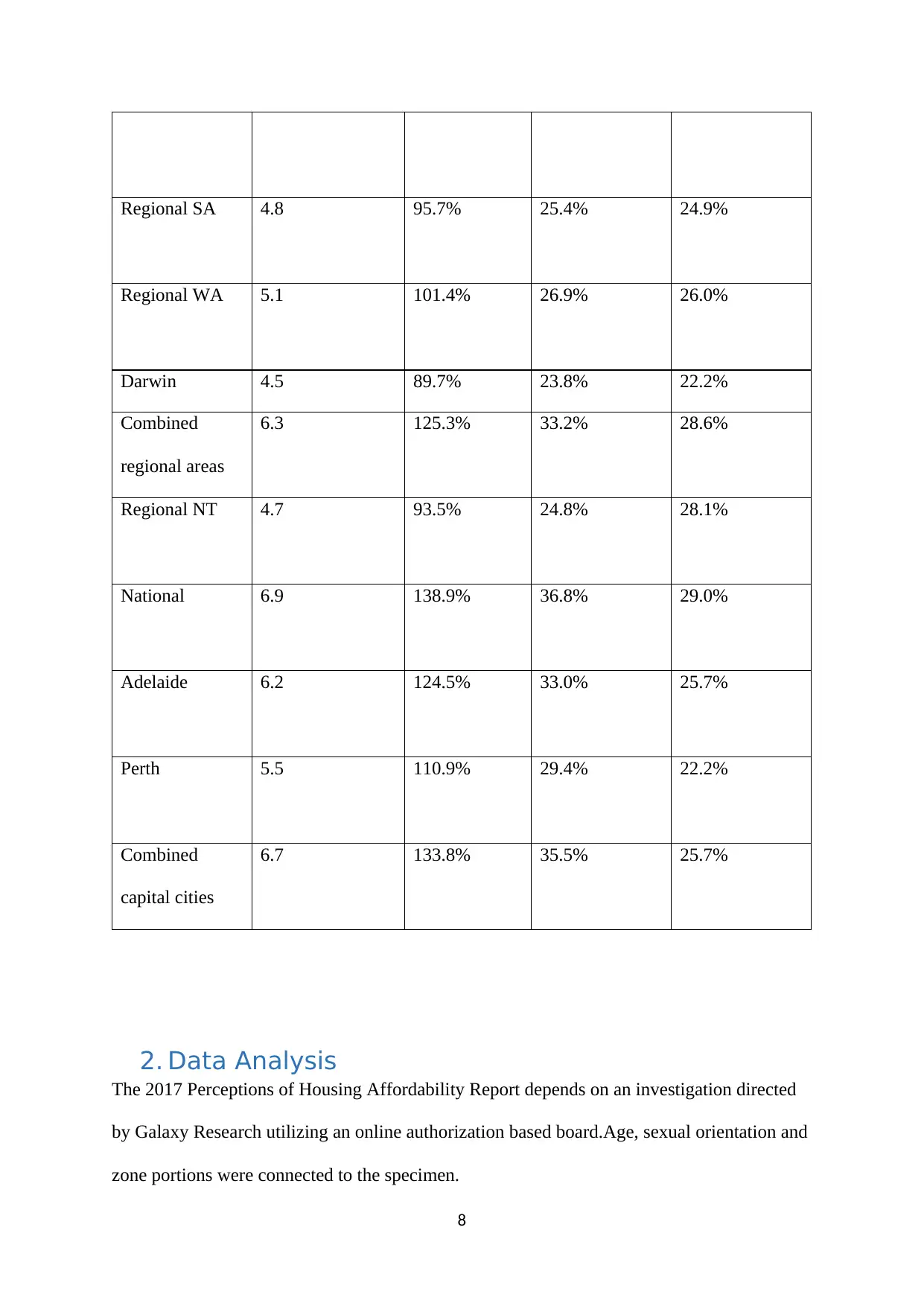

The table underneath demonstrates the reasonableness measures over each of the significant

districts broadly. What turns out to be plentifully certain is that reasonableness weights are

substantially more predominant in Sydney and Melbourne than they are somewhere else in

the nation. With property costs proceeding to rise and wage development much lower,

moderateness keeps on falling apart. Remember that Sydney and Melbourne represent very

6

when loan fees were 215 premise focuses higher.

Extent of family unit salary required to lease a home

Tenants burned through 29.0% of their family unit pay on lease in September 2016. The

going with graph demonstrates that over late years there has been little change in the extent of

family unit pay required to pay lease. This features rental development has for the most part

followed nearly to family unit wage development (dissimilar to property costs).

The table underneath demonstrates the reasonableness measures over each of the significant

districts broadly. What turns out to be plentifully certain is that reasonableness weights are

substantially more predominant in Sydney and Melbourne than they are somewhere else in

the nation. With property costs proceeding to rise and wage development much lower,

moderateness keeps on falling apart. Remember that Sydney and Melbourne represent very

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

nearly 40% of the national populace so disintegrating moderateness in these two urban areas

impacts an extensive extent of the general populace.

Region Price to income

ratio

% of

household

income

required for a

20% deposit

% of household

income required

to

service an 80%

LVR

mortgage

% of of

household

income required

to

rent a home

Brisbane 5.7 114.1% 30.3% 25.4%

Australian

Capital

Territory

5.2 103.5% 27.5% 21.4%

Hobart 5.5 110.7% 29.4% 27.4%

Melbourne 7.1 142.8% 37.9% 25.6%

Regional Qld 6.7 134.0% 35.5% 30.0%

Regional NSW 6.6 132.9% 35.2% 29.9%

Regional Vic 5.6 111.2% 29.5% 27.0%

7

impacts an extensive extent of the general populace.

Region Price to income

ratio

% of

household

income

required for a

20% deposit

% of household

income required

to

service an 80%

LVR

mortgage

% of of

household

income required

to

rent a home

Brisbane 5.7 114.1% 30.3% 25.4%

Australian

Capital

Territory

5.2 103.5% 27.5% 21.4%

Hobart 5.5 110.7% 29.4% 27.4%

Melbourne 7.1 142.8% 37.9% 25.6%

Regional Qld 6.7 134.0% 35.5% 30.0%

Regional NSW 6.6 132.9% 35.2% 29.9%

Regional Vic 5.6 111.2% 29.5% 27.0%

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Regional SA 4.8 95.7% 25.4% 24.9%

Regional WA 5.1 101.4% 26.9% 26.0%

Darwin 4.5 89.7% 23.8% 22.2%

Combined

regional areas

6.3 125.3% 33.2% 28.6%

Regional NT 4.7 93.5% 24.8% 28.1%

National 6.9 138.9% 36.8% 29.0%

Adelaide 6.2 124.5% 33.0% 25.7%

Perth 5.5 110.9% 29.4% 22.2%

Combined

capital cities

6.7 133.8% 35.5% 25.7%

2. Data Analysis

The 2017 Perceptions of Housing Affordability Report depends on an investigation directed

by Galaxy Research utilizing an online authorization based board.Age, sexual orientation and

zone portions were connected to the specimen.

8

Regional WA 5.1 101.4% 26.9% 26.0%

Darwin 4.5 89.7% 23.8% 22.2%

Combined

regional areas

6.3 125.3% 33.2% 28.6%

Regional NT 4.7 93.5% 24.8% 28.1%

National 6.9 138.9% 36.8% 29.0%

Adelaide 6.2 124.5% 33.0% 25.7%

Perth 5.5 110.9% 29.4% 22.2%

Combined

capital cities

6.7 133.8% 35.5% 25.7%

2. Data Analysis

The 2017 Perceptions of Housing Affordability Report depends on an investigation directed

by Galaxy Research utilizing an online authorization based board.Age, sexual orientation and

zone portions were connected to the specimen.

8

Following the culmination of meeting, the information was weighted by age, sexual

orientation and zone to mirror the most recent ABS populace gauges. The outcomes were

dissected to find the deltas that recognized diverse dispositions and practices around lodging

moderateness that were seen to be critical or which could reveal encourage insight into the

perplexing woven artwork of reasonableness crosswise over states, socio-economics, family

cosmetics, wage and home proprietorship sort. The last report was composed to feature these

stories inside the information. To make the report simpler to expend, the information has not

been introduced where there were no huge behavioral contrasts showed. In these occurrences,

national outcomes are demonstrative of how the littler gatherings likewise carry on or feel.

How vital is home possession?

The perfect of property possession is critical for non-mortgage holders - 89% say it is vital,

which incorporates 55% who say it is imperative.

Twenty to thirty year olds – of whom 60% have never possessed a property – are the destined

to seek to the fantasy with 96% rating it as imperative. The study likewise demonstrates the

new wonder of 'lease vesting' is additionally beginning to grab hold with 14% of non-

mortgage holders expressing they would purchase a speculation property to start with, and a

further 27% expressing they would think of it as. Be that as it may, only 4% of non-mortgage

holders officially claimed a speculation property.

Worry about lodging reasonableness

Worry about lodging reasonableness is to a great degree high with 88% of Australian non-

9

orientation and zone to mirror the most recent ABS populace gauges. The outcomes were

dissected to find the deltas that recognized diverse dispositions and practices around lodging

moderateness that were seen to be critical or which could reveal encourage insight into the

perplexing woven artwork of reasonableness crosswise over states, socio-economics, family

cosmetics, wage and home proprietorship sort. The last report was composed to feature these

stories inside the information. To make the report simpler to expend, the information has not

been introduced where there were no huge behavioral contrasts showed. In these occurrences,

national outcomes are demonstrative of how the littler gatherings likewise carry on or feel.

How vital is home possession?

The perfect of property possession is critical for non-mortgage holders - 89% say it is vital,

which incorporates 55% who say it is imperative.

Twenty to thirty year olds – of whom 60% have never possessed a property – are the destined

to seek to the fantasy with 96% rating it as imperative. The study likewise demonstrates the

new wonder of 'lease vesting' is additionally beginning to grab hold with 14% of non-

mortgage holders expressing they would purchase a speculation property to start with, and a

further 27% expressing they would think of it as. Be that as it may, only 4% of non-mortgage

holders officially claimed a speculation property.

Worry about lodging reasonableness

Worry about lodging reasonableness is to a great degree high with 88% of Australian non-

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

property proprietors worried to some degree about having the capacity to bear to purchase a

property. This is comprised of 58% of the individuals who lease/rent who are extremely

worried about having the capacity to stand to purchase their first home, while 53% of the

individuals who live in a condo are exceptionally worried about having the capacity to bear to

purchase.

Notwithstanding owning a property isn't sufficient to soothe this nervousness with 77% of

property

proprietors worried to some degree about having the capacity to bear the cost of what they

need and requirement for their next home move.

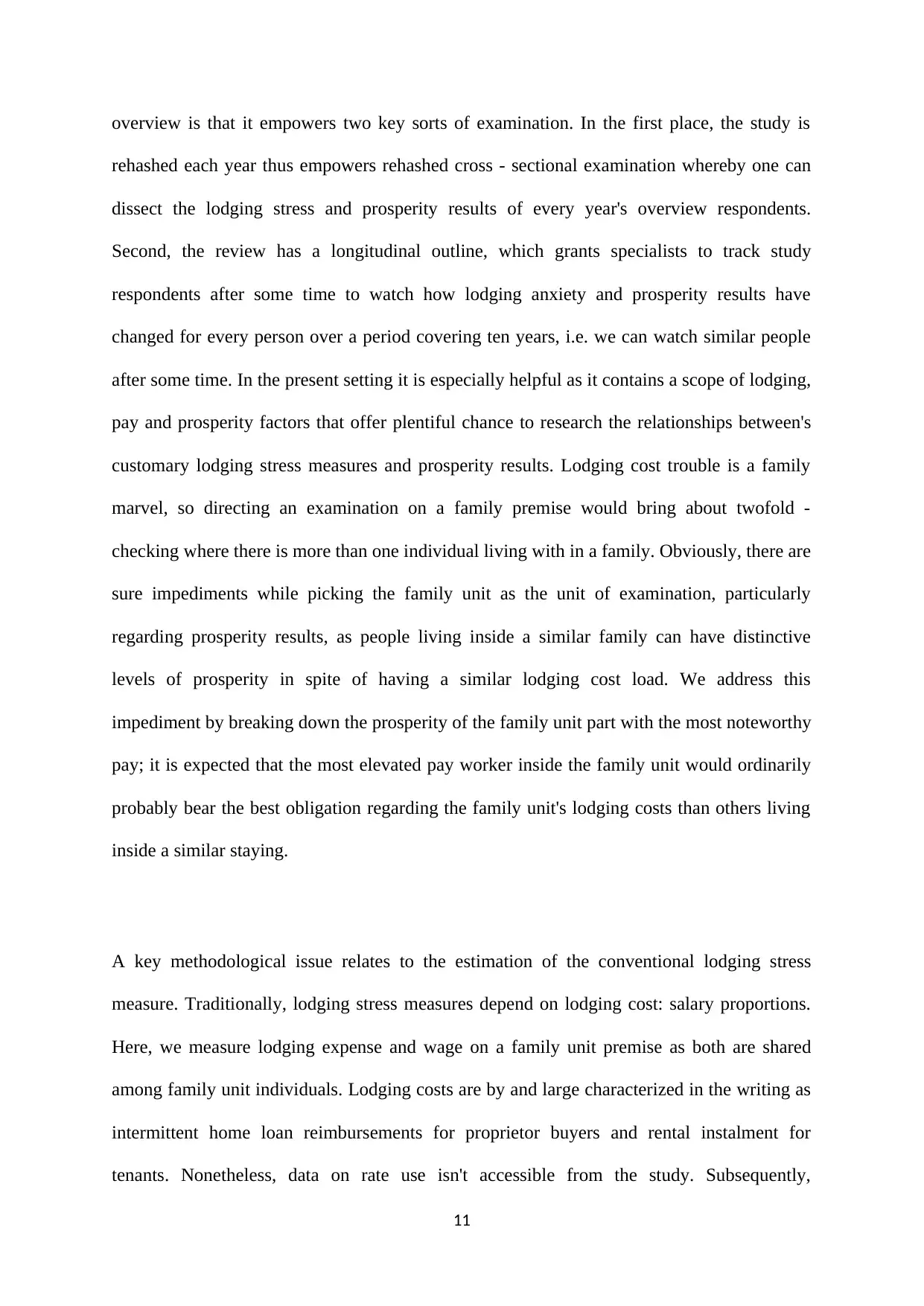

For Data analysis

We use the 2016-17 Survey to dissect connections between customary lodging stress

measures and prosperity results over the investigation time frame. A key element of the

10

property. This is comprised of 58% of the individuals who lease/rent who are extremely

worried about having the capacity to stand to purchase their first home, while 53% of the

individuals who live in a condo are exceptionally worried about having the capacity to bear to

purchase.

Notwithstanding owning a property isn't sufficient to soothe this nervousness with 77% of

property

proprietors worried to some degree about having the capacity to bear the cost of what they

need and requirement for their next home move.

For Data analysis

We use the 2016-17 Survey to dissect connections between customary lodging stress

measures and prosperity results over the investigation time frame. A key element of the

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

overview is that it empowers two key sorts of examination. In the first place, the study is

rehashed each year thus empowers rehashed cross - sectional examination whereby one can

dissect the lodging stress and prosperity results of every year's overview respondents.

Second, the review has a longitudinal outline, which grants specialists to track study

respondents after some time to watch how lodging anxiety and prosperity results have

changed for every person over a period covering ten years, i.e. we can watch similar people

after some time. In the present setting it is especially helpful as it contains a scope of lodging,

pay and prosperity factors that offer plentiful chance to research the relationships between's

customary lodging stress measures and prosperity results. Lodging cost trouble is a family

marvel, so directing an examination on a family premise would bring about twofold -

checking where there is more than one individual living with in a family. Obviously, there are

sure impediments while picking the family unit as the unit of examination, particularly

regarding prosperity results, as people living inside a similar family can have distinctive

levels of prosperity in spite of having a similar lodging cost load. We address this

impediment by breaking down the prosperity of the family unit part with the most noteworthy

pay; it is expected that the most elevated pay worker inside the family unit would ordinarily

probably bear the best obligation regarding the family unit's lodging costs than others living

inside a similar staying.

A key methodological issue relates to the estimation of the conventional lodging stress

measure. Traditionally, lodging stress measures depend on lodging cost: salary proportions.

Here, we measure lodging expense and wage on a family unit premise as both are shared

among family unit individuals. Lodging costs are by and large characterized in the writing as

intermittent home loan reimbursements for proprietor buyers and rental instalment for

tenants. Nonetheless, data on rate use isn't accessible from the study. Subsequently,

11

rehashed each year thus empowers rehashed cross - sectional examination whereby one can

dissect the lodging stress and prosperity results of every year's overview respondents.

Second, the review has a longitudinal outline, which grants specialists to track study

respondents after some time to watch how lodging anxiety and prosperity results have

changed for every person over a period covering ten years, i.e. we can watch similar people

after some time. In the present setting it is especially helpful as it contains a scope of lodging,

pay and prosperity factors that offer plentiful chance to research the relationships between's

customary lodging stress measures and prosperity results. Lodging cost trouble is a family

marvel, so directing an examination on a family premise would bring about twofold -

checking where there is more than one individual living with in a family. Obviously, there are

sure impediments while picking the family unit as the unit of examination, particularly

regarding prosperity results, as people living inside a similar family can have distinctive

levels of prosperity in spite of having a similar lodging cost load. We address this

impediment by breaking down the prosperity of the family unit part with the most noteworthy

pay; it is expected that the most elevated pay worker inside the family unit would ordinarily

probably bear the best obligation regarding the family unit's lodging costs than others living

inside a similar staying.

A key methodological issue relates to the estimation of the conventional lodging stress

measure. Traditionally, lodging stress measures depend on lodging cost: salary proportions.

Here, we measure lodging expense and wage on a family unit premise as both are shared

among family unit individuals. Lodging costs are by and large characterized in the writing as

intermittent home loan reimbursements for proprietor buyers and rental instalment for

tenants. Nonetheless, data on rate use isn't accessible from the study. Subsequently,

11

contemplates that have utilized the study to quantify lodging costs for the most part have a

tendency to avoid rate instalments. In the present examination, because of information

restrictions, we do exclude rate instalments in our lodging cost measure. Nonetheless,

perceive that lodging help adds to lightening qualified families' lodging taken a toll load.

Open lodging rent announced in the review is as of now a net lease measure as open lodging

rents are commonly set at roughly 25 for each penny of the family unit's assessable pay level

up to the market lease of the property inside which the family unit lives. Be that as it may,

private rental inhabitants inside the study are made a request to report how much lease they

pay every week. Some private leaseholders are qualified for Commonwealth Rent Assistance.

3. Findings

How the states look at

Victorians and Tasmanians are well on the way to possess a home inside and out with 22% of

inhabitants being without contract in those states contrasted and 19% for NSW and only 15%

in Queensland. Occupants of the ACT (47%) and WA (41%) are destined to claim their home

with a home loan, contrasted and 33% of inhabitants in NSW. Queensland is the place the

best number of occupants depend on rental settlement with 43% leasing or renting, contrasted

and 31% who claim a property with a home loan.

While living in a remain solitary house overwhelms over the states, flat living is most

noteworthy in NSW at 22%, trailed by Queensland at 17% and Victoria at 15%.

There was a slight inclination towards the view that now is a decent time to offer – especially

in NSW and VIC – instead of purchase which was the more grounded see in WA.

12

tendency to avoid rate instalments. In the present examination, because of information

restrictions, we do exclude rate instalments in our lodging cost measure. Nonetheless,

perceive that lodging help adds to lightening qualified families' lodging taken a toll load.

Open lodging rent announced in the review is as of now a net lease measure as open lodging

rents are commonly set at roughly 25 for each penny of the family unit's assessable pay level

up to the market lease of the property inside which the family unit lives. Be that as it may,

private rental inhabitants inside the study are made a request to report how much lease they

pay every week. Some private leaseholders are qualified for Commonwealth Rent Assistance.

3. Findings

How the states look at

Victorians and Tasmanians are well on the way to possess a home inside and out with 22% of

inhabitants being without contract in those states contrasted and 19% for NSW and only 15%

in Queensland. Occupants of the ACT (47%) and WA (41%) are destined to claim their home

with a home loan, contrasted and 33% of inhabitants in NSW. Queensland is the place the

best number of occupants depend on rental settlement with 43% leasing or renting, contrasted

and 31% who claim a property with a home loan.

While living in a remain solitary house overwhelms over the states, flat living is most

noteworthy in NSW at 22%, trailed by Queensland at 17% and Victoria at 15%.

There was a slight inclination towards the view that now is a decent time to offer – especially

in NSW and VIC – instead of purchase which was the more grounded see in WA.

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 29

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.