Financial Resource Decisions: A Coffee Shop Business Analysis

VerifiedAdded on 2020/02/05

RESOURCE DECISIONS

Paraphrase This Document

INTRODUCTION......................................................................................................................1

TASK 1......................................................................................................................................1

AC 1.1 Various kind of finance sources to mitigate financial requirements....................1

AC 1.2 Implication of different identified financial sources............................................2

AC 1.3 Evaluation of most appropriate finance sources for small business.....................2

TASK 2......................................................................................................................................3

AC 2.1 Cost of identified finance source for the business................................................3

AC 2.2 financial planning: importance.............................................................................3

AC 2.3 Internal and external stakeholders need...............................................................3

AC 2.4 Impact of identified finance sources on firm's account........................................4

TASK 3 .....................................................................................................................................4

AC 3.1 Projected cash budget for coffee shop and its analysis to take strategic decisions4

AC 3.2 Determination of cost per unit and taking price decisions...................................6

AC 3.3 Uses of capital budgeting techniques to take investment decisions.....................6

TASK 4......................................................................................................................................8

AC 4.1 Important financial statements.............................................................................8

AC 4.2 Formats of financial statements............................................................................9

AC 4.3 Analysis of financial statements of Sainsbury...................................................15

CONCLUSION........................................................................................................................15

REFERENCES.........................................................................................................................16

APPENDIX..............................................................................................................................18

Table 1: Projected cash budget for the period of 6 months .......................................................4

Table 2: Computation of cost per unit........................................................................................6

Table 3: Computation of PP and ARR.......................................................................................7

Table 4: Computation of NPV and IRR.....................................................................................7

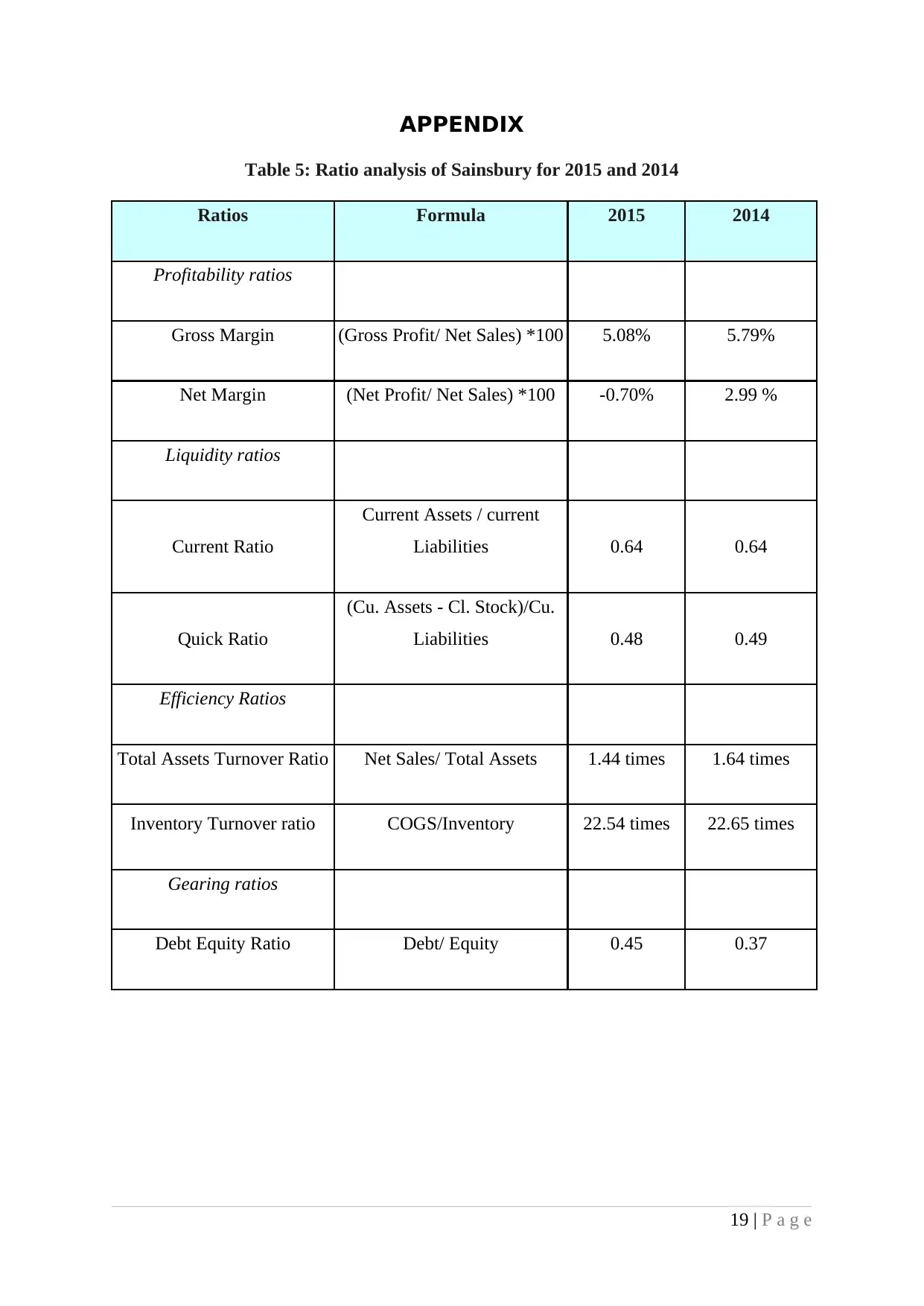

Table 5: Ratio analysis of Sainsbury for 2015 and 2014.........................................................18

Illustration Index

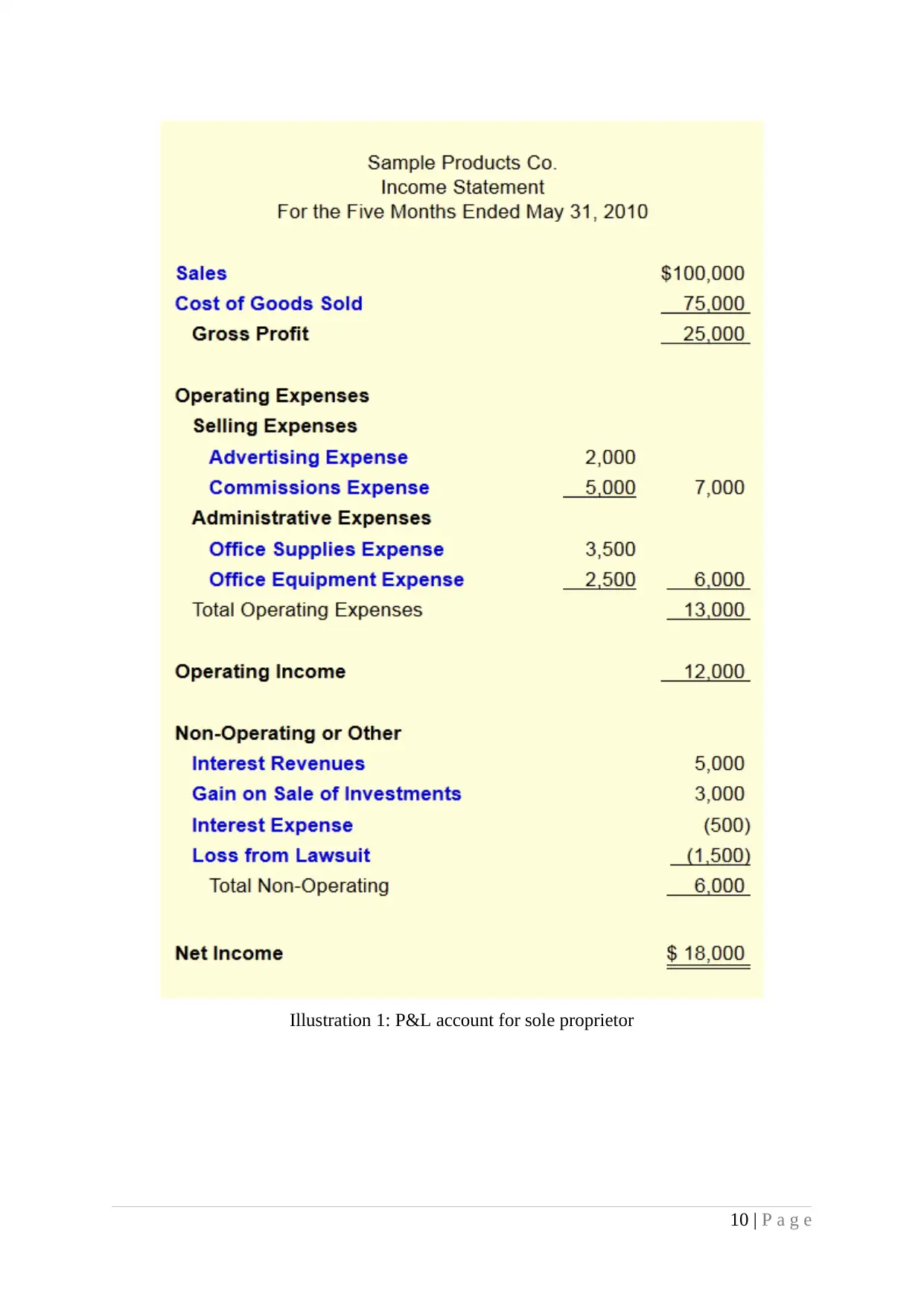

Illustration 1: P&L account for sole proprietor........................................................................10

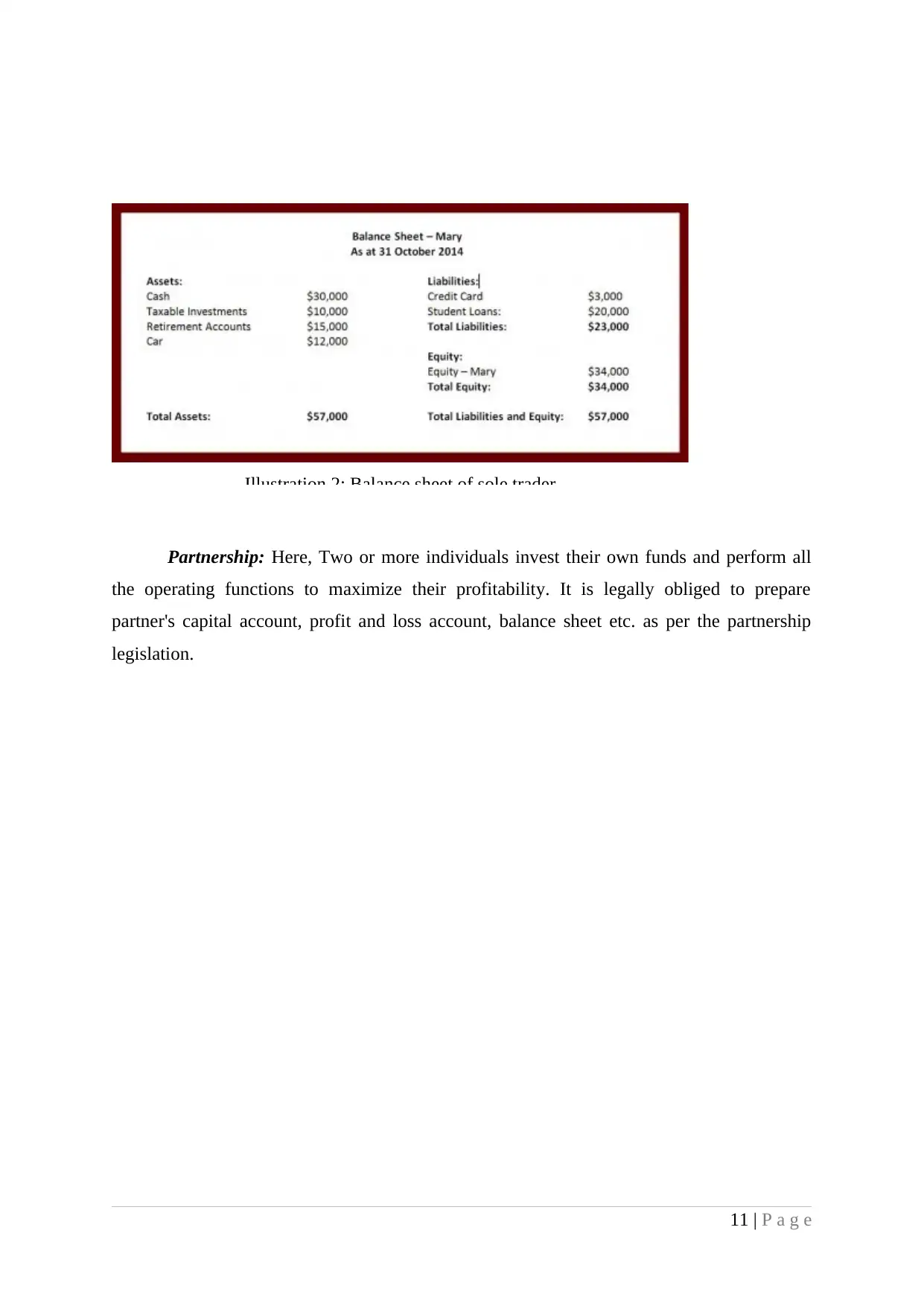

Illustration 2: Balance sheet of sole trader...............................................................................11

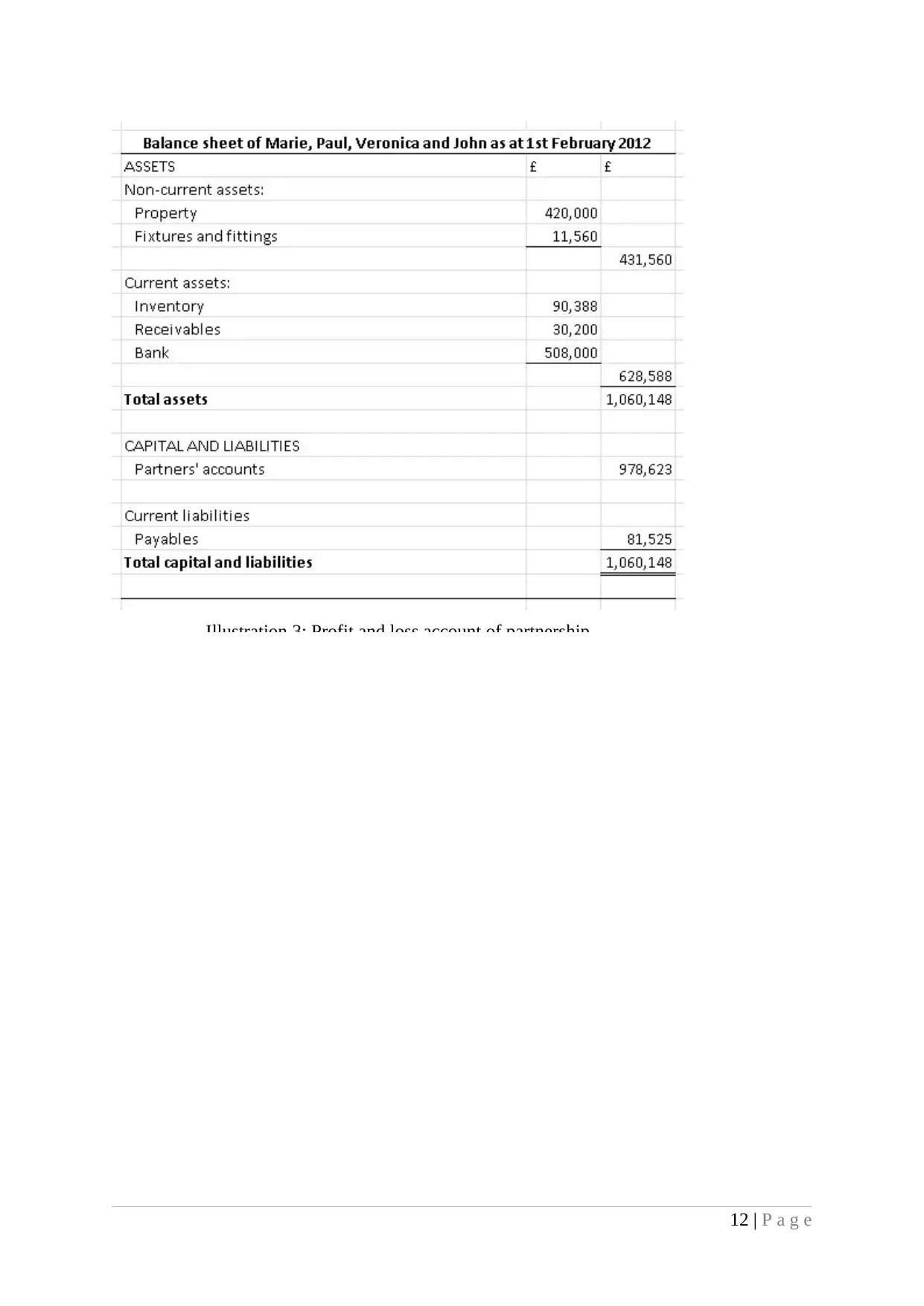

Illustration 3: Profit and loss account of partnership...............................................................11

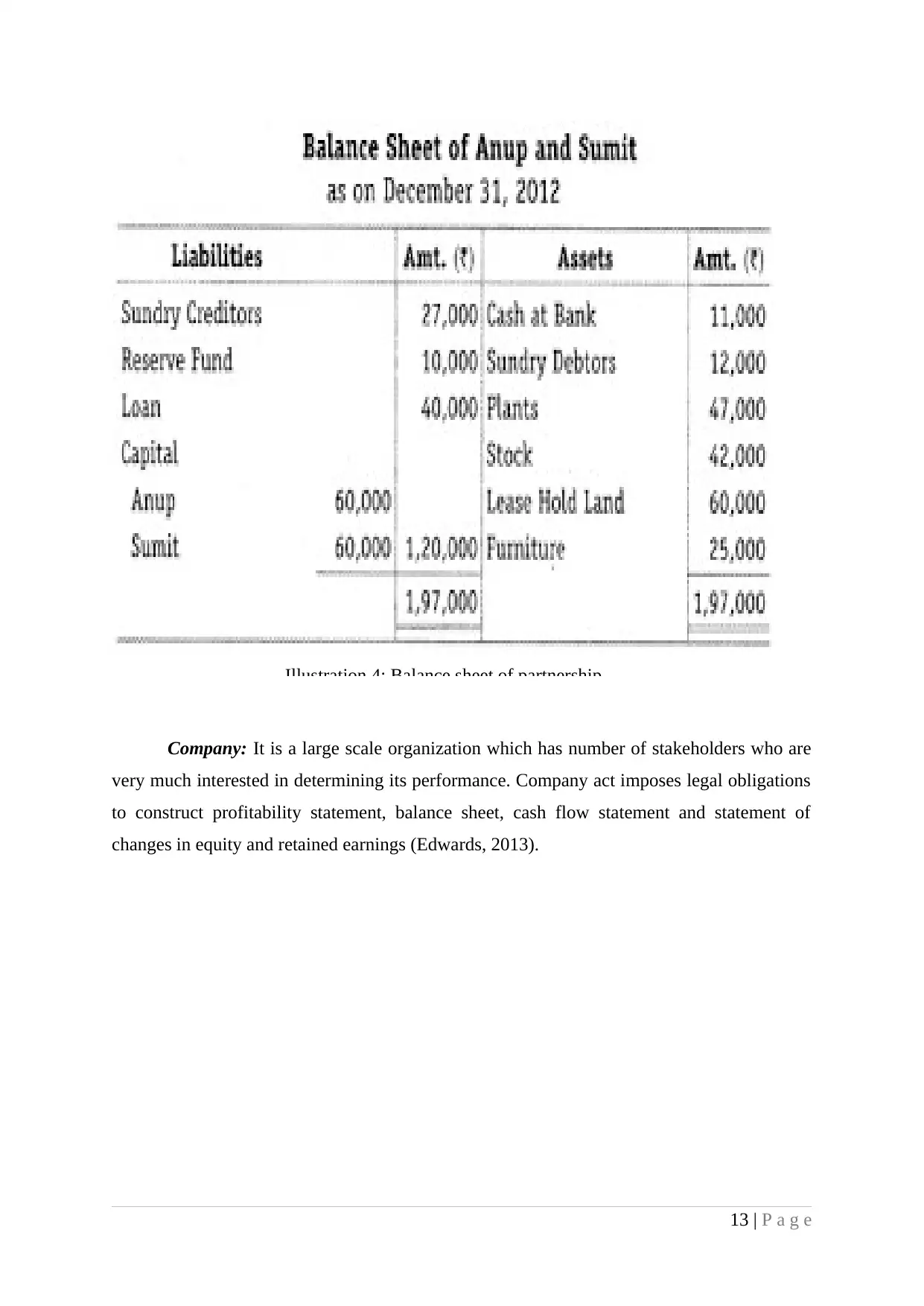

Illustration 4: Balance sheet of partnership..............................................................................12

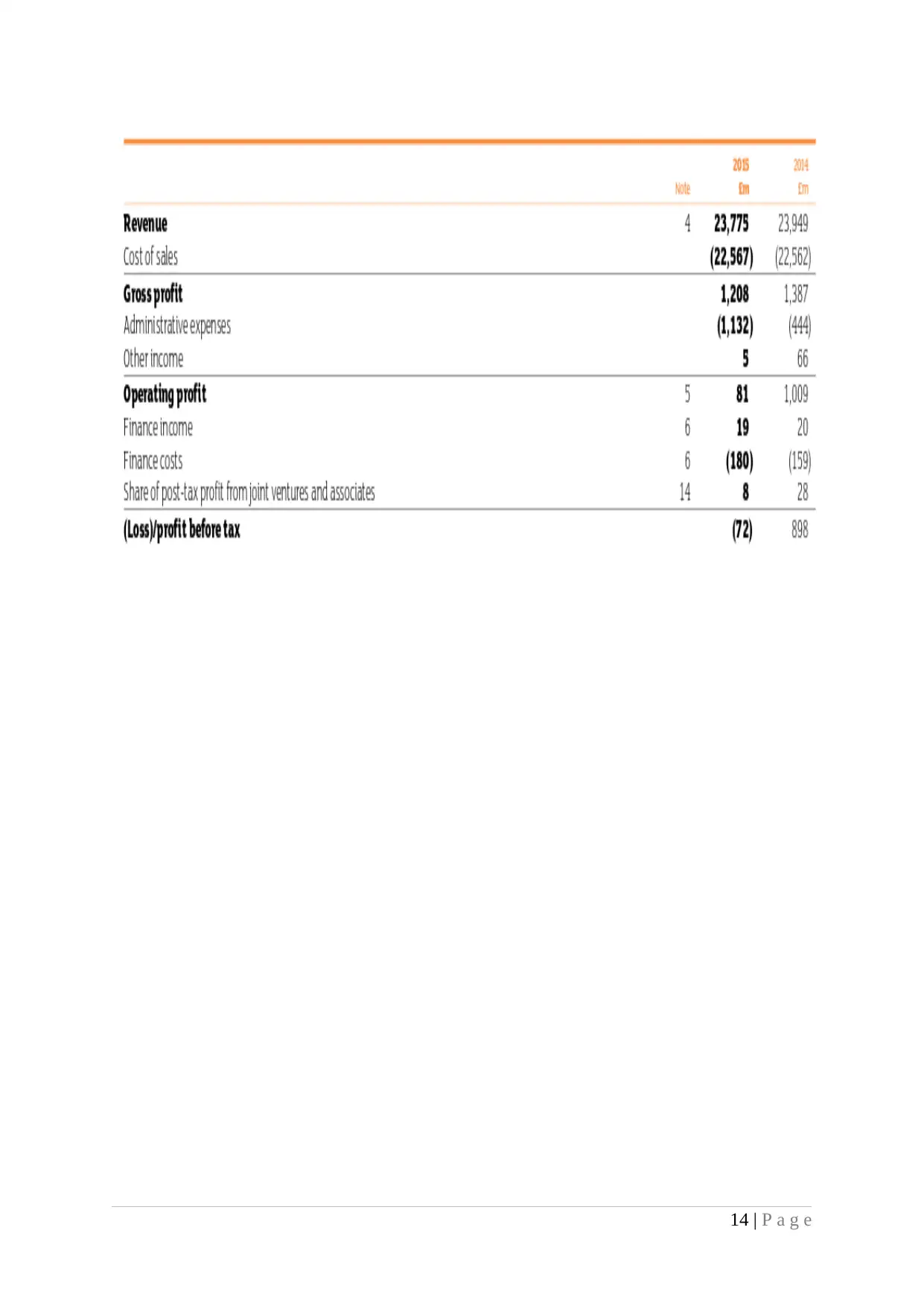

Illustration 5: Sainsbury's profitability statement.....................................................................13

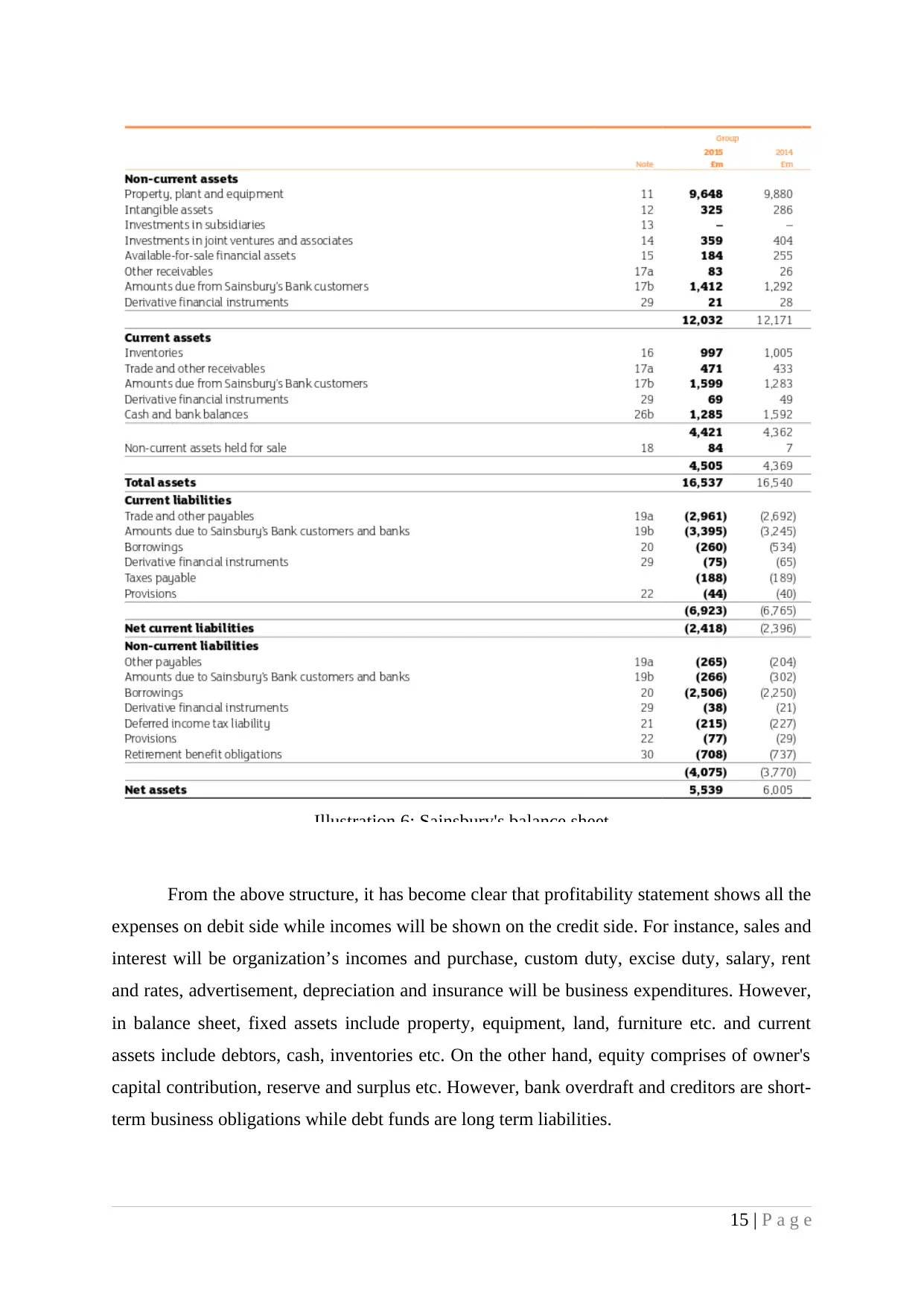

Illustration 6: Sainsbury's balance sheet ..................................................................................14

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Every enterprise needs to collect required funds and manage it efficiently to run

successfully in the market. Financial need can be arisen for its daily routine functions,

purchase equipment, plant and machinery, construct building, business expansion and

investment in new establishment etc. The present project report will determine available

finance sources, its costs and its implications for small coffee shop business to mitigate their

different financial needs. Moreover, it helps to discuss various managerial tools and

techniques that assist corporation to manage their operational functions. The report will make

use of budgetary techniques, unit costing and capital budgeting analysis to take strategic

decisions. In last, it will present various financial statements and its need in the organization.

Along with it, Sainsbury's financial statement will be analysed to assess company's market

performance.

TASK 1

AC 1.1 Various kind of finance sources to mitigate financial requirements

As per the present scenario, UK government makes some strategic planning to

provide funding facilities to the small firms. In the year 2013-2014, it spend £11.4 billion

with small and medium-sized organizations equivalent to the 26% of total government

spending. However, by the year 2020, government has planned that £1 at every £3 of

spending will be for small corporations. Thus, decided ratio of 1:3 will provide great huge

opportunities to the businesses which is employing 250 employees or less. It will make firms

able to meet their individual set targets and objectives to a great manner. A small business

organization, coffee shop is taken here for the present study. Its number of employees is less

than 250 workers hence, it is able to get benefit of financial assistance and funding itself.

For the lease contract, entrepreneur has available funds of £20000 while he needs

£300000 to bid for the contract. Henceforth, additional funds requirement can be resolved

through following sources:

Loans: In UK, bank provides loans to all the small as well as large scale

organizations. Furthermore, government provides guarantee of the loans which will make

coffee shop entrepreneur able to generate funds to a great extent (Demiroglu and James,

2015). They can take loans by fulfilling all the legal formalities with the bank.

Bank overdraft: Along with the loans, banks also provide facility to withdraw some

extent amount than available balance. It helps to eliminate financial urgencies and immediate

1 | P a g e

Paraphrase This Document

source also.

Cash squeezing operations: Firm can negotiate their payments and receive earlier

from their debtors so that they can avail greater funds availability and remove operational

difficulties.

Lease: Coffee shop can take building on the basis of lease financing and mitigate the

need of building acquisition (Wong and Joshi, 2015). The reason behind this is that lease is

the right of using assets without having its ownership at some hiring charges.

AC 1.2 Implication of different identified financial sources

Every source has some kind of legal and operational implications on the coffee shop.

Generating funds from loans will impose obligations to pay timely interest plus instalment.

Further, there is some legal formalities which must be comply with the banks for gathering

funds. For instance, collateral security and guarantee may be demanded by the banks for

securing loans (Allen and Paligorova, 2015). In case of any default in payments, banks have

legal right to collect their funds through dispose of the security. On contrary, its advantage is

that it does not transfer the ownership and interest is considered as deductible expenses for

tax computation. Hence, it reduces tax liabilities and enhances profits. Further, bank charges

interest rate on overdrafts which is comparatively higher than loan interest rate. Moreover, it

cannot be used for long-term financial requirements. However, cash squeezing operation is

not a permanent source of finance. It can be successful if suppliers are ready to provide long-

term credit to the coffee shop. Good liquidity position and profitability make firm able to

extent their credit period. In addition, lease financing imposes obligations to pay periodical

rental charges (Gillispie and Hawkins, 2015). Otherwise, lessor has legal right to get back

their assets again.

AC 1.3 Evaluation of most appropriate finance sources for small business

Through analysing the implications of various identified sources, it can be concluded

that bank loans are comparatively an easier source of finance for establishing the coffee shop.

The reason behind this is that it mitigates financial need for different time duration.

Furthermore, government guarantee and lending schemes increase unsecured loans on the

behalf of government guarantee (SME Access to finance Schemes, n.d.). Thus, it assists coffee

shop to collect adequate funds without providing any security. Further, loan guarantee

schemes, funding for lending schemes and start up loans help to collect funds at cheaper

2 | P a g e

due to considering interest as an allowable expenditure, business tax obligations can be

reduced. This in turn, it will enhance business profits and operational performance. Another

the most important benefit is that it does not diversify business control to the lenders

(Tirumalaiah, Sony and Kumar, 2015). Henceforth, all the controlling rights will be available

in the hand of coffee shop owners.

TASK 2

AC 2.1 Cost of identified finance source for the business

Interest obligations is the cost of borrowed funds thus, coffee shop owner has to

ensure timely payment of their interest charged by the banks. Further, financial risk is existed

with varying the interest rates and amount of loan. For instance, higher amount of loans and

high interest rate will increase business financial obligations and contribute high risk.

Moreover, bank overdraft also imposes cost of interest payment to the organisation (Melzer

and Morgan, 2015). However, the cost of lease financing is rental charges involved some

interest rate which coffee shop owner has to pay timely.

AC 2.2 Financial planning: importance

It is a planning for the collection of required funds and ensuring optimum utilization

of it. Financial manager of Coffee shop has to assess their financial need and generate funds

to support its operations and other capital expenditures. Short-term funds may be needed for

daily functions such as purchase material, pay rent, provide salaries and other payments

(Huang, Leung and Qu, 2015). However, long term funds will be required for purchasing

equipment, building and machinery. Financial planning helps to gather funds from the most

appropriate source. Moreover, it administrates funds efficiently by adopting various tools and

techniques. For instance, budget is a monetary tool that determines potential earnings and

payments to ensure adequate surplus availability in the business. It ensures maximum

utilization of business resources and maximizes revenues (Poynton, Lapan and Marcotte,

2015). Furthermore, it assists managers to control spending through continuous monitoring of

operational activities. It also manages cash inflows and outflows so that firm can maintain

effective cash balance and run successfully.

AC 2.3 Internal and external stakeholders need

There are number of internal stakeholders available in the organization such as

employees and managers, while outsiders who are not an integral part of organization but

3 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

run operations without any difficulties. Thus, they need information about daily functions to

analyse incomes, expenditures and profits. Moreover, they require information about

company's liquidity, managerial efficiency, solvency and cash earning ability to improve

firm’s performance (Ramírez Córcoles, Santos Peñalver and Tejada Ponce, 2011). However,

employees are very much interested in determining business operational result in way of

profits. It is because their personal objectives go towards in same direction of the business

profits. Creditors need information about creditworthiness of the company. They analyse

working capital management so as to take efficient credit decisions. Another, lenders provide

funds at some risk factor henceforth, they need information about firm's capital structure,

profits, cash generating ability and interest bearing capacity.

AC 2.4 Impact of identified finance sources on firm's account

Coffee shop has to prepare their financial statements through presenting all the

business affairs. It has to show its borrowed funds under the liabilities head of balance sheet

with increasing cash in the assets side. However, its cost interest will be shown as finance

cost under the income statement and decrease cash assets. However, bank overdraft is its

liability henceforth, it must be represented in the current liabilities head of B/S and improve

cash assets (Ackermann and Audretsch, 2013). Moreover, interest on overdraft will be shown

as expenses in profitability statement with declined cash balance. Further, rental charges on

lease will be shown as payments in profit and loss account. Moreover, it will be subtracted

from the firm's cash. Under the cash squeezing operation, outstanding creditors will be shown

as current liabilities whilst debtors will be represented as current assets in balance sheet.

Moreover, credit sales will be included in total sales of firm in profitability statement

whereas, credit purchase will be added in cost of goods sold.

TASK 3

AC 3.1 Projected cash budget for coffee shop and its analysis to take strategic decisions

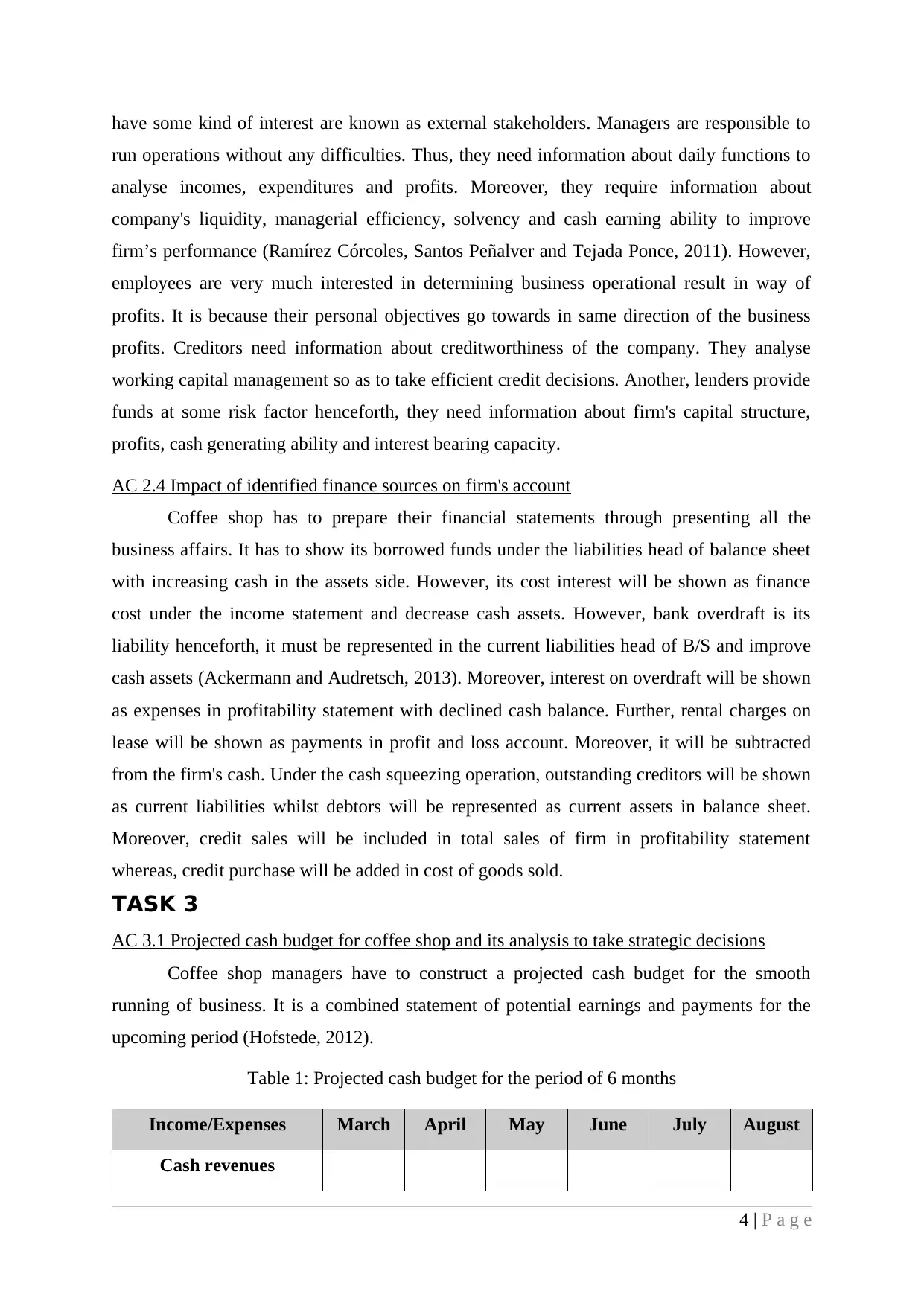

Coffee shop managers have to construct a projected cash budget for the smooth

running of business. It is a combined statement of potential earnings and payments for the

upcoming period (Hofstede, 2012).

Table 1: Projected cash budget for the period of 6 months

Income/Expenses March April May June July August

Cash revenues

4 | P a g e

Paraphrase This Document

Total cash incomes 16000 25000 32000 48000 67000 85000

Purchase of material 7000 12000 18000 32000 54000 60000

building rent 2000 2000 2000 2000 2000 2000

Purchase equipments 3000 2000 2500 4000 3000 4500

staff salaries 1250 1250 1250 1500 1800 2000

Other miscellaneous

expenses (Utilities) 500 500 650 670 750 1000

Total cash expenses 13750 17750 24400 40170 61550 69500

Net cash

flow(Surplus/Deficit) 2250 7250 7600 7830 5450 15500

Initial cash 2000 4250 11500 19100 26930 32380

Ending cash 4250 11500 19100 26930 32380 47880

Presented projected cash budget represents that in all the subsequent months, coffee

shop will have surplus cash available to support its daily functions. It indicates that its

revenues will be enhanced on the continuous basis. Due to new establishment, initial period

revenues will be increased at lower percentage. Thereafter, it will be enhanced at high

percentage. As per the table, coffee shop's revenues have been increased from £16000 to

£85000. However, expenditures will be arisen for purchasing material, salary payment,

purchase equipment, rent and other utility consumption. Due to meet high customer demand,

its purchase payments also have been increasing from £7000 to 6000£. Due to lease contract,

rent does not tend to fluctuate and remain constant to £2000. Moreover, coffee shop has to

purchase many equipment such as coffee wending machine, refrigerator and others. These

expenditures are showing a fluctuating trend over the period. Further, staff salaries and other

utilities also show a little bit increases. This in turn, NCF and closing cash balance have been

reduced from £2250 to £15500 and £4250 to £47880.

Recommendations: On the basis of above analysis, it must be suggested that coffee

shop managers have to frame policies to enhance its cash revenues. It can be done by

constructing strategic marketing policies so that firm will be able to create brand awareness

5 | P a g e

allocation of resources (Einsele, 2013). Along with this, positive cash balance can be

reinvested to earn extra return on it. It will greatly help to maximize revenues and reduce

payments so that firm can avail high cash and do its operations effectively.

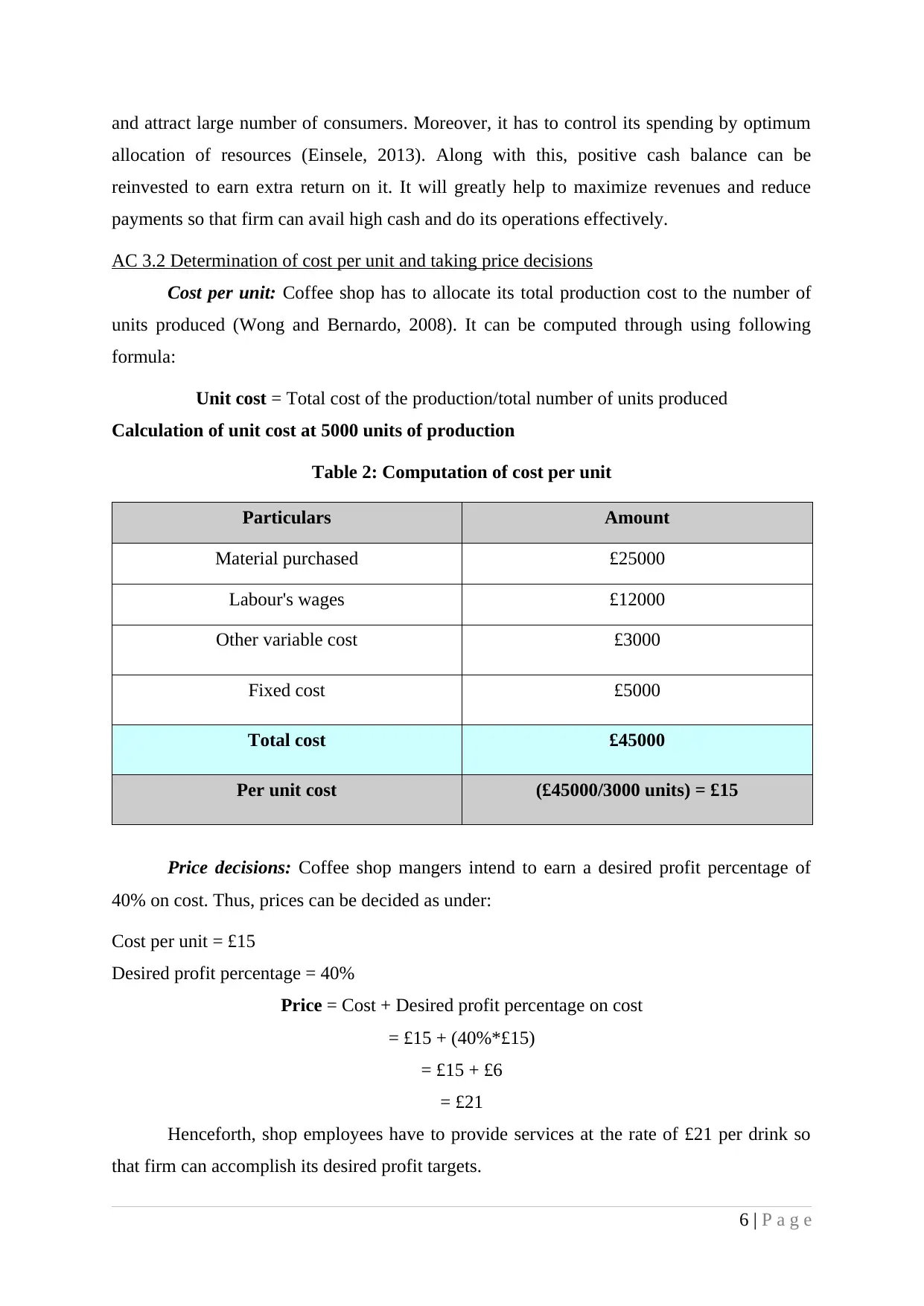

AC 3.2 Determination of cost per unit and taking price decisions

Cost per unit: Coffee shop has to allocate its total production cost to the number of

units produced (Wong and Bernardo, 2008). It can be computed through using following

formula:

Unit cost = Total cost of the production/total number of units produced

Calculation of unit cost at 5000 units of production

Table 2: Computation of cost per unit

Particulars Amount

Material purchased £25000

Labour's wages £12000

Other variable cost £3000

Fixed cost £5000

Total cost £45000

Per unit cost (£45000/3000 units) = £15

Price decisions: Coffee shop mangers intend to earn a desired profit percentage of

40% on cost. Thus, prices can be decided as under:

Cost per unit = £15

Desired profit percentage = 40%

Price = Cost + Desired profit percentage on cost

= £15 + (40%*£15)

= £15 + £6

= £21

Henceforth, shop employees have to provide services at the rate of £21 per drink so

that firm can accomplish its desired profit targets.

6 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

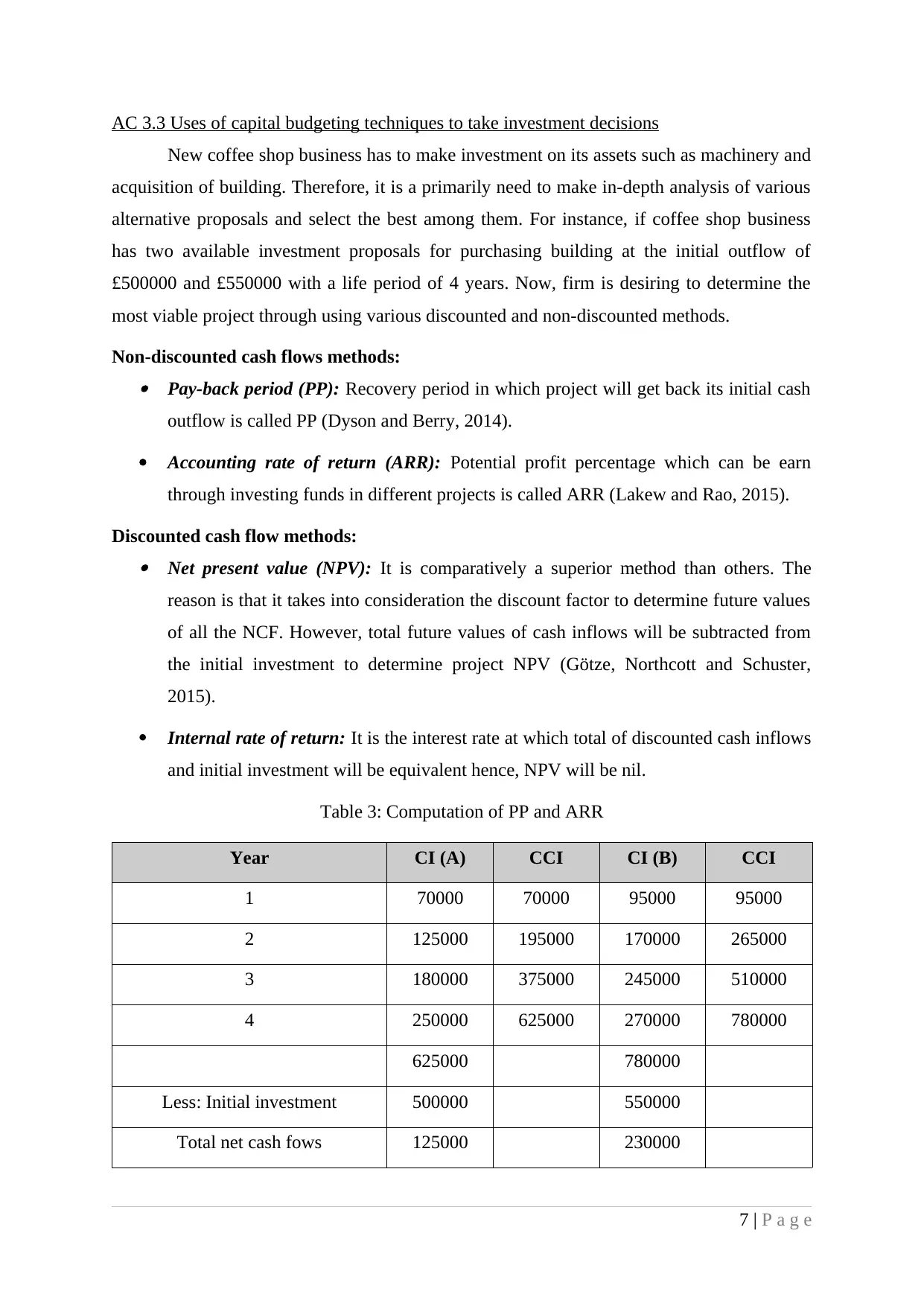

New coffee shop business has to make investment on its assets such as machinery and

acquisition of building. Therefore, it is a primarily need to make in-depth analysis of various

alternative proposals and select the best among them. For instance, if coffee shop business

has two available investment proposals for purchasing building at the initial outflow of

£500000 and £550000 with a life period of 4 years. Now, firm is desiring to determine the

most viable project through using various discounted and non-discounted methods.

Non-discounted cash flows methods: Pay-back period (PP): Recovery period in which project will get back its initial cash

outflow is called PP (Dyson and Berry, 2014).

Accounting rate of return (ARR): Potential profit percentage which can be earn

through investing funds in different projects is called ARR (Lakew and Rao, 2015).

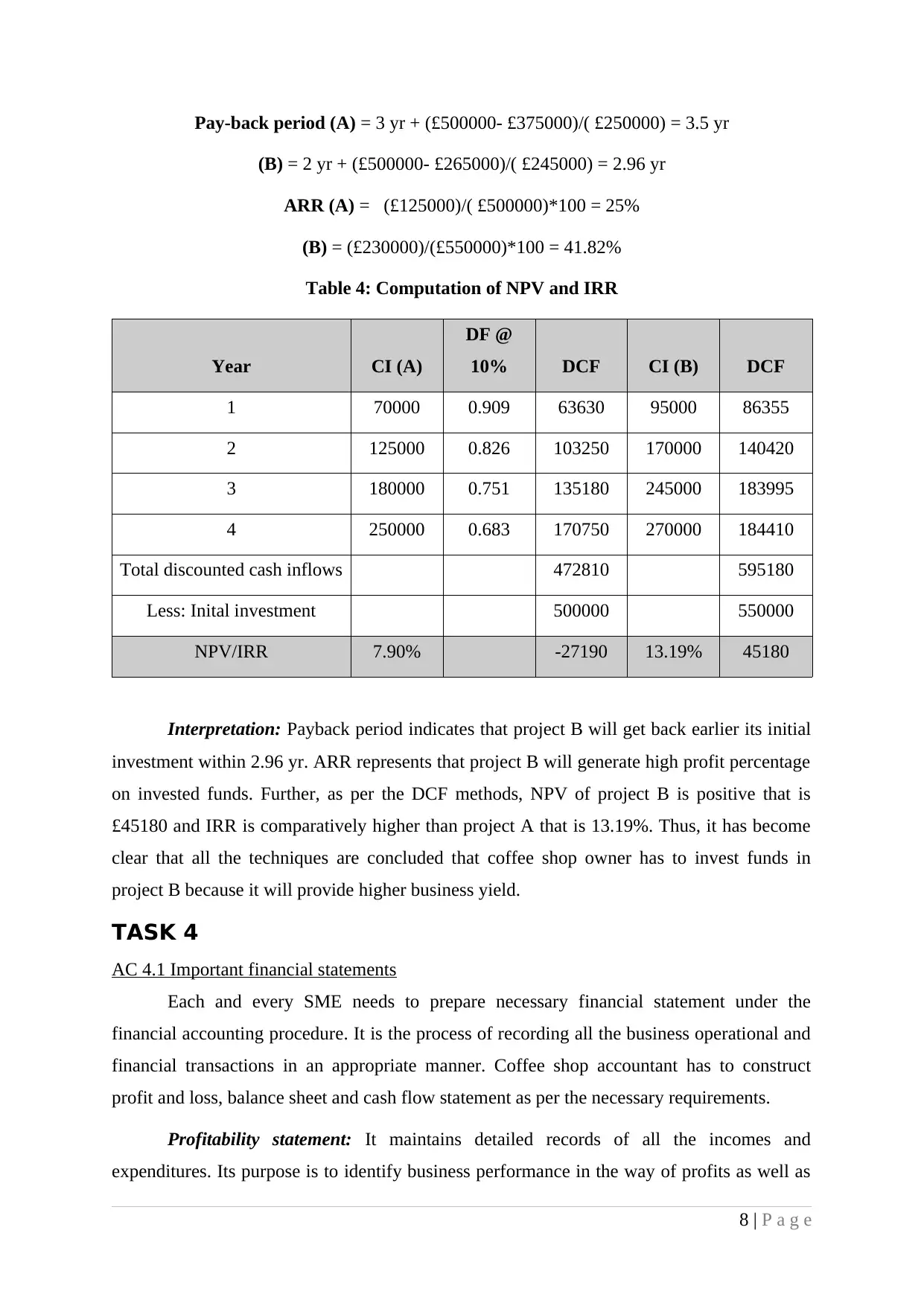

Discounted cash flow methods: Net present value (NPV): It is comparatively a superior method than others. The

reason is that it takes into consideration the discount factor to determine future values

of all the NCF. However, total future values of cash inflows will be subtracted from

the initial investment to determine project NPV (Götze, Northcott and Schuster,

2015).

Internal rate of return: It is the interest rate at which total of discounted cash inflows

and initial investment will be equivalent hence, NPV will be nil.

Table 3: Computation of PP and ARR

Year CI (A) CCI CI (B) CCI

1 70000 70000 95000 95000

2 125000 195000 170000 265000

3 180000 375000 245000 510000

4 250000 625000 270000 780000

625000 780000

Less: Initial investment 500000 550000

Total net cash fows 125000 230000

7 | P a g e

Paraphrase This Document

(B) = 2 yr + (£500000- £265000)/( £245000) = 2.96 yr

ARR (A) = (£125000)/( £500000)*100 = 25%

(B) = (£230000)/(£550000)*100 = 41.82%

Table 4: Computation of NPV and IRR

Year CI (A)

DF @

10% DCF CI (B) DCF

1 70000 0.909 63630 95000 86355

2 125000 0.826 103250 170000 140420

3 180000 0.751 135180 245000 183995

4 250000 0.683 170750 270000 184410

Total discounted cash inflows 472810 595180

Less: Inital investment 500000 550000

NPV/IRR 7.90% -27190 13.19% 45180

Interpretation: Payback period indicates that project B will get back earlier its initial

investment within 2.96 yr. ARR represents that project B will generate high profit percentage

on invested funds. Further, as per the DCF methods, NPV of project B is positive that is

£45180 and IRR is comparatively higher than project A that is 13.19%. Thus, it has become

clear that all the techniques are concluded that coffee shop owner has to invest funds in

project B because it will provide higher business yield.

TASK 4

AC 4.1 Important financial statements

Each and every SME needs to prepare necessary financial statement under the

financial accounting procedure. It is the process of recording all the business operational and

financial transactions in an appropriate manner. Coffee shop accountant has to construct

profit and loss, balance sheet and cash flow statement as per the necessary requirements.

Profitability statement: It maintains detailed records of all the incomes and

expenditures. Its purpose is to identify business performance in the way of profits as well as

8 | P a g e

profits whilst higher payments than revenues will imply business loss.

Statement of financial position: Balance sheet is the statement of financial position

which purpose is to determine financial strength or weakness of the organization. It combines

all the firm’s current as well as non-current assets. On contrary, liability side indicates all the

short-term and long term liabilities. Furthermore, it represents owner's invested funds in the

business.

Statement of cash flows: It evaluates all the business cash inflows and outflows

through operational financing and investing activities. Cash is the most important liquid asset

of the organization henceforth, it is necessary to determine cash changes over the period.

Thus, this statement will be prepared to measure cash changes between two balance sheet

dates (Deegan, 2013). It provides assistance to manage cash flow capacity of the

organization.

AC 4.2 Formats of financial statements

Sole trader: Under this form of organization, all the investments have been made by a

single entrepreneur. He performs all the operating functions and manages it effectively with

an objective of profit maximization. He does not oblige to prepare financial statements but

still in order to determine firm's performance, income statement and balance sheet need to be

prepared by themselves.

9 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Illustration 1: P&L account for sole proprietor

Paraphrase This Document

Partnership: Here, Two or more individuals invest their own funds and perform all

the operating functions to maximize their profitability. It is legally obliged to prepare

partner's capital account, profit and loss account, balance sheet etc. as per the partnership

legislation.

11 | P a g e

12 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Company: It is a large scale organization which has number of stakeholders who are

very much interested in determining its performance. Company act imposes legal obligations

to construct profitability statement, balance sheet, cash flow statement and statement of

changes in equity and retained earnings (Edwards, 2013).

13 | P a g e

Paraphrase This Document

From the above structure, it has become clear that profitability statement shows all the

expenses on debit side while incomes will be shown on the credit side. For instance, sales and

interest will be organization’s incomes and purchase, custom duty, excise duty, salary, rent

and rates, advertisement, depreciation and insurance will be business expenditures. However,

in balance sheet, fixed assets include property, equipment, land, furniture etc. and current

assets include debtors, cash, inventories etc. On the other hand, equity comprises of owner's

capital contribution, reserve and surplus etc. However, bank overdraft and creditors are short-

term business obligations while debt funds are long term liabilities.

15 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Profitability ratios indicate that Sainsbury's performance have been declining over the

period. It is because in 2015, its GM and NM have been reduced to 5.08% and -0.70%.

Declined revenues, high purchase cost and high operating expenditures are the reasons for it.

On contrary, liquidity position has been maintained by the firm because CR remains

unchanged from 0.64 and QR shows a little bit decrease by 0.01 only. Thus, it can be

interpreted that Sainsbury managers have to improve their liquidity position so that firm will

be able to pay off their short-term liabilities effectively. Further, total assets turnover ratio

and inventory turnover ratio have been reduced to 1.44 times and 22.54 times (Sainsbury's

Annual report, 2015). It implies that firm's assets using ability has been reduced hence,

management has to frame policies to improve business efficiency. Furthermore, D/E ratio has

been risen to 0.45 which is imposing greater risk. On the other hand, idle ratio is 0.5:1 thus, it

can be said that Sainsbury is trying to maintain their solvency position to discharge their

long-term obligations effectively. Thus, it can be suggested that by maximizing sales revenue

and controlling cost, Sainsbury can greatly enhance its market performance.

CONCLUSION

Presented project report has been concluded that strategic financial planning makes

firms able to acquire appropriate collection and efficient management of funds. Furthermore,

the report has also been concluded that budgetary tools provide great assistance to ensure

optimum utilization of business resources. However, qualified investment decisions can be

taken through using investment appraisal techniques. In addition to it, ratio analysis is the

best way to analyse company's performance.

16 | P a g e

Paraphrase This Document

Books and Journals

Ackermann, S. J. and Audretsch, D. B., 2013. The economics of small firms: A European

challenge. Springer Science & Business Media.

Allen, J. and Paligorova, T., 2015. Bank loans for private and public firms in a liquidity

crunch. Journal of Financial Stability. 18. pp.106-116.

Deegan, C., 2013. Financial accounting theory. McGraw-Hill Education Australia.

Demiroglu, C. and James, C., 2015. Bank loans and troubled debt restructurings. Journal of

Financial Economics. 118(1). pp.192-210.

Dyson, R. G. and Berry, R. H., 2014. Capital investment appraisal. Developments in

Operational Research: Frontiers of Operational Research and Applied Systems

Analysis. p.59.

Edwards, J. R., 2013. A History of Financial Accounting (RLE Accounting). Routledge.

Einsele, G., 2013. Sedimentary basins: evolution, facies, and sediment budget. Springer

Science & Business Media.

Gillispie, R. J. and Hawkins, J. D., 2015. Operating Leases. Equipment Leasing. 2.

Götze, U., Northcott, D. and Schuster, P., 2015. Discounted Cash Flow Methods. In

Investment Appraisal. Springer Berlin Heidelberg. pp.47-83.

Hofstede, G.H. ed., 2012. The game of budget control. Routledge.

Huang, D. J., Leung, C. K. and Qu, B., 2015. Do bank loans and local amenities explain

Chinese urban house prices?. China Economic Review. 34. pp.19-38.

Lakew, D. M. and Rao, D. P., 2015. Financial Appraisal of Long Term Investment Projects:

Evidence from Ethiopia. Asian Journal of Research in Business Economics and

Management. 5(2). pp.1-16.

Melzer, B. T. and Morgan, D. P., 2015. Competition in a consumer loan market: Payday

loans and overdraft credit. Journal of Financial Intermediation. 24(1). pp.25-44.

Poynton, T. A., Lapan, R. T. and Marcotte, A. M., 2015. Financial Planning Strategies of

High School Seniors: Removing Barriers to Career Success. The Career Development

Quarterly. 63(1). pp.57-73.

Ramírez Córcoles, Y., Santos Peñalver, J. F. and Tejada Ponce, Á., 2011. Intellectual capital

in Spanish public universities: stakeholders' information needs. Journal of Intellectual

capital. 12(3). pp.356-376.

17 | P a g e

Sons.

Tirumalaiah, K., Sony, W. R. and Kumar, V. S., 2015. A study on source of finance as a

motivational factors in purchasing tractors. South Asian Journal of Marketing &

Management Research. 5(5). pp.27-35.

Williams, M. L., 2016. Bank overdraft pricing and myopic consumers. Economics Letters.

139. pp.84-87.

Wong, C. K. and Bernardo, R., 2008. Genomewide selection in oil palm: increasing selection

gain per unit time and cost with small populations. Theoretical and Applied Genetics.

116(6). pp.815-824.

Wong, K. and Joshi, M., 2015. The Impact of Lease Capitalisation on Financial Statements

and Key Ratios: Evidence from Australia. Australasian Accounting, Business and

Finance Journal. 9(3). pp.27-44.

Online

Sainsbury's Annual report, 2015. [Pdf]. Available through:

<https://www.j-sainsbury.co.uk/media/2475907/sainsburys_ar_2015.pdf>. [Accessed

on 25th February, 2016].

SME Access to finance Schemes, n.d. [Pdf]. Available through:

<https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/

192618/bis-13-p176b-sme-access-to-finance-measures.pdf>. [Accessed on 25th

February, 2016].

18 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Table 5: Ratio analysis of Sainsbury for 2015 and 2014

Ratios Formula 2015 2014

Profitability ratios

Gross Margin (Gross Profit/ Net Sales) *100 5.08% 5.79%

Net Margin (Net Profit/ Net Sales) *100 -0.70% 2.99 %

Liquidity ratios

Current Ratio

Current Assets / current

Liabilities 0.64 0.64

Quick Ratio

(Cu. Assets - Cl. Stock)/Cu.

Liabilities 0.48 0.49

Efficiency Ratios

Total Assets Turnover Ratio Net Sales/ Total Assets 1.44 times 1.64 times

Inventory Turnover ratio COGS/Inventory 22.54 times 22.65 times

Gearing ratios

Debt Equity Ratio Debt/ Equity 0.45 0.37

19 | P a g e

Paraphrase This Document

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

© 2024 | Zucol Services PVT LTD | All rights reserved.