Analyzing Global Trade: Impact of China's Steel Production Downturn

VerifiedAdded on 2020/04/15

|13

|2112

|119

Report

AI Summary

This report examines the implications of a downturn in steel production in China on global trade. It explores China's economic situation, focusing on its shift towards internal consumption and the impact on global commodity prices, particularly iron ore. The report analyzes China's steel production trends, export and import data, and the effect of currency devaluation. It also discusses the country's iron ore consumption and its position as a major importer, including the impact of government policies on the steel and iron ore markets. The analysis covers the period from 2015 to 2017, highlighting the decline in steel production, the recovery in demand, and the impact on China's export share in steel production. The report concludes by emphasizing the link between China's economic growth, its steel industry, and the future demand for iron ore.

Running head: IMPLICATIONS OF GLOBAL TRADE OF A DOWNTURN IN STEEL

PRODUCTION IN CHINA

Implications for global trade of a downturn in steel production in China

Name of the Student:

Name of the University:

Author Note:

PRODUCTION IN CHINA

Implications for global trade of a downturn in steel production in China

Name of the Student:

Name of the University:

Author Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2IMPLICATIONS OF GLOBAL TRADE OF A DOWNTURN IN STEEL PRODUCTION IN

CHINA

Contents

Introduction......................................................................................................................................3

Discussion........................................................................................................................................3

China’s economic downturn and steel production.......................................................................3

Export and import of iron ore and its economic downturn..........................................................9

Conclusion.....................................................................................................................................11

References......................................................................................................................................12

CHINA

Contents

Introduction......................................................................................................................................3

Discussion........................................................................................................................................3

China’s economic downturn and steel production.......................................................................3

Export and import of iron ore and its economic downturn..........................................................9

Conclusion.....................................................................................................................................11

References......................................................................................................................................12

3IMPLICATIONS OF GLOBAL TRADE OF A DOWNTURN IN STEEL PRODUCTION IN

CHINA

Introduction

The current economic situation have focused on internal consumption rather than the

exports of the country and it ahs consequences beyond the borders. This is because China’s

economy is more integrated with the economy of the world in terms of trade and investments.

China’s import of resources has contributed to price boom of the global commodities. The

current economic situation has intended to focus on the internal consumption of goods than the

exports of manufactured goods. The reforms implied that the import of resources were very less

and China has showed a growing interest in the import of steel, copper, coal and other mineral

products which are important for the urbanization of the country. This is considered to be the

major priority for China and the higher authorities are trying to bridge the gap between the rural

and urban areas in the country through inland infrastructure development projects. These projects

require a large quantity of metal and mineral products. Moreover, the modernization of railway

system in China also requires a considerable amount of steel. This paper will highlight the

implications of global economic downturn in steel production in China. It will also discuss the

steel and iron ore resources in China. In order to secure the mineral products to green

technologies for long-term period, China will import significant quantities of rare earth from

other countries. Moreover, the domestic supplier helps in making the country one of the largest

reserve of mineral resources in the world (Roberts et al. 2016).

CHINA

Introduction

The current economic situation have focused on internal consumption rather than the

exports of the country and it ahs consequences beyond the borders. This is because China’s

economy is more integrated with the economy of the world in terms of trade and investments.

China’s import of resources has contributed to price boom of the global commodities. The

current economic situation has intended to focus on the internal consumption of goods than the

exports of manufactured goods. The reforms implied that the import of resources were very less

and China has showed a growing interest in the import of steel, copper, coal and other mineral

products which are important for the urbanization of the country. This is considered to be the

major priority for China and the higher authorities are trying to bridge the gap between the rural

and urban areas in the country through inland infrastructure development projects. These projects

require a large quantity of metal and mineral products. Moreover, the modernization of railway

system in China also requires a considerable amount of steel. This paper will highlight the

implications of global economic downturn in steel production in China. It will also discuss the

steel and iron ore resources in China. In order to secure the mineral products to green

technologies for long-term period, China will import significant quantities of rare earth from

other countries. Moreover, the domestic supplier helps in making the country one of the largest

reserve of mineral resources in the world (Roberts et al. 2016).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4IMPLICATIONS OF GLOBAL TRADE OF A DOWNTURN IN STEEL PRODUCTION IN

CHINA

Discussion

China’s economic downturn and steel production

China has devalued the currency so that it can boost its exports and this is considered as

the backbone of the economy. This devaluation is considered as strategic and it contributed to

reactivate China’s export and the economic growth of the country. Moreover, economic growth

is 10 % p.a. for the last three decades. The steel market conditions are improving in many

regions in China, however the crisis is continuing in some regions. Growth in the production of

steel is declining significantly over the past three decades. It has shown a sharp decline during

the first months of 2016, however the decline is diminishing after March, 2016. The prices of

steel are responding positively to gradual upturn in the production during the first half of 2016

although there was abundance supply (Oecd.org 2017).

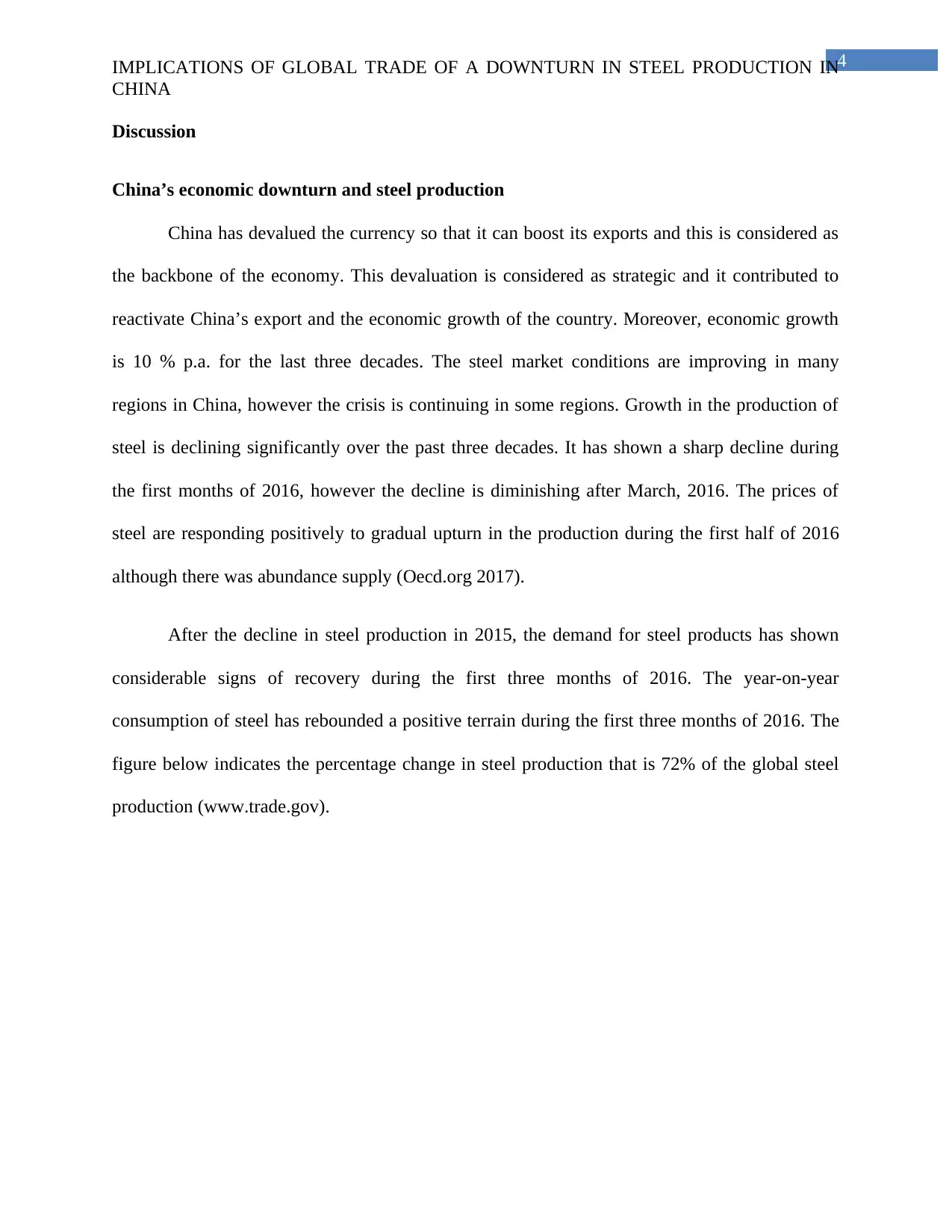

After the decline in steel production in 2015, the demand for steel products has shown

considerable signs of recovery during the first three months of 2016. The year-on-year

consumption of steel has rebounded a positive terrain during the first three months of 2016. The

figure below indicates the percentage change in steel production that is 72% of the global steel

production (www.trade.gov).

CHINA

Discussion

China’s economic downturn and steel production

China has devalued the currency so that it can boost its exports and this is considered as

the backbone of the economy. This devaluation is considered as strategic and it contributed to

reactivate China’s export and the economic growth of the country. Moreover, economic growth

is 10 % p.a. for the last three decades. The steel market conditions are improving in many

regions in China, however the crisis is continuing in some regions. Growth in the production of

steel is declining significantly over the past three decades. It has shown a sharp decline during

the first months of 2016, however the decline is diminishing after March, 2016. The prices of

steel are responding positively to gradual upturn in the production during the first half of 2016

although there was abundance supply (Oecd.org 2017).

After the decline in steel production in 2015, the demand for steel products has shown

considerable signs of recovery during the first three months of 2016. The year-on-year

consumption of steel has rebounded a positive terrain during the first three months of 2016. The

figure below indicates the percentage change in steel production that is 72% of the global steel

production (www.trade.gov).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

5IMPLICATIONS OF GLOBAL TRADE OF A DOWNTURN IN STEEL PRODUCTION IN

CHINA

Figure-Consumption of steel products in some major economies(Year wise % change)

Source-www.oecd.org

There has been modest upturn in the demand of steel that is observed from the beginning

of 2016 in the major steel consuming countries. It has been found that the steel upturn in China

has highlighted temporary measures to boost the aggregate demand in the real estate market and

various steel inventories. The data that has been collected from National Bureau of Statistics has

indicated that the value of sale of steel has been declining after June 2016. It can be said that the

ongoing rebalancing process in the economy affects Chinese demand for steel. This has found

decoupled China’s demand for steel and thus affected the GDP growth in China. The table below

will highlight export development during 2016 in China (Coccia 2014).

Exporter 2015 2016 Change(2016/2015) Change in

%(2016-2015)

China 110,928 109,852 -1,076 -1.0

CHINA

Figure-Consumption of steel products in some major economies(Year wise % change)

Source-www.oecd.org

There has been modest upturn in the demand of steel that is observed from the beginning

of 2016 in the major steel consuming countries. It has been found that the steel upturn in China

has highlighted temporary measures to boost the aggregate demand in the real estate market and

various steel inventories. The data that has been collected from National Bureau of Statistics has

indicated that the value of sale of steel has been declining after June 2016. It can be said that the

ongoing rebalancing process in the economy affects Chinese demand for steel. This has found

decoupled China’s demand for steel and thus affected the GDP growth in China. The table below

will highlight export development during 2016 in China (Coccia 2014).

Exporter 2015 2016 Change(2016/2015) Change in

%(2016-2015)

China 110,928 109,852 -1,076 -1.0

6IMPLICATIONS OF GLOBAL TRADE OF A DOWNTURN IN STEEL PRODUCTION IN

CHINA

Fig-Export development in China

Source-www.oecd.org

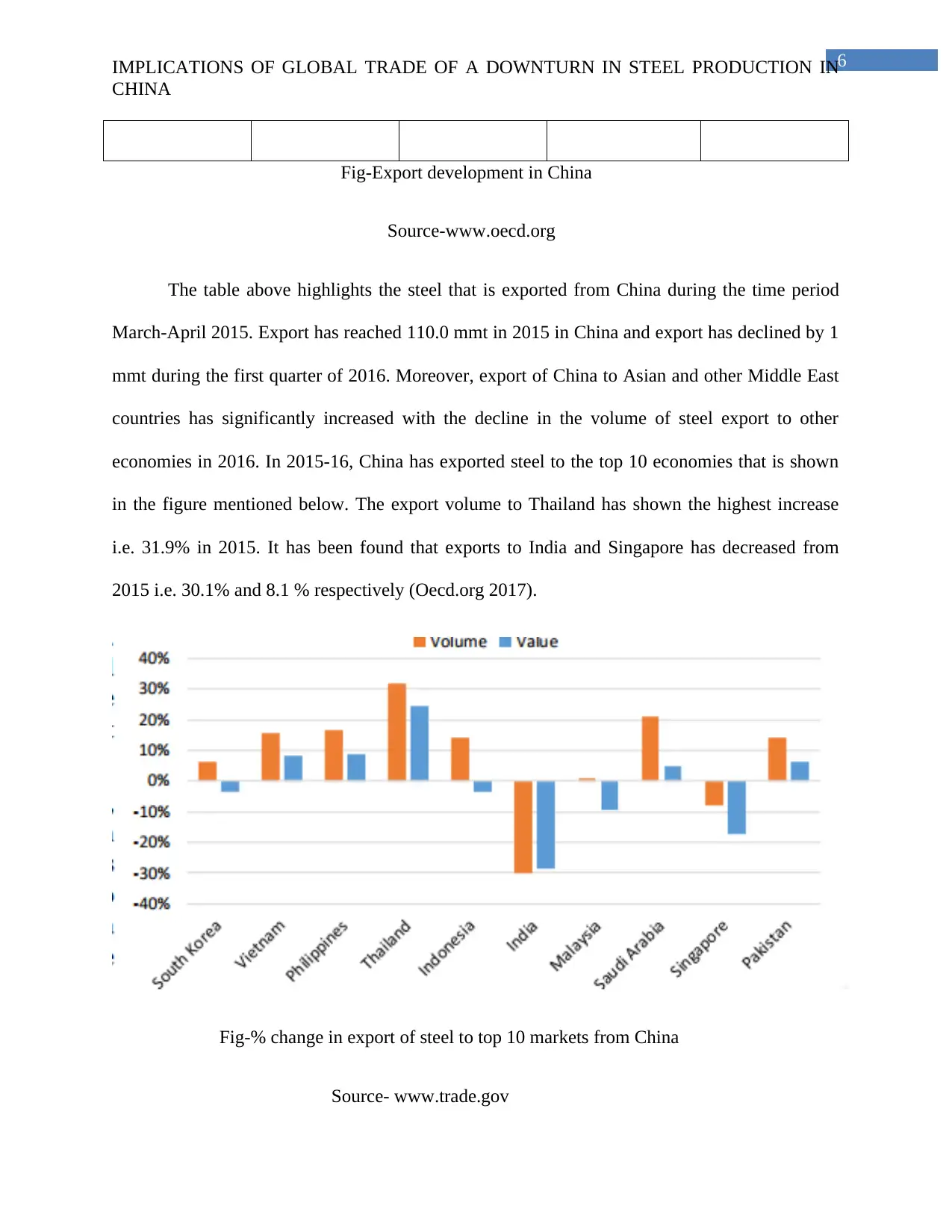

The table above highlights the steel that is exported from China during the time period

March-April 2015. Export has reached 110.0 mmt in 2015 in China and export has declined by 1

mmt during the first quarter of 2016. Moreover, export of China to Asian and other Middle East

countries has significantly increased with the decline in the volume of steel export to other

economies in 2016. In 2015-16, China has exported steel to the top 10 economies that is shown

in the figure mentioned below. The export volume to Thailand has shown the highest increase

i.e. 31.9% in 2015. It has been found that exports to India and Singapore has decreased from

2015 i.e. 30.1% and 8.1 % respectively (Oecd.org 2017).

Fig-% change in export of steel to top 10 markets from China

Source- www.trade.gov

CHINA

Fig-Export development in China

Source-www.oecd.org

The table above highlights the steel that is exported from China during the time period

March-April 2015. Export has reached 110.0 mmt in 2015 in China and export has declined by 1

mmt during the first quarter of 2016. Moreover, export of China to Asian and other Middle East

countries has significantly increased with the decline in the volume of steel export to other

economies in 2016. In 2015-16, China has exported steel to the top 10 economies that is shown

in the figure mentioned below. The export volume to Thailand has shown the highest increase

i.e. 31.9% in 2015. It has been found that exports to India and Singapore has decreased from

2015 i.e. 30.1% and 8.1 % respectively (Oecd.org 2017).

Fig-% change in export of steel to top 10 markets from China

Source- www.trade.gov

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

7IMPLICATIONS OF GLOBAL TRADE OF A DOWNTURN IN STEEL PRODUCTION IN

CHINA

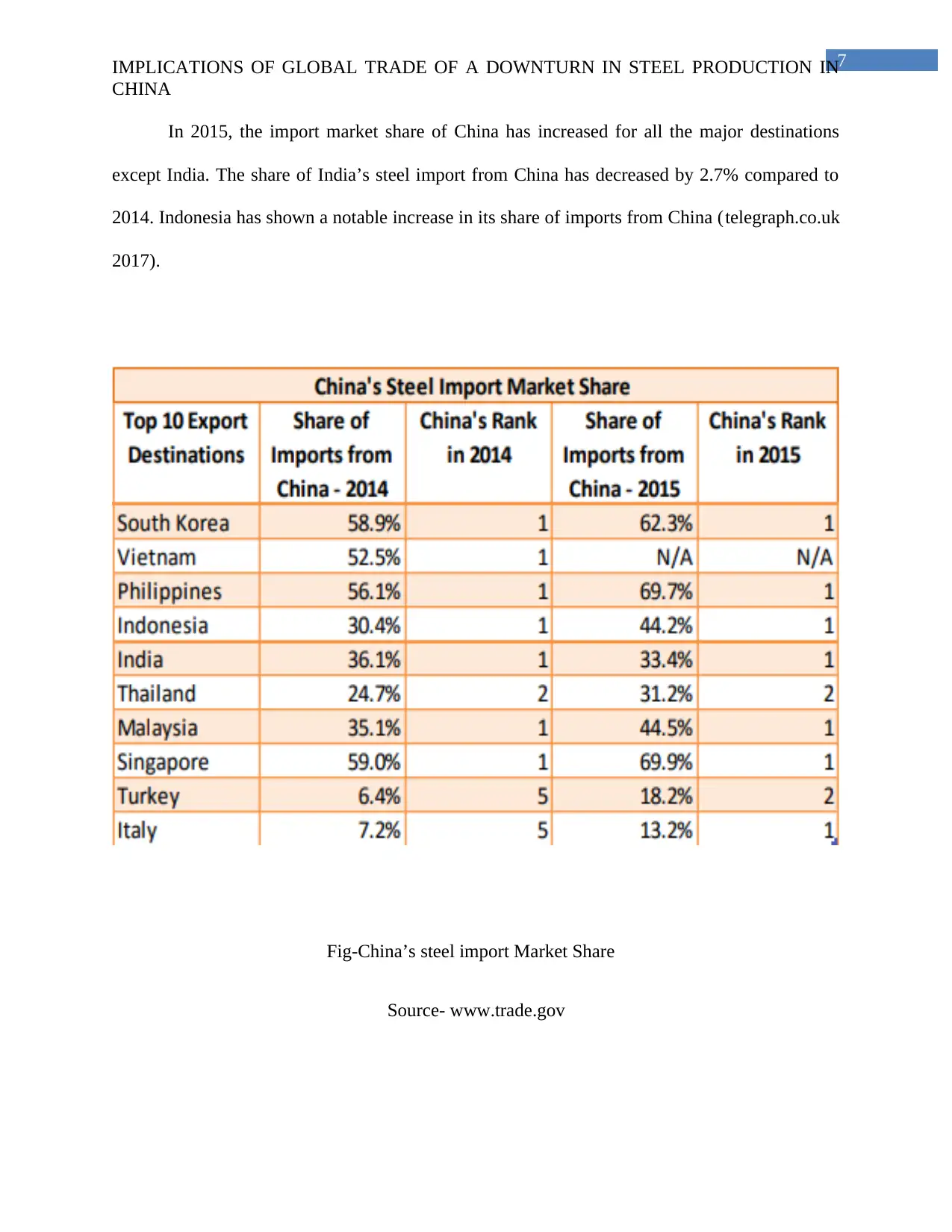

In 2015, the import market share of China has increased for all the major destinations

except India. The share of India’s steel import from China has decreased by 2.7% compared to

2014. Indonesia has shown a notable increase in its share of imports from China (telegraph.co.uk

2017).

Fig-China’s steel import Market Share

Source- www.trade.gov

CHINA

In 2015, the import market share of China has increased for all the major destinations

except India. The share of India’s steel import from China has decreased by 2.7% compared to

2014. Indonesia has shown a notable increase in its share of imports from China (telegraph.co.uk

2017).

Fig-China’s steel import Market Share

Source- www.trade.gov

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8IMPLICATIONS OF GLOBAL TRADE OF A DOWNTURN IN STEEL PRODUCTION IN

CHINA

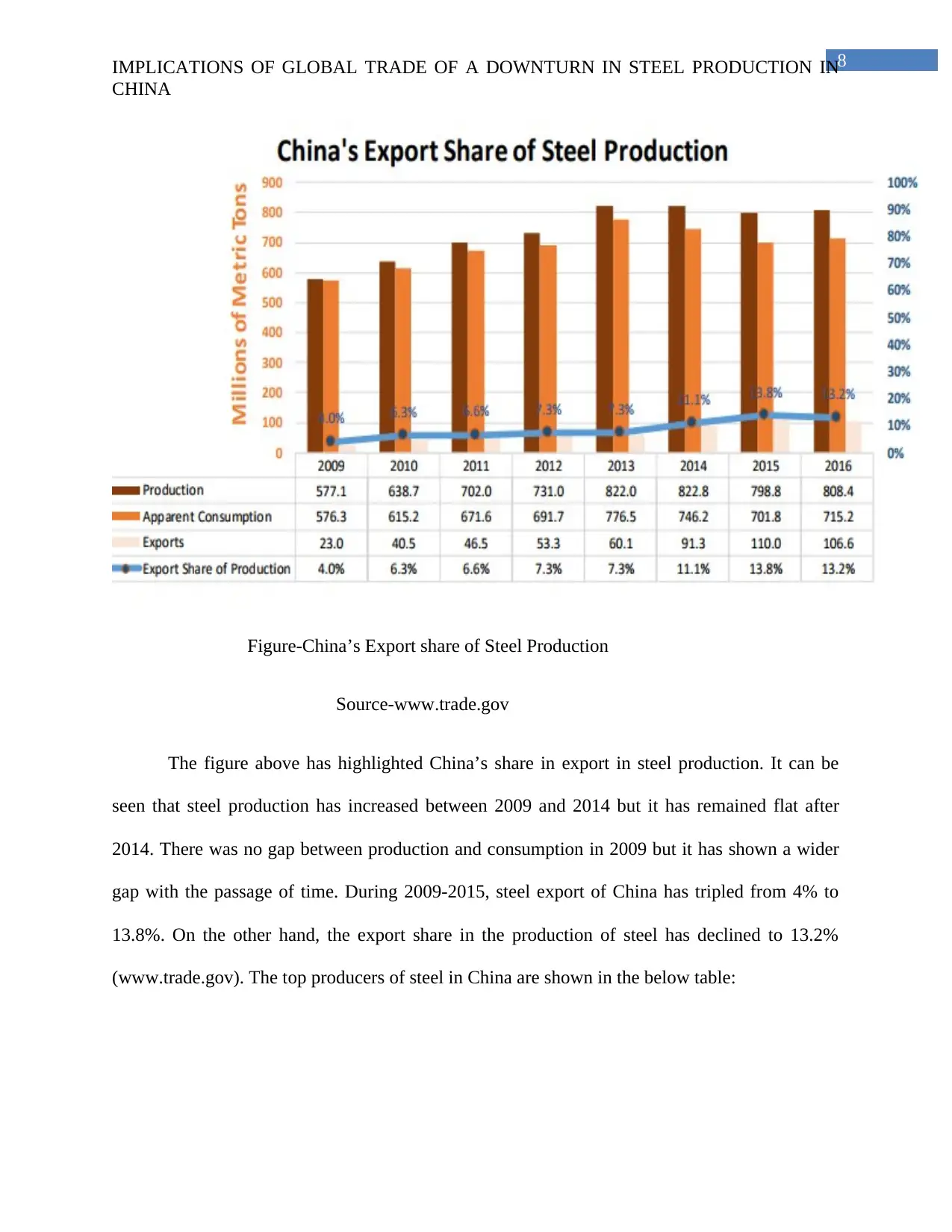

Figure-China’s Export share of Steel Production

Source-www.trade.gov

The figure above has highlighted China’s share in export in steel production. It can be

seen that steel production has increased between 2009 and 2014 but it has remained flat after

2014. There was no gap between production and consumption in 2009 but it has shown a wider

gap with the passage of time. During 2009-2015, steel export of China has tripled from 4% to

13.8%. On the other hand, the export share in the production of steel has declined to 13.2%

(www.trade.gov). The top producers of steel in China are shown in the below table:

CHINA

Figure-China’s Export share of Steel Production

Source-www.trade.gov

The figure above has highlighted China’s share in export in steel production. It can be

seen that steel production has increased between 2009 and 2014 but it has remained flat after

2014. There was no gap between production and consumption in 2009 but it has shown a wider

gap with the passage of time. During 2009-2015, steel export of China has tripled from 4% to

13.8%. On the other hand, the export share in the production of steel has declined to 13.2%

(www.trade.gov). The top producers of steel in China are shown in the below table:

9IMPLICATIONS OF GLOBAL TRADE OF A DOWNTURN IN STEEL PRODUCTION IN

CHINA

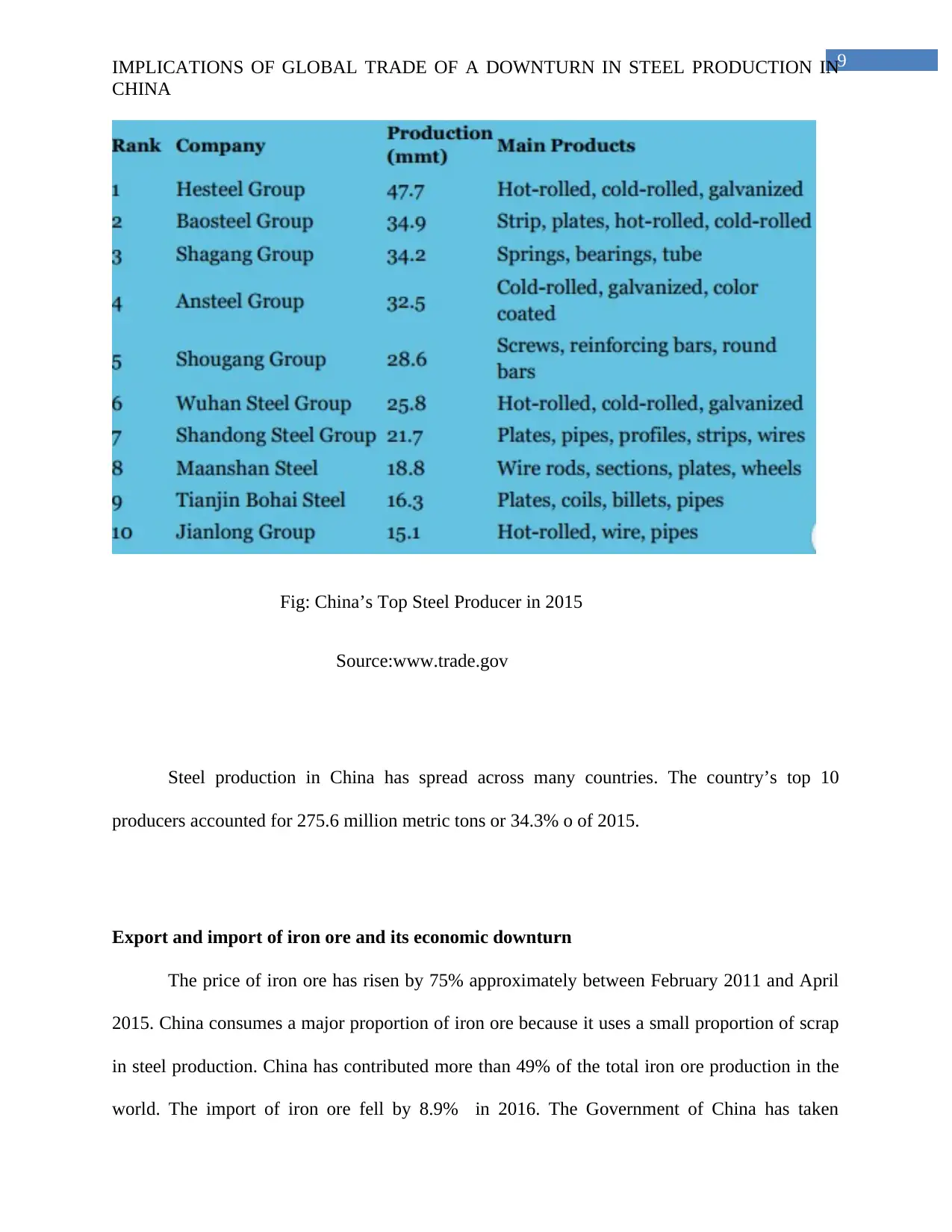

Fig: China’s Top Steel Producer in 2015

Source:www.trade.gov

Steel production in China has spread across many countries. The country’s top 10

producers accounted for 275.6 million metric tons or 34.3% o of 2015.

Export and import of iron ore and its economic downturn

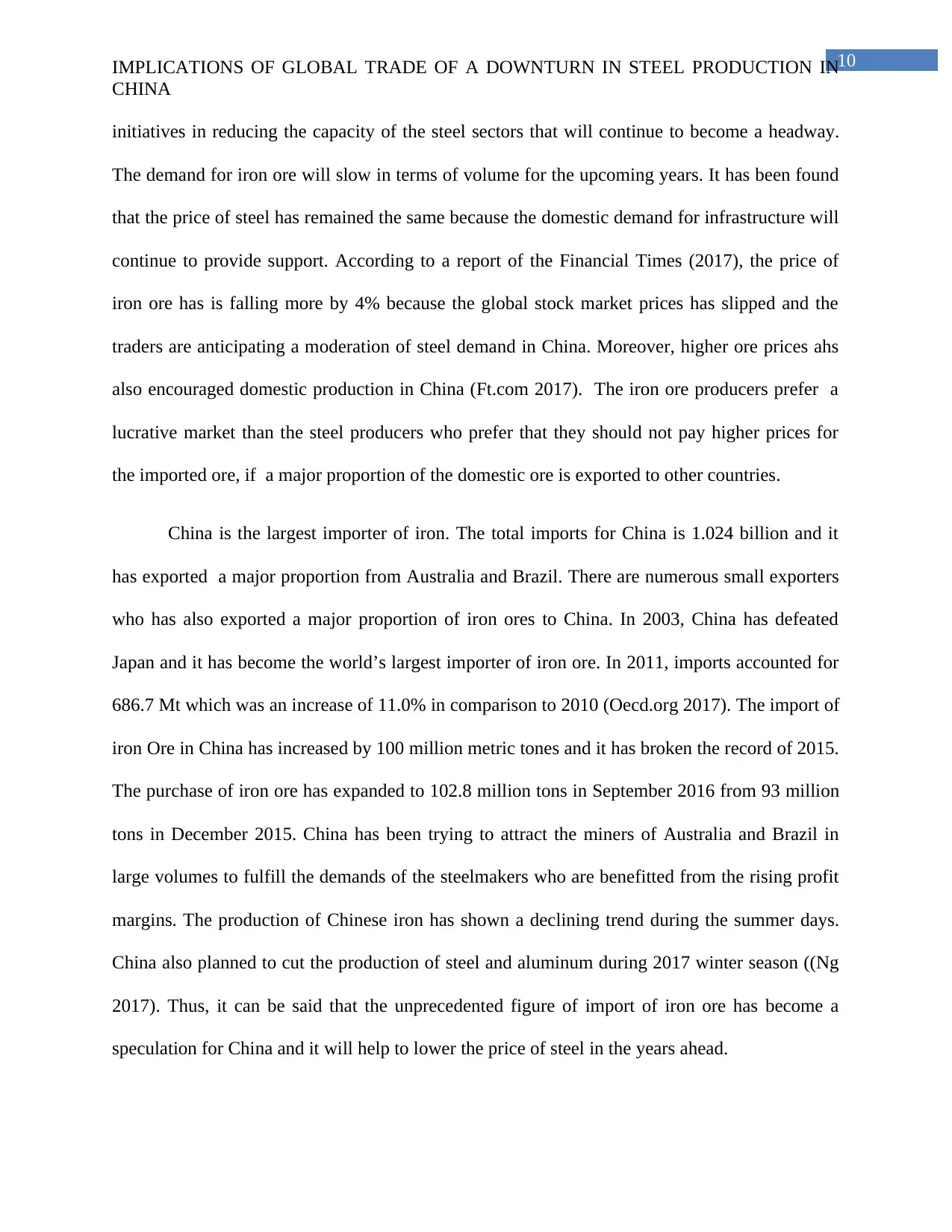

The price of iron ore has risen by 75% approximately between February 2011 and April

2015. China consumes a major proportion of iron ore because it uses a small proportion of scrap

in steel production. China has contributed more than 49% of the total iron ore production in the

world. The import of iron ore fell by 8.9% in 2016. The Government of China has taken

CHINA

Fig: China’s Top Steel Producer in 2015

Source:www.trade.gov

Steel production in China has spread across many countries. The country’s top 10

producers accounted for 275.6 million metric tons or 34.3% o of 2015.

Export and import of iron ore and its economic downturn

The price of iron ore has risen by 75% approximately between February 2011 and April

2015. China consumes a major proportion of iron ore because it uses a small proportion of scrap

in steel production. China has contributed more than 49% of the total iron ore production in the

world. The import of iron ore fell by 8.9% in 2016. The Government of China has taken

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

10IMPLICATIONS OF GLOBAL TRADE OF A DOWNTURN IN STEEL PRODUCTION IN

CHINA

initiatives in reducing the capacity of the steel sectors that will continue to become a headway.

The demand for iron ore will slow in terms of volume for the upcoming years. It has been found

that the price of steel has remained the same because the domestic demand for infrastructure will

continue to provide support. According to a report of the Financial Times (2017), the price of

iron ore has is falling more by 4% because the global stock market prices has slipped and the

traders are anticipating a moderation of steel demand in China. Moreover, higher ore prices ahs

also encouraged domestic production in China (Ft.com 2017). The iron ore producers prefer a

lucrative market than the steel producers who prefer that they should not pay higher prices for

the imported ore, if a major proportion of the domestic ore is exported to other countries.

China is the largest importer of iron. The total imports for China is 1.024 billion and it

has exported a major proportion from Australia and Brazil. There are numerous small exporters

who has also exported a major proportion of iron ores to China. In 2003, China has defeated

Japan and it has become the world’s largest importer of iron ore. In 2011, imports accounted for

686.7 Mt which was an increase of 11.0% in comparison to 2010 (Oecd.org 2017). The import of

iron Ore in China has increased by 100 million metric tones and it has broken the record of 2015.

The purchase of iron ore has expanded to 102.8 million tons in September 2016 from 93 million

tons in December 2015. China has been trying to attract the miners of Australia and Brazil in

large volumes to fulfill the demands of the steelmakers who are benefitted from the rising profit

margins. The production of Chinese iron has shown a declining trend during the summer days.

China also planned to cut the production of steel and aluminum during 2017 winter season ((Ng

2017). Thus, it can be said that the unprecedented figure of import of iron ore has become a

speculation for China and it will help to lower the price of steel in the years ahead.

CHINA

initiatives in reducing the capacity of the steel sectors that will continue to become a headway.

The demand for iron ore will slow in terms of volume for the upcoming years. It has been found

that the price of steel has remained the same because the domestic demand for infrastructure will

continue to provide support. According to a report of the Financial Times (2017), the price of

iron ore has is falling more by 4% because the global stock market prices has slipped and the

traders are anticipating a moderation of steel demand in China. Moreover, higher ore prices ahs

also encouraged domestic production in China (Ft.com 2017). The iron ore producers prefer a

lucrative market than the steel producers who prefer that they should not pay higher prices for

the imported ore, if a major proportion of the domestic ore is exported to other countries.

China is the largest importer of iron. The total imports for China is 1.024 billion and it

has exported a major proportion from Australia and Brazil. There are numerous small exporters

who has also exported a major proportion of iron ores to China. In 2003, China has defeated

Japan and it has become the world’s largest importer of iron ore. In 2011, imports accounted for

686.7 Mt which was an increase of 11.0% in comparison to 2010 (Oecd.org 2017). The import of

iron Ore in China has increased by 100 million metric tones and it has broken the record of 2015.

The purchase of iron ore has expanded to 102.8 million tons in September 2016 from 93 million

tons in December 2015. China has been trying to attract the miners of Australia and Brazil in

large volumes to fulfill the demands of the steelmakers who are benefitted from the rising profit

margins. The production of Chinese iron has shown a declining trend during the summer days.

China also planned to cut the production of steel and aluminum during 2017 winter season ((Ng

2017). Thus, it can be said that the unprecedented figure of import of iron ore has become a

speculation for China and it will help to lower the price of steel in the years ahead.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

11IMPLICATIONS OF GLOBAL TRADE OF A DOWNTURN IN STEEL PRODUCTION IN

CHINA

Conclusion

Thus, it can be said that the economic growth in China relied on the exports of

manufactured goods, industrialization and modernization in the economy. The country is rich in

the import of copper, steel and iron and this is considered crucial fit the economy of China.

Among the top exporters of steel, South Korea, Singapore and Philippines has received more

than 60% of the imports from China. The recent slowing in the steel production has reflected a

variety of factors and it includes the policy measures that are introduced by the government of

China. The demand for resources in China has been strong, this is reflected by the increasing

price of iron ore, and thus this has contributed to the higher terms of trade in China. Moreover,

with the development of Chinese economy, the consumption and production of steel are likely to

increase in the near future and this will lead to a strong demand for iron ore in the future.

CHINA

Conclusion

Thus, it can be said that the economic growth in China relied on the exports of

manufactured goods, industrialization and modernization in the economy. The country is rich in

the import of copper, steel and iron and this is considered crucial fit the economy of China.

Among the top exporters of steel, South Korea, Singapore and Philippines has received more

than 60% of the imports from China. The recent slowing in the steel production has reflected a

variety of factors and it includes the policy measures that are introduced by the government of

China. The demand for resources in China has been strong, this is reflected by the increasing

price of iron ore, and thus this has contributed to the higher terms of trade in China. Moreover,

with the development of Chinese economy, the consumption and production of steel are likely to

increase in the near future and this will lead to a strong demand for iron ore in the future.

12IMPLICATIONS OF GLOBAL TRADE OF A DOWNTURN IN STEEL PRODUCTION IN

CHINA

References

Coccia, M., 2014. Steel market and global trends of leading geo–economic players. International

Journal of trade and global markets, 7(1), pp.36-52.

Ft.com 2017. Financial Times. [online] Available at: https://www.ft.com/content/43b5e314-

0f0d-11e7-b030-768954394623 [Accessed 3 Dec. 2017].

Ng, M 2017. Iron Ore Rallies as China Imports Bust 100 Million Ton Level. [online]

Bloomberg.com. Available at: https://www.bloomberg.com/news/articles/2017-10-13/iron-

imports-by-china-smash-100-million-ton-level-to-hit-record [Accessed 3 Dec. 2017].

Oecd.org 2017. Iron Ore market. [online] Available at: http://www.oecd.org/sti/ind/OECD

%20May12%20Summary%20%20Iron%20ore%20doc%20%283%29.pdf [Accessed 3 Dec.

2017].

Oecd.org 2017. Steel market Development. [online] Available at:

https://www.oecd.org/sti/ind/steel-market-developments-2016Q4.pdf [Accessed 3 Dec. 2017].

Popescu, G.H., Nica, E., Nicolăescu, E. and Lăzăroiu, G., 2016. China’s steel industry as a

driving force for economic growth and international competitiveness. Metalurgija, 55(1),

pp.123-126.

Rba.gov.au 2017. China's steel industry. [online] Available at:

https://www.rba.gov.au/publications/bulletin/2010/dec/pdf/bu-1210-3.pdf [Accessed 3 Dec.

2017].

CHINA

References

Coccia, M., 2014. Steel market and global trends of leading geo–economic players. International

Journal of trade and global markets, 7(1), pp.36-52.

Ft.com 2017. Financial Times. [online] Available at: https://www.ft.com/content/43b5e314-

0f0d-11e7-b030-768954394623 [Accessed 3 Dec. 2017].

Ng, M 2017. Iron Ore Rallies as China Imports Bust 100 Million Ton Level. [online]

Bloomberg.com. Available at: https://www.bloomberg.com/news/articles/2017-10-13/iron-

imports-by-china-smash-100-million-ton-level-to-hit-record [Accessed 3 Dec. 2017].

Oecd.org 2017. Iron Ore market. [online] Available at: http://www.oecd.org/sti/ind/OECD

%20May12%20Summary%20%20Iron%20ore%20doc%20%283%29.pdf [Accessed 3 Dec.

2017].

Oecd.org 2017. Steel market Development. [online] Available at:

https://www.oecd.org/sti/ind/steel-market-developments-2016Q4.pdf [Accessed 3 Dec. 2017].

Popescu, G.H., Nica, E., Nicolăescu, E. and Lăzăroiu, G., 2016. China’s steel industry as a

driving force for economic growth and international competitiveness. Metalurgija, 55(1),

pp.123-126.

Rba.gov.au 2017. China's steel industry. [online] Available at:

https://www.rba.gov.au/publications/bulletin/2010/dec/pdf/bu-1210-3.pdf [Accessed 3 Dec.

2017].

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.