Managing Financial Resources: Clariton Antiques Ltd Analysis Report

VerifiedAdded on 2019/12/28

|22

|6027

|211

Report

AI Summary

This report provides a comprehensive analysis of financial resource management for Clariton Antiques Ltd, focusing on the identification of finance sources, both internal and external, and assessing their implications. It evaluates the most appropriate sources of finance for the company's expansion, particularly considering a venture capital offer. The report delves into the costs associated with different financing options, including dividends, interest, and taxes, and emphasizes the importance of financial planning. It also assesses the information needed for financing decisions, analyzes the impact on financial statements, and compares financial statement formats. The report concludes with recommendations for Clariton Antiques Ltd regarding its financial strategies.

Managing Financial

Resources and Decision

Resources and Decision

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................4

1.1 Identify the sources of finance available...............................................................................4

1.2 Assessment of the implications for using Internal and External sources of finance.............5

1.3 Evaluation of the most appropriate sources of finance for Clariton Antiques Ltd...............7

TASK 2 ..........................................................................................................................................8

2.1 Analysis of the costs of the two sources of finance under consideration.............................8

2.2 Explain the importance of financial planning for Clariton Antiques Ltd............................9

2.3 assessment of the information that will be needed to make decision on financing............10

2.4 Impact on the financial statements through Venture capitalist (We Finance Limited) and

Finance broker...........................................................................................................................11

TASK 3..........................................................................................................................................12

3.1..............................................................................................................................................12

3.2.........................................................................................................................................13

3.3..............................................................................................................................................14

TASK 4 .........................................................................................................................................16

4.1 key components of financial statements.............................................................................16

4.2 Comparison of formats used by Clariton Antiques Ltd to present its financial statements

with that of sole trader or partnership firm...............................................................................17

4.3..............................................................................................................................................18

CONCLUSION..............................................................................................................................19

REFERENCES..............................................................................................................................20

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................4

1.1 Identify the sources of finance available...............................................................................4

1.2 Assessment of the implications for using Internal and External sources of finance.............5

1.3 Evaluation of the most appropriate sources of finance for Clariton Antiques Ltd...............7

TASK 2 ..........................................................................................................................................8

2.1 Analysis of the costs of the two sources of finance under consideration.............................8

2.2 Explain the importance of financial planning for Clariton Antiques Ltd............................9

2.3 assessment of the information that will be needed to make decision on financing............10

2.4 Impact on the financial statements through Venture capitalist (We Finance Limited) and

Finance broker...........................................................................................................................11

TASK 3..........................................................................................................................................12

3.1..............................................................................................................................................12

3.2.........................................................................................................................................13

3.3..............................................................................................................................................14

TASK 4 .........................................................................................................................................16

4.1 key components of financial statements.............................................................................16

4.2 Comparison of formats used by Clariton Antiques Ltd to present its financial statements

with that of sole trader or partnership firm...............................................................................17

4.3..............................................................................................................................................18

CONCLUSION..............................................................................................................................19

REFERENCES..............................................................................................................................20

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Financial resources are soul of the business enterprise. In this report, very financial

resources that an entity can opt for managing its business operations. Further, report talks about

incorporated and unincorporated organisations and their financial resources. Clariton Antique

Ltd was started by four partners. It has its two branches which are situated at London, further

they are also willing to establish another branch at Birmingham. This report also contains a

detailed analysis of offer which is given by We Finance Limited to Clariton Antiques Ltd to

expand its business structure. The report contains a detailed analysis regarding the cost of two

sources of finance in reference to dividend, interest and tax. Besides this, the reader will know

the importance of financial planning for cited entity and they can also derive important

knowledge regarding key components of the financial statements.

TASK 1

1.1 Identify the sources of finance available

There are certain sources of finance which are available for various types of entities.

Weather it is an unincorporated entity or an incorporated entity; they both require funds to carry

out business activities(Brammer and et.al, 2012). But the sources which are appropriate for them

may be different. The various types of financial sources which are available for unincorporated

and incorporated entities are as follows: Unincorporated Entities: A business organisation which does not have a separate legal

identity. If such entity is not following a separate legal concept of accounting then it will

be considered as an unincorporated association or entity. In such entity, owner possesses

all liabilities which are related with the business enterprise. Sole proprietors, partnership

firms can be considered as unincorporated entities(Brigham and Ehrhardt, 2013). The

sources of finance which are available for unincorporated entities are as follows :

◦ Personal Savings: For the organisations like partnership firms and sole proprietors,

personal savings can be a major source of finance. Though this, they can fund their

day to day activities(Chandra, 2011).

◦ Small Business Loan: Unincorporated entities can seek for small business loans to

finance their business requirements. Management of the cited entity can approach

towards bank and other financial institutes.

Financial resources are soul of the business enterprise. In this report, very financial

resources that an entity can opt for managing its business operations. Further, report talks about

incorporated and unincorporated organisations and their financial resources. Clariton Antique

Ltd was started by four partners. It has its two branches which are situated at London, further

they are also willing to establish another branch at Birmingham. This report also contains a

detailed analysis of offer which is given by We Finance Limited to Clariton Antiques Ltd to

expand its business structure. The report contains a detailed analysis regarding the cost of two

sources of finance in reference to dividend, interest and tax. Besides this, the reader will know

the importance of financial planning for cited entity and they can also derive important

knowledge regarding key components of the financial statements.

TASK 1

1.1 Identify the sources of finance available

There are certain sources of finance which are available for various types of entities.

Weather it is an unincorporated entity or an incorporated entity; they both require funds to carry

out business activities(Brammer and et.al, 2012). But the sources which are appropriate for them

may be different. The various types of financial sources which are available for unincorporated

and incorporated entities are as follows: Unincorporated Entities: A business organisation which does not have a separate legal

identity. If such entity is not following a separate legal concept of accounting then it will

be considered as an unincorporated association or entity. In such entity, owner possesses

all liabilities which are related with the business enterprise. Sole proprietors, partnership

firms can be considered as unincorporated entities(Brigham and Ehrhardt, 2013). The

sources of finance which are available for unincorporated entities are as follows :

◦ Personal Savings: For the organisations like partnership firms and sole proprietors,

personal savings can be a major source of finance. Though this, they can fund their

day to day activities(Chandra, 2011).

◦ Small Business Loan: Unincorporated entities can seek for small business loans to

finance their business requirements. Management of the cited entity can approach

towards bank and other financial institutes.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

◦ Small Business Line of Credit: Unincorporated entities can apply for business line of

credit. It is almost same as a small business loan. If the repayment of small business

loan is compared with small business line credit then it is almost same. Cited entity

can take loan in instalments rather than taking it in lump-sum. Incorporated Entities: Those enterprises which are registered and have separate legal

entity from that of its owner is known as the incorporated entities. The sources of finance

which are available to them are mentioned below :

◦ Retained earnings: The retained earnings are the most usual source of finance for any

incorporated entity(DRURY, 2013). Companies earn profit and they retain certain

profits which can be used by them for meeting their future needs and requirements.

These savings are termed as the retained earnings. Clariton Antiques Ltd is an

incorporated entity hence it can finance the short term requirements like funding of

working capital through retained earnings.

◦ Bank loans: Just like unincorporated entities, cited entity can also borrow money

through banks and other financial institutions.

◦ Equity shares: A company can issue shares in public so that they can get adequate

finance(Ebrahimnejad and et.al, 2010).

◦ Debentures and Bonds: Incorporated entities can issue debentures in the public to

finance their business activities. Debentures and bonds are long term business loan

which bears a fix rate of interest.

◦ Venture Capitalists: Cited entity can finance their projects through venture capitalist.

Venture capitalist is considered as an investor who either provides finance to newly

established venture or to start a new project in the existing venture.

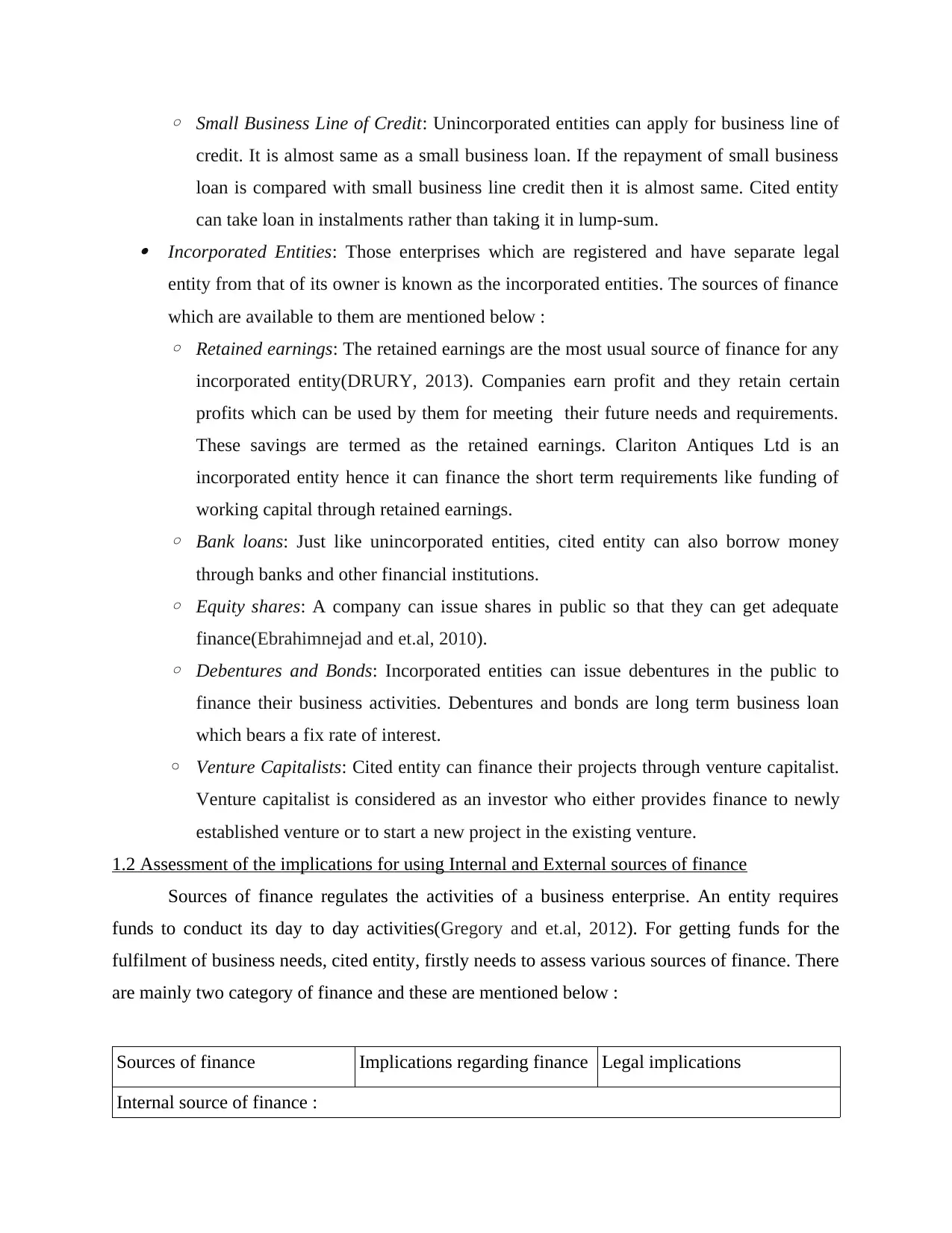

1.2 Assessment of the implications for using Internal and External sources of finance

Sources of finance regulates the activities of a business enterprise. An entity requires

funds to conduct its day to day activities(Gregory and et.al, 2012). For getting funds for the

fulfilment of business needs, cited entity, firstly needs to assess various sources of finance. There

are mainly two category of finance and these are mentioned below :

Sources of finance Implications regarding finance Legal implications

Internal source of finance :

credit. It is almost same as a small business loan. If the repayment of small business

loan is compared with small business line credit then it is almost same. Cited entity

can take loan in instalments rather than taking it in lump-sum. Incorporated Entities: Those enterprises which are registered and have separate legal

entity from that of its owner is known as the incorporated entities. The sources of finance

which are available to them are mentioned below :

◦ Retained earnings: The retained earnings are the most usual source of finance for any

incorporated entity(DRURY, 2013). Companies earn profit and they retain certain

profits which can be used by them for meeting their future needs and requirements.

These savings are termed as the retained earnings. Clariton Antiques Ltd is an

incorporated entity hence it can finance the short term requirements like funding of

working capital through retained earnings.

◦ Bank loans: Just like unincorporated entities, cited entity can also borrow money

through banks and other financial institutions.

◦ Equity shares: A company can issue shares in public so that they can get adequate

finance(Ebrahimnejad and et.al, 2010).

◦ Debentures and Bonds: Incorporated entities can issue debentures in the public to

finance their business activities. Debentures and bonds are long term business loan

which bears a fix rate of interest.

◦ Venture Capitalists: Cited entity can finance their projects through venture capitalist.

Venture capitalist is considered as an investor who either provides finance to newly

established venture or to start a new project in the existing venture.

1.2 Assessment of the implications for using Internal and External sources of finance

Sources of finance regulates the activities of a business enterprise. An entity requires

funds to conduct its day to day activities(Gregory and et.al, 2012). For getting funds for the

fulfilment of business needs, cited entity, firstly needs to assess various sources of finance. There

are mainly two category of finance and these are mentioned below :

Sources of finance Implications regarding finance Legal implications

Internal source of finance :

Retained Earning Retained earning is that part of

profit which is retained out of

it after giving dividend to the

shareholders. An entity can use

retained earning to meet the

current needs and

requirements.

There are no such legal

implications of retained

earnings.

Working capital Working capital can indirectly

be a source of finance. As if a

company reduces the funds

employed in its working

capital then that amount can be

used for other purpose(Pfohl

and et.al, 2010).

Working capital bear no any

legal implications

Sale of assets cited entity can generate funds

through selling out its assets.

The sale proceeds can be used

as the source of finance. But

cited entity needs to analyse

the use of assets before selling

them. So that working capacity

of cited entity cannot be

affected.

It doesn't attracts any legal

implications.

Account receivables Further debtors and other

account receivables can also

be classified as internal source

of finance

Debtors and other account

receivables are outsiders hence

they have certain legal

implications.

External Sources :

profit which is retained out of

it after giving dividend to the

shareholders. An entity can use

retained earning to meet the

current needs and

requirements.

There are no such legal

implications of retained

earnings.

Working capital Working capital can indirectly

be a source of finance. As if a

company reduces the funds

employed in its working

capital then that amount can be

used for other purpose(Pfohl

and et.al, 2010).

Working capital bear no any

legal implications

Sale of assets cited entity can generate funds

through selling out its assets.

The sale proceeds can be used

as the source of finance. But

cited entity needs to analyse

the use of assets before selling

them. So that working capacity

of cited entity cannot be

affected.

It doesn't attracts any legal

implications.

Account receivables Further debtors and other

account receivables can also

be classified as internal source

of finance

Debtors and other account

receivables are outsiders hence

they have certain legal

implications.

External Sources :

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

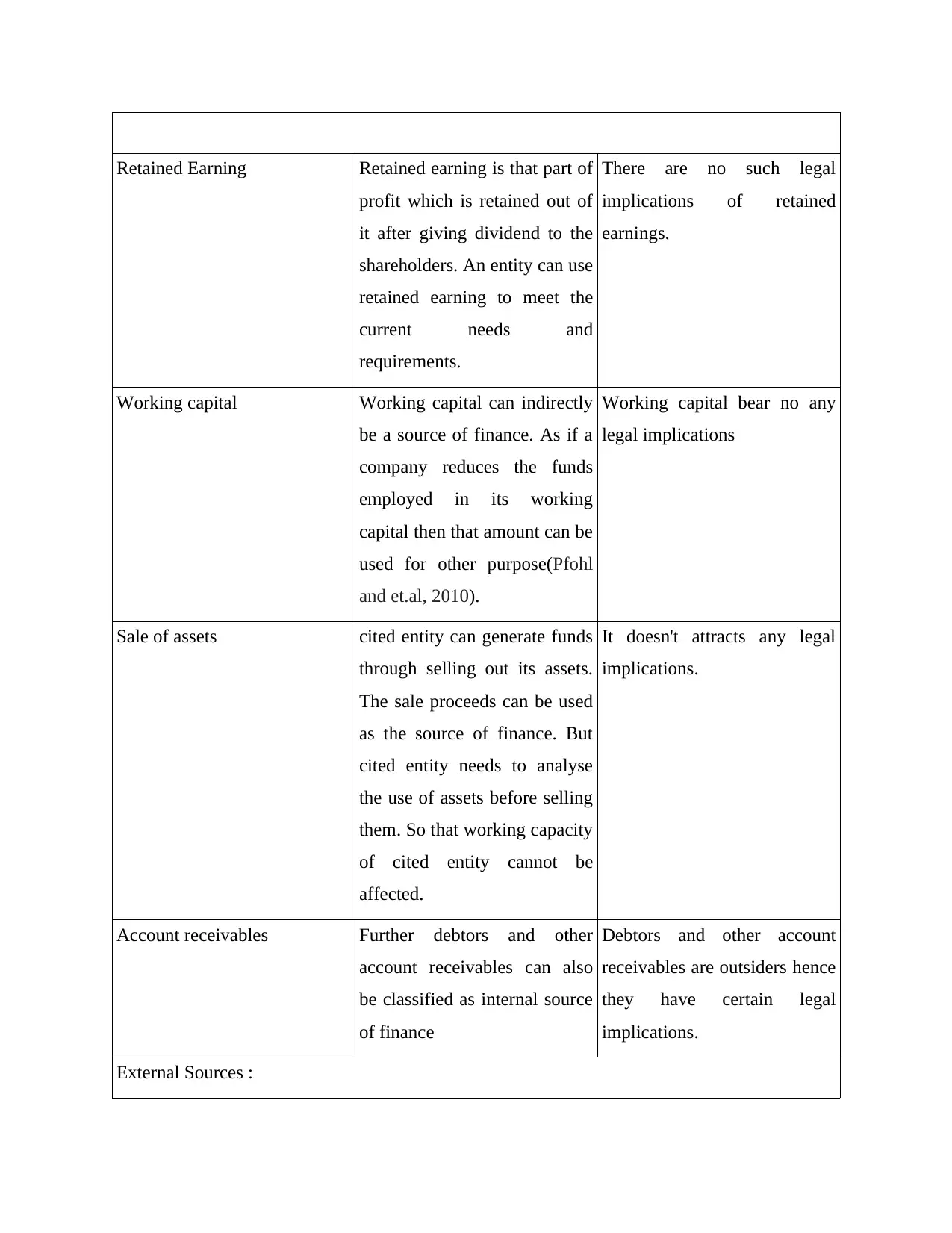

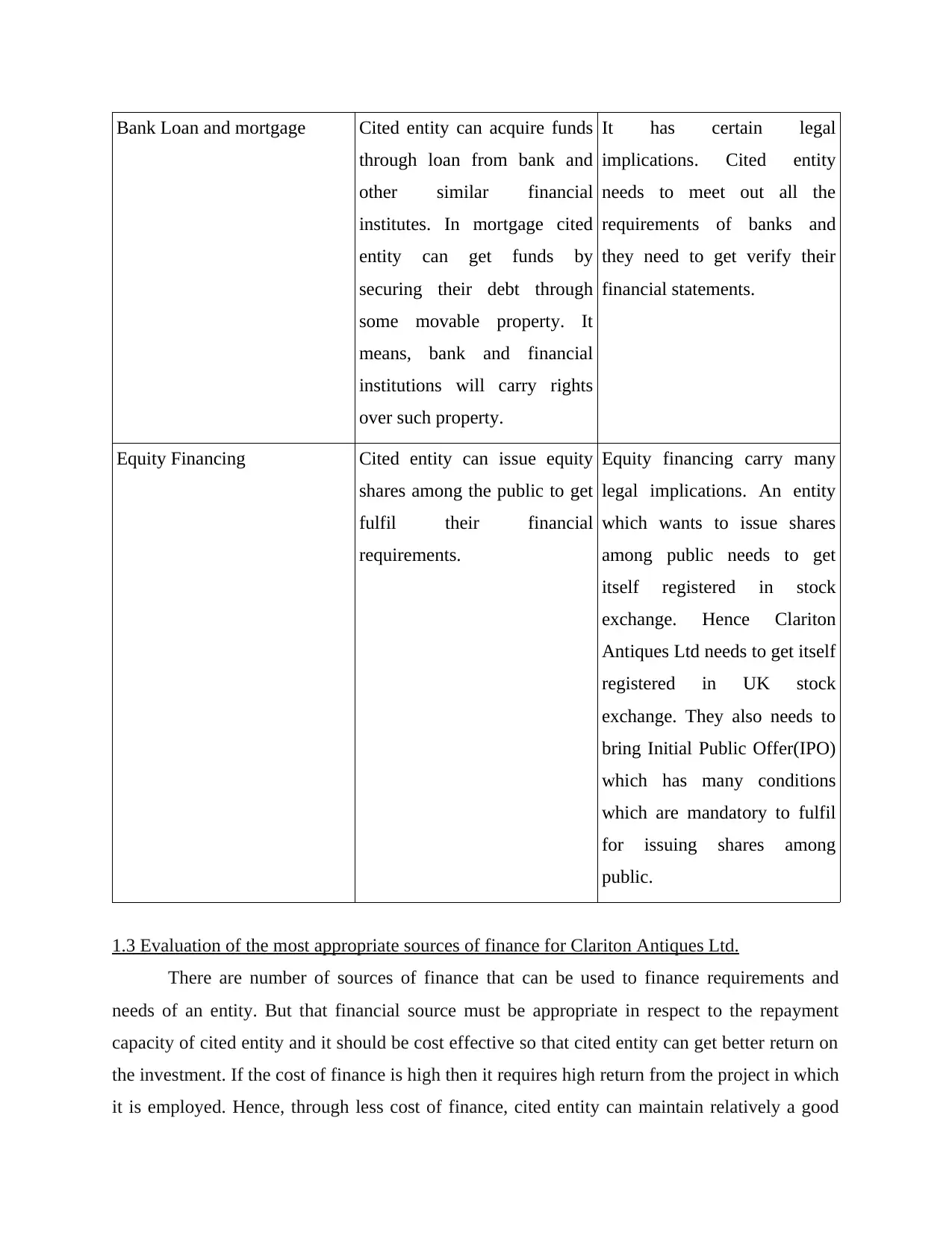

Bank Loan and mortgage Cited entity can acquire funds

through loan from bank and

other similar financial

institutes. In mortgage cited

entity can get funds by

securing their debt through

some movable property. It

means, bank and financial

institutions will carry rights

over such property.

It has certain legal

implications. Cited entity

needs to meet out all the

requirements of banks and

they need to get verify their

financial statements.

Equity Financing Cited entity can issue equity

shares among the public to get

fulfil their financial

requirements.

Equity financing carry many

legal implications. An entity

which wants to issue shares

among public needs to get

itself registered in stock

exchange. Hence Clariton

Antiques Ltd needs to get itself

registered in UK stock

exchange. They also needs to

bring Initial Public Offer(IPO)

which has many conditions

which are mandatory to fulfil

for issuing shares among

public.

1.3 Evaluation of the most appropriate sources of finance for Clariton Antiques Ltd.

There are number of sources of finance that can be used to finance requirements and

needs of an entity. But that financial source must be appropriate in respect to the repayment

capacity of cited entity and it should be cost effective so that cited entity can get better return on

the investment. If the cost of finance is high then it requires high return from the project in which

it is employed. Hence, through less cost of finance, cited entity can maintain relatively a good

through loan from bank and

other similar financial

institutes. In mortgage cited

entity can get funds by

securing their debt through

some movable property. It

means, bank and financial

institutions will carry rights

over such property.

It has certain legal

implications. Cited entity

needs to meet out all the

requirements of banks and

they need to get verify their

financial statements.

Equity Financing Cited entity can issue equity

shares among the public to get

fulfil their financial

requirements.

Equity financing carry many

legal implications. An entity

which wants to issue shares

among public needs to get

itself registered in stock

exchange. Hence Clariton

Antiques Ltd needs to get itself

registered in UK stock

exchange. They also needs to

bring Initial Public Offer(IPO)

which has many conditions

which are mandatory to fulfil

for issuing shares among

public.

1.3 Evaluation of the most appropriate sources of finance for Clariton Antiques Ltd.

There are number of sources of finance that can be used to finance requirements and

needs of an entity. But that financial source must be appropriate in respect to the repayment

capacity of cited entity and it should be cost effective so that cited entity can get better return on

the investment. If the cost of finance is high then it requires high return from the project in which

it is employed. Hence, through less cost of finance, cited entity can maintain relatively a good

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

margin(Loorbach and Rotmans, 2010). Most effective and appropriate source of finance can be

classified as that source which bears minimum cost of capital and it should also carry minimum

obligations. Clariton Antiques Ltd cannot find perfect source of finance because each and every

source of finance contains some advantages and disadvantages. As per the given case study,

Clariton Antiques Ltd wants to purchase a new building in Birmingham to expand its business.

For such expansion plan, the management of the cited entity has estimated a total amount of

investment at £0.5 million. They are previously using some internal and some of external sources

to finance requirements or activities of the business enterprise. They used to take loan from bank

and other similar financial institutions. But particularly for this expansion plan, management of

the cited entity has been suggested to acquire funds through public sources. It simply means that

for funding building in Birmingham, the management has decided to use external source of

finance(McDonald-Madden and et.al., 2010). Cited entity can finance its expansion plan through

venture capitalist. Venture capital funds invest funds in SMEs which cannot get financial

resources easily. Venture capitalist manages the money of investors who seeks private equity

stakes in start-up and small to medium-sized enterprises with strong growth potential. These

investments are generally characterized as a source(Mehran and Peristiani, 2010)

. On the other hand, Clariton Antiques Ltd can finance its expansion plan through bank loan.

Cited entity needs to pay a fixed rate of interest for a certain number of years. As interest is a

charge against profit hence cited entity is obliged to pay interest weather there is profit or not. If

bank loan is compared with venture capitalism, then it can be assessed that venture capital

financing has many advantages. Hence, it is advised to the cited entity to finance its expansion

plan of £0.5 million through venture capital financing(Kaplan and Atkinson, 2015).

TASK 2

2.1 Analysis of the costs of the two sources of finance under consideration

As Clariton Antiques Ltd has decided to expand its business by establishing a building at

Birmingham. That building will cost £0.5 million to cited entity. Earlier management of Clariton

Antiques Ltd used to finance their business needs regarding working capital and projects,

through sources of finance and some of external sources like bank loan. But this time cited entity

have been approached by We Finance Ltd, which is a venture capital organisation. It is providing

£0.5 million to cited entity and in return of this amount it is asking for 20% stake in cited entity.

They also have an option to acquire this amount through loan from financial institutions. For

classified as that source which bears minimum cost of capital and it should also carry minimum

obligations. Clariton Antiques Ltd cannot find perfect source of finance because each and every

source of finance contains some advantages and disadvantages. As per the given case study,

Clariton Antiques Ltd wants to purchase a new building in Birmingham to expand its business.

For such expansion plan, the management of the cited entity has estimated a total amount of

investment at £0.5 million. They are previously using some internal and some of external sources

to finance requirements or activities of the business enterprise. They used to take loan from bank

and other similar financial institutions. But particularly for this expansion plan, management of

the cited entity has been suggested to acquire funds through public sources. It simply means that

for funding building in Birmingham, the management has decided to use external source of

finance(McDonald-Madden and et.al., 2010). Cited entity can finance its expansion plan through

venture capitalist. Venture capital funds invest funds in SMEs which cannot get financial

resources easily. Venture capitalist manages the money of investors who seeks private equity

stakes in start-up and small to medium-sized enterprises with strong growth potential. These

investments are generally characterized as a source(Mehran and Peristiani, 2010)

. On the other hand, Clariton Antiques Ltd can finance its expansion plan through bank loan.

Cited entity needs to pay a fixed rate of interest for a certain number of years. As interest is a

charge against profit hence cited entity is obliged to pay interest weather there is profit or not. If

bank loan is compared with venture capitalism, then it can be assessed that venture capital

financing has many advantages. Hence, it is advised to the cited entity to finance its expansion

plan of £0.5 million through venture capital financing(Kaplan and Atkinson, 2015).

TASK 2

2.1 Analysis of the costs of the two sources of finance under consideration

As Clariton Antiques Ltd has decided to expand its business by establishing a building at

Birmingham. That building will cost £0.5 million to cited entity. Earlier management of Clariton

Antiques Ltd used to finance their business needs regarding working capital and projects,

through sources of finance and some of external sources like bank loan. But this time cited entity

have been approached by We Finance Ltd, which is a venture capital organisation. It is providing

£0.5 million to cited entity and in return of this amount it is asking for 20% stake in cited entity.

They also have an option to acquire this amount through loan from financial institutions. For

such bank loan, broker will charge brokerage fees of 1% of total amount of loan which means

cited entity requires to pay £0.005 million to the broker as his fees. Other then this cited entity

also requires to pay 2% APR which is payable over a period of 10 years(Moser and Ekstrom,

2010).

a) Dividend Cost : when shares are issued in public. Then at the end of financial year,

cited entity requires to pay dividend to its shareholders out of the total profit. This amount of

dividend considered as the cost of equity as dividend paid to equity share holders is known as

dividend cost. If cited entity will opt for the first option then it requires to pay We Finance Ltd

20% of total profit as a dividend to We Finance Ltd. As per the data given in the case study,

Cited entity has earned £33000 as a profit for the last financial year. In previous year 2015

company has earned £23000 as profit. It can assessed that cited entity has a growth trend in its

profits. Further after expansion plan it surely possible that entity will earn a profit more than

£33000. So it can be concluded that cited entity requires to pay at least £6600 to We Finance Ltd.

So this can be considered as the cost of equity or dividend cost.

b) Interest : Interest is a charge against profit. When an entity acquire loan from a bank or

any other financial institutions. In the given case against an amount of £0.005 million cited entity

requires to pay interest.

c) Tax : Interest amount can be considered as tax benefit for the cited entity. As interest

amount is available as deduction out of the profit. Hence this will reduce the amount of profit

and as a result cited entity requires to pay less tax.

2.2 Explain the importance of financial planning for Clariton Antiques Ltd

Financial planning is always considered beneficial for any entity. As it allows a proper

maintenance of finance to the cited entity. Financial planning can be considered as task through

which an entity can utilize its fund appropriately and effectively. Financial planning allows an

entity to achieve its goals and objectives in an effective way. In general, organisations used to

prepare a financial plan before making out any activity regarding any newly established project.

The Importance of financial planning can be understand through the undermentioned points :

a) Budgeting : Clariton Antiques Ltd have focused over the preparation of budget. It

allows the cited entity to allocate the finance properly so that the projects can yield maximum

results. Further through budgeting techniques which are used by cited entity assist the

cited entity requires to pay £0.005 million to the broker as his fees. Other then this cited entity

also requires to pay 2% APR which is payable over a period of 10 years(Moser and Ekstrom,

2010).

a) Dividend Cost : when shares are issued in public. Then at the end of financial year,

cited entity requires to pay dividend to its shareholders out of the total profit. This amount of

dividend considered as the cost of equity as dividend paid to equity share holders is known as

dividend cost. If cited entity will opt for the first option then it requires to pay We Finance Ltd

20% of total profit as a dividend to We Finance Ltd. As per the data given in the case study,

Cited entity has earned £33000 as a profit for the last financial year. In previous year 2015

company has earned £23000 as profit. It can assessed that cited entity has a growth trend in its

profits. Further after expansion plan it surely possible that entity will earn a profit more than

£33000. So it can be concluded that cited entity requires to pay at least £6600 to We Finance Ltd.

So this can be considered as the cost of equity or dividend cost.

b) Interest : Interest is a charge against profit. When an entity acquire loan from a bank or

any other financial institutions. In the given case against an amount of £0.005 million cited entity

requires to pay interest.

c) Tax : Interest amount can be considered as tax benefit for the cited entity. As interest

amount is available as deduction out of the profit. Hence this will reduce the amount of profit

and as a result cited entity requires to pay less tax.

2.2 Explain the importance of financial planning for Clariton Antiques Ltd

Financial planning is always considered beneficial for any entity. As it allows a proper

maintenance of finance to the cited entity. Financial planning can be considered as task through

which an entity can utilize its fund appropriately and effectively. Financial planning allows an

entity to achieve its goals and objectives in an effective way. In general, organisations used to

prepare a financial plan before making out any activity regarding any newly established project.

The Importance of financial planning can be understand through the undermentioned points :

a) Budgeting : Clariton Antiques Ltd have focused over the preparation of budget. It

allows the cited entity to allocate the finance properly so that the projects can yield maximum

results. Further through budgeting techniques which are used by cited entity assist the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

management to control over the operations. Cited entity used budgeting techniques for the

forecasting of expenses regarding the expansion plan. It can assist the work force which are

currently working there to put steps towards right direction to achieve the predetermined goals of

cited entity. Further it provides a benefit of coordination among various departments of Clariton

Antiques Ltd(Nam and et.al, 2011).

b) Implication of failure to finance adequately : Finance can be considered as the soul of

any business organisation. Without availability of finance an entity cant run its operations

effectively. Adequate finance can help an organisation to attain its objectives. Smooth business

activities helps an entity to earn more revenue which makes such projects profitable in which

finance is employed. Availability of finance helps an entity at each and every process. Cited

entity can acquire its raw materials, further they can convert such raw material in finished goods

with the help of adequate finance. Cited entity requires finance to expand its business by

establishing a new building at Birmingham. If cited entity fails to properly maintain the available

finance then it will not get required and expected results out of such expansion plan(Moynihan

and Pandey, 2010).

c) Over Trading : Over trading is a situation which consists trading of goods and services

without any limit. In such trading broker used buy and sell goods on behalf of investor. In return

that broker will get commission as a remuneration for maintaining the activity of trading. Over

trading is also known as ' churning'. Over trading increases sales but it has certain disadvantages

which cannot be avoided. As over trading is a part of business forecasting. In such, over trading

includes purchase of raw material in high quantity which results in increase in liability and it also

increases account receivables as broker will sale goods on credit to increase sales(Swayne, and

et.al, 2012).

2.3 assessment of the information that will be needed to make decision on financing

Financing decisions must be effective so that they can cultivate higher returns. To make

decisions regarding financing of any project cited entity requires to make a detailed analysis over

the facts and information of its organisational structure. Some informations which is required to

analyse before making any decisions regarding financing are as follows :

a) Partners : Cited entity and its management requires to analyse the information

regarding capital which is contributed by the partners, capital ratio of partners and profit sharing

ratio of partners. Further a detailed analysis is to be made of facts and figures which are

forecasting of expenses regarding the expansion plan. It can assist the work force which are

currently working there to put steps towards right direction to achieve the predetermined goals of

cited entity. Further it provides a benefit of coordination among various departments of Clariton

Antiques Ltd(Nam and et.al, 2011).

b) Implication of failure to finance adequately : Finance can be considered as the soul of

any business organisation. Without availability of finance an entity cant run its operations

effectively. Adequate finance can help an organisation to attain its objectives. Smooth business

activities helps an entity to earn more revenue which makes such projects profitable in which

finance is employed. Availability of finance helps an entity at each and every process. Cited

entity can acquire its raw materials, further they can convert such raw material in finished goods

with the help of adequate finance. Cited entity requires finance to expand its business by

establishing a new building at Birmingham. If cited entity fails to properly maintain the available

finance then it will not get required and expected results out of such expansion plan(Moynihan

and Pandey, 2010).

c) Over Trading : Over trading is a situation which consists trading of goods and services

without any limit. In such trading broker used buy and sell goods on behalf of investor. In return

that broker will get commission as a remuneration for maintaining the activity of trading. Over

trading is also known as ' churning'. Over trading increases sales but it has certain disadvantages

which cannot be avoided. As over trading is a part of business forecasting. In such, over trading

includes purchase of raw material in high quantity which results in increase in liability and it also

increases account receivables as broker will sale goods on credit to increase sales(Swayne, and

et.al, 2012).

2.3 assessment of the information that will be needed to make decision on financing

Financing decisions must be effective so that they can cultivate higher returns. To make

decisions regarding financing of any project cited entity requires to make a detailed analysis over

the facts and information of its organisational structure. Some informations which is required to

analyse before making any decisions regarding financing are as follows :

a) Partners : Cited entity and its management requires to analyse the information

regarding capital which is contributed by the partners, capital ratio of partners and profit sharing

ratio of partners. Further a detailed analysis is to be made of facts and figures which are

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

mentioned in the partnership deed. Further they also need to do valuation of companies goodwill

and other such factors which can impact over the financial position of cited entity.

b) Venture Capitalist : Venture capitalist can be considered as an investor who invest in

newly established entity or in new project of any existing entity. In the given case study We

Finance Ltd is a venture capitalist, who offered clariton Antiques Ltd to invest £0.005 million in

its expansion plan and in return of it, a stake of 20% is required by it. We Finance Ltd needs to

get financial information of cited entity through its previous year financial statements. It needs to

assess the liquidity of cited entity. Liquidity could be assessed by it through analysing the total

assets and total liability. After thoroughly analysing assets and liabilities, venture capitalist can

be assured about repayment of its investment.

c) Finance Broker : Financial institutions needs to access the information regarding

indebtedness of cited entity other than this they also need to go through repayment schedule of

previous loan taken. Through this banks and other such financial institutions can get information

regarding the repayment ability of cited entity. Banks needs to use some technical and scientific

methods to analyse financial position of cited entity. Banks should acquire net asset value of

cited entity(Guang Shi and et.al, 2012).

2.4 Impact on the financial statements through Venture capitalist (We Finance Limited) and

Finance broker

a) Venture Capitalist (We Finance Limited) : We Finance Ltd has asked to have a stake

of 20% in the total profit of cited entity, this is actually dividend which is required to pay by

cited entity to We Finance Ltd. 20% of total profit is material amount which can reduce the level

of profit available for owner. But it also increases capital of cited entity. But due to this liability

will also gets increased as the capital is nothing but a liability(Purce, 2014).

b) Finance broker : Banks and other such financial institutions are termed finance

brokers. Bank and financial institutions provides loan to entities. Against those loans they charge

interest. Interest is a charge against profit. Hence it will reduce the profitability that means it puts

an adverse effect over the profitability of cited entity. On the other hand it also consist brokerage

charges. That means 50000 GBP is to be paid by Clariton Antiques Ltd to broker. Interest and

brokerage are indirectly beneficial for cited entity as it will provide tax benefit(Remund, 2010).

and other such factors which can impact over the financial position of cited entity.

b) Venture Capitalist : Venture capitalist can be considered as an investor who invest in

newly established entity or in new project of any existing entity. In the given case study We

Finance Ltd is a venture capitalist, who offered clariton Antiques Ltd to invest £0.005 million in

its expansion plan and in return of it, a stake of 20% is required by it. We Finance Ltd needs to

get financial information of cited entity through its previous year financial statements. It needs to

assess the liquidity of cited entity. Liquidity could be assessed by it through analysing the total

assets and total liability. After thoroughly analysing assets and liabilities, venture capitalist can

be assured about repayment of its investment.

c) Finance Broker : Financial institutions needs to access the information regarding

indebtedness of cited entity other than this they also need to go through repayment schedule of

previous loan taken. Through this banks and other such financial institutions can get information

regarding the repayment ability of cited entity. Banks needs to use some technical and scientific

methods to analyse financial position of cited entity. Banks should acquire net asset value of

cited entity(Guang Shi and et.al, 2012).

2.4 Impact on the financial statements through Venture capitalist (We Finance Limited) and

Finance broker

a) Venture Capitalist (We Finance Limited) : We Finance Ltd has asked to have a stake

of 20% in the total profit of cited entity, this is actually dividend which is required to pay by

cited entity to We Finance Ltd. 20% of total profit is material amount which can reduce the level

of profit available for owner. But it also increases capital of cited entity. But due to this liability

will also gets increased as the capital is nothing but a liability(Purce, 2014).

b) Finance broker : Banks and other such financial institutions are termed finance

brokers. Bank and financial institutions provides loan to entities. Against those loans they charge

interest. Interest is a charge against profit. Hence it will reduce the profitability that means it puts

an adverse effect over the profitability of cited entity. On the other hand it also consist brokerage

charges. That means 50000 GBP is to be paid by Clariton Antiques Ltd to broker. Interest and

brokerage are indirectly beneficial for cited entity as it will provide tax benefit(Remund, 2010).

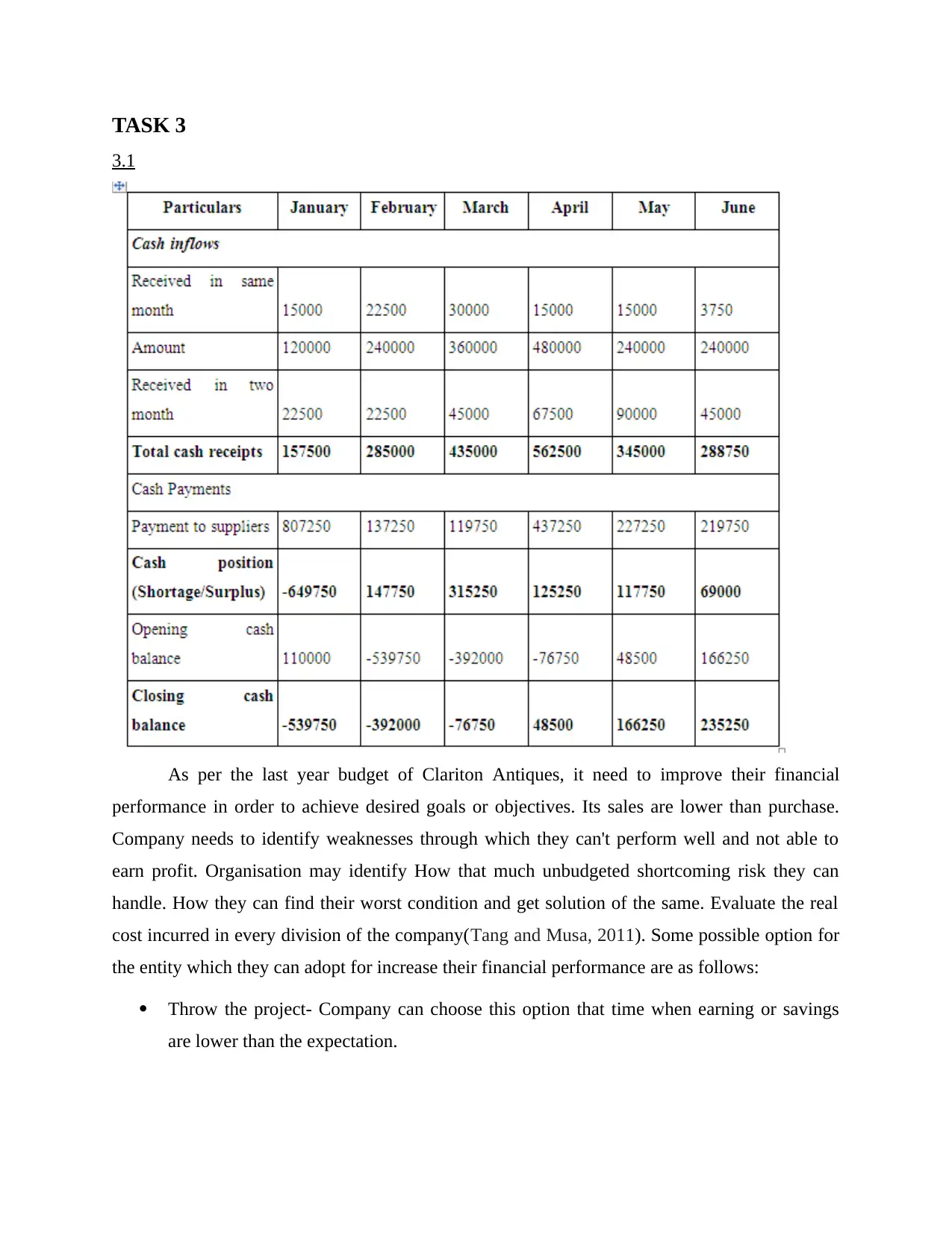

TASK 3

3.1

As per the last year budget of Clariton Antiques, it need to improve their financial

performance in order to achieve desired goals or objectives. Its sales are lower than purchase.

Company needs to identify weaknesses through which they can't perform well and not able to

earn profit. Organisation may identify How that much unbudgeted shortcoming risk they can

handle. How they can find their worst condition and get solution of the same. Evaluate the real

cost incurred in every division of the company(Tang and Musa, 2011). Some possible option for

the entity which they can adopt for increase their financial performance are as follows:

Throw the project- Company can choose this option that time when earning or savings

are lower than the expectation.

3.1

As per the last year budget of Clariton Antiques, it need to improve their financial

performance in order to achieve desired goals or objectives. Its sales are lower than purchase.

Company needs to identify weaknesses through which they can't perform well and not able to

earn profit. Organisation may identify How that much unbudgeted shortcoming risk they can

handle. How they can find their worst condition and get solution of the same. Evaluate the real

cost incurred in every division of the company(Tang and Musa, 2011). Some possible option for

the entity which they can adopt for increase their financial performance are as follows:

Throw the project- Company can choose this option that time when earning or savings

are lower than the expectation.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 22

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.