Analysis of Australian Taxation Law: Cassandra, Oscar, and Ernest

VerifiedAdded on 2020/07/23

|8

|2540

|54

Report

AI Summary

This report provides an analysis of Australian taxation law, focusing on three key aspects: capital gains tax (CGT), deductions, and assessable income. It begins by advising Cassandra Pty Limited on the CGT consequences of a property sale, calculating the capital gains and associated tax liabilities based on the Income Tax Assessment Act 1997 (ITAA 1997). The report then examines the extent to which expenditures incurred by Oscar Pty Ltd are deductible from an Australian income tax perspective, considering issues such as construction costs and salaries. Finally, it calculates the assessable income of Ernest Constructions Pty Ltd, addressing issues related to unpaid installments. The analysis incorporates relevant sections of the ITAA 1997 and other legal precedents to provide a comprehensive understanding of the tax implications for each entity.

Australian Taxation

Law

Law

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................3

MAIN BODY ..................................................................................................................................3

1. Advising to Cassandra Pty Limited of the CGT consequences...............................................3

2. Stating the extent to which expenditures incurred by Oscar Pty Ltd are deductible from the

perspective of Australian income tax ..........................................................................................5

3. Calculating assessable income of Ernest Constructions Pty ltd .............................................7

CONCLUSION ...............................................................................................................................8

INTRODUCTION...........................................................................................................................3

MAIN BODY ..................................................................................................................................3

1. Advising to Cassandra Pty Limited of the CGT consequences...............................................3

2. Stating the extent to which expenditures incurred by Oscar Pty Ltd are deductible from the

perspective of Australian income tax ..........................................................................................5

3. Calculating assessable income of Ernest Constructions Pty ltd .............................................7

CONCLUSION ...............................................................................................................................8

INTRODUCTION

Particular sum of money which is taken by government from earning people or corporate

on the amount generated at the end of year is known as taxation amount Higher the income when

earned by an individual or company, then respective party has to pay more tax amount to

government as per the legal laws and acts. The present project shows about basically three

aspects which are like capital gains, assessable income as well as the deductions. Further, the

study is based on property assess where long term capital gains are computed after considering

various kinds of the sections of Income Tax Assessment Act 1997. Apart from this, with the help

of relevant sections of ITTA 1997, deductions as well as assessable earnings are computed for

companies.

MAIN BODY

1. Advising to Cassandra Pty Limited of the CGT consequences

An amount which is generated as an income or profit from selling any kind of property or

investment is known as capital. In short, when a person or company put some capital on any

asset then generates return which is identified as the capital gains. In the market, companies and

people make investment in order to enhance their total level of gains. Higher the capital gains

boost up total income and economic condition of the firm or person. Further, it is difference

between purchasing and selling amount of property or asset after including associated expenses.

Apart from this, sum of money which is paid by a person in the form of tax on capital generated

is considered as the capital gain tax. When total capital gains are higher, then the candidate has

to pay more taxation amount as per the income tax assessment act 1997. In order to perform

calculation of capital gains and tax, various sections of the Income Tax Assessment Act 1997 are

undertaken. In the present case scenario, Cassandra Pty Limited purchased a building on 1st

January 2016 and sold on 1st July 2016. In between this period, it generated a capital gain which

is stated as below:

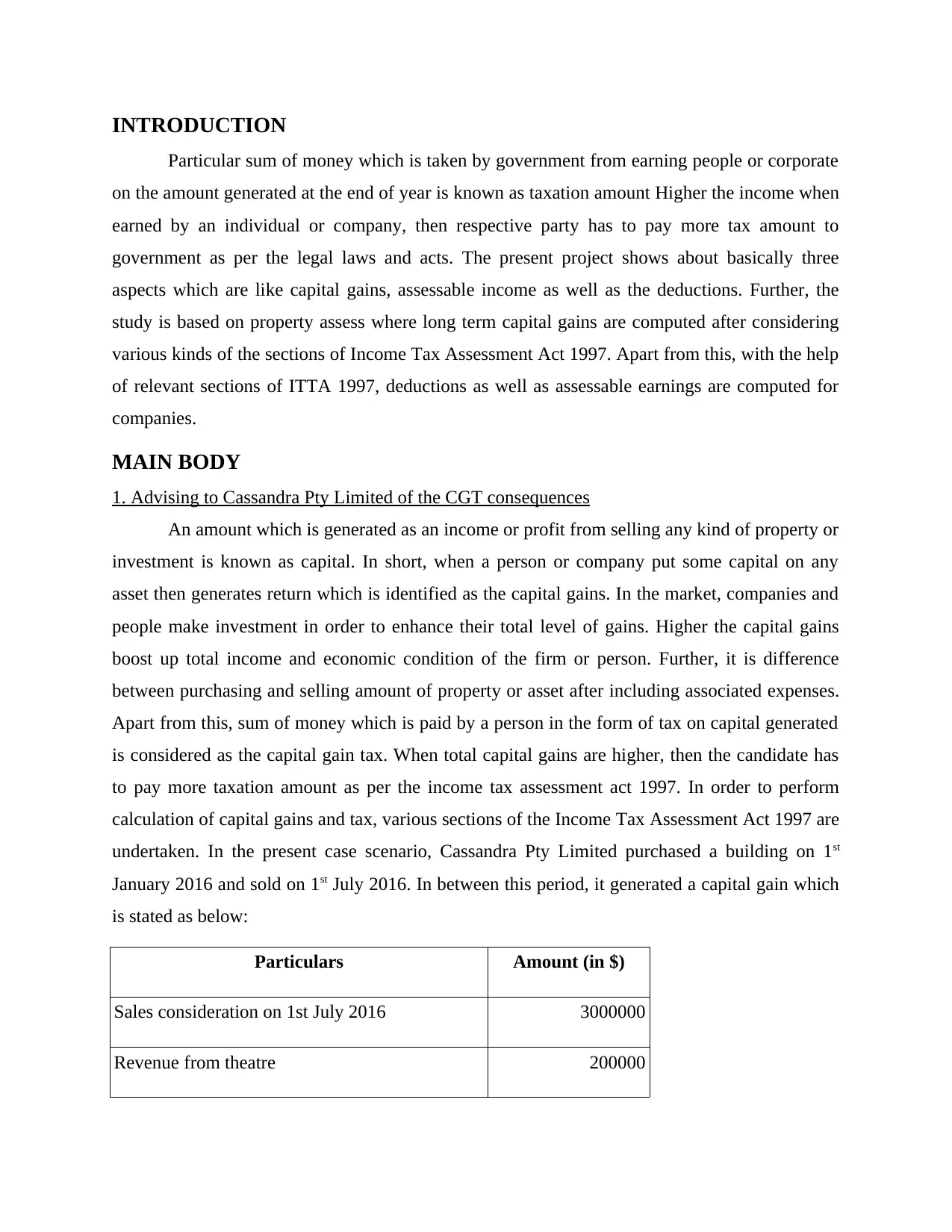

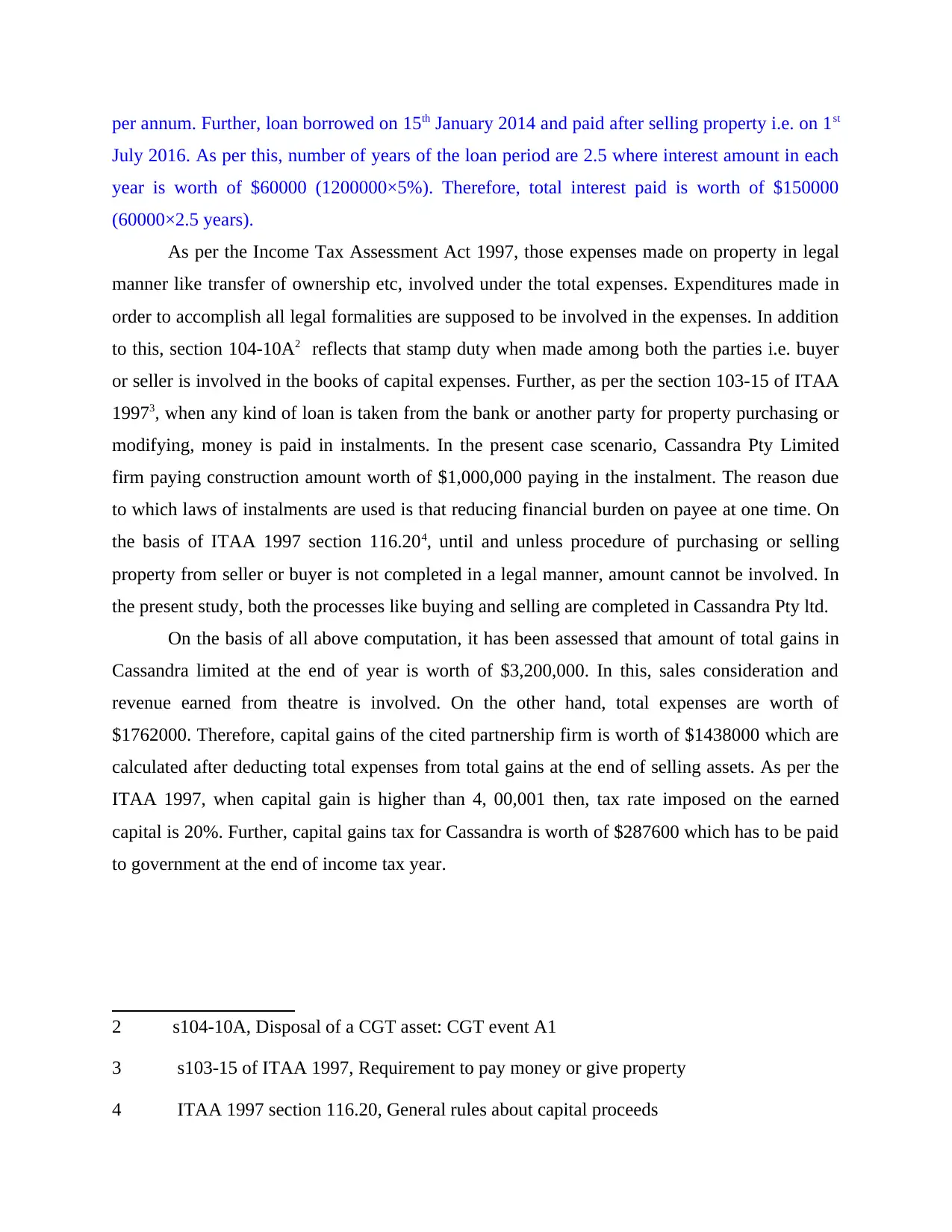

Particulars Amount (in $)

Sales consideration on 1st July 2016 3000000

Revenue from theatre 200000

Particular sum of money which is taken by government from earning people or corporate

on the amount generated at the end of year is known as taxation amount Higher the income when

earned by an individual or company, then respective party has to pay more tax amount to

government as per the legal laws and acts. The present project shows about basically three

aspects which are like capital gains, assessable income as well as the deductions. Further, the

study is based on property assess where long term capital gains are computed after considering

various kinds of the sections of Income Tax Assessment Act 1997. Apart from this, with the help

of relevant sections of ITTA 1997, deductions as well as assessable earnings are computed for

companies.

MAIN BODY

1. Advising to Cassandra Pty Limited of the CGT consequences

An amount which is generated as an income or profit from selling any kind of property or

investment is known as capital. In short, when a person or company put some capital on any

asset then generates return which is identified as the capital gains. In the market, companies and

people make investment in order to enhance their total level of gains. Higher the capital gains

boost up total income and economic condition of the firm or person. Further, it is difference

between purchasing and selling amount of property or asset after including associated expenses.

Apart from this, sum of money which is paid by a person in the form of tax on capital generated

is considered as the capital gain tax. When total capital gains are higher, then the candidate has

to pay more taxation amount as per the income tax assessment act 1997. In order to perform

calculation of capital gains and tax, various sections of the Income Tax Assessment Act 1997 are

undertaken. In the present case scenario, Cassandra Pty Limited purchased a building on 1st

January 2016 and sold on 1st July 2016. In between this period, it generated a capital gain which

is stated as below:

Particulars Amount (in $)

Sales consideration on 1st July 2016 3000000

Revenue from theatre 200000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

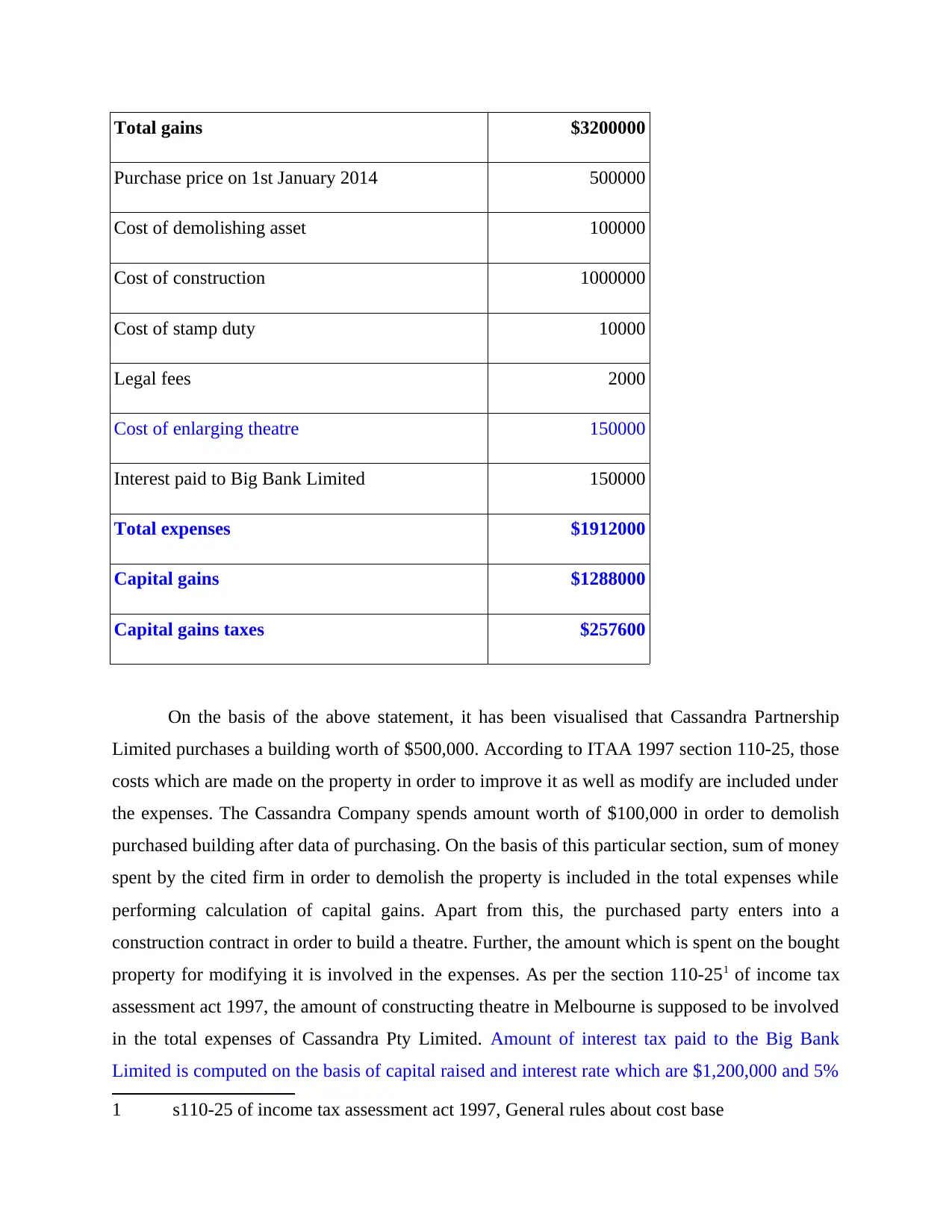

Total gains $3200000

Purchase price on 1st January 2014 500000

Cost of demolishing asset 100000

Cost of construction 1000000

Cost of stamp duty 10000

Legal fees 2000

Cost of enlarging theatre 150000

Interest paid to Big Bank Limited 150000

Total expenses $1912000

Capital gains $1288000

Capital gains taxes $257600

On the basis of the above statement, it has been visualised that Cassandra Partnership

Limited purchases a building worth of $500,000. According to ITAA 1997 section 110-25, those

costs which are made on the property in order to improve it as well as modify are included under

the expenses. The Cassandra Company spends amount worth of $100,000 in order to demolish

purchased building after data of purchasing. On the basis of this particular section, sum of money

spent by the cited firm in order to demolish the property is included in the total expenses while

performing calculation of capital gains. Apart from this, the purchased party enters into a

construction contract in order to build a theatre. Further, the amount which is spent on the bought

property for modifying it is involved in the expenses. As per the section 110-251 of income tax

assessment act 1997, the amount of constructing theatre in Melbourne is supposed to be involved

in the total expenses of Cassandra Pty Limited. Amount of interest tax paid to the Big Bank

Limited is computed on the basis of capital raised and interest rate which are $1,200,000 and 5%

1 s110-25 of income tax assessment act 1997, General rules about cost base

Purchase price on 1st January 2014 500000

Cost of demolishing asset 100000

Cost of construction 1000000

Cost of stamp duty 10000

Legal fees 2000

Cost of enlarging theatre 150000

Interest paid to Big Bank Limited 150000

Total expenses $1912000

Capital gains $1288000

Capital gains taxes $257600

On the basis of the above statement, it has been visualised that Cassandra Partnership

Limited purchases a building worth of $500,000. According to ITAA 1997 section 110-25, those

costs which are made on the property in order to improve it as well as modify are included under

the expenses. The Cassandra Company spends amount worth of $100,000 in order to demolish

purchased building after data of purchasing. On the basis of this particular section, sum of money

spent by the cited firm in order to demolish the property is included in the total expenses while

performing calculation of capital gains. Apart from this, the purchased party enters into a

construction contract in order to build a theatre. Further, the amount which is spent on the bought

property for modifying it is involved in the expenses. As per the section 110-251 of income tax

assessment act 1997, the amount of constructing theatre in Melbourne is supposed to be involved

in the total expenses of Cassandra Pty Limited. Amount of interest tax paid to the Big Bank

Limited is computed on the basis of capital raised and interest rate which are $1,200,000 and 5%

1 s110-25 of income tax assessment act 1997, General rules about cost base

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

per annum. Further, loan borrowed on 15th January 2014 and paid after selling property i.e. on 1st

July 2016. As per this, number of years of the loan period are 2.5 where interest amount in each

year is worth of $60000 (1200000×5%). Therefore, total interest paid is worth of $150000

(60000×2.5 years).

As per the Income Tax Assessment Act 1997, those expenses made on property in legal

manner like transfer of ownership etc, involved under the total expenses. Expenditures made in

order to accomplish all legal formalities are supposed to be involved in the expenses. In addition

to this, section 104-10A2 reflects that stamp duty when made among both the parties i.e. buyer

or seller is involved in the books of capital expenses. Further, as per the section 103-15 of ITAA

19973, when any kind of loan is taken from the bank or another party for property purchasing or

modifying, money is paid in instalments. In the present case scenario, Cassandra Pty Limited

firm paying construction amount worth of $1,000,000 paying in the instalment. The reason due

to which laws of instalments are used is that reducing financial burden on payee at one time. On

the basis of ITAA 1997 section 116.204, until and unless procedure of purchasing or selling

property from seller or buyer is not completed in a legal manner, amount cannot be involved. In

the present study, both the processes like buying and selling are completed in Cassandra Pty ltd.

On the basis of all above computation, it has been assessed that amount of total gains in

Cassandra limited at the end of year is worth of $3,200,000. In this, sales consideration and

revenue earned from theatre is involved. On the other hand, total expenses are worth of

$1762000. Therefore, capital gains of the cited partnership firm is worth of $1438000 which are

calculated after deducting total expenses from total gains at the end of selling assets. As per the

ITAA 1997, when capital gain is higher than 4, 00,001 then, tax rate imposed on the earned

capital is 20%. Further, capital gains tax for Cassandra is worth of $287600 which has to be paid

to government at the end of income tax year.

2 s104-10A, Disposal of a CGT asset: CGT event A1

3 s103-15 of ITAA 1997, Requirement to pay money or give property

4 ITAA 1997 section 116.20, General rules about capital proceeds

July 2016. As per this, number of years of the loan period are 2.5 where interest amount in each

year is worth of $60000 (1200000×5%). Therefore, total interest paid is worth of $150000

(60000×2.5 years).

As per the Income Tax Assessment Act 1997, those expenses made on property in legal

manner like transfer of ownership etc, involved under the total expenses. Expenditures made in

order to accomplish all legal formalities are supposed to be involved in the expenses. In addition

to this, section 104-10A2 reflects that stamp duty when made among both the parties i.e. buyer

or seller is involved in the books of capital expenses. Further, as per the section 103-15 of ITAA

19973, when any kind of loan is taken from the bank or another party for property purchasing or

modifying, money is paid in instalments. In the present case scenario, Cassandra Pty Limited

firm paying construction amount worth of $1,000,000 paying in the instalment. The reason due

to which laws of instalments are used is that reducing financial burden on payee at one time. On

the basis of ITAA 1997 section 116.204, until and unless procedure of purchasing or selling

property from seller or buyer is not completed in a legal manner, amount cannot be involved. In

the present study, both the processes like buying and selling are completed in Cassandra Pty ltd.

On the basis of all above computation, it has been assessed that amount of total gains in

Cassandra limited at the end of year is worth of $3,200,000. In this, sales consideration and

revenue earned from theatre is involved. On the other hand, total expenses are worth of

$1762000. Therefore, capital gains of the cited partnership firm is worth of $1438000 which are

calculated after deducting total expenses from total gains at the end of selling assets. As per the

ITAA 1997, when capital gain is higher than 4, 00,001 then, tax rate imposed on the earned

capital is 20%. Further, capital gains tax for Cassandra is worth of $287600 which has to be paid

to government at the end of income tax year.

2 s104-10A, Disposal of a CGT asset: CGT event A1

3 s103-15 of ITAA 1997, Requirement to pay money or give property

4 ITAA 1997 section 116.20, General rules about capital proceeds

2. Stating the extent to which expenditures incurred by Oscar Pty Ltd are deductible from the

perspective of Australian income tax

On the basis of cited case situation, Oscar Pty ltd is a resident company from tax

perspective. Cited case situation presents that on 1st July 2016, Oscar ltd invested $3000000 for

purchasing land and theater building from Cassandra Pty ltd. In this, after some time, Oscar

found that building which was purchased suffered from mild earth tremor. Hence, Oscar has

taken advice from engineer who suggested that strengthening work is required which in turn

helps in increasing the life of building. On the basis of such aspect, following issues, laws and its

application has been assessed:

Issues: By analyzing the case situation, it has been identified that Oscar Pty ltd agreed to

pay total payable of $500000 in the form of four equal installments during the period of 16

months. In accordance with such aspect, first installment was paid on 1st July 2016 and the last

one will be on 1st November 2017. Along with this, in the month of December 2016, Oscar Pty

Ltd employs various personnel for the smooth functioning of business activities such as

carpenter, stage, lighting technician, finance and marketing manager. Hence, per week salary of

such personnel accounts for $1500 respectively. In addition to this, material amounted to $50000

also purchased and used by Oscar Pty Ltd for the construction work of theater. Further, firm

contracted with actors in relation to pay $500 and $1000 respectively for each rehearsal as well

as performance. In this, main issue is to assess the type of expenses and extent to which they are

free from tax liability.

Laws: In order to present suitable solution of the concerned issue salary, wage and super

section of Income Tax Assessment Act 1936 has been considered. On the basis of such aspect,

business unit or employer can claim for the deductions regarding making payment of salaries and

wages to the workers. Further, section of repairs, maintenance and improvement expenses entail

that one can demand for the deductions in relation to material used. ITAA 1936 clearly exhibits

that expenditures which are incurred by tax payer for repairs come under the category of

deduction. However, as per laws and legislation when specific material is used for the

construction purpose then concerned one will be excluded from deductions5.

Application: Laws assessed above are highly applicable on the situation of Oscar Pty Ltd.

Moreover, laws and sections considered for tax purpose and deductions are highly associated

5 Repairs, maintenance and replacement expenses

perspective of Australian income tax

On the basis of cited case situation, Oscar Pty ltd is a resident company from tax

perspective. Cited case situation presents that on 1st July 2016, Oscar ltd invested $3000000 for

purchasing land and theater building from Cassandra Pty ltd. In this, after some time, Oscar

found that building which was purchased suffered from mild earth tremor. Hence, Oscar has

taken advice from engineer who suggested that strengthening work is required which in turn

helps in increasing the life of building. On the basis of such aspect, following issues, laws and its

application has been assessed:

Issues: By analyzing the case situation, it has been identified that Oscar Pty ltd agreed to

pay total payable of $500000 in the form of four equal installments during the period of 16

months. In accordance with such aspect, first installment was paid on 1st July 2016 and the last

one will be on 1st November 2017. Along with this, in the month of December 2016, Oscar Pty

Ltd employs various personnel for the smooth functioning of business activities such as

carpenter, stage, lighting technician, finance and marketing manager. Hence, per week salary of

such personnel accounts for $1500 respectively. In addition to this, material amounted to $50000

also purchased and used by Oscar Pty Ltd for the construction work of theater. Further, firm

contracted with actors in relation to pay $500 and $1000 respectively for each rehearsal as well

as performance. In this, main issue is to assess the type of expenses and extent to which they are

free from tax liability.

Laws: In order to present suitable solution of the concerned issue salary, wage and super

section of Income Tax Assessment Act 1936 has been considered. On the basis of such aspect,

business unit or employer can claim for the deductions regarding making payment of salaries and

wages to the workers. Further, section of repairs, maintenance and improvement expenses entail

that one can demand for the deductions in relation to material used. ITAA 1936 clearly exhibits

that expenditures which are incurred by tax payer for repairs come under the category of

deduction. However, as per laws and legislation when specific material is used for the

construction purpose then concerned one will be excluded from deductions5.

Application: Laws assessed above are highly applicable on the situation of Oscar Pty Ltd.

Moreover, laws and sections considered for tax purpose and deductions are highly associated

5 Repairs, maintenance and replacement expenses

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

with the aspects of salary, repairs, maintenance and construction. As per ITAA (1936) repairs

and maintenance cost are generally tax deductible and offer relief to the concerned entity.

However, in the case of Oscar Pty Ltd construction of theatre or strengthening work will increase

the value of property as well as its life to a great extent. Thus, material worth of $50000 used by

company is not tax deductible from income tax perspective. The main reason behind this, activity

related to repairs will improve both condition as well as life of an asset.

In the concerned case, it is mentioned that strengthening work will incline the life of asset

to a great extent and so, it would not be tax deductible. Along with this, case of Odeon

Associated Theatres v. Jones (Inspector of Taxes) (1972) presents that an initial repair

expenditure come under the category of capital expenses6. Hence, expenses that help in

producing assessable income or carrying out business are not tax deductible as per ITAA 1936.

On the other side, it is clearly mentioned in ITAA (1936) that salaries and wages paid by the firm

are deductible from the perspective of tax. Thus, Oscar ltd is entitled to get tax benefits in

relation to the salaries paid by it to different workers and managers.

Conclusion: It has been concluded from the case evaluation that Oscar Pty Ltd cannot

claim for deduction regarding material expenses as per ITAA, 1936. Besides this, it has been

found from the evaluation that business unit can demand for the salaries paid by it to workers.

3. Calculating assessable income of Ernest Constructions Pty ltd

Issue: On the basis of given case, Oscar ltd refused Earnest Constructions Pty Ltd for

making payment of installments related to the due date of 1st July and 1st November 2017. Hence,

in against to such aspect, Ernest construction Pty Ltd sued on the aspects of contractual breach.

Laws: ITAA (1936) considered to assess the taxable income and associated liability of

Earnest Construction Pty Ltd.

Application: In accordance with ITAA, assessable income includes several aspects such

as salaries, interest, etc. Income generated by an individual or entity which can be taxed at the

end of a financial year is considered as the assessable income7. Along with this, it provides the

6 ? Income tax: deductions for repairs

7 ? What is income?

and maintenance cost are generally tax deductible and offer relief to the concerned entity.

However, in the case of Oscar Pty Ltd construction of theatre or strengthening work will increase

the value of property as well as its life to a great extent. Thus, material worth of $50000 used by

company is not tax deductible from income tax perspective. The main reason behind this, activity

related to repairs will improve both condition as well as life of an asset.

In the concerned case, it is mentioned that strengthening work will incline the life of asset

to a great extent and so, it would not be tax deductible. Along with this, case of Odeon

Associated Theatres v. Jones (Inspector of Taxes) (1972) presents that an initial repair

expenditure come under the category of capital expenses6. Hence, expenses that help in

producing assessable income or carrying out business are not tax deductible as per ITAA 1936.

On the other side, it is clearly mentioned in ITAA (1936) that salaries and wages paid by the firm

are deductible from the perspective of tax. Thus, Oscar ltd is entitled to get tax benefits in

relation to the salaries paid by it to different workers and managers.

Conclusion: It has been concluded from the case evaluation that Oscar Pty Ltd cannot

claim for deduction regarding material expenses as per ITAA, 1936. Besides this, it has been

found from the evaluation that business unit can demand for the salaries paid by it to workers.

3. Calculating assessable income of Ernest Constructions Pty ltd

Issue: On the basis of given case, Oscar ltd refused Earnest Constructions Pty Ltd for

making payment of installments related to the due date of 1st July and 1st November 2017. Hence,

in against to such aspect, Ernest construction Pty Ltd sued on the aspects of contractual breach.

Laws: ITAA (1936) considered to assess the taxable income and associated liability of

Earnest Construction Pty Ltd.

Application: In accordance with ITAA, assessable income includes several aspects such

as salaries, interest, etc. Income generated by an individual or entity which can be taxed at the

end of a financial year is considered as the assessable income7. Along with this, it provides the

6 ? Income tax: deductions for repairs

7 ? What is income?

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

individual in order to generate enough for exceeding tax-free threshold. This kind of income has

high degree of similarity with the taxable income of an individual. There are different types of

incomes earned by the firm which go under assessable earnings. Further, such kind of profits are

like salary or wages, gratuities, different allowances, interest earned from bank accounts,

dividend or other returns on investment, bonuses, pensions, rental income, commissions, etc.

Apart from this, foreign earnings generated are also involved under the assessable income.

However, there are some amounts excluded while performing calculation of the assessable

earnings for an individual. Further, such excluded terms are like earnings from hobby,

inheritance, awards, gifts, incomes generated through gambling and money borrowed from

externals.

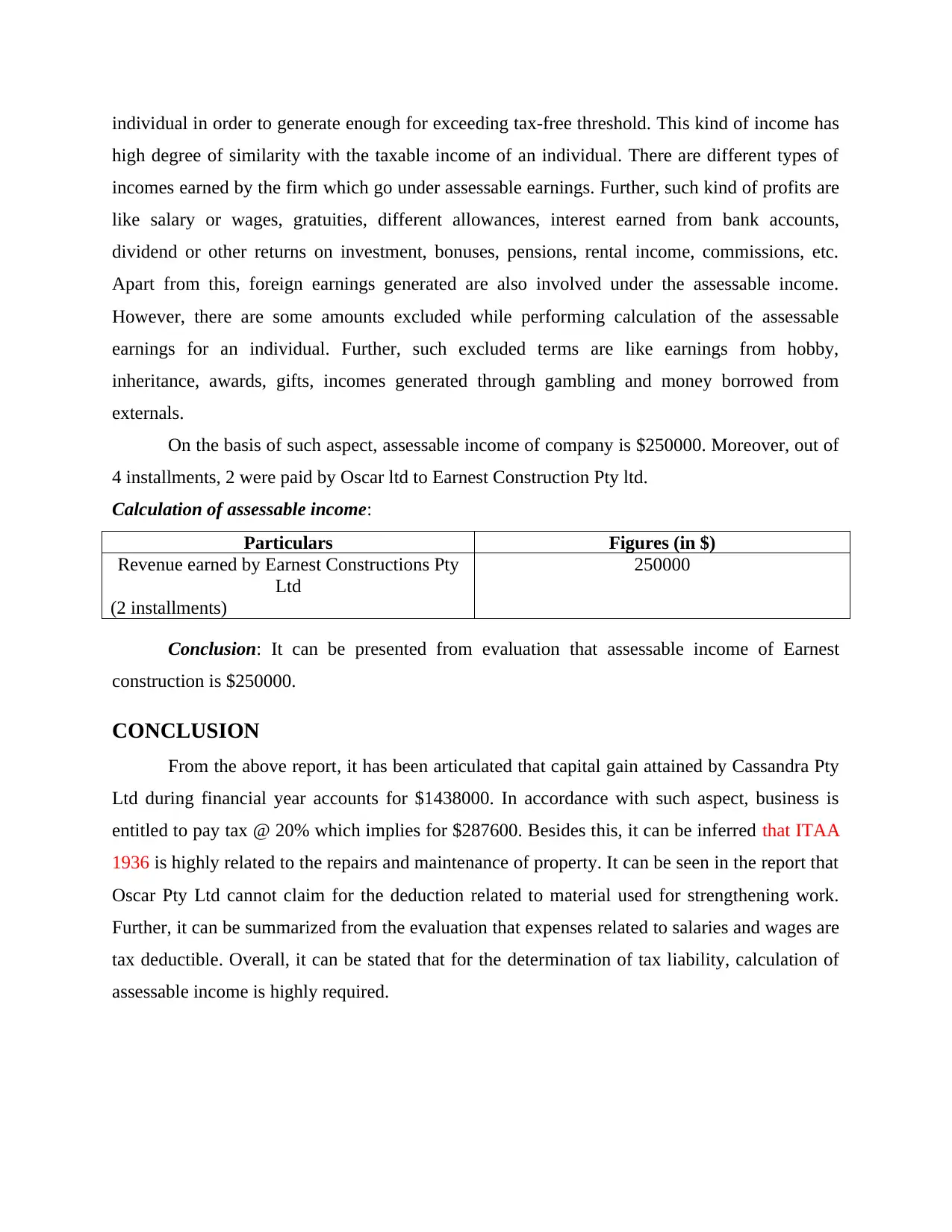

On the basis of such aspect, assessable income of company is $250000. Moreover, out of

4 installments, 2 were paid by Oscar ltd to Earnest Construction Pty ltd.

Calculation of assessable income:

Particulars Figures (in $)

Revenue earned by Earnest Constructions Pty

Ltd

(2 installments)

250000

Conclusion: It can be presented from evaluation that assessable income of Earnest

construction is $250000.

CONCLUSION

From the above report, it has been articulated that capital gain attained by Cassandra Pty

Ltd during financial year accounts for $1438000. In accordance with such aspect, business is

entitled to pay tax @ 20% which implies for $287600. Besides this, it can be inferred that ITAA

1936 is highly related to the repairs and maintenance of property. It can be seen in the report that

Oscar Pty Ltd cannot claim for the deduction related to material used for strengthening work.

Further, it can be summarized from the evaluation that expenses related to salaries and wages are

tax deductible. Overall, it can be stated that for the determination of tax liability, calculation of

assessable income is highly required.

high degree of similarity with the taxable income of an individual. There are different types of

incomes earned by the firm which go under assessable earnings. Further, such kind of profits are

like salary or wages, gratuities, different allowances, interest earned from bank accounts,

dividend or other returns on investment, bonuses, pensions, rental income, commissions, etc.

Apart from this, foreign earnings generated are also involved under the assessable income.

However, there are some amounts excluded while performing calculation of the assessable

earnings for an individual. Further, such excluded terms are like earnings from hobby,

inheritance, awards, gifts, incomes generated through gambling and money borrowed from

externals.

On the basis of such aspect, assessable income of company is $250000. Moreover, out of

4 installments, 2 were paid by Oscar ltd to Earnest Construction Pty ltd.

Calculation of assessable income:

Particulars Figures (in $)

Revenue earned by Earnest Constructions Pty

Ltd

(2 installments)

250000

Conclusion: It can be presented from evaluation that assessable income of Earnest

construction is $250000.

CONCLUSION

From the above report, it has been articulated that capital gain attained by Cassandra Pty

Ltd during financial year accounts for $1438000. In accordance with such aspect, business is

entitled to pay tax @ 20% which implies for $287600. Besides this, it can be inferred that ITAA

1936 is highly related to the repairs and maintenance of property. It can be seen in the report that

Oscar Pty Ltd cannot claim for the deduction related to material used for strengthening work.

Further, it can be summarized from the evaluation that expenses related to salaries and wages are

tax deductible. Overall, it can be stated that for the determination of tax liability, calculation of

assessable income is highly required.

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.