Detailed Income Tax Calculation Assignment: University Coursework

VerifiedAdded on 2022/11/24

|10

|400

|1

Homework Assignment

AI Summary

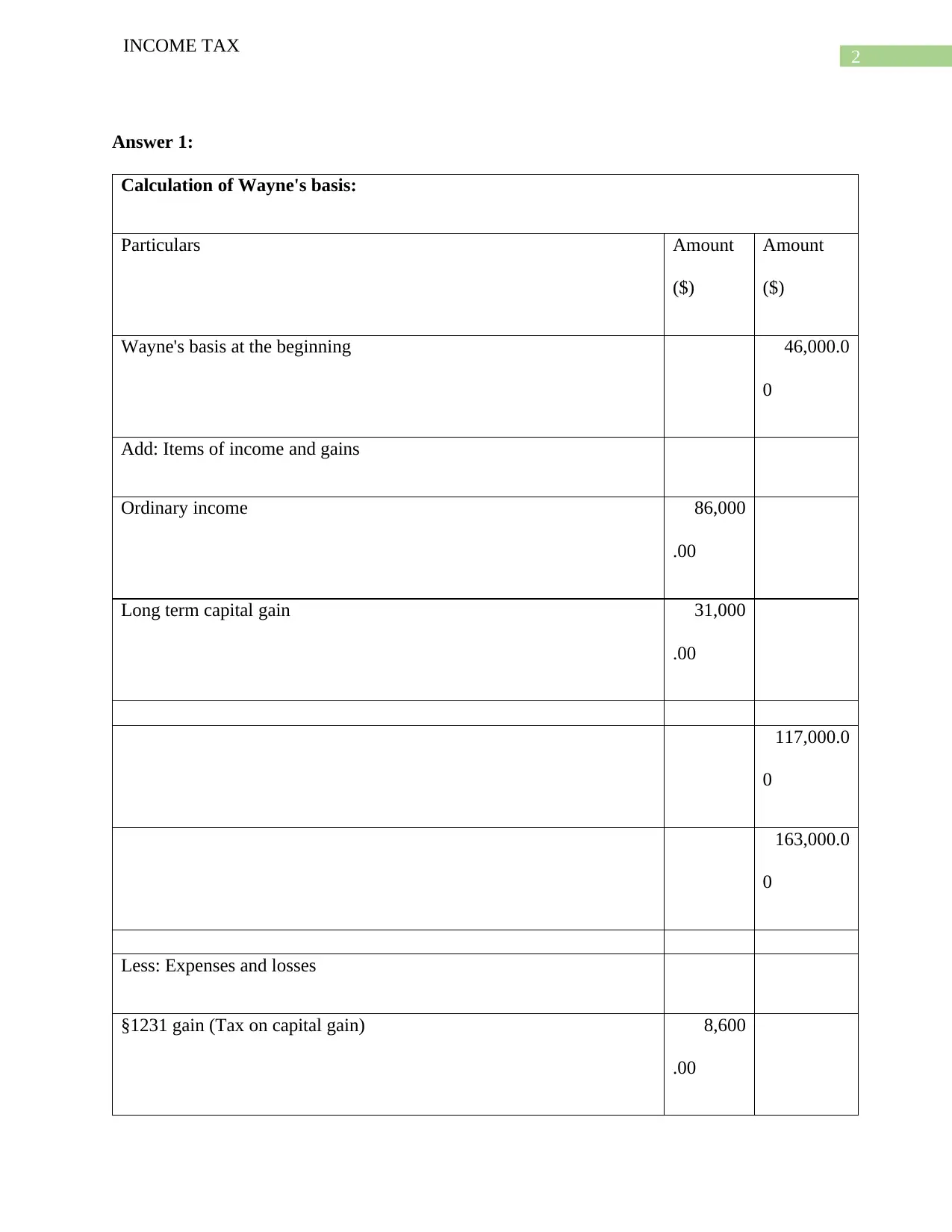

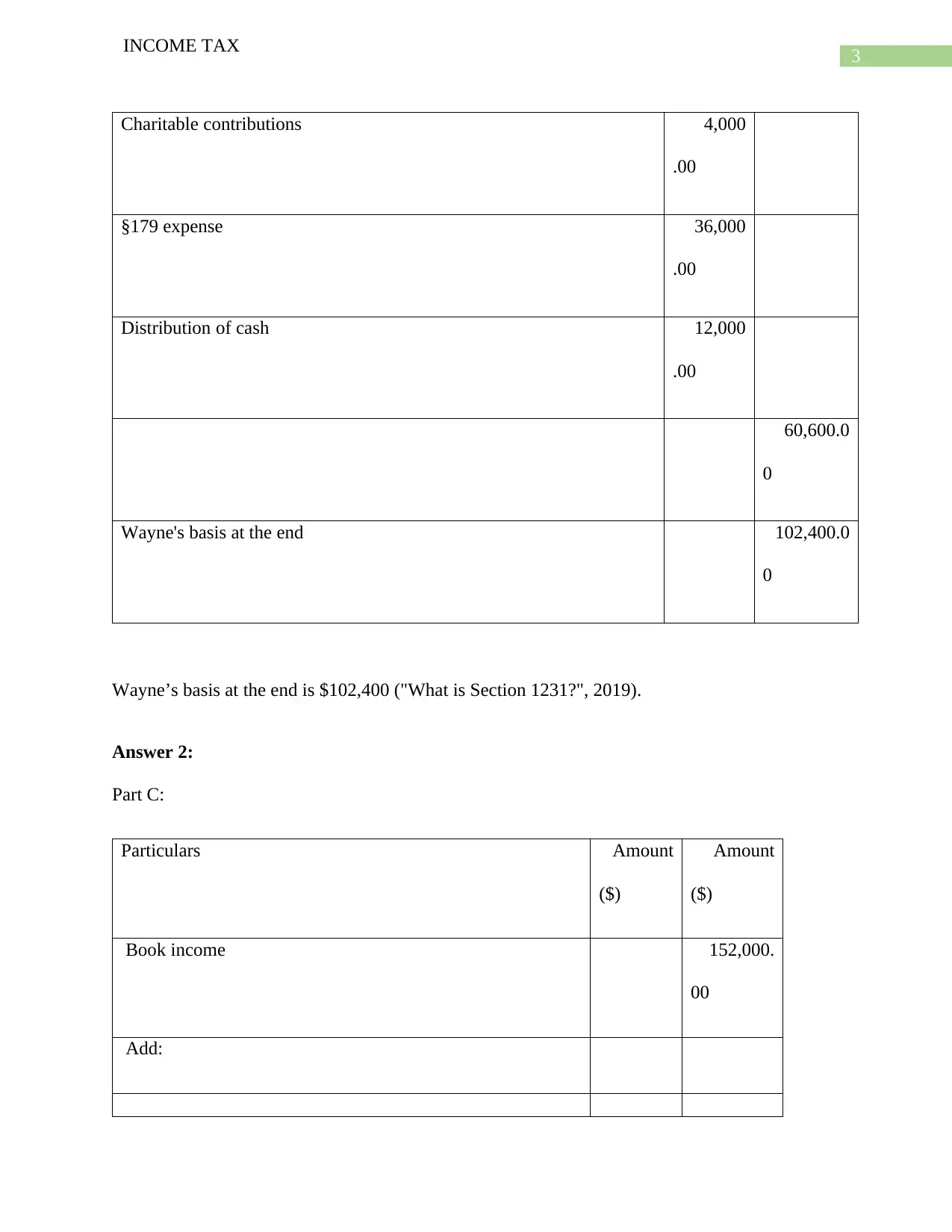

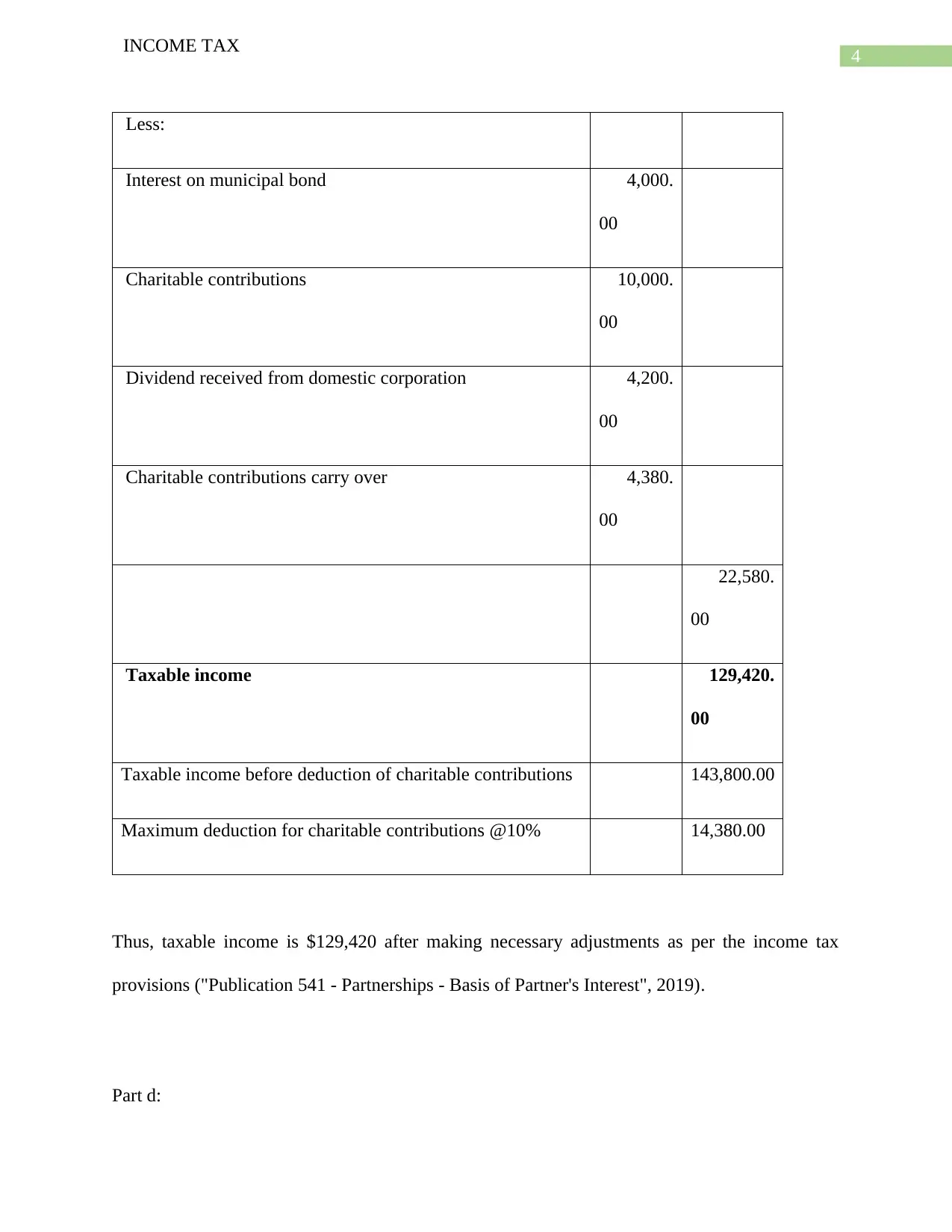

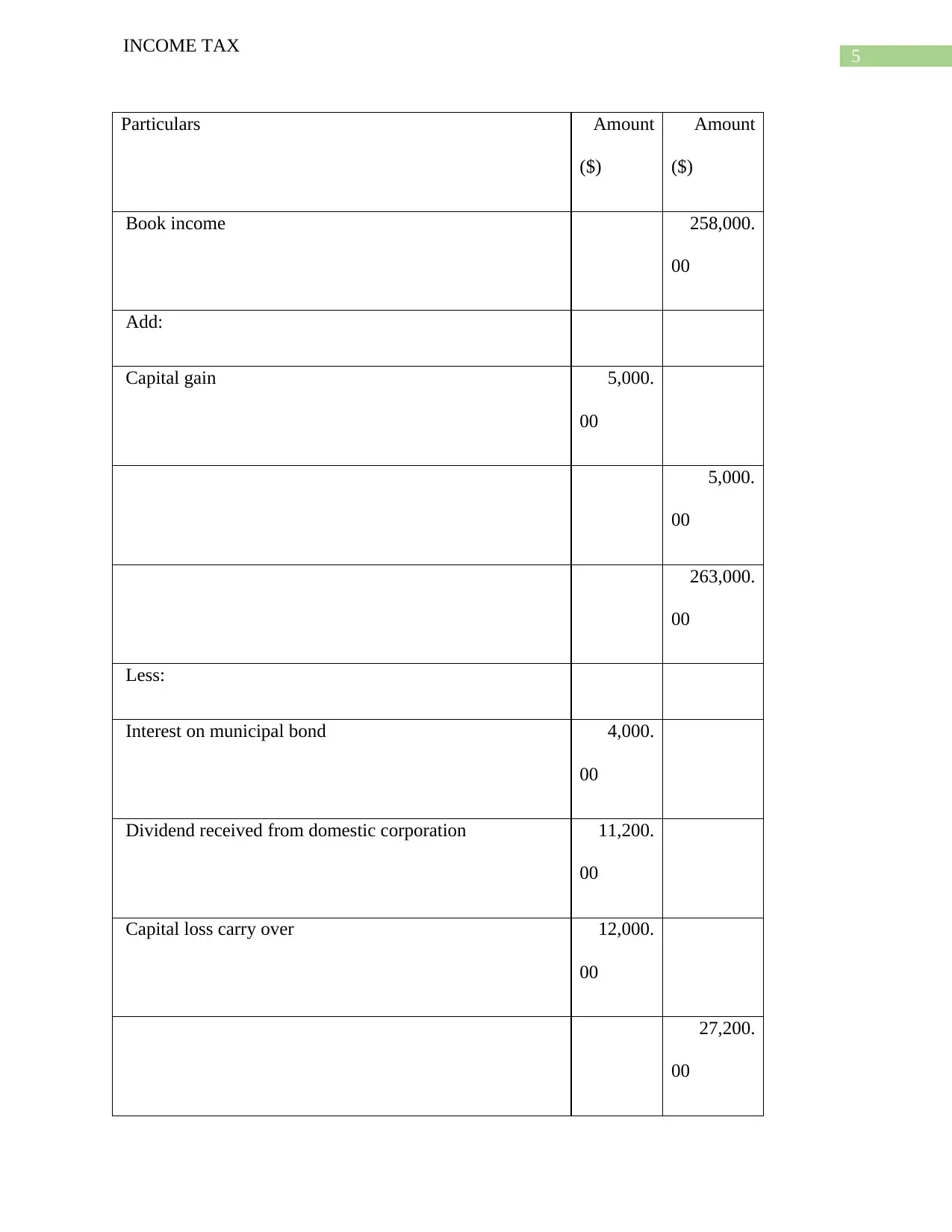

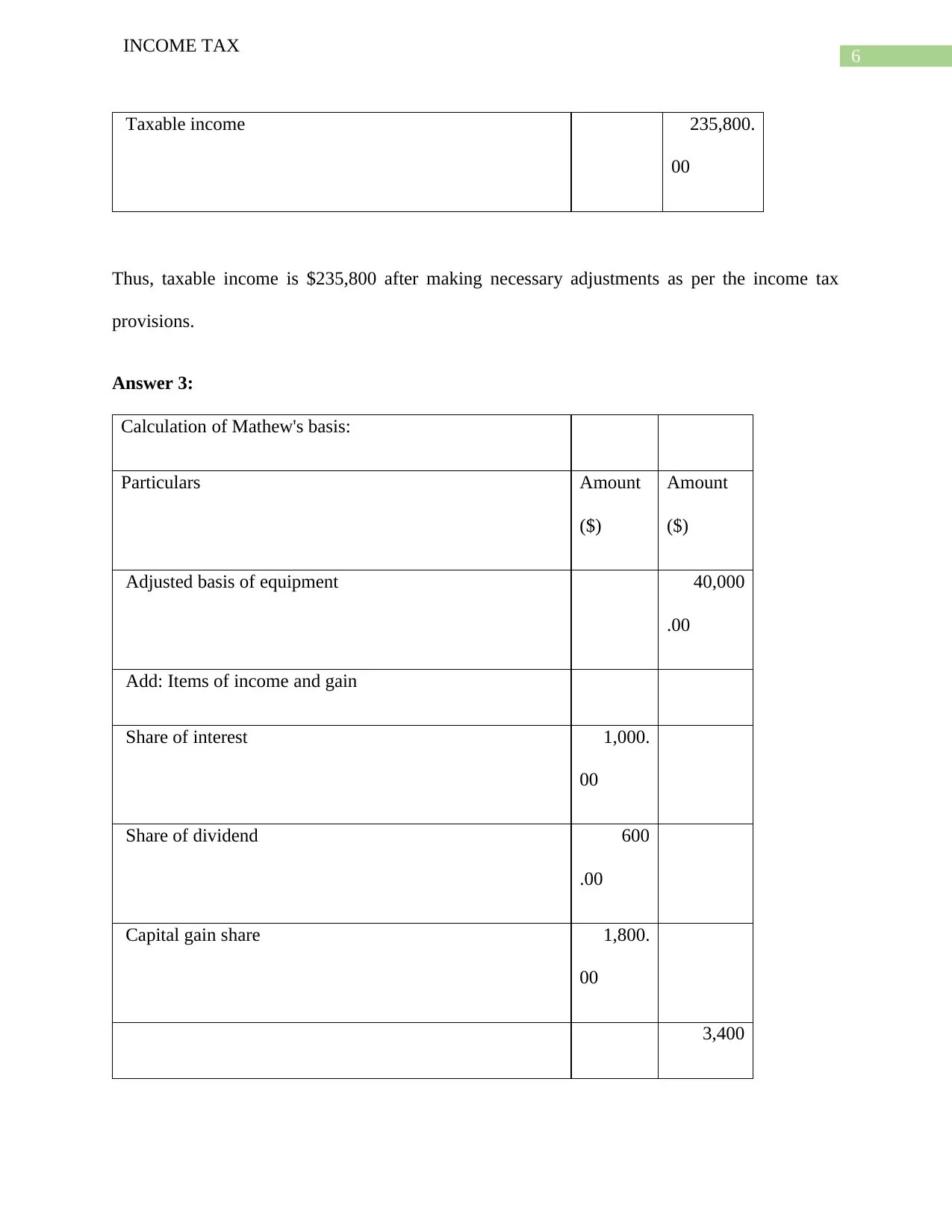

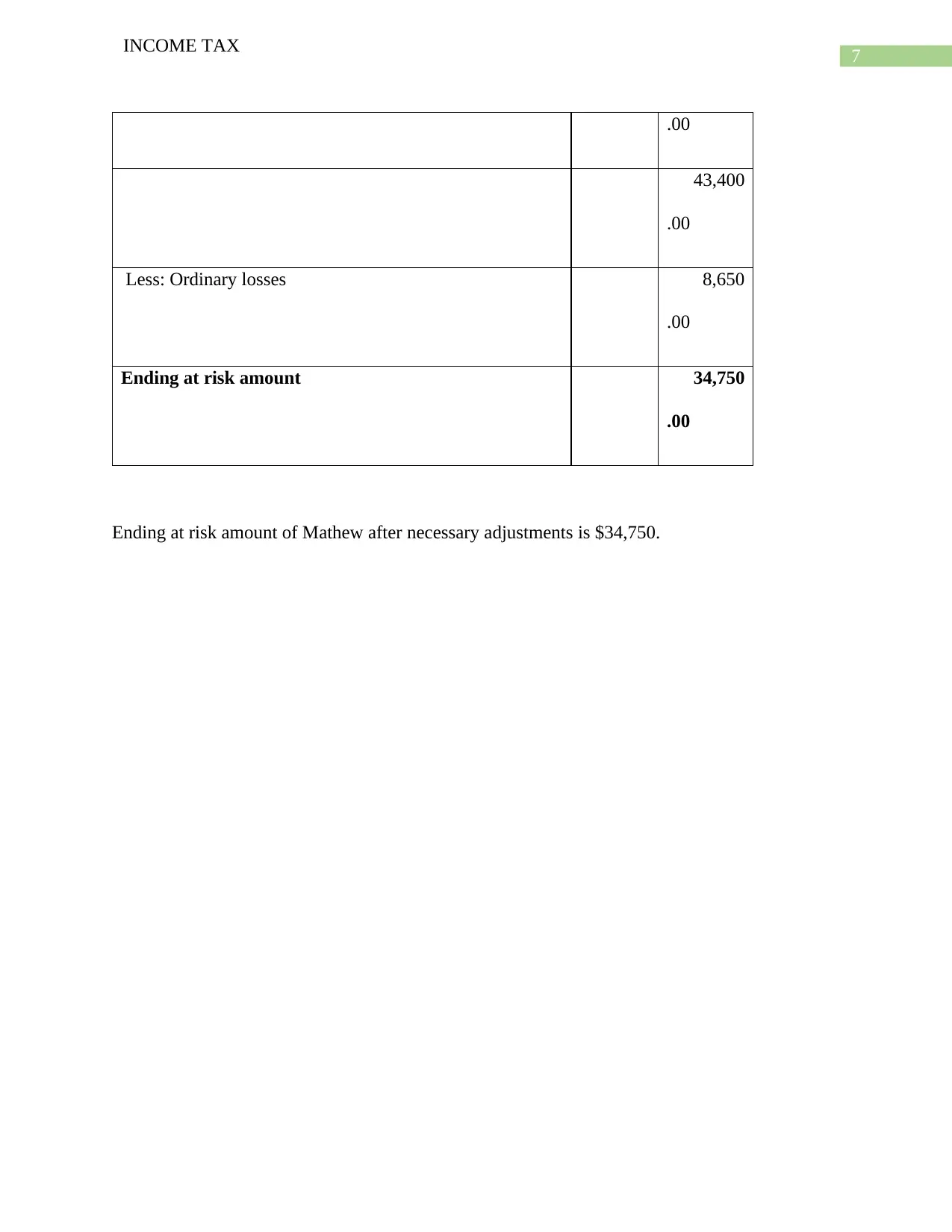

This document presents a solved income tax assignment, detailing the calculations for various scenarios. It includes the computation of Wayne's basis, determining taxable income with adjustments for charitable contributions, dividends, and capital gains (Part C and D), and calculating Mathew's basis, considering ordinary losses and at-risk amounts. The solutions demonstrate the application of income tax provisions, referencing relevant publications and resources. The assignment covers key aspects of income tax, providing a comprehensive guide for students to understand and solve complex tax-related problems. It includes step-by-step calculations and explanations, making it a valuable resource for learning and exam preparation.

1 out of 10

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)