Detailed Analysis of VAT Regulations and Indirect Tax

VerifiedAdded on 2020/12/09

|14

|4145

|54

Report

AI Summary

This report provides a detailed analysis of Value Added Tax (VAT) regulations, focusing on indirect tax principles and their practical application. It covers key aspects such as the sources of VAT information, interactions with government agencies, and the requirements for VAT registration. The report delves into the specifics of business documentation, various VAT schemes (including annual, cash, flat rate, and standard schemes), and the importance of staying updated on legislative changes. Task 2 involves the extraction of data from accounting systems, the calculation of input and output VAT for standard, zero-rated, and exempt supplies, and the determination of VAT due to or from the tax authority, along with submission procedures. Task 3 explores the implications and penalties for non-compliance with VAT regulations, including adjustments for errors. Task 4 focuses on the impact of VAT payments on cash flow and financial forecasts, as well as advising on changes in VAT legislation. The report concludes with a comprehensive overview of VAT regulations and their implications for businesses.

INDIRECT TAX

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

1.1 Source of information on VAT.........................................................................................1

1.2 How organisation interact with government agency........................................................1

1.3 Requirements of VAT registration...................................................................................1

1.4 Information that must be included on business documentation of VAT registered business

................................................................................................................................................2

1.5 VAT schemes required for reporting purposes ...............................................................2

1.6 Be aware about relevant changes of legislation and codes of practices...........................3

TASK 2..........................................................................................................................................4

2.1 Extraction of Data from the accounting system...............................................................4

2.2 Calculation of input and output for various VAT classifications.....................................5

2.3 Calculating VAT due to/from the relevant tax authority..................................................7

2.4 Submission of VAT return and any associated payment under statutory time limits......7

TASK 3............................................................................................................................................8

3.1 Implications and Penalties for an organisation resulting from failure to abide by VAT

regulations..............................................................................................................................8

3.2 Adjustments and Declarations for any errors or omissions identified in previous VAT

periods....................................................................................................................................8

TASK 4 .........................................................................................................................................10

4.1 Inform managers of the impact that the VAT payment may have on an organisation’s cash

flow and financial forecasts..................................................................................................10

4.2 Advise for changes in VAT legislation which would have an effect on an...................10

organisation’s recording systems........................................................................................10

CONCLUSION..............................................................................................................................11

REFERENCES..............................................................................................................................12

INTRODUCTION...........................................................................................................................1

1.1 Source of information on VAT.........................................................................................1

1.2 How organisation interact with government agency........................................................1

1.3 Requirements of VAT registration...................................................................................1

1.4 Information that must be included on business documentation of VAT registered business

................................................................................................................................................2

1.5 VAT schemes required for reporting purposes ...............................................................2

1.6 Be aware about relevant changes of legislation and codes of practices...........................3

TASK 2..........................................................................................................................................4

2.1 Extraction of Data from the accounting system...............................................................4

2.2 Calculation of input and output for various VAT classifications.....................................5

2.3 Calculating VAT due to/from the relevant tax authority..................................................7

2.4 Submission of VAT return and any associated payment under statutory time limits......7

TASK 3............................................................................................................................................8

3.1 Implications and Penalties for an organisation resulting from failure to abide by VAT

regulations..............................................................................................................................8

3.2 Adjustments and Declarations for any errors or omissions identified in previous VAT

periods....................................................................................................................................8

TASK 4 .........................................................................................................................................10

4.1 Inform managers of the impact that the VAT payment may have on an organisation’s cash

flow and financial forecasts..................................................................................................10

4.2 Advise for changes in VAT legislation which would have an effect on an...................10

organisation’s recording systems........................................................................................10

CONCLUSION..............................................................................................................................11

REFERENCES..............................................................................................................................12

INTRODUCTION

Indirect tax is collected by a single party whether producer or a retailer after which it is

paid to the government (Keen, 2013). Basically tax burden of such payments lies on final

consumers whereas retailers or producers act as the intermediaries who handover the collected

amount to the government. Indirect taxes includes sales tax, customs duties on import, excise

duty on production and value added tax (VAT). Since these taxes not directly paid directly to the

government that's why it is called indirect tax. This report studies the rules and regulations of

VAT Act along with their computation. Apart from rules, this report also discusses in detail the

identification, adjustments, implications and penalties regarding VAT Returns of current and

previous accounting periods.

1.1 Source of information on VAT

Value Added Tax or VAT is consumption tax which is application on goods as well as

services with its value added on every stage of production from manufacturing to the point of

sale. The amount of VAT Payable by a taxable person is calculated by subtracting inputs used

for production of goods and services from cost of products. However, VAT is not applicable for

all cities, some places are exempted from this tax.

Necessary information on is readily available from federal government sites. Another

source of information is available from HM revenue and customs (HMRC) portals that is

responsible for tax collection across UK. All the relevant information regarding tax or any other

issue for paying tax is considered by the HMRC and it provide solutions to the tax payers.

1.2 How organisation interact with government agency

At the time of VAT registration organisations have to follow the important procedures.

These procedures include registration form which is filled by organisation and with the relevant

information. During registration process, user may face issues which are solved by the

government agencies. There are different type of registration form available according to type of

business. For the clarification of that issues government agencies will provide help to the

company.

1.3 Requirements of VAT registration

Every organisation is required to apply for VAT registration if the company has more

than £85,000 taxable turnover. It includes all the items that are sold by the firm and there is no

1

Indirect tax is collected by a single party whether producer or a retailer after which it is

paid to the government (Keen, 2013). Basically tax burden of such payments lies on final

consumers whereas retailers or producers act as the intermediaries who handover the collected

amount to the government. Indirect taxes includes sales tax, customs duties on import, excise

duty on production and value added tax (VAT). Since these taxes not directly paid directly to the

government that's why it is called indirect tax. This report studies the rules and regulations of

VAT Act along with their computation. Apart from rules, this report also discusses in detail the

identification, adjustments, implications and penalties regarding VAT Returns of current and

previous accounting periods.

1.1 Source of information on VAT

Value Added Tax or VAT is consumption tax which is application on goods as well as

services with its value added on every stage of production from manufacturing to the point of

sale. The amount of VAT Payable by a taxable person is calculated by subtracting inputs used

for production of goods and services from cost of products. However, VAT is not applicable for

all cities, some places are exempted from this tax.

Necessary information on is readily available from federal government sites. Another

source of information is available from HM revenue and customs (HMRC) portals that is

responsible for tax collection across UK. All the relevant information regarding tax or any other

issue for paying tax is considered by the HMRC and it provide solutions to the tax payers.

1.2 How organisation interact with government agency

At the time of VAT registration organisations have to follow the important procedures.

These procedures include registration form which is filled by organisation and with the relevant

information. During registration process, user may face issues which are solved by the

government agencies. There are different type of registration form available according to type of

business. For the clarification of that issues government agencies will provide help to the

company.

1.3 Requirements of VAT registration

Every organisation is required to apply for VAT registration if the company has more

than £85,000 taxable turnover. It includes all the items that are sold by the firm and there is no

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

VAT exemption except otherwise mentioned. Registration of VAT is done by filling form online

as well as offline too, mostly business entities such as partnership firms or companies opt for

online registrations for themselves. After registration,an online VAT account is opened with the

tax authorities in the name of taxable persons. Organisation can register through agents just to

provide necessary information like VAT returns. After registration company get their value

added tax number from HM Revenue and Customs (HMRC).

Companies can also get themselves registered through offline mode just to fill form, such

as VAT1A form provided for those who are distance sellers, VAT1B I for importers and VAT1C

if company wants to dispose their assets. After completion of VAT registration organisations

receive their VAT certificates within 30 working days. It is directly sent to their online VAT

accounts or by post if registered offline through an agent (Sehrawat and Dhanda, 2015).

1.4 Information that must be included on business documentation of VAT registered business

It is a basic rule in the organizations to maintain business records, mostly in a digital

format. Therefore, organisations fulfil this requirement very well since recorded evidence of

transactions is easily available to comply with the documentation and registration requirements

of VAT system. A VAT registered business needs to include following information and accounts

for due compliance:

Special records for VAT: Generally two types of records are maintained by the

organisation. First one is regarding VAT account and second is VAT invoices. The VAT

Account includes the daily business records and VAT invoices is for suppliers. Here, the

term 'invoices' is just a terminology, it only involves information which is specified in

VAT rules.

Business need to maintain records due to requirement of HMRC such as bank statements,

annual accounts, credit or debit notes, import or export documents, invoices, VAT

accounts etc.

1.5 VAT schemes required for reporting purposes

Annual accounting scheme: - It is a scheme which provides facilities to the organisation

to pay their tax on an annual basis. Under this scheme, the taxable person files their VAT

returns only once in a year instead on a quarterly basis.

Cash accounting scheme: - Usually the amount of difference between sales invoices and

purchase invoices is the net value paid to HMRC as VAT Return (Li and Whalley, 2012).

2

as well as offline too, mostly business entities such as partnership firms or companies opt for

online registrations for themselves. After registration,an online VAT account is opened with the

tax authorities in the name of taxable persons. Organisation can register through agents just to

provide necessary information like VAT returns. After registration company get their value

added tax number from HM Revenue and Customs (HMRC).

Companies can also get themselves registered through offline mode just to fill form, such

as VAT1A form provided for those who are distance sellers, VAT1B I for importers and VAT1C

if company wants to dispose their assets. After completion of VAT registration organisations

receive their VAT certificates within 30 working days. It is directly sent to their online VAT

accounts or by post if registered offline through an agent (Sehrawat and Dhanda, 2015).

1.4 Information that must be included on business documentation of VAT registered business

It is a basic rule in the organizations to maintain business records, mostly in a digital

format. Therefore, organisations fulfil this requirement very well since recorded evidence of

transactions is easily available to comply with the documentation and registration requirements

of VAT system. A VAT registered business needs to include following information and accounts

for due compliance:

Special records for VAT: Generally two types of records are maintained by the

organisation. First one is regarding VAT account and second is VAT invoices. The VAT

Account includes the daily business records and VAT invoices is for suppliers. Here, the

term 'invoices' is just a terminology, it only involves information which is specified in

VAT rules.

Business need to maintain records due to requirement of HMRC such as bank statements,

annual accounts, credit or debit notes, import or export documents, invoices, VAT

accounts etc.

1.5 VAT schemes required for reporting purposes

Annual accounting scheme: - It is a scheme which provides facilities to the organisation

to pay their tax on an annual basis. Under this scheme, the taxable person files their VAT

returns only once in a year instead on a quarterly basis.

Cash accounting scheme: - Usually the amount of difference between sales invoices and

purchase invoices is the net value paid to HMRC as VAT Return (Li and Whalley, 2012).

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

However, under this scheme, the VAT is paid at the time of sale and reclaimed when

payment is made to the supplier by sellers. In order to be an eligible tax payer under this

scheme, VAT taxable turnover must not exceed £1.35 million.

Flat rate scheme: - This scheme is especially designed for the simplification of records

such as sales and purchase transactions. This scheme allows the organisation to use fixed

percentage or flat rates on company's turnover to calculate VAT due. Fixed rate

percentage scheme depends upon the size and type of business. The difference between

the amount charged and amount paid is kept with the organization as their income.

Reclaim on VAT cannot be claimed for purchases except for certain capital assets

exceeding £2,000.In order to be an eligible tax payer under this scheme, VAT taxable

turnover must not exceed £150,000.

Standard scheme: - In this method organisation pays VAT return quarterly in an

accounting period. If any amount is due then that is also paid quarterly. If any organisation has

sales amounting more than product cost then the difference of that amount is to be paid HMRC.

1.6 Be aware about relevant changes of legislation and codes of practices

Every organisation needs to know about the legislation and codes of best practices for

effective work. These are mentioned below:

Organisation have proper knowledge about how to make statistics

Protection of data by computer software

Minimise their records or data

Awareness about governance information

There are some important legislation which is used by these data. If any company is not

sure about how legal thinks effect the organisation than they to consult legal person.

Personal data

Sharing and re-use of data

Intellectual property and copyright

Accountability

TASK 2

2.1 Extraction of Data from the accounting system

1. Data for calculation of Relevant Input and Output for Standard Supplies (year 2012-13):

3

payment is made to the supplier by sellers. In order to be an eligible tax payer under this

scheme, VAT taxable turnover must not exceed £1.35 million.

Flat rate scheme: - This scheme is especially designed for the simplification of records

such as sales and purchase transactions. This scheme allows the organisation to use fixed

percentage or flat rates on company's turnover to calculate VAT due. Fixed rate

percentage scheme depends upon the size and type of business. The difference between

the amount charged and amount paid is kept with the organization as their income.

Reclaim on VAT cannot be claimed for purchases except for certain capital assets

exceeding £2,000.In order to be an eligible tax payer under this scheme, VAT taxable

turnover must not exceed £150,000.

Standard scheme: - In this method organisation pays VAT return quarterly in an

accounting period. If any amount is due then that is also paid quarterly. If any organisation has

sales amounting more than product cost then the difference of that amount is to be paid HMRC.

1.6 Be aware about relevant changes of legislation and codes of practices

Every organisation needs to know about the legislation and codes of best practices for

effective work. These are mentioned below:

Organisation have proper knowledge about how to make statistics

Protection of data by computer software

Minimise their records or data

Awareness about governance information

There are some important legislation which is used by these data. If any company is not

sure about how legal thinks effect the organisation than they to consult legal person.

Personal data

Sharing and re-use of data

Intellectual property and copyright

Accountability

TASK 2

2.1 Extraction of Data from the accounting system

1. Data for calculation of Relevant Input and Output for Standard Supplies (year 2012-13):

3

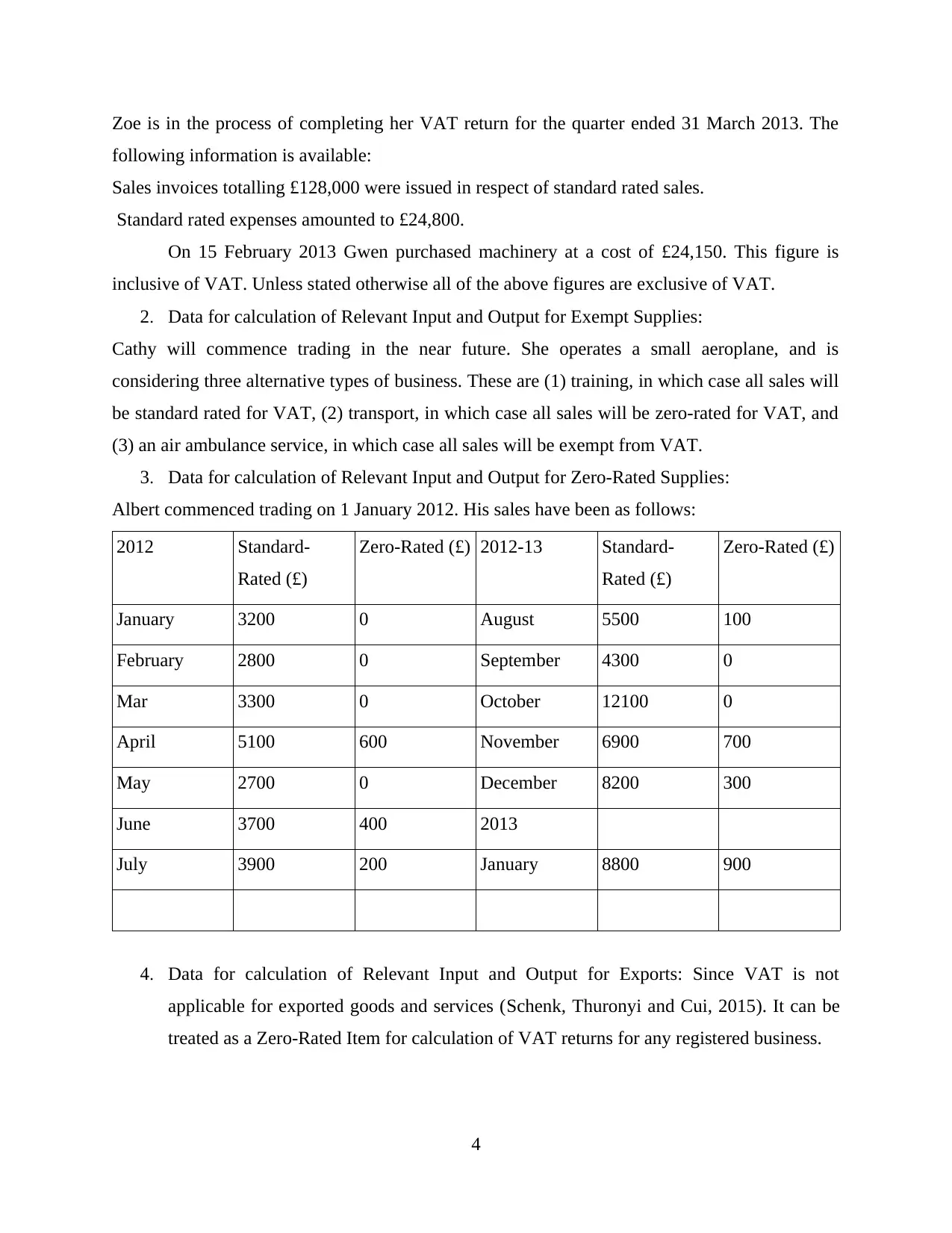

Zoe is in the process of completing her VAT return for the quarter ended 31 March 2013. The

following information is available:

Sales invoices totalling £128,000 were issued in respect of standard rated sales.

Standard rated expenses amounted to £24,800.

On 15 February 2013 Gwen purchased machinery at a cost of £24,150. This figure is

inclusive of VAT. Unless stated otherwise all of the above figures are exclusive of VAT.

2. Data for calculation of Relevant Input and Output for Exempt Supplies:

Cathy will commence trading in the near future. She operates a small aeroplane, and is

considering three alternative types of business. These are (1) training, in which case all sales will

be standard rated for VAT, (2) transport, in which case all sales will be zero-rated for VAT, and

(3) an air ambulance service, in which case all sales will be exempt from VAT.

3. Data for calculation of Relevant Input and Output for Zero-Rated Supplies:

Albert commenced trading on 1 January 2012. His sales have been as follows:

2012 Standard-

Rated (£)

Zero-Rated (£) 2012-13 Standard-

Rated (£)

Zero-Rated (£)

January 3200 0 August 5500 100

February 2800 0 September 4300 0

Mar 3300 0 October 12100 0

April 5100 600 November 6900 700

May 2700 0 December 8200 300

June 3700 400 2013

July 3900 200 January 8800 900

4. Data for calculation of Relevant Input and Output for Exports: Since VAT is not

applicable for exported goods and services (Schenk, Thuronyi and Cui, 2015). It can be

treated as a Zero-Rated Item for calculation of VAT returns for any registered business.

4

following information is available:

Sales invoices totalling £128,000 were issued in respect of standard rated sales.

Standard rated expenses amounted to £24,800.

On 15 February 2013 Gwen purchased machinery at a cost of £24,150. This figure is

inclusive of VAT. Unless stated otherwise all of the above figures are exclusive of VAT.

2. Data for calculation of Relevant Input and Output for Exempt Supplies:

Cathy will commence trading in the near future. She operates a small aeroplane, and is

considering three alternative types of business. These are (1) training, in which case all sales will

be standard rated for VAT, (2) transport, in which case all sales will be zero-rated for VAT, and

(3) an air ambulance service, in which case all sales will be exempt from VAT.

3. Data for calculation of Relevant Input and Output for Zero-Rated Supplies:

Albert commenced trading on 1 January 2012. His sales have been as follows:

2012 Standard-

Rated (£)

Zero-Rated (£) 2012-13 Standard-

Rated (£)

Zero-Rated (£)

January 3200 0 August 5500 100

February 2800 0 September 4300 0

Mar 3300 0 October 12100 0

April 5100 600 November 6900 700

May 2700 0 December 8200 300

June 3700 400 2013

July 3900 200 January 8800 900

4. Data for calculation of Relevant Input and Output for Exports: Since VAT is not

applicable for exported goods and services (Schenk, Thuronyi and Cui, 2015). It can be

treated as a Zero-Rated Item for calculation of VAT returns for any registered business.

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

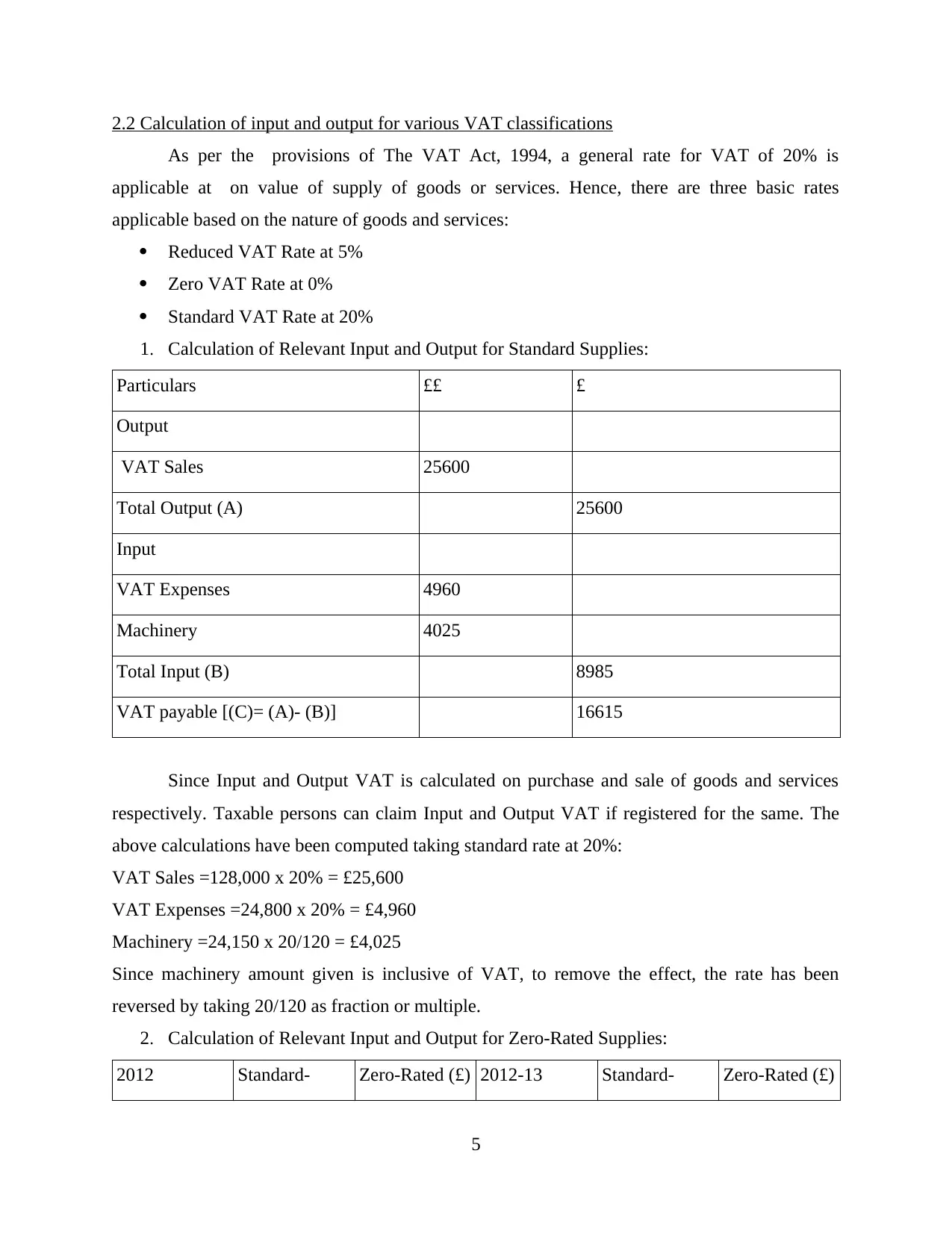

2.2 Calculation of input and output for various VAT classifications

As per the provisions of The VAT Act, 1994, a general rate for VAT of 20% is

applicable at on value of supply of goods or services. Hence, there are three basic rates

applicable based on the nature of goods and services:

Reduced VAT Rate at 5%

Zero VAT Rate at 0%

Standard VAT Rate at 20%

1. Calculation of Relevant Input and Output for Standard Supplies:

Particulars ££ £

Output

VAT Sales 25600

Total Output (A) 25600

Input

VAT Expenses 4960

Machinery 4025

Total Input (B) 8985

VAT payable [(C)= (A)- (B)] 16615

Since Input and Output VAT is calculated on purchase and sale of goods and services

respectively. Taxable persons can claim Input and Output VAT if registered for the same. The

above calculations have been computed taking standard rate at 20%:

VAT Sales =128,000 x 20% = £25,600

VAT Expenses =24,800 x 20% = £4,960

Machinery =24,150 x 20/120 = £4,025

Since machinery amount given is inclusive of VAT, to remove the effect, the rate has been

reversed by taking 20/120 as fraction or multiple.

2. Calculation of Relevant Input and Output for Zero-Rated Supplies:

2012 Standard- Zero-Rated (£) 2012-13 Standard- Zero-Rated (£)

5

As per the provisions of The VAT Act, 1994, a general rate for VAT of 20% is

applicable at on value of supply of goods or services. Hence, there are three basic rates

applicable based on the nature of goods and services:

Reduced VAT Rate at 5%

Zero VAT Rate at 0%

Standard VAT Rate at 20%

1. Calculation of Relevant Input and Output for Standard Supplies:

Particulars ££ £

Output

VAT Sales 25600

Total Output (A) 25600

Input

VAT Expenses 4960

Machinery 4025

Total Input (B) 8985

VAT payable [(C)= (A)- (B)] 16615

Since Input and Output VAT is calculated on purchase and sale of goods and services

respectively. Taxable persons can claim Input and Output VAT if registered for the same. The

above calculations have been computed taking standard rate at 20%:

VAT Sales =128,000 x 20% = £25,600

VAT Expenses =24,800 x 20% = £4,960

Machinery =24,150 x 20/120 = £4,025

Since machinery amount given is inclusive of VAT, to remove the effect, the rate has been

reversed by taking 20/120 as fraction or multiple.

2. Calculation of Relevant Input and Output for Zero-Rated Supplies:

2012 Standard- Zero-Rated (£) 2012-13 Standard- Zero-Rated (£)

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

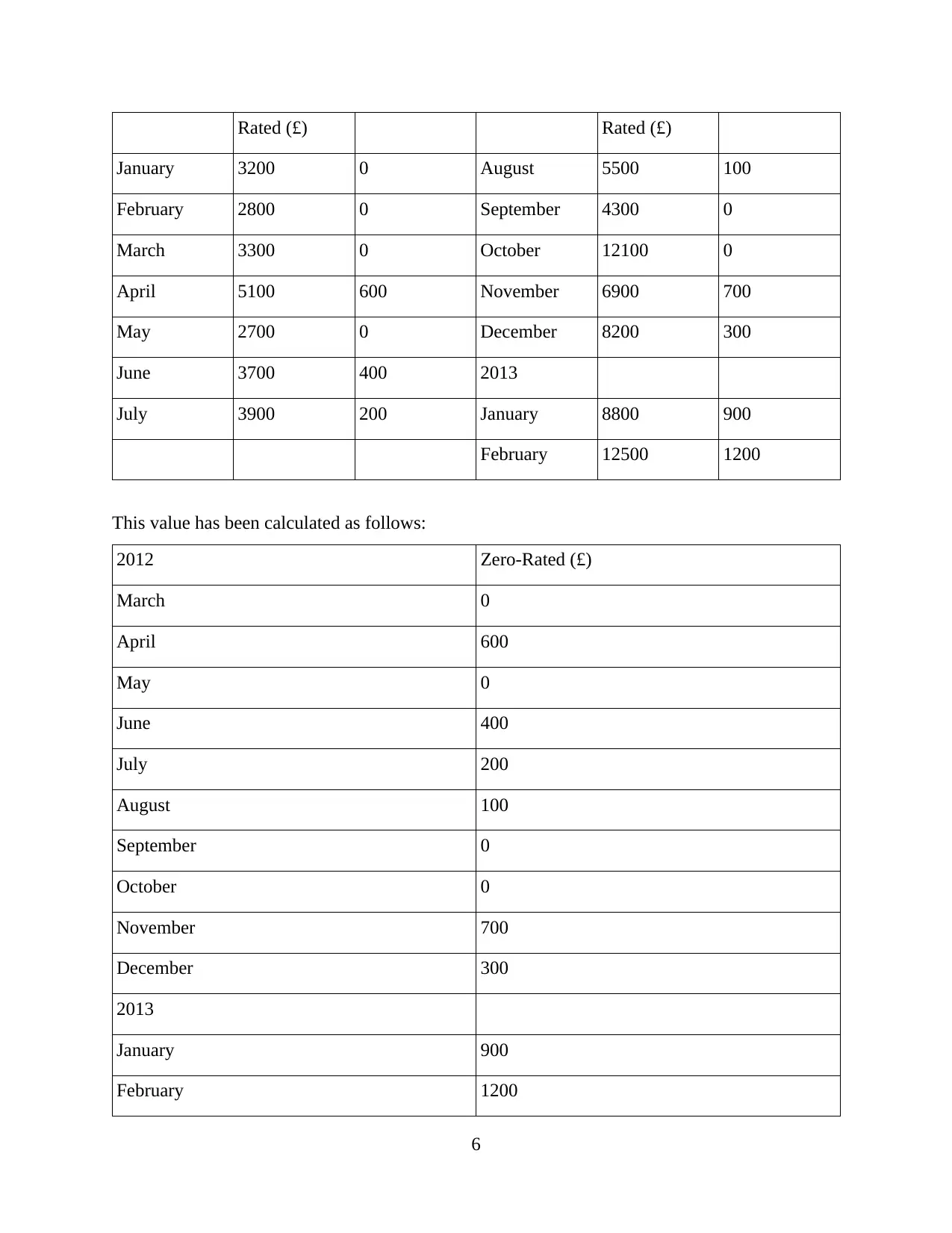

Rated (£) Rated (£)

January 3200 0 August 5500 100

February 2800 0 September 4300 0

March 3300 0 October 12100 0

April 5100 600 November 6900 700

May 2700 0 December 8200 300

June 3700 400 2013

July 3900 200 January 8800 900

February 12500 1200

This value has been calculated as follows:

2012 Zero-Rated (£)

March 0

April 600

May 0

June 400

July 200

August 100

September 0

October 0

November 700

December 300

2013

January 900

February 1200

6

January 3200 0 August 5500 100

February 2800 0 September 4300 0

March 3300 0 October 12100 0

April 5100 600 November 6900 700

May 2700 0 December 8200 300

June 3700 400 2013

July 3900 200 January 8800 900

February 12500 1200

This value has been calculated as follows:

2012 Zero-Rated (£)

March 0

April 600

May 0

June 400

July 200

August 100

September 0

October 0

November 700

December 300

2013

January 900

February 1200

6

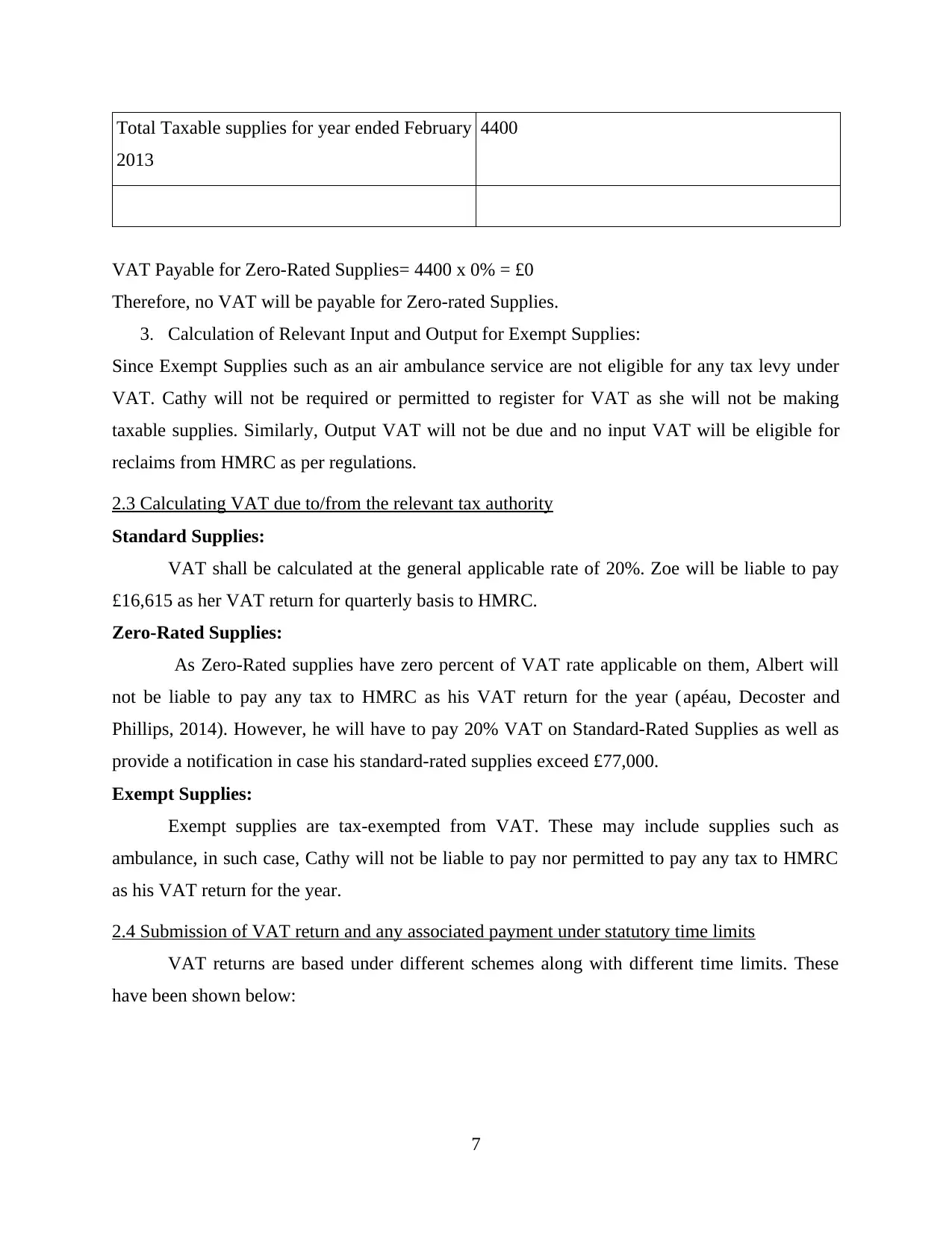

Total Taxable supplies for year ended February

2013

4400

VAT Payable for Zero-Rated Supplies= 4400 x 0% = £0

Therefore, no VAT will be payable for Zero-rated Supplies.

3. Calculation of Relevant Input and Output for Exempt Supplies:

Since Exempt Supplies such as an air ambulance service are not eligible for any tax levy under

VAT. Cathy will not be required or permitted to register for VAT as she will not be making

taxable supplies. Similarly, Output VAT will not be due and no input VAT will be eligible for

reclaims from HMRC as per regulations.

2.3 Calculating VAT due to/from the relevant tax authority

Standard Supplies:

VAT shall be calculated at the general applicable rate of 20%. Zoe will be liable to pay

£16,615 as her VAT return for quarterly basis to HMRC.

Zero-Rated Supplies:

As Zero-Rated supplies have zero percent of VAT rate applicable on them, Albert will

not be liable to pay any tax to HMRC as his VAT return for the year ( apéau, Decoster and

Phillips, 2014). However, he will have to pay 20% VAT on Standard-Rated Supplies as well as

provide a notification in case his standard-rated supplies exceed £77,000.

Exempt Supplies:

Exempt supplies are tax-exempted from VAT. These may include supplies such as

ambulance, in such case, Cathy will not be liable to pay nor permitted to pay any tax to HMRC

as his VAT return for the year.

2.4 Submission of VAT return and any associated payment under statutory time limits

VAT returns are based under different schemes along with different time limits. These

have been shown below:

7

2013

4400

VAT Payable for Zero-Rated Supplies= 4400 x 0% = £0

Therefore, no VAT will be payable for Zero-rated Supplies.

3. Calculation of Relevant Input and Output for Exempt Supplies:

Since Exempt Supplies such as an air ambulance service are not eligible for any tax levy under

VAT. Cathy will not be required or permitted to register for VAT as she will not be making

taxable supplies. Similarly, Output VAT will not be due and no input VAT will be eligible for

reclaims from HMRC as per regulations.

2.3 Calculating VAT due to/from the relevant tax authority

Standard Supplies:

VAT shall be calculated at the general applicable rate of 20%. Zoe will be liable to pay

£16,615 as her VAT return for quarterly basis to HMRC.

Zero-Rated Supplies:

As Zero-Rated supplies have zero percent of VAT rate applicable on them, Albert will

not be liable to pay any tax to HMRC as his VAT return for the year ( apéau, Decoster and

Phillips, 2014). However, he will have to pay 20% VAT on Standard-Rated Supplies as well as

provide a notification in case his standard-rated supplies exceed £77,000.

Exempt Supplies:

Exempt supplies are tax-exempted from VAT. These may include supplies such as

ambulance, in such case, Cathy will not be liable to pay nor permitted to pay any tax to HMRC

as his VAT return for the year.

2.4 Submission of VAT return and any associated payment under statutory time limits

VAT returns are based under different schemes along with different time limits. These

have been shown below:

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

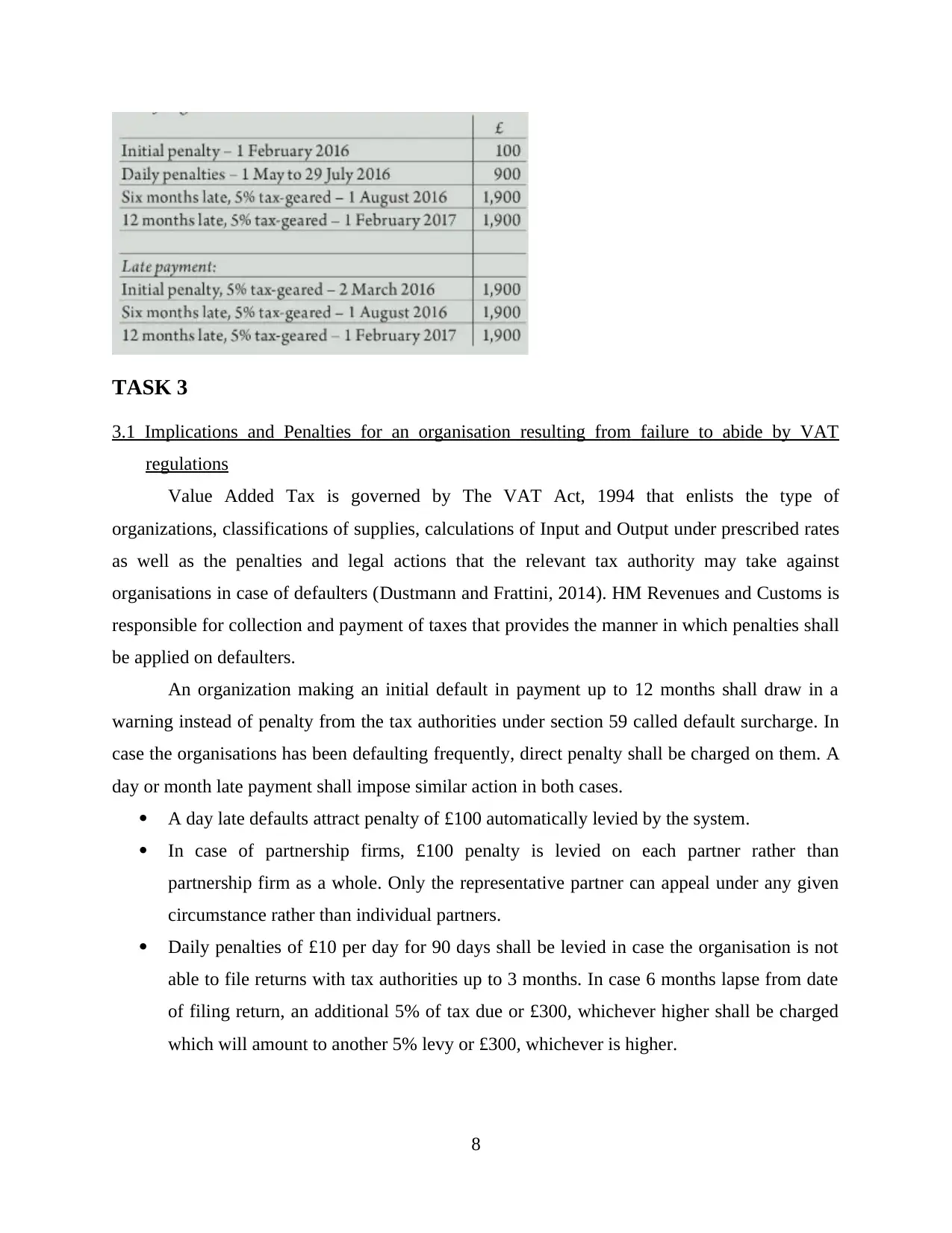

TASK 3

3.1 Implications and Penalties for an organisation resulting from failure to abide by VAT

regulations

Value Added Tax is governed by The VAT Act, 1994 that enlists the type of

organizations, classifications of supplies, calculations of Input and Output under prescribed rates

as well as the penalties and legal actions that the relevant tax authority may take against

organisations in case of defaulters (Dustmann and Frattini, 2014). HM Revenues and Customs is

responsible for collection and payment of taxes that provides the manner in which penalties shall

be applied on defaulters.

An organization making an initial default in payment up to 12 months shall draw in a

warning instead of penalty from the tax authorities under section 59 called default surcharge. In

case the organisations has been defaulting frequently, direct penalty shall be charged on them. A

day or month late payment shall impose similar action in both cases.

A day late defaults attract penalty of £100 automatically levied by the system.

In case of partnership firms, £100 penalty is levied on each partner rather than

partnership firm as a whole. Only the representative partner can appeal under any given

circumstance rather than individual partners.

Daily penalties of £10 per day for 90 days shall be levied in case the organisation is not

able to file returns with tax authorities up to 3 months. In case 6 months lapse from date

of filing return, an additional 5% of tax due or £300, whichever higher shall be charged

which will amount to another 5% levy or £300, whichever is higher.

8

3.1 Implications and Penalties for an organisation resulting from failure to abide by VAT

regulations

Value Added Tax is governed by The VAT Act, 1994 that enlists the type of

organizations, classifications of supplies, calculations of Input and Output under prescribed rates

as well as the penalties and legal actions that the relevant tax authority may take against

organisations in case of defaulters (Dustmann and Frattini, 2014). HM Revenues and Customs is

responsible for collection and payment of taxes that provides the manner in which penalties shall

be applied on defaulters.

An organization making an initial default in payment up to 12 months shall draw in a

warning instead of penalty from the tax authorities under section 59 called default surcharge. In

case the organisations has been defaulting frequently, direct penalty shall be charged on them. A

day or month late payment shall impose similar action in both cases.

A day late defaults attract penalty of £100 automatically levied by the system.

In case of partnership firms, £100 penalty is levied on each partner rather than

partnership firm as a whole. Only the representative partner can appeal under any given

circumstance rather than individual partners.

Daily penalties of £10 per day for 90 days shall be levied in case the organisation is not

able to file returns with tax authorities up to 3 months. In case 6 months lapse from date

of filing return, an additional 5% of tax due or £300, whichever higher shall be charged

which will amount to another 5% levy or £300, whichever is higher.

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

3.2 Adjustments and Declarations for any errors or omissions identified in previous VAT periods

Errors or omissions identified in previous

VAT periods:

Disclosure of errors, omissions or any kind of inaccuracies is necessary. Such errors shall be

reported by filling form VAT652 and submitted to VAT Correction Team. They are categorised

below:

an error identified that is above the reporting threshold.

a deliberate error or a mistake made on purpose

an error made in an accounting period up to 4 previous years.

The error reporting threshold for any organisation is limited to £10,000. Any error

exceeding this threshold shall be reported to HMRC (Williams and Martinez, 2014). To calculate

the threshold, a net value of errors is computed by taking a summation of additional tax due to

HMRC and subtracting tax due from this amount. [Net Value of Errors = Total Additional tax

due to HMRC - Tax Due]

Deliberate errors must be reported separately to HMRC in writing along with supporting

evidence that would include details of date of discovery of error, reasons amounting to cause of

such errors and how it occurred.

An errors identified in accounting period up to 4 previous years that have been identified

by HMRC, a certain amount of interest shall be charged on tax due or misdeclaration penalty to

claim such amounts.

Adjustments for errors or omissions identified in previous

VAT periods:

As per section 4 of Penalties for Errors Regime, 2009 of The VAT Act, 1994,

adjustments must be made after computing the net value of errors. The adjusted amount can be

included in the current VAT providing in following cases:

If the net value does not exceed £10,000 or

If the net value lies between £10,000 and £50,000 but does not exceed 1% of net outputs

mentioned in VAT return declaration for the period in which the error is discovered,

However, if net value of errors does not meet the above criteria or is categorised as a deliberate

error, a separate form- VAT652 must be filled and submitted to HMRC with details including:

Reasons amounting to cause of such errors

9

Errors or omissions identified in previous

VAT periods:

Disclosure of errors, omissions or any kind of inaccuracies is necessary. Such errors shall be

reported by filling form VAT652 and submitted to VAT Correction Team. They are categorised

below:

an error identified that is above the reporting threshold.

a deliberate error or a mistake made on purpose

an error made in an accounting period up to 4 previous years.

The error reporting threshold for any organisation is limited to £10,000. Any error

exceeding this threshold shall be reported to HMRC (Williams and Martinez, 2014). To calculate

the threshold, a net value of errors is computed by taking a summation of additional tax due to

HMRC and subtracting tax due from this amount. [Net Value of Errors = Total Additional tax

due to HMRC - Tax Due]

Deliberate errors must be reported separately to HMRC in writing along with supporting

evidence that would include details of date of discovery of error, reasons amounting to cause of

such errors and how it occurred.

An errors identified in accounting period up to 4 previous years that have been identified

by HMRC, a certain amount of interest shall be charged on tax due or misdeclaration penalty to

claim such amounts.

Adjustments for errors or omissions identified in previous

VAT periods:

As per section 4 of Penalties for Errors Regime, 2009 of The VAT Act, 1994,

adjustments must be made after computing the net value of errors. The adjusted amount can be

included in the current VAT providing in following cases:

If the net value does not exceed £10,000 or

If the net value lies between £10,000 and £50,000 but does not exceed 1% of net outputs

mentioned in VAT return declaration for the period in which the error is discovered,

However, if net value of errors does not meet the above criteria or is categorised as a deliberate

error, a separate form- VAT652 must be filled and submitted to HMRC with details including:

Reasons amounting to cause of such errors

9

accounting period of discovery of error

Type of error - input or output

Net Value of Errors- both under-declared and over-declared amounts

Computation summary for calculating Net Value

If the errors have resulted in additional payments to tax authorities

Total amount to be adjusted

In case the net value of errors have nil or minimal effect on the net VAT due on returns either of

the above methods can be used to rectify the errors. The organisation must notify HMRC about

any kind of deliberate error made on the organisation's part (Onaolapo, Aworemi and Ajala,

2013).

TASK 4

4.1 Inform managers of the impact that the VAT payment may have on an organisation’s cash

flow and financial forecasts

Payment of VAT has huge impact on company's cash flows as well as for future

forecasting (Albayrak, 2017). It totally depends upon the tax amount, if payable tax is high than

net cash flows available for the company is low and vice versa. However,VAT rates change as

time passes by to retain its effect and efficiency. These changes have impact on all financial

accounts across an organisation which eventually affect the VAT control account maintained by

registered businesses.

Every organisation needs to maintain accounts, import or export document, sales and

purchase invoices. Effect of VAT has drastic impact on cash flow. For instance, due to change in

VAT rate from 20% to 25%, if a company has to pay tax £20,000 instead of £10,000 it will

directly effect the net profit of the company which is enough to bring any organisation down.

High tax value is not beneficial for the business, so it is very important aspect in the organisation

for consideration.

Due to changes in VAT payment, financial forecasting will also change. For example,

any business making strategies for the future and the standard tax rate changes to 25%, the

organisation will have to make appropriate changes in strategies according to new tax rates. So it

is totally depend upon the tax rates which can be change any time (Littlewood, Murphy and

Wang, 2013).

10

Type of error - input or output

Net Value of Errors- both under-declared and over-declared amounts

Computation summary for calculating Net Value

If the errors have resulted in additional payments to tax authorities

Total amount to be adjusted

In case the net value of errors have nil or minimal effect on the net VAT due on returns either of

the above methods can be used to rectify the errors. The organisation must notify HMRC about

any kind of deliberate error made on the organisation's part (Onaolapo, Aworemi and Ajala,

2013).

TASK 4

4.1 Inform managers of the impact that the VAT payment may have on an organisation’s cash

flow and financial forecasts

Payment of VAT has huge impact on company's cash flows as well as for future

forecasting (Albayrak, 2017). It totally depends upon the tax amount, if payable tax is high than

net cash flows available for the company is low and vice versa. However,VAT rates change as

time passes by to retain its effect and efficiency. These changes have impact on all financial

accounts across an organisation which eventually affect the VAT control account maintained by

registered businesses.

Every organisation needs to maintain accounts, import or export document, sales and

purchase invoices. Effect of VAT has drastic impact on cash flow. For instance, due to change in

VAT rate from 20% to 25%, if a company has to pay tax £20,000 instead of £10,000 it will

directly effect the net profit of the company which is enough to bring any organisation down.

High tax value is not beneficial for the business, so it is very important aspect in the organisation

for consideration.

Due to changes in VAT payment, financial forecasting will also change. For example,

any business making strategies for the future and the standard tax rate changes to 25%, the

organisation will have to make appropriate changes in strategies according to new tax rates. So it

is totally depend upon the tax rates which can be change any time (Littlewood, Murphy and

Wang, 2013).

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.