Indirect Tax: VAT Regulations, Schemes, and Compliance Report

VerifiedAdded on 2021/01/01

|13

|4050

|92

Report

AI Summary

This report provides a detailed overview of Value Added Tax (VAT) regulations, focusing on the UK context. It begins by identifying sources of information on VAT and explaining the interaction between organizations and relevant government agencies, specifically HMRC. The report outlines VAT registration requirements, the information needed in business documentation, and explains various VAT schemes such as annual accounting, cash accounting, flat rate schemes, and the standard scheme. It also emphasizes the importance of maintaining up-to-date knowledge of changes in VAT codes, regulations, and rules. The report then delves into the practical aspects of completing VAT returns, including extracting data, calculating inputs and outputs, and calculating VAT due. Furthermore, it addresses VAT penalties and adjustments for errors, discussing the implications of non-compliance and the procedures for correcting errors in previous VAT periods. Finally, the report covers the communication of VAT information, including informing managers about the effects of VAT payments on cash flow and financial forecasts and the impact of changes in VAT legislation on an organization's recording system. The report concludes with a practical example of calculating output and input tax for a specific period. It highlights the importance of understanding and adhering to VAT regulations to ensure compliance and avoid penalties.

INDIRECT TAX

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

1. Understanding of VAT regulations..............................................................................................1

1.1 Identification of sources of information on VAT.................................................................1

1.2 Explanation on interaction of organisation with relevant government agency.....................1

1.3 VAT registration requirements.............................................................................................2

1.4 The information that must be included in business documentation of VAT registered

business.......................................................................................................................................2

1.5 Explanation of following VAT schemes...............................................................................3

1.6 Maintaining an updated knowledge of changes in codes, regulations and rules in

legislation....................................................................................................................................4

2. Complete VAT return in prescribed time limit............................................................................4

2.1 Extracting relevant data for a specific period from accounting period.................................4

2.2 Calculating relevant inputs and output using VAT classifications.......................................4

2.3 Calculating VAT due to, from the relevant tax authorities...................................................5

2.4 Completing and submitting VAT return and other payment within prescribed time limit. .6

3. Understanding VAT penalties and adjustments for errors...........................................................7

3.1 Implications and penalties for an organisation from non compliance of VAT regulations. .7

3.2 Adjustments and declarations for errors and omissions in previous VAT periods..............7

4. Communicating VAT information...............................................................................................8

4.1 Informing managers about the effect VAT payment cash flow and financial forecasts......8

4.2 Effect of change in VAT legislation on organisation's recording system.............................8

CONCLUSION................................................................................................................................9

REFERENCES..............................................................................................................................10

INTRODUCTION...........................................................................................................................1

1. Understanding of VAT regulations..............................................................................................1

1.1 Identification of sources of information on VAT.................................................................1

1.2 Explanation on interaction of organisation with relevant government agency.....................1

1.3 VAT registration requirements.............................................................................................2

1.4 The information that must be included in business documentation of VAT registered

business.......................................................................................................................................2

1.5 Explanation of following VAT schemes...............................................................................3

1.6 Maintaining an updated knowledge of changes in codes, regulations and rules in

legislation....................................................................................................................................4

2. Complete VAT return in prescribed time limit............................................................................4

2.1 Extracting relevant data for a specific period from accounting period.................................4

2.2 Calculating relevant inputs and output using VAT classifications.......................................4

2.3 Calculating VAT due to, from the relevant tax authorities...................................................5

2.4 Completing and submitting VAT return and other payment within prescribed time limit. .6

3. Understanding VAT penalties and adjustments for errors...........................................................7

3.1 Implications and penalties for an organisation from non compliance of VAT regulations. .7

3.2 Adjustments and declarations for errors and omissions in previous VAT periods..............7

4. Communicating VAT information...............................................................................................8

4.1 Informing managers about the effect VAT payment cash flow and financial forecasts......8

4.2 Effect of change in VAT legislation on organisation's recording system.............................8

CONCLUSION................................................................................................................................9

REFERENCES..............................................................................................................................10

INTRODUCTION

Indirect tax is the type of tax which is collected by intermediary such as retail stores from

consumers who bears the ultimate economic burden of tax. In this report, explanation will be

developed on indirect tax that is VAT (value-added tax). Its sources of information and

requirements for registration will be discussed. Further, in this assessment, different schemes of

VAT will be discussed which required in reporting. Penalties and adjustments to rectify VAT

error will be discussed in context of organisation. Lastly, in this report information will be

provided on impact of VAT payment on organisation's cash flow and financial forecasting.

1. Understanding of VAT regulations

1.1 Identification of sources of information on VAT

It is the type of consumption based tax which added to goods and services and to

product's sales and price (Zu, 2018). Throughout the production process of company it gets

charged. VAT is an invoice-based tax which charge by each seller in their product chain to

buyer's invoice. It is also known as destination based tax because tax rate is charged according to

the location of consumer. It is first implemented by two countries that is France and Germany

which is in the form of general consumption tax.

Initially VAT only charged by large type of businesses but with the passage of time it

gets extended in every business sector. Therefore, as of 2018, approximately 193 countries have

applied this tax including OECD member of united states. For calculating VAT, there are two

such methods which includes credit-invoice and invoice-based method. Credit-invoice method is

used to record sales transaction of business and invoice-based method is most widely used and

among in all the countries of the world. VAT amount is decided by states in percentage form and

will charge on top services of business (FERREIRA and Veiga, 2016).

1.2 Explanation on interaction of organisation with relevant government agency

Every type of business who engage in providing taxable goods and services and whose

turnover exceeds £85000 must have to registered themselves for VAT. Business whose turnover

is less than the threshold limit may also apply under voluntary registration of VAT. Currently its

default rate is 20% which may reduced from 5% to 0%. It is also known as one of the key

consideration for every size of business.

Organisation who have registered for VAT must have to reclaim for any amount which

they have paid for business related goods and services. Businesses must have to pay amount of

1

Indirect tax is the type of tax which is collected by intermediary such as retail stores from

consumers who bears the ultimate economic burden of tax. In this report, explanation will be

developed on indirect tax that is VAT (value-added tax). Its sources of information and

requirements for registration will be discussed. Further, in this assessment, different schemes of

VAT will be discussed which required in reporting. Penalties and adjustments to rectify VAT

error will be discussed in context of organisation. Lastly, in this report information will be

provided on impact of VAT payment on organisation's cash flow and financial forecasting.

1. Understanding of VAT regulations

1.1 Identification of sources of information on VAT

It is the type of consumption based tax which added to goods and services and to

product's sales and price (Zu, 2018). Throughout the production process of company it gets

charged. VAT is an invoice-based tax which charge by each seller in their product chain to

buyer's invoice. It is also known as destination based tax because tax rate is charged according to

the location of consumer. It is first implemented by two countries that is France and Germany

which is in the form of general consumption tax.

Initially VAT only charged by large type of businesses but with the passage of time it

gets extended in every business sector. Therefore, as of 2018, approximately 193 countries have

applied this tax including OECD member of united states. For calculating VAT, there are two

such methods which includes credit-invoice and invoice-based method. Credit-invoice method is

used to record sales transaction of business and invoice-based method is most widely used and

among in all the countries of the world. VAT amount is decided by states in percentage form and

will charge on top services of business (FERREIRA and Veiga, 2016).

1.2 Explanation on interaction of organisation with relevant government agency

Every type of business who engage in providing taxable goods and services and whose

turnover exceeds £85000 must have to registered themselves for VAT. Business whose turnover

is less than the threshold limit may also apply under voluntary registration of VAT. Currently its

default rate is 20% which may reduced from 5% to 0%. It is also known as one of the key

consideration for every size of business.

Organisation who have registered for VAT must have to reclaim for any amount which

they have paid for business related goods and services. Businesses must have to pay amount of

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

VAT which they have charged on their goods and services (Adam and Roantree, 2015). The

deadline which set by government agency that is HM revenue and commission for filling VAT

return is first calendar month or 7 days after the end of accounting period. Companies which are

engaged in following conditions also have to registered under VAT.

Company have provided an impression of large business.

Have build trust of company

After successful registration, entities are liable towards government agency in order to charge tax

on their goods and services and pay it them.

1.3 VAT registration requirements

Companies must have to registered for VAT when their turnover exceed £85000 with the

period of next 30 days. If total turnover of company in last 12 months exceed thresholds limit

then also business have to compulsory register under VAT. Entities and suppliers also have to

registered under VAT if they sell goods and services which are exempt but buys for more than

£85000 to use in business. Threshold limit was based on taxable turnover of VAT. If goods have

been received from EU which is of more than £83000, then also entity have to registered under

VAT.

Businesses in which goods are exempt did not have to registered themselves under VAT.

Distance selling goods will also take place for business which have registered for selling goods

to country other than EU (Harju, Matikka and Rauhanen, 2015). Companies which do not have

any physical presence but they are doing business in market than they have to provide complete

details and market price of such businesses. Foreign businesses which is not established in UK

must also have to submit their VAT registration application to HMRC under form VAT1. In

order to registration, taxpayer needs to provide details including unique tax references numbers.

For every type of businesses, different VAT rates have been provided by the government agency.

1.4 The information that must be included in business documentation of VAT registered business

A VAT registered business entity must fulfil all the requirements regarding the

documentation. A business organisation must keep records and detailed information of VAT of

about 6 years or 10 years in special cases when company using VAT MOSS service. The

information can be record digitally or manually totally on the preferences of the business entity.

Invoices are the main important part of obtaining records related to VAT. It is the legal

evidence and source of proof for the tax authority that company have adequately and sufficiently

2

deadline which set by government agency that is HM revenue and commission for filling VAT

return is first calendar month or 7 days after the end of accounting period. Companies which are

engaged in following conditions also have to registered under VAT.

Company have provided an impression of large business.

Have build trust of company

After successful registration, entities are liable towards government agency in order to charge tax

on their goods and services and pay it them.

1.3 VAT registration requirements

Companies must have to registered for VAT when their turnover exceed £85000 with the

period of next 30 days. If total turnover of company in last 12 months exceed thresholds limit

then also business have to compulsory register under VAT. Entities and suppliers also have to

registered under VAT if they sell goods and services which are exempt but buys for more than

£85000 to use in business. Threshold limit was based on taxable turnover of VAT. If goods have

been received from EU which is of more than £83000, then also entity have to registered under

VAT.

Businesses in which goods are exempt did not have to registered themselves under VAT.

Distance selling goods will also take place for business which have registered for selling goods

to country other than EU (Harju, Matikka and Rauhanen, 2015). Companies which do not have

any physical presence but they are doing business in market than they have to provide complete

details and market price of such businesses. Foreign businesses which is not established in UK

must also have to submit their VAT registration application to HMRC under form VAT1. In

order to registration, taxpayer needs to provide details including unique tax references numbers.

For every type of businesses, different VAT rates have been provided by the government agency.

1.4 The information that must be included in business documentation of VAT registered business

A VAT registered business entity must fulfil all the requirements regarding the

documentation. A business organisation must keep records and detailed information of VAT of

about 6 years or 10 years in special cases when company using VAT MOSS service. The

information can be record digitally or manually totally on the preferences of the business entity.

Invoices are the main important part of obtaining records related to VAT. It is the legal

evidence and source of proof for the tax authority that company have adequately and sufficiently

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

complied the VAT rules. It is also a proof that company is paying correct tax payment to HMRC.

If any invoice is considered as bad debt then, company has to maintain a separate VAT bad debt

account that have the necessary information regarding amount of VAT charged, sales etc.

A complete summary of the standard VAT account has to be maintained by a VAT

registered firm. This account consist of total VAT sales, purchases, the amount of tax that

company is owing to HMRC, the amount of input credit that can be claimed for refund. If the

entity is registered under flat rate scheme, then it needs to apply required provisions (VAT record

keeping, 2019).

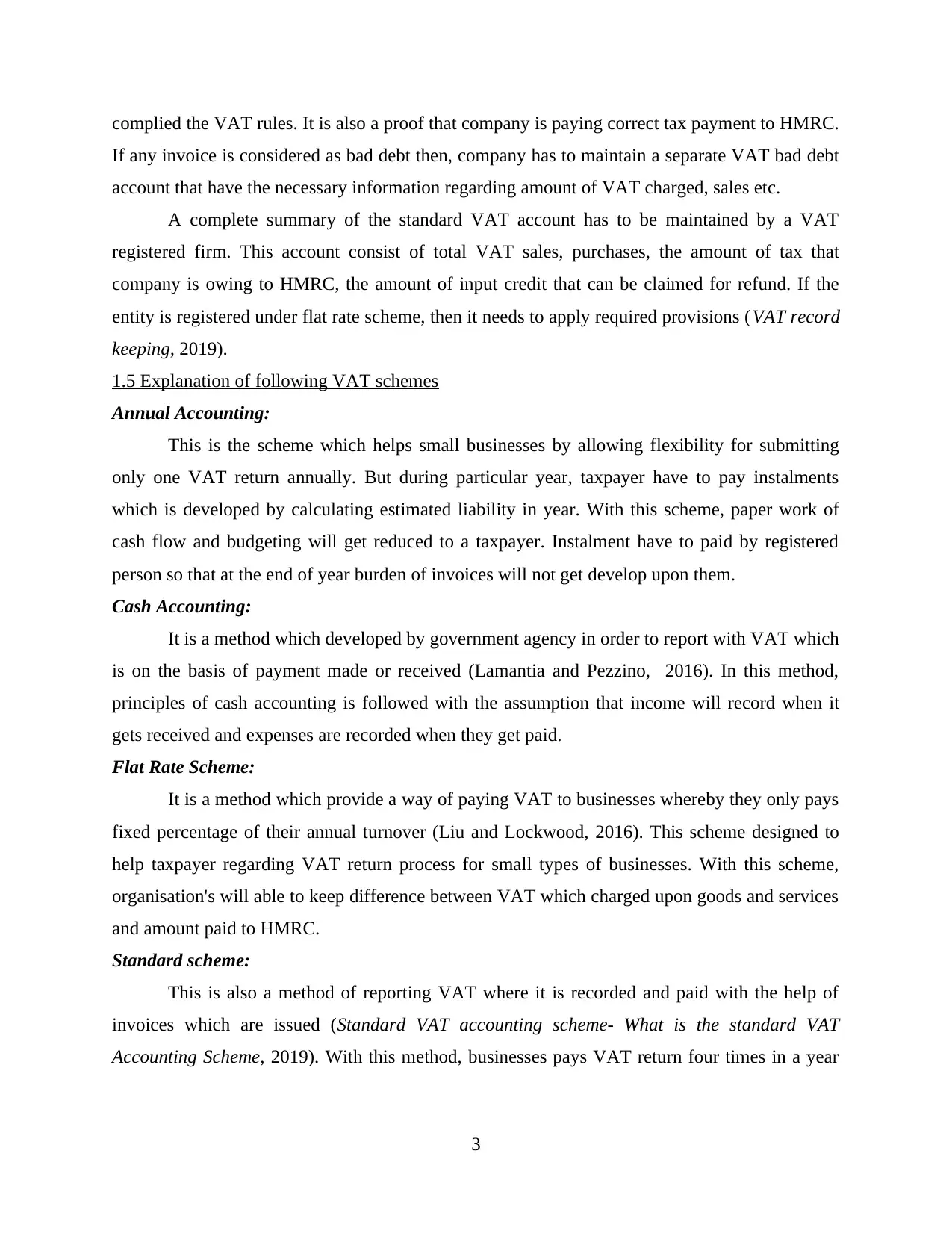

1.5 Explanation of following VAT schemes

Annual Accounting:

This is the scheme which helps small businesses by allowing flexibility for submitting

only one VAT return annually. But during particular year, taxpayer have to pay instalments

which is developed by calculating estimated liability in year. With this scheme, paper work of

cash flow and budgeting will get reduced to a taxpayer. Instalment have to paid by registered

person so that at the end of year burden of invoices will not get develop upon them.

Cash Accounting:

It is a method which developed by government agency in order to report with VAT which

is on the basis of payment made or received (Lamantia and Pezzino, 2016). In this method,

principles of cash accounting is followed with the assumption that income will record when it

gets received and expenses are recorded when they get paid.

Flat Rate Scheme:

It is a method which provide a way of paying VAT to businesses whereby they only pays

fixed percentage of their annual turnover (Liu and Lockwood, 2016). This scheme designed to

help taxpayer regarding VAT return process for small types of businesses. With this scheme,

organisation's will able to keep difference between VAT which charged upon goods and services

and amount paid to HMRC.

Standard scheme:

This is also a method of reporting VAT where it is recorded and paid with the help of

invoices which are issued (Standard VAT accounting scheme- What is the standard VAT

Accounting Scheme, 2019). With this method, businesses pays VAT return four times in a year

3

If any invoice is considered as bad debt then, company has to maintain a separate VAT bad debt

account that have the necessary information regarding amount of VAT charged, sales etc.

A complete summary of the standard VAT account has to be maintained by a VAT

registered firm. This account consist of total VAT sales, purchases, the amount of tax that

company is owing to HMRC, the amount of input credit that can be claimed for refund. If the

entity is registered under flat rate scheme, then it needs to apply required provisions (VAT record

keeping, 2019).

1.5 Explanation of following VAT schemes

Annual Accounting:

This is the scheme which helps small businesses by allowing flexibility for submitting

only one VAT return annually. But during particular year, taxpayer have to pay instalments

which is developed by calculating estimated liability in year. With this scheme, paper work of

cash flow and budgeting will get reduced to a taxpayer. Instalment have to paid by registered

person so that at the end of year burden of invoices will not get develop upon them.

Cash Accounting:

It is a method which developed by government agency in order to report with VAT which

is on the basis of payment made or received (Lamantia and Pezzino, 2016). In this method,

principles of cash accounting is followed with the assumption that income will record when it

gets received and expenses are recorded when they get paid.

Flat Rate Scheme:

It is a method which provide a way of paying VAT to businesses whereby they only pays

fixed percentage of their annual turnover (Liu and Lockwood, 2016). This scheme designed to

help taxpayer regarding VAT return process for small types of businesses. With this scheme,

organisation's will able to keep difference between VAT which charged upon goods and services

and amount paid to HMRC.

Standard scheme:

This is also a method of reporting VAT where it is recorded and paid with the help of

invoices which are issued (Standard VAT accounting scheme- What is the standard VAT

Accounting Scheme, 2019). With this method, businesses pays VAT return four times in a year

3

and due return will get repaid on quarterly basis. Taxpayer will pay to HMRC when amount of

sales is higher than amount of cost.

1.6 Maintaining an updated knowledge of changes in codes, regulations and rules in legislation

Up to date knowledge about the different and new regulations, codes and rules helps the

company in adhering to the VAT legislation properly. Central tax authority of UK HMRC

formulates such regulations and protocol for bringing the uniformity amongst business entities in

collecting tax from various customers. Appropriate knowledge of VAT rules and regulations in

customers helps them in avoiding any fraudulent act that may be practised by some vendors, as

some of them charges higher VAT from their customers for personal gain (Van Thiel and

Lamensch, 2018).

2. Complete VAT return in prescribed time limit

2.1 Extracting relevant data for a specific period from accounting period

A person has made domestic sales for the year ending on 31st December 2018 of 600000

(£).It made purchases of different materials for the operations in the company such as calendars

and diaries for office use (£) 500, food and drinks for the office consumption 250 (£)., electrical

goods. It also purchased sanitary items 200 (£), education fees of children 3000(£). It purchased

uniform of its for worth 300 (£). It imported raw materials from America worth 120000 (£). It

exported its goods of worth 50000 (£).

The person needs to calculate his output and input tax for identifying the amount of tax

payable or for claiming the input tax credit in case the input exceeds the output tax.

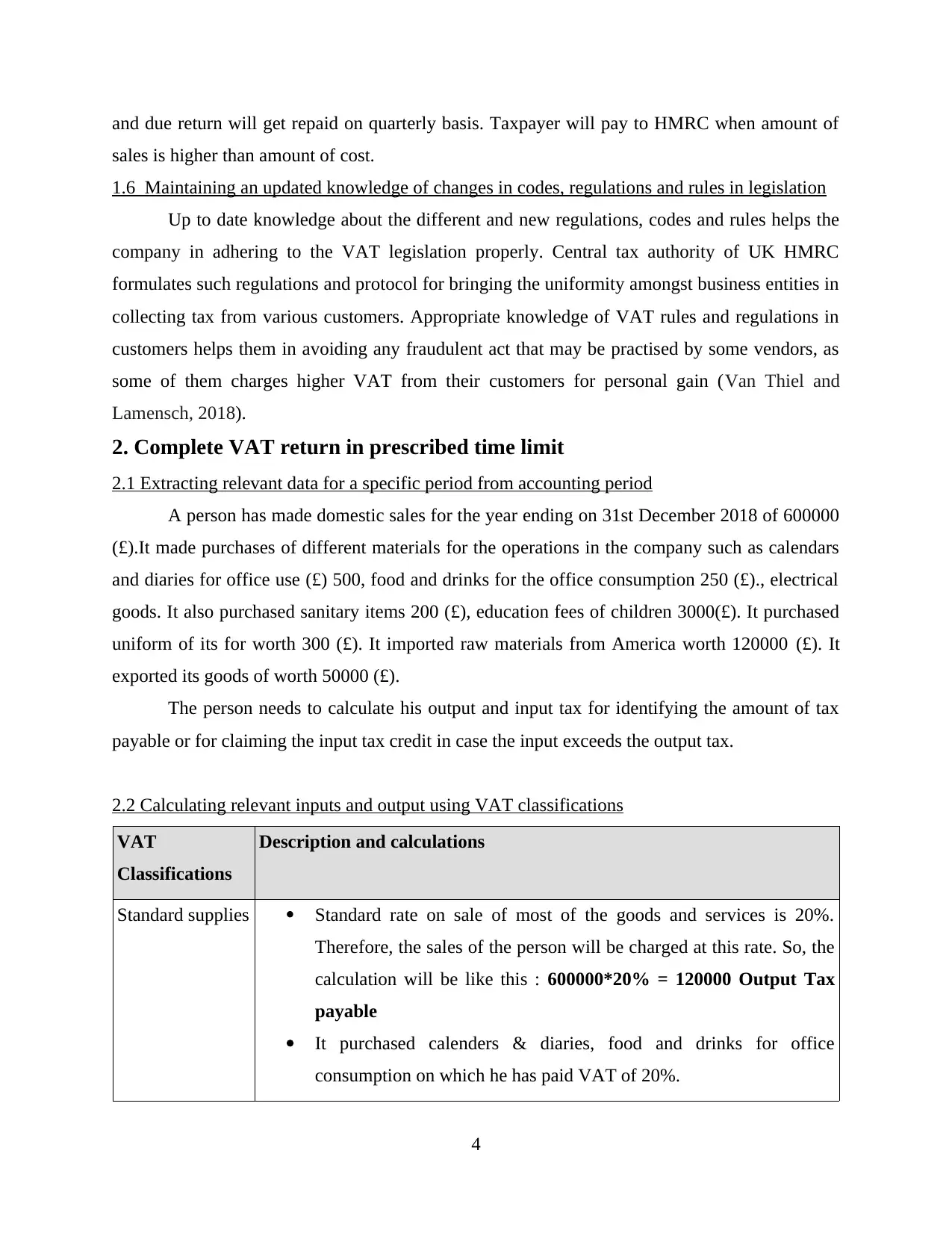

2.2 Calculating relevant inputs and output using VAT classifications

VAT

Classifications

Description and calculations

Standard supplies Standard rate on sale of most of the goods and services is 20%.

Therefore, the sales of the person will be charged at this rate. So, the

calculation will be like this : 600000*20% = 120000 Output Tax

payable

It purchased calenders & diaries, food and drinks for office

consumption on which he has paid VAT of 20%.

4

sales is higher than amount of cost.

1.6 Maintaining an updated knowledge of changes in codes, regulations and rules in legislation

Up to date knowledge about the different and new regulations, codes and rules helps the

company in adhering to the VAT legislation properly. Central tax authority of UK HMRC

formulates such regulations and protocol for bringing the uniformity amongst business entities in

collecting tax from various customers. Appropriate knowledge of VAT rules and regulations in

customers helps them in avoiding any fraudulent act that may be practised by some vendors, as

some of them charges higher VAT from their customers for personal gain (Van Thiel and

Lamensch, 2018).

2. Complete VAT return in prescribed time limit

2.1 Extracting relevant data for a specific period from accounting period

A person has made domestic sales for the year ending on 31st December 2018 of 600000

(£).It made purchases of different materials for the operations in the company such as calendars

and diaries for office use (£) 500, food and drinks for the office consumption 250 (£)., electrical

goods. It also purchased sanitary items 200 (£), education fees of children 3000(£). It purchased

uniform of its for worth 300 (£). It imported raw materials from America worth 120000 (£). It

exported its goods of worth 50000 (£).

The person needs to calculate his output and input tax for identifying the amount of tax

payable or for claiming the input tax credit in case the input exceeds the output tax.

2.2 Calculating relevant inputs and output using VAT classifications

VAT

Classifications

Description and calculations

Standard supplies Standard rate on sale of most of the goods and services is 20%.

Therefore, the sales of the person will be charged at this rate. So, the

calculation will be like this : 600000*20% = 120000 Output Tax

payable

It purchased calenders & diaries, food and drinks for office

consumption on which he has paid VAT of 20%.

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

(250+500 = 750*20% = 150 Input tax)

Exempt supplies These are those goods and services that are not subject to VAT.

Hence, no tax no input credit.

Education fees paid by person for children is exempted under the

VAT act of UK.

Zero rated

supplies

Zero rated supplies means that goods and services are taxable in the

eyes of VAT act but the rate of these supplies prescribed is nil that is

0% (VAT rates on different goods and services. 2019).

The person purchased uniforms for its staff of his office which are

mentioned under the category of zero rated supplies. He paid 0%

VAT on these purchases and hence will not be able to claim any

input credit.

Imports The goods and services that are brought or purchased from outside

the country is termed as imports. The VT is chargeable on such

purchase or sale at the rate mentioned in VAT act that is 10%.

He imported raw materials on which he paid tax :

120000*10%= 12000 (Input tax)

Exports The goods and services that are being sold to places outside the

country is recognised as exports. The exports are chargeable at the

rate of 20% in VAT act of UK.

In the question, person made exports of worth 50000 which is

taxable at the rate of 20%.

50000*20%= 10000 (Output tax)

Reduced rated

supplies

These are those goods which are chargeable at reduced or lesser rate

as compared to standard rate of 20%.

There was a purchase of sanitary materials by the person which are

taxable at the rate of 5%. Hence, the input tax will be calculated as:

200*5%= 10 (Input tax)

5

Exempt supplies These are those goods and services that are not subject to VAT.

Hence, no tax no input credit.

Education fees paid by person for children is exempted under the

VAT act of UK.

Zero rated

supplies

Zero rated supplies means that goods and services are taxable in the

eyes of VAT act but the rate of these supplies prescribed is nil that is

0% (VAT rates on different goods and services. 2019).

The person purchased uniforms for its staff of his office which are

mentioned under the category of zero rated supplies. He paid 0%

VAT on these purchases and hence will not be able to claim any

input credit.

Imports The goods and services that are brought or purchased from outside

the country is termed as imports. The VT is chargeable on such

purchase or sale at the rate mentioned in VAT act that is 10%.

He imported raw materials on which he paid tax :

120000*10%= 12000 (Input tax)

Exports The goods and services that are being sold to places outside the

country is recognised as exports. The exports are chargeable at the

rate of 20% in VAT act of UK.

In the question, person made exports of worth 50000 which is

taxable at the rate of 20%.

50000*20%= 10000 (Output tax)

Reduced rated

supplies

These are those goods which are chargeable at reduced or lesser rate

as compared to standard rate of 20%.

There was a purchase of sanitary materials by the person which are

taxable at the rate of 5%. Hence, the input tax will be calculated as:

200*5%= 10 (Input tax)

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

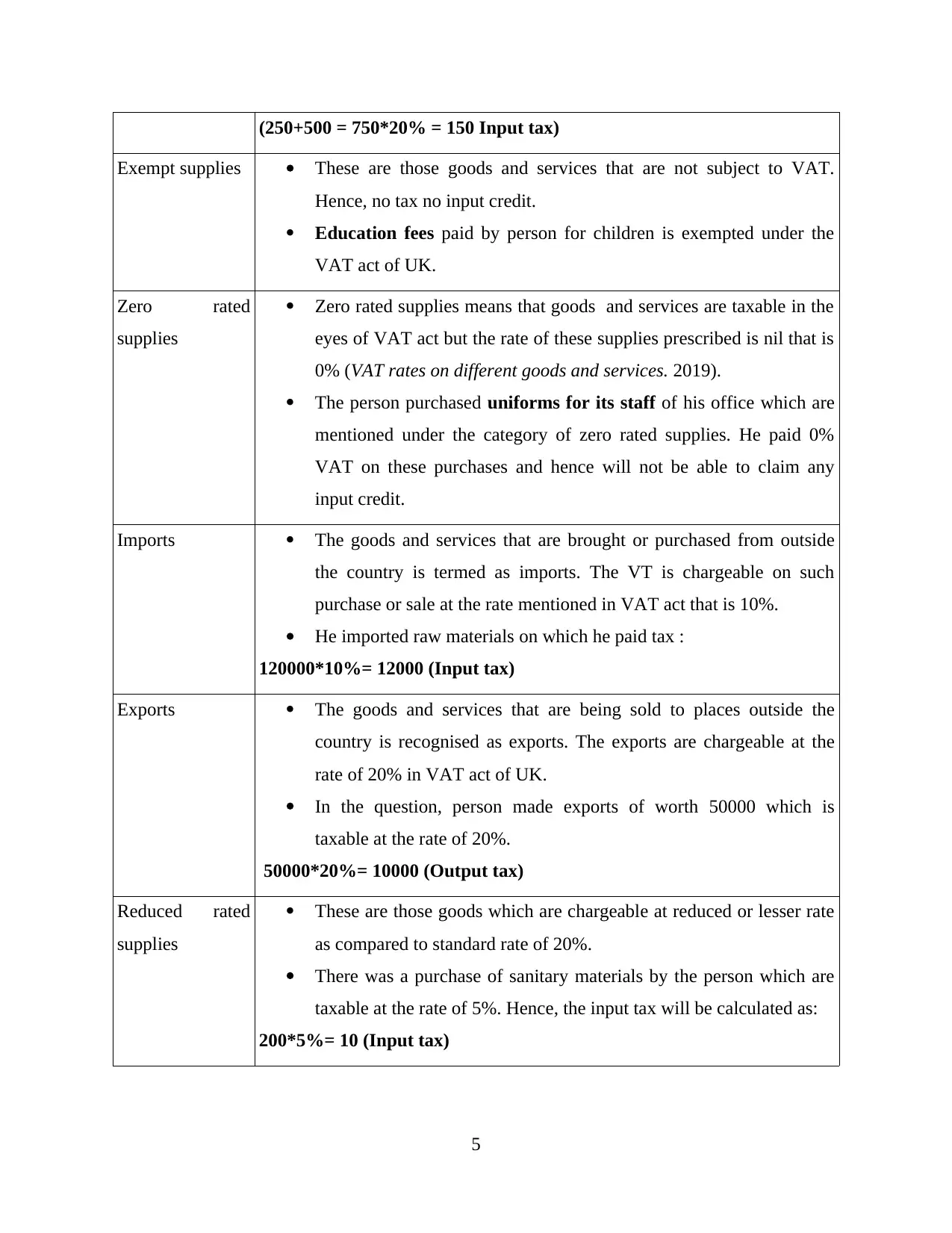

2.3 Calculating VAT due to, from the relevant tax authorities

The VAT is calculated by subtracting input tax from output tax.

Particulars Amount

(£)

Domestic sales: 120000

Exports : 10000

Total output tax 1,30,000

Food&drinks, calender& diaries : 150

Education fees: Exempt

Uniforms: 0

Imports : 10000

Sanitary materials: 10

Total input tax 10,160

VAT payable 1,19,840

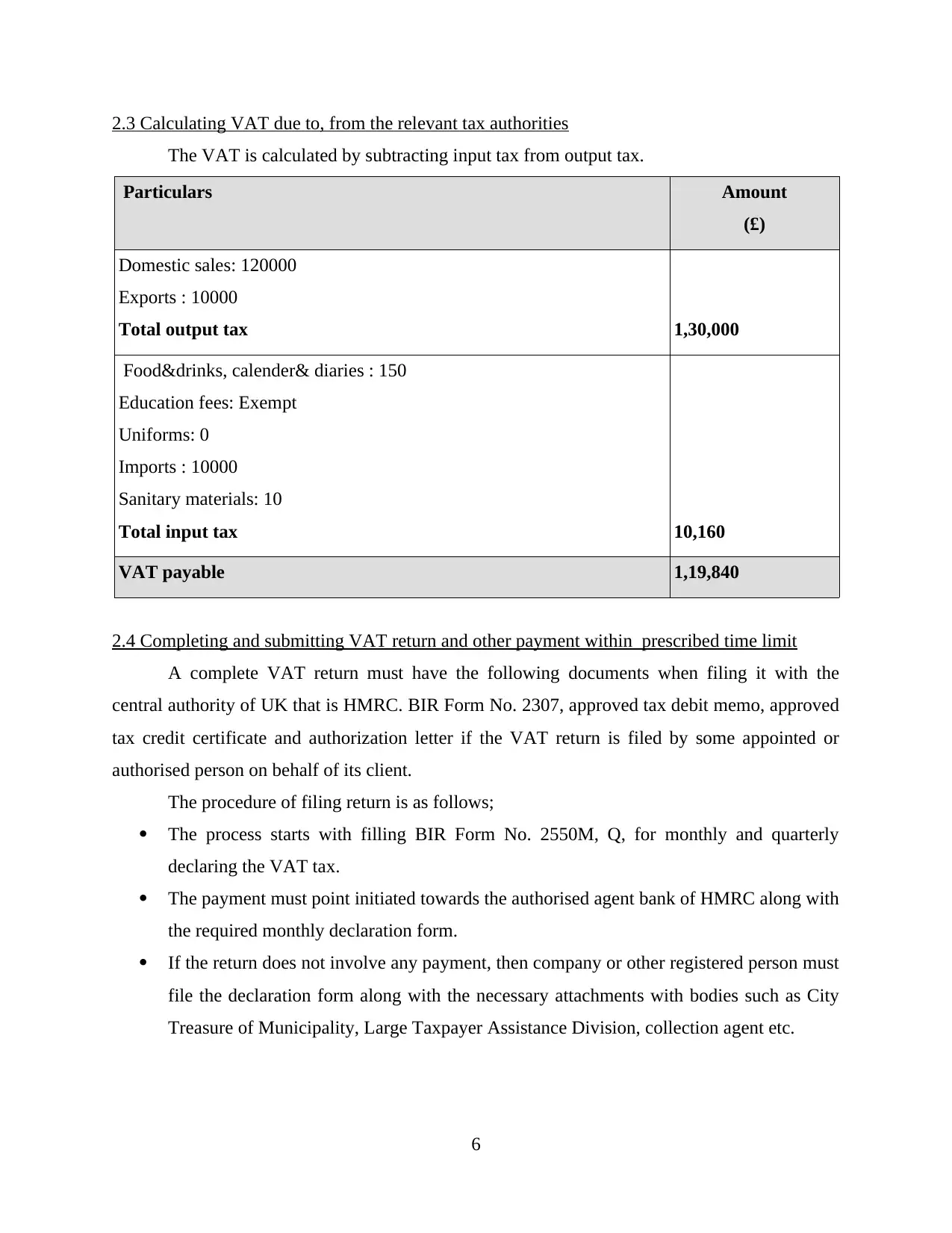

2.4 Completing and submitting VAT return and other payment within prescribed time limit

A complete VAT return must have the following documents when filing it with the

central authority of UK that is HMRC. BIR Form No. 2307, approved tax debit memo, approved

tax credit certificate and authorization letter if the VAT return is filed by some appointed or

authorised person on behalf of its client.

The procedure of filing return is as follows;

The process starts with filling BIR Form No. 2550M, Q, for monthly and quarterly

declaring the VAT tax.

The payment must point initiated towards the authorised agent bank of HMRC along with

the required monthly declaration form.

If the return does not involve any payment, then company or other registered person must

file the declaration form along with the necessary attachments with bodies such as City

Treasure of Municipality, Large Taxpayer Assistance Division, collection agent etc.

6

The VAT is calculated by subtracting input tax from output tax.

Particulars Amount

(£)

Domestic sales: 120000

Exports : 10000

Total output tax 1,30,000

Food&drinks, calender& diaries : 150

Education fees: Exempt

Uniforms: 0

Imports : 10000

Sanitary materials: 10

Total input tax 10,160

VAT payable 1,19,840

2.4 Completing and submitting VAT return and other payment within prescribed time limit

A complete VAT return must have the following documents when filing it with the

central authority of UK that is HMRC. BIR Form No. 2307, approved tax debit memo, approved

tax credit certificate and authorization letter if the VAT return is filed by some appointed or

authorised person on behalf of its client.

The procedure of filing return is as follows;

The process starts with filling BIR Form No. 2550M, Q, for monthly and quarterly

declaring the VAT tax.

The payment must point initiated towards the authorised agent bank of HMRC along with

the required monthly declaration form.

If the return does not involve any payment, then company or other registered person must

file the declaration form along with the necessary attachments with bodies such as City

Treasure of Municipality, Large Taxpayer Assistance Division, collection agent etc.

6

3. Understanding VAT penalties and adjustments for errors

3.1 Implications and penalties for an organisation from non compliance of VAT regulations

VAT is a value added tax which is levied on sale of products and services in United

Kingdom. Standard rate is 20%. It is an indirect tax as the amount is collected by organisations

which is to be deposited in Government's account. All organisations need to comply to rules and

regulations for avoiding huge penalties and government intervention in operations. The

following are some penalties :

Company with more than 85000 (£) needs to register itself for charging and paying VAT

to UK government. Late registration attracts penalty of 5% of tax unpaid in case

registration is 9 months late, 10% for 9 moths to 18 months and 15% for more than 18

months.

If default is made in filing return of VAT on due date, company receives Surcharge

Liability notice for missing of return. Organisations can file return within stipulated

period for avoiding financial penalty.

Late payment of VAT amount to HMRC will attract 2% surcharge on VAT amount due.

The surcharge keeps on increasing to 5%, 10%, 15% on VAT due for the time such

default continues in successive assessment years.

3.2 Adjustments and declarations for errors and omissions in previous VAT periods

Organisations have some reliefs granted by taxation authority in UK in case they make

any error or omission in already filed VAT returns. Below are some adjustments :

A company can report threshold for net errors of more than 10000 (£). The errors can be

only between 10000 to 50000 (£) for which adjustment can be made in next assessment

year. Adding net value in box 1 for amount of tax due to HMRC and adding box 4 for

amount due to company. Firm has to satisfy other necessary conditions such as keeping

all records of errors and inaccurate amount, keeping the summary of how errors occurred

and when these were discovered. Organisation needs to include incorrect amount in their

standard VAT account (Schippers, 2017).

7

3.1 Implications and penalties for an organisation from non compliance of VAT regulations

VAT is a value added tax which is levied on sale of products and services in United

Kingdom. Standard rate is 20%. It is an indirect tax as the amount is collected by organisations

which is to be deposited in Government's account. All organisations need to comply to rules and

regulations for avoiding huge penalties and government intervention in operations. The

following are some penalties :

Company with more than 85000 (£) needs to register itself for charging and paying VAT

to UK government. Late registration attracts penalty of 5% of tax unpaid in case

registration is 9 months late, 10% for 9 moths to 18 months and 15% for more than 18

months.

If default is made in filing return of VAT on due date, company receives Surcharge

Liability notice for missing of return. Organisations can file return within stipulated

period for avoiding financial penalty.

Late payment of VAT amount to HMRC will attract 2% surcharge on VAT amount due.

The surcharge keeps on increasing to 5%, 10%, 15% on VAT due for the time such

default continues in successive assessment years.

3.2 Adjustments and declarations for errors and omissions in previous VAT periods

Organisations have some reliefs granted by taxation authority in UK in case they make

any error or omission in already filed VAT returns. Below are some adjustments :

A company can report threshold for net errors of more than 10000 (£). The errors can be

only between 10000 to 50000 (£) for which adjustment can be made in next assessment

year. Adding net value in box 1 for amount of tax due to HMRC and adding box 4 for

amount due to company. Firm has to satisfy other necessary conditions such as keeping

all records of errors and inaccurate amount, keeping the summary of how errors occurred

and when these were discovered. Organisation needs to include incorrect amount in their

standard VAT account (Schippers, 2017).

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Errors which are made before 4 years or which does not come under reporting threshold

limit needs to be notified by companies to HMRC. This notification can be sent to

HMRC 's VAT correction team or firm can file form VAT652.

4. Communicating VAT information

4.1 Informing managers about the effect VAT payment cash flow and financial forecasts

Financial Manager and other concerned managers needs to be well aware of the VAT

legislations and the consequences of it on organisation in the time of non compliance of laws.

Cash flow of the company determines that which activities are generating cash and which

activities are over utilising the cash resources. It helps in identifying liquidity of firm. VAT

payment and its related provisions have great impact on cash flow . It affects businesses in the

sense that manufacturing process and costs have direct relation to VAT as this indirect tax is

levied on manufactured goods and services. Managers needs available of funds for paying this

tax at the time of purchasing supplies, however, credit could be availed by them.

Forecasting of sales, profits and loss must be made by eliminating the vat that a company

is going to charge from its clients. Managers does this for effectively claiming the costs from

authorities without any complexities.

However, cash flow must be inclusive of VAT in company's receipts and payments. This

is because of the fact they this will be actual cash inflow and outflow that will be taking place

and affecting firm's liquidity. Payment of Value added tax to HMRC will be shown as one of the

payment in forecasted cash flow.

4.2 Effect of change in VAT legislation on organisation's recording system

VAT as discussed above, do not get included in the income and expenditure account of a

company. So any change in rates of VAT, or any other legislations would not affect firm's

system of recording income and expenditure. This is because a firm only acts as a registered

person collecting tax from customers on behalf of UK government (Nechaev and Antipina,

2016).

For example, a recent change in VAT legislation of digitalising the VAT for keeping

records digitally, applying compatible making digital tax for VAT software, for filing returns for

period starting from APRIL 1, 2019. The notification included information pack for legal

advisors, software developers, members of legal bodies, companies, customers etc.

8

limit needs to be notified by companies to HMRC. This notification can be sent to

HMRC 's VAT correction team or firm can file form VAT652.

4. Communicating VAT information

4.1 Informing managers about the effect VAT payment cash flow and financial forecasts

Financial Manager and other concerned managers needs to be well aware of the VAT

legislations and the consequences of it on organisation in the time of non compliance of laws.

Cash flow of the company determines that which activities are generating cash and which

activities are over utilising the cash resources. It helps in identifying liquidity of firm. VAT

payment and its related provisions have great impact on cash flow . It affects businesses in the

sense that manufacturing process and costs have direct relation to VAT as this indirect tax is

levied on manufactured goods and services. Managers needs available of funds for paying this

tax at the time of purchasing supplies, however, credit could be availed by them.

Forecasting of sales, profits and loss must be made by eliminating the vat that a company

is going to charge from its clients. Managers does this for effectively claiming the costs from

authorities without any complexities.

However, cash flow must be inclusive of VAT in company's receipts and payments. This

is because of the fact they this will be actual cash inflow and outflow that will be taking place

and affecting firm's liquidity. Payment of Value added tax to HMRC will be shown as one of the

payment in forecasted cash flow.

4.2 Effect of change in VAT legislation on organisation's recording system

VAT as discussed above, do not get included in the income and expenditure account of a

company. So any change in rates of VAT, or any other legislations would not affect firm's

system of recording income and expenditure. This is because a firm only acts as a registered

person collecting tax from customers on behalf of UK government (Nechaev and Antipina,

2016).

For example, a recent change in VAT legislation of digitalising the VAT for keeping

records digitally, applying compatible making digital tax for VAT software, for filing returns for

period starting from APRIL 1, 2019. The notification included information pack for legal

advisors, software developers, members of legal bodies, companies, customers etc.

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The effect of such changes would be that companies would not be able to store data

manually. Firms' will have to digital store its records in functional compatible software as

described in government's notification. The software contains spreadsheets and other supporting

programs which can be directly be connected to HMRC through connecting interface known as

Application Programming Interface (API) (Miller and Pope, 2016)

VAT is shown as a separate liability head in the cooks of accounts of company. This is

eventually seen in the balance sheet that shows firm's position on a particular date.

Change in VAT legislations such as change in standard rate, special rate etc. will have

effect on recording system of a firm. Company needs to issue invoices of all its sales for

claiming VAT refund. Cash book and daily book have separate column of VAT that does not get

processed through sales and purchase ledger.

CONCLUSION

From the above project report, it can be summarised that sale of all manufactured goods

and services are prone to an indirect tax which is VAT. There must be proper compliance of

VAT regulations for avoiding any penalties relating to registration, default in payment, wrong

filling of returns etc. It is a legal requirement of all the firms whose annual turnover exceeds

85000 pounds to get registered by VAT authority for collecting VAT from its sales on the behalf

of UK government. The report also concluded that late registration attracts the penalty of 5% of

tax due after receiving the legal notice by the HMRC. The penalty keeps on rising till the default

continues.

9

manually. Firms' will have to digital store its records in functional compatible software as

described in government's notification. The software contains spreadsheets and other supporting

programs which can be directly be connected to HMRC through connecting interface known as

Application Programming Interface (API) (Miller and Pope, 2016)

VAT is shown as a separate liability head in the cooks of accounts of company. This is

eventually seen in the balance sheet that shows firm's position on a particular date.

Change in VAT legislations such as change in standard rate, special rate etc. will have

effect on recording system of a firm. Company needs to issue invoices of all its sales for

claiming VAT refund. Cash book and daily book have separate column of VAT that does not get

processed through sales and purchase ledger.

CONCLUSION

From the above project report, it can be summarised that sale of all manufactured goods

and services are prone to an indirect tax which is VAT. There must be proper compliance of

VAT regulations for avoiding any penalties relating to registration, default in payment, wrong

filling of returns etc. It is a legal requirement of all the firms whose annual turnover exceeds

85000 pounds to get registered by VAT authority for collecting VAT from its sales on the behalf

of UK government. The report also concluded that late registration attracts the penalty of 5% of

tax due after receiving the legal notice by the HMRC. The penalty keeps on rising till the default

continues.

9

REFERENCES

Books and Journals

Adam, S. and Roantree, B., 2015. UK tax policy 2010–15: An assessment. Fiscal Studies. 36(3).

pp.349-373.

FERREIRA, R.M.Z. and Veiga, F., 2016. The Revolution of the Tax System based on Flat

Tax. Athens Journal of Law. pp.253-268.

Harju, J., Matikka, T. and Rauhanen, T., 2015, March. The effect of VAT threshold on the

behavior of small businesses: Evidence and implications. In Conference Journal: CESifo

Area Conferences on Public Sector Economics.

Lamantia, F. and Pezzino, M., 2016. Tax evasion, intrinsic motivation, and the evolutionary

effect of a flat rate.

Liu, L. and Lockwood, B., 2016. VAT notches, voluntary registration and bunching: Theory and

UK evidence.

Miller, H. and Pope, T., 2016. The changing composition of UK tax revenues. Institute for

Fiscal Studies, Briefing Note. 26.

Nechaev, A. and Antipina, O., 2016. Analysis of the Impact of Taxation of Business Entities on

the Innovative Development of the Country. European Research Studies. 19(1). p.71.

Schippers, M., 2017. Brexit: Consequences for trade, VAT and customs. EC Tax Review.26(4).

pp.220-225.

Van Thiel, S. and Lamensch, M., 2018. Possible Consequences of Brexit in the Area of Indirect

Taxation: Why Prime Minister May Talks about a Hard Brexit, but Really Needs a Soft

Brexit!. World Tax Journal: WTJ. 10(1). pp.3-41.

Zu, Y., 2018. VAT/GST Thresholds and Small Businesses: Where to Draw the Line?.

Online

Standard VAT accounting scheme- What is the standard VAT Accounting Scheme. 2019.

[Online]. Available through <https://debitoor.com/dictionary/standard-vat-accounting-

scheme>

VAT record keeping. 2019. [Online] . Available through <https://www.gov.uk/vat-record-

keeping/vat-account>

10

Books and Journals

Adam, S. and Roantree, B., 2015. UK tax policy 2010–15: An assessment. Fiscal Studies. 36(3).

pp.349-373.

FERREIRA, R.M.Z. and Veiga, F., 2016. The Revolution of the Tax System based on Flat

Tax. Athens Journal of Law. pp.253-268.

Harju, J., Matikka, T. and Rauhanen, T., 2015, March. The effect of VAT threshold on the

behavior of small businesses: Evidence and implications. In Conference Journal: CESifo

Area Conferences on Public Sector Economics.

Lamantia, F. and Pezzino, M., 2016. Tax evasion, intrinsic motivation, and the evolutionary

effect of a flat rate.

Liu, L. and Lockwood, B., 2016. VAT notches, voluntary registration and bunching: Theory and

UK evidence.

Miller, H. and Pope, T., 2016. The changing composition of UK tax revenues. Institute for

Fiscal Studies, Briefing Note. 26.

Nechaev, A. and Antipina, O., 2016. Analysis of the Impact of Taxation of Business Entities on

the Innovative Development of the Country. European Research Studies. 19(1). p.71.

Schippers, M., 2017. Brexit: Consequences for trade, VAT and customs. EC Tax Review.26(4).

pp.220-225.

Van Thiel, S. and Lamensch, M., 2018. Possible Consequences of Brexit in the Area of Indirect

Taxation: Why Prime Minister May Talks about a Hard Brexit, but Really Needs a Soft

Brexit!. World Tax Journal: WTJ. 10(1). pp.3-41.

Zu, Y., 2018. VAT/GST Thresholds and Small Businesses: Where to Draw the Line?.

Online

Standard VAT accounting scheme- What is the standard VAT Accounting Scheme. 2019.

[Online]. Available through <https://debitoor.com/dictionary/standard-vat-accounting-

scheme>

VAT record keeping. 2019. [Online] . Available through <https://www.gov.uk/vat-record-

keeping/vat-account>

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.