Detailed Financial Analysis and Budget Report for Twin Rivers Cafe

VerifiedAdded on 2023/01/17

|7

|1863

|45

Report

AI Summary

This report presents a detailed budget analysis for Twin Rivers Cafe, focusing on the objectives of budget preparation, variance analysis, and recommendations for financial improvement. It examines the company's revenue and spending variances for July 2018, highlighting favorable and unfavorable variances in areas such as revenue, raw materials, wages, utilities, facility rent, insurance, and fuel. The analysis identifies key areas of concern for management, including declining sales and increased costs in rent, insurance, and fuel. The report provides actionable advice and suggestions to Twin Rivers Cafe, such as the need for quarterly/monthly variance reports, sales target optimization, and effective cost categorization and control. The conclusion emphasizes the importance of budgets in assessing business performance and making strategic decisions for enhanced financial results.

Finance

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

EXECUTIVE SUMMARY.............................................................................................................3

TASK...............................................................................................................................................3

A. Objective of preparing a budget for Twin Rivers Café:....................................................3

B. Report showing the company’s revenue and spending variance for July along with

explanation:............................................................................................................................4

C. Activity of variance should be of concern to management:..............................................5

D. Advise and Suggestions to Twin Rivers Cafe:..................................................................5

CONCLUSION................................................................................................................................6

REFERENCES................................................................................................................................7

EXECUTIVE SUMMARY.............................................................................................................3

TASK...............................................................................................................................................3

A. Objective of preparing a budget for Twin Rivers Café:....................................................3

B. Report showing the company’s revenue and spending variance for July along with

explanation:............................................................................................................................4

C. Activity of variance should be of concern to management:..............................................5

D. Advise and Suggestions to Twin Rivers Cafe:..................................................................5

CONCLUSION................................................................................................................................6

REFERENCES................................................................................................................................7

EXECUTIVE SUMMARY

This report sums up the main goals of Twin Rivers Café's framing budgets with a view to

improving overall business performance. The report also summarizes a thorough report about

variations in the actual revenue, costs and profits figures of the respective corporation. Further

report includes a significant variance activity and advises or recommends to companies that these

variances should be minimised.

TASK

A. Objective of preparing a budget for Twin Rivers Café:

Budgets are general revenues/sales forecasts and various expenses for the

specified period ahead and are typically framed and reviewed on a periodical basis. A budget

acts as an internal structure by managers of corporations like Twin Rivers Café and is not often

required to be communicated by external entities like interested parties. Overall production

activities are subject to financial budgets. The budget is main method used to monitor

expenditure and budgetary discrepancies by financial analysts (Vance and et.al, 2016). Company

should consider inconsistencies between plans and actual-costs by comparing the forecast with

actual figures. The bigger the variances, the bigger the need for managerial assistance. A budget

could help to set priorities, track progresses and make contingency planning, in addition to

apportioning resources. This also encourages the corporation to have those employees

accountable for reducing budget disparities. A well-designed budget allows a corporation to

monitor where it is financially. It makes long-term strategical and visionary planning feasible by

showing deviations from the current operating expenditures. In this regard, some main budget

objectives are as follows:

Provide specific framework: A budget is specifically effective to provide a corporation with

directions as to the path to be pursued. It therefore provides a framework for another steps. A

Manager is instructed that a corporation that has no better direction should enforce a budget.

Obviously, if Manager immediately scraps the budget and he does not update it for another year,

a budget would not provide sufficient framework. A budget generates a significant framework

only if executives continually alludes to it and assesses personnel performance on basis of their

expectations.

This report sums up the main goals of Twin Rivers Café's framing budgets with a view to

improving overall business performance. The report also summarizes a thorough report about

variations in the actual revenue, costs and profits figures of the respective corporation. Further

report includes a significant variance activity and advises or recommends to companies that these

variances should be minimised.

TASK

A. Objective of preparing a budget for Twin Rivers Café:

Budgets are general revenues/sales forecasts and various expenses for the

specified period ahead and are typically framed and reviewed on a periodical basis. A budget

acts as an internal structure by managers of corporations like Twin Rivers Café and is not often

required to be communicated by external entities like interested parties. Overall production

activities are subject to financial budgets. The budget is main method used to monitor

expenditure and budgetary discrepancies by financial analysts (Vance and et.al, 2016). Company

should consider inconsistencies between plans and actual-costs by comparing the forecast with

actual figures. The bigger the variances, the bigger the need for managerial assistance. A budget

could help to set priorities, track progresses and make contingency planning, in addition to

apportioning resources. This also encourages the corporation to have those employees

accountable for reducing budget disparities. A well-designed budget allows a corporation to

monitor where it is financially. It makes long-term strategical and visionary planning feasible by

showing deviations from the current operating expenditures. In this regard, some main budget

objectives are as follows:

Provide specific framework: A budget is specifically effective to provide a corporation with

directions as to the path to be pursued. It therefore provides a framework for another steps. A

Manager is instructed that a corporation that has no better direction should enforce a budget.

Obviously, if Manager immediately scraps the budget and he does not update it for another year,

a budget would not provide sufficient framework. A budget generates a significant framework

only if executives continually alludes to it and assesses personnel performance on basis of their

expectations.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Measuring performance: It is a universal aim of generating a budget, which is based on

budgeting differences, to measure the efficiency of personnel along with whole enterprise. This

is a complex job as managers want to adjust their plans to help them achieve their personal goals

but budgets make it easy for them.

Resource Allocation: In order to decide how to assign funds to numerous operations, like asset

acquisitions, most corporations apply the budgets. Though this is a valuable aim the evaluation

of capability constraint should be integrated in order to ascertain where assets should actually be

distributed (Lidia, 2015)

Cash Flow Projections: A budget is of good use in firms with rapid growth, cyclical sales or

unusual sales trends. These corporations find it harder to estimate the amount of funds they are

actually likely to get in short term, leading to standard cash crises. Budget is advantageous to

project free cash flow, which generates further and further inconsistent results Therefore, the

creation of inflows in coming months is only a fair budgetary goal (Senthilkumar, Nesme,

Mollier and Pellerin, 2012).

Providing incentives: One of the objectives of preceding activity's budgets are to offer

incentives The fact that unusual departmental budget spreads are only absorbed in central

organizational budget at the ending of financial year can lead to rational, albeit inefficient,

decisions of using funds until they lost (Finance and Network, 2013).

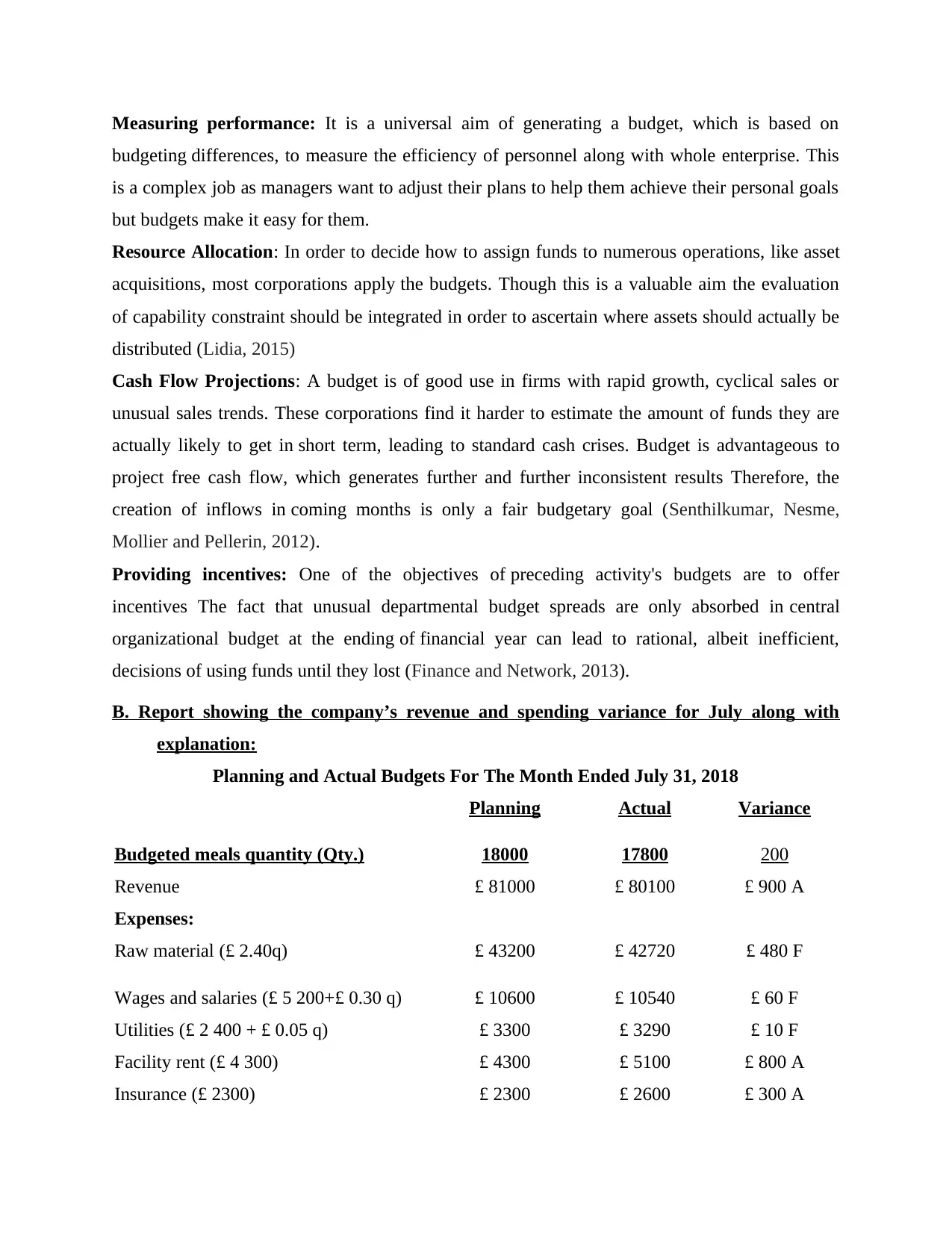

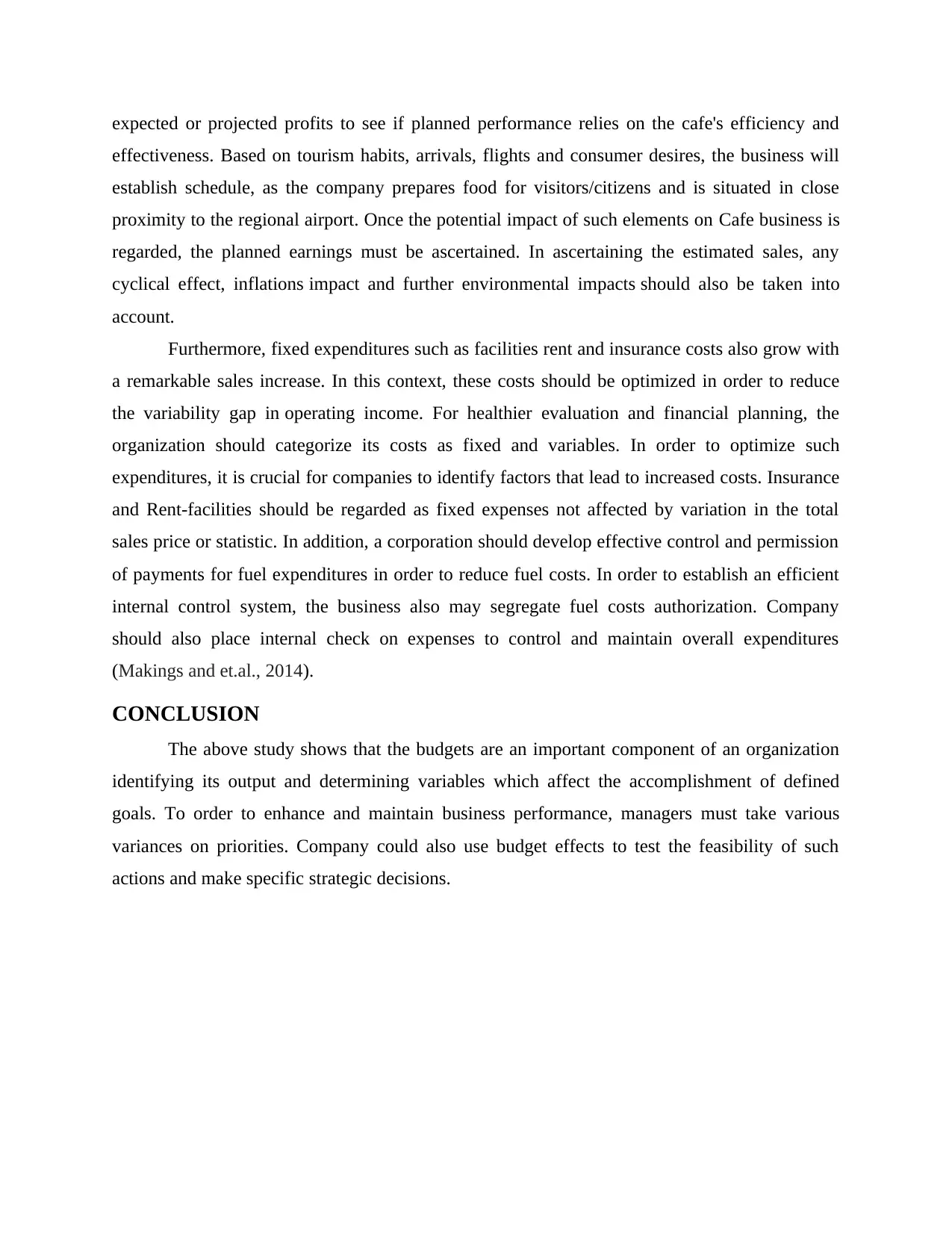

B. Report showing the company’s revenue and spending variance for July along with

explanation:

Planning and Actual Budgets For The Month Ended July 31, 2018

Planning Actual Variance

Budgeted meals quantity (Qty.) 18000 17800 200

Revenue £ 81000 £ 80100 £ 900 A

Expenses:

Raw material (£ 2.40q) £ 43200 £ 42720 £ 480 F

Wages and salaries (£ 5 200+£ 0.30 q) £ 10600 £ 10540 £ 60 F

Utilities (£ 2 400 + £ 0.05 q) £ 3300 £ 3290 £ 10 F

Facility rent (£ 4 300) £ 4300 £ 5100 £ 800 A

Insurance (£ 2300) £ 2300 £ 2600 £ 300 A

budgeting differences, to measure the efficiency of personnel along with whole enterprise. This

is a complex job as managers want to adjust their plans to help them achieve their personal goals

but budgets make it easy for them.

Resource Allocation: In order to decide how to assign funds to numerous operations, like asset

acquisitions, most corporations apply the budgets. Though this is a valuable aim the evaluation

of capability constraint should be integrated in order to ascertain where assets should actually be

distributed (Lidia, 2015)

Cash Flow Projections: A budget is of good use in firms with rapid growth, cyclical sales or

unusual sales trends. These corporations find it harder to estimate the amount of funds they are

actually likely to get in short term, leading to standard cash crises. Budget is advantageous to

project free cash flow, which generates further and further inconsistent results Therefore, the

creation of inflows in coming months is only a fair budgetary goal (Senthilkumar, Nesme,

Mollier and Pellerin, 2012).

Providing incentives: One of the objectives of preceding activity's budgets are to offer

incentives The fact that unusual departmental budget spreads are only absorbed in central

organizational budget at the ending of financial year can lead to rational, albeit inefficient,

decisions of using funds until they lost (Finance and Network, 2013).

B. Report showing the company’s revenue and spending variance for July along with

explanation:

Planning and Actual Budgets For The Month Ended July 31, 2018

Planning Actual Variance

Budgeted meals quantity (Qty.) 18000 17800 200

Revenue £ 81000 £ 80100 £ 900 A

Expenses:

Raw material (£ 2.40q) £ 43200 £ 42720 £ 480 F

Wages and salaries (£ 5 200+£ 0.30 q) £ 10600 £ 10540 £ 60 F

Utilities (£ 2 400 + £ 0.05 q) £ 3300 £ 3290 £ 10 F

Facility rent (£ 4 300) £ 4300 £ 5100 £ 800 A

Insurance (£ 2300) £ 2300 £ 2600 £ 300 A

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

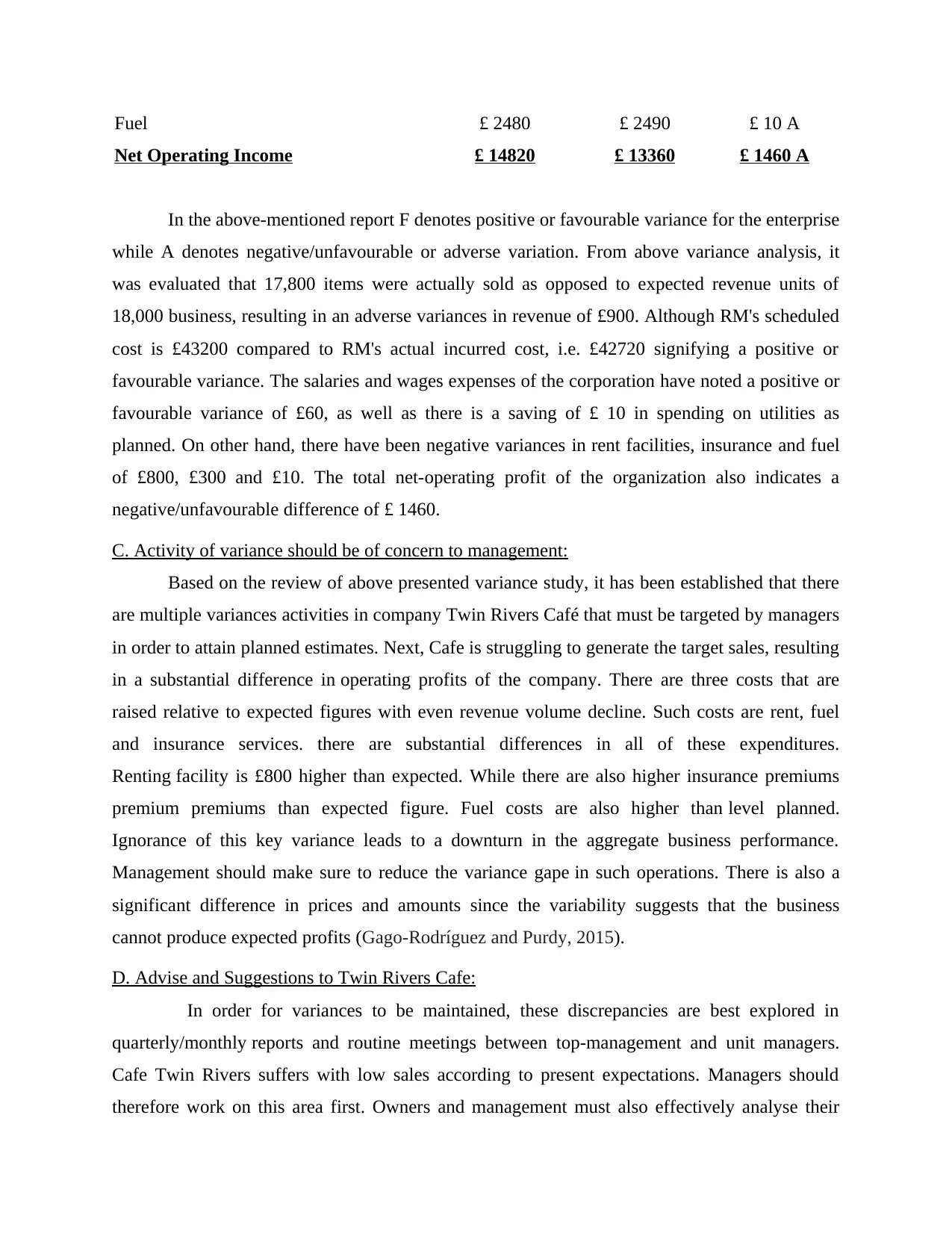

Fuel £ 2480 £ 2490 £ 10 A

Net Operating Income £ 14820 £ 13360 £ 1460 A

In the above-mentioned report F denotes positive or favourable variance for the enterprise

while A denotes negative/unfavourable or adverse variation. From above variance analysis, it

was evaluated that 17,800 items were actually sold as opposed to expected revenue units of

18,000 business, resulting in an adverse variances in revenue of £900. Although RM's scheduled

cost is £43200 compared to RM's actual incurred cost, i.e. £42720 signifying a positive or

favourable variance. The salaries and wages expenses of the corporation have noted a positive or

favourable variance of £60, as well as there is a saving of £ 10 in spending on utilities as

planned. On other hand, there have been negative variances in rent facilities, insurance and fuel

of £800, £300 and £10. The total net-operating profit of the organization also indicates a

negative/unfavourable difference of £ 1460.

C. Activity of variance should be of concern to management:

Based on the review of above presented variance study, it has been established that there

are multiple variances activities in company Twin Rivers Café that must be targeted by managers

in order to attain planned estimates. Next, Cafe is struggling to generate the target sales, resulting

in a substantial difference in operating profits of the company. There are three costs that are

raised relative to expected figures with even revenue volume decline. Such costs are rent, fuel

and insurance services. there are substantial differences in all of these expenditures.

Renting facility is £800 higher than expected. While there are also higher insurance premiums

premium premiums than expected figure. Fuel costs are also higher than level planned.

Ignorance of this key variance leads to a downturn in the aggregate business performance.

Management should make sure to reduce the variance gape in such operations. There is also a

significant difference in prices and amounts since the variability suggests that the business

cannot produce expected profits (Gago-Rodríguez and Purdy, 2015).

D. Advise and Suggestions to Twin Rivers Cafe:

In order for variances to be maintained, these discrepancies are best explored in

quarterly/monthly reports and routine meetings between top-management and unit managers.

Cafe Twin Rivers suffers with low sales according to present expectations. Managers should

therefore work on this area first. Owners and management must also effectively analyse their

Net Operating Income £ 14820 £ 13360 £ 1460 A

In the above-mentioned report F denotes positive or favourable variance for the enterprise

while A denotes negative/unfavourable or adverse variation. From above variance analysis, it

was evaluated that 17,800 items were actually sold as opposed to expected revenue units of

18,000 business, resulting in an adverse variances in revenue of £900. Although RM's scheduled

cost is £43200 compared to RM's actual incurred cost, i.e. £42720 signifying a positive or

favourable variance. The salaries and wages expenses of the corporation have noted a positive or

favourable variance of £60, as well as there is a saving of £ 10 in spending on utilities as

planned. On other hand, there have been negative variances in rent facilities, insurance and fuel

of £800, £300 and £10. The total net-operating profit of the organization also indicates a

negative/unfavourable difference of £ 1460.

C. Activity of variance should be of concern to management:

Based on the review of above presented variance study, it has been established that there

are multiple variances activities in company Twin Rivers Café that must be targeted by managers

in order to attain planned estimates. Next, Cafe is struggling to generate the target sales, resulting

in a substantial difference in operating profits of the company. There are three costs that are

raised relative to expected figures with even revenue volume decline. Such costs are rent, fuel

and insurance services. there are substantial differences in all of these expenditures.

Renting facility is £800 higher than expected. While there are also higher insurance premiums

premium premiums than expected figure. Fuel costs are also higher than level planned.

Ignorance of this key variance leads to a downturn in the aggregate business performance.

Management should make sure to reduce the variance gape in such operations. There is also a

significant difference in prices and amounts since the variability suggests that the business

cannot produce expected profits (Gago-Rodríguez and Purdy, 2015).

D. Advise and Suggestions to Twin Rivers Cafe:

In order for variances to be maintained, these discrepancies are best explored in

quarterly/monthly reports and routine meetings between top-management and unit managers.

Cafe Twin Rivers suffers with low sales according to present expectations. Managers should

therefore work on this area first. Owners and management must also effectively analyse their

expected or projected profits to see if planned performance relies on the cafe's efficiency and

effectiveness. Based on tourism habits, arrivals, flights and consumer desires, the business will

establish schedule, as the company prepares food for visitors/citizens and is situated in close

proximity to the regional airport. Once the potential impact of such elements on Cafe business is

regarded, the planned earnings must be ascertained. In ascertaining the estimated sales, any

cyclical effect, inflations impact and further environmental impacts should also be taken into

account.

Furthermore, fixed expenditures such as facilities rent and insurance costs also grow with

a remarkable sales increase. In this context, these costs should be optimized in order to reduce

the variability gap in operating income. For healthier evaluation and financial planning, the

organization should categorize its costs as fixed and variables. In order to optimize such

expenditures, it is crucial for companies to identify factors that lead to increased costs. Insurance

and Rent-facilities should be regarded as fixed expenses not affected by variation in the total

sales price or statistic. In addition, a corporation should develop effective control and permission

of payments for fuel expenditures in order to reduce fuel costs. In order to establish an efficient

internal control system, the business also may segregate fuel costs authorization. Company

should also place internal check on expenses to control and maintain overall expenditures

(Makings and et.al., 2014).

CONCLUSION

The above study shows that the budgets are an important component of an organization

identifying its output and determining variables which affect the accomplishment of defined

goals. To order to enhance and maintain business performance, managers must take various

variances on priorities. Company could also use budget effects to test the feasibility of such

actions and make specific strategic decisions.

effectiveness. Based on tourism habits, arrivals, flights and consumer desires, the business will

establish schedule, as the company prepares food for visitors/citizens and is situated in close

proximity to the regional airport. Once the potential impact of such elements on Cafe business is

regarded, the planned earnings must be ascertained. In ascertaining the estimated sales, any

cyclical effect, inflations impact and further environmental impacts should also be taken into

account.

Furthermore, fixed expenditures such as facilities rent and insurance costs also grow with

a remarkable sales increase. In this context, these costs should be optimized in order to reduce

the variability gap in operating income. For healthier evaluation and financial planning, the

organization should categorize its costs as fixed and variables. In order to optimize such

expenditures, it is crucial for companies to identify factors that lead to increased costs. Insurance

and Rent-facilities should be regarded as fixed expenses not affected by variation in the total

sales price or statistic. In addition, a corporation should develop effective control and permission

of payments for fuel expenditures in order to reduce fuel costs. In order to establish an efficient

internal control system, the business also may segregate fuel costs authorization. Company

should also place internal check on expenses to control and maintain overall expenditures

(Makings and et.al., 2014).

CONCLUSION

The above study shows that the budgets are an important component of an organization

identifying its output and determining variables which affect the accomplishment of defined

goals. To order to enhance and maintain business performance, managers must take various

variances on priorities. Company could also use budget effects to test the feasibility of such

actions and make specific strategic decisions.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

REFERENCES

Books and Journals:

Finance, E.H. & Network, C., (2013). The eurosystem household finance and consumption

survey-results from the first wave (No. 2). ECB statistics paper.

Gago-Rodríguez, S. & Purdy, D.E., (2015). The effects of budgetary knowledge and extrinsic

motivation on the importance that managers attribute to their budgets. Spanish Journal

of Finance and Accounting/Revista Espanola de Financiacion y Contabilidad, 44(1),

pp. 47-71.

Lidia, T.G., (2015). An analysis of the existence of a link between budgets and performance in

economic entities. Procedia Economics and Finance. 32. pp. 1794-1803.

Makings, U., & et.al., (2014). Importance of budgets for estimating the input of groundwater-

derived nutrients to an eutrophic tidal river and estuary. Estuarine, Coastal and Shelf

Science. 143. pp. 65-76.

Senthilkumar, K., Nesme, T., Mollier, A. & Pellerin, S., (2012). Regional-scale phosphorus

flows and budgets within France: the importance of agricultural production

systems. Nutrient Cycling in Agroecosystems. 92(2). pp. 145-159.

Vance, D., & et.al, (2016). The oceanic budgets of nickel and zinc isotopes: the importance of

sulfidic environments as illustrated by the Black Sea. Philosophical Transactions of the

Royal Society A: Mathematical, Physical and Engineering Sciences. 374(2081). p.

20150294.

Books and Journals:

Finance, E.H. & Network, C., (2013). The eurosystem household finance and consumption

survey-results from the first wave (No. 2). ECB statistics paper.

Gago-Rodríguez, S. & Purdy, D.E., (2015). The effects of budgetary knowledge and extrinsic

motivation on the importance that managers attribute to their budgets. Spanish Journal

of Finance and Accounting/Revista Espanola de Financiacion y Contabilidad, 44(1),

pp. 47-71.

Lidia, T.G., (2015). An analysis of the existence of a link between budgets and performance in

economic entities. Procedia Economics and Finance. 32. pp. 1794-1803.

Makings, U., & et.al., (2014). Importance of budgets for estimating the input of groundwater-

derived nutrients to an eutrophic tidal river and estuary. Estuarine, Coastal and Shelf

Science. 143. pp. 65-76.

Senthilkumar, K., Nesme, T., Mollier, A. & Pellerin, S., (2012). Regional-scale phosphorus

flows and budgets within France: the importance of agricultural production

systems. Nutrient Cycling in Agroecosystems. 92(2). pp. 145-159.

Vance, D., & et.al, (2016). The oceanic budgets of nickel and zinc isotopes: the importance of

sulfidic environments as illustrated by the Black Sea. Philosophical Transactions of the

Royal Society A: Mathematical, Physical and Engineering Sciences. 374(2081). p.

20150294.

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.