Essay: Decision-Making Process, Techniques, and Factors

VerifiedAdded on 2023/01/13

|7

|1252

|80

Essay

AI Summary

This essay provides a comprehensive overview of the decision-making process within a business context. It begins by defining decision-making and highlighting its significance for organizational growth. The essay then delves into investment appraisal techniques, specifically focusing on Net Present Value (NPV) and payback period methods, including their advantages, disadvantages, and application through example project scenarios. The analysis includes detailed calculations of NPV and payback periods for two hypothetical projects, demonstrating how these techniques inform investment choices. Furthermore, the essay explores the financial and non-financial factors that influence business decisions, emphasizing their importance in strategy formulation and policy development. The conclusion summarizes the key takeaways, reinforcing the importance of a holistic approach to decision-making that considers both quantitative and qualitative aspects.

INDIVIDUAL ESSAY

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

ESSAY ............................................................................................................................................1

Decision-making process ............................................................................................................1

Investment Appraisal techniques.................................................................................................1

Financial and Non financial factors in decision making of business. .........................................3

CONCLUSION................................................................................................................................4

REFERENCES................................................................................................................................5

INTRODUCTION...........................................................................................................................1

ESSAY ............................................................................................................................................1

Decision-making process ............................................................................................................1

Investment Appraisal techniques.................................................................................................1

Financial and Non financial factors in decision making of business. .........................................3

CONCLUSION................................................................................................................................4

REFERENCES................................................................................................................................5

INTRODUCTION

Decision-making can be defined as process of choices that is concerned with identifying

the right decisions, by gathering informations and assessing the alternative solutions. It is

concerned with making the most effective decisions that are essential for organisation's growth.

The growth and success of the company depends on the decisions it takes. The study is based on

the importance of decision-making process. The decision-making also involves using various

techniques such as investment appraisal techniques for identifying the feasibility of project. The

benefits and limitations of investment techniques will also be explained in the report.

ESSAY

Decision-making process

Decision making is an integral part of business organisation. Management has the key

function of taking a sound, rational and important decisions for the benefit of organisation. It is

an important process as it defines both managerial and organisational activities. Decision are

taken after analysing the circumstances, collecting all the important information related to the

activities to be taken (Wooldridge and Cowden, 2020). The decisions are to be taken at every

management level for ensuring the growth and success of organisation. It refers to making choice

between the most significant alternatives.

Investment Appraisal techniques.

The investment appraisal technique is used by organisations for identifying the feasibility

of projects before making investments in projects. Techniques used in investment appraisals is

Net Present Value, IRR, payback period, and ARR.

Net Present Value

Net present value can be defined as the method in which present value of cash flows is

measured by discounting them at the required rate of return or the discounting rate generated by

project. It involves identifying whether the cash flows will be sufficient for covering the cost of

investments.

Advantages

The investment technique considers time value of money for checking the feasibility of

projects.

It is an easy and comprehensive method used for assessing the present value (Weber,

2019).

1

Decision-making can be defined as process of choices that is concerned with identifying

the right decisions, by gathering informations and assessing the alternative solutions. It is

concerned with making the most effective decisions that are essential for organisation's growth.

The growth and success of the company depends on the decisions it takes. The study is based on

the importance of decision-making process. The decision-making also involves using various

techniques such as investment appraisal techniques for identifying the feasibility of project. The

benefits and limitations of investment techniques will also be explained in the report.

ESSAY

Decision-making process

Decision making is an integral part of business organisation. Management has the key

function of taking a sound, rational and important decisions for the benefit of organisation. It is

an important process as it defines both managerial and organisational activities. Decision are

taken after analysing the circumstances, collecting all the important information related to the

activities to be taken (Wooldridge and Cowden, 2020). The decisions are to be taken at every

management level for ensuring the growth and success of organisation. It refers to making choice

between the most significant alternatives.

Investment Appraisal techniques.

The investment appraisal technique is used by organisations for identifying the feasibility

of projects before making investments in projects. Techniques used in investment appraisals is

Net Present Value, IRR, payback period, and ARR.

Net Present Value

Net present value can be defined as the method in which present value of cash flows is

measured by discounting them at the required rate of return or the discounting rate generated by

project. It involves identifying whether the cash flows will be sufficient for covering the cost of

investments.

Advantages

The investment technique considers time value of money for checking the feasibility of

projects.

It is an easy and comprehensive method used for assessing the present value (Weber,

2019).

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

It is used in management decision-making for identifying the profitability of project.

Disadvantages

It is difficult to calculate the discounting rate.

The cash flows do not consider the other influential factors.

Project A Project B

Computation of NPV Computation of NPV

Year

Cash

inflows

PV factor

@ 12%

Discounte

d cash

inflows Year

Cash

inflows

PV factor

@ 12%

Discounte

d cash

inflows

1 8000 0.893

7142.8571

428572 1 10000 0.893

8928.5714

285714

2 12000 0.797 9566 2 20000 0.797 15944

3 16000 0.712 11388 3 25000 0.712 17795

4 20000 0.636 12710 4 30000 0.636 19066

5 30000 0.567 17023 5 40000 0.567 22697

Total discounted cash inflow 57831 Total discounted cash inflow 84430

Initial investment 40000 Initial investment 60000

NPV (Total discounted cash

inflows - initial investment) 17831

NPV (Total discounted cash

inflows - initial investment) 24430

Payback period

The payback period method is an investment appraisal techniques used by organisations

for identifying the feasibility of projects. The project is considered profitable if the payback

period is shorter and as company will be earning the profits after recovering its cost of project

(Skyrius, 2018). It is defined as the time length within which the initial cost of the project will

be recovered by company.

Advantages

It is easier to calculate and interpret the payback period.

Profitability of the project could be identified by this method. It makes comparison of two projects easier.

Disadvantages

2

Disadvantages

It is difficult to calculate the discounting rate.

The cash flows do not consider the other influential factors.

Project A Project B

Computation of NPV Computation of NPV

Year

Cash

inflows

PV factor

@ 12%

Discounte

d cash

inflows Year

Cash

inflows

PV factor

@ 12%

Discounte

d cash

inflows

1 8000 0.893

7142.8571

428572 1 10000 0.893

8928.5714

285714

2 12000 0.797 9566 2 20000 0.797 15944

3 16000 0.712 11388 3 25000 0.712 17795

4 20000 0.636 12710 4 30000 0.636 19066

5 30000 0.567 17023 5 40000 0.567 22697

Total discounted cash inflow 57831 Total discounted cash inflow 84430

Initial investment 40000 Initial investment 60000

NPV (Total discounted cash

inflows - initial investment) 17831

NPV (Total discounted cash

inflows - initial investment) 24430

Payback period

The payback period method is an investment appraisal techniques used by organisations

for identifying the feasibility of projects. The project is considered profitable if the payback

period is shorter and as company will be earning the profits after recovering its cost of project

(Skyrius, 2018). It is defined as the time length within which the initial cost of the project will

be recovered by company.

Advantages

It is easier to calculate and interpret the payback period.

Profitability of the project could be identified by this method. It makes comparison of two projects easier.

Disadvantages

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

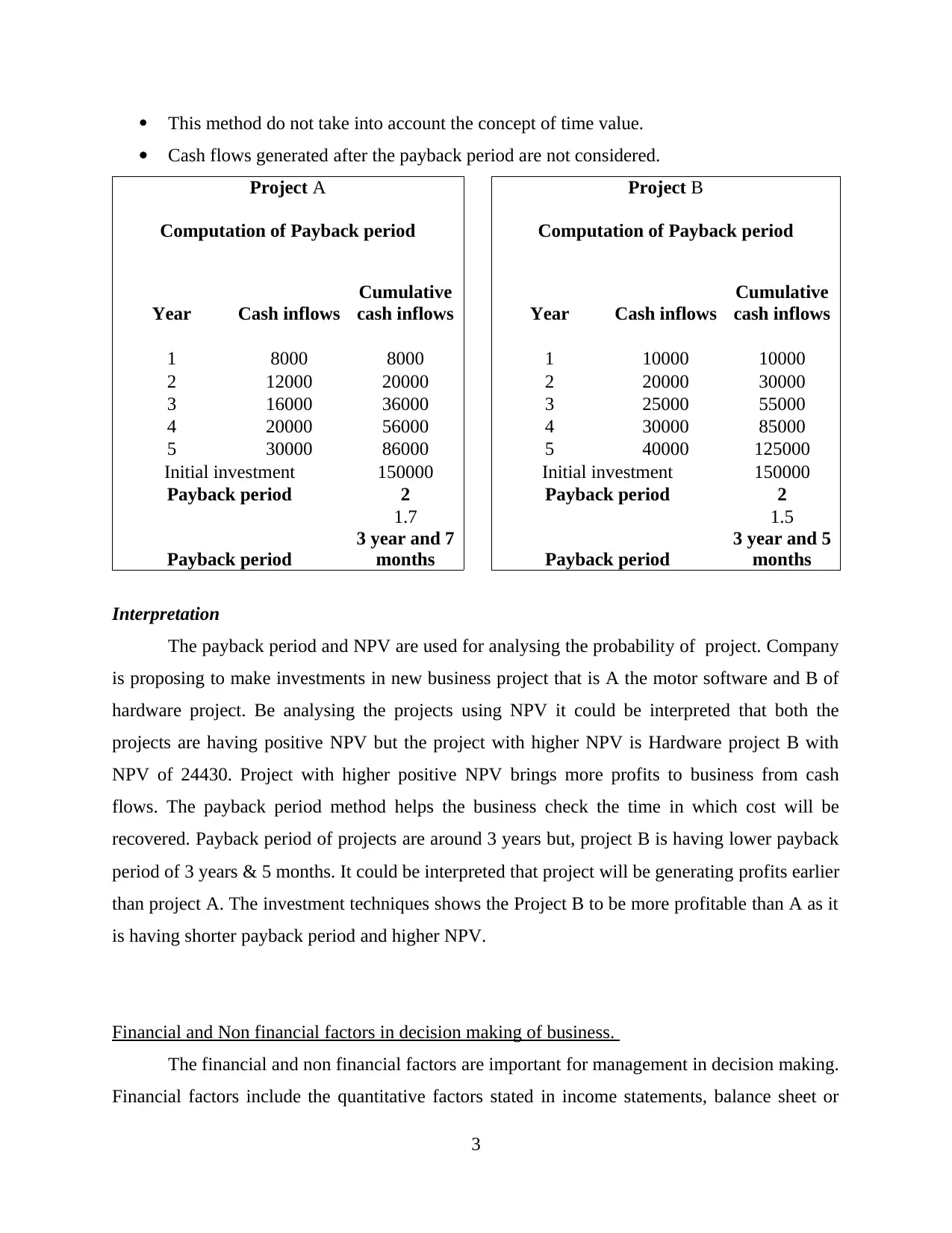

This method do not take into account the concept of time value.

Cash flows generated after the payback period are not considered.

Project A Project B

Computation of Payback period Computation of Payback period

Year Cash inflows

Cumulative

cash inflows Year Cash inflows

Cumulative

cash inflows

1 8000 8000 1 10000 10000

2 12000 20000 2 20000 30000

3 16000 36000 3 25000 55000

4 20000 56000 4 30000 85000

5 30000 86000 5 40000 125000

Initial investment 150000 Initial investment 150000

Payback period 2 Payback period 2

1.7 1.5

Payback period

3 year and 7

months Payback period

3 year and 5

months

Interpretation

The payback period and NPV are used for analysing the probability of project. Company

is proposing to make investments in new business project that is A the motor software and B of

hardware project. Be analysing the projects using NPV it could be interpreted that both the

projects are having positive NPV but the project with higher NPV is Hardware project B with

NPV of 24430. Project with higher positive NPV brings more profits to business from cash

flows. The payback period method helps the business check the time in which cost will be

recovered. Payback period of projects are around 3 years but, project B is having lower payback

period of 3 years & 5 months. It could be interpreted that project will be generating profits earlier

than project A. The investment techniques shows the Project B to be more profitable than A as it

is having shorter payback period and higher NPV.

Financial and Non financial factors in decision making of business.

The financial and non financial factors are important for management in decision making.

Financial factors include the quantitative factors stated in income statements, balance sheet or

3

Cash flows generated after the payback period are not considered.

Project A Project B

Computation of Payback period Computation of Payback period

Year Cash inflows

Cumulative

cash inflows Year Cash inflows

Cumulative

cash inflows

1 8000 8000 1 10000 10000

2 12000 20000 2 20000 30000

3 16000 36000 3 25000 55000

4 20000 56000 4 30000 85000

5 30000 86000 5 40000 125000

Initial investment 150000 Initial investment 150000

Payback period 2 Payback period 2

1.7 1.5

Payback period

3 year and 7

months Payback period

3 year and 5

months

Interpretation

The payback period and NPV are used for analysing the probability of project. Company

is proposing to make investments in new business project that is A the motor software and B of

hardware project. Be analysing the projects using NPV it could be interpreted that both the

projects are having positive NPV but the project with higher NPV is Hardware project B with

NPV of 24430. Project with higher positive NPV brings more profits to business from cash

flows. The payback period method helps the business check the time in which cost will be

recovered. Payback period of projects are around 3 years but, project B is having lower payback

period of 3 years & 5 months. It could be interpreted that project will be generating profits earlier

than project A. The investment techniques shows the Project B to be more profitable than A as it

is having shorter payback period and higher NPV.

Financial and Non financial factors in decision making of business.

The financial and non financial factors are important for management in decision making.

Financial factors include the quantitative factors stated in income statements, balance sheet or

3

cash flow statement. They tell the financial health and position of company so that decision are

made taking them and their influence. On the other hand non financial factors include corporate

governance, management of company and external forces like political, social or environmental

factors. They have great influence over working of organisations , therefore management cannot

ignore these factors while making any management decisions (Bals, Kirchoff and Foerstl,

2016). Businesses frame their strategies, policies and regulations considering both factors for

achieving the goals and objectives of business.

CONCLUSION

The above research has provided understanding about the importance of decisions in any

organisation. There are various investment appraisal techniques like net present value and

payback period which helps in identifying the profitability of project. Apart from these it is also

required to consider the financial factors like funds availability or financial position and non

financial factors like CSR, governance and external influential factors.

4

made taking them and their influence. On the other hand non financial factors include corporate

governance, management of company and external forces like political, social or environmental

factors. They have great influence over working of organisations , therefore management cannot

ignore these factors while making any management decisions (Bals, Kirchoff and Foerstl,

2016). Businesses frame their strategies, policies and regulations considering both factors for

achieving the goals and objectives of business.

CONCLUSION

The above research has provided understanding about the importance of decisions in any

organisation. There are various investment appraisal techniques like net present value and

payback period which helps in identifying the profitability of project. Apart from these it is also

required to consider the financial factors like funds availability or financial position and non

financial factors like CSR, governance and external influential factors.

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

REFERENCES

Books and Journals

Wooldridge, B. and Cowden, B., 2020. Strategic Decision-Making in Business. In Oxford

Research Encyclopedia of Business and Management.

Weber, J., 2019. Understanding the millennials’ integrated ethical decision-making process:

Assessing the relationship between personal values and cognitive moral

reasoning. Business & Society. 58(8). pp.1671-1706.

Skyrius, R., 2018. Business Decision Making. In 2001 Informing Science Conference (Vol. 1).

Bals, L., Kirchoff, J.F. and Foerstl, K., 2016. Exploring the reshoring and insourcing decision

making process: toward an agenda for future research. Operations Management

Research. 9(3-4), pp.102-116.

5

Books and Journals

Wooldridge, B. and Cowden, B., 2020. Strategic Decision-Making in Business. In Oxford

Research Encyclopedia of Business and Management.

Weber, J., 2019. Understanding the millennials’ integrated ethical decision-making process:

Assessing the relationship between personal values and cognitive moral

reasoning. Business & Society. 58(8). pp.1671-1706.

Skyrius, R., 2018. Business Decision Making. In 2001 Informing Science Conference (Vol. 1).

Bals, L., Kirchoff, J.F. and Foerstl, K., 2016. Exploring the reshoring and insourcing decision

making process: toward an agenda for future research. Operations Management

Research. 9(3-4), pp.102-116.

5

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.