Interest Rate Risk Analysis: Bank Comparison Report

VerifiedAdded on 2023/06/03

|5

|1833

|237

Report

AI Summary

This report provides a detailed analysis of interest rate risk within the banking sector, focusing on the impact of fluctuating interest rates on profitability and equity. It begins with a conceptual overview of interest rate risk and summarizes the regulatory requirements outlined by Basel III and APRA. The analysis then compares the interest rate risk profiles of Bendigo and Adelaide Bank and ANZ Bank, examining their exposure through Economic Value of Equity calculations, and highlighting similarities and differences in their risk management strategies, including the use of cash flow hedges and derivative instruments. The report discusses the banks' compliance with regulatory standards. The conclusion summarizes the banks' approaches to meeting regulatory requirements and managing interest rate risk, providing insights into their financial stability and risk management practices.

INTEREST RATE RISK

Interest rate risk is the risk of the bank of decrease in profit and equity on account of fluctuating

interest rates. The sensitivity of change in price of bond to change in interest rate in the market shall

impact the influence of interest rate risk. The sensitivity of the bond shall be influenced by two

factors:

(a) The time to maturity of the bond;

(b) Coupon rate of the bond.

In other words, interest rate risk is the risk of change in equity value on account of change in the

absolute level of interest, change in the spread of two interest rates, change in the shape of yield

curve, or in other relationship. The interest rate risk can be diversified away by hedging or

diversifying.

Summary of Regulatory requirement under BASEL III / APRA for Interest Rate Risk

The Basel Committee on Banking Supervision has issued standard on Interest Rate Risk on Banking

Book. The supervision details out supervisory expectations pertaining to identification of risk,

measuring such risk, monitoring of such risk and control of it. The BASEL III announcement made

enhancement to the guidelines stated in 2004 principles. The enhancements details have been

stated here-in-below:

(a) Stricter threshold for the purpose of identification of outlier banks by reducing the initial

identification of 20% of total bank assets to 15% of the tier -1 Capital.

(b) An updated standardised framework which can be mandated or voluntarily adopted by

managers of bank;

(c) The disclosure requirement has been enhanced on order to provide greater comparability,

consistency and transparency for the purpose of managing and measuring Interest Rate Risk

on Banking Book. The same includes disclosure of quantitative figures on account of common

interest rate shock scenarios;

(d) Extensive guidance has been provided regarding the expectation of bank management of

Interest Rate Risk on Banking Book as well as development of interest rate shock scenarios.

Further, it provides guidelines on the key behavioural and modelling assumptions which shall

be undertaken for the purpose of measuring the risk.

In the said standard, Economic Value of Equity risk measure of Interest Rate Risk on Banking Book.

Under the method, estimation is made regarding the amount by which the net present value of the

cash flows that shall arise to the bank both on and off the balance sheet positions under the

prevailing term structure change in interest rates under different scenarios of interest rates in

future. The exposure of bank to Interest Rate Risk on Banking Book is computed by or equal to the

largest negative change in Economic Value of Equity under different scenarios. In short the risk is

measured by the theoretical risk that may accrue to banks equity on account of change in interest

rates. (IRRBB - Pillar 2 standardised framework - Executive Summary, 2017)

Further, the framework is not fully standardised and specifies six interest rate shock scenarios for

banks to use.

Further Under APRA, the same is covered under Prudential Standard APS 117 Capital Adequacy:

Interest Rate Risk in the banking Books. The computation is done by analysing the sensitivity of

economic value of fundamental tier-1 capital to change in the interest rates

Interest rate risk is the risk of the bank of decrease in profit and equity on account of fluctuating

interest rates. The sensitivity of change in price of bond to change in interest rate in the market shall

impact the influence of interest rate risk. The sensitivity of the bond shall be influenced by two

factors:

(a) The time to maturity of the bond;

(b) Coupon rate of the bond.

In other words, interest rate risk is the risk of change in equity value on account of change in the

absolute level of interest, change in the spread of two interest rates, change in the shape of yield

curve, or in other relationship. The interest rate risk can be diversified away by hedging or

diversifying.

Summary of Regulatory requirement under BASEL III / APRA for Interest Rate Risk

The Basel Committee on Banking Supervision has issued standard on Interest Rate Risk on Banking

Book. The supervision details out supervisory expectations pertaining to identification of risk,

measuring such risk, monitoring of such risk and control of it. The BASEL III announcement made

enhancement to the guidelines stated in 2004 principles. The enhancements details have been

stated here-in-below:

(a) Stricter threshold for the purpose of identification of outlier banks by reducing the initial

identification of 20% of total bank assets to 15% of the tier -1 Capital.

(b) An updated standardised framework which can be mandated or voluntarily adopted by

managers of bank;

(c) The disclosure requirement has been enhanced on order to provide greater comparability,

consistency and transparency for the purpose of managing and measuring Interest Rate Risk

on Banking Book. The same includes disclosure of quantitative figures on account of common

interest rate shock scenarios;

(d) Extensive guidance has been provided regarding the expectation of bank management of

Interest Rate Risk on Banking Book as well as development of interest rate shock scenarios.

Further, it provides guidelines on the key behavioural and modelling assumptions which shall

be undertaken for the purpose of measuring the risk.

In the said standard, Economic Value of Equity risk measure of Interest Rate Risk on Banking Book.

Under the method, estimation is made regarding the amount by which the net present value of the

cash flows that shall arise to the bank both on and off the balance sheet positions under the

prevailing term structure change in interest rates under different scenarios of interest rates in

future. The exposure of bank to Interest Rate Risk on Banking Book is computed by or equal to the

largest negative change in Economic Value of Equity under different scenarios. In short the risk is

measured by the theoretical risk that may accrue to banks equity on account of change in interest

rates. (IRRBB - Pillar 2 standardised framework - Executive Summary, 2017)

Further, the framework is not fully standardised and specifies six interest rate shock scenarios for

banks to use.

Further Under APRA, the same is covered under Prudential Standard APS 117 Capital Adequacy:

Interest Rate Risk in the banking Books. The computation is done by analysing the sensitivity of

economic value of fundamental tier-1 capital to change in the interest rates

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

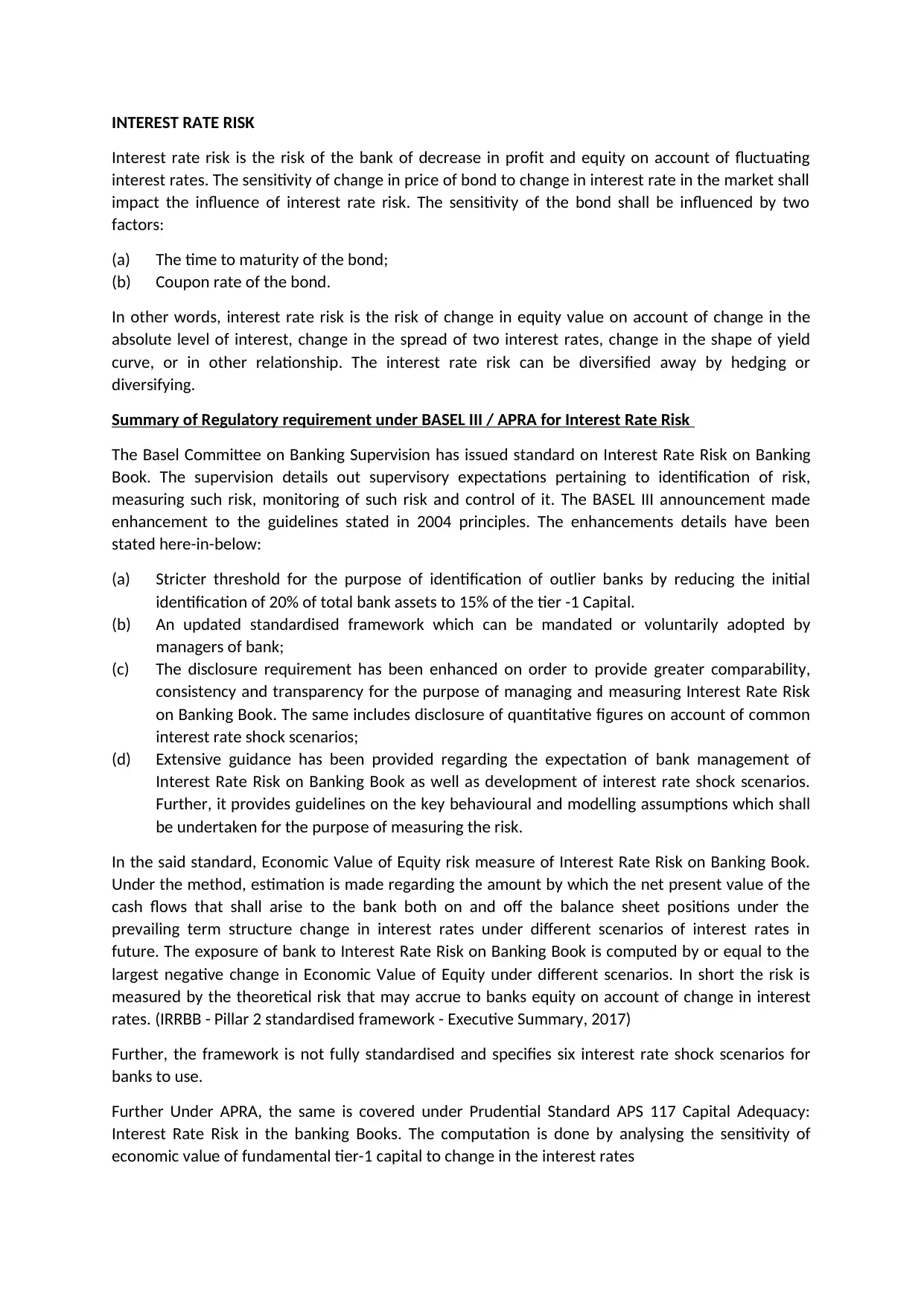

Analysis

The risk of Interest Rate Risk in Banking Books in Bendigo and Adelaide Bank arise generally on

account of non-traded market risk. The risk generally is represented by potentially negative impact

to NII on account of mismatch between maturity and repricing dates of its assets and liabilities which

occur in the normal course of business. For the computation of exposure to risk the Economic Value

of equity risk has been calculated at 100Basis points positive and negative. The detailed simulation

has been presented here-in-below:

For Bendigo and Adelaide Bank

For Group

2016

Assets

Floa

ting

Inter

est

Rate

Less

than

3

Mon

ths

Betw

een 3

and 6

mont

hs

Betw

een 6

and

12

mont

hs

Betw

een 1

and 5

years

Aft

er

5

yea

rs

Non

Inter

est

earni

ng

Total

Carry

ing

value

Weigh

ted

Avera

ge

Effecti

ve

Intere

st

Rate

Cash and Cash

Equivalent 698.7 18 18.1 36.2 108.7

180.

3 1060 1.4

Due from other financial

institutions

220.

8 220.8

Financial Asset held for

trading 1795

2090.

1 2484

6369.

1 1.94

Financial Asset held for

sale

322.

7 0.5 323.2 2.29

Financial Asset held to

maturity 25.3

268.

5 89 382.8 2.86

Loans and other

receivables

3564

8.9 8141

1313.

1

2634.

3

9475,

7

40.

6

4777

7.9 5.02

Derivatives 79 79

Total Financial Assets

3637

2.9

1054

5.2

3510.

3

2670.

5

2592.

7

40.

6

480.

6

5621

2.8

Liabilities

Due to other Financial

Institutions

267.

4 267.4

Deposits

2041

5.9

2031

6.9

9185.

1

5445.

7

1689.

7 1.4

5705

4.7 2.28

Notes Payable 519.6

3302

.9

3822.

5

Derivatives

111.

8 111.8

Convertible Preferenece

shares 824.4 824.4 4.43

Subordinated Debt

583.

4 583.4 5.34

Total Financial Liabilities 2093 2420 10009 5445. 1689. 1.4 379. 6266

The risk of Interest Rate Risk in Banking Books in Bendigo and Adelaide Bank arise generally on

account of non-traded market risk. The risk generally is represented by potentially negative impact

to NII on account of mismatch between maturity and repricing dates of its assets and liabilities which

occur in the normal course of business. For the computation of exposure to risk the Economic Value

of equity risk has been calculated at 100Basis points positive and negative. The detailed simulation

has been presented here-in-below:

For Bendigo and Adelaide Bank

For Group

2016

Assets

Floa

ting

Inter

est

Rate

Less

than

3

Mon

ths

Betw

een 3

and 6

mont

hs

Betw

een 6

and

12

mont

hs

Betw

een 1

and 5

years

Aft

er

5

yea

rs

Non

Inter

est

earni

ng

Total

Carry

ing

value

Weigh

ted

Avera

ge

Effecti

ve

Intere

st

Rate

Cash and Cash

Equivalent 698.7 18 18.1 36.2 108.7

180.

3 1060 1.4

Due from other financial

institutions

220.

8 220.8

Financial Asset held for

trading 1795

2090.

1 2484

6369.

1 1.94

Financial Asset held for

sale

322.

7 0.5 323.2 2.29

Financial Asset held to

maturity 25.3

268.

5 89 382.8 2.86

Loans and other

receivables

3564

8.9 8141

1313.

1

2634.

3

9475,

7

40.

6

4777

7.9 5.02

Derivatives 79 79

Total Financial Assets

3637

2.9

1054

5.2

3510.

3

2670.

5

2592.

7

40.

6

480.

6

5621

2.8

Liabilities

Due to other Financial

Institutions

267.

4 267.4

Deposits

2041

5.9

2031

6.9

9185.

1

5445.

7

1689.

7 1.4

5705

4.7 2.28

Notes Payable 519.6

3302

.9

3822.

5

Derivatives

111.

8 111.8

Convertible Preferenece

shares 824.4 824.4 4.43

Subordinated Debt

583.

4 583.4 5.34

Total Financial Liabilities 2093 2420 10009 5445. 1689. 1.4 379. 6266

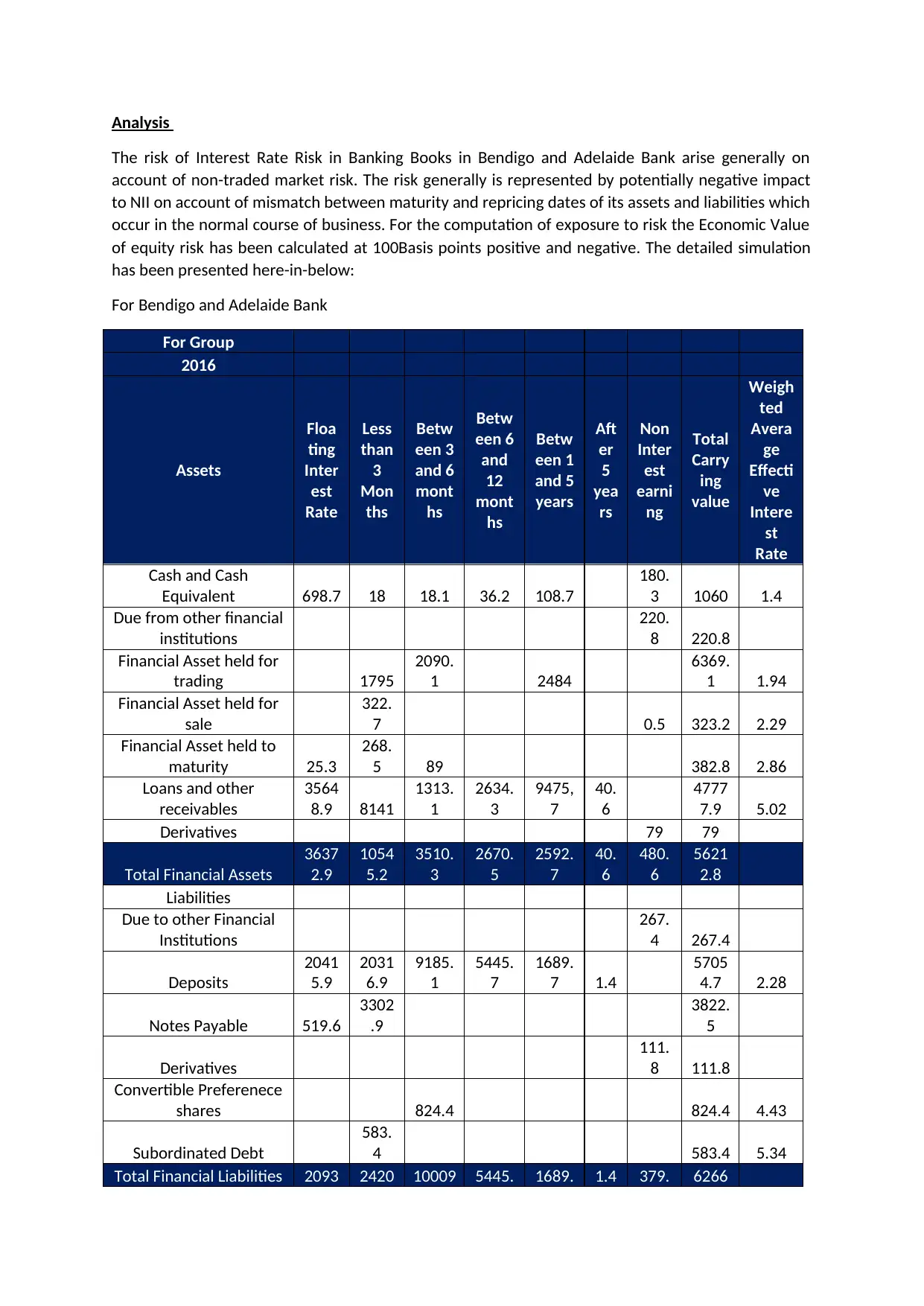

5.5 3.2 .5 7 7 2 4.2

Assets

Floa

ting

Inter

est

Rate

Less

than

3

Mon

ths

Betw

een 3

and 6

mont

hs

Betw

een 6

and

12

mont

hs

Betw

een 1

and 5

years

Aft

er

5

yea

rs

Non

Inter

est

earni

ng

Total

Carry

ing

value

Weigh

ted

Avera

ge

Effecti

ve

Intere

st

Rate

Cash and Cash Equivalent

572.

4 18.1 18.1 36.2 108.7

179.

5 933 1.7

Due from other financial

institutions

220.

8

220.

8

Financial Asset held for

trading

1685

.1

2090.

1

2594.

2

6369

.4 2.02

Financial Asset held for

sale

217.

8

6699

.8

6917

.6 3.1

Financial Asset held to

maturity 62.7 62.7 3.75

Loans and other

receivables

3104

6.8

8031

.9

1313.

9

2362.

6

9473.

1

52.

3

5228

0.6 4.87

Derivatives

290.

3

290.

3

Total Financial Assets

3183

7

1649

7.6

3422.

1

2398.

8

1217

6

52.

3

690.

6

6707

4.4

Liabilities

Due to other Financial

Institutions

266.

9

266.

9

Deposits

1894

5.2

1979

8

8506.

7

4739.

8

1795.

2 1.4

5378

6.3 2.28

Notes Payable

502.

2

502.

2

Loan Instrument to

Securitisation Trusts 7252

143.

3 171.9 327.5

1542.

6

9437

.3 5.02

Derivatives

110.

7

110.

7

Convertible Preference

shares 824.4

824.

4 4.43

Subordinated Debt

573.

4

573.

4 5.34

Total Financial Liabilities

2669

9.4

2051

4.7 9503

5067.

3

3337.

8 1.4

377.

6

6550

1.2

Group -+100 Basis

Point

-100 Basis

Point

Net Interest Income 34.1 -38.1

Assets

Floa

ting

Inter

est

Rate

Less

than

3

Mon

ths

Betw

een 3

and 6

mont

hs

Betw

een 6

and

12

mont

hs

Betw

een 1

and 5

years

Aft

er

5

yea

rs

Non

Inter

est

earni

ng

Total

Carry

ing

value

Weigh

ted

Avera

ge

Effecti

ve

Intere

st

Rate

Cash and Cash Equivalent

572.

4 18.1 18.1 36.2 108.7

179.

5 933 1.7

Due from other financial

institutions

220.

8

220.

8

Financial Asset held for

trading

1685

.1

2090.

1

2594.

2

6369

.4 2.02

Financial Asset held for

sale

217.

8

6699

.8

6917

.6 3.1

Financial Asset held to

maturity 62.7 62.7 3.75

Loans and other

receivables

3104

6.8

8031

.9

1313.

9

2362.

6

9473.

1

52.

3

5228

0.6 4.87

Derivatives

290.

3

290.

3

Total Financial Assets

3183

7

1649

7.6

3422.

1

2398.

8

1217

6

52.

3

690.

6

6707

4.4

Liabilities

Due to other Financial

Institutions

266.

9

266.

9

Deposits

1894

5.2

1979

8

8506.

7

4739.

8

1795.

2 1.4

5378

6.3 2.28

Notes Payable

502.

2

502.

2

Loan Instrument to

Securitisation Trusts 7252

143.

3 171.9 327.5

1542.

6

9437

.3 5.02

Derivatives

110.

7

110.

7

Convertible Preference

shares 824.4

824.

4 4.43

Subordinated Debt

573.

4

573.

4 5.34

Total Financial Liabilities

2669

9.4

2051

4.7 9503

5067.

3

3337.

8 1.4

377.

6

6550

1.2

Group -+100 Basis

Point

-100 Basis

Point

Net Interest Income 34.1 -38.1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

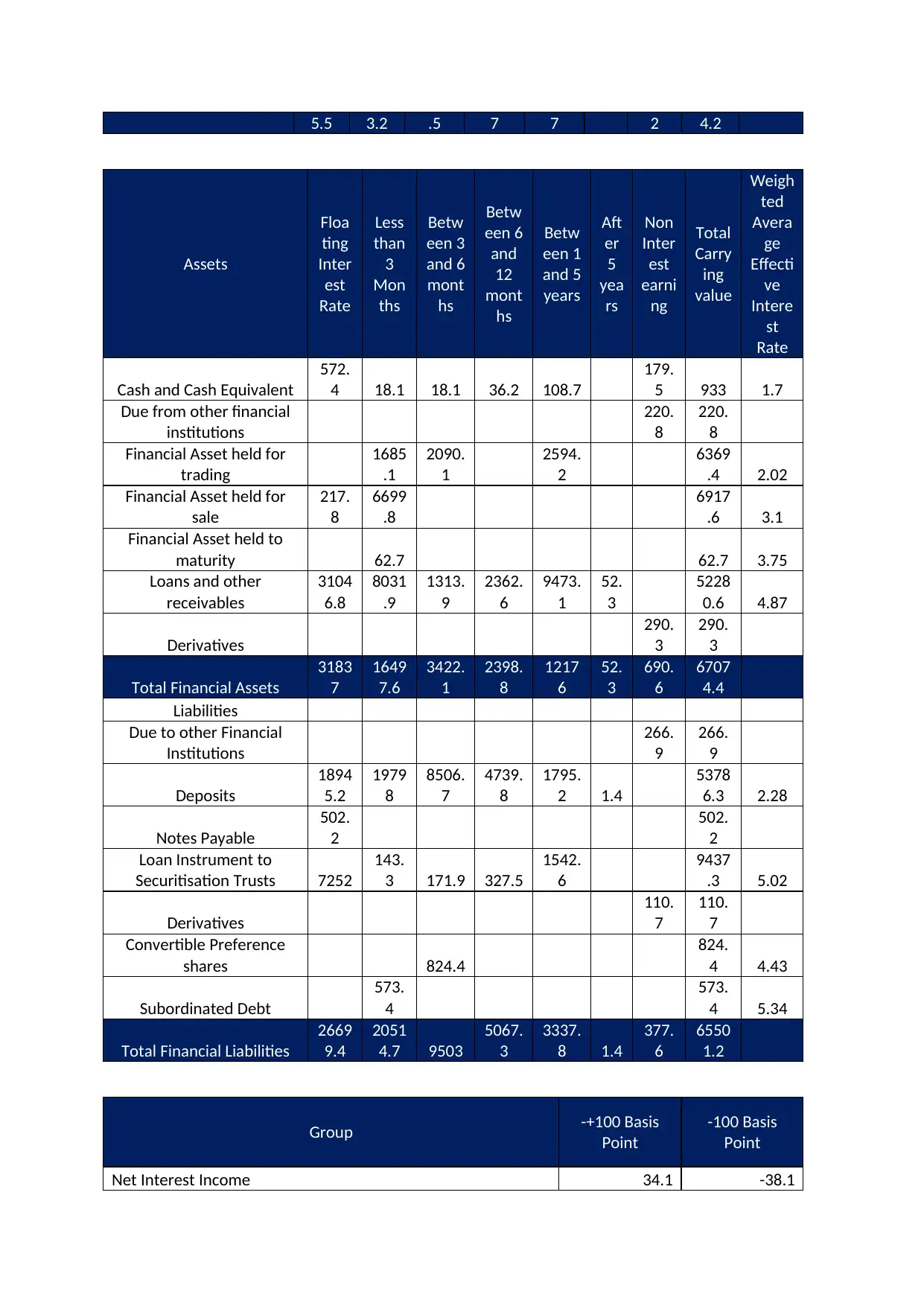

Ineffectiveness of derivatives -33.1 33.1

Income Tax effect @30% -0.3 1.5

Effect on Profit 0.7 -3.5

Effect on Profit 0.7 -3.5

Cash Flow Hedge Reserve -24.2 24.2

Income Tax effect @30% 7.3 -7.3

Effect on Equity -16.2 13.4

Bank -+100 Basis

Point

-100 Basis

Point

Net Interest Income 24.9 -29.2

Ineffectiveness of derivatives -33.1 33.1

Income Tax effect @30% 2.5 -1.2

Effect on Profit -5.7 2.7

Effect on Profit -5.7 2.7

Cash Flow Hedge Reserve -23.2 23.2

Income Tax effect @30% 7 -7

Effect on Equity -21.9 18.9

On perusal of the above, increase in interest rate shall decrease the value of equity by 16.2 Mio for

Group and 21.9 Mio for company on account of loss under cash flow hedge reserves taken for the

purpose of protection against downfall or interest rate risk. Further, in case the interest rate rises

the group shall have profit of 13.4 Mio while the bank shall have the profit of 18.9 Mio on account of

cash flow hedge reserve being fruitful.

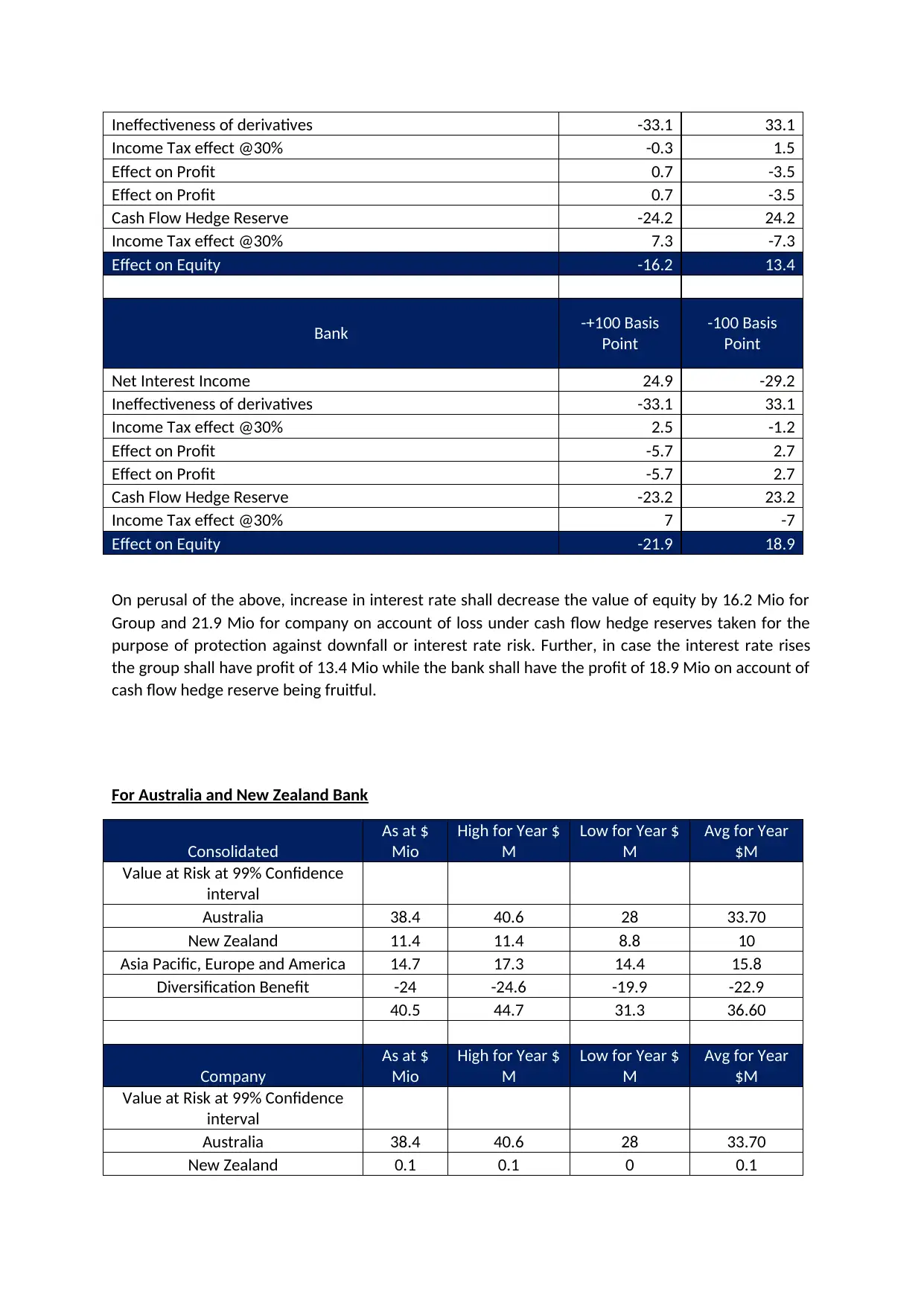

For Australia and New Zealand Bank

Consolidated

As at $

Mio

High for Year $

M

Low for Year $

M

Avg for Year

$M

Value at Risk at 99% Confidence

interval

Australia 38.4 40.6 28 33.70

New Zealand 11.4 11.4 8.8 10

Asia Pacific, Europe and America 14.7 17.3 14.4 15.8

Diversification Benefit -24 -24.6 -19.9 -22.9

40.5 44.7 31.3 36.60

Company

As at $

Mio

High for Year $

M

Low for Year $

M

Avg for Year

$M

Value at Risk at 99% Confidence

interval

Australia 38.4 40.6 28 33.70

New Zealand 0.1 0.1 0 0.1

Income Tax effect @30% -0.3 1.5

Effect on Profit 0.7 -3.5

Effect on Profit 0.7 -3.5

Cash Flow Hedge Reserve -24.2 24.2

Income Tax effect @30% 7.3 -7.3

Effect on Equity -16.2 13.4

Bank -+100 Basis

Point

-100 Basis

Point

Net Interest Income 24.9 -29.2

Ineffectiveness of derivatives -33.1 33.1

Income Tax effect @30% 2.5 -1.2

Effect on Profit -5.7 2.7

Effect on Profit -5.7 2.7

Cash Flow Hedge Reserve -23.2 23.2

Income Tax effect @30% 7 -7

Effect on Equity -21.9 18.9

On perusal of the above, increase in interest rate shall decrease the value of equity by 16.2 Mio for

Group and 21.9 Mio for company on account of loss under cash flow hedge reserves taken for the

purpose of protection against downfall or interest rate risk. Further, in case the interest rate rises

the group shall have profit of 13.4 Mio while the bank shall have the profit of 18.9 Mio on account of

cash flow hedge reserve being fruitful.

For Australia and New Zealand Bank

Consolidated

As at $

Mio

High for Year $

M

Low for Year $

M

Avg for Year

$M

Value at Risk at 99% Confidence

interval

Australia 38.4 40.6 28 33.70

New Zealand 11.4 11.4 8.8 10

Asia Pacific, Europe and America 14.7 17.3 14.4 15.8

Diversification Benefit -24 -24.6 -19.9 -22.9

40.5 44.7 31.3 36.60

Company

As at $

Mio

High for Year $

M

Low for Year $

M

Avg for Year

$M

Value at Risk at 99% Confidence

interval

Australia 38.4 40.6 28 33.70

New Zealand 0.1 0.1 0 0.1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Asia Pacific, Europe and America 14.6 16.8 14 15.3

Diversification Benefit -9.2 -13.6 -12.6 -13.2

Total 43.9 43.9 29.4 35.90

On perusal of the above, that at Value of Risk of 1%, the high can go up to 44.7 Mio and low up to

31.3 Mio at the group level. Similarly at the bank level the highest is at 43.9 Mio and lowest at 29.4

Mio at 1% VAR or shock of 1%.

The exposure to losses in case of Bendigo and Adelaide Bank and ANZ bank are more or less similar

as in both the cases the net impact is loss in case of Value at Risk of 1%. Further, in case of ANZ Bank

tax impact has not been considered for analysis and computation has been done location wise.

Further, the results are similar on account of similar exposure and strategies adopted like cash flow

hedge and interest rate contracts like forward rate agreement, Swap agreement, future agreement

and options.

The companies have been trying effectively to control the risk but the exposure of the same cannot

be eliminate completely and over the year in case of Bendigo and Adelaide Bank things have

worsened on account of increase in business and similar for ANZ Bank.

Conclusion

On the basis of above, it can be concluded that interest rate risk plays a crucial role in the banking

sector as interest is one of the main sources of revenue of the bank and managing the same is

essential for proper functioning of the bank. Further, the methodologies proposed under BASEL III

regarding computation if shocks and value of equity has been tested on the basis of annual report of

the companies and exposure has been computed to find out that the risk exists in the books of both

banks.

References:

IRRBB - Pillar 2 standardised framework - Executive Summary. (2017, june 24). Retrieved October 22,

2018, from www.bis.org: https://www.bis.org/fsi/fsisummaries/irrbb.htm

Diversification Benefit -9.2 -13.6 -12.6 -13.2

Total 43.9 43.9 29.4 35.90

On perusal of the above, that at Value of Risk of 1%, the high can go up to 44.7 Mio and low up to

31.3 Mio at the group level. Similarly at the bank level the highest is at 43.9 Mio and lowest at 29.4

Mio at 1% VAR or shock of 1%.

The exposure to losses in case of Bendigo and Adelaide Bank and ANZ bank are more or less similar

as in both the cases the net impact is loss in case of Value at Risk of 1%. Further, in case of ANZ Bank

tax impact has not been considered for analysis and computation has been done location wise.

Further, the results are similar on account of similar exposure and strategies adopted like cash flow

hedge and interest rate contracts like forward rate agreement, Swap agreement, future agreement

and options.

The companies have been trying effectively to control the risk but the exposure of the same cannot

be eliminate completely and over the year in case of Bendigo and Adelaide Bank things have

worsened on account of increase in business and similar for ANZ Bank.

Conclusion

On the basis of above, it can be concluded that interest rate risk plays a crucial role in the banking

sector as interest is one of the main sources of revenue of the bank and managing the same is

essential for proper functioning of the bank. Further, the methodologies proposed under BASEL III

regarding computation if shocks and value of equity has been tested on the basis of annual report of

the companies and exposure has been computed to find out that the risk exists in the books of both

banks.

References:

IRRBB - Pillar 2 standardised framework - Executive Summary. (2017, june 24). Retrieved October 22,

2018, from www.bis.org: https://www.bis.org/fsi/fsisummaries/irrbb.htm

1 out of 5

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.