Auditing GPSA: Internal Controls, Risks, and Financial Analysis

VerifiedAdded on 2020/03/23

|13

|3078

|33

Report

AI Summary

This report analyzes the internal control system of GPSA, an organization involved in medical equipment and research. It examines various accounts like intangible assets, property assets, and accounts receivable, identifying associated audit risks such as manual data entry and lack of segregation of duties. The report uses ratio analysis to assess GPSA's business risks, highlighting declining returns on equity, increasing debt-to-equity ratio, and concerning trends in accounts receivable and inventory days. Weaknesses in the internal control system for sales and trade receivables are identified, including the trade receivable clerk's responsibilities and bonus structures tied to sales volume. The report provides recommendations for strengthening internal controls, including segregation of duties, written procedures, proper authorization, physical controls, and accounting practices.

Running head: AUDITING THEORY AND PRACTICE

Auditing theory and practice

Name of the University

Name of the student

Authors note

Auditing theory and practice

Name of the University

Name of the student

Authors note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1AUDITING THEORY AND PRACTICE

Executive summary:

The report is prepared to discuss the internal control system of GPSA and its effectiveness. In

the past few years, management of organization has not been keen in enforcing effective

internal control system. Now, with increased business prospects, there arises a need to design

such system. Discussion part of report involves details about accounts, their analysis, audit

risks and steps taken for reducing such risks. Business risk of GPSA has been analyzed using

too of ratio analysis. Internal control system of organization has been discussed in context of

risk alleviation and test of control. Several weaknesses in the internal control system of sales

and trade receivable have also been identified.

Executive summary:

The report is prepared to discuss the internal control system of GPSA and its effectiveness. In

the past few years, management of organization has not been keen in enforcing effective

internal control system. Now, with increased business prospects, there arises a need to design

such system. Discussion part of report involves details about accounts, their analysis, audit

risks and steps taken for reducing such risks. Business risk of GPSA has been analyzed using

too of ratio analysis. Internal control system of organization has been discussed in context of

risk alleviation and test of control. Several weaknesses in the internal control system of sales

and trade receivable have also been identified.

2AUDITING THEORY AND PRACTICE

Table of Contents

Introduction:...............................................................................................................................2

Discussion:.................................................................................................................................3

Answer to question 1A:..............................................................................................................3

Accounts-...................................................................................................................................3

Analysis-....................................................................................................................................3

Audit risk-..................................................................................................................................4

Following steps can be taken for reducing audit risk faced by GPSA:......................................5

Answer to question 1B:..............................................................................................................5

Answer to question 2A:..............................................................................................................6

Effective control-.......................................................................................................................7

Risk alleviated-...........................................................................................................................7

Test of control-...........................................................................................................................8

Answer to question 2b:...............................................................................................................9

Weakness identified in the internal control for sales system and trade receivables of GPSA:..9

Conclusion:..............................................................................................................................10

Table of Contents

Introduction:...............................................................................................................................2

Discussion:.................................................................................................................................3

Answer to question 1A:..............................................................................................................3

Accounts-...................................................................................................................................3

Analysis-....................................................................................................................................3

Audit risk-..................................................................................................................................4

Following steps can be taken for reducing audit risk faced by GPSA:......................................5

Answer to question 1B:..............................................................................................................5

Answer to question 2A:..............................................................................................................6

Effective control-.......................................................................................................................7

Risk alleviated-...........................................................................................................................7

Test of control-...........................................................................................................................8

Answer to question 2b:...............................................................................................................9

Weakness identified in the internal control for sales system and trade receivables of GPSA:..9

Conclusion:..............................................................................................................................10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3AUDITING THEORY AND PRACTICE

Introduction:

The preparation of audit plan of GPSA is done by accounting firm Miller Yates and

Howarth having its offices throughout major regional centre of NSW and Queensland. GPSA

is one of the most longstanding and significant clients of the firm for which audit plan is

required to be conducted. Organization is engaged in wide range of activities related to

medical practitioners that involves making investment in property, research and development

technologies, distribution and manufactures of medical equipments (Jia, 2016). While

conducting audit, accounting firm places great reliance on internal control system of GPSA

and there are various areas of concerns related to few accounts that would be enquired into.

Discussion:

Answer to question 1A:

Accounts-

Auditors of GPSA are concerned about five types of account while planning audit and

this includes intangible assets, property assets, current investment, research and development

capitalization and accounts receivables. Before conducting the audit of organization, auditors

are required to enquire about these accounts that would enable them in gaining audit

evidence.

Analysis-

GPSA is planning to implement a new internal control manual where Trade receivable

clerk is responsible for maintaining records of transactions in the whole sales system. He is

responsible for reconciliation of trade receivable ledger to debtor control account in the

Introduction:

The preparation of audit plan of GPSA is done by accounting firm Miller Yates and

Howarth having its offices throughout major regional centre of NSW and Queensland. GPSA

is one of the most longstanding and significant clients of the firm for which audit plan is

required to be conducted. Organization is engaged in wide range of activities related to

medical practitioners that involves making investment in property, research and development

technologies, distribution and manufactures of medical equipments (Jia, 2016). While

conducting audit, accounting firm places great reliance on internal control system of GPSA

and there are various areas of concerns related to few accounts that would be enquired into.

Discussion:

Answer to question 1A:

Accounts-

Auditors of GPSA are concerned about five types of account while planning audit and

this includes intangible assets, property assets, current investment, research and development

capitalization and accounts receivables. Before conducting the audit of organization, auditors

are required to enquire about these accounts that would enable them in gaining audit

evidence.

Analysis-

GPSA is planning to implement a new internal control manual where Trade receivable

clerk is responsible for maintaining records of transactions in the whole sales system. He is

responsible for reconciliation of trade receivable ledger to debtor control account in the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4AUDITING THEORY AND PRACTICE

general ledger. There is a computer system in which the debtor payment is manual recorded.

Investment is made by organization in commencement of new laser surgery device that led to

incur considerable amount of costs. A loan of amount $ 5 billion is borrowed from bank by

organization with the purpose of financing research activities. Furthermore, a number of

properties have been acquired by GPSA relating to medical equipments. There has been a

decline in property market that is making investment in such branch quite susceptible. Due to

bearish property market, investment in property has become a major area of concern in recent

year. Other principal activity of GPSA is to make investment in research and development

activities relating to technological development of medical equipments. For the funding of

such investments and acquisition of loan from financial institutions, it is required by GPSA to

maintaining debt to equity ratio at around 1.2:1. Organization is required to repay the amount

of loan taken if there is increase in level of debt to equity ratio (Bik et al., 2017).

Audit risk-

One of the significant parts of audit plan of any organization is analysing several risks

related with various accounts while conducting audit. Auditors are able to identify, prioritize

and evaluate the risks related with managing all the accounts as mentioned above while

performing risk analysis. It is certainly possible on part of management of organization and

their incapability of tracking records of all transactions. This is so because value of trade

receivables is recorded manually by trade receivable clerk. Information technology function

of organization and any investment made in same is looked after by sales director that is not

regarded by management as full time job. It can be taken as an instance of lack of duties

segregation that might evolve the risks of some manipulation to their own advantage (Gaynor

et al., 2014).

general ledger. There is a computer system in which the debtor payment is manual recorded.

Investment is made by organization in commencement of new laser surgery device that led to

incur considerable amount of costs. A loan of amount $ 5 billion is borrowed from bank by

organization with the purpose of financing research activities. Furthermore, a number of

properties have been acquired by GPSA relating to medical equipments. There has been a

decline in property market that is making investment in such branch quite susceptible. Due to

bearish property market, investment in property has become a major area of concern in recent

year. Other principal activity of GPSA is to make investment in research and development

activities relating to technological development of medical equipments. For the funding of

such investments and acquisition of loan from financial institutions, it is required by GPSA to

maintaining debt to equity ratio at around 1.2:1. Organization is required to repay the amount

of loan taken if there is increase in level of debt to equity ratio (Bik et al., 2017).

Audit risk-

One of the significant parts of audit plan of any organization is analysing several risks

related with various accounts while conducting audit. Auditors are able to identify, prioritize

and evaluate the risks related with managing all the accounts as mentioned above while

performing risk analysis. It is certainly possible on part of management of organization and

their incapability of tracking records of all transactions. This is so because value of trade

receivables is recorded manually by trade receivable clerk. Information technology function

of organization and any investment made in same is looked after by sales director that is not

regarded by management as full time job. It can be taken as an instance of lack of duties

segregation that might evolve the risks of some manipulation to their own advantage (Gaynor

et al., 2014).

5AUDITING THEORY AND PRACTICE

Risks are also associated with managing the trade receivable accounts that involves

inappropriate reconciliation of accounts into general ledger. There might be inefficacy in

measures adopted for receivables collection. Property market investment might lead to

inflating the value in their financial statements due to decline in property market.

Following steps can be taken for reducing audit risk faced by GPSA:

Organizations should conduct auditing plan in accordance with International standard

requirements and they should also inform stakeholders about duration of audit risks. Some of

the steps that can be taken are as follows:

Auditors are required to make analytical procedures for identification of probable

relationship between accounts.

Enquiries into several accounts can be made for identifying the risk of material

misstatement that involves looking into details of financial and non finacil data

provided (William et al., 2016).

Process of observation and inspection should be collaborated with reporting authority

and management within organization.

Assessing and identifying the risks associated with accounts receivable and normal

course of transactions.

Answer to question 1B:

Business risks faced by GPSA can be analysed using the tool of ratio. The relevant

financial information and analytical procedures that are widely used can be explained and

analyzed using ratio analysis. Comparing and analyzing the ratios over several years or for

considerable time period would help auditors in deriving relevance audit evidence. Financial

Risks are also associated with managing the trade receivable accounts that involves

inappropriate reconciliation of accounts into general ledger. There might be inefficacy in

measures adopted for receivables collection. Property market investment might lead to

inflating the value in their financial statements due to decline in property market.

Following steps can be taken for reducing audit risk faced by GPSA:

Organizations should conduct auditing plan in accordance with International standard

requirements and they should also inform stakeholders about duration of audit risks. Some of

the steps that can be taken are as follows:

Auditors are required to make analytical procedures for identification of probable

relationship between accounts.

Enquiries into several accounts can be made for identifying the risk of material

misstatement that involves looking into details of financial and non finacil data

provided (William et al., 2016).

Process of observation and inspection should be collaborated with reporting authority

and management within organization.

Assessing and identifying the risks associated with accounts receivable and normal

course of transactions.

Answer to question 1B:

Business risks faced by GPSA can be analysed using the tool of ratio. The relevant

financial information and analytical procedures that are widely used can be explained and

analyzed using ratio analysis. Comparing and analyzing the ratios over several years or for

considerable time period would help auditors in deriving relevance audit evidence. Financial

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6AUDITING THEORY AND PRACTICE

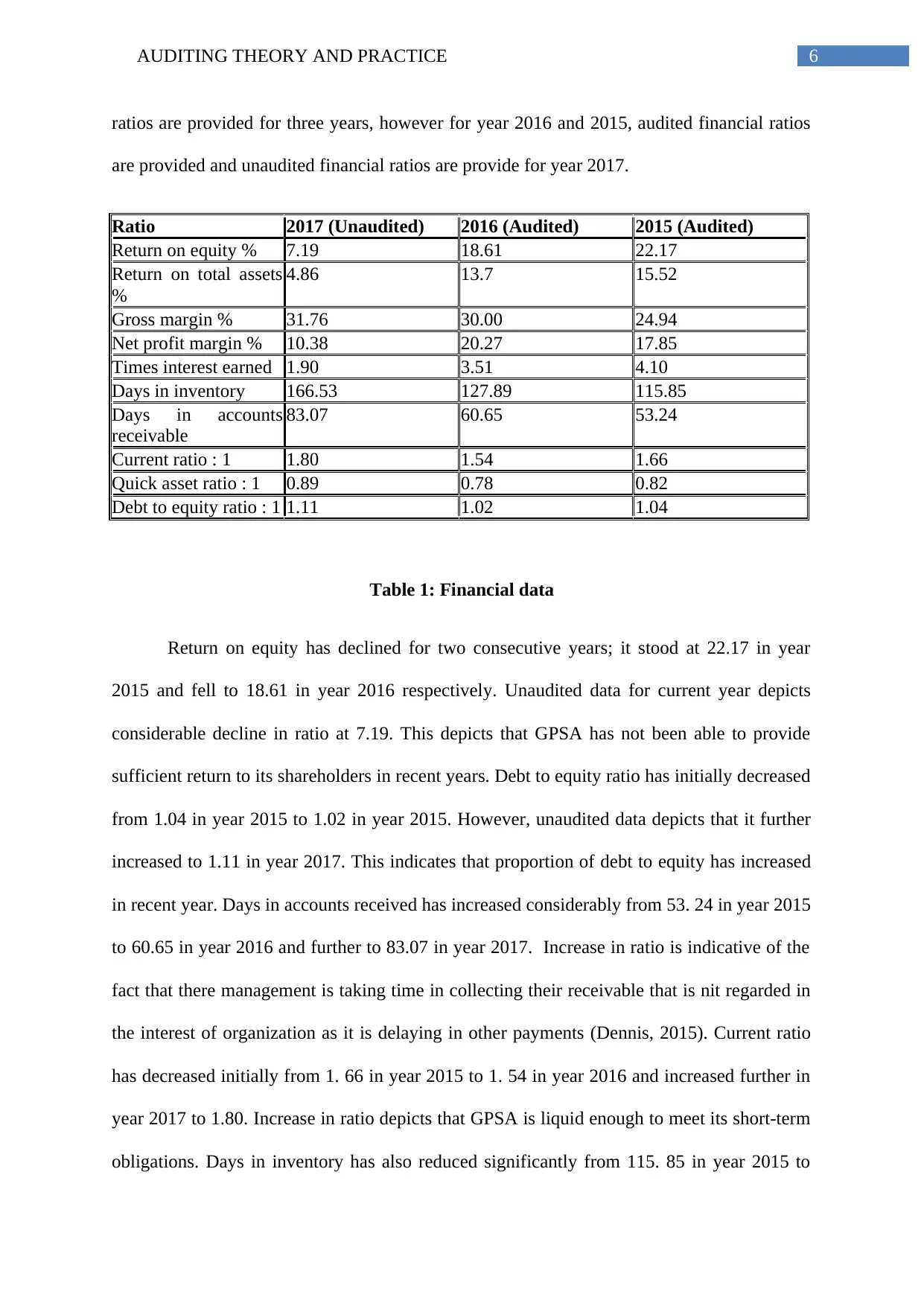

ratios are provided for three years, however for year 2016 and 2015, audited financial ratios

are provided and unaudited financial ratios are provide for year 2017.

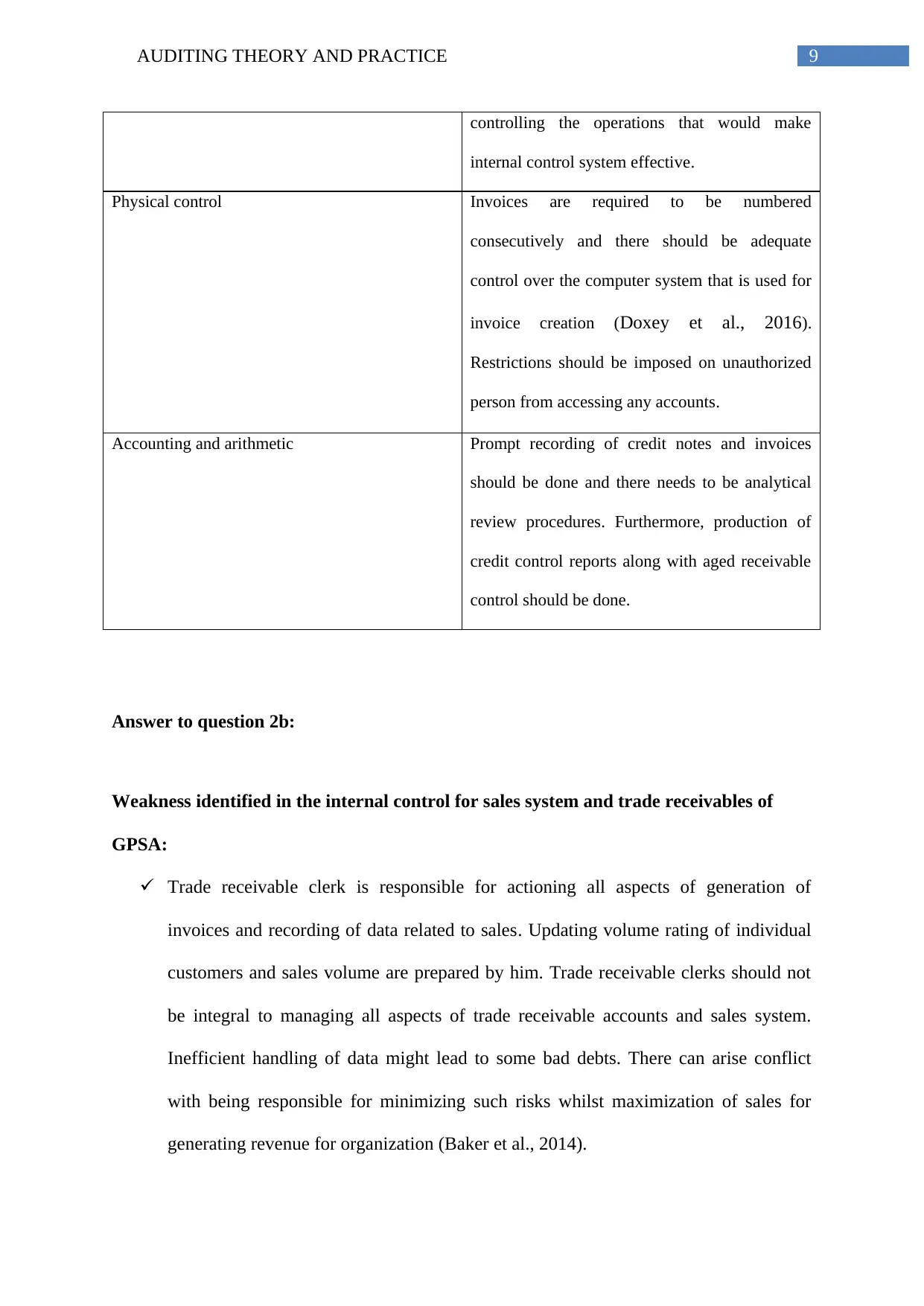

Ratio 2017 (Unaudited) 2016 (Audited) 2015 (Audited)

Return on equity % 7.19 18.61 22.17

Return on total assets

%

4.86 13.7 15.52

Gross margin % 31.76 30.00 24.94

Net profit margin % 10.38 20.27 17.85

Times interest earned 1.90 3.51 4.10

Days in inventory 166.53 127.89 115.85

Days in accounts

receivable

83.07 60.65 53.24

Current ratio : 1 1.80 1.54 1.66

Quick asset ratio : 1 0.89 0.78 0.82

Debt to equity ratio : 1 1.11 1.02 1.04

Table 1: Financial data

Return on equity has declined for two consecutive years; it stood at 22.17 in year

2015 and fell to 18.61 in year 2016 respectively. Unaudited data for current year depicts

considerable decline in ratio at 7.19. This depicts that GPSA has not been able to provide

sufficient return to its shareholders in recent years. Debt to equity ratio has initially decreased

from 1.04 in year 2015 to 1.02 in year 2015. However, unaudited data depicts that it further

increased to 1.11 in year 2017. This indicates that proportion of debt to equity has increased

in recent year. Days in accounts received has increased considerably from 53. 24 in year 2015

to 60.65 in year 2016 and further to 83.07 in year 2017. Increase in ratio is indicative of the

fact that there management is taking time in collecting their receivable that is nit regarded in

the interest of organization as it is delaying in other payments (Dennis, 2015). Current ratio

has decreased initially from 1. 66 in year 2015 to 1. 54 in year 2016 and increased further in

year 2017 to 1.80. Increase in ratio depicts that GPSA is liquid enough to meet its short-term

obligations. Days in inventory has also reduced significantly from 115. 85 in year 2015 to

ratios are provided for three years, however for year 2016 and 2015, audited financial ratios

are provided and unaudited financial ratios are provide for year 2017.

Ratio 2017 (Unaudited) 2016 (Audited) 2015 (Audited)

Return on equity % 7.19 18.61 22.17

Return on total assets

%

4.86 13.7 15.52

Gross margin % 31.76 30.00 24.94

Net profit margin % 10.38 20.27 17.85

Times interest earned 1.90 3.51 4.10

Days in inventory 166.53 127.89 115.85

Days in accounts

receivable

83.07 60.65 53.24

Current ratio : 1 1.80 1.54 1.66

Quick asset ratio : 1 0.89 0.78 0.82

Debt to equity ratio : 1 1.11 1.02 1.04

Table 1: Financial data

Return on equity has declined for two consecutive years; it stood at 22.17 in year

2015 and fell to 18.61 in year 2016 respectively. Unaudited data for current year depicts

considerable decline in ratio at 7.19. This depicts that GPSA has not been able to provide

sufficient return to its shareholders in recent years. Debt to equity ratio has initially decreased

from 1.04 in year 2015 to 1.02 in year 2015. However, unaudited data depicts that it further

increased to 1.11 in year 2017. This indicates that proportion of debt to equity has increased

in recent year. Days in accounts received has increased considerably from 53. 24 in year 2015

to 60.65 in year 2016 and further to 83.07 in year 2017. Increase in ratio is indicative of the

fact that there management is taking time in collecting their receivable that is nit regarded in

the interest of organization as it is delaying in other payments (Dennis, 2015). Current ratio

has decreased initially from 1. 66 in year 2015 to 1. 54 in year 2016 and increased further in

year 2017 to 1.80. Increase in ratio depicts that GPSA is liquid enough to meet its short-term

obligations. Days in inventory has also reduced significantly from 115. 85 in year 2015 to

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7AUDITING THEORY AND PRACTICE

127. 89 in year 2016 and further increased to 166.53 in year 2017. Increase in inventory days

depicts that it’s taking time for management of organization to convert their inventories into

sales. Gross margin has increase and net profit margin on other hand has declined

substantially.

Answer to question 2A:

Internal control is the process that is affected and designed by management of

organization that helps in providing reasonable assurance about objectives of entity

concerning efficiency and effectiveness of operations and reliability of financial reporting. It

can be observed from the given case study that internal control manual system is designed to

enable the business for achieving specific objectives. Control system are mainly designed for

effecting sales system

Effective control-

The internal control system of GPSA has not changed over the years and since there is

no internal audit function of organization, planning stage of audit requires refinement of such

system. Management has employed proper procedures for recording of sales data and they

needs to be properly documented. Sales orders are raised by dispatch department in event of

making any manual delivery.

Staffs are required to manually check the conditions and quality of medical equipment

that is returned by customers. For the follow up of trade receivable procedures, there are

proper procedures. It is required by auditors to examine some relevant aspects for reviewing

internal control procedures and achieving sales system objectives (Knechel & Salterio, 2016).

127. 89 in year 2016 and further increased to 166.53 in year 2017. Increase in inventory days

depicts that it’s taking time for management of organization to convert their inventories into

sales. Gross margin has increase and net profit margin on other hand has declined

substantially.

Answer to question 2A:

Internal control is the process that is affected and designed by management of

organization that helps in providing reasonable assurance about objectives of entity

concerning efficiency and effectiveness of operations and reliability of financial reporting. It

can be observed from the given case study that internal control manual system is designed to

enable the business for achieving specific objectives. Control system are mainly designed for

effecting sales system

Effective control-

The internal control system of GPSA has not changed over the years and since there is

no internal audit function of organization, planning stage of audit requires refinement of such

system. Management has employed proper procedures for recording of sales data and they

needs to be properly documented. Sales orders are raised by dispatch department in event of

making any manual delivery.

Staffs are required to manually check the conditions and quality of medical equipment

that is returned by customers. For the follow up of trade receivable procedures, there are

proper procedures. It is required by auditors to examine some relevant aspects for reviewing

internal control procedures and achieving sales system objectives (Knechel & Salterio, 2016).

8AUDITING THEORY AND PRACTICE

Risk alleviated-

Some the risks that might arise from the sales system would be eliminated with the

implementation of effective internal control system. Recording invoices and entering data

manually is prone to several risks that can be alleviated from adopting the effective system of

internal control. Trade receivable clerk is responsible for recoding all the sales data and

entering the same into computer system and reconciling the general ledger accounts. Risks

arising from manual recording can be reduced from effective system that helps in mitigating

such risks. It is quite possible that there can be either intended manipulation or unintended

mistakes while preparing slip and list of debtors. Moreover, there is a manual updating of

customer volume rating and the report of same is authorized by sales directors. Employing

the effective internal control system would help in alleviating the possible risks that would

arise in recording the data related to transactions (Louwers et al., 2015). Effective system

would help in appropriately responding to finance, operations and business compliance by

facilitating efficient and effective operations.

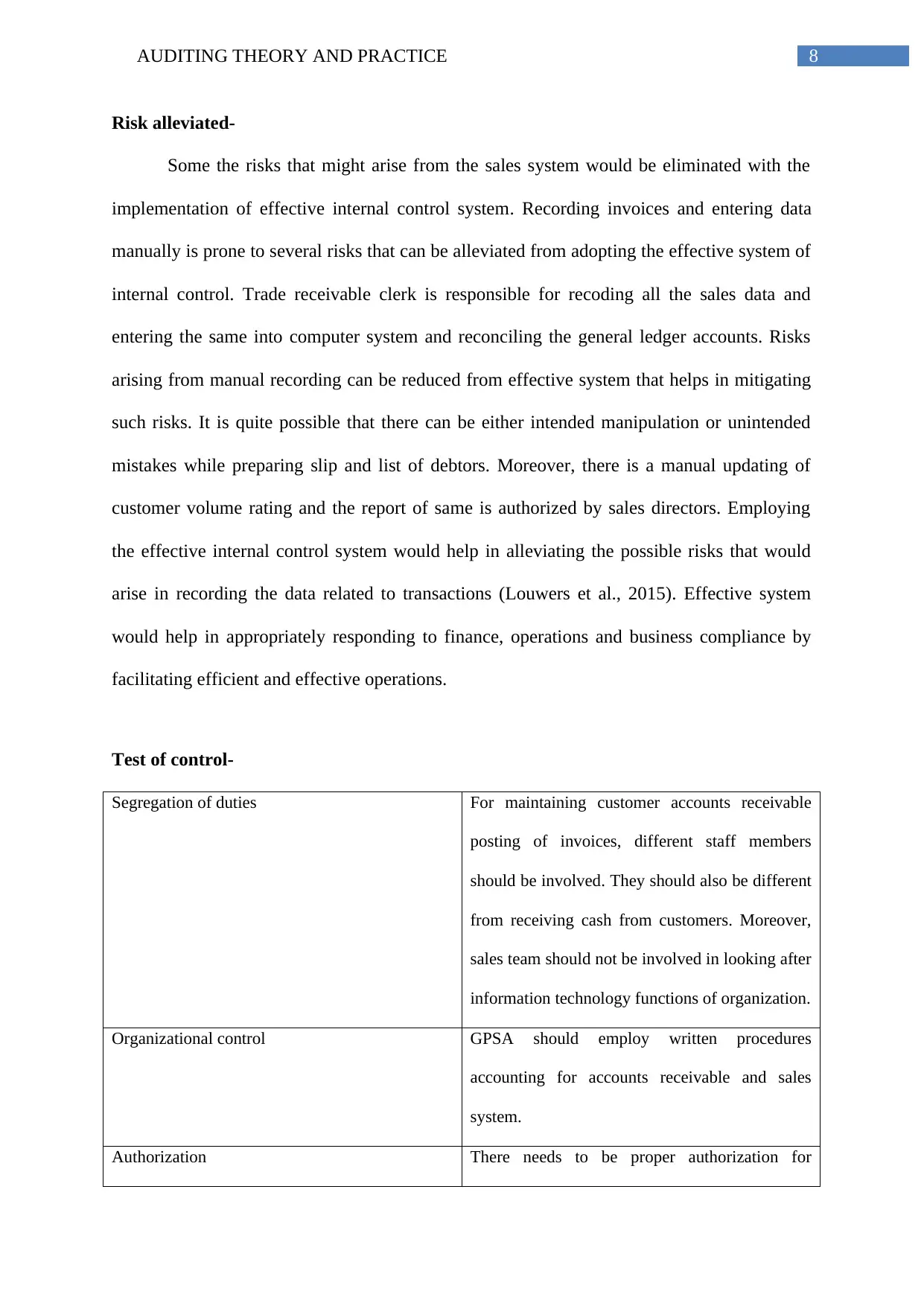

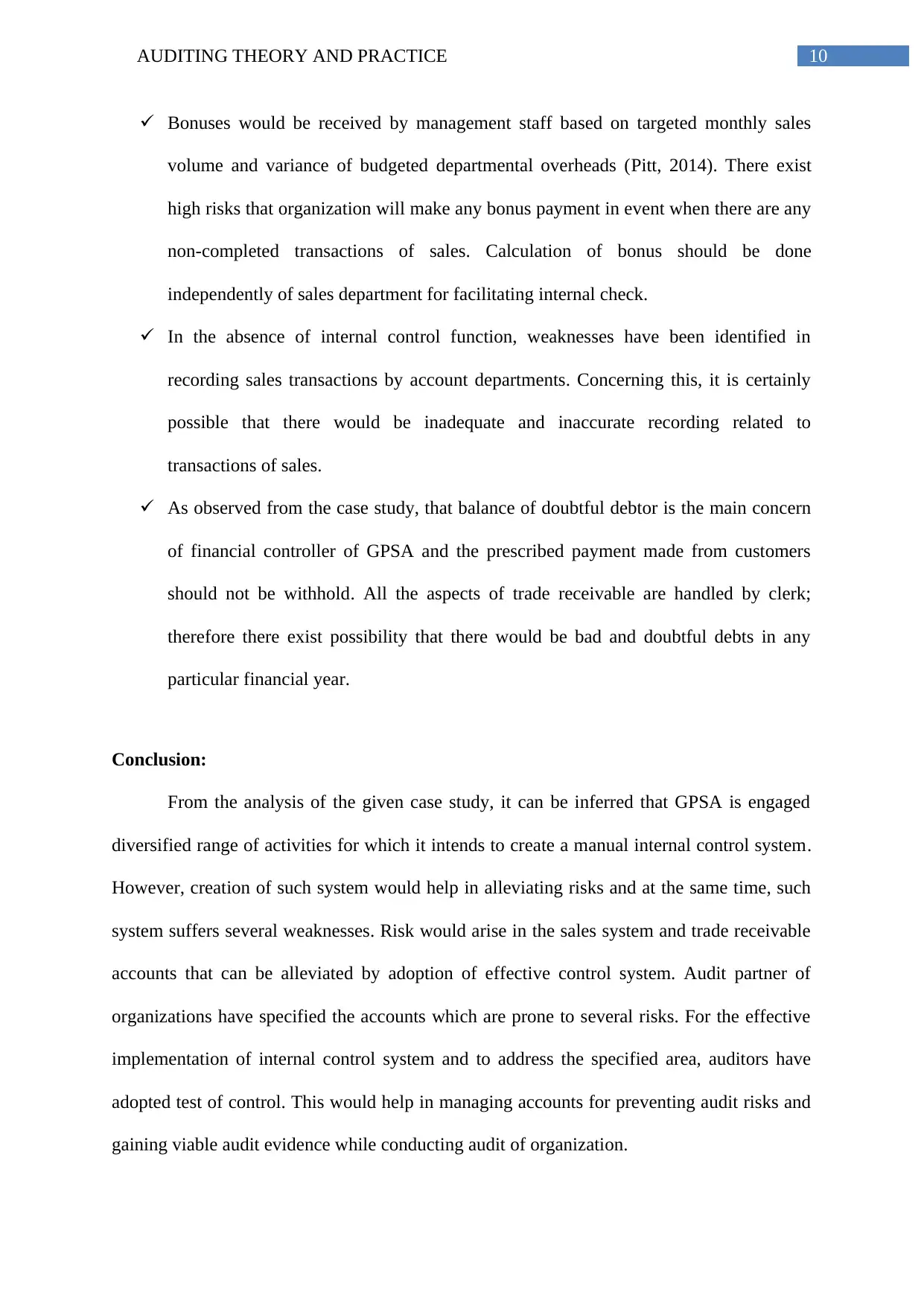

Test of control-

Segregation of duties For maintaining customer accounts receivable

posting of invoices, different staff members

should be involved. They should also be different

from receiving cash from customers. Moreover,

sales team should not be involved in looking after

information technology functions of organization.

Organizational control GPSA should employ written procedures

accounting for accounts receivable and sales

system.

Authorization There needs to be proper authorization for

Risk alleviated-

Some the risks that might arise from the sales system would be eliminated with the

implementation of effective internal control system. Recording invoices and entering data

manually is prone to several risks that can be alleviated from adopting the effective system of

internal control. Trade receivable clerk is responsible for recoding all the sales data and

entering the same into computer system and reconciling the general ledger accounts. Risks

arising from manual recording can be reduced from effective system that helps in mitigating

such risks. It is quite possible that there can be either intended manipulation or unintended

mistakes while preparing slip and list of debtors. Moreover, there is a manual updating of

customer volume rating and the report of same is authorized by sales directors. Employing

the effective internal control system would help in alleviating the possible risks that would

arise in recording the data related to transactions (Louwers et al., 2015). Effective system

would help in appropriately responding to finance, operations and business compliance by

facilitating efficient and effective operations.

Test of control-

Segregation of duties For maintaining customer accounts receivable

posting of invoices, different staff members

should be involved. They should also be different

from receiving cash from customers. Moreover,

sales team should not be involved in looking after

information technology functions of organization.

Organizational control GPSA should employ written procedures

accounting for accounts receivable and sales

system.

Authorization There needs to be proper authorization for

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9AUDITING THEORY AND PRACTICE

controlling the operations that would make

internal control system effective.

Physical control Invoices are required to be numbered

consecutively and there should be adequate

control over the computer system that is used for

invoice creation (Doxey et al., 2016).

Restrictions should be imposed on unauthorized

person from accessing any accounts.

Accounting and arithmetic Prompt recording of credit notes and invoices

should be done and there needs to be analytical

review procedures. Furthermore, production of

credit control reports along with aged receivable

control should be done.

Answer to question 2b:

Weakness identified in the internal control for sales system and trade receivables of

GPSA:

Trade receivable clerk is responsible for actioning all aspects of generation of

invoices and recording of data related to sales. Updating volume rating of individual

customers and sales volume are prepared by him. Trade receivable clerks should not

be integral to managing all aspects of trade receivable accounts and sales system.

Inefficient handling of data might lead to some bad debts. There can arise conflict

with being responsible for minimizing such risks whilst maximization of sales for

generating revenue for organization (Baker et al., 2014).

controlling the operations that would make

internal control system effective.

Physical control Invoices are required to be numbered

consecutively and there should be adequate

control over the computer system that is used for

invoice creation (Doxey et al., 2016).

Restrictions should be imposed on unauthorized

person from accessing any accounts.

Accounting and arithmetic Prompt recording of credit notes and invoices

should be done and there needs to be analytical

review procedures. Furthermore, production of

credit control reports along with aged receivable

control should be done.

Answer to question 2b:

Weakness identified in the internal control for sales system and trade receivables of

GPSA:

Trade receivable clerk is responsible for actioning all aspects of generation of

invoices and recording of data related to sales. Updating volume rating of individual

customers and sales volume are prepared by him. Trade receivable clerks should not

be integral to managing all aspects of trade receivable accounts and sales system.

Inefficient handling of data might lead to some bad debts. There can arise conflict

with being responsible for minimizing such risks whilst maximization of sales for

generating revenue for organization (Baker et al., 2014).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10AUDITING THEORY AND PRACTICE

Bonuses would be received by management staff based on targeted monthly sales

volume and variance of budgeted departmental overheads (Pitt, 2014). There exist

high risks that organization will make any bonus payment in event when there are any

non-completed transactions of sales. Calculation of bonus should be done

independently of sales department for facilitating internal check.

In the absence of internal control function, weaknesses have been identified in

recording sales transactions by account departments. Concerning this, it is certainly

possible that there would be inadequate and inaccurate recording related to

transactions of sales.

As observed from the case study, that balance of doubtful debtor is the main concern

of financial controller of GPSA and the prescribed payment made from customers

should not be withhold. All the aspects of trade receivable are handled by clerk;

therefore there exist possibility that there would be bad and doubtful debts in any

particular financial year.

Conclusion:

From the analysis of the given case study, it can be inferred that GPSA is engaged

diversified range of activities for which it intends to create a manual internal control system.

However, creation of such system would help in alleviating risks and at the same time, such

system suffers several weaknesses. Risk would arise in the sales system and trade receivable

accounts that can be alleviated by adoption of effective control system. Audit partner of

organizations have specified the accounts which are prone to several risks. For the effective

implementation of internal control system and to address the specified area, auditors have

adopted test of control. This would help in managing accounts for preventing audit risks and

gaining viable audit evidence while conducting audit of organization.

Bonuses would be received by management staff based on targeted monthly sales

volume and variance of budgeted departmental overheads (Pitt, 2014). There exist

high risks that organization will make any bonus payment in event when there are any

non-completed transactions of sales. Calculation of bonus should be done

independently of sales department for facilitating internal check.

In the absence of internal control function, weaknesses have been identified in

recording sales transactions by account departments. Concerning this, it is certainly

possible that there would be inadequate and inaccurate recording related to

transactions of sales.

As observed from the case study, that balance of doubtful debtor is the main concern

of financial controller of GPSA and the prescribed payment made from customers

should not be withhold. All the aspects of trade receivable are handled by clerk;

therefore there exist possibility that there would be bad and doubtful debts in any

particular financial year.

Conclusion:

From the analysis of the given case study, it can be inferred that GPSA is engaged

diversified range of activities for which it intends to create a manual internal control system.

However, creation of such system would help in alleviating risks and at the same time, such

system suffers several weaknesses. Risk would arise in the sales system and trade receivable

accounts that can be alleviated by adoption of effective control system. Audit partner of

organizations have specified the accounts which are prone to several risks. For the effective

implementation of internal control system and to address the specified area, auditors have

adopted test of control. This would help in managing accounts for preventing audit risks and

gaining viable audit evidence while conducting audit of organization.

11AUDITING THEORY AND PRACTICE

References:

Arens, A. A., Elder, R. J., Beasley, M. S., & Hogan, C. E. (2016). Auditing and assurance

services. Pearson.

Baker, C. R., Bédard, J., & Prat dit Hauret, C. (2014). The regulation of statutory auditing: an

institutional theory approach. Managerial Auditing Journal, 29(5), 371-394.

Bik, O., Hooghiemstra, R., Bishop, C. C., DeZoort, F. T., Hermanson, D. R.,

Officers’Judgments, F., ... & Glover, S. M. (2017). Auditing: A Journal of Practice &

Theory A Publication of the Auditing Section of the American Accounting

Association.

Dennis, I. (2015). Auditing Theory. Routledge.

Doxey, M. M., Fuller, S. H., Geiger, M. A., Gist, W. E., Hackenbrack, K. E., Janvrin, D. J., ...

& Roush, P. B. (2016). Comments by the Auditing Standards Committee of the

Auditing Section of the American Accounting Association on PCAOB Release No.

2016-003, Proposed Auditing Standard—The Auditor's Report on an Audit of

Financial Statements when the Auditor Expresses an Unqualified Opinion and Related

Amendments to PCAOB Standards. Current Issues in Auditing, 11(1), C26-C40.

Gaynor, L. M., Hackenbrack, K., Lisic, L., & Wu, Y. J. (2014). The Auditing Standards

Committee of the Auditing Section of the American Accounting Association is

pleased to provide comments on the PCAOB Rulemaking Docket Matter No. 029;

PCAOB Release No. 2031-009: Proposed Rule on Improving the Transparency of

References:

Arens, A. A., Elder, R. J., Beasley, M. S., & Hogan, C. E. (2016). Auditing and assurance

services. Pearson.

Baker, C. R., Bédard, J., & Prat dit Hauret, C. (2014). The regulation of statutory auditing: an

institutional theory approach. Managerial Auditing Journal, 29(5), 371-394.

Bik, O., Hooghiemstra, R., Bishop, C. C., DeZoort, F. T., Hermanson, D. R.,

Officers’Judgments, F., ... & Glover, S. M. (2017). Auditing: A Journal of Practice &

Theory A Publication of the Auditing Section of the American Accounting

Association.

Dennis, I. (2015). Auditing Theory. Routledge.

Doxey, M. M., Fuller, S. H., Geiger, M. A., Gist, W. E., Hackenbrack, K. E., Janvrin, D. J., ...

& Roush, P. B. (2016). Comments by the Auditing Standards Committee of the

Auditing Section of the American Accounting Association on PCAOB Release No.

2016-003, Proposed Auditing Standard—The Auditor's Report on an Audit of

Financial Statements when the Auditor Expresses an Unqualified Opinion and Related

Amendments to PCAOB Standards. Current Issues in Auditing, 11(1), C26-C40.

Gaynor, L. M., Hackenbrack, K., Lisic, L., & Wu, Y. J. (2014). The Auditing Standards

Committee of the Auditing Section of the American Accounting Association is

pleased to provide comments on the PCAOB Rulemaking Docket Matter No. 029;

PCAOB Release No. 2031-009: Proposed Rule on Improving the Transparency of

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.