International Corporate and Finance

VerifiedAdded on 2023/01/10

|17

|5481

|71

AI Summary

This document discusses the concept of international corporate finance and its relevance in today's global business environment. It explores the options available to Angle Electronics for expanding its business in India or Poland and provides recommendations based on financial viability analysis. The document also includes a sensitivity analysis to assess the impact of uncertainty on the investment decisions.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

INTERNATIONAL

CORPORATE AND FINANCE

CORPORATE AND FINANCE

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

ANGLE ELECTRONICS................................................................................................................1

a) Option to consider by the Angle Electronics from the two options. .......................................1

b) Purchasing business either in India or Poland.........................................................................3

c) Issues and Considerations related to methods of funding........................................................9

d) Potential benefits and cost savings that could accrue............................................................10

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................13

INTRODUCTION...........................................................................................................................1

ANGLE ELECTRONICS................................................................................................................1

a) Option to consider by the Angle Electronics from the two options. .......................................1

b) Purchasing business either in India or Poland.........................................................................3

c) Issues and Considerations related to methods of funding........................................................9

d) Potential benefits and cost savings that could accrue............................................................10

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................13

INTRODUCTION

Corporate finance is the area of finance dealing with funding sources, capital structures of

the corporations, actions of the managers taken for increasing value of firm to shareholders and

tools and techniques used for allocation of the financial resources. International finance also

referred as international monetary economic is branch of the financial economics that is

concerned broadly with the monetary and macroeconomic interrelation between more than two

countries. Present report will reveals about the Angle Electronics which is a manufacturing

business selling range of electronic products. Majority part of the business is from UK but has

significant level of sales by exports through websites. Sales are directed towards retail customers

and some of the wholesale outlets. Company is proposing to set up manufacturing units in

various parts of world that are Australia and Malaysia. For the establishments company is first

planning to expand its distribution capacity for expansion by considering two option that are

India and Poland. Company wants to make investments in the most viable options.

ANGLE ELECTRONICS

a) Option to consider by the Angle Electronics from the two options.

Companies find it appealing to extend the business overseas. Company by selling the

products internationally in huge markets maximise their profits and sale, gain brand recognition

reducing risks of operating in single market. Business in proposing to expand the business has to

decide the country which is beneficial for expansion. List of different countries should be

prepared and analysing the benefits and limitations of the country are to be identified. Identifying

the demand of the products in each country, political and economic stability and the other factors

influencing the business are to be analysed (Hawbaker, 2018). It has to research on inflation

rates, growth rate and GDP, purchasing power of the people, licensing and exports rules of the

country company is proposing to operate in. Once selecting company is required to analyse the

time which is best for entrance after carefully evaluating the business environment of the

country. Time where there is highest probability of sales should be entered. Organisation then

have to decide about the scale of entry as it is crucial factor. This requires the company to give

important attention as signifiant amount of funds are installed and the failure of business may

affect the existing business of the company. Company is required to find the methods through

which it will be entering in the market.

1

Corporate finance is the area of finance dealing with funding sources, capital structures of

the corporations, actions of the managers taken for increasing value of firm to shareholders and

tools and techniques used for allocation of the financial resources. International finance also

referred as international monetary economic is branch of the financial economics that is

concerned broadly with the monetary and macroeconomic interrelation between more than two

countries. Present report will reveals about the Angle Electronics which is a manufacturing

business selling range of electronic products. Majority part of the business is from UK but has

significant level of sales by exports through websites. Sales are directed towards retail customers

and some of the wholesale outlets. Company is proposing to set up manufacturing units in

various parts of world that are Australia and Malaysia. For the establishments company is first

planning to expand its distribution capacity for expansion by considering two option that are

India and Poland. Company wants to make investments in the most viable options.

ANGLE ELECTRONICS

a) Option to consider by the Angle Electronics from the two options.

Companies find it appealing to extend the business overseas. Company by selling the

products internationally in huge markets maximise their profits and sale, gain brand recognition

reducing risks of operating in single market. Business in proposing to expand the business has to

decide the country which is beneficial for expansion. List of different countries should be

prepared and analysing the benefits and limitations of the country are to be identified. Identifying

the demand of the products in each country, political and economic stability and the other factors

influencing the business are to be analysed (Hawbaker, 2018). It has to research on inflation

rates, growth rate and GDP, purchasing power of the people, licensing and exports rules of the

country company is proposing to operate in. Once selecting company is required to analyse the

time which is best for entrance after carefully evaluating the business environment of the

country. Time where there is highest probability of sales should be entered. Organisation then

have to decide about the scale of entry as it is crucial factor. This requires the company to give

important attention as signifiant amount of funds are installed and the failure of business may

affect the existing business of the company. Company is required to find the methods through

which it will be entering in the market.

1

Angle Electronics proposing to expand the business in India and Australia is first

proposing to expand the distribution channel. Company could go for joint venture in England or

Poland whichever is more suitable options. Joint venturing is a successful expansion strategy hat

is considered by most of the companies for protecting the impact of investments over the existing

business of company. Joint venture refers to forming new business by pooling the resources of

two or more companies. Joint venturing with the local business will provide the company with

all the information and trends of the market that will help the company to establish its business

successfully (Fujiwara, 2019). Joint ventures share their knowledge and resources for promoting

their business. This cuts the investment cost to half of the company. Risks and uncertainties

associated with the business are shared between the venture companies. It could promote its

business over the social platforms for increasing the sales of the products and services. This will

also increasing the brand recognition and awareness among the people of the new company. It

will enable the company to maximise its profits and revenues. The option of joint venture will

have higher returns at lower risks.

It could also adopt for agency services for expanding the distribution channels. This

could be established on contractual basis agency will be providing the products and services to

the markets of country. Sales and orders could be managed online by the company (Guo, 2019).

This will save considerable amount of investments of the company reducing the risks of failure

as the product will be distributed as per demand. Agency business is highly promoted for

expansion of the distribution channels by the corporations. In this system Angle Electronics may

hire a company in India or Poland as its agent for making the distribution of its product in the

local markets of the country. It could be made on commission. It will not require the company to

establish a business in entirety overseas investing funds. It will enable the company to analyse

the local markets of India or Poland whether the products are getting acceptance of the customer.

On getting required demand company can make plans for establishing business units in Country

this will save funds as well as help company in analysing the market.

Company can also enter the market through acquisition of small companies of the

country in which it is proposing to extend its business. Acquisition refers to purchase of one

company by other for gaining significant controlling of the company. This could be acquired by

payment of cash for the assets and liabilities or it can also purchase significant shares of the

2

proposing to expand the distribution channel. Company could go for joint venture in England or

Poland whichever is more suitable options. Joint venturing is a successful expansion strategy hat

is considered by most of the companies for protecting the impact of investments over the existing

business of company. Joint venture refers to forming new business by pooling the resources of

two or more companies. Joint venturing with the local business will provide the company with

all the information and trends of the market that will help the company to establish its business

successfully (Fujiwara, 2019). Joint ventures share their knowledge and resources for promoting

their business. This cuts the investment cost to half of the company. Risks and uncertainties

associated with the business are shared between the venture companies. It could promote its

business over the social platforms for increasing the sales of the products and services. This will

also increasing the brand recognition and awareness among the people of the new company. It

will enable the company to maximise its profits and revenues. The option of joint venture will

have higher returns at lower risks.

It could also adopt for agency services for expanding the distribution channels. This

could be established on contractual basis agency will be providing the products and services to

the markets of country. Sales and orders could be managed online by the company (Guo, 2019).

This will save considerable amount of investments of the company reducing the risks of failure

as the product will be distributed as per demand. Agency business is highly promoted for

expansion of the distribution channels by the corporations. In this system Angle Electronics may

hire a company in India or Poland as its agent for making the distribution of its product in the

local markets of the country. It could be made on commission. It will not require the company to

establish a business in entirety overseas investing funds. It will enable the company to analyse

the local markets of India or Poland whether the products are getting acceptance of the customer.

On getting required demand company can make plans for establishing business units in Country

this will save funds as well as help company in analysing the market.

Company can also enter the market through acquisition of small companies of the

country in which it is proposing to extend its business. Acquisition refers to purchase of one

company by other for gaining significant controlling of the company. This could be acquired by

payment of cash for the assets and liabilities or it can also purchase significant shares of the

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

company to get over the control. Angle Electronics can use this option for entering into the

foreign markets.

This strategy is used by number of companies to enter into new markets. Angle

Electronics by acquisition of company from India or Poland can have access to the local markets

of the country. Products and service of Angle electronics could be delivered by the acquiree

company. The risks and rewards associated with the company are restricted over the company

which has been acquired. It does not significantly impacts the parent company if the operations

are failed or products do not get market acceptance (Alkaraan, 2017). However this is an

expensive process for the company as it involves significant funds to purchase a well established

company. Angle electronics would be having controlling interest therefore will be required to

manage the operations appropriately.

Recommendations.

There are number of options available to the company through which it could enter into

the new markets. Entrance to the new market should be made after appropriately analysing all

the options and the most appropriate option should be chosen by the company. As it is entering

into new markets joint ventures would prove to be most beneficial for the company. The joint

venture form of business to enter in new markets will reduce the risks associated with business.

Joint venture have knowledge and experience in the field of business of their region. This would

enable the company to understand the market base for expanding its business in India or Poland.

b) Purchasing business either in India or Poland

I) Comparable financial viability of the businesses.

Company before investing is required to analyse the financial viability of the investments

projects. Significant funds of the company are involved in the project for extending its

distribution channels to India or Poland. In depth analysis is required to be made by Angle

electronics of the two countries in order to expand the business. Analysis will be made regarding

the political environment, economic environment regarding the inflation rates, interest rates,

purchasing power the country, growth rate and such other factors that could affect the business

operations. Cash flows will be evaluated by the enterprise considering the economic

environment.

Angle Electronics

3

foreign markets.

This strategy is used by number of companies to enter into new markets. Angle

Electronics by acquisition of company from India or Poland can have access to the local markets

of the country. Products and service of Angle electronics could be delivered by the acquiree

company. The risks and rewards associated with the company are restricted over the company

which has been acquired. It does not significantly impacts the parent company if the operations

are failed or products do not get market acceptance (Alkaraan, 2017). However this is an

expensive process for the company as it involves significant funds to purchase a well established

company. Angle electronics would be having controlling interest therefore will be required to

manage the operations appropriately.

Recommendations.

There are number of options available to the company through which it could enter into

the new markets. Entrance to the new market should be made after appropriately analysing all

the options and the most appropriate option should be chosen by the company. As it is entering

into new markets joint ventures would prove to be most beneficial for the company. The joint

venture form of business to enter in new markets will reduce the risks associated with business.

Joint venture have knowledge and experience in the field of business of their region. This would

enable the company to understand the market base for expanding its business in India or Poland.

b) Purchasing business either in India or Poland

I) Comparable financial viability of the businesses.

Company before investing is required to analyse the financial viability of the investments

projects. Significant funds of the company are involved in the project for extending its

distribution channels to India or Poland. In depth analysis is required to be made by Angle

electronics of the two countries in order to expand the business. Analysis will be made regarding

the political environment, economic environment regarding the inflation rates, interest rates,

purchasing power the country, growth rate and such other factors that could affect the business

operations. Cash flows will be evaluated by the enterprise considering the economic

environment.

Angle Electronics

3

Capital Investments Appraisal techniques have been used for analysing the viability of

investments. Capital Investment appraisal techniques enable the experts to identify the

profitability of investments and the period within which the cost of investments will be

recovered.

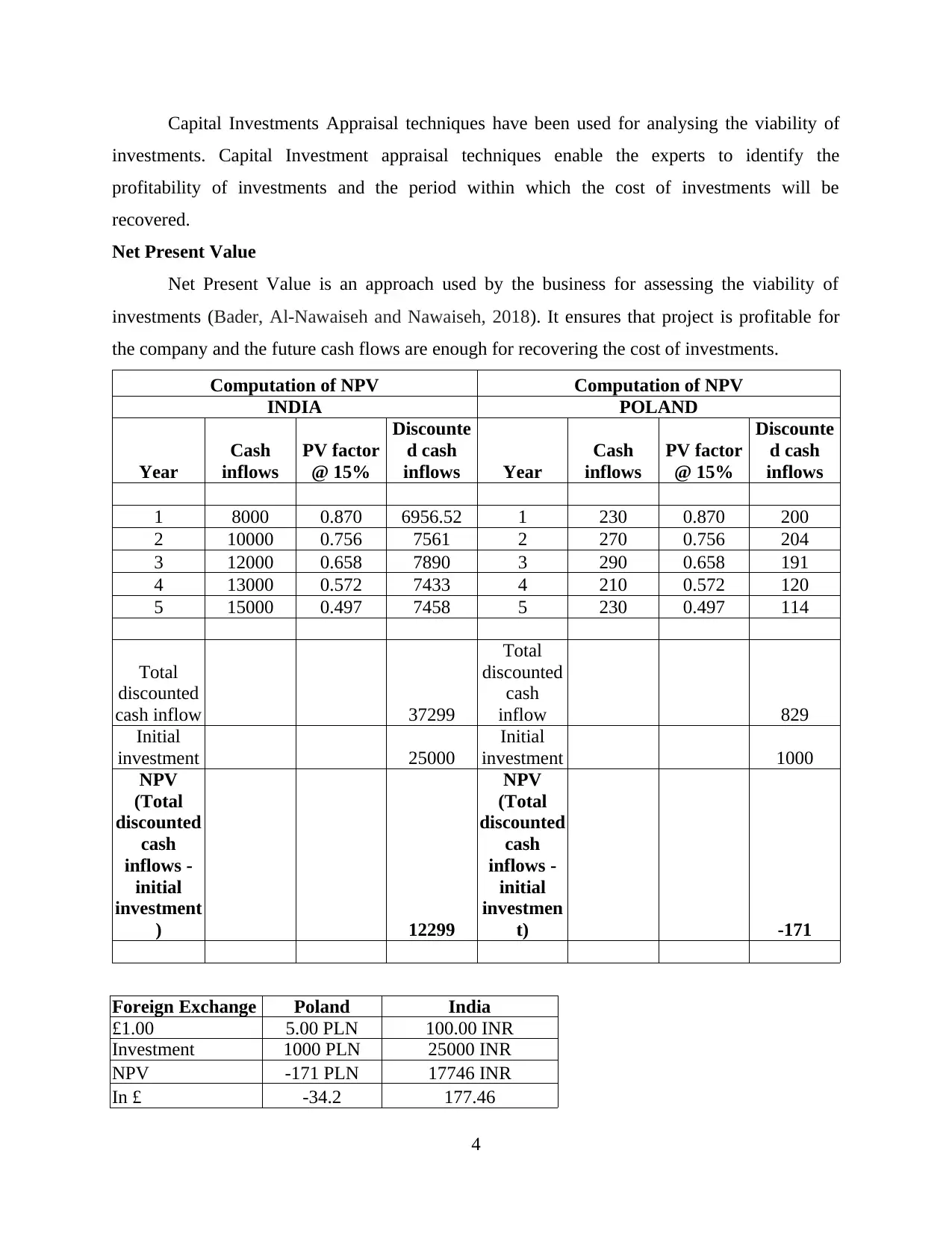

Net Present Value

Net Present Value is an approach used by the business for assessing the viability of

investments (Bader, Al-Nawaiseh and Nawaiseh, 2018). It ensures that project is profitable for

the company and the future cash flows are enough for recovering the cost of investments.

Computation of NPV Computation of NPV

INDIA POLAND

Year

Cash

inflows

PV factor

@ 15%

Discounte

d cash

inflows Year

Cash

inflows

PV factor

@ 15%

Discounte

d cash

inflows

1 8000 0.870 6956.52 1 230 0.870 200

2 10000 0.756 7561 2 270 0.756 204

3 12000 0.658 7890 3 290 0.658 191

4 13000 0.572 7433 4 210 0.572 120

5 15000 0.497 7458 5 230 0.497 114

Total

discounted

cash inflow 37299

Total

discounted

cash

inflow 829

Initial

investment 25000

Initial

investment 1000

NPV

(Total

discounted

cash

inflows -

initial

investment

) 12299

NPV

(Total

discounted

cash

inflows -

initial

investmen

t) -171

Foreign Exchange Poland India

£1.00 5.00 PLN 100.00 INR

Investment 1000 PLN 25000 INR

NPV -171 PLN 17746 INR

In £ -34.2 177.46

4

investments. Capital Investment appraisal techniques enable the experts to identify the

profitability of investments and the period within which the cost of investments will be

recovered.

Net Present Value

Net Present Value is an approach used by the business for assessing the viability of

investments (Bader, Al-Nawaiseh and Nawaiseh, 2018). It ensures that project is profitable for

the company and the future cash flows are enough for recovering the cost of investments.

Computation of NPV Computation of NPV

INDIA POLAND

Year

Cash

inflows

PV factor

@ 15%

Discounte

d cash

inflows Year

Cash

inflows

PV factor

@ 15%

Discounte

d cash

inflows

1 8000 0.870 6956.52 1 230 0.870 200

2 10000 0.756 7561 2 270 0.756 204

3 12000 0.658 7890 3 290 0.658 191

4 13000 0.572 7433 4 210 0.572 120

5 15000 0.497 7458 5 230 0.497 114

Total

discounted

cash inflow 37299

Total

discounted

cash

inflow 829

Initial

investment 25000

Initial

investment 1000

NPV

(Total

discounted

cash

inflows -

initial

investment

) 12299

NPV

(Total

discounted

cash

inflows -

initial

investmen

t) -171

Foreign Exchange Poland India

£1.00 5.00 PLN 100.00 INR

Investment 1000 PLN 25000 INR

NPV -171 PLN 17746 INR

In £ -34.2 177.46

4

Analysis

From the above analysis it could be found that cash flows from the cash flows from

investments in India give positive NPV where the investment in Poland has negative NPV.

Project with positive NPV is considered for investment as the future cash flows generated by the

company are able to cover the initial cost of investment (Kim, Lee and Lee, 2017). Project

which is not able to cover the cost of investment is not profitable and may cause company to

suffer losses. It could be analysed from the NPV that India will be profitable as cash flows from

Poland are giving negative which means company will not be able to cover its investment costs

from the future cash flows.

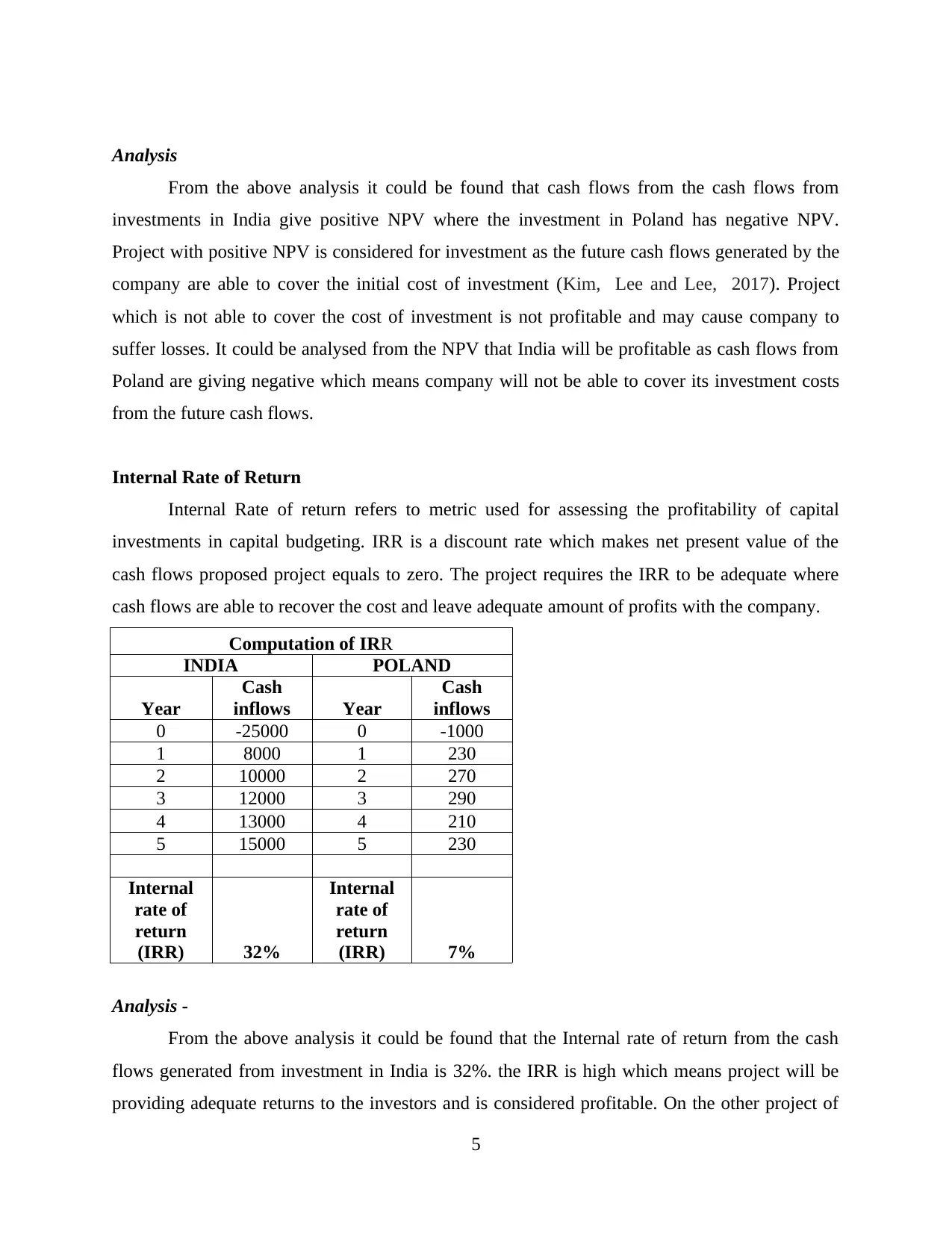

Internal Rate of Return

Internal Rate of return refers to metric used for assessing the profitability of capital

investments in capital budgeting. IRR is a discount rate which makes net present value of the

cash flows proposed project equals to zero. The project requires the IRR to be adequate where

cash flows are able to recover the cost and leave adequate amount of profits with the company.

Computation of IRR

INDIA POLAND

Year

Cash

inflows Year

Cash

inflows

0 -25000 0 -1000

1 8000 1 230

2 10000 2 270

3 12000 3 290

4 13000 4 210

5 15000 5 230

Internal

rate of

return

(IRR) 32%

Internal

rate of

return

(IRR) 7%

Analysis -

From the above analysis it could be found that the Internal rate of return from the cash

flows generated from investment in India is 32%. the IRR is high which means project will be

providing adequate returns to the investors and is considered profitable. On the other project of

5

From the above analysis it could be found that cash flows from the cash flows from

investments in India give positive NPV where the investment in Poland has negative NPV.

Project with positive NPV is considered for investment as the future cash flows generated by the

company are able to cover the initial cost of investment (Kim, Lee and Lee, 2017). Project

which is not able to cover the cost of investment is not profitable and may cause company to

suffer losses. It could be analysed from the NPV that India will be profitable as cash flows from

Poland are giving negative which means company will not be able to cover its investment costs

from the future cash flows.

Internal Rate of Return

Internal Rate of return refers to metric used for assessing the profitability of capital

investments in capital budgeting. IRR is a discount rate which makes net present value of the

cash flows proposed project equals to zero. The project requires the IRR to be adequate where

cash flows are able to recover the cost and leave adequate amount of profits with the company.

Computation of IRR

INDIA POLAND

Year

Cash

inflows Year

Cash

inflows

0 -25000 0 -1000

1 8000 1 230

2 10000 2 270

3 12000 3 290

4 13000 4 210

5 15000 5 230

Internal

rate of

return

(IRR) 32%

Internal

rate of

return

(IRR) 7%

Analysis -

From the above analysis it could be found that the Internal rate of return from the cash

flows generated from investment in India is 32%. the IRR is high which means project will be

providing adequate returns to the investors and is considered profitable. On the other project of

5

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Poland is having IRR of 7% which is very low. The return rate is very low and the company will

not be able to recover its costs with this rate (Ayodele, 2019). Company should investment make

investment in India as the IRR is higher as compared with Poland.

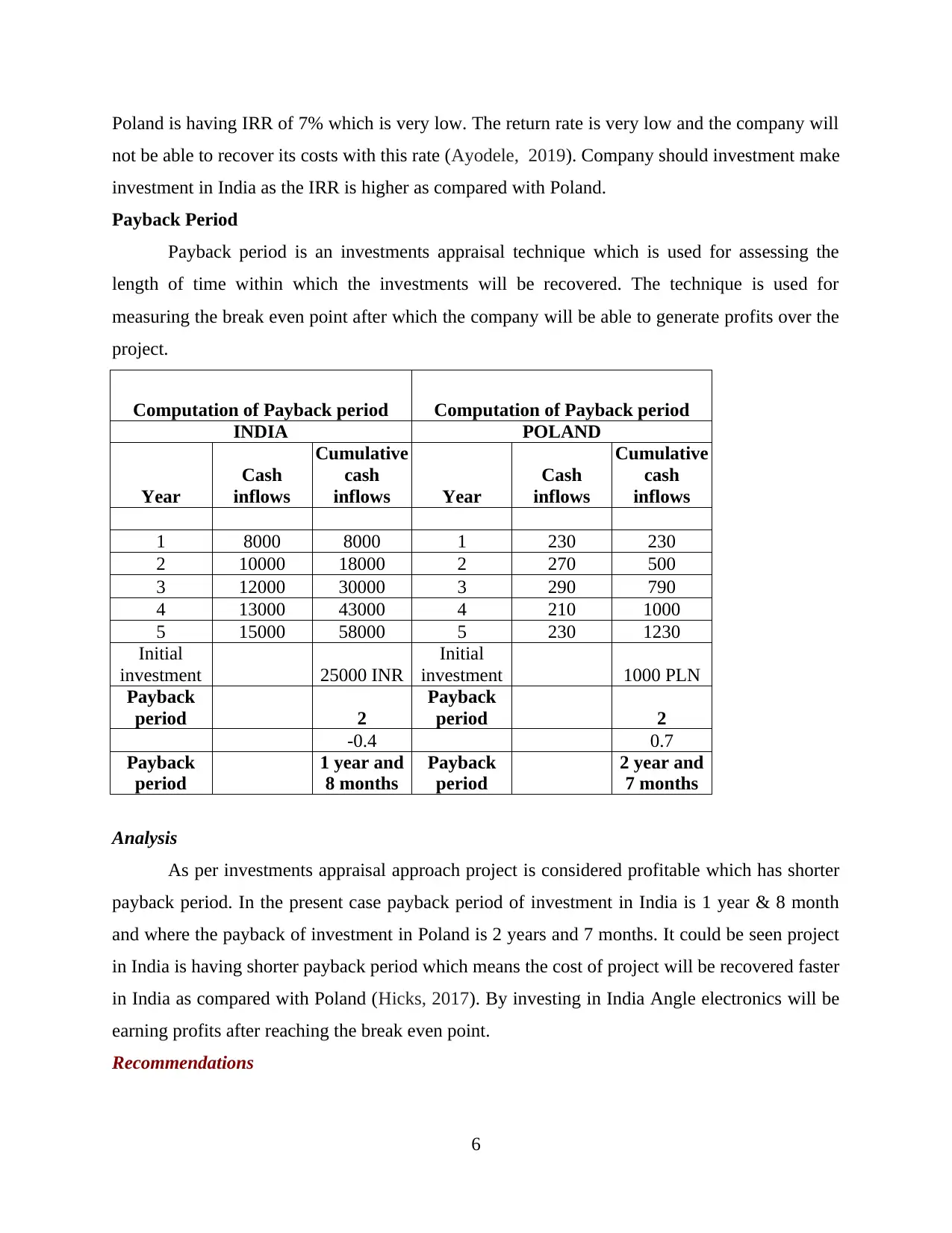

Payback Period

Payback period is an investments appraisal technique which is used for assessing the

length of time within which the investments will be recovered. The technique is used for

measuring the break even point after which the company will be able to generate profits over the

project.

Computation of Payback period Computation of Payback period

INDIA POLAND

Year

Cash

inflows

Cumulative

cash

inflows Year

Cash

inflows

Cumulative

cash

inflows

1 8000 8000 1 230 230

2 10000 18000 2 270 500

3 12000 30000 3 290 790

4 13000 43000 4 210 1000

5 15000 58000 5 230 1230

Initial

investment 25000 INR

Initial

investment 1000 PLN

Payback

period 2

Payback

period 2

-0.4 0.7

Payback

period

1 year and

8 months

Payback

period

2 year and

7 months

Analysis

As per investments appraisal approach project is considered profitable which has shorter

payback period. In the present case payback period of investment in India is 1 year & 8 month

and where the payback of investment in Poland is 2 years and 7 months. It could be seen project

in India is having shorter payback period which means the cost of project will be recovered faster

in India as compared with Poland (Hicks, 2017). By investing in India Angle electronics will be

earning profits after reaching the break even point.

Recommendations

6

not be able to recover its costs with this rate (Ayodele, 2019). Company should investment make

investment in India as the IRR is higher as compared with Poland.

Payback Period

Payback period is an investments appraisal technique which is used for assessing the

length of time within which the investments will be recovered. The technique is used for

measuring the break even point after which the company will be able to generate profits over the

project.

Computation of Payback period Computation of Payback period

INDIA POLAND

Year

Cash

inflows

Cumulative

cash

inflows Year

Cash

inflows

Cumulative

cash

inflows

1 8000 8000 1 230 230

2 10000 18000 2 270 500

3 12000 30000 3 290 790

4 13000 43000 4 210 1000

5 15000 58000 5 230 1230

Initial

investment 25000 INR

Initial

investment 1000 PLN

Payback

period 2

Payback

period 2

-0.4 0.7

Payback

period

1 year and

8 months

Payback

period

2 year and

7 months

Analysis

As per investments appraisal approach project is considered profitable which has shorter

payback period. In the present case payback period of investment in India is 1 year & 8 month

and where the payback of investment in Poland is 2 years and 7 months. It could be seen project

in India is having shorter payback period which means the cost of project will be recovered faster

in India as compared with Poland (Hicks, 2017). By investing in India Angle electronics will be

earning profits after reaching the break even point.

Recommendations

6

The above outcomes shows that the investments in India is more beneficial for the

company. Investment in India has higher NPV of the future cash flows as the growth rate is

higher in India as compared with Poland. This will add higher value to the investments. Positive

NPV reveals that the business is profitable and company will be able to recover the cost of initial

investments and earn reasonable profits. Also the payback period of the project is shorter which

will drive economic benefits faster. The cash flows generated from investments in India are

higher and are adequate for covering the cost of investment. This shows that Angle Electronics

should invest its fund in India for expanding its distribution channels.

ii) Sensitivity of the calculations

Sensitivity analysis refers to study on how uncertainty in output of mathematical system

or model could be allocated or divided to the different sources of the uncertainty in the inputs. It

is also used for financial analysis and stimulation analysis. It could be given for predicting the

outcome of decisions given over certain range of the variables.

Original capital outlay

The capital outlay of the business is required for starting and setting up the business

outside. In the present case Angle electronics is planning to expand its business to India or

Poland. Initial capital outlay proposed in the two case is different. Initial capital outlay in Poland

is 1000 million. Initial capital outlay may have to be increased depending on the inflation and

growth rate (Haynes and Grensing, 2016). Economic environment of Poland is not stable and

fluctuation due to market environment are high affecting the operations of business. Outlay in

India is of 25000 million. For preventing the risks of capital outlays it should keep the reserves

of additional funds.

Projected Cash Flows

Cash flows are determined as per the current market trends in the two countries. The sales

of products is highly influenced by the market forces. The inflation rate in India is currently

10% where it could fall to 6% as per the norms of IMF due to slow economic phase. Rise in

interest rates may not fall the inflation rate with the same proportion. It will affect the purchasing

power affecting the cash flows. Rise in interest rates also affects the economy. On the other

inflation rate is 1% which is very low. The stable inflation rate may not provide the business with

the opportunities to get the required growth in cash flows. The cash inflows are highly based

over market influences which could affect the estimates of the project (Hicks, 2017, July). It has

7

company. Investment in India has higher NPV of the future cash flows as the growth rate is

higher in India as compared with Poland. This will add higher value to the investments. Positive

NPV reveals that the business is profitable and company will be able to recover the cost of initial

investments and earn reasonable profits. Also the payback period of the project is shorter which

will drive economic benefits faster. The cash flows generated from investments in India are

higher and are adequate for covering the cost of investment. This shows that Angle Electronics

should invest its fund in India for expanding its distribution channels.

ii) Sensitivity of the calculations

Sensitivity analysis refers to study on how uncertainty in output of mathematical system

or model could be allocated or divided to the different sources of the uncertainty in the inputs. It

is also used for financial analysis and stimulation analysis. It could be given for predicting the

outcome of decisions given over certain range of the variables.

Original capital outlay

The capital outlay of the business is required for starting and setting up the business

outside. In the present case Angle electronics is planning to expand its business to India or

Poland. Initial capital outlay proposed in the two case is different. Initial capital outlay in Poland

is 1000 million. Initial capital outlay may have to be increased depending on the inflation and

growth rate (Haynes and Grensing, 2016). Economic environment of Poland is not stable and

fluctuation due to market environment are high affecting the operations of business. Outlay in

India is of 25000 million. For preventing the risks of capital outlays it should keep the reserves

of additional funds.

Projected Cash Flows

Cash flows are determined as per the current market trends in the two countries. The sales

of products is highly influenced by the market forces. The inflation rate in India is currently

10% where it could fall to 6% as per the norms of IMF due to slow economic phase. Rise in

interest rates may not fall the inflation rate with the same proportion. It will affect the purchasing

power affecting the cash flows. Rise in interest rates also affects the economy. On the other

inflation rate is 1% which is very low. The stable inflation rate may not provide the business with

the opportunities to get the required growth in cash flows. The cash inflows are highly based

over market influences which could affect the estimates of the project (Hicks, 2017, July). It has

7

to prepare the strategies for maintaining the cash flows even in lower growth and adverse

scenarios in the countries. Profitability of the project will be at question if the required cash

flows are not achieved.

Projected Future exchange rates.

Currency exchange rates are estimated using the concept of Purchasing power parity.

Currency exchange rates fluctuate everyday depending on the international demand and supply.

It is also dependent on the products and services traded by the countries. British pound is heavier

than Polish Zloty and Indian rupees. There could be significant fluctuations seen in the currency

exchange rates of the countries. Indian currency is seen as significantly fluctuating and the

estimates of future exchange rates may be more higher which would could cause company to

book losses over the currency exchange rates. The initial capital outlays may be hedged against

the currency rates fluctuations.

iii) Other relevant issues to be decided regarding the purchase of either business.

Before the Angle electronics proposes to expand over other regions there are different

areas that are required to be considered by the organisation. Business expansion is a big decision

that is required to be analysed by the management of the company over all the sectors hat could

influence the business. Internal and external factors are required to be considered by the

organisation before expanding the business.

Company has to consider the political influences in the countries in which its is planning

to expand its business. Government policies for foreign companies are liberal in India as it

attracts foreign companies to invest. Company can gain tax holidays, subsidies and other benefits

that might help the organisation to grow in market. Government policies are same in Poland for

foreign companies and do not provide tax benefits (Zhang and Warner, 2017). Government

policies and regulations have direct influence over the functioning of the organisation. It has to

consider the tariff rates and other licensing cost for operating business in countries.

Inflation rates affect the demand and supply forces in the market and are therefore

required to be considered effectively. Inflation rates are higher in India as compared with Poland

which is more beneficial for the company. It reflects the growth opportunities healthy inflation

are beneficial for the organisation. In Poland inflation rate is very low that have lower growth

opportunities. Business requires to consider that the economic environment is in favourable

8

scenarios in the countries. Profitability of the project will be at question if the required cash

flows are not achieved.

Projected Future exchange rates.

Currency exchange rates are estimated using the concept of Purchasing power parity.

Currency exchange rates fluctuate everyday depending on the international demand and supply.

It is also dependent on the products and services traded by the countries. British pound is heavier

than Polish Zloty and Indian rupees. There could be significant fluctuations seen in the currency

exchange rates of the countries. Indian currency is seen as significantly fluctuating and the

estimates of future exchange rates may be more higher which would could cause company to

book losses over the currency exchange rates. The initial capital outlays may be hedged against

the currency rates fluctuations.

iii) Other relevant issues to be decided regarding the purchase of either business.

Before the Angle electronics proposes to expand over other regions there are different

areas that are required to be considered by the organisation. Business expansion is a big decision

that is required to be analysed by the management of the company over all the sectors hat could

influence the business. Internal and external factors are required to be considered by the

organisation before expanding the business.

Company has to consider the political influences in the countries in which its is planning

to expand its business. Government policies for foreign companies are liberal in India as it

attracts foreign companies to invest. Company can gain tax holidays, subsidies and other benefits

that might help the organisation to grow in market. Government policies are same in Poland for

foreign companies and do not provide tax benefits (Zhang and Warner, 2017). Government

policies and regulations have direct influence over the functioning of the organisation. It has to

consider the tariff rates and other licensing cost for operating business in countries.

Inflation rates affect the demand and supply forces in the market and are therefore

required to be considered effectively. Inflation rates are higher in India as compared with Poland

which is more beneficial for the company. It reflects the growth opportunities healthy inflation

are beneficial for the organisation. In Poland inflation rate is very low that have lower growth

opportunities. Business requires to consider that the economic environment is in favourable

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

condition to the market. Purchasing power of the people influence the demand of the product

therefore it has to analyse the purchasing power in economy of both countries.

Recommendations

Fluctuations in the exchange rates are to be considered, as the exchange rate profit or loss

are required to be recorded by the business. Exchange rate fluctuations could affect the business

hardly over larger transactions therefore are required to be considered. It has to analyse the

currencies having higher fluctuations as it may require to hedge the transaction against foreign

exchange fluctuations. Political intervention is quite high in Indian market which requires higher

number of compliance procedures to be followed. Economy of India is under developing stage

which means every change in the economy would be directly impacting the Angle Electronics.

Inflation rates are high in India due to developing economy which means the cash flows could

rise even higher with the growth of economy. Angle electronics can excel in Indian markets by

complying with the rules and hedging the funds against fluctuations.

c) Issues and Considerations related to methods of funding.

At the present times there are number of sources available for funding the operations of

company for further expansions. Angle electronics is required to assess the different sources that

could be used for funding the expansion of company. There are issues and considerations to be

kept in mind by the company before choosing the sources of funds.

Equity Share Capital

It is the most commonly used source of raising funds by companies. It refers to offering

shares of company to the public for purchasing the share in ownership at a specified price. In

equity capital shareholders are given sharing in ownership of company. Company is required to

share the profits between the shareholders in proportion to their holdings (Alden and Nariswari,

2017). Angle electronics would not be having any specific obligation for making fixed amount of

payments every year. However company is required to maintain required rate of return as

expected by the shareholders for increasing the wealth of shareholders. It is challenging on new

business and are prices are influenced by the market and performance of company.

Debt Securities

It is another source of financing where company could raise capital by borrowing from

the public. The debt securities are issued in the form of debentures or bonds. These debentures

are issued over a fixed coupon rate to be paid by the company every year irrespective of profits

9

therefore it has to analyse the purchasing power in economy of both countries.

Recommendations

Fluctuations in the exchange rates are to be considered, as the exchange rate profit or loss

are required to be recorded by the business. Exchange rate fluctuations could affect the business

hardly over larger transactions therefore are required to be considered. It has to analyse the

currencies having higher fluctuations as it may require to hedge the transaction against foreign

exchange fluctuations. Political intervention is quite high in Indian market which requires higher

number of compliance procedures to be followed. Economy of India is under developing stage

which means every change in the economy would be directly impacting the Angle Electronics.

Inflation rates are high in India due to developing economy which means the cash flows could

rise even higher with the growth of economy. Angle electronics can excel in Indian markets by

complying with the rules and hedging the funds against fluctuations.

c) Issues and Considerations related to methods of funding.

At the present times there are number of sources available for funding the operations of

company for further expansions. Angle electronics is required to assess the different sources that

could be used for funding the expansion of company. There are issues and considerations to be

kept in mind by the company before choosing the sources of funds.

Equity Share Capital

It is the most commonly used source of raising funds by companies. It refers to offering

shares of company to the public for purchasing the share in ownership at a specified price. In

equity capital shareholders are given sharing in ownership of company. Company is required to

share the profits between the shareholders in proportion to their holdings (Alden and Nariswari,

2017). Angle electronics would not be having any specific obligation for making fixed amount of

payments every year. However company is required to maintain required rate of return as

expected by the shareholders for increasing the wealth of shareholders. It is challenging on new

business and are prices are influenced by the market and performance of company.

Debt Securities

It is another source of financing where company could raise capital by borrowing from

the public. The debt securities are issued in the form of debentures or bonds. These debentures

are issued over a fixed coupon rate to be paid by the company every year irrespective of profits

9

or losses suffered by company. Debentures are to be redeemed after a fixed period either at par

or premium. It is beneficial source of capital as company is allowed tax benefits and it also

reduced the overall cost of capital of firm. However debenture holders do not have controlling

power nor profits are shared with them.

Venture Capitalists

Companies for expanding their business overseas are using venture capitalist for

investing funds in their projects. Venture capitalist are individuals or group of individuals with

high net worth who make investments in the companies and projects that have growth potentials.

It also helps the company in facilitating investments with angel investors (Jensen and

Zámborský, 2018). Venture capitalist exercise their control in the operations of the company and

decision making. It could interrupt the decision making process with different thoughts and

views. However they are specialised and experienced individuals that can provide effective

guidance to company for promoting growth and achieving the desired goals and objectives.

Recommendations

Analysing the organisation structure of Angle electronics it could be seen that raising he

capital through venture capital will be beneficial. It will provide the company with expertise

knowledge and guidance for expanding its business. They will also share the risks and rewards

associated with the business. Raising funds through equity capital will increase the cost of capital

and they are highly influenced by market forces. Angle electronics by raising funds through

venture capital will have access over larger market share and higher possibilities of being

successful in the new markets.

d) Potential benefits and cost savings that could accrue

i) Multinational Financial System

International financial system is management of the finance in international business.

International financial systems help the organisation in connecting with the international dealings

between overseas customers, business partners, suppliers etc. In comparison with domestic

markets the shape & analytics of international markets is different. Proper management of the

international finances helps organisations to achieve efficiency & effectiveness in the markets

(Bartsch, 2019). Main reasons for investing capital in foreign markets is due to increased

efficiency of production, ease of raw materials, diversification and broadening the market or for

earning more higher returns.

10

or premium. It is beneficial source of capital as company is allowed tax benefits and it also

reduced the overall cost of capital of firm. However debenture holders do not have controlling

power nor profits are shared with them.

Venture Capitalists

Companies for expanding their business overseas are using venture capitalist for

investing funds in their projects. Venture capitalist are individuals or group of individuals with

high net worth who make investments in the companies and projects that have growth potentials.

It also helps the company in facilitating investments with angel investors (Jensen and

Zámborský, 2018). Venture capitalist exercise their control in the operations of the company and

decision making. It could interrupt the decision making process with different thoughts and

views. However they are specialised and experienced individuals that can provide effective

guidance to company for promoting growth and achieving the desired goals and objectives.

Recommendations

Analysing the organisation structure of Angle electronics it could be seen that raising he

capital through venture capital will be beneficial. It will provide the company with expertise

knowledge and guidance for expanding its business. They will also share the risks and rewards

associated with the business. Raising funds through equity capital will increase the cost of capital

and they are highly influenced by market forces. Angle electronics by raising funds through

venture capital will have access over larger market share and higher possibilities of being

successful in the new markets.

d) Potential benefits and cost savings that could accrue

i) Multinational Financial System

International financial system is management of the finance in international business.

International financial systems help the organisation in connecting with the international dealings

between overseas customers, business partners, suppliers etc. In comparison with domestic

markets the shape & analytics of international markets is different. Proper management of the

international finances helps organisations to achieve efficiency & effectiveness in the markets

(Bartsch, 2019). Main reasons for investing capital in foreign markets is due to increased

efficiency of production, ease of raw materials, diversification and broadening the market or for

earning more higher returns.

10

Financial management is concerned with making optimum financial decisions that

pertains to investments, dividend policy, capital structure and the working capital management

with view of achieving corporate objectives. International financial function is having mainly

two functions control and treasury. Company has to manage the financial planning analysis,

investment financing, investment decisions, cash management and the risk management. It also

undertake the functions related with tax planning, external reporting, management information

system, budgetary planning& control. Financial & management accounting and accounts

receivable. Companies are required to take analytical decisions analysing the factors influencing

capital structure of company for minimising cost of capital finance and maximising return from

investments. Multinational financial systems is multidisciplinary in the nature and having the

understanding of the economic principles and theories necessary for estimating and modelling

financial decision and management accounting which helps in managing finance at the

multinational level.

Corporate tax rate of Poland is 19% which is levied over corporate income. Standard rate

of CIT is 9% and small taxpayers have to pay lower 9% tax of CIT. On the other tax rate of India

as reduced from 25% to 15% for new manufacturing companies. Even after including cess and

surcharge tax rates are still lower than Poland (Di Mascio and et.al., 2017). The international

financial benefits are more in Indian market for company.

Transfer pricing refers to taxation and accounting practice which is used for pricing the

transactions internationally in the business and among the subsidiaries operating under common

control or the ownership. Practice of transfer pricing extends transactions of cross borders and of

domestic ones. Transfer prices are used for determining cost to be charged to other divisions,

subsidiaries or the holding company for the services rendered (Motylska-Kuzma, 2016).

Multinational firms are permitted legally for using transfer pricing methods to allocate the

earnings between various subsidiaries and affiliating companies which belongs to parent

organisation.

Charging below or above market prices firms could use the transfer pricing for

transferring profits as well as costs to other departments internally for reducing the tax burden.

There are tax authorities with strong rules related to transfer pricing for preventing companies to

use transfer pricing for tax avoidance.

11

pertains to investments, dividend policy, capital structure and the working capital management

with view of achieving corporate objectives. International financial function is having mainly

two functions control and treasury. Company has to manage the financial planning analysis,

investment financing, investment decisions, cash management and the risk management. It also

undertake the functions related with tax planning, external reporting, management information

system, budgetary planning& control. Financial & management accounting and accounts

receivable. Companies are required to take analytical decisions analysing the factors influencing

capital structure of company for minimising cost of capital finance and maximising return from

investments. Multinational financial systems is multidisciplinary in the nature and having the

understanding of the economic principles and theories necessary for estimating and modelling

financial decision and management accounting which helps in managing finance at the

multinational level.

Corporate tax rate of Poland is 19% which is levied over corporate income. Standard rate

of CIT is 9% and small taxpayers have to pay lower 9% tax of CIT. On the other tax rate of India

as reduced from 25% to 15% for new manufacturing companies. Even after including cess and

surcharge tax rates are still lower than Poland (Di Mascio and et.al., 2017). The international

financial benefits are more in Indian market for company.

Transfer pricing refers to taxation and accounting practice which is used for pricing the

transactions internationally in the business and among the subsidiaries operating under common

control or the ownership. Practice of transfer pricing extends transactions of cross borders and of

domestic ones. Transfer prices are used for determining cost to be charged to other divisions,

subsidiaries or the holding company for the services rendered (Motylska-Kuzma, 2016).

Multinational firms are permitted legally for using transfer pricing methods to allocate the

earnings between various subsidiaries and affiliating companies which belongs to parent

organisation.

Charging below or above market prices firms could use the transfer pricing for

transferring profits as well as costs to other departments internally for reducing the tax burden.

There are tax authorities with strong rules related to transfer pricing for preventing companies to

use transfer pricing for tax avoidance.

11

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

ii) Role and Limitation of Treasury centralisation in enabling company to benefit from

Multinational Financial System.

Role of Treasury centralisation

There are number of reason due to which the organisations decide of centralising treasury

operations that typically includes cash management, foreign exchange and financing investment

including strategic management and routine activities.

Treasury centralisation helps the Angle Electronics to identify its risks and financial

liquidity. Keeping overall record of cash position helps the business in timely exposure of risks.

It enables the company to make important decisions related to international monetary financial

system. After obtaining global views of company's cash position it could act over information for

optimising liquidity of firm. Credits is becoming expensive nowadays and is not readily available

(Basnyat, and et.al., 2018). Centralisation helps to access capital instead of relying over external

borrowings. It provides company with alternatives to seek the funding methods that are less

expensive and could benefit the organisation. Also, treasury centralisation enables company to

forecasts by combining all the information that is derived from systems allowing users across

company to feed data by common channel of demand. Companies cold more effectively forecast

about the financial planning and liquidity for deriving the benefits from international monetary

systems.

Limitation of Treasury Centralisation

Treasury centralisation destroy individual initiatives. Single person is not given the

authority of using judgement even where they are seeing lacunae in decisions. Subordinates

involves is reduced and are not involved in decision making and are required to follow the

directions. The operations under centralisation system becomes lengthy and the process of

decision making becomes time making (Katabi, and Dimoso, 2018). The cost of setting and

operating the centralised treasury system is very high for company. On losing security there is

great extent of risk involved in the company. The access of entire data will be broken on cyber

hacks which could lead to major financial crisis for firm.

Recommendations

Centralising the treasury system is advantageous for the company. This allows the

company to access the financial information from everywhere around the world. By

centralisation of the treasury system Angle electronics would be able to access the treasury of

12

Multinational Financial System.

Role of Treasury centralisation

There are number of reason due to which the organisations decide of centralising treasury

operations that typically includes cash management, foreign exchange and financing investment

including strategic management and routine activities.

Treasury centralisation helps the Angle Electronics to identify its risks and financial

liquidity. Keeping overall record of cash position helps the business in timely exposure of risks.

It enables the company to make important decisions related to international monetary financial

system. After obtaining global views of company's cash position it could act over information for

optimising liquidity of firm. Credits is becoming expensive nowadays and is not readily available

(Basnyat, and et.al., 2018). Centralisation helps to access capital instead of relying over external

borrowings. It provides company with alternatives to seek the funding methods that are less

expensive and could benefit the organisation. Also, treasury centralisation enables company to

forecasts by combining all the information that is derived from systems allowing users across

company to feed data by common channel of demand. Companies cold more effectively forecast

about the financial planning and liquidity for deriving the benefits from international monetary

systems.

Limitation of Treasury Centralisation

Treasury centralisation destroy individual initiatives. Single person is not given the

authority of using judgement even where they are seeing lacunae in decisions. Subordinates

involves is reduced and are not involved in decision making and are required to follow the

directions. The operations under centralisation system becomes lengthy and the process of

decision making becomes time making (Katabi, and Dimoso, 2018). The cost of setting and

operating the centralised treasury system is very high for company. On losing security there is

great extent of risk involved in the company. The access of entire data will be broken on cyber

hacks which could lead to major financial crisis for firm.

Recommendations

Centralising the treasury system is advantageous for the company. This allows the

company to access the financial information from everywhere around the world. By

centralisation of the treasury system Angle electronics would be able to access the treasury of

12

business going in India from UK. This will enable company in effectively monitoring the

operations of business and to ensure that resources are employed over productive activities.

Centralisation of treasury will provide effective control over the business and information of the

entire business would be available at single point. Therefore, the Angle electronics should

centralise its treasury operations so that all the information is available at single point.

CONCLUSION

From the above study and research it could be evaluated that for expanding is distribution

channels Angle Electronics should adopt Indian Market. The assessment shows that Indian

market is having more growth opportunities and success factors. Factors such as political and

economic stability is less in Indian market but is favourable for achieving the objectives of

business. Inflation rate is higher in India and also the investments appraisal techniques are giving

positive results in favour of India. Company will be required to manage the financial risks for

effectively running the operations of business. For expansion plan venture capital would prove to

be most beneficial as resources and expertise is shared for achieving the common objective.

13

operations of business and to ensure that resources are employed over productive activities.

Centralisation of treasury will provide effective control over the business and information of the

entire business would be available at single point. Therefore, the Angle electronics should

centralise its treasury operations so that all the information is available at single point.

CONCLUSION

From the above study and research it could be evaluated that for expanding is distribution

channels Angle Electronics should adopt Indian Market. The assessment shows that Indian

market is having more growth opportunities and success factors. Factors such as political and

economic stability is less in Indian market but is favourable for achieving the objectives of

business. Inflation rate is higher in India and also the investments appraisal techniques are giving

positive results in favour of India. Company will be required to manage the financial risks for

effectively running the operations of business. For expansion plan venture capital would prove to

be most beneficial as resources and expertise is shared for achieving the common objective.

13

REFERENCES

Books and Journals

Hawbaker, K., 2018. Examining Emergent Systems Management Strategies in Overseas

Operations.

Fujiwara, N., 2019. International City Network and Public-Private Cooperation Japanese Public

Water Services’ Overseas Expansion (No. 1909). CIRIEC-Université de Liège.

Guo, Y., 2019. Discussion on the Influence of Overseas Financial Institutions’ Partic-ipation in

Shares on the Operation Efficiency of China’s Banking In-dustry. Journal of Economic

Science Research| Volume. 2(04).

Alkaraan, F., 2017. Strategic Investment Appraisal: Multidisciplinary Perspectives', Advances in

Mergers and Acquisitions (Advances in Mergers & Acquisitions, Volume 16).

Bader, A., Al-Nawaiseh, H.N. and Nawaiseh, M.E., 2018. Capital Investment Appraisal

Practices of Jordan Industrial Companies: A Survey of Current Usage. International

Research Journal of Applied Finance. 9(4). pp.146-161.

Ayodele, T.O., 2019. Factors influencing the adoption of real option analysis in RED appraisal:

an emergent market perspective. International Journal of Construction Management,

pp.1-11.

Hicks, C.L., 2017, July. MODERN PROJECT INVESTMENT APPRAISAL: RETURN TO

SIMPLICITY. In Process Optimisation: A Three-Day Symposium Organised by the

Midlands Branch of the Institution of Chemical Engineers and Held at the University of

Nottingham, 7–9 April 1987 (No. 61, p. 53). Elsevier.

Haynes, M. and Grensing, G., 2016. Vadnais Heights Business Retention and Expansion

Strategies Program.

Zhang, X. and Warner, M.E., 2017. Business retention and expansion and business clusters–A

comprehensive approach to community development. Community Development. 48(2).

pp.170-186.

Alden, D.L. and Nariswari, A., 2017. Brand Positioning Strategies During Global Expansion:

Managerial Perspectives from Emerging Market Firms. In The Customer is NOT Always

Right? Marketing Orientationsin a Dynamic Business World(pp. 527-530). Springer,

Cham.

Jensen, C. and Zámborský, P., 2018. Conviviality evaluated: Market entry and expansion

strategies at the pernod ricard groupe. SAGE Publications: SAGE Business Cases

Originals.

Bartsch, C., 2019. CENTRALIZATION OF CORPORATE TREASURY: FACTORS TO

CONSIDER. IMPACT, 3, p.73.

Di Mascio, F., and et.al., 2017. Centralisation of Budgetary Processes as a Response to the Fiscal

Crisis. Public management in times of austerity.

Basnyat, B., and et.al., 2018. Legal-sounding bureaucratic re-centralisation of community

forestry in Nepal. Forest Policy and Economics. 91. pp.5-18.

Katabi, R.J. and Dimoso, R., 2018. Relationship Between SMEs Sources of Funds and

Investment Evaluation Techniques. Business and Management Studies. 4(4). pp.61-70.

Motylska-Kuzma, A., 2016. The cost of crowdfunding capital. In Proceedings of the 3rd

International Multidisciplinary Scientific Conference on Social Sciences and Arts

SGEM (pp. 601-612).

14

Books and Journals

Hawbaker, K., 2018. Examining Emergent Systems Management Strategies in Overseas

Operations.

Fujiwara, N., 2019. International City Network and Public-Private Cooperation Japanese Public

Water Services’ Overseas Expansion (No. 1909). CIRIEC-Université de Liège.

Guo, Y., 2019. Discussion on the Influence of Overseas Financial Institutions’ Partic-ipation in

Shares on the Operation Efficiency of China’s Banking In-dustry. Journal of Economic

Science Research| Volume. 2(04).

Alkaraan, F., 2017. Strategic Investment Appraisal: Multidisciplinary Perspectives', Advances in

Mergers and Acquisitions (Advances in Mergers & Acquisitions, Volume 16).

Bader, A., Al-Nawaiseh, H.N. and Nawaiseh, M.E., 2018. Capital Investment Appraisal

Practices of Jordan Industrial Companies: A Survey of Current Usage. International

Research Journal of Applied Finance. 9(4). pp.146-161.

Ayodele, T.O., 2019. Factors influencing the adoption of real option analysis in RED appraisal:

an emergent market perspective. International Journal of Construction Management,

pp.1-11.

Hicks, C.L., 2017, July. MODERN PROJECT INVESTMENT APPRAISAL: RETURN TO

SIMPLICITY. In Process Optimisation: A Three-Day Symposium Organised by the

Midlands Branch of the Institution of Chemical Engineers and Held at the University of

Nottingham, 7–9 April 1987 (No. 61, p. 53). Elsevier.

Haynes, M. and Grensing, G., 2016. Vadnais Heights Business Retention and Expansion

Strategies Program.

Zhang, X. and Warner, M.E., 2017. Business retention and expansion and business clusters–A

comprehensive approach to community development. Community Development. 48(2).

pp.170-186.

Alden, D.L. and Nariswari, A., 2017. Brand Positioning Strategies During Global Expansion:

Managerial Perspectives from Emerging Market Firms. In The Customer is NOT Always

Right? Marketing Orientationsin a Dynamic Business World(pp. 527-530). Springer,

Cham.

Jensen, C. and Zámborský, P., 2018. Conviviality evaluated: Market entry and expansion

strategies at the pernod ricard groupe. SAGE Publications: SAGE Business Cases

Originals.

Bartsch, C., 2019. CENTRALIZATION OF CORPORATE TREASURY: FACTORS TO

CONSIDER. IMPACT, 3, p.73.

Di Mascio, F., and et.al., 2017. Centralisation of Budgetary Processes as a Response to the Fiscal

Crisis. Public management in times of austerity.

Basnyat, B., and et.al., 2018. Legal-sounding bureaucratic re-centralisation of community

forestry in Nepal. Forest Policy and Economics. 91. pp.5-18.

Katabi, R.J. and Dimoso, R., 2018. Relationship Between SMEs Sources of Funds and

Investment Evaluation Techniques. Business and Management Studies. 4(4). pp.61-70.

Motylska-Kuzma, A., 2016. The cost of crowdfunding capital. In Proceedings of the 3rd

International Multidisciplinary Scientific Conference on Social Sciences and Arts

SGEM (pp. 601-612).

14

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Kim, K.T., Lee, J.S. and Lee, S.Y., 2017. The effects of supply chain fairness and the buyer’s

power sources on the innovation performance of the supplier: A mediating role of social

capital accumulation. Journal of Business & Industrial Marketing.

15

power sources on the innovation performance of the supplier: A mediating role of social

capital accumulation. Journal of Business & Industrial Marketing.

15

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.