International Finance Report: Analyzing Global Stock Performance

VerifiedAdded on 2020/05/28

|15

|2408

|83

Report

AI Summary

This report presents an analysis of international finance, focusing on the stock performance of various companies, including Medibank Private Ltd, TPG Telecom Ltd, James Hardie Industries plc, and Fletcher Building Limited. The report investigates the changes in stock prices on a weekly basis, evaluating portfolio performance and comparing it with other students' portfolios. It examines whether the performance of Australian-based MNCs is driven by the Australian market and identifies the correlation between foreign stock performance and their respective market values. Furthermore, the report assesses the impact of foreign currency exchange rates on the return generation capacity of Australian-based MNCs. The analysis also explores the influence of local currency exchange rates on the stock performance of foreign companies, determining the overall performance of foreign stocks in relation to currency fluctuations. The report uses figures and data from various sources to support its findings and includes a reference and bibliography section.

Running head: INTERNATIONAL FINANCE

International Finance

Name of the Student:

Name of the University:

Authors Note:

International Finance

Name of the Student:

Name of the University:

Authors Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INTERNATIONAL FINANCE

1

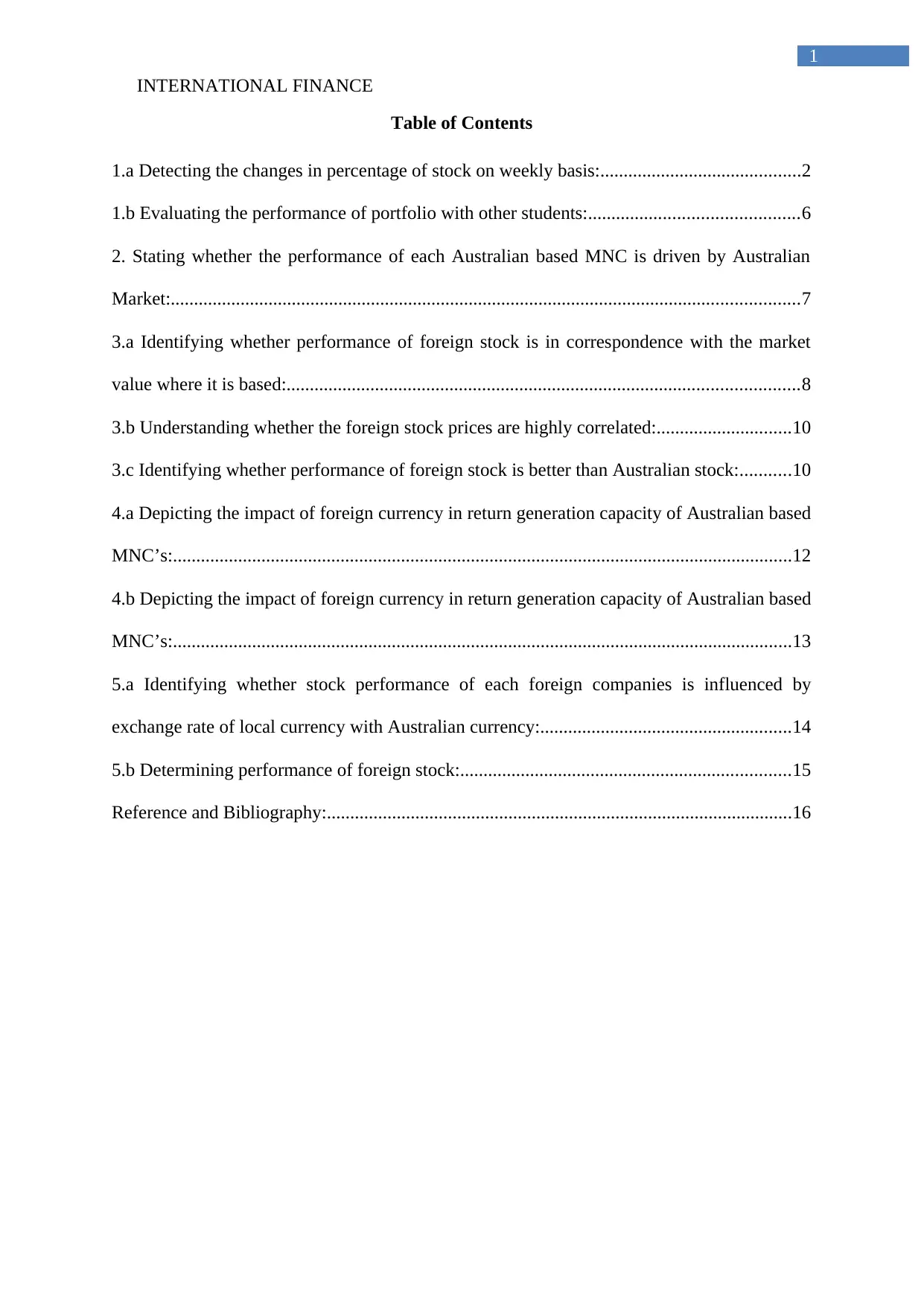

Table of Contents

1.a Detecting the changes in percentage of stock on weekly basis:...........................................2

1.b Evaluating the performance of portfolio with other students:.............................................6

2. Stating whether the performance of each Australian based MNC is driven by Australian

Market:.......................................................................................................................................7

3.a Identifying whether performance of foreign stock is in correspondence with the market

value where it is based:..............................................................................................................8

3.b Understanding whether the foreign stock prices are highly correlated:.............................10

3.c Identifying whether performance of foreign stock is better than Australian stock:...........10

4.a Depicting the impact of foreign currency in return generation capacity of Australian based

MNC’s:.....................................................................................................................................12

4.b Depicting the impact of foreign currency in return generation capacity of Australian based

MNC’s:.....................................................................................................................................13

5.a Identifying whether stock performance of each foreign companies is influenced by

exchange rate of local currency with Australian currency:......................................................14

5.b Determining performance of foreign stock:.......................................................................15

Reference and Bibliography:....................................................................................................16

1

Table of Contents

1.a Detecting the changes in percentage of stock on weekly basis:...........................................2

1.b Evaluating the performance of portfolio with other students:.............................................6

2. Stating whether the performance of each Australian based MNC is driven by Australian

Market:.......................................................................................................................................7

3.a Identifying whether performance of foreign stock is in correspondence with the market

value where it is based:..............................................................................................................8

3.b Understanding whether the foreign stock prices are highly correlated:.............................10

3.c Identifying whether performance of foreign stock is better than Australian stock:...........10

4.a Depicting the impact of foreign currency in return generation capacity of Australian based

MNC’s:.....................................................................................................................................12

4.b Depicting the impact of foreign currency in return generation capacity of Australian based

MNC’s:.....................................................................................................................................13

5.a Identifying whether stock performance of each foreign companies is influenced by

exchange rate of local currency with Australian currency:......................................................14

5.b Determining performance of foreign stock:.......................................................................15

Reference and Bibliography:....................................................................................................16

INTERNATIONAL FINANCE

2

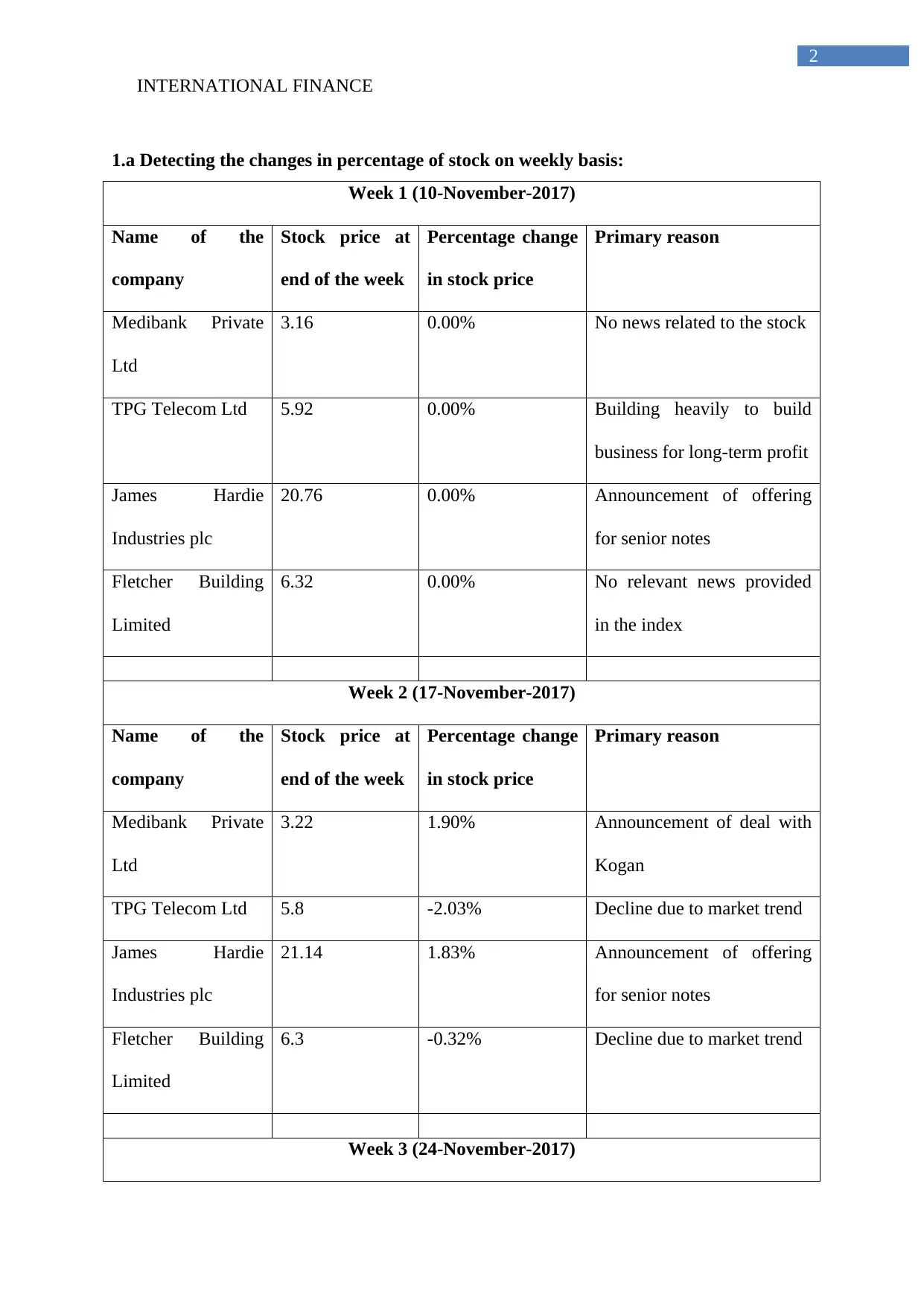

1.a Detecting the changes in percentage of stock on weekly basis:

Week 1 (10-November-2017)

Name of the

company

Stock price at

end of the week

Percentage change

in stock price

Primary reason

Medibank Private

Ltd

3.16 0.00% No news related to the stock

TPG Telecom Ltd 5.92 0.00% Building heavily to build

business for long-term profit

James Hardie

Industries plc

20.76 0.00% Announcement of offering

for senior notes

Fletcher Building

Limited

6.32 0.00% No relevant news provided

in the index

Week 2 (17-November-2017)

Name of the

company

Stock price at

end of the week

Percentage change

in stock price

Primary reason

Medibank Private

Ltd

3.22 1.90% Announcement of deal with

Kogan

TPG Telecom Ltd 5.8 -2.03% Decline due to market trend

James Hardie

Industries plc

21.14 1.83% Announcement of offering

for senior notes

Fletcher Building

Limited

6.3 -0.32% Decline due to market trend

Week 3 (24-November-2017)

2

1.a Detecting the changes in percentage of stock on weekly basis:

Week 1 (10-November-2017)

Name of the

company

Stock price at

end of the week

Percentage change

in stock price

Primary reason

Medibank Private

Ltd

3.16 0.00% No news related to the stock

TPG Telecom Ltd 5.92 0.00% Building heavily to build

business for long-term profit

James Hardie

Industries plc

20.76 0.00% Announcement of offering

for senior notes

Fletcher Building

Limited

6.32 0.00% No relevant news provided

in the index

Week 2 (17-November-2017)

Name of the

company

Stock price at

end of the week

Percentage change

in stock price

Primary reason

Medibank Private

Ltd

3.22 1.90% Announcement of deal with

Kogan

TPG Telecom Ltd 5.8 -2.03% Decline due to market trend

James Hardie

Industries plc

21.14 1.83% Announcement of offering

for senior notes

Fletcher Building

Limited

6.3 -0.32% Decline due to market trend

Week 3 (24-November-2017)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTERNATIONAL FINANCE

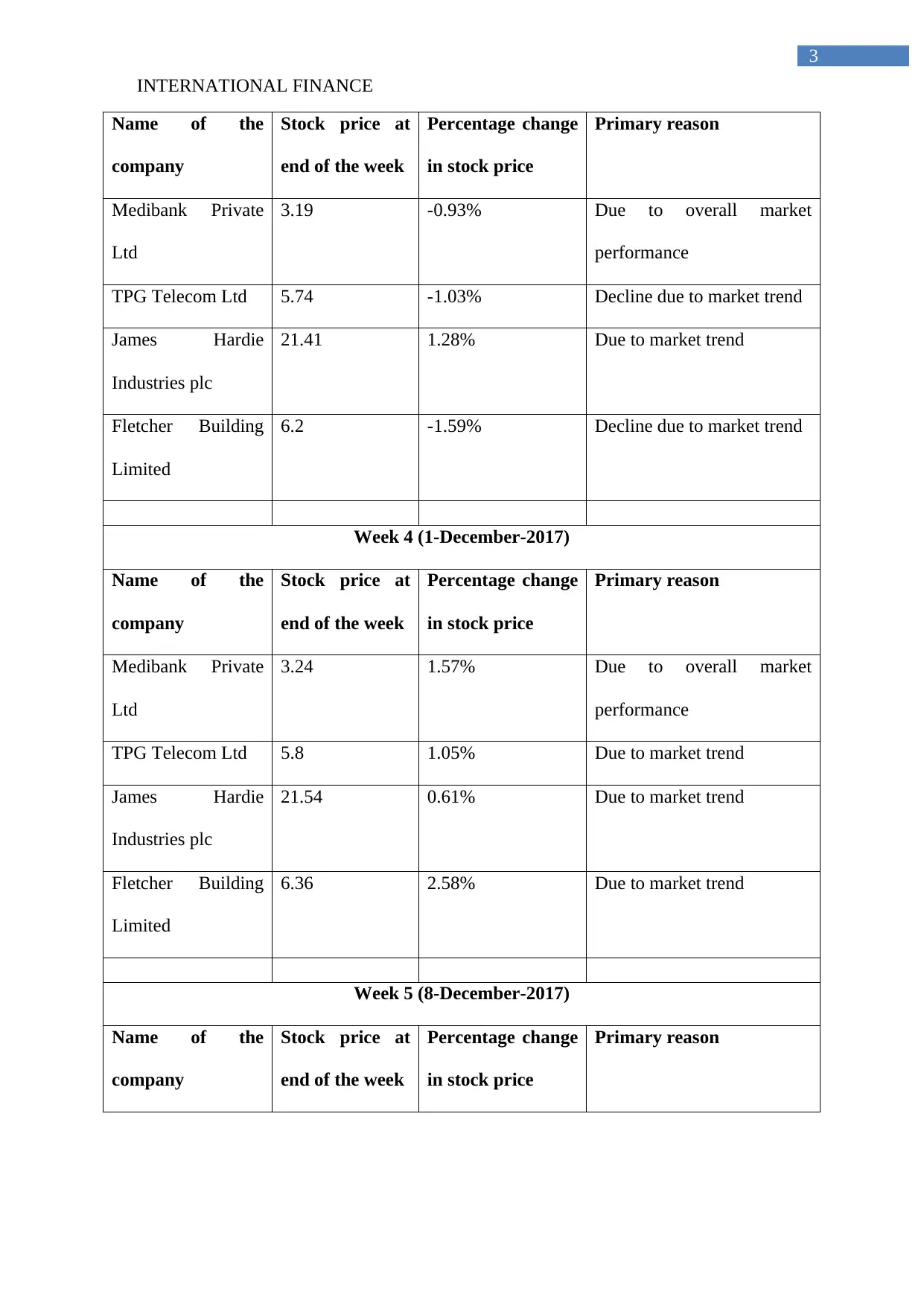

3

Name of the

company

Stock price at

end of the week

Percentage change

in stock price

Primary reason

Medibank Private

Ltd

3.19 -0.93% Due to overall market

performance

TPG Telecom Ltd 5.74 -1.03% Decline due to market trend

James Hardie

Industries plc

21.41 1.28% Due to market trend

Fletcher Building

Limited

6.2 -1.59% Decline due to market trend

Week 4 (1-December-2017)

Name of the

company

Stock price at

end of the week

Percentage change

in stock price

Primary reason

Medibank Private

Ltd

3.24 1.57% Due to overall market

performance

TPG Telecom Ltd 5.8 1.05% Due to market trend

James Hardie

Industries plc

21.54 0.61% Due to market trend

Fletcher Building

Limited

6.36 2.58% Due to market trend

Week 5 (8-December-2017)

Name of the

company

Stock price at

end of the week

Percentage change

in stock price

Primary reason

3

Name of the

company

Stock price at

end of the week

Percentage change

in stock price

Primary reason

Medibank Private

Ltd

3.19 -0.93% Due to overall market

performance

TPG Telecom Ltd 5.74 -1.03% Decline due to market trend

James Hardie

Industries plc

21.41 1.28% Due to market trend

Fletcher Building

Limited

6.2 -1.59% Decline due to market trend

Week 4 (1-December-2017)

Name of the

company

Stock price at

end of the week

Percentage change

in stock price

Primary reason

Medibank Private

Ltd

3.24 1.57% Due to overall market

performance

TPG Telecom Ltd 5.8 1.05% Due to market trend

James Hardie

Industries plc

21.54 0.61% Due to market trend

Fletcher Building

Limited

6.36 2.58% Due to market trend

Week 5 (8-December-2017)

Name of the

company

Stock price at

end of the week

Percentage change

in stock price

Primary reason

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

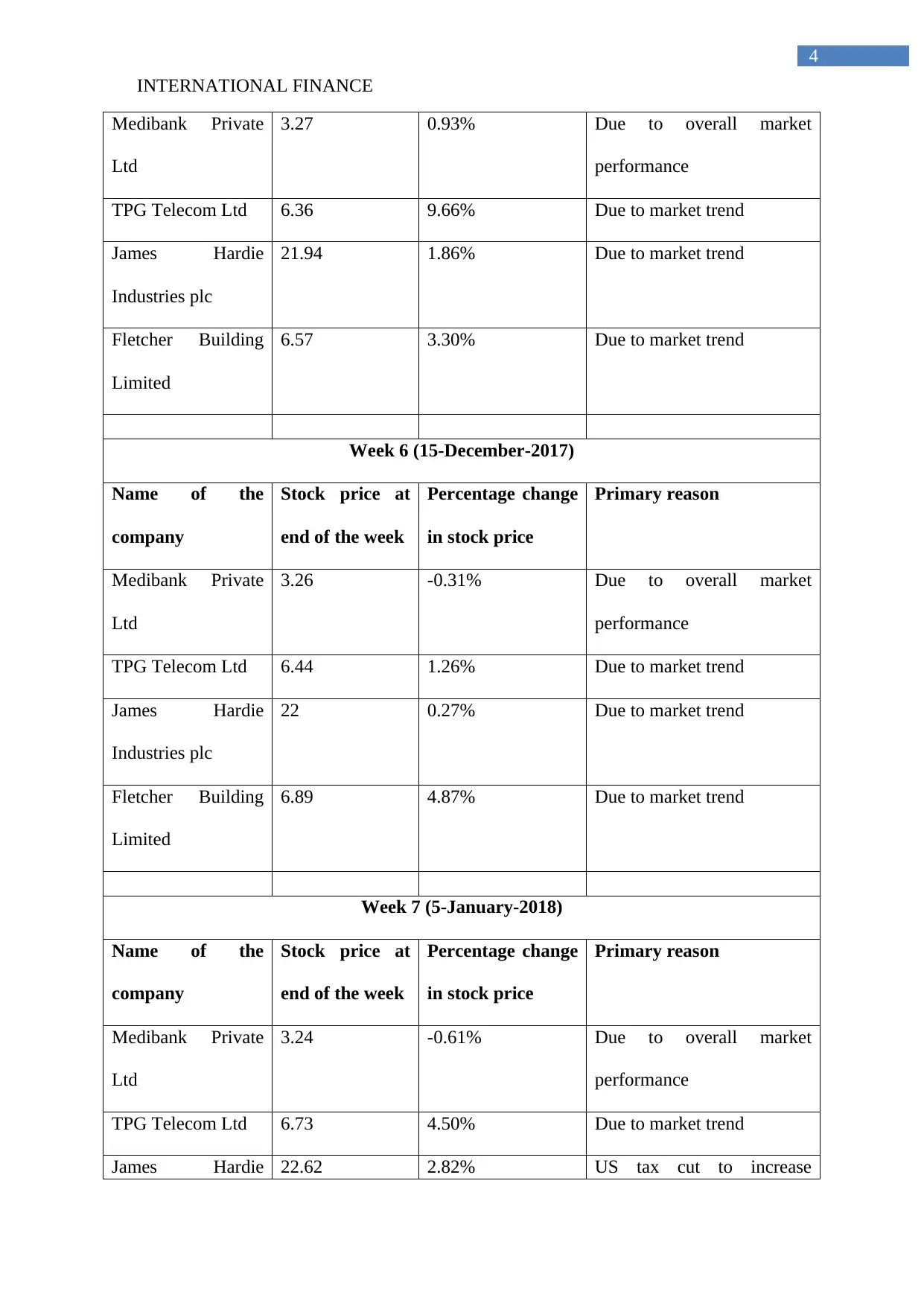

INTERNATIONAL FINANCE

4

Medibank Private

Ltd

3.27 0.93% Due to overall market

performance

TPG Telecom Ltd 6.36 9.66% Due to market trend

James Hardie

Industries plc

21.94 1.86% Due to market trend

Fletcher Building

Limited

6.57 3.30% Due to market trend

Week 6 (15-December-2017)

Name of the

company

Stock price at

end of the week

Percentage change

in stock price

Primary reason

Medibank Private

Ltd

3.26 -0.31% Due to overall market

performance

TPG Telecom Ltd 6.44 1.26% Due to market trend

James Hardie

Industries plc

22 0.27% Due to market trend

Fletcher Building

Limited

6.89 4.87% Due to market trend

Week 7 (5-January-2018)

Name of the

company

Stock price at

end of the week

Percentage change

in stock price

Primary reason

Medibank Private

Ltd

3.24 -0.61% Due to overall market

performance

TPG Telecom Ltd 6.73 4.50% Due to market trend

James Hardie 22.62 2.82% US tax cut to increase

4

Medibank Private

Ltd

3.27 0.93% Due to overall market

performance

TPG Telecom Ltd 6.36 9.66% Due to market trend

James Hardie

Industries plc

21.94 1.86% Due to market trend

Fletcher Building

Limited

6.57 3.30% Due to market trend

Week 6 (15-December-2017)

Name of the

company

Stock price at

end of the week

Percentage change

in stock price

Primary reason

Medibank Private

Ltd

3.26 -0.31% Due to overall market

performance

TPG Telecom Ltd 6.44 1.26% Due to market trend

James Hardie

Industries plc

22 0.27% Due to market trend

Fletcher Building

Limited

6.89 4.87% Due to market trend

Week 7 (5-January-2018)

Name of the

company

Stock price at

end of the week

Percentage change

in stock price

Primary reason

Medibank Private

Ltd

3.24 -0.61% Due to overall market

performance

TPG Telecom Ltd 6.73 4.50% Due to market trend

James Hardie 22.62 2.82% US tax cut to increase

INTERNATIONAL FINANCE

5

Industries plc earnings of ASX stocks

Fletcher Building

Limited

7.07 2.61% Due to market trend

Week 8 (12-January-2018)

Name of the

company

Stock price at

end of the week

Percentage change

in stock price

Primary reason

Medibank Private

Ltd

3.19 -1.54% Due to overall market

performance

TPG Telecom Ltd 6.57 -2.38% Due to overall market

performance

James Hardie

Industries plc

21.55 -4.73% Estimation of AUD fall

againt USD

Fletcher Building

Limited

6.97 -1.41% Due to overall market

performance

Week 9 (19-January-2018)

Name of the

company

Stock price at

end of the week

Percentage change

in stock price

Primary reason

Medibank Private

Ltd

3.25 1.88% Due to overall market

performance

TPG Telecom Ltd 6.43 -2.13% Due to overall market

performance

James Hardie

Industries plc

21.45 -0.46% Due to overall market

performance

Fletcher Building 6.89 -1.15% Due to overall market

5

Industries plc earnings of ASX stocks

Fletcher Building

Limited

7.07 2.61% Due to market trend

Week 8 (12-January-2018)

Name of the

company

Stock price at

end of the week

Percentage change

in stock price

Primary reason

Medibank Private

Ltd

3.19 -1.54% Due to overall market

performance

TPG Telecom Ltd 6.57 -2.38% Due to overall market

performance

James Hardie

Industries plc

21.55 -4.73% Estimation of AUD fall

againt USD

Fletcher Building

Limited

6.97 -1.41% Due to overall market

performance

Week 9 (19-January-2018)

Name of the

company

Stock price at

end of the week

Percentage change

in stock price

Primary reason

Medibank Private

Ltd

3.25 1.88% Due to overall market

performance

TPG Telecom Ltd 6.43 -2.13% Due to overall market

performance

James Hardie

Industries plc

21.45 -0.46% Due to overall market

performance

Fletcher Building 6.89 -1.15% Due to overall market

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTERNATIONAL FINANCE

6

Limited performance

Week 10 (26-January-2018)

Name of the

company

Stock price at

end of the week

Percentage change

in stock price

Primary reason

Medibank Private

Ltd

3.31 1.85% Due to overall market

performance

TPG Telecom Ltd 6.28 -2.33% Due to overall market

performance

James Hardie

Industries plc

21.26 -0.89% Due to overall market

performance

Fletcher Building

Limited

6.85 -0.58% Due to overall market

performance

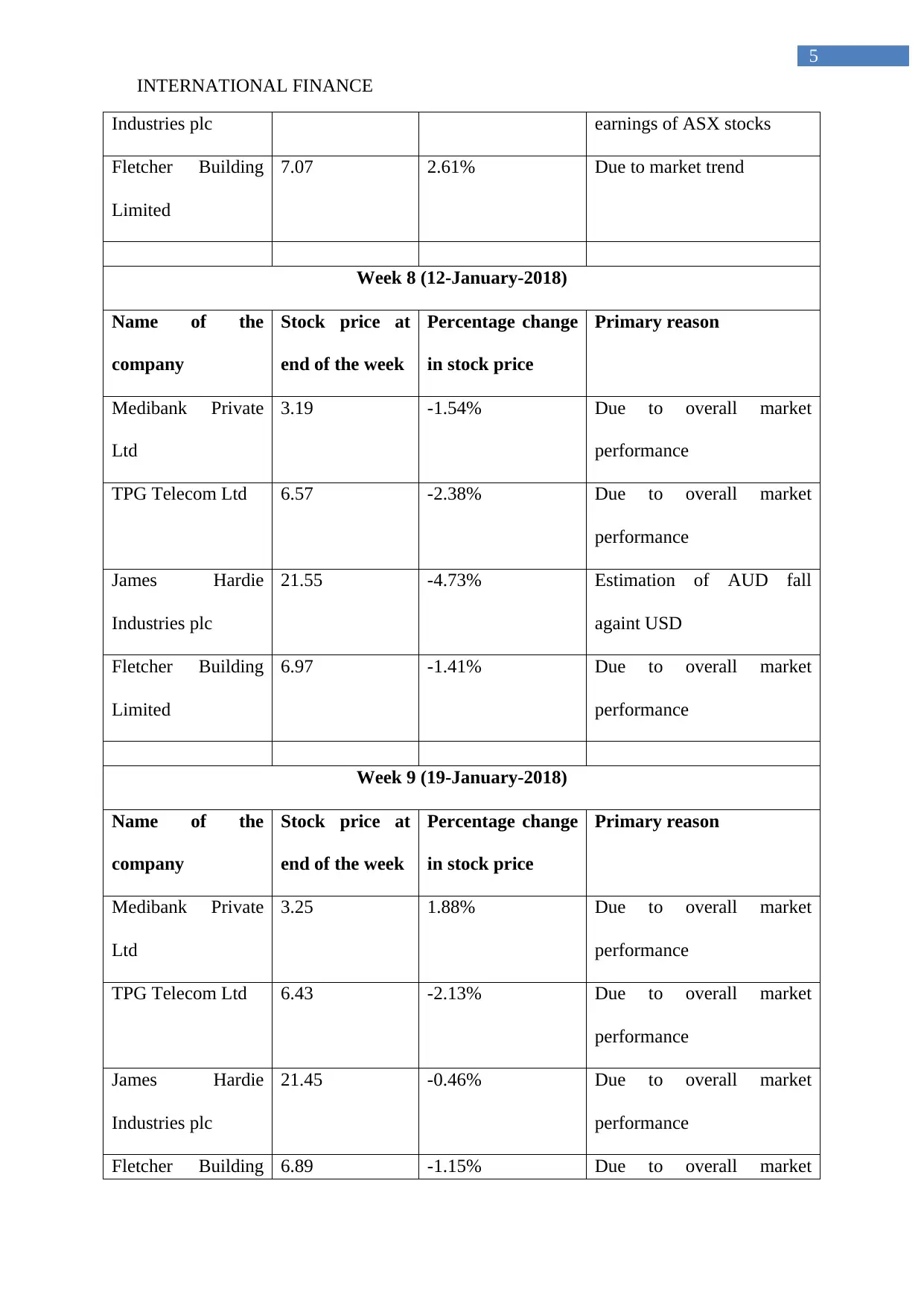

1.b Evaluating the performance of portfolio with other students:

Stock Purchase price Current price Return

Medibank Private Ltd 3.22 3.31 2.80%

TPG Telecom Ltd 5.8 6.28 8.28%

James Hardie Industries plc 21.14 21.26 0.57%

Fletcher Building Limited 6.3 6.85 8.73%

Total Returns from the portfolio 20.37%

The above table mainly represent the overall returns that is provided from the created

portfolio, which is at the levels of 20.37%. This relevant increment in the overall return is

6

Limited performance

Week 10 (26-January-2018)

Name of the

company

Stock price at

end of the week

Percentage change

in stock price

Primary reason

Medibank Private

Ltd

3.31 1.85% Due to overall market

performance

TPG Telecom Ltd 6.28 -2.33% Due to overall market

performance

James Hardie

Industries plc

21.26 -0.89% Due to overall market

performance

Fletcher Building

Limited

6.85 -0.58% Due to overall market

performance

1.b Evaluating the performance of portfolio with other students:

Stock Purchase price Current price Return

Medibank Private Ltd 3.22 3.31 2.80%

TPG Telecom Ltd 5.8 6.28 8.28%

James Hardie Industries plc 21.14 21.26 0.57%

Fletcher Building Limited 6.3 6.85 8.73%

Total Returns from the portfolio 20.37%

The above table mainly represent the overall returns that is provided from the created

portfolio, which is at the levels of 20.37%. This relevant increment in the overall return is

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INTERNATIONAL FINANCE

7

mainly generated from selection of adequate stock, which is presented in the portfolio. After

the comparison with the portfolio of other students the actual returns were not adequate, as

one of the portfolio provided a return of 171.22%. This extraordinary return provided during

the investment period was mainly due to the changes in industry, which was adopted by the

portfolio. The performance of the portfolio was mainly based on the markets in which the

company is performing, while no specific reason is based on company-specific conditions

(Kim, Maurer and Mitchell 2016).

2. Stating whether the performance of each Australian based MNC is driven by

Australian Market:

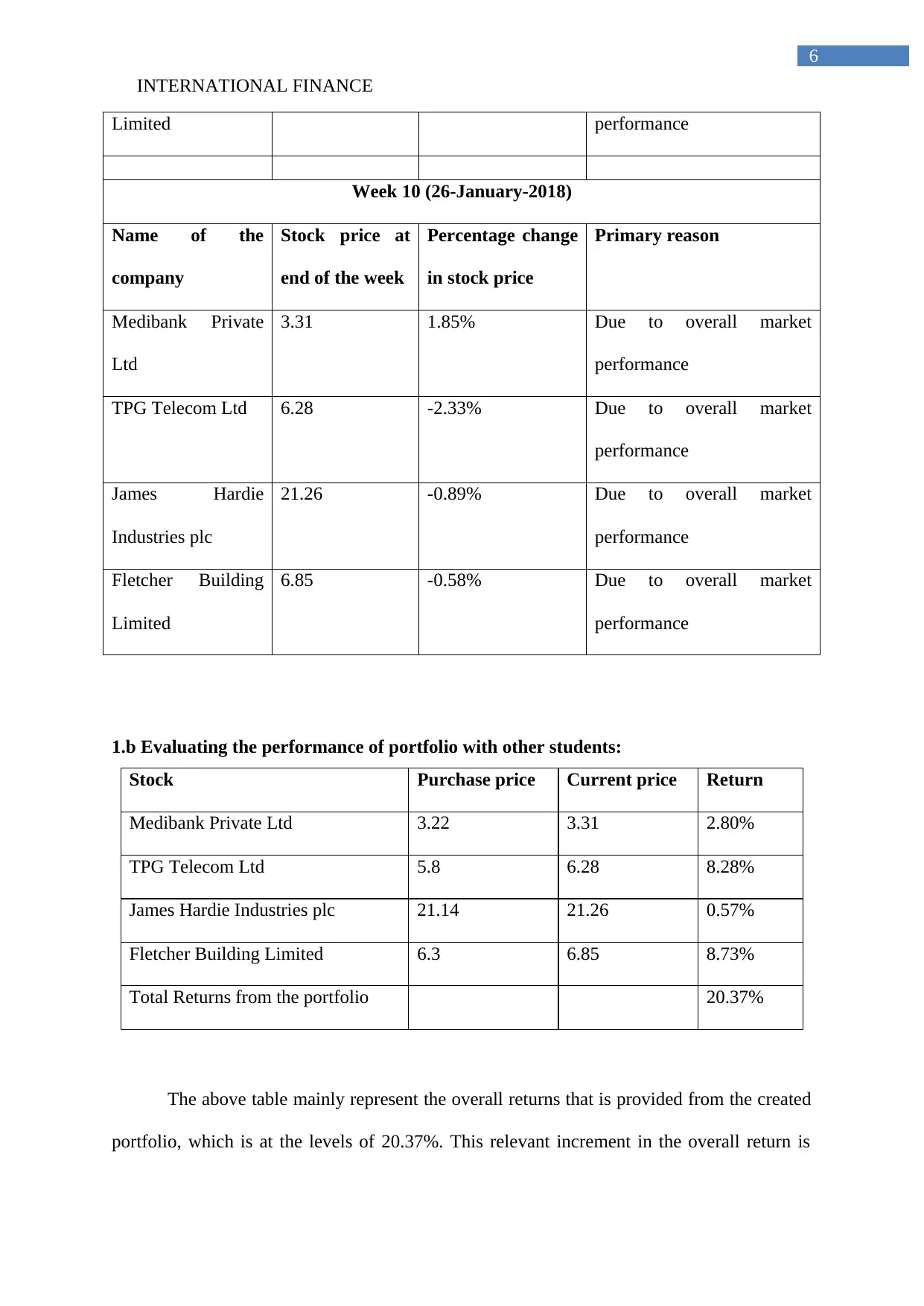

Figure 1: Stating the performance of Australian company with ASX

(Source: Au.finance.yahoo.com 2018)

The figure depicts the overall performance of MPL against the ASX market, which

indicates that the company has been outperforming the market and providing higher returns.

The performance of the organisation is relatively in lieu with the market, which indicates the

overall returns that is generated by the organisation. This indicates that the return of 15.33%

is provided by MPL, while the market is generating return of 4.97%.

7

mainly generated from selection of adequate stock, which is presented in the portfolio. After

the comparison with the portfolio of other students the actual returns were not adequate, as

one of the portfolio provided a return of 171.22%. This extraordinary return provided during

the investment period was mainly due to the changes in industry, which was adopted by the

portfolio. The performance of the portfolio was mainly based on the markets in which the

company is performing, while no specific reason is based on company-specific conditions

(Kim, Maurer and Mitchell 2016).

2. Stating whether the performance of each Australian based MNC is driven by

Australian Market:

Figure 1: Stating the performance of Australian company with ASX

(Source: Au.finance.yahoo.com 2018)

The figure depicts the overall performance of MPL against the ASX market, which

indicates that the company has been outperforming the market and providing higher returns.

The performance of the organisation is relatively in lieu with the market, which indicates the

overall returns that is generated by the organisation. This indicates that the return of 15.33%

is provided by MPL, while the market is generating return of 4.97%.

INTERNATIONAL FINANCE

8

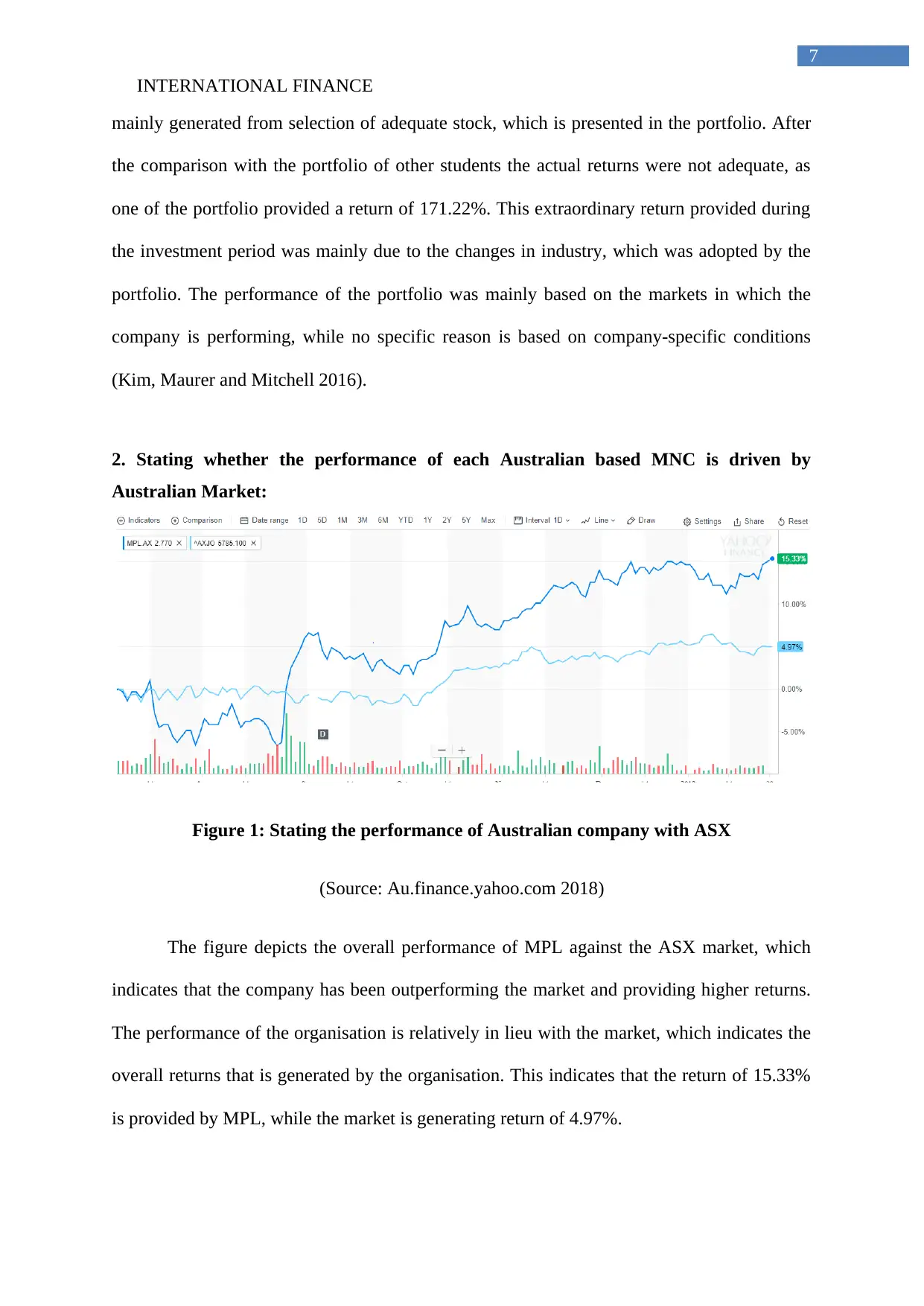

Figure 2: Stating the performance of Australian company with ASX

(Source: Au.finance.yahoo.com 2018)

The organisation has performed exponentially in comparison with the Australian

index, which could be identified from the above figure. The company has been outperforming

the market and providing higher returns to the investors (Kotsantonis, Pinney and Serafeim

2016). The evaluation also indicates that the return of 13.7% is provided by TPM, while the

market is only generating a return of 4.97%.

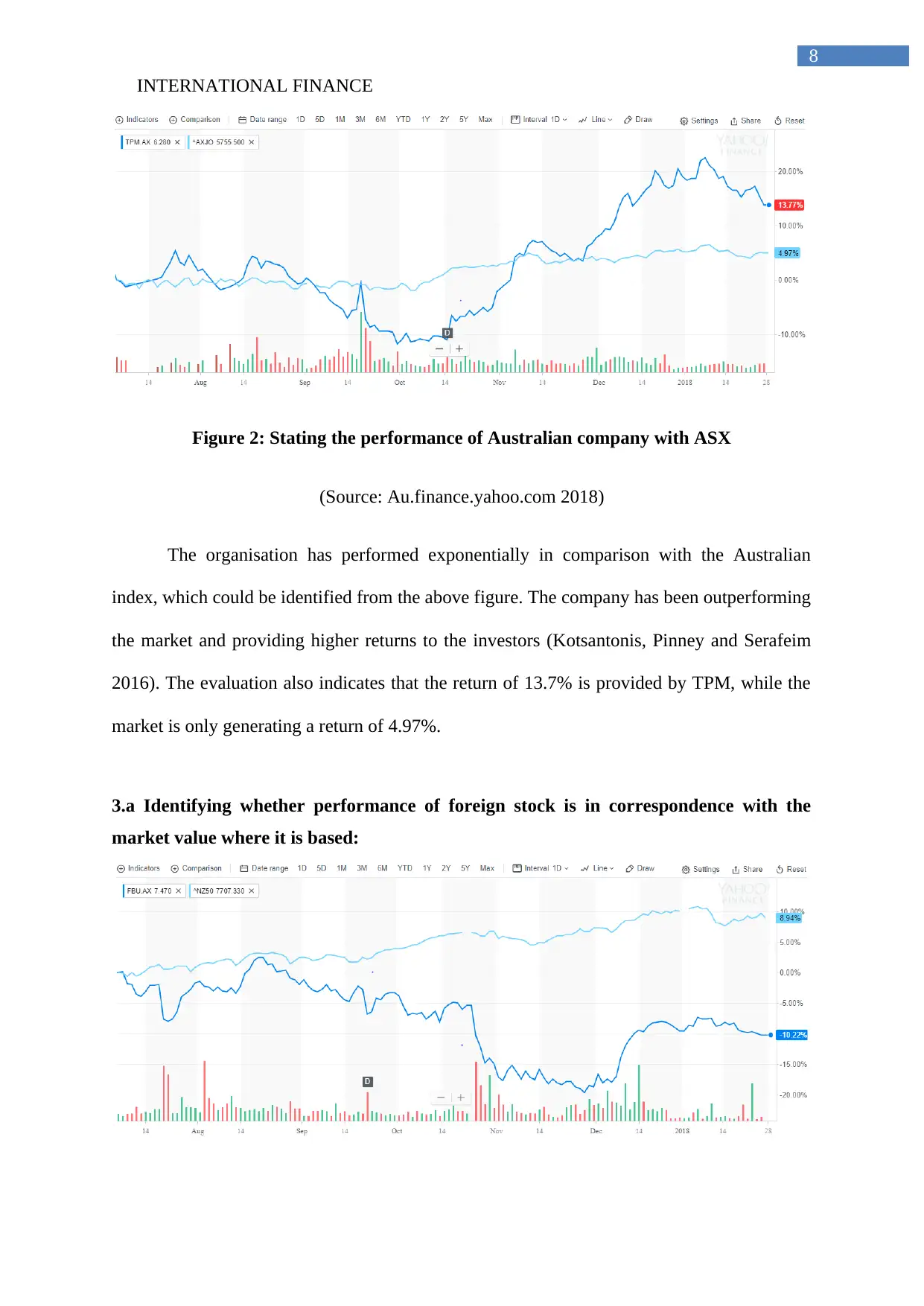

3.a Identifying whether performance of foreign stock is in correspondence with the

market value where it is based:

8

Figure 2: Stating the performance of Australian company with ASX

(Source: Au.finance.yahoo.com 2018)

The organisation has performed exponentially in comparison with the Australian

index, which could be identified from the above figure. The company has been outperforming

the market and providing higher returns to the investors (Kotsantonis, Pinney and Serafeim

2016). The evaluation also indicates that the return of 13.7% is provided by TPM, while the

market is only generating a return of 4.97%.

3.a Identifying whether performance of foreign stock is in correspondence with the

market value where it is based:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTERNATIONAL FINANCE

9

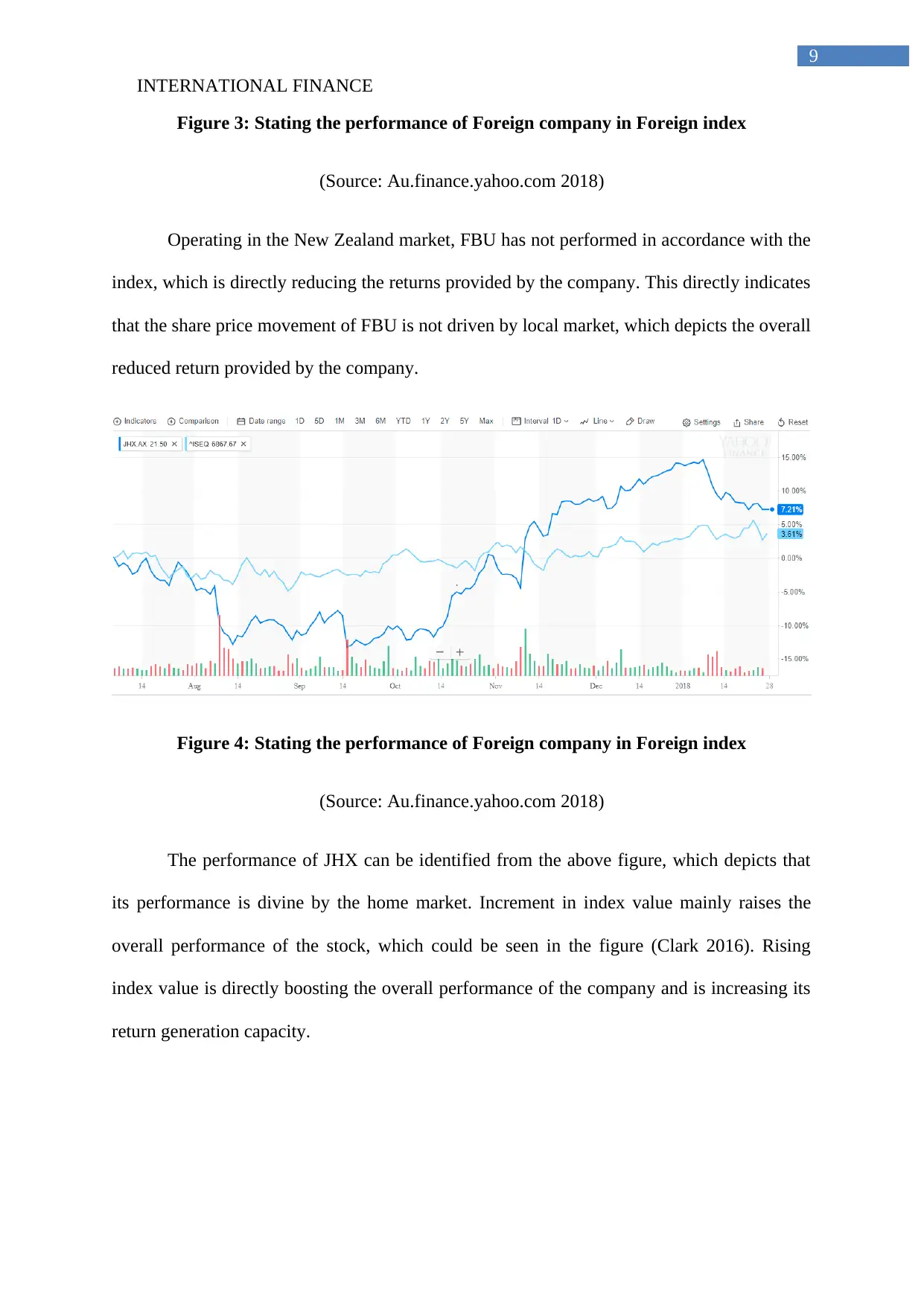

Figure 3: Stating the performance of Foreign company in Foreign index

(Source: Au.finance.yahoo.com 2018)

Operating in the New Zealand market, FBU has not performed in accordance with the

index, which is directly reducing the returns provided by the company. This directly indicates

that the share price movement of FBU is not driven by local market, which depicts the overall

reduced return provided by the company.

Figure 4: Stating the performance of Foreign company in Foreign index

(Source: Au.finance.yahoo.com 2018)

The performance of JHX can be identified from the above figure, which depicts that

its performance is divine by the home market. Increment in index value mainly raises the

overall performance of the stock, which could be seen in the figure (Clark 2016). Rising

index value is directly boosting the overall performance of the company and is increasing its

return generation capacity.

9

Figure 3: Stating the performance of Foreign company in Foreign index

(Source: Au.finance.yahoo.com 2018)

Operating in the New Zealand market, FBU has not performed in accordance with the

index, which is directly reducing the returns provided by the company. This directly indicates

that the share price movement of FBU is not driven by local market, which depicts the overall

reduced return provided by the company.

Figure 4: Stating the performance of Foreign company in Foreign index

(Source: Au.finance.yahoo.com 2018)

The performance of JHX can be identified from the above figure, which depicts that

its performance is divine by the home market. Increment in index value mainly raises the

overall performance of the stock, which could be seen in the figure (Clark 2016). Rising

index value is directly boosting the overall performance of the company and is increasing its

return generation capacity.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INTERNATIONAL FINANCE

10

3.b Understanding whether the foreign stock prices are highly correlated:

Figure 5: Detecting correlation of two foreign stock

(Source: Au.finance.yahoo.com 2018)

From the evaluation of above figure both the stocks are identified to be inversely

correlated, where performance increment in one stock value is directly reducing value of

other stock. This indicates that both the stocks are highly inversely correlated, which could be

used by the investors in hedging its portfolio.

3.c Identifying whether performance of foreign stock is better than Australian stock:

Figure 6: Detecting Foreign stock with Australian index

10

3.b Understanding whether the foreign stock prices are highly correlated:

Figure 5: Detecting correlation of two foreign stock

(Source: Au.finance.yahoo.com 2018)

From the evaluation of above figure both the stocks are identified to be inversely

correlated, where performance increment in one stock value is directly reducing value of

other stock. This indicates that both the stocks are highly inversely correlated, which could be

used by the investors in hedging its portfolio.

3.c Identifying whether performance of foreign stock is better than Australian stock:

Figure 6: Detecting Foreign stock with Australian index

INTERNATIONAL FINANCE

11

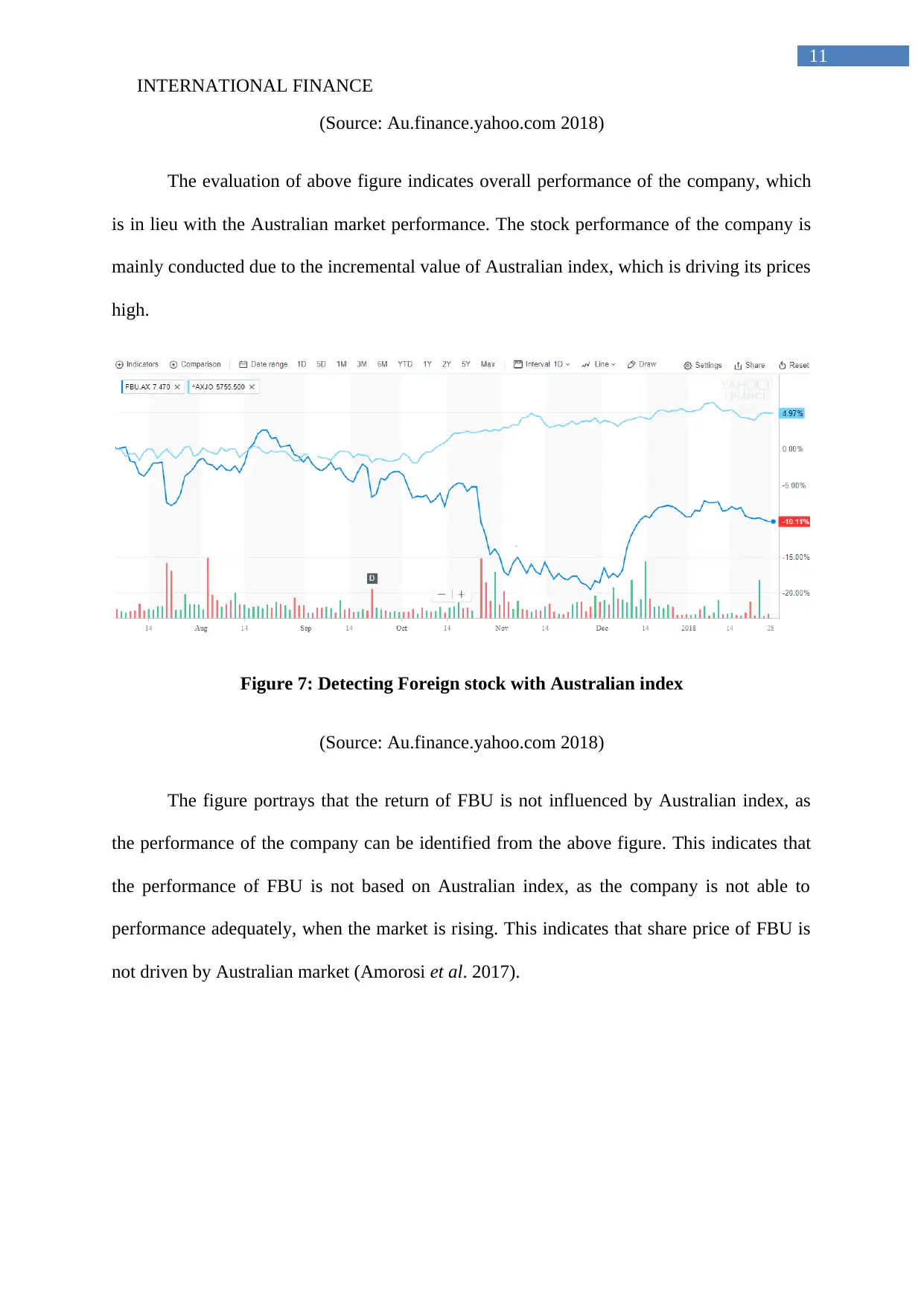

(Source: Au.finance.yahoo.com 2018)

The evaluation of above figure indicates overall performance of the company, which

is in lieu with the Australian market performance. The stock performance of the company is

mainly conducted due to the incremental value of Australian index, which is driving its prices

high.

Figure 7: Detecting Foreign stock with Australian index

(Source: Au.finance.yahoo.com 2018)

The figure portrays that the return of FBU is not influenced by Australian index, as

the performance of the company can be identified from the above figure. This indicates that

the performance of FBU is not based on Australian index, as the company is not able to

performance adequately, when the market is rising. This indicates that share price of FBU is

not driven by Australian market (Amorosi et al. 2017).

11

(Source: Au.finance.yahoo.com 2018)

The evaluation of above figure indicates overall performance of the company, which

is in lieu with the Australian market performance. The stock performance of the company is

mainly conducted due to the incremental value of Australian index, which is driving its prices

high.

Figure 7: Detecting Foreign stock with Australian index

(Source: Au.finance.yahoo.com 2018)

The figure portrays that the return of FBU is not influenced by Australian index, as

the performance of the company can be identified from the above figure. This indicates that

the performance of FBU is not based on Australian index, as the company is not able to

performance adequately, when the market is rising. This indicates that share price of FBU is

not driven by Australian market (Amorosi et al. 2017).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.