International Finance Reflective Essay: Finance Module Assessment

VerifiedAdded on 2020/06/03

|11

|2510

|107

Essay

AI Summary

This reflective essay delves into the core concepts of international finance, drawing upon knowledge gained from the first six weeks of lectures. It examines the importance of international finance management, its components, and the associated risks, including foreign economies and exchange rate movements. The essay explores the concepts of absolute and comparative advantage, illustrating them with examples, and differentiates between future and forward contracts, highlighting their operational aspects and regulatory differences. Furthermore, the essay analyzes the US balance of trade in relation to a stronger dollar, assesses the accuracy of related statements, and explores the effects of the J-curve phenomenon on the economy. The essay concludes by synthesizing these concepts and their implications for economic environments in various countries, referencing key economic terms such as floating exchange rates and trade deficits.

INTERNATIONAL

FINANCE

REFLECTIVE ESSAY

FINANCE

REFLECTIVE ESSAY

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

Question 1........................................................................................................................................3

Question 2........................................................................................................................................3

Question 3........................................................................................................................................6

Question 4........................................................................................................................................8

a) The US balance trade will be enlarged in consideration with the stronger dollar..................8

b) Analysing the accuracy of the statement................................................................................8

c) Analysing the effects of J-curve in the economy....................................................................9

REFERENCES..............................................................................................................................10

Question 1........................................................................................................................................3

Question 2........................................................................................................................................3

Question 3........................................................................................................................................6

Question 4........................................................................................................................................8

a) The US balance trade will be enlarged in consideration with the stronger dollar..................8

b) Analysing the accuracy of the statement................................................................................8

c) Analysing the effects of J-curve in the economy....................................................................9

REFERENCES..............................................................................................................................10

INTRODUCTION

To have the sustainable growth in the trade and finance there will be requirement of

adequate amount of funds as well as record of all the transactions which held during the year.

However, it the present report there will be discussion based on the first 6 weeks of the lectures

and the knowledge gain through it as well as evaluating the advantages and disadvantages of

absolute and comparative advantages. The report will also highlight difference between future

and forward contracts as well as trade deficit balance in US to strengthen the dollar value. There

will be analysis of various economic terms such as Floating exchange rates and J-curve effect

over the nation's economy.

Question 1

First six weeks of the lectures provided me with bundle of knowledge about international

finance and its components. Maximising shareholder health is the main goal of multinational

corporations but in order to achieve this goal they have to face many conflicts like agency

problem, difference between shareholders and managers, etc. thus, international finance

management is essential (Miller, 2016). This provides exposure to the international risk that

includes foreign economy, political risk and exchange rate movement (Gorton and Winton,

2016). International flow of funds, international financial market and exchange rate

determination are the major components of international finance that includes balance of

payments, current accounts, capital or financial accounts, etc. It also studied about the factors

that affect international trade such as impact of inflation, national income and government

restrictions. Further I got knowledge about currency call options and currency put options.

Currency call options provides right to the buyer while, currency put provides right to the seller

to make transactions as per their requirements (Bocola and et.al., 2016). From the lectures it is

also learned that a weak currency is just not a solution to deficit in balance of trade. Knowledge

about various types of international market was also provided. The effect of international

arbitrage and interest rate parity was also learned.

Question 2

Absolute advantage and comparative advantage are two of the main concepts in the

theories of international trade that helps in describing why limited resources are used by the

countries to produce a particular type of goods.

To have the sustainable growth in the trade and finance there will be requirement of

adequate amount of funds as well as record of all the transactions which held during the year.

However, it the present report there will be discussion based on the first 6 weeks of the lectures

and the knowledge gain through it as well as evaluating the advantages and disadvantages of

absolute and comparative advantages. The report will also highlight difference between future

and forward contracts as well as trade deficit balance in US to strengthen the dollar value. There

will be analysis of various economic terms such as Floating exchange rates and J-curve effect

over the nation's economy.

Question 1

First six weeks of the lectures provided me with bundle of knowledge about international

finance and its components. Maximising shareholder health is the main goal of multinational

corporations but in order to achieve this goal they have to face many conflicts like agency

problem, difference between shareholders and managers, etc. thus, international finance

management is essential (Miller, 2016). This provides exposure to the international risk that

includes foreign economy, political risk and exchange rate movement (Gorton and Winton,

2016). International flow of funds, international financial market and exchange rate

determination are the major components of international finance that includes balance of

payments, current accounts, capital or financial accounts, etc. It also studied about the factors

that affect international trade such as impact of inflation, national income and government

restrictions. Further I got knowledge about currency call options and currency put options.

Currency call options provides right to the buyer while, currency put provides right to the seller

to make transactions as per their requirements (Bocola and et.al., 2016). From the lectures it is

also learned that a weak currency is just not a solution to deficit in balance of trade. Knowledge

about various types of international market was also provided. The effect of international

arbitrage and interest rate parity was also learned.

Question 2

Absolute advantage and comparative advantage are two of the main concepts in the

theories of international trade that helps in describing why limited resources are used by the

countries to produce a particular type of goods.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Absolute Advantage: It is the principle of economics that refers to the ability of a country

to produce a good using fewer resources than the other country producing same goods. Initially

in the context of international trade, the concept of absolute advantage was described by Adam

Smith, who used labour as the only input factor (Eichenbaum, Johannsen and Rebelo, 2017). In

simple words absolute advantage is something that describes the ability of an individual, group

or country to carry out an economic activity such as production of a particular type of good more

efficiently than the other individual, group or country.

Comparative advantage: A country has a comparative advantage if it has an ability to

produce a particular type of good with low opportunity cost than the other country. This means a

country has an ability to produce a good relatively cheaper than other countries. There would be

greater economic welfare to a country if it specialises in producing a good with lower

opportunity cost (Berger, Bouwman and Kim, 2017). David Ricardo firstly described the theory

of comparative advantage in his book “On the Principles of Political Economy and Taxation” in

year 1817. For example country 'A' uses its resources to produce a good 'X', these resources then

it cannot use to produce good 'Y', then the resources used to produce good 'X' will be the

opportunity cost to produce good 'Y' for country 'A'.

Numerical example of absolute advantage and comparative advantage

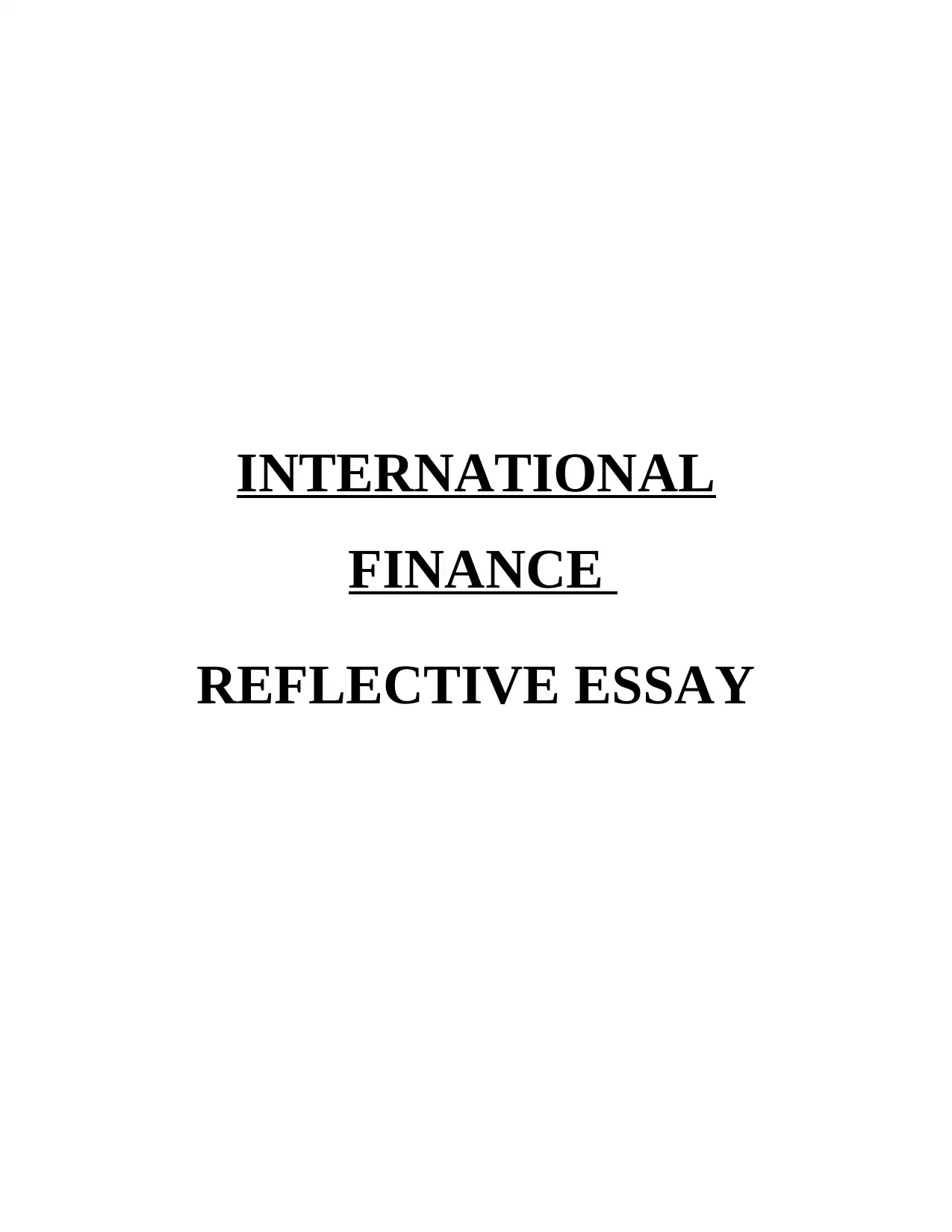

Using a hypothetical example by taking two countries, Saudi Arabia and USA which will

be compared as per their level of production in different operational activities which are shown

in the below listed tables and graphs (Pate and Scullion, 2017).

Illustration 1: Example of absolute advantages

Source: (Absolute and Comparative Advantage, 2017)

to produce a good using fewer resources than the other country producing same goods. Initially

in the context of international trade, the concept of absolute advantage was described by Adam

Smith, who used labour as the only input factor (Eichenbaum, Johannsen and Rebelo, 2017). In

simple words absolute advantage is something that describes the ability of an individual, group

or country to carry out an economic activity such as production of a particular type of good more

efficiently than the other individual, group or country.

Comparative advantage: A country has a comparative advantage if it has an ability to

produce a particular type of good with low opportunity cost than the other country. This means a

country has an ability to produce a good relatively cheaper than other countries. There would be

greater economic welfare to a country if it specialises in producing a good with lower

opportunity cost (Berger, Bouwman and Kim, 2017). David Ricardo firstly described the theory

of comparative advantage in his book “On the Principles of Political Economy and Taxation” in

year 1817. For example country 'A' uses its resources to produce a good 'X', these resources then

it cannot use to produce good 'Y', then the resources used to produce good 'X' will be the

opportunity cost to produce good 'Y' for country 'A'.

Numerical example of absolute advantage and comparative advantage

Using a hypothetical example by taking two countries, Saudi Arabia and USA which will

be compared as per their level of production in different operational activities which are shown

in the below listed tables and graphs (Pate and Scullion, 2017).

Illustration 1: Example of absolute advantages

Source: (Absolute and Comparative Advantage, 2017)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Interpretation: On the basis of above listed table it can be said that, there has been

variations in the numbers of barrels and the production made by these countries. Hence, as per

the Absolute advantages USA will be beneficial dealings. However, such analysis were made on

variations in the numbers of barrels and the production made by these countries. Hence, as per

the Absolute advantages USA will be beneficial dealings. However, such analysis were made on

the basis of the valid reason such as USA has higher productivity rate as well ass the country is

making adequate profitability in context with facilitating the sales. Thus, in accordance with the

production before trade Saudi Arabia have production of Oil for 60 barrels and corn at 10 barrels

while in context with US which has the oil production for 20 barrels and 70 barrels for corn

production.

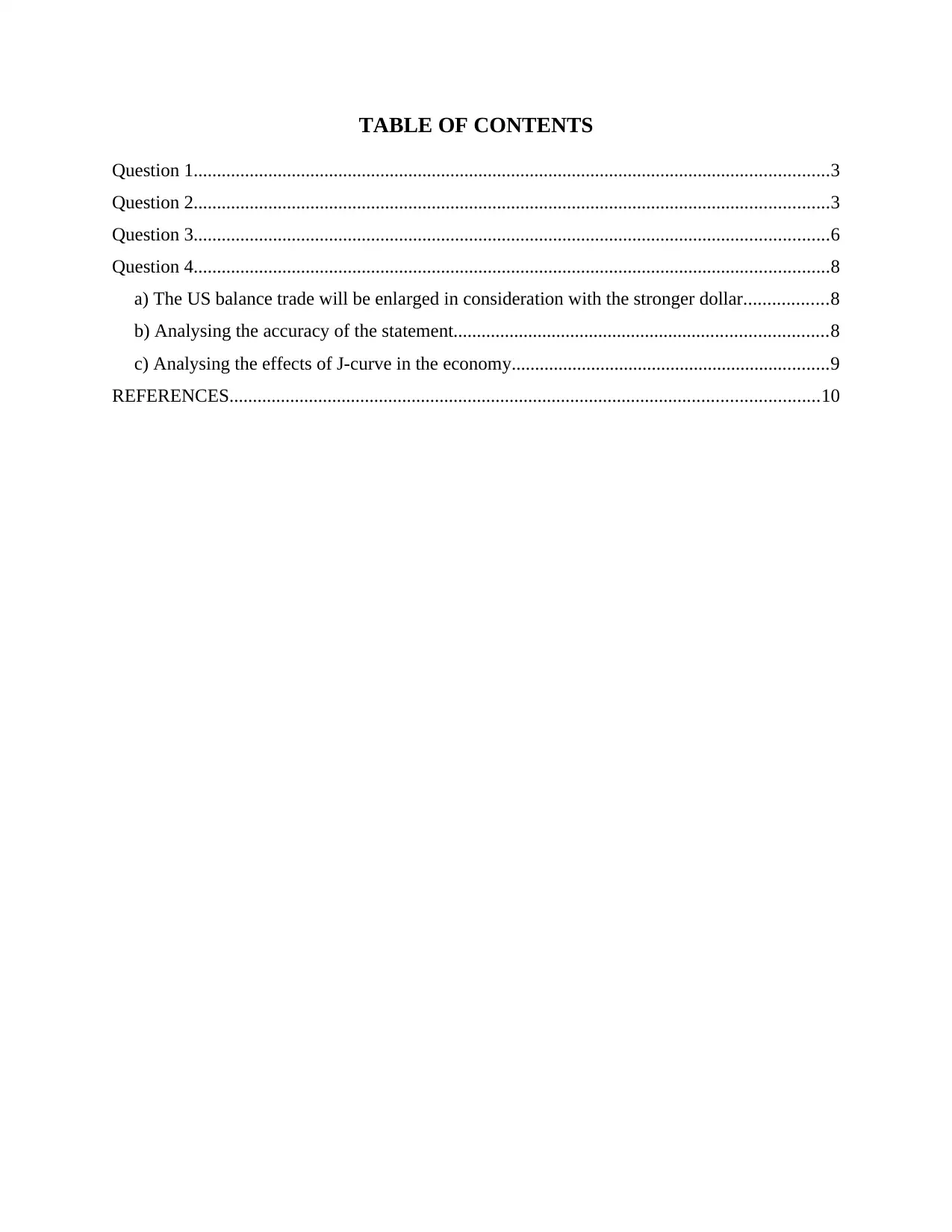

Comparative advantages:

Interpretation: By considering the above listed table which indicates the portion of the

production made by both the countries. Hence, Saudi Arabia I has 1/4th of the production in Oil

manufacturing as well as in the corn production the which is 4 time lower than the oil

production. On the other side USA is 2 time better than oil production as per oil production and

1/2nd time better in corm production than oil production. Hence, it can be said that the availability

of the resources will affect the production process per hour.

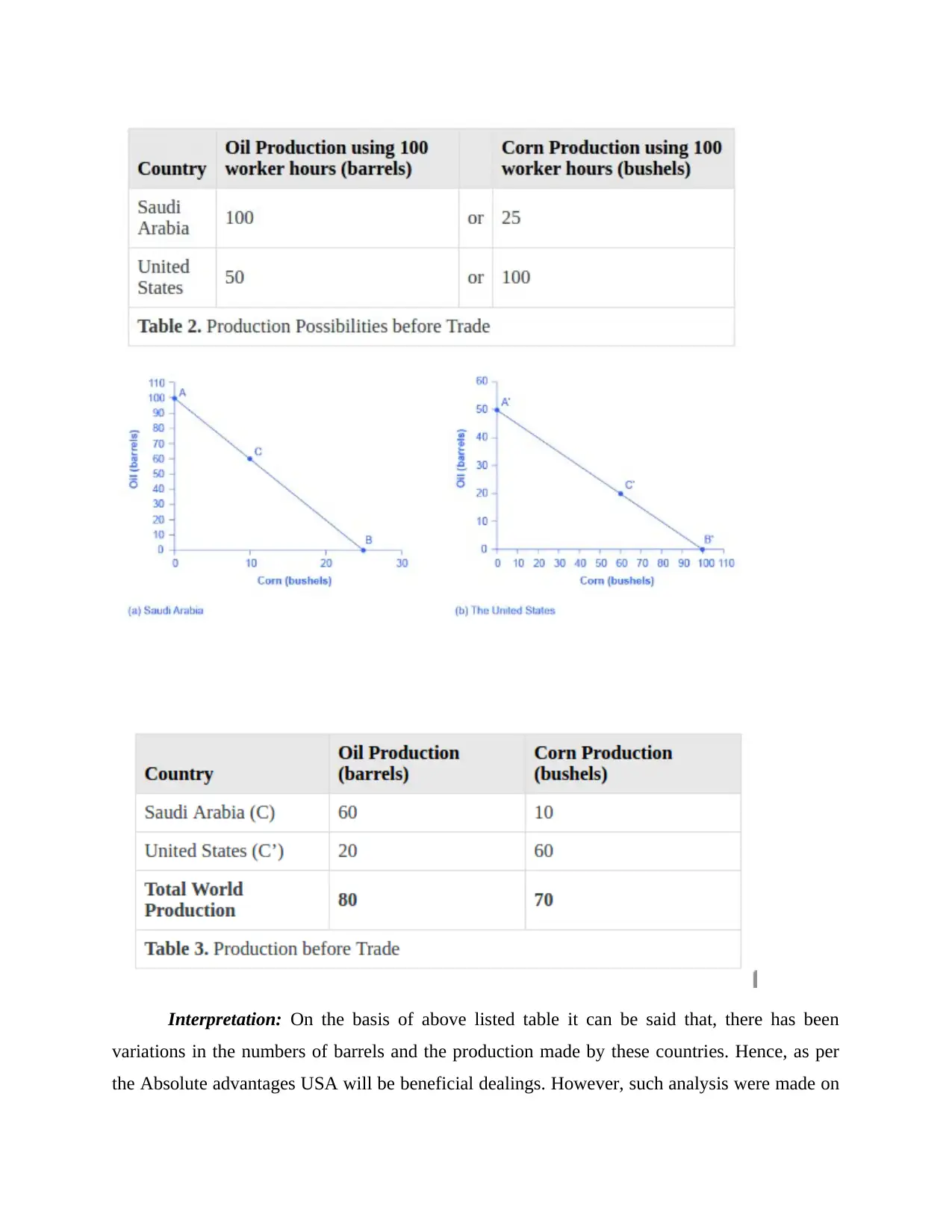

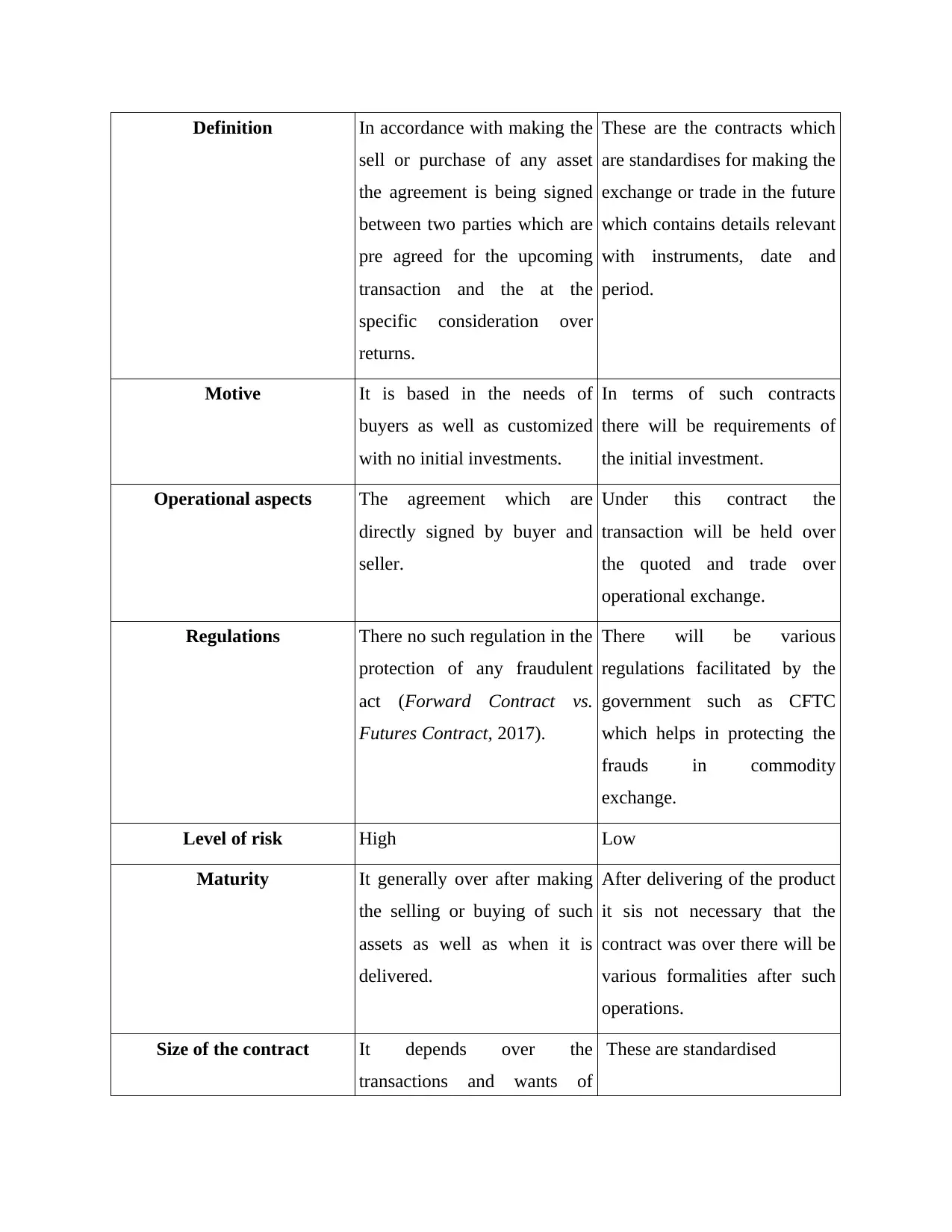

Question 3

Future band Forward methods of contracts are different from each other. Hence, in the

Future contracts there will be influence of various laws and regulations which in turn fruitful for

the parties who are involved in agreement while in Forward agreements these are totally opposite

from each other (Barnaby and Russell, 2016). By considering the differences between future and

forward contracts there has been several variations in both the terms which will be understand as

per the below listed table

Basis Forward Future

making adequate profitability in context with facilitating the sales. Thus, in accordance with the

production before trade Saudi Arabia have production of Oil for 60 barrels and corn at 10 barrels

while in context with US which has the oil production for 20 barrels and 70 barrels for corn

production.

Comparative advantages:

Interpretation: By considering the above listed table which indicates the portion of the

production made by both the countries. Hence, Saudi Arabia I has 1/4th of the production in Oil

manufacturing as well as in the corn production the which is 4 time lower than the oil

production. On the other side USA is 2 time better than oil production as per oil production and

1/2nd time better in corm production than oil production. Hence, it can be said that the availability

of the resources will affect the production process per hour.

Question 3

Future band Forward methods of contracts are different from each other. Hence, in the

Future contracts there will be influence of various laws and regulations which in turn fruitful for

the parties who are involved in agreement while in Forward agreements these are totally opposite

from each other (Barnaby and Russell, 2016). By considering the differences between future and

forward contracts there has been several variations in both the terms which will be understand as

per the below listed table

Basis Forward Future

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Definition In accordance with making the

sell or purchase of any asset

the agreement is being signed

between two parties which are

pre agreed for the upcoming

transaction and the at the

specific consideration over

returns.

These are the contracts which

are standardises for making the

exchange or trade in the future

which contains details relevant

with instruments, date and

period.

Motive It is based in the needs of

buyers as well as customized

with no initial investments.

In terms of such contracts

there will be requirements of

the initial investment.

Operational aspects The agreement which are

directly signed by buyer and

seller.

Under this contract the

transaction will be held over

the quoted and trade over

operational exchange.

Regulations There no such regulation in the

protection of any fraudulent

act (Forward Contract vs.

Futures Contract, 2017).

There will be various

regulations facilitated by the

government such as CFTC

which helps in protecting the

frauds in commodity

exchange.

Level of risk High Low

Maturity It generally over after making

the selling or buying of such

assets as well as when it is

delivered.

After delivering of the product

it sis not necessary that the

contract was over there will be

various formalities after such

operations.

Size of the contract It depends over the

transactions and wants of

These are standardised

sell or purchase of any asset

the agreement is being signed

between two parties which are

pre agreed for the upcoming

transaction and the at the

specific consideration over

returns.

These are the contracts which

are standardises for making the

exchange or trade in the future

which contains details relevant

with instruments, date and

period.

Motive It is based in the needs of

buyers as well as customized

with no initial investments.

In terms of such contracts

there will be requirements of

the initial investment.

Operational aspects The agreement which are

directly signed by buyer and

seller.

Under this contract the

transaction will be held over

the quoted and trade over

operational exchange.

Regulations There no such regulation in the

protection of any fraudulent

act (Forward Contract vs.

Futures Contract, 2017).

There will be various

regulations facilitated by the

government such as CFTC

which helps in protecting the

frauds in commodity

exchange.

Level of risk High Low

Maturity It generally over after making

the selling or buying of such

assets as well as when it is

delivered.

After delivering of the product

it sis not necessary that the

contract was over there will be

various formalities after such

operations.

Size of the contract It depends over the

transactions and wants of

These are standardised

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

contracting individuals.

Question 4

a) The US balance trade will be enlarged in consideration with the stronger dollar

In terms of making the improvements in the US dollars there is need to expand the

exports in compare with the level of imports made during a period. Hence, it can be said that

there is need to make improvements in the EXIM policy of country as well as reducing the rated

over exporting a material, product or services (Alessandria and Choi, 2016). Hence, it can be

said that such reforms will help in enhancing the GDP rate of the country as well as helps in

enhancing the currency rates in international market. However, it can be said that the balance or

trade will be over the favourable scale than there will be fruitful changes in the currency rates

and the current accounts of USA. Hence, it can be said that there is need to enhance the currency

rates which will be due to increase in the domestic production as well as rise in the economy of

small scale industry which in turn motivate them to make the expansion in their operational

aspects.

b) Analysing the accuracy of the statement

In accordance with the exchange rates, currency rates and the net sale obtained by the

country there will be variations in their current accounts and the rates of the currencies. Hence,

such impacts will lower down the currency value of such nation. Thus, it can be said that the

statements is true and total lies with the condition that the reduction in the currency will

eventually reduce the demands for such imported goods and supply as well as there will be

increase in the level or volume or exports (Komar, Uniiat and Lutsiv, 2016). However, it can be

said that the changes will help in enhancing the level of domestic production as well as beneficial

for the small industries. Thus, if the level of the small scale business is improved than the

national economy will be beneficial in making having the stable currency rates as well as they

will be less depended over the imports of any commodity.

Question 4

a) The US balance trade will be enlarged in consideration with the stronger dollar

In terms of making the improvements in the US dollars there is need to expand the

exports in compare with the level of imports made during a period. Hence, it can be said that

there is need to make improvements in the EXIM policy of country as well as reducing the rated

over exporting a material, product or services (Alessandria and Choi, 2016). Hence, it can be

said that such reforms will help in enhancing the GDP rate of the country as well as helps in

enhancing the currency rates in international market. However, it can be said that the balance or

trade will be over the favourable scale than there will be fruitful changes in the currency rates

and the current accounts of USA. Hence, it can be said that there is need to enhance the currency

rates which will be due to increase in the domestic production as well as rise in the economy of

small scale industry which in turn motivate them to make the expansion in their operational

aspects.

b) Analysing the accuracy of the statement

In accordance with the exchange rates, currency rates and the net sale obtained by the

country there will be variations in their current accounts and the rates of the currencies. Hence,

such impacts will lower down the currency value of such nation. Thus, it can be said that the

statements is true and total lies with the condition that the reduction in the currency will

eventually reduce the demands for such imported goods and supply as well as there will be

increase in the level or volume or exports (Komar, Uniiat and Lutsiv, 2016). However, it can be

said that the changes will help in enhancing the level of domestic production as well as beneficial

for the small industries. Thus, if the level of the small scale business is improved than the

national economy will be beneficial in making having the stable currency rates as well as they

will be less depended over the imports of any commodity.

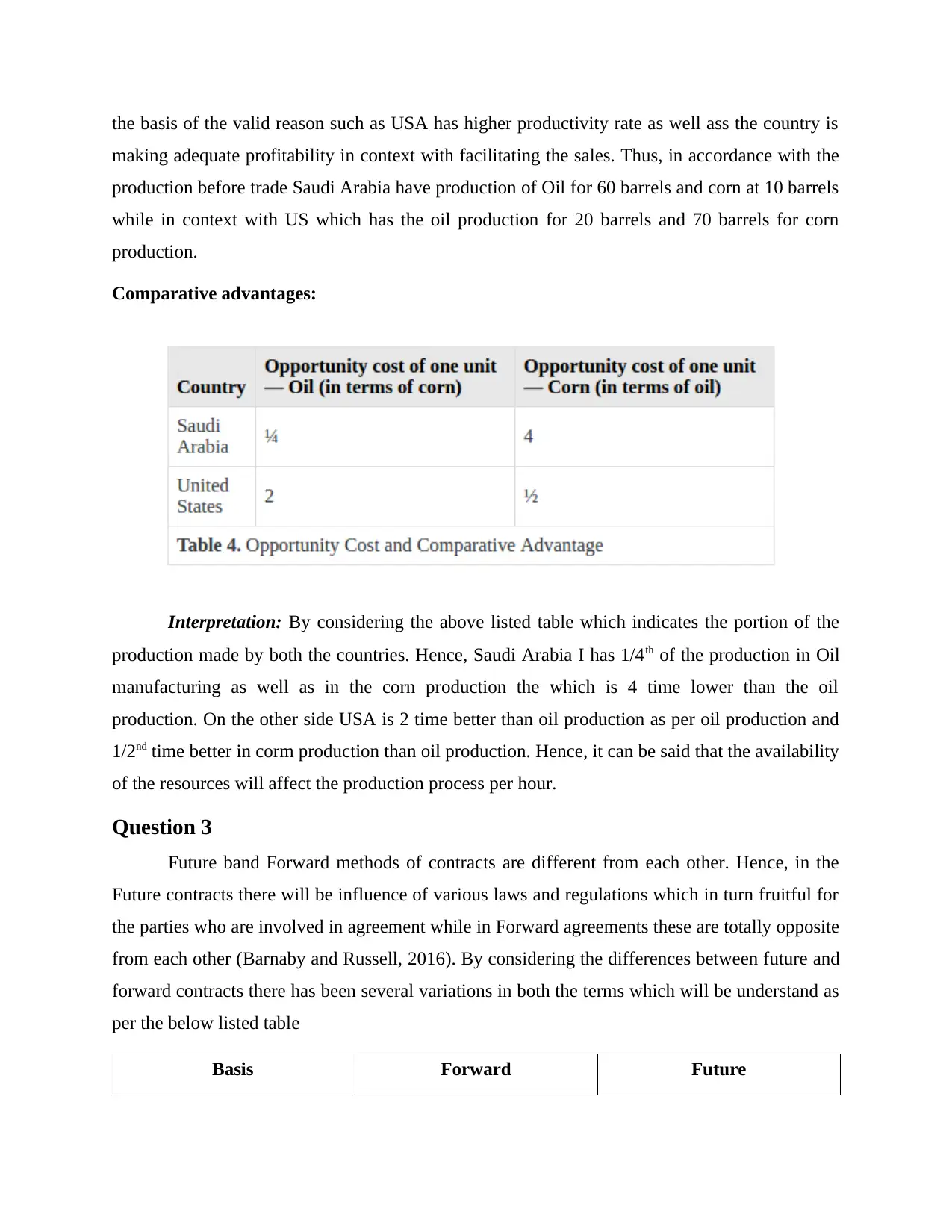

c) Analysing the effects of J-curve in the economy.

Illustration 2: Example of J-curve effect

By considering the Time series graph the event took place when it is giving the negative

returns over any investments and all of a sudden it makes the bull and after that it declines.

Hence, such changes in the economy present the J-shape on such time series graph (Eaton,

Kortum, Neiman and Romalis, 2016). However, such Shape also recognised as the nation's

Equity fund returns and BOT. Hence, such changes in the economy will affect the currency of

the country such as it becomes devalued as well as the overall volume of imports are being rise

or increased than compared to the total level of exports (Gervais, Schembri and Suchanek, 2016).

Thus, these in turn affect the trade deficit but as per the currency devaluation which in turn

affects in reducing the prices for exports so it makes the adequate balance of the profitability of

the nation.

CONCLUSION

By evaluating or understanding such terms of economics which reflects the pros and cons

of the economic environment in different countries. There was discussion based on the

knowledge gain through the 6 weeks of seminars which in turn improved or enhanced the

knowledge and information of economics. Further, the study also facilitates to make analysis

over various terms such as J-curve, floating exchange rates or trade deficit in US.

Illustration 2: Example of J-curve effect

By considering the Time series graph the event took place when it is giving the negative

returns over any investments and all of a sudden it makes the bull and after that it declines.

Hence, such changes in the economy present the J-shape on such time series graph (Eaton,

Kortum, Neiman and Romalis, 2016). However, such Shape also recognised as the nation's

Equity fund returns and BOT. Hence, such changes in the economy will affect the currency of

the country such as it becomes devalued as well as the overall volume of imports are being rise

or increased than compared to the total level of exports (Gervais, Schembri and Suchanek, 2016).

Thus, these in turn affect the trade deficit but as per the currency devaluation which in turn

affects in reducing the prices for exports so it makes the adequate balance of the profitability of

the nation.

CONCLUSION

By evaluating or understanding such terms of economics which reflects the pros and cons

of the economic environment in different countries. There was discussion based on the

knowledge gain through the 6 weeks of seminars which in turn improved or enhanced the

knowledge and information of economics. Further, the study also facilitates to make analysis

over various terms such as J-curve, floating exchange rates or trade deficit in US.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

REFERENCES

Books and Journals

Gorton, G. B. and Winton, A., 2016. Liquidity provision, bank capital, and the macroeconomy.

Miller, R., 2016. Shareholder Advocacy In Corporate Elections: Case Studies In Proxy Voting

Websites For Retail Investors.

Bocola, L. and et.al., 2016. Sustainable Exchange Rates. In 2016 Meeting Papers (No. 1396).

Society for Economic Dynamics.

Eichenbaum, M., Johannsen, B. K. and Rebelo, S., 2017. Monetary policy and the predictability

of nominal exchange rates (No. w23158). National Bureau of Economic Research.

Berger, A. N., Bouwman, C.H. and Kim, D., 2017. Small bank comparative advantages in

alleviating financial constraints and providing liquidity insurance over time. The Review of

Financial Studies, p.hhx038.

Pate, J. and Scullion, H., 2017. The flexpatriate psychological contract: a literature review and

future research agenda. The International Journal of Human Resource Management, pp.1-24.

Barnaby, G. A. and Russell, L. A., 2016. Crop Insurance Will Be at the Center of the 2019 Farm

Bill Debate. Choices. 31(3).

Alessandria, G. and Choi, H., 2016. The Dynamics of the US Trade Balance and the Real

Exchange Rate: The J Curve and Trade Costs?.

Komar, N., Uniiat, A. and Lutsiv, R., 2016. Efficiency of the North American Free Trade Zone.

Journal of european economy, (15,№ 3), pp.279-293.

Eaton, J., Kortum, S., Neiman, B. and Romalis, J., 2016. Trade and the global recession. The

American Economic Review. 106(11). pp.3401-3438.

Gervais, O., Schembri, L. and Suchanek, L., 2016. Current account dynamics, real exchange rate

adjustment, and the exchange rate regime in emerging-market economies. Journal of

Development Economics. 119. pp.86-99.

Online

Absolute and Comparative Advantage. 2017. [Online]. Available through

:<https://opentextbc.ca/principlesofeconomics/chapter/33-1-absolute-and-comparative-

advantage/>.

Books and Journals

Gorton, G. B. and Winton, A., 2016. Liquidity provision, bank capital, and the macroeconomy.

Miller, R., 2016. Shareholder Advocacy In Corporate Elections: Case Studies In Proxy Voting

Websites For Retail Investors.

Bocola, L. and et.al., 2016. Sustainable Exchange Rates. In 2016 Meeting Papers (No. 1396).

Society for Economic Dynamics.

Eichenbaum, M., Johannsen, B. K. and Rebelo, S., 2017. Monetary policy and the predictability

of nominal exchange rates (No. w23158). National Bureau of Economic Research.

Berger, A. N., Bouwman, C.H. and Kim, D., 2017. Small bank comparative advantages in

alleviating financial constraints and providing liquidity insurance over time. The Review of

Financial Studies, p.hhx038.

Pate, J. and Scullion, H., 2017. The flexpatriate psychological contract: a literature review and

future research agenda. The International Journal of Human Resource Management, pp.1-24.

Barnaby, G. A. and Russell, L. A., 2016. Crop Insurance Will Be at the Center of the 2019 Farm

Bill Debate. Choices. 31(3).

Alessandria, G. and Choi, H., 2016. The Dynamics of the US Trade Balance and the Real

Exchange Rate: The J Curve and Trade Costs?.

Komar, N., Uniiat, A. and Lutsiv, R., 2016. Efficiency of the North American Free Trade Zone.

Journal of european economy, (15,№ 3), pp.279-293.

Eaton, J., Kortum, S., Neiman, B. and Romalis, J., 2016. Trade and the global recession. The

American Economic Review. 106(11). pp.3401-3438.

Gervais, O., Schembri, L. and Suchanek, L., 2016. Current account dynamics, real exchange rate

adjustment, and the exchange rate regime in emerging-market economies. Journal of

Development Economics. 119. pp.86-99.

Online

Absolute and Comparative Advantage. 2017. [Online]. Available through

:<https://opentextbc.ca/principlesofeconomics/chapter/33-1-absolute-and-comparative-

advantage/>.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Forward Contract vs. Futures Contract. 2017. [Online]. Available through

:<https://www.diffen.com/difference/Forward_Contract_vs_Futures_Contract>.

:<https://www.diffen.com/difference/Forward_Contract_vs_Futures_Contract>.

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.