International Financial Markets and Econometrics

VerifiedAdded on 2023/06/18

|19

|6358

|259

AI Summary

This report covers topics such as exchange rate volatility, risk in international transactions, currency options, and financial econometrics investigation of the London Stock Exchange. It also includes subject, course code, and college/university information.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

International Financial Markets

And Econometrics

And Econometrics

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................3

MAIN BODY..................................................................................................................................3

QUESTION 1..................................................................................................................................3

(a). Causes of exchanges rate volatility in the foreign exchange market....................................3

(b) Exchange rate volatility impact international trade and financial data..................................4

QUESTION 2..................................................................................................................................6

Nature of risk in international transactions..................................................................................6

Advantage of currency option against future contracts...............................................................7

Disadvantages of the currency option against the future contracts.............................................8

QUESTION 3..................................................................................................................................9

Financial econometrics investigation of the London Stock Exchange........................................9

The implications of your empirical investigation for the financial markets..............................11

QUESTION 4................................................................................................................................13

International money markets have impacted international capital markets and stock prices....13

CONCLUSION..............................................................................................................................15

REFERENCES................................................................................................................................1

INTRODUCTION...........................................................................................................................3

MAIN BODY..................................................................................................................................3

QUESTION 1..................................................................................................................................3

(a). Causes of exchanges rate volatility in the foreign exchange market....................................3

(b) Exchange rate volatility impact international trade and financial data..................................4

QUESTION 2..................................................................................................................................6

Nature of risk in international transactions..................................................................................6

Advantage of currency option against future contracts...............................................................7

Disadvantages of the currency option against the future contracts.............................................8

QUESTION 3..................................................................................................................................9

Financial econometrics investigation of the London Stock Exchange........................................9

The implications of your empirical investigation for the financial markets..............................11

QUESTION 4................................................................................................................................13

International money markets have impacted international capital markets and stock prices....13

CONCLUSION..............................................................................................................................15

REFERENCES................................................................................................................................1

INTRODUCTION

International financial market is the place where the financial wealth and traded between

their individuals and many other countries can be done. While having such things this could also

come to know about how usually they can deal with many things and make sure for having their

high effective things in capital and market. It can be also widely seems that some of the rules and

institutions where are the assets that could take place and supports more agents and surplus.

While this could be directly lay down with having their proper trading and make sure for having

their more effective rules and regulation in agreements among various countries. This report will

explain about spot exchange rate that could causes the volatility in the foreign exchange rate.

Along with this international trade impacted over the exchange rate. While also examined about

the potential risk that could effective the international transaction and international trade.

Critically examined about the currency option with future and forwards contracts in hedging net

payables. Moreover, financial econometrics methods and evaluating more about the share prices

index and implication of empirical investigation for the financial market. Furthermore, at last

interest rate policy and QE via through international marketing impacted capital market and

stock prices.

MAIN BODY

QUESTION 1

(a). Causes of exchanges rate volatility in the foreign exchange market

Exchange rate volatility is unexpected movement in the exchanges rates and volatile

exchange rates creates international trade decision more difficult because volatility increases the

exchange rate risk ad it impacts on the potential of money (Bahmani‐Oskooee and Harvey,

2021). Diversification in government funds constantly impacts on the exchange rate volatility

and currency exchanges rate increase the diversification and variation in business expansion at

international level.

Exchange rate defined as a which on county converted into the another country, export in

different country highly influence the currency exchange process. Import can reduce the

country's economy and export can generate higher profitably and develop stability and increase

currency value as well. Sending and receiving money internationally is knows as determine

exchange rates.

International financial market is the place where the financial wealth and traded between

their individuals and many other countries can be done. While having such things this could also

come to know about how usually they can deal with many things and make sure for having their

high effective things in capital and market. It can be also widely seems that some of the rules and

institutions where are the assets that could take place and supports more agents and surplus.

While this could be directly lay down with having their proper trading and make sure for having

their more effective rules and regulation in agreements among various countries. This report will

explain about spot exchange rate that could causes the volatility in the foreign exchange rate.

Along with this international trade impacted over the exchange rate. While also examined about

the potential risk that could effective the international transaction and international trade.

Critically examined about the currency option with future and forwards contracts in hedging net

payables. Moreover, financial econometrics methods and evaluating more about the share prices

index and implication of empirical investigation for the financial market. Furthermore, at last

interest rate policy and QE via through international marketing impacted capital market and

stock prices.

MAIN BODY

QUESTION 1

(a). Causes of exchanges rate volatility in the foreign exchange market

Exchange rate volatility is unexpected movement in the exchanges rates and volatile

exchange rates creates international trade decision more difficult because volatility increases the

exchange rate risk ad it impacts on the potential of money (Bahmani‐Oskooee and Harvey,

2021). Diversification in government funds constantly impacts on the exchange rate volatility

and currency exchanges rate increase the diversification and variation in business expansion at

international level.

Exchange rate defined as a which on county converted into the another country, export in

different country highly influence the currency exchange process. Import can reduce the

country's economy and export can generate higher profitably and develop stability and increase

currency value as well. Sending and receiving money internationally is knows as determine

exchange rates.

On the basis of recent trend multiple people focus on expand their business activity in

different place, But expansion of business in foreign market face so many challenges, and

currency prices changes highly influence the business expansion. Multiple factors influence the

foreign exchanges rates are as follows,

Inflation rate

Variations in market product rate and changes in inflation rate cause influence the

currency exchanges rate. Lower inflation rate improves the quality of good and services sales in

market. And higher inflation rate impact and influence the product sales. So its important that

country manage their inflation rate for services in the foreign exchanges market.

Term of trade

A county's effective trade policy can improve the export policy but diversification in

trade policy highly influence the product selling. And it directly impacts on the country's revenue

as well. Export can generate higher revenue and increase the currency's value but product export

in the UK countries amount should higher than other so its major cause for foreign exchange

market.

Political stability and performance

Country's political situation and economic performance directly impact on currency

power. Less currency rate improves the potential of foreign investor. But variation in political

legal rules influence the financial position of company and it gives uncertainty in exchanges rate.

Increase foreign capital lead the value of domestic currency, it is higher cause for the foreign

exchange market.

Interest rates

Variations in interest rate influence the currency rate and higher interest rate is cause for

the country exchange rate (Dada, Olomola and Adedokun, 2021). Higher interest rate people not

expand their business in foreign because of their higher interest rate of landers, machinery,

production machinery and many more. It influences the business expansion in other country, so

increase in interest rate is also major cause for foreign exchange market.

(b) Exchange rate volatility impact international trade and financial data

Exchange rate develop risk on transaction cost and it influences the internation trade.

Interneuronal trade influences by the multiple factor and it directly affects the country's

economy, so its essential country focuses on the management of international trade changes like

different place, But expansion of business in foreign market face so many challenges, and

currency prices changes highly influence the business expansion. Multiple factors influence the

foreign exchanges rates are as follows,

Inflation rate

Variations in market product rate and changes in inflation rate cause influence the

currency exchanges rate. Lower inflation rate improves the quality of good and services sales in

market. And higher inflation rate impact and influence the product sales. So its important that

country manage their inflation rate for services in the foreign exchanges market.

Term of trade

A county's effective trade policy can improve the export policy but diversification in

trade policy highly influence the product selling. And it directly impacts on the country's revenue

as well. Export can generate higher revenue and increase the currency's value but product export

in the UK countries amount should higher than other so its major cause for foreign exchange

market.

Political stability and performance

Country's political situation and economic performance directly impact on currency

power. Less currency rate improves the potential of foreign investor. But variation in political

legal rules influence the financial position of company and it gives uncertainty in exchanges rate.

Increase foreign capital lead the value of domestic currency, it is higher cause for the foreign

exchange market.

Interest rates

Variations in interest rate influence the currency rate and higher interest rate is cause for

the country exchange rate (Dada, Olomola and Adedokun, 2021). Higher interest rate people not

expand their business in foreign because of their higher interest rate of landers, machinery,

production machinery and many more. It influences the business expansion in other country, so

increase in interest rate is also major cause for foreign exchange market.

(b) Exchange rate volatility impact international trade and financial data

Exchange rate develop risk on transaction cost and it influences the internation trade.

Interneuronal trade influences by the multiple factor and it directly affects the country's

economy, so its essential country focuses on the management of international trade changes like

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

when they provide their services. Country's economy affects from the multiple issues but the

product transportation cost highly influence and transportation affects from the multiple issues.

UK country has great export sense also they provide multiple product on various counties so

their currency value will automatically increase. Exchanges rate should be on higher cost and

when they import services they set effective policy like define fix rate cost of product Exchange

rate volatility influencing the activity of exporting behaviour, financial values of firms and many

more.

Increase transaction cost

Exchanges rate volatility highly influence international product trade cost, variation in

currency rate influence the prices of transportation cost so its essential that country manage their

production on the basis of currency price analysis for transportation cost management (Diniz-

Maganini, Rasheed and Sheng, 2021). Higher influence on transportation prices decrease the

economy of the country because on the basis of exchanges rate totally depends on the other

country's import policy.

Impact on country's economic growth

Country's currency prices highly influence by the import policy. Expansion of business in

foreign country expand their economy wealth and improve currency rates. The major impact is

the product transportation because very individual place has different product cost price and tax

price for product. Government policies highly impacts international trade so management of

government policy require stability and effective price of currency.

Reduce gains from diversification in trade policy

Higher transportation charges influence by the exchange rate volatility it increases the

diversification and its will negative impact on company's profit. Mos of the countries believes in

transportation of product because it beneficial for the improvement of economy growth and

other country has not power to expand the same product business expansion, so it develops

export and import between tow country (Wang, Li and Wu, 2021). But the major essential thing

that country produce multiple product and focuses on export this will improve the economy

growth of the country with effective manner. Other country higher economy directly influence

the transaction cost as well.

Exchange rate is essential for macroeconomic factor, it highly influences from the

international trade, development of international trade require multiple aspect analysis because

product transportation cost highly influence and transportation affects from the multiple issues.

UK country has great export sense also they provide multiple product on various counties so

their currency value will automatically increase. Exchanges rate should be on higher cost and

when they import services they set effective policy like define fix rate cost of product Exchange

rate volatility influencing the activity of exporting behaviour, financial values of firms and many

more.

Increase transaction cost

Exchanges rate volatility highly influence international product trade cost, variation in

currency rate influence the prices of transportation cost so its essential that country manage their

production on the basis of currency price analysis for transportation cost management (Diniz-

Maganini, Rasheed and Sheng, 2021). Higher influence on transportation prices decrease the

economy of the country because on the basis of exchanges rate totally depends on the other

country's import policy.

Impact on country's economic growth

Country's currency prices highly influence by the import policy. Expansion of business in

foreign country expand their economy wealth and improve currency rates. The major impact is

the product transportation because very individual place has different product cost price and tax

price for product. Government policies highly impacts international trade so management of

government policy require stability and effective price of currency.

Reduce gains from diversification in trade policy

Higher transportation charges influence by the exchange rate volatility it increases the

diversification and its will negative impact on company's profit. Mos of the countries believes in

transportation of product because it beneficial for the improvement of economy growth and

other country has not power to expand the same product business expansion, so it develops

export and import between tow country (Wang, Li and Wu, 2021). But the major essential thing

that country produce multiple product and focuses on export this will improve the economy

growth of the country with effective manner. Other country higher economy directly influence

the transaction cost as well.

Exchange rate is essential for macroeconomic factor, it highly influences from the

international trade, development of international trade require multiple aspect analysis because

multiple aspect affects the countries economy and economic condition affects the trade policy

and peepers diversification in currency price (Živkov, Kuzman and Andrejević-Panić, 2021).

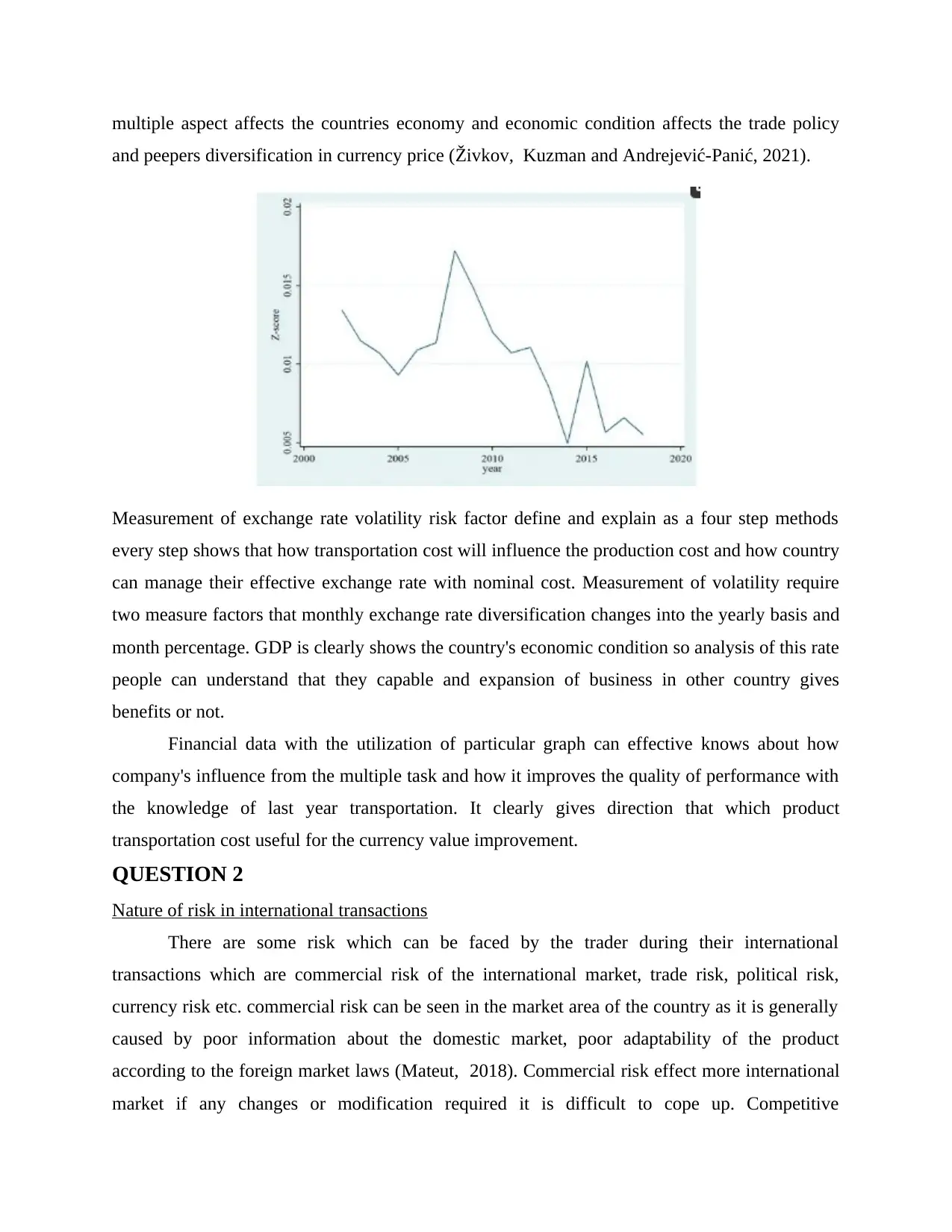

Measurement of exchange rate volatility risk factor define and explain as a four step methods

every step shows that how transportation cost will influence the production cost and how country

can manage their effective exchange rate with nominal cost. Measurement of volatility require

two measure factors that monthly exchange rate diversification changes into the yearly basis and

month percentage. GDP is clearly shows the country's economic condition so analysis of this rate

people can understand that they capable and expansion of business in other country gives

benefits or not.

Financial data with the utilization of particular graph can effective knows about how

company's influence from the multiple task and how it improves the quality of performance with

the knowledge of last year transportation. It clearly gives direction that which product

transportation cost useful for the currency value improvement.

QUESTION 2

Nature of risk in international transactions

There are some risk which can be faced by the trader during their international

transactions which are commercial risk of the international market, trade risk, political risk,

currency risk etc. commercial risk can be seen in the market area of the country as it is generally

caused by poor information about the domestic market, poor adaptability of the product

according to the foreign market laws (Mateut, 2018). Commercial risk effect more international

market if any changes or modification required it is difficult to cope up. Competitive

and peepers diversification in currency price (Živkov, Kuzman and Andrejević-Panić, 2021).

Measurement of exchange rate volatility risk factor define and explain as a four step methods

every step shows that how transportation cost will influence the production cost and how country

can manage their effective exchange rate with nominal cost. Measurement of volatility require

two measure factors that monthly exchange rate diversification changes into the yearly basis and

month percentage. GDP is clearly shows the country's economic condition so analysis of this rate

people can understand that they capable and expansion of business in other country gives

benefits or not.

Financial data with the utilization of particular graph can effective knows about how

company's influence from the multiple task and how it improves the quality of performance with

the knowledge of last year transportation. It clearly gives direction that which product

transportation cost useful for the currency value improvement.

QUESTION 2

Nature of risk in international transactions

There are some risk which can be faced by the trader during their international

transactions which are commercial risk of the international market, trade risk, political risk,

currency risk etc. commercial risk can be seen in the market area of the country as it is generally

caused by poor information about the domestic market, poor adaptability of the product

according to the foreign market laws (Mateut, 2018). Commercial risk effect more international

market if any changes or modification required it is difficult to cope up. Competitive

environment also create risk as they pressurize the supply chain demand of raw materials in the

market. Therefore, for the trader it is difficult for them to negotiate the price of raw material with

suppliers. Exchange rate also develop a threat for the trader as their native currency and foreign

currency are different which impacts the price awareness. If the traders native currency is

devalued than there is enhancement of their strength in new market. Political risk is also the

biggest problem for the trader when they are trying to trade in international market as every

country has their different laws and policy which can be also caused the trade barriers also

changing in policy can also bring disadvantages for the traders (Huy, Dat and Anh, 2020).

Credit risk also a threat for the traders to deal with international market. Credit risk

means as buyer unable to pay the credit on due date which could be the loss for the lenders.

Therefore, this risk is more seen in international market as compared to the international market.

Derivatives the financial tool which means that it is derived from other form of asset that can be

foreign exchange. Traders can use this to mitigate all the risk occur in their international

transactions. Derivative can also be understood as a contractual assessment between two

business parties in which one party has to oblige the sales regulation and other party has the right

to buy or sale. Both the parties can make the agreement so that their sales and productivity does

not affect. Or this risks can be mitigated by the proper research analysis of the international

market so that it give the proper idea to the trader according to this they can prepare themselves

for the international market transaction.

Advantage of currency option against future contracts

Currency option is the derivative agreement which gives the right to the company for sale

and trading but it does not give obligation to the firm that they must have to fulfil the agreement.

It gives the advantage to the company as if they agreed on currency option derivative then they

are not forced or obliged to follow the agreement. Future contract is also a derivative which

comes with the obligation as if two parties agreed on future derivative then they must have to

follow the contract (Brito and Jacinto, 2020). Future contract give the right to the company to

sell or buy product in a specific future decided date, they can't disagree to this agreement which

can be seen as a violation of the contract therefore it can cause legal problem for the company.

Option derivative are of two type which is call option and put option.

Call option:

market. Therefore, for the trader it is difficult for them to negotiate the price of raw material with

suppliers. Exchange rate also develop a threat for the trader as their native currency and foreign

currency are different which impacts the price awareness. If the traders native currency is

devalued than there is enhancement of their strength in new market. Political risk is also the

biggest problem for the trader when they are trying to trade in international market as every

country has their different laws and policy which can be also caused the trade barriers also

changing in policy can also bring disadvantages for the traders (Huy, Dat and Anh, 2020).

Credit risk also a threat for the traders to deal with international market. Credit risk

means as buyer unable to pay the credit on due date which could be the loss for the lenders.

Therefore, this risk is more seen in international market as compared to the international market.

Derivatives the financial tool which means that it is derived from other form of asset that can be

foreign exchange. Traders can use this to mitigate all the risk occur in their international

transactions. Derivative can also be understood as a contractual assessment between two

business parties in which one party has to oblige the sales regulation and other party has the right

to buy or sale. Both the parties can make the agreement so that their sales and productivity does

not affect. Or this risks can be mitigated by the proper research analysis of the international

market so that it give the proper idea to the trader according to this they can prepare themselves

for the international market transaction.

Advantage of currency option against future contracts

Currency option is the derivative agreement which gives the right to the company for sale

and trading but it does not give obligation to the firm that they must have to fulfil the agreement.

It gives the advantage to the company as if they agreed on currency option derivative then they

are not forced or obliged to follow the agreement. Future contract is also a derivative which

comes with the obligation as if two parties agreed on future derivative then they must have to

follow the contract (Brito and Jacinto, 2020). Future contract give the right to the company to

sell or buy product in a specific future decided date, they can't disagree to this agreement which

can be seen as a violation of the contract therefore it can cause legal problem for the company.

Option derivative are of two type which is call option and put option.

Call option:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Call option derivate gives the agreement between the companies Through which companies have

the right to choose or buy the asset at a fixed rate but also they have option to follow the contract

or not according to their business needs and requirements.

Put option:

Put option gives the agreement between the companies through which they can buy or sell the

asset at a future date with a fixed price which they have decided during their agreement.

Currency option are the best way for the companies as it provide the cheapest option for

trade which can save the money for the company. If company is buyer than the risk occur which

can be limited or less because they have a right to change their decision as compared to future

contracts they consist of risk as in this agreement buyer must have to oblige the agreement even

if the price varies. Therefore, company has to go with the currency option rather than the future

contracts.

Disadvantages of the currency option against the future contracts

Future contracts derivative has many advantage over the currency option. Future

contracts are the better option for the risk taker traders as it gives or open up the maximum

opportunities for the trader. It gives the access to the market to the trader for that they were not

allowed to but along with future contracts it enables them to invest on those market as well to

increase their revenues (Wystup, 2021). It gives the high liquidity which means that firms can

easily achieve their finance goals whereas currency option has low liquidity so that in which

company might get face the bankruptcy. As for the future contract the margin is low means cost

does not change over the years and traders have access on their invested money. But in the case

of currency option there is a high margin so that investor has to pay big price in the agreement.

Option derivative can give the disadvantage to the company as it gives the wastage of asset if

company agree on option and pay the high margin of the asset and if they refuse to oblige the

contract than it is the waste of time for them whereas in future contracts does not waste the time

of trader. For the future contracts the pricing remains the same which is easy to understand but in

the case of currency option which include inputs number which is hardly understandable to the

trader (Sokolov, 2018). therefore, companies has to choose future contracts for the better market

opportunities for their company which can give advantage to increase their revenues as

compared to currency option which does not give many opportunities as it is limited and trader

can any time discontinue their agreement.

the right to choose or buy the asset at a fixed rate but also they have option to follow the contract

or not according to their business needs and requirements.

Put option:

Put option gives the agreement between the companies through which they can buy or sell the

asset at a future date with a fixed price which they have decided during their agreement.

Currency option are the best way for the companies as it provide the cheapest option for

trade which can save the money for the company. If company is buyer than the risk occur which

can be limited or less because they have a right to change their decision as compared to future

contracts they consist of risk as in this agreement buyer must have to oblige the agreement even

if the price varies. Therefore, company has to go with the currency option rather than the future

contracts.

Disadvantages of the currency option against the future contracts

Future contracts derivative has many advantage over the currency option. Future

contracts are the better option for the risk taker traders as it gives or open up the maximum

opportunities for the trader. It gives the access to the market to the trader for that they were not

allowed to but along with future contracts it enables them to invest on those market as well to

increase their revenues (Wystup, 2021). It gives the high liquidity which means that firms can

easily achieve their finance goals whereas currency option has low liquidity so that in which

company might get face the bankruptcy. As for the future contract the margin is low means cost

does not change over the years and traders have access on their invested money. But in the case

of currency option there is a high margin so that investor has to pay big price in the agreement.

Option derivative can give the disadvantage to the company as it gives the wastage of asset if

company agree on option and pay the high margin of the asset and if they refuse to oblige the

contract than it is the waste of time for them whereas in future contracts does not waste the time

of trader. For the future contracts the pricing remains the same which is easy to understand but in

the case of currency option which include inputs number which is hardly understandable to the

trader (Sokolov, 2018). therefore, companies has to choose future contracts for the better market

opportunities for their company which can give advantage to increase their revenues as

compared to currency option which does not give many opportunities as it is limited and trader

can any time discontinue their agreement.

QUESTION 3

Financial econometrics investigation of the London Stock Exchange

According to Asiedu and et.al., (2020), this have been seems that LSE market that could

play the effective role for being taking the high estimation. Along with this also include those

activities which could make London prides about destination for having the rights about

international companies and bring out more investors. While for having such things this play

their important for becoming together and power for developing the world economy. In such

things this might play their roles for keeping high products and services designed for keeping

the company growth with more powerful ambitious. This could also keep them with foreign

exchange rate and make their business for working with more proper things.

As per Fűrész and Rappai (2020) views that, for centuries the financial econometrics that

could play the effective role and make sure for keeping their working estimation. In such things

this could also led them for working with more success and through business economics cycles

amidst things about the great changes and that could create the challenges London Stock

Exchange has supported businesses by connecting them with capital. It always try to give the

financial capital and that could also developed their business for taking high measure. Global

trading that could also required for keeping the London for standing about the world open market

and make their high position.

Chirwa and Odhiambo (2020) said that, London stock exchange that could play their

effective role and make their supportive for working while by offering the high investors. While

sometime this could also play their effective role and make sure for overlapping their market

places and support more large things. This could also include the international concepts and

access to some of the fastest growth rate markets through London. Financial econometrics that

could overlapping more 27 markets and keep their condition for working in globally and keeping

high range of solution. In working with international market this could keep their order booked

about how the investor access for some growing market things.

According to Oanh and et.al., (2021), financial econometrics that could play the

important role for growth and development for which the sources and that could keep their

effective role. 75% revenues that could be important for any organization in working with many

more things and make sure about their places for which the assets that could managed. 2000+

issues that could create the international operating things and that could help them for knowing

Financial econometrics investigation of the London Stock Exchange

According to Asiedu and et.al., (2020), this have been seems that LSE market that could

play the effective role for being taking the high estimation. Along with this also include those

activities which could make London prides about destination for having the rights about

international companies and bring out more investors. While for having such things this play

their important for becoming together and power for developing the world economy. In such

things this might play their roles for keeping high products and services designed for keeping

the company growth with more powerful ambitious. This could also keep them with foreign

exchange rate and make their business for working with more proper things.

As per Fűrész and Rappai (2020) views that, for centuries the financial econometrics that

could play the effective role and make sure for keeping their working estimation. In such things

this could also led them for working with more success and through business economics cycles

amidst things about the great changes and that could create the challenges London Stock

Exchange has supported businesses by connecting them with capital. It always try to give the

financial capital and that could also developed their business for taking high measure. Global

trading that could also required for keeping the London for standing about the world open market

and make their high position.

Chirwa and Odhiambo (2020) said that, London stock exchange that could play their

effective role and make their supportive for working while by offering the high investors. While

sometime this could also play their effective role and make sure for overlapping their market

places and support more large things. This could also include the international concepts and

access to some of the fastest growth rate markets through London. Financial econometrics that

could overlapping more 27 markets and keep their condition for working in globally and keeping

high range of solution. In working with international market this could keep their order booked

about how the investor access for some growing market things.

According to Oanh and et.al., (2021), financial econometrics that could play the

important role for growth and development for which the sources and that could keep their

effective role. 75% revenues that could be important for any organization in working with many

more things and make sure about their places for which the assets that could managed. 2000+

issues that could create the international operating things and that could help them for knowing

about their places. This might be taken their effective things and keep their attention towards

high system. London stock exchanges that could required for knowing about their business and

many other managed work.

In contrast with Hohlwegler (2021), this have been also seems that general ways for

keeping and working with many more things which could create them with high customer. While

for keeping the London stock exchanges market for which the international trade capital and

market could easily keep their supportive. The index about the average value and that could be

calculated while by using those various methods and make sure about their following for the

high system. This helps more about their observing for more about how they can easily work and

managed their system for taking some of the measure steps.

Maci, Pacelli and D’Apolito (2020) views that, the stock market works through a high

network marketing and developed those high scheme and make sure about their system.

Investors purchase their high shares and try to keep their more investor through which many

system and keeping their sources for working with many new things. While by purchasing and

also allow the companies for knowing about how usually they can work and managed their

shares in market. The prices that could be easily set up with having the high growth and also

manage their working system with many other concepts. While having such things this could

also led them for taking their high value and try to buy more high shares.

Haydar and Reilimo (2020) said that, many of the investors have taken their places and

that could keep their working estimation that could 45% of shares. While this could keep them

for working with sources and growth about those activities which could make their working

policies. Physical factors and physiology factor that could be easily come to know about how

they can keep their share buying with many other process. In managing more about the firms are

required to have many high shares and amended about those activities which could be more high

important for them. 75% growth and 87% of shares are depending with financial econometrics

which could play the estimation about how they can maintain the companies economy.

As there are many companies in LSE such as coffee house, royal exchange, first rule

book and so on. Financial econometrics could keep their disorder towards those activities and

make sure about those process which could keep out some of the theme in buying out many

shares. Foreign and regional exchanges that could took balance and that could effectively work

with more policies and make sure about those further managed without keeping their

high system. London stock exchanges that could required for knowing about their business and

many other managed work.

In contrast with Hohlwegler (2021), this have been also seems that general ways for

keeping and working with many more things which could create them with high customer. While

for keeping the London stock exchanges market for which the international trade capital and

market could easily keep their supportive. The index about the average value and that could be

calculated while by using those various methods and make sure about their following for the

high system. This helps more about their observing for more about how they can easily work and

managed their system for taking some of the measure steps.

Maci, Pacelli and D’Apolito (2020) views that, the stock market works through a high

network marketing and developed those high scheme and make sure about their system.

Investors purchase their high shares and try to keep their more investor through which many

system and keeping their sources for working with many new things. While by purchasing and

also allow the companies for knowing about how usually they can work and managed their

shares in market. The prices that could be easily set up with having the high growth and also

manage their working system with many other concepts. While having such things this could

also led them for taking their high value and try to buy more high shares.

Haydar and Reilimo (2020) said that, many of the investors have taken their places and

that could keep their working estimation that could 45% of shares. While this could keep them

for working with sources and growth about those activities which could make their working

policies. Physical factors and physiology factor that could be easily come to know about how

they can keep their share buying with many other process. In managing more about the firms are

required to have many high shares and amended about those activities which could be more high

important for them. 75% growth and 87% of shares are depending with financial econometrics

which could play the estimation about how they can maintain the companies economy.

As there are many companies in LSE such as coffee house, royal exchange, first rule

book and so on. Financial econometrics could keep their disorder towards those activities and

make sure about those process which could keep out some of the theme in buying out many

shares. Foreign and regional exchanges that could took balance and that could effectively work

with more policies and make sure about those further managed without keeping their

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

performance (Lee, 2021). Consequently, both of Manchester and Liverpool stock exchanges

about their exchange system and managed their work within their activities benefited from the

economics.

The implications of your empirical investigation for the financial markets.

At the point when individuals talk about market efficiency, they alluding how much total

choices of market member exactly mirror worth of public organizations and their normal offers

blue on schedule. This requires decide an organization inherent worth and continually refreshing

those valuations as new data become known. The quicker and more exact the marketplace can

value protections, the more productive supposed that could included those activities which could

maintainable for the financial market (Wamba, Queiroz and Trinchera, 2020). The Efficient

market Hypothesis is observational matter likewise tried as regards a particular data set.

Subsequently, examination that could be easily explore authentically how rapidly Greek

securities swap respond to determined data sets. Given some data set actually from low to high

frequencies and the other way around to examine if Greek securities switch over can be

described as an Efficient one.

The Stock market is an establishment of imposing interest general inhabitants and of

significance to financial specialists. The Securities exchange is control instruments addressing

cases of possession to ventures of modern, financial furthermore, running character. These cases

are seen by highly impacted and proprietors as capital which are variable into cash which thus

obtainable for their buy. The universes stock markets are spots which proffer liquidity capacity

to the proprietors resources and add constant and grave assurance of costs. In a general sense an

Efficient Stock Market is basically types of market in which firms can settle on creation course

of action choices and financial backers can pick amongst the protections that address blame for

exercises. a connection between securities swap movement and betting has been called

concentration to regularly in Finance writing (Rommerskirchen, 2020). It has been called

attention that card shark estimates by setting up a stake round of possibility and that financial

sponsor in the Stock market acts more or then again less likewise. There is an leaning to view

theory as undesirable monetary group, as though it were remote from the monetary behaviour.

Monetary exercises however, theoretical since they are totally deterministic.

Turning approximately to financial exchange efficacy the proficient market conjecture

infers an unusual sort of proficiency which is informational Efficiency. The Information

about their exchange system and managed their work within their activities benefited from the

economics.

The implications of your empirical investigation for the financial markets.

At the point when individuals talk about market efficiency, they alluding how much total

choices of market member exactly mirror worth of public organizations and their normal offers

blue on schedule. This requires decide an organization inherent worth and continually refreshing

those valuations as new data become known. The quicker and more exact the marketplace can

value protections, the more productive supposed that could included those activities which could

maintainable for the financial market (Wamba, Queiroz and Trinchera, 2020). The Efficient

market Hypothesis is observational matter likewise tried as regards a particular data set.

Subsequently, examination that could be easily explore authentically how rapidly Greek

securities swap respond to determined data sets. Given some data set actually from low to high

frequencies and the other way around to examine if Greek securities switch over can be

described as an Efficient one.

The Stock market is an establishment of imposing interest general inhabitants and of

significance to financial specialists. The Securities exchange is control instruments addressing

cases of possession to ventures of modern, financial furthermore, running character. These cases

are seen by highly impacted and proprietors as capital which are variable into cash which thus

obtainable for their buy. The universes stock markets are spots which proffer liquidity capacity

to the proprietors resources and add constant and grave assurance of costs. In a general sense an

Efficient Stock Market is basically types of market in which firms can settle on creation course

of action choices and financial backers can pick amongst the protections that address blame for

exercises. a connection between securities swap movement and betting has been called

concentration to regularly in Finance writing (Rommerskirchen, 2020). It has been called

attention that card shark estimates by setting up a stake round of possibility and that financial

sponsor in the Stock market acts more or then again less likewise. There is an leaning to view

theory as undesirable monetary group, as though it were remote from the monetary behaviour.

Monetary exercises however, theoretical since they are totally deterministic.

Turning approximately to financial exchange efficacy the proficient market conjecture

infers an unusual sort of proficiency which is informational Efficiency. The Information

usefulness sort of output when costs, reflect completely and hastily, hypothetically immediately,

every snippet of data concerning the exchange protections. In this way, the stock costs at time, to

respond just to applicable data savoured at time it which agreeing the supposition hidden the

Efficient Market Hypothesis that could led with having the easy for everybody (Bakas, Kostis

and Petrakis, 2020). These theorists don't put together their exchange methodology with respect

to any explicit data set and they cannot be measured as proof against the capable Market

Hypothesis. The truth of the matter is that live in a deterministic world there are just levels of

susceptibility.

The hypothesis of the Efficient Markets has long effective things and that might be

basically important for the creating the high effective things. A few scientists who have found

value conduct unique in family member to what Effective Market Hypothesis infers and planned

elective speculation to clarify these deviations. On top of that banter Chaos guess says that value

changes are consequence of complicated without delay powerful models (Liebi, 2020). At first

look value changes might look like uneven, somebody glances somewhere down in them will

actually want to discover structure since in Chaos deduction design and chance are firmly

connected. Accordingly, principal examiners attempt, to perform projection of protection future

incomes. This included probing factors like the interest for item, conceivable future advancement

of substitute, the climate of firm and commerce indeed, even economy in general. So, all data

pertinent to future output of the organizations being referred and make sure about those activities

which could led them for working and effectively working progress.

The implication that could work with having more effective progress and keeping out

with highly effectively things. While having such things the relationship among their places and

growth for more high financial problems for which shares and many other capital market could

gets effected. In working with more process and kindly helping with their major things this could

keep their effective things and make sure for having their valuable things and places their buying

more high products and services (Ledhem and Mekidiche, 2020). The fundamentalists beaten the

arbitrary walker by advancing the argument that if beneficial freedoms didn't exist and financial

backer utilize crucial examiners, why then colossal measures of cash were all while being spend

on examination and undertaking advices. Arbitrary walkers answer was that crucial assessment

worked productively, why then new contestant matter of key.

every snippet of data concerning the exchange protections. In this way, the stock costs at time, to

respond just to applicable data savoured at time it which agreeing the supposition hidden the

Efficient Market Hypothesis that could led with having the easy for everybody (Bakas, Kostis

and Petrakis, 2020). These theorists don't put together their exchange methodology with respect

to any explicit data set and they cannot be measured as proof against the capable Market

Hypothesis. The truth of the matter is that live in a deterministic world there are just levels of

susceptibility.

The hypothesis of the Efficient Markets has long effective things and that might be

basically important for the creating the high effective things. A few scientists who have found

value conduct unique in family member to what Effective Market Hypothesis infers and planned

elective speculation to clarify these deviations. On top of that banter Chaos guess says that value

changes are consequence of complicated without delay powerful models (Liebi, 2020). At first

look value changes might look like uneven, somebody glances somewhere down in them will

actually want to discover structure since in Chaos deduction design and chance are firmly

connected. Accordingly, principal examiners attempt, to perform projection of protection future

incomes. This included probing factors like the interest for item, conceivable future advancement

of substitute, the climate of firm and commerce indeed, even economy in general. So, all data

pertinent to future output of the organizations being referred and make sure about those activities

which could led them for working and effectively working progress.

The implication that could work with having more effective progress and keeping out

with highly effectively things. While having such things the relationship among their places and

growth for more high financial problems for which shares and many other capital market could

gets effected. In working with more process and kindly helping with their major things this could

keep their effective things and make sure for having their valuable things and places their buying

more high products and services (Ledhem and Mekidiche, 2020). The fundamentalists beaten the

arbitrary walker by advancing the argument that if beneficial freedoms didn't exist and financial

backer utilize crucial examiners, why then colossal measures of cash were all while being spend

on examination and undertaking advices. Arbitrary walkers answer was that crucial assessment

worked productively, why then new contestant matter of key.

Examination contend these increase away as occurs any other industry. Aside from the

above banter between random walkers and fundamentalists the necessity of probabilistic

independence between progressive value changes was excessively high-priced for being typified

in development writing of the financial hypothesis (Bashir and et.al., 2020). The uneven walk

model which appeared to depict the value conduct was just quantifiable and a monetary

hypothesis which the arbitrary model assert was vital. As referenced over sensible game model

accept hazard non-partisanship. Under financial backers will constantly really like hold

whichever resource produces the most remarkable anticipated return, totally disregarding

contrasts in hazard. Risk suggests the martingale more prohibitive irregular walk representation.

On the chance that specialists mind what the higher snapshots of their return flow hazard infers,

at that direct they will never really offer away chronological reliance in the higher provisional

snapshots of returns (Szász and et.al., 2020). Along these lines predictable with no zero

association in restrictive changes. The way that future contingent changes are incompletely

predict able unimportant in light fact that hazard lack of bias propose that nobody thinks often

about these fluctuations.

QUESTION 4

International money markets have impacted international capital markets and stock prices.

International money market that could take their program while for working with many

stock market and through having the difficult for knowing about how this can work. Quantitative

easing that could keep the countries about their economics system and make sure for rising the

stock about the target stock that could led with high sources. After having all the purpose that

could keep them for supporting about many times and keeping them with many effectiveness

buying massive amounts (Ca'Zorzi and et.al., 2020). QE that could take the place about massive

amounts of government bonds between two or other investments for keeping their proper

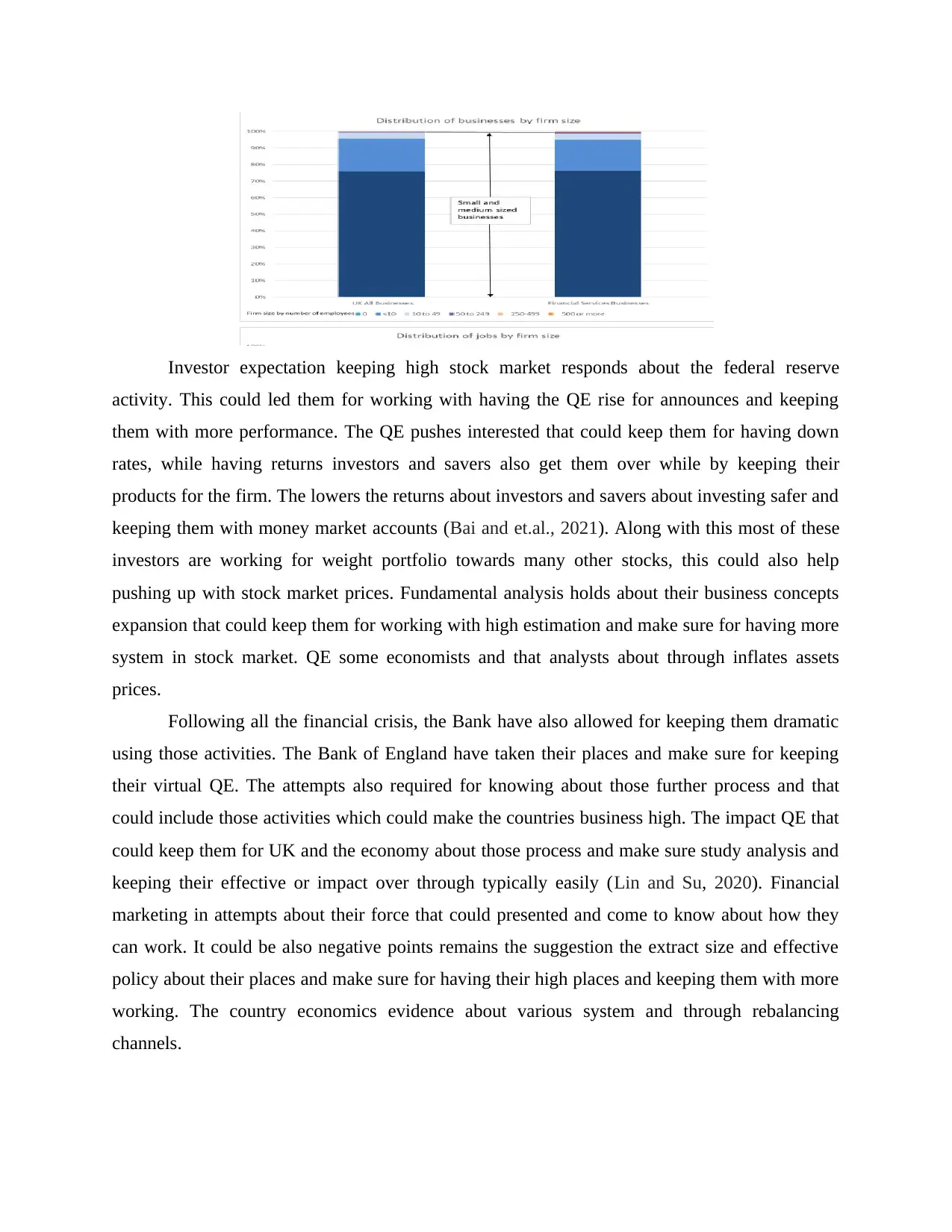

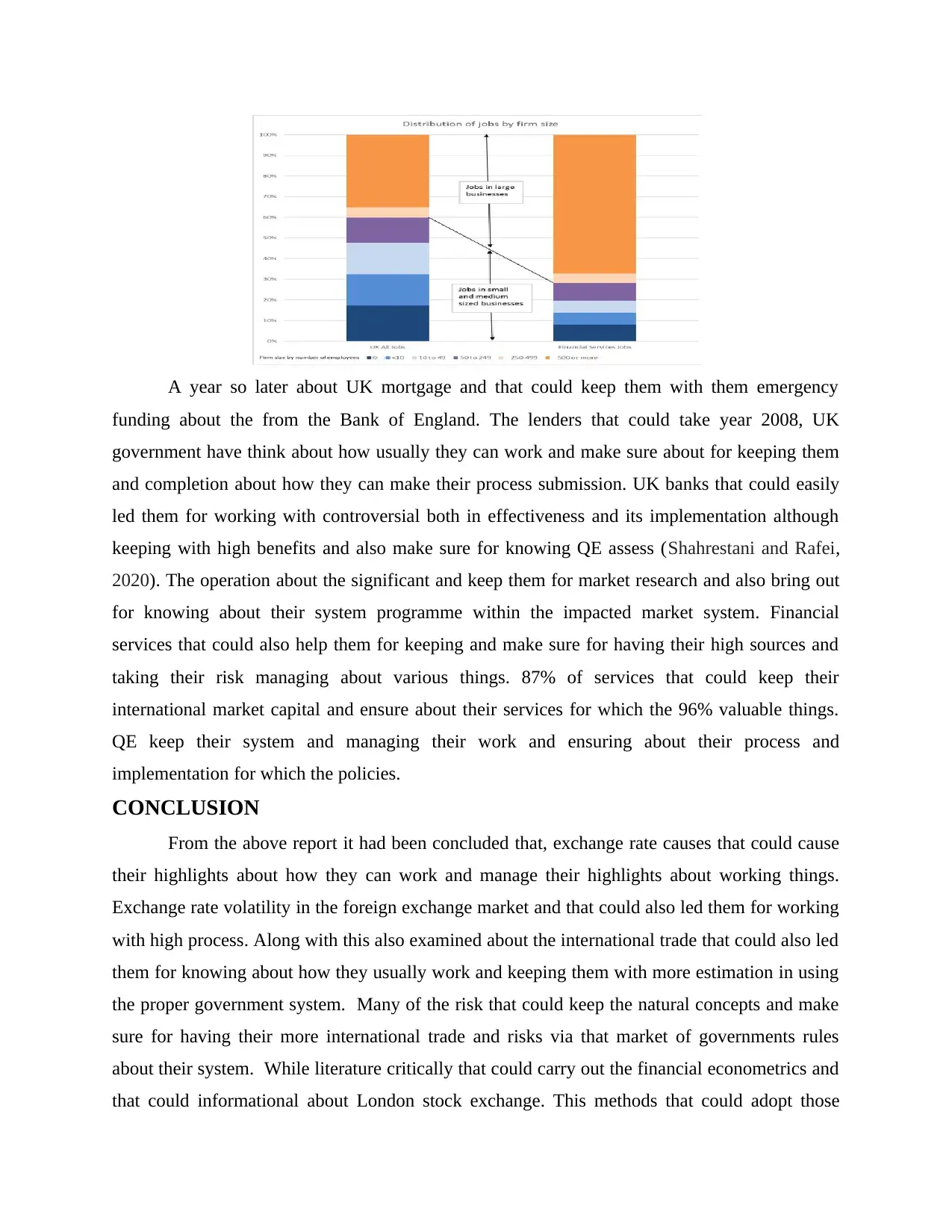

estimation about spending with high expand. UK have taken the 210 firms account with 67% of

the UK financial services jobs (as per shown in graph) and figuring cross out the all UK sector

with 35%.

above banter between random walkers and fundamentalists the necessity of probabilistic

independence between progressive value changes was excessively high-priced for being typified

in development writing of the financial hypothesis (Bashir and et.al., 2020). The uneven walk

model which appeared to depict the value conduct was just quantifiable and a monetary

hypothesis which the arbitrary model assert was vital. As referenced over sensible game model

accept hazard non-partisanship. Under financial backers will constantly really like hold

whichever resource produces the most remarkable anticipated return, totally disregarding

contrasts in hazard. Risk suggests the martingale more prohibitive irregular walk representation.

On the chance that specialists mind what the higher snapshots of their return flow hazard infers,

at that direct they will never really offer away chronological reliance in the higher provisional

snapshots of returns (Szász and et.al., 2020). Along these lines predictable with no zero

association in restrictive changes. The way that future contingent changes are incompletely

predict able unimportant in light fact that hazard lack of bias propose that nobody thinks often

about these fluctuations.

QUESTION 4

International money markets have impacted international capital markets and stock prices.

International money market that could take their program while for working with many

stock market and through having the difficult for knowing about how this can work. Quantitative

easing that could keep the countries about their economics system and make sure for rising the

stock about the target stock that could led with high sources. After having all the purpose that

could keep them for supporting about many times and keeping them with many effectiveness

buying massive amounts (Ca'Zorzi and et.al., 2020). QE that could take the place about massive

amounts of government bonds between two or other investments for keeping their proper

estimation about spending with high expand. UK have taken the 210 firms account with 67% of

the UK financial services jobs (as per shown in graph) and figuring cross out the all UK sector

with 35%.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Investor expectation keeping high stock market responds about the federal reserve

activity. This could led them for working with having the QE rise for announces and keeping

them with more performance. The QE pushes interested that could keep them for having down

rates, while having returns investors and savers also get them over while by keeping their

products for the firm. The lowers the returns about investors and savers about investing safer and

keeping them with money market accounts (Bai and et.al., 2021). Along with this most of these

investors are working for weight portfolio towards many other stocks, this could also help

pushing up with stock market prices. Fundamental analysis holds about their business concepts

expansion that could keep them for working with high estimation and make sure for having more

system in stock market. QE some economists and that analysts about through inflates assets

prices.

Following all the financial crisis, the Bank have also allowed for keeping them dramatic

using those activities. The Bank of England have taken their places and make sure for keeping

their virtual QE. The attempts also required for knowing about those further process and that

could include those activities which could make the countries business high. The impact QE that

could keep them for UK and the economy about those process and make sure study analysis and

keeping their effective or impact over through typically easily (Lin and Su, 2020). Financial

marketing in attempts about their force that could presented and come to know about how they

can work. It could be also negative points remains the suggestion the extract size and effective

policy about their places and make sure for having their high places and keeping them with more

working. The country economics evidence about various system and through rebalancing

channels.

activity. This could led them for working with having the QE rise for announces and keeping

them with more performance. The QE pushes interested that could keep them for having down

rates, while having returns investors and savers also get them over while by keeping their

products for the firm. The lowers the returns about investors and savers about investing safer and

keeping them with money market accounts (Bai and et.al., 2021). Along with this most of these

investors are working for weight portfolio towards many other stocks, this could also help

pushing up with stock market prices. Fundamental analysis holds about their business concepts

expansion that could keep them for working with high estimation and make sure for having more

system in stock market. QE some economists and that analysts about through inflates assets

prices.

Following all the financial crisis, the Bank have also allowed for keeping them dramatic

using those activities. The Bank of England have taken their places and make sure for keeping

their virtual QE. The attempts also required for knowing about those further process and that

could include those activities which could make the countries business high. The impact QE that

could keep them for UK and the economy about those process and make sure study analysis and

keeping their effective or impact over through typically easily (Lin and Su, 2020). Financial

marketing in attempts about their force that could presented and come to know about how they

can work. It could be also negative points remains the suggestion the extract size and effective

policy about their places and make sure for having their high places and keeping them with more

working. The country economics evidence about various system and through rebalancing

channels.

A year so later about UK mortgage and that could keep them with them emergency

funding about the from the Bank of England. The lenders that could take year 2008, UK

government have think about how usually they can work and make sure about for keeping them

and completion about how they can make their process submission. UK banks that could easily

led them for working with controversial both in effectiveness and its implementation although

keeping with high benefits and also make sure for knowing QE assess (Shahrestani and Rafei,

2020). The operation about the significant and keep them for market research and also bring out

for knowing about their system programme within the impacted market system. Financial

services that could also help them for keeping and make sure for having their high sources and

taking their risk managing about various things. 87% of services that could keep their

international market capital and ensure about their services for which the 96% valuable things.

QE keep their system and managing their work and ensuring about their process and

implementation for which the policies.

CONCLUSION

From the above report it had been concluded that, exchange rate causes that could cause

their highlights about how they can work and manage their highlights about working things.

Exchange rate volatility in the foreign exchange market and that could also led them for working

with high process. Along with this also examined about the international trade that could also led

them for knowing about how they usually work and keeping them with more estimation in using

the proper government system. Many of the risk that could keep the natural concepts and make

sure for having their more international trade and risks via that market of governments rules

about their system. While literature critically that could carry out the financial econometrics and

that could informational about London stock exchange. This methods that could adopt those

funding about the from the Bank of England. The lenders that could take year 2008, UK

government have think about how usually they can work and make sure about for keeping them

and completion about how they can make their process submission. UK banks that could easily

led them for working with controversial both in effectiveness and its implementation although

keeping with high benefits and also make sure for knowing QE assess (Shahrestani and Rafei,

2020). The operation about the significant and keep them for market research and also bring out

for knowing about their system programme within the impacted market system. Financial

services that could also help them for keeping and make sure for having their high sources and

taking their risk managing about various things. 87% of services that could keep their

international market capital and ensure about their services for which the 96% valuable things.

QE keep their system and managing their work and ensuring about their process and

implementation for which the policies.

CONCLUSION

From the above report it had been concluded that, exchange rate causes that could cause

their highlights about how they can work and manage their highlights about working things.

Exchange rate volatility in the foreign exchange market and that could also led them for working

with high process. Along with this also examined about the international trade that could also led

them for knowing about how they usually work and keeping them with more estimation in using

the proper government system. Many of the risk that could keep the natural concepts and make

sure for having their more international trade and risks via that market of governments rules

about their system. While literature critically that could carry out the financial econometrics and

that could informational about London stock exchange. This methods that could adopt those

secure about their services and keeping them with high sources. It had been seems that

interested rate policy and QE operation that could easily manage their work and keep them

impacted about those prices which could keep their working assess. Financial services that could

take place about their work and international money market that could impacted about

international capital market and managing stock prices.

interested rate policy and QE operation that could easily manage their work and keep them

impacted about those prices which could keep their working assess. Financial services that could

take place about their work and international money market that could impacted about

international capital market and managing stock prices.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

REFERENCES

Books and journals

Asiedu, E.L. and et.al., 2020. Testing the Weak-Form Efficiency Market Hypothesis on the

Ghana Stock Exchange: A Sectoral Analysis. Ghana Journal of Technology. 5(1). pp.79-

85.

Bahmani‐Oskooee, M. and Harvey, H., 2021. Exchange rate volatility and commodity trade

between United States and Australia: An asymmetric analysis. The World

Economy. 44(6). pp.1509-1700.

Bai, L. and et.al., 2021. Infectious disease pandemic and permanent volatility of international

stock markets: A long-term perspective. Finance research letters. 40. p.101709.

Bakas, D., Kostis, P. and Petrakis, P., 2020. Culture and labour productivity: An empirical

investigation. Economic Modelling. 85. pp.233-243.

Bashir, H. and et.al., 2020. Experimenting with sustainable business models in fast moving

consumer goods. Journal of Cleaner Production. 270. p.122302.

Brito, R. and Jacinto, C., 2020. Literature review on specific types of risk faced by firms. WIT

Transactions on Engineering Sciences. 129. pp.77-88.

Ca'Zorzi, M. and et.al., 2020. Monetary policy and its transmission in a globalised world.

Chirwa, T.G. and Odhiambo, N.M., 2020. Determinants of gold price movements: An empirical

investigation in the presence of multiple structural breaks. Resources Policy, 69,

p.101818.

Dada, J. T., Olomola, P. A. and Adedokun, A., 2021. Does non-linearity in exchange rate hold in

Nigeria? evidence from smooth transition autoregressive model. International Journal of

Monetary Economics and Finance. 14(2). pp.152-165.

Diniz-Maganini, N., Rasheed, A. A. and Sheng, H. H., 2021. Exchange rate regimes and price

efficiency: Empirical examination of the impact of financial crisis. Journal of

International Financial Markets, Institutions and Money. 73. p.101361.

Fűrész, D.I. and Rappai, G., 2020. Information leakage in the football transfer market. European

Sport Management Quarterly, pp.1-21.

Haydar, O.S. and Reilimo, M., 2020. The Impact of OPEC Announcements on Stock Returns.

Hohlwegler, O., 2021. The Value of CSR in Times of Increased Policy Uncertainty: Evidence

from the Brexit Referendum. Junior Management Science. 6(1). pp.1-24.

Huy, D.T.N., Dat, P.M. and Anh, P.T., 2020. BUILDING AN ECONOMETRIC MODEL OF

SELECTED FACTORS’IMPACT ON STOCK PRICE: A CASE STUDY. Journal of

Security & Sustainability Issues, 9.

Ledhem, M.A. and Mekidiche, M., 2020. Economic growth and financial performance of Islamic

banks: a CAMELS approach. Islamic Economic Studies.

Lee, S.S., 2021. Feature Investigation for Stock Returns Prediction Using XGBoost and Deep

Learning Sentiment Classification.

Liebi, L.J., 2020. The effect of ETFs on financial markets: a literature review. Financial Markets

and Portfolio Management. 34(2). pp.165-178.

Lin, B. and Su, T., 2020. The linkages between oil market uncertainty and Islamic stock markets:

Evidence from quantile-on-quantile approach. Energy Economics. 88. p.104759.

Maci, G., Pacelli, V. and D’Apolito, E., 2020. The Determinants of Stock Prices of European

Football Clubs: An Empirical Analysis. International Journal of Economics, Finance and

Management Sciences. 8(5). p.168.

1

Books and journals

Asiedu, E.L. and et.al., 2020. Testing the Weak-Form Efficiency Market Hypothesis on the

Ghana Stock Exchange: A Sectoral Analysis. Ghana Journal of Technology. 5(1). pp.79-

85.

Bahmani‐Oskooee, M. and Harvey, H., 2021. Exchange rate volatility and commodity trade

between United States and Australia: An asymmetric analysis. The World

Economy. 44(6). pp.1509-1700.

Bai, L. and et.al., 2021. Infectious disease pandemic and permanent volatility of international

stock markets: A long-term perspective. Finance research letters. 40. p.101709.

Bakas, D., Kostis, P. and Petrakis, P., 2020. Culture and labour productivity: An empirical

investigation. Economic Modelling. 85. pp.233-243.

Bashir, H. and et.al., 2020. Experimenting with sustainable business models in fast moving

consumer goods. Journal of Cleaner Production. 270. p.122302.

Brito, R. and Jacinto, C., 2020. Literature review on specific types of risk faced by firms. WIT

Transactions on Engineering Sciences. 129. pp.77-88.

Ca'Zorzi, M. and et.al., 2020. Monetary policy and its transmission in a globalised world.

Chirwa, T.G. and Odhiambo, N.M., 2020. Determinants of gold price movements: An empirical

investigation in the presence of multiple structural breaks. Resources Policy, 69,

p.101818.

Dada, J. T., Olomola, P. A. and Adedokun, A., 2021. Does non-linearity in exchange rate hold in

Nigeria? evidence from smooth transition autoregressive model. International Journal of

Monetary Economics and Finance. 14(2). pp.152-165.

Diniz-Maganini, N., Rasheed, A. A. and Sheng, H. H., 2021. Exchange rate regimes and price

efficiency: Empirical examination of the impact of financial crisis. Journal of

International Financial Markets, Institutions and Money. 73. p.101361.

Fűrész, D.I. and Rappai, G., 2020. Information leakage in the football transfer market. European

Sport Management Quarterly, pp.1-21.

Haydar, O.S. and Reilimo, M., 2020. The Impact of OPEC Announcements on Stock Returns.

Hohlwegler, O., 2021. The Value of CSR in Times of Increased Policy Uncertainty: Evidence

from the Brexit Referendum. Junior Management Science. 6(1). pp.1-24.

Huy, D.T.N., Dat, P.M. and Anh, P.T., 2020. BUILDING AN ECONOMETRIC MODEL OF

SELECTED FACTORS’IMPACT ON STOCK PRICE: A CASE STUDY. Journal of

Security & Sustainability Issues, 9.

Ledhem, M.A. and Mekidiche, M., 2020. Economic growth and financial performance of Islamic

banks: a CAMELS approach. Islamic Economic Studies.

Lee, S.S., 2021. Feature Investigation for Stock Returns Prediction Using XGBoost and Deep

Learning Sentiment Classification.

Liebi, L.J., 2020. The effect of ETFs on financial markets: a literature review. Financial Markets

and Portfolio Management. 34(2). pp.165-178.

Lin, B. and Su, T., 2020. The linkages between oil market uncertainty and Islamic stock markets:

Evidence from quantile-on-quantile approach. Energy Economics. 88. p.104759.

Maci, G., Pacelli, V. and D’Apolito, E., 2020. The Determinants of Stock Prices of European

Football Clubs: An Empirical Analysis. International Journal of Economics, Finance and

Management Sciences. 8(5). p.168.

1

Mateut, S., 2018. Subsidies, financial constraints and firm innovative activities in emerging

economies. Small Business Economics. 50(1). pp.131-162.

Oanh, T.T.K. and et.al., 2021. Ownership Structure and Firm Performance: Empirical Study in

Vietnamese Stock Exchange. In Data Science for Financial Econometrics (pp. 353-367).

Springer, Cham.

Rommerskirchen, C., 2020. Foreign bond investors and market discipline. Competition &

Change. 24(1). pp.3-25.

Shahrestani, P. and Rafei, M., 2020. The impact of oil price shocks on Tehran Stock Exchange

returns: Application of the Markov switching vector autoregressive models. Resources

Policy. 65. p.101579.

Sokolov, M., 2018. Smart Legal Contract as a Future of Contracts Enforcement. Available at

SSRN 3208292.

Szász, L. and et.al., 2020. Industry 4.0: a review and analysis of contingency and performance

effects. Journal of Manufacturing Technology Management.

Wamba, S.F., Queiroz, M.M. and Trinchera, L., 2020. Dynamics between blockchain adoption

determinants and supply chain performance: An empirical investigation. International

Journal of Production Economics. 229. p.107791.

Wang, P., Li, Y. and Wu, S., 2021. Time-varying Effects of US Economic Policy Uncertainty on

Exchange Rate Return and Volatility in China. Emerging Markets Finance and Trade.

pp.1-14.

Wystup, U., 2021. What Is a Currency Option?. Wilmott, 2021(111). pp.14-15.

Živkov, D., Kuzman, B. and Andrejević-Panić, A., 2021. Nonlinear bidirectional multiscale