International Financial Reporting: Accounting Standards and Treatments

VerifiedAdded on 2023/01/23

|13

|3608

|25

AI Summary

This project report covers various accounting standards in international financial reporting, including IAS 17, 16, and 2. It explains the accounting treatments for finance and operating leases, the ways leases should be accounted for in financial statements, and the impact on lessee and lessor financial statements. It also discusses the difference between capital and revenue expenditures and their impact on company accounts. Additionally, it covers the determination of inventory cost according to IAS 2.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

INTERNATIONAL

FINANCIAL

REPORTING

FINANCIAL

REPORTING

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

INTRODUCTION

The international financial reporting can be defined as a process of producing the

financial statements on the basis of international accounting standards (Alali and Foote, 2012).

Eventually, it is necessary for the organizations who perform at a global level to implement

various kind of accounting concept and standards. Generally, the accounting standards are issued

by the international accounting standard board. Herein, the project report various kind of

accounting standards are mentioned that helps to the companies to take crucial decision making.

The project report covers about the various accounting treatments in an individual accounting

standard as well as defines about way to apply accounting treatment on the financial treatments.

Apart from it, report is categorized into three parts that consist knowledge about IAS 17, 16 and

2.

MAIN BODY

Part (1)

(a) Description about international accounting standard 16 for lease treatment.

According to the international accounting standard 16, the accounting policies and

principles are applicable for both to the lessees, lessors (Tschopp and Nastanski, 2014).

Eventually, the leases are categorized as finance lease and operating lease. Eventually, the IAS

16, was evolved for lessors and lessees as well as for accurate accounting policies and principles

which are needed to be applied in relation to finance and operating lease. Herein, below some

principles are mentioned below which should be implemented in the financial statements of

lessees for finance lease:

During the commencement of lease, the finance lease must be considered as an assets and

also recorded as assets. As well as should be taken as liability at the lower value of the

assets and present value of the total payment of the lease ().

Apart from it, the depreciation policy for any particular assets that covers under the

finance lease must be consistent (Cotter, 2012). As well as if it is not clear that lessee will

get the ownership in the end of lease then the assets should be depreciated during the

short time period of lease term.

Additionally, the payment of finance lease should be divided between the finance charge

and minimized outstanding liability. Herein, it is important to know that finance charge

should be assigned such as to produce the equal rate of interest on balance of liability.

So this is all about the finance lease that must be treated in above mentioned manner. Apart from

it, herein, below way to treat operating lease is mentioned below such as:

The international financial reporting can be defined as a process of producing the

financial statements on the basis of international accounting standards (Alali and Foote, 2012).

Eventually, it is necessary for the organizations who perform at a global level to implement

various kind of accounting concept and standards. Generally, the accounting standards are issued

by the international accounting standard board. Herein, the project report various kind of

accounting standards are mentioned that helps to the companies to take crucial decision making.

The project report covers about the various accounting treatments in an individual accounting

standard as well as defines about way to apply accounting treatment on the financial treatments.

Apart from it, report is categorized into three parts that consist knowledge about IAS 17, 16 and

2.

MAIN BODY

Part (1)

(a) Description about international accounting standard 16 for lease treatment.

According to the international accounting standard 16, the accounting policies and

principles are applicable for both to the lessees, lessors (Tschopp and Nastanski, 2014).

Eventually, the leases are categorized as finance lease and operating lease. Eventually, the IAS

16, was evolved for lessors and lessees as well as for accurate accounting policies and principles

which are needed to be applied in relation to finance and operating lease. Herein, below some

principles are mentioned below which should be implemented in the financial statements of

lessees for finance lease:

During the commencement of lease, the finance lease must be considered as an assets and

also recorded as assets. As well as should be taken as liability at the lower value of the

assets and present value of the total payment of the lease ().

Apart from it, the depreciation policy for any particular assets that covers under the

finance lease must be consistent (Cotter, 2012). As well as if it is not clear that lessee will

get the ownership in the end of lease then the assets should be depreciated during the

short time period of lease term.

Additionally, the payment of finance lease should be divided between the finance charge

and minimized outstanding liability. Herein, it is important to know that finance charge

should be assigned such as to produce the equal rate of interest on balance of liability.

So this is all about the finance lease that must be treated in above mentioned manner. Apart from

it, herein, below way to treat operating lease is mentioned below such as:

Eventually as the finance lease, the operating lease does not treated as recognition of an

assets or liability in the balance sheets of lessee. The income and expenditure of operating lease

is considered in the books of lessor or lessee at a uniform base. As per the international

accounting standard 16, in the operating lease accounting, it is being assumed that the lessor has

the leased assets and the lessee takes the assets for a particular fixed time period. So basically on

the basis of this kind of ownership and way to use the assets, the accounting treatment of an

operating lease by the lessee and lessor.

Operating lease accounting by lessee- If an operating lease consists fixed rental increasing

during the lease. In such condition, there are two ways to account for the altered payment which

are follows:

Scheduled increase- If there is scheduled increase in the rent on a straight line basis then

some recognition systems can present the usage of operating assets (Shan, and Taylor,

2015).

Contingent rentals- If there is change in the lease payment which are based future events.

(inflation, tax occurred etc.)

Operating lease accounting by lessor- This must be account for lease in below mentioned way

which is as follows:

The leased property must be depreciate during its life.

The direct cost of the lease should be deferred.

(b) Explanation of ways in which leases should be accounted for financial statements of

lessee.

As accordance to the international accounting standard 16, herein some conditions in that

leases must be accounted for financial statements of lessee which are as follows:

- If lease contract allows to lessee to buy the same leased assets on a price that is below in

compare to fair value of assets in further.

-As well as in a condition in which term of lease is equal to 75% or more then to the 75% of the

total life of the leased assets.

-If present value of total payment of lease is more then the 90% of fair value of assets.

Lease accounting by lessee and lessor:

In general terms there are two kind of lease one is finance lease and second is operating

lease (Flower, 2018). The finance lease can be defined as to buy an assets by external finance. As

well as the operating lease is related to get an assets on rent.

Accounting for finance lease by lessee- The finance lease is presented by lessee such as in

various financial statements like:

Balance sheet- In this both the leased assets and lease liability is recorded.

assets or liability in the balance sheets of lessee. The income and expenditure of operating lease

is considered in the books of lessor or lessee at a uniform base. As per the international

accounting standard 16, in the operating lease accounting, it is being assumed that the lessor has

the leased assets and the lessee takes the assets for a particular fixed time period. So basically on

the basis of this kind of ownership and way to use the assets, the accounting treatment of an

operating lease by the lessee and lessor.

Operating lease accounting by lessee- If an operating lease consists fixed rental increasing

during the lease. In such condition, there are two ways to account for the altered payment which

are follows:

Scheduled increase- If there is scheduled increase in the rent on a straight line basis then

some recognition systems can present the usage of operating assets (Shan, and Taylor,

2015).

Contingent rentals- If there is change in the lease payment which are based future events.

(inflation, tax occurred etc.)

Operating lease accounting by lessor- This must be account for lease in below mentioned way

which is as follows:

The leased property must be depreciate during its life.

The direct cost of the lease should be deferred.

(b) Explanation of ways in which leases should be accounted for financial statements of

lessee.

As accordance to the international accounting standard 16, herein some conditions in that

leases must be accounted for financial statements of lessee which are as follows:

- If lease contract allows to lessee to buy the same leased assets on a price that is below in

compare to fair value of assets in further.

-As well as in a condition in which term of lease is equal to 75% or more then to the 75% of the

total life of the leased assets.

-If present value of total payment of lease is more then the 90% of fair value of assets.

Lease accounting by lessee and lessor:

In general terms there are two kind of lease one is finance lease and second is operating

lease (Flower, 2018). The finance lease can be defined as to buy an assets by external finance. As

well as the operating lease is related to get an assets on rent.

Accounting for finance lease by lessee- The finance lease is presented by lessee such as in

various financial statements like:

Balance sheet- In this both the leased assets and lease liability is recorded.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Income statement- Under this the interest expenditure on the lease payable is recorded.

As well as it is being calculated on the basis of lease payment at starting applying the

interest rate in the lease.

Cash flow statement- Interest of the payment of lease is being recorded as an operating

cash out flow in the cash flow statement. Along with, the repayment is recorded as a

financing cash outflow. As well as the expenses of interest may be recorded as an

operating or financing cash outflow.

Accounting for operating lease by lessee- The operating lease is presented by lessee such as in

various financial statements like:

Balance sheet- The operating lease is not reported in the balance sheet.

Income statement- It includes the rent of assets that is similar to the lease payment.

Cash flow statement- Under it, the total payment of lease or rent is considered as

operating cash outflow (Walton, 2012).

Impact of lease accounting on the lessee’s financial statements- The variation of finance and

operating lease effects the different types of elements of financial statements such as:

Total income and cash flow remain equal in both leases.

Assets, liabilities, earning before income and tax of various operations are more in the

finance lease in compare to the operating lease.

Accounting for finance lease by the lessor-

Balance sheet- In this lease receivable is recorded. As well as value of the assets is

minimized on the basis of book value of the leased assets.

Income statement- In this the revenue from the interest is recorded. This is computed on

the basis of received lease in the starting of the interest rate in the lease.

Cash flow statement- The interest of the revenue of lease is included in the cash flow

statement in the form of cash inflow. As well as the principle of the total payable amount

is recorded as an investing cash inflow.

Accounting for operating lease by the lessor-

Balance sheet- In this the leased assets is recorded.

Income statement- Under it, the interest revenue is recorded along with the depreciation

.Cash flow statement- Total payment is considered as an operating cash inflow in the

cash flow statement.

Impact of the lease accounting on the lessor’s financial statements: The difference of finance and

operating lease effects the different types of elements of financial statements such as:

Income of the early year is more then the finance lease.

Income of the later year is less then the finance lease.

The total amount of tax in the initial year is more in the finance lease in compare to the

operating lease.

The operating cash flow is more of the operating lease in compare to the finance lease

(Erb and Pelger, 2015).

As well as it is being calculated on the basis of lease payment at starting applying the

interest rate in the lease.

Cash flow statement- Interest of the payment of lease is being recorded as an operating

cash out flow in the cash flow statement. Along with, the repayment is recorded as a

financing cash outflow. As well as the expenses of interest may be recorded as an

operating or financing cash outflow.

Accounting for operating lease by lessee- The operating lease is presented by lessee such as in

various financial statements like:

Balance sheet- The operating lease is not reported in the balance sheet.

Income statement- It includes the rent of assets that is similar to the lease payment.

Cash flow statement- Under it, the total payment of lease or rent is considered as

operating cash outflow (Walton, 2012).

Impact of lease accounting on the lessee’s financial statements- The variation of finance and

operating lease effects the different types of elements of financial statements such as:

Total income and cash flow remain equal in both leases.

Assets, liabilities, earning before income and tax of various operations are more in the

finance lease in compare to the operating lease.

Accounting for finance lease by the lessor-

Balance sheet- In this lease receivable is recorded. As well as value of the assets is

minimized on the basis of book value of the leased assets.

Income statement- In this the revenue from the interest is recorded. This is computed on

the basis of received lease in the starting of the interest rate in the lease.

Cash flow statement- The interest of the revenue of lease is included in the cash flow

statement in the form of cash inflow. As well as the principle of the total payable amount

is recorded as an investing cash inflow.

Accounting for operating lease by the lessor-

Balance sheet- In this the leased assets is recorded.

Income statement- Under it, the interest revenue is recorded along with the depreciation

.Cash flow statement- Total payment is considered as an operating cash inflow in the

cash flow statement.

Impact of the lease accounting on the lessor’s financial statements: The difference of finance and

operating lease effects the different types of elements of financial statements such as:

Income of the early year is more then the finance lease.

Income of the later year is less then the finance lease.

The total amount of tax in the initial year is more in the finance lease in compare to the

operating lease.

The operating cash flow is more of the operating lease in compare to the finance lease

(Erb and Pelger, 2015).

So these are the ways in which the leases should be accounted for financial statements of lessee.

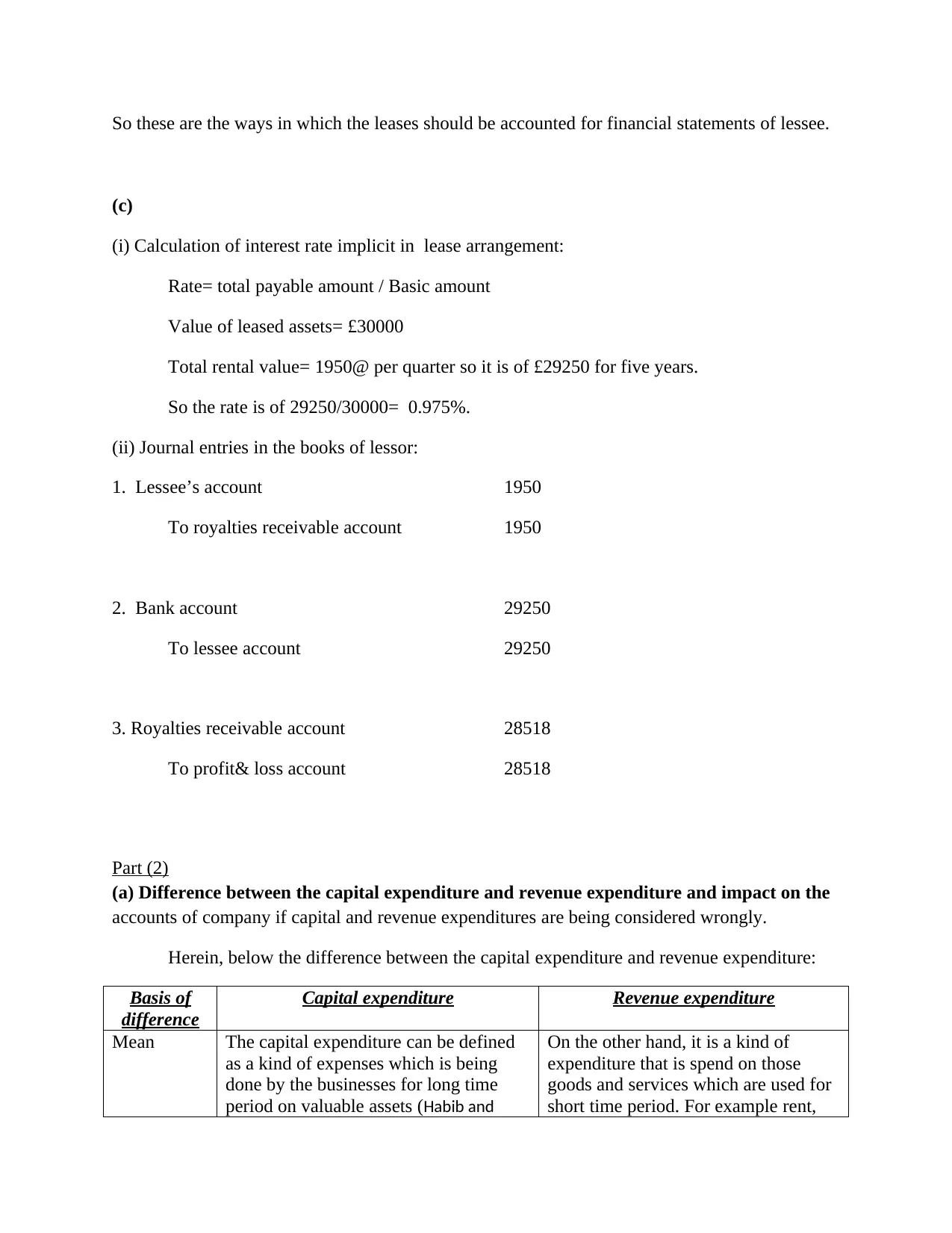

(c)

(i) Calculation of interest rate implicit in lease arrangement:

Rate= total payable amount / Basic amount

Value of leased assets= £30000

Total rental value= 1950@ per quarter so it is of £29250 for five years.

So the rate is of 29250/30000= 0.975%.

(ii) Journal entries in the books of lessor:

1. Lessee’s account 1950

To royalties receivable account 1950

2. Bank account 29250

To lessee account 29250

3. Royalties receivable account 28518

To profit& loss account 28518

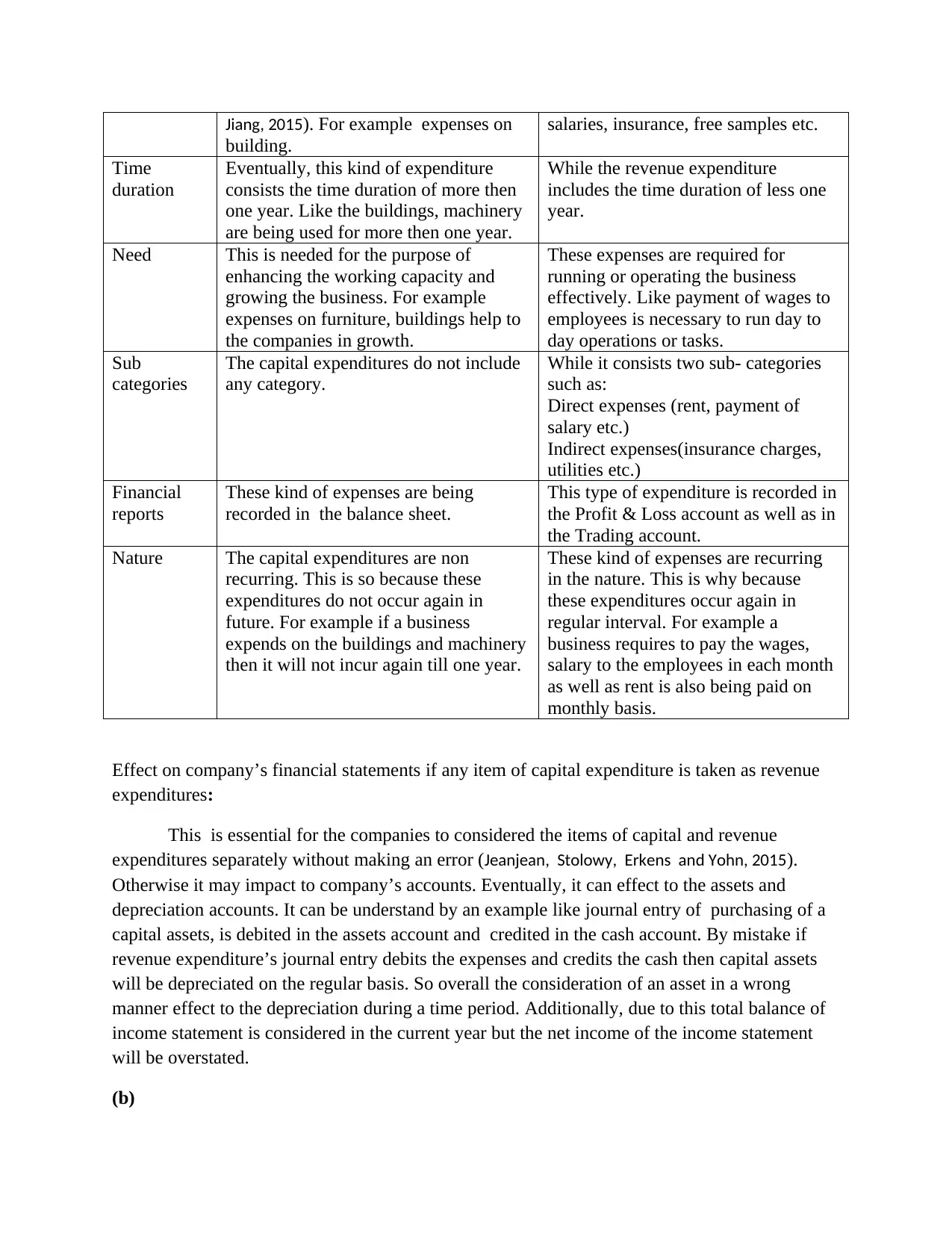

Part (2)

(a) Difference between the capital expenditure and revenue expenditure and impact on the

accounts of company if capital and revenue expenditures are being considered wrongly.

Herein, below the difference between the capital expenditure and revenue expenditure:

Basis of

difference

Capital expenditure Revenue expenditure

Mean The capital expenditure can be defined

as a kind of expenses which is being

done by the businesses for long time

period on valuable assets (Habib and

On the other hand, it is a kind of

expenditure that is spend on those

goods and services which are used for

short time period. For example rent,

(c)

(i) Calculation of interest rate implicit in lease arrangement:

Rate= total payable amount / Basic amount

Value of leased assets= £30000

Total rental value= 1950@ per quarter so it is of £29250 for five years.

So the rate is of 29250/30000= 0.975%.

(ii) Journal entries in the books of lessor:

1. Lessee’s account 1950

To royalties receivable account 1950

2. Bank account 29250

To lessee account 29250

3. Royalties receivable account 28518

To profit& loss account 28518

Part (2)

(a) Difference between the capital expenditure and revenue expenditure and impact on the

accounts of company if capital and revenue expenditures are being considered wrongly.

Herein, below the difference between the capital expenditure and revenue expenditure:

Basis of

difference

Capital expenditure Revenue expenditure

Mean The capital expenditure can be defined

as a kind of expenses which is being

done by the businesses for long time

period on valuable assets (Habib and

On the other hand, it is a kind of

expenditure that is spend on those

goods and services which are used for

short time period. For example rent,

Jiang, 2015). For example expenses on

building.

salaries, insurance, free samples etc.

Time

duration

Eventually, this kind of expenditure

consists the time duration of more then

one year. Like the buildings, machinery

are being used for more then one year.

While the revenue expenditure

includes the time duration of less one

year.

Need This is needed for the purpose of

enhancing the working capacity and

growing the business. For example

expenses on furniture, buildings help to

the companies in growth.

These expenses are required for

running or operating the business

effectively. Like payment of wages to

employees is necessary to run day to

day operations or tasks.

Sub

categories

The capital expenditures do not include

any category.

While it consists two sub- categories

such as:

Direct expenses (rent, payment of

salary etc.)

Indirect expenses(insurance charges,

utilities etc.)

Financial

reports

These kind of expenses are being

recorded in the balance sheet.

This type of expenditure is recorded in

the Profit & Loss account as well as in

the Trading account.

Nature The capital expenditures are non

recurring. This is so because these

expenditures do not occur again in

future. For example if a business

expends on the buildings and machinery

then it will not incur again till one year.

These kind of expenses are recurring

in the nature. This is why because

these expenditures occur again in

regular interval. For example a

business requires to pay the wages,

salary to the employees in each month

as well as rent is also being paid on

monthly basis.

Effect on company’s financial statements if any item of capital expenditure is taken as revenue

expenditures:

This is essential for the companies to considered the items of capital and revenue

expenditures separately without making an error (Jeanjean, Stolowy, Erkens and Yohn, 2015).

Otherwise it may impact to company’s accounts. Eventually, it can effect to the assets and

depreciation accounts. It can be understand by an example like journal entry of purchasing of a

capital assets, is debited in the assets account and credited in the cash account. By mistake if

revenue expenditure’s journal entry debits the expenses and credits the cash then capital assets

will be depreciated on the regular basis. So overall the consideration of an asset in a wrong

manner effect to the depreciation during a time period. Additionally, due to this total balance of

income statement is considered in the current year but the net income of the income statement

will be overstated.

(b)

building.

salaries, insurance, free samples etc.

Time

duration

Eventually, this kind of expenditure

consists the time duration of more then

one year. Like the buildings, machinery

are being used for more then one year.

While the revenue expenditure

includes the time duration of less one

year.

Need This is needed for the purpose of

enhancing the working capacity and

growing the business. For example

expenses on furniture, buildings help to

the companies in growth.

These expenses are required for

running or operating the business

effectively. Like payment of wages to

employees is necessary to run day to

day operations or tasks.

Sub

categories

The capital expenditures do not include

any category.

While it consists two sub- categories

such as:

Direct expenses (rent, payment of

salary etc.)

Indirect expenses(insurance charges,

utilities etc.)

Financial

reports

These kind of expenses are being

recorded in the balance sheet.

This type of expenditure is recorded in

the Profit & Loss account as well as in

the Trading account.

Nature The capital expenditures are non

recurring. This is so because these

expenditures do not occur again in

future. For example if a business

expends on the buildings and machinery

then it will not incur again till one year.

These kind of expenses are recurring

in the nature. This is why because

these expenditures occur again in

regular interval. For example a

business requires to pay the wages,

salary to the employees in each month

as well as rent is also being paid on

monthly basis.

Effect on company’s financial statements if any item of capital expenditure is taken as revenue

expenditures:

This is essential for the companies to considered the items of capital and revenue

expenditures separately without making an error (Jeanjean, Stolowy, Erkens and Yohn, 2015).

Otherwise it may impact to company’s accounts. Eventually, it can effect to the assets and

depreciation accounts. It can be understand by an example like journal entry of purchasing of a

capital assets, is debited in the assets account and credited in the cash account. By mistake if

revenue expenditure’s journal entry debits the expenses and credits the cash then capital assets

will be depreciated on the regular basis. So overall the consideration of an asset in a wrong

manner effect to the depreciation during a time period. Additionally, due to this total balance of

income statement is considered in the current year but the net income of the income statement

will be overstated.

(b)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

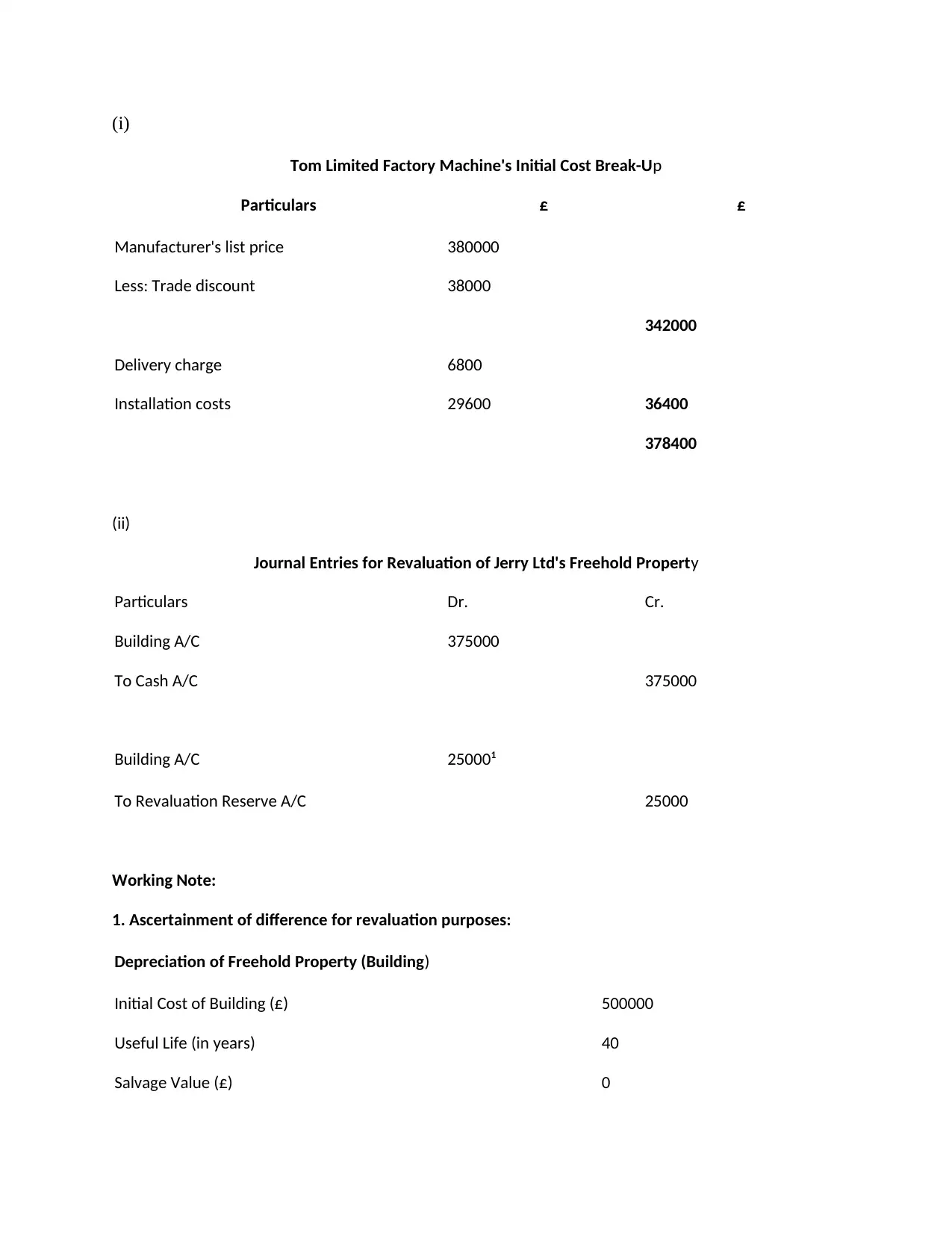

(i)

Tom Limited Factory Machine's Initial Cost Break-Up

Particulars £ £

Manufacturer's list price 380000

Less: Trade discount 38000

342000

Delivery charge 6800

Installation costs 29600 36400

378400

(ii)

Journal Entries for Revaluation of Jerry Ltd's Freehold Property

Particulars Dr. Cr.

Building A/C 375000

To Cash A/C 375000

Building A/C 250001

To Revaluation Reserve A/C 25000

Working Note:

1. Ascertainment of difference for revaluation purposes:

Depreciation of Freehold Property (Building)

Initial Cost of Building (£) 500000

Useful Life (in years) 40

Salvage Value (£) 0

Tom Limited Factory Machine's Initial Cost Break-Up

Particulars £ £

Manufacturer's list price 380000

Less: Trade discount 38000

342000

Delivery charge 6800

Installation costs 29600 36400

378400

(ii)

Journal Entries for Revaluation of Jerry Ltd's Freehold Property

Particulars Dr. Cr.

Building A/C 375000

To Cash A/C 375000

Building A/C 250001

To Revaluation Reserve A/C 25000

Working Note:

1. Ascertainment of difference for revaluation purposes:

Depreciation of Freehold Property (Building)

Initial Cost of Building (£) 500000

Useful Life (in years) 40

Salvage Value (£) 0

Depreciation on Building to be charged annually 12500

Depreciation Charged between 2007 and 2017 125000

Value after Depreciation 375000

Revaluation Amount of Building 400000

Total Appreciation 25000

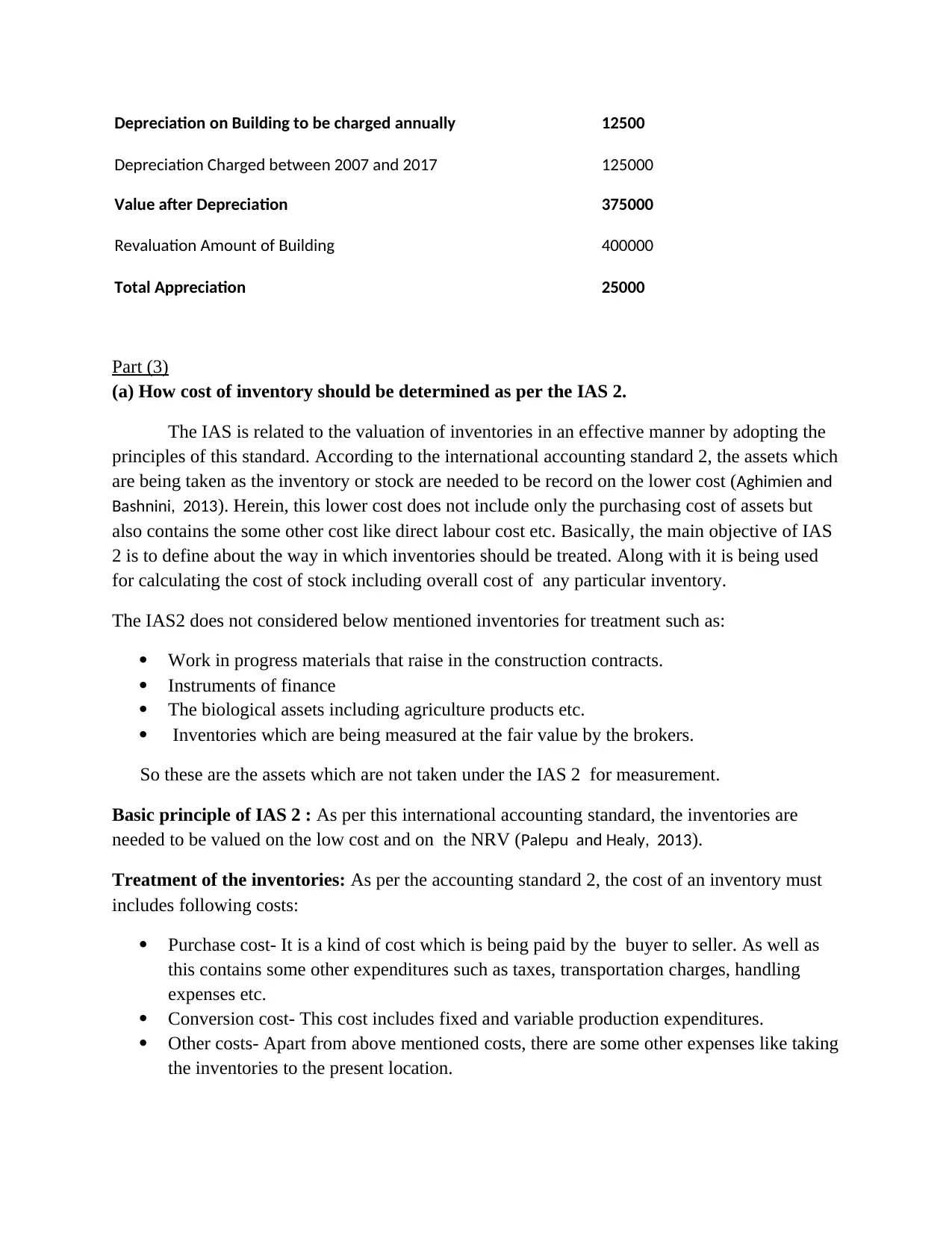

Part (3)

(a) How cost of inventory should be determined as per the IAS 2.

The IAS is related to the valuation of inventories in an effective manner by adopting the

principles of this standard. According to the international accounting standard 2, the assets which

are being taken as the inventory or stock are needed to be record on the lower cost (Aghimien and

Bashnini, 2013). Herein, this lower cost does not include only the purchasing cost of assets but

also contains the some other cost like direct labour cost etc. Basically, the main objective of IAS

2 is to define about the way in which inventories should be treated. Along with it is being used

for calculating the cost of stock including overall cost of any particular inventory.

The IAS2 does not considered below mentioned inventories for treatment such as:

Work in progress materials that raise in the construction contracts.

Instruments of finance

The biological assets including agriculture products etc.

Inventories which are being measured at the fair value by the brokers.

So these are the assets which are not taken under the IAS 2 for measurement.

Basic principle of IAS 2 : As per this international accounting standard, the inventories are

needed to be valued on the low cost and on the NRV (Palepu and Healy, 2013).

Treatment of the inventories: As per the accounting standard 2, the cost of an inventory must

includes following costs:

Purchase cost- It is a kind of cost which is being paid by the buyer to seller. As well as

this contains some other expenditures such as taxes, transportation charges, handling

expenses etc.

Conversion cost- This cost includes fixed and variable production expenditures.

Other costs- Apart from above mentioned costs, there are some other expenses like taking

the inventories to the present location.

Depreciation Charged between 2007 and 2017 125000

Value after Depreciation 375000

Revaluation Amount of Building 400000

Total Appreciation 25000

Part (3)

(a) How cost of inventory should be determined as per the IAS 2.

The IAS is related to the valuation of inventories in an effective manner by adopting the

principles of this standard. According to the international accounting standard 2, the assets which

are being taken as the inventory or stock are needed to be record on the lower cost (Aghimien and

Bashnini, 2013). Herein, this lower cost does not include only the purchasing cost of assets but

also contains the some other cost like direct labour cost etc. Basically, the main objective of IAS

2 is to define about the way in which inventories should be treated. Along with it is being used

for calculating the cost of stock including overall cost of any particular inventory.

The IAS2 does not considered below mentioned inventories for treatment such as:

Work in progress materials that raise in the construction contracts.

Instruments of finance

The biological assets including agriculture products etc.

Inventories which are being measured at the fair value by the brokers.

So these are the assets which are not taken under the IAS 2 for measurement.

Basic principle of IAS 2 : As per this international accounting standard, the inventories are

needed to be valued on the low cost and on the NRV (Palepu and Healy, 2013).

Treatment of the inventories: As per the accounting standard 2, the cost of an inventory must

includes following costs:

Purchase cost- It is a kind of cost which is being paid by the buyer to seller. As well as

this contains some other expenditures such as taxes, transportation charges, handling

expenses etc.

Conversion cost- This cost includes fixed and variable production expenditures.

Other costs- Apart from above mentioned costs, there are some other expenses like taking

the inventories to the present location.

So these costs must be included in the valuation of inventories. Apart from it there are some

other costs which are not considered such as:

Cost of storage.

Abnormal wastage

Expenses which are not related to the production

Cost of sales.

Interest cost

As per this international accounting standard, inventories which are interchanged and non

interchanged are being determined in such manner:

Interchanged inventories- Eventually, these inventories are determined by the FIFO (First in

first out) and weighted average cost method (Haller and van Staden, 2014).

Non interchanges inventories- These inventories are valued by the specific cost to any

particular item of inventory.

Written down to NRV- The net realizable value is the predicted price of selling. Eventually, the

written down value to the net realizable value must be taken as an expenditure for any particular

time period in that written down incurred. In the context of inventory valuation, the NRV for any

inventory should be written off as per the time duration (Boachie, 2016).

So this is all about the international accounting standard that defines about the way in which

inventories should be valued.

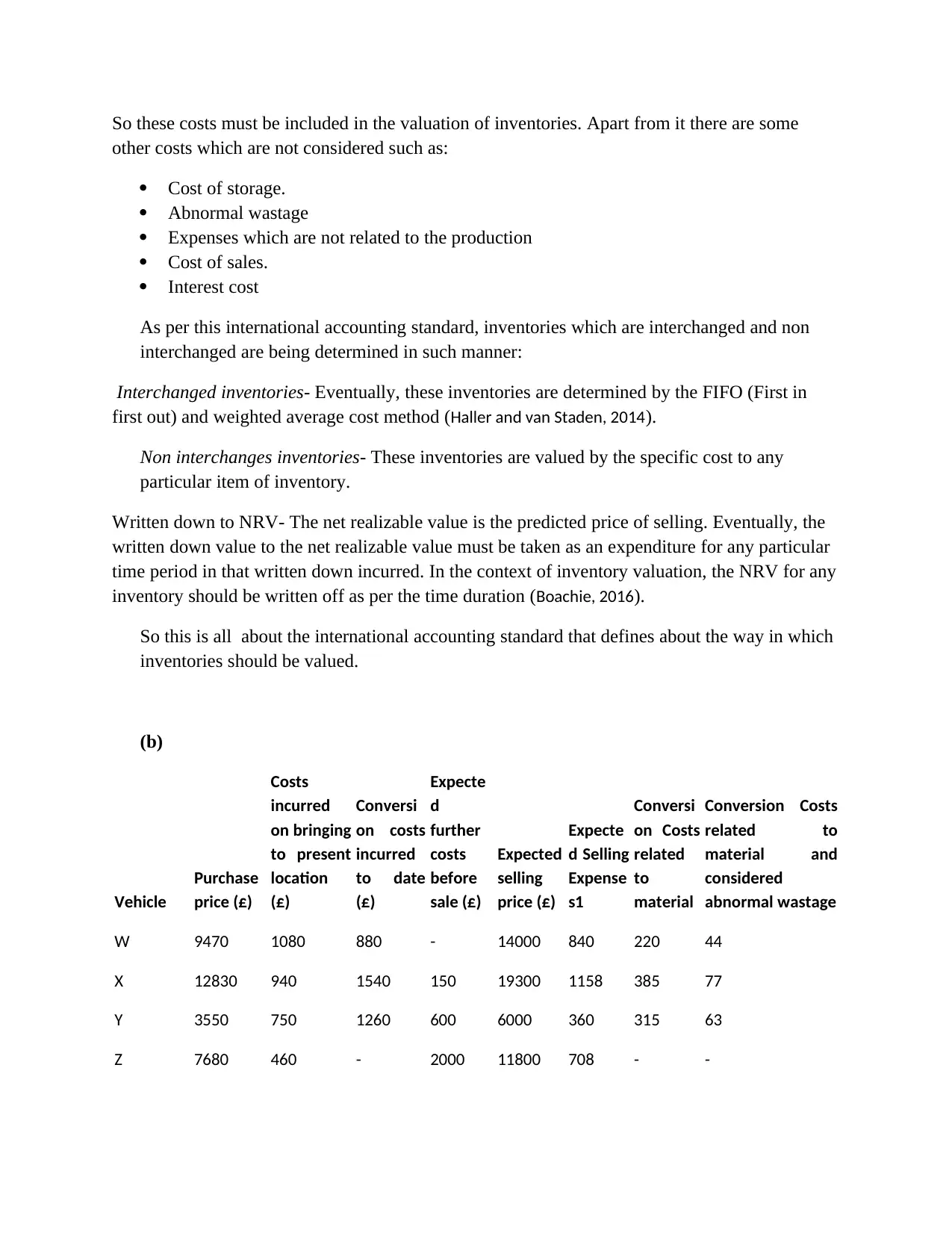

(b)

Vehicle

Purchase

price (£)

Costs

incurred

on bringing

to present

location

(£)

Conversi

on costs

incurred

to date

(£)

Expecte

d

further

costs

before

sale (£)

Expected

selling

price (£)

Expecte

d Selling

Expense

s1

Conversi

on Costs

related

to

material

Conversion Costs

related to

material and

considered

abnormal wastage

W 9470 1080 880 - 14000 840 220 44

X 12830 940 1540 150 19300 1158 385 77

Y 3550 750 1260 600 6000 360 315 63

Z 7680 460 - 2000 11800 708 - -

other costs which are not considered such as:

Cost of storage.

Abnormal wastage

Expenses which are not related to the production

Cost of sales.

Interest cost

As per this international accounting standard, inventories which are interchanged and non

interchanged are being determined in such manner:

Interchanged inventories- Eventually, these inventories are determined by the FIFO (First in

first out) and weighted average cost method (Haller and van Staden, 2014).

Non interchanges inventories- These inventories are valued by the specific cost to any

particular item of inventory.

Written down to NRV- The net realizable value is the predicted price of selling. Eventually, the

written down value to the net realizable value must be taken as an expenditure for any particular

time period in that written down incurred. In the context of inventory valuation, the NRV for any

inventory should be written off as per the time duration (Boachie, 2016).

So this is all about the international accounting standard that defines about the way in which

inventories should be valued.

(b)

Vehicle

Purchase

price (£)

Costs

incurred

on bringing

to present

location

(£)

Conversi

on costs

incurred

to date

(£)

Expecte

d

further

costs

before

sale (£)

Expected

selling

price (£)

Expecte

d Selling

Expense

s1

Conversi

on Costs

related

to

material

Conversion Costs

related to

material and

considered

abnormal wastage

W 9470 1080 880 - 14000 840 220 44

X 12830 940 1540 150 19300 1158 385 77

Y 3550 750 1260 600 6000 360 315 63

Z 7680 460 - 2000 11800 708 - -

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

184

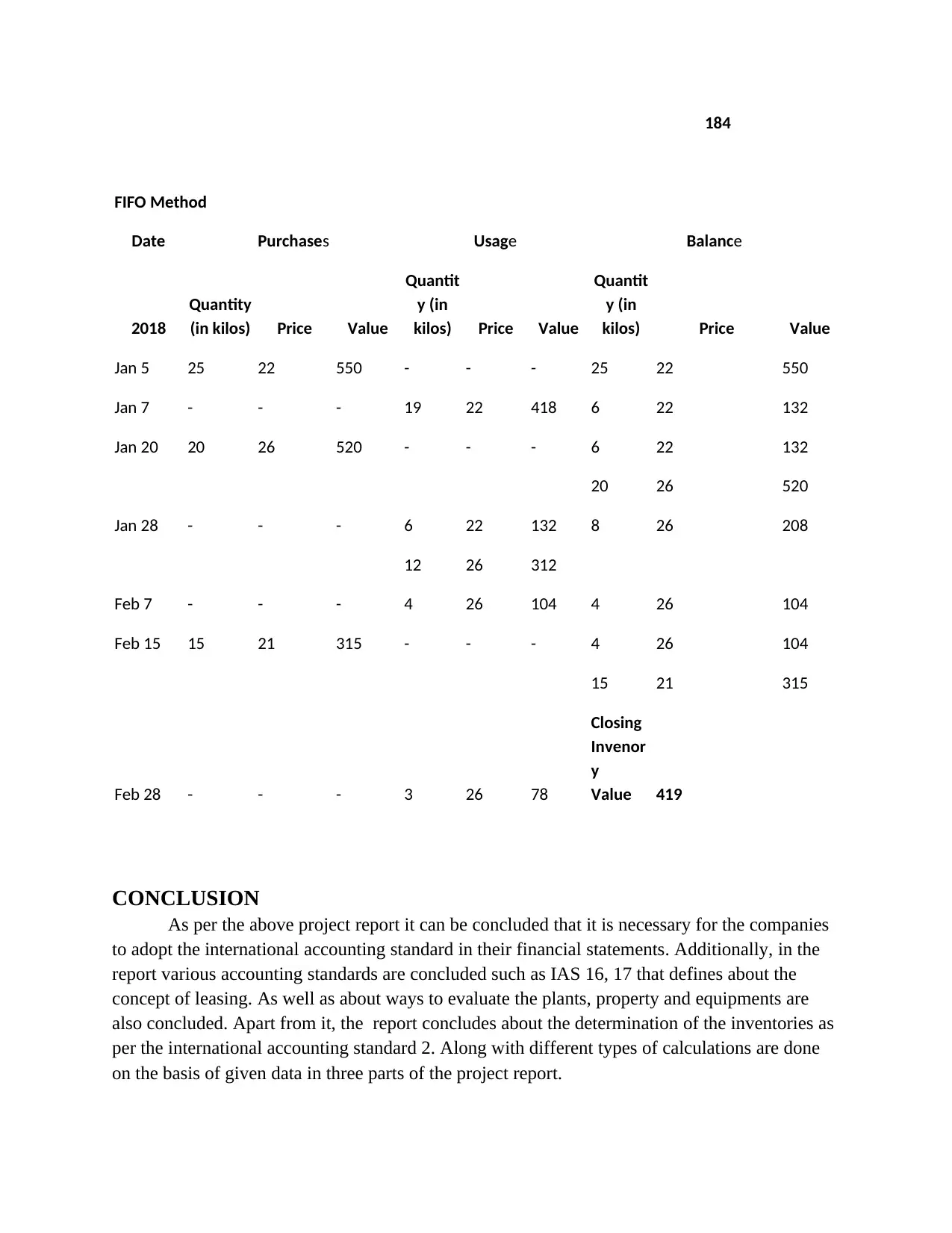

FIFO Method

Date Purchases Usage Balance

2018

Quantity

(in kilos) Price Value

Quantit

y (in

kilos) Price Value

Quantit

y (in

kilos) Price Value

Jan 5 25 22 550 - - - 25 22 550

Jan 7 - - - 19 22 418 6 22 132

Jan 20 20 26 520 - - - 6 22 132

20 26 520

Jan 28 - - - 6 22 132 8 26 208

12 26 312

Feb 7 - - - 4 26 104 4 26 104

Feb 15 15 21 315 - - - 4 26 104

15 21 315

Feb 28 - - - 3 26 78

Closing

Invenor

y

Value 419

CONCLUSION

As per the above project report it can be concluded that it is necessary for the companies

to adopt the international accounting standard in their financial statements. Additionally, in the

report various accounting standards are concluded such as IAS 16, 17 that defines about the

concept of leasing. As well as about ways to evaluate the plants, property and equipments are

also concluded. Apart from it, the report concludes about the determination of the inventories as

per the international accounting standard 2. Along with different types of calculations are done

on the basis of given data in three parts of the project report.

FIFO Method

Date Purchases Usage Balance

2018

Quantity

(in kilos) Price Value

Quantit

y (in

kilos) Price Value

Quantit

y (in

kilos) Price Value

Jan 5 25 22 550 - - - 25 22 550

Jan 7 - - - 19 22 418 6 22 132

Jan 20 20 26 520 - - - 6 22 132

20 26 520

Jan 28 - - - 6 22 132 8 26 208

12 26 312

Feb 7 - - - 4 26 104 4 26 104

Feb 15 15 21 315 - - - 4 26 104

15 21 315

Feb 28 - - - 3 26 78

Closing

Invenor

y

Value 419

CONCLUSION

As per the above project report it can be concluded that it is necessary for the companies

to adopt the international accounting standard in their financial statements. Additionally, in the

report various accounting standards are concluded such as IAS 16, 17 that defines about the

concept of leasing. As well as about ways to evaluate the plants, property and equipments are

also concluded. Apart from it, the report concludes about the determination of the inventories as

per the international accounting standard 2. Along with different types of calculations are done

on the basis of given data in three parts of the project report.

REFERENCES

Books and journals:

Alali, F. A. and Foote, P .S., 2012. The value relevance of international financial reporting standards:

Empirical evidence in an emerging market. The international journal of accounting. 47(1).

pp.85-108.

Tschopp, D. and Nastanski, M., 2014. The harmonization and convergence of corporate social

responsibility reporting standards. Journal of Business Ethics. 125(1). pp.147-162.

Cotter, D., 2012. Advanced financial reporting: A complete guide to IFRS. Financial Times/Prentice Hall.

Jin, K., Shan, Y. and Taylor, S., 2015. Matching between revenues and expenses and the adoption of

International Financial Reporting Standards. Pacific-Basin Finance Journal. 35. pp.90-107.

Flower, J., 2018. Global financial reporting. Macmillan International Higher Education.

Walton, P. ed., 2012. The Routledge companion to fair value and financial reporting. Routledge.

Erb, C. and Pelger, C., 2015. “Twisting words”? A study of the construction and reconstruction of

reliability in financial reporting standard-setting. Accounting, Organizations and Society. 40.

pp.13-40.

Habib, A. and Jiang, H., 2015. Corporate governance and financial reporting quality in China: A survey of

recent evidence. Journal of International Accounting, Auditing and Taxation. 24. pp.29-45.

Jeanjean, T., Stolowy, H., Erkens, M. and Yohn, T.L., 2015. International evidence on the impact of

adopting English as an external reporting language. Journal of International Business Studies.

46(2). pp.180-205.

Aghimien, P. and Bashnini, K., 2013. THE DEVELOPMENT OF INTERNATIONAL FINANCIAL REPORTING

STANDARDS: ORIGINATION TO PRESENT DAY. International Journal of Business, Accounting, &

Finance. 7(2).

Palepu, K .G. and Healy, P .M., 2013. Business analysis and valuation: Using financial statements, text

and cases.

Haller, A. and van Staden, C., 2014. The value added statement–an appropriate instrument for

Integrated Reporting. Accounting, Auditing & Accountability Journal. 27(7). pp.1190-1216.

Boachie, C., 2016. The effect of international financial reporting standards adoption on foreign direct

investment and the economy. In Economics and Political Implications of International Financial

Reporting Standards (pp. 342-361). IGI Global.

Online

About accounting standards. 2018 . [online]. Available through: <

https://www.iasplus.com/en/standards/ias/ias17 >

Books and journals:

Alali, F. A. and Foote, P .S., 2012. The value relevance of international financial reporting standards:

Empirical evidence in an emerging market. The international journal of accounting. 47(1).

pp.85-108.

Tschopp, D. and Nastanski, M., 2014. The harmonization and convergence of corporate social

responsibility reporting standards. Journal of Business Ethics. 125(1). pp.147-162.

Cotter, D., 2012. Advanced financial reporting: A complete guide to IFRS. Financial Times/Prentice Hall.

Jin, K., Shan, Y. and Taylor, S., 2015. Matching between revenues and expenses and the adoption of

International Financial Reporting Standards. Pacific-Basin Finance Journal. 35. pp.90-107.

Flower, J., 2018. Global financial reporting. Macmillan International Higher Education.

Walton, P. ed., 2012. The Routledge companion to fair value and financial reporting. Routledge.

Erb, C. and Pelger, C., 2015. “Twisting words”? A study of the construction and reconstruction of

reliability in financial reporting standard-setting. Accounting, Organizations and Society. 40.

pp.13-40.

Habib, A. and Jiang, H., 2015. Corporate governance and financial reporting quality in China: A survey of

recent evidence. Journal of International Accounting, Auditing and Taxation. 24. pp.29-45.

Jeanjean, T., Stolowy, H., Erkens, M. and Yohn, T.L., 2015. International evidence on the impact of

adopting English as an external reporting language. Journal of International Business Studies.

46(2). pp.180-205.

Aghimien, P. and Bashnini, K., 2013. THE DEVELOPMENT OF INTERNATIONAL FINANCIAL REPORTING

STANDARDS: ORIGINATION TO PRESENT DAY. International Journal of Business, Accounting, &

Finance. 7(2).

Palepu, K .G. and Healy, P .M., 2013. Business analysis and valuation: Using financial statements, text

and cases.

Haller, A. and van Staden, C., 2014. The value added statement–an appropriate instrument for

Integrated Reporting. Accounting, Auditing & Accountability Journal. 27(7). pp.1190-1216.

Boachie, C., 2016. The effect of international financial reporting standards adoption on foreign direct

investment and the economy. In Economics and Political Implications of International Financial

Reporting Standards (pp. 342-361). IGI Global.

Online

About accounting standards. 2018 . [online]. Available through: <

https://www.iasplus.com/en/standards/ias/ias17 >

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.