International Financial Reporting: Accounting for Intangible and Tangible Assets

VerifiedAdded on 2023/06/10

|17

|4420

|464

AI Summary

This article discusses the accounting treatment of intangible and tangible assets under International Financial Reporting Standards (IFRS) in Germany and Japan. It covers the definition and classification of intangible assets, treatment of goodwill, and accounting for tangible assets. It also touches on creative accounting and the differences between German GAAP and Japan GAAP.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running Head: INTERNATIONAL FINANCIAL REPORTING

0

International Financial Reporting

0

International Financial Reporting

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

INTERNATIONAL FINANCIAL REPORTING 1

Table of Contents

Introduction................................................................................................................................2

Accounting for intangible assets................................................................................................2

Definition and classification...................................................................................................3

Definitional of goodwill.........................................................................................................4

Treatment of the goodwill......................................................................................................4

Accounting for tangible assets...................................................................................................6

Tangible assets........................................................................................................................6

Creative Accounting...................................................................................................................8

Conclusion................................................................................................................................11

References................................................................................................................................12

Table of Contents

Introduction................................................................................................................................2

Accounting for intangible assets................................................................................................2

Definition and classification...................................................................................................3

Definitional of goodwill.........................................................................................................4

Treatment of the goodwill......................................................................................................4

Accounting for tangible assets...................................................................................................6

Tangible assets........................................................................................................................6

Creative Accounting...................................................................................................................8

Conclusion................................................................................................................................11

References................................................................................................................................12

INTERNATIONAL FINANCIAL REPORTING 2

Introduction

In the period 1973 to 2000, there was the introduction of the International Accounting

Standards commonly known as IASs. The IASB took the place of the IASC in 2001. From

that point forward, the IASB has corrected some IASs and has proposed to change others, has

supplanted some IASs with new International Financial Reporting Standards (IFRSs), and has

received or proposed certain new IFRSs on themes for which there was no past IAS (Nobes,

2014). Germany is an EU part state. Therefore, the organizations of Germany which are

recorded on the EU/EEA securities showcase take after IFRS since 2005. The European

Commission (EC) intermittently which gives a rundown of the utilization of alternatives of

the IAS control which are executed by the European Union part states

In Japan under the Tokyo understanding, between the bookkeeping Standards leading body of

Japan (ASBJ) and the International Accounting Standards Board (IASB) marked in August

2007. The meeting between the IFRS and the Accounting Principles Accepted in Japan is

under advance. As a result, IFRS is incorporated into the Japanese accounting standards. For

IFRS appropriation in Japan, nine organizations have just begun to apply IFRS by March

2013, in light of the beginning of wilful selection of IFRS from March 2010. The quantity of

organizations that choose wilful reception of IFRS is exceptionally prone to extend in light of

expanding cross-outskirt exercises and systems involving the mid-and long haul designs of

Japanese organizations.

Introduction

In the period 1973 to 2000, there was the introduction of the International Accounting

Standards commonly known as IASs. The IASB took the place of the IASC in 2001. From

that point forward, the IASB has corrected some IASs and has proposed to change others, has

supplanted some IASs with new International Financial Reporting Standards (IFRSs), and has

received or proposed certain new IFRSs on themes for which there was no past IAS (Nobes,

2014). Germany is an EU part state. Therefore, the organizations of Germany which are

recorded on the EU/EEA securities showcase take after IFRS since 2005. The European

Commission (EC) intermittently which gives a rundown of the utilization of alternatives of

the IAS control which are executed by the European Union part states

In Japan under the Tokyo understanding, between the bookkeeping Standards leading body of

Japan (ASBJ) and the International Accounting Standards Board (IASB) marked in August

2007. The meeting between the IFRS and the Accounting Principles Accepted in Japan is

under advance. As a result, IFRS is incorporated into the Japanese accounting standards. For

IFRS appropriation in Japan, nine organizations have just begun to apply IFRS by March

2013, in light of the beginning of wilful selection of IFRS from March 2010. The quantity of

organizations that choose wilful reception of IFRS is exceptionally prone to extend in light of

expanding cross-outskirt exercises and systems involving the mid-and long haul designs of

Japanese organizations.

INTERNATIONAL FINANCIAL REPORTING 3

Accounting for intangible assets

The intangible assets are of greater importance for both the managers and the investors. There

is a significant increase in the intangible assets such as trademarks, goodwill, brands, and

patents. The intangible assets are basically those assets whose value cannot be touched or

calculated in a quantified manner but can only be determined in a qualitative manner. The

tangible assets are of utmost importance and its recognition at the early stages there has

always been a debate in the case of the definition of the intangible assets. Basically, the

intangible assets are measured at the cost on the date of the purchase. To measure the assets

at the fair value the relevant requires of 255(4) shall be applicable while calculating. All the

expenses related to the development of the intangible asset must be included in the cost from

the date on which the recognition criteria were met (Adeyemo, et al 2017).

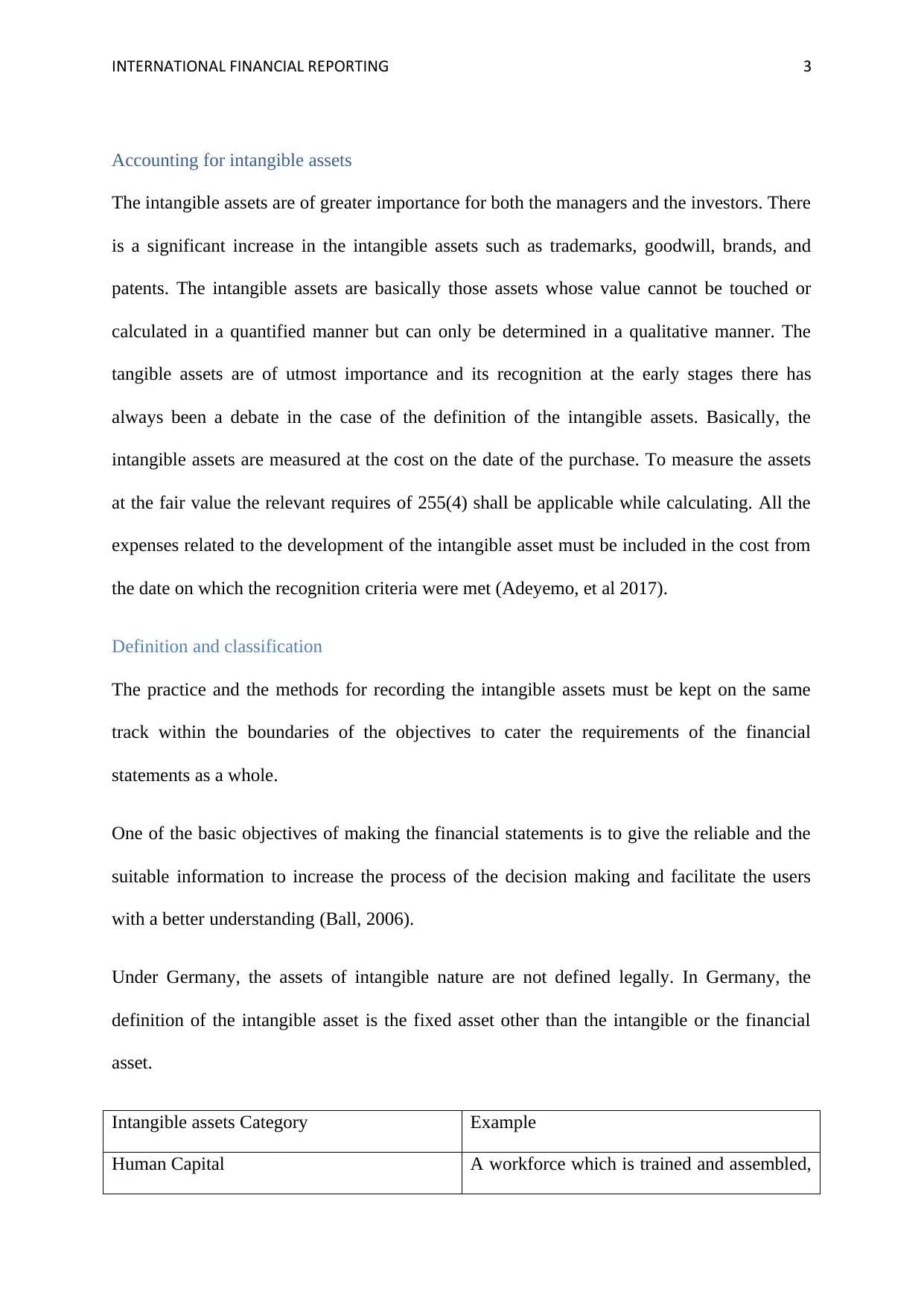

Definition and classification

The practice and the methods for recording the intangible assets must be kept on the same

track within the boundaries of the objectives to cater the requirements of the financial

statements as a whole.

One of the basic objectives of making the financial statements is to give the reliable and the

suitable information to increase the process of the decision making and facilitate the users

with a better understanding (Ball, 2006).

Under Germany, the assets of intangible nature are not defined legally. In Germany, the

definition of the intangible asset is the fixed asset other than the intangible or the financial

asset.

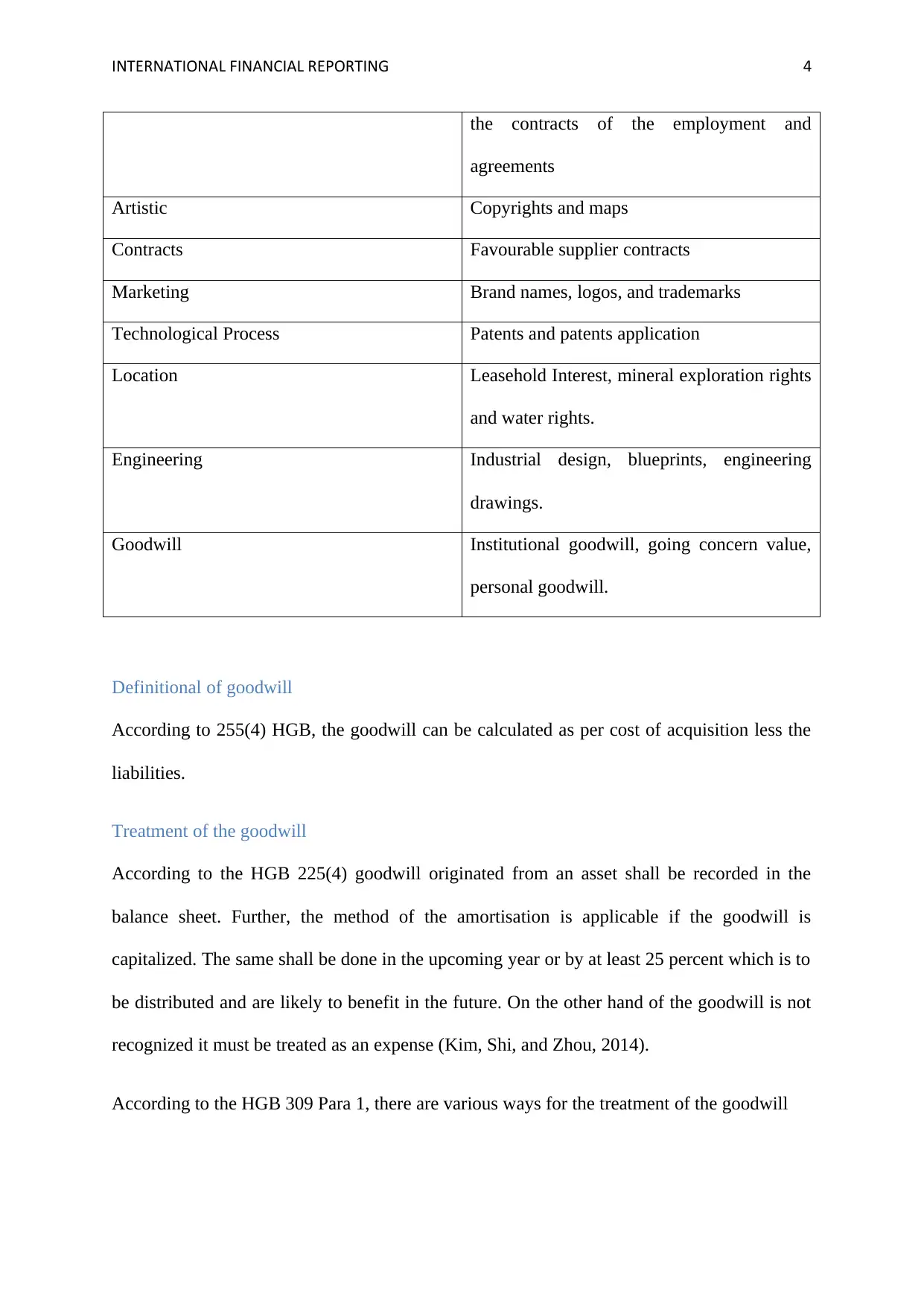

Intangible assets Category Example

Human Capital A workforce which is trained and assembled,

Accounting for intangible assets

The intangible assets are of greater importance for both the managers and the investors. There

is a significant increase in the intangible assets such as trademarks, goodwill, brands, and

patents. The intangible assets are basically those assets whose value cannot be touched or

calculated in a quantified manner but can only be determined in a qualitative manner. The

tangible assets are of utmost importance and its recognition at the early stages there has

always been a debate in the case of the definition of the intangible assets. Basically, the

intangible assets are measured at the cost on the date of the purchase. To measure the assets

at the fair value the relevant requires of 255(4) shall be applicable while calculating. All the

expenses related to the development of the intangible asset must be included in the cost from

the date on which the recognition criteria were met (Adeyemo, et al 2017).

Definition and classification

The practice and the methods for recording the intangible assets must be kept on the same

track within the boundaries of the objectives to cater the requirements of the financial

statements as a whole.

One of the basic objectives of making the financial statements is to give the reliable and the

suitable information to increase the process of the decision making and facilitate the users

with a better understanding (Ball, 2006).

Under Germany, the assets of intangible nature are not defined legally. In Germany, the

definition of the intangible asset is the fixed asset other than the intangible or the financial

asset.

Intangible assets Category Example

Human Capital A workforce which is trained and assembled,

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

INTERNATIONAL FINANCIAL REPORTING 4

the contracts of the employment and

agreements

Artistic Copyrights and maps

Contracts Favourable supplier contracts

Marketing Brand names, logos, and trademarks

Technological Process Patents and patents application

Location Leasehold Interest, mineral exploration rights

and water rights.

Engineering Industrial design, blueprints, engineering

drawings.

Goodwill Institutional goodwill, going concern value,

personal goodwill.

Definitional of goodwill

According to 255(4) HGB, the goodwill can be calculated as per cost of acquisition less the

liabilities.

Treatment of the goodwill

According to the HGB 225(4) goodwill originated from an asset shall be recorded in the

balance sheet. Further, the method of the amortisation is applicable if the goodwill is

capitalized. The same shall be done in the upcoming year or by at least 25 percent which is to

be distributed and are likely to benefit in the future. On the other hand of the goodwill is not

recognized it must be treated as an expense (Kim, Shi, and Zhou, 2014).

According to the HGB 309 Para 1, there are various ways for the treatment of the goodwill

the contracts of the employment and

agreements

Artistic Copyrights and maps

Contracts Favourable supplier contracts

Marketing Brand names, logos, and trademarks

Technological Process Patents and patents application

Location Leasehold Interest, mineral exploration rights

and water rights.

Engineering Industrial design, blueprints, engineering

drawings.

Goodwill Institutional goodwill, going concern value,

personal goodwill.

Definitional of goodwill

According to 255(4) HGB, the goodwill can be calculated as per cost of acquisition less the

liabilities.

Treatment of the goodwill

According to the HGB 225(4) goodwill originated from an asset shall be recorded in the

balance sheet. Further, the method of the amortisation is applicable if the goodwill is

capitalized. The same shall be done in the upcoming year or by at least 25 percent which is to

be distributed and are likely to benefit in the future. On the other hand of the goodwill is not

recognized it must be treated as an expense (Kim, Shi, and Zhou, 2014).

According to the HGB 309 Para 1, there are various ways for the treatment of the goodwill

INTERNATIONAL FINANCIAL REPORTING 5

1. Amortisation of the goodwill over the period of the four years following the first

consolidation. The first consolidation shall be done quarterly each year.

2. Amortisation over its economic life irrespective of the description of the maximum

period.

3. The balance can also be set off against the group reserves

4. Additionally along with these individual practices or the combination of both along

with the proportional set off against the reserves (Chandra, Erlina, Maksum and

Supriana, 2018).

5. In case of the impairment the German GAAP lacks in knowledge of the impairment

however, amortization is mandatory except for the permanent diminution in value.

In case of Japan the concept of intangible assets in case of the assets which are currently not

available for use or having an indefinite life. In case of any slight indication for the

impairment, the annual impairment testing is not required yet all the intangible assets are

tested along with the goodwill as well. Generally the business units are in benefit due to the

goodwill and is not required otherwise but permitted; so that it can be allocate to the different

group of assets for assessment of the impairment (PWC, 2013).

Accounting treatment of concessions, Brands Patents, and similar Intangible assets

Concessions and similar rights, patents, licenses, brands processes are not explicitly recorded

in the balance sheet according to 266(2) HGB. According to the HGB 248(2), an intangible

asset generated internally cannot be capitalized. Both the purchased software and the

internally developed and during their useful life of asset are capitalised and amortised (Bryan,

Dafferty, and Wigan, 2017).

In Germany most recently it has been decided that if the acquired-in-process research project

is continued at the risk of the entity for the development of the intangible asset the

1. Amortisation of the goodwill over the period of the four years following the first

consolidation. The first consolidation shall be done quarterly each year.

2. Amortisation over its economic life irrespective of the description of the maximum

period.

3. The balance can also be set off against the group reserves

4. Additionally along with these individual practices or the combination of both along

with the proportional set off against the reserves (Chandra, Erlina, Maksum and

Supriana, 2018).

5. In case of the impairment the German GAAP lacks in knowledge of the impairment

however, amortization is mandatory except for the permanent diminution in value.

In case of Japan the concept of intangible assets in case of the assets which are currently not

available for use or having an indefinite life. In case of any slight indication for the

impairment, the annual impairment testing is not required yet all the intangible assets are

tested along with the goodwill as well. Generally the business units are in benefit due to the

goodwill and is not required otherwise but permitted; so that it can be allocate to the different

group of assets for assessment of the impairment (PWC, 2013).

Accounting treatment of concessions, Brands Patents, and similar Intangible assets

Concessions and similar rights, patents, licenses, brands processes are not explicitly recorded

in the balance sheet according to 266(2) HGB. According to the HGB 248(2), an intangible

asset generated internally cannot be capitalized. Both the purchased software and the

internally developed and during their useful life of asset are capitalised and amortised (Bryan,

Dafferty, and Wigan, 2017).

In Germany most recently it has been decided that if the acquired-in-process research project

is continued at the risk of the entity for the development of the intangible asset the

INTERNATIONAL FINANCIAL REPORTING 6

recognition option in the 248(2) section sentence 1 of the HGB shall be applicable. If the

previous option is considered than the carrying amount of the research project is partially or

fully clubbed with the production cost of the new intangible asset (Vetoshkina and

Tukhvatullin, 2015).

In the case of the finite-lived non-current intangible assets, the accounting treatment of the

assets is to amortize the same over the expected entity specific useful life of an asset. In case

there is confusion regarding the specific useful life of asset than the assets are amortized over

the period of 10 years.

Further, there are certain assets which are used for the indefinite period and they are not

amortized (Heng Wang, 2016). The brand's mastheads, customer lists, the publishing titles

and other similar non-current intangible assets fall under the section 248(2) of HGB they

cannot be used indefinitely as they have a definite life and therefore they must be amortized

(Osinski, Selig, Matos and Roman, 2017). In the concept of the intangible asset with

indefinite useful life the useful life under tax law is often used under the Japan GAAP.

In association with the 266(2) of the HGB, the internally generated assets of the intangible

nature are recorded in the heading A.I.1. In addition to the disclosure of the accounting

policies, the statement of changes in the intangible asset must also reflect the notes. The

expenses related to the consumption of the goods, or the use of the services for the purpose of

the research and the development must be clubbed in the aggregate amount and shall be

disclosed only if the recognition option under the section 248(2) sentence 1 of the HGB is

activated (Bianchi, 2017). Under the Japan GAAP, all the soft wares that fall under the

particular criteria are capitalised. However, the recognition criteria are different from IFRS

(PWC, 2013).

recognition option in the 248(2) section sentence 1 of the HGB shall be applicable. If the

previous option is considered than the carrying amount of the research project is partially or

fully clubbed with the production cost of the new intangible asset (Vetoshkina and

Tukhvatullin, 2015).

In the case of the finite-lived non-current intangible assets, the accounting treatment of the

assets is to amortize the same over the expected entity specific useful life of an asset. In case

there is confusion regarding the specific useful life of asset than the assets are amortized over

the period of 10 years.

Further, there are certain assets which are used for the indefinite period and they are not

amortized (Heng Wang, 2016). The brand's mastheads, customer lists, the publishing titles

and other similar non-current intangible assets fall under the section 248(2) of HGB they

cannot be used indefinitely as they have a definite life and therefore they must be amortized

(Osinski, Selig, Matos and Roman, 2017). In the concept of the intangible asset with

indefinite useful life the useful life under tax law is often used under the Japan GAAP.

In association with the 266(2) of the HGB, the internally generated assets of the intangible

nature are recorded in the heading A.I.1. In addition to the disclosure of the accounting

policies, the statement of changes in the intangible asset must also reflect the notes. The

expenses related to the consumption of the goods, or the use of the services for the purpose of

the research and the development must be clubbed in the aggregate amount and shall be

disclosed only if the recognition option under the section 248(2) sentence 1 of the HGB is

activated (Bianchi, 2017). Under the Japan GAAP, all the soft wares that fall under the

particular criteria are capitalised. However, the recognition criteria are different from IFRS

(PWC, 2013).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INTERNATIONAL FINANCIAL REPORTING 7

Accounting for tangible assets

Tangible assets

To generate the revenue for the company the tangible assets are one of the good sources.

Tangible assets are either current or fixed in the nature. The items which are generally

followed in the list of the current assets are cash, inventory and the marketable securities.

These items are readily available for cash as these are used within a period of one year

(Contractor, Yang, and Gaur, 2016).

The tangible fixed assets are initially recorded at the historic purchase as per the section 255

subsection 1 or manufacturing costs as per the section 255 of subsection 2. The treatment is

according to the German tax law; German GAAP does not permit revaluation of fixed assets

in excess of original cost as reduced by depreciation (Accounting Standards Committee of

Germany, 2017). In case of Japan the fixed assets are recorded at the cost less market value.

The acquisition cost of machinery and equipment used solely for the purpose of a specific

research and development project which cannot be used for any other purpose is expensed as

research and development cost when acquired (PWC, 2013).

The valuation of stock is done on the basis of market value; replacement value; net realisable

value or another value permitted by tax rules whichever is lower as per section 253 (3), 254

HGB, there were certain stocks which are purchased in terms of foreign currency and are

recorded at a cost lower than the original cost and there was the corresponding write down in

the stock’s carrying value due to subsequent fall in the exchange rate, same as for UK GAAP,

under section 280 HGB. Such exceptions are not allowed by German GAAP, where the

stocks were being prohibited to be carried on such a value that exceeds the cost.

In case of the investments especially the long-term investments are recorded at a difference of

the cost and the provision for any permanent value being diminished. Fixed assets

Accounting for tangible assets

Tangible assets

To generate the revenue for the company the tangible assets are one of the good sources.

Tangible assets are either current or fixed in the nature. The items which are generally

followed in the list of the current assets are cash, inventory and the marketable securities.

These items are readily available for cash as these are used within a period of one year

(Contractor, Yang, and Gaur, 2016).

The tangible fixed assets are initially recorded at the historic purchase as per the section 255

subsection 1 or manufacturing costs as per the section 255 of subsection 2. The treatment is

according to the German tax law; German GAAP does not permit revaluation of fixed assets

in excess of original cost as reduced by depreciation (Accounting Standards Committee of

Germany, 2017). In case of Japan the fixed assets are recorded at the cost less market value.

The acquisition cost of machinery and equipment used solely for the purpose of a specific

research and development project which cannot be used for any other purpose is expensed as

research and development cost when acquired (PWC, 2013).

The valuation of stock is done on the basis of market value; replacement value; net realisable

value or another value permitted by tax rules whichever is lower as per section 253 (3), 254

HGB, there were certain stocks which are purchased in terms of foreign currency and are

recorded at a cost lower than the original cost and there was the corresponding write down in

the stock’s carrying value due to subsequent fall in the exchange rate, same as for UK GAAP,

under section 280 HGB. Such exceptions are not allowed by German GAAP, where the

stocks were being prohibited to be carried on such a value that exceeds the cost.

In case of the investments especially the long-term investments are recorded at a difference of

the cost and the provision for any permanent value being diminished. Fixed assets

INTERNATIONAL FINANCIAL REPORTING 8

investments (long-term investments) are the investments which are recorded at provision for

any permanent diminution in value minus cost under section 253 (2) HGB. Such deduction in

amount is charged to the profit and loss account, and such provisions should be no longer

required to write back under section 280 (1) HGB.

Current assets investments generally the investments which are purchased for the purpose of

short term period are recorded at market value or cost whichever is less, where its market

value is calculated on the basis of investment which is listed or publicly traded under section

253 (3) HGB) According to the German GAAP there is hardly any difference between the

fixed assets and the assets purchased for the investment purposes. Following are the rules

relating to the fixed assets (Saunders and Brynjolfsson, 2016). As per the Japan GAAP the

assets like investment and the rental property are generally recorded at the cost with the

subtraction of the depreciation. However, some of the value is also recorded at the after value

(PWC, 2013).

The valuation of the stock is done on different basis such as

Market value

Replacement value

Net realizable value or any another value permitted by tax rules whichever is lower as

per section 253 (3), 254 HGB.

There were certain stocks which are purchased in terms of foreign currency and are recorded

at a cost lower than the original cost and there was the corresponding write down in the

stock’s carrying value due to subsequent fall in the exchange rate, same as for UK GAAP,

under section 280 HGB. These kinds of exceptions are limited by German GAAP, where the

stocks were being prohibited to be carried on such a value that is more than cost (Hope,

Thomas, and Vyas, 2017). To check whether the direct costs are in any kind of alignment

investments (long-term investments) are the investments which are recorded at provision for

any permanent diminution in value minus cost under section 253 (2) HGB. Such deduction in

amount is charged to the profit and loss account, and such provisions should be no longer

required to write back under section 280 (1) HGB.

Current assets investments generally the investments which are purchased for the purpose of

short term period are recorded at market value or cost whichever is less, where its market

value is calculated on the basis of investment which is listed or publicly traded under section

253 (3) HGB) According to the German GAAP there is hardly any difference between the

fixed assets and the assets purchased for the investment purposes. Following are the rules

relating to the fixed assets (Saunders and Brynjolfsson, 2016). As per the Japan GAAP the

assets like investment and the rental property are generally recorded at the cost with the

subtraction of the depreciation. However, some of the value is also recorded at the after value

(PWC, 2013).

The valuation of the stock is done on different basis such as

Market value

Replacement value

Net realizable value or any another value permitted by tax rules whichever is lower as

per section 253 (3), 254 HGB.

There were certain stocks which are purchased in terms of foreign currency and are recorded

at a cost lower than the original cost and there was the corresponding write down in the

stock’s carrying value due to subsequent fall in the exchange rate, same as for UK GAAP,

under section 280 HGB. These kinds of exceptions are limited by German GAAP, where the

stocks were being prohibited to be carried on such a value that is more than cost (Hope,

Thomas, and Vyas, 2017). To check whether the direct costs are in any kind of alignment

INTERNATIONAL FINANCIAL REPORTING 9

with the other prevailing standards, it is the duty of the entity to evaluate the direct costs from

all possible areas. Otherwise in the vice versa cases the costs gets capitalised if the cost is

relatable to the contract and the future performance in case of the rules as per the Japan

GAAP.

Cost includes both manufacturing cost and purchase cost. Manufacturing cost is a direct cost

which includes the cost of raw material and production costs (including special production

costs) which are directly included in the cost of production (Nastase, Calin, and Margina,

2016). As per section 255 (2) of HGB: Other costs such as an appropriate proportion of

material overheads, depreciation on fixed assets of the tangible nature, overheads relating to

the production and manufacturing of the material are also included. Such cost is recorded on

the basis of the requirement of tax purposes as they are a part of the manufacturing process

which is incurred at the time of production (Zhang and Zhang, 2017). The cost of general

administration cost is inclusive of expenditure for voluntary staff benefits, social

infrastructure and facilities and pensions after excluding the selling cost under section 255 (2)

HGB The finance used in the production of an asset received in the form of loan, such

interest on loan may be recorded during the period of production as per section 255 (3) HGB.

The method of weighted average cost and LIFO as per section 256 HGB) are commonly

accepted in the general practice and also accepted for tax purposes. FIFO method is not

generally practiced or accepted for tax purposes until shows its ties with the actual pattern of

consumption (Madhani, 2015).

Creative Accounting

Innovative bookkeeping comprises of bookkeeping and accounting practices following the

required laws and controls but usually diverts from what those standards intend to achieve.

Creative accounting emphasizes loopholes and standards of accounting exploit a superior

with the other prevailing standards, it is the duty of the entity to evaluate the direct costs from

all possible areas. Otherwise in the vice versa cases the costs gets capitalised if the cost is

relatable to the contract and the future performance in case of the rules as per the Japan

GAAP.

Cost includes both manufacturing cost and purchase cost. Manufacturing cost is a direct cost

which includes the cost of raw material and production costs (including special production

costs) which are directly included in the cost of production (Nastase, Calin, and Margina,

2016). As per section 255 (2) of HGB: Other costs such as an appropriate proportion of

material overheads, depreciation on fixed assets of the tangible nature, overheads relating to

the production and manufacturing of the material are also included. Such cost is recorded on

the basis of the requirement of tax purposes as they are a part of the manufacturing process

which is incurred at the time of production (Zhang and Zhang, 2017). The cost of general

administration cost is inclusive of expenditure for voluntary staff benefits, social

infrastructure and facilities and pensions after excluding the selling cost under section 255 (2)

HGB The finance used in the production of an asset received in the form of loan, such

interest on loan may be recorded during the period of production as per section 255 (3) HGB.

The method of weighted average cost and LIFO as per section 256 HGB) are commonly

accepted in the general practice and also accepted for tax purposes. FIFO method is not

generally practiced or accepted for tax purposes until shows its ties with the actual pattern of

consumption (Madhani, 2015).

Creative Accounting

Innovative bookkeeping comprises of bookkeeping and accounting practices following the

required laws and controls but usually diverts from what those standards intend to achieve.

Creative accounting emphasizes loopholes and standards of accounting exploit a superior

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

INTERNATIONAL FINANCIAL REPORTING 10

picture of the organization (Seetharaman, Helmi Bin Zaini Sooria, and Saravanan, 2012).

Albeit creative accounting practices are legalized, and the areas they dig are often reframed to

avoid such practices.

Governments can participate in "creative accounting" to hide the borrowings and sugar coat

the spending balance and recommend utilizing "the contrast between spending deficiencies

and the adjustment out in the public debt" to quantify creative accounting. Stock-stream

modifications depict the distinction amongst shortages and the adjustment of the change in

the debt (Stolowy and Jeny-Cazavan, 2013).

An essential advantage of public accounting statements is that they enable investors to

analyze the financial health of contending organizations. In any case, when firms enter into

creative accounting methods the value of the information gets distorted and the financials so

provided are not reliable in nature. Innovative bookkeeping also is known as the creative

accounting can be utilized to keep the debt securities out of the balance sheet and to keep a

track of the earnings. For instance, Pressure to complete the term expectations of the Wall

Street of the financial targets due at the end of each year can be due to the creative accounting

activities. The CFO of a company belonging to the software industry can keep a portion of

the revenue and record it as the liability on the balance sheet and recognize the same as

current period earnings to achieve a certain goal.

The CFO of a product organization may take a part of incomes that ought to be recorded as

an obligation on the asset report and remember it as earned in the present time frame to

achieve a specific income objective. A CFO of an assembling organization could defer the

account of current period costs to an ensuing period to improve current period profit look. On

the off chance that a hazy area of bookkeeping is discovered, it might be misused (German

climate Finance, 2017).

picture of the organization (Seetharaman, Helmi Bin Zaini Sooria, and Saravanan, 2012).

Albeit creative accounting practices are legalized, and the areas they dig are often reframed to

avoid such practices.

Governments can participate in "creative accounting" to hide the borrowings and sugar coat

the spending balance and recommend utilizing "the contrast between spending deficiencies

and the adjustment out in the public debt" to quantify creative accounting. Stock-stream

modifications depict the distinction amongst shortages and the adjustment of the change in

the debt (Stolowy and Jeny-Cazavan, 2013).

An essential advantage of public accounting statements is that they enable investors to

analyze the financial health of contending organizations. In any case, when firms enter into

creative accounting methods the value of the information gets distorted and the financials so

provided are not reliable in nature. Innovative bookkeeping also is known as the creative

accounting can be utilized to keep the debt securities out of the balance sheet and to keep a

track of the earnings. For instance, Pressure to complete the term expectations of the Wall

Street of the financial targets due at the end of each year can be due to the creative accounting

activities. The CFO of a company belonging to the software industry can keep a portion of

the revenue and record it as the liability on the balance sheet and recognize the same as

current period earnings to achieve a certain goal.

The CFO of a product organization may take a part of incomes that ought to be recorded as

an obligation on the asset report and remember it as earned in the present time frame to

achieve a specific income objective. A CFO of an assembling organization could defer the

account of current period costs to an ensuing period to improve current period profit look. On

the off chance that a hazy area of bookkeeping is discovered, it might be misused (German

climate Finance, 2017).

INTERNATIONAL FINANCIAL REPORTING 11

The government of Germany intends to guarantee €4 billion of every 2020 not exclusively by

means of the financial plan, but rather additionally by counting the low-intrigue KfW

advances. In any case, just spending stores were considered to build up the 2014 benchmark.

Consequently, the expansion is certifiably not a genuine multiplying. A legitimate use of the

promise would require the €4 billion to be raised completely by means of the financial plan in

2020 and apart from this anything would qualify for the creative accounting (Hill, 2017).

One of the major incidents that happened in Germany had two phases, first was when the

banks and the stockbrokers bought and sold shares for the investors of the foreign countries

in such a way that they went to claim a tax refund for which they were not eligible. The

second was when the banks and the investors purchased and sold the shares just before and

after the dividend was distributed BBC, (2018). This practice was outlawed in the financial

year 2012and the Panama papers were in the major highlight when the systematic tax

dodging at the offshores were revealed unintentionally. The total number of banks that were

involved in the practice of the creative accounting was around 40. Literature provides

evidence that creative accounting exists and is still practiced. Organizations search for the

best graduates and experts who know the law and bookkeeping direction by heart and still

discover approaches to influence the association to look great and alluring for speculation.

While opinions on the acceptability of accounting manipulation, control change, usually saw

as ethically unpardonable since it includes out of line exercise of intensity, injustice to clients

and also involves in the unfair practices that weaken the authority of the regulations and the

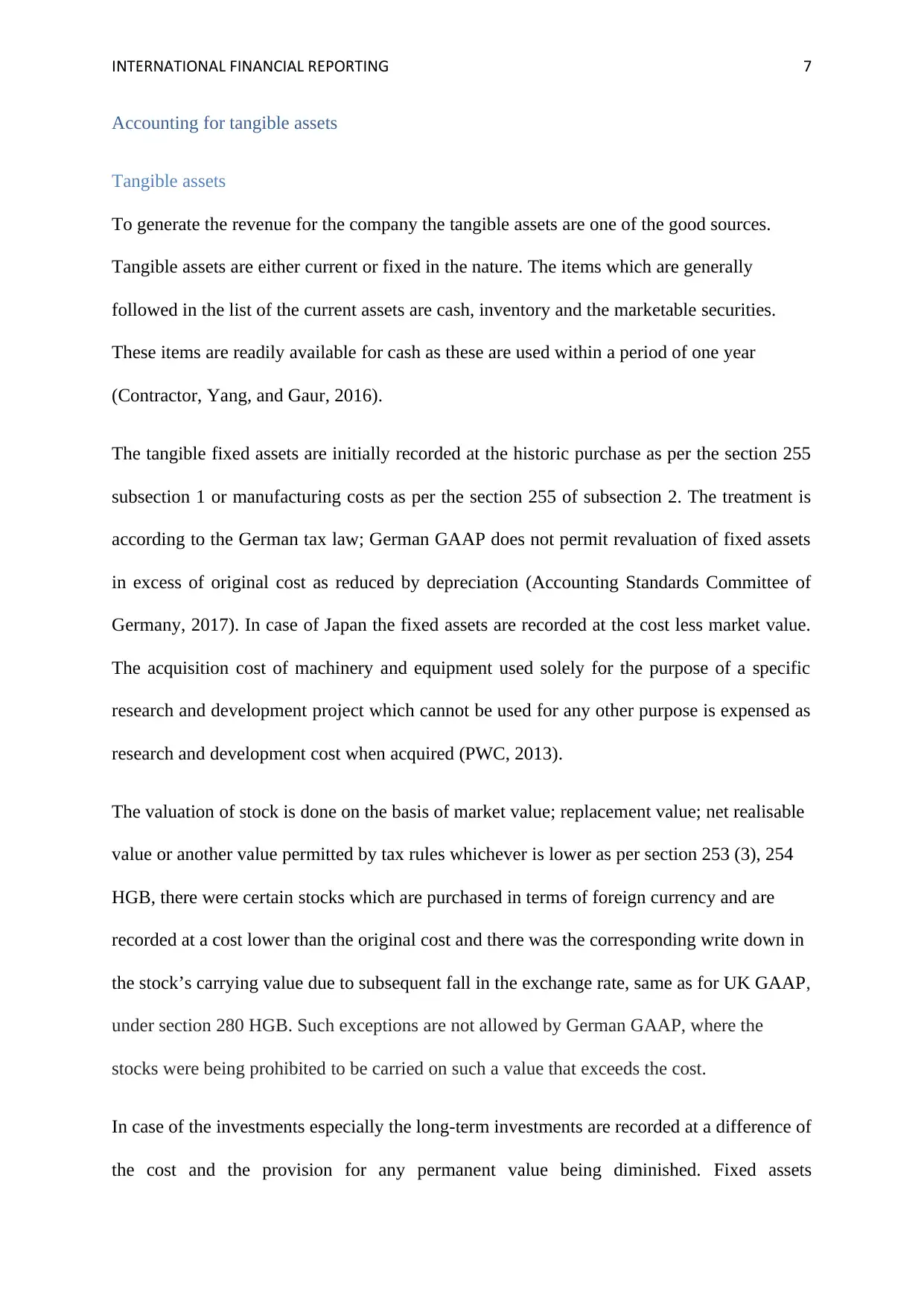

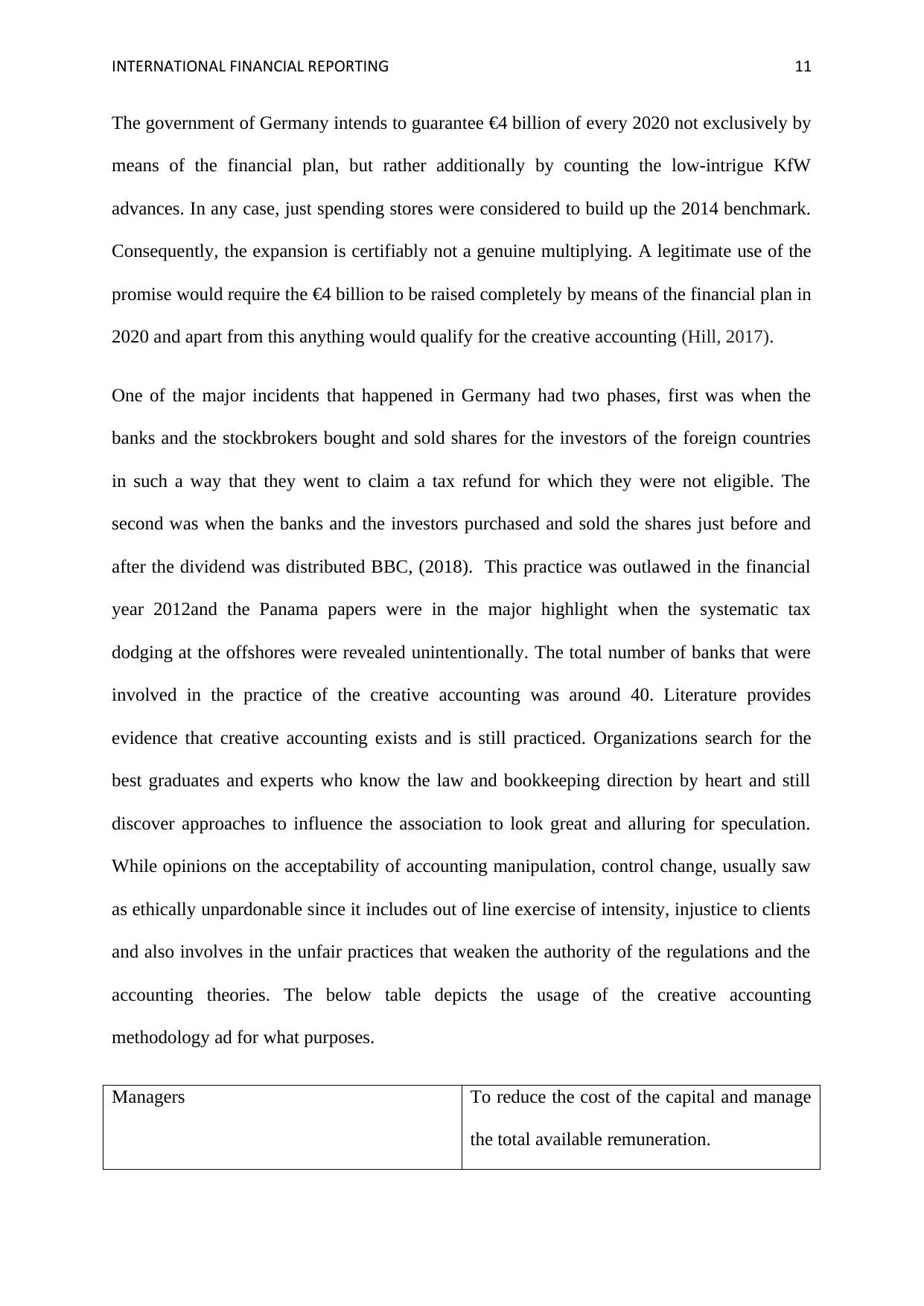

accounting theories. The below table depicts the usage of the creative accounting

methodology ad for what purposes.

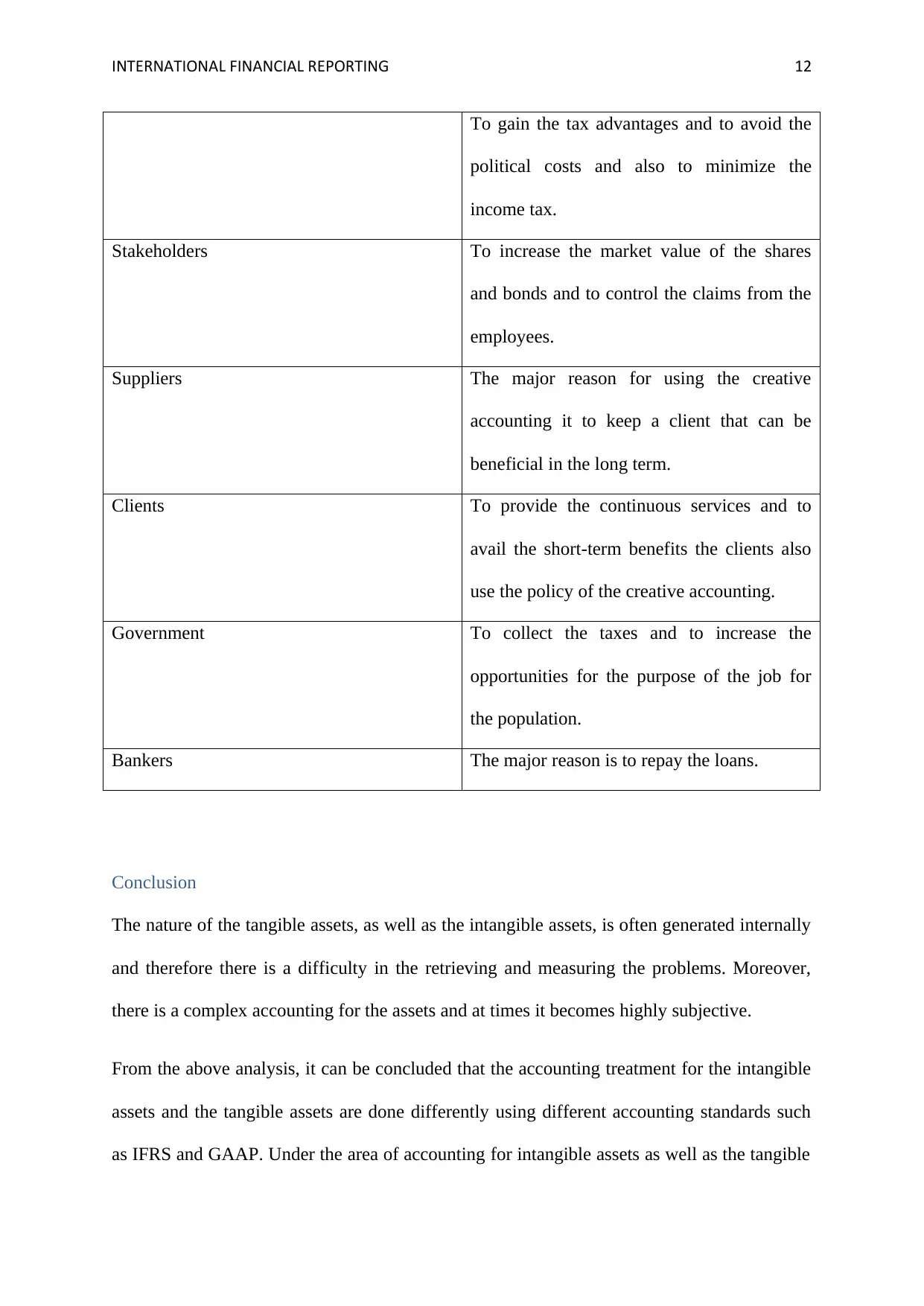

Managers To reduce the cost of the capital and manage

the total available remuneration.

The government of Germany intends to guarantee €4 billion of every 2020 not exclusively by

means of the financial plan, but rather additionally by counting the low-intrigue KfW

advances. In any case, just spending stores were considered to build up the 2014 benchmark.

Consequently, the expansion is certifiably not a genuine multiplying. A legitimate use of the

promise would require the €4 billion to be raised completely by means of the financial plan in

2020 and apart from this anything would qualify for the creative accounting (Hill, 2017).

One of the major incidents that happened in Germany had two phases, first was when the

banks and the stockbrokers bought and sold shares for the investors of the foreign countries

in such a way that they went to claim a tax refund for which they were not eligible. The

second was when the banks and the investors purchased and sold the shares just before and

after the dividend was distributed BBC, (2018). This practice was outlawed in the financial

year 2012and the Panama papers were in the major highlight when the systematic tax

dodging at the offshores were revealed unintentionally. The total number of banks that were

involved in the practice of the creative accounting was around 40. Literature provides

evidence that creative accounting exists and is still practiced. Organizations search for the

best graduates and experts who know the law and bookkeeping direction by heart and still

discover approaches to influence the association to look great and alluring for speculation.

While opinions on the acceptability of accounting manipulation, control change, usually saw

as ethically unpardonable since it includes out of line exercise of intensity, injustice to clients

and also involves in the unfair practices that weaken the authority of the regulations and the

accounting theories. The below table depicts the usage of the creative accounting

methodology ad for what purposes.

Managers To reduce the cost of the capital and manage

the total available remuneration.

INTERNATIONAL FINANCIAL REPORTING 12

To gain the tax advantages and to avoid the

political costs and also to minimize the

income tax.

Stakeholders To increase the market value of the shares

and bonds and to control the claims from the

employees.

Suppliers The major reason for using the creative

accounting it to keep a client that can be

beneficial in the long term.

Clients To provide the continuous services and to

avail the short-term benefits the clients also

use the policy of the creative accounting.

Government To collect the taxes and to increase the

opportunities for the purpose of the job for

the population.

Bankers The major reason is to repay the loans.

Conclusion

The nature of the tangible assets, as well as the intangible assets, is often generated internally

and therefore there is a difficulty in the retrieving and measuring the problems. Moreover,

there is a complex accounting for the assets and at times it becomes highly subjective.

From the above analysis, it can be concluded that the accounting treatment for the intangible

assets and the tangible assets are done differently using different accounting standards such

as IFRS and GAAP. Under the area of accounting for intangible assets as well as the tangible

To gain the tax advantages and to avoid the

political costs and also to minimize the

income tax.

Stakeholders To increase the market value of the shares

and bonds and to control the claims from the

employees.

Suppliers The major reason for using the creative

accounting it to keep a client that can be

beneficial in the long term.

Clients To provide the continuous services and to

avail the short-term benefits the clients also

use the policy of the creative accounting.

Government To collect the taxes and to increase the

opportunities for the purpose of the job for

the population.

Bankers The major reason is to repay the loans.

Conclusion

The nature of the tangible assets, as well as the intangible assets, is often generated internally

and therefore there is a difficulty in the retrieving and measuring the problems. Moreover,

there is a complex accounting for the assets and at times it becomes highly subjective.

From the above analysis, it can be concluded that the accounting treatment for the intangible

assets and the tangible assets are done differently using different accounting standards such

as IFRS and GAAP. Under the area of accounting for intangible assets as well as the tangible

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INTERNATIONAL FINANCIAL REPORTING 13

assets, there is a debate and disagreement between the standards and the rules as per the

individual requirements and the convenience. On the other hand, the practice of the creative

accounting shall not be used for the person or the professional means.

assets, there is a debate and disagreement between the standards and the rules as per the

individual requirements and the convenience. On the other hand, the practice of the creative

accounting shall not be used for the person or the professional means.

INTERNATIONAL FINANCIAL REPORTING 14

References

Accounting Standards Committee of Germany, (2017) Tangible Assets [online] Available

from http://alt.drsc.de/service/drs/standards/index_en.php?

ixstds_do=show_details&entry_id=96 [Accessed on 29th July 2018]

Adeyemo, K.A., Ajibolade, S.O., Uwuigbe, U. and Uwuigbe, O.R., (2017) Mandatory

Adoption of International Financial Reporting Standards (IFRS) by Nigerian Listed Banks:

Any Implication for Value Relevance?. International Journal of Accounting

Research, 42(90), pp.1-13.

Ball, R., (2006) International Financial Reporting Standards (IFRS): pros and cons for

investors. Accounting and business research, 36(sup1), pp.5-27.

BBC, (2018) Germany fears huge losses in massive tax scandal [Online] Available from

https://www.bbc.com/news/world-europe-40199259 [Accessed on 29th July 2018]

Bianchi, P., (2017) The economic importance of intangible assets. California: Routledge.

Bryan, D., Rafferty, M., and Wigan, D., (2017) Capital unchained: finance, intangible assets

and the double life of capital in the offshore world. Review of International Political

Economy, 24(1), pp.56-86.

Chandra, S., Erlina, E., Maksum, A. and Supriana, T., (2018) Effect of corporate governance

on the cost of equity before and after international financial reporting standard

implementation, United States: John Wiley.

The contractor, F., Yang, Y. and Gaur, A.S., (2016) Firm-specific intangible assets and

subsidiary profitability: The moderating role of distance, ownership strategy and subsidiary

experience. Journal of World Business, 51(6), pp.950-964.

References

Accounting Standards Committee of Germany, (2017) Tangible Assets [online] Available

from http://alt.drsc.de/service/drs/standards/index_en.php?

ixstds_do=show_details&entry_id=96 [Accessed on 29th July 2018]

Adeyemo, K.A., Ajibolade, S.O., Uwuigbe, U. and Uwuigbe, O.R., (2017) Mandatory

Adoption of International Financial Reporting Standards (IFRS) by Nigerian Listed Banks:

Any Implication for Value Relevance?. International Journal of Accounting

Research, 42(90), pp.1-13.

Ball, R., (2006) International Financial Reporting Standards (IFRS): pros and cons for

investors. Accounting and business research, 36(sup1), pp.5-27.

BBC, (2018) Germany fears huge losses in massive tax scandal [Online] Available from

https://www.bbc.com/news/world-europe-40199259 [Accessed on 29th July 2018]

Bianchi, P., (2017) The economic importance of intangible assets. California: Routledge.

Bryan, D., Rafferty, M., and Wigan, D., (2017) Capital unchained: finance, intangible assets

and the double life of capital in the offshore world. Review of International Political

Economy, 24(1), pp.56-86.

Chandra, S., Erlina, E., Maksum, A. and Supriana, T., (2018) Effect of corporate governance

on the cost of equity before and after international financial reporting standard

implementation, United States: John Wiley.

The contractor, F., Yang, Y. and Gaur, A.S., (2016) Firm-specific intangible assets and

subsidiary profitability: The moderating role of distance, ownership strategy and subsidiary

experience. Journal of World Business, 51(6), pp.950-964.

INTERNATIONAL FINANCIAL REPORTING 15

German climate finance, (2017) Climate finance in Germany’s 2017 federal budget: more

creative accounting than a true doubling [online] Available from

https://www.germanclimatefinance.de/2017/02/03/climate-finance-germanys-2017-federal-

budget-creative-accounting-true-doubling/ [Accessed on 29th July 2018]

Heng Wang, (2016) Intangible Assets [online] Available from

http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.688.3279&rep=rep1&type=pdf

[Accessed on 29th July 2018]

Hope, O.K., Thomas, W.B. and Vyas, D., (2017) Stakeholder demand for accounting quality

and economic usefulness of accounting in US private firms. Journal of Accounting and

Public Policy, 36(1), pp.1-13.

Hung, M. and Subramanyam, K.R., (2017) Financial statement effects of adopting

international accounting standards: the case of Germany. Review of accounting studies, 12(4),

pp.623-657.

Kim, J.B., Shi, H. and Zhou, J., (2014) International Financial Reporting Standards,

institutional infrastructures, and implied cost of equity capital around the world. Review of

Quantitative Finance and Accounting, 42(3), pp.469-507.

Madhani, P.M., (2015) A Study on the Corporate Governance and Disclosure Practices of

Tangible Assets and Intangible Assets-Dominated Firms and Their Relationship.

Nastase, G., Calin, A.M. and Margina, O., (2016) International accounting standard no. 16

tangible assets and its practical implementation. Quality-Access to Success, 17.

Nobes, C., (2014) International classification of financial reporting. California: Routledge.

German climate finance, (2017) Climate finance in Germany’s 2017 federal budget: more

creative accounting than a true doubling [online] Available from

https://www.germanclimatefinance.de/2017/02/03/climate-finance-germanys-2017-federal-

budget-creative-accounting-true-doubling/ [Accessed on 29th July 2018]

Heng Wang, (2016) Intangible Assets [online] Available from

http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.688.3279&rep=rep1&type=pdf

[Accessed on 29th July 2018]

Hope, O.K., Thomas, W.B. and Vyas, D., (2017) Stakeholder demand for accounting quality

and economic usefulness of accounting in US private firms. Journal of Accounting and

Public Policy, 36(1), pp.1-13.

Hung, M. and Subramanyam, K.R., (2017) Financial statement effects of adopting

international accounting standards: the case of Germany. Review of accounting studies, 12(4),

pp.623-657.

Kim, J.B., Shi, H. and Zhou, J., (2014) International Financial Reporting Standards,

institutional infrastructures, and implied cost of equity capital around the world. Review of

Quantitative Finance and Accounting, 42(3), pp.469-507.

Madhani, P.M., (2015) A Study on the Corporate Governance and Disclosure Practices of

Tangible Assets and Intangible Assets-Dominated Firms and Their Relationship.

Nastase, G., Calin, A.M. and Margina, O., (2016) International accounting standard no. 16

tangible assets and its practical implementation. Quality-Access to Success, 17.

Nobes, C., (2014) International classification of financial reporting. California: Routledge.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

INTERNATIONAL FINANCIAL REPORTING 16

Osinski, M., Selig, P.M., Matos, F., and Roman, D.J., (2017) Methods of evaluation of

intangible assets and intellectual capital. Journal of Intellectual Capital, 18(3), pp.470-485.

PWC, (2013) Similarities and differences [online] Available from

https://www.pwc.dk/da/nyt/finance/regnskab/assets/similarities-nov-2013.pdf [Accessed on

3oth July 2018]

Saunders, A. and Brynjolfsson, E., (2016) Valuing Information Technology Related

Intangible Assets. Mis Quarterly, 40(1).

Seetharaman, A., Helmi Bin Zaini Sooria, H. and Saravanan, A.S., (2012) Intellectual capital

accounting and reporting in the knowledge. New York: Springer.

Stolowy, H. and Jeny-Cazavan, A., (2013) International accounting disharmony: the case of

intangibles. Accounting, Auditing & Accountability Journal, 14(4), pp.477-497.

Vetoshkina, E.Y. and Tukhvatullin, R.S., (2015) Economic efficiency estimation of

intangible assets use. Mediterranean Journal of Social Sciences, 6(1 S3), p.440.

Zhang, I.X. and Zhang, Y., (2017) Accounting discretion and purchase price allocation after

acquisitions. Journal of Accounting, Auditing & Finance, 32(2), pp.241-270.

Osinski, M., Selig, P.M., Matos, F., and Roman, D.J., (2017) Methods of evaluation of

intangible assets and intellectual capital. Journal of Intellectual Capital, 18(3), pp.470-485.

PWC, (2013) Similarities and differences [online] Available from

https://www.pwc.dk/da/nyt/finance/regnskab/assets/similarities-nov-2013.pdf [Accessed on

3oth July 2018]

Saunders, A. and Brynjolfsson, E., (2016) Valuing Information Technology Related

Intangible Assets. Mis Quarterly, 40(1).

Seetharaman, A., Helmi Bin Zaini Sooria, H. and Saravanan, A.S., (2012) Intellectual capital

accounting and reporting in the knowledge. New York: Springer.

Stolowy, H. and Jeny-Cazavan, A., (2013) International accounting disharmony: the case of

intangibles. Accounting, Auditing & Accountability Journal, 14(4), pp.477-497.

Vetoshkina, E.Y. and Tukhvatullin, R.S., (2015) Economic efficiency estimation of

intangible assets use. Mediterranean Journal of Social Sciences, 6(1 S3), p.440.

Zhang, I.X. and Zhang, Y., (2017) Accounting discretion and purchase price allocation after

acquisitions. Journal of Accounting, Auditing & Finance, 32(2), pp.241-270.

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.