International Financial Reporting

VerifiedAdded on 2023/01/20

|17

|4122

|28

AI Summary

This document provides an overview of international financial reporting, including the regulatory framework and its governance. It discusses the purpose of financial reporting for meeting organizational objectives, development, and growth. The document also includes the preparation of financial statements for GODWIN Plc and the calculation of various ratios. It explores the benefits of IAS and IFRS and the models of financial reporting and auditing. Additionally, it highlights the differences and importance of financial reporting across different countries.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

International Financial

Reporting

Reporting

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................4

P1.Context of financial reporting including regulatory framework and its governance:............4

P2.Purpose of financial reporting for meeting organisational objectives, development and

growth..........................................................................................................................................5

TASK 2 ...........................................................................................................................................6

P3.Preparation of financial statements of GODWIN Plc:...........................................................6

P4. Calculation of various ratios and its interpretation: ..............................................................8

TASK 3..........................................................................................................................................11

P5.Benefits of IAS and IFRS:....................................................................................................11

P6.Models of financial reporting and auditing: ........................................................................13

TASK 4..........................................................................................................................................14

P7.Difference and importance of financial reporting across different countries: .....................14

CONCLUSION .............................................................................................................................14

REFERENCES..............................................................................................................................15

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................4

P1.Context of financial reporting including regulatory framework and its governance:............4

P2.Purpose of financial reporting for meeting organisational objectives, development and

growth..........................................................................................................................................5

TASK 2 ...........................................................................................................................................6

P3.Preparation of financial statements of GODWIN Plc:...........................................................6

P4. Calculation of various ratios and its interpretation: ..............................................................8

TASK 3..........................................................................................................................................11

P5.Benefits of IAS and IFRS:....................................................................................................11

P6.Models of financial reporting and auditing: ........................................................................13

TASK 4..........................................................................................................................................14

P7.Difference and importance of financial reporting across different countries: .....................14

CONCLUSION .............................................................................................................................14

REFERENCES..............................................................................................................................15

INTRODUCTION

In any business environment, financial reporting of its business operations are essential

for providing true and fair view of affairs of company to its shareholders and other stakeholders.

For any multinational business organisation, international financial reporting shall be required

for follow the different countries laws and regulations. International financial reporting

frameworks set common rules for preparation of financial statements which are consistent and

transparent around the world.

For better understanding of international financial reporting, a business firm named

Deloitte is chosen which is engaged in providing professional consultancy services. It specializes

in audit and assurance, tax, advisory and risk. This report explains about the context and

purposes of financial accounting reporting for meeting business related growth and objectives. It

provides interpretation of financial statements by calculating various ratios. This report

prescribes the benefits of international accounting standards (IAS) and IFRS and various models

financial reporting and auditing. It also provides the differences and importance of financial

reporting across different countries.

TASK 1

P1.Context of financial reporting including regulatory framework and its governance:

Financial reporting concerns with the annual disclosure requirements of financial

statements which includes income & expenditure statement, balance sheet and cash flows to the

management and concerned stakeholders. It is a regulatory norm to disclose critical financial

data by the organisation to the general public in order to ensure transparency, diligence and

accountability. It is integral to corporate governance. The stakeholders who are deeply concerned

with an organisation's financial health are investors, creditors, regulators, financial institutions,

government and society at large. Deloitte Ensues financial reporting as vital to its operations and

to satisfy the needs to disclose critical information to the public it annually meets its disclosure

requirements (Nobes, 2014).

Regulatory framework:

Company law 2006 recognises International financial reporting standards (IFRS) UK and

Generally accepted accounting practices (GAAP) as standard principles to record financial

statements and follow guidelines issued by these standards for disclosure requirements . FRS 100

In any business environment, financial reporting of its business operations are essential

for providing true and fair view of affairs of company to its shareholders and other stakeholders.

For any multinational business organisation, international financial reporting shall be required

for follow the different countries laws and regulations. International financial reporting

frameworks set common rules for preparation of financial statements which are consistent and

transparent around the world.

For better understanding of international financial reporting, a business firm named

Deloitte is chosen which is engaged in providing professional consultancy services. It specializes

in audit and assurance, tax, advisory and risk. This report explains about the context and

purposes of financial accounting reporting for meeting business related growth and objectives. It

provides interpretation of financial statements by calculating various ratios. This report

prescribes the benefits of international accounting standards (IAS) and IFRS and various models

financial reporting and auditing. It also provides the differences and importance of financial

reporting across different countries.

TASK 1

P1.Context of financial reporting including regulatory framework and its governance:

Financial reporting concerns with the annual disclosure requirements of financial

statements which includes income & expenditure statement, balance sheet and cash flows to the

management and concerned stakeholders. It is a regulatory norm to disclose critical financial

data by the organisation to the general public in order to ensure transparency, diligence and

accountability. It is integral to corporate governance. The stakeholders who are deeply concerned

with an organisation's financial health are investors, creditors, regulators, financial institutions,

government and society at large. Deloitte Ensues financial reporting as vital to its operations and

to satisfy the needs to disclose critical information to the public it annually meets its disclosure

requirements (Nobes, 2014).

Regulatory framework:

Company law 2006 recognises International financial reporting standards (IFRS) UK and

Generally accepted accounting practices (GAAP) as standard principles to record financial

statements and follow guidelines issued by these standards for disclosure requirements . FRS 100

includes in its purview IFRS, FRS 101,102,105 which are to be strictly followed by every

publicly listed company. These standards are bifurcated according to the characteristics of the

entity concerned. They are comprehensively adopted by European union as central standards to

meet the disclosure requirements. Deloitte Being a publicly listed company adheres to IFRS for

its internal reporting and for its sister concerns. As the complexity of functions increase along

with the threshold limit, results into increase in the more complex disclosure requirements.

Deloitte discloses annual financial statements based on the parameters set by the aforesaid

standards and strictly abide by the laws prescribed. Financial reporting council is the supreme

authority in UK to promote reporting and governance standards. It is responsible for perpetual

alteration in the norms, laws and procedures to ensure greater reliability (Madawaki, 2012).

Governance of Financial reporting:

Financial reporting is a pursuit of strong corporate governance practices which an

organisation must abide to. Corporate governance is a framework of crafted rules, regulations,

managerial practices and regulatory standards through which an organisation runs. It ensures

parallel development of business goals with ensuing ethical practices for utmost care of

stakeholder interests. Financial reporting in modern context is not limited to mere a low priority

accounting exercise, but a central function of good corporate governance practice. Information

flow is certainly very crucial in the formation of a broad network of information economics

which paves a significant way of delineating information to major factors affecting with the data

set. Linkage between good governance and financial reporting empowers the brand value of a

business firm. The provisions of companies act stretches a border line for a company's business

scope. It further adds greater reliance on the firm to prove its sanctity based on the premise of

just and fair principles of good corporate governance backed by true and fair financial reporting

practices.

International financial reporting standards (IFRS):

IFRS 1: First time adoption of international financial reporting standards and It requires

a firm that is adopting IFRS standards for the very first time to prepare a comprehensive

set of financial statements to covering its beginning IFRS reporting period and the

previous year.

IFRS10: It makes principles for preparing and presenting consolidated financial

statements for the entity which controls various other subsidiaries or sister concerns.

publicly listed company. These standards are bifurcated according to the characteristics of the

entity concerned. They are comprehensively adopted by European union as central standards to

meet the disclosure requirements. Deloitte Being a publicly listed company adheres to IFRS for

its internal reporting and for its sister concerns. As the complexity of functions increase along

with the threshold limit, results into increase in the more complex disclosure requirements.

Deloitte discloses annual financial statements based on the parameters set by the aforesaid

standards and strictly abide by the laws prescribed. Financial reporting council is the supreme

authority in UK to promote reporting and governance standards. It is responsible for perpetual

alteration in the norms, laws and procedures to ensure greater reliability (Madawaki, 2012).

Governance of Financial reporting:

Financial reporting is a pursuit of strong corporate governance practices which an

organisation must abide to. Corporate governance is a framework of crafted rules, regulations,

managerial practices and regulatory standards through which an organisation runs. It ensures

parallel development of business goals with ensuing ethical practices for utmost care of

stakeholder interests. Financial reporting in modern context is not limited to mere a low priority

accounting exercise, but a central function of good corporate governance practice. Information

flow is certainly very crucial in the formation of a broad network of information economics

which paves a significant way of delineating information to major factors affecting with the data

set. Linkage between good governance and financial reporting empowers the brand value of a

business firm. The provisions of companies act stretches a border line for a company's business

scope. It further adds greater reliance on the firm to prove its sanctity based on the premise of

just and fair principles of good corporate governance backed by true and fair financial reporting

practices.

International financial reporting standards (IFRS):

IFRS 1: First time adoption of international financial reporting standards and It requires

a firm that is adopting IFRS standards for the very first time to prepare a comprehensive

set of financial statements to covering its beginning IFRS reporting period and the

previous year.

IFRS10: It makes principles for preparing and presenting consolidated financial

statements for the entity which controls various other subsidiaries or sister concerns.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

IFRS 13: It prescribes framework to measure fair value, fair value and disclosure of the

fair value measurements.

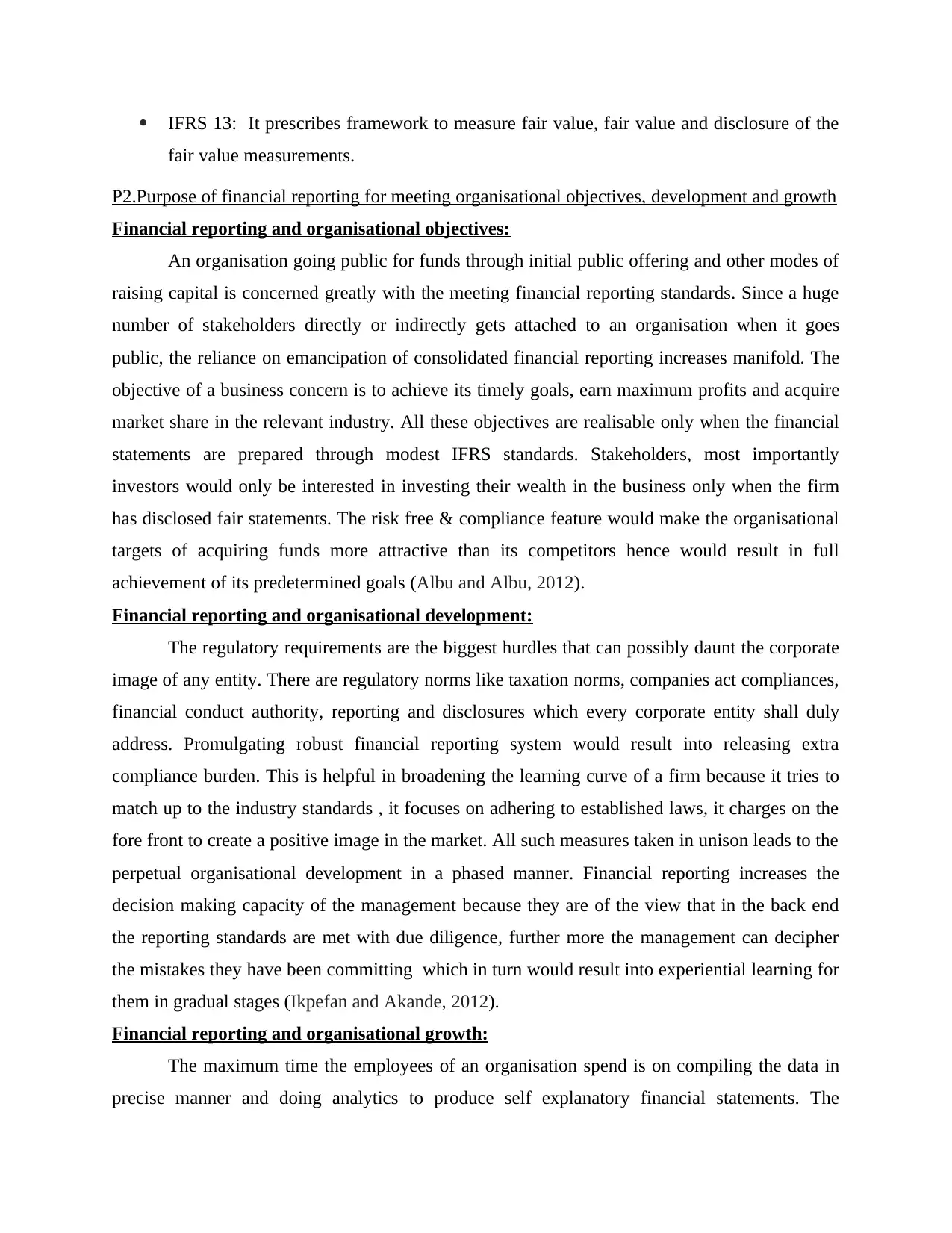

P2.Purpose of financial reporting for meeting organisational objectives, development and growth

Financial reporting and organisational objectives:

An organisation going public for funds through initial public offering and other modes of

raising capital is concerned greatly with the meeting financial reporting standards. Since a huge

number of stakeholders directly or indirectly gets attached to an organisation when it goes

public, the reliance on emancipation of consolidated financial reporting increases manifold. The

objective of a business concern is to achieve its timely goals, earn maximum profits and acquire

market share in the relevant industry. All these objectives are realisable only when the financial

statements are prepared through modest IFRS standards. Stakeholders, most importantly

investors would only be interested in investing their wealth in the business only when the firm

has disclosed fair statements. The risk free & compliance feature would make the organisational

targets of acquiring funds more attractive than its competitors hence would result in full

achievement of its predetermined goals (Albu and Albu, 2012).

Financial reporting and organisational development:

The regulatory requirements are the biggest hurdles that can possibly daunt the corporate

image of any entity. There are regulatory norms like taxation norms, companies act compliances,

financial conduct authority, reporting and disclosures which every corporate entity shall duly

address. Promulgating robust financial reporting system would result into releasing extra

compliance burden. This is helpful in broadening the learning curve of a firm because it tries to

match up to the industry standards , it focuses on adhering to established laws, it charges on the

fore front to create a positive image in the market. All such measures taken in unison leads to the

perpetual organisational development in a phased manner. Financial reporting increases the

decision making capacity of the management because they are of the view that in the back end

the reporting standards are met with due diligence, further more the management can decipher

the mistakes they have been committing which in turn would result into experiential learning for

them in gradual stages (Ikpefan and Akande, 2012).

Financial reporting and organisational growth:

The maximum time the employees of an organisation spend is on compiling the data in

precise manner and doing analytics to produce self explanatory financial statements. The

fair value measurements.

P2.Purpose of financial reporting for meeting organisational objectives, development and growth

Financial reporting and organisational objectives:

An organisation going public for funds through initial public offering and other modes of

raising capital is concerned greatly with the meeting financial reporting standards. Since a huge

number of stakeholders directly or indirectly gets attached to an organisation when it goes

public, the reliance on emancipation of consolidated financial reporting increases manifold. The

objective of a business concern is to achieve its timely goals, earn maximum profits and acquire

market share in the relevant industry. All these objectives are realisable only when the financial

statements are prepared through modest IFRS standards. Stakeholders, most importantly

investors would only be interested in investing their wealth in the business only when the firm

has disclosed fair statements. The risk free & compliance feature would make the organisational

targets of acquiring funds more attractive than its competitors hence would result in full

achievement of its predetermined goals (Albu and Albu, 2012).

Financial reporting and organisational development:

The regulatory requirements are the biggest hurdles that can possibly daunt the corporate

image of any entity. There are regulatory norms like taxation norms, companies act compliances,

financial conduct authority, reporting and disclosures which every corporate entity shall duly

address. Promulgating robust financial reporting system would result into releasing extra

compliance burden. This is helpful in broadening the learning curve of a firm because it tries to

match up to the industry standards , it focuses on adhering to established laws, it charges on the

fore front to create a positive image in the market. All such measures taken in unison leads to the

perpetual organisational development in a phased manner. Financial reporting increases the

decision making capacity of the management because they are of the view that in the back end

the reporting standards are met with due diligence, further more the management can decipher

the mistakes they have been committing which in turn would result into experiential learning for

them in gradual stages (Ikpefan and Akande, 2012).

Financial reporting and organisational growth:

The maximum time the employees of an organisation spend is on compiling the data in

precise manner and doing analytics to produce self explanatory financial statements. The

financial reporting eliminates the accounting risks and ensures free movement of capital across

boundaries and reduces listing defaults and stock exchange thrashings. Financial statements

prepared based on international standards makes the organisation more appealing for the global

investors because of the comparable data set justified by records. Efficient disclosure mechanism

improves the legal and ethical quality of the entity resulting into market appreciation for it . The

dependence of contributories on the financial data creates more burden on the business to

disseminate proper and judicious information. However the major benefit it could receive for

doing so it the international growth , employee growth and accountability.

TASK 2

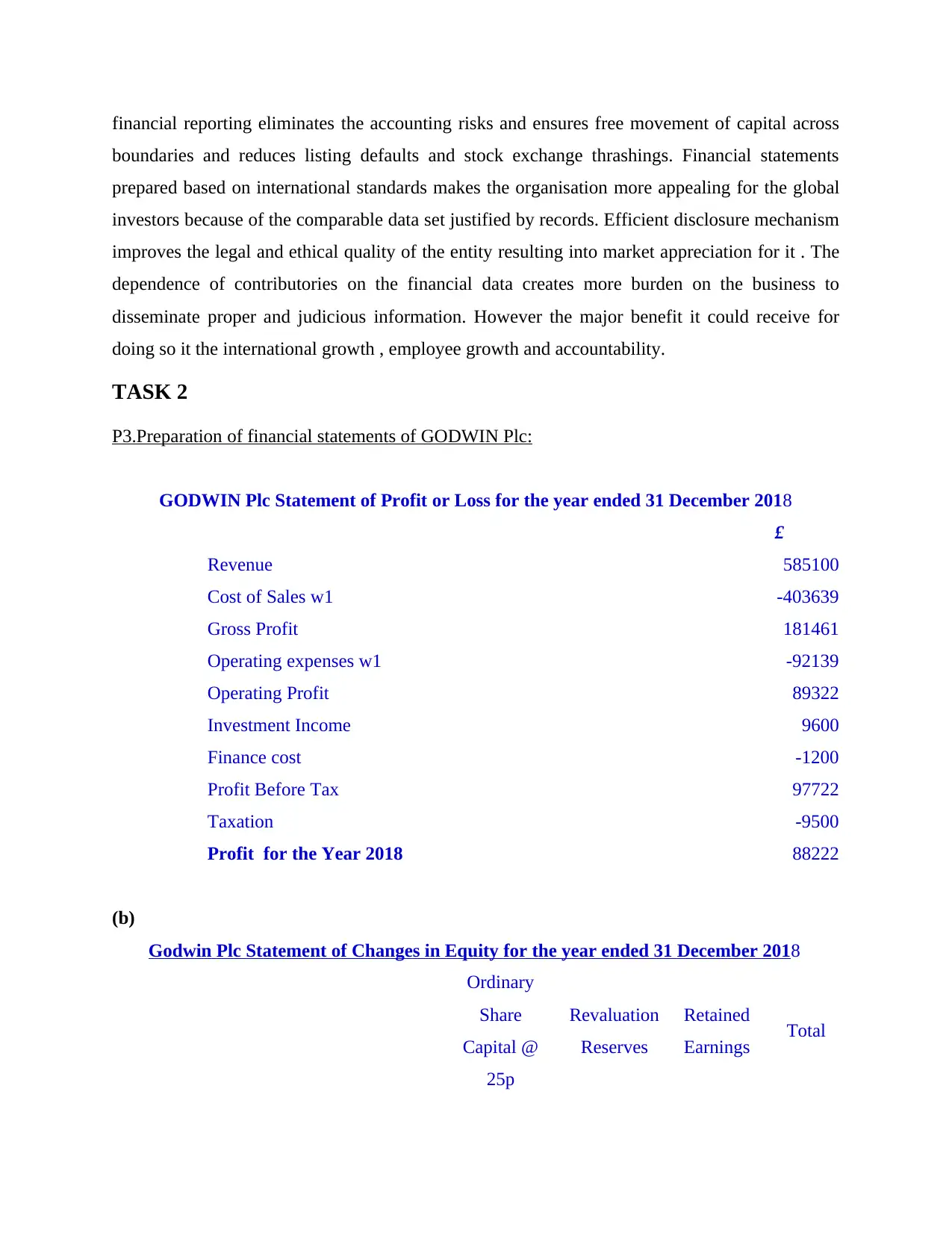

P3.Preparation of financial statements of GODWIN Plc:

GODWIN Plc Statement of Profit or Loss for the year ended 31 December 2018

£

Revenue 585100

Cost of Sales w1 -403639

Gross Profit 181461

Operating expenses w1 -92139

Operating Profit 89322

Investment Income 9600

Finance cost -1200

Profit Before Tax 97722

Taxation -9500

Profit for the Year 2018 88222

(b)

Godwin Plc Statement of Changes in Equity for the year ended 31 December 2018

Ordinary

Share

Capital @

25p

Revaluation

Reserves

Retained

Earnings Total

boundaries and reduces listing defaults and stock exchange thrashings. Financial statements

prepared based on international standards makes the organisation more appealing for the global

investors because of the comparable data set justified by records. Efficient disclosure mechanism

improves the legal and ethical quality of the entity resulting into market appreciation for it . The

dependence of contributories on the financial data creates more burden on the business to

disseminate proper and judicious information. However the major benefit it could receive for

doing so it the international growth , employee growth and accountability.

TASK 2

P3.Preparation of financial statements of GODWIN Plc:

GODWIN Plc Statement of Profit or Loss for the year ended 31 December 2018

£

Revenue 585100

Cost of Sales w1 -403639

Gross Profit 181461

Operating expenses w1 -92139

Operating Profit 89322

Investment Income 9600

Finance cost -1200

Profit Before Tax 97722

Taxation -9500

Profit for the Year 2018 88222

(b)

Godwin Plc Statement of Changes in Equity for the year ended 31 December 2018

Ordinary

Share

Capital @

25p

Revaluation

Reserves

Retained

Earnings Total

£ £ £ £

Balance as per TB 86700 40000 45500 172200

Profit for the year 88222 88222

Preference dividend -2500 -2500

Ordinary dividend -4500 -4500

Total Equity 86700 40000 126722 253422

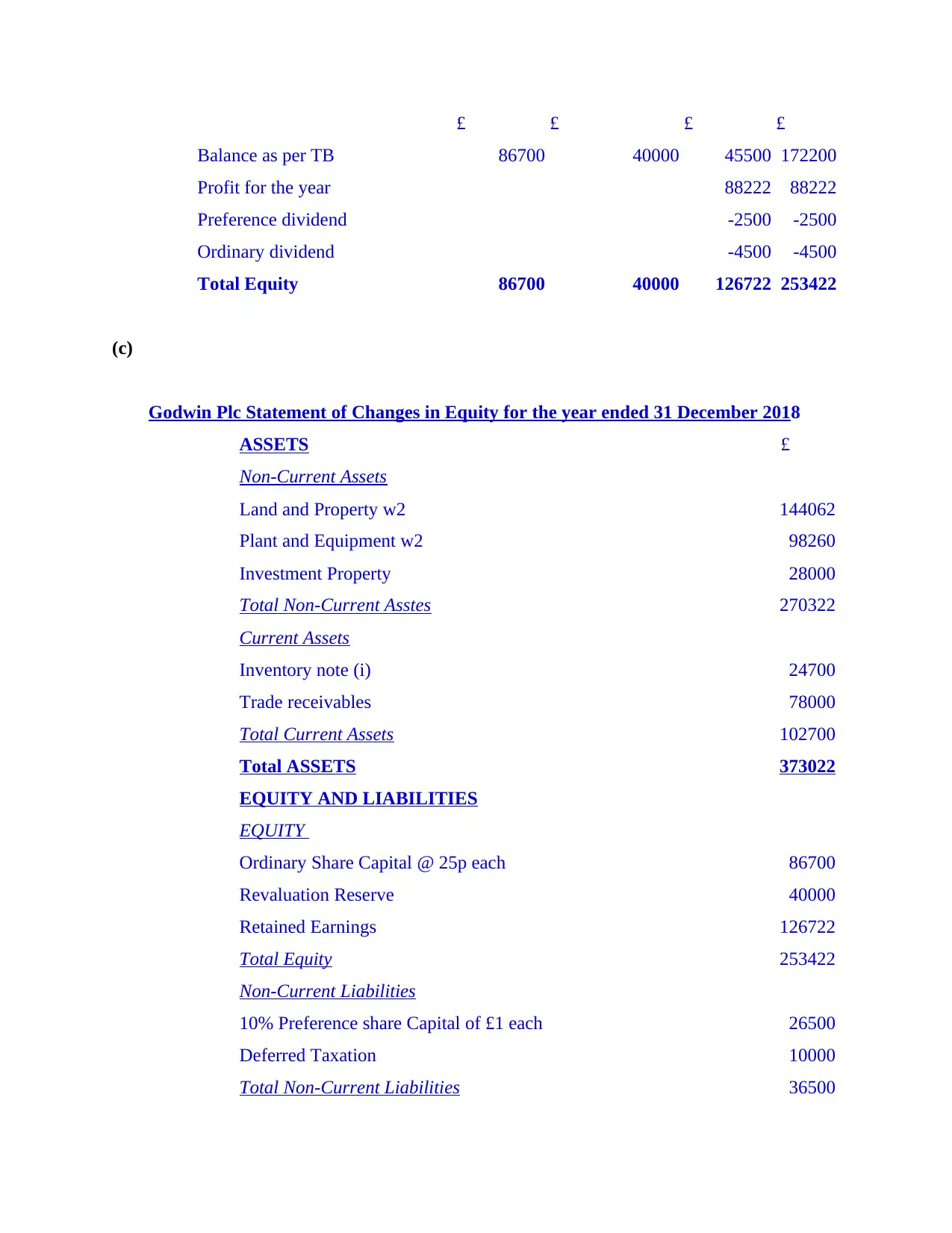

(c)

Godwin Plc Statement of Changes in Equity for the year ended 31 December 2018

ASSETS £

Non-Current Assets

Land and Property w2 144062

Plant and Equipment w2 98260

Investment Property 28000

Total Non-Current Asstes 270322

Current Assets

Inventory note (i) 24700

Trade receivables 78000

Total Current Assets 102700

Total ASSETS 373022

EQUITY AND LIABILITIES

EQUITY

Ordinary Share Capital @ 25p each 86700

Revaluation Reserve 40000

Retained Earnings 126722

Total Equity 253422

Non-Current Liabilities

10% Preference share Capital of £1 each 26500

Deferred Taxation 10000

Total Non-Current Liabilities 36500

Balance as per TB 86700 40000 45500 172200

Profit for the year 88222 88222

Preference dividend -2500 -2500

Ordinary dividend -4500 -4500

Total Equity 86700 40000 126722 253422

(c)

Godwin Plc Statement of Changes in Equity for the year ended 31 December 2018

ASSETS £

Non-Current Assets

Land and Property w2 144062

Plant and Equipment w2 98260

Investment Property 28000

Total Non-Current Asstes 270322

Current Assets

Inventory note (i) 24700

Trade receivables 78000

Total Current Assets 102700

Total ASSETS 373022

EQUITY AND LIABILITIES

EQUITY

Ordinary Share Capital @ 25p each 86700

Revaluation Reserve 40000

Retained Earnings 126722

Total Equity 253422

Non-Current Liabilities

10% Preference share Capital of £1 each 26500

Deferred Taxation 10000

Total Non-Current Liabilities 36500

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Current Liabilities

Trade Payables 62700

Tax Payables 9500

Bank Overdraft 10900

Total Current Liabilities 83100

Total EQUITY AND LIABILITIES 373022

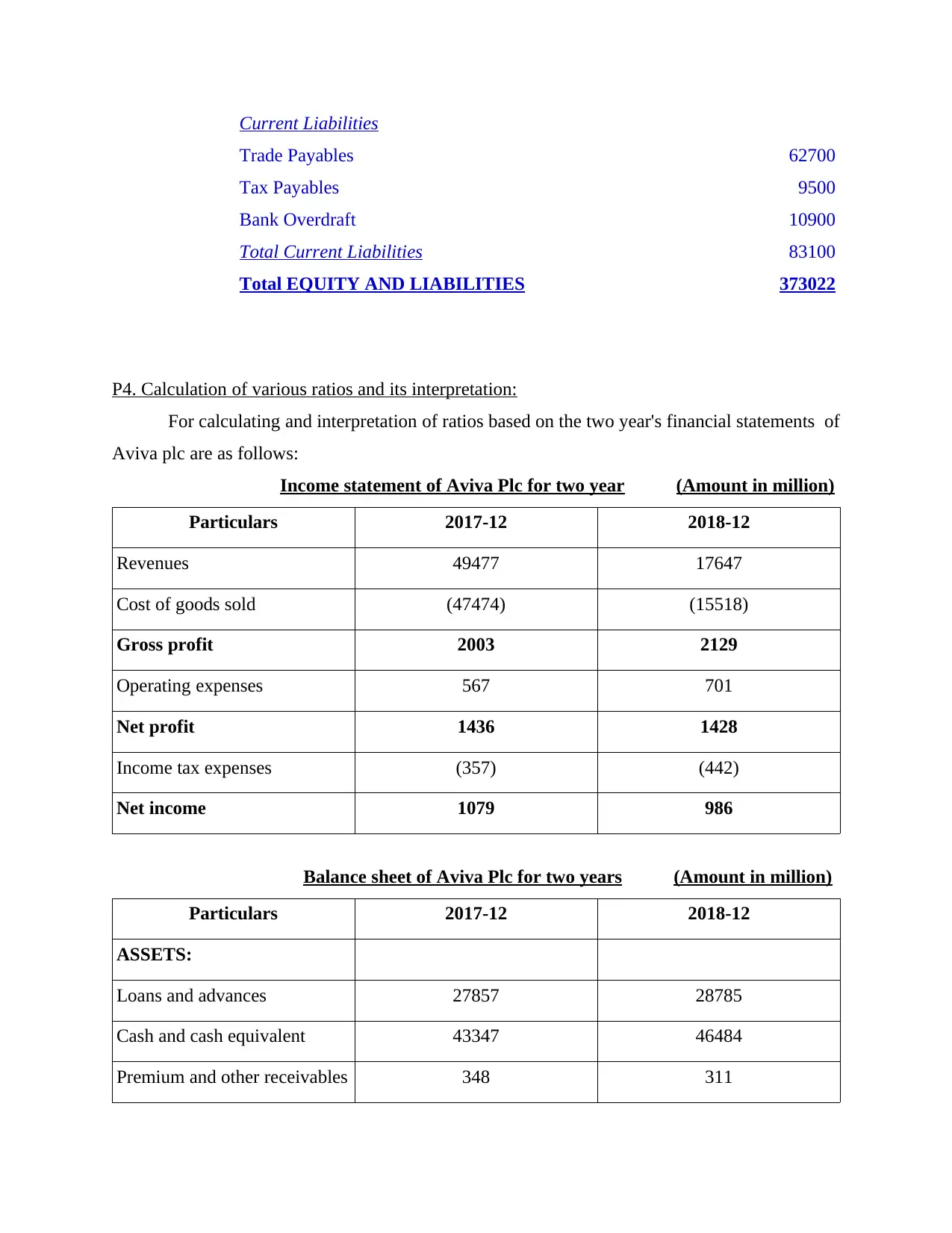

P4. Calculation of various ratios and its interpretation:

For calculating and interpretation of ratios based on the two year's financial statements of

Aviva plc are as follows:

Income statement of Aviva Plc for two year (Amount in million)

Particulars 2017-12 2018-12

Revenues 49477 17647

Cost of goods sold (47474) (15518)

Gross profit 2003 2129

Operating expenses 567 701

Net profit 1436 1428

Income tax expenses (357) (442)

Net income 1079 986

Balance sheet of Aviva Plc for two years (Amount in million)

Particulars 2017-12 2018-12

ASSETS:

Loans and advances 27857 28785

Cash and cash equivalent 43347 46484

Premium and other receivables 348 311

Trade Payables 62700

Tax Payables 9500

Bank Overdraft 10900

Total Current Liabilities 83100

Total EQUITY AND LIABILITIES 373022

P4. Calculation of various ratios and its interpretation:

For calculating and interpretation of ratios based on the two year's financial statements of

Aviva plc are as follows:

Income statement of Aviva Plc for two year (Amount in million)

Particulars 2017-12 2018-12

Revenues 49477 17647

Cost of goods sold (47474) (15518)

Gross profit 2003 2129

Operating expenses 567 701

Net profit 1436 1428

Income tax expenses (357) (442)

Net income 1079 986

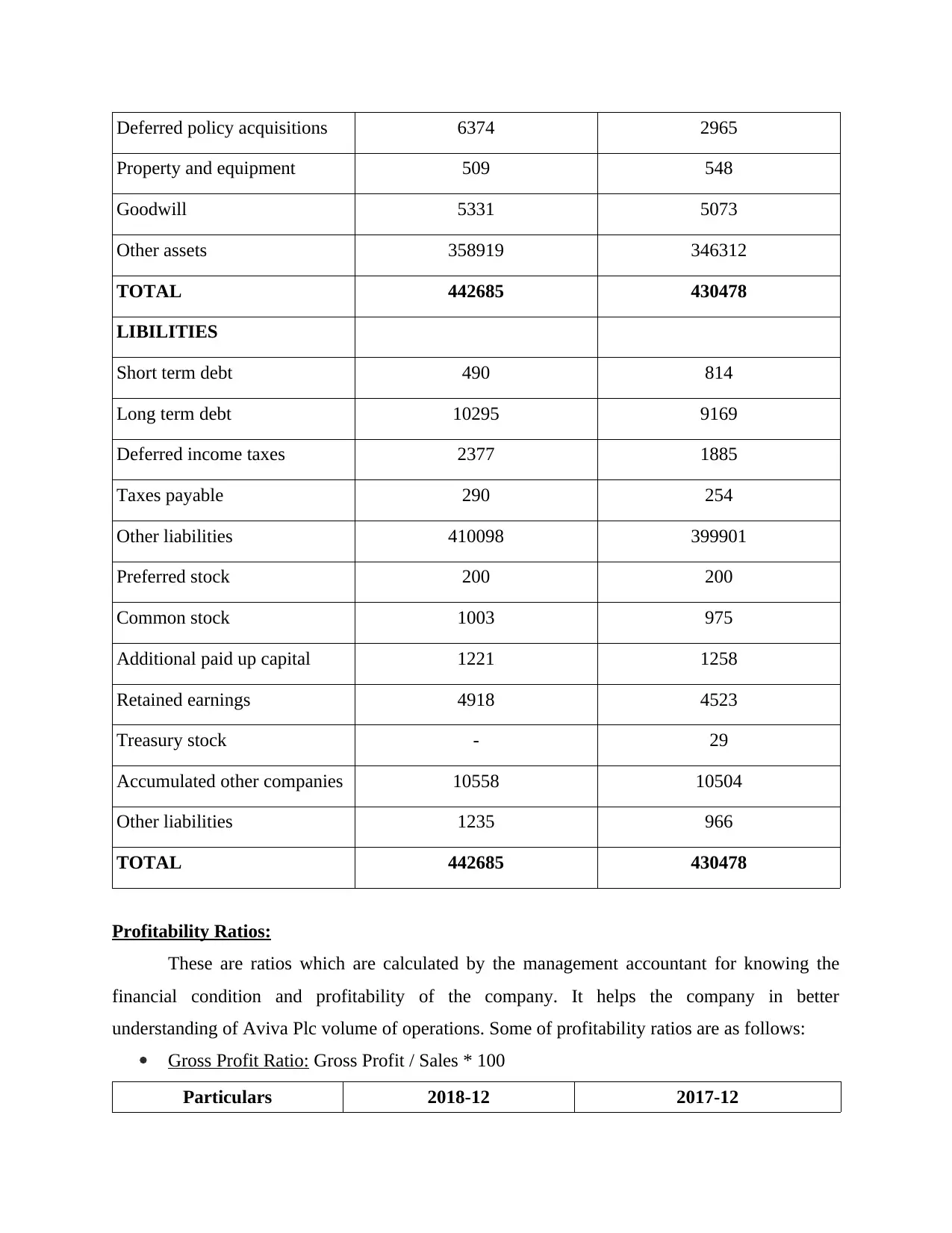

Balance sheet of Aviva Plc for two years (Amount in million)

Particulars 2017-12 2018-12

ASSETS:

Loans and advances 27857 28785

Cash and cash equivalent 43347 46484

Premium and other receivables 348 311

Deferred policy acquisitions 6374 2965

Property and equipment 509 548

Goodwill 5331 5073

Other assets 358919 346312

TOTAL 442685 430478

LIBILITIES

Short term debt 490 814

Long term debt 10295 9169

Deferred income taxes 2377 1885

Taxes payable 290 254

Other liabilities 410098 399901

Preferred stock 200 200

Common stock 1003 975

Additional paid up capital 1221 1258

Retained earnings 4918 4523

Treasury stock - 29

Accumulated other companies 10558 10504

Other liabilities 1235 966

TOTAL 442685 430478

Profitability Ratios:

These are ratios which are calculated by the management accountant for knowing the

financial condition and profitability of the company. It helps the company in better

understanding of Aviva Plc volume of operations. Some of profitability ratios are as follows:

Gross Profit Ratio: Gross Profit / Sales * 100

Particulars 2018-12 2017-12

Property and equipment 509 548

Goodwill 5331 5073

Other assets 358919 346312

TOTAL 442685 430478

LIBILITIES

Short term debt 490 814

Long term debt 10295 9169

Deferred income taxes 2377 1885

Taxes payable 290 254

Other liabilities 410098 399901

Preferred stock 200 200

Common stock 1003 975

Additional paid up capital 1221 1258

Retained earnings 4918 4523

Treasury stock - 29

Accumulated other companies 10558 10504

Other liabilities 1235 966

TOTAL 442685 430478

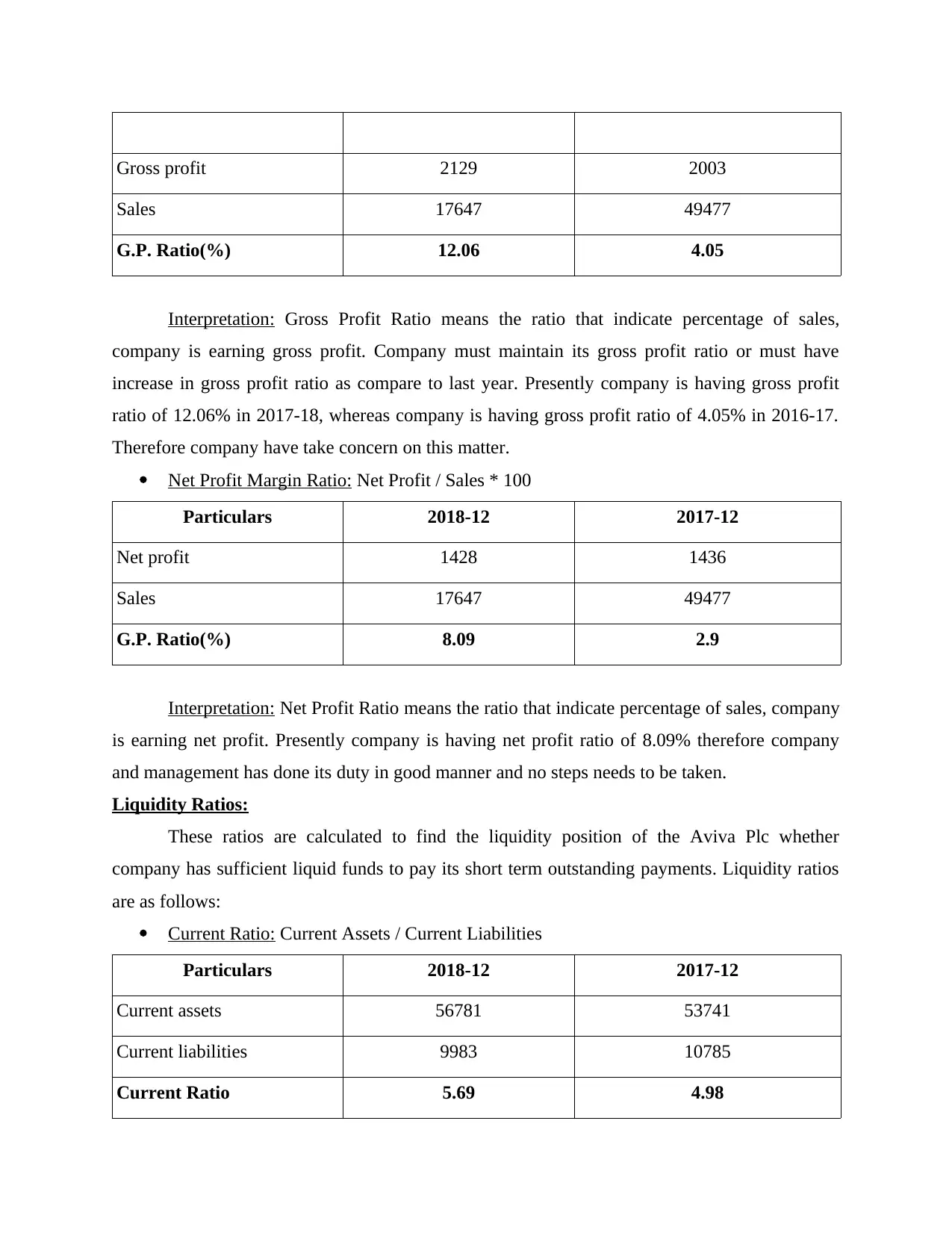

Profitability Ratios:

These are ratios which are calculated by the management accountant for knowing the

financial condition and profitability of the company. It helps the company in better

understanding of Aviva Plc volume of operations. Some of profitability ratios are as follows:

Gross Profit Ratio: Gross Profit / Sales * 100

Particulars 2018-12 2017-12

Gross profit 2129 2003

Sales 17647 49477

G.P. Ratio(%) 12.06 4.05

Interpretation: Gross Profit Ratio means the ratio that indicate percentage of sales,

company is earning gross profit. Company must maintain its gross profit ratio or must have

increase in gross profit ratio as compare to last year. Presently company is having gross profit

ratio of 12.06% in 2017-18, whereas company is having gross profit ratio of 4.05% in 2016-17.

Therefore company have take concern on this matter.

Net Profit Margin Ratio: Net Profit / Sales * 100

Particulars 2018-12 2017-12

Net profit 1428 1436

Sales 17647 49477

G.P. Ratio(%) 8.09 2.9

Interpretation: Net Profit Ratio means the ratio that indicate percentage of sales, company

is earning net profit. Presently company is having net profit ratio of 8.09% therefore company

and management has done its duty in good manner and no steps needs to be taken.

Liquidity Ratios:

These ratios are calculated to find the liquidity position of the Aviva Plc whether

company has sufficient liquid funds to pay its short term outstanding payments. Liquidity ratios

are as follows:

Current Ratio: Current Assets / Current Liabilities

Particulars 2018-12 2017-12

Current assets 56781 53741

Current liabilities 9983 10785

Current Ratio 5.69 4.98

Sales 17647 49477

G.P. Ratio(%) 12.06 4.05

Interpretation: Gross Profit Ratio means the ratio that indicate percentage of sales,

company is earning gross profit. Company must maintain its gross profit ratio or must have

increase in gross profit ratio as compare to last year. Presently company is having gross profit

ratio of 12.06% in 2017-18, whereas company is having gross profit ratio of 4.05% in 2016-17.

Therefore company have take concern on this matter.

Net Profit Margin Ratio: Net Profit / Sales * 100

Particulars 2018-12 2017-12

Net profit 1428 1436

Sales 17647 49477

G.P. Ratio(%) 8.09 2.9

Interpretation: Net Profit Ratio means the ratio that indicate percentage of sales, company

is earning net profit. Presently company is having net profit ratio of 8.09% therefore company

and management has done its duty in good manner and no steps needs to be taken.

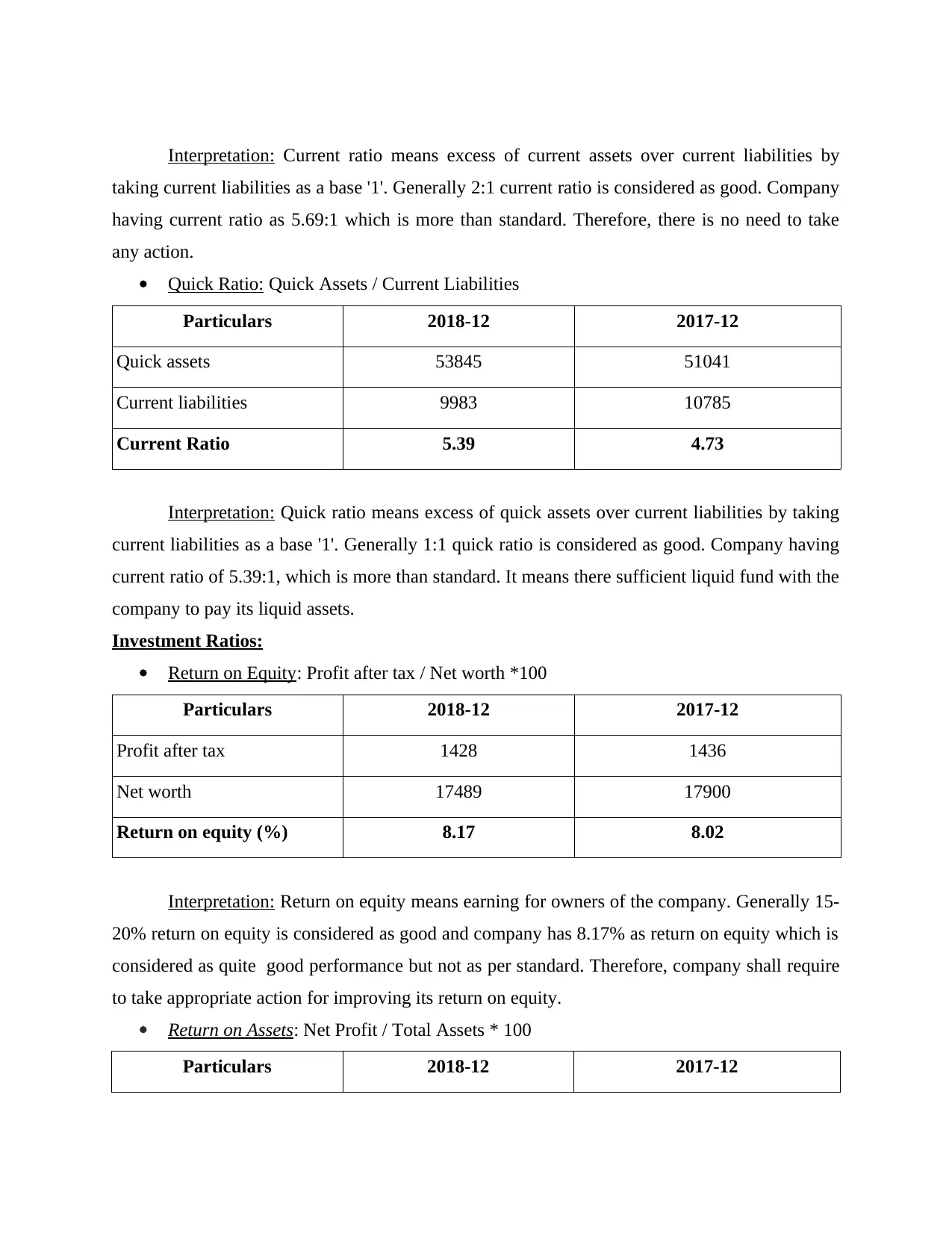

Liquidity Ratios:

These ratios are calculated to find the liquidity position of the Aviva Plc whether

company has sufficient liquid funds to pay its short term outstanding payments. Liquidity ratios

are as follows:

Current Ratio: Current Assets / Current Liabilities

Particulars 2018-12 2017-12

Current assets 56781 53741

Current liabilities 9983 10785

Current Ratio 5.69 4.98

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Interpretation: Current ratio means excess of current assets over current liabilities by

taking current liabilities as a base '1'. Generally 2:1 current ratio is considered as good. Company

having current ratio as 5.69:1 which is more than standard. Therefore, there is no need to take

any action.

Quick Ratio: Quick Assets / Current Liabilities

Particulars 2018-12 2017-12

Quick assets 53845 51041

Current liabilities 9983 10785

Current Ratio 5.39 4.73

Interpretation: Quick ratio means excess of quick assets over current liabilities by taking

current liabilities as a base '1'. Generally 1:1 quick ratio is considered as good. Company having

current ratio of 5.39:1, which is more than standard. It means there sufficient liquid fund with the

company to pay its liquid assets.

Investment Ratios:

Return on Equity: Profit after tax / Net worth *100

Particulars 2018-12 2017-12

Profit after tax 1428 1436

Net worth 17489 17900

Return on equity (%) 8.17 8.02

Interpretation: Return on equity means earning for owners of the company. Generally 15-

20% return on equity is considered as good and company has 8.17% as return on equity which is

considered as quite good performance but not as per standard. Therefore, company shall require

to take appropriate action for improving its return on equity.

Return on Assets: Net Profit / Total Assets * 100

Particulars 2018-12 2017-12

taking current liabilities as a base '1'. Generally 2:1 current ratio is considered as good. Company

having current ratio as 5.69:1 which is more than standard. Therefore, there is no need to take

any action.

Quick Ratio: Quick Assets / Current Liabilities

Particulars 2018-12 2017-12

Quick assets 53845 51041

Current liabilities 9983 10785

Current Ratio 5.39 4.73

Interpretation: Quick ratio means excess of quick assets over current liabilities by taking

current liabilities as a base '1'. Generally 1:1 quick ratio is considered as good. Company having

current ratio of 5.39:1, which is more than standard. It means there sufficient liquid fund with the

company to pay its liquid assets.

Investment Ratios:

Return on Equity: Profit after tax / Net worth *100

Particulars 2018-12 2017-12

Profit after tax 1428 1436

Net worth 17489 17900

Return on equity (%) 8.17 8.02

Interpretation: Return on equity means earning for owners of the company. Generally 15-

20% return on equity is considered as good and company has 8.17% as return on equity which is

considered as quite good performance but not as per standard. Therefore, company shall require

to take appropriate action for improving its return on equity.

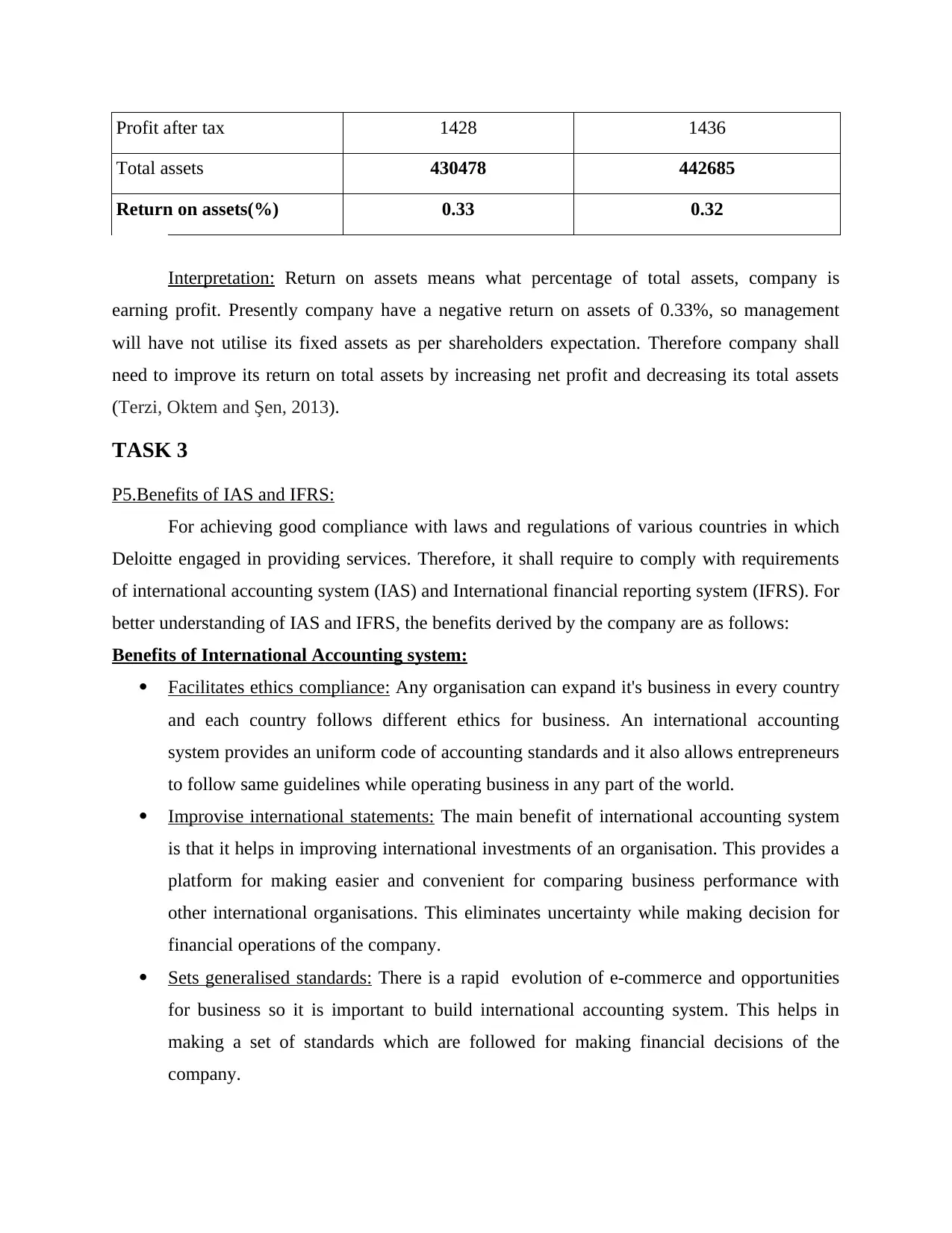

Return on Assets: Net Profit / Total Assets * 100

Particulars 2018-12 2017-12

Profit after tax 1428 1436

Total assets 430478 442685

Return on assets(%) 0.33 0.32

Interpretation: Return on assets means what percentage of total assets, company is

earning profit. Presently company have a negative return on assets of 0.33%, so management

will have not utilise its fixed assets as per shareholders expectation. Therefore company shall

need to improve its return on total assets by increasing net profit and decreasing its total assets

(Terzi, Oktem and Şen, 2013).

TASK 3

P5.Benefits of IAS and IFRS:

For achieving good compliance with laws and regulations of various countries in which

Deloitte engaged in providing services. Therefore, it shall require to comply with requirements

of international accounting system (IAS) and International financial reporting system (IFRS). For

better understanding of IAS and IFRS, the benefits derived by the company are as follows:

Benefits of International Accounting system:

Facilitates ethics compliance: Any organisation can expand it's business in every country

and each country follows different ethics for business. An international accounting

system provides an uniform code of accounting standards and it also allows entrepreneurs

to follow same guidelines while operating business in any part of the world.

Improvise international statements: The main benefit of international accounting system

is that it helps in improving international investments of an organisation. This provides a

platform for making easier and convenient for comparing business performance with

other international organisations. This eliminates uncertainty while making decision for

financial operations of the company.

Sets generalised standards: There is a rapid evolution of e-commerce and opportunities

for business so it is important to build international accounting system. This helps in

making a set of standards which are followed for making financial decisions of the

company.

Total assets 430478 442685

Return on assets(%) 0.33 0.32

Interpretation: Return on assets means what percentage of total assets, company is

earning profit. Presently company have a negative return on assets of 0.33%, so management

will have not utilise its fixed assets as per shareholders expectation. Therefore company shall

need to improve its return on total assets by increasing net profit and decreasing its total assets

(Terzi, Oktem and Şen, 2013).

TASK 3

P5.Benefits of IAS and IFRS:

For achieving good compliance with laws and regulations of various countries in which

Deloitte engaged in providing services. Therefore, it shall require to comply with requirements

of international accounting system (IAS) and International financial reporting system (IFRS). For

better understanding of IAS and IFRS, the benefits derived by the company are as follows:

Benefits of International Accounting system:

Facilitates ethics compliance: Any organisation can expand it's business in every country

and each country follows different ethics for business. An international accounting

system provides an uniform code of accounting standards and it also allows entrepreneurs

to follow same guidelines while operating business in any part of the world.

Improvise international statements: The main benefit of international accounting system

is that it helps in improving international investments of an organisation. This provides a

platform for making easier and convenient for comparing business performance with

other international organisations. This eliminates uncertainty while making decision for

financial operations of the company.

Sets generalised standards: There is a rapid evolution of e-commerce and opportunities

for business so it is important to build international accounting system. This helps in

making a set of standards which are followed for making financial decisions of the

company.

International trades: Every organisation seeks for strategic patterns, suppliers, customers

and foreign countries. The international accounting system provides an opportunity for

companies to have a common financial language and understanding. This makes it easier

to do business in any part of the world. This accounting system helps in creating an entire

new industry and new opportunities for entrepreneurs in any country (Adams, 2015).

Benefits of international financial reporting standards:

Improve transparency: By implementing the IFRS in an organisation, it assist the

management accountant in improving transparency in accounting system which gives

better view and presentation of financial information covered under financial statements.

Globally accepted: As international financial reporting standards are accepted in whole of

the world, then IFRS gives an advantage to the business organisation to operate its

business anywhere in the world outside the its home country.

Reduced accounting complexities: IFRS gives a benefits to the organisation to simplified

its business operations by comply only with one standards which is applicable to whole

of the world by eliminating the need of compliance with various laws and regulations of

different-different companies.

Benefit to economy: It would benefit the economy of the country in which company is

established by giving opportunity to company to do its business operation across the

other countries of the world. As a result, company shall make more sales and may

enhance its profits and ultimately it helps the domestic country in development of its

economy.

P6.Models of financial reporting and auditing:

In any business environment, various models relating to financial reporting are very

beneficial for the company for sufficient compliance with the various laws and regulations.

These models are as follows:

Financial reporting model:

This model is followed by organisations to evaluate the interpretation of financial

statements and various related accounts. Dlloite prepares its financial statements as per the

applicable regulatory framework issued by International Accounting Standard Board (IASB).

Some of these models are explained below:

and foreign countries. The international accounting system provides an opportunity for

companies to have a common financial language and understanding. This makes it easier

to do business in any part of the world. This accounting system helps in creating an entire

new industry and new opportunities for entrepreneurs in any country (Adams, 2015).

Benefits of international financial reporting standards:

Improve transparency: By implementing the IFRS in an organisation, it assist the

management accountant in improving transparency in accounting system which gives

better view and presentation of financial information covered under financial statements.

Globally accepted: As international financial reporting standards are accepted in whole of

the world, then IFRS gives an advantage to the business organisation to operate its

business anywhere in the world outside the its home country.

Reduced accounting complexities: IFRS gives a benefits to the organisation to simplified

its business operations by comply only with one standards which is applicable to whole

of the world by eliminating the need of compliance with various laws and regulations of

different-different companies.

Benefit to economy: It would benefit the economy of the country in which company is

established by giving opportunity to company to do its business operation across the

other countries of the world. As a result, company shall make more sales and may

enhance its profits and ultimately it helps the domestic country in development of its

economy.

P6.Models of financial reporting and auditing:

In any business environment, various models relating to financial reporting are very

beneficial for the company for sufficient compliance with the various laws and regulations.

These models are as follows:

Financial reporting model:

This model is followed by organisations to evaluate the interpretation of financial

statements and various related accounts. Dlloite prepares its financial statements as per the

applicable regulatory framework issued by International Accounting Standard Board (IASB).

Some of these models are explained below:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Three statement model: It is a type of model which is prepared by all companies to

analyse the financial position during an accounting year. It has three statements which is balance

sheet, income statement, cash flow statement. Balance sheet is a statement of financial position

that covers impact of assets, shareholder's fund and liabilities. This is made by organisations to

evaluate its working capital position. Presentation of balance sheet includes a 'T' shaped

presentation where assets are shown on the top followed by equity & liabilities. Assets are the

estate which cause economic enhancement to an entity whereas liabilities may be defined as a

current responsibility due to past happening. Profit & loss account may be defined as a statement

which record gains & losses which may appear within an accounting year. It is created by

entities to assess their profitability position. It covers revenue, cost of sales, administrative

expenses etc. Cash flow statement may be defined as a statement that records inflows and

outflows of cash for companies. It is made based on IAS-7. Statement of cash flows that includes

three activities i.e. operating, investing and financing. These consists of loss/profit on investment

and working capital changes, purchase/sale of fixed assets, issue/repayment of shares etc.

(Cheng, 2014).

Consolidation model: It is a model formulated by combining financial results of various

businesses into one model. It includes a parent and subsidiary company and created as

per requirements of IFRS-10 Consolidated financial statements. These are represented in

the form of tables in a spreadsheet or in the form of graphs or charts. It includes

calculation of goodwill, group retained earnings, non controlling interest, unrealised

profit etc. for preparation of final accounts of a company. The effect of IFRS-3 Business

combinations is also considered while preparing consolidated financial statements.

Auditing model: This is a type of model which provides systematic examination of

books, statutory records, vouchers etc. of an entity. This covers the various methods to

examine the wholeness of data. Some of them are given as follows:

Reconciliation: This is a method used by auditors to check any errors in the statement of

accounts. These are prepared to identify any misconduct, fraud or error, loss of theft

which may arise while preparing financial statements.

Physical examination: This requires verification and physical inspection of tangible assets

and other line items in balance sheet as it confirms their existence.

analyse the financial position during an accounting year. It has three statements which is balance

sheet, income statement, cash flow statement. Balance sheet is a statement of financial position

that covers impact of assets, shareholder's fund and liabilities. This is made by organisations to

evaluate its working capital position. Presentation of balance sheet includes a 'T' shaped

presentation where assets are shown on the top followed by equity & liabilities. Assets are the

estate which cause economic enhancement to an entity whereas liabilities may be defined as a

current responsibility due to past happening. Profit & loss account may be defined as a statement

which record gains & losses which may appear within an accounting year. It is created by

entities to assess their profitability position. It covers revenue, cost of sales, administrative

expenses etc. Cash flow statement may be defined as a statement that records inflows and

outflows of cash for companies. It is made based on IAS-7. Statement of cash flows that includes

three activities i.e. operating, investing and financing. These consists of loss/profit on investment

and working capital changes, purchase/sale of fixed assets, issue/repayment of shares etc.

(Cheng, 2014).

Consolidation model: It is a model formulated by combining financial results of various

businesses into one model. It includes a parent and subsidiary company and created as

per requirements of IFRS-10 Consolidated financial statements. These are represented in

the form of tables in a spreadsheet or in the form of graphs or charts. It includes

calculation of goodwill, group retained earnings, non controlling interest, unrealised

profit etc. for preparation of final accounts of a company. The effect of IFRS-3 Business

combinations is also considered while preparing consolidated financial statements.

Auditing model: This is a type of model which provides systematic examination of

books, statutory records, vouchers etc. of an entity. This covers the various methods to

examine the wholeness of data. Some of them are given as follows:

Reconciliation: This is a method used by auditors to check any errors in the statement of

accounts. These are prepared to identify any misconduct, fraud or error, loss of theft

which may arise while preparing financial statements.

Physical examination: This requires verification and physical inspection of tangible assets

and other line items in balance sheet as it confirms their existence.

TASK 4

P7.Difference and importance of financial reporting across different countries:

There are various differences in reporting of financial statement between various

countries, this is due to some business environment changes in country to country. As a result,

there are various importance of these financial reporting due to these differences. Some of such

differences and importances are as follows:

Differences:

It may be due to difference in accounting standards between various countries.

It may be due to differences in currencies used to measure the foreign entity's

operations.

Different accounting regulation and enforcement due different geographical locations

and different condition (Shah, Liang and Akbar, 2013).

Importance:

It provides a clear cut understanding that how a financial information may be presented.

As per different geographical location is gives more importance to that location for

which it is presented.

CONCLUSION

Form the above report it is concluded that financial reporting is very essential for every

business environment for better view of its financial information. Various techniques are given

by the laws and regulation for this, consequently, company should require to comply with these

specific laws. For comply with the international requirements and for doing business across the

world, there is a requirement to comply with international financial reporting standards and

international accounting standards.

P7.Difference and importance of financial reporting across different countries:

There are various differences in reporting of financial statement between various

countries, this is due to some business environment changes in country to country. As a result,

there are various importance of these financial reporting due to these differences. Some of such

differences and importances are as follows:

Differences:

It may be due to difference in accounting standards between various countries.

It may be due to differences in currencies used to measure the foreign entity's

operations.

Different accounting regulation and enforcement due different geographical locations

and different condition (Shah, Liang and Akbar, 2013).

Importance:

It provides a clear cut understanding that how a financial information may be presented.

As per different geographical location is gives more importance to that location for

which it is presented.

CONCLUSION

Form the above report it is concluded that financial reporting is very essential for every

business environment for better view of its financial information. Various techniques are given

by the laws and regulation for this, consequently, company should require to comply with these

specific laws. For comply with the international requirements and for doing business across the

world, there is a requirement to comply with international financial reporting standards and

international accounting standards.

REFERENCES

Books and journal

Nobes, C., 2014. International classification of financial reporting. Routledge.

Madawaki, A., 2012. Adoption of international financial reporting standards in developing

countries: The case of Nigeria. International Journal of Business and management, 7(3),

p.152.

Mackenzie, B., Coetsee, D., Njikizana, T., Chamboko, R., Colyvas, B. and Hanekom, B.,

2012. Wiley IFRS 2013: Interpretation and Application of International Financial

Reporting Standards. John Wiley & Sons.

Albu, N. and Albu, C.N., 2012. International Financial Reporting Standards in an emerging

economy: lessons from Romania. Australian accounting review, 22(4), pp.341-352.

Christiaens, J., Vanhee, C., Manes-Rossi, F., Aversano, N. and Van Cauwenberge, P., 2015. The

effect of IPSAS on reforming governmental financial reporting: An international

comparison. International Review of Administrative Sciences, 81(1), pp.158-177.

Ikpefan, O.A. and Akande, A.O., 2012. International financial reporting standard (IFRS):

Benefits, obstacles and intrigues for implementation in Nigeria. Business Intelligence

Journal, 5(2), pp.299-307.

Terzi, S., Oktem, R. and Şen, İ.K., 2013. Impact of adopting international financial reporting

standards: empirical evidence from Turkey.

Adams, C.A., 2015. The international integrated reporting council: a call to action. Critical

Perspectives on Accounting, 27, pp.23-28.

Cheng, M., Green, W., Conradie, P., Konishi, N. and Romi, A., 2014. The international

integrated reporting framework: key issues and future research opportunities. Journal of

International Financial Management & Accounting, 25(1), pp.90-119.

Books and journal

Nobes, C., 2014. International classification of financial reporting. Routledge.

Madawaki, A., 2012. Adoption of international financial reporting standards in developing

countries: The case of Nigeria. International Journal of Business and management, 7(3),

p.152.

Mackenzie, B., Coetsee, D., Njikizana, T., Chamboko, R., Colyvas, B. and Hanekom, B.,

2012. Wiley IFRS 2013: Interpretation and Application of International Financial

Reporting Standards. John Wiley & Sons.

Albu, N. and Albu, C.N., 2012. International Financial Reporting Standards in an emerging

economy: lessons from Romania. Australian accounting review, 22(4), pp.341-352.

Christiaens, J., Vanhee, C., Manes-Rossi, F., Aversano, N. and Van Cauwenberge, P., 2015. The

effect of IPSAS on reforming governmental financial reporting: An international

comparison. International Review of Administrative Sciences, 81(1), pp.158-177.

Ikpefan, O.A. and Akande, A.O., 2012. International financial reporting standard (IFRS):

Benefits, obstacles and intrigues for implementation in Nigeria. Business Intelligence

Journal, 5(2), pp.299-307.

Terzi, S., Oktem, R. and Şen, İ.K., 2013. Impact of adopting international financial reporting

standards: empirical evidence from Turkey.

Adams, C.A., 2015. The international integrated reporting council: a call to action. Critical

Perspectives on Accounting, 27, pp.23-28.

Cheng, M., Green, W., Conradie, P., Konishi, N. and Romi, A., 2014. The international

integrated reporting framework: key issues and future research opportunities. Journal of

International Financial Management & Accounting, 25(1), pp.90-119.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Shah, S.Z.A., Liang, S. and Akbar, S., 2013. International Financial Reporting Standards and the

value relevance of R&D expenditures: Pre and post IFRS analysis. International Review

of Financial Analysis, 30, pp.158-169.

value relevance of R&D expenditures: Pre and post IFRS analysis. International Review

of Financial Analysis, 30, pp.158-169.

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.