London Residential Market: The Impact of International Investment

VerifiedAdded on 2023/01/10

|25

|6259

|35

Report

AI Summary

This report investigates the effects of international investment on the London residential market, particularly focusing on its impact on house prices, demand, and supply for the local population. It highlights the significance of housing investment and how the equilibrium between demand and supply influences house prices, often making homeownership unaffordable for some households. The research explores how increasing international investments in London contribute to rising house prices, affecting local residents' access to housing. It also examines the role of foreign investments in large residential developments and build-to-rent schemes, further influencing the market dynamics. The study employs primary data collection through questionnaires distributed to real estate brokers to gather insights on the changes in the housing market due to foreign investments and the challenges faced by the local population, aiming to provide a comprehensive understanding of the interplay between international investment and the London housing market.

Research Pilot Paper

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CONTENTS

TITLE: “International Investment in London Residential market effect the house price, demand

and supply for local population”......................................................................................................3

INTRODUCTION...........................................................................................................................3

Overview and background of study.............................................................................................3

Research Objectives.....................................................................................................................5

Research questions.......................................................................................................................5

SELECTION CRITERIA................................................................................................................5

RESEARCH INSTRUMENT PROTOTYPE..................................................................................6

PROPOSED DATA ANALYSIS TECHNIQUES..........................................................................9

Data Analysis...............................................................................................................................9

Data Interpretation.....................................................................................................................11

CONCLUSION..............................................................................................................................16

REFERENCES..............................................................................................................................18

2

TITLE: “International Investment in London Residential market effect the house price, demand

and supply for local population”......................................................................................................3

INTRODUCTION...........................................................................................................................3

Overview and background of study.............................................................................................3

Research Objectives.....................................................................................................................5

Research questions.......................................................................................................................5

SELECTION CRITERIA................................................................................................................5

RESEARCH INSTRUMENT PROTOTYPE..................................................................................6

PROPOSED DATA ANALYSIS TECHNIQUES..........................................................................9

Data Analysis...............................................................................................................................9

Data Interpretation.....................................................................................................................11

CONCLUSION..............................................................................................................................16

REFERENCES..............................................................................................................................18

2

TITLE: “International Investment in London Residential market effect the house

price, demand and supply for local population”

INTRODUCTION

Overview and background of study

The housing investment is considering to be one of the most significant and long term

investment that an individual perform within his or her life. When it is considering in economic

term the house price within equilibrium are mainly set by the balance of demand as well as

supply. Even within equilibrium the price gets beyond the budget for some household that make

them unable to pay and get access to home ownership. This happens due to increasing cost of

living, overcrowded area, insecure tenure, high rent charges etc. The housing price within

London are relatively higher and are constantly rising the faster rate that country as a whole. The

main reason behind it is increasing international investments (Akimov, Stevenson, and Young,

2015). This is so because the measures of foreign investments are directly using the new data set

which is released by the Land Registry which contains information regarding all the property

transaction within England and wales registered to overseas companies. The foreign investments

are considering to have a positive as well as significant effect over the house price. This is

because with the increase in one percent point in the volume share of residential transaction

registered to overseas company results into an increase of around 2.1 percent within the house

price.

The increase in international investment within eth London residential market affect the

price, demand and supply of it for local population to a great extent (Auspurg, Hinz, and Schmid,

2017). As housing is a thing which is mainly demanded by the people in order to get access to

local facilities, employment opportunities as well as other kind of services provided within a

country. And due to all this the desire for purchasing a house will get affected by demand for

these other market. The higher price within a particular area may therefore affect a relative

abundance of amenities and offering residence the high quality of life. The London is

considering as home for several institutions, business houses and bank which consider to be a

major factor which attract more and more people to come and stay for availing the utilities and

amenities which this city usually provide (Baptista and et. al., 2016). This in turn attract more

people from foreign countries in search of job opportunities as well as a better life to stay within

London and hence their moment in country is high which increases the price of residential

3

price, demand and supply for local population”

INTRODUCTION

Overview and background of study

The housing investment is considering to be one of the most significant and long term

investment that an individual perform within his or her life. When it is considering in economic

term the house price within equilibrium are mainly set by the balance of demand as well as

supply. Even within equilibrium the price gets beyond the budget for some household that make

them unable to pay and get access to home ownership. This happens due to increasing cost of

living, overcrowded area, insecure tenure, high rent charges etc. The housing price within

London are relatively higher and are constantly rising the faster rate that country as a whole. The

main reason behind it is increasing international investments (Akimov, Stevenson, and Young,

2015). This is so because the measures of foreign investments are directly using the new data set

which is released by the Land Registry which contains information regarding all the property

transaction within England and wales registered to overseas companies. The foreign investments

are considering to have a positive as well as significant effect over the house price. This is

because with the increase in one percent point in the volume share of residential transaction

registered to overseas company results into an increase of around 2.1 percent within the house

price.

The increase in international investment within eth London residential market affect the

price, demand and supply of it for local population to a great extent (Auspurg, Hinz, and Schmid,

2017). As housing is a thing which is mainly demanded by the people in order to get access to

local facilities, employment opportunities as well as other kind of services provided within a

country. And due to all this the desire for purchasing a house will get affected by demand for

these other market. The higher price within a particular area may therefore affect a relative

abundance of amenities and offering residence the high quality of life. The London is

considering as home for several institutions, business houses and bank which consider to be a

major factor which attract more and more people to come and stay for availing the utilities and

amenities which this city usually provide (Baptista and et. al., 2016). This in turn attract more

people from foreign countries in search of job opportunities as well as a better life to stay within

London and hence their moment in country is high which increases the price of residential

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

purchases which in directly affect the supply of housing. Other than this several business belongs

to other country also hold up their branch within London due to its higher spending rate which

help them in getting better earning of profit (Bonell, and et. al., 2015). So, these organizations to

purchase the houses for their staff members which in turn increases the price of housing. Other

than this for setting up their business and other branches within city they also invest more over

its development which bring up foreign investment over the land of London which is relatively

higher rate. So when the real estate dealer of London gets better earning from the overseas

investors then they usually increase the price of their Land and hence it increases the price the

residency lands and building which further affect the affordability of local people. Hence it can

be said that local population is highly affected with eth international investments that are going

within country from overseas.

The involvement of overseas investment is relatively higher within several properties

specially residency in London. Almost all of the London’s large residential development sites

used overseas investment for getting them a speed up development and a quick start to project

(Nuuter, Lill, and Tupenaite, 2015). Additionally, many build to rent schemes also get benefited

with the overseas funding which the development process and are owned by the foreign

institutions. Hence, it can be said that the international investors are very much interested within

the property of London and remain focused toward investing over it as they found huge return

over it. This is the main cause that international investment has a huge impact over the demand

and supply of residential property within London and hence it affects its price which make it

difficult to afford for local people. The overseas buyer is investing within London property from

years by countries like USA, Russia, Arab countries, Europe, Africa etc. Mainly investors invest

within the estate in London is to hold the money for some time in the form of real estate and then

get it sold in higher amount to get a significant return over this (Moser, and Kalton, 2017).

Therefore, it can be said that the strong long run performance of London housing relative

to alternative investment contributed a lot toward the London’s housing stock which is being

increasingly seen as a vehicle in order to hold money and acting as possible further incentives. In

context of foreign ownership, the evidence on it suggest that it is responsible only for the small

share of transaction and likely to present only modest effect over the house prices within

London. There are also remain certain factors which suggest that following the economic crises,

the more demand for the new build properties may have extend lessened the negative impact of

4

to other country also hold up their branch within London due to its higher spending rate which

help them in getting better earning of profit (Bonell, and et. al., 2015). So, these organizations to

purchase the houses for their staff members which in turn increases the price of housing. Other

than this for setting up their business and other branches within city they also invest more over

its development which bring up foreign investment over the land of London which is relatively

higher rate. So when the real estate dealer of London gets better earning from the overseas

investors then they usually increase the price of their Land and hence it increases the price the

residency lands and building which further affect the affordability of local people. Hence it can

be said that local population is highly affected with eth international investments that are going

within country from overseas.

The involvement of overseas investment is relatively higher within several properties

specially residency in London. Almost all of the London’s large residential development sites

used overseas investment for getting them a speed up development and a quick start to project

(Nuuter, Lill, and Tupenaite, 2015). Additionally, many build to rent schemes also get benefited

with the overseas funding which the development process and are owned by the foreign

institutions. Hence, it can be said that the international investors are very much interested within

the property of London and remain focused toward investing over it as they found huge return

over it. This is the main cause that international investment has a huge impact over the demand

and supply of residential property within London and hence it affects its price which make it

difficult to afford for local people. The overseas buyer is investing within London property from

years by countries like USA, Russia, Arab countries, Europe, Africa etc. Mainly investors invest

within the estate in London is to hold the money for some time in the form of real estate and then

get it sold in higher amount to get a significant return over this (Moser, and Kalton, 2017).

Therefore, it can be said that the strong long run performance of London housing relative

to alternative investment contributed a lot toward the London’s housing stock which is being

increasingly seen as a vehicle in order to hold money and acting as possible further incentives. In

context of foreign ownership, the evidence on it suggest that it is responsible only for the small

share of transaction and likely to present only modest effect over the house prices within

London. There are also remain certain factors which suggest that following the economic crises,

the more demand for the new build properties may have extend lessened the negative impact of

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

credit constraints over the construction activity. The purchasing price of a house is not same as

cost of owning a home (Leone, Haynes-Maslow and Ammerman, 2017). Buyers, specially the

first time buyers have to face a significant upfront cost within buying a house. In so far with the

high house price in London are usually supported with the low cost credit which in turn may

make the economy vulnerable to risk of price correction, particularly of the price of borrowing

get rise or access to credit. The demand among the overseas buyers for housing in London is

mainly driven by the desire of living and working within London, but it is also driven partly from

the natural changes in population as well as social economic factors that driven household

formation. This demand results into coupled with increasing ability to finance home ownership,

upward pressure over the price of housing in capital (Hulse, and Yates, 2017).

The house prices in London are high and have been increasing speedily than nation as a

whole. It is specifically true in desirable boroughs in Central London which medium prices of

house in year 2014 is as high as 860000 pounds in Westminster. Many ups and downs have been

witnessed in the housing market of London with volatile prices of houses tending to amplify

alterations in National house prices. Though, falls in nominal value of average home is rare,

several episodes of deflation of real house price has been experienced in London since ONS data

series initiates in year 1969. According to the previous cycles patterns, no clear trends are there

from price data to suggest whether the house prices in London are approaching a peak or a more

exceptional decline adjustment. The house prices ratio to mortgage holders’ income gives an

alternative affordability measure. On the basis of this measure, the pre-crisis average prices of

house in London ranged between 1.9 - 3.5 of mortgage applicant’s income. Housing prices

standard measures in terms of link between earnings, incomes and house prices, thus advise that

an increasing affordability gap is there. With the growth in buy to let market and private rented

sector and overseas ownership, two extra components are there of demand in comparison to the

past. It is also evident that the extra demand of new developed properties might have to some

degree lessen the adverse influence of credit constraints on the activity of construction.

In purchasing a house, buyers and specifically first time purchasers face relevant upfront

cost. In London, the housing demand is partially driven through desirability to work and live in

London as well as is partially driven through natural changes in social economic forces and

population which drives formation of household. The implications of knock-on effects and

market distortions can we serious and influence profoundly on the economy of London as well as

5

cost of owning a home (Leone, Haynes-Maslow and Ammerman, 2017). Buyers, specially the

first time buyers have to face a significant upfront cost within buying a house. In so far with the

high house price in London are usually supported with the low cost credit which in turn may

make the economy vulnerable to risk of price correction, particularly of the price of borrowing

get rise or access to credit. The demand among the overseas buyers for housing in London is

mainly driven by the desire of living and working within London, but it is also driven partly from

the natural changes in population as well as social economic factors that driven household

formation. This demand results into coupled with increasing ability to finance home ownership,

upward pressure over the price of housing in capital (Hulse, and Yates, 2017).

The house prices in London are high and have been increasing speedily than nation as a

whole. It is specifically true in desirable boroughs in Central London which medium prices of

house in year 2014 is as high as 860000 pounds in Westminster. Many ups and downs have been

witnessed in the housing market of London with volatile prices of houses tending to amplify

alterations in National house prices. Though, falls in nominal value of average home is rare,

several episodes of deflation of real house price has been experienced in London since ONS data

series initiates in year 1969. According to the previous cycles patterns, no clear trends are there

from price data to suggest whether the house prices in London are approaching a peak or a more

exceptional decline adjustment. The house prices ratio to mortgage holders’ income gives an

alternative affordability measure. On the basis of this measure, the pre-crisis average prices of

house in London ranged between 1.9 - 3.5 of mortgage applicant’s income. Housing prices

standard measures in terms of link between earnings, incomes and house prices, thus advise that

an increasing affordability gap is there. With the growth in buy to let market and private rented

sector and overseas ownership, two extra components are there of demand in comparison to the

past. It is also evident that the extra demand of new developed properties might have to some

degree lessen the adverse influence of credit constraints on the activity of construction.

In purchasing a house, buyers and specifically first time purchasers face relevant upfront

cost. In London, the housing demand is partially driven through desirability to work and live in

London as well as is partially driven through natural changes in social economic forces and

population which drives formation of household. The implications of knock-on effects and

market distortions can we serious and influence profoundly on the economy of London as well as

5

wellbeing of its citizens. The increase in prices of houses which are unrelated to significant

drivers of supply and demand can create a threat to stability of economy. House price inflation

maximized indebtedness comparative to income as well as distorted economic behaviour. High

prices of houses have also been related to numerous social challenges including overcrowding,

sub-standard living situations and insecure tenure. It may present serious outcomes for

wellbeing, health and sustenance of population of London. Lack of affordability placed

maximized pressure on domestic public finances, for instance, maximizing Reliance on benefits

of housing along with the cost related to education health and lesser extent, offending and crime.

There are several issues related to house price affordability including quality terms, efficiency

terms etc.

Research Objectives

The key objectives of this research study are mentioned below:

To get understanding about Residential market of London.

To assess the role of international investors in housing market of London.

To assess the impact of international investment in London housing market on house

price, demand and supply for local population.

Research questions

The questions in relation to this specific study are as follows:

Discuss and evaluate the role of overseas investors in London Housing Market?

What are the social and economic aspects of International Investment in London

Residential Market?

Critically evaluate the implications of foreign investment in London housing market on

price, demand and supply?

SELECTION CRITERIA

The current investigation is based on “International Investment in London Residential

market effect the house price, demand and supply for local population”, which support in

presenting data regarding the manner in which foreign investments bring influence over the

house residency market of London (Hochstenbach, and Arundel, 2020). This will further support

in determining the actual reason due to which the demand and supply of housing market is

getting affected within London. In order to conduct this investigation, the primary source of data

6

drivers of supply and demand can create a threat to stability of economy. House price inflation

maximized indebtedness comparative to income as well as distorted economic behaviour. High

prices of houses have also been related to numerous social challenges including overcrowding,

sub-standard living situations and insecure tenure. It may present serious outcomes for

wellbeing, health and sustenance of population of London. Lack of affordability placed

maximized pressure on domestic public finances, for instance, maximizing Reliance on benefits

of housing along with the cost related to education health and lesser extent, offending and crime.

There are several issues related to house price affordability including quality terms, efficiency

terms etc.

Research Objectives

The key objectives of this research study are mentioned below:

To get understanding about Residential market of London.

To assess the role of international investors in housing market of London.

To assess the impact of international investment in London housing market on house

price, demand and supply for local population.

Research questions

The questions in relation to this specific study are as follows:

Discuss and evaluate the role of overseas investors in London Housing Market?

What are the social and economic aspects of International Investment in London

Residential Market?

Critically evaluate the implications of foreign investment in London housing market on

price, demand and supply?

SELECTION CRITERIA

The current investigation is based on “International Investment in London Residential

market effect the house price, demand and supply for local population”, which support in

presenting data regarding the manner in which foreign investments bring influence over the

house residency market of London (Hochstenbach, and Arundel, 2020). This will further support

in determining the actual reason due to which the demand and supply of housing market is

getting affected within London. In order to conduct this investigation, the primary source of data

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

collection will be used which help in gathering the fresh and more relevant information about

current area of study. The primary information will be gathered with the help of questionnaire as

it helps in collecting information from larger number of people selected as a sample size in less

possible time period and also provide data in more concise manner which will allow easy

interpretation of information and presenting findings in line with the research aims and

objectives set for the study (Hill, and Syed, 2016).

For this report the sample size is selected as 20 respondents who are real estate brokers that

will be selected using random sampling method under probability sampling. The main reason

behind choosing real estate broker as a sample for this study is that they are dealing with both the

local clients as well as foreign investors within purchasing and sell of houses. This in turn remain

more beneficial for the researcher to gathered the right information about the actual scenario of

housing market. This is so because these brokers will be able to present a comparison between

how the changes has been taken place within housing market after the increase within foreign

investments (Gao and et. al., 2017). Other than this it will also help them in presenting an idea

about manner in which the prices are increasing and the main cause behind it. Other than this it

will also become easier for them to present the true picture of what issues that local population is

facing due to increase within the foreign investment that bring an inequality within the demand

and supply of housing through increasing the price of residential houses. For collecting this

information, the questionnaire will be send to the real estate brokers with the help of personal

mail and they will revert it over using mail only which is one of the most convenient and less

time consuming method to be adopted (Easthope, Stone, and Cheshire, 2018) .

RESEARCH INSTRUMENT PROTOTYPE

Questionnaire is the tool or research instrument that consists of several questions with the

aim to collect information from respondents. The main reason behind using questionnaires that it

is cheap and provide advantage over other survey types. Apart from this, it does not require

much effort from questioner and often considered standardized answers which makes it simple

for the researcher to compile data. It helps investigator in collecting data appropriately by

distributing the questionnaire for taking their responses over the questions or by sending these

through emails to get responses of respondents (Gadziński, 2018). In relation to this particular

investigation, the questionnaire is developed which consist of 11 questions related to the title,

7

current area of study. The primary information will be gathered with the help of questionnaire as

it helps in collecting information from larger number of people selected as a sample size in less

possible time period and also provide data in more concise manner which will allow easy

interpretation of information and presenting findings in line with the research aims and

objectives set for the study (Hill, and Syed, 2016).

For this report the sample size is selected as 20 respondents who are real estate brokers that

will be selected using random sampling method under probability sampling. The main reason

behind choosing real estate broker as a sample for this study is that they are dealing with both the

local clients as well as foreign investors within purchasing and sell of houses. This in turn remain

more beneficial for the researcher to gathered the right information about the actual scenario of

housing market. This is so because these brokers will be able to present a comparison between

how the changes has been taken place within housing market after the increase within foreign

investments (Gao and et. al., 2017). Other than this it will also help them in presenting an idea

about manner in which the prices are increasing and the main cause behind it. Other than this it

will also become easier for them to present the true picture of what issues that local population is

facing due to increase within the foreign investment that bring an inequality within the demand

and supply of housing through increasing the price of residential houses. For collecting this

information, the questionnaire will be send to the real estate brokers with the help of personal

mail and they will revert it over using mail only which is one of the most convenient and less

time consuming method to be adopted (Easthope, Stone, and Cheshire, 2018) .

RESEARCH INSTRUMENT PROTOTYPE

Questionnaire is the tool or research instrument that consists of several questions with the

aim to collect information from respondents. The main reason behind using questionnaires that it

is cheap and provide advantage over other survey types. Apart from this, it does not require

much effort from questioner and often considered standardized answers which makes it simple

for the researcher to compile data. It helps investigator in collecting data appropriately by

distributing the questionnaire for taking their responses over the questions or by sending these

through emails to get responses of respondents (Gadziński, 2018). In relation to this particular

investigation, the questionnaire is developed which consist of 11 questions related to the title,

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

i.e., “International Investment in London Residential market effect the house price, demand and

supply for local population”. The questionnaire is provided below:

Questionnaire

Name:

Age:

Email:

Address:

Q 1) Do you have any knowledge regarding trends in housing market of London?

a) Yes

b) No

Q 2) According to you, which is the main factor that influence housing market of London?

a) Economic growth

b) Interest rate

c) Unemployment rate

d) Mortgage availability

e) All of the above

Q 3) As per your opinion, what is the impact of higher economic growth on demand of

housing in London?

a) Increase in demand

b) Decrease in demand

c) Neither increase, nor decrease in demand

Q 4) Which is the main type of overseas investor active in residential development in

London?

a) Financial and investment institutions

b) Sovereign wealth funds

c) Developers based in other nations

d) Wealthy individuals

e) All of the above

Q 5) Which is the way that government use to boost the demand of real estate in the market

8

supply for local population”. The questionnaire is provided below:

Questionnaire

Name:

Age:

Email:

Address:

Q 1) Do you have any knowledge regarding trends in housing market of London?

a) Yes

b) No

Q 2) According to you, which is the main factor that influence housing market of London?

a) Economic growth

b) Interest rate

c) Unemployment rate

d) Mortgage availability

e) All of the above

Q 3) As per your opinion, what is the impact of higher economic growth on demand of

housing in London?

a) Increase in demand

b) Decrease in demand

c) Neither increase, nor decrease in demand

Q 4) Which is the main type of overseas investor active in residential development in

London?

a) Financial and investment institutions

b) Sovereign wealth funds

c) Developers based in other nations

d) Wealthy individuals

e) All of the above

Q 5) Which is the way that government use to boost the demand of real estate in the market

8

on temporarily basis?

a) Tax credits

b) Subsidies

c) Deductions

Q 6) Which is the main reason for overseas buyers behind purchasing property or house in

London?

a) To accommodate family

b) For investment purpose

c) To be use for vacation visit

Q 7) According to you, is there any impact of government policies and regulations related

to housing market on demand and supply of housing?

a) Yes

b) No

c) Neutral

Q 8) How international investment impact on demand and supply for local population and

house price in London housing market?

a) Positively

b) Negatively

c) Neither positively, nor negatively

Q 9) What is your sense of existing price levels being accomplished in London and its

different areas?

a) Very Expensive

b) Expensive

c) Fair Value

d) Cheap

e) Very Cheap

Q 10) What role does overseas investors play in housing market of London?

a) Equity financiers

b) Purchasers of rented property

c) Buyers of bonds of housing association

d) Developers

9

a) Tax credits

b) Subsidies

c) Deductions

Q 6) Which is the main reason for overseas buyers behind purchasing property or house in

London?

a) To accommodate family

b) For investment purpose

c) To be use for vacation visit

Q 7) According to you, is there any impact of government policies and regulations related

to housing market on demand and supply of housing?

a) Yes

b) No

c) Neutral

Q 8) How international investment impact on demand and supply for local population and

house price in London housing market?

a) Positively

b) Negatively

c) Neither positively, nor negatively

Q 9) What is your sense of existing price levels being accomplished in London and its

different areas?

a) Very Expensive

b) Expensive

c) Fair Value

d) Cheap

e) Very Cheap

Q 10) What role does overseas investors play in housing market of London?

a) Equity financiers

b) Purchasers of rented property

c) Buyers of bonds of housing association

d) Developers

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

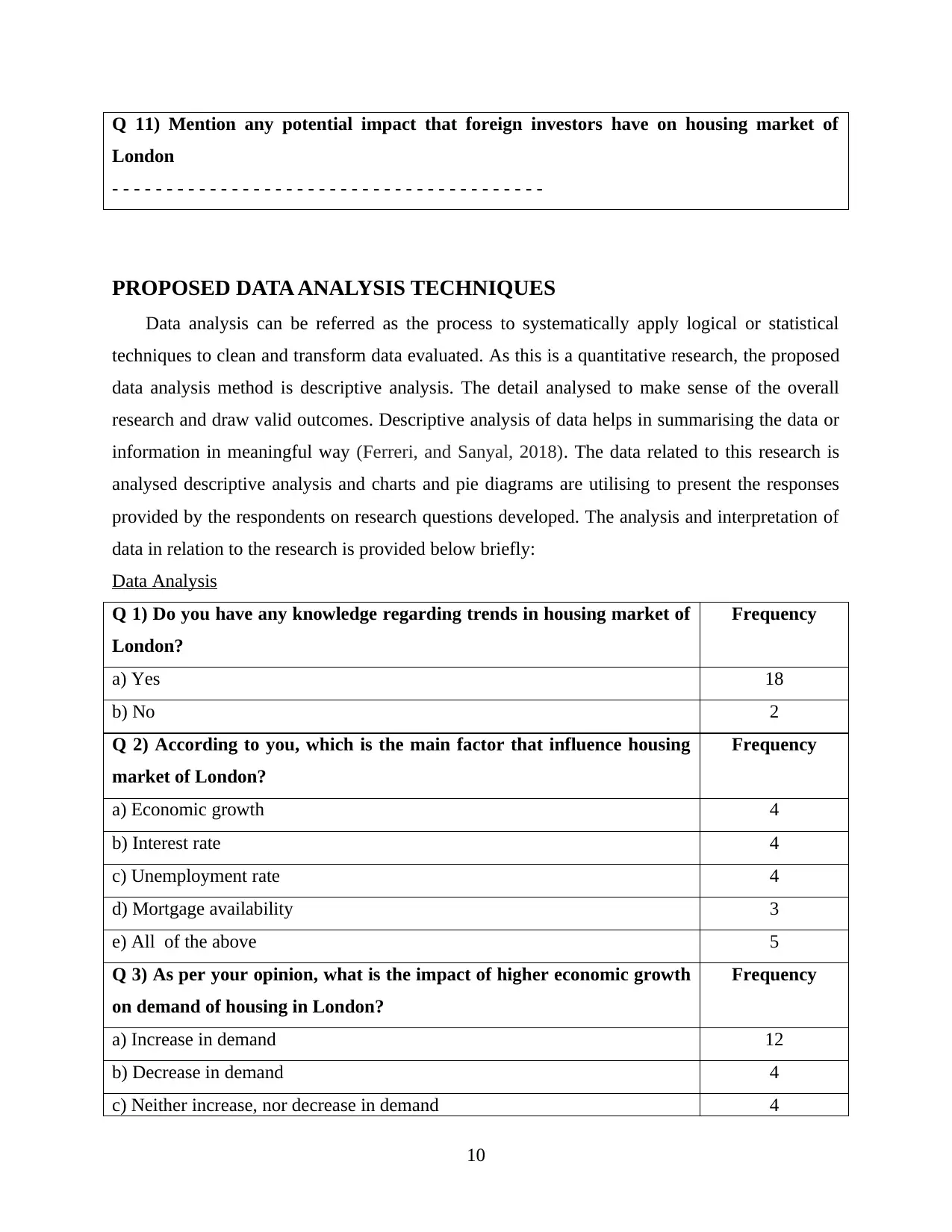

Q 11) Mention any potential impact that foreign investors have on housing market of

London

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

PROPOSED DATA ANALYSIS TECHNIQUES

Data analysis can be referred as the process to systematically apply logical or statistical

techniques to clean and transform data evaluated. As this is a quantitative research, the proposed

data analysis method is descriptive analysis. The detail analysed to make sense of the overall

research and draw valid outcomes. Descriptive analysis of data helps in summarising the data or

information in meaningful way (Ferreri, and Sanyal, 2018). The data related to this research is

analysed descriptive analysis and charts and pie diagrams are utilising to present the responses

provided by the respondents on research questions developed. The analysis and interpretation of

data in relation to the research is provided below briefly:

Data Analysis

Q 1) Do you have any knowledge regarding trends in housing market of

London?

Frequency

a) Yes 18

b) No 2

Q 2) According to you, which is the main factor that influence housing

market of London?

Frequency

a) Economic growth 4

b) Interest rate 4

c) Unemployment rate 4

d) Mortgage availability 3

e) All of the above 5

Q 3) As per your opinion, what is the impact of higher economic growth

on demand of housing in London?

Frequency

a) Increase in demand 12

b) Decrease in demand 4

c) Neither increase, nor decrease in demand 4

10

London

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

PROPOSED DATA ANALYSIS TECHNIQUES

Data analysis can be referred as the process to systematically apply logical or statistical

techniques to clean and transform data evaluated. As this is a quantitative research, the proposed

data analysis method is descriptive analysis. The detail analysed to make sense of the overall

research and draw valid outcomes. Descriptive analysis of data helps in summarising the data or

information in meaningful way (Ferreri, and Sanyal, 2018). The data related to this research is

analysed descriptive analysis and charts and pie diagrams are utilising to present the responses

provided by the respondents on research questions developed. The analysis and interpretation of

data in relation to the research is provided below briefly:

Data Analysis

Q 1) Do you have any knowledge regarding trends in housing market of

London?

Frequency

a) Yes 18

b) No 2

Q 2) According to you, which is the main factor that influence housing

market of London?

Frequency

a) Economic growth 4

b) Interest rate 4

c) Unemployment rate 4

d) Mortgage availability 3

e) All of the above 5

Q 3) As per your opinion, what is the impact of higher economic growth

on demand of housing in London?

Frequency

a) Increase in demand 12

b) Decrease in demand 4

c) Neither increase, nor decrease in demand 4

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

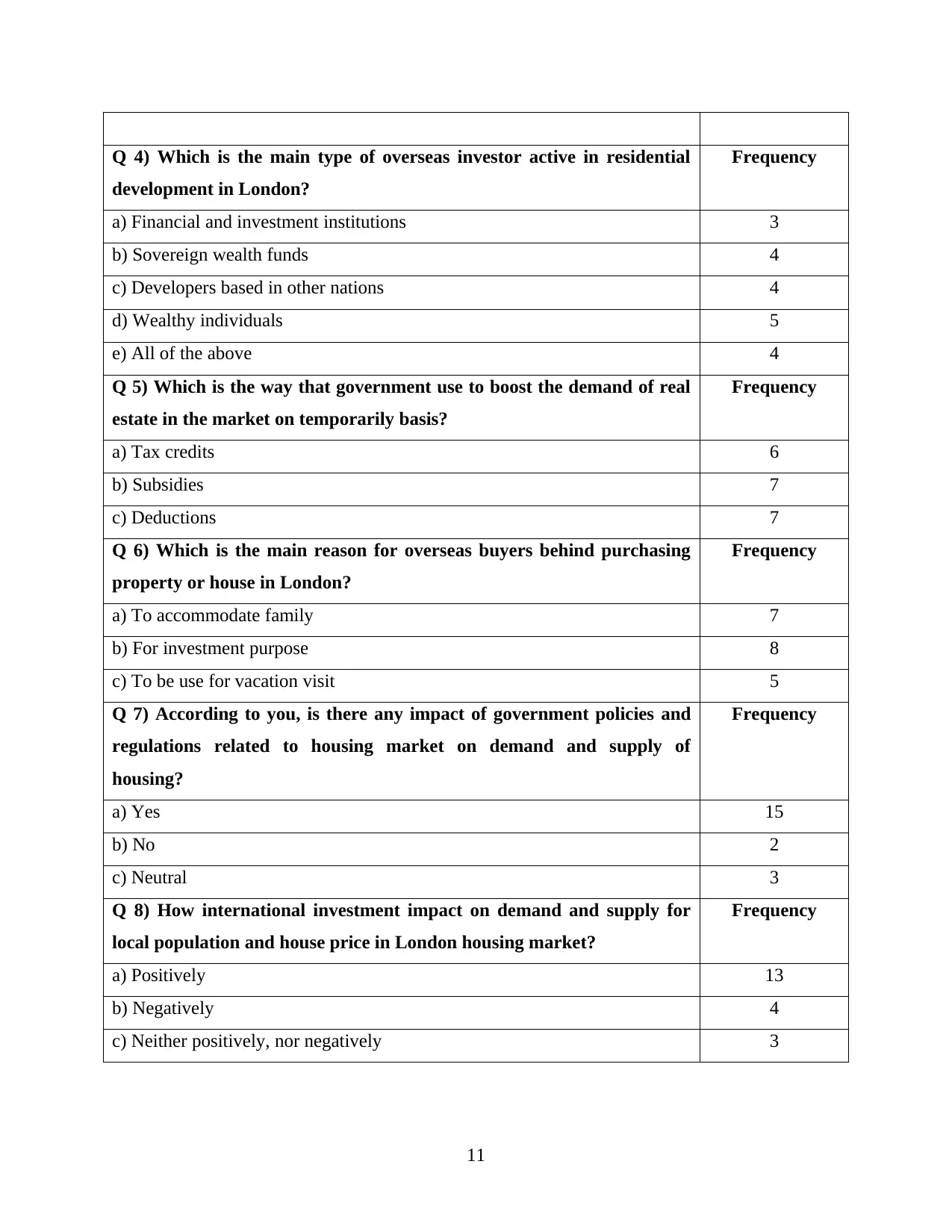

Q 4) Which is the main type of overseas investor active in residential

development in London?

Frequency

a) Financial and investment institutions 3

b) Sovereign wealth funds 4

c) Developers based in other nations 4

d) Wealthy individuals 5

e) All of the above 4

Q 5) Which is the way that government use to boost the demand of real

estate in the market on temporarily basis?

Frequency

a) Tax credits 6

b) Subsidies 7

c) Deductions 7

Q 6) Which is the main reason for overseas buyers behind purchasing

property or house in London?

Frequency

a) To accommodate family 7

b) For investment purpose 8

c) To be use for vacation visit 5

Q 7) According to you, is there any impact of government policies and

regulations related to housing market on demand and supply of

housing?

Frequency

a) Yes 15

b) No 2

c) Neutral 3

Q 8) How international investment impact on demand and supply for

local population and house price in London housing market?

Frequency

a) Positively 13

b) Negatively 4

c) Neither positively, nor negatively 3

11

development in London?

Frequency

a) Financial and investment institutions 3

b) Sovereign wealth funds 4

c) Developers based in other nations 4

d) Wealthy individuals 5

e) All of the above 4

Q 5) Which is the way that government use to boost the demand of real

estate in the market on temporarily basis?

Frequency

a) Tax credits 6

b) Subsidies 7

c) Deductions 7

Q 6) Which is the main reason for overseas buyers behind purchasing

property or house in London?

Frequency

a) To accommodate family 7

b) For investment purpose 8

c) To be use for vacation visit 5

Q 7) According to you, is there any impact of government policies and

regulations related to housing market on demand and supply of

housing?

Frequency

a) Yes 15

b) No 2

c) Neutral 3

Q 8) How international investment impact on demand and supply for

local population and house price in London housing market?

Frequency

a) Positively 13

b) Negatively 4

c) Neither positively, nor negatively 3

11

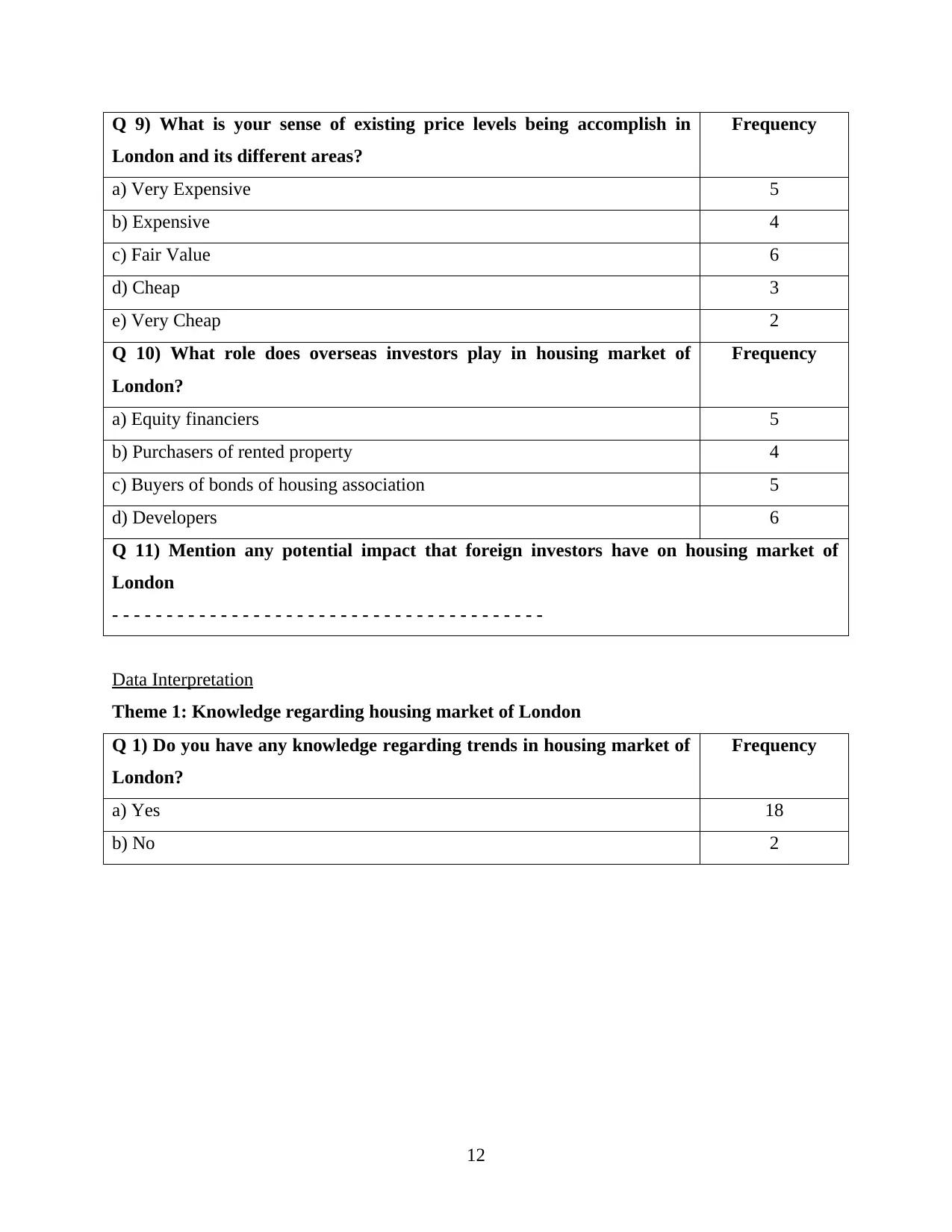

Q 9) What is your sense of existing price levels being accomplish in

London and its different areas?

Frequency

a) Very Expensive 5

b) Expensive 4

c) Fair Value 6

d) Cheap 3

e) Very Cheap 2

Q 10) What role does overseas investors play in housing market of

London?

Frequency

a) Equity financiers 5

b) Purchasers of rented property 4

c) Buyers of bonds of housing association 5

d) Developers 6

Q 11) Mention any potential impact that foreign investors have on housing market of

London

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Data Interpretation

Theme 1: Knowledge regarding housing market of London

Q 1) Do you have any knowledge regarding trends in housing market of

London?

Frequency

a) Yes 18

b) No 2

12

London and its different areas?

Frequency

a) Very Expensive 5

b) Expensive 4

c) Fair Value 6

d) Cheap 3

e) Very Cheap 2

Q 10) What role does overseas investors play in housing market of

London?

Frequency

a) Equity financiers 5

b) Purchasers of rented property 4

c) Buyers of bonds of housing association 5

d) Developers 6

Q 11) Mention any potential impact that foreign investors have on housing market of

London

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Data Interpretation

Theme 1: Knowledge regarding housing market of London

Q 1) Do you have any knowledge regarding trends in housing market of

London?

Frequency

a) Yes 18

b) No 2

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 25

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.