Effect of Bankruptcy Prediction Using Ohlson Score Model on Stock Returns

VerifiedAdded on 2023/04/21

|6

|4915

|268

AI Summary

This study investigates the impact of Ohlson Score model on stock returns in textile and garment companies listed in IDX for the years 2010-2014. The study analyzes the data using panel data regression and Mann Whitney test. The results indicate a negative influence of Ohlson Score on stock returns, although the effect is not significant.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

International Journal of Science and Research (IJSR)

ISSN (Online): 2319-7064

Index Copernicus Value (2013): 6.14 | Impact Factor (2014): 5.611

Volume 4 Issue 12, December 2015

www.ijsr.net

Licensed Under Creative Commons Attribution CC BY

The Effect of Bankruptcy Prediction Using Ohlson

Score Model Towards Stock Returns (Study in

Textile and Garment Company Listed in IDX For

Year 2010-2014)

Ayu Putri Wulandari1, Norita2, Aldilla Iradianty3

Abstract: The deceleration of Indonesian economics growth seen by the slowdown of GDP’s growth has brought a lot of impact in

various sector of Industry. One of them are manufacturing Industry, particulary in Textile and Garment industry. It can be seen from

the decline of manufacturing company’s growth which reached -1,98% in the second quarter of 2015, and also the decline of the textile

products export trend, as well as a number of textile and garment companies which went bankrupt. Those condition which affect textile

and garment companies are the symptomps of impending Financial Distress which is the beginning of Bankruptcy. Bankruptcy can be

early predicted by various methods, one of them is Ohlson Score (1980). Besides bankruptcy prediction, another important thing which

should be known is investor welfare, which is reflected from stock return. This is the main question of the research, that is how far could

Ohlson Score influences stock return. The statistical analysis techniques used are panel data regression method, and Mann Whitney test.

This study consists of 7 companies. The result shows that there is a negative influence between ohlson score towards stock return, but

not significantly.

Keyword: Financial Distress, Bankruptcy, Ohlson Score, Stock Return

1. Introduction

The existence of the industry in a country can be affected

by various factors, one of themis external environment ,

especially economic factors. Each year, Indonesia suffered

economic events, which affect global and regional

economic situation. According to the Central Bureau of

Statistics [1], Indonesia has affected a situasion called

economic deceleration. Indonesia's economic deceleration

began to seen in 2014 that continues to touch the figure of

the second quarter to 4.67%. Beside those condition, other

policy issues Indonesia experienced is the rising price of

fuel oil (BBM). These condition and economic policies

above have brought changes in conditions of various

industrial sectors in Indonesia, one of them is the declining

in manufacturing sector, particularly the Textile and

Garment company. Economic deceleration also impact the

export declining of textile products that fall to 1.09%.

Other events can be highlighted in the textile and garment

companies are delisting, Delisting is the issuer of the stock

exchange. Delisting incident ever affected a Sector Textile

and Garment company, as quoted in the Kontan

Newspaper [2] on March 16, 2013 thatPanasia Filamen

Inti Tbk (PAFI)delisted because it does not improve the

financial performance and do not have a clear business

plan.

Those events that affected textile and garment industry

have abig potential for the occurrence of Financial

Distress. According to Black's Law Dictionary in Rodoni

and Ali [3] that the financal distress is the deterioration of

the company's previous condition. The occurrence of

Financial Distress in a company can be predicted by

analyzing the company's financial statements. In addition

to performing a simple ratio analysis, there are several

models for mempredisikan Financial Distress of a

company, including Altman Z-Score, Springate,

Zmijewski, and Ohlson Score. Compared with other

methods, Ohlson method is a method that not only involve

the financial ratio only, but involve elements of inflation,

which is reflected in the formula Size, which is the logit of

the total assets divided by GNP-price index level. This

study also applies atrends straight line forecasting

methods, with the smallest quadrant models. These

decision made beacuse the Central Bureau of Statistics has

not released any real GNP Indonesia in 2014.

For public companies, the stock is a main source of

corporate funding. The presence of the stock price may

reflect a general picture of a company. Stock prices tend to

fall in a relatively long period of time, can give an

indication to investors that the company is in a poor and

unhealthy condition. Conversely, if the stock price tends to

rise, it will indicate the condition of the company is good

and healthy. Besides considering the stock price, the main

purpose of an investor to buy stocks is to gain some return,

one of which is in the form of stock returns.

Return is the main investor’s motivation and consideration

in selecting a stock, maximizing investor return is the main

goal in investing. Tandelilin [4] reveals the sources of

return consists of two main components, namely yield and

capital gain (loss).This study emphasizes on several

things,those are the corporate bankruptcy prediction using

Ohlson Score models, The Influence between Ohlson

Score towards stock returns, and the difference between

stock return in failed and non failed company.

2. Literature Survey

2.1 Financial Performace

Evaluating company's financial performance is one of

many tool to determine the quality of the company. By

evaluating the financial performance, company will

Paper ID: NOV152403 1853

ISSN (Online): 2319-7064

Index Copernicus Value (2013): 6.14 | Impact Factor (2014): 5.611

Volume 4 Issue 12, December 2015

www.ijsr.net

Licensed Under Creative Commons Attribution CC BY

The Effect of Bankruptcy Prediction Using Ohlson

Score Model Towards Stock Returns (Study in

Textile and Garment Company Listed in IDX For

Year 2010-2014)

Ayu Putri Wulandari1, Norita2, Aldilla Iradianty3

Abstract: The deceleration of Indonesian economics growth seen by the slowdown of GDP’s growth has brought a lot of impact in

various sector of Industry. One of them are manufacturing Industry, particulary in Textile and Garment industry. It can be seen from

the decline of manufacturing company’s growth which reached -1,98% in the second quarter of 2015, and also the decline of the textile

products export trend, as well as a number of textile and garment companies which went bankrupt. Those condition which affect textile

and garment companies are the symptomps of impending Financial Distress which is the beginning of Bankruptcy. Bankruptcy can be

early predicted by various methods, one of them is Ohlson Score (1980). Besides bankruptcy prediction, another important thing which

should be known is investor welfare, which is reflected from stock return. This is the main question of the research, that is how far could

Ohlson Score influences stock return. The statistical analysis techniques used are panel data regression method, and Mann Whitney test.

This study consists of 7 companies. The result shows that there is a negative influence between ohlson score towards stock return, but

not significantly.

Keyword: Financial Distress, Bankruptcy, Ohlson Score, Stock Return

1. Introduction

The existence of the industry in a country can be affected

by various factors, one of themis external environment ,

especially economic factors. Each year, Indonesia suffered

economic events, which affect global and regional

economic situation. According to the Central Bureau of

Statistics [1], Indonesia has affected a situasion called

economic deceleration. Indonesia's economic deceleration

began to seen in 2014 that continues to touch the figure of

the second quarter to 4.67%. Beside those condition, other

policy issues Indonesia experienced is the rising price of

fuel oil (BBM). These condition and economic policies

above have brought changes in conditions of various

industrial sectors in Indonesia, one of them is the declining

in manufacturing sector, particularly the Textile and

Garment company. Economic deceleration also impact the

export declining of textile products that fall to 1.09%.

Other events can be highlighted in the textile and garment

companies are delisting, Delisting is the issuer of the stock

exchange. Delisting incident ever affected a Sector Textile

and Garment company, as quoted in the Kontan

Newspaper [2] on March 16, 2013 thatPanasia Filamen

Inti Tbk (PAFI)delisted because it does not improve the

financial performance and do not have a clear business

plan.

Those events that affected textile and garment industry

have abig potential for the occurrence of Financial

Distress. According to Black's Law Dictionary in Rodoni

and Ali [3] that the financal distress is the deterioration of

the company's previous condition. The occurrence of

Financial Distress in a company can be predicted by

analyzing the company's financial statements. In addition

to performing a simple ratio analysis, there are several

models for mempredisikan Financial Distress of a

company, including Altman Z-Score, Springate,

Zmijewski, and Ohlson Score. Compared with other

methods, Ohlson method is a method that not only involve

the financial ratio only, but involve elements of inflation,

which is reflected in the formula Size, which is the logit of

the total assets divided by GNP-price index level. This

study also applies atrends straight line forecasting

methods, with the smallest quadrant models. These

decision made beacuse the Central Bureau of Statistics has

not released any real GNP Indonesia in 2014.

For public companies, the stock is a main source of

corporate funding. The presence of the stock price may

reflect a general picture of a company. Stock prices tend to

fall in a relatively long period of time, can give an

indication to investors that the company is in a poor and

unhealthy condition. Conversely, if the stock price tends to

rise, it will indicate the condition of the company is good

and healthy. Besides considering the stock price, the main

purpose of an investor to buy stocks is to gain some return,

one of which is in the form of stock returns.

Return is the main investor’s motivation and consideration

in selecting a stock, maximizing investor return is the main

goal in investing. Tandelilin [4] reveals the sources of

return consists of two main components, namely yield and

capital gain (loss).This study emphasizes on several

things,those are the corporate bankruptcy prediction using

Ohlson Score models, The Influence between Ohlson

Score towards stock returns, and the difference between

stock return in failed and non failed company.

2. Literature Survey

2.1 Financial Performace

Evaluating company's financial performance is one of

many tool to determine the quality of the company. By

evaluating the financial performance, company will

Paper ID: NOV152403 1853

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

International Journal of Science and Research (IJSR)

ISSN (Online): 2319-7064

Index Copernicus Value (2013): 6.14 | Impact Factor (2014): 5.611

Volume 4 Issue 12, December 2015

www.ijsr.net

Licensed Under Creative Commons Attribution CC BY

determine its deficiency, so it could be fixed as soon as

possible.

Financial performance also has a close relation with the

financial management, where its the one of financial

management activity. Like Keown [5] describes "Financial

management concerned with the maintenance and creation

of economic value or wealth. Consequently, this course

focuses on decision making with an eye toward creating

wealth.... "

One of the main sources about company's financial

performance is by observing and analyzing financial

statements. This was revealed by Keown, et al [5] "... by

looking at the basic financial statements that are a primary

source of information about a firm's financial

performance"

2.2 Financial Statement

The company financial statements is a sheet that provides

information on some of the company's business activities,

including financing, investing,and operating activities.

These statement reflectes by some statements about

financial statement definition. There are several definitions

of financial statement. One of them was stated by Titman

[6] that A Firm’s statements provide a visual

representation of the firm that is used to describe the

business to investors and other outside of the firm as well

as to form employee”. Another statement came form

Kamaludin [7] whom states that "The financial statements

are the final result of a recording process which is a

summary of financial transaction that occured during the

financial year concerned"

According to Rodoni and Ali [3] , the financial statements

is a report published by a compant for its shareholders.

This report contains the basic of financial statements, and

also the management's analysis about former operating

activites, and opinion about company;s prospects for the

future.

2.3 Financial Statement Analysis

According to Subramanyam and Wild [8] Financial

statement analysis is the application of tools and analytical

techniques for financial statement general purposes, and

the related data which generate useful estimatation and

conclusions in business analysis.

Subramanyam and Wild [8] explained that the analysis of

financial statements are an integral important part of the

wider business analysis. Described in the same book that

analyzes the business (business analysis) is the process of

evaluating the economic outlook and the risk of the

company. It includes an analysis of the company's business

environment. , as well as the financial position and

performance

2.4 Financial Distress

Financial distress is one of the company's condition which

can be detected by the analysis of financial statements.

This company's condition can be a sign of impending a

worse situation, which is bankruptcy. Companies should

aware of the coming of financial distress, so that does not

lead to a worse stage.

There are several definitions of financial distress, as

described by Black Law's Dictionary in Rodoni and Ali [3]

that the Financial distress is defined as an insolvency, the

condition of assets or property and obligations of a person

who was formerly available to be not enough to pay off the

debt.

Tirapat and Nittayagasetawat (1999) in Rodoni and Ali [3]

defines financial distress as the company which terminated

its operations by the authority of the government and the

company is required to carry out the restructuring plan.

2.5 Bankruptcy

Bankruptcy is one of many things that is avoided by any

company. Knowing the bankruptcy possibility is one of the

financial statement analysis's objective. By knowing the

bankruptcy possibility, the company can make long-term

plans, and anticipate to avoid the situation

Commonly, bankruptcy can occur because companies can

not afford to pay the debt. As stated Gitman (1996) in

Karamzadeh [9] that bankruptcy is a legal status that

applies to the bankruptiest, the parties are not able to pay

their debts to creditors. Commonly, bankruptcy decided by

the courts many by the debtor, that is, when the amount of

debt the company is higher than total assets.

Goudie (1987) in Karamzadeh [9] revealed there are some

things that can lead to bankruptcy, such as

mismanagement, economic events, the government's

decision, as well as natural events and accidents.

2.6 Ohlson Score

Ohlson Score discovered by James Ohlson in 1980. In the

early discoveries time, Ohlson dubious Multiple

Discriminant Analysis (MDA) method founded by Altman

(1968). As his equal, O-score using logistic regression in

its calculations.According Ghozali [10] "Logistic

regression is actually similar to discriminant analysis that

we want to test whether the probability of occurrence of

the dependent variable can be predicted by the

independent variables". The formula of Ohlson Score is:

O-Score = -1,32 – 0,407(Size) + 6,03 ( ) -1,43 ( ) +

0,0757 ( ) – 2,37 ( ) – 1,83 ( ) + 0,285 (INTWO)

– 1,72 (OENEG) -0,521 (1)

Description:

a. Size = log(total assets/GNP price-level index)

b. TLTA = Total liabilities/Total Asset

c. WCTA = Working Capital/Total Assets

Paper ID: NOV152403 1854

ISSN (Online): 2319-7064

Index Copernicus Value (2013): 6.14 | Impact Factor (2014): 5.611

Volume 4 Issue 12, December 2015

www.ijsr.net

Licensed Under Creative Commons Attribution CC BY

determine its deficiency, so it could be fixed as soon as

possible.

Financial performance also has a close relation with the

financial management, where its the one of financial

management activity. Like Keown [5] describes "Financial

management concerned with the maintenance and creation

of economic value or wealth. Consequently, this course

focuses on decision making with an eye toward creating

wealth.... "

One of the main sources about company's financial

performance is by observing and analyzing financial

statements. This was revealed by Keown, et al [5] "... by

looking at the basic financial statements that are a primary

source of information about a firm's financial

performance"

2.2 Financial Statement

The company financial statements is a sheet that provides

information on some of the company's business activities,

including financing, investing,and operating activities.

These statement reflectes by some statements about

financial statement definition. There are several definitions

of financial statement. One of them was stated by Titman

[6] that A Firm’s statements provide a visual

representation of the firm that is used to describe the

business to investors and other outside of the firm as well

as to form employee”. Another statement came form

Kamaludin [7] whom states that "The financial statements

are the final result of a recording process which is a

summary of financial transaction that occured during the

financial year concerned"

According to Rodoni and Ali [3] , the financial statements

is a report published by a compant for its shareholders.

This report contains the basic of financial statements, and

also the management's analysis about former operating

activites, and opinion about company;s prospects for the

future.

2.3 Financial Statement Analysis

According to Subramanyam and Wild [8] Financial

statement analysis is the application of tools and analytical

techniques for financial statement general purposes, and

the related data which generate useful estimatation and

conclusions in business analysis.

Subramanyam and Wild [8] explained that the analysis of

financial statements are an integral important part of the

wider business analysis. Described in the same book that

analyzes the business (business analysis) is the process of

evaluating the economic outlook and the risk of the

company. It includes an analysis of the company's business

environment. , as well as the financial position and

performance

2.4 Financial Distress

Financial distress is one of the company's condition which

can be detected by the analysis of financial statements.

This company's condition can be a sign of impending a

worse situation, which is bankruptcy. Companies should

aware of the coming of financial distress, so that does not

lead to a worse stage.

There are several definitions of financial distress, as

described by Black Law's Dictionary in Rodoni and Ali [3]

that the Financial distress is defined as an insolvency, the

condition of assets or property and obligations of a person

who was formerly available to be not enough to pay off the

debt.

Tirapat and Nittayagasetawat (1999) in Rodoni and Ali [3]

defines financial distress as the company which terminated

its operations by the authority of the government and the

company is required to carry out the restructuring plan.

2.5 Bankruptcy

Bankruptcy is one of many things that is avoided by any

company. Knowing the bankruptcy possibility is one of the

financial statement analysis's objective. By knowing the

bankruptcy possibility, the company can make long-term

plans, and anticipate to avoid the situation

Commonly, bankruptcy can occur because companies can

not afford to pay the debt. As stated Gitman (1996) in

Karamzadeh [9] that bankruptcy is a legal status that

applies to the bankruptiest, the parties are not able to pay

their debts to creditors. Commonly, bankruptcy decided by

the courts many by the debtor, that is, when the amount of

debt the company is higher than total assets.

Goudie (1987) in Karamzadeh [9] revealed there are some

things that can lead to bankruptcy, such as

mismanagement, economic events, the government's

decision, as well as natural events and accidents.

2.6 Ohlson Score

Ohlson Score discovered by James Ohlson in 1980. In the

early discoveries time, Ohlson dubious Multiple

Discriminant Analysis (MDA) method founded by Altman

(1968). As his equal, O-score using logistic regression in

its calculations.According Ghozali [10] "Logistic

regression is actually similar to discriminant analysis that

we want to test whether the probability of occurrence of

the dependent variable can be predicted by the

independent variables". The formula of Ohlson Score is:

O-Score = -1,32 – 0,407(Size) + 6,03 ( ) -1,43 ( ) +

0,0757 ( ) – 2,37 ( ) – 1,83 ( ) + 0,285 (INTWO)

– 1,72 (OENEG) -0,521 (1)

Description:

a. Size = log(total assets/GNP price-level index)

b. TLTA = Total liabilities/Total Asset

c. WCTA = Working Capital/Total Assets

Paper ID: NOV152403 1854

International Journal of Science and Research (IJSR)

ISSN (Online): 2319-7064

Index Copernicus Value (2013): 6.14 | Impact Factor (2014): 5.611

Volume 4 Issue 12, December 2015

www.ijsr.net

Licensed Under Creative Commons Attribution CC BY

d. CLCA = Current Liabilities/Current assets

e. OENEG = One if total liabilities exceeds total assets,

zero otherwise

f. NITA = Net Income/Total Assets

g. FUTL = Funds provided by operation divided by total

liabilities

h. INTWO = One if net income was negative for the last

two years, zero otherwise

i. CHIN = ( - )/(| | + | |)

The result of Ohlson Score calculation above can be

categorized by two, such as Failed and Non-Failed:

Table 1: Bankruptcy Probability’s Criteria

Probability or P(O-score) Category

O-Score > 0,038 Failed

O-Score < 0,038 Non-Failed

Source: Ohlson [11]

2.5. Investment

Tandelilin [4] revealed that investment is a commitment of

a number of funds or other resources were done at this

time, with the purpose that to get some number of

advantages in the future. An opinion about the definition

of investment also disclosed by Relly and Brown (2009) in

Fahmi [12] "Investment is the current commitment of

dollars for a period of time to derive future payments that

will compensate the investor for (1) the time the funds are

commited. (2) the expected rate of inflation, (3) the

uncertainty of the future payments. "

While Herlianto [13] stated that the investment is basically

the placement of the funds at this time in order to gain

some advantage in the future.

According Tandelilin [4] if it is associated with a variety

of activities, types of investment can be divided into two,

such as: Real Investment and Financial Investment.

2.7 Stock Return

Return in investment can be either a profit or a loss.

According Tandelilin [4] There are two components of

total return on investment. First, any cash received when it

has investments. For shares, a cash payment from the

company to the shareholders is called dividend. Second,

the value of the assets purchased may change, which

means that is a capital gain or capital loss. For stocks, the

price can be increased so that the holder is said to derive

capital gains or can also be decreased called a capital loss.

Because the source of the return comes from dividends and

capital gains / capital loss, the calculation of return can be

started by calculating the dividend the company, and

continued to calculate the capital gain or capital loss.

Dividen Yield = (2)

Capital Gains = (3)

Description:

Dt: Dividend beginning of year t

Pt: The stock price per share at the end of the year

: The stock price per share at the beginning of the year

3. Problem Definiton

Based on the background and theoritical framework, the

problem definition in this research can be formulated as

follows:

1. How does bankruptcy prediction using O-Score on the

company Textile and Garment company listed in

Indonesia Stock Exchange for year 2010-2014?

2. How is the movement of stock returns Textile and

Garment company listed in Indonesia Stock Exchange in

2010-2014?

3. How is the condition of stock returns in company

indicated failed?

4. How is the condition of stock returns in company

indicated non failed?

5. Is there any stock returns's difference in company

indicated failed and non failed?

6. How does the O-Score effect towards stock returns

Textile and Garment company listed in Indonesia Stock

Exchange in 2010-2014?

4. Methodology or Approach

This study uses quantitative methods, and the type is

causal research. Type of scale used in this study is a ratio

scale. According Sedarmayanti [14] The scale of numbers

in a scalar ratio is the ratio of the absolute number at zero

point. The population in this study are all textile and

garment company listed on the Indonesia Stock Exchange

until 2014. The total population is 18 companies.

Populations are then selected by purposive sampling

technique, and obtained 7 samples of the company, namely

Polychem Indonesia Tbk, Argo Pantes Tbk, Apac Citra

Tbk Centertex, Pan Brothers Tbk, Asia Pacific Fiber Tbk,

Nusantara Inti Corpora Tbk, and Unitex Tbk. Authors

obtain research data from the official website of Indonesia

Stock Exchange (idx.co.id), and stock price history from

Yahoo Finance official website.

To answer the problem definition, there are several tests

and statistical analysis used. The first is descriptive

analysis, to describe the condition of the stock return. Then

proceed with the Kolmogorov-Smirnov test, which is a test

for normality before continue to Mann Whitney Test. Next

one is a different test Mann Whitney, the different test that

can be done in the absence of normality. Then, regression

panel data, regression model used in this research is panel

data regression model. According Rosadi [15] Data panel

is a combination of a time-cross (cross section) and time

series data type, the number of observed variables or the

number of categories and collected within a certain period.

While the model used so-called panel data model. Before

performing regression panel data, researchers conducted a

test panel data model first, namely Test Chow / Likehood

and Lagrange Multiplier Test.

Paper ID: NOV152403 1855

ISSN (Online): 2319-7064

Index Copernicus Value (2013): 6.14 | Impact Factor (2014): 5.611

Volume 4 Issue 12, December 2015

www.ijsr.net

Licensed Under Creative Commons Attribution CC BY

d. CLCA = Current Liabilities/Current assets

e. OENEG = One if total liabilities exceeds total assets,

zero otherwise

f. NITA = Net Income/Total Assets

g. FUTL = Funds provided by operation divided by total

liabilities

h. INTWO = One if net income was negative for the last

two years, zero otherwise

i. CHIN = ( - )/(| | + | |)

The result of Ohlson Score calculation above can be

categorized by two, such as Failed and Non-Failed:

Table 1: Bankruptcy Probability’s Criteria

Probability or P(O-score) Category

O-Score > 0,038 Failed

O-Score < 0,038 Non-Failed

Source: Ohlson [11]

2.5. Investment

Tandelilin [4] revealed that investment is a commitment of

a number of funds or other resources were done at this

time, with the purpose that to get some number of

advantages in the future. An opinion about the definition

of investment also disclosed by Relly and Brown (2009) in

Fahmi [12] "Investment is the current commitment of

dollars for a period of time to derive future payments that

will compensate the investor for (1) the time the funds are

commited. (2) the expected rate of inflation, (3) the

uncertainty of the future payments. "

While Herlianto [13] stated that the investment is basically

the placement of the funds at this time in order to gain

some advantage in the future.

According Tandelilin [4] if it is associated with a variety

of activities, types of investment can be divided into two,

such as: Real Investment and Financial Investment.

2.7 Stock Return

Return in investment can be either a profit or a loss.

According Tandelilin [4] There are two components of

total return on investment. First, any cash received when it

has investments. For shares, a cash payment from the

company to the shareholders is called dividend. Second,

the value of the assets purchased may change, which

means that is a capital gain or capital loss. For stocks, the

price can be increased so that the holder is said to derive

capital gains or can also be decreased called a capital loss.

Because the source of the return comes from dividends and

capital gains / capital loss, the calculation of return can be

started by calculating the dividend the company, and

continued to calculate the capital gain or capital loss.

Dividen Yield = (2)

Capital Gains = (3)

Description:

Dt: Dividend beginning of year t

Pt: The stock price per share at the end of the year

: The stock price per share at the beginning of the year

3. Problem Definiton

Based on the background and theoritical framework, the

problem definition in this research can be formulated as

follows:

1. How does bankruptcy prediction using O-Score on the

company Textile and Garment company listed in

Indonesia Stock Exchange for year 2010-2014?

2. How is the movement of stock returns Textile and

Garment company listed in Indonesia Stock Exchange in

2010-2014?

3. How is the condition of stock returns in company

indicated failed?

4. How is the condition of stock returns in company

indicated non failed?

5. Is there any stock returns's difference in company

indicated failed and non failed?

6. How does the O-Score effect towards stock returns

Textile and Garment company listed in Indonesia Stock

Exchange in 2010-2014?

4. Methodology or Approach

This study uses quantitative methods, and the type is

causal research. Type of scale used in this study is a ratio

scale. According Sedarmayanti [14] The scale of numbers

in a scalar ratio is the ratio of the absolute number at zero

point. The population in this study are all textile and

garment company listed on the Indonesia Stock Exchange

until 2014. The total population is 18 companies.

Populations are then selected by purposive sampling

technique, and obtained 7 samples of the company, namely

Polychem Indonesia Tbk, Argo Pantes Tbk, Apac Citra

Tbk Centertex, Pan Brothers Tbk, Asia Pacific Fiber Tbk,

Nusantara Inti Corpora Tbk, and Unitex Tbk. Authors

obtain research data from the official website of Indonesia

Stock Exchange (idx.co.id), and stock price history from

Yahoo Finance official website.

To answer the problem definition, there are several tests

and statistical analysis used. The first is descriptive

analysis, to describe the condition of the stock return. Then

proceed with the Kolmogorov-Smirnov test, which is a test

for normality before continue to Mann Whitney Test. Next

one is a different test Mann Whitney, the different test that

can be done in the absence of normality. Then, regression

panel data, regression model used in this research is panel

data regression model. According Rosadi [15] Data panel

is a combination of a time-cross (cross section) and time

series data type, the number of observed variables or the

number of categories and collected within a certain period.

While the model used so-called panel data model. Before

performing regression panel data, researchers conducted a

test panel data model first, namely Test Chow / Likehood

and Lagrange Multiplier Test.

Paper ID: NOV152403 1855

International Journal of Science and Research (IJSR)

ISSN (Online): 2319-7064

Index Copernicus Value (2013): 6.14 | Impact Factor (2014): 5.611

Volume 4 Issue 12, December 2015

www.ijsr.net

Licensed Under Creative Commons Attribution CC BY

5. Result / Discussion

5.1 Banktuptcy Prediction

Based on Ohlson Score calculation, showed that from

overall 35 calculation, which consists of 7 companies and

5 period (2010-2014). 22, og those of that identified

Failed, while 13 others identified Non failed. Polychem

Indonesia Tbk has different conditions in every year. In

2010 these company identified Failed, but two subsequent

period the condition of the company changed to Non

Failed. In 2013 the condition of the company changes

again to Failed, and ends with Non Failed in 2014. While

the company Argo Pantes Tbk, Apac Citra Tbk Centertex,

Unitex Tbk, and Asia Pasicif Fiber Tbk identified Failed

for 5 consecutive years. Two others, namely Pan Brothers

Tbk, and Nusantara Inti Corpora Tbk, identified Non

Failed for 5 consecutive years.

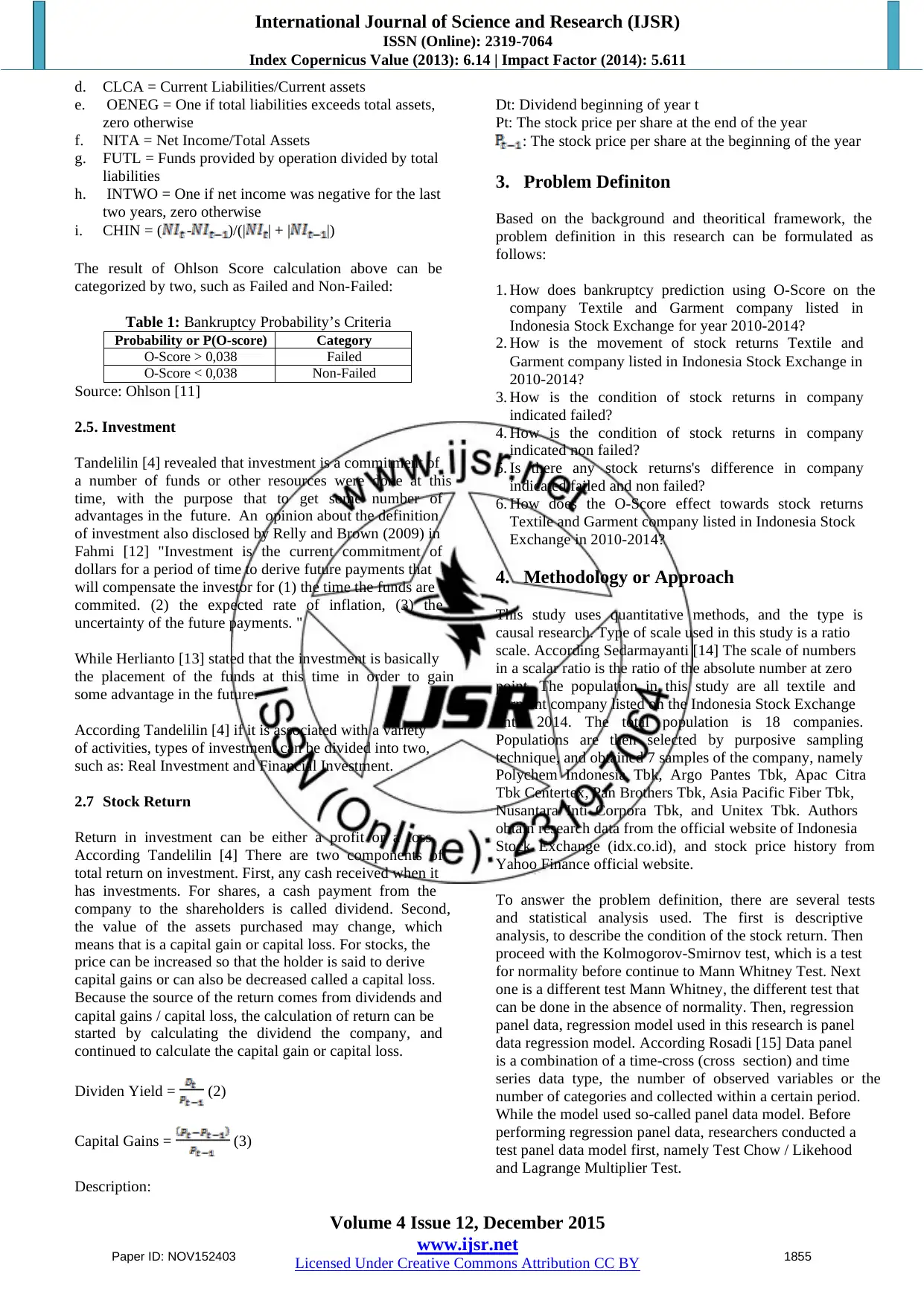

5.2 Descriptive Analysis of Stock Return

Based on descriptive analysis between the Failed an Non

Failed company . There are some differences between

them. Such differences are outlined in Table 2:

Tabel 2: The Ohlson Score’s Comparison in Failed and

Non Failed Company

Company’s Category

Failed Non Failed

Mean 0,184136 Mean 1,099077

Median 0,000000 Median 0,000000

Max 2,309000 Max 12,79400

Min -0,580000 Min -0,702000

Sum 4,051000 Sum 14,28800

Std. Dev 0,590857 Std. Dev 3,581412

Skew 2,304475 Skew 2,973632

Kurt 8,943273 Kurt 10,28603

Observation 22 Observation 13

The average of stock returns of Non Failed category has a

higher nominal, that 1.099077 or 1.0, compared to Failed

companies, 0.18. The highest value of stock returns are

also still occupied by the Non Failed company, which

amounted to 12.79 or 1279%. Compared with stock

returns Failed company ie 2.31 or 231%. However, the

company categorized Failed has the lowest value smaller

than the companies categorized as Non-Failed which

amounted to -0.70 or -70%, while the category Failed

company has a minimum value of -0.58 or -58%. Overall

stock returns Failed category is 4.05 or 405%, and the

company categorized Non Failed 14.29 or 1429%.

5.2 Mann Whitney Test

Based on the Mann Whitney test, obtained the test results

in Table 3.

Table 3: Mann Whitney Test

Test Statisticsb

return

Mann-Whitney U 131.500

Wilcoxon W 384.500

Z -.394

Asymp. Sig. (2-tailed) .694

Exact Sig. [2*(1-tailed Sig.)] .699a

a. Not corrected for ties.

b. Grouping Variable: kategori perusahaan

Based on the results of Mann Whitney test, a score P-value

(Asymp. Sig 2-tailed) of 0.694, where the the P-value is

greater than 0,025. According to the test criteria, when the

P value (Asymp. Sig. 2-tailed)> 0.025, then Ho is

accepted. So there is no difference in the value of company

stock returns in failed and non failed company.

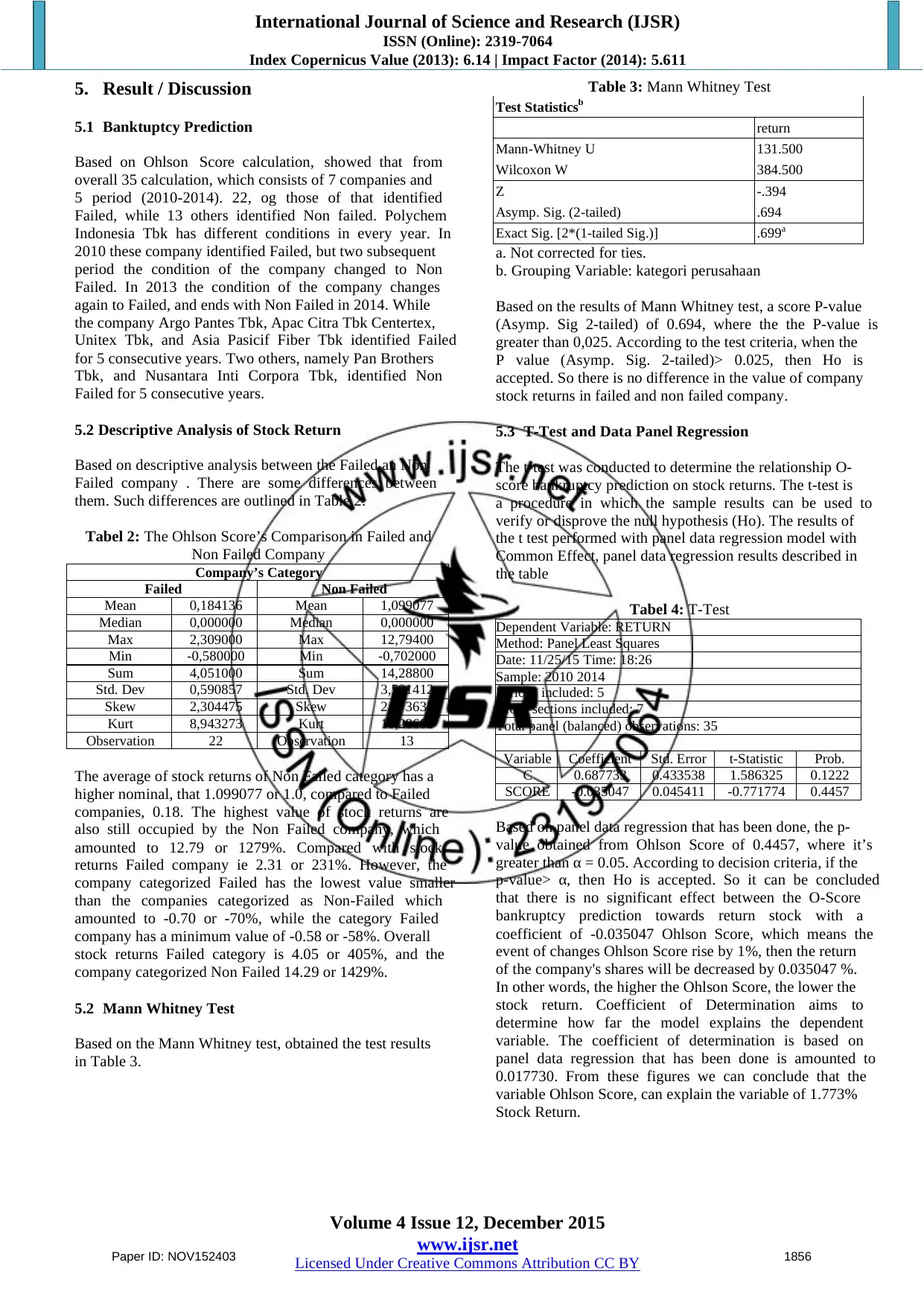

5.3 T-Test and Data Panel Regression

The t-test was conducted to determine the relationship O-

score bankruptcy prediction on stock returns. The t-test is

a procedure in which the sample results can be used to

verify or disprove the null hypothesis (Ho). The results of

the t test performed with panel data regression model with

Common Effect, panel data regression results described in

the table

Tabel 4: T-Test

Dependent Variable: RETURN

Method: Panel Least Squares

Date: 11/25/15 Time: 18:26

Sample: 2010 2014

Periods included: 5

Cross-sections included: 7

Total panel (balanced) observations: 35

Variable Coefficient Std. Error t-Statistic Prob.

C 0.687733 0.433538 1.586325 0.1222

SCORE -0.035047 0.045411 -0.771774 0.4457

Based on panel data regression that has been done, the p-

value obtained from Ohlson Score of 0.4457, where it’s

greater than α = 0.05. According to decision criteria, if the

p-value> α, then Ho is accepted. So it can be concluded

that there is no significant effect between the O-Score

bankruptcy prediction towards return stock with a

coefficient of -0.035047 Ohlson Score, which means the

event of changes Ohlson Score rise by 1%, then the return

of the company's shares will be decreased by 0.035047 %.

In other words, the higher the Ohlson Score, the lower the

stock return. Coefficient of Determination aims to

determine how far the model explains the dependent

variable. The coefficient of determination is based on

panel data regression that has been done is amounted to

0.017730. From these figures we can conclude that the

variable Ohlson Score, can explain the variable of 1.773%

Stock Return.

Paper ID: NOV152403 1856

ISSN (Online): 2319-7064

Index Copernicus Value (2013): 6.14 | Impact Factor (2014): 5.611

Volume 4 Issue 12, December 2015

www.ijsr.net

Licensed Under Creative Commons Attribution CC BY

5. Result / Discussion

5.1 Banktuptcy Prediction

Based on Ohlson Score calculation, showed that from

overall 35 calculation, which consists of 7 companies and

5 period (2010-2014). 22, og those of that identified

Failed, while 13 others identified Non failed. Polychem

Indonesia Tbk has different conditions in every year. In

2010 these company identified Failed, but two subsequent

period the condition of the company changed to Non

Failed. In 2013 the condition of the company changes

again to Failed, and ends with Non Failed in 2014. While

the company Argo Pantes Tbk, Apac Citra Tbk Centertex,

Unitex Tbk, and Asia Pasicif Fiber Tbk identified Failed

for 5 consecutive years. Two others, namely Pan Brothers

Tbk, and Nusantara Inti Corpora Tbk, identified Non

Failed for 5 consecutive years.

5.2 Descriptive Analysis of Stock Return

Based on descriptive analysis between the Failed an Non

Failed company . There are some differences between

them. Such differences are outlined in Table 2:

Tabel 2: The Ohlson Score’s Comparison in Failed and

Non Failed Company

Company’s Category

Failed Non Failed

Mean 0,184136 Mean 1,099077

Median 0,000000 Median 0,000000

Max 2,309000 Max 12,79400

Min -0,580000 Min -0,702000

Sum 4,051000 Sum 14,28800

Std. Dev 0,590857 Std. Dev 3,581412

Skew 2,304475 Skew 2,973632

Kurt 8,943273 Kurt 10,28603

Observation 22 Observation 13

The average of stock returns of Non Failed category has a

higher nominal, that 1.099077 or 1.0, compared to Failed

companies, 0.18. The highest value of stock returns are

also still occupied by the Non Failed company, which

amounted to 12.79 or 1279%. Compared with stock

returns Failed company ie 2.31 or 231%. However, the

company categorized Failed has the lowest value smaller

than the companies categorized as Non-Failed which

amounted to -0.70 or -70%, while the category Failed

company has a minimum value of -0.58 or -58%. Overall

stock returns Failed category is 4.05 or 405%, and the

company categorized Non Failed 14.29 or 1429%.

5.2 Mann Whitney Test

Based on the Mann Whitney test, obtained the test results

in Table 3.

Table 3: Mann Whitney Test

Test Statisticsb

return

Mann-Whitney U 131.500

Wilcoxon W 384.500

Z -.394

Asymp. Sig. (2-tailed) .694

Exact Sig. [2*(1-tailed Sig.)] .699a

a. Not corrected for ties.

b. Grouping Variable: kategori perusahaan

Based on the results of Mann Whitney test, a score P-value

(Asymp. Sig 2-tailed) of 0.694, where the the P-value is

greater than 0,025. According to the test criteria, when the

P value (Asymp. Sig. 2-tailed)> 0.025, then Ho is

accepted. So there is no difference in the value of company

stock returns in failed and non failed company.

5.3 T-Test and Data Panel Regression

The t-test was conducted to determine the relationship O-

score bankruptcy prediction on stock returns. The t-test is

a procedure in which the sample results can be used to

verify or disprove the null hypothesis (Ho). The results of

the t test performed with panel data regression model with

Common Effect, panel data regression results described in

the table

Tabel 4: T-Test

Dependent Variable: RETURN

Method: Panel Least Squares

Date: 11/25/15 Time: 18:26

Sample: 2010 2014

Periods included: 5

Cross-sections included: 7

Total panel (balanced) observations: 35

Variable Coefficient Std. Error t-Statistic Prob.

C 0.687733 0.433538 1.586325 0.1222

SCORE -0.035047 0.045411 -0.771774 0.4457

Based on panel data regression that has been done, the p-

value obtained from Ohlson Score of 0.4457, where it’s

greater than α = 0.05. According to decision criteria, if the

p-value> α, then Ho is accepted. So it can be concluded

that there is no significant effect between the O-Score

bankruptcy prediction towards return stock with a

coefficient of -0.035047 Ohlson Score, which means the

event of changes Ohlson Score rise by 1%, then the return

of the company's shares will be decreased by 0.035047 %.

In other words, the higher the Ohlson Score, the lower the

stock return. Coefficient of Determination aims to

determine how far the model explains the dependent

variable. The coefficient of determination is based on

panel data regression that has been done is amounted to

0.017730. From these figures we can conclude that the

variable Ohlson Score, can explain the variable of 1.773%

Stock Return.

Paper ID: NOV152403 1856

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

International Journal of Science and Research (IJSR)

ISSN (Online): 2319-7064

Index Copernicus Value (2013): 6.14 | Impact Factor (2014): 5.611

Volume 4 Issue 12, December 2015

www.ijsr.net

Licensed Under Creative Commons Attribution CC BY

6. Conclusion

Based on the analysis above it can be concluded that of all

35 calculation, which consists of seven companies, in

which each company is divided into five periods (2010-

2014), there are 22 calculations indicated Failed company,

and 13 as Non Failed company. Based on descriptive

analysis there are differences in the average and the

number of stock returns failed and non-failed, but by

Mann Whitney test, proved that there is no difference

between the value of company stock returns failed and non

failed.

From the results of this study can also be concluded that

there is no significant influence between the O-Score

bankruptcy prediction on stock returns, with a coefficient

of Ohlson Score of -0.03547 and determination coefficient

of .017730, or 1.773%, which means if there is an increase

of Ohlson Score 1%, then the return of the company's

shares will be decreased by 0.035047%. In other words,

the higher the Ohlson Score, the lower the stock return.

7. Future Scope

For further research that will predict Ohlson Score, it is

advisable to use real GNP in 2014 with the data that were

not foreseen, as well as the views of the value of R-

Squared are very small, namely 1.773%, further research

can could input other variables that are expected to have

high influence on the stock returns, mainly from external

factors, such as the macroeconomic situation, the political

situation, natural conditions, government regulations, or

inside either outside nation issues.

References

[1] Central Bureau of Statistics (Badan Pusat Statistika).

(2015). Berita Resmi Statistik Badan Pusat Statistik

(No. 45/05/Th.XVIII). Jakarta,Indonesia:BPS

[2] Kontan (2013). BEI kembali coret satu emiten.

Accesed on9 September 2015,

fromhttp://investasi.kontan.co.id/news/bei-kembali-

coret-satu-emiten

[3] Rodoni, A., Ali, H. (2010). Manajemen Keuangan.

Bogor: Mitra Wacana Media

[4] Tandelilin, E. (2010). Portofolio dan Investasi Teori

dan Aplikasi (Teori Pertama). Yogyakarta:Kansius

[5] Keown, A.,J., Martin, J.,D., Petty, J.,W., Scott., D.,J.

(2005). Financial Management: Principles and

Application. New York: Pearson Prentice Hall.

[6] Titman, S., Keown, A.,J., Martin, J.,D. (2011).

Financial Management (Principles and

Applications)7th ed. New York: Pearson Education

Inc.

[7] Kamaludin. (2011). Manajemen Keuangan, Konsep

Dasar dan Penerapanya. Bandung: CV.Mandar Maju

[8] Subramanyam,K.,R., Wild,J.,J.(2010). Analisis

Laporan Keuangan ’Financial Statement Analysis’.

Jakarta:Salemba Empat.

[9] Karamzadeh, M.,S. (2013). Application and

Comparison of Altman and Ohlson Model to Predict

Banruptcy of Companies. Research Journal of

Applied Science, Engineering and Technology, 5(6),

2007-2013.

[10] Ghozali, Imam. (2013). Aplikasi Analisis Multivariate

dengan Program IBM SPSS 21 Update PLS Regresi

(Edisi 7). Semarang: Badan Penerbit Universitas

Diponegoro.

[11] Ohlson, J. (1980). Financial Ratio and Probabilistic

Prediction Of Bankruptcy. Journal Of Accounting

Research, 18(1), (Spring,1980).109-131. Publsihed by

The Institute Of Professional Accounting, Graduate

School Of Business, University of Chicago.

[12] Fahmi, I. (2012). Pengantar Manajemen Keuangan

Teori dan Soal Jawab. Bandung: Alfabeta

[13] Herlianto, D. (2013). Manajemen Investasi Plus Jurus

Mendeteksi Investasi. Yogyakarta: Gosyen.

[14] Sedarmayanti., Hidayat, S. (2011). Metodologi

Penelitian. Bandung: CV. Mandar Maju.

[15] Rosadi, D. (2012). Ekonometrika & Analisis Runtun

Waktu Terapan dengan E Views. Yogyakarya: Andi

Author Profile

Name Ayu Putri Wulandari

Date Of Birth November, 21st 1994

Education SMP N 1 Kuta Utara

SMK N 1 Denpasar

Telkom University, Bandung

Interest in Financial Management.

E-mail Ayputriw@gmail.com

Phone Number +6287862420621

Occupation Entrepreneur, Fresh graduate

Name Dr. Norita, SE., M.Si., Ak.,

CA

Date Of Birth May, 22nd, 1961

Education Andalas University, Padang

(S1)

Padjadjaran University

Bandung (S2)

Padjadjaran University

Bandung (S3)

E-mail Ayputriw@gmail.com

Phone Number 081320454655

Occupation Lecturer

JOURNAL OR PROCEEDINGS

No Year Title Journal

1 2012

Intellectual Capital: Concepts,

Models and Applications (Studies

in Banking Sector Listed in

Indonesia Stock Exchange Period

2007-2010)

SNAB

2 2013

Comparative Analysis On

Corporate Condition Using Z”-

Score Value On

Telecommunication Sector and

“Gray” Zone Trend Determination

For The Year 2013

ICOI

Paper ID: NOV152403 1857

ISSN (Online): 2319-7064

Index Copernicus Value (2013): 6.14 | Impact Factor (2014): 5.611

Volume 4 Issue 12, December 2015

www.ijsr.net

Licensed Under Creative Commons Attribution CC BY

6. Conclusion

Based on the analysis above it can be concluded that of all

35 calculation, which consists of seven companies, in

which each company is divided into five periods (2010-

2014), there are 22 calculations indicated Failed company,

and 13 as Non Failed company. Based on descriptive

analysis there are differences in the average and the

number of stock returns failed and non-failed, but by

Mann Whitney test, proved that there is no difference

between the value of company stock returns failed and non

failed.

From the results of this study can also be concluded that

there is no significant influence between the O-Score

bankruptcy prediction on stock returns, with a coefficient

of Ohlson Score of -0.03547 and determination coefficient

of .017730, or 1.773%, which means if there is an increase

of Ohlson Score 1%, then the return of the company's

shares will be decreased by 0.035047%. In other words,

the higher the Ohlson Score, the lower the stock return.

7. Future Scope

For further research that will predict Ohlson Score, it is

advisable to use real GNP in 2014 with the data that were

not foreseen, as well as the views of the value of R-

Squared are very small, namely 1.773%, further research

can could input other variables that are expected to have

high influence on the stock returns, mainly from external

factors, such as the macroeconomic situation, the political

situation, natural conditions, government regulations, or

inside either outside nation issues.

References

[1] Central Bureau of Statistics (Badan Pusat Statistika).

(2015). Berita Resmi Statistik Badan Pusat Statistik

(No. 45/05/Th.XVIII). Jakarta,Indonesia:BPS

[2] Kontan (2013). BEI kembali coret satu emiten.

Accesed on9 September 2015,

fromhttp://investasi.kontan.co.id/news/bei-kembali-

coret-satu-emiten

[3] Rodoni, A., Ali, H. (2010). Manajemen Keuangan.

Bogor: Mitra Wacana Media

[4] Tandelilin, E. (2010). Portofolio dan Investasi Teori

dan Aplikasi (Teori Pertama). Yogyakarta:Kansius

[5] Keown, A.,J., Martin, J.,D., Petty, J.,W., Scott., D.,J.

(2005). Financial Management: Principles and

Application. New York: Pearson Prentice Hall.

[6] Titman, S., Keown, A.,J., Martin, J.,D. (2011).

Financial Management (Principles and

Applications)7th ed. New York: Pearson Education

Inc.

[7] Kamaludin. (2011). Manajemen Keuangan, Konsep

Dasar dan Penerapanya. Bandung: CV.Mandar Maju

[8] Subramanyam,K.,R., Wild,J.,J.(2010). Analisis

Laporan Keuangan ’Financial Statement Analysis’.

Jakarta:Salemba Empat.

[9] Karamzadeh, M.,S. (2013). Application and

Comparison of Altman and Ohlson Model to Predict

Banruptcy of Companies. Research Journal of

Applied Science, Engineering and Technology, 5(6),

2007-2013.

[10] Ghozali, Imam. (2013). Aplikasi Analisis Multivariate

dengan Program IBM SPSS 21 Update PLS Regresi

(Edisi 7). Semarang: Badan Penerbit Universitas

Diponegoro.

[11] Ohlson, J. (1980). Financial Ratio and Probabilistic

Prediction Of Bankruptcy. Journal Of Accounting

Research, 18(1), (Spring,1980).109-131. Publsihed by

The Institute Of Professional Accounting, Graduate

School Of Business, University of Chicago.

[12] Fahmi, I. (2012). Pengantar Manajemen Keuangan

Teori dan Soal Jawab. Bandung: Alfabeta

[13] Herlianto, D. (2013). Manajemen Investasi Plus Jurus

Mendeteksi Investasi. Yogyakarta: Gosyen.

[14] Sedarmayanti., Hidayat, S. (2011). Metodologi

Penelitian. Bandung: CV. Mandar Maju.

[15] Rosadi, D. (2012). Ekonometrika & Analisis Runtun

Waktu Terapan dengan E Views. Yogyakarya: Andi

Author Profile

Name Ayu Putri Wulandari

Date Of Birth November, 21st 1994

Education SMP N 1 Kuta Utara

SMK N 1 Denpasar

Telkom University, Bandung

Interest in Financial Management.

E-mail Ayputriw@gmail.com

Phone Number +6287862420621

Occupation Entrepreneur, Fresh graduate

Name Dr. Norita, SE., M.Si., Ak.,

CA

Date Of Birth May, 22nd, 1961

Education Andalas University, Padang

(S1)

Padjadjaran University

Bandung (S2)

Padjadjaran University

Bandung (S3)

E-mail Ayputriw@gmail.com

Phone Number 081320454655

Occupation Lecturer

JOURNAL OR PROCEEDINGS

No Year Title Journal

1 2012

Intellectual Capital: Concepts,

Models and Applications (Studies

in Banking Sector Listed in

Indonesia Stock Exchange Period

2007-2010)

SNAB

2 2013

Comparative Analysis On

Corporate Condition Using Z”-

Score Value On

Telecommunication Sector and

“Gray” Zone Trend Determination

For The Year 2013

ICOI

Paper ID: NOV152403 1857

International Journal of Science and Research (IJSR)

ISSN (Online): 2319-7064

Index Copernicus Value (2013): 6.14 | Impact Factor (2014): 5.611

Volume 4 Issue 12, December 2015

www.ijsr.net

Licensed Under Creative Commons Attribution CC BY

3 2013

Comparative Analysis on Stock

Intrinsic Value with Estimation of

Stock Value and Stock Market

Value For Decision Making “Buy,

Sell, or Hold” In

Telecommunication Sector at

Quarter I of 2013

ISCLO

4 2014

Analysis and Forecasting of

Bankruptcy Potential Using

Multiple Discriminant Analysis and

Double Moving Average on PT.

Bakrie Telecom, Tbk Year 2013

ICOI

5 2014

IDENTIFICATION OF FACTORS

THAT CONTRIBUTE TO

CAPITAL STRUCTURE YEAR

2009-2012 (CASE STUDY IN

FOREIGN EXCHANGE BANKS

IN INDONESIA)

GTAR

6 2015

An Analysis of Telecommunication

Vendor Company Bankruptcy

Potency Based on the Problematic

Financial Ratio with Altman,

Springate and Zmijewski Methods

ICOI

Name Aldilla Iradianty, S.E, M.M

Date Of Birth June 30th,1987

Education Parahyangan University

Bandung, Indonesia

Magister Management,

majoring in Strategic

Management

2005 – 2009 Padjajaran

University Bandung, Indonesia

Economic Faculty, majoring in

Finance Management

E-mail Aldilla@ypt.or.id

Phone Number 0821 2630 5599

Occupation Lecturer

Paper ID: NOV152403 1858

ISSN (Online): 2319-7064

Index Copernicus Value (2013): 6.14 | Impact Factor (2014): 5.611

Volume 4 Issue 12, December 2015

www.ijsr.net

Licensed Under Creative Commons Attribution CC BY

3 2013

Comparative Analysis on Stock

Intrinsic Value with Estimation of

Stock Value and Stock Market

Value For Decision Making “Buy,

Sell, or Hold” In

Telecommunication Sector at

Quarter I of 2013

ISCLO

4 2014

Analysis and Forecasting of

Bankruptcy Potential Using

Multiple Discriminant Analysis and

Double Moving Average on PT.

Bakrie Telecom, Tbk Year 2013

ICOI

5 2014

IDENTIFICATION OF FACTORS

THAT CONTRIBUTE TO

CAPITAL STRUCTURE YEAR

2009-2012 (CASE STUDY IN

FOREIGN EXCHANGE BANKS

IN INDONESIA)

GTAR

6 2015

An Analysis of Telecommunication

Vendor Company Bankruptcy

Potency Based on the Problematic

Financial Ratio with Altman,

Springate and Zmijewski Methods

ICOI

Name Aldilla Iradianty, S.E, M.M

Date Of Birth June 30th,1987

Education Parahyangan University

Bandung, Indonesia

Magister Management,

majoring in Strategic

Management

2005 – 2009 Padjajaran

University Bandung, Indonesia

Economic Faculty, majoring in

Finance Management

E-mail Aldilla@ypt.or.id

Phone Number 0821 2630 5599

Occupation Lecturer

Paper ID: NOV152403 1858

1 out of 6

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.