Audit Report: Modifications and Qualifications - Finance Module

VerifiedAdded on 2023/04/19

|8

|5326

|366

Report

AI Summary

This report delves into the critical aspects of audit reports, specifically focusing on modifications and qualifications. It aims to clarify the different types of audit opinions that can be issued by auditors, including unqualified, qualified, adverse, and disclaimer of opinion. The report will outline the circumstances that lead to each type of opinion. For instance, a qualified opinion is issued when there are material misstatements or limitations in the scope of the audit but overall, the financial statements present a fair view. An adverse opinion is issued when material misstatements are pervasive, indicating that the financial statements do not fairly present the financial position or performance. A disclaimer of opinion is issued when the auditor is unable to obtain sufficient appropriate audit evidence to form an opinion. The report will provide clear explanations and examples to help students understand the significance of each type of modification and qualification in the context of financial auditing. It serves as a valuable resource for students studying accounting and auditing, providing a clear understanding of the different audit opinions and their implications.

International Review of Management and Marketing

Vol. 4, No. 1, 2014, pp.34-41

ISSN: 2146-4405

www.econjournals.com

34

The Effect of the Internal Audit and Firm Performance:

A Proposed Research Framework

Ebrahim Mohammed Al-Matari

Faculty of Business and Economics, Ammran University,

Yemen and Faculty of Accountancy, Universiti Utara Malaysia,

Malaysia. Email: ibrahim_matri@yahoo.com

Abdullah Kaid Al-Swidi

Othman Yeop Abdullah Graduate School of Business,

University Utara Malaysia, Sintok, Malaysia.

Email: swidi@uum.edu.my

Faudziah Hanim Binti Fadzil

Othman Yeop Abdullah Graduate School of Business,

University Utara Malaysia, Sintok, Malaysia.

Email: fhanim@uum.edu.my

ABSTRACT: This study attempts to propose a structure of the relationships between the internal

audits characteristics (IAC); such as professional qualifications of the chief audit executive of the

Internal Audit (IA), size, experience, and qualification; and firm performance. The presence of an

internal audit department is significant as it is considered as the main element in employing

accounting systems and this, in turn, assists in evaluating the department’s work. The internal audit is

deemed as the core of business accounting as it is the section that keeps track of all businesses

associated with the sector. The internal audit efficiency assists in developing the company’s work

because the financial reports present the internal audit department’s quality. In addition, an internal

audit is a crucial part of corporate governance structure in an organization and corporate governance

(CG) covers the activities of oversight conducted by the board of directors and audit committees to

ensure credible financial reporting process (Public Oversight Board, 1994). Consistent with previous

studies of the importance of internal audit, this study provides comprehensive oversights on the

relationship between internal audit and firm performance. The past literature reveals there is a paucity

of studies exploring the association between internal audit characteristics (IAC) and firm performance

whether conceptual or empirical. The main objective of this study is to fill up the gap in the literature

and provide an opportunity for future research to deeply to investigate this relationship.

Keywords: Internal Audit Characteristics (IAC); Agency Theory (AT); Resource Dependence Theory

(RDT); Firm Performance (FP).

JEL Classifications: M40; M41; M42

1. Introduction

The internal audit department is very important inside a firm that the internal audit is regarded

as the key element in the application of accounting systems which in turn, helps in evaluating the work

of the department. The internal audit is considered as the backbone of the business accounting as it is

the section that records all businesses related to the sector. The efficiency of internal audit helps

develop the work of the company because the financial reports reflect the internal audit department’s

quality. Moreover, an internal audit is a significant part of the CG structure in an organization and CG

encompasses oversight activities taken by the board of directors and audit committees to make sure

that the financial reporting process is credible (Public Oversight Board, 1994). Three monitoring

mechanisms have been highlighted in the CG literature, namely, external auditing, internal auditing

Vol. 4, No. 1, 2014, pp.34-41

ISSN: 2146-4405

www.econjournals.com

34

The Effect of the Internal Audit and Firm Performance:

A Proposed Research Framework

Ebrahim Mohammed Al-Matari

Faculty of Business and Economics, Ammran University,

Yemen and Faculty of Accountancy, Universiti Utara Malaysia,

Malaysia. Email: ibrahim_matri@yahoo.com

Abdullah Kaid Al-Swidi

Othman Yeop Abdullah Graduate School of Business,

University Utara Malaysia, Sintok, Malaysia.

Email: swidi@uum.edu.my

Faudziah Hanim Binti Fadzil

Othman Yeop Abdullah Graduate School of Business,

University Utara Malaysia, Sintok, Malaysia.

Email: fhanim@uum.edu.my

ABSTRACT: This study attempts to propose a structure of the relationships between the internal

audits characteristics (IAC); such as professional qualifications of the chief audit executive of the

Internal Audit (IA), size, experience, and qualification; and firm performance. The presence of an

internal audit department is significant as it is considered as the main element in employing

accounting systems and this, in turn, assists in evaluating the department’s work. The internal audit is

deemed as the core of business accounting as it is the section that keeps track of all businesses

associated with the sector. The internal audit efficiency assists in developing the company’s work

because the financial reports present the internal audit department’s quality. In addition, an internal

audit is a crucial part of corporate governance structure in an organization and corporate governance

(CG) covers the activities of oversight conducted by the board of directors and audit committees to

ensure credible financial reporting process (Public Oversight Board, 1994). Consistent with previous

studies of the importance of internal audit, this study provides comprehensive oversights on the

relationship between internal audit and firm performance. The past literature reveals there is a paucity

of studies exploring the association between internal audit characteristics (IAC) and firm performance

whether conceptual or empirical. The main objective of this study is to fill up the gap in the literature

and provide an opportunity for future research to deeply to investigate this relationship.

Keywords: Internal Audit Characteristics (IAC); Agency Theory (AT); Resource Dependence Theory

(RDT); Firm Performance (FP).

JEL Classifications: M40; M41; M42

1. Introduction

The internal audit department is very important inside a firm that the internal audit is regarded

as the key element in the application of accounting systems which in turn, helps in evaluating the work

of the department. The internal audit is considered as the backbone of the business accounting as it is

the section that records all businesses related to the sector. The efficiency of internal audit helps

develop the work of the company because the financial reports reflect the internal audit department’s

quality. Moreover, an internal audit is a significant part of the CG structure in an organization and CG

encompasses oversight activities taken by the board of directors and audit committees to make sure

that the financial reporting process is credible (Public Oversight Board, 1994). Three monitoring

mechanisms have been highlighted in the CG literature, namely, external auditing, internal auditing

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The Effect of the Internal Audit and Firm Performance: A proposed Research Framework

35

and directorship (Al Matarneh, 2011; Anderson et al. 1993; Blue Ribbon Committee, 1999; IIA,

2003).

The financial and corporate strategy of a company is underpinned by effective internal

systems in which the internal audit has an important role in raising the reliability of the internal control

system, improving the process of risk management and above all, satisfying the needs of internal

users. The internal audit support enhances the system of responsibility that the executive directors and

employees have towards the owners and other stakeholders (Eighme & Cashell, 2002). Taken

together, the internal audit department provides a reliable, objective, and neutral service to the

management, board of directors, and audit committee, while stakeholders are interested in return on

investments, sustainable growth, strong leadership, and reliable reporting on the financial performance

and business practices of a company (Ljubisavljević & Jovanovi, 2011).

2. Internal Audit function

Internal audit makes a large contribution to the achievement of company goals, and the

implementation of strategies for their achievement (Ljubisavljević & Jovanovi, 2011). In addition, the

internal audit function is responsible for reinforcing management and audit committee (Hutchinson &

Zain, 2009).

Likewise, internal audit determines the reliability, reality, and integrity of financial and

operational information that comes from different organizational units, on which appropriate business

decisions at all levels of management are based. Successful implementation of internal audit tasks

means that it must be independent, i.e., company management should in no way influenced by its

work, information, conclusions, and evaluations. In this way the internal audit report becomes a means

of communication between internal audit and management, and an important guideline for the

successful management of the company (Ljubisavljević & Jovanovi, 2011).

Furthermore, the internal audit function facilitates the operation and effective working of the

audit committee as the audit function goals are consistent with the former’s financial reporting

oversight responsibilities (Goodwin and Yeo, 2001; Goodwin, 2003; Scarbrough, Rama &

Raghunandan, 1998). The creation of an internal audit function is supported by the governance reports

(NYSE, 2002) and previous studies (Collier & Gregory 1996; Goodwin & Kent, 2003) as a

mechanism to enhance internal governance processes.

Along this line of argument, Al-Shammari (2010) mentioned many factors of internal audit

functions and they are provided below:

1. The internal control systems and arithmetic evaluations in an attempt to; ensure that the

accounting system and internal controls systems are appropriate, ensure that the systems are

suitable for the facility and propos system enhancements.

2. Assessing plans and procedures to determine weaknesses or defects in the systems and

procedures used by the company and to propose modifications and enhancements needed, and

to provide authority to the internal auditor for the examination of the aspects of establishment

activity.

3. Taking into consideration the staff commitment to the company policies and procedures and

therefore, internal auditor has to monitor these policies and procedures’ implementation and to

clarify them to the employees.

4. Safeguarding established funds as the development and implementation of systems is an

attempt to make sure that the facility safeguards assets and funds against manipulation and

fraud, to detect fraud and minimize losses stemming from neglect/abuse (e.g. loss of proper

storage).

IAC in this study comprises four factors namely, qualifications of the chief audit executive, size,

qualification and experience of the audit department. Generally, the previous study dedicated to

examining the relationship between internal audit and firm performance is so limited in both

developed countries and developing countries. Several studies have called for further studies to

conduct extensive investigations; for instance, Hutchinson and Zain (2009), explored the association

between internal (audit experience and accounting qualification) audit and firm performance (ROA)

with growth opportunities and audit committee independence in the context of Malaysia. Their study

has two future recommendations. First, future studies should examine the role of the board and the

interaction between internal audit quality and audit committee independence. Secondly, this study

35

and directorship (Al Matarneh, 2011; Anderson et al. 1993; Blue Ribbon Committee, 1999; IIA,

2003).

The financial and corporate strategy of a company is underpinned by effective internal

systems in which the internal audit has an important role in raising the reliability of the internal control

system, improving the process of risk management and above all, satisfying the needs of internal

users. The internal audit support enhances the system of responsibility that the executive directors and

employees have towards the owners and other stakeholders (Eighme & Cashell, 2002). Taken

together, the internal audit department provides a reliable, objective, and neutral service to the

management, board of directors, and audit committee, while stakeholders are interested in return on

investments, sustainable growth, strong leadership, and reliable reporting on the financial performance

and business practices of a company (Ljubisavljević & Jovanovi, 2011).

2. Internal Audit function

Internal audit makes a large contribution to the achievement of company goals, and the

implementation of strategies for their achievement (Ljubisavljević & Jovanovi, 2011). In addition, the

internal audit function is responsible for reinforcing management and audit committee (Hutchinson &

Zain, 2009).

Likewise, internal audit determines the reliability, reality, and integrity of financial and

operational information that comes from different organizational units, on which appropriate business

decisions at all levels of management are based. Successful implementation of internal audit tasks

means that it must be independent, i.e., company management should in no way influenced by its

work, information, conclusions, and evaluations. In this way the internal audit report becomes a means

of communication between internal audit and management, and an important guideline for the

successful management of the company (Ljubisavljević & Jovanovi, 2011).

Furthermore, the internal audit function facilitates the operation and effective working of the

audit committee as the audit function goals are consistent with the former’s financial reporting

oversight responsibilities (Goodwin and Yeo, 2001; Goodwin, 2003; Scarbrough, Rama &

Raghunandan, 1998). The creation of an internal audit function is supported by the governance reports

(NYSE, 2002) and previous studies (Collier & Gregory 1996; Goodwin & Kent, 2003) as a

mechanism to enhance internal governance processes.

Along this line of argument, Al-Shammari (2010) mentioned many factors of internal audit

functions and they are provided below:

1. The internal control systems and arithmetic evaluations in an attempt to; ensure that the

accounting system and internal controls systems are appropriate, ensure that the systems are

suitable for the facility and propos system enhancements.

2. Assessing plans and procedures to determine weaknesses or defects in the systems and

procedures used by the company and to propose modifications and enhancements needed, and

to provide authority to the internal auditor for the examination of the aspects of establishment

activity.

3. Taking into consideration the staff commitment to the company policies and procedures and

therefore, internal auditor has to monitor these policies and procedures’ implementation and to

clarify them to the employees.

4. Safeguarding established funds as the development and implementation of systems is an

attempt to make sure that the facility safeguards assets and funds against manipulation and

fraud, to detect fraud and minimize losses stemming from neglect/abuse (e.g. loss of proper

storage).

IAC in this study comprises four factors namely, qualifications of the chief audit executive, size,

qualification and experience of the audit department. Generally, the previous study dedicated to

examining the relationship between internal audit and firm performance is so limited in both

developed countries and developing countries. Several studies have called for further studies to

conduct extensive investigations; for instance, Hutchinson and Zain (2009), explored the association

between internal (audit experience and accounting qualification) audit and firm performance (ROA)

with growth opportunities and audit committee independence in the context of Malaysia. Their study

has two future recommendations. First, future studies should examine the role of the board and the

interaction between internal audit quality and audit committee independence. Secondly, this study

International Review of Management and Marketing, Vol. 4, No.1, 2014, pp.34-41

36

encourages future studies to look into alternate models of factors that would possibly impact IAQ and

improve corporate governance.

There are some studies that have concentrated on problems concerning internal auditing in

developed countries including the U.S. and the U.K. but little evidence is found in emerging markets.

Hutchinson and Zain’s (2009) study involved the examination of the relationship between internal

(audit experience and accounting qualification) audit and firm performance (ROA) with growth

opportunities and audit committee independence in Malaysia. They recommended future research to

consider different factor models that may impact quality of internal audit and improve corporate

governance. From this recommendation, the current study focuses on investigating the association

between internal audit function and performance of firm both accounting measurement and market

measurement while taking some new variables such as qualification of the chairman of internal audit,

the internal audit size, experience of internal audit and internal audit qualification and consider

moderators such as audit quality between internal audit and firm performance. More importantly, there

is a lack of research in both developed and emerging nations concerning the direct relationship

between internal audits functions with performance of firm. In addition to that, Al-Matari et al. (2012)

investigated the relationship between board characteristics and firm performance in Kuwait. They

recommended that future researchers examine the association between internal audit and firm

performance whether directly or through a moderator. Moreover, the qualification of chairman of the

internal audit is a new variable added by the present study.

In a related study, Davidson, Goodwin-Stewart and Kent (2005) investigated the relationship

between internal governance structure comprising of board of directors, audit committee, internal audit

function and the selection of external auditors, and earnings management in Australia. They used

broad cross-sectional regression to test the association between independent variables and dependent

variable. The sample comprised of 434 firms which were listed on the Australian stock exchange

during 2000. The outcome disclosed no significant relation between the internal audit function and the

choice of external auditors. In the same context, Ljubisavljević and Jovanovi (2011) studied the

relationship between the roles of internal audit in Serbian firms. The sample comprised of 200 small

and medium firms during 2011. This study used questionnaire survey and found that the effectiveness

of the internal audit entity is weak.

Consistent with the above is Hutchinson and Zain (2009) who aimed to explore the relationship

between internal audit quality (audit experience and accounting qualification) and firm performance

(ROA) in Malaysia. The data were collected by a mail questionnaire among public listed companies in

Malaysia during the period 2003. The results showed a strong relationship between internal audit

quality and firm performance with opportunities of high growth and that this positive link is decreased

by the increasing independence of audit committee. This study preferred an independent audit

committee.

3. Internal Audit Characteristics and Firm Performance

3.1 Qualifications of the Chief Audit Executive and Firm Performance

In today’s dynamic business environment, it is imperative that internal auditors are qualified

as they should be thorough in their knowledge of business, systems, developments and other business

topics. They should be able to decipher what works and what doesn’t, the strengths, weaknesses of

standards, code systems and procedures (Hala, 2003; Clikeman, 2003). In addition, the high quality

profession of a chief audit executive is to improve the quality of audit and hence, the current study

measured this variable through the questionnaire.

The head of internal audit qualified with auditing certification such as the Certified Internal

Auditor (CIA), Certified Government Auditing Professional (CGAP), Certified Financial Services

Auditor (CFSA), Certification in Control Self-Assessment (CCSA), and Certification in Risk

Management Assurance (CRMA) where useful feedback for any mistake is provided. A certified

auditor is able to make a good decision in the fastest time without having to wait or to consult with

another team. The current study expects the qualification of a chief audit executive to absolutely

enhance performance (Eighme & Cashell, 2002).

Firms that have undergone a period of strong performance may be in a more appropriate

position to employ external directors. The prestige that an external director holds stems from various

sources such as the director’s title and the job position (D’Aveni, 1990). Moreover, those with higher

36

encourages future studies to look into alternate models of factors that would possibly impact IAQ and

improve corporate governance.

There are some studies that have concentrated on problems concerning internal auditing in

developed countries including the U.S. and the U.K. but little evidence is found in emerging markets.

Hutchinson and Zain’s (2009) study involved the examination of the relationship between internal

(audit experience and accounting qualification) audit and firm performance (ROA) with growth

opportunities and audit committee independence in Malaysia. They recommended future research to

consider different factor models that may impact quality of internal audit and improve corporate

governance. From this recommendation, the current study focuses on investigating the association

between internal audit function and performance of firm both accounting measurement and market

measurement while taking some new variables such as qualification of the chairman of internal audit,

the internal audit size, experience of internal audit and internal audit qualification and consider

moderators such as audit quality between internal audit and firm performance. More importantly, there

is a lack of research in both developed and emerging nations concerning the direct relationship

between internal audits functions with performance of firm. In addition to that, Al-Matari et al. (2012)

investigated the relationship between board characteristics and firm performance in Kuwait. They

recommended that future researchers examine the association between internal audit and firm

performance whether directly or through a moderator. Moreover, the qualification of chairman of the

internal audit is a new variable added by the present study.

In a related study, Davidson, Goodwin-Stewart and Kent (2005) investigated the relationship

between internal governance structure comprising of board of directors, audit committee, internal audit

function and the selection of external auditors, and earnings management in Australia. They used

broad cross-sectional regression to test the association between independent variables and dependent

variable. The sample comprised of 434 firms which were listed on the Australian stock exchange

during 2000. The outcome disclosed no significant relation between the internal audit function and the

choice of external auditors. In the same context, Ljubisavljević and Jovanovi (2011) studied the

relationship between the roles of internal audit in Serbian firms. The sample comprised of 200 small

and medium firms during 2011. This study used questionnaire survey and found that the effectiveness

of the internal audit entity is weak.

Consistent with the above is Hutchinson and Zain (2009) who aimed to explore the relationship

between internal audit quality (audit experience and accounting qualification) and firm performance

(ROA) in Malaysia. The data were collected by a mail questionnaire among public listed companies in

Malaysia during the period 2003. The results showed a strong relationship between internal audit

quality and firm performance with opportunities of high growth and that this positive link is decreased

by the increasing independence of audit committee. This study preferred an independent audit

committee.

3. Internal Audit Characteristics and Firm Performance

3.1 Qualifications of the Chief Audit Executive and Firm Performance

In today’s dynamic business environment, it is imperative that internal auditors are qualified

as they should be thorough in their knowledge of business, systems, developments and other business

topics. They should be able to decipher what works and what doesn’t, the strengths, weaknesses of

standards, code systems and procedures (Hala, 2003; Clikeman, 2003). In addition, the high quality

profession of a chief audit executive is to improve the quality of audit and hence, the current study

measured this variable through the questionnaire.

The head of internal audit qualified with auditing certification such as the Certified Internal

Auditor (CIA), Certified Government Auditing Professional (CGAP), Certified Financial Services

Auditor (CFSA), Certification in Control Self-Assessment (CCSA), and Certification in Risk

Management Assurance (CRMA) where useful feedback for any mistake is provided. A certified

auditor is able to make a good decision in the fastest time without having to wait or to consult with

another team. The current study expects the qualification of a chief audit executive to absolutely

enhance performance (Eighme & Cashell, 2002).

Firms that have undergone a period of strong performance may be in a more appropriate

position to employ external directors. The prestige that an external director holds stems from various

sources such as the director’s title and the job position (D’Aveni, 1990). Moreover, those with higher

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

The Effect of the Internal Audit and Firm Performance: A proposed Research Framework

37

qualifications have backgrounds ripe with increased abilities in monitoring management and

contributing to the strategic decision making (Hillman & Dalziel, 2003). These directors may also

possess the potential to influence external resource provides including financial institutions and to

signal firm value to investors. From this logical perspective and with a consistent recommendation as

mentioned above, this current study considers the qualification of chief audit executive variable into

account.

The majority of previous studies is focused on investigation of the qualifications of all

members of the committee and their impact on firm performance, earnings management, audit quality

and other in general. However, no study has examined the relationship between qualification of

chairman in the internal audit committee and firm performance. Owing to the lack of literature review

and consistent with Hutchinson and Zain (2009), the present study attempts to fill the gap by studying

the relationship of member qualification with firm performance. Thus, the following proposition can

be articulated:

H1: There is a relationship between qualifications of the chief audit executive and Firm

Performance.

3.2 Size of the Internal Audit and Firm Performance

The second factor of IAC, which is the internal audit size (IAS), is essential to improve

performance of companies. The size of internal audit is measured by the number of internal audit

seating on the committee of the internal audit department.

In this section, the role of size in the committee is explained in light of different theories. First

of all, Jensen’s (1993) study seems consistent with Lipton and Lorsch (1992) who suggested the

suitable number of board members to be seven to eight. Also, Firsteberg and Malkiel (1994) claimed

that a board with eight to fewer members encourages greater concentration, participation and authentic

interactions and discussion. Consistent with the above, Shaver (2005) argued that larger boards are

often characterized by responsibility diffusion, which leads to social loafing, it encourages group

fractionalization and minimizes group commitment to modifying strategy.

From the perspective of resource dependence theory, it postulates that larger board size would

result in superior corporate performance owing to the various skills, knowledge, and expertise

contributed into the boardroom debate. In addition, large boards could also offer the diversity that

would assist companies to obtain critical resources and minimize environmental risks (Goodstein,

Goodstein, Gautam & Boeker1994; Ghazal, 2010; Pearce & Zahra, 1992; Pfeffer, 1987).

In another related study, Hutchinson and Zain (2009) explored the association between

internal (audit experience and accounting qualification) audit and firm performance (ROA) in light of

growth opportunities and audit committee independence in Malaysia. The sample was selected by two

methods namely the questionnaire and secondary data from the annual report. It comprised of 60 firms

listed on Malaysia Bursa during 2003. This study used multiple regressions to test the association

between internal audit and firm performance. They recommended studying new factors of internal

audit with firm performance. Due to their recommendation, the current study considers testing the

quality of a chief audit executive and the size of the internal audit with firm performance.

Although the importance of internal audit inside a firm is confirmed, no study has considered

examining the relationship between IAS and firm performance. Hence, the current study attempts to

do the same and expects that the size of internal audit helps a committee to improve performance.

Thus, the following is proposed for empirical investigation:

H2: There is a relationship between the size of the internal audit and firm performance.

3.3 Experience of the Internal Audit and Firm Performance

The third value of IAC is experience of internal audit. When a person has many years of

experience, he/she can make a right decision, decide fast and deal with any situation. This variable is

measured by the number of years the members have gathered through a questionnaire that is sent to

every firm by email.

Consistent with the resource dependence theory and its proponents, expert individuals help in

firm growth because they have a clear insight about how to deal with process and accomplish their

tasks with superior quality. And when the firm provides a board with high experts, they help to

understand external environment and as a result, will improve performance of companies.

There are few studies that examined the relationship between the experience of internal audit

and firm performance in both developed countries and developing countries. There is also lack of

37

qualifications have backgrounds ripe with increased abilities in monitoring management and

contributing to the strategic decision making (Hillman & Dalziel, 2003). These directors may also

possess the potential to influence external resource provides including financial institutions and to

signal firm value to investors. From this logical perspective and with a consistent recommendation as

mentioned above, this current study considers the qualification of chief audit executive variable into

account.

The majority of previous studies is focused on investigation of the qualifications of all

members of the committee and their impact on firm performance, earnings management, audit quality

and other in general. However, no study has examined the relationship between qualification of

chairman in the internal audit committee and firm performance. Owing to the lack of literature review

and consistent with Hutchinson and Zain (2009), the present study attempts to fill the gap by studying

the relationship of member qualification with firm performance. Thus, the following proposition can

be articulated:

H1: There is a relationship between qualifications of the chief audit executive and Firm

Performance.

3.2 Size of the Internal Audit and Firm Performance

The second factor of IAC, which is the internal audit size (IAS), is essential to improve

performance of companies. The size of internal audit is measured by the number of internal audit

seating on the committee of the internal audit department.

In this section, the role of size in the committee is explained in light of different theories. First

of all, Jensen’s (1993) study seems consistent with Lipton and Lorsch (1992) who suggested the

suitable number of board members to be seven to eight. Also, Firsteberg and Malkiel (1994) claimed

that a board with eight to fewer members encourages greater concentration, participation and authentic

interactions and discussion. Consistent with the above, Shaver (2005) argued that larger boards are

often characterized by responsibility diffusion, which leads to social loafing, it encourages group

fractionalization and minimizes group commitment to modifying strategy.

From the perspective of resource dependence theory, it postulates that larger board size would

result in superior corporate performance owing to the various skills, knowledge, and expertise

contributed into the boardroom debate. In addition, large boards could also offer the diversity that

would assist companies to obtain critical resources and minimize environmental risks (Goodstein,

Goodstein, Gautam & Boeker1994; Ghazal, 2010; Pearce & Zahra, 1992; Pfeffer, 1987).

In another related study, Hutchinson and Zain (2009) explored the association between

internal (audit experience and accounting qualification) audit and firm performance (ROA) in light of

growth opportunities and audit committee independence in Malaysia. The sample was selected by two

methods namely the questionnaire and secondary data from the annual report. It comprised of 60 firms

listed on Malaysia Bursa during 2003. This study used multiple regressions to test the association

between internal audit and firm performance. They recommended studying new factors of internal

audit with firm performance. Due to their recommendation, the current study considers testing the

quality of a chief audit executive and the size of the internal audit with firm performance.

Although the importance of internal audit inside a firm is confirmed, no study has considered

examining the relationship between IAS and firm performance. Hence, the current study attempts to

do the same and expects that the size of internal audit helps a committee to improve performance.

Thus, the following is proposed for empirical investigation:

H2: There is a relationship between the size of the internal audit and firm performance.

3.3 Experience of the Internal Audit and Firm Performance

The third value of IAC is experience of internal audit. When a person has many years of

experience, he/she can make a right decision, decide fast and deal with any situation. This variable is

measured by the number of years the members have gathered through a questionnaire that is sent to

every firm by email.

Consistent with the resource dependence theory and its proponents, expert individuals help in

firm growth because they have a clear insight about how to deal with process and accomplish their

tasks with superior quality. And when the firm provides a board with high experts, they help to

understand external environment and as a result, will improve performance of companies.

There are few studies that examined the relationship between the experience of internal audit

and firm performance in both developed countries and developing countries. There is also lack of

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

International Review of Management and Marketing, Vol. 4, No.1, 2014, pp.34-41

38

studies among the developing emerging markets. Few studies are discussed below in light of this

association.

Hutchinson and Zain (2009) explored the association between internal (audit experience and

accounting qualification) audit and firm performance (ROA) with growth opportunities and audit

committee independence in Malaysia. The sample was selected by two methods namely questionnaire

and secondary data from the annual reports. It involved 60 firms which were listed on Malaysia Bursa

in 2003. This study used multiple regression analysis to test the association between internal audit and

firm performance and found a significant relationship between experience of internal audit quality and

firm performance.

Additionally, Prawitt, Smith and Wood (2009) examined the association between internal

audit quality (experience and qualification) and earnings management. This study obtained sufficient

data to estimate abnormal accrual models for 528 firm-year observations (218 unique companies) for

the fiscal years 2000 to 2005. It used OLS regression to test the association between independent

variables and dependent variable. The finding shows that a relationship between experience of internal

audit and earning management.

As mentioned above, there is a lack of studies examining the relationship between the

experience of internal audit and firm performance. Moreover, Al-Matari et al. (2012) recommended

the re-examination of the relationship between the experience of internal audit and firm performance.

Therefore, this study proposes the following.

H3: There is a positive relationship between the experience of internal audit and firm performance.

3.4 Qualification of the Internal Audit and Firm Performance

The fourth factor of IAC is the qualification of internal audit and it enhances the quality of

internal audit. The member of internal audit who has high qualification can deal with any issue inside

the department of internal audit. Hence, the present study attempts to measure the qualification of

internal audit by questionnaire.

Consistent to agency theory and resource dependence theory and their proponents, qualified

persons help to improve firm performance because they have a clear insight about how to deal with

operation and achieve their work with high quality.

It is notable that there are only few studies that examined the association between the

qualification of internal audit and firm performance both in developed countries and developing

countries. There is also lack of studies among the developing emerging markets. Among the few

studies of this caliber, Hutchinson and Zain (2009) explored the association between internal (audit

experience and accounting qualification) audit and firm performance (ROA) with growth opportunities

and audit committee independence in Malaysia. The sample was selected by two methods namely

questionnaire and secondary data from the annual report. It comprised of 60 firms which were listed

on Malaysia Bursa in 2003. They used multiple regression analysis to test the connection between

internal audit and firm performance. The findings revealed a significant association between

qualification of internal audit quality and firm performance.

In another study, Prawitt et al. (2009) examined the association between internal audit quality

(experience and qualification) and earning management. This study obtained sufficient data to

estimate our abnormal accrual models for 528 firm-year observations (218 unique companies) for

fiscal years 2000 to 2005. It used OLS regression to test the association between independent variables

and dependent variable. The finding shows an association between qualification of internal audit and

earning management. As stated above, there is a lack of studies that examined the relationship

between the experience of internal audit and firm performance and as evidenced by Al-Matari et al.

(2012). As such, the current study attempts to re-examine the relationship between the qualification of

internal audit and firm performance. Therefore, the following hypotheses are proposed to be tasted:

H4: There is a positive relationship between qualification of internal audit and firm performance.

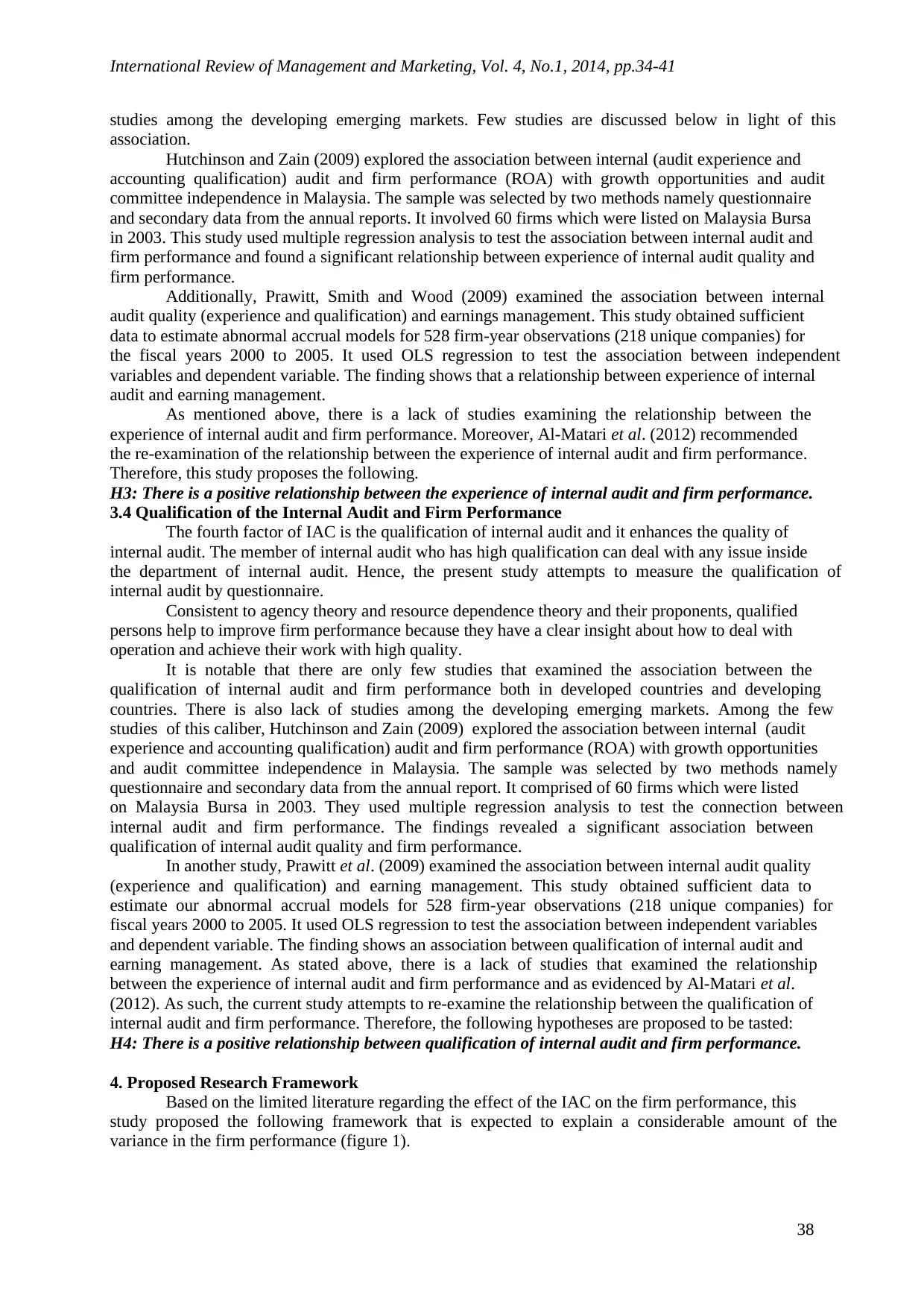

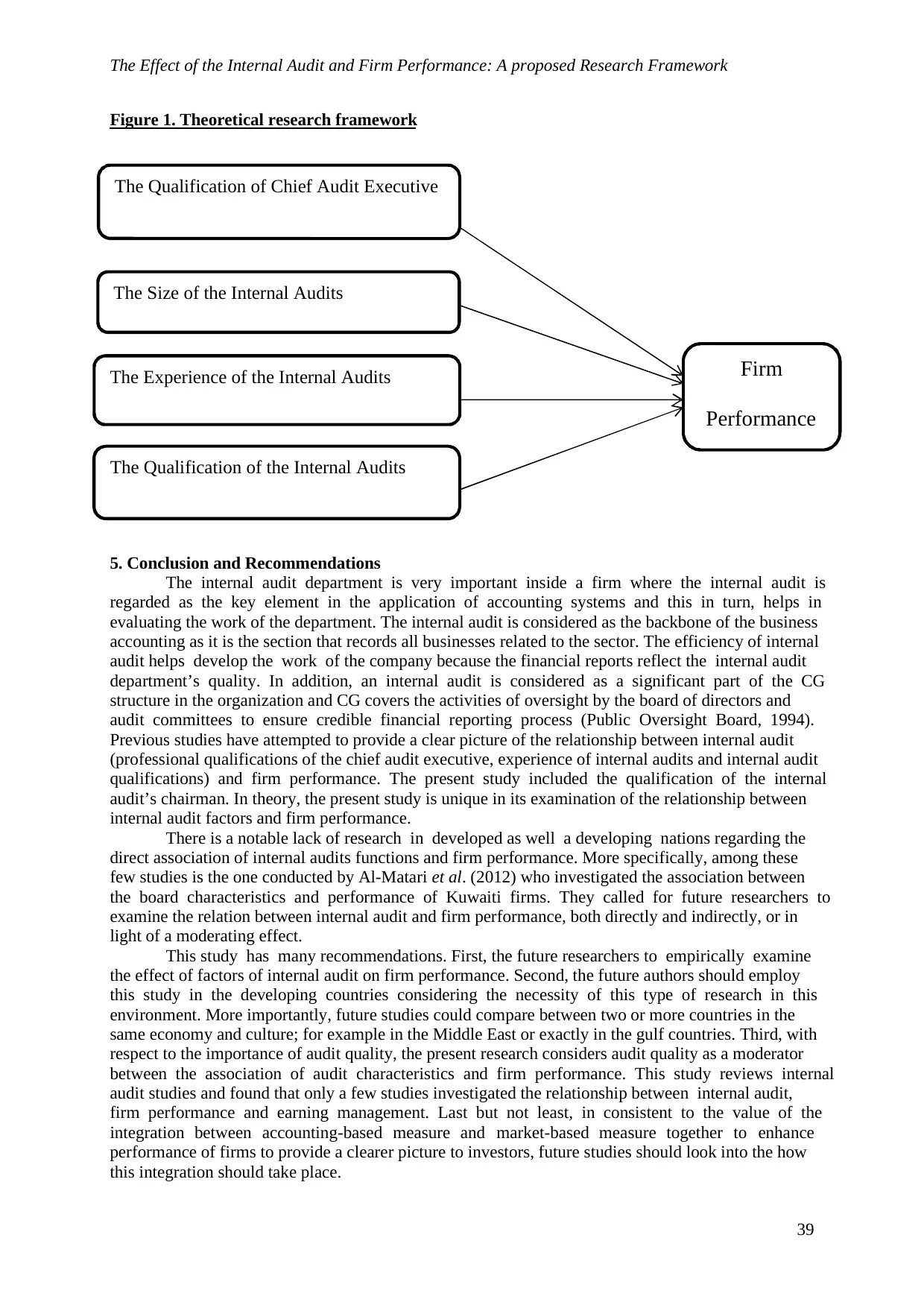

4. Proposed Research Framework

Based on the limited literature regarding the effect of the IAC on the firm performance, this

study proposed the following framework that is expected to explain a considerable amount of the

variance in the firm performance (figure 1).

38

studies among the developing emerging markets. Few studies are discussed below in light of this

association.

Hutchinson and Zain (2009) explored the association between internal (audit experience and

accounting qualification) audit and firm performance (ROA) with growth opportunities and audit

committee independence in Malaysia. The sample was selected by two methods namely questionnaire

and secondary data from the annual reports. It involved 60 firms which were listed on Malaysia Bursa

in 2003. This study used multiple regression analysis to test the association between internal audit and

firm performance and found a significant relationship between experience of internal audit quality and

firm performance.

Additionally, Prawitt, Smith and Wood (2009) examined the association between internal

audit quality (experience and qualification) and earnings management. This study obtained sufficient

data to estimate abnormal accrual models for 528 firm-year observations (218 unique companies) for

the fiscal years 2000 to 2005. It used OLS regression to test the association between independent

variables and dependent variable. The finding shows that a relationship between experience of internal

audit and earning management.

As mentioned above, there is a lack of studies examining the relationship between the

experience of internal audit and firm performance. Moreover, Al-Matari et al. (2012) recommended

the re-examination of the relationship between the experience of internal audit and firm performance.

Therefore, this study proposes the following.

H3: There is a positive relationship between the experience of internal audit and firm performance.

3.4 Qualification of the Internal Audit and Firm Performance

The fourth factor of IAC is the qualification of internal audit and it enhances the quality of

internal audit. The member of internal audit who has high qualification can deal with any issue inside

the department of internal audit. Hence, the present study attempts to measure the qualification of

internal audit by questionnaire.

Consistent to agency theory and resource dependence theory and their proponents, qualified

persons help to improve firm performance because they have a clear insight about how to deal with

operation and achieve their work with high quality.

It is notable that there are only few studies that examined the association between the

qualification of internal audit and firm performance both in developed countries and developing

countries. There is also lack of studies among the developing emerging markets. Among the few

studies of this caliber, Hutchinson and Zain (2009) explored the association between internal (audit

experience and accounting qualification) audit and firm performance (ROA) with growth opportunities

and audit committee independence in Malaysia. The sample was selected by two methods namely

questionnaire and secondary data from the annual report. It comprised of 60 firms which were listed

on Malaysia Bursa in 2003. They used multiple regression analysis to test the connection between

internal audit and firm performance. The findings revealed a significant association between

qualification of internal audit quality and firm performance.

In another study, Prawitt et al. (2009) examined the association between internal audit quality

(experience and qualification) and earning management. This study obtained sufficient data to

estimate our abnormal accrual models for 528 firm-year observations (218 unique companies) for

fiscal years 2000 to 2005. It used OLS regression to test the association between independent variables

and dependent variable. The finding shows an association between qualification of internal audit and

earning management. As stated above, there is a lack of studies that examined the relationship

between the experience of internal audit and firm performance and as evidenced by Al-Matari et al.

(2012). As such, the current study attempts to re-examine the relationship between the qualification of

internal audit and firm performance. Therefore, the following hypotheses are proposed to be tasted:

H4: There is a positive relationship between qualification of internal audit and firm performance.

4. Proposed Research Framework

Based on the limited literature regarding the effect of the IAC on the firm performance, this

study proposed the following framework that is expected to explain a considerable amount of the

variance in the firm performance (figure 1).

The Effect of the Internal Audit and Firm Performance: A proposed Research Framework

39

Figure 1. Theoretical research framework

5. Conclusion and Recommendations

The internal audit department is very important inside a firm where the internal audit is

regarded as the key element in the application of accounting systems and this in turn, helps in

evaluating the work of the department. The internal audit is considered as the backbone of the business

accounting as it is the section that records all businesses related to the sector. The efficiency of internal

audit helps develop the work of the company because the financial reports reflect the internal audit

department’s quality. In addition, an internal audit is considered as a significant part of the CG

structure in the organization and CG covers the activities of oversight by the board of directors and

audit committees to ensure credible financial reporting process (Public Oversight Board, 1994).

Previous studies have attempted to provide a clear picture of the relationship between internal audit

(professional qualifications of the chief audit executive, experience of internal audits and internal audit

qualifications) and firm performance. The present study included the qualification of the internal

audit’s chairman. In theory, the present study is unique in its examination of the relationship between

internal audit factors and firm performance.

There is a notable lack of research in developed as well a developing nations regarding the

direct association of internal audits functions and firm performance. More specifically, among these

few studies is the one conducted by Al-Matari et al. (2012) who investigated the association between

the board characteristics and performance of Kuwaiti firms. They called for future researchers to

examine the relation between internal audit and firm performance, both directly and indirectly, or in

light of a moderating effect.

This study has many recommendations. First, the future researchers to empirically examine

the effect of factors of internal audit on firm performance. Second, the future authors should employ

this study in the developing countries considering the necessity of this type of research in this

environment. More importantly, future studies could compare between two or more countries in the

same economy and culture; for example in the Middle East or exactly in the gulf countries. Third, with

respect to the importance of audit quality, the present research considers audit quality as a moderator

between the association of audit characteristics and firm performance. This study reviews internal

audit studies and found that only a few studies investigated the relationship between internal audit,

firm performance and earning management. Last but not least, in consistent to the value of the

integration between accounting-based measure and market-based measure together to enhance

performance of firms to provide a clearer picture to investors, future studies should look into the how

this integration should take place.

The Qualification of Chief Audit Executive

The Size of the Internal Audits

Firm

Performance

The Experience of the Internal Audits

The Qualification of the Internal Audits

39

Figure 1. Theoretical research framework

5. Conclusion and Recommendations

The internal audit department is very important inside a firm where the internal audit is

regarded as the key element in the application of accounting systems and this in turn, helps in

evaluating the work of the department. The internal audit is considered as the backbone of the business

accounting as it is the section that records all businesses related to the sector. The efficiency of internal

audit helps develop the work of the company because the financial reports reflect the internal audit

department’s quality. In addition, an internal audit is considered as a significant part of the CG

structure in the organization and CG covers the activities of oversight by the board of directors and

audit committees to ensure credible financial reporting process (Public Oversight Board, 1994).

Previous studies have attempted to provide a clear picture of the relationship between internal audit

(professional qualifications of the chief audit executive, experience of internal audits and internal audit

qualifications) and firm performance. The present study included the qualification of the internal

audit’s chairman. In theory, the present study is unique in its examination of the relationship between

internal audit factors and firm performance.

There is a notable lack of research in developed as well a developing nations regarding the

direct association of internal audits functions and firm performance. More specifically, among these

few studies is the one conducted by Al-Matari et al. (2012) who investigated the association between

the board characteristics and performance of Kuwaiti firms. They called for future researchers to

examine the relation between internal audit and firm performance, both directly and indirectly, or in

light of a moderating effect.

This study has many recommendations. First, the future researchers to empirically examine

the effect of factors of internal audit on firm performance. Second, the future authors should employ

this study in the developing countries considering the necessity of this type of research in this

environment. More importantly, future studies could compare between two or more countries in the

same economy and culture; for example in the Middle East or exactly in the gulf countries. Third, with

respect to the importance of audit quality, the present research considers audit quality as a moderator

between the association of audit characteristics and firm performance. This study reviews internal

audit studies and found that only a few studies investigated the relationship between internal audit,

firm performance and earning management. Last but not least, in consistent to the value of the

integration between accounting-based measure and market-based measure together to enhance

performance of firms to provide a clearer picture to investors, future studies should look into the how

this integration should take place.

The Qualification of Chief Audit Executive

The Size of the Internal Audits

Firm

Performance

The Experience of the Internal Audits

The Qualification of the Internal Audits

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

International Review of Management and Marketing, Vol. 4, No.1, 2014, pp.34-41

40

References

Al Matarneh, G.F. (2011). Factors determining the internal audit quality in banks: Empirical Evidence

from Jordan. International Research Journal of Finance and Economics, 73, 99-108.

Al-Matari, E.M., Al-Swidi, A.K., Faudziah, H.B., Al-Matari, Y.A. (2012). The Impact of board

characteristics on Firm Performance: Evidence from Nonfinancial Listed Companies in Kuwaiti

Stock Exchange. International Journal of Accounting and Financial Reporting, 2(2), 310-332.

Al-Shammari, Aid. (2010). The role of the Audit Committees in Corporate Governance in Saudi

Arabia. Workshop paper. College of Business Administration - King Saud University.

Anderson, N. J., B. Rippey & C. E. Gibson (1993). A comparison of sedimentary and diatom-inferred

phosphorus profiles: implications for defining pre-disturbance nutrient conditions. Hydrobiologia

253:357-366.

Blue ribbon committee on improving the effectiveness of corporate audit committees (Blue Ribbon

Committee). (1999). Report and Recommendations, Blue Ribbon Committee, New York, NY.

charge? Sloan Management Review, 36(1), 27-55.

Clikeman, P.M. (2003). Where auditors fear to tread: internal auditors should be proactive in

educating companies on the perils of earnings management and in searching for signs of its use.

Internal Auditor, 75-80.

Collier, P., & A. Gregory (1996). Audit committee effectiveness and the audit fee, The European

Accounting Review, 5, 177-198.

D’Aveni, R.A. (1990). Top managerial prestige and organizational bankruptcy, Organization Science,

1(2), 121-42.

Davidson, R., Goodwin-Stewart, J., Kent, P. (2005,). Internal Governance Structures and Earnings

Management. Accounting and Finance, 45, 241-267.

Eighme, J., Cashell, J. (2002). Internal auditors’ roles in overcoming the financial reporting crisis.

International Auditing, 17, 3-10.

Firstenberg, P.B., & Malkiel, B.G. (1994). The twenty-first century boardroom: Who will be in

Ghazali, N. (2010). Ownership structure, corporate governance and corporate performance in

Malaysia. International Journal of Commerce and Management, 20(2), 109-119.

Goodstein, J., Gautam, K. & Boeker, W. (1994) The effects of board size and diversity on strategic

change, Strategic Management Journal, 15, 241-250.

Goodwin, J. (2003). The relationship between the audit committee and the internal audit function:

Evidence from Australia and New Zealand. International Journal of Auditing 7(3): 263-278.

Goodwin, J., & P. Kent, 2003, Factors affecting the voluntary use of internal audit, Paper presented at

the Annual Meeting of the American Accounting Association, Hawaii.

Goodwin, J., Yeo, T.Y. (2001). Two Factors Affecting Internal Audit Independence and Objectivity:

Evidence from Singapore. International Journal of Auditing 5(2), 107-125.

Hala, N. (2003), Sherron Watkins – If capitalists were angels, Internal Auditor 60(11), 38–43.

Hillman, A., Dalziel, T. (2003). Boards of directors and firm performance: Integrating agency and

resource dependence perspectives. Academy of Management Review, 28(3), 383-396.

Hutchinson, M.R., & Zain, M.M. (2009). Internal audit quality, audit committee independence, growth

opportunities and firm performance. Corporate Ownership and Control, 7(2), 50-63.

Institute of Internal Auditors (IIA). (2003). Comment letter to SEC on standards relating to listed

company audit committees.

Jensen, M. (1993). The modern industrial revolution, exit and the failure of internal control systems.

Journal of Finance, 48, 831-880.

Lipton, M., Lorsch, J. (1992). Modest proposal for improved corporate governance. Business Lawyer,

12(3), 48-59.

Ljubisavljević, S., Jovanovi, D. ( 2011). Empirical research on the internal audit position of companies

in Serbia. Economic Annals, LVI( 191), 123-141.

New York stock exchange corporate accountability and listing standards committee (NYSE), 2002,

Report (NYSE, New York).

Pearce, J.H., Zahra, S.A. (1992). Board composition from a strategic contingency perspective. Journal

of Management Studies, 29(2), 411-438.

40

References

Al Matarneh, G.F. (2011). Factors determining the internal audit quality in banks: Empirical Evidence

from Jordan. International Research Journal of Finance and Economics, 73, 99-108.

Al-Matari, E.M., Al-Swidi, A.K., Faudziah, H.B., Al-Matari, Y.A. (2012). The Impact of board

characteristics on Firm Performance: Evidence from Nonfinancial Listed Companies in Kuwaiti

Stock Exchange. International Journal of Accounting and Financial Reporting, 2(2), 310-332.

Al-Shammari, Aid. (2010). The role of the Audit Committees in Corporate Governance in Saudi

Arabia. Workshop paper. College of Business Administration - King Saud University.

Anderson, N. J., B. Rippey & C. E. Gibson (1993). A comparison of sedimentary and diatom-inferred

phosphorus profiles: implications for defining pre-disturbance nutrient conditions. Hydrobiologia

253:357-366.

Blue ribbon committee on improving the effectiveness of corporate audit committees (Blue Ribbon

Committee). (1999). Report and Recommendations, Blue Ribbon Committee, New York, NY.

charge? Sloan Management Review, 36(1), 27-55.

Clikeman, P.M. (2003). Where auditors fear to tread: internal auditors should be proactive in

educating companies on the perils of earnings management and in searching for signs of its use.

Internal Auditor, 75-80.

Collier, P., & A. Gregory (1996). Audit committee effectiveness and the audit fee, The European

Accounting Review, 5, 177-198.

D’Aveni, R.A. (1990). Top managerial prestige and organizational bankruptcy, Organization Science,

1(2), 121-42.

Davidson, R., Goodwin-Stewart, J., Kent, P. (2005,). Internal Governance Structures and Earnings

Management. Accounting and Finance, 45, 241-267.

Eighme, J., Cashell, J. (2002). Internal auditors’ roles in overcoming the financial reporting crisis.

International Auditing, 17, 3-10.

Firstenberg, P.B., & Malkiel, B.G. (1994). The twenty-first century boardroom: Who will be in

Ghazali, N. (2010). Ownership structure, corporate governance and corporate performance in

Malaysia. International Journal of Commerce and Management, 20(2), 109-119.

Goodstein, J., Gautam, K. & Boeker, W. (1994) The effects of board size and diversity on strategic

change, Strategic Management Journal, 15, 241-250.

Goodwin, J. (2003). The relationship between the audit committee and the internal audit function:

Evidence from Australia and New Zealand. International Journal of Auditing 7(3): 263-278.

Goodwin, J., & P. Kent, 2003, Factors affecting the voluntary use of internal audit, Paper presented at

the Annual Meeting of the American Accounting Association, Hawaii.

Goodwin, J., Yeo, T.Y. (2001). Two Factors Affecting Internal Audit Independence and Objectivity:

Evidence from Singapore. International Journal of Auditing 5(2), 107-125.

Hala, N. (2003), Sherron Watkins – If capitalists were angels, Internal Auditor 60(11), 38–43.

Hillman, A., Dalziel, T. (2003). Boards of directors and firm performance: Integrating agency and

resource dependence perspectives. Academy of Management Review, 28(3), 383-396.

Hutchinson, M.R., & Zain, M.M. (2009). Internal audit quality, audit committee independence, growth

opportunities and firm performance. Corporate Ownership and Control, 7(2), 50-63.

Institute of Internal Auditors (IIA). (2003). Comment letter to SEC on standards relating to listed

company audit committees.

Jensen, M. (1993). The modern industrial revolution, exit and the failure of internal control systems.

Journal of Finance, 48, 831-880.

Lipton, M., Lorsch, J. (1992). Modest proposal for improved corporate governance. Business Lawyer,

12(3), 48-59.

Ljubisavljević, S., Jovanovi, D. ( 2011). Empirical research on the internal audit position of companies

in Serbia. Economic Annals, LVI( 191), 123-141.

New York stock exchange corporate accountability and listing standards committee (NYSE), 2002,

Report (NYSE, New York).

Pearce, J.H., Zahra, S.A. (1992). Board composition from a strategic contingency perspective. Journal

of Management Studies, 29(2), 411-438.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The Effect of the Internal Audit and Firm Performance: A proposed Research Framework

41

Pfeffer, J. (1987). A resource dependence perspective on interorganizational relations. In M. S.

Mizruchi, & M. Schwartz (Eds.), Intercorporate relations: The structural analysis of business:

22-55. Cambridge, UK: Cambridge University Press.

Prawitt, D., Smith, J., Wood, D. (2009). Internal Audit Quality and Earnings Management. The

Accounting Review, 84, 1255-1280.

Public Oversight Board. (1994). Strengthening the professionalism of the independent auditor.

Stamford, CT: POB.

Scarbrough, P., Rama, D., Raghunandan, K. (1998). Audit committee composition and interaction

with internal auditing: Canadian evidence. Accounting Horizons, 12(1), 51-62.

Shaver, D. (2005). Characteristics of corporate boards in single-industry and conglomerate media

companies. International Journal of Media Management, 7(3&4), 112-120.

41

Pfeffer, J. (1987). A resource dependence perspective on interorganizational relations. In M. S.

Mizruchi, & M. Schwartz (Eds.), Intercorporate relations: The structural analysis of business:

22-55. Cambridge, UK: Cambridge University Press.

Prawitt, D., Smith, J., Wood, D. (2009). Internal Audit Quality and Earnings Management. The

Accounting Review, 84, 1255-1280.

Public Oversight Board. (1994). Strengthening the professionalism of the independent auditor.

Stamford, CT: POB.

Scarbrough, P., Rama, D., Raghunandan, K. (1998). Audit committee composition and interaction

with internal auditing: Canadian evidence. Accounting Horizons, 12(1), 51-62.

Shaver, D. (2005). Characteristics of corporate boards in single-industry and conglomerate media

companies. International Journal of Media Management, 7(3&4), 112-120.

1 out of 8

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.